DEPARTMENT OF ENERGY

Inspector General’s Budget Estimates for Audits of Certain Contractors’ Costs Need Improvement

Report to Congressional Committees

United States Government Accountability Office

A report to congressional committees.

For more information, contact: Kristen Kociolek at kociolekk@gao.gov and Allison Bawden at bawdena@gao.gov.

What GAO Found

Since establishment of its Incurred Cost Audits Division (ICAD) in 2021, the Department of Energy (DOE) Office of Inspector General (OIG) has used its own auditors, as well as auditors from other federal agencies and private accounting firms, to conduct the incurred cost audits. When establishing the ICAD, DOE’s OIG did not sufficiently assess the resources needed to implement incurred cost audits of management and operating (M&O) contracts. Specifically, the OIG, developed an $18.7 million per year rough order of magnitude estimate based on limited data in 2021. As a result, the OIG’s initial estimate substantially underestimated the resources needed. As of its fiscal year 2025 budget justification, the OIG estimated that conducting incurred cost audits will cost $43.7 million per year. GAO found that the OIG’s 2021 estimate had several limitations (see table).

Limitations of DOE OIG Rough Order of Magnitude Estimate

|

Limitation |

Description |

|

Audit entity |

The OIG’s estimate assumed that the OIG would use its own auditors. However, the OIG has used other audit entities to conduct audits with oversight by the OIG, and the cost of conducting the audits differs for each entity. |

|

Audit activities |

The OIG based the estimate on only the activities required for incurred cost audits and not on the additional audit services required for an effective program, such as reviewing contractor business systems. |

|

Number of M&O contracts |

The estimate assumed that the OIG would perform audits for 23 management and operating (M&O) contracts. The estimate did not account for the fact that the number of contracts may change over time. |

Source: GAO analysis of Department of Energy (DOE) Office of Inspector General (OIG) documents. | GAO-25-107199

According to GAO’s Cost Guide, a rough order of magnitude estimate can be helpful for examining differences in high-level alternatives but is not precise and should never be considered a budget-quality estimate. In contrast, developing a life cycle cost estimate entails identifying and estimating all cost elements that pertain to a program from initial concept through execution. The Cost Guide states that a life cycle cost estimate can support budgetary decisions, including determining the most cost-effective approaches. Further, using it as a budget baseline helps to ensure that all costs are fully accounted for so that resources are adequate for a selected approach. Developing life cycle cost estimates of the alternatives for conducting incurred cost audits—using its own auditors, using other audit entities with OIG oversight, or both—would better enable the OIG to determine the most cost-effective approach and request adequate funding.

The processes the OIG had in place when it began conducting incurred cost audits were generally consistent with applicable standards, but the chapter for these audits had not been codified in its audit manual. GAO found that the audit manual was generally consistent with generally accepted government auditing standards related to ethics, independence, professional judgment, competence and continuing professional education, and quality control. However, initially, there were some minor inconsistencies related to peer review, fieldwork, and reporting standards for performance audits. During GAO’s audit, the OIG updated the manual to address noted inconsistencies and included a chapter for incurred cost audits. As a result, the design of the OIG controls over incurred costs audits is now consistent with applicable standards.

Why GAO Did This Study

DOE is one of the largest civilian contracting agencies in the federal government. In fiscal year 2023, DOE obligated about $36.7 billion for M&O contracts. DOE’s M&O contracts have inherent financial risks, as the contractor is allowed to withdraw funds without first submitting an invoice. To mitigate these risks, in 2021 the OIG established a division to audit incurred costs from these contracts and provide related contract audit services to DOE program offices.

The Joint Explanatory Statement to the Consolidated Appropriations Act, 2023 includes a provision for GAO to review the OIG’s strategic planning for incurred cost audits. This GAO report examines the extent to which (1) the OIG assessed the resources needed to effectively implement incurred cost audits of M&O contracts and (2) the OIG’s process for planning and implementing incurred cost audits of M&O contracts is consistent with applicable auditing standards.

GAO reviewed OIG documentation and interviewed DOE and OIG officials about the OIG’s initial estimate and assumptions. GAO used its Cost Guide to identify the type of assessments that the OIG developed. GAO also assessed the OIG’s controls to perform incurred cost audits for consistency with applicable audit standards.

What GAO Recommends

GAO recommends that the DOE Inspector General develop life cycle cost estimates of all relevant alternatives for conducting incurred cost audits. The OIG concurred with GAO’s recommendation.

Abbreviations

|

BPA |

blanket purchase agreement |

|

DCAA |

Defense Contract Audit Agency |

|

DOD |

Department of Defense |

|

DOE |

Department of Energy |

|

Interior |

Department of the Interior |

|

FTE |

full-time equivalents |

|

GAGAS |

generally accepted government auditing standards |

|

GS |

General Schedule |

|

ICAD |

Incurred Cost Audits Division |

|

IG |

Inspector General |

|

IPA |

independent public accounting |

|

M&O |

management and operating |

|

NNSA |

National Nuclear Security Administration |

|

OIG |

Office of Inspector General |

|

ROM |

rough order of magnitude |

|

WCF |

working capital fund |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

July 24, 2025

Congressional Committees

The Department of Energy (DOE) Office of Inspector General (OIG) faces a complex environment in which it carries out oversight of the department. DOE is one of the largest civilian contracting agencies in the federal government. It relies primarily on contractors to carry out its diverse missions related to energy development, basic and applied scientific research, nuclear security, and waste cleanup, among others. In addition, aspects of DOE’s acquisition processes have been on our High-Risk List since 1990, with DOE’s record of inadequate contract management and contractor oversight leaving the department vulnerable to fraud, waste, and abuse.[1]

The OIG is responsible for providing independent and objective oversight of the department with the aim of preventing and detecting fraud, waste, and abuse. Under the Inspector General Act of 1978, as amended, the OIG’s oversight role is to conduct various reviews of the department’s programs and operations—including audits, investigations, inspections, and evaluations—and provide findings and recommendations to improve them.[2] Each year the OIG receives an annual appropriation from Congress to carry out its work. In fiscal year 2024, the OIG received $86 million.[3]

Under DOE policy, the OIG is responsible for ensuring completion of audits of the department’s management and operating (M&O) contracts.[4] DOE—including the National Nuclear Security Administration (NNSA), a semi-autonomous agency within DOE—uses the M&O contracts to manage and operate the department’s scientific laboratories and engineering and production facilities, construct additional facilities, and provide other support services. In fiscal year 2023, the department had 24 M&O contracts obligated at about $36.7 billion.

DOE’s M&O contracts are unique in the federal government and have inherent financial risks. Among other features, under these contracts DOE allows the contractor to withdraw funds directly from federal accounts to cover its own spending for contract performance without first submitting an invoice. Improper payments associated with these contracts are identified through post-payment reviews, such as incurred cost audits. The OIG is responsible for advising DOE contracting officers on the allowability of contractor costs. DOE contracting officers can consider this advice in making their determinations on cost allowability. DOE can seek to recover unallowable costs through negotiations with the contractor.

Beginning in the early 1990s, the OIG fulfilled this responsibility through its cooperative audit strategy, in which the OIG conducted limited assessments of audits that the M&O contractors’ own internal auditors completed. At the time, we raised concerns about the cooperative audit strategy, that the OIG’s reliance on contractors’ internal audits could pose some risks.[5] Over the years, the OIG and GAO have continued to raise significant concerns regarding the cooperative audit strategy. For example, during a multiyear review that ran from 2017 to 2021, the OIG conducted nine reviews of the cooperative audit strategy and found that the M&O contractors’ internal audits did not adequately evaluate incurred costs.[6] Further, in 2019 we reported that in a 10-year look back more than $3.4 billion in subcontract costs had not been audited as required.[7] In 2020, Congress directed DOE and NNSA to reassess the strategy and to draft a plan to conduct independent audits of M&O contracts.[8]

In 2021, the OIG issued a special report detailing its plan to transition to independent incurred cost audits for M&O contracts.[9] In the report, the OIG estimated that establishing a capability in its office to conduct independent audits would require an additional $18.7 million in annual appropriations.[10] According to the report, a key element of the OIG’s new strategy for ensuring independent audits would be to conduct them following processes consistent with generally accepted government auditing standards (GAGAS).[11]

Division D of the Joint Explanatory Statement accompanying the Consolidated Appropriations Act, 2023 includes a provision for us to review the OIG’s planning for carrying out audits that had been previously conducted under the cooperative audit strategy.[12] In this report we examine the extent to which (1) the OIG assessed the resources needed to effectively implement incurred cost audits of M&O contracts, and (2) the OIG’s process for planning and implementing incurred cost audits of M&O contracts is consistent with applicable auditing standards.

To address our first objective, we reviewed documentation and conducted interviews with OIG officials about the OIG’s plans and actions to transition independent incurred cost audits. This included reviewing documentation of the OIG’s resource estimates and assumptions that formed the basis for its initial assessment in 2021 that it would cost $18.7 million to complete the incurred cost audits.[13] We also reviewed the Federal Acquisition Regulation to identify key requirements, roles, and responsibilities related to incurred cost audits. We used the GAO Cost Estimating and Assessment Guide (Cost Guide), which defines types of common cost estimates and cost analyses used in industry and government, to identify the type of resource assessments that the OIG developed.[14] We also interviewed officials in DOE’s mission offices that use M&O contracts,[15] the DOE Office of Chief Financial Officer, and NNSA’s Offices of Management and Budget and Partnership and Acquisition Services regarding the OIG’s plans, as well as the department’s use of the OIG’s audit results.

To address our second objective, we conducted interviews, made observations, and requested documentation from OIG officials to determine the extent to which the OIG designed procedures and key internal controls related to incurred cost audit planning, staffing, independence, field work, reporting, and performance monitoring. We evaluated these procedures and key internal controls for consistency with federal internal control standards that would help ensure that incurred cost audits are performed in accordance with GAGAS.[16] We evaluated whether the OIG had implemented the designed processes by determining if the procedures and controls exist and if the OIG had placed them in operation. We also conducted interviews, and evaluated policies and contract documents, to determine the quality assurance practices and controls for using third parties to conduct incurred cost audits. We reviewed the OIG performance audit policies; we did not review policies of the independent public accountants (IPA), Defense Contract Audit Agency (DCAA), or Department of the Interior, which perform some of the incurred cost audits on behalf of the OIG. The OIG contracted with these other entities to perform audit services of M&O contractors and relied on these entities’ contract audit requirements and processes.

We conducted this performance audit from November 2023 to July 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Overview of DOE’s M&O Contracts

The M&O contract is a type of cost reimbursable contract. Under this contract model, the contractor’s financial records are integrated into DOE’s financial accounts.[17] The M&O contract authorizes the contractor to determine how to perform work that DOE has deemed necessary to accomplish the contract’s mission and to charge DOE monthly, using a letter of credit funding vehicle for any allowable cost incurred in performance of this work. The letter of credit enables the contractor to withdraw government funds in amounts needed to cover its own disbursements of cash for contract performance, without the need to submit invoices for government reviews or approvals. As we previously reported, DOE does not use prepayment reviews to determine the appropriateness of M&O contract costs prior to payment.[18] Therefore, post-payment oversight controls, such as incurred cost audits, that may detect unallowable costs, are important to protect the government’s interest.[19]

The number of DOE M&O contracts varies based on the department’s priorities. According to OIG officials, in fiscal year 2019, DOE had 23 M&O contracts, which incurred $17.3 billion in costs that year.[20] By fiscal year 2023, DOE had 24 M&O contracts, which incurred over $30 billion in costs that year, according to the OIG information we reviewed.

Incurred Cost Audits

Incurred cost audits help agencies identify and recover unallowable costs on cost reimbursement contracts and are typically considered to be an important internal control. Specifically, the results of these audits help validate cost compliance and may identify unallowable costs. For DOE, these audits are the primary post-payment control mechanism for ensuring that payments made on M&O contracts are proper. Contracting officers may consider the results of audits in determining the allowability of costs paid under cost reimbursable contracts. Recoveries are generally subject to a 6-year statute of limitations period.[21] Ultimately, savings to programs are realized from recoveries resulting from unallowable costs and identified from these audits.

Incurred Cost Audits Under the Cooperative Audit Strategy

In the early 1990s, OIG employees were responsible for auditing DOE’s M&O contractors’ Statements of Costs Incurred and Claimed. However, the OIG had difficulty promptly completing the audits due to resource constraints.[22] Accordingly, in 1992, the OIG piloted the cooperative audit strategy in consultation with DOE’s Office of the Chief Financial Officer and Office of Acquisition Management. Key elements of the cooperative audit strategy included requiring M&O contractors to conduct an annual internal audit and examination, satisfactory to DOE, of the records, operations, expenses, and transactions with respect to costs claimed to be allowable under the M&O contract, using the Institute of Internal Auditors’ standards. The OIG’s role was to conduct a limited assessment of the contractors’ internal audit work.[23]

Prior to its implementation, we reported that the cooperative audit strategy should be approached carefully. We raised concern that the OIG adopted the change without first conducting sufficient analysis, and that its reliance on contractors’ internal audits could pose some risks. These risks included the appearance of conflicts of interest and a need to ensure that the government, not the contractors’ internal auditors, determined whether contract costs were allowable. We also recommended that the OIG identify and assess alternatives to the cooperative audit strategy, such as relying more on DCAA auditors or independent external auditors, to audit integrated contractors.[24] Despite the risks associated with the strategy, in 1994, the OIG adopted and approved the cooperative audit strategy in consultation with DOE’s Office of the Chief Financial Officer and Office of Acquisition Management and the Contractor Internal Audit Council.

Over the years, we, the OIG, and Congress continued to raise significant concerns regarding the completeness and timeliness of the audits of DOE’s M&O contractors under the strategy. For example, from 2017 to 2021 the OIG conducted reviews of the cooperative audit strategy and identified significant deficiencies in audit coverage.[25] In 2019, we reported that more than $3 billion in subcontract costs, awarded by DOE’s 24 largest contractors, the majority of which were M&Os, had not been audited as required, and some of these costs were beyond the 6-year window to recover them if unallowable.[26] In addition, in 2020, congressional reports from the House Committee on Appropriations and House Committee on Armed Services directed DOE and NNSA, respectively, to review the strategy. The reports cited concern as to whether the strategy was rigorous enough for overseeing the tens of billions of dollars DOE spends in contracts every year.[27]

Transition to Independent Incurred Cost Audits

In April 2021, the OIG issued a special report that summarized the results of a multi-year review of the cooperative audit strategy and recommended that the OIG and DOE transition to an independent audit strategy as soon as the resources became available.[28] The report cited concerns such as inadequate audit coverage, lack of independence, and inconsistency with standards. According to OIG officials, to implement the findings of its multiyear review, in 2021 the OIG established the Incurred Cost Audits Division (ICAD) within its Office of Audit to conduct incurred cost audits of M&O contracts and provide related contract audit services (e.g., business systems audits and cost accounting standards audits) to DOE program offices in support of their acquisition activities.

The OIG’s implementation plan estimated that annual, independent audits would require approximately 87 full-time-equivalent (FTE) employees at an annual cost of approximately $18.7 million in additional appropriations. The OIG assumed the additional appropriations would be spent on independent audits conducted by the OIG audit staff, DCAA auditors, IPAs, or some combination of these options to provide flexibility.[29] The OIG further reported that it estimated DOE may recover as much as $48.75 million per year from the independent incurred cost audits once the OIG’s capability was fully operational. According to the OIG, this figure was based on DCAA’s reporting that its return on investment for incurred cost audits in 2019 was 2.6 times their cost.

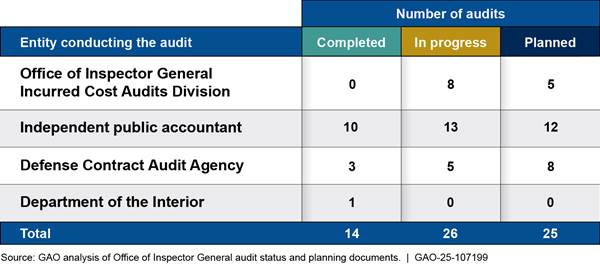

Incurred Cost Audit Progress

According to the OIG officials, the OIG’s initial plan for auditing DOE’s 23 M&O contracts (the number of M&O contracts the department had at the time the OIG completed its initial plan) was to assign one audit to Interior and split the rest of the audits evenly between the OIG ICAD, an IPA, and DCAA. As of December 2024, the OIG’s audit partners had completed 14 audits of 11 M&O contracts and the OIG’s ICAD staff had not yet completed any incurred cost audits.[30] Figure 1 below lists audits completed, in progress, and planned as of December 2024.

Figure 1: Department of Energy Number and Status of Incurred Cost Audits by Entity Conducting the Audit, as of December 2024

Note: Individual audits may cover multiple fiscal years.

The OIG Did Not Sufficiently Assess Resources Necessary to Implement Incurred Cost Audits

Upon taking over responsibility for incurred cost audits of M&O contracts in 2021, the OIG did not sufficiently assess the resources needed to implement these audits. OIG officials told us that they developed the $18.7 million per year estimate based on limited data from the DCAA. As a result, the OIG’s initial estimate substantially underestimated the resources it needed. Notably, as of its 2025 budget request, the OIG estimates that implementing the capability to conduct incurred cost audits will cost $43.7 million per year.[31]

We found that the OIG’s estimate of $18.7 million per year had the following limitations:

· Audit entity. In developing the estimate, the OIG assumed it would use its own auditors to conduct the incurred cost audits. Specifically, the OIG assumed a federal OIG workforce of 87 FTEs would be required.[32] At the time that the OIG developed the estimate, in 2021, the office did not have this number of audit staff.[33] Thus, in the short and medium term, the OIG, as mentioned above, also has used other audit entities, including DCAA, an IPA firm, and Interior to conduct audits. The OIG has found that the cost of conducting the audits differs for each entity in part because they have different pay structures. OIG officials told us that the IPA is the most expensive.[34] Officials also told us that the OIG and Interior have similar pay structures, with auditor positions at a General Schedule (GS)-13 level.[35] Further, DCAA auditor positions are generally capped at the GS-12 level.[36]

· Audit activities. The OIG based the estimate on only the work activities required to perform incurred cost audits. However, the OIG determined that additional types of audit services, such as reviewing contractor business systems, would be required to have an effective incurred cost audits program.

· Number of M&O contracts. The estimate assumed that the OIG would perform audits for 23 M&O contracts. However, according to the OIG, the number of M&O contracts is now 25, and will change periodically as DOE awards additional contracts. The estimate did not account for the increasing requirements over time.

OIG officials said that their initial estimate was a rough order of magnitude (ROM) estimate of the one approach to use federal OIG auditors. As discussed in GAO’s Cost Guide, a ROM cost estimate is a type of estimate that is developed from limited data.[37] Such estimates can be helpful for examining differences in high-level alternatives to see which are the most feasible, but they should never be considered budget-quality estimates.

In contrast to a ROM estimate, according to the Cost Guide, programs use a life cycle cost estimate to analyze the costs of different alternatives and as the basis for developing budget requests.[38] A life cycle cost estimate entails identifying and estimating all cost elements that pertain to a program from initial concept all the way through each phase in the program’s duration. According to the Cost Guide, a life cycle cost estimate can support budgetary decisions, including determining the most cost-effective approaches.[39] Further, using a life cycle cost estimate as a budget baseline helps to ensure that all costs are fully accounted for so that resources are adequate to support a selected approach.

According to the OIG officials, they used DCAA data to develop their ROM estimate because the effort was a new initiative, and the OIG did not have historical cost data of its own to support a more rigorous analysis.[40] The OIG officials told us the ROM estimate was not meant to be precise, but was rather meant to start conversations within the department and to seek support for the OIG transitioning to conduct the incurred cost audits for M&O contracts. According to OIG officials, the OIG leadership initially asked the DOE Office of Management whether the DOE programs would fund the audits that the OIG would perform, but instead decided to seek an increase in the OIG’s appropriations.[41] The OIG officials also told us they quickly rolled out the program knowing they had not completed sufficient resource planning because they felt urgency to implement the independent audits. As the OIG gains experience conducting the audits and collects better cost data, officials said they intend to analyze the data and determine the best approach for implementing the incurred cost audits.

Developing life cycle cost estimates of all relevant alternatives—using DCAA, using an IPA, performing the audits in-house, or any combination of these approaches—would provide the OIG and decision-makers a better understanding of the most cost-effective approaches and anticipated long-term costs of the program. Such information would help the OIG more effectively communicate the resources needed to implement its new independent incurred cost audit strategy. The OIG officials told us that they anticipate the demand for audit services will vary as the number or value of M&O contracts change, so reliable cost and resource information will be critical.

OIG Recently Revised Its Procedures for Incurred Cost Audits to Be Consistent with Applicable Standards

OIG processes that were in place when it began conducting incurred cost audits were generally consistent with applicable standards, but the chapter for incurred cost audits had not been codified into its audit manual. The OIG initially used its Office of Audit manual to guide its ICAD work when it assumed the responsibility for performing DOE incurred cost audits. That manual consolidated the standards, policies, and procedures that personnel assigned to plan, conduct, and report the OIG audit work must follow.

We found that the Office of Audit manual was generally consistent with GAGAS requirements related to ethics, independence, professional judgment, competence and continuing professional education, and quality control. However, during our audit, we found that the OIG had some inconsistencies related to GAGAS peer review, fieldwork, and reporting standards for performance audits.[42]

We also found that specific guidance and requirements for incurred cost audits at the time the OIG began performing them had not been officially codified in the audit manual. Additionally, the audit programs and templates used to perform incurred cost audits had not been codified in the manual. Instead, the OIG relied on the performance audit requirements in the audit manual and an incurred cost audit chapter developed externally from the audit manual.

In addition, we found the OIG had not included in the Office of Audit manual procedures for some performance audit fieldwork, reporting, and peer review standards. For example, the OIG

· had no process in place to communicate to the auditee the (1) objectives, scope, and methodology and (2) timing of the audit and planned reporting when the entrance conference is waived;

· had not designed or implemented a process to document the work of specialists;

· had not designed a policy requiring the audit report to contain the objectives, scope, and methodology of the audit;

· had not designed a policy requiring reporting of internal control deficiencies that are not significant to the objectives, but warrant the attention of those charged with governance;

· had not designed or implemented a policy requiring reporting of known or likely noncompliance with provisions of laws, regulations, contracts, and grant agreements or fraud directly to parties outside the audited entity if circumstances require it; and

· had not designed or implemented a policy requiring that its peer review letter of response must contain the corrective actions already taken, target dates for planned corrective actions, or both.

We shared these observations with the OIG officials during our review, including that the incurred cost audit policy had not been codified in the audit manual and that additional procedures were missing from its Office of Audit manual.

During our audit, the OIG included the incurred cost audit chapter and addressed procedures we identified as lacking in the existing Office of Audit manual. In August 2024, the OIG updated the manual to reflect current requirements for incurred cost audits and required the use of the audit program templates for incurred cost audits. Additionally, the OIG updated its manual to require auditors to communicate key information to the auditee, document specialists’ audit work, report key audit information, report internal control deficiencies not significant to the objectives, and report noncompliance to external entities if necessary.

By taking these actions, the OIG enhanced its ability to conduct incurred cost audits consistent with applicable auditing standards. Moving forward, these documented processes will provide the OIG personnel performing incurred cost audits with the requirements and guidance to conduct audits consistently and effectively.

Conclusions

Aspects of DOE’s acquisition processes have been on our High-Risk List since 1990, with DOE’s record of inadequate contract management and contractor oversight leaving the department vulnerable to fraud, waste, and abuse. For example, DOE M&O contracts allow the contractor to perform the work that it concludes is needed and to withdraw funds directly from federal accounts, without having to submit invoices. Given the risks this introduces, post payment oversight controls, such as incurred cost audits, which may detect unallowable costs, are important to protecting the government’s interest. The OIG has taken steps to identify the resources needed to conduct incurred cost audits of its M&O contracts and made some progress implementing its independent audit strategy. However, more fully assessing the OIG needs would better position the OIG to request and secure sustainable funding needed to ensure completion of the audits.

Recommendation for Executive Action

The Inspector General of the Department of Energy should develop life cycle cost estimates of all relevant alternatives for ensuring completion of incurred cost audits to provide the OIG and decision-makers a better understanding of the most cost-effective approaches and anticipated long-term costs of the program. (Recommendation 1)

Agency Comments

We provided a draft report to the Secretary of Energy and DOE’s OIG for review and comment. We received written comments on the draft report from the OIG and confirmation from DOE that it did not have any comments on the draft report. In its comments, the OIG concurred with our recommendation. It stated that continued improvements in budget estimates may better position it to secure sustainable funding needed to complete the required work. The OIG provided additional factual information that did not affect our findings. See appendix II for the full written response from the OIG.

We are sending copies of this report to the appropriate congressional committees, the Secretary of Energy, and the Inspector General of the Department of Energy. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or members of your staffs have any questions regarding this report, please contact Kristen Kociolek at kociolekk@gao.gov or Allison B. Bawden at bawdena@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. Key contributors to this report are listed in appendix III.

Kristen Kociolek

Managing Director, Financial Management and Assurance

Allison B Bawden

Director, Natural Resources and Environment

List of Committees

The Honorable John Kennedy

Chair

The Honorable Patty Murray

Ranking Member

Subcommittee on Energy and Water Development

Committee on Appropriations

United States Senate

The Honorable Chuck Fleischmann

Chairman

The Honorable Marcy Kaptur

Ranking Member

Subcommittee on Energy and Water Development and Related Agencies

Committee on Appropriations

House of Representatives

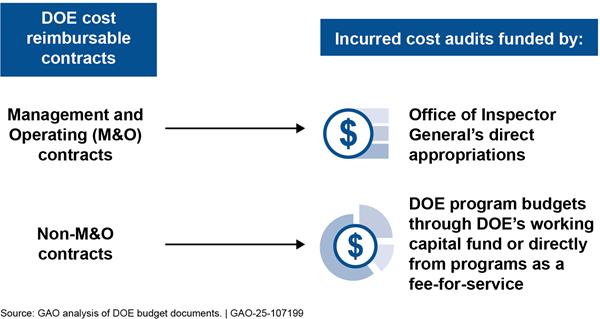

The Department of Energy (DOE) relies on two categories of cost reimbursable contracts to carry out its diverse missions: management and operating (M&O) prime contracts, and non-M&O contracts.[43] Both categories are subject to incurred cost audits.[44] DOE uses different approaches to complete these incurred cost audits. As shown in figure 2 and described below, DOE’s Office of Inspector General (OIG) is responsible for incurred cost audits of M&O contracts and pays for them using the OIG’s own direct appropriations. Incurred cost audits of non-M&O contracts are completed by the Defense Contract Audit Agency (DCAA) or an independent public accountant (IPA) via agreements with DOE and are paid for using program budgets through DOE’s working capital fund (WCF).[45] DOE policy also allows DOE programs the discretion to fund any incurred cost audit directly from their program appropriations.[46]

Note: According to DOE officials no law or regulation prohibits DOE from funding M&O contract audits from benefiting program budgets.

M&O Contracts

Under DOE policy, the OIG is responsible for performing incurred cost audits of DOE’s M&O contracts on behalf of DOE. The OIG funds its oversight work, including incurred cost audits, investigations, and other activities, through a direct annual appropriation from Congress. The OIG prioritizes and balances the amount of audit work it can accomplish each year based on these appropriations, according to OIG officials. In addition, the OIG uses its appropriations to fund contract audit services from an IPA firm and to reimburse other federal agencies that provide the OIG with incurred cost audit services. The OIG has relied on auditors from DCAA and the Department of the Interior to support incurred cost audits of DOE’s M&O contracts.

Non-M&O Cost Reimbursable Contracts

To conduct incurred cost audits of DOE’s non-M&O contracts, DOE programs obtain contract audit services from external audit entities such as DCAA and an IPA.[47] DOE programs fund these incurred cost audits either through DOE’s WCF or through the benefiting programs’ annual budgets as a fee-for-service.[48]

DOE programs can fund contract audit services needed for their acquisition activities, including incurred cost audits, through DOE’s WCF. According to policy documents we reviewed, starting at the beginning of the fiscal year, DOE programs provide the WCF funds from each program based on its plan for audit services. When DOE programs purchase contract audit services from outside audit entities, such as DCAA or an IPA, a contractual agreement or interagency agreement establishes the services, and DOE pays the provider from DOE’s WCF. In cases where a program may exceed or underuse its allotted share of funds, DOE adjusts the funding estimate for the next fiscal year to accommodate the difference. As outlined in DOE policy, funding the audits via the WCF also provides flexibility to meet typical fluctuation in the demand for audit services from one year to the next.

Under both approaches for funding incurred cost audits of non-M&O contracts—using the WCF or directly paying a fee-for-service through a program’s budget—the benefiting programs’ budgets reflect the costs of audits and any resulting savings to DOE.

According to DOE officials, no law or regulation prohibits DOE from funding its M&O contract audits the same way it funds its non-M&O contract audits, by using DOE programs’ funding.[49] Historically, however, this has not been its practice—DOE’s programs have not budgeted to include the costs of funding M&O independent contract audits—and instead the OIG has used its direct appropriations to fund these audits. OIG officials told us that when the OIG decided to transition to independent incurred cost audits, OIG officials discussed options for funding the audits with DOE’s Office of Management, but DOE declined to fund the audits. The OIG subsequently sought direct appropriations for the program, according to OIG officials.

GAO Contacts

Kristen Kociolek, kociolekk@gao.gov

Allison B. Bawden, bawdena@gao.gov

Staff Acknowledgments

In addition to the contacts named above, Brian Friedman (Assistant Director), Jonathan Meyer (Assistant Director), John Ledford (Auditor in Charge), Lidiana Cunningham, and Vanessa Taja made major contributions to this report. Other key contributors include James Arp, Brian Bothwell, Antoinette Capaccio, Anthony Clark, Giovanna Cruz, Carlos Diz, Jennifer Echard, Patrick Frey, Jamila Kennedy, Jason Kirwan, Jennifer Leotta, Anne Rhodes-Kline, Kevin Scott, Amanda Stogsdill, Matthew Valenta, and Mary Weiland.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]GAO, High-Risk Series: Heightened Attention Could Save Billions More and Improve Government Efficiency and Effectiveness, GAO-25-107743 (Washington, D.C.: Feb. 2025). In January 2009, to recognize progress made at DOE’s Office of Science, we narrowed the focus of the department’s high-risk designation to the National Nuclear Security Administration (NNSA) and the Office of Environmental Management. In February 2013, to acknowledge progress made in managing smaller-value efforts, we further narrowed the focus of DOE’s high-risk designation to major projects and contracts (i.e., those with values of at least $750 million) within NNSA and Office of Environmental Management. GAO, High-Risk Series: An Update, GAO‑13‑283 (Washington, D.C.: Feb. 2013).

[2]U.S.C. §§ 401-424.

[3]Consolidated Appropriations Act, 2024, Pub. L. No. 118-42, § 2, div. D, title III, 138 Stat. 25, 201.

[4]M&O contracts are agreements under which the government contracts for the operation, maintenance, or support, on its behalf, of a government-owned or government-controlled research, development, special production, or testing establishment wholly or principally devoted to one or more of the major programs of the contracting federal agency.

[5]See GAO, Financial Management: Energy’s Material Financial Management Weaknesses Require Corrective Action, GAO/AIMD‑93‑29 (Washington, D.C.: Sept. 30, 1993).

[6]Department of Energy, Office of Inspector General, Special Report: The Transition to Independent Audits of Management and Operating Contractors’ Annual Statements of Costs Incurred and Claimed, DOE-OIG-21-26 (Washington, D.C.: Apr. 2021).

[7]GAO, Department of Energy Contracting: Actions Needed to Strengthen Subcontract Oversight, GAO‑19‑107 (Washington, D.C.: Mar. 12, 2019).

[8]H.R. Rep. No. 116-449, pt.1 at 91 (2020), and H.R. Rep. No. 116-442, pt.1 at 307-308 (2020).

[9]An incurred cost audit is a post-payment audit to validate cost compliance and is typically considered a detective internal control tool that may identify unallowable costs. An effective incurred cost audit program may also serve as a deterrence against fraud.

[10]Department of Energy, Office of Inspector General, Special Report.

[11]GAO, Government Auditing Standards: 2018 Revision, GAO‑18‑568G (Washington, D.C.: July 2017). We have subsequently published a new version of Government Auditing Standards, effective for performance audits beginning on or after December 15, 2025. The professional standards presented in Government Auditing Standards provide a framework for performing high-quality audit work with competence, integrity, objectivity, and independence.

[12]Comm. On Appropriations, 117th Cong., H.R. 2617/Public Law 117-328, Legislative Text and Explanatory Statement (Comm. Print 2023).

[13]Department of Energy, Office of Inspector General, Special Report.

[14]GAO, Cost Estimating and Assessment Guide: Best Practices for Developing and Managing Program Costs, GAO‑20‑195G (Washington, D.C.: Mar. 12, 2020).

[15]We interviewed officials from five of six DOE programs that use the M&O contract model. These included officials from NNSA, the Office of Science, the Office of Environmental Management, the Office of Nuclear Energy, and the Office of Energy Efficiency and Renewable Energy. We did not interview officials from the Office of Strategic Petroleum Reserve. The Office of Naval Reactors, within NNSA also has one M&O contract but never participated in the cooperative audit strategy. Naval Reactors has its own audit process for its M&O contract.

[16]GAO, Standards for Internal Control in the Federal Government, GAO‑14‑704G (Washington, D.C.: Sept. 2014).

[17]The M&O contract model is a direct outgrowth of the effort during World War II to build the first atomic bomb known as the Manhattan Project. During the Manhattan Project, the federal government was unable to define the technical scope, cost, or schedule of contracted work that it needed for the atomic bomb program. Although M&O contractors’ financial information is integrated with DOE accounts, contractors are required to maintain their own separate books and records to support their claims. These separate books and records are subject to audits. See Department of Energy, Office of Inspector General, Special Report, for a discussion of the history of M&O contracts and their use at DOE.

[18]GAO, Department of Energy: Use of Leading Practices Could Help Manage the Risk of Fraud and Other Improper Payments, GAO‑17‑235 (Washington, D.C.: Mar. 30, 2017), and Improper Payments: Improvements Needed to Ensure Reliability and Accuracy in DOE’s Risk Assessments and Reporting, GAO‑20‑442 (Washington, D.C.: June 17, 2020).

[19]In our previous, work we highlighted the importance of agencies implementing prepayment controls to avoid operating in the “pay and chase model,” which refers to the practice of waiting to address improper payment and fraud until after payments have been made. We have also noted that establishing post-payment controls and processes can help agencies identify and recover improper payments and fraud when the quick disbursement of funds makes prepayment controls difficult to apply fully. See GAO, COVID-19: Lessons Can Help Agencies Better Prepare for Future Emergencies, GAO‑24‑107175 (Washington, D.C.: Aug. 1, 2024).

[20]The OIG’s initial estimate was based on fiscal year 2019 data.

[21]41 U.S.C § 7103(a)(4)(A), The Contract Dispute Act, provides that each claim by a contractor against the federal government relating to a contract and each claim by the federal government against a contractor relating to a contract shall be submitted within 6 years after the accrual of the claim. The government may recover costs for contracts within a 6-year period following the submission of an adequate incurred cost claim.

[22]GAO, Financial Management: Energy’s Material Financial Management Weaknesses Require Corrective Action, GAO/AIMD‑93‑29 (Washington, D.C.: Sept. 30, 1993).

[23]Department of Energy, Office of Inspector General, Special Report.

[25]Department of Energy, Office of Inspector General, Special Report.

[27]H.R. Rep. No. 116-449, pt.1 at 91 (2020), and H.R. Rep. No. 116-442, pt.1 at 307-308 (2020).

[28]Department of Energy, Office of Inspector General, Special Report.

[29]DCAA is a component of the Department of Defense (DOD) that provides contract audit services for DOD. DCAA also provides contract audit services to other federal agencies, as appropriate. See DOD Directive 5105.36, December 1, 2021.

[30]Some M&O contracts were audited more than once.

[31]The OIG requested additional budget authority starting in fiscal year 2021 for conducting the incurred cost audits. App. I provides a description of the different approaches DOE uses to fund incurred cost audits for all types of cost reimbursable contracts.

[32]For the purposes of estimating FTEs, 2,080 hours of work in 1 year would be equal to one FTE (40 hours x 52 weeks = 2,080 hours).

[33]As of March 2024, the OIG had 40 FTEs dedicated to incurred cost audits.

[34]In 2024, the contracted hourly rate for IPA auditors ranged from $185 to $110 depending on experience, according to contract documents we reviewed.

[35]The GS classification and pay system covers most civilian white-collar federal employees in professional, technical, administrative, and clerical positions. The schedule has 15 grades—GS-1 (lowest) to GS-15 (highest). Agencies establish (classify) the grade of each job based on the level of difficulty, responsibility, and qualifications required. The OIG’s estimated an fiscal year 2024 hourly rate of $80 for its GS-13 auditors, according to documents we reviewed.

[36]GAO, DCAA Audits: Widespread Problems with Audit Quality Require Significant Reform, GAO‑09‑468 (Washington, D.C.: Sept. 23, 2009). Historically, DCAA’s caps auditor positions at the GS-12 level to maintain its competitive advantage over the comparable national public firm composite rate.

[39]GAO‑20‑195G. The Cost Guide identifies different types of analyses. For example, a cost-effectiveness analysis is a systematic quantitative method for comparing the costs of alternative means of achieving the same stream of benefits or a given objective. Cost-effectiveness analysis is appropriate when the benefits from competing alternatives are the same or where a policy decision has been made that the benefits be provided.

[40]DCAA has nearly 60 years of experience providing contract audit services to the federal government.

[41]See app I for our discussion of how DOE funds incurred cost audits of its M&O and non-M&O contracts.

[43]DOE has an agreement with the Defense Contract Audit Agency (DCAA) that identifies DCAA as the responsible auditor for M&O subcontracts and non-M&O reimbursable contracts. For simplification, we will refer to M&O subcontracts and non-M&O reimbursable contracts collectively as non-M&O cost reimbursable contracts.

[44]The purpose of incurred cost audits is to determine whether such incurred costs are reasonable; applicable to the contract; determined under generally accepted accounting principles and cost accounting standards applicable in the circumstances; and not prohibited by the contract, statute, or regulation. Incurred cost audits help agencies identify and recover improper payments related to cost reimbursable contracts and are typically considered an important control. Specifically, the results of these audits help validate cost compliance and may identify improper payments. Contracting officials consider the results of audits in making determinations regarding allowability of costs paid under cost reimbursable contracts. Ultimately, entities can realize savings to programs from recoveries resulting from improper payments that these audits identify.

[45]A WCF is a revolving fund designed to carry out cycle of business-type operations with other federal agencies or separately funded components of the same agency. This type of fund is typically used to finance the centralized provision of common services within an agency. A key feature of a WCF is that collected receipts are available to fund the authorized purposes of the fund without the need for further congressional action and without fiscal year limitation. Often, the activity supported by a WCF will become self-sustaining, eliminating the need for future annual appropriations. See GAO, Revolving Funds: Key Features, GAO‑24‑107270 (Washington, D.C.: Jan. 17, 2024).

[46]According to the DOE Acquisition Guide FY2024, Version 7, DOE has a blanket purchase agreement (BPA) with the IPA. DOE/National Nuclear Security Administration programs can order audit services through this agreement. In 2022, DOE’s Office of Environmental Management paid for an incurred cost audits of one of its M&Os using DOE’s BPA, according to documents we reviewed.

[47]According to fiscal year 2023 DOE WCF budget documents we reviewed, DCAA provides audit services to DOE’s program offices in support of their acquisition activities, at the request of their contracting officers. These services benefit DOE by supporting contracting officers in determining reasonableness and by validating contractor costs, indirect rates, disclosure statements, and accounting systems.

[48]According to fiscal year 2023 budget documents we reviewed, the objectives of DOE’s WCF are to (1) improve the efficiency of administrative services by providing managers with the opportunity and responsibility to make choices regarding the administrative services that their programs use, (2) ensure that program budgets reflect the costs of common administrative services, and (3) expand the flexibility of the department's budget structure to permit service providers to respond to customer needs.

[49]According to DOE documents we reviewed and information we obtained from DOE officials and that the OIG confirmed, in 2022 DOE’s Office of Environmental Management used program funds to pay for an M&O incurred cost audit performed by an IPA.