FEDERAL REAL PROPERTY

Brokers Were Involved in Fewer Leases in Recent Years and Generally Met Performance Targets

Report to Congressional Committees

United States Government Accountability Office

For more information, contact David Marroni at (202) 512-2834 or marronid@gao.gov.

Highlights of GAO-25-107050, a report to congressional committees

Brokers Were Involved in Fewer Leases in Recent Years and Generally Met Performance Targets

Why GAO Did This Study

As of December 2024, GSA managed about 7,500 leases that totaled about 174 million square feet and $6 billion annually in rental payments. For almost 2 decades, brokers have supported GSA in acquiring leases—especially those that are high dollar-value and complex—with the expectation that brokers’ involvement will lead to cost avoidance for the federal government.

The National Defense Authorization Act for Fiscal Year 2020 includes a provision for GAO to review GSA’s use of brokers. This report examines: (1) recent trends in GSA leases and GSA’s use of brokers; (2) the extent to which GSA’s performance metrics for brokers align with key practices, and the extent to which brokers have met performance targets; and (3) the outcomes that GSA identified of exempting brokers from enhanced competition.

To address these objectives, GAO reviewed data on GSA’s leases and use of brokers from fiscal year 2016 through fiscal year 2024. GAO also compared GSA’s performance metrics for brokers with GAO key practices for procurement organizations, and reviewed GSA’s aggregated performance data for brokers from the second half of calendar year 2020 (when the current contract with brokers started) through calendar year 2023 (the last full year of data available). In addition, GAO reviewed documentation and interviewed officials from GSA, and interviewed representatives of the six brokers currently working with GSA.

What GAO Found

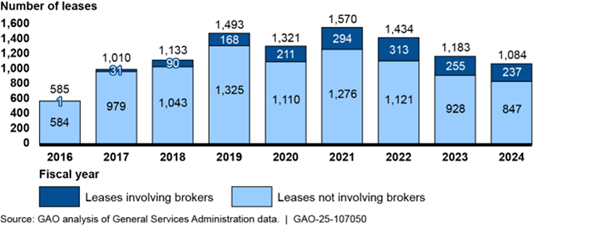

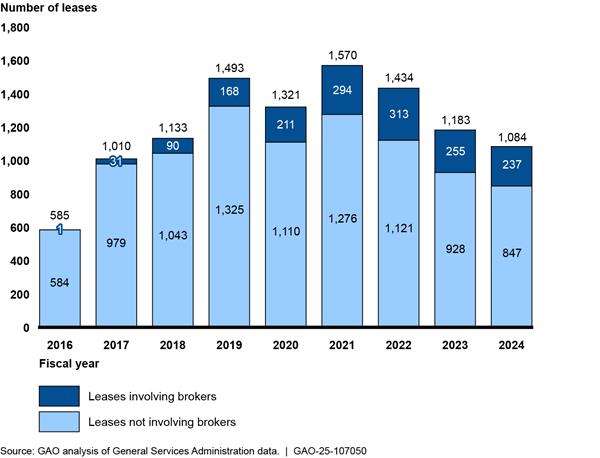

The General Services Administration (GSA) is the main landlord and leasing agent for the federal government. GSA uses commercial real estate brokerage firms (brokers) to help lease space by, for example, negotiating lease rates and terms for federal agencies. GAO found that from fiscal year 2016 through fiscal year 2024, the length of leases, amount of square footage GSA leased, and rental rates fluctuated from year to year. GAO also found that the total number of leases GSA completed decreased in recent years (see figure). GSA officials and brokers told GAO that GSA pursued fewer leases in recent years due, in part, to federal agencies’ uncertainty about future space needs in the wake of the COVID-19 pandemic and their increased use of telework.

Note: GSA completed additional leases in fiscal years 2016 and 2017 but those leases were initiated prior to fiscal year 2016 and were outside the scope of review.

GSA assesses brokers on cost avoidance, schedule, and other performance metrics outlined in its contract with brokers. GAO found that the performance metrics for cost avoidance and schedule link to agency strategic goals and are outcome-oriented, in line with key practices for procurement organizations. Linking performance metrics to strategic goals enables GSA to ensure its brokers are helping to achieve those goals. GSA’s use of outcome-oriented performance metrics enables the agency to quantitatively measure the extent to which brokers are achieving desired outcomes, such as avoiding costs and staying on schedule. From July 2020 through 2023, brokers met almost all targets for cost avoidance and all targets for schedule.

From May 2020 to February 2023, pursuant to a 2019 law, GSA exempted brokers from “enhanced competition”—that is, brokers did not have to compete to provide services for task orders with broker commissions below a $2 million threshold. GSA anticipated that the exemption would result in additional cost avoidance and improved broker performance. However, following a review of 16 completed projects, GSA found that the exemption did not result in these benefits. Based on the results of its review, GSA ended the exemption in February 2023 because it did not achieve anticipated benefits and was not in the best interest of the federal government, according to officials.

Abbreviations

FAR Federal Acquisition Regulation

GLS GSA Leasing Support Services

G-REX GSA Real Estate Exchange data system

GSA General Services Administration

REXUS Real Estate across the United States data system

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

March 19, 2025

The Honorable Shelley Moore Capito

Chairman

The Honorable Sheldon Whitehouse

Ranking Member

Committee on Environment and Public Works

United States Senate

The Honorable Sam Graves

Chairman

The Honorable Rick Larsen

Ranking Member

Committee on Transportation and Infrastructure

House of Representatives

As of December 2024, federal agencies spend about $6 billion each year on rental payments for about 7,500 leases and 174 million square feet of space at a variety of properties, ranging from office space to laboratories to warehouses. As the main landlord and leasing agent for the federal government, the General Services Administration (GSA) is generally responsible for leasing space from private building owners for federal agencies. For almost 2 decades, GSA has used commercial real estate brokerage firms (brokers) to assist its staff with the leasing process. GSA does so through its GSA Leasing Support Services (GLS) program.

Brokers bring real estate expertise to lease negotiations and perform other leasing services, with the expectation that their involvement will lead to cost avoidance for the federal government. Brokers also serve as a workforce multiplier, as they enable GSA to complete leasing work for which it would otherwise not have the staffing resources. Over the past several years, we have reported on how GSA demonstrates cost avoidance and other benefits of using brokers.[1]

The GLS program and federal real property have experienced several changes in recent years. From September 2015 through May 2020, brokers provided leasing services to GSA through a contract vehicle called GLS. In 2020, GSA awarded new contracts to brokers through a contract vehicle called GLS Plus.[2] GLS Plus enabled brokers to provide services beyond those established in GLS, such as on-site monitoring of construction progress for the leased space. GLS Plus also modified some of the metrics GSA uses to assess the performance of brokers, including metrics for cost avoidance and schedule. In addition, from May 2020 to February 2023, GSA exempted brokers from competing to provide services for task orders with broker commissions under a $2 million threshold. GSA took this action pursuant to a 2019 law in which Congress exempted leasing services from “enhanced competition” for a certain period.[3] These changes coincided with the COVID-19 pandemic, during which agencies reported significant increases in their use of telework and, as a result, underutilization of many federal buildings and office spaces.[4]

Looking forward, federal real property will continue to experience changes. According to GSA, more than half of its leases are set to expire by 2027, which may affect how and when GSA uses brokers. Further, now that the country has emerged from the COVID-19 pandemic and with recent changes in telework and remote work policies for federal employees, the federal government has a unique opportunity to reconsider how much and what type of leased space it needs, as well as how it might best use brokers to help implement any changes in leased space.

The National Defense Authorization Act for Fiscal Year 2020 includes a provision for GAO to review GSA’s use of brokers, particularly whether GSA’s use of brokers achieves cost avoidance and other benefits.[5] This report examines: (1) recent trends in GSA leases and GSA’s use of brokers; (2) the extent to which GSA’s performance metrics for brokers align with key practices, and the extent to which brokers have met performance targets; and (3) the outcomes that GSA identified of exempting brokers from enhanced competition.[6]

To address the first objective, we analyzed GSA leasing data obtained from two data systems: Real Estate across the United States (REXUS) and GSA Real Estate Exchange (G-REX). We analyzed data on GLS and GLS Plus leases from fiscal year 2016 through fiscal year 2024. We selected this time frame to capture the first full fiscal year of the GLS contract until the last full fiscal year available for the GLS Plus contract. We included leases that GSA both initiated and completed from fiscal year 2016 through fiscal year 2024. We assessed the reliability of the GSA leasing data and determined the data were sufficiently reliable for the purposes of our report.[7]

For each fiscal year, we calculated the number of leases GSA completed work on and the length of leases, the physical size of leased space, rental rates, commissions brokers earned from lessors, and the portion of the commissions earned by brokers remitted to federal tenants through reduced rent.[8] We conducted these calculations for two groups: all GSA leases (i.e., leases involving and not involving brokers) and only those leases that involved brokers. Additionally, we interviewed GSA officials and brokers about trends affecting GSA’s lease portfolio and its use of brokers.

To address the second objective, we compared the performance metrics for brokers that GSA included in its GLS Plus contract with two key practices for procurement organizations.[9] The key practices call for procurement leaders at federal agencies to link performance metrics to strategic goals and use outcome-oriented performance metrics.[10] We also assessed the extent to which brokers met targets for the performance metrics in the GLS Plus contract by reviewing aggregate GSA performance assessment data. Specifically, we reviewed GSA aggregate performance data for brokers under the GLS Plus contract, from the second half of calendar year 2020 through calendar year 2023. We chose this period because it was the earliest available start and last full year of data available. The GLS Plus contract included new performance metrics; therefore, we focused only on the period covered by GLS Plus, rather than the longer period covered in the first objective. Additionally, we aggregated GSA cost avoidance data from fiscal year 2020 (the first fiscal year including GSA’s current broker contract) through fiscal year 2023 (the last full fiscal year for which we requested cost avoidance data).

To address the third objective, we reviewed GSA’s analyses of the outcomes of exempting brokers from enhanced competition. We interviewed the six brokers currently participating in the GLS program about the effect of the exemption on competition and on the number of task orders received. In addition, we interviewed GSA officials about the outcomes of exempting brokers from enhanced competition.

To address all the objectives, we interviewed the six brokers currently participating in the GLS program, officials from GSA’s headquarters and seven of its 11 regional offices, and three federal tenants—the Federal Bureau of Investigation, the Internal Revenue Service, and the Social Security Administration.[11]

We conducted this performance audit from September 2023 to March 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

GSA’s Public Buildings Service acquires space on behalf of federal agencies through new construction, purchase, and leasing. GSA has established two metrics for its leasing efforts: (1) to achieve cost avoidance and (2) to complete leasing work on schedule.[12] According to GSA’s data, in fiscal year 2023, the Public Buildings Service achieved cost avoidance of about $989 million in total contract value, more than double its target of about $402 million.[13] The Public Buildings Service also completed 89 percent of its leases on-schedule, surpassing its target of 80 percent.

To achieve these goals, GSA staff perform work to acquire leases, and they obtain support from brokers for some of those leases. Brokers generally support GSA on high dollar-value, complex leases, and they earn a commission for the work they perform based on a percentage of the aggregate lease value.[14] For leases that do not involve brokers, GSA staff perform all tasks.

Although most GSA leases do not involve brokers, those leases involving brokers generally have larger square footage and higher annual rents than leases not involving brokers (see table 1). Brokers generally do not support GSA on low dollar-value leases and, according to GSA officials, cannot support GSA on certain types of leases such as renewals, leased space for airports, and other non-commissionable leases.

|

|

Leases |

Leases |

|

Number of leases |

1,600 |

9,213 |

|

Average annual rent |

$1,058,505 |

$533,691 |

|

Average rentable square footage |

30,727 |

15,955 |

Source: GAO analysis of General Services Administration’s (GSA) leasing data. | GAO‑25‑107050

Note: Leases include new leases; replacing leases; lease extensions; lease renewals; succeeding leases, which secure continued occupancy of the current premises without a break in occupancy under a new, negotiated contract; and superseding leases, which replace an existing lease prior to expiration.

As of February 2025, six brokers provide leasing support services to GSA under the GLS Plus contract, which was awarded in May 2020 and expires in May 2025.[15] Two of these brokers are small businesses. In 2015, when GLS—the prior contract with brokers—went into effect, GSA shifted from using brokers on a nationwide basis to using brokers within geographical zones. Each broker can serve up to two zones (see table 2).

|

Zone |

Major markets |

Brokers |

|

Northern Zone 1 |

Chicago, Detroit, and New York |

· CBRE Inc · Jones Lang LaSalle Americas, Inc. |

|

Southern Zone 2 |

Atlanta, Austin, Dallas/Fort Worth, Houston, Miami, and New Orleans |

· Public Properties LCC · Savills, Inc. |

|

Western Zone 3 |

Las Vegas, Los Angeles, Portland San Francisco, and Seattle |

· Carpenter/Robbins Commercial Real Estate, Inc. · Cushman and Wakefield |

|

National Capital Region Zone 4 |

Washington, D.C. |

· CBRE, Inc. · Public Properties LLC · Savills, Inc. |

Source: GAO analysis of General Services Administration’s (GSA) information. | GAO‑25‑107050

The federal leasing process has multiple phases (see fig.1), and brokers can support GSA during those phases. For example, in the requirements development phase, brokers can help tenants determine space needs.[16] In the lease acquisition phase, brokers can conduct market research on rental rates, negotiate rates and terms of the lease, and prepare final contract forms.

Pursuant to the Federal Acquisition Regulation (FAR), brokers are not allowed to complete some activities, as contractors cannot perform inherently governmental functions.[17] For example, according to GSA officials, a broker cannot approve a lease contract with a lessor on behalf of the federal government, since that action is considered an inherently governmental function.

In 2020, GSA included services in the GLS Plus contract not previously included in the GLS contract. For example, the GLS Plus contract included services that would enable brokers to perform market 360 surveys (i.e., virtual market tours using the latest camera technology) and additional post-award services, such as providing an active role in minimizing costs during design and construction and on-site monitoring of construction progress for the leased space.

GSA is responsible for overseeing and approving broker activities and assessing the performance of brokers through metrics identified in its contract with the brokers. The GLS Plus contract modified some of the metrics from the prior GLS contract that GSA uses to assess the performance of brokers, including the cost avoidance and schedule metrics.

During the requirements development and lease acquisition phases, GSA staff and brokers work with federal agencies to identify and acquire the type of leased space they need. GSA and its brokers can acquire leased space through several different types of leases (see table 3).

|

Lease type |

Description |

|

New lease |

Acquires new space |

|

Replacing lease |

Moves an existing federal tenant to a new space |

|

Lease extension |

Extends occupancy of a space beyond the negotiated term of the lease, generally executed when an agency has evolving needs or experiences delays in moving to a different space |

|

Lease renewal |

Exercises a previously negotiated option to extend occupancy in a space |

|

Succeeding lease |

Secures continued occupancy of the current premises without a break in occupancy under a new, negotiated contract |

|

Superseding lease |

Replaces an existing lease prior to expiration |

Source: GAO analysis of General Services Administration (GSA) information. | GAO‑25‑107050

GSA’s Leasing Activity Has Fluctuated, with Brokers Involved in Fewer Leases in Recent Years

According to our analysis of GSA data, from fiscal year 2016 through fiscal year 2024, GSA leasing activity fluctuated year to year.[18] Specifically, we found that throughout the 8-year period, the length of leases, the size of GSA leased space, and rental rates increased or decreased year to year. We also found that the total number of leases GSA completed, including leases involving brokers, decreased in recent years.

Number of Leases

According to GSA data, the total number of leases GSA completed fluctuated year to year from fiscal year 2018 through fiscal year 2024, with a peak in fiscal year 2021 and decrease in recent years.[19] The total number of leases GSA completed involving brokers increased from fiscal year 2018 through fiscal year 2022 and then decreased through fiscal year 2024. Over the period from fiscal year 2018 through fiscal year 2024, the proportion of broker-involved leases generally increased. Broker-involved leases comprised about 8 percent of all GSA leases in fiscal year 2018 (2 years after the start of the GLS contract), and about 22 percent in fiscal year 2024 (see fig. 2).

Figure 2: Number of General Services Administration (GSA) Leases Involving and Not Involving Brokers, Fiscal Years 2016–2024

Notes: Leases include new leases; replacing leases; lease extensions; lease renewals; succeeding leases, which secure continued occupancy of the current premises without a break in occupancy under a new, negotiated contract; and superseding leases, which replace an existing lease prior to expiration. Our analysis focused on leases that GSA both initiated and completed from fiscal year 2016 through fiscal year 2024. Once GSA initiates a lease, the leasing process can take several years before a lease is completed. As a result, there are fewer completed leases in fiscal years 2016 and 2017 than in later years. GSA completed other leases in fiscal years 2016 and 2017, but those leases were initiated prior to fiscal year 2016 and were outside of our scope.

GSA officials and brokers said that the COVID-19 pandemic led to uncertainty among federal tenants about their future space needs. As agencies continued to determine their return-to-work postures post-pandemic, they pursued fewer leases. GSA officials also told us that GSA is trying to move agencies into federally owned space, and GSA’s key performance goals include optimizing its real estate portfolio and reducing the square footage of office space. These goals have also contributed to the decrease in the number of leases GSA has pursued in recent years.

Length of Leases

For all GSA leases and leases involving brokers, the length of leases that GSA cannot cancel without cause—known as the firm term—fluctuated year to year but generally increased slightly on average for all GSA leases from fiscal year 2020 through fiscal year 2024.[20] For all GSA leases, average firm terms increased from about 6 years in fiscal year 2020 to about 7 years in fiscal year 2024.[21] For leases involving brokers, average firm terms increased from about 8 years in fiscal year 2020 to about 10 years in fiscal year 2024.

While we observed that average firm terms have increased slightly, brokers we spoke with expressed concerns about a 2023 change to GSA’s policy, which limits the approval of cancelable occupancy agreements.[22] Occupancy agreements designated as cancelable allow federal tenants to vacate a space before completion of the firm term under certain conditions, such as the provision of 120 days’ notice to GSA. In such cases, GSA would assume financial responsibility for the time remaining in the firm term.[23] Under the 2023 policy change, all occupancy agreements for new occupancy in leased space, regardless of the lease type, will generally be noncancelable. The change generally makes federal tenants financially responsible for the full firm terms of leases, even if they choose to vacate early, and may cause decreases in firm terms in future leases completed after fiscal year 2024. Brokers and GSA officials said that in general, shorter firm terms increase the costs of leases, as lessors typically pursue higher rental rates for shorter-term leases.

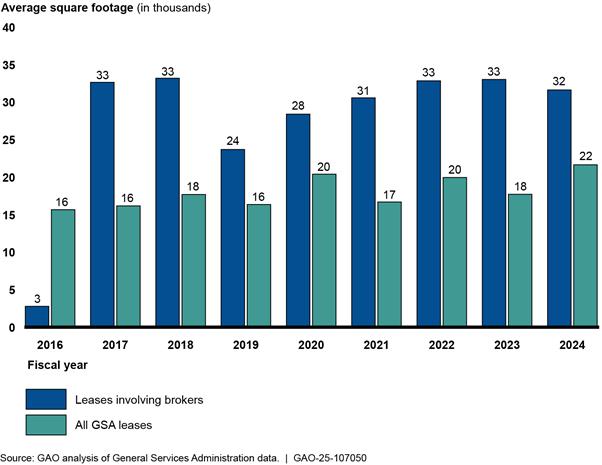

Size of Leased Space

The physical size of leased space—specifically, the average rentable square footage of leases—fluctuated year to year but generally increased for all GSA leases from an average of about 16,000 square feet per lease in fiscal year 2016 to an average of about 22,000 square feet per lease in fiscal year 2024. The average rentable square footage of leases involving brokers dropped in fiscal year 2019, but then recovered to pre-2019 levels. In general, the average rentable square footage for leases involving brokers was higher than for all GSA leases, at about 31,000 square feet per lease throughout the period (see fig. 3). GSA officials and brokers said that because federal tenants were uncertain about their future space needs, they may not have committed to changing the amount of space they lease.

Figure 3: Average Rentable Square Footage Per Lease for All General Services Administration (GSA) Leases and GSA Leases Involving Brokers, Fiscal Years 2016–2024

Notes: Leases include new leases; replacing leases; lease extensions; lease renewals; succeeding leases, which secure continued occupancy of the current premises without a break in occupancy under a new, negotiated contract; and superseding leases, which replace an existing lease prior to expiration. Our analysis focused on leases that GSA both initiated and completed from fiscal year 2016 through fiscal year 2024. Once GSA initiates a lease, the leasing process can take several years before a lease is completed. As a result, there are fewer completed leases in fiscal years 2016 and 2017 than later years. GSA completed other leases in fiscal years 2016 and 2017, but those leases were initiated prior to fiscal year 2016 and were outside of our scope.

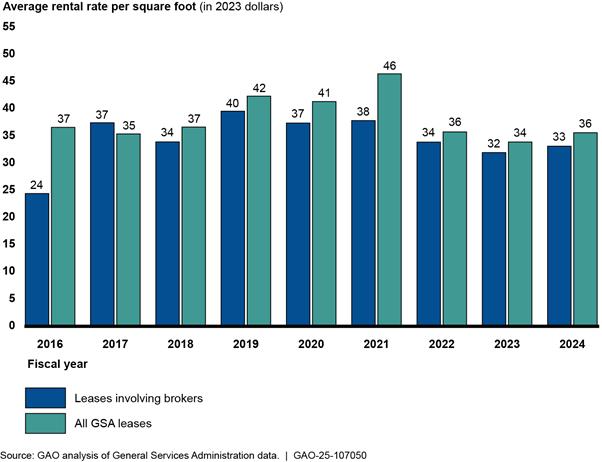

Rental Rates

Rental rates—specifically, the average negotiated rental rate per rentable square foot of a space—for all GSA leases generally peaked in fiscal year 2021 at about $46 and then decreased, when accounting for inflation.[24] The average negotiated rental rate of leases involving brokers showed a similar pattern, with a peak of about $40 per rentable square foot in fiscal year 2019 (see fig. 4).

Figure 4: Average Negotiated Rental Rate Per Rentable Square Foot in 2023 Dollars for All General Services Administration (GSA) Leases and GSA Leases Involving Brokers, Fiscal Years 2016–2024

Notes: Dollar values are inflation adjusted to 2023 dollars. Leases include new leases; replacing leases; lease extensions; lease renewals; succeeding leases, which secure continued occupancy of the current premises without a break in occupancy under a new, negotiated contract; and superseding leases, which replace an existing lease prior to expiration. Our analysis focused on leases that GSA both initiated and completed from fiscal year 2016 through fiscal year 2024. Once GSA initiates a lease, the leasing process can take several years before a lease is completed. As a result, there are fewer completed leases in fiscal years 2016 and 2017 than later years. GSA completed other leases in fiscal years 2016 and 2017, but those leases were initiated prior to fiscal year 2016 and were outside of our scope.

GSA officials and brokers identified several factors that may have affected rental rates since the start of the COVID-19 pandemic. They said that increases in the cost of construction and capital may have contributed to increases in rental rates. Some brokers told us that after the pandemic, demand in the leasing market for certain types of buildings decreased, which contributed to lower rental rates. Some GSA staff told us that some markets were slow to respond to decreased demand, which kept negotiated rates higher.

Commissions

GSA leases involving brokers include a standard commission earned by brokers.[25] The standard commission a broker earns is normally a percentage of the total lease value. In fiscal year 2020, brokers earned a total of about $18 million in standard commissions.[26] The total generally increased in subsequent years, as GSA completed more leases involving brokers and determined their commissions. In fiscal year 2024, brokers earned a total of about $39 million in standard commissions. Standard commission was about $99,000 per lease on average in fiscal year 2020 and about $176,000 per lease on average in fiscal year 2024.

GSA leases involving brokers also include a commission credit, which is the portion of the commission that is credited to the government. The broker foregoes this percentage of the commission in accordance with its awarded contract percentages. The commission credit is reflected as a reduction to the shell rent applied as a one-time lump sum deduction from the federal tenant’s rental payment. Or, if the amount is larger than the monthly rental payment, then the commission credit is paid to the federal tenant in monthly installments during the first few months of the lease.[27] In fiscal year 2020, commission credits totaled about $28 million. The total generally increased in subsequent years, with commission credits totaling about $55 million in fiscal year 2024. The commission credit was about $155,000 per lease on average in fiscal year 2020 and generally increased in subsequent years, reaching about $249,000 per lease on average in fiscal year 2024.

We previously reported on concerns about GSA’s commission structure for brokers. One such concern is potential conflicts of interest, as brokers may have the financial incentive to negotiate higher rental rates to increase their commission.[28] This conflict is inherent in any commission-based payment for services, including in the commercial real estate industry. GSA believes it has at least partially addressed this concern, because the brokers have committed to a cap on the amount of commission they retain. Another concern raised by stakeholders is that GSA could underestimate the cost of using brokers. While GSA does not pay brokers through appropriated funds, some stakeholders argue that the broker commission is a cost that is ultimately passed onto the federal tenant through the rental rate.[29] We have not assessed the effect of commissions on rental rates, and it is not within the scope of this review.

GSA’s Performance Metrics for Brokers Align with Key Practices, and Brokers Met Almost All Targets for Those Metrics

GSA’s Performance Metrics for Cost Avoidance and Schedule Link to Strategic Goals and Are Outcome-Oriented

GSA assesses brokers on cost avoidance, schedule, and other performance metrics outlined in the GLS Plus contract.[30] As described below, we found that GSA’s cost avoidance and schedule metrics align with selected key practices for procurement organizations that we identified in prior work.[31] Specifically, the metrics link to the strategic goals of the Public Buildings Service, the division of GSA responsible for leasing, and the metrics are outcome-oriented. Linking performance metrics to strategic goals enables agencies to ensure they are achieving their strategic goals and making good decisions. Outcome-oriented performance metrics enable organizations to measure the results of their procurement activities and to determine whether procurement teams are achieving desired outcomes, such as avoiding costs and staying on schedule.

Cost avoidance metric. GSA’s cost avoidance metric assesses how much money a broker helped GSA avoid spending when negotiating rental rates and helping federal tenants determine square footage needs.

· Negotiating rental rates. GSA calculates how much money a broker helped GSA avoid spending by negotiating rental rates below market rates, when there is sufficient market information to calculate a market rate for the area. GSA determines market rates using a tool called the “Bullseye” report. To develop the report, GSA gathers available market data from three commercial real estate sources and compiles these data for information, analysis, and insights regarding the local real estate submarket.[32]

· Determining square footage needs. GSA calculates how much money a broker helped GSA avoid spending by helping federal tenants reduce their square footage, as compared with the square footage of the prior space the tenant occupied. GSA assesses reductions in square footage when a broker works with federal tenants to determine square footage needs during the requirements development phase of the leasing process.

To assess a broker’s performance on cost avoidance, GSA calculates the percentage of a broker’s leases for which that broker achieved cost avoidance from negotiating rental rates and determining square footage needs. GSA also calculates a broker’s total cost avoidance as a weighted average of the number of leases for which a broker achieved cost avoidance and the dollar value of cost avoidance achieved. GSA compares these calculations with performance targets, which we discuss in more detail later in this report.

We found that the cost avoidance metric aligns with strategic goals and is outcome-oriented, in line with key practices for procurement organizations. Specifically, based on our analysis, the cost avoidance metric aligns with a goal in the Public Buildings Service’s strategic plan that aims to reduce costs in leasing, among other things. The cost avoidance metric is outcome-oriented because it enables GSA to quantitatively measure the extent to which brokers helped GSA achieve the outcome of reduced cost.

Schedule metric. GSA’s schedule metric assesses the timeliness of a broker’s actions. Specifically, GSA assesses:

· The extent to which the broker helps federal tenants find long-term solutions for space prior to the expiration of the existing leases. This performance metric calculates the percentage of the expiring leases that are replaced with long-term solutions, weighted by the dollar value of the leases.

· The extent to which the broker completes leasing work within established time frames.

We found that the schedule metric aligns with strategic goals and is outcome-oriented, in line with key practices for procurement organizations. Specifically, the schedule metric aligns with the Public Buildings Service’s initiative in the strategic plan to enhance the project delivery process, including enhancing the delivery experience for customers. The schedule metric is outcome-oriented because it allows GSA to quantitatively measure the extent to which brokers delivered leasing solutions in a timely manner.

Brokers Met Almost All Performance Targets for Cost Avoidance and Schedule

According to our analysis of GSA data, brokers met almost all performance targets for cost avoidance and schedule from the second half of calendar year 2020 through calendar year 2023.[33] Using the calculations for the cost avoidance and schedule metrics, GSA assigns each broker an overall rating of unsatisfactory, marginal, satisfactory, very good, or exceptional.[34] Each rating for the cost avoidance and schedule metrics is associated with a quantitative level of performance. For example, to achieve a “very good” rating for schedule, a broker must replace 61 percent to 70 percent of the leases it has been assigned to work on prior to the expiration of the associated existing leases. GSA officials told us that they developed the quantitative levels of performance based on past performance data and professional judgment. According to the GLS Plus contract, GSA’s target is for brokers to earn a rating of “satisfactory” or higher in each metric.

Cost avoidance target. GSA determines a broker’s rating on cost avoidance by the number of leases the broker completed under cost and the total dollar value of cost the broker avoided on its leases. To meet targets for cost avoidance a broker needs to earn at least a satisfactory rating.[35] According to GSA’s performance data, from the second half of calendar year 2020 through calendar 2023, four of the six brokers met the targets for cost avoidance in all periods in which they had completed leases. Two brokers did not meet targets for cost avoidance in the first half of calendar year 2023. In the second half of the year, one of these brokers improved its performance from “unsatisfactory” to “very good,” and the other broker did not have any completed leases in that zone for GSA to assess performance on this metric. See appendix I for a summary of GSA data on cost avoidance for fiscal years 2020 through 2023.

Schedule target. To earn a “satisfactory” rating or better for schedule, a broker must replace 51 percent or more of the leases it is assigned to work on prior to the expiration of the existing leases. According to GSA’s performance data, from the second half of calendar year 2020 through calendar year 2023, all six brokers met targets for schedule in all periods in which they had completed leases.

GSA Found That Exempting Brokers from Enhanced Competition Did Not Result in Cost Avoidance or Other Anticipated Benefits

GSA analyzed 16 projects that were exempt from enhanced competition over about a 2-year time frame and found that the exemption did not result in cost avoidance, improved broker performance, or a significantly shorter award process. GSA also found that the exemption resulted in substantial disparities in the number of task orders awarded to brokers beyond those 16 projects and a greater drop in enhanced competition than expected.

In 2008, Congress passed a law directing that the FAR be amended to require that each individual purchase of property or services above the simplified acquisition threshold made under a multiple award contract be made on a competitive basis, in which contractors would generally have notice and a fair opportunity to submit an offer.[36] This was referred to in the law as the enhanced competition requirement.

Pursuant to this law, GSA provided brokers an opportunity to propose competitive pricing on task orders with a commission value above the simplified acquisition threshold of $250,000.[37] According to GSA officials, this enhanced competition allowed brokers to revise pricing they established in their base contract and offer a lower commission percentage for task orders with a commission value above the simplified acquisition threshold. GSA awarded task orders to brokers based on the most competitive price for the task order, past performance, and expertise.

In 2019, Congress passed a law exempting leasing services from enhanced competition until December 31, 2025.[38] Pursuant to that law, in May 2020, GSA exempted brokers from providing competitive pricing for task orders with broker commissions under $2 million. Instead of awarding those task orders to brokers based on competitive pricing beyond the initial base contract pricing, GSA awarded them based on the base contract price, past performance, and expertise. GSA ended the exemption in February 2023. According to GSA, the agency was able to end the exemption at that time because Congress gave GSA the authority to exempt commercial leasing services from enhanced competition until 2025 but did not require GSA to do so.

GSA anticipated that exempting brokers from enhanced competition would result in additional cost avoidance, improved broker performance, and a shorter award process. According to GSA officials and some brokers, when proposing competitive pricing on task orders, brokers would seek to offer the lowest price and to do so, would assign less experienced, less skilled staff to perform the services described in the task order. While brokers generally met the cost avoidance performance targets outlined in the GLS Plus contract, these less skilled staff might negotiate higher lease rates than more skilled staff, resulting in increased costs. GSA anticipated that if brokers were exempt from price competition, they would not need to offer the lowest price and could afford more expensive, highly skilled staff who could negotiate lower lease rates, resulting in cost avoidance. In addition, according to GSA, brokers had advised that preparing price proposals for every task order above $250,000 was time-consuming. Therefore, after consulting with brokers, GSA reasoned that raising the threshold for price competition to $2 million could allow brokers and GSA to spend less time preparing and reviewing price proposals.

After exempting brokers from enhanced competition for task orders for over 2 years, GSA assessed 16 of the 544 projects that were exempt. GSA officials told us that they analyzed those 16 projects because they had been completed by the time GSA performed its analysis.[39] As discussed below, GSA found that the exemption did not result in anticipated benefits. Given the results of this analysis, GSA officials said they did not see value for the government in waiting for more projects to be completed to perform further analysis.

No observed cost avoidance. GSA’s analysis of the 16 projects found that exempting brokers from enhanced competition did not result in cost avoidance.[40] Specifically, for the five projects for which GSA was able to calculate cost avoidance, the exemption resulted in a cost of about $580,000—an expense to agencies for which GSA leases space.[41] Upon conclusion of the exemption, GSA determined that increasing competition would also likely increase the amount of commission credit that brokers forego to win a task order solicitation, which would lead to additional cost avoidance for task orders.[42]

Decline or no change in most brokers’ performance. GSA found that exempting brokers from enhanced competition resulted in a decline or no change in most brokers’ performance (see table 4). As discussed above, GSA assesses broker performance through metrics on cost avoidance and schedule.

Table 4: Changes in Broker Performance Ratings When the General Services Administration (GSA) Exempted Brokers from Enhanced Competition

|

Broker performance rating |

Number of brokers |

|

Performance improved |

1 |

|

Performance declined |

4 |

|

Performance remained constant |

3 |

|

Performance information not availablea |

2 |

Source: GAO analysis of GSA information. | GAO‑25‑107050

Note: While there are six brokers currently involved in GSA’s Leasing Support Services program, the number of brokers adds up to 10 because three of GSA’s designated geographic zones each had two brokers, while four brokers operated in the fourth geographic zone.

aAccording to GSA officials, GSA did not have enough data to assess the performance of two brokers in one of GSA’s designated geographic zones.

Slightly shorter award process. Some brokers and GSA officials said that exempting brokers from enhanced competition resulted in a slightly shorter task award process. Several GSA officials said that the exemption only reduced the length of the process—which can take several months—by about 3 to 5 days.

Disparity in task order awards. GSA found that exempting brokers from enhanced competition created disparities in the number of task orders awarded to brokers in some zones. For example, in one zone, GSA awarded 10 task orders to a small business broker, whereas GSA awarded 150 task orders to a larger broker in the same zone.[43] Another broker explained that such a disparity in task order awards existed in other zones as well. According to GSA, the primary reason for the disparity was the larger broker’s lower base contract prices; both brokers had the resources to support contract requirements and exceptional past performance. During the time frame of the exemption, for task orders below the $2 million threshold, GSA generally awarded task orders to the broker that had the lowest base contract pricing. Brokers that were awarded more task orders told us they had no issue with the exemption. Other brokers told us they were negatively affected by the exemption. One broker also told us that since February 2023, when GSA returned to competitive pricing on task orders, rebidding has created additional work for brokers—especially those that do not have the same resources as larger firms—as they have needed to reprice the base contract price. According to the broker, however, this has not been a significant negative effect of ending the exemption.

Substantial drop in enhanced competition. When GSA exempted brokers from enhanced competition, brokers competed for very few task orders. Specifically, brokers competed for about 0.5 percent of projects awarded (three of 547 projects). If the threshold had been $250,000, as it was before the exemption, then approximately 11 percent of the projects (about 60 of the 547 projects) would have been subject to competition. According to GSA officials, the drop in competition during the exemption was greater than they expected.

In February 2023, after conducting its analysis of the exemption from enhanced competition, GSA ended the exemption because it did not achieve anticipated benefits, as described above. GSA returned to providing brokers the opportunity to compete for all task orders with commission values above the simplified acquisition threshold of $250,000.[44] GSA officials told us that competing task orders above the simplified acquisition threshold is in the best interest of the federal government.

Agency Comments

We provided a draft of this report to GSA for review and comment. GSA provided technical comments, which we incorporated as appropriate. We also sent relevant excerpts of the report to the Federal Bureau of Investigation, the Internal Revenue Service, the Social Security Administration, and all six brokers. The Federal Bureau of Investigation, the Internal Revenue Service, the Social Security Administration did not provide any comments. Four brokers provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the appropriate congressional committees, the Administrator of the General Services Administration, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at (202) 512-2834 or marronid@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix II.

David Marroni

Director, Physical Infrastructure

General Services Administration’s (GSA) cost avoidance metric assesses how much money it avoided spending when negotiating lease rental rates and helping federal tenants determine square footage needs. Below, we present the cost avoidance resulting from leases involving brokers and leases involving only GSA staff (without any broker involvement). However, these metrics cannot be used to compare the cost avoidance achieved by GSA staff with the cost avoidance achieved by brokers. The amounts of cost avoidance from brokers and GSA staff are not comparable because GSA staff are involved in leases negotiated by brokers; therefore, it is not possible to identify what proportion of cost avoidance is directly attributable to the brokers. Furthermore, leases involving brokers are generally high dollar-value leases while leases involving only GSA staff are generally low dollar-value leases. This means that the relative magnitude of cost avoidance for leases involving brokers will be higher than for leases negotiated by GSA staff.

We did not assess GSA’s cost avoidance estimates. Our analysis is based on our tabulations of GSA’s calculations of cost avoidance.

Leases Involving Brokers

According to our tabulations of GSA’s calculations of cost avoidance, leases involving brokers resulted in about $3.2 billion in cost avoidance from fiscal year 2020 through fiscal year 2023. Of this amount, about

· $2.1 billion in cost avoidance was from negotiating rental rates below market rate. There were 278 leases involving brokers below market rate and 181 above market rate.

· $1.1 billion in cost avoidance was from reducing rentable square footage.

Leases Involving Only GSA Staff

According to our tabulations of GSA’s calculations of cost avoidance, leases involving only GSA staff resulted in about $78 million in cost avoidance. Of this amount, about

· $42 million in cost avoidance was from negotiating rental rates below market rate. During this period, 157 leases not involving brokers were below market rate and 280 above market rate.

· $35 million in cost avoidance was from reducing rentable square footage.

GAO Contact

David Marroni, 202-512-2834 or marronid@gao.gov

Staff Acknowledgments

In addition to the contact named above, Roshni Davé (Assistant Director), Kieran McCarthy (Analyst in Charge), Kevin Barsaloux, Terence Lam, Rebecca Morrow, Josh Ormond, Guisseli Reyes-Turnell, Minette Richardson, Laurel Voloder, Alicia Wilson, and Elizabeth Wood made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on Facebook, Flickr, X, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

Congressional Relations

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S. Government Accountability Office, 441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

Sarah Kaczmarek, Managing Director, KaczmarekS@gao.gov, (202) 512-4800, U.S.

Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Strategic Planning and External Liaison

Stephen J. Sanford, Managing

Director, spel@gao.gov, (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814, Washington,

DC 20548

[1]GAO, Federal Leasing: Quality Information and Metrics Would Allow GSA to Better Assess the Value of Its Broker Program, GAO‑20‑361 (Washington, D.C.: Mar. 31, 2020); Federal Real Property: GSA Should Clarify Savings Goals for the National Broker Contract Program, GAO‑14‑14 (Washington, D.C.: Oct. 31, 2013); and GSA Leasing: Initial Implementation of the National Broker Services Contracts Demonstrates Need for Improvements, GAO‑07‑17 (Washington, D.C.: Jan. 31, 2007). We made a total of 14 recommendations in these reports to improve GSA’s management of the broker program and how it measures program performance. GSA has implemented 11 of these recommendations. GSA did not implement three recommendations—from the 2007 report—related to broker practices that could create conflicts of interest and to GSA’s use of federal information security controls. In our 2013 report, we reported on some actions GSA had taken to address conflict of interest concerns.

[2]The GLS and GLS Plus contract vehicles consist of indefinite-delivery, indefinite-quantity contracts awarded to multiple contractors. Agencies may use this type of contract when they do not know the exact quantities and delivery times of needed products and services at the time of contract award. Once awarded, an agency places orders against the contract for specific products or services as needs arise. The order generally must be competed, through fair opportunity, among all the contract holders. Throughout this report, we refer to the GLS and GLS Plus contract vehicles as the GLS and GLS Plus contracts, respectively.

[3]See National Defense Authorization Act for Fiscal Year 2020, Pub. L. No. 116-92, § 893, 133 Stat. 1198, 1540 (2019). In 2008, Congress passed a law directing the amendment of the Federal Acquisition Regulation (FAR) to require that each individual purchase of property or services above the simplified acquisition threshold under a multiple award contract be made on a competitive basis in which contractors would generally have notice and a fair opportunity to submit an offer. Duncan Hunter National Defense Act for Fiscal Year 2009, Pub. L. No. 110-417, § 863, 122 Stat. 4356, 4547 (2008) (codified as amended at 41 U.S.C. § 3302). This was referred to in the law as the “enhanced competition” requirement. For the purposes of this report, we refer to this requirement as “enhanced competition.” As implemented in the FAR, this requirement may also be referred to as “fair opportunity.” FAR 16.505(b)(1)(iii).

[4]GAO, Federal Real Property: Agencies Need New Benchmarks to Measure and Shed Underutilized Space, GAO‑24‑107006 (Washington, D.C.: Oct. 26, 2023).

[5]National Defense Authorization Act for Fiscal Year 2020, § 893. This Act includes a provision for GAO to conduct reviews on GSA’s use of brokers on a recurring basis for a certain period. We issued a report in March 2020 to meet the Act’s requirements for the first review and submission of the first report no later than September 2022. See GAO‑20‑361.

[6]For the purposes of this report, we refer to the minimum performance standards in the GLS Plus contract as targets.

[7]We performed electronic testing to assess the reliability of data, including identifying missing values. We also reviewed documentation on the data and interviewed officials knowledgeable about the data.

[8]We focused our analysis on lease types for which GSA obtained new leased space (new and replacing leases), or for which GSA modified or continued the use of currently leased space (renewals, extensions, succeeding leases, and superseding leases). We did not capture lease actions, such as step rent increases, for which leased space was not obtained or modified or an existing lease continued. Throughout this report, we use the term “leases” to include new leases, replacing leases, lease extensions, lease renewals, succeeding leases, and superseding leases.

[9]We did not assess the quality of the performance metrics included in the GLS Plus contract, such as whether performance targets for brokers were reasonable.

[10]GAO, Federal Contracting: Senior Leaders Should Use Leading Companies’ Key Practices to Improve Performance, GAO‑21‑491 (Washington, D.C.: July 27, 2021). This report includes one more key practice that calls for procurement leaders at federal agencies to collaborate with internal stakeholders, particularly end users, when developing performance metrics. We did not include this key practice in our review because the development of performance metrics was not within our scope.

[11]We selected the seven regional offices to obtain diversity in locations and in the number of leases. We selected the three federal tenants because they have a large number of leases, amount of square footage, and annual rent in space leased by GSA. Officials from these agencies were not able to provide perspectives on working with brokers because they said that they generally did not work with brokers directly.

[12]According to GSA, cost avoidance is how much cost GSA was able to avoid by negotiating leases below market rates, reducing leased square footage, and moving to federally owned space.

[13]All the financial figures in this report are in nominal dollars unless indicated otherwise.

[14]GSA categorizes leases as high, moderate, or low dollar-value depending on their square footage and location within or outside a large urban area. For example, high dollar-value leases are those leases above 2,000 square feet and in the 100 largest urban areas.

[15]The performance period of the GLS Plus contract is 1 year with four 1-year option periods. Exercising an option is a unilateral right of the government.

[16]Brokers may also calculate agency utilization rates per the tenant agency’s established standards and provide space-efficient solutions to assist agencies in greater alignment with GSA and tenant agency standards, as necessary.

[17]FAR 7.503.

[18]We use the term “leases” to include new leases, replacing leases, lease extensions, lease renewals, succeeding leases, and superseding leases. Leasing activity refers to the lease-related data we discuss in this objective: the number of leases, the length of leases, the size of leased space, and lease rental rates

[19]Our analysis shows an increase in the number of leases from fiscal year 2016 to fiscal year 2018. However, our analysis focused on leases that GSA initiated and completed from fiscal year 2016 through fiscal year 2024. Once GSA initiates a lease, the leasing process can take several years before a lease is completed. As a result, there are fewer completed leases during the earlier years of our analysis than later years. For example, GSA initiated and also completed only one broker-involved lease in fiscal year 2016.

[20]About half of the leases in our data had a firm term. Of the leases without firm terms, most were extensions and renewals, and most were completed before 2020.

[21]GSA did not have any leases with firm terms for fiscal years 2016 or 2018, and GSA had fewer than 20 leases with firm terms in fiscal years 2017 and 2019 at the time of our analysis.

[22]Occupancy agreements are written agreements describing the financial terms and conditions under which GSA assigns, and a tenant agency occupies, the GSA-controlled space. 41 C.F.R. § 102-85.35.

[23]The Public Buildings Act Amendments of 1972 established the Federal Buildings Fund into which GSA deposits rent collected from tenant agencies. Pub. L. No. 92-312, § 3, 86 Stat. 216, 218 (June 14, 1972) (codified as amended at 40 U.S.C. § 592). Congress annually provides obligational authority to GSA for use of the Federal Building Fund’s resources for the construction, operation, and maintenance of assets in its buildings portfolio. GSA has established regulations to set forth its policy and principles for the assignment and occupancy of space under its control and the rights and obligations of GSA and the tenant agencies that request or occupy such space pursuant to occupancy agreements. 41 C.F.R. § 102-85.10. Spaces designated as cancelable in occupancy agreements may be terminated by tenant agencies when certain conditions are met, including written notice to GSA at least 120 days prior to termination. 41 C.F.R. § 102-85.75.

[24]All rent per rentable square foot values are in 2023 dollars.

[25]Under the GLS contract, which was replaced by the GLS Plus contract in 2020, the total commission sometimes included a “best value” commission that was a performance incentive that a broker could earn on top of the standard commission. In fiscal year 2017, the total of the best value commissions that brokers earned was about $53,000. The current GLS Plus contract does not include a best value commission.

[26]Fiscal year 2016 data included only one completed lease under the GLS broker contract— an extension with a standard commission value of about $1,300. In fiscal years 2017, 2018, and 2019, the proportion of lease extensions that brokers completed was higher than for the entire period. Because the average commission on extensions was lower than for other lease types, the commission values for these fiscal years was lower. For this reason, we report on commissions starting in fiscal year 2020.

[27]Shell rent is rent for the building shell, the base-building systems, and the finished common areas.

[30]The FAR requires that performance-based contracts for services include measurable performance standards (in terms of quality, timeliness, quantity, etc.) and the method of assessing contractor performance against performance standards. FAR 37.601. The FAR section that establishes procedures for agency evaluations of contractor past performance generally requires that agencies assess a contractor’s cost control and schedule/timeliness. FAR 42.1503(b)(2). The FAR also requires agencies to evaluate a contractor’s quality, management, and small business subcontracting. Id. We did not focus on quality, management, and small business subcontracting for our review as cost avoidance and schedule relate more directly to performance of individual leases and any efficiencies brokers provide.

[31]GAO‑21‑491. We compared performance metrics for brokers in the GLS Plus contract with two key practices identified in our prior work. We did not assess the quality of the performance metrics, such as whether performance targets for brokers were reasonable.

[32]Our previous work identified issues with GSA data systems and cited some concerns with the Bullseye report—specifically, with its accuracy; its timeliness, given the lengthy lease procurement process; and the quality of data used in it. See GAO‑20‑361. We recommended that GSA take steps to improve the accuracy of its data, and GSA did so by updating inaccurate data in its system and creating a monitoring program with its regional offices to ensure data accuracy. GSA officials said that the Bullseye report is the best available tool to determine market rental rates, as it uses market data from three sources—CoStar, Moody’s, and CBRE-EA—to determine the market rate for the lease. The market rate is one input for the total value of the lease that is used in the lease cost relative to market calculations. Officials told us that the total value of the lease reflects additional factors, such as tenant improvement allowances, concessions (additional incentives given by the landlord such as funding toward building out the rentable space), step rents (rent changes built into the lease contract), property taxes, and inflation assumptions.

[33]We chose this period as it was the earliest available start and last full year of performance data available for brokers participating in the GLS Plus contract.

[34]See also FAR 42.1503.

[35]To earn a satisfactory rating or better for cost avoidance in terms of the number of leases, brokers must achieve some amount of cost avoidance on at least 51 percent of their leases. To earn a satisfactory rating or better in terms of the dollar amount of savings, brokers must achieve at least 10 percent cost avoidance as the percentage of the total value of all their leases. A broker’s overall rating is the weighted average of these values with the dollar amount weighted twice as much as the number of leases.

[36]Duncan Hunter National Defense Act for Fiscal Year 2009, Pub. L. No. 110-417, § 863, 122 Stat. 4356, 4547 (2008) (codified as amended at 41 U.S.C. § 3302); FAR 16.505(b)(1)(iii).The GLS Plus contract is a multiple award indefinite delivery/indefinite quantity contract, which is a type of contract agencies may use when they do not know the exact quantities and delivery times of needed products and services at the time of contract award. Once awarded, an agency places orders against the contract for specific products or services as needs arise.

[37]The simplified acquisition threshold is generally $250,000 as of March 2025. FAR 2.101.

[38]National Defense Authorization Act for Fiscal Year 2020, Pub. L. No. 116-92, § 893, 133 Stat. 1198, 1540 (2019).

[39]We did not assess the methodology GSA used to perform its analysis.

[40]Cost avoidance is how much money a broker helped GSA avoid spending by (1) negotiating rental rates below market rate, and (2) reducing square footage and vacant space.

[41]Of the 16 projects GSA analyzed, GSA calculated cost avoidance for five of them. According to GSA officials, they could not calculate cost avoidance for the other 11 projects because cost avoidance can only be calculated after leases are effective, and the leases were not effective yet. Further, for the other 11 projects, GSA did not have market rate information to compare with negotiated rental rates, or there was not a reduction in square footage for the lease, such that GSA could not assess the lease on that metric.

[42]The commission credit is the portion of the commission that is credited to the government, reflected as a deduction in the shell rent, as specified in the lease contract.

[43]A broker is considered a small business if its annual revenue is under $15 million. 13 C.F.R. § 121.201.

[44]GSA’s decision to end the exemption means that GSA is once again under the requirements of FAR 16.505(b)(1)(iii), which would otherwise apply to GSA broker contracts if not for the 2019 law.