Highlights

What GAO Found

aCOVID-19 relief appropriations reflect amounts appropriated under the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020, Pub. L. No. 116-123, 134 Stat. 146; Families First Coronavirus Response Act, Pub. L. No. 116-127, 134 Stat. 178 (2020); CARES Act, Pub. L. No. 116-136, 134 Stat. 281 (2020); and Paycheck Protection Program and Health Care Enhancement Act, Pub. L. No. 116-139, 134 Stat. 620 (2020). These data are based on appropriations warrant information provided by the Department of the Treasury as of July 31, 2020. These amounts could increase in the future for programs with indefinite appropriations, which are appropriations that, at the time of enactment, are for an unspecified amount. In addition, this table does not represent transfers of funds that federal agencies may make between appropriation accounts or transfers of funds they may make to other agencies.

bObligations and expenditures data for July 2020 are based on preliminary data reported by applicable agencies.

cThese expenditures relate to the loan subsidy costs (the loan’s estimated long-term costs to the United States government).

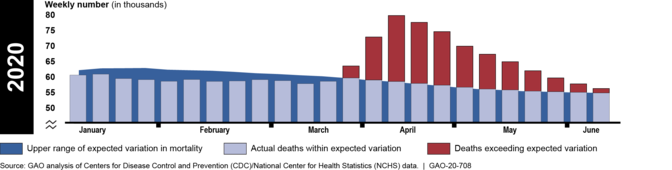

CDC Data on Higher-Than-Expected Weekly Mortality, January 1 through June 13, 2020

- To reduce the potential for duplicate payments from the Paycheck Protection Program (PPP)—a program that provides guaranteed loans through lenders to small businesses—and unemployment insurance, GAO recommended that the Department of Labor (DOL), in consultation with the Small Business Administration (SBA) and the Department of the Treasury (Treasury), immediately provide information to state unemployment agencies that specifically addresses PPP loans, and the risk of improper unemployment insurance payments. DOL issued guidance on August 12, 2020, that, among other things, clarified that individuals working full-time and being paid through PPP are not eligible for UI.

- To recoup economic impact payments totaling more than $1.6 billion sent to decedents, GAO recommended that the Internal Revenue Service (IRS) consider cost-effective options for notifying ineligible recipients of economic impact payments how to return payments. IRS has taken steps to address this recommendation. According to a Treasury official, nearly 70 percent of the payments sent to decedents have been recovered. However, GAO was unable to verify that amount before finalizing work on this report. GAO is working with Treasury to determine the number of payments sent to decedents that have been recovered. Treasury was considering sending letters to request the return of remaining outstanding payments but has not moved forward with this effort because, according to Treasury, Congress is considering legislation that would clarify or change payment eligibility requirements.

- To reduce the potential for fraud and ensure program integrity, GAO recommended that SBA develop and implement plans to identify and respond to risks in PPP to ensure program integrity, achieve program effectiveness, and address potential fraud. SBA has begun developing oversight plans for PPP but has not yet finalized or implemented them.

- GAO urged Congress to take legislative action to require the Department of Transportation (DOT) to work with relevant agencies and stakeholders, such as HHS, the Department of Homeland Security (DHS), and international organizations, to develop a national aviation-preparedness plan to ensure safeguards are in place to limit the spread of communicable disease threats from abroad, while also minimizing any unnecessary interference with travel and trade. In early July 2020, DOT collaborated with HHS and DHS to issue guidance to airports and airlines for implementing measures to mitigate the public health risks associated with COVID-19, but it has not developed a preparedness plan for future communicable disease threats. DOT has maintained that HHS and DHS should lead such planning efforts as they are responsible for communicable disease response and preparedness planning, respectively. In June 2020, HHS stated that it is not in a position to develop a national aviation-preparedness plan as it does not have primary jurisdiction over the entire aviation sector or the relevant transportation expertise. In May 2020, DHS stated that it had reviewed its existing plans for pandemic preparedness and response activities and determined it is not best situated to develop a national aviation-preparedness plan. Without such a plan, the U.S. will not be as prepared to minimize and quickly respond to future communicable disease events.

- GAO also urged Congress to amend the Social Security Act to explicitly allow the Social Security Administration (SSA) to share its full death data with Treasury for data matching to help prevent payments to ineligible individuals. In June 2020, the Senate passed S.4104, referred to as the Stopping Improper Payments to Deceased People Act. If enacted, the bill would allow SSA to share these data with Treasury's Bureau of the Fiscal Service to avoid paying deceased individuals.

- Finally, GAO urged Congress to use GAO's Federal Medical Assistance Percentage (FMAP) formula for any future changes to the FMAP—the statutory formula according to which the federal government matches states' spending for Medicaid services—during the current or any future economic downturn. Congress has taken no action thus far on this issue.

Why GAO Did This Study

Introduction

Background

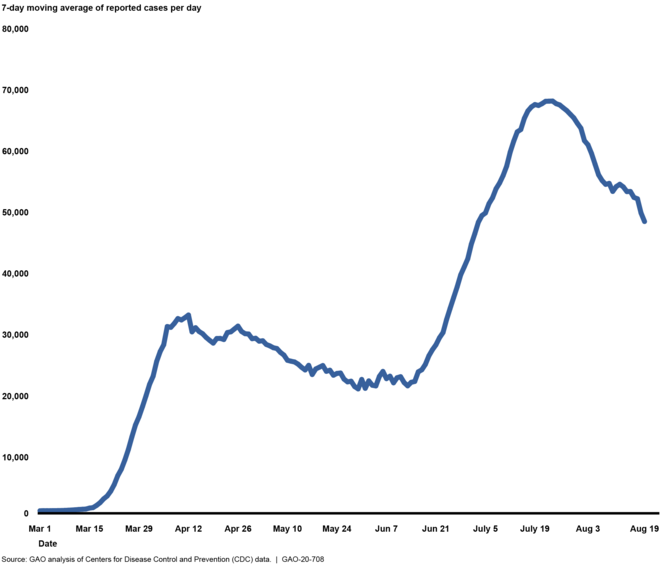

Figure 1: Reported COVID-19 Cases per Day in the United States, as of August 20, 2020

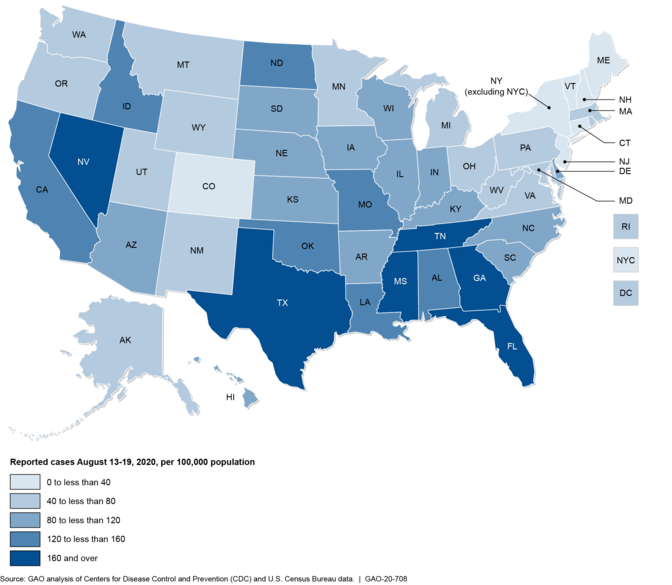

Figure 2: Reported COVID-19 Cases August 13-19, 2020, by State, per 100,000 Population

Major Findings

IN THIS SECTION

Federal COVID-19 Funding and Spending

Note: USAspending.gov is a publicly available website that includes detailed data on federal spending for nearly all accounts across the federal government and is maintained by the Department of the Treasury.

aCOVID-19 relief appropriations reflect amounts appropriated under the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020, Pub. L. No. 116-123, 134 Stat. 146; Families First Coronavirus Response Act, Pub. L. No. 116-127, 134 Stat. 178 (2020); CARES Act, Pub. L. No. 116-136, 134 Stat. 281 (2020); and Paycheck Protection Program and Health Care Enhancement Act, Pub. L. No. 116-139, 134 Stat. 620 (2020). These data are based on appropriations warrant information provided by the Department of the Treasury as of July 31, 2020. These amounts could increase in the future for programs with indefinite appropriations, which are appropriations that, at the time of enactment, are for an unspecified amount. In addition, this table does not represent transfers of funds that federal agencies may make between appropriation accounts or transfers of funds they may make to other agencies.

bObligations and expenditures data for May 2020 are based on agency-reported data from the Department of the Treasury as of May 31, 2020. Some amounts differ from our June 2020 report (

GAO-20-625

) because they are based on more current information that has been made available since then.

cObligations and expenditures data for June 2020 are based on data from

USAspending.gov

as of August 19, 2020.

dObligations and expenditures data for July 2020 are based on preliminary data reported by applicable agencies.

eThese expenditures relate to the loan subsidy costs (the loan’s estimated long-term costs to the United States government).

- Business Loan Programs. The Small Business Administration’s (SBA) Business Loan Programs received $687 billion in appropriations and had obligated $538.1 billion of these funds as of July 31, 2020. SBA’s Business Loan Program account includes amounts for the PPP and for subsidies for certain SBA loan programs. Most of the appropriations went to the PPP, which is a loan guarantee program in which loans are guaranteed at 100 percent by SBA, are low-interest (1 percent), and will be fully forgiven if the borrower meets certain conditions. As of July 31, 2020, SBA reported that lenders had made about 5.1 million PPP loans, up from 4.6 million loans as of June 12, 2020. [15] SBA stated that its loan guarantee expenditures were $522.2 billion as of July 31, 2020, which represents the estimated cost to the federal government to satisfy the loan guarantee obligations to lenders. [16] The amount SBA ultimately spends largely depends on the number of loans actually forgiven. When the loans are forgiven, payments will be made to the lenders.

-

Economic Stabilization and Assistance to Distressed Sectors. The Economic Stabilization and Assistance to Distressed Sectors programs received $500 billion in appropriations.

[17]

Most of these appropriations—about $454 billion—relate to support for lending facilities administered by the Federal Reserve. Since early June 2020, five additional emergency lending programs (or facilities) supported through CARES Act appropriated funds became operational, resulting in a total of seven CARES Act facilities being operational as of July 31, 2020. As of that date, Treasury had committed $195 billion, or about 43 percent, of the $454 billion from the CARES Act available to support the facilities and disbursed $102.5 billion of that commitment, up from $55 billion in early June.

[18]

Most of the $19.2 billion of expenditures also relate to this program. Budget expenditures related to the lending facilities administered by the Federal Reserve represent the loan subsidy costs (the loan’s estimated long-term costs to the United States government) of the facilities to the federal government. The subsidy cost is calculated as the estimated net present value of both cash disbursements made to the facilities and cash received from the facilities when the facilities are terminated. Treasury estimates, on a net present value basis, that cash disbursed to the facilities will exceed the cash received from the facilities by $18 billion, as of July 31, 2020. The Economic Stabilization and Assistance to Distressed Sectors program also includes an appropriation of $46 billion in loans, loan guarantees, and other investments to provide liquidity to the aviation sector and businesses critical to maintaining national security, including non-aviation sector businesses. As of July 2020, Treasury had made one loan for up to $700 million to a business designated as critical to maintaining national security, and had also signed letters of intent with 10 passenger carriers to provide loans that could total over $20 billion.

- Unemployment Insurance. Between May and July 2020, obligations for regular unemployment insurance increased from $107.1 billion to $301.1billion, and expenditures increased from $101.8 billion to $296.8 billion. In May 2020, 9.4 million initial unemployment claims were processed. In July 2020, states processed 6.7 million initial unemployment claims. [19]

- Economic Impact Payments. Both cumulative obligations and cumulative expenditures for economic impact payments—direct payments to individuals and households to mitigate the effects of the pandemic—increased from $267.4 billion in May 2020 to $273.5 billion in July 2020. The vast majority of the 164 million economic impact payments disbursed by Treasury and Internal Revenue Service (IRS) had been disbursed by May 22, 2020. Those who received payments in June and July 2020 were individuals who filed their taxes up until the extended tax filing season deadline of July 15, individuals who previously filed a paper return that IRS was unable to process due to certain functions being shut down during the pandemic, and individuals who did not file taxes but used the IRS’s non-filer portal to claim their economic impact payment. [20]

- Public Health and Social Services Emergency Fund. Payments to health care providers for costs related to COVID-19 or lost revenues are one of the activities supported by Public Health and Social Services Emergency Fund appropriations, through what is known as the Provider Relief Fund. Payments to providers totaled $65.2 billion as of May 31, 2020, and increased to $92.4 billion by the end of July. After initially making general relief payments to health care providers in April, HHS subsequently began allocating more funding to areas particularly affected by the COVID-19 outbreak, including rural health care facilities, high-impact hospitals (those hospitals with a high rate of COVID-19 inpatient admissions), safety net hospitals, health care providers that participate in Medicaid and the Children’s Health Insurance Program, skilled nursing facilities, Indian health care providers, and dental providers.

- Coronavirus Relief Fund. As of July 31, 2020, Treasury had received $150 billion in appropriations and had provided $149.5 billion in direct assistance to states, localities, tribal governments, the District of Columbia, and U.S. territories to help offset costs of their response to the COVID-19 pandemic. The approximately $2.9 billion in additional obligations and expenditures since the end of May were payments to tribal governments that Treasury made in June.

Key Health Care and Economic Indicators

Four Indicators Help to Monitor Areas of the Health Care System’s Response and Recovery

Positivity Rate for COVID-19 Testing

- In May 2020, the World Health Organization recommended that governments target a test positivity rate of less than 5 percent over a 14-day period. As of August 12, 2020, 12 states and the District of Columbia had met the World Health Organization recommended threshold of less than 5 percent over a 14-day period (38 states did not), according to data reported publicly by states. [28] In June and July 2020, several organizations also included the positivity rate as a key indicator in their new guidance to help governments assess progress in reducing the incidence of COVID-19. [29] For example, Resolve to Save Lives recommended that governments target a positivity rate of less than 3 percent based on a 7-day average and that they monitor positivity rates by age and race. [30] As of August 12, 2020, 11 states and the District of Columbia had met the threshold of less than 3 percent over a 7-day period (39 states did not), according to data reported publicly by states. [31]

- Similarly, in July 2020, the Harvard Global Health Institute and the Edmond J. Safra Center for Ethics published a framework—developed in collaboration with a network of research, policy, and public health experts—that includes targets for positivity rates that depend on a government’s goal to achieve “mitigation” (i.e., reduce the incidence of COVID-19) or “suppression” (i.e., eliminate the incidence of COVID-19 almost entirely) through the use of testing, contact tracing, and isolation. [32] Harvard officials told us they established these targets based on the World Health Organization’s recommendation and positivity rates observed in other countries that have made progress in working toward suppression (e.g., South Korea, Germany). Harvard officials explained that these goals are part of a continuum, with the ultimate goal of suppression, and that governments should work toward a goal that is achievable. For example, governments that are faced with serious outbreaks in their communities should first work toward a goal of mitigation before suppression. Under the framework, it is suggested that governments target a positivity rate of about 10 percent for mitigation or a positivity rate of less than 3 percent for suppression. [33]

Contact Tracing Performance

Proportion of Intensive Care Unit Beds Available

Higher than Expected Deaths from All Causes

Figure 3: CDC Data on Higher Than Expected Weekly Mortality, January 1 through June 13, 2020

The Economy Remains Weak but Indicators Suggest Modest Improvement in Key Areas Supported by the Federal Pandemic Response

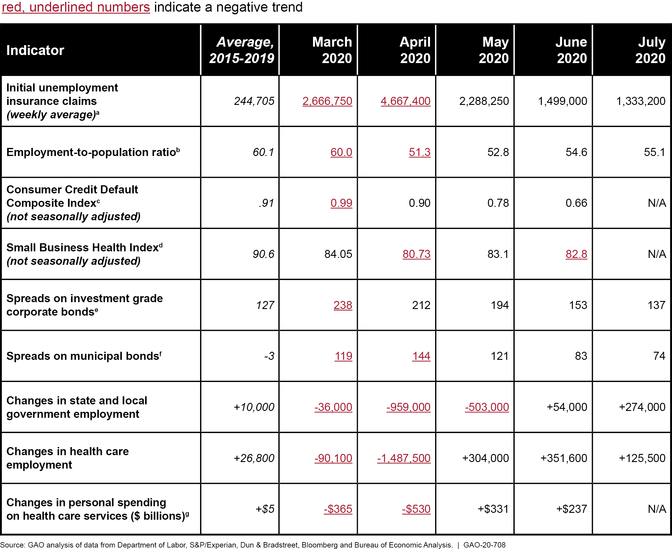

Figure 4: Indicators for Areas of the Economy Supported by the Federal Pandemic Response, 2015-2019 and March 2020-July 2020

bThe employment-to-population ratio represents the number of employed people as a percentage of the civilian noninstitutional population 16 years and over and is subject to misclassification errors with respect to consistently identifying workers as employed and absent from work or unemployed on temporary layoff.

cHigher levels of the Consumer Credit Default Composite Index indicate more defaults on consumer loans, including auto loans, bank cards, and mortgages. The Consumer Credit Default Composite Index could be subject to seasonal variation but is not seasonally adjusted.

dLower levels of the Small Business Health Index indicate higher utilization of credit, delayed payments on credit, and more small business failures. The Small Business Health Index is published under license and permission from Dun & Bradstreet and no commercial use can be made of these data.

eCorporate bond spreads are option-adjusted spreads on dollar-denominated investment grade corporate bonds and are measured in basis points or 1/100th of a percentage point. Higher spreads reflect higher perceived risk among corporate borrowers by investors.

fSpreads on municipal bonds are calculated relative to interest rates on Treasury securities based on the Bloomberg-Barclays Municipal Bond Index and are measured in basis points or 1/100th of a percentage point. Higher spreads reflect higher perceived risk among municipal borrowers by investors.

gExpenditures are in real (inflation-adjusted) dollars using chained (2012) dollars and are seasonally adjusted at annual rates.

Figure 5: National Weekly Initial Regular Unemployment Insurance Claims, January 2019–July 2020

Status of GAO’s June 2020 Recommendations and Matters for Congressional Consideration

Recommendations

Matters for Congressional Consideration

Agency Comments and Our Evaluation

Congressional Addressees

The Honorable Richard C. Shelby

Chairman

The Honorable Patrick J. Leahy

Vice Chairman

Committee on Appropriations

United States Senate

The Honorable Lamar Alexander

Chairman

The Honorable Patty Murray

Ranking Member

Committee on Health, Education, Labor, and Pensions

United States Senate

The Honorable Ron Johnson

Chairman

The Honorable Gary C. Peters

Ranking Member

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Nita M. Lowey

Chairwoman

The Honorable Kay Granger

Ranking Member

Committee on Appropriations

House of Representatives

The Honorable Frank Pallone, Jr.

Chairman

The Honorable Greg Walden

Republican Leader

Committee on Energy and Commerce

House of Representatives

The Honorable Bennie Thompson

Chairman

The Honorable Mike D. Rogers

Ranking Member

Committee on Homeland Security

House of Representatives

The Honorable Carolyn B. Maloney

Chairwoman

The Honorable James R. Comer

Ranking Member

Committee on Oversight and Reform

House of Representatives

References

Figures

- CDC Data on Higher-Than-Expected Weekly Mortality, January 1 through June 13, 2020

- National Weekly Initial Unemployment Insurance Claims, January 2019–July 2020

- Figure 1: Reported COVID-19 Cases per Day in the United States, as of August 20, 2020

- Figure 2: Reported COVID-19 Cases August 13-19, 2020, by State, per 100,000 Population

- Figure 3: CDC Data on Higher Than Expected Weekly Mortality, January 1 through June 13, 2020

- Figure 4: Indicators for Areas of the Economy Supported by the Federal Pandemic Response, 2015-2019 and March 2020-July 2020

- Figure 5: National Weekly Initial Regular Unemployment Insurance Claims, January 2019–July 2020

- Figure 6: Real Personal Consumption Expenditures for Health Care, Seasonally Adjusted, June 2019–June 2020

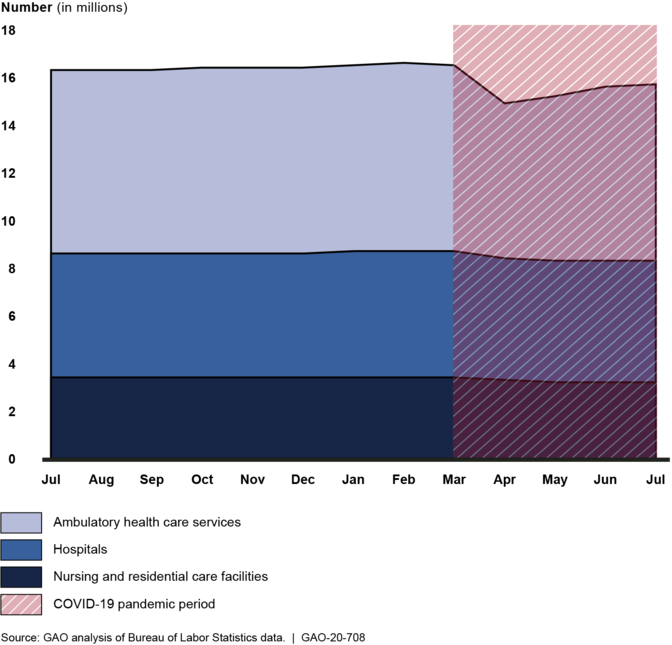

- Figure 7: Health Care Sector Employment, Seasonally Adjusted, July 2019–July 2020

Tables

- COVID-19 Relief Appropriations, Obligations, and Expenditures for Six Major Spending Areas, as of July 2020

- Table 1: Time Frames for Reporting and Certifying COVID-19 Relief Spending Data

- Table 2: COVID-19 Relief Appropriations, Obligations, and Expenditures for the Six Largest Spending Areas, as of May, June, and July 2020

Abbreviations

| Abbreviation | Description |

|---|---|

| BLS | Bureau of Labor Statistics |

| CDC | Centers for Disease Control and Prevention |

| COVID-19 | Coronavirus Disease 2019 |

| DATA Act | Digital Accountability and Transparency Act of 2014 |

| DHS | Department of Homeland Security |

| DOT | Department of Transportation |

| Federal Reserve | Board of Governors of the Federal Reserve System |

| FMAP | Federal Medical Assistance Percentage |

| HHS | Department of Health and Human Services |

| HS | Harmonized Schedule |

| ICU | intensive care unit |

| IRS | Internal Revenue Service |

| NCHS | National Center for Health Statistics |

| NHSN | National Healthcare Safety Network |

| OMB | Office of Management and Budget |

| PPP | Paycheck Protection Program |

| PUA | Pandemic Unemployment Assistance |

| SAO | Senior Accountable Official |

| SBA | Small Business Administration |

| SNAP | Supplemental Nutrition Assistance Program |

| SSA | Social Security Administration |

| Treasury | Department of the Treasury |

| UI | unemployment insurance |

End Notes

Contacts

A. Nicole Clowers

Managing Director, Health Care, clowersa@gao.gov , (202) 512-7114Congressional Relations

U.S. Government Accountability Office

441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

U.S. Government Accountability Office

441 G Street NW, Room 7149, Washington, DC 20548

Strategic Planning and External Liaison

U.S. Government Accountability Office

441 G Street NW, Room 7814, Washington, DC 20548

Obtaining Copies of GAO Reports and Testimony

Order by Phone

To Report Fraud, Waste, and Abuse in Federal Programs

Automated answering system: (800) 424-5454 or (202) 512-7470

Connect with GAO

GAO’s Mission

Copyright

(104461)