Revised September 16, 2022 to clarify that the Consolidated Appropriations Act, 2022 designated funds for 4,963 projects at the request of Members of Congress as noted in the Highlights page, Introduction, and Appendix V. This change is based on new information from the U.S. Department of Agriculture showing that four of its projects identified in the Consolidated Appropriations Act, 2022 and the accompanying joint explanatory statement were appropriated funds from other sources.

Highlights

What GAO Found

The Consolidated Appropriations Act, 2022 designated $9.1 billion for 4,963 projects at the request of Members of Congress. The act includes provisions designating amounts of funds for particular recipients, such as local governments and nonprofit organizations, to use for specific projects. These provisions are called “Congressionally Directed Spending” in the U.S. Senate and “Community Project Funding” in the House of Representatives. Eighteen federal agencies were appropriated funds for these provisions. The agencies are responsible for distributing these funds to designated recipients and monitoring the funds.

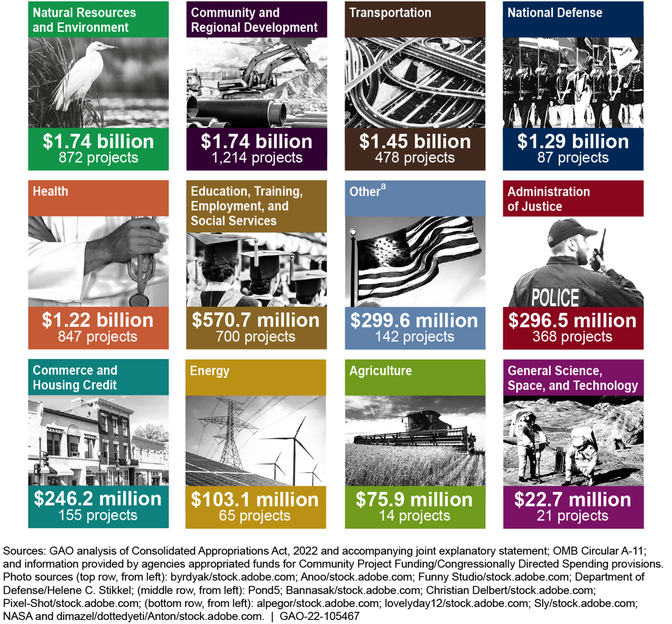

The funds are designated for several broad purposes, or budget functions, as shown in the figure below. Budget functions are broad categories into which all federal spending is placed.

Budget Functions for Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022

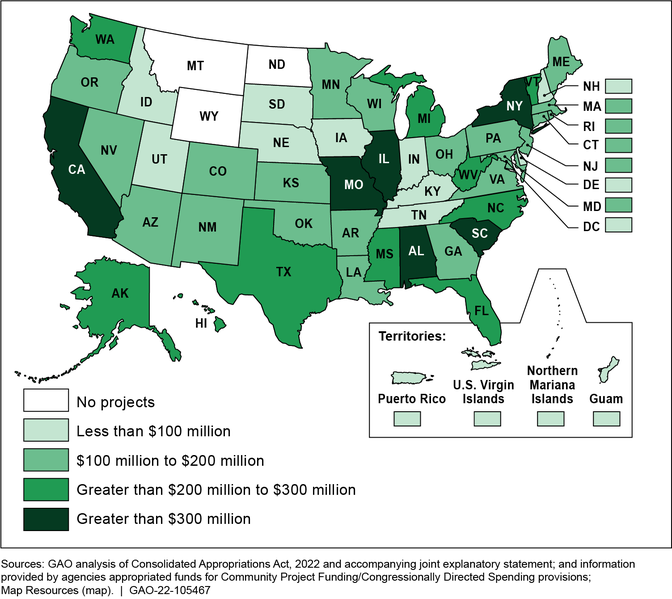

The designated recipients for about half (over 2,300) of the nearly 5,000 projects are tribal, state, territorial, or local governments. Recipients for the other projects are higher education and other nonprofit organizations or the federal government. Under the process for requesting these provisions, members could not request funds directly for for-profit entities. The projects are located in 47 states, four U.S. territories, and the District of Columbia (see figure below).

Distribution of Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022, by Location

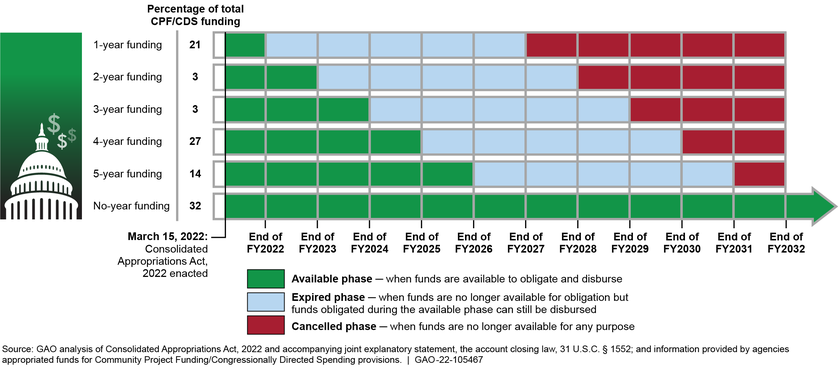

The Consolidated Appropriations Act, 2022 specifies a period of availability for each appropriation from which funds were designated. For example, 68 percent of the funds are available for agencies to obligate to recipients for a fixed period, ranging from 1 year to 5 years. After the funds’ period of availability expires, agencies generally will have 5 years to fully disburse the funds. The remaining 32 percent of funds are not time limited, so the funds are available for obligation until they are expended. In some instances, the timeline that agencies set for recipients to spend funds may be shorter than what is specified in law.

Why GAO Did This Study

During the fiscal year 2022 appropriations process, Members of Congress could request funds for specific projects.

Congress established new requirements to help ensure transparency around these requests. It also included a provision in the joint explanatory statement accompanying the Consolidated Appropriations Act, 2022, for GAO to review the agencies’ implementation of these provisions.

This report provides an overview of fiscal year 2022 Community Project Funding/Congressionally Directed Spending. Specifically, it provides information on (1) the agencies that were appropriated these funds; (2) the purpose of the funds, types of designated recipients, and location of projects; and (3) the period of availability of these funds.

This report also includes information on the scope and methodology for GAO’s reviews of the 18 agencies’ plans to distribute and monitor these funds. These 18 agency-specific reviews are available at https://www.gao.gov/tracking-funds.

GAO analyzed data from the Consolidated Appropriations Act, 2022 and accompanying joint explanatory statement to describe the agencies receiving funds and the purpose of the funds, and to provide information on the designated recipients and projects. To develop the 18 agency-specific reports, GAO also interviewed officials from these agencies using a standardized question set, among other things.

Introduction

Congressional Committees

The Consolidated Appropriations Act, 2022 designated $9.1 billion for 4,963 projects at the request of Members of Congress. The act includes specific provisions that designate an amount of funds for a particular recipient, such as a nonprofit organization or local government, to use for a specific project. These provisions are called “Congressionally Directed Spending” in the U.S. Senate and “Community Project Funding” in the House of Representatives.

The funds designated through these provisions are part of larger lump-sum appropriations that cover a number of programs, projects, or other items. Agencies that receive lump-sum appropriations for the purpose of executing a grant program might use a merit-based or competitive allocation process to distribute the funds. However, because these provisions designate a recipient or project, agencies do not use such processes for these funds. Rather, agencies are directed to distribute these funds to the recipients designated by the provisions.

In fiscal year 2022, the Senate and House limited funds designated through these provisions to 1 percent or less of total discretionary appropriations. They also included other constraints such as prohibiting members from designating funds directly for for-profit entities. The funds will be administered by 18 federal agencies and will go toward projects addressing a broad range of purposes such as education, health care, and transportation.

The joint explanatory statement accompanying the Consolidated Appropriations Act, 2022 includes a provision for us to review agencies’ implementation of Community Project Funding/Congressionally Directed Spending. This report provides an overview of fiscal year 2022 Community Project Funding/Congressionally Directed Spending. Specifically, it provides information on (1) the agencies that were appropriated these funds and the types of steps they may take to distribute and monitor the funds; (2) the purposes of the funds, types of designated recipients, and location of projects; and (3) the period of availability of these funds. This report also contains information on the scope and methodology of our agency-specific reviews of each agency’s plans to distribute and monitor these funds (see app. I). The resulting 18 agency-specific reports can be accessed on https://www.gao.gov/tracking-funds. For a list of these reports, see appendix II.[1]

To identify the agencies that were appropriated funds for these projects, we analyzed tables included in the joint explanatory statement accompanying the Consolidated Appropriations Act, 2022. To identify any steps agencies may follow when distributing and monitoring funds, we reviewed Office of Management and Budget (OMB) guidance and related documents.[2] We also reviewed written responses that OMB staff provided to our questions about OMB’s role in overseeing agency implementation of these provisions.

To describe the purposes and recipients of Community Project Funding/Congressionally Directed Spending as well as the locations of the projects, we analyzed data from the Consolidated Appropriations Act, 2022 and the accompanying joint explanatory statement. To characterize the purpose of the provisions, we matched the account name to the applicable OMB budget function.[3] We also categorized the designated recipients of these funds into four types: federal government; tribal, state, territorial, and local government; higher education organization; and other nonprofit organization.

To determine the period of availability of these funds, we reviewed the Consolidated Appropriations Act, 2022 and supplemental materials. For further details on the scope and methods of our review, see appendix III.

We conducted this performance audit from September 2021 to September 2022, in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives. Each of the 18 agency-specific reports will contain a separate quality assurance statement specific to the audit work conducted for those reports.

Background

Power of the Purse

The U.S. Constitution gives Congress the power to finance government operations through appropriations and to prescribe the conditions governing use of those appropriations.[4] This power is generally referred to as the congressional “power of the purse.”

In an appropriation, Congress specifies the purposes for which the funds may be used and the length of time the funds may remain available for these uses. Congress can also specify the maximum amount an agency may spend on particular elements of a program. In this manner, Congress may use its appropriations power to accomplish policy objectives and establish priorities among federal programs. Federal agencies, under presidential supervision, are to faithfully execute these policy objectives and priorities.

Community Project Funding/Congressionally Directed Spending in the Fiscal Year 2022 Appropriations Process

In the 117th Congress (2020-2021), the Senate and House Appropriations Committees adopted a process inviting Members of Congress to request funding for specific projects. The requests were reviewed by the Appropriations subcommittees of jurisdiction. Approved requests were included in the Consolidated Appropriations Act, 2022, and the accompanying joint explanatory statement, enacted in March 2022. As noted above, these requests are called Congressionally Directed Spending in the Senate and Community Project Funding in the House of Representatives.[5]

The Senate and House observed similar rules for these requests. The rules limited the amount of funds that could be approved through this process to 1 percent of total discretionary appropriations. In addition, Senate and House Appropriations Subcommittees limited the agencies and budget accounts for which Members could submit requests. For example, the Senate Homeland Security Appropriations subcommittee allowed Members to request funds for the Department of Homeland Security only for Pre-Disaster Mitigation and Emergency Operations Center grant programs administered by the Federal Emergency Management Agency.

In addition, both chambers prohibited requests to provide funds directly to for-profit entities, required Members to post their requests online, and required that Members certify that they had no financial interest in the projects for which they submitted requests. The House also set a maximum number of Community Project Funding requests at 10 per Member and required Members to provide evidence of community support for their requests.[6] (See app. IV for more details on the rules applied by the Senate and House).

Major Findings

IN THIS SECTION

Eighteen Agencies are Responsible for Distributing and Monitoring Fiscal Year 2022 Community Project Funding/Congressionally Directed Spending

Congress appropriated funds to 18 federal agencies for specific Community Project Funding/Congressionally Directed Spending provisions included in the Consolidated Appropriations Act, 2022 and its joint explanatory statement, as shown in table 1.

Note: In the joint explanatory statement for provisions under the Energy and Water Development Subcommittee, there are three dollar amounts listed for each provision: “Budget Request,” “Additional Amount,” and “Total Amount Provided.” The table containing these provisions noted that amounts shown over the President’s budget request level (the “Additional Amount” column) are considered Community Project Funding/Congressionally Directed Spending. Accordingly, we report the “Additional Amount” as the value of Community Project Funding/Congressionally Directed Spending. This practice affected the number and dollar value of provisions directed to the U.S. Army Corps of Engineers and the dollar value of provisions directed to the Department of the Interior’s Bureau of Reclamation.aThe U.S. Army Corps of Engineers is a part of the Army that has military and civilian responsibilities. The military programs provide engineering, construction, and environmental services for Department of Defense agencies. In this series of reports, the military programs are covered in our discussion of the Department of Defense, and the Civil Works programs are discussed separately under the U.S. Army Corps of Engineers.

Four federal agencies—the Departments of Defense, Health and Human Services, Housing and Urban Development, and Transportation—each received over $1 billion in funding for these provisions. For example, the Department of Housing and Urban Development received about $1.5 billion through more than 1,000 provisions.

| Key Appropriations Terms Apportionment. The action by which the Office of Management and Budget (OMB) distributes amounts available for obligation, in an appropriation or fund account. An apportionment divides amounts available for obligation by specific time periods (usually quarters), activities, projects, objects, or a combination thereof. This limits the amount of obligations that may be incurred. An apportionment may be further subdivided by an agency into allotments. Allotment. An authorization by either the agency head or another authorized employee, such as a Chief Financial Officer, to program offices, subunits, or subordinates to incur obligations within a specified amount. The amount allotted by an agency cannot exceed the amount apportioned by OMB. An allotment is part of an agency system of administrative control of funds whose purpose is to keep obligations and expenditures from exceeding apportionments. |

As shown in figure 1, after Congress appropriates funds, there are multiple steps before agencies can make funds available to recipients. Specifically, after Congress appropriates funds, OMB apportions or distributes the funds to agencies prior to obligation.[7] Agencies then allot the apportioned funds within the account to program offices or subunits, consistent with the agency’s funds control system. Once the funds have been allotted, the program office or subunit can begin the process of making the funds available to recipients. These controls are designed to ensure an agency does not obligate or expend in excess of an agency’s appropriation and that the funds can be identified and monitored through the agency’s funds control system in Treasury accounts appropriate to the agency’s program offices or subunits.

Generally, federal agencies must follow specific requirements when providing financial assistance to nonfederal entities. These requirements may also apply to financial assistance provided to entities identified as designated recipients of Community Project Funding/Congressionally Directed Spending in the Consolidated Appropriations Act, 2022. For example, agencies distributing and monitoring funds as grants typically follow the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards.[8] In addition, generally, agencies making procurements are required to follow the Federal Acquisition Regulation.[9]

The steps agencies take before distributing these funds may include (1) requiring designated recipients to register with the System for Award Management, through which entities generally must register to receive federal funds, and (2) checking the Department of the Treasury’s Do Not Pay working system, a data service agencies use to determine if an entity is barred from receiving federal awards.[10] In addition, agencies may require designated recipients to complete an application and submit information, such as project spending plans. As with all funds that pass through federal agencies, each agency’s Office of Inspector General may decide to review these funds or the programs through which the funds are provided.

OMB staff told us OMB does not expect to provide specific guidance to federal agencies for distributing and monitoring funds provided through Community Project Funding/Congressionally Directed Spending provisions. OMB staff said they expect federal agencies to distribute and monitor these funds in accordance with laws and agencies’ internal controls, just as they would for any other requirement in an appropriations act.

Purposes of Funds, Types of Recipients, and Location of Projects Vary Across Agencies

Purpose of These Funds

Community Project Funding/Congressionally Directed Spending covers a range of purposes. Specifically, across 18 agencies, the funds are designated for several broad purposes, or budget functions—broad categories into which all federal spending is placed—as shown in figure 2.[11] Some agencies are distributing funds for more than one budget function. For example, the Department of Health and Human Services is distributing funds that fall into the budget functions of Health and Education, Training, Employment, and Social Services.

Figure 2: Budget Functions for Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022

The five budget functions with the largest amount of funding are:

- Natural Resources and Environment ($1.74 billion), for projects such as improvements to infrastructure along waterways, flood mitigation efforts, and the replacement of water and wastewater facilities;

- Community and Regional Development ($1.74 billion), for projects such as efforts to prevent homelessness, expand affordable housing, and improve community infrastructure;

- Transportation ($1.45 billion), for projects such as highway improvements and expansion, airport renovations, and replacement of buses;

- National Defense ($1.29 billion), for military construction projects, such as a child development center on an Air Force base, and research, test, development, and evaluation projects, such as studies on cybersecurity; and

- Health ($1.22 billion), for projects such as upgrades to facilities and equipment for health-related facilities and support for mental and behavioral health programs.

Types of Designated Recipients

We categorized designated recipients of Community Project Funding/Congressionally Directed Spending into the following categories: federal government; tribal, state, territorial, or local governments; higher education organizations such as universities and colleges; and other nonprofit organizations. Members could not request funds directly for for-profit entities. Most recipients are tribal, state, territorial, or local governments, as shown in table 2.

In some cases, the designated recipient is the federal government, such as the U.S. Army Corps of Engineers or the Department of the Interior. For example, the U.S. Army Corps of Engineers is designated to receive funds to undertake specific dam and dredging projects.

Location of Projects

Community Project Funding/Congressionally Directed Spending was designated for projects in 47 states, the District of Columbia, and four U.S. territories (see fig. 3). The number of projects and amount of funding varies across locations, with projects in California and Alabama receiving the largest amount of funding. For example, about $774 million was designated for almost 500 projects in California, and about $590 million was designated for 38 projects in Alabama. About $30 million was designated for 33 projects in the four territories (Guam, Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands) and the District of Columbia (see app. V for more details).

Figure 3: Distribution of Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022, by Location

Period of Availability for These Funds Varies by Budget Account

When Congress appropriates funds, it specifies the period during which the funds are available to the agency to incur new obligations. When Congress appropriated funds in the Consolidated Appropriations Act, 2022 for Community Project Funding/Congressionally Directed Spending, it specified a time period applicable to each appropriation from which funds were designated to specific recipients. Sixty-eight percent of the funds’ time availability are for a fixed period ranging from 1 year to 5 years, while the remaining 32 percent are not time limited—meaning funds will be available until they are expended. Appropriated funds that are available until they are expended are generally known as no-year funds.

An agency may only obligate funds during the period in which they are available. After the period of availability, the funds are said to be expired. Although expired funds remain available to the agency for expenditure, they are not available for the agency to enter into new obligations. The agency may use expired funds to record, adjust, and liquidate prior obligations that were properly incurred. Specifically:

- Expired funds remain available to an agency to make payments to recipients as they incur costs associated with the designated project.

- Although appropriated funds generally remain expired for 5 years after the period of availability ends, an agency may require recipients to incur costs and receive payments within a shorter time period.

- Once the expired period ends—which is generally 5 years from the end of the period of availability—funds are considered cancelled. The agency can no longer use them to either incur new obligations or to make payments to recipients.[12]

Agencies will have until at least the end of fiscal year 2027 to expend funds made available for Community Project Funding/Congressionally Directed Spending provisions through the Consolidated Appropriations Act, 2022 (see fig. 4).

Figure 4: Appropriations Life Cycle for Funding Provided through Community Project Funding/Congressionally Directed Spending (CPF/CDS) Provisions in the Consolidated Appropriations Act, 2022

Because of these rules, it is important that an agency ensures it properly incurs an obligation before the funds expire. An agency may record an obligation only when an obligational event occurs.[13] The timing of the event depends on the nature of the activity the agency undertakes:

- Contracts. The obligational event occurs when an agency enters into a binding agreement with the contractor.

- Work performed by agency employees. The agency incurs obligations for employees’ salaries at the time they perform the work.

- Grants. The time when an obligational event occurs depends on the nature of the grant. In some situations, the obligational event occurs when the agency awards a grant. In other situations, the obligational event may be outside the agency’s control. For example, in some circumstances the obligational event occurs immediately when the appropriation for the grant becomes law. For further discussion of when obligational events occur, see appendix VI.

Agency Comments

We provided a draft of this report to OMB and the 18 agencies that were appropriated funds through Community Project Funding/Congressionally Directed Spending provisions for review and comment. We received technical comments from OMB, the Department of Commerce, the Department of Energy, the Department of Health and Human Services, and the Department of Labor that we incorporated, as appropriate. The remaining 14 agencies informed us they had no comments or did not provide comments.

We are sending copies of this report to the appropriate congressional committees, OMB, the 18 agencies that were appropriated funds through Community Project Funding/Congressionally Directed Spending provisions, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact Allison Bawden at (202) 512-3841 or bawdena@gao.gov or Heather Krause at (202) 512-2834 or krauseh@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix VII.

Allison Bawden

Director, Natural Resources and Environment

Heather Krause

Director, Physical Infrastructure

Congressional Addressees

The Honorable Patrick Leahy

Chairman

The Honorable Richard Shelby

Vice Chairman

Committee on Appropriations

United States Senate

The Honorable Chris Van Hollen

Chair

The Honorable Cindy Hyde-Smith

Ranking Member

Subcommittee on Financial Services and General Government

Committee on Appropriations

United States Senate

The Honorable Jack Reed

Chair

The Honorable Mike Braun

Ranking Member

Subcommittee on Legislative Branch

Committee on Appropriations

United States Senate

The Honorable Rosa DeLauro

Chair

The Honorable Kay Granger

Ranking Member

Committee on Appropriations

House of Representatives

The Honorable Mike Quigley

Chairman

The Honorable Steve Womack

Ranking Member

Subcommittee on Financial Services and General Government

Committee on Appropriations

House of Representatives

The Honorable Tim Ryan

Chairman

The Honorable Jaime Herrera Beutler

Ranking Member

Subcommittee on Legislative Branch

Committee on Appropriations

House of Representatives

Appendixes

IN THIS SECTION

- Appendix I: Objectives, Scope, and Methodology for Agency-Specific Reports

- Appendix II: List of Agency-Specific Reports

- Appendix III: Objectives, Scope, and Methodology

- Appendix IV: Senate and House Rules on Community Project Funding/Congressionally Directed Spending Requests

- Appendix V: Number and Amount of Community Project Funding/Congressionally Directed Spending Provisions, by Location

- Appendix VI: Obligational Events for Grants

- Appendix VII: GAO Contacts and Staff Acknowledgments

Appendix I: Objectives, Scope, and Methodology for Agency-Specific Reports

Bookmark:This appendix describes the scope and methodology for our reviews of 18 agencies’ plans to distribute and monitor the Community Project Funding/Congressionally Directed Spending appropriated in the Consolidated Appropriations Act, 2022. For these reviews, we (1) describe the intended uses and designated recipients of the funds; (2) examine how agencies intend to ensure recipients of these funds are ready to receive federal funds and that the funds are spent properly; (3) describe when agencies expect recipients will have access to these funds and when the funds might be spent; and (4) describe risks and challenges the agency may face in distributing and monitoring these funds. The resulting agency-specific reports can be accessed on https://www.gao.gov/tracking-funds.

The 18 agencies covered by these reviews are:

- U.S. Army Corps of Engineers[14]

- U.S. Department of Agriculture

- Department of Commerce

- Department of Defense

- Department of Education

- Department of Energy

- Department of Health and Human Services

- Department of Homeland Security

- Department of Housing and Urban Development

- Department of the Interior

- Department of Justice

- Department of Labor

- Department of Transportation

- Environmental Protection Agency

- General Services Administration

- National Aeronautics and Space Administration

- National Archives and Records Administration

- Small Business Administration

For the 18 agency-specific reports, we augmented our analysis described in appendix III with structured interviews of agency officials responsible for distributing and monitoring the funds. The number of interviews with each agency depended on the number of subunits within an agency responsible for distributing and monitoring the funds. We used the same standardized set of questions for all interviews. We developed these questions based on our objectives. In January and February 2022, we pretested these questions with officials from three of the 18 federal agencies covered in our review. We conducted the interviews with officials from the 18 agencies between April 2022 and June 2022. In addition, between July 2022 and August 2022, we gave the agencies the opportunity to review and update the information they had provided us.

To examine how the agencies intend to ensure designated recipients are ready to receive funds and able to use them, we asked agency officials questions on the following topics:

- steps agencies plan to take to ensure recipients are ready to receive federal funds, such as confirming that the recipients are registered in the System for Award Management;[15]

- agencies’ plans to assess recipients’ capacity—including financial, human capital, or organizational capacity—to spend the funds; and

- steps agencies would take if they found a recipient was unable to receive or spend the funds.

To describe how agencies plan to ensure funds are spent properly, we asked questions on the following topics:

- who within the agency is responsible for monitoring funds;

- agencies’ plans to monitor recipients’ use of funds, including the information they plan to collect (such as recipients’ spend plans);

- agencies’ use of the Department of the Treasury’s Do Not Pay working system[16] and other systems; and

- steps agencies plan to take to prevent fraud, waste, or abuse of funds.

To describe when agencies expect recipients to have access to the funds and the expected period for spending those funds, we asked agencies questions about when they expected to make funds available to recipients and the factors that may affect these plans.

We also reviewed reports by GAO and the agencies’ Offices of Inspector General to identify known issues and risks the agencies faced with distributing and monitoring these funds. In addition, we contacted the Offices of Inspector General for each of the 18 federal agencies covered in our review to determine their plans to review these funds.

We conducted these performance audits from March 2022 to October 2022, in accordance with generally accepted government auditing standards. An attestation that each of the 18 performance audits was conducted in accordance with generally accepted government auditing standards is included in each agency-specific report.

Appendix II: List of Agency-Specific Reports

Bookmark:- Tracking the Funds: Specific Fiscal Year 2022 Provisions for U.S. Army Corps of Engineers. GAO-22-105919.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for U.S. Department of Agriculture. GAO-23-105913.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Commerce. GAO-22-105911.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Defense. GAO-23-105914.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Education. GAO-22-105909.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Energy. GAO-22-105918.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Health and Human Services. GAO-23-105897.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Homeland Security. GAO-22-105899.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Housing and Urban Development. GAO-23-105902.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of the Interior. GAO-22-105904.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Justice. GAO-23-105893.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Labor. GAO-22-105901.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Department of Transportation. GAO-22-105892.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Environmental Protection Agency. GAO-22-105903.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for General Services Administration. GAO-22-105896.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for National Aeronautics and Space Administration. GAO-22-105921.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for National Archives and Records Administration. GAO-22-105883.

- Tracking the Funds: Specific Fiscal Year 2022 Provisions for Small Business Administration. GAO-23-105907.

Appendix III: Objectives, Scope, and Methodology

Bookmark:This report provides an overview of the fiscal year 2022 Community Project Funding/ Congressionally Directed Spending. Specifically, it provides information on (1) the agencies that were appropriated these funds and the types of steps they may take to distribute and monitor the funds; (2) the purposes of the funds, types of designated recipients, and location of projects; and (3) the period of availability of these funds.

To describe the fiscal year 2022 appropriations process, we reviewed the Senate and House Appropriations Committees’ websites for information on the Congressionally Directed Spending and Community Project Funding processes, rules, and deadlines. We also reviewed Principles of Federal Appropriations Law for definitions of terms and the sequence of the appropriations process.[17]

To identify the agencies appropriated these funds, we analyzed tables included in the joint explanatory statement accompanying the Consolidated Appropriations Act, 2022. These tables list each Community Project Funding/Congressionally Directed Spending provision and represent the complete list of these provisions.

We then used this information to create a dataset. In addition to the information gathered from the joint explanatory statement, the dataset reflects information we collected through interviews with cognizant officials from the relevant agencies about how they intended to administer the funds. We used the joint explanatory statement to determine the following data fields: subcommittee, agency, subunit, account, project, recipient, location, amount, and requester. If information for one of these fields was not in the joint explanatory statement, we inferred it from other information. For example, if the location field was not included for a particular provision, we used the description of the recipient, project, or congressional requester to determine the state. We used information we obtained through the agency interviews and supplemental documents agency officials provided us to determine the subunit, when it was not included in the joint explanatory statement, and to create an additional data field: agency-implemented budget account. This field represents the budget account associated with the relevant projects, as reported by the agency.

In the joint explanatory statement for provisions under the Energy and Water Development Subcommittee, there are three columns which may list dollar amounts for each provision: “Budget Request,” “Additional Amount,” and “Total Amount Provided.”[18] The table containing these Energy and Water Development subcommittee provisions noted that amounts shown over the President’s budget request level (the “Additional Amount” column) are considered Community Project Funding/Congressionally Directed Spending. In accordance with this, we used the “Additional Amount” as the value of Community Project Funding/Congressionally Directed Spending. This practice affected the number and dollar value of provisions directed to the U.S. Army Corps of Engineers and the dollar value of provisions directed to the Department of the Interior’s Bureau of Reclamation.

To identify any steps agencies must follow when distributing and monitoring funds, we reviewed Office of Management and Budget (OMB) guidance and related documents. We also reviewed written responses that OMB staff provided to our questions about OMB’s role in overseeing agency implementation of these provisions.

To describe the purposes of the funds, types of designated recipients, and location of projects, we analyzed the dataset described above. Specifically, to describe the broad purpose of these funds, we matched the accounts for the provisions listed in the joint explanatory statement to budget accounts from the Budget Appendix volume of the President’s budget published by OMB. We used the budget account number to determine the applicable budget function from OMB Circular No. A-11 for each provision. Budget functions are broad categories of spending into which all federal spending is divided, regardless of the federal agency that oversees the individual federal program.

To help describe the type of designated recipients of these funds, we categorized them into four categories: federal government; tribal, state, territorial, or local governments; higher education organizations; and other nonprofit organizations. These categories are based on categories used in USAspending.gov, the official open-data source of federal spending information. The Senate and House Appropriations Committees’ process for requesting these provisions specified that a designated recipient cannot be a for-profit entity. We did not assess compliance with this requirement. Thus, for the purposes of this report, we assigned all recipients that are not federal government; tribal, state, territorial, and local government; or higher education organizations to the “other nonprofit organization” category.

We categorized recipients into these four types based on (1) the recipient’s name and project description and (2) information provided by the federal agency that was appropriated funds to distribute to these recipients. In cases where the accurate categorization of a recipient was still not clear, we used (1) information on the recipient included in the initial Community Project Funding/Congressionally Directed Spending request submitted by a Member of Congress, and (2) information about the recipient that we gathered through a review of its website.

To determine the period of availability of these funds, we identified the period of availability for each applicable provision in the Consolidated Appropriations Act, 2022. To determine the amount of each budget account designated for Community Project Funding/Congressionally Directed Spending, we identified the total amount of funding appropriated in fiscal year 2022 for each account in the Consolidated Appropriations Act, 2022 and reviewed the provisions in the accompanying joint explanatory statement.

We provided a subset of the dataset described above to each of the applicable agencies to confirm accuracy. Specifically, we provided each of the 18 agencies with all of the data fields described above for the Community Project Funding/Congressionally Directed Spending provisions for which they are responsible. We asked the agencies to verify the accuracy of the data and provide information on how the agency was implementing these provisions.

As part of this review, we did not assess the merits of the projects funded in the Community Project Funding/Congressionally Directed Spending provisions. We also did not assess the ability of specific recipients to carry out the projects described in the Consolidated Appropriations Act, 2022.

We conducted this performance audit from September 2021 to September 2022 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Appendix IV: Senate and House Rules on Community Project Funding/Congressionally Directed Spending Requests

Bookmark:— = No similar requirement adopted by the Senate

Note: Individual committees and subcommittees have their own additional requirements beyond chamber-level rules.

Appendix V: Number and Amount of Community Project Funding/Congressionally Directed Spending Provisions, by Location

Bookmark:Note: Community Project Funding/Congressionally Directed Spending provisions include several projects that will affect more than one state, such as water management projects along a river. Appropriated funds for these multi-state projects are over $100 million and affect 31 states. These projects are not included in the individual state totals but are included in the last row of the table. We identified the location of these projects using the location field in the Community Project Funding/Congressionally Directed Spending tables included in the joint explanatory statement accompanying the Consolidated Appropriations Act, 2022. When that field was not present, we used location information provided in the recipient and/or project fields to identify a project’s location.

Appendix VI: Obligational Events for Grants

Bookmark:An agency may record an obligation only when a proper event, or obligational event, occurs.[19] For grants, the time when an obligational event occurs varies depending on the nature of the grant.

In some situations, the obligational event occurs when the agency takes discretionary action to award a grant. The evidence of this obligational event may take the form of a letter of commitment or an agency’s written approval of a grant application. In such cases, the obligational event arises only after the agency affirmatively takes action to award the grant.

For other grants, the obligational event may occur based on actions outside the agency’s control. For example, in some circumstances the obligational event occurs immediately when the appropriation for the grant becomes law. When this occurs, the agency must still record an accounting charge against the appropriation in its obligational records. However, this charge is a reflection of—not the creation of—the obligation and usually is generated subsequent to the time the actual obligation arose. When an obligational event occurs for a grant depends on the underlying legal authorities for the specific grant at issue.

The timing has practical implications for both agencies and grantees. If the obligational event occurs when the agency takes discretionary action to award a grant, the agency must take this action before the appropriation expires. Otherwise, the appropriation will no longer be available to award funds. In contrast, if the obligational event occurs immediately when the appropriation becomes law, the amount remains obligated even after the appropriation’s period of availability for new obligations expires. The agency would thus remain legally bound to pay the amount to the grantee.

If an obligational event arises when the appropriation for the grant is enacted, the appropriation’s period of availability for the agency to incur new obligations may reflect Congress’s expectations for the general time frames for execution of the larger appropriation from which the grant is derived. An appropriation’s period of availability will also affect the manner in which the agency carries out the appropriation, as the agency must ensure it takes discretionary actions to award contracts, employ salaried workers, and award discretionary grants before the appropriation expires. However, if an obligational event arises when the appropriation for the grant is enacted, a recipient will not be barred from receiving grant amounts solely because the appropriation is no longer available for new obligations.

For example, a law established a grant program and set a formula that determined the amount due to each recipient. Before a grantee could receive a payment, it needed to file with the administering agency a certification that it met particular requirements. We concluded that the grant amounts were obligated upon enactment of the appropriation for the grant program. Accordingly, a grantee could receive its payment even if it filed the necessary certification after the appropriation was no longer available for new obligations.[20]

We have not determined when the obligational event would arise for each specific grant action that agencies may take for funds designated through Community Project Funding/Congressionally Directed Spending provisions in the Consolidated Appropriations Act, 2022. However, the point at which the obligational event arises will affect the time period during which agencies must act to administer a particular grant. Where an obligational event arose on the enactment of the Consolidated Appropriations Act, 2022, the appropriation’s period of availability for new obligations may not impose a legally binding deadline on when the agency must take action to provide the amounts to a grantee for its use.

In addition, some of the amounts appropriated for Community Project Funding/Congressionally Directed Spending are available without fiscal year limitation. These amounts remain available, with no fixed time limit, to agencies to incur new obligations. In these cases, an agency might face no legally binding deadline to administer grants for which the obligational event arose at the time of appropriation. Moreover, it also may face no legally binding deadline to administer funding provided through other mechanisms, such as the awarding of a contract or the payment of salaries to federal employees.

Appendix VII: GAO Contacts and Staff Acknowledgments

Bookmark:GAO Contacts

Allison Bawden, (202) 512-3841 or bawdena@gao.gov

Heather Krause, (202) 512-2834 or krauseh@gao.gov

Staff Acknowledgments

In addition to the contacts named above, Tom McCabe (Assistant Director), Sarah Arnett (Analyst in Charge), Tara Congdon, Ann Marie Cortez, Lawrence Crockett, Jr., John Delicath, Skip McClinton, Omari Norman, Cynthia Norris, and Dan Royer made key contributions to this report. Additional assistance was provided by Jeff Arkin, Susan Irving, Ron La Due Lake, Gabriel Nelson, Anna Maria Ortiz, Rebecca Shea, Dawn Simpson, and Walter Vance.

References

Figures

- Budget Functions for Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022

- Distribution of Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022, by Location

- Figure 1: Funding Execution: From Congress to Designated Recipient

- Figure 2: Budget Functions for Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022

- Figure 3: Distribution of Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022, by Location

- Figure 4: Appropriations Life Cycle for Funding Provided through Community Project Funding/Congressionally Directed Spending (CPF/CDS) Provisions in the Consolidated Appropriations Act, 2022

Tables

- Table 1: Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022, by Federal Agency

- Table 2: Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022, by Type of Recipient

- Table 3: Requirements for Members Requesting Community Project Funding/Congressionally Directed Spending

- Table 4: Number of Projects and Funding Amounts Designated for Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2022, by Location of Project

End Notes

Contacts

Allison Bawden

Director, Natural Resources and Environment, bawdena@gao.gov, (202) 512-3841Heather Krause

Director, Physical Infrastructure, krauseh@gao.gov, (202) 512-2834Congressional Relations

U.S. Government Accountability Office

441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

U.S. Government Accountability Office

441 G Street NW, Room 7149, Washington, DC 20548

Strategic Planning and External Liaison

U.S. Government Accountability Office

441 G Street NW, Room 7814, Washington, DC 20548

Obtaining Copies of GAO Reports and Testimony

Order by Phone

To Report Fraud, Waste, and Abuse in Federal Programs

Automated answering system: (800) 424-5454 or (202) 512-7470

Connect with GAO

GAO’s Mission

Copyright

(105467)