2024 ANNUAL REPORT

Additional Opportunities to Reduce Fragmentation, Overlap, and Duplication and Achieve Billions of Dollars in Financial Benefits

Report to Congressional Addressees

May 2024

GAO-24-106915

United States Government Accountability Office

View GAO‑24‑106915. For additional information, contact Jessica Lucas-Judy at (202) 512-6806 or lucasjudyj@gao.gov or Michelle Sager at (202) 512-6806 or sagerm@gao.gov.

Highlights of GAO‑24‑106915, a report to congressional addressees

May 2024

2024 ANNUAL REPORT

Additional Opportunities to Reduce Fragmentation, Overlap, and Duplication and Achieve Billions of Dollars in Financial Benefits

Why GAO Did This Study

GAO annually reports on federal programs, agencies, offices, and initiatives–either within departments or government-wide–that have duplicative goals or activities. As part of this work, GAO also identifies additional opportunities for greater efficiency and effectiveness that result in cost savings or enhanced revenue collection.

This report discusses new opportunities to achieve billions of dollars in financial savings and improve the efficiency and effectiveness of a wide range of federal programs.

It also evaluates the status of previous matters for congressional consideration and recommendations for federal agencies related to the Duplication and Cost Savings body of work.

In addition, this report provides examples of open matters to Congress and recommendations to federal agencies where further implementation steps could yield significant financial and other benefits.

Source: GAO. | GAO-24-106915

GAO’s Duplication and Cost Savings website provides information on the body of work.

What GAO Found

GAO identified 112 new matters and recommendations in 42 new topic areas for Congress or federal agencies to improve the efficiency and effectiveness of government. For example:

· The Defense Counterintelligence and Security Agency should ensure its working capital fund cash balance is within its operating range, potentially saving its federal customers hundreds of millions of dollars through reduced prices.

· Congress and the Internal Revenue Service should take action to improve sole proprietor tax compliance, which could increase revenue by hundreds of millions of dollars per year.

· Agencies could save one hundred million dollars or more by using predictive models to make investment decisions on deferred maintenance and repair for federal buildings and structures.

· Congress should consider taking action that could help the Armed Forces Retirement Home address financial shortfalls to reduce the risk of exhausting the trust fund that supports it and potentially generate revenue of one hundred million dollars or more over 10 years.

· Federal agencies need building utilization benchmarks to help them identify and reduce underutilized office space, which could save ten million dollars or more over 5 years.

· The Department of Defense should reduce the risk of overlapping management activities and potentially save ten million dollars or more over 5 years in medical facility management by continuing its efforts to reevaluate its market structure and establishing performance goals.

· Congress could close regulatory gaps and seven federal financial regulators should improve coordination to better manage fragmented efforts to identify and mitigate risks posed by blockchain applications in finance.

· The Office of Science and Technology Policy should facilitate the sharing of information about identifying foreign ownership of research entities to better manage fragmentation of federal efforts to help safeguard federally funded research from foreign threats.

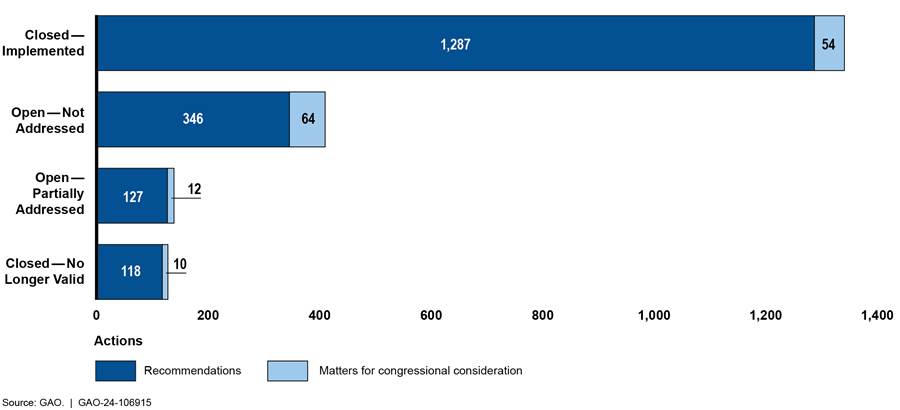

As of March 2024, Congress and agencies had fully addressed 1,341 (66 percent) of the 2,018 matters and recommendations GAO identified from 2011-2024 and partially addressed 139 (about 7 percent). This has resulted in financial and other benefits, such as improved interagency coordination and reduced mismanagement, fraud, waste, and abuse.

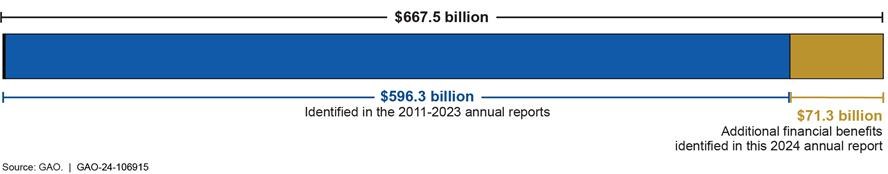

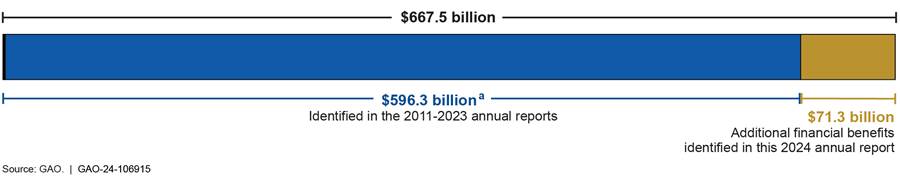

As shown in the figure below, these efforts have cumulatively resulted in about $667 billion in financial benefits, an increase of about $71 billion from GAO’s last report on this topic. These are rough estimates based on a variety of sources that considered different time periods and used different data sources, assumptions, and methodologies.

Total Financial Benefits of $667.5 Billion Identified in GAO’s 2011-2024 Duplication and Cost Savings Annual Reports

Further steps are needed to fully address the matters and recommendations GAO identified from 2011 to 2024. Of the 549 open matters and recommendations, 162 (about 30 percent) have the potential for financial benefits. Legislation was introduced in the 117th or 118th Congress to address 31 (about 41 percent) of the 76 open matters. As of March 2024, legislation had not been enacted, and those matters remained open. While GAO is no longer tracking 128 matters and recommendations due to changing circumstances, GAO estimates that fully addressing the remaining open matters and recommendations could yield financial benefits of tens of billions of dollars and improved government services, among other benefits. For example:

|

Topic area and

description |

Mission |

Potential financial benefits (Source of estimate) |

|

*Medicare Payments by Place of Service: Congress could realize additional financial benefits if it took steps to direct the Secretary of Health and Human Services to equalize payment rates between settings for evaluation and management office visits and other services that the Secretary deems appropriate. (GAO-16-189) |

Health |

$141 billion over 10 years (Congressional Budget Office) |

|

COVID Employer Tax Relief: The Internal Revenue Service should document processes used to address certain compliance risks for COVID-19 employer tax credits and implement additional compliance activities to potentially recapture ineligible claims. (GAO-22-104280) |

General Government |

Tens of billions of dollars over 2 years (GAO analysis of IRS data) |

|

*Public-Safety Broadband Network: Congress should consider reauthorizing FirstNet, including different options for its placement, and ensure key statutory and contract responsibilities are addressed before current authorities sunset in 2027. (GAO-22-104915) |

Information Technology |

$15 billion over 15 yearsa (GAO analysis of the FirstNet Contract) |

|

Student Loan Income-Driven Repayment Plans: The Department of Education should obtain data to verify income information for borrowers reporting zero income on Income-Driven Repayment applications. (GAO‑19‑347) |

Training, Employment, and Education |

More than $2 billion over 10 years (Congressional Budget Office) |

|

*DOE’s Treatment of Hanford’s Low-Activity Waste: Congress should consider clarifying two issues, including the Department of Energy’s (DOE) authority to determine whether portions of Hanford’s tank waste, such as the low-activity tank waste, can be managed as a waste type other than high-level radioactive waste and disposed of outside the state of Washington. (GAO-22-104365) |

Energy |

Billions of dollars over 11 years (GAO analysis of DOE data) |

Legend: * = Legislation is likely to be necessary to fully address all matters or recommendations in this topic area.

Source: GAO. | GAO-24-106915

aIf FirstNet sunsets, it is unclear what will happen to the remaining $15 billion in scheduled annual payments, which FirstNet currently has authority to collect and reinvest.

Note: The potential financial benefits shown in this table represent estimates of amounts GAO or others believe could accrue if steps are taken to implement the actions described. The estimates are dependent on various factors, such as whether action is taken and how it is taken. Realized financial benefits may be less, depending on costs associated with implementing the action, unintended consequences, and the effect of controlling for other factors. The individual estimates in this table should be compared with caution, as they come from a variety of sources, which consider different time periods and use different data sources, assumptions, and methodologies.

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

May 15, 2024

Congressional Addressees

We annually report on federal programs, agencies, offices, and initiatives—either within departments or government-wide—that have duplicative goals or activities.[1] As part of this work, we also identify additional opportunities for greater efficiency and effectiveness that result in cost savings or enhanced revenue collection.

Since 2011, we have issued 140 matters for Congress and 1,878 recommendations for federal agencies to eliminate, reduce, or better manage fragmentation, overlap, or duplication or realize financial benefits—cost savings or enhanced revenue collection. Actions by Congress and federal agencies in these areas have resulted in about $667.5 billion in financial benefits. We also estimate tens of billions more dollars could be saved by fully implementing our remaining open matters and recommendations.[2]

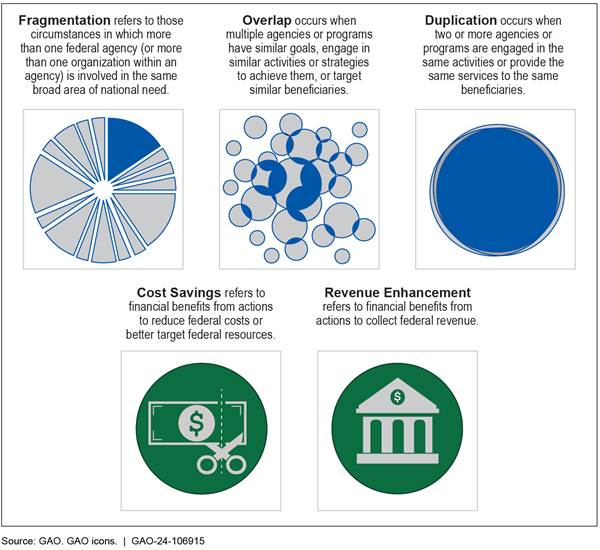

Figure 1 defines the terms we use in this work.

|

Tracking action on GAO matters and recommendations GAO’s Duplication and Cost Savings website is publicly accessible and allows Congress, agencies, and the public to track the federal government’s progress in addressing the issues we have identified. This website includes a downloadable spreadsheet containing all matters and recommendations related to the work on fragmentation, overlap, duplication, cost savings, or revenue enhancements. The spreadsheet can be filtered by the GAO report number, mission, report name, implementation status, and implementing entities (Congress or federal agencies). The spreadsheet additionally notes which recommendations are also GAO priority recommendations—those recommendations GAO believes warrant priority attention from the heads of departments or agencies. Additionally, GAO’s Duplication and Cost Savings website provides real-time updates on the status of open matters and recommendations related to duplication, overlap, fragmentation, cost savings, and revenue enhancements. Source: GAO; Icon: GAO. | GAO‑24-106915 |

This report identifies 42 new topic areas where a broad range of federal agencies could achieve greater efficiency or effectiveness. For each area, we suggest matters for Congress or recommendations for federal agencies to reduce, eliminate, or better manage fragmentation, overlap, or duplication, or achieve other financial benefits.

In addition to identifying new topic areas, we continue to monitor the progress Congress and agencies have made in addressing matters and recommendations we previously identified (see sidebar).

This report is based upon work we previously conducted in accordance with generally accepted government auditing standards. See appendix I for more information on our scope and methodology.

New Opportunities Exist to Improve Efficiency and Effectiveness across the Federal Government

This report presents 112 matters for Congress and recommendations for federal agencies across 42 new topic areas.[3] Of these 42 new topic areas, 29 concern fragmentation, overlap, or duplication in government missions and functions (see table 1). Appendix II provides more detailed information about these 29 new topic areas.

|

Mission |

Topic area |

|

Agriculture |

1. National Wildlife Disease Surveillance: Federal agencies should better manage fragmentation and enhance their efforts to establish a national wildlife disease surveillance system by more fully following leading practices for collaboration, including clearly defining common outcomes and involving relevant participants. |

|

Defense |

2. DOD Medical Facility Management: The Department of Defense should reduce the risk of overlapping management activities and potentially save ten million dollars or more over 5 years by reevaluating its market structure and establishing performance goals. |

|

3. DOD Wargames: The Department of Defense should better manage fragmentation of wargame efforts by establishing requirements or standards for reporting wargame data and developing and implementing a department-wide approach for effectively sharing wargame plans and data. |

|

|

4. Service Member Fatigue: The Department of Defense should take action to better manage fragmentation in research projects on using wearable devices to address service member fatigue, potentially saving costs. |

|

|

5. DOD Financial Management Systems: The Department of Defense should improve oversight of its business and financial management systems to allow for more informed investment decisions, which could result in cost savings and more effective identification of potential overlap and duplication. |

|

|

General Government |

6. Background Investigation Reciprocity Among Agencies: The Office of the Director of National Intelligence and the Office of Personnel Management should better manage fragmentation and potentially realize cost savings by avoiding duplicative background investigations. |

|

7. Blockchain in Finance: Congress could close regulatory gaps and seven federal regulators should improve coordination to better manage fragmented efforts to identify risks and develop appropriate, timely regulatory responses. |

|

|

8. Interior’s Management of Tribal Trust Services: The Department of the Interior should address overlap in trust services for Tribes and individuals by routinely monitoring and updating its collaboration guidance for the Bureau of Trust Funds Administration and Bureau of Indian Affairs’ Office of Trust Services. |

|

|

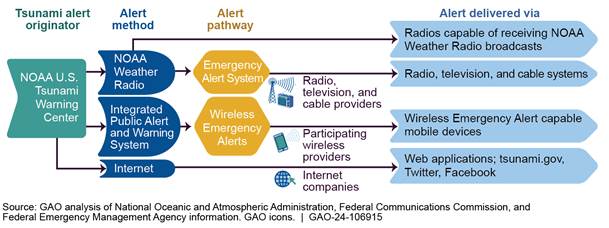

9. Tsunami Alerts: Responsible federal agencies should clarify and document their responsibilities and decision-making process to better manage fragmented efforts to improve how the public is alerted to tsunami hazards. |

|

|

Health |

10. Autism Research and Support Services: The Department of Health and Human Services should clearly track and report progress made toward goals for federal autism activities to better manage fragmentation and document procedures the National Institutes of Health uses to help ensure these activities are not unnecessarily duplicative. |

|

11. Dietary Guidelines for Americans: Federal agencies should strengthen collaboration to help ensure that federal human nutrition research effectively informs future editions of the Dietary Guidelines for Americans and reduce the risk of fragmented, overlapping, or duplicative work. |

|

|

Homeland Security, Law Enforcement or both |

12. Anti-Money Laundering Data: The Department of Justice should better manage fragmentation of data on outcomes of anti-money laundering investigations by working with the Departments of Homeland Security and the Treasury to develop a standardized methodology for producing the data. |

|

13. Biosurveillance: The Department of Homeland Security’s National Biosurveillance Integration Center should better manage fragmentation among federal biosurveillance partners by developing clear performance measures with associated time frames in cooperation with federal agency partners. |

|

|

14. DHS Acquisition of Major Assets: The Department of Homeland Security and its Joint Requirements Council should better coordinate the acquisition of major assets by finding common solutions that help avoid inefficient duplication and overlap, potentially saving one hundred million dollars or more. |

|

|

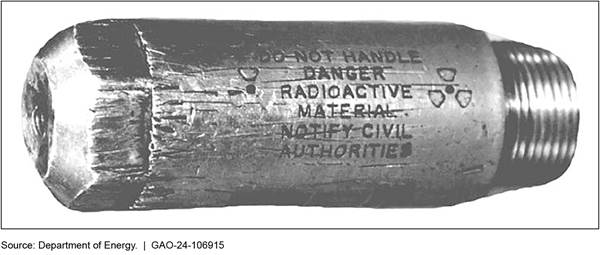

15. Disposal of Radioactive Sources: Federal agencies should better manage fragmentation by coordinating their efforts in radioactive source disposal to help mitigate the risk of its improper use. |

|

|

16. Efforts to Combat Child Trafficking: Offices in the Departments of Justice and Health and Human Services that oversee anti-trafficking grant programs should establish a collaboration mechanism focused solely on anti-trafficking efforts for children to better manage fragmentation among their grant programs and other activities. |

|

|

Information Technology |

17. Cyber Risks to Critical Operational Technology Infrastructure: The Cybersecurity and Infrastructure Security Agency should implement guidance to better manage fragmentation and improve its interagency collaboration efforts aimed at addressing risks to operational technology used in operating critical infrastructure, such as oil and gas distribution. |

|

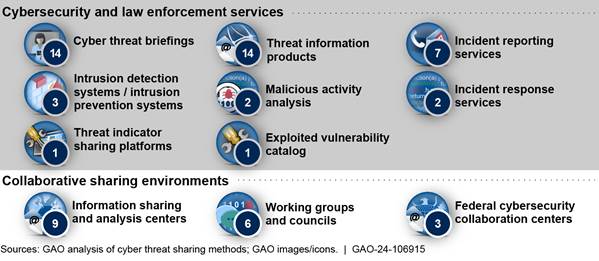

18. Cybersecurity Threat Information Sharing: The Cybersecurity and Infrastructure Security Agency should conduct a comprehensive assessment of centralized and federated sharing methods to better manage fragmentation and assess the overlap of federal cyber threat sharing efforts. |

|

|

19. Federal Agencies’ Software Licenses: Federal agencies could save millions of dollars by regularly comparing their inventories of software license agreements currently in use to purchase records to reduce costs on duplicative or unnecessary software licenses. |

|

|

20. Medical Device Cybersecurity: The Food and Drug Administration and Cybersecurity and Infrastructure Security Agency should better manage fragmentation by updating their collaboration agreement focused on medical device cybersecurity. |

|

|

21. Spectrum IT Modernization: The National Telecommunications and Information Administration should document how it will communicate with stakeholders on its spectrum IT modernization to help ensure it can identify stakeholders’ requirements and better manage fragmentation issues that could impair IT interoperability. |

|

|

International Affairs |

22. Special Rules of Origin for Automotive Goods: The U.S. Trade Representative, as chair of the Interagency Autos Committee, should work with committee members to develop written guidance to help ensure accountability and better manage fragmentation among the nine member agencies. |

|

Science and the Environment |

23. Biomedical Research: The Advanced Research Projects Agency for Health should clearly define how its interagency advisory committee members agree to share information to help reduce the risk of unnecessary duplication in biomedical research and potentially save costs. |

|

24. Justice40 Initiative Guidance and Tools: Entities within the Executive Office of the President should better manage fragmentation and potential overlap in more than 500 programs at 19 federal agencies by implementing leading practices for collaboration to help ensure guidance and tools for the Justice40 Initiative are effective, timely, and consistent. |

|

|

25. Low-Dose Radiation: The Department of Energy should take steps to better manage fragmentation and help ensure clear leadership of federal research on the health effects of low-dose radiation. |

|

|

26. Managing Risks from Wildfire Smoke: The Environmental Protection Agency should better coordinate its fragmented efforts to manage risks related to air quality and public health from wildfire smoke. |

|

|

27. Safeguarding Federally Funded Research from Foreign Threats: The Office of Science and Technology Policy should facilitate the sharing of information about identifying foreign ownership, control, or influence to better manage fragmentation of efforts to help safeguard federally funded research from foreign threats. |

|

|

Training, Employment, and Education |

28. Meat and Poultry Worker Safety: The Occupational Safety and Health Administration and the Food Safety and Inspection Service should better manage fragmentation by following leading collaboration practices to improve worker safety. |

|

29. Nonstandard and Contract Work Arrangements: The Department of Labor and the Office of Management and Budget should take steps to improve data on nonstandard and contract work arrangements, which will help better manage fragmentation across at least seven federal agencies. |

Source: GAO. | GAO 24-106915

We also present 13 new topic areas where Congress or federal agencies could take action to reduce the cost of government operations or enhance federal revenue collections (see table 2). Appendix III provides more detailed information about these 13 new topic areas.

Table 2: New Topic Areas with Cost Savings and Revenue Enhancement Opportunities Identified in This Report

|

Mission |

Topic area |

|

Defense |

30. Armed Forces Retirement Home: Congress should consider taking action that could help the Armed Forces Retirement Home address financial shortfalls and potentially generate revenue of one hundred million dollars or more over 10 years. |

|

31. National Background Investigation Services: Congress should consider requiring the Department of Defense to use best practices to develop a reliable program schedule and cost estimate for deploying its new background investigation service to better manage the costs of the program. |

|

|

32. Personnel Vetting Working Capital Fund: The Defense Counterintelligence and Security Agency should ensure its working capital fund cash balance is within its operating range, potentially saving its federal customers hundreds of millions of dollars through reduced prices. |

|

|

General Government |

33. Army Corps Administrative Fees: The Army Corps of Engineers could increase the amount it collects from real estate administrative fees by one million dollars or more over 10 years by improving how it sets, reviews, and updates the fees. |

|

34. Federal Office Space Utilization: Federal agencies need building utilization benchmarks to help them identify and reduce underutilized office space, which could save ten million dollars or more over 5 years. |

|

|

35. Federal Real Property: Agencies could save one hundred million dollars or more by using predictive models to make investment decisions on deferred maintenance and repair for federal buildings and structures. |

|

|

36. IRS Audits of High-Income/High-Wealth Taxpayers: The Internal Revenue Service should improve its efforts to audit high-income and high-wealth taxpayers, which could enhance federal government revenue. |

|

|

37. IRS Audits of Large Partnerships: IRS should improve its efforts to audit large, complex partnerships, which could enhance federal government revenue by potentially millions of dollars over several years. |

|

|

38. Sole Proprietor Tax Compliance: Congress and the Internal Revenue Service should take action to improve sole proprietor tax compliance which could increase revenue by hundreds of millions of dollars per year. |

|

|

Homeland Security, Law Enforcement or both |

39. Coast Guard Housing: The Coast Guard should assess the potential benefits of certain housing authorities and develop a legislative proposal, if appropriate, to better manage its housing program costs. |

|

Information Technology |

40. Cloud Computing Security: The Office of Management and Budget should take action to improve the tracking and reporting of data associated with authorizing cloud computing services to potentially reduce the costs of cloud services. |

|

International Affairs |

41. Grants Management in Freely Associated States: The Departments of Health and Human Services and the Interior should issue timely grant management decisions related to Federated States of Micronesia, Republic of the Marshall Islands, and Republic of Palau that could result in cost savings. |

|

42. Steel and Aluminum Tariffs: The Department of Homeland Security should take steps, as appropriate, to prevent invalid use of tariff exclusions and to recover unpaid duties because of invalid use, which could result in millions of dollars in savings. |

Source: GAO. | GAO 24-106915

Congress and Federal Agencies Continue to Address Matters and Recommendations Identified over the Last 14 Years, Resulting in Significant Benefits

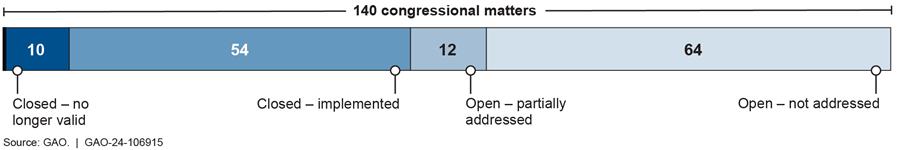

Congress and federal agencies have addressed many of the matters and recommendations we have identified, as shown in figure 2 and table 3. As of March 2024, Congress and agencies had fully or partially addressed 1,480 (73 percent) of the 2,018 matters and recommendations; of these, they had fully addressed 1,341 and partially addressed 139.

Note: These data include matters and recommendations related to our prior annual reports, from our prior reports not previously tracked in this body of work but that have potential or realized financial benefits, and those newly identified in this annual report. Matters and recommendations categorized as ”closed – no longer valid” are no longer assessed. These are generally “closed – no longer valid” when the matter or recommendation is no longer relevant due to changing circumstances.

|

Status |

Number of matters (percentage) |

Number of recommendations (percentage) |

Total |

|

Closed – implemented |

54 (39%) |

1,287 (69%) |

1,341 (66%) |

|

Open – not addressed |

64 (46%) |

346 (18%) |

410 (20%) |

|

Open – partially addressed |

12 (9%) |

127 (7%) |

139 (7%) |

|

Closed – no longer valid |

10 (7%) |

118 (6%) |

128 (6%) |

|

Total |

140 (100%) |

1,878 (100%) |

2,018 (100%) |

Source: GAO. | GAO-24-106915

Note: Due to rounding, the total percentages may not add up to exactly 100 percent.

These data include matters and recommendations related to our prior annual reports, from our prior reports not previously tracked in this body of work but that have potential or realized financial benefits, and those newly identified in this annual report. Matters and recommendations categorized as ”closed – no longer valid” are no longer assessed. These are generally “closed – no longer valid” when the matter or recommendation is no longer relevant due to changing circumstances.

Actions Taken by Congress and Federal Agencies Led to Hundreds of Billions in Financial Benefits

As a result of steps Congress and agencies have taken in response to our work, we have identified approximately $667.5 billion in total financial benefits, including $71.3 billion identified in this 2024 annual report. About $596.3 billion of the total benefits were identified in our 2011 – 2023 annual reports, as shown in figure 3.

Figure 3: Total Financial Benefits of $667.5 Billion Identified in Our 2011-2024 Duplication and Cost Savings Annual Reports

Note: In calculating these totals, we relied on individual estimates from a variety of sources, which considered different time periods and used different data sources, assumptions, and methodologies. These totals represent a rough estimate of financial benefits and have been rounded to the nearest $100 million. Due to rounding, the two subtotals do not add up to exactly $667.5 billion.

aAs we reported in 2023, we made improvements to standardize our data by moving from tracking realized financial benefits as accrued and expected amounts to tracking financial benefits in fiscal year net present value. During our 2024 update, we continued our efforts to refine these data, including through our communications with agencies. This resulted in some previously reported savings being recalculated from earlier years into the total for 2024. As a result, the total financial benefits for 2011-2023 have been updated from $599.5 billion to $596.3 billion.

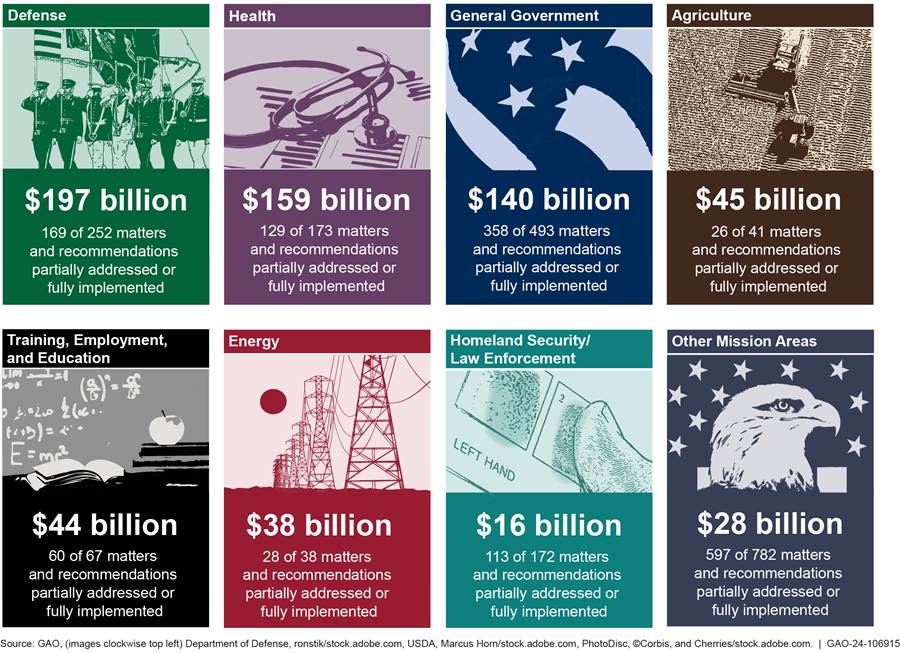

These benefits have contributed to missions across the federal government, as shown in figure 4.

Notes: Due to rounding, the combined benefits do not add up to exactly $667.5 billion. Other Mission Areas include Economic Development, Information Technology, Income Security, International Affairs, Science and the Environment, and Social Services. These totals rely on individual estimates from a variety of sources, which considered different time periods and used different data sources, assumptions, and methodologies, and represent a rough estimate of financial benefits that have been rounded to the nearest $1 billion.

Table 4 highlights examples of results achieved over the past 14 years.

Table 4: Examples of Financial Benefits Resulting from Actions Taken by Congress and Federal Agencies, as of March 2024

|

Topic area (GAO report number linked) |

Actions taken |

Financial benefit |

|

Federal Buying Power (GAO-17-164 and GAO-21-40) |

The Office of Management and Budget’s (OMB) Category Management initiative directed agencies across the federal government to buy more like a single enterprise, setting agency targets for using category management contracts including those it designated as Best-In-Class, beginning in fiscal year 2017, and reporting on agency performance against those targets beginning in fiscal year 2018. |

Cost savings of approximately $48.8 billion from fiscal years 2017 through 2021, according to OMB reporting. |

|

COVID-19 Funding and Spending |

Congress rescinded certain COVID-19 relief funding that we identified as unexpired and unobligated in the Fiscal Responsibility Act of 2023.a |

Federal savings of $27.1 billion in fiscal year 2023, according to Congressional Budget Office (CBO) estimates. |

|

Paycheck Protection Program |

The Small Business Administration (SBA) implemented an oversight plan for its Paycheck Protection Program, including an automated screening system to identify potentially ineligible or fraudulent applicants and recipients. SBA applied similar oversight controls to identify potentially ineligible or fraudulent applicants to its Restaurant Revitalization Fund. |

Cost savings of about $13.2 billion from fiscal years 2020 through 2023, according to our analysis of SBA data. |

|

Federal Passport Taxes |

Following enactment of the Fixing America’s Surface Transportation (FAST) Act in 2015, the Internal Revenue Service (IRS) provided information to the Department of State about individuals with certain seriously delinquent tax debts, which State used to restrict the issuance of passports to such individuals.b As a result, many delinquent taxpayers were incentivized to resolve their liabilities. IRS may realize additional financial benefits through continued enforcement of the FAST Act, although no estimate is available. |

Revenue enhancement of about $8.2 billion from fiscal years 2018 through 2022, according to IRS and State. |

|

Identity Theft Refund Fraud |

Following enactment of the Protecting Americans from Tax Hikes Act of 2015, IRS enhanced its fraud and noncompliance detection tools to use W-2 data to verify wage and other information reported on tax returns prior to issuing refunds.c By using W-2 information prior to issuing refunds, IRS has avoided paying billions in fraudulent and noncompliant refunds and yielded additional savings by reducing taxpayer burden. |

Cost savings of about $7.1 billion from fiscal years 2017 through 2021, according to our analysis of W-2 information obtained from IRS. IRS concurred with our methodology for calculating estimates. |

|

Required Auction of Public Safety Spectrum |

Congress repealed the requirement to reallocate and auction radio spectrum used by public safety officials (e.g., firefighters and police).d The Federal Communications Commission (FCC) terminated the auction proceedings in January 2021, thereby avoiding reallocation and auction costs that were projected to exceed auction revenues. |

Cost savings of about $3 billion from fiscal years 2021 through 2023, according to FCC. |

|

Medicare Advantage |

Congress took steps to increase the minimum adjustment made for differences in diagnostic coding patterns between Medicare Advantage plans and traditional Medicare providers, which reduced excess payments by the Centers for Medicare & Medicaid Services (CMS) to Medicare Advantage plans for beneficiaries’ care.e CMS could realize additional financial benefits by adjusting payments for differences between Medicare Advantage plans and traditional Medicare providers in the reporting of beneficiary diagnoses. |

Cost savings of about $2.5 billion from fiscal years 2013 through 2022, according to CBO, and tens of billions of dollars of additional savings are possible, according to the Medicare Payment Advisory Commission. |

|

Medicare Payments by Place of Service |

CMS issued a final rule in 2018 capping payment rates for certain hospital outpatient clinic visits furnished by off-campus hospital outpatient departments that existed or were under construction in 2015 at the physician fee schedule rate.f Congress could realize additional financial benefits if it took steps to direct the Secretary of Health and Human Services to equalize payment rates between settings for evaluation and management office visits and other services that the Secretary deems appropriate. |

Cost savings of about $2.2 billion from fiscal years 2019 through 2022, according to CMS, and $141 billion of additional savings could potentially accrue over 10 years, according to CBO estimates. |

Source: GAO. | GAO-24-106915

Note: The estimates in this report are from a range of sources, including us, executive branch agencies, CBO, and the Joint Committee on Taxation. Some estimates have been updated since our 2023 report to reflect more recent analyses.

aFor example, section 2 of division B of the Fiscal Responsibility Act of 2023 rescinded certain unobligated funds in the Public Health and Social Services Emergency Fund (PHSSEF) within the Department of Health and Human Services that were appropriated by the six COVID-19 relief laws. Pub. L. No. 118-5, 137 Stat. 10 (2023), CBO estimates that the PHSSEF rescissions amount to approximately $9.9 billion.

bPub. L. No. 114-94, 32101, 129 Stat. 1312, 1731 1729–1732 (2015), codified at 26 U.S.C. 6103(k)(11), 7345.

cThe act advanced the deadline for employers to file W-2s to SSA to January 31. Pub. L. No. 114-113, div. Q, 201, 129 Stat. 2242, 3076 (2015) codified at 26 U.S.C. 6071(c).

dDon't Break Up the T-Band Act of 2020, Pub. L. No. 116-260, div. FF, 902(b), 134 Stat 1182, 3206 (2020).

eThe Health Care and Education Reconciliation Act of 2010 required minimum increases in the annual adjustment for coding differences starting in 2014 and required CMS to continue making adjustments in subsequent years until the agency implements risk adjustment based on diagnostic, cost, and use data from Medicare Advantage plan. Pub. L. No. 111-152, 1102(e), 124 Stat. 1029, 1046. The American Taxpayer Relief Act of 2012 subsequently increased the statutory minimum for the annual adjustment. Pub. L. No. 112-240, 639, 126 Stat. 2313, 2357 (2013), codified at 42 U.S.C. 1395w-23(a)(1)(C)(ii)(III).

fMedicare Program: Changes to Hospital Outpatient Prospective Payment and Ambulatory Surgical Center Payment Systems and Quality Reporting Programs; 83 Fed. Reg. 58, 818 (Nov. 21, 2018).

Other Benefits Resulting from Actions Taken by Congress and Federal Agencies

Our matters and recommendations, when implemented, often result in other benefits, such as more effective government through improved interagency coordination; improvements in major government programs or agencies; reduced mismanagement, fraud, waste, and abuse; and increased assurance that programs comply with internal guidance. The following examples illustrate some of these types of benefits.

· Overseas Nuclear Material Security (GAO-23-106486). The U.S. and other countries have made efforts to secure nuclear material from theft and to prevent sabotage of facilities containing nuclear materials; however, significant risks remain that could result in catastrophic damage and mass casualties. As part of those efforts, certain programs in the Department of Defense (DOD) and the Department of Energy’s National Nuclear Security Administration (NNSA) have an overlapping mission to secure nuclear materials, and they conduct similar activities—in some cases, in the same countries and in collaboration with the same foreign officials.

In 2023, we recommended that DOD and NNSA clarify and document the roles and responsibilities for programs that work to address similar issues in the same countries as other federal programs to avoid potential duplication.

In response, the agencies signed a new memorandum of agreement in 2023 for cooperation, integration, and synchronization between NNSA and the Defense Threat Reduction Agency. As a result of these efforts, DOD and NNSA can better prevent duplication of effort and improve the efficiency of international nuclear security efforts.

· Veterans’ Long-Term Care (GAO-20-284). The Department of Veterans Affairs (VA) provides or pays for long-term care for veterans through 14 long-term care programs. As one of the largest health care systems in the United States, VA faces challenges similar to other health care providers when seeking to meet the growing need for long-term care as the U.S. population ages.

In 2020, we found that VA Medical Centers did not have a consistent approach to managing VA’s 14 long-term care programs, and their management of these programs was fragmented across multiple departments. We recommended that VA set time frames for and implement a consistent structure for offices overseeing long-term care services at VA Medical Centers.

In response, VA realigned its programs in 2022 so that veterans seeking long-term care now primarily access that care through VA’s primary care teams. Specifically, primary care providers will consult veterans seeking long-term care about available institutional and noninstitutional programs based on the veterans’ preferences. As a result of these efforts, veterans will have a more consistent experience accessing long-term care through VA Medical Centers.

Action on Open Matters and Recommendations Could Yield Additional Benefits

Congress and federal agencies have taken action on many of the 2,018 matters and recommendations we have identified since 2011. However, further steps are needed to fully address the 549 matters and recommendations that remain open. We estimate that tens of billions of dollars in additional financial benefits could be realized should Congress and agencies fully address these. In addition, other improvements can be achieved.[4].

Open Duplication and Cost Savings Matters and Recommendations

We identified 140 matters directed to Congress that have the opportunity to address fragmentation, overlap, and duplication, or achieve financial benefits. Of the 140 matters, 76 (54 percent) remained open as of March 2024. Legislation was introduced in the 117th or 118th Congress to address 31 (about 41 percent) of the open matters. As of March 2024, legislation had not been enacted, and those matters remained open. Appendix IV has a full list of the 76 open matters.

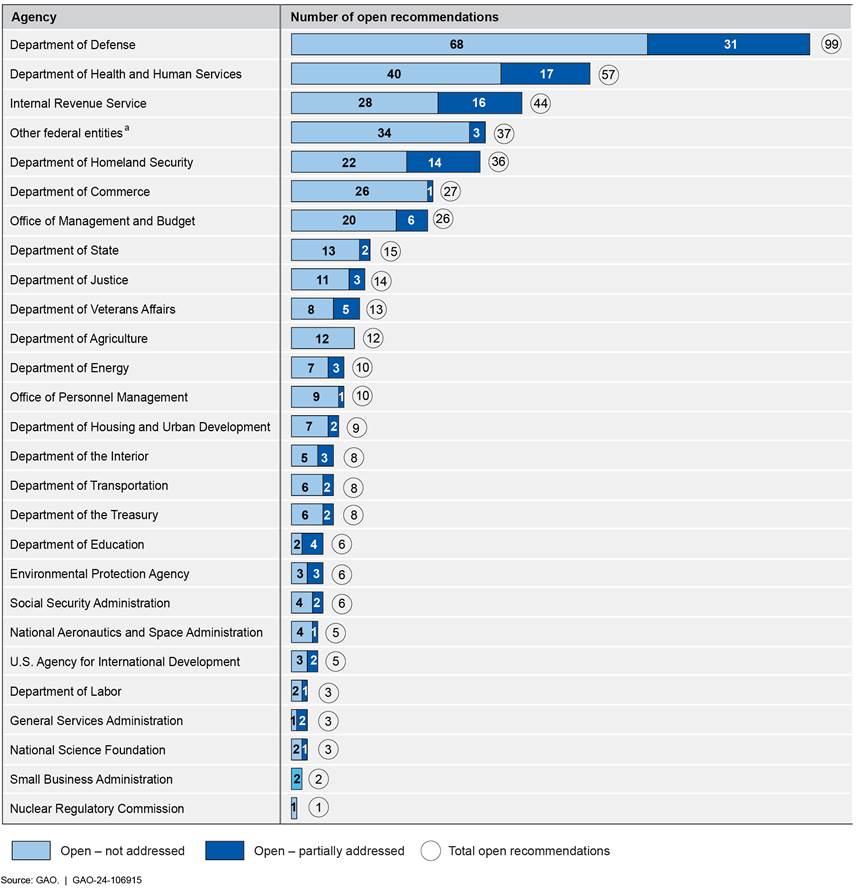

We also identified 1,878 recommendations directed to federal agencies. As shown in figure 5, these recommendations span the government. Of the 1,878 recommendations, 473 (25 percent) remained open as of March 2024. Six agencies—Department of Defense, Department of Health and Human Services, the Internal Revenue Service, Department of Homeland Security, Department of Commerce, and the Office of Management and Budget—each have at least 20 open recommendations.

Note: These data include recommendations related to our prior annual reports, from our prior reports not previously tracked in this body of work but that have potential or realized financial benefits, and those newly identified in this annual report.

a“Other federal entities” reflects open recommendations directed to the following federal entities: AmeriCorps, Capitol Police Board, Committee on Science, Technology, Engineering, and Math Education, Commodity Futures Trading Commission, Consumer Financial Protection Bureau, Consumer Product Safety Commission, Cybersecurity and Infrastructure Security Agency, Executive Office of the President, Federal Communications Commission, Federal Deposit Insurance Corporation, Federal Energy Regulatory Commission, Federal Reserve System, National Credit Union Administration, Office of the Director of National Intelligence, Railroad Retirement Board, U.S. Agency for Global Media, U.S. Geological Survey, United States Commission on International Religious Freedom, United States Interagency Council on Homelessness, United States Postal Service, and United States Securities and Exchange Commission.

Approximately 63 percent of the open recommendations are directed to 10 agencies—Department of Health and Human Services, Social Security Administration, Department of the Treasury, Department of Defense, Department of Education, Department of Veterans Affairs, Department of Agriculture, Office of Personnel Management, Department of Transportation, and Department of Homeland Security—that made up about 93 percent of federal outlays in fiscal year 2023. Figure 6 highlights agencies with open recommendations, as well as their fiscal year 2023 share of federal outlays.

Figure 6: Fiscal Year 2023 Outlays and Number of Open Duplication and Cost Savings Recommendations, by Agency

Notes: Due to rounding, the total percentages may not add up to exactly 100 percent.

These data include recommendations related to our prior annual reports, from our prior reports not previously tracked in this body of work but that have potential or realized financial benefits, and those newly identified in this annual report.

aThe Department of the Treasury’s percentage of fiscal year 2023 outlays includes interest payments on the national debt as well as costs associated with administering its bureaus, including the Internal Revenue Service (IRS). The total open recommendations to Treasury also include open recommendations to IRS.

bOther agencies include all federal agencies with fiscal year 2023 outlays not listed above.

Open Matters and Recommendations to Address Fragmentation, Overlap, and Duplication and with Potential for Financial Benefits

For the 549 matters and recommendations that were open as of March 31, 2024, about 37 percent relate to improvements in public safety and security; 23 percent to business process and management; 14 percent to public insurance and benefits; 12 percent to tax law administration; 11 percent to program efficiency and effectiveness; and 4 percent to acquisition and contract management.[5]

Congress and agencies can take action on open matters and recommendations to eliminate, reduce, and better manage fragmentation, overlap, and duplication and achieve other benefits, such as maintaining global economic competitiveness, strengthening homeland and national security, and improving delivery of federal services. See table 5 for examples.

|

Topic area and description |

Mission |

Potential benefit |

|

Cell-Cultured Meat Oversight: The Secretary of Agriculture, in coordination with the Commissioner of the Food and Drug Administration, should more fully incorporate the seven leading practices for effective collaboration in the agencies' interagency agreement for the joint oversight of cell-cultured meat. (GAO-20-325) |

Agriculture |

More effective regulatory oversight of cell-cultured meat |

|

DOD Predictive Maintenance: The Secretaries of the Army, Navy, and Air Force and the Commandant of the Marine Corps should designate a single entity with sufficient authority and resources necessary to support the implementation of predictive maintenance. (GAO-23-105556) |

Defense |

Improved oversight of predictive maintenance efforts |

|

Federal Disaster Recovery Programs: The Federal Emergency Management Agency (FEMA) and the Departments of Housing and Urban Development and Transportation should each identify and take steps to better manage fragmentation between their respective disaster recovery programs and other federal programs and FEMA should also do so across its own disaster recovery programs. (GAO-23-104956) |

Homeland Security, Law Enforcement or both |

More effective recovery efforts and improved service delivery to disaster survivors |

|

Antibiotic Resistance Diagnostic Test Research: The Secretary of Health and Human Services should identify leadership and clarify roles and responsibilities among Department of Health and Human Services (HHS) agencies to assess the clinical outcomes of diagnostic testing for identifying antibiotic-resistant bacteria. (GAO-20-341) |

Health |

Better coordination to improve patient care and antibiotic use |

|

Cybersecurity in K-12 Schools: The Secretary of Education, in coordination with federal and nonfederal stakeholders, should determine how best to help school districts overcome the identified challenges and consider the identified opportunities for addressing cyber threats. (GAO-23-105480) |

Information Technology |

Improved cybersecurity assistance for schools |

|

Research on Air Travel and Communicable Diseases: Congress should consider directing the Federal Aviation Administration to develop and implement a strategy to identify and advance needed research on communicable diseases in air travel, in coordination with appropriate federal agencies, such as the HHS, the Department of Homeland Security, and external partners. (GAO-22-104579) |

Science and the Environment |

Improved research on and response to communicable diseases in air travel |

Source: GAO. | GAO-24-106915

Of the 549 open matters and recommendations, we identified 162 as having the potential to yield financial benefits. Of these 162, we estimate a lower bound of financial benefits of:

· ten billion dollars for five,

· one billion dollars for 14, and

· less than one billion dollars for 93.

We were not able to estimate the value of the potential financial benefits for 50 matters and recommendations, due, for example, to a lack of data or uncertainties in when or how the matter or recommendation would be implemented.

Further steps by Congress and federal agencies are needed to fully address the matters and recommendations that could yield significant financial benefits, as shown in table 6. Specifically, Congress and agencies could potentially realize tens of billions of dollars in financial benefits by implementing these matters and recommendations.[6]

|

Topic area and description |

Mission |

Potential financial benefits (Source) |

|

*Medicaid Demonstration Waivers: Congress should consider requiring the Secretary of Health and Human Services to improve the demonstration review process through steps such as (1) clarifying criteria for reviewing and approving states' proposed spending limits, (2) better ensuring that valid methods are used to demonstrate budget neutrality, and (3) documenting and making public material explaining the basis for any approvals. |

Health |

Tens of billions of dollars (GAO analysis of Centers for Medicare & Medicaid Services data) |

|

COVID Employer Tax Relief: The Internal Revenue Service (IRS) should document processes used to address certain compliance risks for COVID-19 employer tax credits and implement additional compliance activities to potentially recapture ineligible claims. (GAO-22-104280) |

General Government |

Tens of billions of dollars over 2 years (GAO analysis of IRS data) |

|

*Public-Safety Broadband Network: Congress should consider reauthorizing FirstNet, including different options for its placement, and ensure key statutory and contract responsibilities are addressed before current authorities sunset in 2027. (GAO-22-104915) |

Information Technology |

$15 billion over 15 yearsa (GAO analysis of the FirstNet Contract) |

|

*Crop Insurance: Congress should consider repealing the 2014 farm bill requirement that any revision to the standard reinsurance agreement not reduce companies’ expected underwriting gains, and directing the Risk Management Agency to, during the next renegotiation of the agreement, (1) adjust the participating insurance companies’ target rate of return to reflect market conditions and (2) assess the portion of premiums that participating insurance companies retain and, if warranted, adjust it. (GAO-17-501) |

Agriculture |

About $7 billion over 10 years (GAO analysis of Congressional Budget Office data) |

|

*Disability and Unemployment Benefits: Congress should consider passing legislation to require the Social Security Administration to offset Disability Insurance benefits for any Unemployment Insurance benefits received in the same period. (GAO-14-343SP) |

Income Security |

$2.2 billion over 10 years (Office of Management and Budget) |

|

Student Loan Income-Driven Repayment Plans: The Department of Education should obtain data to verify income information for borrowers reporting zero income on Income-Driven Repayment applications. (GAO‑19‑347) |

Training, Employment, and Education |

More than $2 billion over 10 years (Congressional Budget Office) |

|

*DOE’s Treatment of Hanford’s Low-Activity Waste: Congress should consider clarifying two issues, including the Department of Energy’s (DOE) authority to determine whether portions of Hanford’s tank waste, such as the low-activity tank waste, can be managed as a waste type other than high-level radioactive waste and disposed of outside the state of Washington. (GAO-22-104365) |

Energy |

Billions of dollars over 11 years (GAO analysis of DOE data) |

|

*Internal Revenue Service Enforcement Efforts: Congress should consider enhancing IRS enforcement and service capabilities can help reduce the gap between taxes owed and paid by collecting tax revenue and facilitating voluntary compliance. This could include expanding third-party information reporting. For example, reporting could be required for certain payments that rental real estate owners make to service providers, such as contractors who perform repairs on their rental properties. In addition, Congress could grant IRS the explicit authority to establish professional requirements for paid tax preparers. (GAO-08-956, GAO-09-238, GAO-14-467T, GAO-23-105217) |

General Government |

Billions of dollars over 10 years (Joint Committee on Taxation and the Department of the Treasury) |

Legend: * = Legislation is likely to be necessary to fully address all matters or recommendations in this topic area.

Source: GAO. | GAO-24-106915

aIf FirstNet sunsets, it is unclear what will happen to the remaining $15 billion in scheduled annual payments, which FirstNet currently has authority to collect and reinvest.

Note: The potential financial benefits shown in this table represent estimates of amounts GAO or others believe could accrue if steps are taken to implement the actions described. The estimates are dependent on various factors, such as whether action is taken and how it is taken. Realized financial benefits may be less, depending on costs associated with implementing the action, unintended consequences, and the effect of controlling for other factors. The individual estimates in this table should be compared with caution, as they come from a variety of sources, which consider different time periods and use different data sources, assumptions, and methodologies.

We are sending copies of this report to the appropriate congressional committees and relevant federal agencies. In addition, this report is available at no charge on the GAO website at https://www.gao.gov.

This report was prepared under the coordination of Jessica Lucas-Judy, Director, Strategic Issues, who may be reached at (202) 512-6806 or lucasjudyj@gao.gov, and Michelle Sager, Managing Director, Strategic Issues, who may be reached at (202) 512-6806 or sagerm@gao.gov. Contact points for our Office of Congressional Relations and Public Affairs may be found on the last page of this report.

Gene L. Dodaro

Comptroller General of the United States

List of Congressional Addressees

The Honorable Patty Murray

Chair

The Honorable Susan Collins

Vice Chair

Committee on Appropriations

United States Senate

The Honorable Sheldon Whitehouse

Chairman

The Honorable Chuck Grassley

Ranking Member

Committee on the Budget

United States Senate

The Honorable Gary C. Peters

Chairman

The Honorable Rand Paul, M.D.

Ranking Member

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Tom Cole

Chairman

The Honorable Rosa DeLauro

Ranking Member

Committee on Appropriations

House of Representatives

The Honorable Jodey Arrington

Chairman

The Honorable Brendan Boyle

Ranking Member

Committee on the Budget

House of Representatives

The Honorable James Comer

Chairman

The Honorable Jamie Raskin

Ranking Member

Committee on Oversight and Accountability

House of Representatives

The Honorable Mark R. Warner

United States Senate

Section 21 of Public Law 111-139, enacted in February 2010, requires us to conduct routine investigations to identify federal programs, agencies, offices, and initiatives with duplicative goals and activities within departments and government-wide.[7] This provision also requires us to report annually to Congress on our findings, including the cost of such duplication, with recommendations for consolidation and elimination to reduce duplication and specific rescissions (legislation canceling previously enacted budget authority) that Congress may wish to consider.

Our objectives in this report are to (1) identify potentially significant topic areas of (a) fragmentation, overlap, and duplication, or (b) opportunities for cost savings and enhanced revenues that exist across the federal government; (2) provide the implementation status on matters and recommendations identified; and (3) highlight examples of open matters directed to Congress and recommendations to federal agencies.

For the purposes of our analysis, we used the term “fragmentation” to refer to circumstances in which more than one federal agency (or more than one organization within an agency) is involved in the same broad area of national need. We used the term “overlap” when multiple agencies or programs have similar goals, engage in similar activities or strategies to achieve them, or target similar beneficiaries. We considered “duplication” to occur when two or more agencies or programs are engaged in the same activities or provide the same services to the same beneficiaries.[8] While fragmentation, overlap, and duplication are associated with a range of potential costs and benefits, we include them in this report only if there may be opportunities to improve how the government delivers these services.

To identify new topic areas with matters and recommendations to address fragmentation, overlap, and duplication, we examined programs and operations for these conditions, considered the potential positive and negative effects, and determined what, if any, actions Congress may wish to consider and agencies may need to take.[9] For example, we used our prior work that identified leading practices that could help agencies address challenges associated with interagency coordination and collaboration and with evaluating performance and results in achieving efficiencies.[10] The new areas of fragmentation, overlap, and duplication in this report are drawn from recently issued work with relevant matters and recommendations that have not been previously presented in an annual report.

To identify whether matters and recommendations create new opportunities for cost savings and enhanced revenues, we first considered if implementing the matter or recommendation could result in efficiencies in program operations or increased revenue to the government. We then collected and analyzed data on costs and potential savings to the extent they were available to develop our estimates. As a result, the new opportunities for potential cost savings or revenue enhancements in this report are drawn from recent work where we have determined that our matters and recommendations have the potential for a positive financial benefit.[11] More detail on our methodology for estimating potential financial benefits is presented below.

To provide illustrative examples of open matters and recommendations that could yield potential financial or other benefits, we selected matters and recommendations in a variety of topic areas and to a diverse set of federal agencies. These examples include matters and recommendations with nonfinancial benefits, as well as those with potential financial benefits of $1 billion or more.

We assessed the reliability of any computer-processed data that materially affected our findings, including cost savings and revenue enhancement estimates. The steps that we take to assess the reliability of data vary but are chosen to accomplish the auditing requirement that the data be sufficiently reliable given the purposes for which they are used in our products. We review published documentation about the data system and inspector general or other reviews of the data. We may interview agency or outside officials to better understand system controls and to assure ourselves that we understand how the data are produced and any limitations associated with the data. We may also electronically test the data to see whether values in the data conform to agency testimony and documentation regarding valid values, or we may compare data to source documents. In addition to these steps, we often compare data with other sources as a way to corroborate our findings.

We provided drafts of our new topic area summaries to the relevant agencies for their review and incorporated these comments as appropriate.

Assessing the Status of Previously Identified Matters and Recommendations

For this review, we provide the status on 2,018 matters and recommendations to address fragmentation, overlap, and duplication or potentially achieve financial benefits. This number combines 1,880 matters and recommendations included in our 2023 annual report, 19 matters and recommendations from other prior reports with newly identified financial benefits, and 119 matters and recommendations from recent work that are introduced in this report.[12]

To examine the extent to which Congress and federal agencies have taken action on implementing the 2,018 matters and recommendations associated with this report, we reviewed relevant legislation and agency documents such as budgets, policies, strategic and implementation plans, guidance, and other information between May 2023 and March 2024. In addition, we discussed the implementation status of the matters and recommendations with officials at the relevant agencies. Throughout this report, we present our counts as of March 2024, the latest date in which we received our most recent updates. We used data from our internal performance monitoring and accountability systems.[13] The final data summary reports, used to capture data updated through March 29, 2024, were generated on April 1, 2024.

We used the following criteria in assessing the status of matters and recommendations:

· In assessing the status of matters for Congress, we applied the following criteria:

· “closed – implemented” means relevant legislation has been enacted and addresses the intent of the matter, or a federal agency has taken steps that address all of the matter, with or without relevant legislation;

· “open – partially addressed” means a relevant bill has passed a committee, the House of Representatives, or the Senate during the current congressional session, or relevant legislation has been enacted but only addressed part of the action needed; or a federal agency has taken steps to address part of the matter with or without legislation. At the beginning of a new congressional session, we reapply the criteria. As a result, the status of a matter may move from open – partially addressed to open – not addressed in a future report if relevant legislation is not reintroduced from the prior congressional session;

· “open – not addressed” means a bill may have been introduced but did not pass out of a committee, or no relevant legislation has been introduced; and

· “closed – no longer valid” (formerly referred to as “closed – not implemented”) means the matter is no longer relevant because of changing circumstances.

In assessing the status of recommendations to agencies, we applied the following criteria:

· “closed – implemented” means the agency has completed all actions to implement the recommendation or when actions have been taken that essentially meet the recommendation’s intent;

· “open – partially addressed” means the agency has completed action(s) that contribute to the implementation of the recommendation, but has not yet completed all actions to implement the recommendation;

· “open – not addressed” means the agency has not yet taken any actions or has action(s) planned or underway, but not completed, to implement the recommendation; and

· “closed – no longer valid” (formerly referred to as “closed – not implemented”) means the recommendation is no longer relevant because of changing circumstances.

We also analyzed, to the extent possible, whether financial or other benefits have been realized, and included this information as appropriate. To identify financial and other benefits realized as a result of implementing our matters and recommendations, we interviewed relevant agency and program officials, and gathered and analyzed data on the net benefit of such actions. More detail on our methodology for determining realized financial benefits is presented below.

Methodologies for Determining Financial Benefits

Realized Financial Benefits

To determine net financial benefits that have resulted from action to implement our matters and recommendations, we collected and analyzed any preexisting estimates and other data on costs and potential savings, to the extent they were available, and linked supporting documentation to those estimates. While the implementation of our recommendations can result in a wide variety of improvements to program economy, effectiveness, efficiency, and equity, many of these improvements do not readily have the data necessary to calculate financial benefits. For some actions, available data may only capture a portion of the realized benefits. For all estimates of financial benefits, we estimate a net benefit to account both for the positive effects of the action and any related implementation costs.

We report the total financial benefits achieved through this work as a combination of the total savings reported in the previous annual report and the net present value of financial benefits achieved in fiscal year 2023.[14] Estimates of financial benefits rely on a variety of sources, including our analysis, Congressional Budget Office estimates, individual agencies, and others, and use different time frames, underlying assumptions, data quality, and methodologies. To account for the imprecision resulting from differences among individual estimates, we calculate our total realized financial benefits rounded to the nearest $100 million.

Potential Financial Benefits

Potential financial benefits are the financial benefits that could occur as a result of implementation of our matters and recommendations.[15] To develop estimates of potential financial benefits, we collected and analyzed any preexisting estimates and other data on costs and potential savings, to the extent they were available.[16] Estimating the potential benefits was not possible in some cases, for a variety of reasons. These include: (1) inability to predict the timing and nature of agency or congressional actions; (2) limited data on performance, funding, the extent of any identified deficiencies, or potential costs associated with taking action; and (3) external factors such as changes to the economy.[17]

Each estimate was reviewed by one of our technical specialists to ensure that estimates were based on reasonably sound methodologies. We used partial data and conservative assumptions to provide rough estimates of the magnitude of potential savings when more precise estimates were not possible. There is a higher level of uncertainty for estimates of potential financial benefits that could accrue from actions on matters and recommendations not yet taken because these estimates are dependent on whether, how, and when agencies and Congress implement them, or due to a lack of sufficiently detailed data to make reliable forecasts.

As a result, many estimates of potential financial benefits are notionally stated using terms such as millions, tens of millions, or billions to demonstrate a rough magnitude without providing a more precise estimate. Further, many of these estimates are not tied to specific time frames for the same reason. To calculate a total for potential financial benefits with a conservative approach, we used the minimum number associated with each term.[18] To account for the increased uncertainty of estimates of potential financial benefits and the imprecision resulting from differences among individual estimates, we calculated the total potential financial benefits to the nearest $10 billion, rounded down, and presented our results using a notional term.

This report is based upon work we previously conducted in accordance with generally accepted government auditing standards. Generally accepted government auditing standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

This appendix presents 29 new topic areas in which we found evidence of fragmentation, overlap, or duplication among federal government programs.

|

|

1. National Wildlife Disease SurveillanceFederal agencies should better manage fragmentation and enhance their efforts to establish a national wildlife disease surveillance system by more fully following leading practices for collaboration, including clearly defining common outcomes and involving relevant participants. |

|

|

Implementing Entity Animal and Plant Health Inspection Service and U.S. Geological Survey Related GAO Product

|

Recommendations and Matters One recommendation for APHIS and one recommendation for USGS Contact Information Steve Morris at (202) 512-3841 or morriss@gao.gov |

|

Zoonotic diseases, or diseases that can spread between animals and people, account for an estimated 75 percent of new and emerging infectious diseases and are a serious public health concern around the world. Zoonotic pathogens can be carried by agricultural animals, pets, and wildlife, including wildlife in the U.S. and animals imported to the U.S. from other countries. In recent decades, zoonotic pathogens have caused numerous outbreaks, epidemics, and pandemics in people—including HIV/AIDS, severe acute respiratory syndrome, and Ebola. Such pathogens have collectively resulted in tens of millions of deaths and hundreds of billions of dollars in economic costs worldwide.

Multiple federal agencies share responsibilities for mitigating disease threats from U.S. wildlife. For example, the U.S. Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS) and the Department of the Interior’s U.S. Geological Survey (USGS) each conduct some surveillance to detect zoonotic diseases in U.S. wildlife.

In 2020, APHIS and USGS established an ad hoc interagency committee to recommend ways to address the threat of zoonotic diseases emerging from U.S. wildlife. Among other things, the committee identified the need for a coordinated national wildlife surveillance system to rapidly detect and diagnose zoonotic diseases in wildlife.

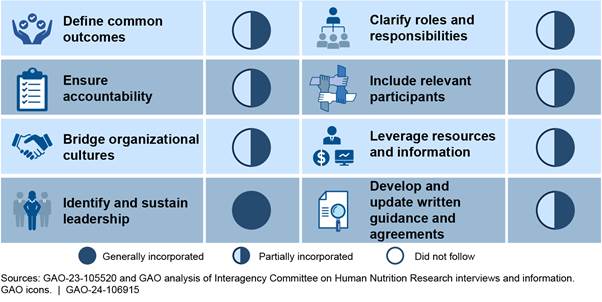

In its prior work, GAO has identified leading practices to enhance and sustain collaboration between federal agencies. These practices include defining outcomes and monitoring accountability, identifying or sharing leadership, including relevant participants, identifying and leveraging resources, and developing written guidance and agreements.

In May 2023, GAO found that certain actions that APHIS and USGS have taken since 2020 to collaborate are consistent with aspects of some of these leading practices. For example, the agencies developed a written agreement in February 2021, in which they agreed to take several steps toward establishing a national wildlife disease surveillance system.

As APHIS and USGS progress through the remaining steps to establish such a system, they have opportunities to more fully follow leading practices for collaboration. For example, the agencies jointly identified the common outcome of a national wildlife disease surveillance system, but they had not clearly defined what will make up the surveillance system. Some officials described the system as a communication network to facilitate interagency coordination, while others described it as a nationwide plan that would target high-risk species, locations, and pathogens for surveillance. Officials from both APHIS and USGS said that other relevant federal, state, and tribal agencies will be involved at some point, but they had not yet taken steps to include them.

In May 2023, GAO made one recommendation each to APHIS and USGS to follow leading practices more fully—including clearly defining common outcomes, involving relevant participants, and identifying resources and staffing—while coordinating with each other to develop and implement a national wildlife disease surveillance system. Each agency concurred with its recommendation. In December 2023, officials from both APHIS and USGS said that they have been working with other relevant agencies in efforts to develop the surveillance system through agreements separate from the one established in February 2021. APHIS estimated that a surveillance system that encompasses USGS and APHIS actions and processes will be defined and implemented by June 30, 2024, dependent on available resources.

More fully following leading practices for collaboration could help the agencies better manage fragmentation in their efforts to develop and implement a national wildlife disease surveillance system. Such a system, if implemented effectively, would better position the U.S. to address emerging wildlife diseases.

Agency Comments and GAO’s Evaluation: GAO provided a draft of this report section to APHIS and USGS for review and comment. The agencies provided technical comments, which GAO incorporated as appropriate.

GAO Product: Zoonotic Diseases: Federal Actions Needed to Improve Surveillance and Better Assess Human Health Risks Posed by Wildlife. GAO-23-105238. Washington, D.C.: May 31, 2023.

|

|

2. DOD Medical Facility ManagementThe Department of Defense should reduce the risk of overlapping management activities and potentially save ten million dollars or more over 5 years by reevaluating its market structure and establishing performance goals. |

|

|

Implementing Entity Department of Defense Related GAO Product

|

Recommendations and Matters Two recommendations for DOD Contact Information Diana Maurer at (202) 512-9627 or maurerd@gao.gov |

|

Section 702 of the National Defense Authorization Act for Fiscal Year 2017 (Public Law 114-328) mandated sweeping reforms to the military health system, including transitioning military medical treatment facilities from the military departments to the Defense Health Agency (DHA). There are about 700 such facilities in the United States and overseas. These facilities deliver health care to service members and their families, retirees, and other eligible beneficiaries, and provide essential on-the-job training for active-duty medical providers. For fiscal year 2023, the Department of Defense (DOD) budgeted $36.9 billion to fund (1) these facilities, (2) private-sector care provided by civilian network providers, and (3) other health system expenses for its beneficiaries.

In November 2022, DOD completed its multiyear transition of the military medical treatment facilities to DHA from the three military departments—the Army, the Navy, and the Air Force. DHA’s management approach divided facilities in the United States into groups—called markets—based on geographic proximity and facility type. Specifically, DHA established 36 U.S. markets and two overseas regions, and established 22 management organizations—market and regional offices—to lead them and provide shared support functions.

In August 2023, GAO found that DOD had not studied and validated the number of personnel required to staff the market and regional offices. DOD’s estimate of over 1,400 personnel for the 22 offices could be higher than needed because, among other reasons, DHA had not yet fully identified and implemented opportunities for consolidating functions as planned. The estimated requirements could also exceed expected budgetary and personnel resources. DHA also faced difficulties staffing these offices with military and federal civilian personnel in their first years of operations. However, DOD has not reevaluated the efficiency of the office structure since adopting it in 2019. It is DOD policy to periodically evaluate existing structures to ensure efficient and effective use of personnel (Department of Defense Directive 1100.4, Guidance for Manpower Management (Feb. 12, 2005)).

Further, GAO found that the extent to which DOD had realized or will realize savings from the transition of military medical treatment facilities is unknown. For example, in fiscal year 2022, DHA began 10 initiatives reforming clinical and business processes intended to save over $1.6 billion by fiscal year 2026. However, DOD officials were unable to track execution of the initiatives and had not established performance goals for tracking them. GAO’s Business Process Reengineering Assessment Guide states that an agency’s business case should have specific performance goals for a reengineered process. Without such goals, DOD cannot identify its progress in achieving the $1.6 billion savings and take any corrective actions.

In August 2023, GAO recommended that the Secretary of Defense ensure that the Deputy Secretary of Defense, in coordination with the Under Secretary of Defense for Personnel and Readiness, prioritizes a reevaluation of its organizational approach for DHA's market-based management structure. This includes the possible consolidation under DHA headquarters of some or all management activities currently vested with market offices and use of the conclusions to study and validate workloads and personnel requirements. DOD concurred with this recommendation.

As of January 2024, DOD stated that it is transitioning to a network approach to improve management of military medical treatment facilities. DOD’s new approach realigns its 36 U.S. markets and two overseas regions into nine Defense Health Networks. In doing so, DOD reduced the number of management organizations from 22 to nine. DOD also stated that, in December 2023, the Deputy Secretary of Defense directed the department to review and establish personnel requirements at all military medical treatment facilities. In implementing this direction, DOD is also identifying performance measures for the effective use of personnel across the military health system, according to officials.

GAO also recommended that the Secretary of Defense ensure that the Under Secretary of Defense for Personnel and Readiness establishes performance goals for its transition-related clinical and business reform initiatives, and then monitor the results in relation to projected savings. DOD partially concurred with this recommendation, noting that virtually all transition-related clinical and business reform initiatives were completed, and that DHA and the military health system had processes to monitor resource utilization.

However, GAO’s recommendation was specific to 10 reform initiatives that were ongoing throughout fiscal year 2023, and DHA officials stated they did not yet track them. GAO continues to maintain that the recommendation is feasible to ensure DOD’s clinical and business reform initiatives for the military health system are on track to achieve the intended efficiency benefits.

By reevaluating its market-based management approach, establishing performance goals, and monitoring results, DOD could reduce the risk of overlapping functions and inefficient allocations of personnel and budgetary resources, and improve its ability to realize intended savings. GAO cannot precisely calculate the potential savings from doing so because actual savings would depend on the scale of management consolidation, and the extent to which improved monitoring will affect total savings related to reform implementation. However, implementing these recommendations could help DOD save more than $10 million by fiscal year 2029.

Agency Comments and GAO’s Evaluation: GAO provided a draft of this report section to DOD for review and comment. DOD provided technical comments, which GAO incorporated as appropriate.

GAO Product: Defense Health Care: DOD Should Reevaluate Market Structure for Military Medical Treatment Facility Management. GAO-23-105441. Washington, D.C.: August 21, 2023.

|

|