Highlights

What GAO Found

- Congress increased the passenger security fee from a prior boarding payment structure to a flat fee, resulting in increased revenues of about $12.9 billion over a 10-year period beginning in 2014 through 2023.

- The Department of Health and Human Services changed its spending limit determinations for Medicaid demonstrations, resulting in federal savings of approximately $120.8 billion from 2016 through 2020, with tens of billions of additional savings to potentially accrue in the future.

- The Department of Energy may be able to reduce certain risks by adopting alternative approaches to treating a portion of its low-activity radioactive waste, saving tens of billions of dollars.

- Enhanced Internal Revenue Service enforcement and service capabilities can help reduce the gap between taxes owed and paid by collecting billions in tax revenue and facilitating voluntary compliance.

- The Department of Veterans Affairs could manage fragmentation and improve access to long-term care for veterans by implementing a more consistent approach to this care.

Why GAO Did This Study

Introduction

| GAO’s online Action Tracker GAO's Action Tracker, a publicly accessible website, allows Congress, executive branch agencies, and the public to track the government’s progress in addressing the issues we have identified. GAO’s Action Tracker includes a downloadable spreadsheet containing all actions. Areas and actions in the spreadsheet can be sorted and filtered by the year identified, mission, area name, implementation status, and implementing entities (Congress or executive branch agencies). The spreadsheet additionally notes which actions are also GAO priority recommendations—those recommendations GAO believes warrant priority attention from the heads of departments or agencies. With the release of this report, GAO is concurrently releasing the latest updates to these resources. Source: GAO. | GAO-21-104648 |

Major Findings

IN THIS SECTION

Congress and Executive Branch Agencies Continue to Address Actions Identified over the Last 11 Years across the Federal Government, Resulting in Significant Benefits

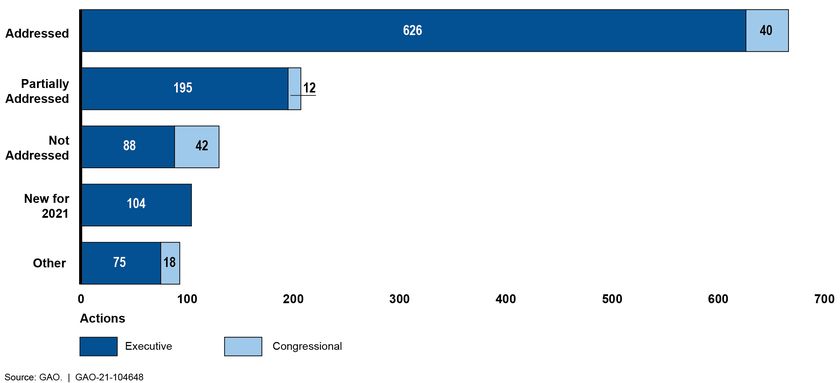

Notes: Due to rounding, the total percentages may not add up to exactly 100 percent.

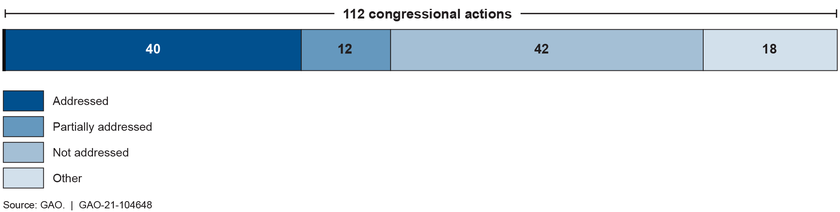

In our 2021 annual report, there were 112 new, open actions introduced, seven of which were updated for this report and one of which was introduced as partially addressed.

aIn assessing actions suggested for Congress, GAO applied the following criteria: “addressed” means relevant legislation has been enacted and addresses all aspects of the action needed; “partially addressed” means a relevant bill has passed a committee, the House of Representatives, or the Senate during the current congressional session, or relevant legislation has been enacted but only addressed part of the action needed; and “not addressed” means a bill may have been introduced but did not pass out of a committee, or no relevant legislation has been introduced. Actions suggested for Congress may also move to “addressed” or “partially addressed,” with or without relevant legislation, if an executive branch agency takes steps that address all or part of the action needed. At the beginning of a new congressional session, GAO reapplies the criteria. As a result, the status of an action may move from partially addressed to not addressed if relevant legislation is not reintroduced from the prior congressional session.

bIn assessing actions suggested for the executive branch, GAO applied the following criteria: “addressed” means implementation of the action needed has been completed; “partially addressed” means the action needed is in development or started but not yet completed; and “not addressed” means the administration, the agencies, or both have made minimal or no progress toward implementing the action needed.

cOf the 93 “other” actions, 50 are categorized as “consolidated or other” and 43 as “closed-not addressed.” GAO no longer assesses actions categorized as “closed-not addressed” or “consolidated or other.” In most cases, “consolidated or other” actions were replaced or subsumed by new actions based on additional audit work or other relevant information. Actions categorized as “closed-not addressed” is when the action is no longer relevant due to changing circumstances. In 2021, two executive branch actions were consolidated, and one congressional action was established as a result of consolidation.

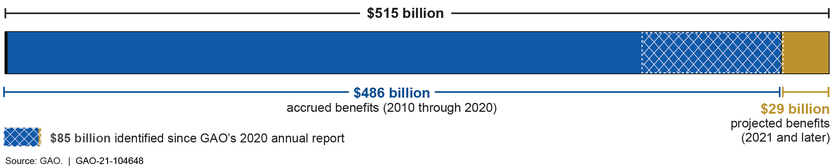

Actions Taken by Congress and Executive Branch Agencies Led to Hundreds of Billions in Financial Benefits

Figure 3: Total Reported Financial Benefits of $515 Billion, as of August 2021

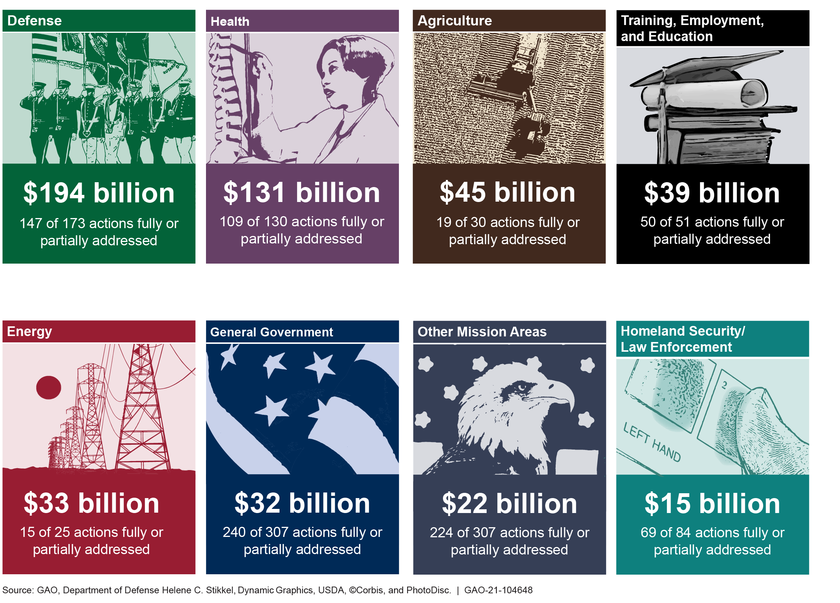

Figure 4: Summary of 11 Years of Benefits Achieved by Mission, as of August 2021

| Area name (annual report year/area number links to Action Tracker) | Actions taken | Financial benefit |

|---|---|---|

| Weapon Systems Acquisition Programs (2011-38) | Congress passed the Weapon Systems Acquisition Reform Act of 2009, which implemented a number of GAO’s recommendations for how the Department of Defense (DOD) develops and acquires weapon systems. GAO highlighted the need for additional action in this area in its 2011 report. Since then, DOD has followed more best practices for these acquisitions, which greatly reduced cost growth for weapons systems over time.a | Savings of approximately $180.0 billion from 2011 through 2017, according to GAO analysis. DOD concurred with GAO’s methodology. |

| Medicaid Demonstration Waivers (2014-21) | The Department of Health and Human Services changed processes to curtail some problematic methods of determining budget neutrality, restricted the amount of unspent funds states can accrue and carry forward to expand demonstrations. The department could further reduce federal spending by addressing other problematic methods. | Federal savings of approximately $120.8 billion from 2016 through 2020, and tens of billions of additional savings could potentially accrue from 2020-2022, according to agency and GAO estimates. |

| Farm Program Payments (2011-35) | Congress passed the Agricultural Act of 2014, which eliminated direct payments to farmers, thereby eliminating a duplicative payments structure that had not been intended to be permanent.b | Savings of approximately $44.5 billion from fiscal year 2015 through fiscal year 2023, of which about $29.7 billion has accrued and $14.8 billion is expected to accrue in fiscal year 2021 or later, according to the Congressional Budget Office (CBO). |

| Higher Education Assistance (2013-16) | The Department of Education adjusted borrower incomes for inflation in its Direct Loan program reestimates for the fiscal year 2017 Agency Financial Report. GAO previously reported that this step resulted in a downward reestimate of income-driven repayment plan costs for loans issued through the 2016 cohort totaling $17.5 billion. Education also estimated that Direct Loan subsidy costs for new loans issued from the fiscal year 2017 through 2019 cohorts were a net present value of $12 billion lower than they would have been without this correction. | Savings of approximately $39 billion through 2019, with additional savings in 2021, according to agency estimates. |

| Passenger Aviation Security Fees (2012-48) | Congress passed the Bipartisan Budget Act of 2013, which modified the passenger security fee from its prior per enplanement structure ($2.50 per enplanement with a maximum one-way-trip fee of $5.00) to a structure that increases the passenger security fee to a flat $5.60 per one-way-trip.c | Increased revenue of about $12.9 billion in fee collections over a 10-year period beginning in fiscal year 2014 and continuing through fiscal year 2023, of which $9 billion has accrued and $3.9 billion is expected to accrue in fiscal year 2021 or later, according to CBO and other estimates. |

| Agencies’ Use of Strategic Sourcing (2013-23) | The Department of Veterans Affairs evaluated strategic sourcing opportunities, set goals, tracked metrics, and ultimately procured a larger share of goods and services–including information technology (IT)–using contracts aligned with strategic sourcing principles. | The Department of Veterans Affairs realized cost avoidance of about $10.8 billion from fiscal years 2013 through 2017, according to GAO estimates. Veterans Affairs concurred with GAO’s methodology. Billions more of savings are possible across the federal government, according to OMB estimates based on 2017 to 2019 data. |

| Tax Policies and Enforcement (2015-17) | Congress amended the audit procedures applicable to certain large partnerships to require that they pay audit adjustments at the partnership level.d | Increased revenue of about $9.3 billion from fiscal years 2019 to 2025, of which about $2.7 billion has accrued and $6.6 billion is expected to accrue in fiscal year 2021 or later, according to the Joint Committee on Taxation. Hundreds of millions in additional savings could potentially accrue by addressing other actions in this area, according to GAO estimates. |

| Real Estate-Owned Properties (2014-18) | The Department of Housing and Urban Development made improvements to increase the recoveries from disposing of properties it receives when loans default, such as by selling these loans and increasing property inspections and oversight of contractors disposing of these properties. | Savings of about $5.5 billion from fiscal years 2013 through 2018, according to agency estimates. |

| Children’s Disability Reviews (2015-21) | The Social Security Administration conducted additional continuing disability reviews in fiscal years 2013 through 2015 to ensure that only child Supplemental Security Income recipients who are eligible for benefits receive them, thereby preventing potentially costly overpayments. | Savings of approximately $5.4 billion from fiscal year 2013 through fiscal year 2015, according to agency estimates. Billions in additional savings could potentially accrue, according to agency estimates. |

| Federal Payments for Hospital Uncompensated Care (2017-25) | Centers for Medicare & Medicaid Services announced in a final rule that the agency would begin basing Medicare Uncompensated Care payments on hospital uncompensated care costs.e | Savings of about $4.8 billion in fiscal years 2018 through 2020 with potential for billions in fiscal year 2021. Centers for Medicare & Medicaid Services concurred with GAO’s estimates. Billions in potential savings could accrue by addressing an additional action in this area, according to GAO estimates. |

| Overseas Military Presence (2011-36) | The Department of Defense has conducted a comprehensive reassessment of its overseas presence in Europe and the Pacific, including the costs and benefits of various alternatives. | Savings of approximately $2.3 billion from fiscal year 2013 through fiscal year 2017, according to agency estimates. Millions in additional savings could potentially accrue annually, according to agency estimates. |

| Strategic Petroleum Reserve (2015-15) | The Department of Energy completed a long-term strategic review of the reserve in August 2016, allowing it to carry out oil sales from the Strategic Petroleum Reserve that Congress had authorized.f | Savings of approximately $2 billion from fiscal year 2017 through fiscal year 2019, according to agency estimates. Billions in additional savings could potentially accrue from fiscal years 2020 through 2025, according to CBO. |

Note: The estimates in this report are from a range of sources, including GAO, executive branch agencies, CBO, and the Joint Committee on Taxation. Some estimates have been updated since GAO’s 2020 report to reflect more recent analysis.

aPub. L. No. 111-23, 123 Stat. 1704 (May 22, 2009).

bPub. L. No. 113-79, § 1101, 128 Stat. 649, 658 (Feb. 7, 2014).

cPub. L. No. 113-67, § 601(b), 127 Stat. 1165, 1187 (Dec. 26, 2013).

dBipartisan Budget Act of 2015, Pub. L. No. 114-74, § 1101, 129 Stat. 584, 625–638 (Nov. 2, 2015).

e82 Fed. Reg. 37990, 38000 (Aug. 14, 2017).

fPub. L. No. 114-74, § 404, 129 Stat. 584, 590 (Nov. 2, 2015).

Other Benefits Resulting from Actions Taken by Congress and Executive Branch Agencies

- National Strategy for Transportation Security (2020-14). The nation’s transportation systems facilitate over 5 trillion miles of passenger travel annually while moving billions of tons of cargo. The scale and scope of these systems make them targets for terrorist attacks. The Department of Homeland Security (DHS) is required to work jointly with the Department of Transportation (DOT) to develop, revise, and update a biennial National Strategy for Transportation Security that governs federal transportation security efforts.[6]In 2019, we found that the 2018 strategy generally does not guide federal efforts due in part to its unclear alignment with several strategies that also inform federal transportation security efforts. We recommended that DHS, in consultation with DOT, communicate to key stakeholders how the strategy aligns with related strategies to guide federal efforts as it develops future iterations of the national strategy.In response, DHS updated the strategy to guide federal security efforts and agency roles and responsibilities. By communicating how the strategy aligns with related strategies to guide efforts, the department and other federal stakeholders are better positioned to use the national strategy as part of a whole-of-government approach to preventing terrorist attacks.

- USDA’s Nutrition Education Efforts (2020-18). The U.S. Department of Agriculture (USDA) administers five key programs that provide nutrition education and has information on participation, expenditures, and effectiveness for most of these programs.In 2019, we found that USDA did not have a formal coordination mechanism for its nutrition education efforts and did not fully leverage the department’s nutrition expertise. We recommended that USDA develop a formal mechanism for better coordinating fragmented nutrition education efforts across the department to maximize program reach and impact and avoid potential duplication of effort.In response, in July 2020, USDA established a nutrition promotion working group coordinated by USDA’s Office of the Chief Scientist and made up of representatives from each USDA mission area conducting nutrition promotion or related research and evaluation. These efforts to better coordinate nutrition education efforts across the department will help USDA to maximize program reach and impact and avoid potentially wasteful duplication of effort.

- Security of Federal Facilities (2016-09). The Federal Protective Service (FPS) and the General Services Administration (GSA) share responsibility for protecting federal facilities. FPS is primarily responsible for protecting federal employees and visitors in federal facilities held or leased by GSA.In 2015, we found that while each agency had some individual policies for collaboration, the two agencies had made limited progress in agreeing on several key practices to enhance the agencies’ ability to protect federal facilities and to improve day-to-day operations at the regional level. We recommended that FPS and GSA establish a plan for a joint strategy.In response, FPS and GSA finalized and signed a joint strategy to meet bi-annually to discuss progress and to monitor, evaluate, and report on the agencies’ regional efforts to protect federal facilities. This strategy also identifies a process and provides information for ensuring that compatible policies and procedures for information sharing are communicated at the regional level. Additionally, the strategy identifies and clarifies FPS’s and GSA’s information sharing and communication efforts, related policies and procedures, and agency roles and responsibilities. As a result of these efforts, FPS and GSA are better positioned to improve their collaborative efforts to protect federal facilities.

Action on Remaining Open Areas Could Yield Significant Additional Benefits

Open Areas Directed to Congress and Executive Branch Agencies with Potential Financial Benefits

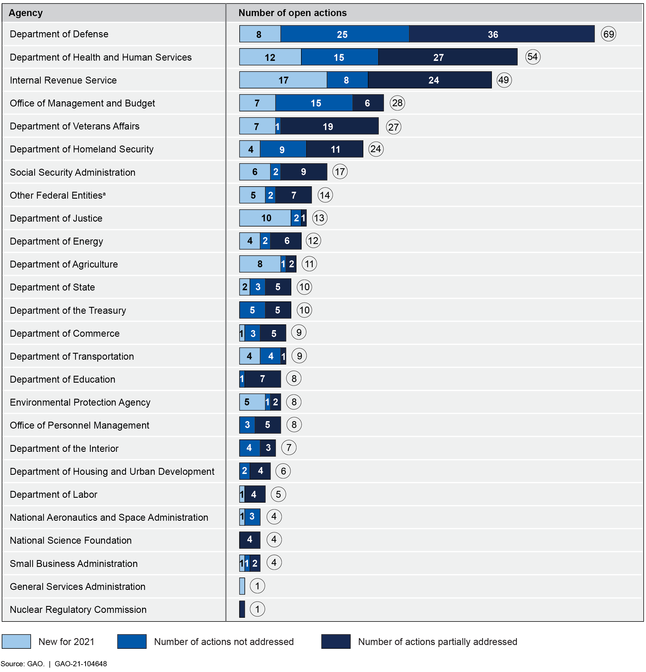

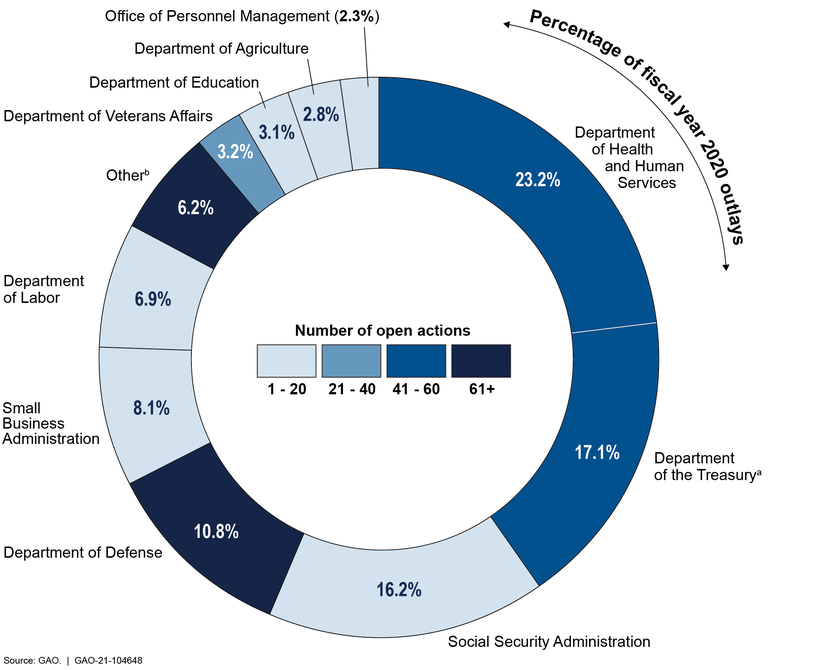

Figure 5: Number of Partially Addressed and Not Addressed Actions Since 2011 by Agency, as of August 2021

Figure 6: Fiscal Year 2020 Outlays and Number of Open Actions Since 2011, by Agency

| Area name and description (Year-number links to Action Tracker) | Mission | Potential financial benefitsa (Source) |

|---|---|---|

| *DOE’s Treatment of Hanford’s Low-Activity Waste (2018‑17): The Department of Energy may be able to reduce certain risks by adopting alternative approaches to treating a portion of its low-activity radioactive waste. (GAO-19-28, GAO-17-306, GAO-09-913, GAO-03-593) | Energy | Tens of billions (GAO) |

| *Medicare Payments by Place of Service (2016-30): Congress should consider directing the Secretary of Health and Human Services to equalize payment rates between settings for evaluation and management office visits and other services that the Secretary deems appropriate and return the associated savings to the Medicare program. (GAO-16-189) | Health | Billions annually (MedPAC and Bipartisan Policy Center) |

| Category Management (2021-06): The Office of Management and Budget (OMB) should further its Category Management initiative to improve how agencies buy common goods and services by taking such actions as addressing agencies’ data management challenges and establishing additional performance metrics to help the federal government achieve cost savings, as well as potentially eliminate duplicative contracts. (GAO-21-40) | General Government | Billions of dollars over the next 5 years (OMB) |

| *Disability and Unemployment Benefits (2014-08): Congress should consider passing legislation to require the Social Security Administration to offset Disability Insurance benefits for any Unemployment Insurance benefits received in the same period. (GAO-12-764) | Income Security | $2.2 billion over 10 years (OMB) |

| Federal Shared Services (2019-05): OMB and the General Services Administration could better position themselves to achieve their cost savings goals and reduce inefficient overlap and duplication by strengthening their implementation of selected federal shared service reform efforts. (GAO-20-263, GAO-19-94) | General Government | $2 billion over 10 years (OMB) |

| Student Loan Income-Driven Repayment Plans (2020-29): The Department of Education should obtain data in order to verify income information for borrowers reporting zero income on Income-Driven Repayment applications. (GAO-19-347) | Training, Employment, and Education | More than $2 billion over 10 years (The Congressional Budget Office) |

| Navy Shipbuilding (2017-18): The U.S. Navy could achieve cost savings by improving its acquisition practices and ensuring that ships can be efficiently sustained. (GAO-20-2, GAO-17-211,GAO-16-71) | Defense | Billions (GAO) |

| *Internal Revenue Service Enforcement Efforts (2012-44): Enhancing the Internal Revenue Service enforcement and service capabilities can help reduce the gap between taxes owed and paid by collecting tax revenue and facilitating voluntary compliance. This could include expanding third-party information reporting. For example, reporting could be required for certain payments that rental real estate owners make to service providers, such as contractors who perform repairs on their rental properties, and for payments that businesses make to corporations for services. (GAO-12-176, GAO-11-493, GAO-09-238, GAO-08-956) | General Government | Billions (GAO) |

Note: The potential financial benefits shown in this table represent estimates of amounts GAO or others believe could accrue if steps are taken to implement the actions described. All estimates of potential savings are dependent on various factors, such as whether action is taken and how it is taken. Actual savings may be less, depending on costs associated with implementing the action, unintended consequences, and the effect of controlling for other factors. The individual estimates in this table should be compared with caution, as they come from a variety of sources, which consider different time periods and use different data sources, assumptions, and methodologies.

aGAO developed the notional estimates, which are intended to provide a sense of the potential magnitude of savings. Notional estimates have been developed using broad assumptions about potential savings, which are rooted in previously identified losses, the overall size of the program, previous experience with similar reforms, and similar rough indicators of potential savings. GAO generally determines the notional labels (millions, tens of millions, hundreds of millions, etc.) using a risk-based approach that takes into account factors such as the possible minimum and maximum values of the cost savings estimate (where available), the quality of the data underlying those values, the certainty of those values, and the rigor of the estimation method used.

Open Areas with Other Benefits Directed to Executive Branch Agencies

| Area name and description (Year-number links to Action Tracker) | Mission | Potential benefit |

|---|---|---|

| Economic Development | Improved coordination and collaboration in microlending activities. | |

| VA Long-Term Care Fragmentation (2020-11): The Department of Veterans Affairs should implement a consistent approach to better manage long-term care programs at the Veterans Affairs Medical Center level and improve access to the right care for veterans. (GAO-20-284) | Health | Improved ability to provide consistent care and access to long-term care for veterans. |

| Chemical Terrorism (2019-09): The Department of Homeland Security should develop a strategy and implementation plan for its chemical defense programs and activities to better manage these fragmented efforts. (GAO-18-562) | Homeland security/law enforcement | Improved support, guidance, integration, and coordination of DHS’s chemical defense efforts. |

| Federal Research (2019-15): Federal agencies could improve their research efforts to maintain U.S. competitiveness in quantum computing and synthetic biology by implementing leading practices for collaboration to better manage fragmentation. (GAO-18-656) | Science and the environment | Maintain U.S. competitiveness in the global economy. |

| Imported Seafood Oversight (2018-01): Improved coordination between the Food and Drug Administration and the Food Safety and Inspection Service on the oversight of imported seafood would help the agencies better manage fragmentation and more consistently protect consumers from unsafe drug residues. (GAO-17-443) | Agriculture | More effective oversight of imported seafood. |

| Graduate Medical Education Funding (2018-05): The Department of Health and Human Services should coordinate with federal agencies, including the Department of Veterans Affairs, to improve the effectiveness and oversight of fragmented federal funding for physician graduate medical education, which cost the federal government $14.5 billion in 2015. (GAO-18-240) | Health | Better data quality for examining graduate medical education programs. |

Closing

Comptroller General of the United States

Congressional Addressees

The Honorable Patrick Leahy

Chairman

The Honorable Richard Shelby

Vice Chairman

Committee on Appropriations

United States Senate

The Honorable Bernie Sanders

Chairman

The Honorable Lindsey Graham

Ranking Member

Committee on the Budget

United States Senate

The Honorable Gary C. Peters

Chairman

The Honorable Rob Portman

Ranking Member

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Rosa L. DeLauro

Chair

The Honorable Kay Granger

Ranking Member

Committee on Appropriations

House of Representatives

The Honorable John Yarmuth

Chairman

The Honorable Jason Smith

Ranking Member

Committee on the Budget

House of Representatives

The Honorable Carolyn B. Maloney

Chairwoman

The Honorable James Comer

Ranking Member

Committee on Oversight and Reform

House of Representatives

The Honorable Mark R. Warner

United States Senate

Appendixes

IN THIS SECTION

Appendix I: Objectives, Scope, and Methodology

Bookmark:Assessing the Status of Selected Previously Identified Actions

- In assessing actions suggested for Congress, we applied the following criteria: “addressed” means relevant legislation has been enacted and addresses all aspects of the action needed; “partially addressed” means a relevant bill has passed a committee, the House of Representatives, or the Senate during the current congressional session, or relevant legislation has been enacted but only addressed part of the action needed; and “not addressed” means a bill may have been introduced but did not pass out of a committee, or no relevant legislation has been introduced. Actions identified as “new for 2021” in this report were identified for inclusion in 2021 and have not yet been assessed for updates. Actions suggested for Congress may also move to “addressed” or “partially addressed” with or without relevant legislation if an executive branch agency takes steps that address all or part of the action needed. At the beginning of a new congressional session, we reapply the criteria. As a result, the status of an action may move from partially addressed to not addressed if relevant legislation is not reintroduced from the prior congressional session.

- In assessing actions suggested for the executive branch, we applied the following criteria: “addressed” means implementation of the action needed has been completed; “partially addressed” means the action needed is in development or started but not yet completed; and “not addressed” means the administration, the agencies, or both have made minimal or no progress toward implementing the action needed.

Methodology for Generating Financial Benefits Estimates

Appendix II: Open Congressional Actions, by Mission

Bookmark:Figure 7: Status of Congressional Actions from 2011 to 2021, as of August 2021

| Mission Area: Health | |||

|---|---|---|---|

| Area name (links to Action Tracker) | Underlying report (links to report) | Potential benefit | |

| Save billions of dollars annually | |||

| DOD U.S. Family Health Plan (2015-06) | Save millions of dollars in fiscal year 2022 | ||

| Save hundreds of millions of dollars annually | |||

| Save tens of billions of dollars from 2020 to 2022 | |||

| Save hundreds of millions or billions of dollars | |||

| Achieve cost savings in jointly furnished services | |||

| Area (links to Action Tracker) | Action summary and status, when partially addressed | ||

| Congress should consider directing the Secretary of Health and Human Services to equalize payment rates between settings for evaluation and management office visits and other services that the Secretary deems appropriate and return the associated savings to the Medicare program. Partially Addressed: As of June 2021, no additional legislative action had been identified that would address GAO’s December 2015 suggestion. Congress enacted legislation in November 2015 to exclude services furnished by off-campus hospital outpatient departments from higher payment rates. Effective January 1, 2017, this exclusion, as amended, does not apply to services furnished by providers that were under construction or billing as hospital outpatient departments prior to November 2015. All providers billing as hospital outpatients during GAO's study (issued in December 2015) continue to be paid under the higher rate. In addition, this exclusion does not apply to services provided by on-campus hospital outpatient departments. However, the Centers for Medicare & Medicaid Services (CMS) has taken some actions. In November 2018, CMS issued a final rule adopting payment changes that capped payment rates for certain services furnished by the off-campus hospital outpatient departments that existed or were under construction in 2015 at the physician fee schedule rate. Since these services furnished by these off-campus hospital outpatient departments were paid at a higher rate, the payment cap, which was to be implemented over 2 years, was intended to equalize payment rates for certain clinical visits between settings where services can be provided; for example, physicians’ offices. In 2019, CMS applied 50 percent of the payment reduction and adopted another final rule to apply 100 percent of the payment reduction in 2020 and subsequent years. The rule applied to specific clinical visits; other services would continue to be paid at the higher rate. In response to a lawsuit challenging CMS’s authority to issue the November 2018 rule, a federal court of appeals ruled in July 2020 that CMS had the authority to adopt these payment changes. An appeal of that ruling was filed, and in June 2021, the Supreme Court declined to take up the case. GAO plans to continue monitoring congressional action and any additional agency actions, including actions to equalize payment rates that Medicare pays for evaluation and management services in all hospital outpatient departments, regardless of whether they are deemed on-campus or off-campus. Until action is taken to equalize the rates Medicare pays for certain health care services, Medicare and beneficiaries could continue to pay more for the same health care service depending on where the service is performed. | |||

| Congress should terminate the Secretary of Defense's authority to contract with the U.S. Family Health Plan (USFHP) designated providers in a manner consistent with a reasonable transition of affected USFHP enrollees into TRICARE's regional managed care program or other health care programs, as appropriate. | |||

| Congress should consider requiring Medicare to pay prospective payment system (PPS)-exempt cancer hospitals (PCH) as it pays PPS teaching hospitals for both inpatient and outpatient services, or provide the Secretary of HHS with the authority to otherwise modify how Medicare pays PCHs, and provide that all forgone outpatient payment adjustment amounts be returned to the Supplementary Medical Insurance Trust Fund. | |||

| Congress could consider requiring the Secretary of Health and Human Services to improve the Medicaid demonstration review process, through steps such as improving the review criteria, better ensuring that valid methods are used to demonstrate budget neutrality, and documenting and making clear the basis for the approved limits. GAO had previously recommended that the Department of Health and Human Services (HHS) take these actions. GAO elevated these actions for Congress to consider after HHS disagreed with the need to improve budget neutrality criteria, methods, and documentation of the basis for approved spending limits. Partially Addressed: No legislative action taken. As of July 2021, no legislation had been passed in the 117th Congress, and no legislation was enacted in the 116th Congress to require HHS to improve the Medicaid demonstration review process as GAO suggested in January 2008. Over the past several years, however, CMS (within HHS) has taken actions that improve some aspects of the Medicaid demonstration review process. In May 2016, the agency began implementing new policies to curtail some problematic methods of determining budget neutrality as states renewed their demonstrations. In August 2018, CMS issued written guidance on the process and criteria the agency uses to determine whether Social Security Act section 1115 demonstration projects are budget neutral, including the policies begun in 2016. The guidance was communicated as a State Medicaid Directors Letter and is available on the CMS website. These new policies and related guidance letter partially address the recommendation; for example, they place limits on the amount of unspent funds under demonstration spending limits that states are allowed to carry over from previous years. Additionally, the letter describes the process and methods for determining budget neutrality. GAO maintains that more changes are needed in the methods allowed to determine budget neutrality of section 1115 demonstrations so that they do not add to what federal spending would have been in their absence. In particular, relying on a state's actual spending rather than hypothetical cost estimates could potentially result in significant federal savings. | |||

| Congress should consider requiring the Administrator of CMS to require states to submit an annual independent certified audit verifying state compliance with permissible methods for calculating non-Disproportionate Share Hospital supplemental payments. | |||

| Congress could exempt from the budget neutrality requirement savings attributable to policies that reflect efficiencies occurring when services are furnished together. Partially Addressed: Congress has exempted savings from the implementation of multiple procedure payment reductions (MPPR) for certain diagnostic imaging and therapy services from the budget neutrality requirement, as GAO suggested in July 2009. However, as of May 2021, other policies that may result in a reduction in payments for the professional component for imaging services remained subject to budget neutrality; savings from these services are redistributed to other services and do not accrue to the Medicare program. The Consolidated Appropriations Act of 2016 revised the payment reduction for the professional component of multiple diagnostic imaging services from 25 percent to 5 percent beginning on January 1, 2017, and exempted the reduced expenditures attributable to this MPPR from the budget neutrality provision. (Pub. L. No. 114-113, 129 Stat. 2242 (Dec. 18, 2015)). MPPRs or other policies that may result in a reduction to payments for the technical component for diagnostic cardiovascular and ophthalmology services continue to be subject to budget neutrality for 2021. Unless Congress exempts from the budget neutrality requirement savings realized from the implementation of all MPPRs or other policies that reflect efficiencies occurring when services are furnished together, these savings will not accrue to the Medicare program. | |||

Note: Unless otherwise indicated, actions in these tables are not addressed. These tables provide estimates of cost savings or increased revenue where such information was available. The potential cost savings for implementing individual actions are provided when known, or for implementing multiple actions in an area, when the savings are not attributable to a specific action.

References

Figures

- Total Reported Financial Benefits of $515 Billion, as of 2021

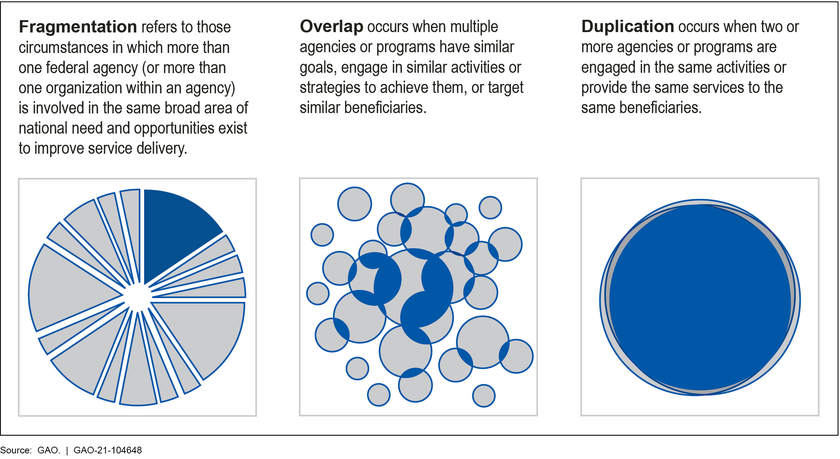

- Figure 1: Definitions of Fragmentation, Overlap, and Duplication

- Figure 2: Status of 2011 to 2021 Actions, as of August 2021

- Figure 3: Total Reported Financial Benefits of $515 Billion, as of August 2021

- Figure 4: Summary of 11 Years of Benefits Achieved by Mission, as of August 2021

- Figure 5: Number of Partially Addressed and Not Addressed Actions Since 2011 by Agency, as of August 2021

- Figure 6: Fiscal Year 2020 Outlays and Number of Open Actions Since 2011, by Agency

- Figure 7: Status of Congressional Actions from 2011 to 2021, as of August 2021

Tables

- Table 1: Status of 2011 to 2021 Actions Directed to Congress and the Executive Branch, as of August 2021

- Table 2: Examples of Fully Addressed or Partially Addressed Actions with Associated Cost Savings and Revenue Enhancements, as of August 2021

- Table 3: Examples of Areas with Open Actions with Potential Financial Benefits of $1 Billion or More

- Table 4: Additional Examples of Open Areas Directed to Executive Branch Agencies

- Table 5: Open Congressional Actions in the Agriculture Mission Area

- Table 6: Open Congressional Actions in the Defense Mission Area

- Table 7: Open Congressional Actions in the Economic Development Mission Area

- Table 8: Open Congressional Actions in the Energy Mission Area

- Table 9: Open Congressional Actions in the General Government Mission Area

- Table 10: Open Congressional Actions in the Health Mission Area

- Table 11: Open Congressional Actions in the Homeland Security/Law Enforcement Mission Area

- Table 12: Open Congressional Actions in the Income Security Mission Area

- Table 13: Open Congressional Actions in the Information Technology Mission Area

- Table 14: Open Congressional Actions in the International Affairs Mission Area

- Table 15: Open Congressional Actions in the Social Services Mission Area

- Table 16: Open Congressional Actions in the Training, Employment, and Education Mission Area

End Notes

Contacts

Jessica Lucas-Judy

Director, Strategic Issues, lucasjudyj@gao.gov, (202) 512-6806Michelle Sager

Managing Director, Strategic Issues, sagerm@gao.gov., (202) 512-6806Congressional Relations

U.S. Government Accountability Office

441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

U.S. Government Accountability Office

441 G Street NW, Room 7149, Washington, DC 20548

Strategic Planning and External Liaison

U.S. Government Accountability Office

441 G Street NW, Room 7814, Washington, DC 20548

Obtaining Copies of GAO Reports and Testimony

Order by Phone

To Report Fraud, Waste, and Abuse in Federal Programs

Automated answering system: (800) 424-5454 or (202) 512-7470

Connect with GAO

GAO’s Mission

Copyright

(104648)