DEBT LIMIT

Statutory Changes Could Avert the Risk of a Government Default and Its Potentially Severe Consequences

Report to Congressional Committees

United States Government Accountability Office

View GAO-25-107089. For more information, contact Michael E. Clements at (202) 512-8678 or clementsm@gao.gov.

Highlights of GAO-25-107089, a report to congressional committees.

Statutory Changes Could Avert the Risk of a Government Default and Its Potentially Severe Consequences

Why GAO Did This Study

To meet the federal government’s borrowing needs, Treasury issues debt in the form of bills, notes, and bonds. These securities play a vital role in U.S. and global financial markets. Congress imposes a legal limit on federal borrowing, known as the debt limit. In recent years, when outstanding debt has reached the limit, extended congressional negotiations have frequently brought the federal government close to being unable to continue paying its obligations. If Treasury exhausts its borrowing authority and runs out of cash to continue paying government obligations, a default will occur.

GAO prepared this report as part of its continuing efforts to assist Congress in addressing challenges related to the debt limit. This report examines (1) factors related to the debt limit that expose the U.S. to a potential default, (2) immediate consequences of a U.S. default for the U.S. financial system, and (3) longer-term consequences of a U.S. default for the economy. GAO reviewed academic literature and agency documents and interviewed agency officials, economists, and market participants from banks, money market funds, and rating agencies, among others.

What GAO Recommends

GAO previously outlined alternatives to the current debt limit process and recommends that Congress consider immediately replacing it with an approach that links debt decisions to spending and revenue decisions at the time they are made.

What GAO Found

The current debt limit process separates decisions on revenue and spending from decisions on debt. As a result, the government periodically runs out of borrowing authority needed to pay existing, legally committed obligations. The Department of the Treasury has used extraordinary measures, which can temporarily free up existing borrowing authority, and cash on hand to continue making payments. However, these resources are limited and eventually run out. Predictions about when the government will no longer be able to pay all of its obligations—the “X-date”—are inherently imprecise due to the unpredictable size and timing of federal cash flows. Consequently, last-minute negotiations on the debt limit can increase the risk of a default. Further, these negotiations do not directly tackle structural spending and revenue levels that contribute to the growing debt.

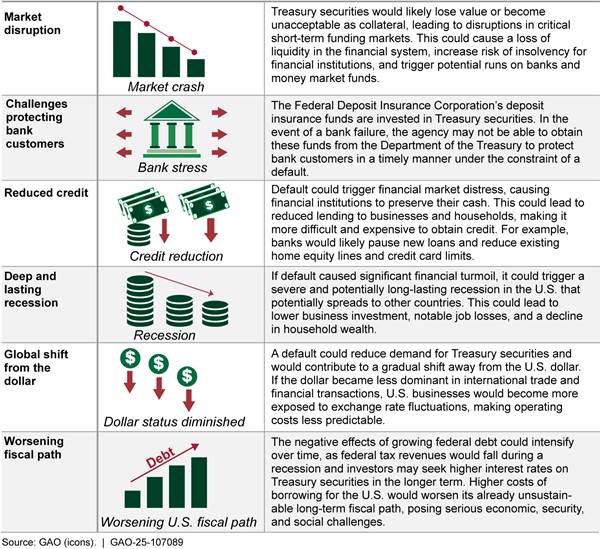

A default would disrupt financial markets, with immediate, potentially severe consequences for businesses and households. A default could also inflict long-lasting damage to the U.S. and global economies (see figure).

Abbreviations

|

FDIC |

Federal Deposit Insurance Corporation |

|

Federal Reserve |

Board of Governors of the Federal Reserve System |

|

GDP |

gross domestic product |

|

IMF |

International Monetary Fund |

|

SIFMA |

Securities Industry and Financial Markets Association |

|

TMPG |

Treasury Market Practices Group |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

December 11, 2024

The Honorable Sheldon Whitehouse

Chairman

Committee on the Budget

United States Senate

The Honorable Brendan Boyle

Ranking Member

Committee on the Budget

House of Representatives

In recent years, delays in raising the debt limit have led to impasses, where the debt reached the statutory limit and Congress did not immediately raise or suspend the limit. Such impasses have created a risk of the government defaulting on its debt and other obligations and caused significant uncertainty about the safety of Treasury securities, which play a vital role in U.S. and global financial markets. Congress sets a legal limit on the total amount of federal debt that can be outstanding at one time, known as the debt limit. While this limit restricts the Department of the Treasury’s borrowing authority, it does not limit the need to issue debt as a result of congressional decisions about spending and revenue. As a result, the current process allows Congress to increase spending or cut taxes without providing Treasury sufficient borrowing authority to finance these decisions.

Because Treasury securities are widely regarded as among the world’s safest assets, they are broadly used in financial transactions and held by a diverse range of governments, financial institutions, businesses, and individuals, including in pension funds and mutual funds. With the current debt limit suspension ending on January 1, 2025, Congress will need to provide Treasury authority to borrow to pay existing obligations.[1] If Congress does not take timely action, another impasse could ensue and risk a default.

We prepared this report at the initiative of the Comptroller General. This report is part of our continuing efforts to help Congress address challenges related to the debt limit and to improve the sustainability of federal debt. This report examines (1) factors related to the debt limit that expose the U.S. to a potential default, (2) immediate consequences of a U.S. default for the U.S. financial system, and (3) longer-term consequences of a U.S. default for the economy.

To address these objectives, we reviewed past transcripts of the Federal Reserve System’s Federal Open Market Committee conference calls, which included descriptions of potential procedures that Treasury might direct the Federal Reserve to implement to handle government payments in the event of a U.S. default.[2] We also reviewed Congressional Research Service and Congressional Budget Office reports, as well as prior GAO reports on past debt limit impasses and resolutions.[3] We interviewed staff from Treasury, the Board of Governors of the Federal Reserve System (Federal Reserve), Federal Reserve Bank of New York, Federal Deposit Insurance Corporation (FDIC), and Office of the Comptroller of the Currency.

We also interviewed representatives of the three major credit rating agencies, 17 financial market participants (representing primary dealers, banks, money market funds, clearing banks, hedge funds, and data processing vendors), and the Securities Industry and Financial Markets Association (SIFMA). We selected financial market participants for interviews to achieve diversity in the types of institutions, their size measured by total assets, and their participation in the Treasury market, including their holdings of Treasury securities. In addition, we interviewed researchers from the International Monetary Fund (IMF); 13 economists in industry and academia; and a legal expert on sovereign debt. We generally selected economists who are knowledgeable and recognized in their field and have published at least two papers or books on financial markets and the macroeconomy. The views expressed in these interviews are not generalizable to all market participants or market observers. For the purpose of this report, we use “some” to refer to three to five interviewees, “several” for more than five but less than half of the interviewees, and “most” for more than half of the interviewees.

To address the first objective, we reviewed contingency plan documents from two organizations: the Treasury Market Practices Group (TMPG) and SIFMA.[4] We analyzed Treasury documents and relevant laws from January 2011 through June 2023 to identify dates when the U.S. reached the debt limit and the limit was raised or suspended. We also identified the estimated dates when the government would exhaust its cash, borrowing authority, or available extraordinary measures to continue to make payments for Treasury debt and other obligations.

To address the second and third objectives, we reviewed academic and IMF research on financial and economic consequences of past financial crises and sovereign defaults and the role of Treasury securities and the U.S. dollar in the global economy.[5] To identify the research, we searched for articles and reports published since 2007, including peer-reviewed articles, working papers, and government agency reports. We searched for keywords related to the debt limit, sovereign default, and financial market spillovers, among other things. We also reviewed research conducted by agencies, IMF, and financial industry researchers that estimated the potential financial and economic consequences of a U.S. default.[6] Moreover, we reviewed FDIC’s default response plan. To understand the potential effect of a U.S. default on the federal fiscal outlook and the role of the U.S. dollar in the global economy, we reviewed related reports from GAO, the Congressional Research Service, and the Congressional Budget Office.[7]

In addition, we examined the following data to understand the U.S. and global financial and economic consequences that could potentially result from a U.S. default:

· Federal Reserve data on holdings of Treasury securities by holder type;

· Census Bureau data on inflation-adjusted median household income from 2007 to 2016;

· Bank for International Settlements data on total credit to the private, nonfinancial sector as a share of gross domestic product (GDP) from 2007 to 2021;

· Office of Management and Budget data on federal receipts as a share of GDP from fiscal years 2007 to 2014; and

· IMF data on foreign currency reserves, to determine the share of reported reserves held in U.S. dollars from 2000 through 2023.[8]

We conducted this performance audit from September 2023 to December 2024 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

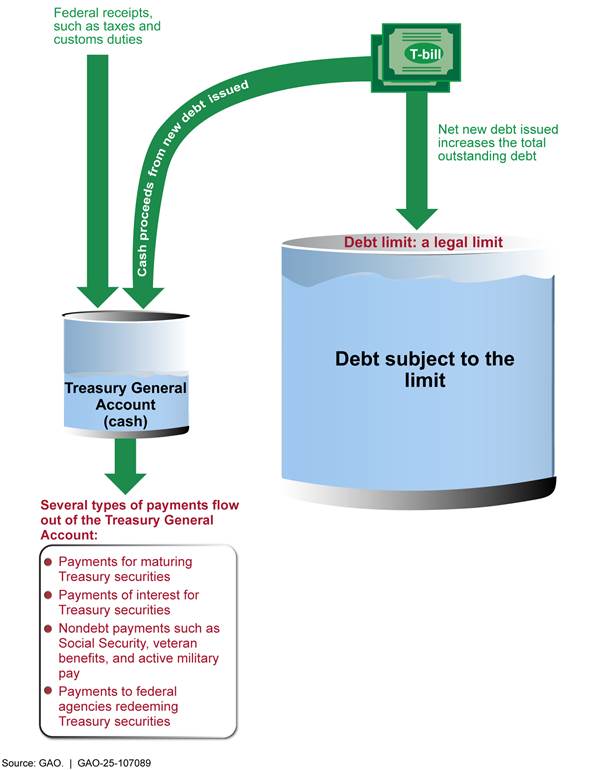

Treasury General Account and Debt Subject to the Limit

Treasury maintains an operating balance in the Treasury General Account, which is equivalent to a checking account for the federal government. The account is maintained at the Federal Reserve Bank of New York.[9] The Treasury General Account receives deposits of taxes and proceeds from the sale of Treasury securities and makes payments for government obligations, including payments on outstanding debt. The Treasury General Account balance fluctuates on a daily basis. Treasury must borrow by issuing Treasury securities to generate funds when government spending exceeds revenue. The amount of federal debt outstanding cannot exceed the statutory debt limit set by Congress.

The debt limit is not a control on the amount of government spending but rather a limit on the total amount of federal debt that can be outstanding. It is an after-the-fact threshold that restricts Treasury’s borrowing authority to finance already-enacted spending and revenue decisions made by Congress and the President. In effect, borrowing allows the government to meet existing, legally committed obligations, such as Social Security and Medicare benefits, military salaries, interest on the national debt, and tax refunds. Raising the debt limit does not authorize new spending.

The debt subject to the limit comprises two categories: debt held by the public and debt held in government accounts. Debt held by the public primarily consists of Treasury-issued securities, including Treasury bills, notes, and bonds, which are sold through regular auctions Treasury conducts.[10] Debt held in government accounts consists of investments in special Treasury securities made by trust funds, such as those for Social Security, civil service retirement, and Medicare, as well as FDIC’s Deposit Insurance Fund and the Department of Labor’s Unemployment Trust Fund. All of this debt counts toward the debt limit.

Debt Limit Impasse, Extraordinary Measures, X-Date, and Default

Under current law, when outstanding debt reaches the statutory limit and Treasury runs out of cash to finance government commitments already made, Congress must pass legislation to avoid default. Congress can (1) increase the debt limit, (2) suspend the debt limit, or (3) abolish the debt limit. From 2011 through 2023, there were 12 debt limit impasses, which were resolved by increases or temporary suspensions of the debt limit.

During debt limit impasses, Treasury must manage the level of cash on hand and borrowing so that it does not breach the debt limit. To continue to pay government obligations, including payments on outstanding debt, Treasury can draw down the Treasury General Account balance and continue to make payments as they come due (see fig. 1). Treasury also can temporarily use what are termed extraordinary measures. These measures either reduce the amount of outstanding debt subject to the limit or suspend or postpone certain future increases in debt subject to the limit. For example, Treasury can suspend investment of government employee retirement contributions in the Federal Employees’ Thrift Savings Plan Government Securities Investment Fund (known as the G-Fund). It also can redeem certain existing investments of and suspend new investment in the Civil Service Retirement and Disability Fund.

When the outstanding debt is near or at the statutory limit, Treasury typically estimates a date or a range of possible dates for when the government will no longer have sufficient cash, borrowing authority, or available extraordinary measures to make timely payments on Treasury debt or other federal obligations. This date is commonly referred to as the X-date. For the purposes of this report, the U.S. would be considered in default if it reached the X-date and did not make timely payments on Treasury debt obligations. A default also would hinder making nondebt payments, such as program benefits, contractual services and supplies, and federal employees’ salaries.

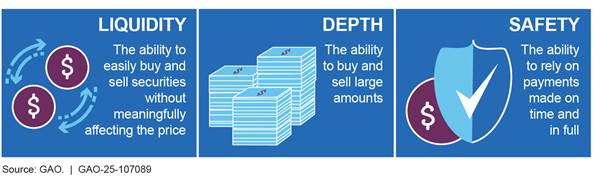

The Treasury Securities Market

Treasury securities have three key characteristics that support the broad-based demand for them: liquidity, depth, and safety (see fig. 2).

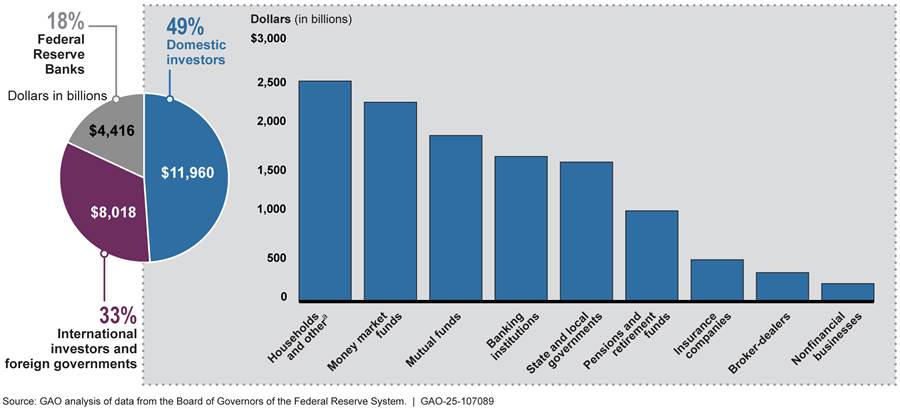

Treasury securities are held by a wide variety of public and private investors in the U.S. and abroad (see fig. 3). Among domestic investors, the top holders of Treasury securities as of December 2023 included households, money market funds, mutual funds, and banking institutions.[11]

Figure 3: Public and Private Investors Holding Treasury Securities in the U.S. and Abroad, December 2023

Notes: These sectors are defined by the Federal Reserve. Domestic investors may include foreign-owned institutions based in the U.S., while international investors may include U.S.-owned institutions based outside the U.S. The data include Treasury marketable securities only and generally do not include intragovernmental holdings. These securities can be sold on secondary markets and include Treasury bills, notes, and bonds.

aThe households and other category encompasses individual households and entities such as nonprofit organizations, domestic hedge funds, issuers of asset-backed securities, and government-sponsored enterprises.

|

Repurchase Agreements A repurchase agreement, or “repo,” is a financial transaction in which an institution borrows funds from an investor using a security as collateral and commits to repurchasing the security later for a higher price. The difference between the initial sale price and the repurchase price represents the interest paid on the loan. Repos rely heavily on Treasury securities as collateral. Source: GAO. | GAO‑25‑107089 |

Investors hold Treasury securities for a variety of reasons, including cash and liquidity management, collateral, hedging, and long-term buy-and-hold investments. For example, Treasury securities serve as a close substitute for cash for financial institutions and corporate treasurers. They are one of the least expensive and most widely used forms of collateral for financial transactions, including repurchase agreements, or “repos.” On December 29, 2023, over $4.7 trillion in repo transactions were processed by a clearinghouse or custodian bank, according to data from the Office of Financial Research.[12] Further, Treasury securities serve as a benchmark for pricing many other financial products, such as corporate bonds, derivatives, and mortgages.[13]

Prior GAO Recommendations to Replace the Current Debt Limit Process

In previous reports, we made recommendations designed to help Congress improve its approach to delegating borrowing authority and to inform fiscal policy debate in a more timely way. Specifically, we have recommended that Congress consider adopting an approach to limit debt that both (1) minimizes disruptions to Treasury and financial markets and (2) better links decisions about the debt limit with decisions about spending and revenue at the time those decisions are made.[14] In 2015, we identified three alternatives to the current debt limit process. All of the alternatives meet these two criteria and maintain congressional control and oversight over federal borrowing:

· Alternative 1: Link action on the debt limit to the budget resolution.

· Alternative 2: Provide the administration with the authority to increase the debt limit, subject to a congressional motion of disapproval.

· Alternative 3: Delegate broad authority to the administration to borrow as necessary to finance laws enacted by Congress and the President.

Eliminating the current debt limit process does not prevent Congress from enacting policies that improve the sustainability of the nation’s fiscal path. In previous work, we reported that fiscal rules and targets can help manage debt by controlling spending and revenue.[15] Integrating these rules and targets into budget discussions can ensure their ongoing use and provide for a built-in enforcement mechanism. We identified key considerations, such as flexibility for national emergencies, to help Congress adopt new fiscal rules and targets. As of October 2024, Congress had not implemented a debt limit process that better links decisions about the debt limit with decisions about spending and revenue at the time those decisions are made.

Uncertainties and Operational Complexities Raise the Risk of Default

Negotiating the Debt Limit Close to an Inherently Uncertain X-Date Increases the Risk of Default

The current debt limit process, which separates budgetary decisions on revenue and spending from decisions on Treasury’s borrowing authority, exposes the country to an unnecessary risk of default. This is partly due to the uncertainty of projecting an X-date, which is inherently imprecise and subject to revision due to unpredictable federal cash flows. If unexpected outflows deplete the Treasury General Account’s cash balance more quickly than expected during a debt limit impasse, or cash receipts are lower than planned, Treasury’s ability to meet government obligations may be compromised earlier than projected, leaving Congress with limited time to act and avoid default. Treasury officials stated that given these uncertainties, waiting until the projected X-date is near to raise or suspend the debt limit creates a substantial risk of default.

Some federal cash flows, such as quarterly corporate income tax receipts and beginning-of-month Medicare payments, have predictable timing but unpredictable amounts. For example, during the 2015 debt limit impasse, weaker-than-expected September tax receipts contributed to decreases in Treasury’s projected resources, causing the projected X-date to shift from November 5 to November 3.

|

Federal Government Accounts Invested in Treasury Securities Federal government accounts invested in Treasury securities support a wide range of federal programs. The accounts with some of the largest holdings of securities include trust funds that support Social Security, Medicare, and highway construction. As of the end of fiscal year 2023, the federal government reported that approximately $6.8 trillion of debt was held by government accounts. Source: GAO. | GAO‑25‑107089 |

Some federal intragovernmental transfers are unpredictable in their size or timing, which also can unexpectedly alter the X-date range. These unpredictable investments increase the amount of the outstanding debt subject to the debt limit.

For example, the Department of Defense receives an annual transfer from Treasury for the Military Retirement Fund, a portion of which can be invested in Treasury securities, directly increasing the outstanding debt, according to Treasury officials. The annual transfer was approximately $131 billion in fiscal year 2023 and approximately $171 billion in fiscal year 2024, according to budget documents.[16] Treasury officials stated that if the entire annual transfer were invested in Treasury securities during a debt limit impasse, it could cause the government to unintentionally exceed the debt limit.

Moreover, during a debt limit impasse, Treasury may need to manage the investment of appropriations under newly passed legislation. For example, during the 2021 impasse, in response to the Infrastructure Investment and Jobs Act enacted on November 15, 2021, Treasury transferred $118 billion to the Highway Trust Fund on December 15, 2021. According to Treasury, these funds were then invested in Treasury securities that counted against the debt limit. At the time, Treasury stated that it could make this transfer but might not have sufficient resources to finance the government’s operations beyond December 15. The Congressional Budget Office reported in November 2021 that Treasury might have been able to fund the government beyond December 15 had it been able to defer part or all of the investment of those funds.[17]

Treasury officials also told us that they may receive little advance notice for some large payments, potentially in the billions of dollars. For example, one of Treasury’s payment systems permits same-day agency payments to external recipients. Treasury officials told us that while they can disable same-day fund drawdowns by agencies, which they would consider if approaching the projected X-date, this measure has never been tested. In addition, officials stated that unexpected payments would disrupt projections of the government’s total remaining resources.

Complicating matters further, Treasury officials told us their debt processing systems have a lag in reflecting total outstanding debt until the next morning. Treasury officials also stated that they typically would not know the exact Treasury General Account balance until later in the evening, due to activity that may not settle until the close of the business day (eastern time). This means there could be uncertainty in how much room was left under the debt limit and how much available cash Treasury had on hand. As a result, Treasury might only discover the next morning that it did not have sufficient resources to meet government obligations and that the X-date had already passed. By this point, it would be too late for Congress to act to avoid a default.

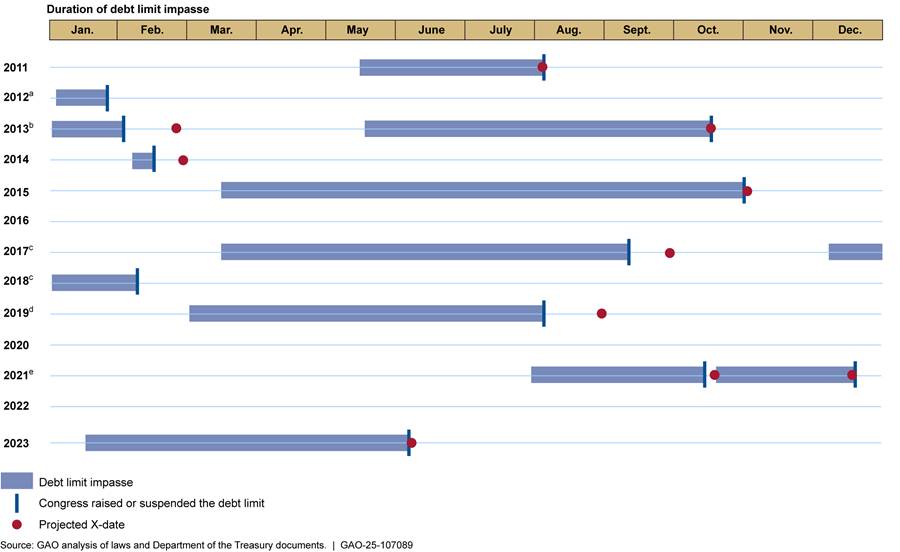

As shown in figure 4, in six of the 12 debt limit impasses between 2011 and 2023, the debt limit was raised or suspended within days before the projected X-date. Negotiating an increase in or suspension of the debt limit so close to an X-date considerably increases the risk of a potential default. As previously discussed, Treasury may need to manage unexpected federal outflows, a reduction of inflows, or an increase in trust fund investments that could hasten the X-date. Several market participants and economists we interviewed stated that the risk of default has risen in recent years, based on their experience or observation of past debt limit impasses.

Figure 4: The U.S. Government Was Within Days of a Potential Default in Six of the Most Recent Debt Limit Impasses

Note: A debt limit impasse generally is understood to start when the outstanding debt reaches the debt limit. The impasse lasts until Congress passes legislation to raise or suspend the limit. For the purposes of this report, the projected X-date is when the Department of the Treasury projects the government may have insufficient cash, extraordinary measures, or borrowing authority to continue meeting all of its obligations.

aTreasury did not project an X-date for the 2012 debt limit impasse. The debt limit was raised automatically on Jan. 27, 2012, in accordance with the Budget Control Act of 2011. Specifically, after the President certified that a debt limit increase was necessary on Jan. 12, 2012, Congress had 15 calendar days to pass a joint resolution to disapprove a debt limit increase. Congress was unable to reach a joint resolution.

bThe early 2013 impasse began on Dec. 31, 2012, when the debt limit was reached. On Jan. 14, 2013, Treasury projected the X-date could occur between mid-February and early March of 2013. For this figure, we used Feb. 25, 2013, as the projected X-date, which is an approximate midpoint of this range.

cFor the first 2017 impasse, we used September 29, 2017, as the projected X-date, which was the date the Secretary of the Treasury indicated as a critical date for Congress to raise the debt limit by. Treasury did not project an X-date for the impasse beginning in late 2017 and ending in early 2018.

dOn July 12, 2019, Treasury projected the X-date could occur in early September 2019. For this figure, we used Sept. 1, 2019, as the projected X-date.

eOn Nov. 16, 2021, Treasury projected Dec. 15, 2021, as a potential X-date. The debt limit was raised on Dec. 16, 2021. This did not result in a U.S. default.

Operational Complexities May Make Default Difficult to Avoid, Even If the Debt Limit Is Raised at the Last Minute

Even if Congress were to raise or suspend the debt limit on Treasury’s projected X-date, when Treasury may exhaust its funds, a default on Treasury securities and nondebt obligations would remain a significant risk. For example, the President must receive the legislation from Congress and sign it into law, which takes some time. This legislation would provide Treasury with the legal authority to borrow additional funds, but it would not provide immediate financing. To raise funds needed to pay government obligations due that day, Treasury would need to immediately announce, conduct, and settle an auction within the same day, steps that typically occur over several days or a week. Despite past impasses that were resolved within a day of the projected X-date, raising or suspending the debt limit close to a projected X-date poses the risk that Treasury would not have sufficient time to complete and settle an auction.

Treasury and Federal Reserve officials noted that although rare, a same-day auction could be possible. However, the success of a same-day auction is not guaranteed, and sufficient funds might not be raised until the next day. For example, Treasury and Federal Reserve officials stated that the success of a same-day auction would depend on factors including market demand, the time of day the auction occurs, and the size of the auction. Treasury officials added that condensing a multiday automated process into a same-day manual process would significantly increase operational risk.

In addition, the speed at which payments could resume after a last-minute debt limit increase depends on the circumstances, according to Treasury officials. For example, they noted that Automated Clearing House payments, which include principal and interest payments for securities purchased through TreasuryDirect, are typically initiated the day before they are due.[18] According to Treasury officials, if Treasury lacked funds to initiate these payments the night before the X-date, it is unclear when they would be initiated and how soon they could be settled after the debt limit was raised. This uncertainty raises the risk of default even if the debt limit were raised before or in the early morning of the X-date. Treasury officials stated that the same uncertainty about when payments could be fully resumed would also exist after a default is resolved.

Contingency Plans to Facilitate Market Functioning during a Default Are Risky and Operationally Complex

Two financial market organizations—the Securities Industry and Financial Markets Association (SIFMA) and the Treasury Market Practices Group (TMPG)—have published complementary potential contingency plans to help reduce market disruptions in a default.[19] However, some market participants and industry groups cautioned that these plans rely on complex coordination among multiple government and private entities and their operational systems, and the plans have not been tested in a default scenario. While mitigating actions may be feasible under some scenarios, they have not been endorsed by Treasury, and their implementation largely hinges on Treasury’s ability to act some time before the X-date. Therefore, the effectiveness of these plans in reducing market disruptions remains uncertain.

Extending the Operational Maturity Date of Treasury Securities

SIFMA’s and TMPG’s contingency documents address potential delays in Treasury security payments. According to these documents, the Federal Reserve can extend in its bookkeeping systems the operational maturity date of Treasury securities that are subject to a payment delay by 1 business day if instructed by Treasury with sufficient notice.[20] An extension of the operational maturity date would not change the legal maturity date, the original date when a security was due to mature. Under normal circumstances, a security becomes nontransferable from one market participant to another in the Federal Reserve’s bookkeeping systems once the Fedwire Securities Service starts its end-of-day processes on the night before the legal maturity date.[21] Hence, an extension of the operational maturity of Treasury securities would ensure they remain transferable on the Fedwire Securities Service beyond the legal maturity date.

This extension could help facilitate continued trading and transfer of affected securities and enable their continued use as collateral in short-term funding markets, but it would not avoid a default. Several market participants emphasized that being able to trade and transfer affected securities during a default was crucial for their operations.

However, Treasury officials told us that they have never endorsed or agreed to the SIFMA and TMPG contingency documents. Treasury officials emphasized that these practices would have little mitigating effect on the substantial harms caused by a default, as we discuss later. Further, the two organizations emphasized that their suggested practices and plans would only partly reduce the operational difficulties posed by delayed debt payments. In particular, TMPG states its suggested plans may not be implementable by all market participants and may require manual intervention in trading and settlement processes. This could introduce risk to the market participants’ operations, the document notes.

The ability to extend the operational maturity date of Treasury securities would depend on when Treasury notifies the Federal Reserve of its decision, according to SIFMA representatives and Federal Reserve officials. SIFMA’s contingency plan requires Treasury to instruct the Federal Reserve to extend maturity dates of affected securities by 10 p.m. (eastern time) on the night before the day of a potential default. This is approximately the latest time the Federal Reserve’s Fedwire Securities Service and financial institutions can extend their end-of-day processes, according to SIFMA.[22] SIFMA representatives noted that earlier notification—ideally between 3:00 p.m. and 5:00 p.m. (eastern time) to account for the opening of international markets—would better ensure that financial institutions can make necessary modifications to their end-of-day processes and reduce room for error.

Moreover, most market participants described uncertainties associated with extending operational maturity dates. These uncertainties include potential gaps in private-sector systems’ capacity to handle a delayed payment and whether market participants would consider securities with extended maturities as acceptable collateral.

In addition, according to the TMPG document and Federal Reserve officials, once Treasury instructs the Federal Reserve to extend the operational maturity date of a security, it becomes impossible to subsequently make payments on the original, legal maturity date. Thus, even if Congress were to raise the debt limit in time for the government to make all payments due on the legal maturity date of the securities, if a security had its operational maturity date extended, the government would be in default.

Prioritizing Principal and Interest Payments on Treasury Securities

Federal Open Market Committee meeting transcripts indicate that during the 2011 and 2013 debt limit impasses, Treasury staff considered an alternative contingency plan.[23] This plan would have prioritized principal and interest payments on Treasury securities over other government payments. However, current and past Secretaries of the Treasury have publicly rejected prioritization as a viable option to avoid default, with some stating it would effectively constitute a default, as the government would miss payment for nondebt obligations already committed to by Congress.[24]

In our interviews, Treasury officials underscored that prioritization would constitute a default on government obligations and is extraordinarily risky and untested. They noted that Treasury’s systems are not designed to accommodate prioritization. Importantly, Treasury officials also told us that interest costs on certain days during the year could be larger than the cash on hand to pay them. Thus, prioritization does not guarantee that Treasury will have sufficient cash to make all principal and interest payments on Treasury securities in time.

Treasury officials added that implementing prioritization would be operationally challenging. Treasury can distinguish between debt payments and federal agencies’ nondebt payments in certain payment systems that process both, such as the Automated Clearing House. However, officials said the government might still default on Treasury securities if these debt payments could not be paid out in time. According to Treasury officials, this is because any form of prioritization would require the implementation of untested manual and nonstandard processes, which inherently carry higher operational risk compared with Treasury’s established, standard process. Some market participants and one rating agency expressed uncertainty about the feasibility of prioritization, as it has never been tested.

Several market participants stated that if Treasury were to prioritize paying debt obligations over nondebt obligations, the financial and economic consequences would be less severe compared with defaulting on Treasury securities. Yet, some market participants, economists, and one rating agency expressed concern about the effect of delaying nondebt payments, such as Social Security and veteran benefits and payments to the military, on the broader economy. For instance, one bank noted that prioritization could negatively affect households that rely on nondebt payments as their income source, such as Social Security benefits, to make credit card and mortgage payments. Treasury officials also underscored that a delay in payment on nondebt obligations could nevertheless have severe negative effects on the financial system and the economy.

U.S. Default Would Disrupt Financial Markets, with Potentially Severe Consequences for Financial Institutions, Businesses, and Households

Default Could Significantly Harm Financial Markets and Institutions

A U.S. default associated with a failure to raise the debt limit could produce several interrelated effects on financial markets that could significantly harm U.S. and global financial systems and ultimately businesses and households. These effects include

· disruption of critical short-term funding markets that could lead to a system-wide liquidity shortage,

· spread of financial distress to other markets and increased insolvency risk for financial institutions, and

· risk of runs on banks and money market funds.

Any such event would undermine goals set by Congress for Treasury and financial regulators to maintain financial stability. The exact severity of the financial turmoil is highly uncertain and may depend on the length of default, according to several market participants and economists. Several suggested that default could cause substantial harm and trigger financial market stress at least as severe as that of the 2007–2009 financial crisis.

Default Would Disrupt Short-Term Funding Markets and Could Cause a Liquidity Crisis

Default would rapidly disrupt short-term funding markets and could cause a sudden loss of liquidity in the financial system. Short-term funding markets, including repo markets, allow financial institutions to lend or borrow cash and are key to the functioning of the financial system. Financial institutions and corporations rely on cash borrowing in these markets to support many of their routine financial transactions. Treasury securities are used as collateral in a substantial majority of overnight repo lending, according to SIFMA. Some market participants told us that if Treasury securities declined in value or became unacceptable as collateral because of a U.S. default, they would need to be supplemented or substituted with additional collateral in repo and other relevant markets. The common practice of using a single Treasury security as collateral in a chain of transactions would amplify these markets’ susceptibility to a substantial liquidity disruption, with multiple institutions facing the need to identify new collateral for every Treasury security that defaults.[25]

In addition, during a default, many financial institutions that typically lend in the short-term funding markets would have a strong incentive to hold onto their cash and reduce their short-term lending, according to research on past liquidity disruptions.[26] This would reduce the availability of liquidity across the financial system, making it challenging for financial institutions to borrow in short-term funding markets. Consequently, these institutions would reduce their own lending to businesses and households, exacerbating the credit shortage.

In past instances of market stress, liquidity shortages have spread quickly through short-term funding markets. For example, during the early phase of the 2007–2009 financial crisis, a French bank suspended investors’ redemptions in August 2007 from certain investment funds, sparking a liquidity disruption that curtailed credit to banks in Italy, with most of the credit cost increases happening within one day.[27]

Disruptions in Treasury and Short-Term Funding Markets Would Likely Spread Financial Distress to Other Markets

If default disrupted Treasury and short-term funding markets, it would also likely have damaging spillover effects on other markets. A system-wide liquidity crisis combined with heightened concern about increased risks to financial markets and the economy could trigger a broad-based sell-off of tradable assets, including stocks, bonds, commercial paper, and nondefaulted Treasury securities, and therefore potentially a general decline in those asset values.

Furthermore, research suggests that if default caused an initial decline in liquidity, the decline could become self-reinforcing and widespread, as market participants become less willing or able to participate in the financial markets. For example, some hedge funds, which play a significant role in repo and traded asset markets, could have difficulty raising cash, particularly if they had significant exposure to Treasury securities.[28] As a result, affected hedge funds would need to scale back their normally substantial lending and market-making activities, which facilitate the buying and selling of securities. These hedge funds may also need to sell assets, including Treasury securities, corporate bonds, commercial paper, and stocks. Research has shown that a reduction in lending and market-making by these institutions could be a major source of financial contagion, amplifying and transmitting financial stress and crisis conditions more widely.[29]

A U.S. default would present various risks of insolvency for financial institutions.

· An increased demand for cash and a reassessment of financial and economic risks that could lead to general decline in asset values would weaken the financial position of some institutions. In a fast-moving crisis, even institutions that had protected themselves from Treasury securities at immediate risk of default could suffer significant losses across multiple portfolios, increasing insolvency risks.

· Because the financial system consists of a network of institutions, if one institution failed, other institutions could also experience stress or fail.[30] For example, during the 2007–2009 financial crisis, the failure of Lehman Brothers and near failure of American International Group demonstrated how the distress of one financial institution can rapidly spread instability in the financial system.[31]

The consequences of a default would likely extend beyond U.S. financial markets, as foreign private institutions, such as banks, insurers, hedge funds, and pension funds, hold a significant amount of Treasury securities. As in the U.S., a default could affect the liquidity, asset values, and confidence of foreign financial institutions.

Default Could Trigger Runs on Banks and Money Market Funds

In the event of a U.S. default, a liquidity crisis and the risk of severe market stress could trigger runs on banks and money market funds. If customers anticipate the possible insolvency of their banking institution and question the availability of FDIC deposit insurance (as discussed below), they might rush to withdraw some or all of their cash, triggering runs. These runs could spread rapidly across the banking system because of heightened depositor fears about banks’ insolvency.[32]

Money market funds are also vulnerable to runs during periods of market stress, including in the event of default. Both prime funds, which invest in a mix of assets, and government funds, which heavily invest in Treasury securities, could be vulnerable to runs.[33] Historical crisis events, such as the 2008 Lehman Brothers collapse and the onset of the COVID-19 pandemic, have shown that prime funds are vulnerable to significant withdrawals, with investors pulling out approximately 30 percent of their holdings within a 2-week period.[34] In a previous report, we noted that market participants said in past debt limit impasses, money market funds were sensitive to volatilities in the Treasury market and prone to outflows.[35]

Runs on money market funds or banks could amplify the initial effects of Treasury market disruptions. In turn, this could intensify the reluctance of institutions not directly affected by runs to lend cash, further exacerbating disruptions in short-term funding markets. If a run caused a financial institution to fail, it could result in additional financial harm to the institution’s counterparties and spread distress across markets. This happened with the 2008 Lehman Brothers failure, which contributed to a reassessment of risk across the financial system as the subprime mortgage crisis evolved into a global financial crisis.[36]

Default Could Limit Tools for Protecting Bank Deposits and Preventing Runs on Banks and Money Market Funds

A U.S. default could limit access to funding for important FDIC protection for bank deposits and make it difficult for the Federal Reserve to provide liquidity support to banks, money market funds, and the financial system. FDIC deposit insurance maintains stability and public confidence in the U.S. financial system, and it can prevent runs on banks by assuring depositors that their funds are protected in the event of bank failures.

In the event of a U.S. default, FDIC could face challenges in providing uninterrupted protection to depositors.[37] FDIC officials said the Deposit Insurance Fund, which invests in Treasury securities, would need to redeem these securities for cash from Treasury.[38] However, according to FDIC officials, FDIC’s ability to access cash after redeeming securities could be restricted in a default if the Treasury General Account does not have sufficient cash. This could limit FDIC’s ability to pay depositors in a timely manner in the event of a bank failure. According to FDIC’s default response plan, a potential delay in access to cash from the Deposit Insurance Fund could hinder FDIC’s ability to fund cash needs related to possible financial institution failures and provide funds to insured depositors. Treasury officials said Treasury has made no commitment to prioritize debt payments, including those to FDIC, in the event of a default.

In the event of a bank failure, FDIC could set up a bridge bank to help ensure depositors have continued access to their deposits.[39] FDIC has previously used bridge banks to resolve large or complex failing banks.[40]

However, bridge banks may face several operational challenges. While bridge banks are legally eligible to borrow from the Federal Reserve, any such loan would be subject to the discretion of the Reserve Bank. Moreover, even if the Federal Reserve did agree to make a loan to a bridge bank, the bridge bank would need to have sufficient collateral available to borrow from the Federal Reserve.

The Federal Reserve also has tools to help provide liquidity to financial institutions, such as banks and money market funds. However, these tools may be constrained during a financial crisis induced by a default. For example:

· Discount window and Standing Repo Facility. Depository institutions can borrow from the Federal Reserve’s discount window, and larger depository institutions can also borrow from the Standing Repo Facility.[41] Several market participants told us they envision that the Standing Repo Facility could be an important funding source in a default, particularly if the Federal Reserve accepted defaulted Treasury securities as collateral. However, there is a risk that depository institutions may be reluctant to seek Federal Reserve support because they do not want to be perceived as financially weak. This reluctance could exacerbate the risk of runs, according to academic and Federal Reserve staff research.[42]

· Emergency lending facilities. The Federal Reserve has established emergency facilities in the past to provide liquidity directly to financial institutions, including facilities that assisted money market funds in meeting redemption demands.[43] These facilities were designed to help stabilize financial markets and address macroeconomic issues and meet the needs of small- and medium-sized businesses, including during the onset of the COVID-19 pandemic and the 2007–2009 financial crisis.[44] Several market participants envision that similar emergency lending facilities could be used to provide liquidity to financial institutions, including money market funds, in the event of a default. However, as we previously reported, facilities may use financial support from Treasury, which may not be available during a default.[45] In addition, Federal Reserve officials stated that emergency lending tools may not calm a financial crisis triggered by default and that no precedent exists to guide setting up facilities in a default.

Default Would Likely Reduce Lending to Households and Businesses

If default triggered financial market distress, it would result in an immediate contraction in new lending, even if banks did not fail, increasing the cost of remaining available credit and harming households and businesses. Some market participants anticipated that lending would rapidly decrease across the system, as financial institutions sought to preserve their cash and reduce risk. Any bank failures induced by a U.S. default would shrink credit availability even further.

In particular, financial institutions, such as banks, would likely pause making new loans, according to bank representatives we interviewed. In addition, they could reduce existing home equity lines and credit card limits. In the past, banks have cut back home equity lending in times of stress prior to their failure.[46] Many lenders cut credit card limits during the 2007–2009 financial crisis. Consumers relying on these lines of credit for essential expenses or major purchases could be left without the means to pay.

Similarly, some businesses could lose access to existing lines of credit, as they have during prior crises.[47] Many businesses, particularly small and midsized companies, rely on lines of credit from banks as a primary source of funding. One study found that used lines of credit accounted for 53 percent of funds lent to businesses by large banks in 2012–2019.[48]

Large, nonfinancial corporations that typically borrow directly from the financial markets may find it more expensive to issue commercial paper. Past debt limit impasses, such as in 2013, saw disruptions in commercial paper markets, with issuers facing increased borrowing costs.[49] Historically, commercial paper issuance has also become more expensive during crises. For example, research found that during the worst phases of the 2007–2009 financial crisis, firms in certain sectors had to pay higher rates to borrow through commercial paper markets, and generally for shorter periods.[50] Similarly, during the initial weeks of the COVID-19 pandemic, firms only had access to the commercial paper market if they were willing to pay substantially higher prices for credit.[51]

During a default, large nonfinancial corporations may take steps that would magnify the credit contraction and spread financial distress further. They, like financial institutions, would likely hold onto cash rather than investing in money market funds, commercial paper, or Treasury securities, thereby further reducing market liquidity. These corporations also would likely draw on unused credit lines with banks, reducing banks’ capacity to lend to other customers. The value of unused credit lines has been estimated to exceed all bank credit to businesses by 40 percent.[52] Therefore, a quick drawdown in these lines could lead to a period of reduced lending by banks, even after the default was resolved. Such drawdowns would represent a substantial unintended expansion of banks’ lending. This could force banks to reduce other asset holdings to meet regulatory capital requirements.[53] One study estimated that during the 2007–2009 financial crisis, 90 percent of the decline in new bank lending resulted from businesses drawing down credit lines.[54] This can especially adversely affect credit availability for new applicants.[55]

Credit Downgrades Would Further Increase Rates of Treasury Securities and Other Bonds

According to representatives of credit rating agencies, the federal government’s rising national debt and repeated debt limit impasses have eroded confidence in the nation’s fiscal management. In response to past debt limit impasses, rating agencies have taken actions such as credit downgrades that reflected their lowered assessment of U.S. creditworthiness. Representatives of rating agencies told us that a U.S. default would likely prompt them to substantially downgrade the U.S. sovereign credit rating. A credit rating downgrade could increase interest rates in the Treasury, corporate bond, and municipal debt markets. Increased rates could reduce investment by companies and state and local governments.

Rating agency representatives stated that the impact of a default would be immediate and negative, leading to higher borrowing costs and a reduction in the overall supply of credit to the private and municipal sectors. For example, a default that triggers a credit rating downgrade could force mutual funds that are committed to investing only in AAA-rated securities to sell their Treasury securities into an already distressed market, according to some market participants. These forced sales could amplify market disruptions, exacerbating price declines even for Treasury securities that are not in default. In other cases, money market funds seeking to maintain an average credit rating for their portfolio might continue holding downgraded Treasury securities after a default, according to one market participant.

According to representatives of two rating agencies, a U.S. downgrade could also trigger immediate downgrades across other sectors, including government-sponsored enterprises and the municipal sector, whose ratings are tied to the sovereign rating. This would increase borrowing costs and reduce access to credit for state and local governments. The resulting higher borrowing costs or delays could affect state and local infrastructure investments, such as road repairs or new schools. Since states and localities play a critical role in funding U.S. infrastructure, a default could adversely affect this key sector of the U.S. economy.

Under Certain Conditions, Default Could Inflict Long-Lasting Damage on the U.S. and Global Economies

Default Could Trigger a Deep and Long-Lasting Recession in the U.S. with Widespread Economic Repercussions

If significant financial turmoil were to develop after a default due to the debt limit, it would likely lead to a substantial and potentially long-lasting recession.[56] The severity of a recession stemming from a U.S. default would depend on several factors, including the extent of the initial financial turmoil or the economic context in which the default occurred, according to several economists and market participants. While the exact consequences of a U.S. default are impossible to predict, Federal Reserve and Treasury officials underscored that a default could lead to potentially catastrophic economic harm. Similarly, economists we spoke with generally emphasized that a default would likely lead to negative economic consequences. Most warned that a recession could be at least as severe as the one resulting from the 2007–2009 financial crisis. That crisis resulted in trillions of dollars of lost economic output, according to our past work.[57]

Research on historical sovereign defaults supports this view, indicating that sovereign defaults have been associated with significant recessions.[58] Projections on the potential effects of a U.S. default similarly indicate that it would result in a serious recession, particularly if a default were long-lasting.[59] Additional studies also indicated that financial crises can reduce output and productivity, potentially for an extended period.[60] However, several market participants and economists and a rating agency noted that if a U.S. default were not expected to be long-lasting, the financial and economic consequences could be less severe.

Several economists and market participants and two rating agencies we interviewed warned that a U.S. default could lead to damaging reductions in credit for the private sector. For example, during the 2007–2009 financial crisis, banks raised borrowing costs and tightened lending standards, according to the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices.[61] Total credit to the private, nonfinancial sector as a share of GDP took over 14 years to recover to its January 2007 level, according to data from the Bank for International Settlements.[62]

If credit were to become scarce and expensive, businesses would reduce investment in response.[63] For example, bank lending remained lower and economic activity was weaker in the aftermath of the European sovereign debt crisis in 2008.[64]

Further, recessions are generally associated with job losses. While the extent of job losses resulting from a U.S. default is uncertain, projections we reviewed suggest that a default would likely result in a notable increase in unemployment.[65] Previous financial crises also can offer insights. The 2007–2009 financial crisis saw the unemployment rate surge to around 10 percent in October 2009, and it remained above 8 percent 3 years later. Between December 2009 and November 2012, over 40 percent of job seekers searched for a job for more than 6 months. Median household income after adjusting for inflation did not recover fully to the 2007 level until 2016, according to data from the Census Bureau.[66] Job losses and reduced access to credit can cause households to reduce spending.

A U.S. default would also likely decrease household consumption by disrupting households’ income flows or wealth, contributing to the economic downturn. Projections we reviewed anticipated that a U.S. default would lead to considerably reduced government payments, such as federal purchases, Social Security, Medicare, and grants.[67] Although households and businesses would eventually receive federal government payments, the temporary disruption could cause spending difficulties. The longer the default lasted, the more severe the economic disruption would be.

In addition, research has found that the risk of sovereign default is connected to stock market declines.[68] As households face reduced wealth, consumption typically decreases, worsening recessionary pressures.[69] Moreover, the federal government’s options for using fiscal policy to stimulate the economy after a default could be constrained, particularly if the markets’ demand for Treasury securities were to fall substantially.

Furthermore, a financial crisis stemming from a U.S. default would likely spread quickly beyond the U.S. and have global consequences. The 2007–2009 financial crisis illustrates this phenomenon; the crisis originated in the U.S. but led to recessions in many countries. The effect of a default of Treasury securities could be even more severe given their prominent role in the financial sector. According to IMF research, a U.S. sovereign debt crisis would lead to moderate to severe losses in economic growth in many countries.[70] Countries with economies that are more integrated with the U.S. and global financial and trading systems could experience more severe economic consequences.[71]

A U.S. default also would disrupt international trade flows, as was the case during the 2007–2009 financial crisis. Demand for U.S. goods and services would decline with any contraction in trade partner economies. Moreover, trade financing would likely be less available and more expensive, according to studies we reviewed.[72] As a result, U.S. businesses reliant on exports or imports could face increased costs and operational challenges, such as disruptions in their supply chains.

Most economists and market participants and two rating agencies we spoke with anticipated that the Federal Reserve would implement monetary policy and emergency lending measures to reduce the severity of a recession triggered by a U.S. default. However, several economists and market participants noted that these efforts would not fully shield businesses and households from harm. Federal Reserve officials noted the possibility that if the Federal Reserve were to respond as it did in past financial crises, such responses may be more difficult to implement or less effective after a default. The Federal Reserve’s current Chair stated in February 2023 that no one should assume the Federal Reserve can protect the economy from the consequences of a U.S. default.[73]

Moreover, several market participants and economists expressed concerns about the Federal Reserve’s ability to accept defaulted Treasury securities through its lending facilities, which could hinder its efforts to inject liquidity in the financial system. In addition, some market participants also told us that if the Federal Reserve’s response were to deviate from the market’s expectations, that could undermine market confidence and make it harder to contain economic damage.

Default Could Hinder the Effectiveness of Future Monetary Policy

Most economists and market participants told us that they expect the Federal Reserve would take steps to mitigate the consequences of a U.S. default. However, several cautioned that overly aggressive Federal Reserve intervention after a default could undermine its ability to conduct monetary policy effectively going forward.

For example, several market participants and economists told us that certain actions by the Federal Reserve, such as accepting defaulted Treasury securities as collateral, might lead to the perception that the Federal Reserve is no longer independent from political decisions around the budget. This could raise concerns about the Federal Reserve’s credibility in controlling inflation and promoting full employment going forward. In Federal Open Market Committee meetings in 2011 and 2013, Federal Reserve staff underscored the importance of avoiding any appearance of financing government spending after a default, emphasizing the need for the Federal Reserve to avoid entanglement in fiscal policy.[74]

Default Could Accelerate Global Movement Away from Treasury Securities and the U.S. Dollar, with Adverse Consequences for the U.S. in the Long Run

While near-term challenges to the dollar’s dominance appear limited, a U.S. default would likely contribute to a gradual shift away from the U.S. dollar, eroding its status as the world’s dominant reserve currency, according to most economists, market participants, and rating agencies we interviewed. Any shift from dollar-denominated assets, including Treasury securities, would likely be gradual, occurring over a prolonged period, as noted by several economists and market participants.

|

Reserve Currency The U.S. dollar is the dominant reserve currency—that is, the currency used by foreign central banks in their official foreign exchange reserves. A reserve currency is widely used to conduct international trade and financial transactions, eliminating the costs of settling transactions involving different currencies. Source: GAO. | GAO‑25‑107089 |

The dollar’s reserve currency status is closely tied to the safety and liquidity of Treasury securities, which have historically contributed to the dollar’s dominance. In turn, the dollar’s status as the dominant global reserve currency is important in supporting demand for Treasury securities.[75]

While still dominant, the dollar’s share of reserve currency declined from 71 percent in 2000 to 58 percent by year-end 2023, according to IMF data. Foreign central banks hold reserves in assets such as bonds, deposits, and government securities, with Treasury securities being a preferred choice due to the depth of the market and their liquidity. At year-end 2023, foreign governments and investors held 33 percent (about $8 trillion) of Treasury securities, according to Federal Reserve data.[76]

However, events that undermine the liquidity and safety of Treasury securities or the depth of the Treasury market—such as a U.S. default—could prompt foreign central banks to reduce their U.S. dollar-denominated reserves. This could weaken the dollar’s status as the dominant reserve currency over time. Moreover, representatives of one bank operating in foreign countries stated that after a U.S. default, they might need to replace Treasury securities with other safer assets to comply with local financial regulations, as Treasury securities would no longer be deemed acceptable. However, several economists and market participants we interviewed also acknowledged that a move away from Treasury securities to other assets would be possible but difficult, given the limited options for desirable substitutes.

If the demand for the dollar weakens and the dollar loses its dominant reserve currency status, the consequences for the U.S. economy and U.S. global leadership could be far-reaching. For example, because the U.S. dollar is used for half of international trade invoicing and denominates half of international debt, U.S. consumers and businesses benefit from lower costs for trade and financial transactions.[77] Studies suggest that if the dollar was less dominant in its trade and financial roles, the U.S. economy would become more exposed to exchange rate fluctuations.[78]

Further, the U.S. may experience reduced diplomatic leverage. For example, past GAO and Congressional Research Service reports link the effectiveness of economic sanctions to the dollar’s dominant status.[79] If the dollar’s dominant status were to decline, these sanctions could become less effective as a tool to advance U.S. foreign policy.

Default Could Raise Federal Borrowing Costs and Further Worsen U.S. Fiscal Health

A U.S. default could intensify the negative effects of the growing federal debt. Investors may demand higher interest rates on Treasury securities even after a default is resolved. While Treasury interest rates may not immediately increase, the longer-term consequence would likely be higher Treasury rates due to a diminished perception of Treasury securities as safe assets. Economists and market participants noted that there are no substitutes for Treasury securities. However, some market participants told us that interest rates on Treasury securities could increase considerably after a default to compensate for increased risk.

Increased interest rates would lead to higher costs of borrowing for the U.S. government to finance its activities. Higher rates would increase the cost of issuing new debt and refinancing existing debt. Treasury relies on high levels of liquidity to achieve its goal of financing the government at the lowest borrowing cost over time. However, following a default, the Treasury market could experience a long-lasting decline in liquidity, which could intensify if the dollar were to lose its dominant reserve currency status.

To cover higher borrowing and debt service costs, Treasury would have to further increase borrowing. In fiscal year 2023, net interest on the federal debt was $659 billion. As part of our work on U.S. long-term fiscal health, we have projected that net interest will exceed $1 trillion in 2029 and account for 13 percent of all federal spending.[80] A U.S. default would likely increase these costs.

The likely economic downturn triggered by a U.S. default also would reduce federal government tax revenues and increase certain expenditures, such as unemployment insurance and Medicaid. A decline in tax revenue occurred during the 2007–2009 financial crisis, with annual federal receipts as a share of GDP dropping from 18 percent in fiscal year 2007 to 14.5 percent in 2009 and staying below 17 percent until 2014. These trends would likely affect all levels of government—federal, state, and local.

Higher costs of borrowing for the U.S. would worsen its already unsustainable long-term fiscal path, which poses serious economic, security, and social challenges. Even absent a default, fiscal simulations in our Fiscal Health report project worsening U.S. debt levels.[81] Specifically, under current revenue and spending policies, debt held by the public will reach a historical high of 106 percent of GDP by 2028 and grow more than twice as fast as the economy over a 30-year period, reaching 200 percent of GDP by 2050. A U.S. default that triggered a recession would only accelerate this trend.

Conclusions

The current debt limit process creates an unnecessary risk of U.S. default, which could have significant and, under certain conditions, devastating consequences for individuals, financial institutions, and the economy. A default has the potential to disrupt financial markets; destabilize the economy; challenge financial regulators’ effectiveness in maintaining financial stability, including protecting depositors; weaken the dollar’s global use; and undermine the safety of Treasury securities, worsening the long-term fiscal path. These are risks with serious negative consequences that could be avoided and that underscore the need to reform the current debt limit process. Removing the separation between revenue and spending decisions and debt would protect the U.S. and global economies from unnecessary risk.

Our 2015 matter for congressional consideration that Congress consider alternative approaches to the current debt limit process has not yet been addressed. Events since that time, including continued impasses that have threatened default, only underscore the need for reform in this area. To avoid potentially devastating damage to the U.S. economy, maintain financial stability, and improve the nation’s fiscal path, it is imperative for Congress to eliminate structural constraints that risk a U.S. default. By implementing effective alternatives to the debt limit, Congress could eliminate the risk of default and focus on taking action to address the nation’s unsustainable fiscal path.

Matter for Congressional Consideration

Congress should consider immediately removing the debt limit and adopting an approach that better links decisions about the debt with decisions about spending and revenue at the time those decisions are made. (Matter for Consideration 1)

Agency Comments

We provided a draft of this report to FDIC, the Federal Reserve, the Office of the Comptroller of the Currency, and Treasury for review and comment. The agencies provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the appropriate congressional committees, the Chairman of FDIC, the Chair of the Federal Reserve, the Acting Comptroller of the Currency, the Secretary of the Treasury, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact Michael E. Clements at (202) 512-8678 or clementsm@gao.gov, Michael Hoffman at (202) 512-6445 or hoffmanme@gao.gov, or James R. McTigue Jr. at (202) 512-6806 or mctiguej@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix I.

Michael E. Clements

Director, Financial Markets and Community Investment

Michael Hoffman

Director, Center for Economics, Applied Research and Methods

James R. McTigue, Jr.

Director, Strategic Issues

GAO Contacts

Michael E. Clements, (202) 512-8678 or clementsm@gao.gov

Michael Hoffman, (202) 512-6445 or hoffmanme@gao.gov

James R. McTigue Jr., (202) 512-6806 or mctiguej@gao.gov

Staff Acknowledgments

In addition to the contacts named above, Theresa Osborne (Chief Economist), Tara Carter (Assistant Director), Anna Chung (Analyst in Charge), Abigail Brown, Paul Foderaro, Christoph Hoashi-Erhardt, Debra Hoffman, Risto Laboski, Ying (Sophia) Liu, Douglas Luo, Daniel Mahoney, Emmy Rhine-Paule, Stephen Ruszczyk, Jessica Sandler, Jennifer Schwartz, Lindsay Shapray, Farrah Stone, and Jena Sinkfield made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on Facebook, Flickr, X, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

Congressional Relations

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S. Government Accountability Office, 441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

Sarah Kaczmarek, Managing Director, KaczmarekS@gao.gov, (202) 512-4800, U.S.

Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Strategic Planning and External Liaison

Stephen J. Sanford, Managing

Director, spel@gao.gov, (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814, Washington,

DC 20548

[1]Under a debt limit suspension, Treasury is allowed to borrow as necessary to pay for existing expenditures during the suspension period.

[2]See Federal Open Market Committee Secretariat, “Conference Call of the Federal Open Market Committee on October 16, 2013,” Oct. 16, 2013, at https://www.federalreserve.gov/monetarypolicy/files/FOMC20131016confcall.pdf; and “Conference Call of the Federal Open Market Committee on August 1, 2011,” Aug. 1, 2011, at https://www.federalreserve.gov/monetarypolicy/files/FOMC20110801confcall.pdf.

[3]For example, see Congressional Research Service, Debt Limit Policy Questions: How Long Do Extraordinary Measures Last? (Jan. 25, 2024); The Debt Limit (Sept. 15, 2023); The Debt Limit Since 2011 (Dec. 23, 2022); and Reaching the Debt Limit: Background and Potential Effects on Government Operations (Mar. 27, 2015); as well as Congressional Budget Office, Federal Debt and the Statutory Limit, May 2023 (May 2023); and Federal Debt and the Risk of a Fiscal Crisis (July 27, 2010). See also GAO, Debt Limit: Market Response to Recent Impasses Underscores Need to Consider Alternative Approaches, GAO-15-476 (Washington, D.C.: July 9, 2015); Debt Limit: Analysis of 2011–2012 Actions Taken and Effect of Delayed Increase on Borrowing Costs, GAO-12-701 (Washington, D.C.: July 23, 2012); and Debt Limit: Delays Create Debt Management Challenges and Increase Uncertainty in the Treasury Market, GAO-11-203 (Washington, D.C.: Feb. 22, 2011).

[4]Securities Industry and Financial Markets Association, Disruption in Treasury Payments: Discussion of Scenarios (June 2023), and Treasury Market Practices Group, Operational Plans for Various Contingencies for Treasury Debt Payments (December 2021).

[5]See, for example, Christoph Trebesch and Michael Zabel, “The Output Costs of Hard and Soft Sovereign Default,” European Economic Review, vol. 92 (2017): 416–432; Sandro C. Andrade and Vidhi Chhaochharia, “The Costs of Sovereign Default: Evidence from the Stock Market,” The Review of Financial Studies, vol. 31, no. 5 (2018): 1707–1751; Matthieu Crozet, Banu Demir, and Beata Javorcik, “International Trade and Letters of Credit: A Double-Edged Sword in Times of Crises,” IMF Economic Review, vol. 70 (2022): 185–211; and Linda S. Goldberg, “The International Role of the Dollar: Does It Matter If It Changes?,” in Global Interdependence, Decoupling, and Recoupling, ed. Yin-Wong Cheung and Frank Westermann (The MIT Press, 2013). Also see International Monetary Fund, 2012 Spillover Report (Washington, D.C.: July 9, 2012); and 2012 Spillover Report—Background Papers (July 10, 2012).

[6]See, for example, Eric Engen, Glenn Follette, and Jean-Philippe Laforte, “Possible Macroeconomic Effects of a Temporary Federal Debt Default,” Board of Governors of the Federal Reserve System’s memorandum to the Federal Open Market Committee (Oct. 4, 2013); Council of Economic Advisers, “The Potential Economic Impacts of Various Debt Ceiling Scenarios” (May 3, 2023) at https://www.whitehouse.gov/cea/written‑materials/2023/05/03/debt‑ceiling‑scenarios/; International Monetary Fund, 2012 Spillover Report—Background Papers (July 10, 2012); and Mark Zandi, Adam Kamins, and Bernard Yaros, Debt Limit Scenario Update (Moody’s Analytics: May 2023).

[7]See, for example, GAO, The Nation’s Fiscal Health: Road Map Needed to Address Projected Unsustainable Debt Levels, GAO-24-106987 (Washington, D.C.: Feb. 15, 2024); Economic Sanctions: Agency Efforts Help Mitigate Some of the Risks Posed by Digital Assets, GAO-24-106178 (Washington, D.C.: Dec. 13, 2023); and The Nation’s Fiscal Health: Road Map Needed to Address Projected Unsustainable Debt Levels, GAO-23-106201 (Washington, D.C.: May 8, 2023). See also Congressional Research Service, The U.S. Dollar as the World’s Dominant Reserve Currency (Sept. 15, 2022); and Congressional Budget Office, “The U.S. Dollar as an International Currency and Its Economic Effects,” working paper 2023-04 (Washington, D.C.: April 2023).