Highlights

What GAO Found

The Consolidated Appropriations Act, 2023 and the accompanying joint explanatory statement designated about $15.3 billion for 7,234 Community Project Funding/Congressionally Directed Spending provisions. The provisions designate funds for particular recipients to use for specific projects. For fiscal year 2022, about $9.1 billion was designated for 4,963 provisions.

Nineteen federal agencies were appropriated funds for these provisions and are responsible for planning and executing projects using these funds. Other than one new agency—the Office of National Drug Control Policy—the same 18 agencies that were appropriated funds for fiscal year 2022 provisions also were appropriated funds for fiscal year 2023 provisions.

While the amount of funding and number of provisions in fiscal year 2023 increased relative to fiscal year 2022, the pattern of total designated funding to various purposes, recipient types, and locations was generally proportionate.

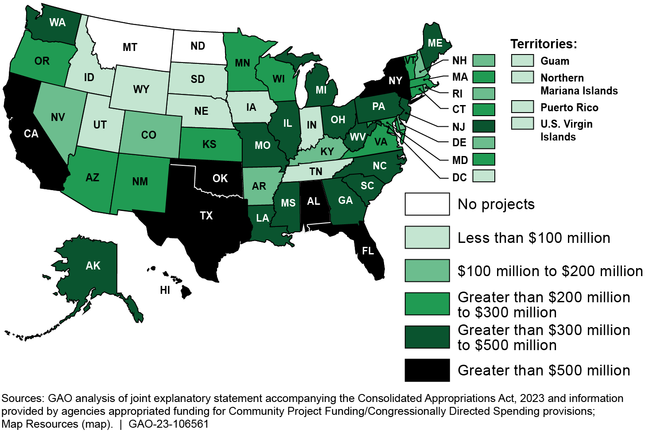

Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023 by Location

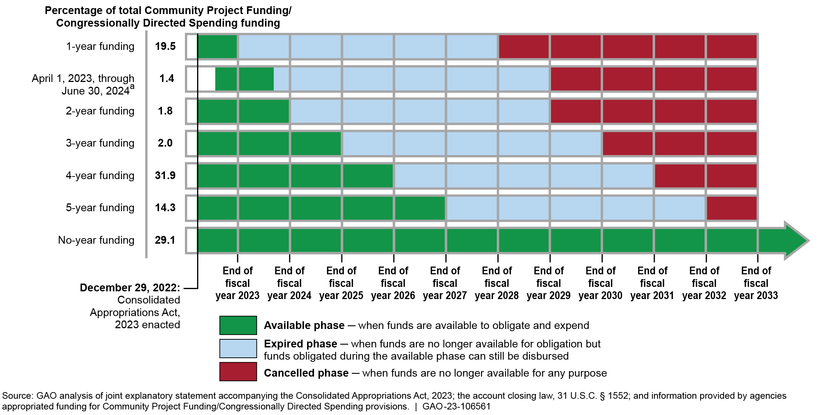

When Congress appropriated funds for fiscal year 2023, it specified a time period applicable to each appropriation from which funds were designated for specific recipients. For example, 71 percent of the funds are available for agencies to obligate (for example, by signing a contract or awarding a grant) for a fixed period, ranging from 1 year to 5 years. The remaining 29 percent of funds are not time limited, so the funds are available for obligation at any point in the future. These are about the same percentages as in fiscal year 2022. Once funds are obligated, agencies generally have 5 years to expend (or outlay) the funds.

Why GAO Did This Study

In the 117th Congress, Members of Congress began a new process for requesting funds for specific projects, and Congress established constraints such as prohibiting members from designating funds directly to for-profit entities. Congress has continued this process in fiscal year 2023. These provisions are called “Community Project Funding” in the House of Representatives and “Congressionally Directed Spending” in the U.S. Senate.

Congress included a provision in the joint explanatory statement accompanying the Consolidated Appropriations Act, 2023 for GAO to review the agencies’ implementation of these fiscal year 2023 provisions. This report provides an overview of fiscal year 2023 Community Project Funding/Congressionally Directed Spending and how it compares with fiscal year 2022. Specifically, this report provides information on (1) the agencies that were appropriated these funds; (2) the purpose of the funds, types of designated recipients, and location of projects; and (3) the period of availability of the funds.

GAO analyzed data from the Consolidated Appropriations Act, 2023 and accompanying joint explanatory statement to describe the agencies designated funds and the purpose of the funds. GAO also analyzed this information to provide information on the designated recipients and projects. GAO compared this information to the corresponding information for the fiscal year 2022 provisions.

Introduction

Congressional Committees

Beginning in the 117th Congress, the Senate and House Appropriations Committees adopted a process inviting Members of Congress to request funding for specific projects. The Consolidated Appropriations Act, 2023 and accompanying joint explanatory statement designated $15.3 billion for 7,234 such provisions.[1] The Act includes specific provisions designating a certain amount of funds for a particular recipient, such as a nonprofit organization or local government, to use for a specific project. These provisions are called “Community Project Funding” in the House of Representatives and “Congressionally Directed Spending” in the U.S. Senate. For the purposes of our report, we refer to them as “provisions.”

The funds designated through these provisions are part of larger lump-sum appropriations that cover a number of programs, projects, or other items. Agencies that receive lump-sum appropriations for the purpose of executing a grant program might use a merit-based or competitive allocation process to distribute the funds. However, because provisions in the Act designate funds for a specific recipient or project, agencies do not use such processes to award the funds. Rather, agencies are directed to distribute these funds to the specific recipients designated in the provisions in the Act. In addition, agencies may require designated recipients to complete an application and submit information, such as project spending plans.

In fiscal year 2023, the Senate and House limited funds designated through the provisions to 1 percent or less of total discretionary appropriations. Congress also included other constraints, such as prohibiting members from designating funds directly to for-profit entities. The fiscal year 2023 funds are administered by 19 federal agencies and are designated for projects with a broad range of purposes such as agriculture, national defense, and transportation.

The joint explanatory statement accompanying the Consolidated Appropriations Act, 2023 includes a provision for us to review agencies’ implementation of fiscal year 2023 Community Project Funding and Congressionally Directed Spending. Specifically, this report provides information on (1) the agencies that were appropriated these funds and the steps they expect to take to plan and execute the funds; (2) the purposes of the funds, types of designated recipients, and location of projects; and (3) the period of availability for the funds. For each of these objectives, we also compared what we found for fiscal year 2023 provisions with the corresponding information from our prior work on the fiscal year 2022 provisions, the first year these provisions were included in appropriations.

To identify the agencies that were appropriated funds covering these provisions, we analyzed tables included in the joint explanatory statement accompanying the Consolidated Appropriations Act, 2023.[2] Our report focuses on the 18 agencies responsible for administering provisions in fiscal year 2022 and 2023, and one additional agency in fiscal year 2023.[3] To identify the steps that agencies expect to take to plan and execute the funds, we interviewed officials from the 19 agencies about their plans and processes for executing the fiscal year 2023 provisions compared with the processes they used for the fiscal year 2022 provisions, as applicable.

To describe the purposes and designated recipients of fiscal year 2023 provisions as well as the locations of the projects, we analyzed data from the Consolidated Appropriations Act, 2023 and the accompanying joint explanatory statement. To characterize the purpose of the provisions, we matched the account number to the applicable budget function from the Office of Management and Budget (OMB).[4] We also organized the designated recipients for the funds into four categories: federal government; tribal/state/local/territorial government; higher education organizations; and other nonprofit organizations.

To determine the period of availability of the funds, we reviewed the Consolidated Appropriations Act, 2023.

To confirm our analysis of the Consolidated Appropriations Act, 2023 and the accompanying joint explanatory statement, we created data collection instruments for the 19 agencies to use to confirm or correct the information that we developed from our analysis. We also conducted checks to identify and address errors or omissions in the data from these data collection instruments. We found the data to be reliable for the purpose of describing the government-wide execution of Community Project Funding/Congressionally Directed Spending provisions. Appendix I provides more information on our objectives, scope, and methodology.

We conducted this performance audit from January 2023 to September 2023 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

The U.S. Constitution gives Congress the power to finance government operations through appropriations and to prescribe the conditions governing the use of those appropriations. The Senate and House Appropriations Committees have adopted a process by which Members of Congress may submit requests for funding for specific projects that are reviewed by the Committees.[5] Approved requests for fiscal year 2023 were included in the Consolidated Appropriations Act, 2023 and the accompanying joint explanatory statement. The Senate and House observed similar rules for these requests. For example, both chambers prohibited requests to provide funds directly to for-profit entities and required that Members certify that they had no financial interest in the projects for which they submitted requests for funds. They observed these same rules in fiscal year 2022.

Congress provides budget authority to federal agencies to incur financial obligations through annual appropriations acts or other legislation. See table 1 for key terms and definitions in the budget process.

After Congress appropriates funds, federal agencies must take several steps before they can make the funds available to recipients. Specifically, once Congress has appropriated funds, OMB apportions or distributes the funds to executive branch agencies.[6] Agencies then allot the apportioned funds to program offices or subunits, consistent with each agency’s funds control system. These controls are designed to ensure (1) that an agency does not obligate funding in excess of the agency’s appropriation, and (2) that the funds can be identified and monitored through the agency’s funds control system. After an appropriation has been apportioned and allotted, program offices or subunits may begin making the funds available to recipients by obligating them.

The steps that agencies may take prior to obligating funds to designated recipients may include requiring designated funding recipients to register with OMB’s System for Award Management, through which entities generally must register to receive federal funds. Additionally, agencies may check the Department of the Treasury’s Do Not Pay working system, a data system that agencies use to determine if an entity is prohibited from receiving federal awards.[7]

Agencies must ensure that they properly incur all appropriate obligations before the funds expire. An agency may record an obligation only when an obligational event occurs.[8] The timing of the event depends on the nature of the agency’s actions. For example, an agency incurs an obligation for a contract when it enters into a binding agreement with the contractor, or it incurs obligations for employees’ salaries at the time they perform the work. For grants, the time when an obligational event occurs varies depending on the nature of the grant. In some situations, the obligational event occurs when the agency awards a grant. For other grants, the timing of the obligational event may be outside of the agency’s control. For example, in some circumstances, the obligational event occurs immediately when the appropriation for the grant becomes law.[9]

Major Findings

IN THIS SECTION

- Almost the Same Agencies Were Appropriated Funds for Fiscal Years 2022 and 2023, and Agencies Expect to Rely on Similar Steps to Execute the Provisions for Each Year

- The Funding Designated for Various Purposes, Recipient Types, and Locations for Fiscal Year 2023 Is Proportionally Similar Compared with Fiscal Year 2022

- Most Fiscal Year 2023 Funds Must Be Obligated in Five Years or Less, as Was the Case for Fiscal Year 2022 Funds

Almost the Same Agencies Were Appropriated Funds for Fiscal Years 2022 and 2023, and Agencies Expect to Rely on Similar Steps to Execute the Provisions for Each Year

Congress Appropriated Funds to Mostly the Same Agencies

Congress appropriated funds to 19 federal agencies for specific Community Project Funding/Congressionally Directed Spending provisions included in the Consolidated Appropriations Act, 2023 and accompanying joint explanatory statement. Other than one new agency—the Office of National Drug Control Policy (ONDCP)—the same 18 agencies received appropriations covering provisions in fiscal year 2022.

As shown in table 2, for fiscal year 2023, Congress designated $15.3 billion to 19 agencies through 7,234 provisions. The amounts of funding designated by the provisions range from $7,000 for a solar power project at the Brandon Senior Citizens Center in Vermont to $200 million for the Alabama State Port Authority for intermodal and terminal expansion.

aThe Office of National Drug Control Policy was not responsible for administering provisions in fiscal year 2022.

Generally, similar subunits—such as program offices within the agencies—are responsible for executing the fiscal year 2023 provisions as compared with the provisions for fiscal year 2022. Of the 49 agency subunits responsible for executing fiscal year 2022 provisions, 41 were also responsible for doing so in fiscal year 2023. For example, within the Department of Justice, the Office of Justice Programs and the Office of Community Oriented Policing Services were responsible for executing all of the agency’s provisions for both years, given the provisions were related to the responsibilities of these subunits.[10]

Agencies Expect to Use Processes for Planning and Executing Funds Similar to Those Used for Fiscal Year 2022 Provisions

Officials from the 18 agencies that received provisions in both fiscal years 2022 and 2023 said they will plan and execute the fiscal year 2023 provisions using processes similar to those they used for fiscal year 2022, though some agencies reported making improvements. For example, officials from the Department of Housing and Urban Development increased staffing capacity for the delivery and oversight of both fiscal year 2022 and 2023 provisions, including grants management and the environmental review process that is required prior to distribution of funds. Similarly, Department of Health and Human Services officials told us they had increased staffing capacity for executing the fiscal year 2023 provisions. These officials also said they conducted a webinar to provide guidance to recipients of fiscal year 2023 funding. Additionally, officials from the Department of Commerce told us they had posted a standardized set of terms and conditions online to facilitate communication with funding recipients.

Officials from ONDCP—the sole agency that received provisions for fiscal year 2023 but not in fiscal year 2022—identified its Office of Public Heath as the office responsible for administering the almost $10.5 million appropriated in funds designated for eight provisions. ONDCP officials told us they plan to execute the provisions using processes similar to those they use to execute competitive awards. For example, according to ONDCP officials, ONDCP will follow OMB’s Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards guidance to distribute and monitor funding for these provisions.[11] Other steps these officials said they plan to take to reduce the risk of fraud, waste, and abuse included requiring recipients to register in the System for Award Management and conducting risk evaluations to help ensure recipients have plans to achieve project goals.

The Funding Designated for Various Purposes, Recipient Types, and Locations for Fiscal Year 2023 Is Proportionally Similar Compared with Fiscal Year 2022

Consistent with our prior work on the fiscal year 2022 provisions, we examined the distribution of provisions across purposes, recipient types, and locations for where the provisions will be administered.[12] Overall, when comparing across the two fiscal years, the proportion of provisions for different purposes was similar. Further, the types of recipients designated and the locations of these designated recipients (in states, the District of Columbia, and territories) was also proportionally similar.

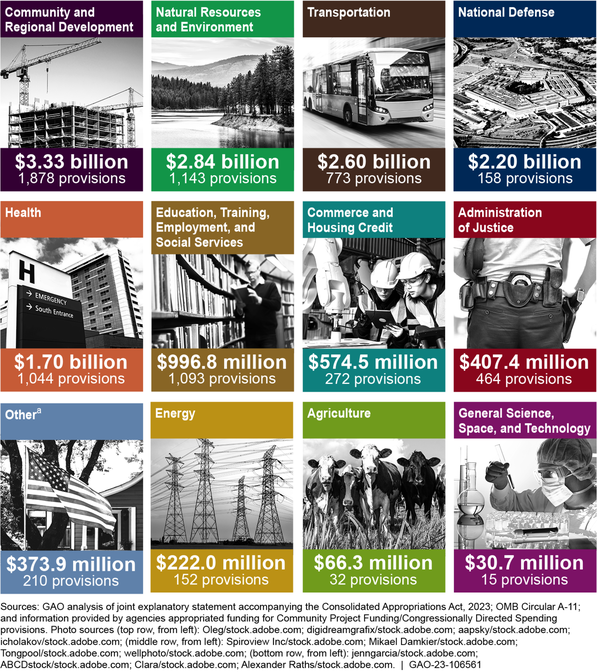

The Same Five Purposes Were Designated to Receive the Largest Proportions of Funding in Fiscal Years 2022 and 2023

Fiscal year 2023 provisions are designated for a variety of purposes—also known as budget functions—and represent broad categories into which all federal spending is placed. The proportion of funding designated to these purposes was similar in fiscal years 2023 and 2022. For example, more than $1 billion was designated for the same five purposes in both fiscal years 2022 and 2023. As shown in figure 1, the following five purposes were designated to each receive more than $1 billion in fiscal year 2023.[13]

- Community and Regional Development. $3.3 billion (about 22 percent of the total designated funds in fiscal year 2023) for projects such as the construction, restoration, or improvement of public libraries and performing arts centers, and expansion of domestic violence shelters. In fiscal year 2022, $1.7 billion was designated for this purpose (about 19 percent of total designated funding for that fiscal year).

- Natural Resources and Environment. $2.8 billion (about 19 percent) for projects including efforts to conserve aquatic habitats, manage watersheds, and improve sewer systems. In fiscal year 2022, $1.7 billion was designated for this purpose (about 19 percent).

- Transportation. $2.6 billion (about 17 percent) for projects including efforts to extend airport runways, expand and improve bus rapid transit lines, and install traffic lights. In fiscal year 2022, $1.5 billion was designated for this purpose (about 16 percent).

- National Defense. $2.2 billion (about 14 percent) for projects including the planning and design of a munitions maintenance and inspection facility, constructing a child development center at an Air Force base, and researching and developing next generation explosives. In fiscal year 2022, $1.3 billion was designated for this purpose (about 14 percent).

- Health. $1.7 billion (about 11 percent) for projects including efforts to cover equipment and operational costs for an oral health program, provide children’s mental health services, and upgrade tribal water distribution systems. In fiscal year 2022, $1.2 billion was designated for this purpose (about 13 percent).

Figure 1: Budget Functions for Funds Designated through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023

Tribal, State, Local, and Territorial Governments Were Again Designated to Receive almost Half the Funding for Fiscal Year 2023 Provisions

As shown in table 3, tribal, state, local, and territorial governments were designated to receive almost half of the total amount designated by the fiscal year 2023 provisions (about 47 percent), about the same proportion of funding they were designated to receive in fiscal year 2022. The federal government is the designated recipient for about 22 percent of the fiscal year 2023 funding. For example, a provision designated funds to the Department of Agriculture to undertake watershed and flood prevention operations.

aThe joint explanatory statement did not designate an amount or recipient for one provision for the Environmental Protection Agency to fund a solid waste shredder for the Metlakatla Indian Community in Alaska. The agency confirmed our assessment. We made the decision to keep this provision in our analysis since Congress included it in the joint explanatory statement.

Fiscal Year 2023 Funding Designated for Recipients in Various Locations Is Generally Proportionate to Fiscal Year 2022

As shown in figure 2, fiscal year 2023 provisions were designated to recipients in 48 states (every state except Montana and North Dakota), the District of Columbia, and four U.S. territories (Guam, Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands). This is consistent with the locations for the fiscal year 2022 provisions plus one additional state—Wyoming—for fiscal year 2023. The amount of funding and number of provisions varies across locations, from $1.4 million for one provision in Guam to $1.4 billion for 732 provisions in California. Overall, the pattern of total funding designated by recipient location was generally proportionate to the amounts we identified in the provisions for fiscal year 2022. For example, recipients in California were designated to receive the most provisions and the largest total amount of funds for any location in both fiscal years.

Figure 2: Distribution of Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023, by Location

Most Fiscal Year 2023 Funds Must Be Obligated in Five Years or Less, as Was the Case for Fiscal Year 2022 Funds

When Congress appropriated funds covering the fiscal year 2023 provisions, it specified a time period applicable to each appropriation from which funds were designated to specific recipients. As shown in figure 3, about 71 percent of the funds designated for fiscal year 2023 provisions are available for a fixed period ranging from 1 year to 5 years, while the approximately 29 percent remaining are no-year funds that will be available until they are expended. The percentage of funds in each period of availability for fiscal year 2023 is about the same as in fiscal year 2022, when 68 percent of funds were available for a fixed period of 1 to 5 years and 32 percent were no-year funds.

Agencies may only obligate funds during the period in which they are available, after which the funds are said to be expired. Although expired funds remain available to agencies to record, adjust, and liquidate prior obligations that were properly incurred, they are not available for the agency to enter into new obligations. Once the expired period ends—generally 5 fiscal years from the end of the period of availability—funds are considered cancelled. Once funds are cancelled, the funds are not available for obligation or expenditure for any purpose.[14] Agencies will have until at least the end of fiscal year 2028 to expend funds made available for fiscal year 2023 provisions.

Figure 3: Periods of Availability for Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023

Agency Comments

We provided a draft of this report to the 19 agencies that were appropriated funds through Community Project Funding/Congressionally Directed Spending provisions for fiscal year 2023 for review and comment. We received technical comments from the Departments of Agriculture, Defense, Energy, and the Interior, and the Office of National Drug Control Policy that we incorporated, as appropriate. The remaining 14 agencies informed us they had no comments.

We are sending copies of this report to the appropriate congressional committees, and heads of the 19 agencies that were appropriated funds through Community Project Funding/Congressionally Directed Spending provisions for fiscal year 2023, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact Allison Bawden at (202) 512-3841 or bawdena@gao.gov or Heather Krause at (202) 512-2834 or krauseh@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix II.

Allison Bawden

Director, Natural Resources and Environment

Heather Krause

Director, Physical Infrastructure

Congressional Addressees

The Honorable Patty Murray

Chair

The Honorable Susan Collins

Vice Chair

Committee on Appropriations

United States Senate

The Honorable Chris Van Hollen

Chair

The Honorable Bill Hagerty

Ranking Member

Subcommittee on Financial Services and General Government

Committee on Appropriations

United States Senate

The Honorable Jack Reed

Chair

The Honorable Deb Fischer

Ranking Member

Subcommittee on Legislative Branch

Committee on Appropriations

United States Senate

The Honorable Kay Granger

Chairwoman

The Honorable Rosa DeLauro

Ranking Member

Committee on Appropriations

House of Representatives

The Honorable Steve Womack

Chair

The Honorable Steny Hoyer

Ranking Member

Subcommittee on Financial Services and General Government

Committee on Appropriations

House of Representatives

The Honorable Mark Amodei

Chair

The Honorable Adriano Espaillat

Ranking Member

Subcommittee on Legislative Branch

Committee on Appropriations

House of Representatives

Appendixes

IN THIS SECTION

Appendix I: Objectives, Scope, and Methodology

Bookmark:This report provides an overview of fiscal year 2023 Community Project Funding/ Congressionally Directed Spending. Specifically, this report provides information on (1) the agencies that were appropriated these funds and the steps they expect to take to plan and execute the funds; (2) the purposes of the funds, types of designated recipients, and location of projects; and (3) the period of availability for the funds.

For each of these objectives, we reviewed previous GAO reports and compared what we found for fiscal year 2023 provisions to the corresponding information from our prior work on the fiscal year 2022 provisions.

To identify the agencies that were appropriated funds for these projects, we analyzed tables included in the joint explanatory statement accompanying the Consolidated Appropriations Act, 2023. These tables list each Community Project Funding/Congressionally Directed Spending provision and represent the complete list of these provisions. Our report focuses on the 18 agencies responsible for administering provisions in fiscal year 2022 and 2023, and one additional agency in fiscal year 2023—the Office of National Drug Control Policy.

We then used this information to create a dataset. We used the joint explanatory statement to identify the following data fields: subcommittee, agency, subunit, account, project, recipient, location, funding amount, and requester. If information for one of these fields was not in the joint explanatory statement, we inferred it from other information. For example, if the location field was not included for a particular provision, we used the description of the recipient, project, or congressional requester to determine the state. We also compared information from the joint explanatory statement to the Fiscal Year 2023 President’s Budget Appendix to identify the budget account number. This field represents the budget account associated with the relevant projects.

In the joint explanatory statement for provisions under the House and Senate Appropriations Committees’ Energy and Water Development Subcommittees, there are three columns which may list dollar amounts for each provision: “Budget Request,” “Additional Amount,” and “Total Amount Provided.”[15] The table containing these Energy and Water Development Subcommittees’ provisions noted that amounts shown over the President’s budget request level (the “Additional Amount” column) are considered Community Project Funding/Congressionally Directed Spending. In accordance with this, we used the “Additional Amount” as the value of Community Project Funding/Congressionally Directed Spending for provisions included by these subcommittees. This practice affected the number and dollar value of provisions directed to the U.S. Army Corps of Engineers, the Department of the Interior’s Bureau of Reclamation, and the Department of Energy’s Energy Project account.

To identify the steps that agencies expect to take to plan and execute the funds, we interviewed officials from the 19 agencies about their plans and processes for executing the fiscal year 2023 provisions compared with the processes they used for the fiscal year 2022 provisions.

To describe the purposes of the funds, types of designated recipients, and locations of projects, we analyzed the dataset described above. Specifically, to describe the broad purpose of these funds, we matched the accounts for the provisions listed in the joint explanatory statement to budget accounts from the Budget Appendix of the President’s Budget. We used the budget account number to determine the applicable budget function from Office of Management and Budget (OMB) Circular No. A-11 for each provision.[16] Budget functions are broad categories of spending into which all federal spending is divided, regardless of the federal agency that oversees the individual federal program.

To help describe the type of designated recipients of these funds, we organized them into four categories: federal government; tribal, state, territorial, or local governments; higher education organizations; and other nonprofit organizations. These categories are based on categories used in USAspending.gov, and are consistent with the categories we used for our prior work on the fiscal year 2022 provisions. The Senate and House Appropriations Committees’ process for requesting these provisions specified that a designated recipient cannot be a for-profit entity. We did not assess compliance with this requirement. Thus, for the purposes of this report, we assigned all recipients that are not federal government; tribal, state, territorial, and local government; or higher education organizations to the “other nonprofit organization” category.

We categorized recipients into these four categories based on (1) the recipient’s name and project description and (2) information provided by the federal agency that was designated funds to obligate to these recipients. In some cases where the accurate categorization of a recipient was still not clear, we used information about the recipient that we gathered through a review of its website.

To determine the period of availability of these funds, we identified the period of availability for each applicable appropriation in the Consolidated Appropriations Act, 2023.

We provided the relevant subset of the dataset described above to each of the applicable agencies to confirm accuracy. Specifically, we provided each of the 19 agencies (see table 4) with the data fields described above for the Community Project Funding/Congressionally Directed Spending provisions for which they are responsible. We asked the agencies to verify the accuracy of the data and provide any corrections as needed. We discussed these corrections with agency officials. Almost all corrections were from the Department of Transportation concerning recipient names and the U.S. Army Corps of Engineers concerning recipient categories. Officials from the Department of Education said they did not categorize recipients in this way and could not confirm our categorizations. We made these determinations to the best of our ability. We also conducted checks to identify and address errors or omissions in the data from these data collection instruments. Overall, we found the data to be reliable for the purpose of describing the government-wide execution of Community Project Funding/Congressionally Directed Spending provisions.

As part of this review, we did not assess the merits of the projects funded in the Community Project Funding/Congressionally Directed Spending provisions. We also did not assess the ability of specific recipients to carry out the projects described in the Consolidated Appropriations Act, 2023.

We conducted this performance audit from January 2023 to September 2023 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Appendix II: GAO Contacts and Staff Acknowledgments

Bookmark:GAO Contacts

Allison Bawden, (202) 512-3841 or bawdena@gao.gov

Heather Krause, (202) 512-2834 or krauseh@gao.gov

Staff Acknowledgments

In addition to the contacts named above, Janice Latimer (Assistant Director), Adam Gomez (Analyst in Charge), Ann Marie Cortez, John Delicath, Katherine Morris, Gabriel Nelson, Omari Norman, Emily Quick-Cole, Dan Royer, and Walter Vance made key contributions to this report.

References

Figures

- Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023 by Location

- Figure 1: Budget Functions for Funds Designated through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023

- Figure 2: Distribution of Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023, by Location

- Figure 3: Periods of Availability for Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023

Tables

- Table 1: Key Terms in the Budget Process

- Table 2: Community Project Funding/Congressionally Directed Spending Provisions in the 2022 and 2023 Consolidated Appropriations Acts, by Federal Agency

- Table 3: Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023, by Type of Recipient

- Table 4: Federal Agencies Designated for Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2023

End Notes

Contacts

Allison Bawden

Director, Natural Resources and Environment, bawdena@gao.gov, (202) 512-3841Heather Krause

Director, Physical Infrastructure, krauseh@gao.gov, (202) 512-2834Congressional Relations

U.S. Government Accountability Office

441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

U.S. Government Accountability Office

441 G Street NW, Room 7149, Washington, DC 20548

Strategic Planning and External Liaison

U.S. Government Accountability Office

441 G Street NW, Room 7814, Washington, DC 20548

Obtaining Copies of GAO Reports and Testimony

Order by Phone

To Report Fraud, Waste, and Abuse in Federal Programs

Automated answering system: (800) 424-5454 or (202) 512-7470

Connect with GAO

GAO’s Mission

Copyright

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

Citing This Report

This report should be cited as:

GAO, Tracking the Funds: Specific FY 2023 Provisions for Federal Agencies, GAO-23-106561 (Washington, D.C.: September 2023).