Highlights

What GAO Found

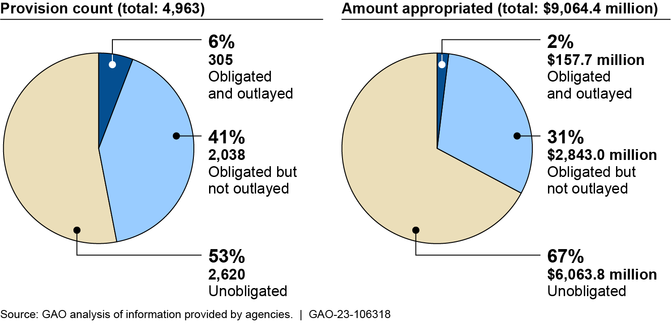

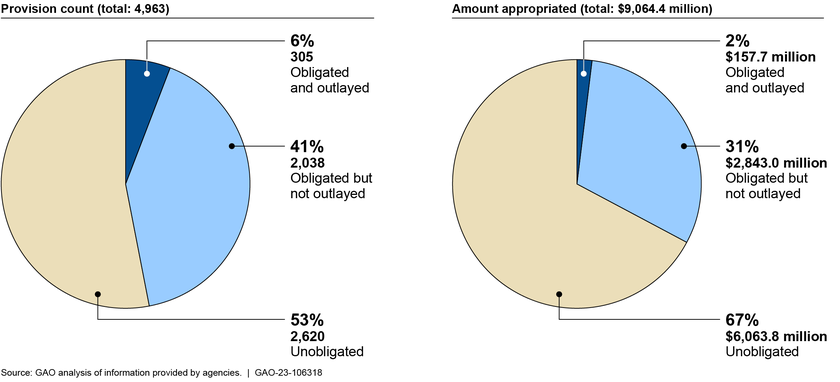

As of the end of fiscal year 2022, agencies recorded obligations (actions that create a legal duty of the government for the payment of goods or services) toward almost half (2,343) of the fiscal year 2022 Community Project Funding/Congressionally Directed Spending projects and made outlays (disbursement of cash) toward 305 (about 6 percent) of these provisions. Of the $9.1 billion in total funds for these provisions, about a third of the funds were obligated, and almost 2 percent were outlayed.

Agency-Recorded Obligations and Outlays for Community Project Funding/Congressionally Directed Spending, End of Fiscal Year 2022

As shown in the table, agencies recorded obligations toward 99.2 percent of the provisions with one-year funding before the funds expired at the end of fiscal year 2022. Agency officials reported they were unable to record obligations toward the remaining 1 percent (13 provisions) because the recipient organizations closed, or the recipients withdrew their applications or declined funding.

Note: Percentages are based on total, unrounded amounts of agency-reported obligations and outlays. aThis column indicates the number and percentage of provisions for which agencies reported they had either fully or partially obligated the designated funds.

Why GAO Did This Study

The Consolidated Appropriations Act, 2022, and accompanying joint explanatory statement, designated $9.1 billion for 4,963 projects at the request of Members of Congress. These provisions designate a particular recipient—such as a nonprofit organization or local government—to receive an amount of funds to use for a specific project. These provisions are called “Community Project Funding” in the House of Representatives and “Congressionally Directed Spending” in the U.S. Senate.

The joint explanatory statement accompanying the Consolidated Appropriations Act, 2022, includes a provision for GAO to review agencies’ implementation of Community Project Funding/Congressionally Directed Spending contained in the Consolidated Appropriations Act, 2022. This report describes the amount of funds for these specific provisions that have been recorded as obligated and outlayed as of the end of fiscal year 2022, as reported by the 18 agencies responsible for distributing and monitoring the funds.

GAO collected budget execution data—obligations and outlays—along with data quality information from each of the relevant agencies. These data reflect agencies’ recorded obligations and outlays as of the end of fiscal year 2022.

Introduction

Congressional Committees

The Consolidated Appropriations Act, 2022 designated a total of $9.1 billion for 4,963 projects at the request of Members of Congress.[1] The Act and its accompanying joint explanatory statement included specific provisions that designate a certain amount of funds for a particular recipient, such as a nonprofit organization or local government, to use for a specific project. These provisions are called “Community Project Funding” in the House of Representatives and “Congressionally Directed Spending” in the U.S. Senate.[2] The funds are being administered by 18 federal agencies and go toward projects with a broad range of purposes, such as education, health care, and transportation.

The joint explanatory statement accompanying the Consolidated Appropriations Act, 2022, includes a provision for us to review agencies’ implementation of Community Project Funding/Congressionally Directed Spending contained in the Consolidation Appropriations Act, 2022.[3] This report describes the amount of funds designated by the fiscal year 2022 Community Project Funding/Congressionally Directed Spending provisions that have been recorded as obligated and outlayed as of the end of fiscal year 2022, as reported by the responsible agencies.[4] We are also publishing an online dataset to accompany this report.[5]

To report on the amount of obligations and outlays, we used data collection instruments to obtain information the 18 agencies had recorded as of the end of fiscal year 2022 for each of the provisions.[6] The obligation and outlay amounts we included in this report and our online dataset are reported according to the agencies. We did not compare all the obligations and outlay data that agencies submitted to us against agency records.

Most agencies used their financial systems to provide the obligation and outlay data we requested.[7] To help understand potential broader financial management data quality issues within each agency, we reviewed the independent auditor’s reports on each agency’s fiscal year 2022 financial statements, which includes examination of the agency’s internal controls over financial reporting and compliance with selected provisions of applicable laws, regulations, contracts, and grants.[8] Where applicable, we also reviewed auditors’ reports on whether each agency’s financial management systems complied substantially with the three requirements of the Federal Financial Management Improvement Act of 1996.[9]

All the agencies that submitted data to us also responded to standardized data quality questions. None of the agencies noted any issues of concern related to the completeness, accuracy, timeliness, or usability of the data within the scope of our review. We performed reasonability and logic checks, such as checking for duplicate records, on the data we collected using data analysis software and followed up with agencies when we found inconsistencies with the data they had reported. We found the data to be reliable for the purpose of reporting the status of agency-reported obligations and outlays.

We conducted this performance audit from October 2022 to September 2023 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Congress provides budget authority to federal agencies to incur financial obligations through annual appropriations acts or other legislation. See table 1 for key terms and definitions in the budget process.

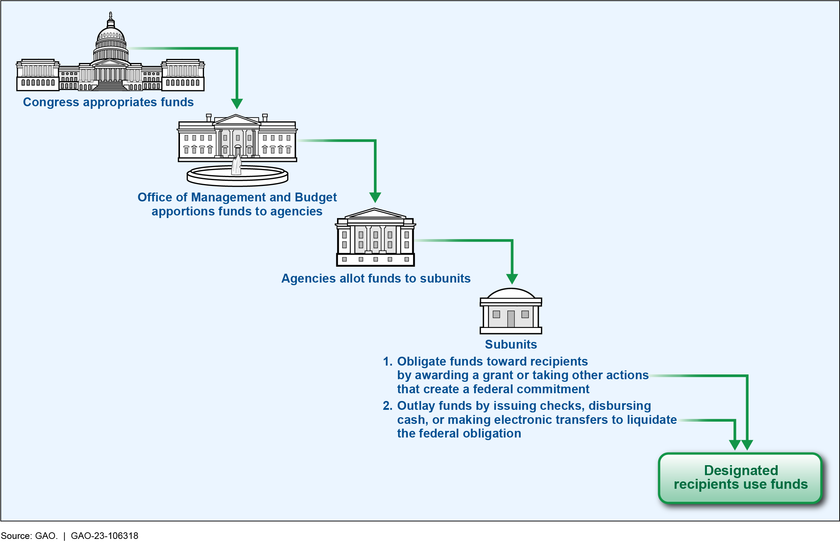

As shown in figure 1, after Congress appropriates funds, there are multiple steps before agencies can make funds available to recipients. Specifically, after Congress appropriates funds, the Office of Management and Budget apportions, or distributes, the funds to executive branch agencies prior to obligation.[10] Agencies then allot the apportioned funds within the account to program offices or subunits, consistent with the agency’s funds control system. Once the funds have been allotted, the program office or subunit can begin the process of making the funds available to recipients by first obligating the funds and then outlaying them.

The funds designated through these provisions are part of larger lump-sum appropriations that cover a number of programs, projects, or other items. Many of the provisions may be administered through the award of grants. Agencies that receive lump-sum appropriations for the purpose of executing a grant program might otherwise use a merit-based or competitive allocation process to distribute the funds. However, because these provisions designate a specific recipient or project, agencies do not use such processes to award these funds.

An agency may record an obligation only at the point of incurring an obligation, known as the obligational event. For grants, the time when an agency incurs an obligation varies depending on the nature of the grant. In some situations, the agency incurs an obligation when it awards a grant. For other grants, the timing of the obligational event may be outside of the agency’s control. For example, in some circumstances, the agency may incur an obligation immediately when the appropriation for the grant becomes law. In these instances, an agency must still record an accounting charge against the appropriation in its obligational records, but this charge reflects the obligation the agency already incurred and is not the creation of the obligation.[11]

Finding

Agencies Recorded Obligations toward Almost Half of the Projects

As of the end of fiscal year 2022, agencies recorded obligations toward 2,343 of 4,963 projects, representing 47 percent of the provisions.[12] Agencies made outlays toward 305 projects, or about 6 percent. Broken out in dollars, 33 percent of the funds for the provisions were obligated, and almost 2 percent were outlayed by the end of fiscal year 2022. See figure 2.

Figure 2: Agency-Recorded Obligations and Outlays for Community Project Funding/Congressionally Directed Spending Provisions, End of Fiscal Year 2022

Agencies Recorded Obligations Consistent with the Funds’ Period of Availability

Generally, an agency may only obligate funds during the period in which they are available (e.g., one-year, two-year, no-year). After the period of availability expires, the agency generally has 5 additional fiscal years to outlay the funds.[13]

When Congress appropriated funds in the Consolidated Appropriations Act, 2022, it specified a period of availability applicable to each appropriation from which funds were designated to specific recipients. As shown in table 2, obligations were made toward 99.2 percent of the provisions designated with one-year funding before they expired, as of the end of fiscal year 2022.

Notes: Percentages are based on total, unrounded amounts of agency-reported obligations and outlays. Based on input from the U.S. Department of Agriculture, we recategorized the period of availability for two provisions, since we reported on the fiscal year 2022 provisions in GAO-22-105467.aThis column indicates the number and percentage of provisions for which agencies reported they had either fully or partially obligated the designated funds.

Agency officials reported they were unable to obligate the designated one-year funds for the remaining 13 provisions (or 1 percent) because the recipient organizations closed, or the recipients withdrew their applications or declined funding.[14] For example, officials from the Department of Education told us the department was unable to obligate the designated funds for one of its provisions because the recipient organization no longer exists.

Additionally, agencies recorded obligations for less than the full amount available for some provisions designated with one-year funding.[15] For example, officials from the Federal Emergency Management Agency within the Department of Homeland Security told us that they had to reduce the award amount for three of their projects because the recipients’ proposed budgets for executing the provisions included ineligible costs. In other cases, agencies reported the recipients did not apply for the full amount available because their project budget was less than the designated amount.[16]

Generally, agencies recorded fewer obligations as of the end of fiscal year 2022 for provisions designating funds with periods of availability longer than one year. Similarly, agencies reported more outlays as of the end of fiscal year 2022 for provisions designating funds with a one-year period of availability than the provisions designating funds with longer periods of availability. While the period of availability has expired for the one-year funds, most agencies will have until the end of fiscal year 2027 to complete recording outlays toward those projects.[17] In some instances, the timeline that agencies set for recipients to spend the funds may be shorter than what is specified in law.

Six of 18 Agencies Recorded Obligations for at Least 90 Percent of Their Projects

As shown in table 3, six of the 18 agencies recorded obligations toward at least 90 percent of their projects as of the end of fiscal year 2022. For most of these agencies, such as with the Department of Education, Department of Homeland Security, and Small Business Administration (SBA), all of their provisions had designated funds with one-year periods of availability.

Note: Percentages are based on total, unrounded amounts of agency-reported obligations and outlays. aThis column indicates the number and percentage of provisions for which agencies reported that they had either fully or partially obligated the designated funds.bThese agencies have provisions with different periods of availability, but the listed category reflects the period of availability for the majority of their provisions. For more detailed information about the provisions and their periods of availability, see the full online dataset at https://www.gao.gov/products/gao-23-106318.

Agency officials told us different reasons that led them to record obligations for a large percent of their projects regardless of the period of availability. For example, officials from SBA told us they established a contract to meet their goal of obligating the funds before the end of fiscal year 2022. Officials said that, among other tasks, the contractors helped SBA obtain all the required information from applicants and supported the administration of the grants and associated monitoring tasks. Officials from the Department of Justice said they obligated designated funds for most of their projects, even though the funds were available indefinitely (no-year) for obligation, because the agency understood it was a congressional priority to make the funds available to recipients quickly.

The Departments of Energy, Housing and Urban Development, and Labor, and the Environmental Protection Agency (EPA) did not record obligations toward any of their provisions by September 30, 2022. Officials from EPA told us that one of the agency’s biggest challenges obligating these funds has been ensuring the projects comply with applicable federal requirements, which needs to occur before the agency can obligate any of the funds. In some cases, EPA officials said the difficulty is due to a lack of technical capacity on the part of designated recipients. Officials said many of these recipients face challenges in completing their applications to receive funding, and a small percentage of recipients have no experience applying for federal funds. As a result, many recipients require significant technical assistance from EPA, which can delay obligating the funds.[18]

Similarly, officials from the Department of Labor told us that the timing of obligations depends on when recipients submit their applications and how much technical assistance they require to make their applications suitable for funding. The funding for the provisions at these agencies did not expire as of the end of fiscal year 2022, so they can continue to record obligations.

Agencies Have Recorded Obligations toward More than a Quarter of the Projects within Most States and Territories

During fiscal year 2022, Community Project Funding/Congressionally Directed Spending was designated for projects in 47 states, the District of Columbia, and four U.S. territories.[19] The number of projects for designated recipients in individual states or territories that received any ranged from one to 493. The total amounts appropriated for those projects ranged from $2.4 million in one territory to $774 million in one state.[20]

As shown in figure 3, agencies recorded obligations for more than a quarter of the projects in each of 44 states, the District of Columbia, and two U.S. territories. Among these locations, agencies recorded obligations for over half of the projects in 13 states and one U.S. territory. Agencies recorded no obligations in only one U.S. territory, as of the end of fiscal year 2022.[21]

Figure 3: Percentage of Community Project Funding/Congressionally Directed Spending Projects with Obligations, by Location of Designated Recipient, End of Fiscal Year 2022

Agencies Recorded Obligations at a Higher Rate for Projects for Higher Education Organizations than Other Recipient Types

In our prior work analyzing these provisions for fiscal year 2022, we classified the designated recipients as either (1) federal government, (2) tribal/state/local/territorial government, (3) higher education organizations, or (4) other nonprofit organizations.[22] Most recipients for fiscal year 2022 were tribal, state, local, or territorial governments.

As shown in table 4, agencies recorded obligations for almost 84 percent of the projects designated to higher education organizations. Most of these projects, 414 of 593 (70 percent), have one-year funds that were only available for obligation during fiscal year 2022.

Agencies recorded obligations at a lower rate for provisions whose designated recipients were the federal government, tribal/state/local/territorial government, and other nonprofit organizations. Most of the funding for these provisions is available for obligation for more than one year.

Notes: Percentages are based on total, unrounded amounts of agency-reported obligations and outlays. Based on input from the Department of the Interior, we recategorized the recipient type for 20 provisions, since we reported on the fiscal year 2022 provisions in GAO-22-105467.aThis column indicates the number and percentage of provisions for which agencies reported that they had either fully or partially obligated the designated funds.

Agency Comments

We provided a draft of this report to the 18 agencies that were appropriated funds through Community Project Funding/Congressionally Directed Spending provisions for fiscal year 2022 for review and comment. We received technical comments from the Departments of Education, Health and Human Services, Homeland Security, Housing and Urban Development, and Transportation and the Environmental Protection Agency that we incorporated, as appropriate. The remaining 12 agencies informed us they had no comments.

We are sending copies of this report to the appropriate congressional committees and the 18 agencies that were appropriated funds through Community Project Funding/Congressionally Directed Spending provisions for fiscal year 2022, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact Allison Bawden at (202) 512-3841 or bawdena@gao.gov or Heather Krause at (202) 512-2834 or krauseh@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix II.

Allison Bawden

Director, Natural Resources and Environment

Heather Krause

Director, Physical Infrastructure

Congressional Addressees

The Honorable Patty Murray

Chair

The Honorable Susan Collins

Vice Chair

Committee on Appropriations

United States Senate

The Honorable Chris Van Hollen

Chair

The Honorable Bill Hagerty

Ranking Member

Subcommittee on Financial Services and General Government

Committee on Appropriations

United States Senate

The Honorable Jack Reed

Chair

The Honorable Deb Fischer

Ranking Member

Subcommittee on Legislative Branch

Committee on Appropriations

United States Senate

The Honorable Kay Granger

Chairwoman

The Honorable Rosa DeLauro

Ranking Member

Committee on Appropriations

House of Representatives

The Honorable Steve Womack

Chair

The Honorable Steny Hoyer

Ranking Member

Subcommittee on Financial Services and General Government

Committee on Appropriations

House of Representatives

The Honorable Mark Amodei

Chair

The Honorable Adriano Espaillat

Ranking Member

Subcommittee on Legislative Branch

Committee on Appropriations

House of Representatives

Appendixes

IN THIS SECTION

Appendix I: Objectives, Scope, and Methodology

Bookmark:This report describes the amount of funds designated by the fiscal year 2022 Community Project Funding/Congressionally Directed Spending provisions that have been recorded as obligated and outlayed as of the end of fiscal year 2022, as reported by the responsible agencies. We are also publishing an online dataset to accompany this report.[23]

To report on the amount of obligations and outlays for these provisions, we used data collection instruments to obtain the obligations and outlays agencies had recorded as of the end of fiscal year 2022 for each of the provisions from each of the 18 agencies that received them. We created a data collection instrument for each agency that included information on each of the provisions we identified through our prior work—and that agencies had verified—and space for agencies to input the amounts of obligations they had recorded and outlays they had made by the end of fiscal year 2022.[24]

The obligations and outlays data we included in this report and our online dataset are reported according to the agencies. We gave the agencies an opportunity to comment and submit additional evidence along with their data if they requested a change. We did not compare the obligations and outlay data agencies submitted to us against agency records.

All of the agencies that submitted data to us also responded to standardized data quality questions through our data collection instrument. None of the agencies noted any issues of concern related to the completeness, accuracy, timeliness, or usability of the data they reported to us through the data collection instrument.

Most agencies used their financial systems to provide the obligation and outlay data we requested.[25] To help understand potential broader financial management data quality issues within each agency, we reviewed the independent auditor’s reports on each agency’s fiscal year 2022 financial statements, which includes examination of the agency’s internal controls over financial reporting and compliance with selected provisions of applicable laws, regulations, contracts, and grants.[26] Where applicable, we also reviewed auditors’ reports on whether each agency’s financial management systems complied substantially with the three requirements of the Federal Financial Management Improvement Act of 1996.[27] We gathered these reports through prior work on government-wide financial reporting.[28] We did not evaluate how these issues may specifically affect the obligation and outlay data we collected from agencies.

An agency may record an obligation only at the point of incurring an obligation, known as the obligational event. For grants, the time when an agency incurs an obligation varies depending on the nature of the grant. In some situations, the agency incurs an obligation when it awards a grant. For other grants, the timing of the obligational event may be outside of the agency’s control. For example, in some circumstances, the agency may incur an obligation immediately when the appropriation for the grant becomes law. In these instances, an agency must still record an accounting charge against the appropriation in its obligational records, but this charge reflects the obligation the agency already incurred and is not the creation of the obligation.

We have not determined when an obligation would arise for each specific grant action that agencies may take for funds designated through Community Project Funding/Congressionally Directed Spending provisions in the Consolidated Appropriations Act, 2022.[29] Throughout this report, we present the obligations that agencies reported to us as being recorded as of the end of fiscal year 2022, but the point of obligation for some of the provisions may have already occurred through the enactment of law.

We performed reasonability and logic checks, such as checking for duplicate records, on the collected data using data analysis software. We ensured that there were no missing or duplicate data and that the reported amounts reflected expected budget execution patterns, such as that obligations did not exceed the amount of the provision. We followed up with agencies in the few cases where we found inconsistencies with the data they had reported and resolved the issues. We found the data to be reliable for the purpose of reporting the status of agency-reported obligations and outlays of amounts designated by these provisions.

Our data reflect the status of obligations and outlays as of September 30, 2022, as reported by the agencies. While some agencies reported to us that they made or planned to make adjustments to the obligations or outlays after September 30, 2022, we did not include these adjustments in our data, as they were made after September 30, 2022. For example, officials from the Substance Abuse and Mental Health Services Administration within the Department of Health and Human Services told us they plan to revise the obligations for one of its provisions from $351,164 to $350,000. We reported the obligations for that provision as $351,164 in our data, since that is the amount the agency reported to us as obligated as of the end of fiscal year 2022.[30]

The Department of Education and the Health Resources and Services Administration within the Department of Health and Human Services did not report their data through the data collection instrument. In these cases, the agencies provided output from their internal agency systems, and we matched the records. Agency officials told us that some of the recipient and project descriptions in the agencies’ internal systems’ records did not exactly match the descriptions enacted in law because they were populated from the recipient grant applications, but the agencies reviewed the data collection instruments and confirmed we matched the data correctly. We maintained the project and recipient descriptions as they were presented in the joint explanatory statement.[31]

Through the process of completing the data collection instruments, two agencies identified corrections to the information that was part of our prior work. We incorporated these corrections as we deemed appropriate after discussions with the agency officials. Specifically, the Department of the Interior helped us recategorize the recipient type for 20 of its provisions. The Department of Agriculture helped us identify two provisions that had no-year periods of availability that we had previously categorized as having one-year and two-year periods of availability. We also identified a few instances where the dataset that accompanied GAO-22-105467 incorrectly identified requestor names. The summary tables in this report and the accompanying online dataset include those corrections.

Many of the figures included in this report are counts of the number of provisions for which any amount of funds were obligated—partially or fully obligated. We decided to include any amount of obligations as obligated in these counts. Of the 2,343 provisions for which funds had been obligated—2,245 provisions had 90 percent or more of their total designated funds obligated. Further, the presence of an obligation is an indication that the agency has begun taking steps to implement the provision.

There is one provision for the Department of Justice for which Congress did not specify an amount of funds in the joint explanatory statement. While we do not expect obligations to be made toward this provision, we continue to include it in our data to present a faithful representation of the provisions that were included in the joint explanatory statement. The Department of Defense reported obligating additional funds toward one of its provisions that came from another source of appropriations, but we excluded the additional appropriations, as they were beyond the scope of our review.

We conducted this performance audit from October 2022 to September 2023 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Appendix II: GAO Contacts and Staff Acknowledgments

Bookmark:GAO Contacts

Allison Bawden, (202) 512-3841 or bawdena@gao.gov

Heather Krause, (202) 512-2834 or krauseh@gao.gov

Staff Acknowledgments

In addition to the contacts named above, Janice Latimer (Assistant Director), Katherine D. Morris (Analyst in Charge), Jeff Arkin, Maria Belaval, Ann Marie Cortez, John Delicath, Thomas Hackney, Gabriel Nelson, Omari Norman, Emily Quick-Cole, Paula M. Rascona, Nina M. Rostro, Dan Royer, and Walter Vance made key contributions to this report.

References

Figures

- Agency-Recorded Obligations and Outlays for Community Project Funding/Congressionally Directed Spending, End of Fiscal Year 2022

- Figure 1: Funding Execution: From Congress to Designated Recipient

- Figure 2: Agency-Recorded Obligations and Outlays for Community Project Funding/Congressionally Directed Spending Provisions, End of Fiscal Year 2022

- Figure 3: Percentage of Community Project Funding/Congressionally Directed Spending Projects with Obligations, by Location of Designated Recipient, End of Fiscal Year 2022

Tables

- Obligations and Outlays for Community Project Funding/Congressionally Directed Spending Appropriations by Period of Availability, End of Fiscal Year 2022

- Table 1: Key Terms and Definitions in the Federal Budget Process

- Table 2: Obligations and Outlays for Community Project Funding/Congressionally Directed Spending Appropriations by Period of Availability, End of Fiscal Year 2022

- Table 3: Obligations and Outlays for Community Project Funding/Congressionally Directed Spending Funds by Agency, End of Fiscal Year 2022

- Table 4: Obligations for Community Project Funding/Congressionally Directed Spending by Recipient Type, End of Fiscal Year 2022

End Notes

Contacts

Allison Bawden

Director, Natural Resources and Environment, bawdena@gao.gov, (202) 512-3841Heather Krause

Director, Physical Infrastructure, krauseh@gao.gov, (202) 512-2834Congressional Relations

U.S. Government Accountability Office

441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

U.S. Government Accountability Office

441 G Street NW, Room 7149, Washington, DC 20548

Strategic Planning and External Liaison

U.S. Government Accountability Office

441 G Street NW, Room 7814, Washington, DC 20548

Obtaining Copies of GAO Reports and Testimony

Order by Phone

To Report Fraud, Waste, and Abuse in Federal Programs

Automated answering system: (800) 424-5454 or (202) 512-7470

Connect with GAO

GAO’s Mission

Copyright

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

Citing This Report

This report should be cited as:

GAO, Tracking the Funds: Agencies Have Begun Executing FY 2022 Community Project Funding/Congressionally Directed Spending , GAO-23-106318 (Washington, D.C.: September 2023).