STATE DEPARTMENT

Spending on Pay, Benefits, and Allowances for Overseas Employees

Report to Congressional Requesters

United States Government Accountability Office

View GAO‑25‑107098. For more information, contact Tatiana Winger at (202) 512-4128 or wingert@gao.gov.

Highlights of GAO‑25‑107098, a report to congressional requesters

Spending on Pay, Benefits, and Allowances for Overseas Employees

Why GAO Did This Study

Around the world, State employees play critical roles in achieving U.S. foreign policy goals. State offers a range of pay, benefits, and allowances to its employees. State employees serving abroad may be eligible for allowances in locations where they encounter harsh or dangerous living conditions. They also may be compensated for costs related to working abroad. For example, they may receive allowances for the cost of dependent education; relocating to a new post; or living in locations where the cost of living is substantially higher than in Washington, D.C. In addition, they may receive certain non-cash benefits, such as housing.

GAO was asked to review the total compensation, including allowances and non-cash benefits, for State employees serving abroad. This report examines (1) how much State spent on pay, benefits, and allowances for employees serving abroad in FY 2023 and (2) how State’s spending on pay, benefits, and allowances varied for Foreign Service employees serving abroad in FY 2023.

GAO analyzed State accounting, payroll, and housing

data and reviewed documents to calculate aggregate and average spending by rank

and location. Since the payroll data did not contain certain benefits,

allowances, and employee characteristics, GAO constructed illustrative examples

of State spending for employees of different ranks and with different family

sizes. For these examples, GAO selected posts in five countries in different

regions with varying rent costs and allowance rates: Mali, Peru, Saudi Arabia,

Thailand, and the United Kingdom.

What GAO Found

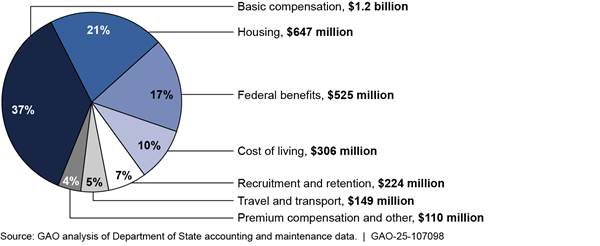

The Department of State spent about $3.1 billion on pay, benefits, and allowances for employees serving abroad in fiscal year (FY) 2023. As of September 30, 2023, State operated 279 foreign posts staffed by about 9,000 U.S. direct hire employees. Most of the amount State spent went to basic compensation, housing, and federal benefits, such as employer’s contributions to retirement and health insurance. Cost-of-living allowances, which include reimbursement for dependents’ education and extra pay in locations with high living costs, accounted for 10 percent of State’s spending.

Notes: For more details, see figure 1 in GAO-25-107098. Percentages do not sum to 100 because of rounding.

State spending per Foreign Service employee serving abroad in FY 2023 varied by rank, location, and family size.

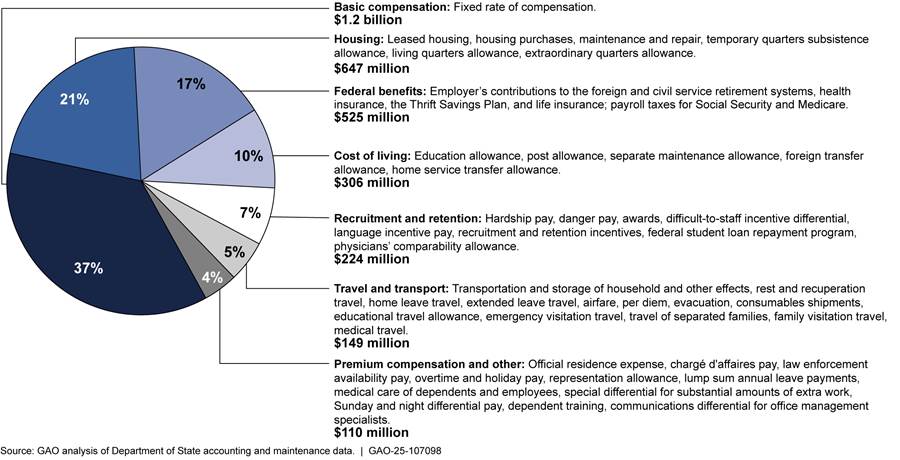

· Rank: State spent an average of $159,500 per entry-level employee and $321,311 per executive employee in FY 2023, according to GAO analysis of payroll data, which excluded some costs, such as housing and dependent education.

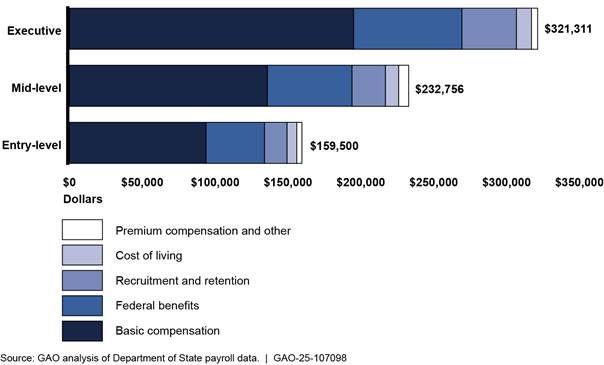

· Location: State’s average spending per employee ranged from $182,151 in Malta to $325,181 in the Central African Republic, according to GAO analysis of payroll data.

· Family size: As an illustrative example, State’s spending on selected benefits and allowances for a mid-level employee serving in Riyadh, Saudi Arabia, in FY 2023 could have been $292,524 for a single employee with no dependents and $375,745 for an employee with a family of four, according to GAO estimates.

|

Abbreviations |

|

|

FY |

fiscal year |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

December 19, 2024

The Honorable James E. Risch

Ranking Member

Committee on Foreign Relations

United States Senate

The Honorable Michael T. McCaul

Chairman

Committee on Foreign Affairs

House of Representatives

The Department of State is the lead agency involved in implementing U.S. foreign policy and representing the U.S. abroad. As of September 30, 2023, State operated 279 foreign posts staffed by about 9,000 U.S. direct hire employees.[1] Its employees serving around the world play critical roles in achieving U.S. foreign policy goals, such as formulating and implementing policy, collecting information, and engaging with governments and citizens of foreign countries.

State offers a range of pay, benefits, and allowances to its employees. State employees serving abroad may be eligible for allowances in locations where they encounter harsh or dangerous living conditions. They also may be compensated for costs related to serving abroad—for example, through allowances for the cost of dependent education; relocating to a new post; or living in locations where the cost of living is substantially higher than in Washington, D.C. In addition, State employees serving abroad may receive certain non-cash benefits, such as housing.

We have issued several products related to compensation for State employees serving abroad.[2] You asked us to review total compensation, including allowances and non-cash benefits, for State employees serving abroad. This report examines (1) how much State spent on pay, benefits, and allowances for employees serving abroad in fiscal year (FY) 2023, and how it calculates amounts for pay, benefits, and allowances, and (2) how State’s spending on pay, benefits, and allowances varied for Foreign Service employees serving abroad in FY 2023.

To examine how much State spent on pay, benefits, and allowances for employees serving abroad in FY 2023, we reviewed relevant State documentation and prior GAO reports and interviewed State officials to compile a list of 55 types of pay, benefits, and allowances for which direct hire, full-time State employees serving abroad are eligible. State officials reviewed our list for comprehensiveness and accuracy. We grouped the pay, benefits, and allowances into seven categories for reporting purposes: basic compensation, housing, federal benefits, cost of living, recruitment and retention, travel and transport, and premium compensation and other. We included spending on all employees that received these types of pay, benefits, and allowances, including Foreign Service and Civil Service employees, in this reporting objective because it was not possible to isolate the spending on Foreign Service employees in State’s accounting data. We analyzed State accounting data on expenditures in FY 2023 for pay, benefits, and allowances on our list. We determined that the accounting data were sufficiently reliable for the purposes of analyzing the amounts State spent on pay, benefits, and allowances for employees serving abroad in FY 2023. To examine how State calculates amounts for pay, benefits, and allowances, we reviewed its policies, regulations, and other documentation.

To examine how State’s spending on pay, benefits, and allowances varied for Foreign Service employees serving abroad in FY 2023, we analyzed data on expenditures for pay, benefits, and allowances that State processed through payroll and reviewed relevant State documentation. We determined that the payroll data were sufficiently reliable for the purposes of providing average amounts State spent on pay, benefits, and allowances by rank and location for Foreign Service employees.

Since State’s payroll data did not contain spending on certain benefits and allowances (e.g., housing and the education allowance) and key employee characteristics such as family size, we constructed illustrative examples to show how State spending may have varied by rank, location, and family size for Foreign Service employees serving abroad in FY 2023. To select posts for the illustrative examples, we reviewed State data on government-leased housing, payroll data, and documentation on pay, benefits, and allowance amounts and rates. For each of the posts in our examples, we calculated the amounts that State may have spent on selected pay, benefits, and allowances for employees of different family sizes and ranks using State’s 2023 Foreign Service Salary Schedule, housing and payroll data, Office of Personnel Management health insurance rate documentation, and allowance rates posted on State’s website as of the end of FY 2023. We determined that State’s housing and payroll data were sufficiently reliable for the purposes of calculating approximate rent costs and federal benefits for illustrative examples. Appendix I provides additional details on our scope and methodology.

We conducted this performance audit from October 2023 to December 2024 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Five key offices within State are involved in administering and processing pay, benefits, and allowances for employees serving abroad.

· State’s Office of Allowances in the Bureau of Administration establishes rates for benefits and allowances under the Department of State Standardized Regulations for U.S. government civilian direct hire employees assigned to foreign areas, according to State officials. The Department of State Standardized Regulations covers the education, educational travel, extraordinary quarters, foreign transfer, home service transfer, living quarters, post, representation, separate maintenance, and temporary quarters subsistence allowances. It also covers advances of pay, compensatory time off, danger pay, the difficult-to-staff incentive differential, evacuation, foreign per diem, hardship pay, and the official residence expense.

· State’s Bureau of Budget and Planning is responsible for requesting resources from the Office of Management and Budget and Congress to fund compensation and allocating available funds across and within respective funding accounts, according to State officials. The bureau oversees the allocation that funds approximately 70 percent of State’s U.S. direct hire workforce, as well as the direct funding allocations to other bureaus and programs related to pay, benefits, and allowances, according to officials. In addition, the bureau works with stakeholders to project, justify, request, and implement resources for pay, benefits, and allowances. It also coordinates with other bureaus and international commissions to manage payroll for their U.S. direct hire workforce.

· State’s Bureau of the Comptroller and Global Financial Services administers payroll operations for employees worldwide through State’s payroll system, called the Global Foreign Affairs Compensation System, and maintains the department’s accounting system, called the Global Financial Management System. State’s payroll system captures pay, benefits, and allowances that are paid directly to employees, such as danger pay and hardship pay. According to State officials, State’s accounting system captures information on payments for all pay, benefits, and allowances for employees, including those paid through vouchers, such as rent paid directly to landlords or tuition paid directly to foreign schools.

· The Bureau of Overseas Buildings Operations manages State’s overseas housing program and maintains records of the department’s leased and owned real property holdings abroad through a system called the Real Property Application.

· The Bureau of Global Talent Management administers some benefits and allowances, such as the difficult-to-staff incentive differential and federal student loan repayment program, and maintains the department’s system for assigning employees to foreign posts.

State Spent $3.1 Billion on Pay, Benefits, and Allowances for Employees Serving Abroad in FY 2023

State spent about $3.1 billion on pay, benefits, and allowances for employees serving abroad in FY 2023.[3] Of that amount, 37 percent ($1.2 billion) went to basic compensation, 21 percent ($647 million) to housing, 17 percent ($525 million) to federal benefits, and 10 percent ($306 million) to cost-of-living allowances, according to our analysis of State accounting data. The remaining 16 percent of the total ($483 million) went to recruitment and retention, travel and transport, and premium compensation and other benefits and allowances (see fig. 1).[4] Appendixes II through VII provide descriptions of the pay, benefits, and allowances that State offers, including how it calculates amounts, and how much it spent on them in FY 2023.

Figure 1: State Spending on Pay, Benefits, and Allowances for Employees Serving Abroad in Fiscal Year 2023

Notes: Figure includes State spending on all employees that received the above pay, benefits, and allowances while serving abroad, including Foreign Service and Civil Service employees. Most of State’s employees serving abroad are Foreign Service.

Percentages do not sum to 100 because of rounding.

The housing total in this figure includes about $199 million that State spent on housing purchases and maintenance and repair for housing occupied by State and other federal civilians serving abroad.

Basic compensation is the fixed rate of compensation as determined by the employee’s rank. State compensates its employees according to government-regulated pay scales. Foreign Service compensation follows the Foreign Service Salary Schedule, which has nine pay classes, with 14 steps within each class. State determines an employee’s initial class on the basis of education level, work experience, and current salary. Most Civil Service employees are on the General Schedule classification system, which has 15 pay grades, with 10 steps within each grade. State classifies Civil Service positions within the system according to the requirements of the job and can consider employees’ qualifications and experience when determining their rank in the pay schedule. State spent about $1.2 billion on basic compensation for employees serving abroad in FY 2023.

Housing benefits and allowances are intended to provide safe and secure housing that meets the personal and professional requirements of employees, according to State policy. These benefits and allowances include government-leased and -owned housing, temporary quarters subsistence allowance, living quarters allowance, and extraordinary quarters allowance, among others. State spent about $647 million on housing for federal employees serving abroad in FY 2023.[5] Of this amount, 66 percent went to expenses for leased housing for State employees abroad.[6] Of the government-leased and -owned housing for State employees serving abroad in the posts where State had an active diplomatic presence, government-leased units accounted for about 75 percent and government-owned units accounted for about 25 percent, according to State housing data as of the end of fiscal year 2023.

Federal benefits are benefits available to most federal employees as well as benefits that all U.S. employers are required to provide. These benefits consist of employer’s contributions to the Civil and Foreign Service retirement systems, health insurance, payroll taxes for Social Security and Medicare, the Thrift Savings Plan, and life insurance.[7] State spent about $525 million on federal benefits for employees serving abroad in FY 2023.

Cost-of-living allowances reimburse employees for certain extra costs, exclusive of any housing costs, incurred from employment abroad. These consist of the education allowance, post allowance, separate maintenance allowance, foreign transfer allowance, and home service transfer allowance. State spent about $306 million on cost-of-living allowances for employees serving abroad in FY 2023, 74 percent of which went to the education allowance, according to our analysis of State accounting data.

Recruitment and retention benefits and allowances are designed to attract qualified applicants, recruit employees to posts where living conditions differ substantially from environmental conditions in the continental U.S., and retain employees with outstanding qualifications for certain positions. These benefits and allowances consist of hardship pay, danger pay, awards, the difficult-to-staff incentive differential, language incentive pay, recruitment and retention incentives, the federal student loan repayment program, and the physicians’ comparability allowance. State spent about $224 million on recruitment and retention benefits and allowances for employees serving abroad in FY 2023, 69 percent of which went to hardship pay, according to our analysis of State accounting data.

Travel and transport benefits and allowances cover the costs associated with traveling and transporting items to and from overseas posts. These benefits and allowances include transportation and storage of household and other effects, rest and recuperation travel, home leave travel, per diem, evacuation, consumables shipments, and the educational travel allowance, among others. State spent about $149 million on travel and transport benefits and allowances for employees serving abroad in FY 2023, 35 percent of which went to transportation and storage of household and other effects, according to our analysis of State accounting data.

Premium compensation and other benefits and allowances include the official residence expense, overtime and holiday pay, the representation allowance, lump sum annual leave payments, the special differential for substantial amounts of extra work, and Sunday and night differential pay, among others. State spent about $110 million on premium compensation and other benefits and allowances for employees serving abroad in FY 2023, according to our analysis of State accounting data.

State calculates amounts for the 55 types of pay, benefits, and allowances we compiled in a variety of ways.

· Fixed rates. Some types of pay, benefits, and allowances, such as employer’s contributions to payroll taxes for Social Security and Medicare, have a fixed rate set by law. For example, the employer’s contribution to Medicare payroll tax was 1.45 percent of the employee’s taxable compensation in 2023.

· Specific factors. State calculates amounts for some types of benefits and allowances according to factors that are specific to those benefits or allowances. For example, State calculates payments for consumables shipments according to the allowable weight for such shipments, which ranged from 200 net pounds to 3,750 net pounds per employee in FY 2023, regardless of family status and depending on the length of the overseas assignment.

· Rank, location, or family size. State calculates amounts for some types of pay, benefits, and allowances according to rank, location, or family size. For example, the difficult-to-staff differential allowance, which was up to 15 percent above basic compensation in FY 2023, is available to employees assigned to certain hardship posts when especially adverse conditions of environment warrant additional pay as a recruitment and retention incentive.

State’s Spending per Foreign Service Employee on Pay, Benefits, and Allowances Varied by Rank, Location, and Family Size

The amount State spent on pay, benefits, and allowances processed through payroll per Foreign Service employee serving abroad in FY 2023 varied depending on the specific employee’s circumstances. Our analysis of employee-level State payroll data for Foreign Service employees shows that the average amounts State spent on pay, benefits, and allowances ranged widely depending on rank and location.[8] Family size was also a key factor in State’s determination of benefit and allowance amounts for Foreign Service employees serving abroad.[9] Spending increased with family size for certain benefits and allowances, such as the post allowance, the education allowance, and government-owned and -leased housing.

|

Foreign Service Rank Foreign Service employees typically enter the workforce at Class (i.e., pay grade) 6, 5, or 4 and can be promoted up to Class 1, after which they can apply for the Senior Foreign Service. The Senior Foreign

Service has three classes, in ascending order: Counselor, Minister-Counselor,

and Career Minister. Source: GAO analysis of Department of State documentation. | GAO‑25‑107098 |

State’s Spending Varied by Employee Rank

State’s spending on pay, benefits, and allowances per Foreign Service employee serving abroad varied by rank, and on average State spent more on employees in higher ranks than in lower ranks. Basic compensation for all Foreign Service employees increases as they rise in rank. Additionally, some allowances, such as danger pay and hardship pay, are calculated as a percentage of basic compensation and are thus higher for employees in higher ranks than for employees in lower ranks. Figure 2 shows that State’s average spending per Foreign Service employee on pay, benefits, and allowances processed through payroll was $159,500 per entry-level employee and $321,311 per executive employee in FY 2023.

Figure 2: Average State

Spending Processed Through Payroll per Foreign Service Employee Serving Abroad,

by Rank, Fiscal Year 2023

Notes: Entry-level Foreign Service employees are in Classes 6, 5, and 4; mid-level employees are in Classes 3, 2, and 1; and executive employees are in the Senior Foreign Service.

We categorized State’s pay, benefits, and allowances as follows: Basic compensation is the employee’s fixed rate of compensation as determined by rank; federal benefits consist of the employer’s contributions to the Civil and Foreign Service retirement systems, health insurance, payroll taxes for Social Security and Medicare, the Thrift Savings Plan, and life insurance; recruitment and retention consists of hardship pay, danger pay, awards, language incentive pay, recruitment and retention incentives, and physicians’ comparability allowance; cost of living consists of the post allowance and separate maintenance allowance; premium compensation and other consists of chargé d’affaires pay, law enforcement availability pay, overtime and holiday pay, lump sum annual leave payments, the special differential for substantial amounts of extra work, Sunday and night differential pay, and the communications differential for office management specialists.

This analysis only includes spending on benefits or allowances that are processed fully through payroll. Therefore, it does not include spending on the education allowance, the official residence expense, the representation allowance, the difficult-to-staff incentive differential, medical care of dependents and employees, the federal student loan repayment program, the foreign transfer allowance, dependent training, or the home service transfer allowance. It also does not include spending on any benefits or allowances in the categories of housing or travel and transport.

Illustrative examples of State spending by employee rank.[10] State’s spending on selected pay, benefits, and allowances for single Foreign Service employees with no dependents serving in Riyadh, Saudi Arabia, in FY 2023 could have varied from $158,724 for an entry-level employee to $377,224 for an executive-level employee, according to our calculations, all other things being equal (see table 1).[11] Of the total spending in these illustrative examples, the post allowance, which was 30 percent of spendable income in Riyadh in FY 2023, could have been $8,640 for an entry-level employee and $13,950 for an executive-level employee in Riyadh.[12] Hardship pay, which was 25 percent of basic compensation in Riyadh in FY 2023, could have been $16,448 for an entry-level employee and $42,490 for an executive-level employee. Additionally, annual average rent in Riyadh could have been $39,468 for an entry-level employee and $82,382 for an executive-level employee in FY 2023, according to State housing data.[13]

Table 1: Illustrative Examples of Approximate State Spending on Selected Pay, Benefits, and Allowances for Single Foreign Service Employees with No Dependents Serving in Riyadh, Saudi Arabia, by Rank, Fiscal Year 2023

|

Benefit or allowance |

Entry-level |

Mid-level |

Executive |

|

Basic compensation |

$65,793 |

$138,332 |

$169,961 |

|

Rent |

39,468 |

51,914 |

82,382 |

|

Federal benefits |

28,374 |

54,555 |

68,440 |

|

Hardship pay |

16,448 |

34,583 |

42,490 |

|

Post allowance |

8,640 |

13,140 |

13,950 |

|

Total |

$158,724 |

$292,524 |

$377,224 |

Source: GAO analysis of Department of State documentation, housing data, and payroll data and Office of Personnel Management health insurance rate documentation. | GAO‑25‑107098

Notes: These illustrative examples do not include all pay, benefits, and allowances State may have spent on a Foreign Service employee in Riyadh. Basic compensation was calculated using the mid-range salary for each class in State’s 2023 Foreign Service Salary Schedule. Rent was calculated using actual State housing data for fiscal year 2023 and excludes spending on designated housing for positions that have representational responsibilities, such as ambassador. Federal benefits were calculated using State payroll data and the Office of Personnel Management’s 2023 premium rates for the Nationwide Foreign Service Benefit Plan and consist of employer’s contributions to the Civil and Foreign Service retirement systems, health insurance, payroll taxes for Social Security and Medicare, the Thrift Savings Plan, and life insurance. Hardship pay was calculated by applying the rates on State’s website as of the end of fiscal year 2023 to the estimated basic compensation amounts. The post allowance came from State’s 2023 post allowance payment tables. The entry-level employee in our illustrative examples is a Class 6 employee, the mid-level employee is a Class 2 employee, and the executive is a Counselor-class employee.

Numbers may not sum to the total because of rounding.

State’s Spending Varied by Employee Location

State’s spending on pay, benefits, and allowances per Foreign Service employee serving abroad varied by location and was higher for employees at posts with higher allowance rates. Specifically, State determines the rates of allowances such as danger pay, the post allowance, and hardship pay depending on the living conditions at each post.[14]

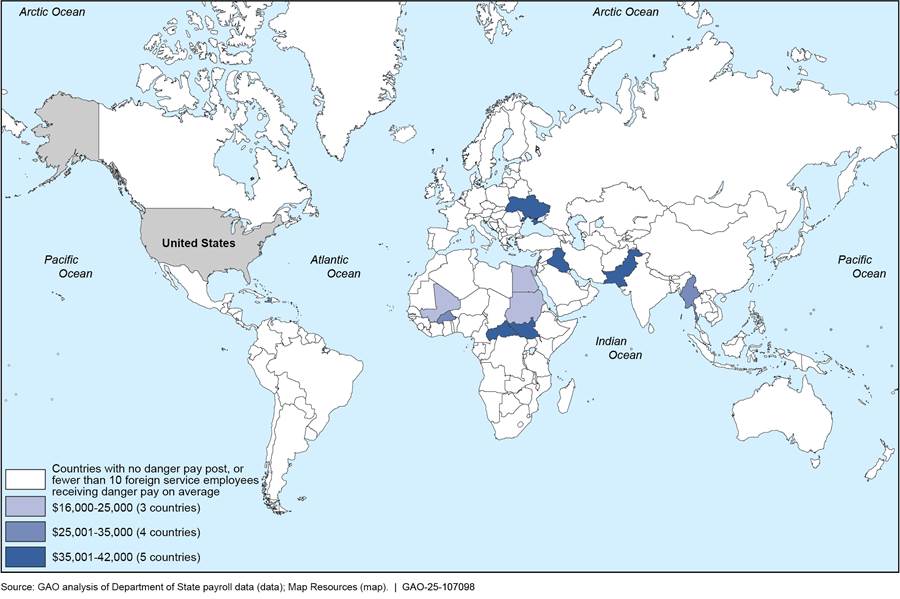

· Danger pay is only available to employees serving at designated posts where civil insurrection, civil war, terrorism, or wartime conditions threaten physical harm or pose imminent danger to the health or well-being of the employee. Danger pay ranged from 15 percent to 35 percent above basic compensation, and 29 countries had designated danger pay posts as of the end of FY 2023. About 7 percent of Foreign Service employees received danger pay during FY 2023, according to State payroll data. See appendix IX for details on how average State spending on danger pay per Foreign Service employee varied by country in FY 2023.

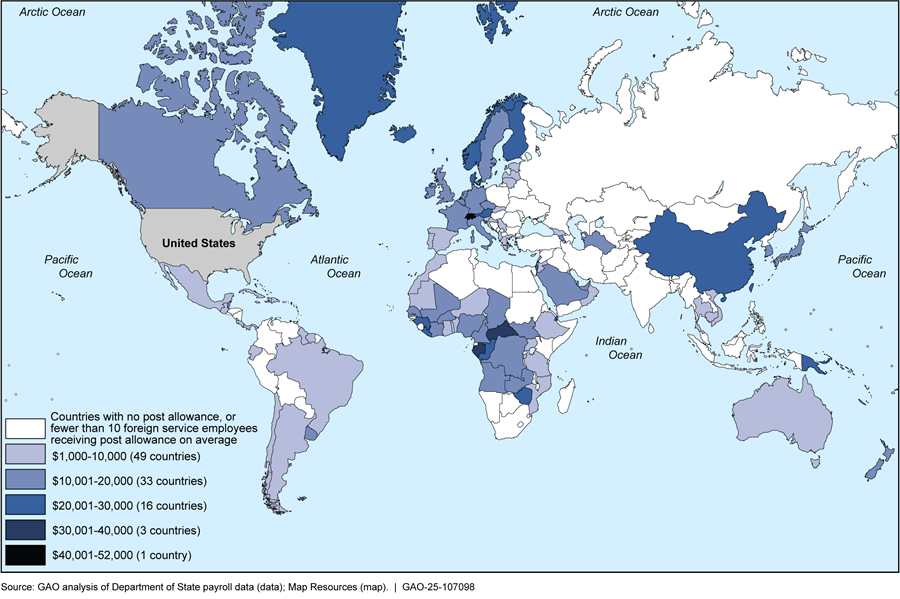

· The post allowance adjusts for cost-of-living differences and is only available to employees serving at posts where the costs of goods and services is substantially higher than in Washington, D.C. Post allowance rates ranged from 5 percent to 120 percent of spendable income, and 120 countries had posts with post allowance as of the end of FY 2023. About 55 percent of Foreign Service employees received the post allowance during FY 2023, according to State payroll data. See appendix X for details on how average State spending on the post allowance per Foreign Service employee varied by country in FY 2023.

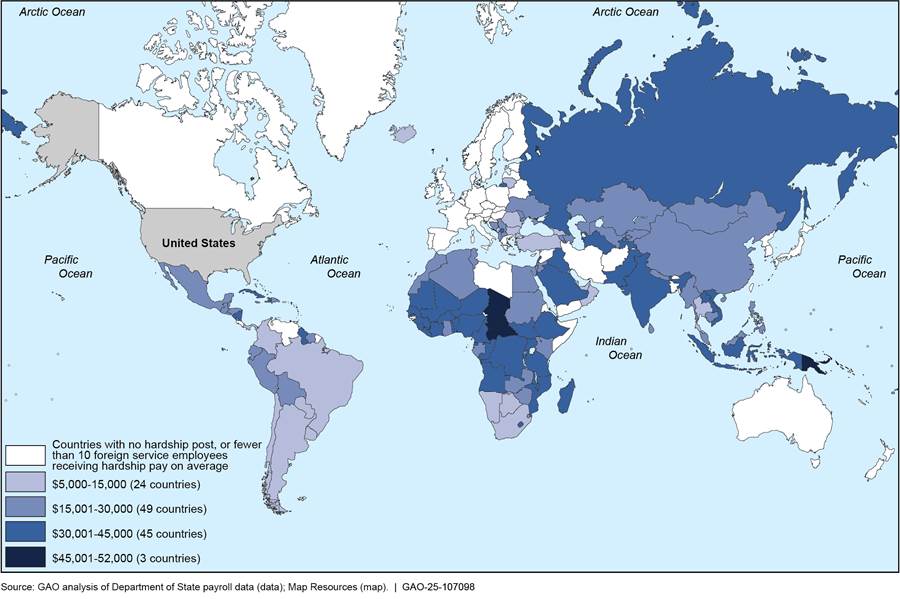

· Hardship pay is only available to employees serving at posts where conditions of environment differ substantially from conditions of environment in the continental U.S. Hardship pay ranged from 5 percent to 35 percent above basic compensation, and 151 countries had designated hardship posts as of the end of FY 2023. About 66 percent of Foreign Service employees received hardship pay during FY 2023, according to State payroll data. See appendix XI for details on how average State spending on hardship pay per Foreign Service employee varied by country in FY 2023.

Our analysis of State payroll data for countries with an average of 10 or more employees in FY 2023 shows that State had the lowest average spending per Foreign Service employee in Malta ($182,151), which had a 5 percent post allowance rate and a 5 percent hardship pay rate as of the end of FY 2023. State had the highest average spending per Foreign Service employee in the Central African Republic ($325,181), which had a 90 percent post allowance rate, a 35 percent hardship pay rate, and a 35 percent danger pay rate. Figure 3 shows how State’s average spending per Foreign Service employee on pay, benefits, and allowances processed through payroll varied by country in FY 2023.

Figure 3: Average State Spending Processed Through Payroll per Foreign Service Employee Serving Abroad, by Country, Fiscal Year 2023

Notes: Spending includes basic compensation (the employee’s fixed rate of compensation as determined by rank); federal benefits (employer’s contributions to the Civil and Foreign Service retirement systems, health insurance, payroll taxes for Social Security and Medicare, the Thrift Savings Plan, and life insurance); recruitment and retention (hardship pay, danger pay, awards, language incentive pay, recruitment and retention incentives, the federal student loan repayment program, and the physicians’ comparability allowance); cost of living (the post allowance and separate maintenance allowance); and premium compensation and other (chargé d’affaires pay, law enforcement availability pay, overtime and holiday pay, lump sum annual leave payments, the special differential for substantial amounts of extra work, Sunday and night differential pay, and the communications differential for office management specialists). This analysis only includes spending on benefits or allowances that are processed fully through payroll. Therefore, it does not include spending on the education allowance, the official residence expense, the representation allowance, the difficult-to-staff incentive differential, medical care of dependents and employees, the federal student loan repayment program, the foreign transfer allowance, dependent training, or the home service transfer allowance. The analysis also does not include spending on any benefits or allowances in the categories of housing or travel and transport.

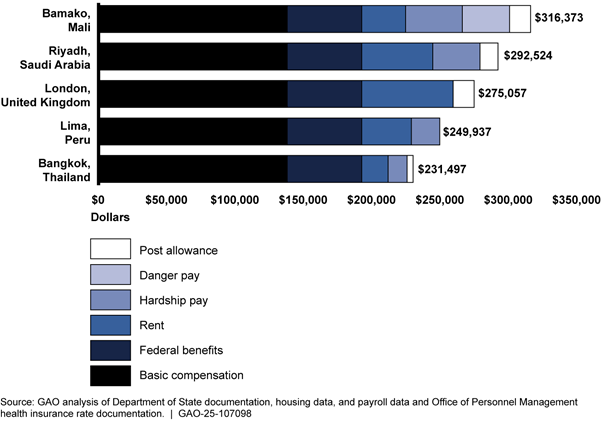

Illustrative examples of State spending by employee location.[15] State’s spending on single mid-level Foreign Service employees with no dependents serving at five different posts in FY 2023 could have been $231,497 in Bangkok, Thailand, and $316,373 in Bamako, Mali, according to our calculations, all other things being equal (see fig. 4).[16] The availability and rates of allowances such as danger pay, the post allowance, and hardship pay at each post can explain most of the differences in approximate State spending across locations. In addition, annual average rent for such employees could have varied from $20,397 in Bangkok to $66,840 in London in FY 2023, according to State housing data.

Figure 4: Illustrative

Examples of Approximate State Spending on Selected Pay, Benefits, and

Allowances for Single Mid-level Foreign Service Employees with No Dependents

Serving at Various Posts, Fiscal Year 2023

Notes: The mid-level employees in our illustrative examples are Class 2 employees. Basic compensation was calculated using the mid-range salary for each class in State’s 2023 Foreign Service Salary Schedule. Federal benefits were calculated using State payroll data and the Office of Personnel Management’s 2023 premium rates for the Nationwide Foreign Service Benefit Plan and consist of employer’s contributions to the Civil and Foreign Service retirement systems, health insurance, payroll taxes for Social Security and Medicare, the Thrift Savings Plan, and life insurance. Rent was calculated using actual State housing data for fiscal year 2023 and excludes spending on designated housing for positions that have representational responsibilities, such as ambassador. Hardship pay and danger pay were calculated by applying the rates on State’s website as of the end of fiscal year 2023 to the estimated basic compensation amounts. The post allowance came from State’s 2023 post allowance payment tables.

State’s Spending Varied by Employee Family Size

State’s spending on benefits and allowances per Foreign Service employee serving abroad varied by the employee’s family size and was higher for employees with larger family sizes, all other things being equal. For example, the amounts State spends per employee for the separate maintenance allowance, post allowance, education allowance, and government-owned and -leased housing are determined by the employee’s family size.

· The separate maintenance allowance is only available to employees with dependents who do not live with them at post for various reasons, such as dangerous living conditions at post, the convenience of the U.S. government, or family considerations. These employees receive voluntary or involuntary separate maintenance allowance to help defray the additional expense of maintaining family members at another location. The more dependent family members an employee has, the more State spends on the separate maintenance allowance. Table 2 shows the rates of voluntary and involuntary separate maintenance allowance.

Table 2: Annual Rate of Voluntary and Involuntary Separate Maintenance Allowance, by Family Size, Fiscal Year 2023

|

Type of separate maintenance allowance |

One child only |

Two or more children |

One adult only |

One adult and one additional family member |

One adult and two or three additional family members |

One adult and four or more additional family members |

|

Voluntary |

$6,000 |

$9,900 |

$11,300 |

$15,300 |

$17,300 |

$20,200 |

|

Involuntary |

$8,400 |

$13,800 |

$15,800 |

$21,300 |

$24,200 |

$28,300 |

Source: Department of State, Department of State Standardized Regulations. | GAO‑25‑107098

Notes: State can authorize voluntary separate maintenance allowance at an employee’s request because of special needs or hardship at posts for reasons including, but not limited to, career, health, educational, or family considerations. State can grant involuntary separate maintenance allowance when it determines that an adverse, dangerous, or notably unhealthful living condition may warrant the exclusion of family members from accompanying employees at a post.

· Post allowance amounts are adjusted for employee family size. The post allowance is a percentage of spendable income, and State calculates higher amounts of spendable income for employees with larger family sizes, resulting in higher post allowance amounts. The more dependent family members an employee has at post, the more State spends on the post allowance.

· The education allowance assists employees in covering the costs of educational services (grades K–12) that would normally be free of charge in U.S. public schools. State also provides the educational travel allowance to fund one round trip annually to reunite a full-time post-secondary student with the employee/parent serving the U.S. government in the foreign area. In addition, State may provide the educational travel allowance in lieu of the education allowance for a child attending a secondary school (grades 9 through 12) that is in a different location from the employee’s post. The more dependent children an employee has, the higher the amount State may spend on the education allowance or educational travel allowance.

· Government-owned and -leased housing space size and the amount of living quarters allowance State provides employees serving abroad are also determined by the employee’s family size. State takes into consideration an employee’s family size and rank at the time of arrival at post to determine their maximum residential space authorization, adjusted for locality factors. The larger an employee’s family size, the larger the space allocated to them. When government-owned or -leased housing is not available at post, State provides the living quarters allowance to help defray the annual cost of suitable, adequate housing for the employee and their family. State allows for up to 30 percent above living quarters allowance rates for employees with larger family sizes.

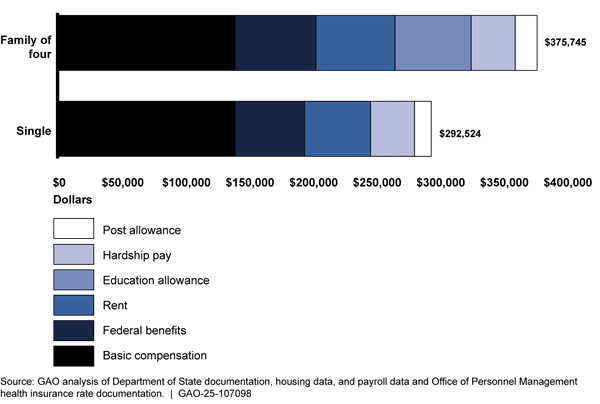

Illustrative examples of State spending by employee family size.[17] State’s spending on mid-level Foreign Service employees serving in Riyadh, Saudi Arabia, in FY 2023 could have been $292,524 for a single employee with no dependents and $375,745 for an employee with a family of four, according to our estimates, all other things being equal (see fig. 5).[18] One reason for the difference in approximate spending is that the post allowance, which was 30 percent of spendable income in Riyadh in FY 2023, could have increased from $13,140 for an employee with no dependents to $17,220 for an employee with a family of four. Another reason is that State could have spent an estimated additional $59,869 on the education allowance for two dependent children to attend school at post. In addition, average annual rent in Riyadh could have varied from $51,914 for an employee with no dependents to $62,183 for an employee with a family of four, according to State housing data.

Figure 5: Illustrative Examples of Approximate State Spending on Selected Pay, Benefits, and Allowances for Mid-level Foreign Service Employees Serving in Riyadh, Saudi Arabia, Single versus Family of Four, Fiscal Year 2023

Notes: These illustrative examples do not include all pay, benefits, and allowances State may have spent on Foreign Service employees in Riyadh. Basic compensation was calculated using the mid-range salary for each class in State’s 2023 Foreign Service Salary Schedule. Federal benefits were calculated using State payroll data and the Office of Personnel Management’s 2023 premium rates for the Nationwide Foreign Service Benefit Plan and consist of employer’s contributions to the Civil and Foreign Service retirement systems, health insurance, payroll taxes for Social Security and Medicare, the Thrift Savings Plan, and life insurance. Rent was calculated using actual State housing data for fiscal year 2023 and excludes spending on designated housing for positions that have representational responsibilities, such as ambassador. The education allowance was calculated using the average of the rates on State’s website as of the end of fiscal year 2023 for Riyadh. Hardship pay was calculated by applying the rates on State’s website as of the end of fiscal year 2023 to the estimated basic compensation amounts. The post allowance came from State’s 2023 post allowance payment tables. The mid-level employees in our illustrative examples are Class 2 employees.

Agency Comments

We provided a draft of this report to State for review and comment. State did not have any comments on the report.

We are sending copies of this report to the appropriate congressional committees and the Secretary of State. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at (202) 512-4128 or wingert@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix XII.

Tatiana Winger

Acting Director, International Affairs and Trade

This report examines (1) how much the Department of State spent on pay, benefits, and allowances for employees serving abroad in fiscal year (FY) 2023, and how it calculates amounts for pay, benefits and allowances, and (2) how State’s spending on pay, benefits, and allowances varied for Foreign Service employees serving abroad in FY 2023.

To examine how much State spent on pay, benefits, and allowances for employees serving abroad in FY 2023, we compiled a list of 55 types of pay, benefits, and allowances for which direct hire, full-time State Foreign Service and Civil Service employees serving abroad are eligible. We did so by

· reviewing the Foreign Affairs Manual, Foreign Affairs Handbooks, the Department of State Standardized Regulations, and prior GAO reports;

· interviewing officials from State’s Bureaus of the Comptroller and Global Financial Services, Global Talent Management, Overseas Buildings Operations, and Budget and Planning, as well as the Office of Allowances; and

· providing the list to State officials to review for comprehensiveness and accuracy.

We grouped the pay, benefits, and allowances into seven categories for reporting purposes: basic compensation, housing, federal benefits, cost of living, recruitment and retention, travel and transport, and premium compensation and other.[19] We included spending on all employees that received these types of pay, benefits, and allowances, including Foreign Service and Civil Service employees, in this reporting objective because it was not possible to isolate the spending on Foreign Service employees in State’s accounting data. We analyzed accounting data from State’s Global Financial Management System on expenditures in FY 2023 for our list of pay, benefits, and allowances by aggregating the amount by the budget sub-object code associated with each type of pay, benefit, and allowance.[20] To assess the reliability of State’s accounting data, we performed electronic testing to identify missing data and errors and interviewed State officials. We determined that the accounting data were sufficiently reliable for the purposes of analyzing the amounts that State spent on pay, benefits, and allowances for employees serving abroad in FY 2023. To examine how State calculates amounts for pay, benefits, and allowances, we reviewed State policy documents, regulations, and other documentation.

To examine how State’s spending on pay, benefits, and allowances varied for Foreign Service employees serving abroad in FY 2023, we analyzed State data on expenditures for the pay, benefits, and allowances that State processed through payroll and reviewed State documentation, including the Department of State Standardized Regulations.[21] We analyzed biweekly payroll data for 26 pay periods with pay dates from October 6, 2022, to September 19, 2023, for direct hire, full-time Foreign Service employees who were stationed abroad.[22] We excluded all pay advances and repayments of pay advances. We also excluded all other repayments by employees to State, adjustments, and retroactive payments that were associated with pay actions prior to FY 2023.[23]

To analyze how State’s average spending per Foreign Service employee varied by rank, we grouped employees into three ranks: entry-level (Foreign Service Classes six through four); mid-level (Foreign Service Classes three through one), and executive (Senior Foreign Service).[24] We aggregated the amount spent on employees in each rank in FY 2023 by the budget sub-object code associated with each pay, benefit, and allowance processed through payroll and divided it by the average number of employees that were in that rank during FY 2023.

To analyze how State’s average spending per Foreign Service employee varied by location, we aggregated the amount spent on pay, benefits, and allowances for all budget sub-object codes in FY 2023 for all employees serving in countries with an average of 10 or more employees and divided it by the average number of employees that served in that country during FY 2023. To analyze State’s average spending on danger pay, the post allowance, and hardship pay by country, we aggregated the amount spent by sub-object code for the respective allowances in countries where an average of 10 or more employees received that allowance; we then divided the aggregated amount by the average number of employees in that country that received the respective allowances during FY 2023. To protect employee privacy, we excluded countries with an average of fewer than 10 employees per pay period when reporting country-level results.[25]

To describe how State’s spending per Foreign Service employee may have varied by family size, we reviewed State documentation, including the Department of State Standardized Regulations. To assess the reliability of the payroll data that State provided, we performed testing to identify missing data, outliers, and errors and interviewed State officials from the Bureau of the Comptroller and Global Financial Services. We determined that the payroll data were sufficiently reliable for the purposes of averaging the amounts State spent on pay, benefits, and allowances processed through payroll by rank and location for Foreign Service employees serving abroad.

Since State’s payroll data did not contain spending on certain benefits and allowances (e.g., housing and the education allowance) and key employee characteristics such as family size, we constructed illustrative examples to show how State spending may have varied by rank, location, and family size for Foreign Service employees serving abroad in FY 2023. To select posts for the illustrative examples, we reviewed State data on government-leased housing, payroll data, and documentation on pay, benefits, and allowance amounts and rates.[26] We analyzed State rent data on leased housing to identify a list of posts at which at least one entry-level, mid-level, and executive employee with no dependents and at least one entry-level, mid-level, and executive employee with a family size of four lived in leased housing as of the end of FY 2023.[27] We also identified a list of designated danger pay posts at which at least one entry-level, mid-level, and executive employee with no dependents lived in leased housing as of the end of FY 2023. From this list, we selected a non-generalizable sample of five posts in different geographical regions with varying rent costs and rates for three allowances: the post allowance, danger pay, and hardship pay. These selected posts were Bamako, Mali; Lima, Peru; Riyadh, Saudi Arabia; Bangkok, Thailand; and London, United Kingdom.

For each of the posts in our examples, we calculated the amounts that State may have spent on selected pay, benefits, and allowances for employees of different family sizes and ranks in FY 2023. Specifically, for each location, we compared amounts State may have spent on a single employee with no dependents and an employee with a family of four (employee, spouse, and two dependent school-age children), as well as amounts State may have spent on an entry-level (Class 6), mid-level (Class 2), and executive (Counselor-class) employee.

We calculated spending on basic compensation for our examples by using the mid-salary level of State’s 2023 Foreign Service Salary Schedule for a Class 6 entry-level employee, a Class 2 mid-level employee, and a Counselor-class Senior Foreign Service employee. To calculate spending on federal benefits except health insurance, we used State payroll data to calculate the average amount spent in FY 2023 on employer’s contributions to the Civil and Foreign Service retirement systems, payroll taxes for Social Security and Medicare, the Thrift Savings Plan, and life insurance for the three selected classes. We aggregated the amount spent by the budget sub-object codes associated with the federal benefits and divided it by the average number of employees that received those benefits in the selected classes during FY 2023. To calculate spending on health insurance, adjusted for family size, we used the 2023 premium rates for the Nationwide Foreign Service Benefit Plan published by the Office of Personnel Management for an individual plan and a family plan. We calculated the education allowance according to the average rates on State’s website for each post as of the end of FY 2023. We used State housing data to calculate the average rent amount by family size (single and family of four) at each selected post. We excluded from our averages spending on designated housing, which is housing for officials in positions that have representational responsibilities, such as ambassador, deputy chief of mission, and consul general.[28]

To calculate hardship pay and danger pay for our illustrative examples, we applied the rates published on State’s website as of the end of FY 2023 for each post to the estimated basic compensation amounts. To calculate the post allowance, we used State’s 2023 post allowances payment tables, which provided allowance amounts for employees with different levels of basic compensation, family sizes, and post allowance rates. In all of our illustrative example posts except Bamako, we assumed family members lived with the employee at posts. In Bamako, we assumed family members lived away from post for safety reasons, as Bamako was the only selected danger pay post and the employee received the separate maintenance allowance. To calculate the separate maintenance allowance for Bamako, we used the involuntary separate maintenance allowance rate in the Department of State Standardized Regulations. To assess the reliability of State’s payroll and housing data, we performed testing to identify missing data, outliers, and errors and interviewed State officials from the bureaus of the Comptroller and Global Financial Services and Overseas Buildings Operations. We determined that State’s payroll and housing data were sufficiently reliable for the purposes of calculating approximate federal benefits and rent costs by location and number of occupants for our illustrative examples.

We conducted this performance audit from October 2023 to December 2024 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Table 3: Amounts State Spent on Housing Benefits and Allowances It Offers Employees Serving Abroad, Fiscal Year 2023

|

Benefit or allowance |

Description |

How amount is calculated |

Amount spent |

|

Government-leased housing |

Covers the costs of rents or leases for housing for State employees living abroad, including land, structures, and improvements, as well as fixed equipment and furnishings when included in the price. Also covers landlord charges for services such as porterage and separate maintenance costs.a |

Space authorization for housing is calculated according to location, family size, and rank. |

$428 million |

|

Government-owned housing |

Covers the costs of acquiring housing for State employees serving abroad, most of which State purchases or constructs.b |

Space authorization for housing is calculated according to location, family size, and rank. |

$139 millionc |

|

Maintenance and repair |

Pays for costs associated with maintaining and repairing government-leased and -owned housing abroad. |

Varies according to budget. |

$60 milliond |

|

Temporary quarters subsistence allowance |

Assists with the reasonable cost of temporary lodging, meals, and laundry in a foreign area when an employee first arrives at a new post and permanent quarters are not available, or when an employee is getting ready to depart the post permanently and must vacate their housing. |

Calculated according to the per diem at post, the size of an employee’s family, and the amount of time the employee receives the allowance. Employees cannot receive this allowance while receiving the post allowance. |

$8 million |

|

Living quarters allowance |

Defrays the annual cost of suitable, adequate living quarters at an overseas post where government-leased or -owned housing is not provided. |

Calculated according to rank and family size and designed to substantially cover the average employee’s costs for rent, utilities, required taxes levied by the local government, and other allowable expenses. |

$7 million |

|

Extraordinary quarters allowance |

Granted to employees and eligible family members at a foreign post when they are required to partially or completely vacate their permanent quarters because of renovations, repairs, or unhealthy or dangerous conditions. |

Calculated according to the per diem at post, the post allowance, and family size. |

$5 millione |

|

Total |

— |

— |

$647 million |

Legend: — = not applicable

Source: GAO analysis of Department of State documentation, accounting data, and maintenance data. | GAO‑25‑107098

Notes: Table includes State spending on all employees that received the above benefits and allowances while serving abroad, including Foreign Service and Civil Service employees.

None of these benefits and allowances are available to State employees serving domestically, according to State officials.

aA greater number of State employees serving abroad along with their family members resided in leased housing compared to owned housing. As of the end of fiscal year 2023, State had 8,773 leased units for its employees abroad in 240 posts around the world where it had an active diplomatic presence, according to State housing data. These units housed 23,657 people, including employees and family members. The average number of bedrooms was 3.4 and the average size was 1,638 square feet, respectively, for these government-leased housing units.

bState has also acquired housing through transfers, use agreements, property exchanges, and gifts. As of the end of fiscal year 2023, State owned 2,971 housing units in 187 posts where it had an active diplomatic presence, according to State housing data. These units housed 5,624 people, including employees and family members. The average number of bedrooms was three and the average size was 1,866 square feet, respectively, for these government-owned housing units.

cThis amount only reflects spending for purchased housing occupied by State and other federal civilian employees serving abroad in fiscal year 2023. Purchase costs for housing vary from year to year. State spent an average of $40 million annually to purchase housing from fiscal year 2018 through fiscal year 2022. State does not have comprehensive data on construction costs because it generally builds and pays for constructed housing as part of larger embassy construction projects, according to State officials.

dThis amount includes maintenance and repair spending for housing occupied by State and other federal civilian employees serving abroad in fiscal year 2023.

eThis amount includes spending for locally employed staff and other employees, according to State officials.

Table 4: Amounts State Spent on Federal Benefits It Offers Employees Serving Abroad, Fiscal Year 2023

|

Benefit |

Description |

How amount is calculated |

Amount spent |

|

Foreign Service retirement systems |

Employer’s contributions to pension fund under either the Foreign Service Pension System (employees hired in 1984 or later) or the Foreign Service Retirement and Disability System (employees hired before 1984). |

Foreign Service Pension System: actuarially determined amount to reflect the “normal cost” (less the employee contribution). Foreign Service Retirement and Disability System: 7.25 percent of the employee’s basic compensation. |

$220 million |

|

Health insurance |

Employer’s contributions to the Federal Employees Health Benefits program. |

Varies depending on the employee’s chosen health insurance plan and number of family member enrollees. |

$104 million |

|

Social Security payroll tax |

Employer’s contributions to payroll taxes for federal Old-Age, Survivors, and Disability Insurance. |

6.2 percent of the employee’s taxable compensation up to $160,200 in calendar year 2023. |

$85 million |

|

Thrift Savings Plan |

Employer’s contributions to the federal employee retirement savings and investment plan (similar to 401k accounts in the private sector). |

1 percent automatic agency contribution; matching contributions up to 5 percent of pay. |

$63 million |

|

Civil Service retirement system |

Employer’s contributions to pension fund under the Federal Employees Retirement System. |

Actuarially determined amount to reflect the “normal cost” (less the employee contribution). |

$29 million |

|

Medicare payroll tax |

Employer’s contributions to Medicare Hospital Insurance. |

1.45 percent of the employee’s taxable compensation in calendar year 2023. |

$22 million |

|

Life insurance |

Employer’s contributions to the Federal Employee Group Life Insurance program. |

One-half the amount withheld from the employee’s pay. |

$2 million |

|

Total |

— |

— |

$525 million |

Legend: — = not applicable

Source: GAO analysis of Department of State, Internal Revenue Service, and Office of Personnel Management documentation and State accounting data. | GAO‑25‑107098

Notes: Table includes State spending on all employees that received the above benefits and allowances while serving abroad, including Foreign Service and Civil Service employees.

All of these benefits and allowances are available to State employees serving domestically as well as abroad, according to State officials.

Table 5: Amounts State Spent on Cost-of-Living Allowances It Offers Employees Serving Abroad, Fiscal Year 2023

|

Allowance |

Description |

How amount is calculated |

Amount spent |

|

Education allowance |

Defrays extraordinary and necessary costs, not otherwise compensated for, to obtain adequate elementary and secondary education for dependent children at a foreign post that would normally be free of charge in U.S. public schools. |

Calculated according to the allowable education expenses for (1) a school at the post, (2) a school away from the post, (3) home schooling and private instruction, or (4) special-needs education. |

$227 million |

|

Post allowance |

Granted to employees officially stationed at foreign posts where the cost of living, exclusive of quarters costs, is substantially higher than in Washington, D.C. |

Percentage above spendable income, calculated on the basis of a cost-of-living index that shows living costs in the foreign location relative to living costs in Washington, D.C. The index is based on market data that State collects from private firms. |

$70 million |

|

Separate maintenance allowance |

Defrays the additional expense of maintaining family members at another location because of (1) dangerous, notably unhealthful, or excessively adverse living conditions at the foreign post of assignment; (2) the convenience of the U.S. government; or (3) special needs or hardship involving the employee or a family member. There are three types: involuntary, voluntary, and transitional. |

Involuntary and voluntary: calculated using the Bureau of Labor Statistics consumer expenditure data and family size, with annual rates ranging from $6,000 for one child only to $28,300 for an adult and four or more family members. Transitional: calculated on the basis of the number of eligible family members, the standard continental U.S. per diem rate, and the amount of time the employee receives the allowance. |

$9 million |

|

Othera |

— |

— |

$163,000 |

|

Total |

— |

— |

$306 million |

Legend: — = not applicable

Source: GAO analysis of Department of State documentation and accounting data. | GAO‑25‑107098

Notes: Table includes State spending on all employees that received the above allowances while serving abroad, including Foreign Service and Civil Service employees.

None of these allowances are available to State employees serving domestically, according to State officials.

a“Other” is State spending on the foreign transfer allowance and home service transfer allowance, on which State spent less than $1 million in fiscal year 2023.

Appendix V: Amounts State Spent on Recruitment and Retention Benefits and Allowances in Fiscal Year 2023

Table 6: Amounts State Spent on Recruitment and Retention Benefits and Allowances It Offers Employees Serving Abroad, Fiscal Year 2023

|

Benefit or allowance |

Description |

How amount is calculated |

Amount spent |

|

Hardship pay |

Compensates employees for serving in places where conditions of environment differ substantially from those in the U.S. |

5 percent to 35 percent above basic compensation in 5 percent increments, depending on the severity of the hardship as determined by State. |

$154 million |

|

Danger pay |

Compensates employees for serving in places where conditions of civil insurrection, civil war, terrorism, or wartime conditions threaten physical harm or imminent danger to the health or well-being of the employee. |

15 percent to 35 percent above basic compensation in 10 percent increments, depending on the determined level of danger and whether non-essential personnel and dependents are at the foreign post. |

$25 million |

|

Awardsa |

Paid to employees for outstanding performance, sustained and extraordinary accomplishments, and efforts of special merit, among other things. |

Varies |

$13 million |

|

Difficult-to-staff incentive differential |

Paid to employees assigned to certain hardship posts when especially adverse conditions of environment warrant additional pay as a recruitment and retention incentive. |

Up to 15 percent above basic compensation. Cannot exceed 35 percent above basic compensation when combined with danger pay allowance. |

$10 million |

|

Language incentive pay |

Provides monetary incentives to employees who achieve proficiency in designated hard and super-hard languages and who serve at a post where the incentive language is primarily spoken or in a position that requires an incentive language. |

5 percent to 15 percent of the base schedule salary for a Foreign Service Class 1 employee, depending on the employee’s level of proficiency. |

$9 million |

|

Retention incentive |

Provides monetary incentives to retain employees with outstanding qualifications in designated employment categories. |

Up to 25 percent of basic compensation, depending on several factors, including the success of recent efforts to recruit qualified candidates and labor market conditions. |

$8 million |

|

Federal student loan repayment program |

Paid directly to the lender or loan servicing organization to reduce student loan debt for employees assigned to certain hard-to-staff posts. |

Up to $10,000 per calendar year and up to a lifetime maximum of $60,000 per employee, depending on funding resources and recruiting and retention needs. |

$3 million |

|

Physicians’ comparability allowance |

Provides monetary incentives to recruit and retain qualified physicians. |

$14,000 per year for full-time service of 2 years or less or up to $30,000 per year for full-time service of more than 2 years. |

$3 million |

|

Otherb |

— |

— |

$723,000 |

|

Total |

— |

— |

$224 million |

Legend: — = not applicable

Source: GAO analysis of Department of State documentation and accounting data. | GAO‑25‑107098

Notes: Table includes State spending on all employees that received the above benefits and allowances while serving abroad, including Foreign Service and Civil Service employees.

Numbers do not sum to the total because of rounding.

Awards, language incentive pay, recruitment and retention incentives, the federal student loan repayment program, and the physicians’ comparability allowance are available to State employees serving domestically as well as abroad, according to State officials.

aAwards included in this review were cash awards, performance awards, and meritorious or distinguished executive awards.

b“Other” is State spending on recruitment incentives, on which State spent less than $1 million in fiscal year 2023.

Appendix VI: Amounts State Spent on Travel and Transport Benefits and Allowances in Fiscal Year 2023

Table 7: Amounts State Spent on Travel and Transport Benefits and Allowances It Offers Employees Serving Abroad, Fiscal Year 2023

|

Benefit or allowance |

Description |

How amount is calculated |

Amount spent |

|

Transportation and storage of household and other effectsa |

Covers the costs of preparing, storing, transporting, and unpacking property, household, personal effects, and privately-owned vehicles for employees, volunteers, trainees, and dependents. |

Varies depending on the type of item and the location of the foreign post. |

$53 million |

|

Rest and recuperation travel |

Covers the cost of travel expenses for employees and eligible family members serving at posts with distinct and significant difficulties. |

One round trip during any continuous 2-year period of service unbroken by home leave or two round trips during any continuous 3-year period of service unbroken by home leave. |

$34 millionb |

|

Home and extended leave travel |

Covers the cost of travel expenses for employees who live abroad for an extended period to travel to the U.S. for reorientation and re-exposure on a regular basis. Generally granted at the conclusion of an overseas assignment. |

One trip to the U.S. for employees who have completed at least 18 months of continuous service abroad, or 12 months of continuous service abroad at a post experiencing extraordinary circumstances. |

|

|

Airfare |

Covers the costs of passenger transportation by air, including allowable free accompanied baggage. |

Varies depending on U.S. government fares, including the General Services Administration’s City Pair fares, which are discounted fares for federal government travelers. |

$22 million |

|

Per diem |

Daily payment intended to substantially cover the costs of lodging, meals, and incidental travel expenses for official travel away from an employee’s permanent duty station. |

Calculated using costs reported in the Hotel and Restaurant Survey submitted by foreign posts, which includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical federal travelers. |

$13 millionc |

|

Evacuation |

Covers the following costs when employees and family members are authorized or ordered to evacuate a foreign post: (1) a subsistence allowance to help cover the costs of lodging and meals; (2) local transportation allowance at the safe haven when a personally owned vehicle is not available; (3) an air freight replacement allowance if air freight is not shipped from post; and (4) a pet shipment and required quarantine allowance to assist with getting the family pet or pets out of and back to the post. |

Subsistence amounts are calculated using the safe haven’s per diem rate, and the lodging amounts depend on whether the employee occupies commercial or non-commercial quarters. Evacuation payments terminate no later than 180 days after the evacuation order is issued unless the evacuation order has been extended past the 180-day mark and an employee’s account for 180 days of subsistence has not been reached. |

$12 million |

|

Consumables shipments |

Covers the costs of shipping foodstuff and personal or household maintenance such as toiletries and nonhazardous cleaning supplies to posts at which conditions make it difficult to obtain such items locally. |

200 to 3,750 net pounds per employee, regardless of family status, depending on length of the overseas assignment. |

$11 milliond |

|

Educational travel allowance |

Covers the cost of travel expenses for dependent children between the school and the employee’s post once each way annually for secondary or postsecondary education. |

One round trip annually. |

$2 million |

|

Emergency visitation travel |

Covers the cost of travel expenses from a foreign post to the U.S. or to other locations in certain situations of family emergency. |

Round-trip airfare, airport taxes, connecting transportation between airports, two pieces of checked luggage up to 50 pounds, and seat selection. |

$2 million |

|

Othere |

— |

— |

$730,000 |

|

Total |

— |

— |

$149 million |

Legend: — = not applicable

Source: GAO analysis of Department of State documentation and accounting data. | GAO‑25‑107098

Notes: Table includes State spending on all employees that received the above benefits and allowances while serving abroad, including Foreign Service and Civil Service employees.

Numbers do not sum to the total because of rounding.

Per diem and all types of transportation and storage of household and other effects included in our scope except ocean freight and air freight are available to State employees serving domestically as well as abroad, according to State officials.

aTransportation and storage of household and other effects includes packing and crating, local haul and inland freight, ocean freight, air freight, unpacking, residence-to-residence, temporary storage, and continuous storage as well as shipment of privately-owned vehicles.

bSpending for rest and recuperation travel, home leave travel, and extended leave travel are tracked together in State’s accounting system.

cThis amount includes other travel spending, such as temporary duty travel and personal services contractor travel, according to State officials.

dThis amount may include other transportation spending, according to State officials.

e“Other” is State spending on travel of separated families, family visitation travel, and medical travel, on which State spent less than $1 million in fiscal year 2023.

Appendix VII: Amounts State Spent on Premium Compensation and Other Benefits and Allowances in Fiscal Year 2023

Table 8: Amounts State Spent on Premium Compensation and Other Benefits and Allowances It Offers Employees Serving Abroad, Fiscal Year 2023

|

Compensation, benefit, or allowance |

Description |

How amount is calculated |

Amount spent |

|

Official residence expense |

Reimburses a principal representative (e.g., an ambassador) at a foreign post for expenses related to operating and maintaining a suitable official residence in-country when those expenses exceed the usual expenses incurred if they were serving at the post in any other official capacity. |

Generally, principal representatives are expected to direct at least 3.5 percent of their salary toward maintaining their residences, and State may reimburse expenses above that. |

$32 million |

|

Chargé d’affaires pay |

Compensates employees who are temporarily in charge of a foreign post during the absence or incapacity of the principal officer. |

One-half the difference between the basic compensation of the officer acting in charge and the basic compensation provided for the position of chief of mission or the basic compensation of the principal officer most recently in charge, as appropriate. A special rate of three-quarters of the difference or the full difference between the two salaries may be authorized in certain cases. |

$24 milliona |

|

Law enforcement availability pay |

Paid to special agents who perform at least 2 or more hours of unscheduled duty per regular workday on average per year. |

25 percent of the employee’s basic compensation. |

|

|

Overtime and holiday pay |

Compensates employees for hours of work officially ordered or approved in excess of 40 hours per work week or 8 hours per day, whichever is greater. Not available to tenured and commissioned (i.e., permanent and appointed) Foreign Service officers. |

1.5 times the employee’s hourly rate of basic compensation for employees making less than or equal to the equivalent of a General Schedule 10, step 1 employee. Either (a) 1.5 times the employee’s hourly rate of basic compensation or (b) the employee’s hourly rate of basic compensation (whichever is greater) for employees making more than the equivalent of a General Schedule 10, step 1 employee. |

$18 million |

|

Representation allowance |

Reimburses employees and adult family members acting with or on behalf of employees, for expenses incurred in establishing and maintaining relationships of value to the U.S. in foreign countries. |

Specific guidelines are formulated at each foreign post depending on need, custom, and budget. |

$15 million |

|

Lump sum annual leave payments |

Compensates employees for unused annual leave when they separate from the department. |

Rate or rates at which the employee would have been paid had the employee remained employed until the expiration of the leave balance times the total number of hours of the annual and restored annual leave balances at the time of separation. |

$8 million |

|

Medical care of dependents |

Covers costs such as hospitalization and outpatient services of family members, including spouses, domestic partners, or unmarried dependent children who are stationed with the employee or who would normally reside with the employee were it not for the granting of a separate maintenance allowance. |

Varies. |

$6 million |

|

Special differential for substantial amounts of extra work |

Compensates commissioned (i.e., appointed) Foreign Service officers in Classes 6 through 1 for additional work required by their supervisors on a regular continuing basis in substantial excess of normal requirements. |

10 percent to 18 percent of basic compensation, depending on the average number of hours per week the employee is required to work, or the number of hours they are scheduled to work at night, on Sundays, or on holidays. |

$5 million |

|

Sunday differential pay |

Compensates employees for hours of work performed during a regularly scheduled 8-hour period that begins or ends on a Sunday. Not available to executives or tenured Foreign Service officers. |

25 percent of the employee’s hourly rate of basic compensation. |

$2 million |

|

Otherb |

— |

— |

$403,000 |

|

Total |

— |

— |

$110 million |

Legend: — = not applicable

Source: GAO analysis of Department of State and Office of Personnel Management documentation and State accounting data. | GAO‑25‑107098

Notes: Table includes State spending on all employees that received the above compensation and benefits while serving abroad, including Foreign Service and Civil Service employees.

All of these compensation and benefits except the official residence expense, chargé d’affaires pay, the representation allowance, and the communications differential for office management specialists are available to State employees serving domestically as well as abroad, according to State officials.

aSpending for chargé d’affaires pay and law enforcement availability pay are tracked together in State’s accounting system.

b“Other” is State spending on night differential pay, dependent training, medical care of employees, and the communications differential for office management specialists, on which State spent less than $1 million in fiscal year 2023.

We calculated the amount the Department of State may have spent on pay, benefits, and allowances in fiscal year 2023 for Foreign Service employees of various ranks, locations, and family sizes to provide illustrative examples of how State’s spending may have varied.[29] As shown in table 9, State’s spending varies by these three factors as follows:

· Rank. State’s spending on basic compensation, federal benefits, and allowances such as post allowance, hardship pay, and danger pay increases for employees of higher rank.

· Location. State’s spending increases for employees in locations with higher rent and rates for allowances such as danger pay, post allowance, hardship pay, and education allowance.

· Family size. State’s spending on the separate maintenance allowance, the post allowance, the education allowance, and government-owned and -leased housing increases for employees with more dependents.

Table 9: Illustrative Examples of Approximate State Spending on Selected Benefits and Allowances, per Foreign Service Employee by Rank, Location, and Family Size, Fiscal Year 2023

|

Post |

Benefit or allowance |

Entry-level (single) |

Entry-level (family of 4) |

Mid-level (single) |

Mid-level (family of 4) |

Executive (single) |

Executive (family of 4) |

|

Bangkok, Thailand |

Basic compensation |

$65,793 |

$65,793 |

$138,332 |

$138,332 |

$169,961 |

$169,961 |

|

Federal benefits |

28,374 |

37,377 |

54,555 |

63,558 |

68,440 |

77,443 |

|

|

Education |

N/A |

67,369 |

N/A |

67,369 |

N/A |

67,369 |

|

|