DOD FINANCIAL MANAGEMENT

Greater Accountability Needed over Contractor-Acquired Property

Report to Congressional Committees

United States Government Accountability Office

For more information, contact Kristen A. Kociolek at kociolekk@gao.gov.

Highlights of GAO-25-106868, a report to congressional committees

July 2025

DOD Financial Management

Greater Accountability Needed over Contractor-Acquired Property

Why GAO Did This Study

DOD’s contractors track and manage billions of dollars in government property. This report, developed in connection with fulfilling GAO’s mandate to audit the U.S. government’s consolidated financial statements, examines DOD’s (1) monitoring of contractors’ tracking of CAP assets associated with selected major defense acquisition programs and (2) identifying and accounting for certain specialized and high-dollar CAP assets.

GAO reviewed relevant audit reports, DOD policy and guidance, and federal regulations; interviewed agency and contractor officials; and reviewed DOD’s documented oversight for nine selected contracts. In addition, GAO visited three contractor locations, one each for the Army, Navy, and Air Force, and tested 90 CAP assets at each location. GAO’s testing focused on whether key data were accurately recorded for these assets in the contractors’ property management systems.

What GAO Recommends

GAO is making three recommendations to DOD to (1) develop monitoring procedures to help ensure that DCMA follows existing policies for conducting oversight of CAP assets, (2) evaluate whether the Navy’s oversight procedures provide a sufficient level of CAP oversight, and (3) clarify its policy for accounting for certain specialized and high-dollar CAP assets.

DOD concurred with the recommendations.

What GAO Found

The Department of Defense (DOD) reported $4.1 trillion in assets in fiscal year 2024. DOD’s assets include those in its physical custody as well as those in the possession of contractors. These assets include those procured and held by contractors on DOD’s behalf, referred to as contractor-acquired property (CAP). DOD relies on its contractors to track and manage CAP assets. DOD is responsible for ensuring that these contractors follow DOD policies and federal regulations. DOD policy requires components to assess the accuracy of contractors’ CAP records. Some DOD components regularly delegate these assessments to the Defense Contract Management Agency (DCMA). The Department of the Navy conducts its own assessments.

![]()

GAO found that for five of nine selected major defense acquisition program contracts, DOD officials did not perform all required contractor oversight procedures. In addition, GAO found that the Navy’s written procedures lacked a sufficient level of contractor oversight. GAO also found that out of the 270 CAP asset records tested, 116 had errors in the data recorded for them in the contractors’ property management systems. Inaccurate or incomplete CAP asset data could negatively affect DOD’s financial reporting and could also result in inefficient program management.

Additionally, GAO found that DOD did not consistently follow its policy for managing specialized and high-dollar CAP assets at the Air Force and Navy. Specifically, GAO found that DOD officials did not timely direct delivery or record 917 assets valued at approximately $109 million. Developing written procedures to ensure sufficient contractor oversight and clarifying policy for the management of specialized, high-dollar CAP could help DOD address its long-standing control issues related to property in the possession of contractors.

Abbreviations

|

APSR |

accountable property system of record |

|

CAP |

contractor-acquired property |

|

DCMA |

Defense Contract Management Agency |

|

DOD |

Department of Defense |

|

DODI |

Department of Defense Instruction |

|

FAR |

Federal Acquisition Regulation |

|

GFP |

government-furnished property |

|

NAVSEA |

Naval Sea Systems Command |

|

OUSD (A&S) |

Office of the Under Secretary

of Defense for |

|

PMSA |

property management system analysis |

|

ST |

special tooling |

|

STE |

special test equipment |

|

SUPSHIP |

Supervisor of Shipbuilding, Conversion, and Repair |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

July 28, 2025

Congressional Committees

The Department of Defense (DOD) is the only major federal agency that has never received a clean audit opinion on its department-wide financial statements, which is one of the three major impediments preventing GAO from expressing an opinion on the accrual-based consolidated financial statements of the U.S. government.[1] In addition, GAO continues to report DOD financial management as a high-risk area in its biennial High-Risk List.[2]

DOD’s financial statement auditors have reported a DOD-wide material weakness related to government property in the possession of contractors since fiscal year 2001.[3] Most recently, in DOD’s fiscal year 2024 agency financial report, auditors reported that DOD components did not have the policies, procedures, and internal controls in place to effectively oversee and report on government property in the possession of contractors. As a result, DOD has been unable to accurately and completely account for the total amount of government property possessed by its contractors. Proper oversight and accounting for these assets will be key to DOD’s ability to address the material weakness, mitigate the risks the weakness creates, and help produce auditable financial statements.

In fiscal year 2024, DOD reported $4.1 trillion in assets—approximately 72 percent of the federal government’s total assets. DOD’s assets include those in its physical custody as well as those procured and held by contractors on DOD’s behalf, referred to as contractor-acquired property (CAP). In fiscal year 2023 alone, DOD spent $440.7 billion on contracts with over 59,000 companies that provide DOD with materials, products, and services in the United States.[4] DOD relies on its contractors to track and manage billions of dollars in government property on a portion of these contracts.

We performed this performance audit in connection with the statutory requirement for GAO to audit the U.S. government’s consolidated financial statements, which cover all accounts and associated activities of executive branch agencies, including DOD.[5] This report examines the extent to which DOD (1) monitors the contractors’ tracking and reporting of CAP assets associated with selected major defense acquisition programs and (2) identified and accounted for certain specialized and high-dollar CAP assets at selected contractor locations consistent with applicable policies and procedures.

To address our objectives, we reviewed prior reports by GAO, DOD’s Office of Inspector General, and the Congressional Research Service to understand DOD’s accountability, oversight, and monitoring of CAP. We also reviewed relevant regulations, as well as DOD policies and guidance.

Additionally, we interviewed officials from various DOD offices as well as contractors to understand how DOD oversees, manages, and tracks CAP assets held at contractor facilities. These DOD offices included the Office of the Under Secretary of Defense for Acquisition and Sustainment (OUSD (A&S)), the Defense Contract Management Agency (DCMA), the Department of the Air Force, the Department of the Army, and the Department of the Navy.

Specifically, to address our first objective, we identified major defense acquisition programs and then selected one program for review from each of the three largest military services—Air Force, Army, and Navy—based on highest dollar value of total acquisition cost. We then obtained a list of contracts associated with these programs for the fiscal years 2016 through 2023. From this list, we filtered by contract type and selected the nine contracts from a universe of cost-type contracts that were most likely to contain CAP according to OUSD (A&S) officials.[6] We also obtained DOD’s contractor oversight documentation associated with these nine contracts and assessed it against DOD policy to determine whether required oversight reviews were performed and documented.

To determine whether DOD followed relevant guidance for overseeing such assets, from the nine contracts we selected for oversight testing we selected a nongeneralizable sample of three contractor locations (one each for the Army, Navy, and Air Force) based on the listings of CAP assets we received from various government contractors. We selected contractor locations where large amounts of CAP assets were being managed and we conducted site visits at the three locations.[7] We randomly selected a sample of 90 CAP assets from each of these three locations and performed tests on these samples to determine whether the contractors tracked in their property management systems certain information required by the Federal Acquisition Regulation (FAR) and DOD policies. Specifically, we identified five attributes required by the FAR (out of the 10 required attributes)—unique identifier, quantity, location, acquisition cost, and acquisition date—that we considered key for providing a complete, accurate, current, and auditable record of CAP assets in contractors’ property management systems. We focused our testing on these five key attributes.

To address our second objective, we identified assets from each CAP listing that were identified by the contractor as ST/STE.[8] These assets are of a specialized nature and can be used by DOD or its contractors on follow-on contracts. We also identified assets from each CAP listing that had an acquisition cost recorded in the contactor’s property management system that exceeded the military service’s capitalization threshold.[9] We then requested supporting documentation from DOD and used that to determine whether these CAP assets were scheduled for delivery or recorded in a DOD accountable property system of record (APSR) per DOD policy.

For a detailed description of our scope and methodology, see appendix I.

We conducted this performance audit from May 2023 to July 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Tracking and Managing CAP

Federal regulations define CAP as property acquired or fabricated by a contractor for performing a contract and to which the government has title.[10] These CAP assets include material, equipment, special tooling, and special test equipment. Specifically, contractors can procure or internally fabricate assets such as tools or fixtures for final product assembly—all of which are bought using public funds but managed and controlled by DOD’s contractors.

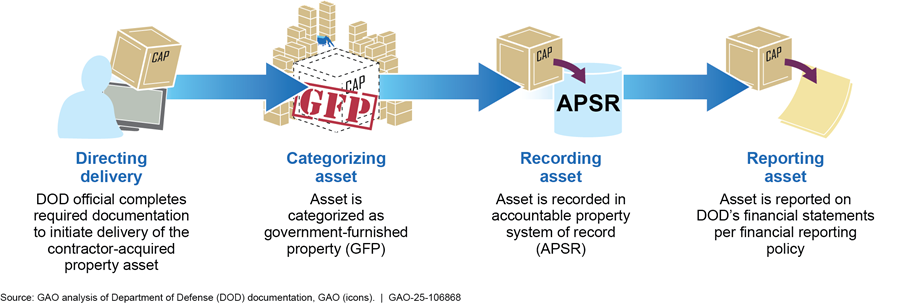

According to DOD officials, contractors are responsible for tracking and managing CAP assets until DOD performs formal receipt and acceptance of the property. To carry out this process, a DOD official completes required documentation to initiate delivery of the CAP assets to DOD (called directing delivery), at which point the assets become classified as government-furnished property (GFP).[11] The conversion from CAP to GFP, in turn, formally begins the process of recording the assets in a DOD APSR. Once recorded in an APSR, an asset is reported on DOD’s financial statements per financial reporting policy. Figure 1 illustrates this process.

Figure 1: Directing Delivery of Contractor-Acquired Property (CAP) Assets to Be Reported on the DOD Financial Statements

DOD policy states that the contracting officer should direct delivery of CAP assets as soon as they are identified if (1) they are classified as special tooling or special test equipment (ST/STE) or (2) their cost exceeds a specific dollar amount (referred to as the capitalization threshold).[12] CAP that is not scheduled for delivery during the contract period can be consumed into an end item, repurchased by the contractor, or identified for disposal.

DOD’s Contractor Oversight

According to DOD policy, OUSD (A&S) is responsible for establishing DOD-wide policies and procedures to manage and account for government property in the possession of DOD contractors, including ensuring that contractors are following requirements in the FAR.[13] Specifically, these DOD-wide policies require a contractor to maintain a complete, accurate, current, and auditable record of all government property accountable to the contract, including CAP. These records must track 10 specific attributes for CAP assets, including a unique identification number, location, quantity, description, acquisition cost, and acquisition date. The presence of these key attributes allows for a complete, accurate, and current auditable record of CAP assets. In addition, DOD requires contractors to identify any equipment classified as ST/STE in their property management systems.

Army and Air Force

Both DOD policy and federal regulations instruct DOD components to assess the accuracy of contractors’ records for CAP assets, including whether the records contain all required key attributes. To do so, DOD’s components conduct specific oversight procedures or delegate these procedures to DCMA, a defense agency under the authority of OUSD (A&S).

The Army and Air Force frequently use DCMA to oversee contractor performance. One of DCMA’s primary oversight tools is a property management system analysis (PMSA). DCMA conducts PMSAs to assess whether a contractor’s property management system complies with the FAR.

The DCMA guidebook outlines a variety of methods for carrying out PMSAs. These methods include selected reviews of various contractor documentation; limited contractor questionnaires; interviews with contractor staff; and statistical testing for certain aspects, such as a review of the contractor’s property records to ensure that key attributes are properly recorded.[14] DCMA officials are instructed to document the specific contract numbers covered on each PMSA report to ensure that government property associated with those contracts is sufficiently covered during the PMSA.

The DCMA guidebook directs officials to conduct PMSAs in accordance with the level of risk that is assigned. Specifically, officials must consider the risk that there will be shortcomings in the contractor’s property management system that will materially affect the ability of DOD officials to rely on information produced by the system. Risk is assessed as low, moderate, or high and is assigned based on factors outlined in the guidebook. Risk assessments must be revalidated at least annually. PMSAs should be conducted annually for high risk, every 2 years for moderate risk, and every 3 years for low risk.

Navy

Instead of delegating contractor oversight to DCMA, the Navy performs its own procedures for certain large programs, including for the Navy contract we reviewed. To do so, the Supervisor of Shipbuilding, Conversion, and Repair (SUPSHIP) serves as the Navy’s primary on-site representative at contractor locations and performs contract management and oversight activities. To conduct oversight procedures, SUPSHIP follows guidance issued by Naval Sea Systems Command (NAVSEA).[15]

DOD Did Not Effectively Monitor Whether Contractors Were Properly Tracking and Reporting CAP for Selected Major Defense Acquisition Programs

We found that the contract administrators for the Army and Air Force (DCMA) and the Navy (SUPSHIP) were not consistently verifying the accuracy of contractors’ CAP records for selected major defense acquisition programs. Specifically, we found that DCMA contract administrators did not perform all required oversight procedures for five out of the seven DCMA-administered contracts we reviewed. In addition, for the contracts we reviewed, we found that DCMA and SUPSHIP did not identify a total of 116 inaccurate asset records in the contractors’ property management systems out of the 270 assets we tested.

Air Force

In our review of two Air Force contracts, we found that DCMA did not perform the required monitoring activities over the CAP assets. Specifically, we found that DCMA did not conduct (1) PMSAs covering the CAP assets for either of the contracts in our sample or (2) a risk assessment for one of the contracts in our sample. As a result, DCMA could not provide evidence that officials provided sufficient oversight of all CAP assets associated with either of the selected contracts. This lack of consistent oversight could have contributed to inaccuracies we found in the contractor’s property records.

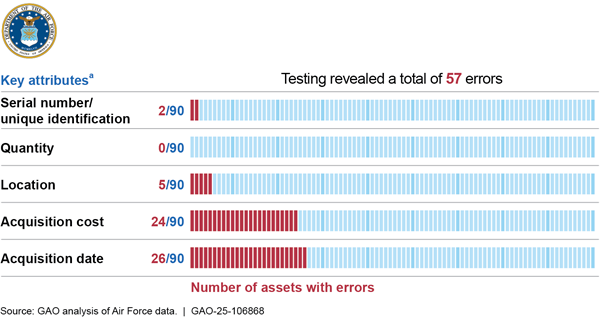

Specifically, out of the 90 CAP assets we tested at the Air Force contractor location we visited in June 2024, we found that 39 had one or more out of five key attributes inaccurately recorded in the contractor’s property management system, resulting in 57 total errors (inaccurately recorded data). Figure 2 presents the number of errors by CAP asset attribute.

aWe tested five key attributes for 90 sampled assets, which resulted in 450 total attributes being tested. The contractor attribute data we tested were as of June 2024.

Army

For three of the five Army contracts we reviewed, we found that DCMA did not perform the required monitoring activities over the CAP assets. Specifically, we found that DCMA could not provide evidence that it provided oversight of all CAP assets associated with the three selected contracts since those contract numbers were not identified on a PMSA. This lack of consistent oversight could have contributed to inaccuracies we found in the contractor’s property records, as shown below.

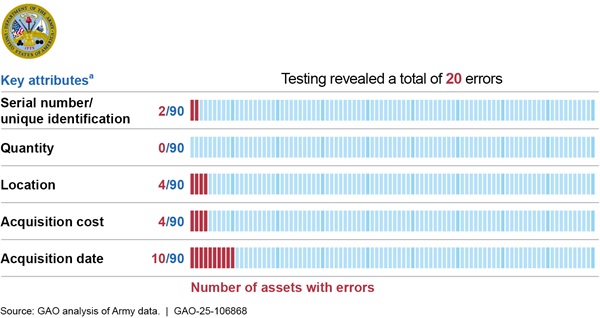

We found that 18 of the 90 CAP assets we tested at the Army contractor location in July 2024 had one or more out of five key attributes inaccurately recorded in the contractor’s property management system. These 18 assets had a total of 20 errors for the key attributes (see fig. 3).

aWe tested five key attributes for 90 sampled assets, which resulted in 450 total attributes being tested. The contractor attribute data we tested were as of July 2024.

Navy

While we found that the Navy performed the required risk assessments and oversight audit for the contracts we reviewed, we determined that SUPSHIP’s oversight procedures were not consistent with those outlined in the DCMA guidebook. Specifically, while NAVSEA officials told us that the DCMA guidebook was used to develop the NAVSEA guidance, we found that the guidance did not include certain oversight elements included in the DCMA guidebook. For example, the NAVSEA guidance did not include these specific elements when determining the necessary level of contractor oversight and related risk:

· Investigations or findings of fraud, waste and abuse

· Public safety or national security concerns

· Increased losses of government property identified over previous years

· Determining PMSA frequency based on assessed risk level

· Requiring more frequent PMSAs for sensitive property

The absence of these oversight elements in NAVSEA’s guidance could have contributed to inaccurate records we found in the contractor’s property management system, as shown below.

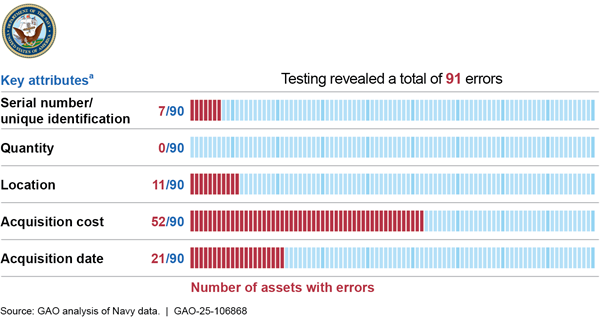

Of the 90 CAP assets we tested at the Navy contractor location, we found that 59 had one or more out of five key attributes inaccurately recorded in the contractor’s property management system. These 59 assets had a total of 91 errors for the key attributes (see fig. 4).

aWe tested five key attributes for 90 sampled assets, which resulted in 450 total attributes being tested. The contractor attribute data we tested were as of July 2024.

DOD policy requires OUSD (A&S) to monitor and evaluate whether DOD components and contractors adhere to policies and procedures. However, we found that OUSD (A&S) did not have written procedures in place to (1) monitor whether DCMA officials were consistently performing required PMSAs or (2) evaluate the NAVSEA contractor oversight guidance used by SUPSHIP officials to determine whether contracts the Navy administered received the sufficient level of oversight.

Without written procedures to (1) monitor DCMA’s performance of PMSAs and risk assessment and (2) review SUPSHIP oversight guidance, DOD is at greater risk for inaccurate or incomplete CAP data. Inaccurate or incomplete CAP asset data in contractors’ property management systems could negatively affect DOD’s financial reporting and management’s ability to make informed decisions about future acquisitions and could result in inefficient program management. In addition, these issues could hinder DOD’s efforts to address the agencywide material weakness related to government property in the possession of contractors.

DOD Did Not Properly Manage CAP Assets Classified as ST/STE or over the Capitalization Threshold at Selected Contractor Locations

We found that specialized equipment and high-dollar assets associated with the Air Force and Navy contracts we reviewed were not scheduled for delivery by DOD or recorded in an APSR.[16] Specifically, we found that a combined total of 917 CAP assets valued at approximately $109 million had been identified by the contractor as ST/STE or over the capitalization threshold but had not been directed for delivery to the government by the contracting officers responsible for the contracts.

Air Force

We determined that 394 ST/STE assets and one CAP asset that was over the capitalization threshold were identified by the contractor at the Air Force contractor location we visited. However, we found that none of these assets had been scheduled for delivery by DOD or recorded in an APSR as of the date of our testing in June 2024. The total value of these assets was approximately $9.3 million, or 54 percent of the total value of the CAP ($17.4 million) at this location. Some of these assets were acquired as far back as October 2019. Examples of assets labeled as ST/STE at this Air Force contractor location include various items used for satellite antenna production, such as support brackets, assembly fixtures, acoustic testing equipment, and a noise test set.

Navy

At the Navy contractor location we visited, we determined that 523 ST/STE assets identified by the contractor—10 of which were also over the capitalization threshold—were not scheduled for delivery or recorded in an APSR as of the date of our testing in August 2024. The total value of these assets was approximately $102 million, or 88 percent of the total value of the CAP ($116 million) at this location. Several of these assets had acquisition dates as far back as 2018. Examples of assets labeled as ST/STE at this Navy contractor location include items used in submarine production, such as wheeled transfer vehicles, a stationary pipe cutter, a horizontal milling and boring machine, and pressure gauges. Approximately 6 months after our site visit, Navy officials stated that several of the CAP assets at this contractor location had been misclassified as ST/STE and that the Navy had subsequently reclassified 62 of the 523 assets. However, the Navy did not provide the necessary supporting documentation for us to validate the reclassification of the 62 assets.

DOD policy states that the contracting officer should direct delivery of CAP assets that are classified as ST/STE or over the capitalization threshold “as soon as they are identified.” However, several agency officials with responsibility for CAP asset oversight stated that the existing DOD policy was unclear related to scheduling delivery of the assets “as soon as they are identified.”

Without clear policy for the timely identification and delivery of ST/STE and CAP assets over the capitalization threshold, DOD may not timely identify such assets. As a result, DOD could lack visibility of unique, high-dollar assets that could be used on other mission-critical contracts. In addition, these assets may not be reported in DOD’s financial statements until years after they were acquired. This, in turn, could hinder DOD’s efforts to address its agencywide material weakness related to government property in the possession of contractors.

Conclusions

DOD’s contractors track and manage billions of dollars in government property. As we and other auditors have previously reported, serious control issues preclude DOD from having accurate and complete asset records. As a result, DOD’s financial statement auditors continue to identify a material weakness in this area. The lack of reliable and auditable financial information continues to prevent DOD from receiving an opinion on its financial statement audit. It can also negatively affect management’s ability to make informed decisions about future acquisitions and lead to inefficient program management.

Developing written procedures for OUSD (A&S) to monitor whether officials are consistently and sufficiently performing required oversight reviews will help ensure that key information recorded by contractors for contractor-acquired property is complete, accurate, and reliable. In addition, clarifying the policy for identifying and scheduling delivery of specialized and high-dollar CAP assets will help ensure that these assets are timely scheduled for delivery by DOD officials, recorded in an APSR, and properly reported in DOD’s financial statements. By addressing these issues, DOD could improve the reliability of its financial information and help address its long-standing material weakness related to government property in the possession of contactors.

Recommendations for Executive Action

We are making the following three recommendations to DOD:

The Secretary of Defense should ensure that OUSD (A&S) develops written monitoring procedures to help ensure that DCMA is following existing policies for conducting PMSAs. (Recommendation 1)

The Secretary of Defense should ensure that OUSD (A&S) evaluates the NAVSEA guidance to determine whether it provides for the sufficient level of contractor oversight. (Recommendation 2)

The Secretary of Defense should ensure that OUSD (A&S) updates its policy for the identification of CAP assets classified as ST/STE or over the capitalization threshold to clarify when these assets are to be scheduled for delivery by the contracting officer and recorded in an APSR. (Recommendation 3)

Agency Comments

We provided a draft of this report to DOD for review and comment. In its comments, reproduced in appendix II, DOD concurred with all three of our recommendations, stating that it will develop monitoring procedures around existing PMSA policy and evaluate NAVSEA guidance to ensure there is sufficient contractor oversight. In addition, DOD stated that it will review and update relevant policy to ensure clarity regarding identification of CAP assets that are classified as ST/STE or over the capitalization threshold. DOD also provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the appropriate congressional committees, the Secretary of Defense, the Under Secretary of Defense (Acquisition and Sustainment), and other interested parties. In addition, this report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at kociolekk@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix III.

Kristen A. Kociolek

Managing Director, Financial Management and Assurance

List of Committees

The Honorable Roger Wicker

Chairman

The Honorable Jack Reed

Ranking Member

Committee on Armed Services

United States Senate

The Honorable Rand Paul, M.D.

Chairman

The Honorable Gary C. Peters

Ranking Member

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Mike Rogers

Chairman

The Honorable Adam Smith

Ranking Member

Committee on Armed Services

House of Representatives

The Honorable James Comer

Chairman

The Honorable Robert Garcia

Ranking Member

Committee on Oversight and Government Reform

House of Representatives

This report examines the extent to which the Department of Defense (DOD) (1) monitors contractors’ tracking and reporting of contractor-acquired property (CAP) assets associated with selected major defense acquisition programs and (2) identified and accounted for certain specialized and high-dollar CAP assets consistent with applicable policies and procedures.[17]

To address our objectives, we interviewed DOD officials from the Office of the Under Secretary of Defense for Acquisition and Sustainment (OUSD (A&S)), the Department of the Army, the Department of the Navy, the Department of the Air Force, and the Defense Contract Management Agency (DCMA). In addition, in conjunction with our site visits discussed below, we interviewed officials from three of the five largest DOD contractors by government contract revenue—Lockheed Martin, Northrop Grumman, and General Dynamics.

To identify relevant DOD and federal government policy and guidance for managing CAP, we reviewed DOD reports, policies, and procedures, such as the DCMA Guidebook for Contract Property Administration[18] and the Naval Sea Systems Command (NAVSEA) Supervisor of Shipbuilding (SUPSHIP) Government Property Standard Audit and Surveillance Operating Procedures.[19] We also reviewed the Federal Acquisition Regulation (FAR) and DOD’s supplemental acquisition regulations, particularly as they relate to CAP and the associated responsibilities of DOD and its contractors.[20] Additionally, we reviewed DOD’s agency financial reports for fiscal years 2002 through 2024 to gain an understanding of CAP-related issues reported by DOD’s auditors. We also reviewed prior reports by GAO, DOD’s Office of Inspector General, and the Congressional Research Service to understand DOD’s accountability, oversight, and monitoring of CAP.

Next, we used GAO’s June 2023, Weapon Systems Annual Assessment, to identify the top 16 major defense acquisition programs by acquisition cost.[21] We used this list to select a nongeneralizable sample of three programs, one for each of the largest military services—Army, Navy, and Air Force—based on highest dollar value of total acquisition costs.[22] We then requested from OUSD (A&S) a list of contracts associated with these three programs for fiscal year 2016 through fiscal year 2023.[23] From this list, we filtered by contract type and selected the nine contracts from a universe of cost-type contracts that were most likely to contain CAP according to OUSD (A&S) officials.

For our selected contracts we requested DOD’s associated contractor oversight documentation for the period.[24] Specifically, we requested

· DCMA’s property management system assessments,

· risk assessments,

· SUPSHIP’s oversight audits,

· any other related contractor surveillance and oversight procedures documented by DOD, and

· listings of CAP assets from the contractor.

We compared this oversight documentation with DOD’s policies to determine whether DOD components were performing and documenting contractor oversight procedures as required.[25]

To determine whether DOD was ensuring that contractors followed applicable policies and regulations for tracking CAP in their property management systems, out of our nine contracts, we selected a nongeneralizable sample of three of these contracts, one each for the Army, Navy, and Air Force based on the listings of CAP assets we received from the government contractors. We selected contractor locations where large amounts of CAP assets were being managed and conducted site visits to these three locations[26] For the three selected locations, we performed the following test procedures:

· We randomly selected 270 CAP assets (90 assets at each of the three locations).[27]

· For each of the randomly selected assets, we performed tests to determine whether the (1) contractor’s property management system recorded certain information required by the FAR and DOD policy, including a unique identifier (such as serial number), quantity, location, acquisition cost, and acquisition date, and (2) information recorded was complete and accurate based on supporting documentation.[28]

We identified five attributes required by the FAR (out of the 10 required attributes)—unique identifier, quantity, location, acquisition cost, and acquisition date—that we considered key for providing a complete, accurate, current, and auditable record of CAP assets. We focused our testing on these five key attributes.

To determine whether DOD followed requirements for CAP assets classified as special tooling or special test equipment (ST/STE) or with an acquisition cost exceeding the applicable military service’s specific dollar amount (capitalization threshold) using the CAP listings from our site visits, we[29]

· identified assets from each CAP listing that were identified by the contractor as ST/STE at the selected locations (ST/STE assets are of a specialized nature and can be used by DOD or its contractors on follow-on contracts),[30]

· identified assets from each CAP listing that had an acquisition cost recorded in the contactor’s property management system that exceeded the military service’s capitalization threshold,[31] and

· requested documentation from DOD showing that these CAP assets had been either scheduled for delivery or recorded in a DOD accountable property system of record and compared what we received to DOD policy.

We conducted this performance audit from May 2023 to July 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objective. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

GAO Contact

Kristen A. Kociolek, kociolekk@gao.gov

Staff Acknowledgments

In addition to the contact named above, Christopher Spain (Assistant Director), James Haynes (Analyst in Charge), Seth Brewington, Jody Ecie, Jason Kelly, Matthew Minteer, and Walter Vance made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]GAO, Financial Audit: FY 2024 and FY 2023 Consolidated Financial Statements of the U.S. Government, GAO‑25‑107421 (Washington, D.C.: Jan. 16, 2025). The other two major impediments are (1) the federal government’s inability to adequately account for intragovernmental activity and balances between federal entities and (2) weaknesses in the federal government’s process for preparing the consolidated financial statements.

[2]GAO’s High-Risk List is a biennial report that identifies government operations with vulnerabilities to fraud, waste, abuse, and mismanagement or in need of transformation. Each biennial update describes the status of high-risk areas, outlines actions that are needed to assure further progress, and identifies new high-risk areas needing attention by the executive branch and Congress. GAO, High-Risk Series: Heightened Attention Could Save Billions More and Improve Government Efficiency and Effectiveness, GAO‑25‑107743 (Washington, D.C.: Feb. 25, 2025).

[3]A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis. A deficiency in internal control exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent, or detect and correct, misstatements on a timely basis.

[4]Congressional Research Service, The U.S. Defense Industrial Base: Background and Issues for Congress, R47751 (Sept. 23, 2024).

[5]The Secretary of the Treasury, in coordination with the Director of Office of Management and Budget, is required to annually prepare and submit audited financial statements for the executive branch of the U.S. government to the President and Congress. GAO is required to audit these statements. 31 U.S.C. § 331(e).

[6]We selected two Air Force contracts, five Army contracts, and two Navy contracts.

[7]The three contractor locations were (1) Lockheed Martin at the Waterton campus, Colorado; (2) Northrop Grumman in Huntsville, Alabama; and (3) General Dynamics/Electric Boat in Quonset Point, Rhode Island.

[8]The FAR defines special tooling (ST) as jigs, dies, fixtures, molds, patterns, taps, gauges, and all components of these items, including foundations and similar improvements necessary for installing special tooling, and which are of such a specialized nature that without substantial modification or alteration their use is limited to the development or production of particular supplies or parts thereof or to the performance of particular services. ST does not include material, special test equipment, real property, equipment, machine tools, or similar capital items. The FAR defines special test equipment (STE) as either single or multipurpose integrated test units engineered, designed, fabricated, or modified to accomplish special-purpose testing in performing a contract. STE consists of items or assemblies of equipment, including foundations and similar improvements necessary for installing STE, and standard or general-purpose items or components that are interconnected and interdependent so as to become a new functional entity for special testing purposes. STE does not include material, special tooling, real property, or equipment items used for general testing purposes or property that with relatively minor expense can be made suitable for general-purpose use.

[9]Capitalization thresholds for CAP assets are $250,000 for the Army and $1 million for the Air Force and Navy.

[10]FAR § 45.101, Government Property, Definitions, January 2025.

[11]Defense Federal Acquisition Regulation Supplement Procedures, Guidance, and Information § 245.402-71, Delivery of contractor-acquired property, January 2025.

[12]The asset capitalization thresholds established for the military services are $250,000 for the Army and $1 million for the Air Force and Navy. DOD policy requires that assets with a dollar value exceeding these amounts be recorded in DOD’s financial reporting system as capitalized assets.

[13]Department of Defense, Office of the Under Secretary of Defense for Acquisition and Sustainment, Accountability and Management of DOD Equipment and Other Accountable Property, DODI 5000.64 (June 10, 2019), and Accountability and Management of Government Contract Property, DODI 4161.02 (Aug. 31, 2018).

[14]Defense Contract Management Agency, DCMA Guidebook for Government Contract Property Administration (Aug. 2022). The guidebook provides a process summary to DCMA personnel for consistent oversight of contractor property management systems and is intended to promote consistency in DCMA’s methodology and analysis techniques. The guidebook also provides detailed guidance for performing PMSA.

[15]Naval Sea Systems Command, Supervisor of Shipbuilding, Conversion, and Repair, Government Property Standard Audit and Surveillance Operating Procedures (Sept. 2021).

[16]The Army contracts we reviewed did not include any ST/STE or CAP assets over the capitalization threshold.

[17]Major defense acquisition programs are generally either (1) designated as such by the Secretary of Defense or (2) estimated to require a total expenditure amount above a certain threshold. See 10 U.S.C. § 4201(a); DOD Instruction (DODI) 5000.85, Major Capability Acquisition (Aug. 6, 2020) (incorporating change 1, Nov. 4, 2021).

[18]Defense Contract Management Agency, DCMA Guidebook for Government Contract Property Administration (Aug. 2022).

[19]Naval Sea Systems Command, Supervisor of Shipbuilding, Government Property Standard Audit and Surveillance Operating Procedures (Sept. 2021).

[20]FAR Part 45, Government Property, January 2025; FAR § 52.245-1, Government Property, September 2021; and the Defense Federal Acquisition Regulation Supplement Procedures, Guidance, and Information (PGI) 245.402-71, Delivery of contractor-acquired property, January 2025.

[21]GAO, Weapon Systems Annual Assessment: Programs Are Not Consistently Implementing Practices That Can Help Accelerate Acquisitions (Washington, D.C.: June 8, 2023).

[22]The programs we sampled were (1) the Air Force’s Global Positioning System IIIF; (2) the Army’s Integrated Air & Missile Defense; and (3) the Navy’s Ship, Submersible, Ballistic, Nuclear.

[23]We chose this period because, according to OUSD (A&S) officials, system limitations would prohibit obtaining CAP lists for contracts prior to 2016.

[24]We selected two Air Force contracts, five Army contracts, and two Navy contracts.

[25]For the purposes of this audit, DOD’s oversight policies were the (1) DCMA Guidebook for Government Contract Property Administration, August 2022; (2) NAVSEA’s Government Property Standard Audit and Surveillance Operating Procedure, September 2021; (3) Department of Defense Instruction (DODI) 5000.64, Accountability and Management of DOD Equipment and Other Accountable Property; (4) PGI 245.4, Title to Government Property; (5) DODI 4161.02, Accountability and Management of Government Contract Property; and (6) PGI § 245.402-71, Delivery of Contractor-acquired Property.

[26]The contractor sites we chose were Lockheed Martin (Air Force contractor), located at the Waterton campus, Colorado; Northrop Grumman (Army contractor), located in Huntsville, Alabama; and General Dynamics/Electric Boat (Navy contractor), located in Quonset Point, Rhode Island.

[27]Generally, DOD officials categorize CAP as (1) “material,” or items that lose their individual identity when consumed within the end-product, or (2) “tagged assets,” or items that are labeled with unique identifiers for tracking purposes. For the purposes of this audit, we focused only on tagged assets, which are generally high-dollar assets that are not consumed into an end item.

[28]FAR § 52.245-1, DODI 500.64, DODI 4161.02, PGI 245.4, and PGI 245.402-71.

[29]The FAR defines special tooling (ST) as jigs, dies, fixtures, molds, patterns, taps, gauges, and all components of these items, including foundations and similar improvements necessary for installing special tooling, and which are of such a specialized nature that without substantial modification or alteration their use is limited to the development or production of particular supplies or parts thereof or to the performance of particular services. ST does not include material, special test equipment, real property, equipment, machine tools, or similar capital items. The FAR defines special test equipment (STE) as either single or multipurpose integrated test units engineered, designed, fabricated, or modified to accomplish special-purpose testing in performing a contract. STE consists of items or assemblies of equipment, including foundations and similar improvements necessary for installing STE, and standard or general-purpose items or components that are interconnected and interdependent so as to become a new functional entity for special testing purposes. STE does not include material, special tooling, real property, or equipment items used for general testing purposes or property that with relatively minor expense can be made suitable for general-purpose use.

[30]The Army contracts we reviewed did not include any ST/STE or CAP assets over the capitalization threshold.

[31]Capitalization thresholds for CAP assets are $250,000 for the Army and $1 million for the Air Force and Navy.