FINANCIAL AUDIT

Bureau of the Fiscal Service’s FY 2024 Schedules of the General Fund

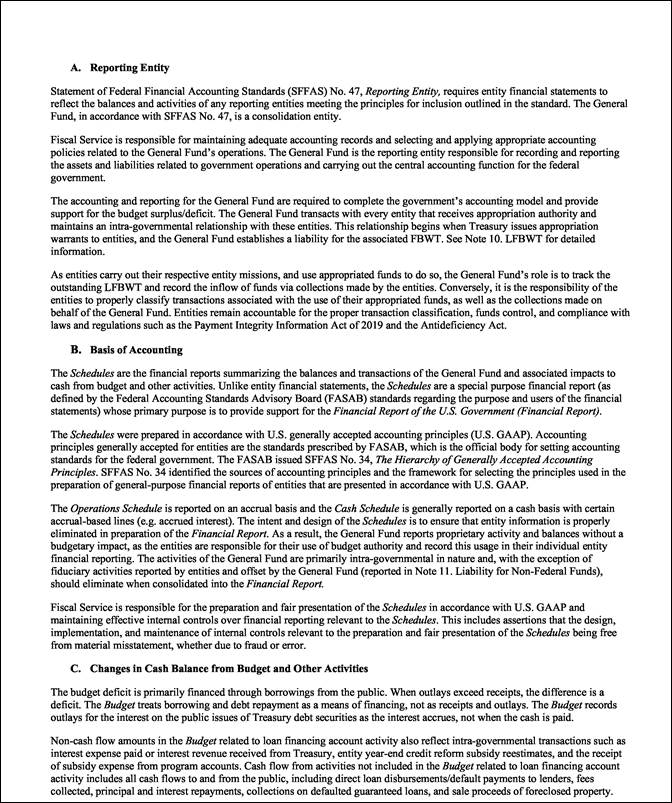

Report to the Commissioner of the Bureau of the Fiscal Service, Department of the Treasury

United States Government Accountability Office

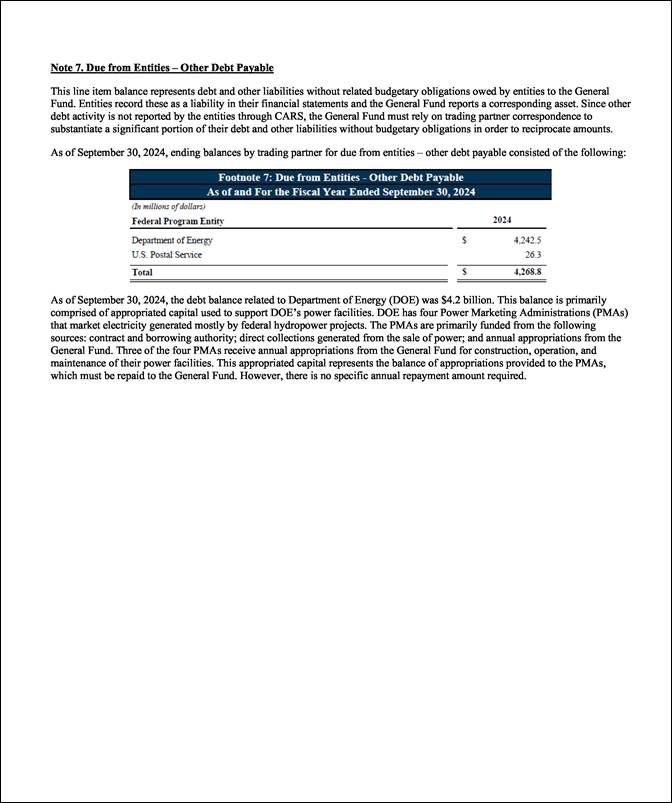

View GAO-25-106679. For more information, contact Anne Sit-Williams at (202) 512-7795 or sitwilliamsa@gao.gov.

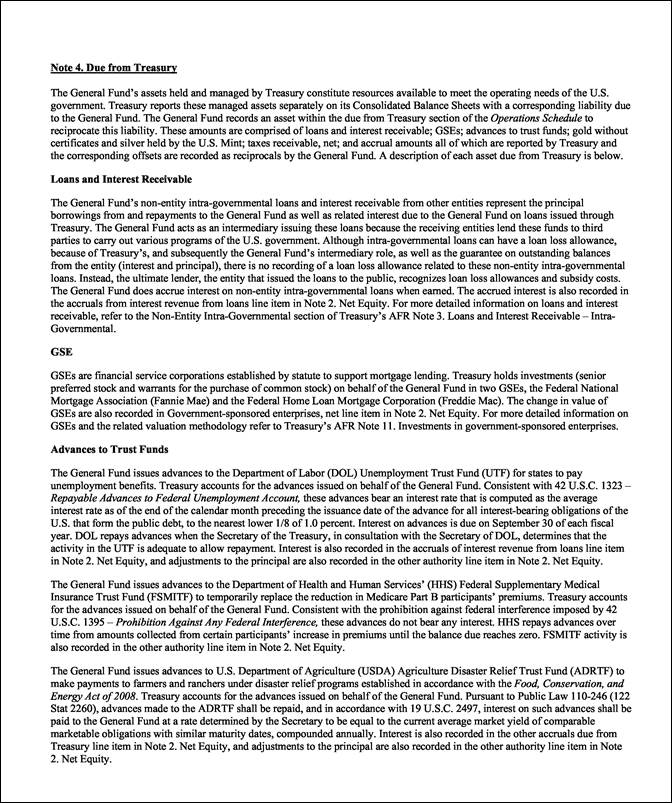

Highlights of GAO-25-106679, a report to the Commissioner of the Bureau of the Fiscal Service, Department of the Treasury

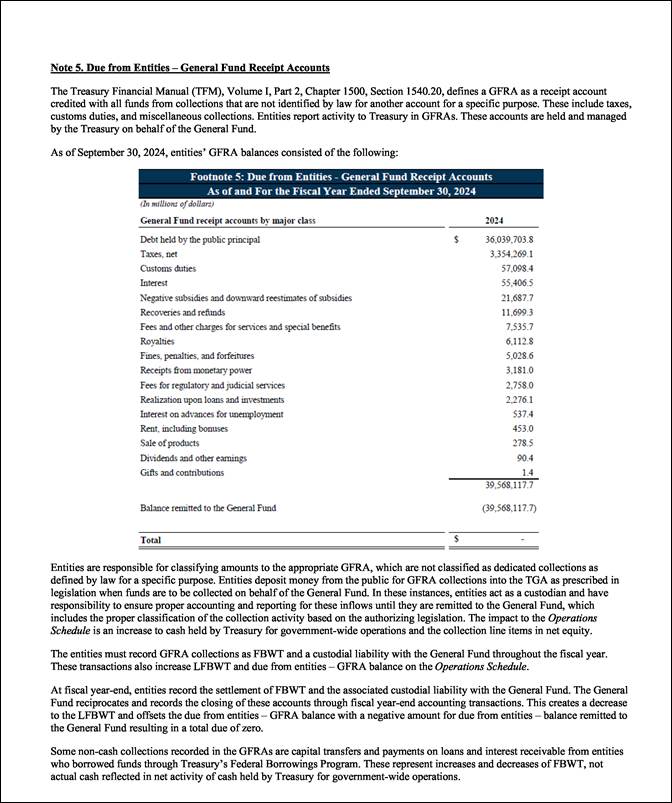

Bureau of the Fiscal Service’s FY 2024 Schedules of the General Fund

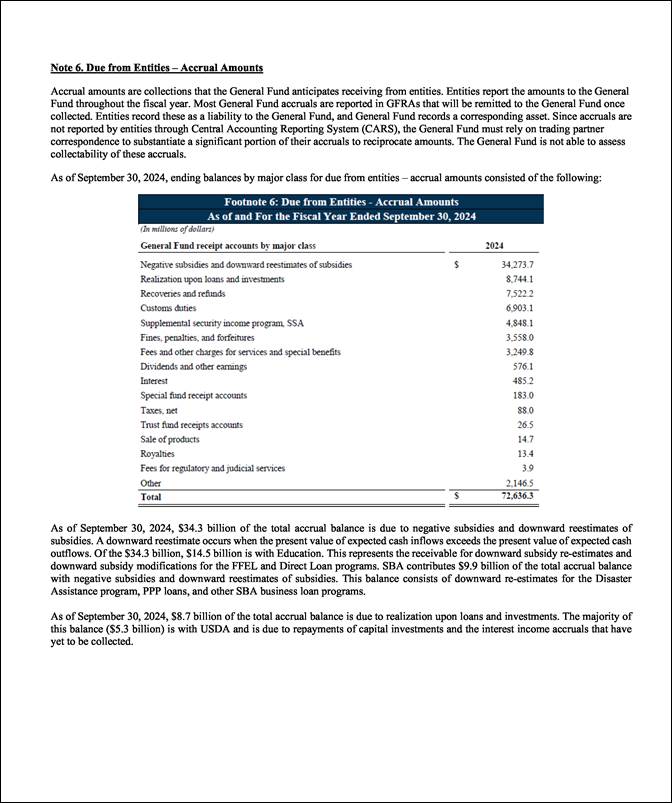

Why GAO Did This Study

The General Fund is the reporting entity responsible for accounting for the cash activity of the U.S. government. The Secretary of the Treasury delegated management of the General Fund to Fiscal Service. In fiscal year 2024, the General Fund reported $33.9 trillion of cash inflows, including debt issuances and tax collections, and $33.6 trillion of cash outflows, including debt repayments. It also reported a budget deficit of $1.8 trillion.

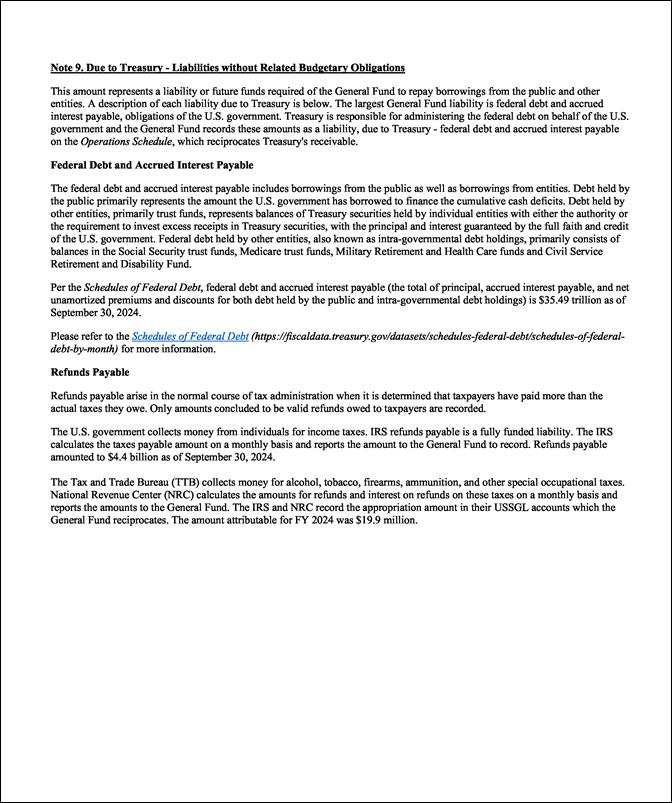

GAO audits the consolidated financial statements of the U.S. government. Because of the significance of the General Fund to the government-wide financial statements, GAO audited the fiscal year 2024 Schedules of the General Fund to determine whether, in all material respects, (1) the Schedules of the General Fund are fairly presented and (2) Fiscal Service management maintained effective internal control over financial reporting relevant to the Schedules of the General Fund. Further, GAO tested compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedules of the General Fund.

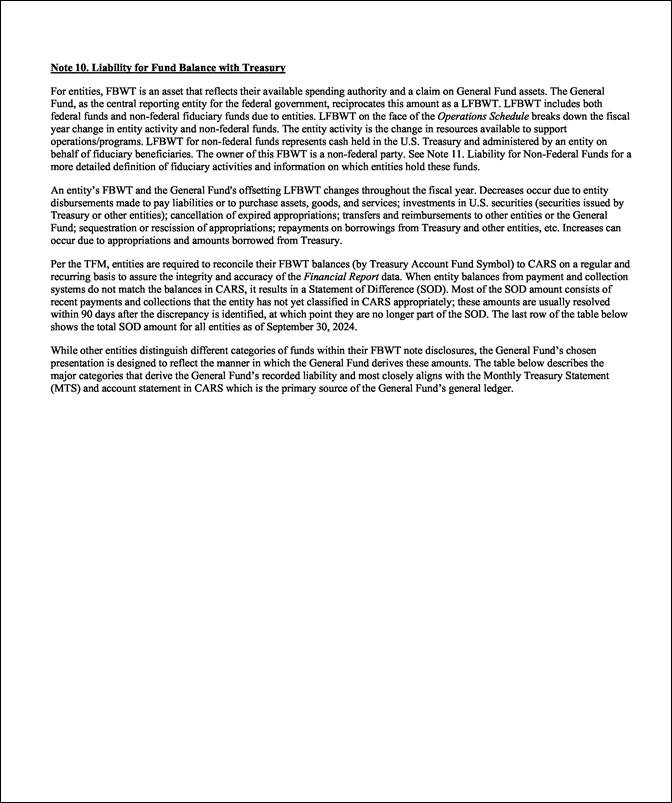

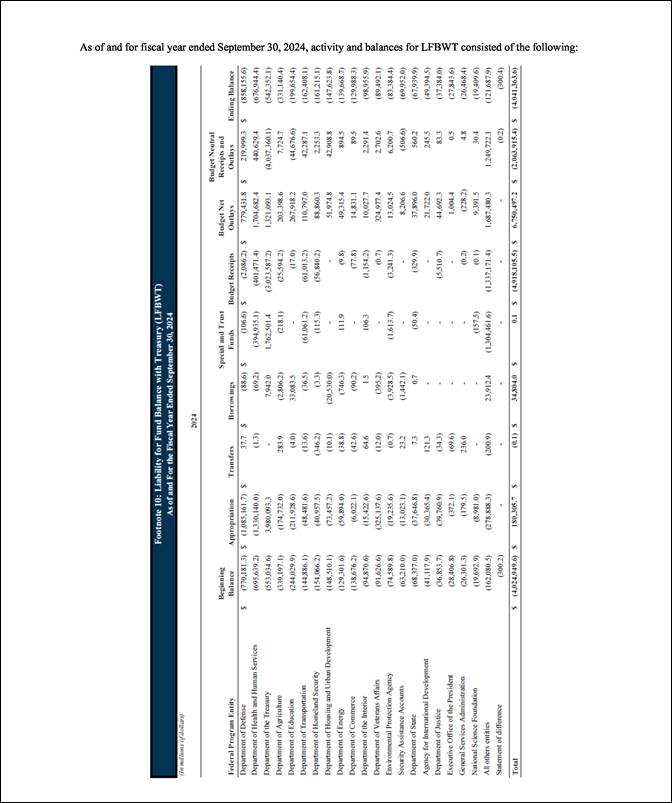

GAO performed this audit in accordance with U.S. generally accepted government auditing standards.

What GAO Found

GAO encountered limitations that affected the scope of its work, which

1) prevented GAO from expressing an opinion on the Schedules of the General Fund as of and for the fiscal year ended September 30, 2024;

2) prevented GAO from obtaining sufficient appropriate audit evidence to provide a basis for an opinion on the effectiveness of the Bureau of the Fiscal Service’s internal control over financial reporting relevant to the Schedules of the General Fund as of September 30, 2024; and

3) limited tests of compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements for fiscal year 2024.

The continuing scope limitations relate to Fiscal Service’s inability to readily (1) identify and trace General Fund of the U.S. government (General Fund) transactions to determine whether they were complete and properly recorded in the correct general ledger accounts and line items within the Schedules of the General Fund, which GAO determined to be a significant deficiency, and (2) provide sufficient appropriate audit evidence to support the account attributes assigned to active Treasury Account Symbols that determine how transactions are reported in the line items of the Schedules of the General Fund. As a result of these limitations, GAO cautions that amounts Fiscal Service reported in the Schedules of the General Fund and related notes may not be reliable.

In addition to continuing control deficiencies that relate to the scope limitations and contributed to GAO’s disclaimer of opinion on the Schedules of the General Fund, GAO found one other continuing significant deficiency in internal control related to management’s monitoring of internal control over financial reporting.

GAO previously reported a significant deficiency in information system controls. Fiscal Service made progress in addressing information system control deficiencies such that GAO no longer considers the current control deficiencies in this area, individually or collectively, a significant deficiency. However, GAO performed limited information system control procedures due to the disclaimer of opinion on the Schedules of the General Fund.

In commenting on a draft of this report, Fiscal Service concurred with the results of GAO’s audit.

|

Abbreviations |

|

|

|

|

|

ALC |

agency location code |

|

BETC |

Business Event Type Code |

|

CARS |

Central Accounting Reporting System |

|

CFS |

consolidated financial statements of the U.S. government |

|

FAA |

Financial Agency Agreement |

|

FMFIA |

Federal Managers’ Financial Integrity Act of 1982 |

|

FRB |

Federal Reserve Bank |

|

General Fund |

General Fund of the U.S. government |

|

GTAS |

Governmentwide Treasury Account Symbol Adjusted Trial Balance System |

|

OMB |

Office of Management and Budget |

|

TAS |

Treasury Account Symbol |

|

TDO |

Treasury Disbursing Office |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

March 13, 2025

Mr. Timothy Gribben

Commissioner

Bureau of the Fiscal Service

Department of the Treasury

Dear Mr. Gribben:

The accompanying independent auditor’s report presents the results of our audits of the fiscal year 2024 Schedules of the General Fund. This is the fourth integrated audit we performed of the Schedules of the General Fund.[1] In summary, we encountered limitations that affected the scope of our work, which

· prevented us from expressing an opinion on the Schedules of the General Fund as of and for the fiscal year ended September 30, 2024;

· prevented us from obtaining sufficient appropriate audit evidence to provide a basis for an opinion on the effectiveness of the Bureau of the Fiscal Service’s internal control over financial reporting relevant to the Schedules of the General Fund as of September 30, 2024;[2] and

· limited our tests of compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements for fiscal year 2024.

The General Fund of the U.S. government (General Fund), an entity that the Department of the Treasury’s Fiscal Service manages, is responsible for reporting on the central activities fundamental to funding the federal government. The General Fund consists of assets and liabilities used to finance the daily and long-term operations of the U.S. government. More specifically, the General Fund is the reporting entity responsible for accounting for the cash activity of the U.S. government.

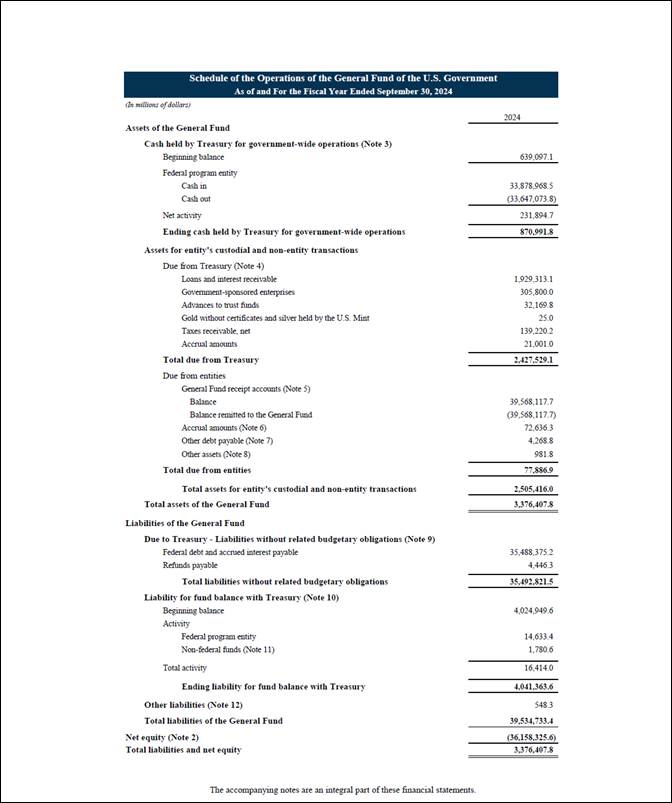

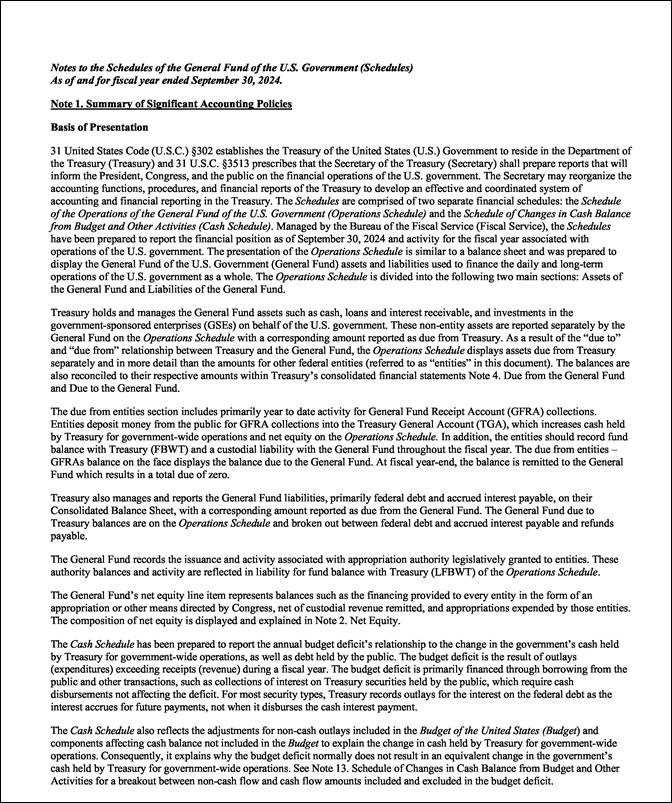

The fiscal year 2024 Schedules of the General Fund consist of two schedules: the Schedule of the Operations of the General Fund of the U.S. Government and the Schedule of Changes in Cash Balance from Budget and Other Activities.

Schedule of the Operations of the General Fund

The Schedule of the Operations of the General Fund presents the (1) cash balance and related cash activity of the U.S. government, (2) General Fund assets and liabilities that Treasury holds and manages, (3) other intragovernmental assets and liabilities, and (4) net equity of the General Fund.

The Cash held by Treasury for government-wide operations section of this schedule reflects the cash balance and related cash activity of the U.S. government. The largest inflows of cash are collections from debt issuances and taxes, while the largest outflows are debt repayments and Social Security and health care benefit payments. For fiscal year 2024, the Schedule of the Operations of the General Fund reported $33.9 trillion of cash inflows and $33.6 trillion of cash outflows. These amounts include cash activity related to debt issuances and repayments reported in the fiscal year 2024 Schedules of Federal Debt and tax collections reported in the Internal Revenue Service’s fiscal year 2024 financial statements, both of which GAO audited.

Specifically, for fiscal year 2024, the Schedules of Federal Debt reported borrowings from the public totaling $28.6 trillion and repayments of debt held by the public totaling $26.7 trillion.[3] Internal Revenue Service tax collections during fiscal year 2024 totaled $5.1 trillion.[4] In addition to the cash activity, the Schedules of the General Fund include other significant line items, which are discussed below.

General Fund assets and liabilities consists of the intragovernmental assets and liabilities that Treasury holds and manages and other amounts that entities owe to the General Fund and that the General Fund owes to entities. The General Fund’s largest asset is its loans and interest receivable, which Treasury holds and manages, that is related to the Federal Borrowings Program ($1.9 trillion as of September 30, 2024).[5] This program facilitates loans to federal entities that have the legal authority to borrow funds from the U.S. Treasury. Its largest liability is the outstanding federal debt and interest payable that Treasury holds and manages ($35.5 trillion as of September 30, 2024).

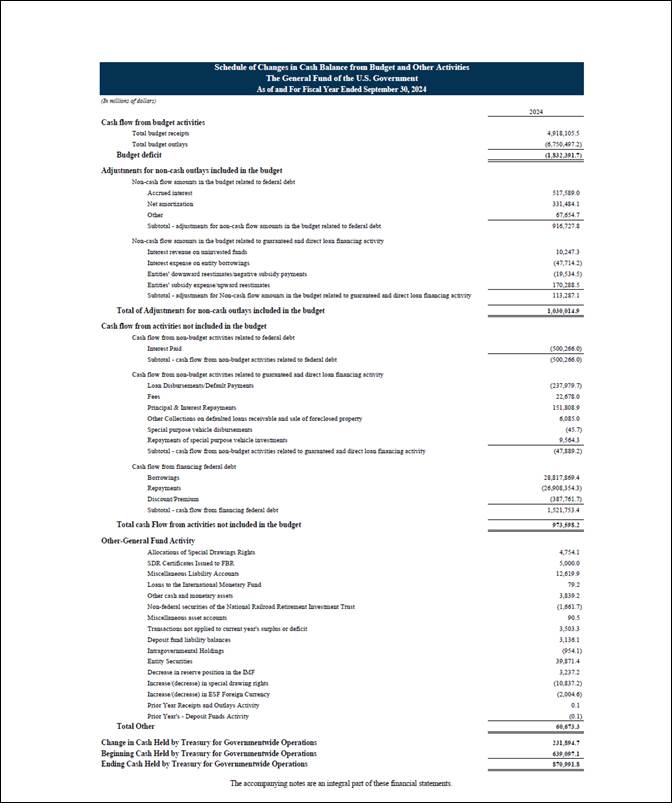

Schedule of Changes in Cash Balance from Budget and Other Activities

The Schedule of Changes in Cash Balance from Budget and Other Activities reports how the annual budget deficit relates to the change in the cash held by Treasury for government-wide operations. This schedule reconciles the $1.8 trillion budget deficit to the net activity for the Cash held by Treasury for government-wide operations line item reported on the Schedule of the Operations of the General Fund of $232 billion, including information on the federal government’s investing and financing activities.

The Schedule of Changes in Cash Balance from Budget and Other Activities presents three categories of reconciling items: (1) adjustments for noncash outlays included in the budget, (2) cash flow from activities not included in the budget, and (3) other General Fund activity. For fiscal year 2024, accrued interest on federal debt resulted in the largest adjustment for noncash activity to the budget deficit ($518 billion). Further, net cash flow from financing federal debt resulted in the largest adjustment for cash activity not included in the budget ($1.5 trillion).

General Fund Impact on the Financial Report of the U.S. Government

Treasury delegated to a separate Fiscal Service group responsibility for preparing the Financial Report of the U.S. Government, which includes the consolidated financial statements of the U.S. government (CFS). The preparation of and audit assurance over the General Fund’s Schedule of the Operations of the General Fund is necessary to account for and eliminate General Fund intragovernmental activity and balances with other reporting entities in the CFS. In connection with our fiscal year 2024 audit of the CFS,[6] we continued to report that the federal government’s inability to adequately account for intragovernmental activity and balances between federal entities represented a material weakness in internal control over financial reporting.[7]

Fiscal Service anticipates that the preparation of and audit assurance over the General Fund’s Schedule of Changes in Cash Balance from Budget and Other Activities will significantly contribute to resolving a material weakness that we continued to report in connection with our fiscal year 2024 CFS audit. Specifically, Fiscal Service expects these efforts to help reasonably assure that the information used to prepare the Statements of Changes in Cash Balance from Budget and Other Activities in the Financial Report of the U.S. Government is complete and consistent with the underlying information in the audited entities’ financial statements and other financial data.

Fiscal Service’s Progress Toward Auditability of the Schedules of the General Fund

Two previously identified scope limitations contributed to our disclaimer of opinion on the fiscal year 2024 Schedules of the General Fund and relate to certain deficiencies in internal control over financial reporting. The first scope limitation, identified during our fiscal year 2018 audit, relates to Fiscal Service’s inability to readily identify and trace transactions in the General Fund general ledgers.

Fiscal Service made progress in addressing the significant deficiency contributing to this scope limitation. For example, it implemented a new process for federal entities to report transfers and noncash transactions, which improves the traceability for these types of transactions. However, implementation of this new process remains limited to one federal entity. Fiscal Service also implemented automated edit checks designed to reasonably assure that federal entities use the new loan Business Event Type Codes appropriately for fiscal year 2025 reporting.

However, Fiscal Service anticipates remediation to occur over several years in part to allow time for it to (1) complete development and implementation of a manual or systematic process to trace postpayments, (2) complete information system modernization efforts needed to address transaction traceability issues, and (3) design and implement new reporting requirements to improve transaction traceability and to allow time for federal entities to implement the new requirements.

The second scope limitation, identified during our fiscal year 2020 audit, relates to Fiscal Service’s inability to provide adequate documentation supporting account attributes of active Treasury Account Symbols (TAS), which determine how transactions are reported in line items on the Schedules of the General Fund. Fiscal Service is addressing this deficiency by reviewing the population of active TASs and compiling a standard support package for attributes assigned to each, with final remediation anticipated to occur in fiscal year 2027.

We also continued to identify a significant deficiency related to management’s monitoring of internal control over financial reporting that will require continued and consistent commitment from Fiscal Service management to address.

We previously reported a significant deficiency in information system controls. Fiscal Service made progress in addressing the underlying control deficiencies such that we no longer consider them, individually or collectively, a significant deficiency. However, our information system control procedures were limited due to the scope limitations.

We separately issued a report detailing two new deficiencies identified during the fiscal year 2024 audits and the status of recommendations related to previously reported deficiencies that remained open as of the completion of our fiscal year 2022 audits.[8]

We are sending copies of this report to the appropriate congressional committees, the Deputy Inspector General of the Department of the Treasury, the Director of the Office of Management and Budget, and other interested parties. In addition, this report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions concerning this report, please contact me at (202) 512-2989 or kociolekk@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report.

Sincerely,

Kristen Kociolek

Managing Director

Financial Management and Assurance

Independent Auditor’s Report

Independent Auditor’s Report

To the Commissioner of the Bureau of the Fiscal Service

In our audits of the fiscal year 2024 Schedules of the General Fund, we encountered limitations that affected the scope of our work, which

· prevented us from expressing an opinion on the Schedules of the General Fund as of and for the fiscal year ended September 30, 2024;

· prevented us from obtaining sufficient appropriate audit evidence to provide a basis for an opinion on the effectiveness of the Bureau of the Fiscal Service’s internal control over financial reporting relevant to the Schedules of the General Fund as of September 30, 2024;[9] and

· limited our tests of compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements for fiscal year 2024.

The following sections discuss in more detail (1) our report on the Schedules of the General Fund and on internal control over financial reporting, which includes an emphasis-of-matter paragraph related to federal entities’ classification of transactions; (2) our report on compliance with laws, regulations, contracts, and grant agreements; and (3) agency comments.

Report on the Schedules of the General Fund and on Internal Control over Financial Reporting

Disclaimer of Opinion on the Schedules of the General Fund

In connection with fulfilling our requirement to audit the consolidated financial statements of the U.S. government,[10] and consistent with our authority to audit statements and schedules prepared by executive agencies,[11] we conducted an audit of the Schedules of the General Fund as of and for the year ended September 30, 2024, because of the significance of the General Fund of the U.S. government (General Fund) to the consolidated financial statements of the U.S. government.[12] The Schedules of the General Fund comprise the

· Schedule of the Operations of the General Fund of the U.S. Government, which presents the assets and liabilities of the General Fund, including cash activity;

· Schedule of Changes in Cash Balance from Budget and Other Activities, which presents a reconciliation of the budget deficit to the change in Cash held by Treasury for government-wide operations; and

· related notes.

Because of the significance of the matters described in the Basis for Disclaimer of Opinion section below, we were unable to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on the Schedules of the General Fund. Accordingly, we do not express an opinion on the accompanying Schedules of the General Fund.

We considered the limitations on the scope of our work regarding the Schedules of the General Fund in forming our conclusions. We performed sufficient audit work to provide this report on the Schedules of the General Fund. We performed our work in accordance with U.S. generally accepted government auditing standards.

Disclaimer of Opinion on Internal Control over Financial Reporting

We were engaged to audit Fiscal Service’s internal control over financial reporting relevant to the Schedules of the General Fund as of September 30, 2024, based on criteria established under 31 U.S.C. 3512(c), (d), commonly known as the Federal Managers’ Financial Integrity Act of 1982 (FMFIA).[13]

Because of the significance of the matters described in the Basis for Disclaimer of Opinion on Internal Control over Financial Reporting section below, we were unable to obtain sufficient appropriate audit evidence to provide a basis for an opinion on internal control over financial reporting. Accordingly, we do not express an opinion on the effectiveness of Fiscal Service’s internal control over financial reporting relevant to the Schedules of the General Fund.

Basis for Disclaimer of Opinion on the Schedules of the General Fund

Fiscal Service was not able to demonstrate the reliability of significant portions of the accompanying Schedules of the General Fund as of and for the fiscal year ended September 30, 2024, principally because of limitations that affected the scope of our work. These scope limitations relate to Fiscal Service’s inability to readily (1) identify and trace transactions in the Schedules of the General Fund general ledgers and (2) provide adequate support for account attributes of active Treasury Account Symbols (TAS), which are discussed below and in more detail in appendix I.[14]

Because of the scope limitations and the following related deficiencies in internal control that contributed to the disclaimer of opinion, we caution that amounts reported in the Schedules of the General Fund and related notes may not be reliable.

Significant deficiency related to readily identifying and tracing transactions within the Schedules of the General Fund general ledgers. Fiscal Service was unable to readily identify and trace General Fund transactions to determine whether they were complete and properly recorded in the correct general ledger accounts and line items within the Schedules of the General Fund. As a result, we were unable to complete audit procedures designed to substantiate the information reported in the affected line items on the Schedules of the General Fund. The three areas related to identifying and tracing transactions follow:

· Identifying all relevant journal entries. Fiscal Service established mapping rules to generate the journal entries recorded to the General Fund general ledgers for the transaction data transmitted daily from the Central Accounting Reporting System (CARS).[15] Given the complexities involved in how journal entries post, Fiscal Service is unable to readily identify all journal entries related to a specific transaction and is similarly unable to identify the transaction that is the source of a given journal entry.[16] Identifying journal entries is further complicated after initial journal entries are posted, as federal entities can make adjustments that cannot be traced to the original transaction.

· Identifying transactions that comprise certain line items. Amounts recorded in certain line items on the Schedules of the General Fund are summarized and lack sufficient details for tracing them to specific transactions. Specifically, Fiscal Service is unable to use data from its own general ledger to identify transactions reported in certain line items. Instead, Fiscal Service uses data from external sources because it did not design sufficient transaction codes that federal entities could use to provide it with information, at a transaction level, to support certain line items (e.g., the budget deficit) on the Schedules of the General Fund.

· Tracing postpayment vouchers to related cancellation schedules. Fiscal Service processes the majority of federal payments using entity-certified and entity-submitted payment schedules. The Federal Reserve Bank then groups payment schedules into vouchers to route funds through the banking system.[17] When there are returns or cancellations of payments previously issued, a Federal Reserve Bank or Fiscal Service payment system generates postpayment vouchers to route funds through the banking system, and these vouchers are recorded in the General Fund general ledgers. Fiscal Service’s payment systems also generate cancellation schedules to credit federal entities for returned or canceled payments. However, Fiscal Service cannot readily verify that the postpayment amounts recorded in its general ledgers are consistent with the canceled amounts that are credited to federal entities.

Internal control deficiency related to adequately supporting account attributes of active TASs. Fiscal Service was unable to readily provide adequate support for certain TAS attributes and Business Event Type Code (BETC) assignments. A TAS is a unique identification code that the Department of the Treasury, in collaboration with the Office of Management and Budget (OMB), assigns to a federal entity’s individual appropriation, receipt, or other fund account. The attributes assigned to a TAS, such as an agency identification code, main account code, and available BETCs, determine how Fiscal Service reports transactions within the line items on the Schedules of the General Fund.

Fiscal Service’s progress to address these previously identified scope limitations is discussed in more detail in appendix I.

Basis for Disclaimer of Opinion on Internal Control over Financial Reporting

The scope limitations described in the Basis for Disclaimer of Opinion on the Schedules of the General Fund section above prevented us from obtaining sufficient appropriate audit evidence about whether Fiscal Service management maintained effective internal control over financial reporting.

Significant and Other Internal Control Deficiencies

In addition to the significant deficiency and internal control deficiency that contributed to our disclaimer of opinion on the Schedules of the General Fund, we identified one other continuing significant deficiency in internal control related to management’s monitoring of internal control over financial reporting.

We previously reported a significant deficiency in information system controls. Fiscal Service made progress in addressing information system control deficiencies such that we no longer consider the current control deficiencies in this area, individually or collectively, a significant deficiency. However, we performed limited information system control procedures due to the disclaimer of opinion on the Schedules of the General Fund.

We discuss the continuing significant deficiency in more detail in appendix I. We also discuss six previously reported deficiencies, which we do not consider to be significant deficiencies or material weaknesses, in more detail in appendix I. We also separately issued a report detailing (1) two new deficiencies identified during the fiscal year 2024 audits, which we do not consider to be significant deficiencies or material weaknesses, and (2) the status of recommendations related to previously reported deficiencies that remained open as of the completion of our fiscal year 2022 audits.[18]

Emphasis of Matter

The following key item deserves emphasis in order to put the information contained in the Schedules of the General Fund into context. However, our disclaimer of opinion is not modified with respect to this matter.

Classification of federal entities’ transactions. As described in note 1 of the Schedules of the General Fund, federal entities are responsible for properly classifying transactions associated with the use of their appropriated funds as well as the collection of funds. Federal entities initiate these transactions outside of the General Fund. Fiscal Service implemented CARS to capture the relevant data for these transactions. Federal entities assign certain classifications, such as TAS and BETC, to transactions in CARS. This information determines how Fiscal Service reports the activity on the Schedules of the General Fund based on mapping rules that generate journal entries posted to the General Fund general ledgers.

Fiscal Service provides guidance to federal entities in the Treasury Financial Manual as well as separately on its website regarding the appropriate classifications for different types of business transactions. Federal entities are responsible for classifying transactions appropriately. As such, federal entities maintain the detailed information supporting the transactions and are responsible for the related internal controls.

Responsibilities of Management for the Schedules of the General Fund and Internal Control over Financial Reporting

Fiscal Service management is responsible for

· the preparation and fair presentation of the Schedules of the General Fund in accordance with U.S. generally accepted accounting principles;

· designing, implementing, and maintaining effective internal control over financial reporting relevant to the preparation and fair presentation of the Schedules of the General Fund that are free from material misstatement, whether due to fraud or error; and

· assessing the effectiveness of internal control over financial reporting based on the criteria established under FMFIA.

Auditor’s Responsibilities for the Audits of the Schedules of the General Fund and Internal Control over Financial Reporting

Our responsibility is to conduct an audit of the Schedules of the General Fund, and of Fiscal Service’s internal control over financial reporting relevant to the Schedules of the General Fund, in accordance with U.S. generally accepted government auditing standards and to issue an auditor’s report. However, because of the matters described in the Basis for Disclaimer of Opinion on the Schedules of the General Fund and Basis for Disclaimer of Opinion on Internal Control over Financial Reporting sections of our report, we were not able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on the Schedules of the General Fund or on Fiscal Service’s internal control over financial reporting relevant to the Schedules of the General Fund.

We are required to be independent of Fiscal Service and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit.

Definition and Inherent Limitations of Internal Control over Financial Reporting

An entity’s internal control over financial reporting is a process effected by those charged with governance, management, and other personnel. The objectives of internal control over financial reporting are to provide reasonable assurance that

· transactions are properly recorded, processed, and summarized to permit the preparation of the Schedules of the General Fund in accordance with U.S. generally accepted accounting principles, and assets are safeguarded against loss from unauthorized acquisition, use, or disposition, and

· transactions are executed in accordance with provisions of applicable laws, regulations, contracts, and grant agreements, noncompliance with which could have a material effect on the Schedules of the General Fund.

Because of its inherent limitations, internal control over financial reporting may not prevent, or detect and correct, misstatements due to fraud or error.

Report on Compliance with Laws, Regulations, Contracts, and Grant Agreements

In connection with our audits of the Schedules of the General Fund, we tested compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements consistent with our auditor’s responsibilities discussed below.

Results of Our Tests for Compliance with Laws, Regulations, Contracts, and Grant Agreements

Our tests for compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements were limited by the scope limitations described in the Basis for Disclaimer of Opinion on the Schedules of the General Fund section above. The objective of our tests was not to provide an opinion on compliance with laws, regulations, contracts, and grant agreements applicable to Fiscal Service related to the Schedules of the General Fund. Accordingly, we do not express such an opinion. U.S. generally accepted government auditing standards and OMB guidance require auditors to report on entities’ compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements.

Basis for Results of Our Tests for Compliance with Laws, Regulations, Contracts, and Grant Agreements

We performed our tests of compliance in accordance with U.S. generally accepted government auditing standards.

Responsibilities of Management for Compliance with Laws, Regulations, Contracts, and Grant Agreements

Fiscal Service management is responsible for complying with laws, regulations, contracts, and grant agreements applicable to Fiscal Service related to the Schedules of the General Fund.

Auditor’s Responsibilities for Tests of Compliance with Laws, Regulations, Contracts, and Grant Agreements

Our responsibility is to test compliance with selected provisions of laws, regulations, contracts, and grant agreements applicable to Fiscal Service that have a direct effect on the determination of material amounts and disclosures in the Schedules of the General Fund, and to perform certain other limited procedures. Accordingly, we did not test compliance with all provisions of laws, regulations, contracts, and grant agreements applicable to Fiscal Service related to the Schedules of the General Fund. We caution that, because of the audit scope limitations discussed above and the scope of our procedures, noncompliance may occur and not be detected by these tests.

Intended Purpose of Report on Compliance with Laws, Regulations, Contracts, and Grant Agreements

The purpose of this report is solely to describe the scope of our testing of compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements, and the results of that testing, and not to provide an opinion on compliance. This report is an integral part of an audit performed in accordance with U.S. generally accepted government auditing standards in considering compliance. Accordingly, this report on compliance with laws, regulations, contracts, and grant agreements is not suitable for any other purpose.

Agency Comments

We provided a draft of this report to Fiscal Service for review and comment. In its comments, reproduced in appendix II, Fiscal Service concurred with the results of our audit. It also noted that it maintains controls to confirm the integrity of the government’s cash flow.

Anne Y. Sit-Williams

Director

Financial Management and Assurance

February 18, 2025

Appendix I: Previously Reported Internal Control Deficiencies Outstanding as of the Completion of Our Fiscal Year 2024 Audits

This appendix includes a description of previously reported deficiencies, the Bureau of the Fiscal Service’s progress in addressing the deficiencies, and their potential effect on the Schedules of the General Fund.[19] The first two sections include the two significant deficiencies related to (1) readily identifying and tracing transactions in the Schedules of the General Fund general ledgers and (2) management’s monitoring of internal control over financial reporting. The third section includes the six control deficiencies related to (1) adequately supporting account attributes of active Treasury Account Symbols (TAS), (2) restricting access to TASs, (3) tracing postpayment vouchers to cancellation schedules, (4) line item classification of cash activity, (5) Fiscal Service oversight of financial agents, and (6) Fiscal Service oversight of Federal Reserve Bank (FRB) fiscal agents.

Significant Deficiency That Contributed to Our Disclaimer of Opinion on the Schedules of the General Fund

The significant deficiency related to readily identifying and tracing transactions in the Schedules of the General Fund general ledgers contributed to our disclaimer of opinion on the Schedules of the General Fund. This significant deficiency, which we initially identified in fiscal year 2018 in the Schedules of the General Fund general ledgers, involved (1) identifying journal entries and (2) identifying transactions that comprise certain line items. Below is a description of the deficiency and an update on Fiscal Service’s progress to date.

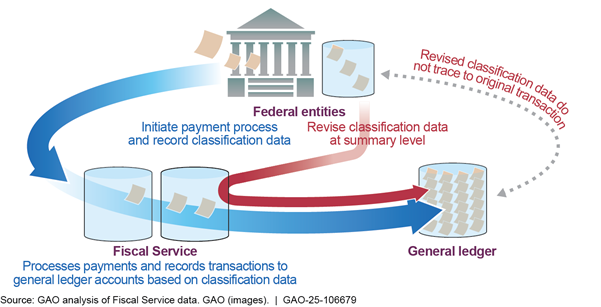

Identifying all relevant journal entries. Fiscal Service established mapping rules to generate the journal entries recorded to the General Fund of the U.S. government (General Fund) general ledgers for the transaction data transmitted daily from the Central Accounting Reporting System (CARS). Given the complexities involved in how journal entries post, Fiscal Service is unable to readily identify all journal entries related to a specific transaction and is similarly unable to identify the originating transaction for a given journal entry. Contributing to this complexity is how federal entities report transaction data to CARS daily from a variety of source systems. Identifying journal entries is further complicated after initial journal entries are posted, as federal entities can make adjustments that cannot be traced to the original transaction.

Most of the transaction data reported to CARS include the TAS and Business Event Type Code (BETC) classification information necessary to report transactions to the proper line items of the Schedules of the General Fund. A TAS is a unique identifier associated with a federal entity’s individual appropriation, receipt, or other fund account. Fiscal Service assigns attributes to each TAS, including available BETCs, which determine how transactions recorded to each TAS are reported within the line items on the Schedules of the General Fund. However, certain entities report TAS and BETC classification information to CARS at a summary level that does not provide the needed details for their transaction data.

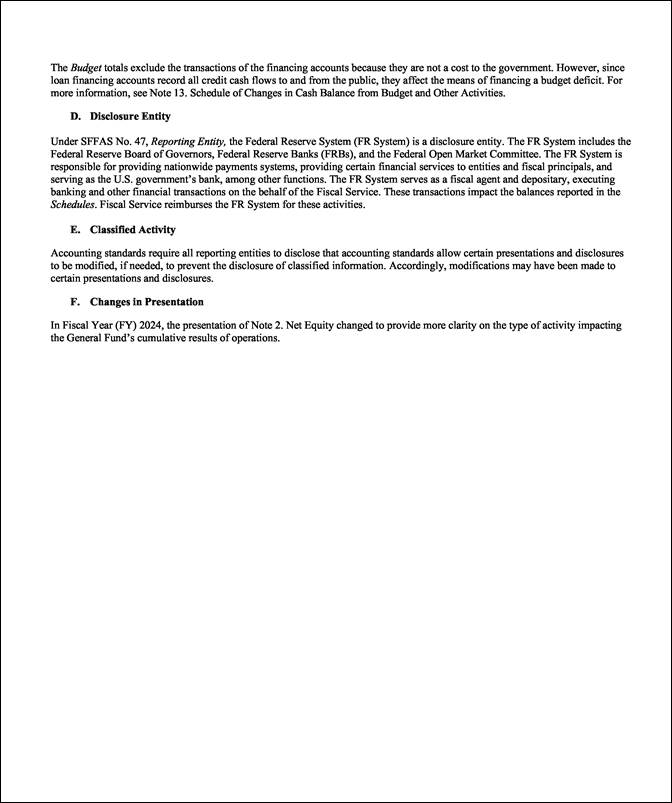

In addition, entities may submit reclassifications to transaction data previously reported to CARS, which are not readily identifiable to the originating transactions (see fig. 1).

In fiscal year 2020, Fiscal Service developed a remediation plan to address its inability to readily trace the final TAS and BETC classification information that entities report for their transaction data. Fiscal Service identified the need to link journal entries that report (1) TAS and BETC classification information to CARS separately from the transaction data reported through the source systems and (2) entities’ reclassification of TAS and BETC information to transactions previously recorded in CARS. In both instances, the entity transaction data are recorded at a summarized level, which prevents Fiscal Service from tracing the data to the original transaction data that the source systems reported.

Fiscal Service determined that the best use of its resources for resolving the first key area would be to convert federal entities to full-CARS reporters, rather than redesign the reporting process to obtain the level of detail required for traceability from non-CARS reporters.[20] While Fiscal Service has made progress in converting federal entities to full-CARS reporters, it does not anticipate full conversion until approximately fiscal year 2029.[21] Fiscal Service acknowledges that this plan depends significantly on federal entities’ cooperation.

To address the second key area—identifying and tracing reclassifications to the original journal entries reported to CARS—Fiscal Service began by analyzing the population of reclassifications and meeting with entities to discuss the reasons for their reporting reclassifications. It found that entities were using the reclassification submission process to report transactions other than reclassifications, such as transfers of funding and noncash transactions.[22] As a result, Fiscal Service developed a new process for reporting transfers and noncash transactions in CARS, which one federal entity implemented as of the end of fiscal year 2024. To improve the reporting and traceability of transfers and noncash transactions, Fiscal Service plans to work with additional federal entities to implement this new process.

In addition, Fiscal Service plans to improve the reclassification submission process within CARS by approximately fiscal year 2027 to enable federal entities to report reclassification data at an appropriately detailed level. Until entities do so, Fiscal Service cannot determine whether it has completely and accurately recorded and reported transactions in the appropriate general ledger accounts and line items on the Schedules of the General Fund.

Identifying transactions that comprise certain line items. Federal entities report the majority of the federal government’s financial transactions to CARS daily. Fiscal Service established mapping rules to generate the journal entries recorded in the General Fund general ledgers for the transaction data transmitted daily from CARS. Federal entities that have fully implemented CARS can classify payments, collections, and intragovernmental transactions upon initiation, including assigning the TAS and BETC, which based on mapping rules determine how transactions are recorded in the General Fund general ledgers and reported on the Schedules of the General Fund. However, Fiscal Service must manually record some transactions for the data not reported in CARS, or adjust net activity from CARS transactions, so that they are properly reported on the Schedules of the General Fund.

During our fiscal year 2018 audit, we found that amounts recorded in certain line items on the Schedules of the General Fund, such as direct and guaranteed loan financing activity, which totaled $65.4 billion in fiscal year 2024, lacked sufficient details for tracing the amounts to specific transactions. Fiscal Service did not design sufficient transaction codes (i.e., BETCs) that federal entities could use to provide it with information, at the transaction level, to support certain line items (e.g., the budget deficit) on the Schedules of the General Fund.

In response to this finding, during fiscal year 2020, Fiscal Service developed, but did not fully implement, several new BETCs and the corresponding mapping rules for (1) recording direct and guaranteed loan financing activity and (2) distinguishing between disbursement types that would enable it to trace transactions from the general ledgers to the respective line items and improve the reporting of General Fund transactions and balances. Fiscal Service also annually publishes guidance on its website, and developed automated data checks within the Governmentwide Treasury Account Symbol Adjusted Trial Balance System (GTAS), to help federal entities understand how to properly use the new BETCs.[23]

Fiscal Service fully implemented the GTAS edit checks for direct and guaranteed loan financing activity for fiscal year 2025 reporting.[24] Therefore, while we found that the number of federal entities using the new loan BETCs correctly has increased since Fiscal Service first established them, the reported balances were still not fully traceable as of the end of fiscal year 2024. In addition, Fiscal Service has been working to fix certain reporting complications that were affecting federal entities’ ability to pass the GTAS edit checks for disbursement BETCs.[25]

Fiscal Service is also working to identify and trace the transactions that make up the federal debt line items to potentially avoid establishing new BETCs. Fiscal Service determined that it needs to improve its reclassification process to identify all related journal entries for each specific transaction and enhance its methodology to sufficiently support its classification of cash activity before it can complete its assessment of other General Fund activity. Therefore, as of the fiscal year ended September 30, 2024, Fiscal Service continues to use sources external to the General Fund to obtain the information used to allocate this activity to the appropriate line items. Until all transactions can be identified at the appropriate level of detail in the general ledgers, Fiscal Service cannot determine whether certain line items are properly supported.

Other Significant Deficiency

In addition to the significant deficiency discussed above that contributed to our disclaimer of opinion on the Schedules of the General Fund, we continued to find another significant deficiency in internal control related to management’s monitoring of internal control over financial reporting.

Management’s monitoring of internal control over financial reporting. The significant deficiency in Fiscal Service management’s monitoring of internal control over financial reporting, initially identified in our fiscal year 2018 audit, remains as of September 30, 2024. Fiscal Service continued to improve its procedures for evaluating risk and monitoring controls over financial reporting relevant to the Schedules of the General Fund, including by updating its monitoring test plans to more accurately and completely describe the procedures performed and documenting its risks and associated controls to identify risks that are not mitigated by a process or control.

However, we continued to find that Fiscal Service did not adequately test all relevant controls over material financial statement line items. For example, we found that Fiscal Service did not test a relevant control over segregation of duties in the Secure Payment System as part of its Office of Management and Budget (OMB) Circular A-123, Management’s Responsibility for Enterprise Risk Management and Internal Control, review for the Schedules of the General Fund. In another example, we found that Fiscal Service stopped testing a relevant control over its cash reconciliation in fiscal year 2024, without including it in a rotational testing plan for testing going forward, which results in a gap in its consideration of controls in that area.

Further, though Fiscal Service began to document its oversight of internal controls applicable to service organizations, we found an instance in fiscal year 2024 where Fiscal Service did not timely communicate a significant change in one of its service organizations to all internal stakeholders. Until Fiscal Service fully establishes proper monitoring activities for its internal control system, management’s ability to identify deficiencies, if any, and evaluate and develop remediation plans to address those issues in a timely manner is impaired.

Other Control Deficiencies

In addition to the significant deficiencies discussed above, the following six previously reported deficiencies, which we do not consider to be material weaknesses or significant deficiencies, were outstanding as of the completion of our fiscal year 2024 audits.

Supporting Account Attributes of Active TASs

Fiscal Service is responsible for establishing TASs and ensuring that any changes to TAS attributes are properly reflected in CARS. A TAS is a unique identification code associated with a federal entity’s individual appropriation, receipt, or other fund account. The attributes assigned to a TAS, including available BETCs, determine how Fiscal Service reports transactions within the line items on the Schedules of the General Fund.

When establishing a TAS, Fiscal Service documents information such as the account name, responsible entity, and legal authority used to support the establishment (as applicable). To document its decisions on which attributes to assign to the account, Fiscal Service compiles this information from a variety of sources, including statutes and regulations, OMB, and the requesting federal entity. During our fiscal year 2020 audit, we found that Fiscal Service could not readily provide sufficient support that the TAS attributes and BETC assignments were appropriate.

In 2022, Fiscal Service developed a remediation plan to address its inability to adequately support account attributes and available BETCs for approximately 18,500 active TASs. As part of that plan, Fiscal Service began reviewing account attributes assigned to each active TAS for appropriateness and prepare a standard set of supporting documentation.

During 2024, Fiscal Service continued to make progress and anticipates completing its review as well as the support packages for all active TASs by approximately fiscal year 2027. Specifically, Fiscal Service has updated its documentation compilation process to address issues previously communicated. During our fiscal year 2024 audit, we requested documentation packages from Fiscal Service to validate the attributes for a nonstatistical selection of 30 active TASs from the approximately 10,000 active TASs that Fiscal Service identified as ready for testing. We found that Fiscal Service lacked sufficient appropriate documentation to support the account attributes assigned for two of the 30 TASs selected.

Fiscal Service is also in the process of analyzing BETCs available to active TASs and plans to develop criteria and implement procedures for assigning BETCs to newly established TASs and for periodically reviewing BETCs available to active TASs. Until Fiscal Service can demonstrate that it has appropriately assigned TAS attributes, including assigned BETCs, to active TASs, it cannot determine whether it properly reports entity transactions in the Schedules of the General Fund.

Restricting Access to TASs

Fiscal Service assigns federal entities agency location codes (ALC) to use when reporting transactions to CARS.[26] Subsequently, federal entities report transactions to TASs associated with their assigned ALCs. Each TAS has certain attributes (for example, agency identification code and main account code) that determine how those transactions are reported within the line items on the Schedules of the General Fund. During our fiscal year 2020 audit, we identified a control deficiency related to federal entities’ capability to report transactions to any TAS that is active within CARS regardless of whether the TAS belongs to the entity. Additionally, if a federal entity reports a transaction to a TAS that is not assigned to that entity’s ALCs, it could unintentionally use appropriated funds belonging to another federal entity.

During our fiscal year 2022 audit, Fiscal Service developed a remediation plan to design a control to either prevent federal entities from using TASs not assigned to their ALCs or to detect when that occurs. During fiscal years 2023 and 2024, Fiscal Service completed a monthly process to validate TAS and ALC relationships through federal entity outreach to compile a list of approved TAS and ALC relationships to use as a means to either prevent or detect inappropriate TAS use. Until Fiscal Service fully develops a process to restrict TAS use for only assigned ALCs or to detect inappropriate usage, it cannot determine whether transactions assigned to an entity are valid and reported accurately in the Schedules of the General Fund.

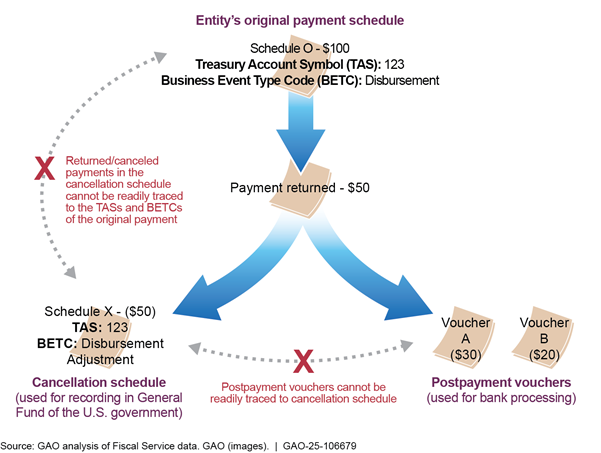

Tracing Postpayment Vouchers to Cancellation Schedules

Fiscal Service’s Treasury Disbursing Offices (TDO) process the majority of federal entity payments. Postpayments are the payments returned or canceled and for which a voucher is recorded in the General Fund general ledgers to cancel the electronic or check payment. Additionally, Fiscal Service’s payment systems generate cancellation schedules by assigning the return or cancellation with the same ALC, TAS, and adjustment BETC as the original payment or to a Fiscal Service ALC and TAS so that Fiscal Service can credit the funds to the federal entity. While the cancellation schedules provide detailed information on the TDO postpayment transaction, the postpayment vouchers recorded in the General Fund general ledgers are at a summary level, and each postpayment voucher consists of one or multiple cancellation schedules.

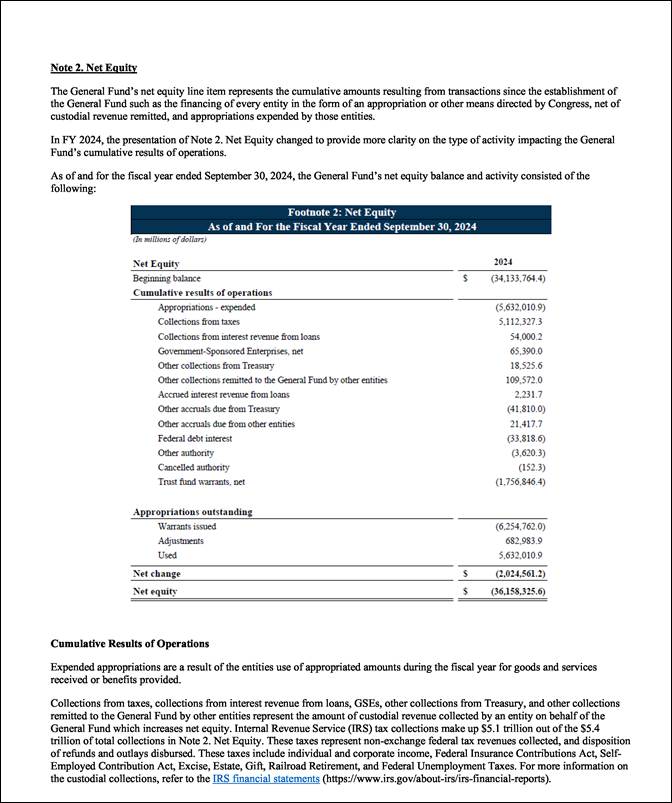

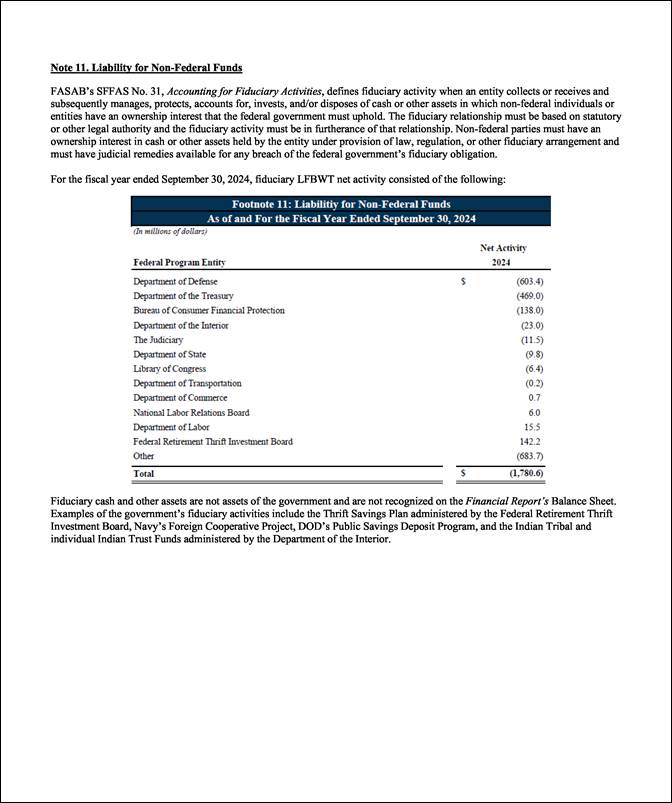

During our fiscal year 2022 audit, we found that electronic and check postpayment vouchers recorded in the general ledgers, which are included in the Cash In and Cash Out line items of the Schedules of the General Fund, could not be readily traced to the cancellation schedules that are credited to federal entities. Specifically, Fiscal Service does not have a process in place to reconcile the TDO postpayment voucher amounts recorded in the general ledgers to the cancellation schedule(s) to reasonably assure accurate, complete, and timely information is recorded in the Schedules of General Fund and amounts are returned to the appropriate entity (see fig. 2). In addition, we found that the returned or canceled payments in the cancellation schedules could not be readily traced to federal entities’ TASs and adjustment BETCs for the original payments. This control deficiency contributes to the significant deficiency related to identifying and tracing transactions within the Schedules of the General Fund general ledgers.

Fiscal Service is analyzing postpayment processes in place for fiscal year 2024 to plan for a manual or systematic process to trace (1) postpayment vouchers to the cancellation schedules and (2) the returned or canceled payments in the cancellation schedule to the TASs and adjustment BETCs of the original payment. Fiscal Service is using fiscal year 2024 postpayment data from its TDO payment system, CARS, and the General Fund general ledgers to manually trace postpayment vouchers to the cancellation schedules for certain postpayment transaction types.[27] Fiscal Service is currently documenting procedures for this process and considering ways to automate the reconciliation. Until Fiscal Service completes the tracing of postpayment vouchers to cancellation schedules and can reconcile all TDO postpayment activity, it cannot readily trace postpayment transactions to the canceled amounts that are credited to federal entities for their postpayments.

Line Item Classification of Cash Activity

The Schedules of the General Fund presents cash activity for government-wide operations in the Cash In and Cash Out line items. Fiscal Service manually classifies cash transactions, which consist of collection, payment (including check issuances), and adjustment (such as corrections) vouchers, as Cash In or Cash Out as part of preparing the Schedules of the General Fund. During our fiscal year 2022 audit, we found that Fiscal Service’s methodology did not include its rationale for classifying its various cash transactions. For example, adjustments to some collection transactions are offset within the same line item as the original transaction; however, adjustments to payment transactions were not consistently recorded within the same line item as the original transaction, potentially overstating amounts. Additionally, certain activity, such as payments related to federal entity taxes, is included in both the Cash In and Cash Out line items.

During fiscal year 2024, Fiscal Service analyzed and evaluated its cash classification process to identify enhancements it could make to its methodology for proper reporting of the cash line items on the Schedules of the General Fund. Fiscal Service also began to document its rationale for manually classifying some cash transaction types to the Cash In or Cash Out line items. Additionally, Fiscal Service is considering a new presentation of its cash note disclosure to identify the cash transaction types that make up the Cash In and Cash Out line items. Until Fiscal Service clearly documents and implements its methodology for classifying cash activity, it risks inaccurately reporting the cash line items on the Schedules of the General Fund.

Fiscal Service Oversight of Financial Agents

Treasury has statutory authority under 12 U.S.C. 90 and 12 U.S.C. 265 to designate financial institutions as its financial agents.[28] Financial agents are responsible for operating a variety of collection-reporting programs to process, settle, and report collection transactions on behalf of the federal government. Fiscal Service designates and specifies its relationship with each financial agent through a Financial Agency Agreement (FAA) and implemented a policy for overseeing financial agents and verifying that internal controls over collection-reporting programs are effective. There are 11 FAAs for collection-reporting programs relevant to the Schedules of the General Fund.

During our fiscal year 2022 audit, we found deficiencies with both Fiscal Service’s financial agent oversight policy and the contents of the FAAs with its financial agents. Specifically, Fiscal Service’s policy did not clearly document how it verifies that internal control over financial reporting at the collection-reporting programs is designed, implemented, and operating effectively. Further, Fiscal Service did not update the respective FAAs for five collection-reporting programs to include new internal control requirements. Additionally, Fiscal Service’s documented internal control requirements were incomplete. For example, it did not include an appropriate coverage period for verifying internal control over financial reporting and timely submission of results to Fiscal Service.

During fiscal year 2024, Fiscal Service updated its policy and executed new or amended FAAs for all 11 collection-reporting programs with updated requirements for assessing internal control over financial reporting. Fiscal Service anticipates implementation of its oversight requirements by fiscal year 2026. Until Fiscal Service fully implements its requirements to monitor internal control over financial reporting for the collection-reporting programs, it risks inaccurate and incomplete reporting of collection transactions on the Schedules of the General Fund.

Fiscal Service Oversight of FRB Fiscal Agents

Treasury has statutory authority under 12 U.S.C. 391 to designate the FRBs as its fiscal agents responsible for operating a variety of systems to process, settle, and report cash transactions on behalf of the federal government. In some instances, an FRB initiates the transactions on behalf of certain entities using written instructions from authorized entity officials. During our fiscal year 2022 audit, we found that Fiscal Service had not established sufficient policies and procedures related to its oversight of its fiscal agents to reasonably assure transactions FRBs recorded are accurate and complete, such as tests to verify that (1) the amounts and other data were recorded accurately in the FRB-operated systems and (2) the transaction files from these systems that are reported to CARS are complete.

During fiscal year 2023, Fiscal Service began to develop a remediation plan to address the deficiencies with its fiscal agent oversight policies and procedures. However, during fiscal year 2024, Fiscal Service reevaluated whether the corrective actions previously developed would adequately address the deficiencies and halted progress citing resource constraints. Until Fiscal Service designs and implements policies and procedures to effectively monitor the fiscal agents, it risks inaccurate and incomplete reporting of collection and payment transactions in the Schedules of the General Fund.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on Facebook, Flickr, X, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what‑gao‑does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

Congressional Relations

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S. Government Accountability Office, 441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

Sarah Kaczmarek, Managing Director, KaczmarekS@gao.gov, (202) 512-4800, U.S.

Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Strategic Planning and External Liaison

Stephen J. Sanford, Managing

Director, spel@gao.gov, (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814, Washington,

DC 20548

[1]We conduct an audit of the financial information for the General Fund every 2 years to allow the Bureau of the Fiscal Service sufficient time to develop and begin to implement a remediation plan to address the issues we identified as part of our audit of the fiscal year 2022 Schedules of the General Fund. See GAO, Financial Audit: Bureau of the Fiscal Service’s FY 2022 Schedules of the General Fund, GAO‑23‑104786 (Washington, D.C.: Mar. 30, 2023).

[2]The Secretary of the Treasury delegated management of the General Fund of the U.S. government to the Department of the Treasury’s Bureau of the Fiscal Service.

[3]GAO, Financial Audit: Bureau of the Fiscal Service’s FY 2024 and FY 2023 Schedules of Federal Debt, GAO‑25‑107138 (Washington, D.C.: Nov. 7, 2024).

[4]GAO, Financial Audit: IRS’s FY 2024 and FY 2023 Financial Statements, GAO‑25‑107202 (Washington, D.C.: Nov. 7, 2024).

[5]The Federal Borrowings Program, administered by Fiscal Service’s Federal Investments and Borrowings Branch, facilitates loans to authorized federal entities on behalf of Treasury. Federal entities that have the appropriate statutory authority may borrow funds from the U.S. Treasury. For example, the Department of Education requests loans from Treasury’s borrowing program to help fund the student loan program.

[6]GAO, Financial Audit: FY 2024 and FY 2023 Consolidated Financial Statements of the U.S. Government, GAO‑25‑107421 (Washington, D.C.: Jan. 16, 2025).

[7]A deficiency in internal control exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent, or detect and correct, misstatements on a timely basis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those charged with governance. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis.

[8]GAO, General Fund: Improvements Needed in Controls over Retention of Key System Security and Cash Activity Documentation, GAO‑25‑107819 (Washington, D.C.: Mar. 13, 2025).

[9]The Secretary of the Treasury delegated management of the General Fund of the U.S. government to the Department of the Treasury’s Bureau of the Fiscal Service.

[10]GAO, Financial Audit: FY 2024 and FY 2023 Consolidated Financial Statements of the U.S. Government, GAO‑25‑107421 (Washington, D.C.: Jan. 16, 2025).

[11]31 U.S.C. §§ 331(e)(2), 3521(g), (i). Because Fiscal Service is a bureau within Treasury, the General Fund of the U.S. government that it manages is also significant to Treasury’s financial statements. See 31 U.S.C. § 3515(b).

[12]Our prior audit of the Schedules of the General Fund resulted in a disclaimer of opinion for fiscal year 2022. The financial information for the General Fund was not audited for fiscal year 2023 to allow Fiscal Service sufficient time to develop and begin to implement a remediation plan to address the issues we identified as part of the fiscal year 2022 audit. See GAO, Financial Audit: Bureau of the Fiscal Service’s Fiscal Year 2022 Schedules of the General Fund, GAO‑23‑104786 (Washington, D.C.: Mar 30, 2023).

[13]Pub. L. No. 97-255, 96 Stat. 814. This act requires executive agency heads to evaluate and report annually to the President and Congress on the adequacy of their internal control and accounting systems and on actions to correct significant problems.

[14]A deficiency in internal control exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent, or detect and correct, misstatements on a timely basis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those charged with governance. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis.

[15]The majority of the federal government’s financial transactions are recorded in CARS, which the Federal Reserve System operates.

[16]Fiscal Service has designed certain controls related to the journal entry posting process to help mitigate this deficiency. For example, each month Fiscal Service reconciles federal entities’ account balances in CARS with the Liability for Fund Balance with Treasury amounts recorded in the General Fund general ledger to reasonably assure that the amounts agree.

[17]Treasury has statutory authority under 12 U.S.C. § 391 to designate the Federal Reserve Banks as its fiscal agents responsible for operating a variety of systems to process, settle, and report cash transactions on behalf of the federal government.

[18]GAO, General Fund: Improvements Needed in Controls over Retention of Key System Security and Cash Activity Documentation, GAO‑25‑107819 (Washington, D.C.: Mar. 13, 2025).

[19]GAO, Financial Audit: Bureau of the Fiscal Service’s Fiscal Year 2022 Schedules of the General Fund, GAO‑23‑104786 (Washington, D.C.: Mar. 30, 2023).

[20]Full-CARS reporters submit classification information for a transaction through the source system in which the transaction occurs. Non-CARS reporters summarize the classification information for transactions on a monthly basis and report it separately from the source system in which the transactions occur.

[21]Due to the extended remediation timeline, Fiscal Service is determining if it can use information from sources other than CARS to quantify the effect of activity from non-CARS reporters, such as the Department of Defense, on each affected line item on the Schedules of the General Fund. In addition, Fiscal Service is determining whether the Department of Defense can use an alternative method to report the requisite detail without becoming a full-CARS reporter.

[22]A transfer or noncash transaction is activity not related to a payment or collection reported by a source system but that is still required to be reported to CARS for government-wide reporting purposes.

[23]GTAS is an application used to compile all federal entity data submissions of fiscal year-end adjusted trial balances and additional details from audited financial statements for the Department of the Treasury to use to prepare the consolidated financial statements of the U.S. government.

[24]GTAS edit checks are the tool Fiscal Service uses to help reasonably assure that entities are using the correct BETC when reporting activity to CARS. The GTAS edit checks reconcile specific U.S. Standard General Ledger account balances against the entity’s BETC balances when an entity uploads its trial balances to GTAS.

[25]Specifically, repayable advances are recorded to a separate general ledger account in the reporting entity’s general ledger. Therefore, while the federal entities that disburse these repayable advances use the new disbursement BETCs, the GTAS edit check fails because the amount does not agree to the General Fund’s reciprocating general ledger account. In addition, a capital transfer and rescission are reported within the same transaction in CARS, which causes federal entities reporting this activity to fail the GTAS edit check that is meant to verify that the activity using the new disbursement BETC agrees with the reporting entity’s disbursement balance.

[26]An ALC is a unique numeric symbol used to identify an accounting office within a federal entity that reports payments and collections to CARS. A federal entity can have multiple ALCs assigned to it, and each ALC can be associated with multiple TASs.

[27]As of fiscal year 2024, Fiscal Service traced postpayment transaction types, such as the majority of the returns of electronic payments and canceled checks that are processed by certain TDOs. In addition, Fiscal Service has not yet traced other postpayment transaction types, such as postpayments related to courtesy disbursements, which are the issuance of replacement checks associated with nonreceipt of benefit payments, such as Social Security benefit checks.

[28]Financial institutions include banks under national banking associations and insured banks.