INFLATION REDUCTION ACT OF 2022

Initial Implementation of Medicare Drug Pricing Provisions

Report to Congressional Committees

United States Government Accountability Office

View GAO‑25‑106996. For more information, contact John E. Dicken at dickenj@gao.gov.

Highlights of GAO‑25‑106996, a report to congressional committees

Inflation Reduction Act of 2022

Initial Implementation of Medicare Drug Pricing Provisions

Why GAO Did This Study

The IRA requires changes to prescription drug coverage under Medicare Part B (which generally covers physician-administered drugs) and Part D (which provides voluntary prescription drug coverage). The IRA established two programs—the negotiation program and inflation rebate program—that aim to lower the prices Medicare and beneficiaries pay for prescription drugs.

The IRA included a provision for us to support oversight of the use of funds appropriated in the IRA. This report (1) describes CMS’s implementation of the negotiation program, (2) describes CMS’s implementation of the inflation rebate program, and (3) assesses CMS’s plans for using funds for both programs.

For all objectives, GAO reviewed CMS documentation, including agency guidance and its spending planning documents, and interviewed CMS officials.

What GAO Found

The Centers for Medicare & Medicaid Services (CMS) has begun implementing the Medicare drug price negotiation program (negotiation program) and Medicare prescription drug inflation rebate program (inflation rebate program), as the Inflation Reduction Act of 2022 (IRA) requires. The negotiation program requires CMS to negotiate prices for certain high-expenditure drugs. The inflation rebate program requires drug manufacturers to pay CMS a rebate if the prices of certain Medicare-covered drugs increase faster than the rate of inflation. As of December 2024, CMS’s implementation of the negotiation program has included, for example, hiring staff, issuing program implementation guidance, and drug price negotiation. In August 2024, CMS announced negotiated prices for the first 10 drugs selected for negotiation, and these prices will go into effect in 2026. CMS’s implementation of the inflation rebate program has included, for example, hiring program staff, issuing guidance and regulations, and developing program infrastructure to support rebate invoicing. CMS plans to begin invoicing manufacturers for rebates in late 2025.

GAO found that CMS’s plans for monitoring appropriated funds for the negotiation and inflation rebate programs are consistent with relevant federal internal control principles. As of December 2024, CMS plans to obligate approximately $2.9 billion of the $3 billion in negotiation program appropriated funds from fiscal years 2022 through 2033. CMS plans to use the majority—85 percent—of actual and planned obligations for program support—including contractors to support access to negotiated prices by pharmacies and other dispensing entities—and administration.

CMS plans to obligate approximately $155 million of the $160 million in inflation rebate program appropriated funds from 2022 through 2031. CMS plans to use the majority—approximately 82 percent—of actual and planned obligations for rebate operations, administration, and program support.

|

Abbreviations |

|

|

|

|

|

CMS |

Centers for Medicare & Medicaid Services |

|

FDA |

Food and Drug Administration |

|

IRA |

Inflation Reduction Act of 2022 |

|

OMB |

Office of Management and Budget |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

April 28, 2025

Congressional Committees

The Inflation Reduction Act of 2022 (IRA) established several Medicare drug-related provisions. This report focuses on two programs that aim to lower the prices Medicare and beneficiaries pay for prescription drugs: the Medicare drug price negotiation program (negotiation program) and the Medicare prescription drug inflation rebate program (inflation rebate program).[1] The negotiation program requires the Centers for Medicare & Medicaid Services (CMS), which oversees the Medicare program, to negotiate prices with drug manufacturers for the first time for certain high-expenditure drugs; these prices will take effect starting in 2026. The inflation rebate program requires drug manufacturers to pay CMS rebates if their prices for certain Medicare-covered drugs increase faster than the rate of inflation, beginning October 1, 2022, for Part D drugs and January 1, 2023, for Part B drugs.

The IRA included a provision for us to support oversight of the use of funds appropriated in the IRA.[2] This report focuses on CMS’s use of funds and the early implementation of the drug pricing provisions in the IRA—the negotiation program and the inflation rebate program. Specifically, this report

(1) describes CMS’s implementation of the Medicare drug price negotiation program,

(2) describes CMS’s implementation of the Medicare prescription drug inflation rebate program, and

(3) assesses CMS’s plans for using funds appropriated for the negotiation and inflation rebate programs.

To describe CMS’s implementation of the negotiation and inflation rebate programs, we reviewed documentation, such as program guidance, and interviewed CMS officials. To assess CMS’s plans for using funds appropriated for the negotiation and inflation rebate programs, we reviewed documentation and interviewed CMS officials about CMS’s planned use of these funds for these programs and the process CMS uses to monitor the use of these funds. The documentation we reviewed included program guidance and documentation on the agency’s actual and planned use of appropriated funds for both programs, and we report information on actual and planned obligations for both programs. In addition, we analyzed CMS’s planned use of appropriated funds to determine the extent to which it is consistent with the amount appropriated in the IRA and includes relevant internal controls for the federal government.[3]

We conducted this performance audit from August 2023 to April 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Prescription Drug Supply Chain

Several entities are involved with, and pay different prices for, prescription drugs as they move from the manufacturer to the beneficiary (this is referred to as the prescription drug supply chain). In general, for outpatient prescription drugs provided to beneficiaries by pharmacies, manufacturers develop and sell their drugs to wholesalers, and wholesalers then sell the drugs to pharmacies. When a beneficiary purchases a drug from a pharmacy, the pharmacy is paid by the beneficiary’s plan and by the beneficiary through any applicable cost-sharing.[4] Physician administered drugs are purchased by physicians or hospitals from manufacturers or other sellers. When a beneficiary receives a drug from a physician, the physician is paid by the Medicare program or the beneficiary’s plan, as applicable, and by the beneficiary through any applicable cost-sharing.

Medicare Prescription Drug Coverage

Medicare Part D provides voluntary outpatient prescription drug coverage through plans offered by Part D plan sponsors, which are private companies that contract with CMS to provide prescription drug coverage to Medicare beneficiaries. Beneficiaries may receive Part D coverage through either stand-alone Part D prescription drug plans that supplement the traditional Medicare fee-for-service program or through private Medicare Advantage plans that generally must cover all Medicare benefits and usually offer Part D coverage. These Medicare prescription drug plans must offer a standard package of benefits or alternative coverage that is actuarially equivalent to a standard plan. Although all plans must meet certain minimum requirements, plans may charge different premiums and have different beneficiary cost-sharing arrangements—such as deductibles and cost-sharing for covered drugs.[5] Plans may also differ in which Part D drugs they cover—known as “formularies.”[6]

Medicare Part B generally covers drugs that typically are administered by a physician or under a physician’s supervision, in the office or at hospital outpatient departments. Part B drugs include injectable drugs, some oral cancer drugs, and drugs infused or inhaled through durable medical equipment. Part B drugs are generally purchased by physicians or hospitals. Medicare Part B generally pays such providers 80 percent of the price of the drug and the beneficiary is responsible for the remaining 20 percent, which may be covered by a Medicare supplemental health insurance policy.[7]

The IRA requires Medicare to negotiate prices for selected high-expenditure Part B or Part D drugs with manufacturers as described in more detail below. For most Part B drugs, the prices Medicare pays providers for drugs are determined based on the average sales prices manufacturers report to CMS, plus an additional six percent. For most Part D drugs, plan sponsors negotiate prices with drug manufacturers and payment rates with pharmacies, which may include price concessions in the form of rebates or other discounts.

Medicare Drug Price Negotiation Program

Under the drug price negotiation program required by the IRA, CMS must negotiate prices with manufacturers for certain high-expenditure Part D and Part B drugs. In accordance with the act, CMS must negotiate what the IRA defines as maximum fair prices for the following price years: 10 drugs to take effect in 2026, 15 additional drugs in 2027, 15 additional drugs in 2028, and 20 additional in 2029 and in each following year. In 2026 and 2027, the program only applies to Part D drugs; starting in 2028, the program applies to both Part D and Part B drugs.[8]

The IRA includes the process CMS is to use to select drugs for negotiation, develop and negotiate maximum fair prices with manufacturers, and assess penalties for non-compliance with the program, as follows.

· Select drugs for negotiation. Under the IRA, Part D and Part B drugs must meet the following criteria to qualify for negotiation: (1) be among the highest expenditure, (2) be single-source prescription drugs (i.e., those lacking competition from generic drugs or biosimilars); and (3) be approved for at least 7 years (drugs) or licensed for at least 11 years (biologics).[9] CMS must select drugs for negotiation from among the 50 qualifying Part D or Part B drugs with the highest total expenditures during the most recent 12-month period for which data are available.[10]

· Development of initial maximum fair price offer. The IRA requires CMS to develop an initial offer for the maximum fair price for drugs selected for negotiation. The IRA sets a ceiling for the maximum fair price, which is the lesser of (1) the weighted average price of a Part D drug, net of rebates and discounts or the average price of a Part B drug, and (2) a percentage of the average nonfederal average manufacturer price for 2021 increased by inflation.[11] The IRA requires CMS to develop an initial offer for the maximum fair price of a drug based on information submitted by the drug manufacturer, including data on the costs of research, development, and production of the drug. Manufacturers may also submit evidence about alternative treatments to the extent it is available, including information related to comparative effectiveness.[12]

· Negotiation of the maximum fair price. CMS and manufacturers of selected drugs enter into agreements to negotiate a maximum fair price for each selected drug. CMS submits its initial offer for the maximum fair price in writing to manufacturers, which includes a concise justification of the offer. Manufacturers then have 30 days to accept or counter with a different price. If the manufacturer does not accept the initial price and CMS does not accept the manufacturer’s counteroffer, the IRA specifies an end date for the negotiation period, but not the requirements for what must occur during this period. If no agreement is reached, CMS will submit a “final maximum fair price offer,” which the manufacturer can accept or decline. Each year, CMS is required to select additional drugs and, in general, is required to negotiate prices for those selected drugs each year. The maximum fair price for a selected drug remains in effect until the drug has generic or biosimilar competition or the price has been renegotiated.[13] The maximum fair price is subject to annual adjustments based on inflation as measured by the Consumer Price Index for All Urban Consumers.[14]

· Maximum fair price payment. The IRA requires that manufacturers provide access to the maximum fair price to beneficiaries, pharmacies, and other dispensers for drugs covered under Part D; and to hospitals, physicians, and other providers and suppliers for drugs covered under Part B. Part D plan sponsors may negotiate reimbursement rates to pharmacies lower than the maximum fair price, but the prices these sponsors pay pharmacies may not exceed the maximum fair price plus pharmacy dispensing fees. For Part B drugs selected for negotiation beginning in price year 2028, the maximum fair price will be used in place of the average sales price so that payment will be 106 percent of the maximum fair price.[15]

· Non-compliance and non-participation. Participating manufacturers who fail to offer the maximum fair price as required by law or violate certain terms of their negotiation agreement with CMS shall be subject to civil monetary penalties. Manufacturers who decline to enter a negotiation agreement with CMS, fail to reach an agreement with CMS on a maximum fair price, or terminate the negotiation agreement while participating in the Medicare and Medicaid programs are subject to an excise tax on the sale of the drug. Manufacturers who do not wish to participate in the negotiation program and do not wish to pay the excise tax may choose to terminate their participation in the Medicare and Medicaid programs.[16]

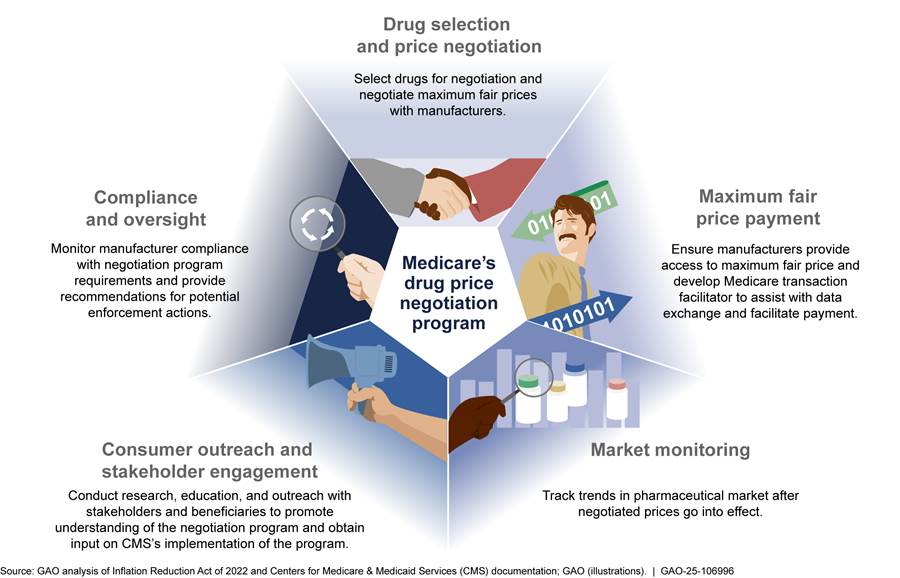

See figure 1 for a description of the negotiation program.

Notes: The number of drugs to be negotiated each year and the negotiation process are outlined in statute: 10 drugs to take effect in 2026, 15 additional drugs in 2027, 15 additional drugs in 2028, and 20 additional in 2029 and each following year. The number of drugs may be fewer for a given year if not all drugs meet the eligibility criteria. In 2026 and 2027, the program only applies to Part D drugs; in subsequent years it applies to Part D and Part B drugs.

The IRA establishes the timeline CMS is to use for the negotiation program. The timeline for price year 2026 is unique to that year, with the timeline for 2027 and future price years falling on the same calendar dates. See table 1 for the key negotiation program dates for price years 2026 through 2029.

|

|

Number of drugsa |

Negotiation period |

Maximum fair prices announced |

Maximum fair price goes into effect |

|

Price year 2026 |

10 Part D drugs |

October 21, 2023 – August 1, 2024 |

No later than September 1, 2024 |

January 1, 2026 |

|

Price year 2027 |

15 additional Part D drugs |

February 28, 2025 – November 1, 2025 |

No later than November 30, 2025 |

January 1, 2027 |

|

Price year 2028 |

15 additional Part D or Part B drugs |

February 28, 2026 – November 1, 2026 |

No later than November 30, 2026 |

January 1, 2028 |

|

Price year 2029 |

20 additional Part D or Part B drugs |

February 28, 2027 – November 1, 2027 |

No later than November 30, 2027 |

January 1, 2029 |

Source: GAO analysis of Inflation Reduction Act of 2022. | GAO‑25‑106996

Notes: See Pub. L. No 117-169, 11001(a), 136 Stat. 1818, 1836-41, 1843-48 (adding 42 U.S.C. 1320f-1, which sets forth the number of drugs CMS is to negotiate prices for each year, and 42 U.S.C. 1320f-3, which provides the negotiation timeline).

The price year is the year negotiated prices will go into effect.

aThe number of drugs may be fewer for a given price year if not all drugs meet the eligibility criteria.

Inflation Rebate Program

The IRA requires CMS to establish an inflation rebate program whereby manufacturers will be required to pay Medicare a rebate if they raise prices for certain Part B and Part D drugs faster than the rate of inflation.[17] In accordance with the act, CMS is to determine whether a manufacturer’s drug is subject to a rebate and, for Part D drugs, is to invoice manufacturers based on changes in prices for each 12-month period, starting October 1, 2022. CMS does the same for Part B drugs, but these rebates are based on quarterly changes in prices starting January 1, 2023.

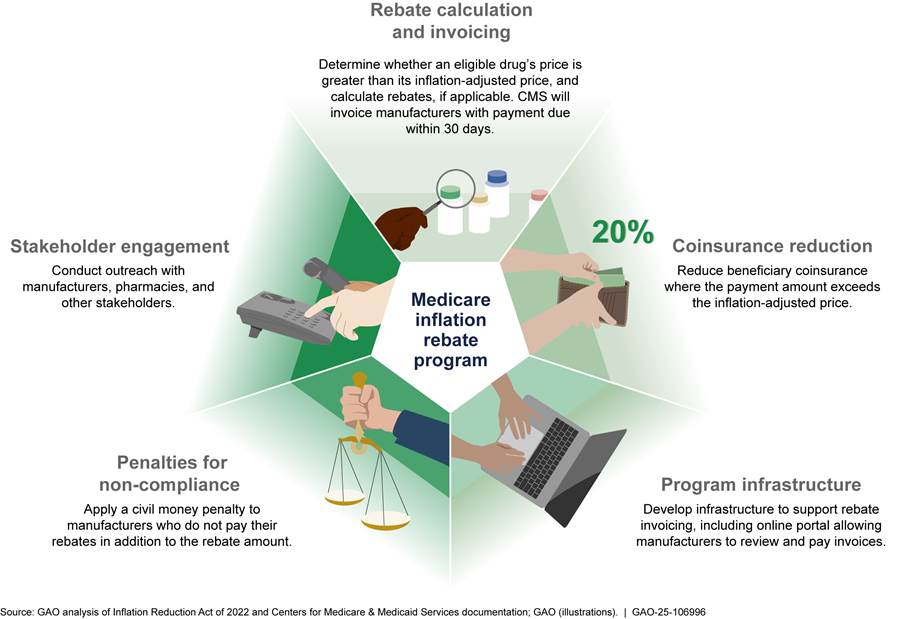

The IRA outlines the processes CMS is to use to determine drugs eligible for the rebate program, calculate rebates and invoicing manufacturers, and assess penalties for non-compliance, as follows.

· Rebate-eligible drugs. Rebate-eligible Part B drugs include single-source drugs, including certain biosimilars.[18] Rebate-eligible Part D drugs include Part D-covered drugs that are brand-name drugs or generic drugs lacking competition.[19] The IRA provides for CMS to reduce or waive rebate amounts for Part B and D drugs experiencing shortages or Part B and Part D biosimilars or Part D generics experiencing supply chain disruptions, such as those caused by a natural disaster.[20]

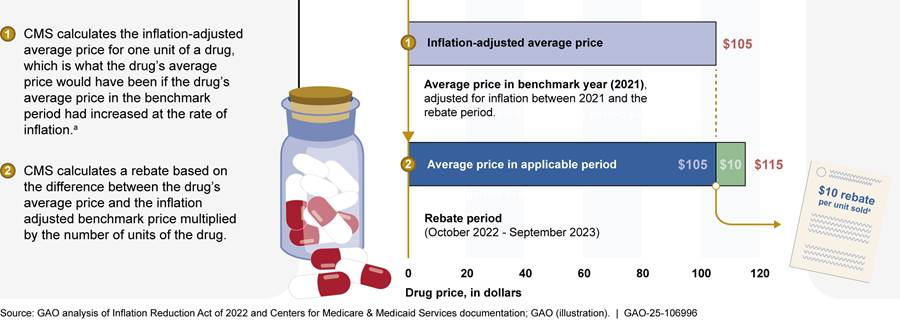

· Rebate calculation. The IRA specifies how CMS is to calculate inflation rebates. CMS determines whether the price of a drug has increased faster than inflation.[21] CMS does this by determining whether the average price of a drug for Medicare beneficiaries during an applicable period exceeds the average price from an earlier benchmark period that has been adjusted for inflation—the inflation-adjusted average price.[22] If so, CMS multiplies the price difference by the number of drug units billed under Part B or dispensed under Part D and invoices the manufacturer for that amount.[23] See figure 2 for an illustration of an inflation rebate for a Part D drug during the first rebate period.

Note: Under the Inflation Reduction Act of 2022 (IRA), the Centers for Medicare & Medicaid Services (CMS) determines the extent to which manufacturer prices for Part D and Part B drugs increase faster than the rate of inflation between a benchmark period and an applicable period. This figure illustrates a calculation of a single unit of a Part D drug during the first applicable period. Inflation rebates are calculated based on drug units—that is the lowest dispensable amount of a drug, such as a capsule or tablet, milligram of molecules, or grams. For Part D, applicable periods are annual, beginning October 1, 2022, and are quarterly for Part B, beginning January 1, 2023. Manufacturers that fail to pay rebates within 30 days face a civil monetary penalty equal to at least 125 percent of the rebate amount plus the original rebate amount.

aThe rebate amount is calculated by taking the difference between the average drug price and inflation adjusted benchmark price and multiplying it by the number of units dispensed during the applicable period.

· Rebate invoicing. CMS must provide manufacturers invoices for Part B drug rebates within 6 months of the end of a rebate period and invoices for Part D drug rebates within 9 months of the end of a rebate period. The IRA allows CMS to delay its issuance of manufacturer invoices for Part B drugs for rebate periods from January 2023 through December 2024 and for Part D drugs for rebate periods from October 2022 through September 2024. CMS must issue rebate invoices covering all calendar quarters in 2023 and 2024 for Part B drugs by September 30, 2025, and rebate invoices covering fiscal years 2023 and 2024 for Part D drugs by December 31, 2025. Part D manufacturers may submit a “suggestion of error” to CMS when they believe there is a mathematical error in their invoices. Such submissions are subject to the agency’s discretionary consideration. According to the IRA, rebates are to be deposited into the Federal Supplementary Medical Insurance Trust Fund.[24] See table 2 for the inflation rebate timeline for Part D and Part B drugs.

|

|

Benchmark perioda |

Rebate periods |

Invoice date |

|

Part B Drugs |

July 1-September 30, 2021 |

2023 (quarters 1-4); 2024 (quarters 1-4) |

No later than September 30, 2025 |

|

Part D Drugs |

January 1-September 30, 2021 |

October 2022-September 2023; October 2023-September 2024 |

No later than December 31, 2025 |

Source: GAO analysis of Inflation Reduction Act of 2022. | GAO‑25‑106996

aThis table reports the benchmark period for Part B drugs approved or licensed by December 1, 2020, and for Part D drugs approved or licensed by October 1, 2021. Drugs approved or licensed after these time frames have different benchmark periods.

· Beneficiary coinsurance reduction for Part B drugs. The IRA requires CMS to reduce beneficiary coinsurance for certain Part B drugs where the payment amount exceeds the inflation-adjusted average price. Therefore, beginning April 1, 2023, beneficiaries have paid coinsurance based on the inflation-adjusted price of these drugs.

· Penalty for non-compliance. Manufacturers who fail to pay their rebate invoices for Part B or Part D drugs within 30 calendar days of receipt must pay a civil monetary penalty equal to at least 125 percent of the rebate amount.

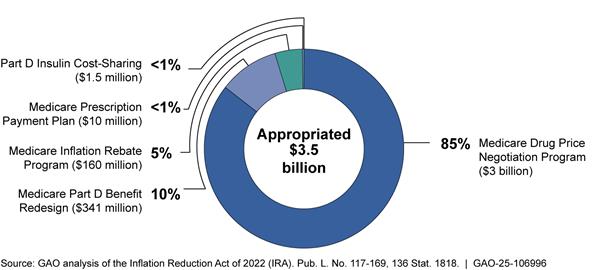

IRA Appropriations for Medicare Drug-Related Provisions

The IRA appropriated approximately $3.5 billion to CMS to implement the drug-related provisions in the IRA. This included funds for the drug pricing provisions: $3 billion for the negotiation program and $160 million for the inflation rebate programs.[25] The remaining funds are for the following provisions affecting the drug benefits for Medicare beneficiaries:

|

Federal Budget Process Overview The Office of Management and Budget distributes funds appropriated to executive branch agencies. Agencies then allot the apportioned funds to program offices, which begin the process of first obligating the funds and then outlaying funds (these terms are described below). · Appropriation. An appropriation provides budget authority to incur obligations and to make payments from the Treasury for specified purposes. · Obligation. An obligation is a definite commitment that creates a legal liability on the part of the federal government for the payment of goods and services ordered or received. Payments may be made immediately or in the future. · Outlays. An outlay is the issuance of checks, disbursement of cash, or electronic transfer of funds made to liquidate an obligation. Outlays during a fiscal year may be for payment of obligations incurred in prior years (referred to as prior-year obligations) or in the same year. Source: GAO. | GAO‑25‑106996 |

· Part D benefit redesign. The IRA appropriated $341 million to CMS to implement changes to the Part D benefit. The Part D benefit redesign capped beneficiary cost-sharing beginning in 2025 ($2,000 in 2025, indexed for inflation thereafter), among other things.[26]

· Medicare prescription payment plan. The IRA appropriated $10 million to CMS to implement the Medicare prescription payment plan. The payment plan provision requires Part D plan sponsors to offer beneficiaries the opportunity to pay out-of-pocket costs over the course of the plan year through monthly payments beginning January 1, 2025.[27]

· $35 cap on insulin cost-sharing. The IRA appropriated $1.5 million to CMS to implement a $35 monthly cap on beneficiary cost-sharing for each covered Part D insulin product. The cap began January 1, 2023. (See fig. 3.)

Notes: The IRA appropriated $80 million for Part B and $80 million for Part D, for a total of $160 million for the inflation rebate program. For the inflation rebate program, this appropriation included, for Part B and Part D each, $12.5 million for fiscal year 2022 and $7.5 million annually for fiscal years 2023 through 2031. According to agency officials, due to sequestration, the amount available for the Part B and Part D inflation rebate program is $7,072,500 for fiscal years 2024 and 2025. The IRA appropriated $3 billion for the negotiation program for fiscal year 2022, making all those funds immediately available.

CMS’s Implementation of the Negotiation Program Has Included Staffing, Developing Guidance, and Negotiating Prices

CMS’s implementation of the negotiation program as of December 2024 has included staffing, developing and issuing guidance for program implementation, drug price negotiation, and developing program components.

Staffing. CMS officials reported that they created the Medicare Drug Rebate and Negotiations Group in September 2022 following the enactment of the IRA in August.[28] As of December 2024, CMS officials said they had filled 97 of 108 planned positions in the group. Approximately 40 percent of staff persons were filled internally by CMS staff with the rest hired externally. Officials stated that 91 staff persons work on the negotiation program, with approximately half also working part-time on the inflation rebate program.[29]

Developing and issuing guidance. CMS has developed and issued guidance for program implementation, including the selection and negotiation of drugs with maximum fair prices to take effect in 2026 and 2027, the creation of processes to help ensure maximum fair price payment, and the development of plans for CMS oversight.[30]

· Price year 2026. In June 2023, CMS published revised guidance for the selection and negotiation for the 10 drugs with prices to take effect in 2026. The guidance described the agency’s plans for implementing the negotiation program. The revised guidance for price year 2026 provided responses to public comments on initial guidance CMS issued in March 2023 and highlighted changes CMS made to the policies.[31]

· Price year 2027. In October 2024, CMS published final guidance on the negotiations for price year 2027 and updated policies for making the maximum fair prices available for 2026 and 2027.[32] The final guidance provided responses to public comments on CMS’s May 2024 draft guidance and highlighted changes CMS made to the policies.[33] CMS also noted that the guidance builds on the experience and lessons learned from the negotiation process for price year 2026.

Drug selection and price negotiation. CMS negotiated maximum fair prices with manufacturers for the 10 selected drugs with prices to take effect in January 2026. The process began in August 2023 with CMS announcing the first 10 drugs selected for negotiation. To select these 10 drugs, CMS identified the 50 Part D drugs with the highest gross expenditures (based on the 12-month period, beginning June 1, 2022), and excluded drugs ineligible for negotiation such as biologics that had a high likelihood of a biosimilar entering the market.[34] See appendix I for information on the 10 drugs selected for negotiation for 2026.

CMS negotiated prices with manufacturers for the 10 selected drugs from February 1 through August 1, 2024. According to CMS, the agency held three meetings with each drug manufacturer to discuss offers, counteroffers, and evidence, which resulted in the agency and manufacturers offering revised offers and counteroffers. For five of the drugs, the process resulted in an agreed upon maximum fair price during the meetings. For the remaining five drugs, negotiations with manufacturers did not result in an agreed upon price during the meetings. However, consistent with its guidance, CMS sent a final maximum fair price offer after the meetings, which was accepted by the manufacturers.[35] CMS published the maximum fair prices in August 2024. To support the negotiation process, CMS engaged two information technology systems contractors to update the Health Plan Management System platform to allow manufacturers and others to submit information on the selected drugs, including negotiation offers and counteroffers.[36]

In January 2025, CMS published the 15 Part D drugs selected for negotiation with prices to go into effect in 2027. The agency’s process for selecting the 15 drugs for negotiation for price year 2027 was similar to the process used for the previous year. Specifically, the agency selected 15 of the 50 Part D drugs with the highest gross expenditures (based on the 12-month period, beginning November 1, 2023), and excluded drugs ineligible for negotiation such as drugs that qualify for a small biotech exception.[37] CMS plans to negotiate with manufacturers for the second round of drugs no later than February 28 through November 1, 2025 with prices to take effect January 1, 2027.[38] See appendix II for information on the 15 drugs selected for negotiation for 2027.

Developing program components. As of December 2024, CMS was developing the broad components of the negotiation program as follows.

· Manufacturer compliance and oversight. CMS will oversee the negotiation program to ensure that manufacturers comply with program requirements, including that manufacturers make the maximum fair price for selected drugs available to Medicare beneficiaries and pharmacies and other dispensers. According to the October 2024 final guidance, CMS anticipates conducting audits based on complaints and CMS experience with the program as well as more generalized audits of manufacturer compliance with the program’s requirements. According to CMS officials, CMS plans to engage a contractor to audit data submissions, conduct oversight analytics to monitor manufacturer compliance with program requirements, process complaints, conduct investigations, and provide recommendations for potential enforcement actions (e.g., civil monetary penalties or excise taxes).

· Market monitoring. According to CMS officials, CMS will engage in ongoing market monitoring activities to track trends and patterns in the pharmaceutical marketplace after the negotiated prices go into effect. For example, CMS will explore stakeholder responses to incentives related to generic entry and competition. This may include an analysis on the timing of generic approvals and biosimilar licensures and market entry. CMS plans to engage a contractor to monitor pharmaceutical industry trends. CMS officials we interviewed described this contract as a proactive effort to keep abreast of new developments in the pharmaceutical industry as the negotiation program is being implemented. CMS officials told us that they were currently working with their federally funded research and development center to lay the groundwork for this contract.[39]

· Consumer outreach and stakeholder engagement. CMS will conduct research, education, and outreach with beneficiaries to promote understanding of the negotiation program. CMS sought input on its implementation of the negotiation program through patient-focused listening sessions, monthly calls with manufacturers, and the process of obtaining public comments on guidance as part of its outreach for price year 2026.[40] According to the October 2024 final guidance, CMS intends to hold public engagement events for drugs selected for price year 2027 and will conduct a variety of education and outreach efforts with beneficiaries, pharmacists, and others closer to the start of price year 2026.

· Maximum fair price payment. CMS has developed requirements and processes intended to ensure that the maximum fair prices go into effect. Specifically, payments by pharmacies, plan sponsors, and beneficiaries are based on the maximum fair price for selected Part D drugs.[41] In its October 2024 final guidance, CMS stated manufacturers have two options for ensuring that pharmacies and other dispensers pay no more than the maximum fair price for selected Part D drugs provided to eligible Medicare beneficiaries. Specifically, manufacturers may (1) prospectively ensure that pharmacies and other dispensers pay no more than the maximum fair price when acquiring these drugs or (2) retrospectively reimburse pharmacies and other dispensers for the difference between their acquisition costs and the maximum fair price within 14 calendar days.[42]

· Medicare transaction facilitator. As of December 2024, CMS is engaging contractors, referred to collectively as the Medicare transaction facilitator, to facilitate the exchange of data and payment between pharmaceutical supply chain entities to support maximum fair price payment. According to the October 2024 final guidance, there will be two parts to the Medicare transaction facilitator, the data module and the payment module.

· Data module. The data module will (1) support verification that a drug with a maximum fair price was dispensed to an eligible beneficiary, (2) establish a requirement for retrospectively reimbursing pharmacies and other dispensers for the difference between the dispensing entity’s acquisition cost and the maximum fair price within 14 calendar days for any amounts paid in excess of the maximum fair price, and (3) collect payment-related data on pharmacy dispensing of eligible drugs.[43] CMS anticipates that data module activities in late 2024 and 2025 will include developing, building, testing, data collection and security, and onboarding of manufacturers and pharmacies and other dispensers. As of December 2024, CMS officials stated they had engaged a contractor to build the data module.

· Payment module. The payment module will (1) provide manufacturers a voluntary mechanism for electronic or paper payment of maximum fair price refunds to pharmacies and other dispensers and (2) provide manufacturers with a voluntary system to track the flow of refunds and to handle reversals, adjustments, and other claim revisions that arise.

See figure 4 for an overview of the broad components of the negotiation program.

CMS’s Implementation of the Inflation Rebate Program Has Included Issuing Guidance, Reducing Part B Coinsurance, and Developing Program Infrastructure

CMS’s implementation of the inflation rebate program as of December 2024 has included staffing, issuing guidance and regulations, adjusting beneficiary coinsurance for Part B drugs, and infrastructure development. In late 2025, CMS plans to send manufacturers rebate reports with final invoices for rebates that accrued from January 2023 through December 2024 for Part B drugs and from October 2022 through September 2024 for Part D drugs.[44]

Staffing. CMS officials reported that approximately half of the 97 positions filled as of December 2024 in the Medicare Drug Rebate and Negotiations Group work on the inflation rebate program, in addition to working on the negotiation program.[45]

Issuing guidance and regulations. CMS issued guidance and regulations for program implementation. This guidance includes descriptions of CMS’s processes for identifying drugs eligible for rebates (rebate-eligible drugs), calculating and invoicing rebates, and developing program infrastructure. CMS published initial guidance for the inflation rebate program in February of 2023. CMS officials reported that the agency developed the initial guidance quickly following the enactment of the IRA as manufacturers would be held accountable for drug price increases in the first applicable rebate period, starting October 1, 2022, for Part D drugs and starting January 1, 2023, for Part B drugs. CMS issued revised guidance in December 2023 following a comment period. The revised guidance responded to public comments on the initial guidance and highlighted changes CMS made to the policies. In December 2024, CMS issued a final rule codifying policies in program guidance and establishing new policies for the program.[46]

Reducing coinsurance for Part B drugs. Beginning in April 2023, CMS started reducing beneficiary coinsurance for certain Part B drugs where the payment amount exceeds the inflation-adjusted price. Prior to the start of each calendar quarter, CMS has provided and will continue to provide an updated list of rebate-eligible Part B drugs with adjusted beneficiary coinsurance because these drugs’ prices rose faster than inflation. For example, for the July 1 through September 30, 2024, rebate period, 64 rebate-eligible drugs had an adjusted coinsurance rate based on the inflation-adjusted payment amount. According to CMS, the agency intends to publish information on the rebate-eligible drugs subject to coinsurance adjustments several weeks before the quarter they go into effect.

Developing inflation rebate program and infrastructure. As of December 2024, CMS has developed the broad rebate program components and has taken steps to develop the processes to invoice manufacturers for rebates, as follows.

· Identification of rebate-eligible drugs. CMS’s final rule—issued in December 2024—described how the agency identifies Part B and Part D drugs eligible for inflation rebates.[47] For Part D drugs, CMS stated it will exclude drugs not participating in the Medicaid drug rebate program, which is the source of pricing data in CMS’s rebate calculations.[48]

· Rebate calculation and invoicing. CMS’s revised December 2023 guidance included example calculations of rebates for Part B and Part D drugs. The preamble to the final rule also explained how rebates would be reduced for Part B and Part D drugs facing severe supply chain disruption and shortages. Beginning in 2025, CMS plans to send manufacturers preliminary and then final rebate invoices for the rebate periods (1) from January 2023 through December 2024 for Part B drugs and (2) from October 2022 through September 2024 for Part D drugs. Specifically, for Part B rebate-eligible drugs, CMS plans to issue preliminary invoices in summer 2025, allowing manufacturers 30 days to review preliminary invoices prior to being sent a final invoice no later than September 30, 2025. For Part D rebate-eligible drugs, CMS plans to provide preliminary invoices in summer 2025, allowing manufacturers at least 30 days to review preliminary invoices before receiving a final invoice on December 31, 2025. Payment of invoices for Part B and Part D rebate-eligible drugs will be due within 30 days of receipt of the final invoice. For rebate periods beginning January 2025 for Part B drugs and October 2024 for Part D drugs, manufacturers will have 10 days to review the preliminary invoices.

· Penalties for non-compliance. CMS’s final rule provided that CMS may impose a civil money penalty of 125 percent of the rebate amount on manufacturers that do not pay rebates within the 30-day time frame in addition to the rebate amount.[49]

· Program infrastructure. CMS is developing infrastructure to support the rebate invoicing process. As part of this, CMS officials stated they have engaged a contractor to develop a website to serve as a secure rebate portal through which the agency will issue rebate invoices to manufacturers. The portal will allow manufacturers to review and suggest corrections to mathematical errors on their invoices and to submit payments to CMS. According to CMS officials, the contractor began testing the portal in August 2024, and CMS will work with manufacturers to ensure they can use the portal.

· Stakeholder engagement. In addition to obtaining and responding to comments on guidance, CMS sought perspectives from the relevant stakeholders related to its implementation of the inflation rebate program. For example, CMS officials told us they have held monthly meetings since October 2022 related to the implementation of the IRA drug-related provisions and gave manufacturers, pharmacies, pharmacy benefit managers, and plan sponsors the opportunity to ask questions and raise concerns about the inflation rebate program through calls and public comment periods.

See figure 5 for an overview of the broad components of the inflation rebate program.

CMS Plans to Obligate Negotiation and Inflation Rebate Program Funds for Hiring and Other Program Support Activities

CMS Developed Plans to Obligate Funds for the Negotiation and Inflation Rebate Programs

As of December 2024, CMS developed plans for the obligation of funds to implement the negotiation and inflation rebate programs for fiscal years 2022 through 2033. CMS’s planned use of funds is detailed in (1) an estimates table with actual and planned obligations and (2) a formal spend plan.[50]

· Estimates table. According to CMS officials, the estimates table is a long-term planning document detailing how CMS plans to obligate funds for the inflation rebate and negotiation programs. As of December 2024, the estimates table contained actual obligations for fiscal years 2022 through 2024 for both programs. It also contained planned obligations for fiscal years 2025 through 2031 for the inflation rebate program and for fiscal years 2025 through 2033 for the negotiation program.[51] CMS officials stated the tables provide a rough estimate of how the agency plans to use funds based on current information.

· Formal spend plan. The formal spend plan contains CMS’s actual and planned obligations for the negotiation and inflation rebate programs for two fiscal years, with the most recent being for fiscal years 2023 and 2024. CMS officials stated the formal spend plan is a short-term document intended to provide more detailed estimates of planned obligations. CMS officials stated that future versions will account for actual obligations for the previous year along with planned obligations for the current year. As of October 2024, CMS officials stated they were still developing the spend plan for fiscal year 2025.

CMS used a standardized process for developing the formal spend plan and is annually monitoring the use of funds. The formal spend plan contains actual and planned obligations, including descriptions, for the various activities for each program.[52] CMS officials stated they submit the formal spend plan for approval by the Department of Health and Human Services’ Office of the Assistant Secretary for Financial Resources and by the Office of Management and Budget (OMB). In addition, CMS officials stated that CMS staff conduct real-time monitoring of fund use and the agency has a system to track obligations over time and track whether obligations exceed budget authority. CMS also conducts an annual reconciliation process to ensure planned obligations align with actual obligations at the end of the fiscal year for each provision. As part of this process, CMS officials stated they will update the formal spend plan annually based on actual obligations.

CMS’s plans for monitoring appropriated fund use are consistent with internal control principles.[53] CMS officials stated their review of fund use adheres to the policies and procedures in the agency’s annual budget cycle memos and in OMB Circulars. For example, the September 2024 budget cycle memo describes key control activities with all activities, policies, and procedures used from the time funds are authorized by Congress until they are obligated and expended. OMB Circulars A-11 and A-123 define these internal control activities. Circular A-11 provides instructions on executing the use of funds and A-123 defines policies around risk management and internal controls, including actions around the use of funds.[54]

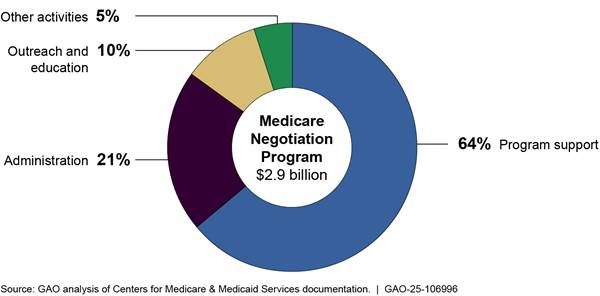

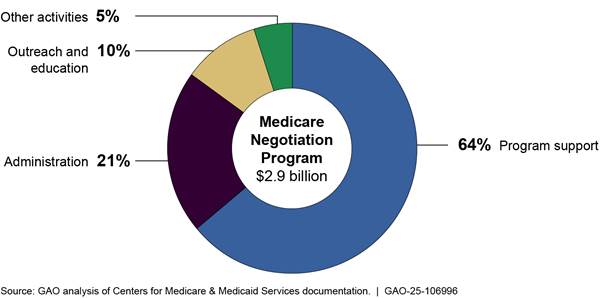

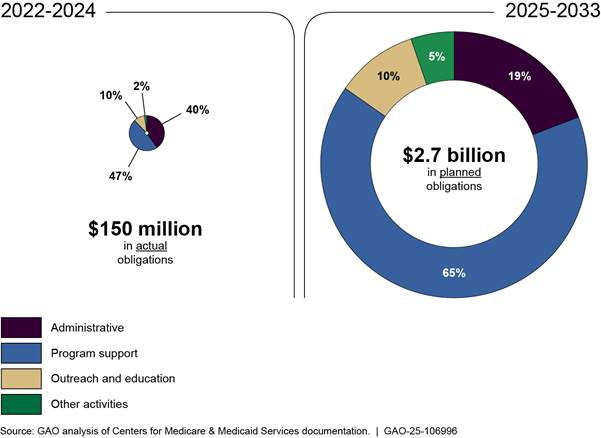

CMS Plans to Obligate the Majority of Negotiation Program Funds Through 2033 for Program Support and Administration

As of December 2024, CMS plans to obligate approximately $2.9 billion of the $3 billion in negotiation program funds through fiscal year 2033. CMS plans to use the majority—64 percent—of planned funds for program support, which includes the Medicare transaction facilitator. CMS plans to use 21 percent of funds for administration and 15 percent of funds for outreach and education and other activities. This includes both actual and planned obligations from fiscal year 2022 through fiscal year 2033 as detailed in CMS’s estimates table for the negotiation program.

· Program support. Accounting for 64 percent of obligations, program support activities include data analysis for negotiations, selecting drugs, the activities of the Medicare transaction facilitator, and monitoring pharmaceutical market trends. CMS is seeking several contractors to assist with program support. For example, the agency is seeking contractors for the Medicare transaction facilitator, for which officials reported estimating the costs based on historical data from similar CMS systems, market research, and activities of other contractors.[55] Program support also includes monitoring fraud, waste, and abuse. The agency has two contracts with its federally funded research and development center to assist with these other program support activities.[56]

· Administration. Accounting for 21 percent of obligations, administrative activities include payroll, training, travel, supplies, and other related expenses for CMS employees.

· Outreach and education. Accounting for 10 percent of obligations, outreach and education activities include planned additional call volume from Medicare beneficiaries, seeking input from Medicare beneficiaries, and outreach campaigns.

· Other activities. Accounting for the remaining 5 percent of obligations, other activities include overseeing manufacturer compliance with program requirements and agency oversight, updating information and technology systems, and drug pricing data collection.

See figure 6 for information on CMS’s planned use of appropriated funds for the negotiation program from fiscal year 2022 through fiscal year 2033.

Figure 6: Centers for Medicare & Medicaid Services’ Total Obligations to Implement the Medicare Negotiation Program, Fiscal Years 2022-2033

Note: This figure represents total obligations, as of December 2024, for the negotiation program for fiscal years 2022 through 2033. This includes actual obligations for fiscal years 2022 through 2024 and planned obligations for fiscal years 2025 through 2033. Program support activities include data analysis for negotiations, selecting and negotiating prices for drugs, and the activities of the Medicare transaction facilitator. Administrative activities include payroll, training, travel, supplies, and other related expenses for CMS employees. Outreach and education activities include planned additional call volume from Medicare beneficiaries, seeking input from Medicare beneficiaries, and outreach campaigns. Other activities include overseeing manufacturer compliance with program requirements and agency oversight, updating information and technology systems, and drug pricing data collection.

CMS’s actual and planned obligations increase over time. For fiscal years 2022 through 2024, actual obligations average $49.8 million each fiscal year, with the majority of obligations for program support and administrative activities—47 and 40 percent respectively. For fiscal years 2025 through 2033, planned obligations average $301 million each fiscal year, with the majority continuing to go to program support and administrative activities—65 and 19 percent respectively.

See figure 7 for information on actual obligations of appropriated funds for the negotiation program for fiscal years 2022 through 2024 and planned obligations for fiscal years 2025 through 2033.

Figure 7: Centers for Medicare & Medicaid Services’ Actual and Planned Obligations to Implement the Medicare Drug Price Negotiation Program, Fiscal Years 2022-2024 and 2025-2033

Note: This figure represents actual and planned obligations, as of December 2024, for the negotiation program for fiscal years 2022 through 2033. This includes actual obligations for fiscal years 2022 through 2024 and planned obligations for fiscal years 2025 through 2033. Program support activities include data analysis for negotiations, selecting and negotiating prices for drugs, and the activities of the Medicare transaction facilitator. Administrative activities include payroll, training, travel, supplies, and other related expenses for CMS employees. Outreach and education activities include planned additional call volume from Medicare beneficiaries, seeking input from Medicare beneficiaries, and outreach campaigns. Other activities include overseeing manufacturer compliance with program requirements and agency oversight, updating information and technology systems, and drug pricing data collection. Percentages may not sum to 100 due to rounding.

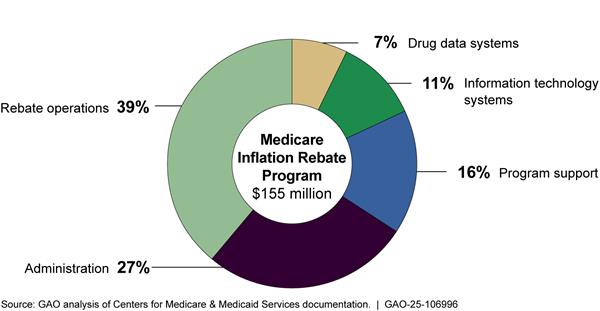

CMS Plans to Obligate the Majority of Inflation Rebate Program Funds Through 2031 for Rebate Operations, Administration, and Program Support

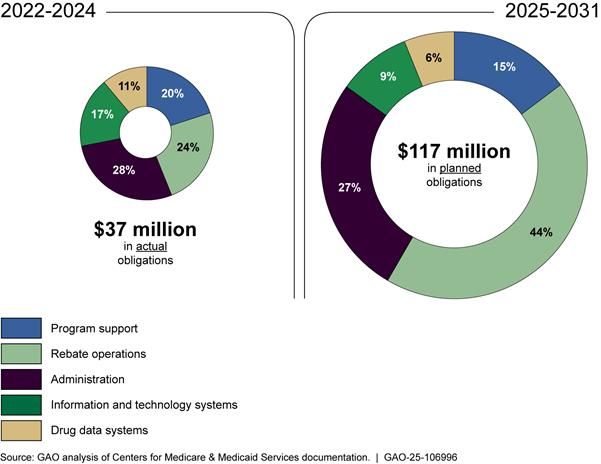

As of December 2024, CMS’ plans to obligate approximately $155 million of the $160 million in inflation rebate program appropriated funds through 2031. CMS plans to use the majority—approximately 82 percent—of planned obligations for rebate operations, administration, and program support.[57] CMS plans to use the remaining 18 percent of planned obligations for information and technology and drug data systems. This includes both actual and planned obligations from 2022 through 2031 as detailed in CMS’s estimates table for the inflation rebate program.

· Rebate operations. Accounting for 39 percent of obligations, rebate operations primarily include hiring a contractor to develop a rebate portal for manufacturers and CMS to share information and rebate invoices. Rebate operations also involve activities by a contractor such as verifying rebate amounts calculated by CMS.

· Administration. Accounting for 27 percent of obligations, administrative activities include payroll, training, travel, supplies, and other related expenses for CMS employees.

· Program support. Accounting for 16 percent of obligations, program support includes two contractor-supported efforts: 1) the identification of drugs eligible for rebates and support of rebate calculation and invoicing and 2) logistical support for program management.[58]

· Information and technology. Accounting for 11 percent of obligations, information and technology accounts for modifications to the Part B average sale price reporting system and enhancements to the drug data process system.

· Drug data systems. Accounting for 7 percent of obligations, drug data systems accounts for the collection of Part B data.

See figure 8 for information on CMS’s planned use of appropriated funds for the inflation rebate program from fiscal year 2022 through fiscal year 2031.

Figure 8: Centers for Medicare & Medicaid Services’ Total Obligations to Implement the Medicare Inflation Rebate Program, Fiscal Years 2022-2031

Note: This figure represents total obligations, as of December 2024, for the inflation rebate program for fiscal years 2022 through 2031. This includes actual obligations for fiscal years 2022 through 2024 and planned obligations for fiscal years 2025 through 2031. Rebate operations primarily include calculating rebates and issuing rebate invoices to manufacturers and hiring a contractor to develop a rebate portal for manufacturers. Administration activities include payroll, training, travel, supplies, and other related expenses for CMS employees. Program support primarily includes two contractor-led efforts: 1) the identification of drugs eligible for rebates and support of rebate calculation and invoicing and 2) logistical support for program management. Information and technology systems obligations are for modifications to the Part B average sale price reporting system and enhancements to the drug data process system. Drug data systems obligations are for the collection of Part B data.

CMS’s actual and planned obligations increase over time. For fiscal years 2022 through 2024, actual and planned obligations average $12.5 million each fiscal year, with the majority of obligations for administrative activities and rebate operations—28 and 24 percent respectively. For fiscal years 2025 through 2031, planned obligations average $16.8 million each fiscal year, with the majority continuing to go to rebate operations and administrative activities—44 and 27 percent respectively.

See figure 9 for information on actual obligations of appropriated funds for the inflation rebate program for fiscal years 2022 through 2024 and planned obligations for fiscal years 2025 through 2031.

Figure 9: Centers for Medicare & Medicaid Services’ Actual and Planned Use of Obligations to Implement the Medicare Inflation Rebate Program, Fiscal Years 2022-2024 and 2025-2031

Note: This figure represents actual and planned obligations, as of December 2024, for inflation rebate program for fiscal years 2022 through 2031. This includes actual obligations for fiscal years 2022 through 2024 and planned obligations for fiscal years 2025 through 2031. Rebate operations primarily include calculating rebates and issuing rebate invoices to manufacturers and hiring a contractor to develop a rebate portal for manufacturers. Administration activities include payroll, training, travel, supplies, and other related expenses for CMS employees. Program support primarily includes two contractor-led efforts: 1) the identification of drugs eligible for rebates and support of rebate calculation and invoicing and 2) logistical support for program management. Information and technology systems obligations are for modifications to the Part B average sale price reporting system and enhancements to the drug data process system. Drug data systems obligations are for the collection of Part B data. Percentages may not sum to 100 due to rounding.

Agency Comments

We provided a draft of this report to the Department of Health and Human Services for comment. The agency provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the appropriate congressional committees, the Secretary of Health and Human Services, and other interested parties. In addition, the report will be available at no charge on the GAO website at http://www.gao.gov.

If you or your staff have any questions about this report, please contact me at dickenj@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made major contributions to this report are listed in appendix III.

John E. Dicken

Director, Health Care

List of Committees

The Honorable Mike Crapo

Chairman

Committee on Finance

United States Senate

The Honorable Ron Wyden

Ranking Member

Committee on Finance

United States Senate

The Honorable Rand Paul

Chairman

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Gary Peters

Ranking Member

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Jason Smith

Chairman

Committee on Ways & Means

House of Representatives

The Honorable Richard Neal

Ranking Member

Committee on Ways & Means

House of Representatives

The Honorable Brett Guthrie

Chairman

Committee on Energy and Commerce

House of Representatives

The Honorable Frank Pallone, Jr.

Ranking Member

Committee on Energy and Commerce

House of Representatives

The Honorable James Comer

Chairman

Committee on Oversight and Government Reform

House of Representatives

The Honorable Gerald E. Connolly

Ranking Member

Committee on Oversight and Government Reform

House of Representatives

In August 2023, the Centers for Medicare & Medicaid Services (CMS) published the first 10 drugs selected for the Medicare drug price negotiation program, with prices going into effect in price year 2026. To select these 10 drugs, CMS identified the 50 Part D drugs with the highest gross expenditures (based on the 12-month period, beginning June 1, 2022), and excluded drugs ineligible for negotiation such as biologics that had a high likelihood of a biosimilar entering the market.[59] According to CMS, these 10 drugs accounted for $50.5 billion in total Part D gross covered prescription drug costs, or about 20 percent of total Part D gross covered prescription drug costs during the 12-month period, beginning June 1, 2022. See table 3 for information on the 10 drugs selected for negotiation for price year 2026.

|

Drug name |

Commonly treated conditions |

Total Part D gross covered prescription drug costs from June 2022-May 2023 (in millions) |

Number of Medicare Part D enrollees who used the drug from June 2022- May 2023 (in thousands) |

|

Eliquis |

Prevention and treatment of blood clots |

$16,483 |

3,706 |

|

Jardiance |

Diabetes; heart failure; chronic kidney disease |

$7,058 |

1,573 |

|

Xarelto |

Prevention and treatment of blood clots; Reduction of risk for patients with coronary or peripheral artery disease |

$6,031 |

1,337 |

|

Januvia |

Diabetes |

$4,087 |

869 |

|

Farxiga |

Diabetes; heart failure; chronic kidney disease |

$3,268 |

799 |

|

Entresto |

Heart failure |

$2,885 |

587 |

|

Enbrel |

Rheumatoid arthritis; psoriasis; psoriatic arthritis |

$2,791 |

48 |

|

Imbruvica |

Blood cancers |

$2,664 |

20 |

|

Stelara |

Psoriasis; psoriatic arthritis; Crohn’s disease; ulcerative colitis |

$2,639 |

22 |

|

Fiasp; Fiasp FlexTouch; Fiasp PenFill; NovoLog; NovoLog FlexPen; NovoLog PenFill |

Diabetes |

$2,577 |

777 |

Source: Centers for Medicare & Medicaid Services documentation. I GAO‑25‑106996

In January 2025, the Centers for Medicare & Medicaid Services (CMS) published the 15 Part D drugs selected for the Medicare drug price negotiation program, with prices going into effect in price year 2027. To select these 15 drugs, CMS identified the 50 Part D drugs with the highest gross expenditures (based on the 12-month period, beginning November 1, 2023), and excluded drugs ineligible for negotiation such as drugs that qualify for a small biotech exception.[60] According to CMS, these 15 drugs accounted for $40.7 billion in total Part D gross covered prescription drug costs, or about 14 percent of total Part D gross covered prescription drug costs during the 12-month period, beginning November 1, 2023. See table 4 for information on the 15 drugs selected for negotiation for price year 2027.

|

Drug name |

Commonly treated conditions |

Total Part D gross covered prescription drug costs from November 2023-October 2024 (in millions) |

Number of Medicare Part D enrollees who used the drug from November 2023 - October 2024 (in thousands) |

|

Ozempic; Rybelsus; Wegovy |

Type 2 diabetes; Type 2 diabetes and cardiovascular disease; obesity/overweight and cardiovascular disease |

$14,426,566 |

2,287 |

|

Trelegy Ellipta |

Asthma; chronic obstructive pulmonary disease |

$5,138,107 |

1,252 |

|

Xtandi |

Prostate cancer |

$3,159,055 |

35 |

|

Pomalyst |

Kaposi sarcoma; multiple myeloma |

$2,069,147 |

14 |

|

Ibrance |

Breast cancer |

$1,984,624 |

16 |

|

Ofev |

Idiopathic pulmonary fibrosis |

$1,961,060 |

24 |

|

Linzess |

Chronic idiopathic constipation; irritable bowel syndrome with constipation |

$1,937,912 |

627 |

|

Calquence |

Chronic lymphocytic leukemia/small lymphocytic lymphoma; mantle cell lymphoma |

$1,614,250 |

15 |

|

Austedo; Austedo XR |

Chorea in Huntington’s disease; tardive dyskinesia |

$1,531,855 |

26 |

|

Breo Ellipta |

Asthma; chronic obstructive pulmonary disease |

$1,420,971 |

634 |

|

Tradjenta |

Type 2 diabetes |

$1,148,977 |

278 |

|

Xifaxan |

Hepatic encephalopathy; irritable bowel syndrome with diarrhea |

$1,128,314 |

104 |

|

Vraylar |

Bipolar I disorder; major depressive disorder; schizophrenia |

$1,085,788 |

116 |

|

Janumet; Janumet XR |

Type 2 diabetes |

$1,082,464 |

243 |

|

Otezla |

Oral ulcers in Behçet’s disease; plaque psoriasis; psoriatic arthritis |

$994,001 |

31 |

Source: Centers for Medicare & Medicaid Services documentation. I GAO‑25‑106996

GAO Contact

John E. Dicken, dickenj@gao.gov

Staff Acknowledgments

In addition to the contact named above, William Black, Assistant Director; William A. Crafton, Analyst-in-Charge; Jessie Biltz, Dan Lee, and Tim Planert, made key contributions to this report. Also contributing were Ivy Benjenk, Patricia Broadbent, Joy Grossman, Laurie Pachter, Ethiene Salgado-Rodriguez, and Jennifer Whitworth.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email

Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]Pub. L. No. 117-169, §§ 11001 – 11102, 136 Stat. 1818, 1833-77. Medicare is the federally financed health insurance program for persons aged 65 and over, individuals under age 65 with certain disabilities, and individuals with end-stage renal disease. In addition to drug pricing provisions, the act also included changes to Medicare drug benefits, such as a cap on beneficiary spending for insulin beginning in 2023, among other things. Throughout this report, unless otherwise noted, we use the term “drug” to refer to both drugs and biologics, which are products derived from living sources, such as humans, animals, or microorganisms.

[2]Pub. L. No. 117-169, § 70004, 136 Stat. at 2087.

[3]GAO, Standards for Internal Control in the Federal Government, GAO‑14‑704G (Washington, D.C.: Sept. 10, 2014). Internal control is a process effected by an entity’s oversight body, management, and other personnel that provides reasonable assurance that the objectives of an entity will be achieved. We examined CMS oversight relative to two principles: (1) Principle 10, which states that management should design control activities to achieve the entity’s objectives and respond to risks and (2) Principle 16, which states that management should establish and operate monitoring activities to monitor the internal control system and evaluate the results.

[4]In some instances, a pharmacy may be reimbursed by a pharmacy benefit manager on a plan’s behalf. Pharmacy benefit managers are entities Part D plan sponsors contract with to provide pharmacy benefit services.

[5]A deductible is a fixed dollar amount that beneficiaries must pay before coverage takes effect. Part D payments to pharmacies generally include payment from the Part D plan sponsor and beneficiary cost-sharing, which may be a flat amount (copayment) or a percentage of the drug’s costs (coinsurance). Part D also includes a low-income subsidy that provides assistance with premiums and cost-sharing. Low-income subsidy beneficiaries pay zero or nominal cost-sharing and the subsidy pays for the remainder of cost-sharing.

[6]In developing their formularies, Part D plan sponsors must adhere to certain federal requirements. For example, plan sponsors’ formularies (1) must provide access to an acceptable range of Part D drug choices; (2) must not be likely to substantially discourage enrollment of certain beneficiaries; (3) cover all or substantially all drugs in the following six therapeutic classes: antineoplastic; antipsychotics; anticonvulsants, antidepressants, immunosuppressants, and antiretrovirals; and (4) include two drugs in each class.

[7]The prices Medicare pays for most Part B drugs are based on the average sales price, which is the average amount that purchasers such as physicians and wholesalers paid to manufacturers, net of discounts and rebates. CMS adds 6 percent to the average sales price. A Medicare supplemental health insurance policy is health insurance sold by private insurers that covers all or part of deductibles, copayments, and coinsurance and may cover some services that Medicare fee-for-service does not cover.

[8]According to the IRA, the number of drugs may be fewer than specified for a given price year if not all drugs meet the eligibility criteria. For purposes of this report, we use the term “price year” to refer to the initial price applicability year.

[9]See 42 U.S.C. § 1320f-1(d) and (e). A generic drug is therapeutically equivalent to a corresponding brand-name drug and is generally marketed under a nonproprietary generic name. A biosimilar is a biologic that is highly similar to and has no clinically meaningful differences from an existing biologic licensed by the Food and Drug Administration (FDA).

[10]The IRA excludes the following drugs from the negotiation program: (1) drugs with low Medicare spending, as defined in statute; (2) biologics derived from human whole blood or plasma; and (3) certain orphan drugs. Orphan drugs are intended to treat rare conditions, generally defined as those affecting fewer than 200,000 people in the United States, or those affecting more than 200,000 people but for which there is no reasonable expectation that the costs of developing the drug will be recouped in the United States. Certain drugs made by small biotech firms are excluded from negotiation through 2028. In addition, biologics are excluded when CMS approves a manufacturer’s request for delayed inclusion because there is a high likelihood of a biosimilar entering the market.

[11]For 2027 and subsequent years, the calculation of the average nonfederal average manufacturer price is the lower of (1) the average nonfederal average manufacturer price for 2021 increased by inflation, or (2) the average nonfederal average manufacturer price for the year prior to the selected drug publication date. The nonfederal average manufacturer price means the weighted average price of a single form and dosage unit of the drug that is paid by wholesalers in the United States to the manufacturer, taking into account any cash discounts or similar price reductions during the period. The nonfederal average manufacturer price excludes prices paid by the federal government and is used to calculate maximum prices for the Department of Veterans Affairs and other federal purchasers.

[12]Evidence about alternative treatments includes (1) the extent to which the drug represents a therapeutic advance as compared to existing therapeutic alternatives, (2) prescribing information from the FDA for such drug and therapeutic alternatives, (3) comparative effectiveness of the drug and its therapeutic alternatives, taking into consideration the effects on specific populations (e.g., those with disabilities, the elderly, etc.), and (4) the extent to which the drug and its therapeutic alternatives address unmet needs for a condition that is not adequately addressed by available therapy.

[13]The IRA provides for the renegotiation of the maximum fair price in certain circumstances (e.g., when there is a new indication treated by the drug). See 42 U.S.C. § 1320f-3(f). CMS guidance states it will provide additional information in the future on renegotiation, which will be implemented for price year 2028 and subsequent years, in accordance with the statute. Manufacturers may decide to cease participation in the program under certain conditions as well.

[14]The Consumer Price Index for All Urban Consumers is a monthly measure of the average change over time in the prices paid by consumers for a market basket of consumer goods and services.

[15]Some drug manufacturers with drugs selected for negotiation also sell drugs at discounted prices through the 340B Drug Pricing Program (340B program). These manufacturers will be required to provide entities participating in the 340B program the lower of either the 340B program ceiling price or the maximum fair price for selected drugs. The 340B program requires pharmaceutical manufacturers to sell outpatient drugs at discounted prices to “covered entities” for their drugs to be covered by Medicaid. See 42 U.S.C § 256b. These covered entities, such as eligible hospitals or federally qualified health centers that serve medically underserved populations then dispense these drugs to their patients.

[16]The Internal Revenue Service is responsible for administering and enforcing the excise tax. The excise tax amount on the sale of a selected drug would be set as a percentage of the sum of the drug’s sales price plus the excise tax imposed by the act. This percentage could range from 65 percent to a maximum of 95 percent, if a manufacturer were out of compliance more than 270 days. See 26 U.S.C. § 5000D.

[17]The IRA contains two provisions related to the inflation rebate program, one for Part B (section 11101) and one for Part D (section 11102). Pub. L. No. 117-169, §§ 11101–02, 136 Stat. at 1865, 1871. CMS describes both as the “inflation rebate program.”

[18]Certain Part B drugs are excluded, including those with annual average total Part B allowed charges per individual of less than $100 (adjusted for inflation), specified Part B-covered vaccines, and certain qualifying biosimilars, which are defined under 42 U.S.C. § 1395w-3a(b)(8)(B)(iii).

[19]Part D drugs are excluded if their average annual cost is less than $100 (adjusted for inflation).

[20]Drugs in shortage are those identified by FDA under section 506E of the Federal Food, Drug, and Cosmetic Act. The IRA provides CMS flexibility to determine when there is a severe supply chain disruption for Part B or Part D biosimilars and Part D generics. CMS is also authorized to reduce or waive rebate amounts for Part D drugs if it determines those drugs are likely to be in shortage.

[21]CMS is to use average quarterly prices for Part B drugs and average annual prices based on unit-weighted quarterly sales for Part D drugs. According to CMS guidance, drugs subject to a maximum fair price are eligible for inflation rebates, but the maximum fair price will not be factored into the pricing information used to determine inflation rebates.

[22]To calculate an inflation-adjusted benchmark price, CMS first calculates the average price during the benchmark period, which is the average price of the drug prior to the rebate period. The average price for Part D is based on the average manufacturer price and average sales price for Part B. CMS then adjusts this amount for inflation between the benchmark and rebate period to develop the inflation-adjust benchmark price.

[23]The IRA requires that CMS exclude from the calculation of Part B rebates units of drugs purchased under the 340B program, units with respect to which the manufacturer pays a Medicaid drug rebate, or units that are packaged into the payment for an item or service and are not separately payable. In addition, the IRA requires the removal of 340B units from the calculation of Part D rebates beginning January 1, 2026.

[24]The Federal Supplementary Medical Insurance Trust is a fund that helps pay for Medicare Part B and Part D.

[25]The IRA appropriated $80 million for Part B and $80 million for Part D, for a total of $160 million for the inflation rebate program. For the inflation rebate program, this appropriation included, for Part B and Part D each, $12.5 million for fiscal year 2022 and $7.5 million annually for fiscal years 2023 through 2031. According to agency officials, due to sequestration, the amount available for the Part B and Part D inflation rebate program is $7,072,500 for fiscal years 2024 and 2025. The IRA appropriated $3 billion for the negotiation program for fiscal year 2022, making all those funds immediately available.

[26]Prior to January 1, 2024, there was no limit on beneficiary cost-sharing for covered drugs. According to agency officials, due to sequestration, the total amount available for the program is $337,552,000.

[27]Prior to January 1, 2025, beneficiaries were responsible for paying associated cost-sharing at the time of filling a prescription.

[28]CMS officials reported that the agency created the organizational structure and number of positions in the Medicare Drug Rebate and Negotiations Group based on the staffing model, skill sets, and experience needed for similar work in the agency (e.g., the groups responsible for overseeing the Part C and Part D programs).

[29]CMS officials stated that the group’s 91 staff persons do not support any other programs at CMS besides the negotiation program and the inflation rebate program. Additionally, there are CMS staff outside of this group who support certain aspects of the negotiation and inflation rebate programs.

[30]The IRA provided for program implementation from 2026 through 2028 by program instruction or other forms of guidance for program implementation for 2026 through 2028; that is, without going through the rulemaking process. CMS plans on publishing draft guidance for price year 2028 in spring 2025 and final guidance in fall or winter 2025, according to agency officials. CMS will undergo rulemaking for drugs with prices to take effect in 2029 and beyond.

[31]CMS provided a 30-day comment period for the March 2023 initial guidance, beginning March 15, 2023. The agency reported receiving 7,500 comment letters in response to the draft guidance, representing experts, consumer and patient organizations, health plans, providers, drug manufacturers, pharmacies, pharmacy benefit managers, and others.

[32]CMS referred to the updated guidance for price year 2026 as revised guidance and referred to the updated guidance for price year 2027 as final guidance. According to the October 2024 final guidance, CMS may supplement the final guidance with further program instruction to explain how these policies will be implemented for price year 2027.

[33]CMS provided a 60-day comment period for the May 2024 draft guidance, beginning May 3, 2024. The agency reported receiving 145 comment letters in response to the draft guidance, representing experts, consumer and patient organizations, health plans, providers, drug manufacturers, pharmacies, pharmacy benefit managers, and others.

[34]Manufacturers of biosimilars may request a delay in the selection of the reference biologic from CMS prior to publication date of drugs selected for negotiation; CMS will grant a delay to requests that demonstrate that the eligibility criteria outlined in the IRA are met and that the biosimilar is highly likely to be licensed and marketed within 2 years of the publication date of drugs selected for negotiation. See 42 U.S.C. § 1320f-1(f).

[35]According to CMS guidance, if negotiation meetings do not result in an agreed upon maximum fair price, CMS will send final maximum fair price offer, which manufacturers either accept or decline. Manufacturers who decline the final offer may be subject to an excise tax.

[36]The Health Plan Management System is a CMS website where health and drug plans, third party vendors, and pharmaceutical manufactures can work with CMS to fulfill the plan enrollment and compliance requirements of the Medicare Advantage and Part D programs.

[37]A Part D drug may qualify for a small biotech exception if the total expenditures for the qualifying single source drug under Part D (1) are equal to or less than 1 percent of the total expenditures for all Part D drugs during such year, and (2) are equal to at least 80 percent of the total expenditures for all covered Part D drugs for which the manufacturer of the drug has a Manufacturer Discount Program agreement in effect during such year.

[38]According to the October 2024 final guidance, the negotiation period will begin on the earlier of two dates: the date CMS and a manufacturer sign an agreement or February 28, 2025.