FARM LOANS

Status of USDA Debt Assistance for Distressed Borrowers

Report to Congressional Committees

December 2024

GAO-25-107008

United States Government Accountability Office

View GAO-25-107008. For more information, contact Steve Morris at (202) 512-3841 or Morriss@gao.gov.

Highlights of GAO-25-107008, a report to congressional committees

December 2024

Farm loans

Status of USDA Debt Assistance for Distressed Borrowers

Why GAO Did This Study

Federal farm loan programs serve as a safety net for agricultural producers. The programs provide an important source of credit when farmers and ranchers are otherwise unable to secure a commercial loan. Disruptions from the COVID-19 pandemic and climate-related weather events put agricultural producers at risk of falling behind on loan payments and potentially losing their farms and ranches.

Congress appropriated $3.1 billion to the Secretary of Agriculture for loan debt assistance under section 22006 of IRA. FSA’s financial assistance pays off delinquent loan amounts and covers the next payment with no additional debt incurred by the borrower.

The IRA also provides that GAO support oversight of the distribution and use of funds appropriated under the act. This report describes the status of FSA’s distribution of loan debt assistance to qualifying borrowers under IRA Section 22006 from October 2022 through April 2024.

GAO analyzed FSA data as of April 29, 2024 (the most recent data available), including borrowers’ loan status, amounts of financial assistance, and the location of their farm or ranch, or where their loans were serviced. GAO reviewed federal laws, program eligibility requirements, and FSA handbooks on farm loans. GAO also interviewed FSA officials to discuss actions the agency is taking to implement IRA Section 22006.

What GAO Found

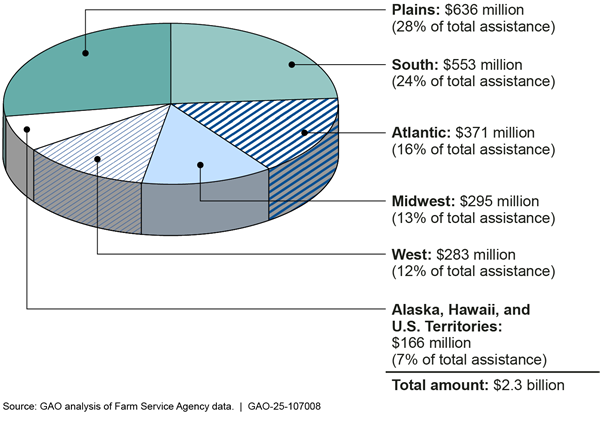

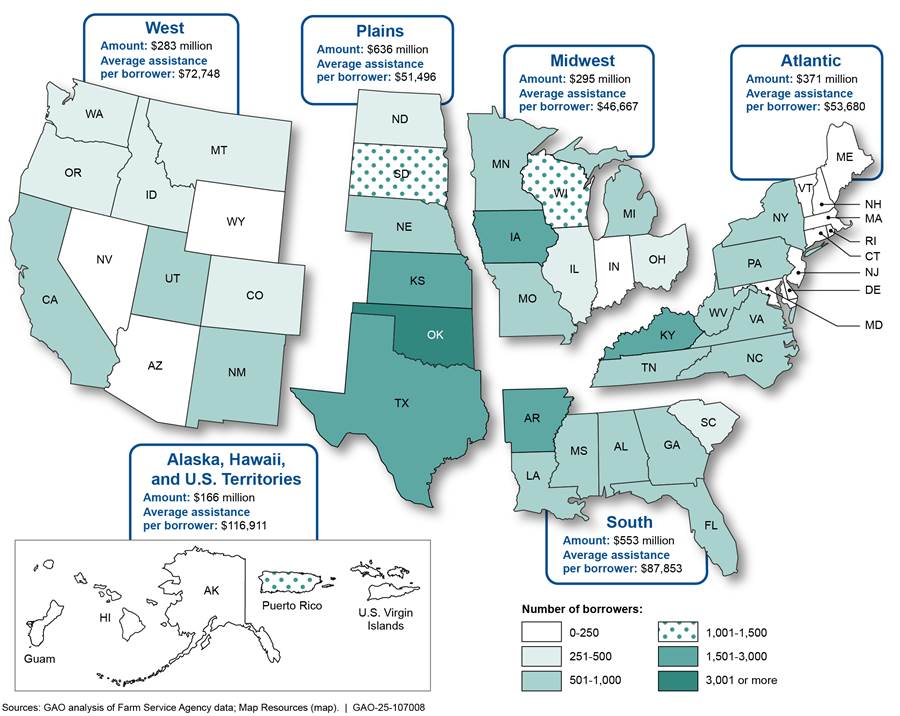

The U.S. Department of Agriculture’s (USDA) Farm Service Agency (FSA) is responsible for distributing $3.1 billion in loan debt assistance appropriated under the Inflation Reduction Act of 2022 (IRA) to distressed borrowers with qualifying farm loans. As of April 2024, GAO found that FSA had distributed approximately $2.3 billion to borrowers who were delinquent on their FSA or other qualifying loan. According to FSA officials, about 44 percent of FSA delinquent loans received assistance. Approximately half of the borrowers (52 percent) received $25,000 or less. About half of all assistance distributed went to borrowers in the Plains and South regions—areas where delinquent farm loan amounts were highest. In October 2024, FSA officials said they are using $250 million of the remaining funds to assist about 4,600 borrowers. GAO will continue to track the distribution and use of the funds.

Inflation Reduction Act Section 22006 Assistance Recipients by Region, as of April 29, 2024

According to agency officials, FSA is taking steps to measure the impact of IRA loan debt assistance. For example, FSA is tracking whether such assistance has resulted in improvements in borrowers’ delinquency rates, the number of loan accounts in bankruptcy, and foreclosure rates. FSA expects to complete its performance monitoring and report results later this year.

Abbreviations

FSA Farm Service Agency

IRA Section 22006 Section 22006 of the Inflation Reduction Act of 2022

USDA U. S. Department of Agriculture

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

December 3, 2024

Congressional Committees

Federal farm loan programs serve as a financial safety net for agricultural producers such as farmers and ranchers. These programs provide an important source of credit when agricultural producers are otherwise unable to secure a commercial loan to start, expand, or operate their business. The U.S. Department of Agriculture’s (USDA) Farm Service Agency (FSA) administers these programs. FSA makes direct loans to producers and guarantees loans made by USDA-approved commercial lenders and credit associations.

The disruptions to agricultural producers caused by the COVID-19 pandemic and climate-related weather events are two recent challenges that place producers at risk of falling behind on loan payments and potentially losing their farms and ranches. Congress appropriated $3.1 billion in section 22006 of the Inflation Reduction Act of 2022 (IRA Section 22006) to the Secretary of Agriculture to provide financial assistance for distressed borrowers with qualifying farm loans. In doing so, the Secretary must expedite assistance to those whose agricultural operations are at financial risk.[1]

Starting in October 2022, FSA began providing financial assistance for distressed borrowers with qualifying direct or guaranteed loans using funds appropriated under IRA Section 22006. In general, FSA used various types of loan account information to identify distressed borrowers. This information included accounts late on loan installment payments, referred for debt collection, or with outstanding interest that exceeded principal balances. USDA’s website states that a goal of loan debt assistance is to remove obstacles that may prevent borrowers from farming.

The Inflation Reduction Act also includes a provision for GAO to support oversight of the distribution and use of funds appropriated under the act. This report describes the status of FSA’s distribution of loan debt assistance for borrowers provided under IRA Section 22006 as of April 29, 2024.

To address this objective, we analyzed FSA IRA Section 22006 assistance data from October 30, 2022 to April 29, 2024. Specifically, we analyzed Federal Loan Program data for direct loan and guaranteed loan borrowers in the 50 states, Puerto Rico, U.S. Virgin Islands and Western Pacific. These data included the number of borrowers who received assistance, the dates on which they received assistance and how much assistance they received on each loan. These data also included the status of each loan and the location of their farm or ranch, or where their loans were serviced. We also reviewed available data on unpaid balances. In addition, we analyzed loan delinquency data of direct and guaranteed Federal Loan Program borrowers in the 50 states, Puerto Rico, U.S. Virgin Islands and Western Pacific in the FSA Farm Loan Program National Summary data file as of April 30, 2024.[2]

We assessed the reliability of the data by examining distribution and summary statistics of loan debt assistance provided under IRA Section 22006. We obtained explanations in writing from FSA about the measures it takes to ensure the reliability of these data. We determined that the data we obtained from FSA were sufficiently reliable for the purposes of reporting on numbers of borrowers, total assistance amounts, and average assistance amounts by key loan categories of loan debt assistance. Although we found the data to be reliable overall, we found some instances of inconsistent values, which we addressed in our calculations by limiting the amounts of assistance to no more than the outstanding amount owed on the loan.

In addition, we interviewed FSA officials to discuss actions the agency is taking to distribute assistance provided under IRA Section 22006. We also discussed FSA’s internal control activities, such as processes to help ensure that staff correctly determine borrower eligibility and assistance amounts.[3] We also met with USDA, Office of Inspector General officials who were conducting a review of FSA’s internal controls related to reviews of applications for IRA Section 22006 extraordinary measures assistance and improper payments.[4] Finally, we reviewed federal laws, program eligibility requirements, and FSA handbooks on farm loans.

We conducted this performance audit from September 2023 through December 2024 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

FSA’s Farm Loan Program offers direct and guaranteed loans to agricultural producers who are unable to obtain commercial credit to start, expand, or operate farms or ranches, but who can provide collateral to secure the loan and show sufficient ability to repay. FSA finances and services direct farm loans.[5] USDA-approved lenders to whom FSA will reimburse covered losses finance and service guaranteed loans. In total, as of May 6, 2024, FSA held about 136,000 direct loans and about 50,000 guaranteed loans, according to FSA officials. Farmers and ranchers may have more than one direct or guaranteed loan with FSA.

According to FSA officials, the agency’s goal in distributing financial assistance provided under IRA Section 22006 is to assist qualifying distressed farmers as quickly as possible. FSA first provided financial assistance by paying off delinquent loan amounts and covering the next scheduled loan installment (with no additional debt incurred by the borrower). Specifically, according to FSA, the goal for all IRA Section 22006 assistance is to expedite assistance to distressed borrowers at financial risk, including those who have been hard hit by pandemic-induced market disruptions and climate-driven natural disasters.

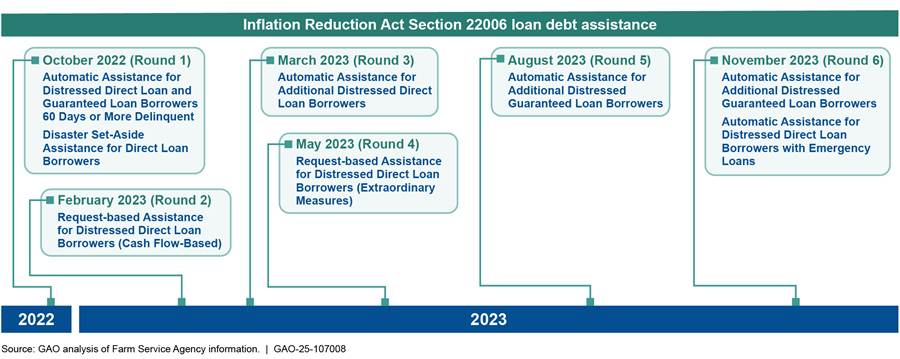

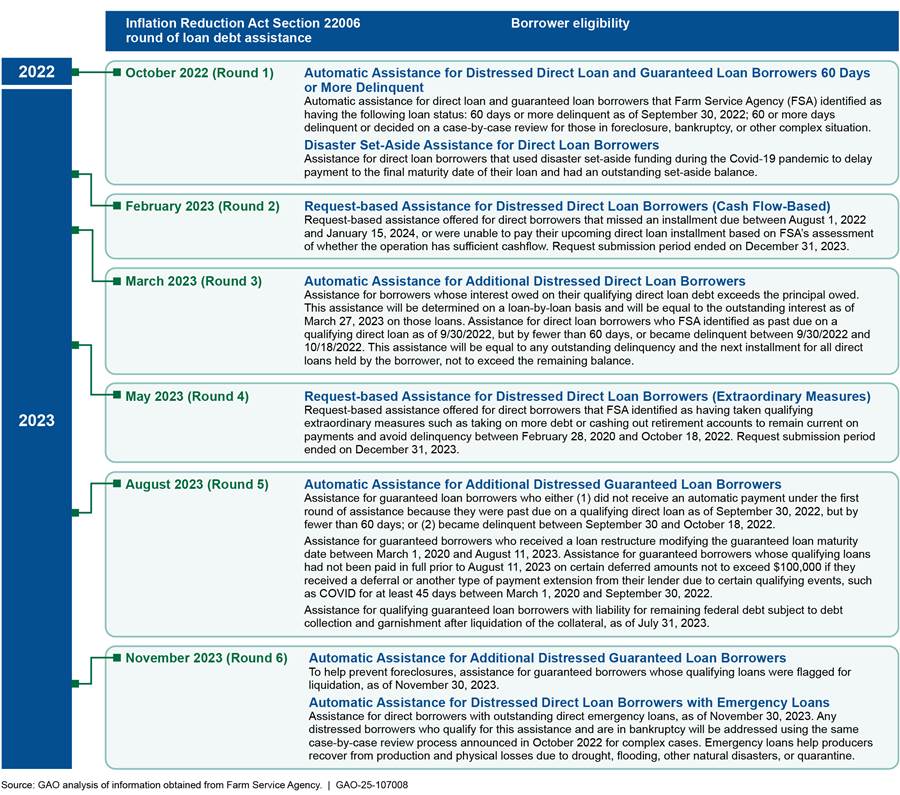

FSA distributed assistance first to borrowers who were the furthest behind in their loan payments, then considered additional categories of assistance for distressed borrowers who did not fall within the initial category of distressed borrowers. As of April 29, 2024, FSA distributed loan debt assistance to borrowers in six phases, or “rounds of assistance.” (See fig. 1.)

Figure 1: Inflation Reduction Act Section 22006 Rounds of Loan Debt Assistance, as of April 29, 2024

Notes: According to FSA officials, while Inflation Reduction Act Section 22006

assistance was announced on the dates noted, implementation of the announced

assistance may not have been completed prior to the next announced assistance.

Assistance that required borrower requests, analysis of complex cases, or

additional information from guaranteed lenders may have required additional

implementation time. In October 2022, FSA also announced automatic IRA Section

22006 assistance for direct borrowers who had an outstanding amount remaining

on their loans after using the disaster set-aside option during the COVID-19

pandemic to delay a loan payment.

Under the IRA Section 22006 farm loan debt assistance program, as of April 29, 2024, FSA provided assistance both automatically and in response to a request for assistance from a borrower. Automatic assistance was provided to direct and guaranteed borrowers after FSA used information it already had about borrowers to assess whether they qualified for assistance. Request-based assistance was available to direct borrowers requesting assistance once FSA approved the request. Of the six rounds of assistance, four were automatic assistance (see table 1).

Table 1: Inflation Reduction Act (IRA) Section 22006 Automatic and Request-Based Assistance, as of April 29, 2024

|

IRA Section 22006 automatic or request-based assistance (by round of assistance) |

Oct. |

Feb. |

Mar. |

May |

Aug. |

Nov. 2023 |

|

|

Months in which IRA assistance was announced |

|||||

|

Automatic assistance (Direct or guaranteed loan borrowers) |

● |

○ |

● |

○ |

● |

● |

|

Request-based assistance (Direct loan borrowers) FSA reviewed required financial documents and production information submitted in a direct borrower’s request for assistance prior to December 31, 2024. |

○ |

● |

○ |

● |

○ |

○ |

Legend: ● = IRA Section 22006 assistance was announced ○= IRA Section 22006 assistance was not announced

Source: GAO analysis of information obtained from the Farm

Service Agency. I GAO‑25‑107008

FSA established certain eligibility criteria for receiving assistance provided under IRA Section 22006. See appendix I for specific borrower eligibility criteria for IRA Section 22006 assistance over the six rounds of assistance, as of April 29, 2024. Generally, the eligibility criteria to receive automatic assistance and request-based assistance, as of April 2024, consisted of the following:

· Automatic assistance for direct and guaranteed loan borrowers. FSA used direct borrowers’ account status information, indicating whether they were behind in their payments to FSA or other information that may indicate distress, such as foreclosure or having been referred to debt collection. FSA also considered other indicators of distress, such as certain loan servicing actions—restructuring, deferrals, and debt write-downs. FSA worked with its guaranteed lenders to collect information about guaranteed loan accounts that were behind in payments, identified for liquidation actions, or had a recent history of requiring loan servicing or payment modifications.

· Request-based assistance for direct loan borrowers. According to FSA officials, depending on the specific requirements of the round of assistance, FSA required direct loan borrowers who were requesting assistance to submit information on their finances and agricultural production. FSA required the documents or information to show borrowers had cash flow challenges causing them to have been delinquent and unable to make future payments. Alternatively, borrowers could show that they had taken extraordinary measures such as taking on more debt or cashing out retirement accounts to avoid delinquency during a certain time frame.

FSA Has Distributed the Majority of Assistance, with Half of Borrowers Receiving $25,000 or Less

FSA has distributed approximately three-quarters of the $3.1 billion loan debt assistance provided under IRA Section 22006 to help distressed borrowers and expedite assistance to those at financial risk, based on our analysis of agency data as of April 29, 2024. FSA distributed almost half of these funds in the first few months of the program’s implementation. Based on our analysis, about half of all borrowers received payments of $25,000 or less. Approximately half of the assistance FSA provided went to borrowers whose farm or ranch was located or whose loans were serviced in the Plains and South, where the numbers of delinquent farm loans were the highest. Lastly, FSA officials provided information about the agency’s internal control processes intended to identify and correct erroneous determinations of IRA 22006 loan debt assistance to borrowers.

FSA Has Distributed the Majority of the Assistance Provided under IRA Section 22006

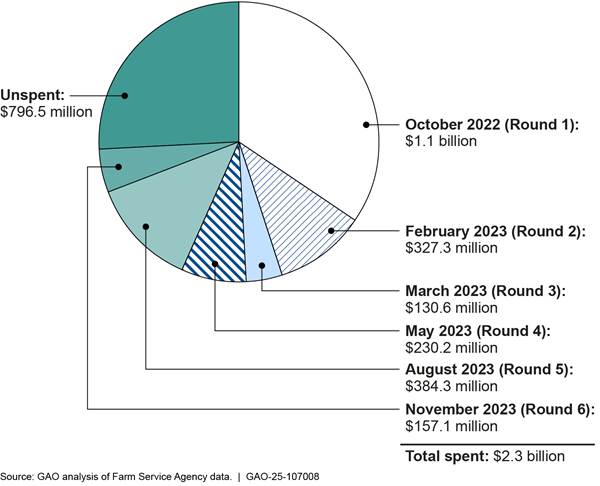

As of April 29, 2024, FSA had distributed approximately $2.3 billion of the $3.1 billion (or approximately 75 percent) of the funding provided under IRA Section 22006 for loan debt assistance, according to our analysis of FSA data.[6] FSA provided this assistance for 37,185 unique borrowers. According to FSA officials, borrowers receiving assistance held more than 82,000 loans (see fig. 2). About 44 percent of FSA loans qualified for a distressed determination and received IRA Section 22006 assistance in at least one of the rounds, according to officials. The agency applied the funds to direct loan borrowers’ accounts. Borrowers with guaranteed loans were mailed Department of Treasury checks jointly payable to the borrowers and their lenders.

Figure 2: Inflation Reduction Act Section 22006 Assistance Distributed to Direct and Guaranteed Loan Borrowers, by Round, as of April 29, 2024

Notes: All figures are rounded. We found the data to be generally reliable but found some instances of inconsistent values, which we addressed in our calculations by limiting the amounts of assistance to no more than the outstanding amount owed on the loan.

FSA officials we interviewed in July 2024 said that the agency was processing

about $150 million more in assistance, and would continue to provide assistance

for distressed borrowers with the remaining IRA Section 22006 funding but

provided no further details. In October 2024, FSA officials said they were

providing another $250 million of the remaining funds in automatic assistance

for approximately 4,600 distressed direct and guaranteed loan borrowers. These

officials told us they anticipate a remaining balance of about $300 million,

which the agency may consider using to provide assistance for borrowers

distressed as a result of natural disasters. We will continue to follow up on

FSA’s actions.

Almost Half of the Total Funds Distributed Were Provided Early in the Program

FSA provided $1.1 billion to borrowers announced in Round 1 (October 2022), which was 46.6 percent of the $2.3 billion distributed across the six rounds of assistance (as of April 29, 2024).[7] (See fig. 3.) While almost all of Round 1 assistance went to borrowers who held direct loans, the average size of the assistance was higher for guaranteed borrowers. For example, direct borrowers 60 or more days delinquent received $64,565 on average in assistance while guaranteed borrowers 60 days or more delinquent received $336,817 on average.

FSA distributed the remaining $1.2 billion of total assistance provided as of April 2024, to direct and guaranteed borrowers announced in rounds 2 through 6 (February through November 2023). The breakdown of this assistance by loan type was as follows:

· 24.2 percent of the assistance went to direct borrowers who were approved for request-based assistance announced in Round 2 (February 2023) and Round 4 (May 2023). Direct loan borrowers received $327 million announced in Round 2 and $230 million in assistance announced in Round 4.

· 9.6 percent went to direct borrowers who received about $131 million in automatic assistance announced in Round 3 (March 2023) and about $90 million announced in Round 6 (November 2023).

· 19.6 percent ($452 million) went to guaranteed loan borrowers who received automatic assistance announced in Round 5 (August 2023) and Round 6.

According to FSA officials, most of the assistance went to

direct loans for multiple reasons. Guaranteed loan borrowers are typically

considered to have a lower rate of delinquency on their loan installments

because they must meet commercial credit requirements to obtain loans.

Additionally, officials said that since FSA guaranteed loans have a higher

overall loan limit, amounts of IRA Section 22006 assistance on guaranteed loans

tended to also be higher than the average direct loan.

Figure 3: Inflation Reduction Act Section 22006 Assistance for Borrowers by Round, as of April 29, 2024

Notes: All figures are rounded. According to FSA officials, while Inflation Reduction Act Section 22006 assistance was announced on the dates noted, implementation of the announced assistance may not have been completed prior to the next announced assistance. Assistance that required borrower requests, analysis of complex cases, or additional information from guaranteed lenders may have required additional implementation time. Our analysis of FSA data indicated that many borrowers who had more than one loan received financial assistance in more than one round.

aIn October 2022, the Farm Service Agency (FSA) announced automatic IRA Section 22006 assistance for direct borrowers who had used disaster set-aside funding during the Covid-19 pandemic to delay their payment to the final maturity date of their loan and had an outstanding set-aside balance. According to FSA officials, the assistance, as of April 29, 2024, used $57,842,919 from Consolidated Appropriations Act, 2022 funding and $1,013,052 in IRA Section 22006 funding.

Some borrowers may elect not to accept assistance due to potential tax liability, or other reasons which do not need to be explained or documented, according to FSA officials. FSA officials we interviewed said that 83 loan borrowers refused IRA Section 22006 assistance after FSA provided the assistance to the borrower.

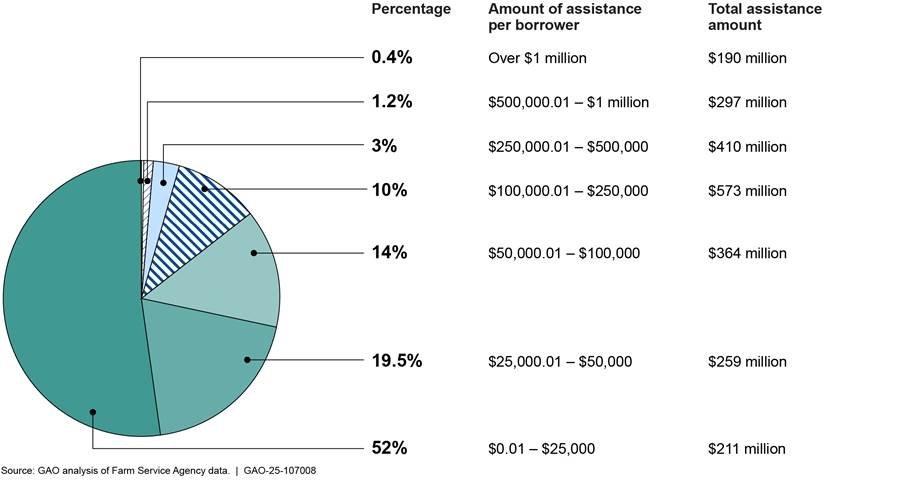

About Half of Borrowers Received $25,000 or Less

Of the borrowers who received IRA Section 22006 assistance, 52 percent received $25,000 or less. Less than 2 percent of borrowers received assistance of $500,000.01 or more. (See fig. 4.)

Figure 4: Inflation Reduction Act Section 22006 Assistance, by Amount of Assistance (in dollars), as of April 29, 2024

Note: All figures are rounded.

FSA officials said that, in general, borrowers whose accounts had multiple missed loan installment payments qualified for a higher assistance amount than those who were behind by only one installment.

About Half of The Assistance Went to Borrowers in the Plains and South

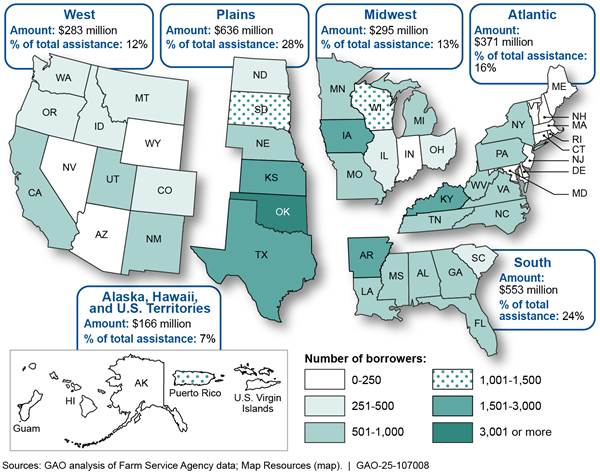

Of all financial assistance distributed (approximately $1.2 billion), 52 percent went to borrowers whose farms or ranches were located or whose loans were serviced in the Plains and South, as indicated by our analysis of FSA data as of April 29, 2024.[8] (See fig. 5.) Borrowers who operated or whose loans were serviced in Alaska, Hawaii, and the U.S. territories received 7 percent of assistance.

Figure 5: Distribution of Inflation Reduction Act Section 22006 Assistance by Region, as of April 29, 2024

Notes: All figures are rounded. Our analysis of FSA data as of April 29, 2024, indicated that some borrowers had multiple loans for farming operations located or serviced in more than one region.

The overall distribution of IRA Section 22006 assistance as of April 29, 2024, by region, generally aligns with areas with the highest total amounts of FSA loan delinquency. (See fig. 6.) According to our analysis, the Plains and South had the highest amounts of delinquent principal and interest, as of April 30, 2024, of direct and guaranteed loans.[9]

Figure 6: Recipients of Inflation Reduction Act Section 22006 Assistance, by Region, as of April 29, 2024

Notes: All figures are rounded. Geographic data on loans provided by FSA corresponded in some cases to the location of the borrower’s farm or ranch and in other cases the state servicing the loan. Our analysis of FSA data (as of April 29, 2024) indicated that some borrowers had multiple loans serviced in or for farming operations located in more than one region. Borrowers whose farms or ranches were located in the Plains and South regions, or whose loans were serviced in these regions had the highest amounts of delinquency across the nation as of April 30, 2024, as indicated by our analysis of FSA data. According to FSA officials, Oklahoma has historically held higher delinquencies. In addition, according to these officials, Oklahoma experienced significant drought conditions in 2021 and 2022 (prior to IRA assistance) which likely caused higher amounts of distress to farmers. We did not independently verify FSA’s statements.

According to FSA officials, borrowers’ operations include cattle, sheep, and swine; dairy; row crops, fruits, and vegetables; and aquaculture (e.g., fish farms).

FSA Has a Process to Correct Assistance Determinations

We asked FSA officials to describe the agency’s internal control activities as part of understanding how the agency assists distressed borrowers using funds provided under IRA Section 22006. FSA officials provided information about how the agency is (1) measuring its progress toward the goal of keeping farmers and ranchers operating, (2) ensuring that its determinations on borrower eligibility were correct, and (3) ensuring that the correct amount of assistance was provided.

To assess progress in meeting the goals for implementing IRA Section 22006 assistance, FSA plans to review certain performance indicators. For example, as the program continues, FSA will examine whether there are improvements in borrowers’ loan delinquency rates, the number of loan accounts in bankruptcy, and the rate of foreclosures.[10] FSA officials said that they expect to have some information about their progress in achieving program goals by the end of calendar year 2024.

FSA officials described steps to correctly identify borrowers for automatic assistance, and said the agency is determining how to verify information provided by loan borrowers requesting assistance. To ensure that borrowers were correctly identified to receive assistance, FSA officials said that the agency conducts routine verifications for automatic assistance. For guaranteed loan borrowers, incorrect or outdated account status information from lenders may have resulted in an incorrect determination of eligibility.

In addition to correcting eligibility, FSA officials provided information on how the agency makes corrections to the amount of assistance provided. For example, a direct loan borrower may have been incorrectly determined to be eligible for assistance, or their loan account may have had an incorrect assistance amount applied due to incorrect delinquency flags. As with eligibility, incorrect or outdated loan account information could lead to incorrect amounts of assistance.

FSA officials estimated that the agency has identified about 3 percent of the total automatic assistance provided to borrowers as needing to be corrected and made the corrections.[11] Payment corrections may result in an additional payment being made, a reversal of a payment made to a direct borrower, or an overpayment to a guaranteed borrower being refunded, according to FSA officials.

Agency Comments

We provided a draft of this report to the Secretary of Agriculture and FSA for review and comment. FSA generally agreed with our findings and did not provide written comments. The agency provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the appropriate congressional committees, the Secretary of Agriculture, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at (202) 512-3841 or morriss@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix II.

Steve D. Morris, Director

Natural Resources and Environment

List of Committees

The

Honorable Debbie Stabenow

Chairwoman

The Honorable John Boozman

Ranking Member

Committee on Agriculture, Nutrition, and Forestry

United States Senate

The Honorable Gary C. Peters

Chairman

The Honorable Rand Paul, M.D.

Ranking Member

Committee on Homeland Security and Government Affairs

United States Senate

The Honorable Martin Heinrich

Chair

The Honorable John Hoeven

Ranking Member

Subcommittee on Agriculture, Rural Development, Food and Drug

Administration, and Related Agencies

Committee on Appropriations

United States Senate

The Honorable Glenn “GT” Thompson

Chairman

The Honorable David Scott

Ranking Member

Committee on Agriculture

House of Representatives

The Honorable James Corner

Chairman

The Honorable Jamie Raskin

Ranking Member

Committee on

Oversight and Accountability

House of Representatives

The Honorable Andy Harris

Chairman

The Honorable Sanford Bishop, Jr.

Ranking Member

Subcommittee on Agriculture, Rural Development, Food and Drug

Administration, and Related Agencies

Committee on Appropriations

House of Representatives

Appendix I: Inflation Reduction Act Section 22006 Borrower Eligibility Criteria, as of April 29, 2024

The U.S. Department of Agriculture’s (USDA) Farm Service Agency (FSA) administers the farm loan debt assistance program using funds appropriated under Section 22006 of the Inflation Reduction Act. With those appropriated funds, FSA has provided loan debt for direct and guaranteed loan borrowers over six rounds of assistance, as of April 29, 2024. Each round of assistance has specific eligibility criteria. (See fig. 7.)

Figure 7: Inflation Reduction Act Section 22006 Borrower Eligibility Criteria for Rounds 1 Through 6, as of April 29, 2024

Note: According to FSA officials, while Inflation Reduction Act Section 22006 assistance was announced on the dates noted, implementation of the announced assistance may not have been completed prior to the next announced assistance. Assistance that required borrower requests, analysis of complex cases, or additional information from guaranteed lenders may have required additional implementation time.

GAO Contact

Steve D. Morris at (202) 512-3841 or morriss@gao.gov

Staff Acknowledgments

In addition to the contact named above, the following staff members made key contributions to this report: Tahra Nichols (Assistant Director), Farah Angersola (Analyst in Charge), Kevin Bray, Shannon Brooks, John Delicath, David Dornisch, Madeline Kasik, Nancy Kintner-Meyer, Lena Nour, Dan C. Royer, and Jack Wang.

GAO’s Mission

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on Facebook, Flickr, X, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

Congressional Relations

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S. Government Accountability Office, 441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

Sarah Kaczmarek, Managing Director, KaczmarekS@gao.gov, (202) 512-4800, U.S.

Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Strategic Planning and External Liaison

Stephen J. Sanford, Managing

Director, spel@gao.gov, (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814, Washington,

DC 20548

[1]Pub. L. No. 117-169, § 22006, 136 Stat. 1818,2021 (2022).

[2]The FSA Farm Loan Program National Summary data file provides a summary of the number of direct and guaranteed loan borrowers, and delinquent principal and interest amounts in all 50 states and Puerto Rico. The information for Florida includes the U.S. Virgin Islands. The state of Hawaii includes the Western Pacific. Information about the location of a borrower’s farm or ranch and loan service is also in the data file, typically where the farm or ranch is located.

[3]We did not independently review FSA’s determinations of a borrower’s eligibility or whether FSA provided the correct amount of assistance to the borrower.

[4]USDA’s Office of Inspector General reported on internal controls related to debt relief. US Department of Agriculture, Office of Inspector General, IRA—Oversight of the Inflation Reduction Act for Distressed Borrowers With Direct Loans That Took Extraordinary Measures to Avoid Delinquency, Audit Report 03601-0001-21 (Washington, D.C.: September 2024).

[5]Loan servicing includes a range of activities that FSA defines as regular—sometimes referred to as routine—and special. Routine servicing activities include processing payments made by borrowers and conducting security inspections. Special servicing activities include actions to resolve distressed or delinquent borrower accounts and loan restructuring and foreclosure actions, where necessary.

[6]We limited our analysis to loan accounts showing no more than the outstanding amount owed.

[7]Our analysis of FSA data indicated that many borrowers who had more than one loan received financial assistance in more than one round.

[8]According to FSA officials, for direct and guaranteed loan borrowers who received automatic assistance from October 2022 through April 2024, the state in the data FSA provided represents where the borrower’s farm or ranch was located, or where the loan was serviced; and for borrowers who received request-based assistance, the state indicates where the farm operation was located or where the loan was serviced.

[9]The FSA Farm Loan Program National Summary data includes delinquency information for active direct and guaranteed borrowers in all 50 states Puerto Rico, U.S. Virgin Islands and Western Pacific. Our analysis of FSA IRA Section 22006 data included these locations.

[10]As noted earlier, FSA goals in implementing the IRA Section 22006 loan debt assistance program included keeping borrowers farming and removing obstacles that currently prevent many borrowers from returning to their land.

[11]We did not independently review how FSA determined eligibility of a borrower to receive assistance and the amount of assistance provided to the borrower. The FSA data we analyzed did not include information on corrections, including the specific loans or the amount of any corrections.