PROPERTY TECHNOLOGY FOR HOMEBUYING

Products Present Benefits and Risks Amid Evolving Federal Oversight

Report to Congressional Requesters

United States Government Accountability Office

A report to congressional requesters

For more information, contact: Alicia Puente Cackley at cackleya@gao.gov.

What GAO Found

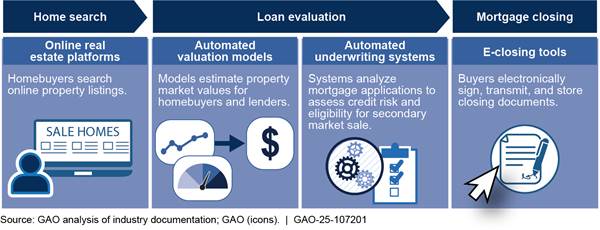

Property technology encompasses a wide range of digital tools used in real estate and is used in nearly every phase of the homebuying process.

These products can simplify homebuying and reduce costs for homebuyers but also pose risks, particularly related to artificial intelligence (AI). Online real estate platforms offer consumers one-stop shopping but may raise privacy concerns by collecting sensitive consumer data. Chatbots or advertising algorithms also may violate fair housing laws by steering consumers in protected classes toward certain listings, according to studies GAO reviewed and interviews with federal entities, selected companies, and other stakeholders.

Fair lending and other consumer protection laws and regulations may apply to property technology products. With the exception of the Federal Housing Finance Agency (FHFA), agency oversight generally has not focused specifically on the products. FHFA—which examines Fannie Mae and Freddie Mac (enterprises)—has conducted examinations specifically focused on products such as automated mortgage underwriting systems and automated valuation models. The Consumer Financial Protection Bureau’s (CFPB) examinations of mortgage lenders could involve lenders’ use of technology but were not product-focused. The other three agencies in GAO’s review generally have not conducted product-specific oversight.

In 2025, FHFA began implementing new priorities and responding to executive orders directing changes to certain policies and programs. FHFA made changes to its fair lending oversight program, including changing its examination approach, waiving components of its fair lending rule, and rescinding related guidance. Although the enterprises remain subject to fair lending and other consumer protection laws, FHFA has not communicated its revised compliance requirements or supervisory expectations. Given the extent of FHFA’s changes, providing additional written direction for the enterprises on the changes would help ensure the enterprises clearly understand FHFA’s compliance requirements and its supervisory expectations. This would help to ensure that the enterprises appropriately carry out requirements, which are intended to help promote sustainable housing opportunities for underserved communities.

Why GAO Did This Study

Property technology products have transformed homebuying. But their use of AI has raised questions about potential effects on homebuyers and the housing market, particularly regarding compliance with fair housing and other consumer protection laws.

GAO was asked to review issues related to use and oversight of property technology products in the homebuying process. This report examines (1) the use of selected products, (2) their potential benefits and risks, and (3) agency oversight of compliance with fair lending and relevant consumer protection laws for the products.

GAO focused on online real estate platforms, automated valuation models and underwriting systems, and electronic closing products, selected for their use at different stages of the homebuying process and potential risks they may pose to homebuyers. GAO conducted a literature review, reviewed industry and government reports, and examined relevant federal laws, regulations, and guidance. GAO also interviewed officials of five federal agencies—CFPB, Department of Housing and Urban Development, FHFA, Federal Trade Commission, and Department of Veterans Affairs—Fannie Mae and Freddie Mac; selected companies; and other stakeholders, chosen in part for their expertise and diverse characteristics.

What GAO Recommends

GAO recommends that FHFA provide written direction to the enterprises clarifying how they are to comply with fair lending requirements and how FHFA will supervise their compliance. FHFA neither agreed nor disagreed with the recommendation.

Abbreviatons

|

AI |

artificial intelligence |

|

CFPB |

Consumer Financial Protection Bureau |

|

e-closing |

electronic closing |

|

enterprises |

government-sponsored enterprises |

|

FHA |

Federal Housing Administration |

|

FHEO |

Office of Fair Housing and Equal Opportunity |

|

FHFA |

Federal Housing Finance Agency |

|

FTC |

Federal Trade Commission |

|

HUD |

Department of Housing and Urban Development |

|

proptech |

property technology |

|

VA |

Department of Veterans Affairs |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

September 22, 2025

The Honorable Elizabeth Warren

Ranking Member

Committee on Banking, Housing, and Urban Affairs

United States Senate

The Honorable Maxine Waters

Ranking Member

Committee on Financial Services

House of Representatives

Property technology (proptech)—a broad range of digital tools used in real estate—has transformed nearly every aspect of the homebuying process. Homebuyers can use online platforms to search listings, browse estimated home values, explore financing options, and apply for mortgage loans. Lenders can use automated underwriting systems to assess creditworthiness and inform underwriting decisions.

As the use of artificial intelligence (AI), including machine learning, has grown, questions have emerged about how proptech products use these technologies and their potential effects on homebuyers and the housing market.[1] Because the data inputs and decision-making processes of these tools may not be transparent, questions also have arisen about the extent of federal oversight of proptech products for ensuring compliance with fair lending and other consumer protection laws.[2]

You asked us to review issues related to the use and oversight of proptech products in the homebuying process. This report examines (1) how selected proptech products are used in the homebuying process, (2) the potential benefits and risks these products may pose to homebuyers and the housing market, and (3) how federal entities oversee compliance with fair lending and other relevant consumer protection laws for selected products.[3]

For this report, we selected four types of proptech products: online real estate platforms, automated valuation models, automated underwriting systems, and electronic closing tools (e-closing tools).[4] We selected these products because they are used by different participants (e.g., homebuyers and lenders) during various stages of the homebuying process and because some may pose potential risks to homebuyers. We focused on the use and development of these products for new purchase loans by nonbank mortgage lenders, proptech companies (companies that develop the selected products), and the government-sponsored enterprises Fannie Mae and Freddie Mac (enterprises).[5]

For the first and second objectives, we reviewed and analyzed reports and studies by researchers, industry stakeholders, and federal entities. We also reviewed proptech company websites and media reports related to the selected products. We also conducted a literature review for the second objective, examining relevant research on the selected products published from 2013 through 2024 in peer-reviewed journals and other sources.

For the third objective, we analyzed federal laws, regulations, and agency guidance applicable to the selected products and nonbank mortgage lenders.[6] The federal entities in our review were the Consumer Financial Protection Bureau (CFPB), Department of Housing and Urban Development (HUD), Federal Housing Finance Agency (FHFA), Federal Trade Commission (FTC), Department of Veterans Affairs (VA), and the enterprises.[7] We reviewed these entities’ fair lending and other consumer protection oversight practices for our selected products. We also interviewed representatives of the Conference of State Bank Supervisors to understand the states’ oversight roles. In addition, we determined that the information and communication component of internal control was significant to this objective. We reviewed documentation of FHFA’s communications to the enterprises about changes in its oversight to assess the extent to which they aligned with these standards.[8]

For all the objectives, we interviewed representatives of the federal agencies and enterprises cited above, as well as five industry groups, four research organizations, two consumer advocacy groups, and one law firm. We also interviewed representatives of eight companies that provide or use the selected products. We judgmentally selected these entities based on factors such as expertise and other relevant characteristics. For more information on our scope and methodology, see appendix I.

We conducted this performance audit from November 2023 to September 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Oversight of Proptech Products

Fair lending and other consumer protection laws apply to mortgage lending and, in general, to the use of proptech products in mortgage lending (see table 1).[9] Table 1 lists examples of fair housing, fair lending, and other consumer protection laws and regulations that agency officials cited as relevant to use of the selected proptech products.

Table 1: Examples of Fair Housing, Fair Lending, and Other Consumer Protection Laws and Regulations Relevant to Selected Property Technology Products

|

Law or regulationa |

Example of relevant requirements |

Applicability to products selected for this reviewb |

|

Fair Housing Act |

Prohibits discrimination in the sale, rental, and financing of housing and other housing-related decisions because of race, color, religion, sex, familial status, national origin, and disability. |

Online real estate platforms Automated underwriting systems Automated valuation models Electronic closing tools |

|

Equal Credit Opportunity Act |

Prohibits creditors—including mortgage lenders—from discriminating against credit applicants on a prohibited basis, such as race, color, religion, national origin, sex, marital status, or certain other factors. Creditors must also disclose, or disclose upon request, specific reasons for adverse actions, including credit denials. |

Online real estate platforms Automated underwriting systems Automated valuation models Electronic closing tools |

|

Truth in Lending Act |

Requires creditors, and in some cases advertisers, to disclose information about the costs and terms of consumer credit transactions. |

Online real estate platforms Automated underwriting systems Electronic closing tools |

|

Real Estate Settlement Procedures Act |

Requires mortgage borrowers to receive disclosures about the nature and costs of the settlement process and provides protections against certain abusive practices that could result in unnecessarily high settlement charges. |

Online real estate platforms Electronic closing tools |

|

Federal Housing Enterprises Financial Safety and Soundness Act of 1992 |

Includes provisions that promote fair housing and equitable housing finance. |

Automated underwriting systemsc Automated valuation modelsc |

|

Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 |

Sets standards and rules for real estate appraisals. |

Automated valuation models |

|

Quality Control Standards for Automated Valuation Models ruled |

Requires lending institutions to implement quality control standards, adopt policies and practices to protect against data manipulation, and comply with nondiscrimination laws. |

Automated valuation models |

Source: GAO analysis of Consumer Financial Protection Bureau, Department of Housing and Urban Development, Federal Housing Finance Agency, Federal Trade Commission, and Department of Veterans Affairs documentation and interviews with agency officials. | GAO‑25‑107201

aAll statutes are as amended to the most updated versions.

bWhether a law or regulation applies to a product depends on how a product is used or constructed and specific facts and circumstances. Agency officials we interviewed informed us that the selected proptech products listed here may be involved in violations of, or subject to, relevant laws and regulations.

cApplicable to automated underwriting systems or automated valuation models used or developed by Fannie Mae or Freddie Mac.

d89 Fed. Reg. 64538 (Aug. 7, 2024). The rule becomes effective October 1, 2025.

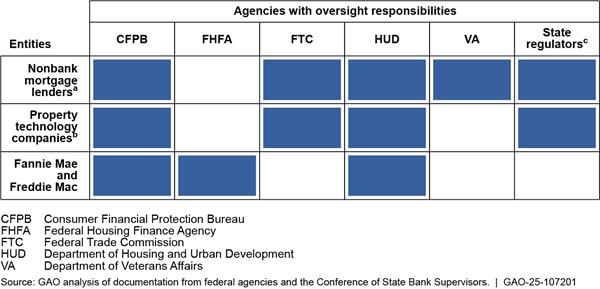

Several federal agencies have fair lending and consumer protection oversight responsibilities related to the development and use of the selected proptech products in the mortgage market (see fig. 1).

Figure 1: Agencies Involved in Oversight of Fair Lending and Consumer Protection of Property Technology Products

aOversight of products used by depository institution mortgage lenders was outside the scope of this review.

b“Property technology companies” refers to companies that develop property technology products. Some nonbank mortgage lenders may develop such products for internal use.

cNo uniform framework gives state regulators authority over property technology companies, but some state laws and regulations may apply depending on a company’s activities.

CFPB. CFPB is responsible for enforcing federal consumer financial protection laws, including fair lending laws, and has supervisory authority over nonbank mortgage lenders of all sizes.[10] It also has oversight authority over third-party service providers to nonbank lenders, which can include proptech companies for purposes of enforcing the consumer financial protection laws.[11] CFPB is also authorized under federal consumer financial protection laws to administer, enforce, and otherwise implement the provisions of those laws. In addition, CFPB is responsible for monitoring financial markets for risks to consumers, collecting and reviewing consumer complaints, and promoting financial education. In some situations, CFPB may have oversight of Fannie Mae and Freddie Mac in connection with the Equal Credit Opportunity Act, according to Freddie Mac officials. As of July 2025, the administration and Members of Congress were reviewing CFPB’s role in overseeing consumer financial protection laws, including fair lending laws.[12]

FHFA and the enterprises. FHFA regulates Fannie Mae and Freddie Mac.[13] It has supervisory and enforcement authorities related to ensuring the enterprises operate in a safe and sound manner and comply with fair lending laws. FHFA also may issue regulations, guidelines, or orders necessary to carry out its mission. Fannie Mae and Freddie Mac generally purchase mortgages that meet certain criteria and hold the loans in their portfolios or pool them as collateral for mortgage-backed securities sold to investors.[14] In exchange for a fee, the enterprises guarantee the timely payment of interest and principal on the securities they issue.

FTC. FTC is responsible for enforcing a variety of consumer protection laws, including Section 5 of the Federal Trade Commission Act (which prohibits unfair or deceptive acts or practices in or affecting commerce), the Equal Credit Opportunity Act, and the Truth in Lending Act. It has consumer protection enforcement authorities over most nonbank entities, including mortgage companies and mortgage brokers. FTC also investigates and brings cases against individuals and companies, which could include proptech companies. FTC also may issue rules and general statements of policy with respect to unfair or deceptive acts or practices in or affecting commerce, including defining such practices as needed.

HUD. HUD’s Federal Housing Administration (FHA) is responsible for overseeing its single-family loan programs, which insure mortgage loans for the purchase or refinancing of a home. FHA helps ensure that lenders (both bank and nonbank) meet FHA loan program requirements and adhere to applicable laws, including fair lending laws. HUD’s Office of Fair Housing and Equal Opportunity (FHEO) enforces the Fair Housing Act. It investigates consumer complaints regarding companies’ compliance with laws related to housing discrimination, including the Fair Housing Act. Under the Housing and Economic Recovery Act of 2008, HUD is also authorized to prohibit the enterprises from engaging in discriminatory practices and to require them to submit data to support investigations of potential violations of the Fair Housing Act and Equal Credit Opportunity Act.[15]

VA. VA’s Veterans Benefits Administration administers the VA Home Loan Guaranty Program, which guarantees mortgage loans for the purchase, construction, or repair of a home by eligible veterans. VA is responsible for overseeing participating lenders (both bank and nonbank) to ensure they meet program requirements.

State regulators. State financial regulators oversee fair lending and other consumer protection laws for nonbank mortgage lenders operating in their states. They have broad licensing, examination, investigation, enforcement, and prudential regulatory authority over these lenders. Although no uniform regulatory framework provides state regulators authority over proptech companies, some state laws and regulations may apply if a company’s conduct or activities do not comply with relevant state law. States also have the authority to pursue claims under Title X of the Dodd-Frank Wall Street Reform and Consumer Protection Act and implementing regulations in federal district court or other appropriate state regulatory proceedings.

Use of Proptech Products by Homebuyers and Lenders Is Widespread

Nearly all homebuyers use online real estate platforms to search for homes and some may use other services and features, such as valuation models, to get home price estimates. Lenders and the enterprises use automated valuation models for multiple functions, including estimating the market value of properties. The enterprises developed their own automated underwriting systems used by nonbank mortgage lenders. Fully virtual real estate closings remain limited, although one or more closing documents are often accessed, transferred, or signed electronically.

Homebuyers Use Online Platforms to Search for Homes and Access Other Services

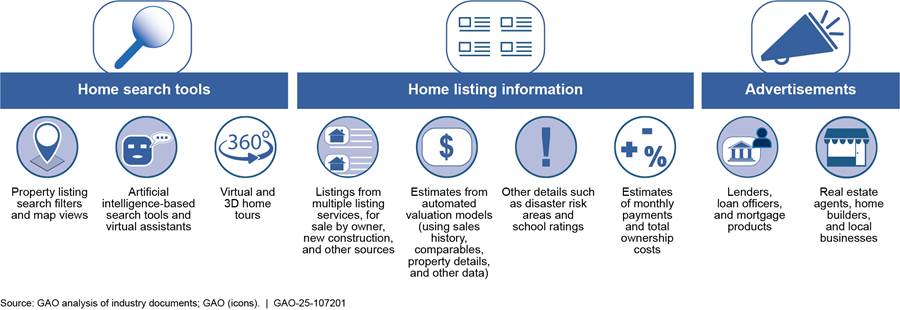

Online real estate platforms are websites or online applications that provide tools and information homebuyers can use to search for and purchase homes (see fig. 2). Nearly all homebuyers use online platforms to search for homes, according to a 2021 report by the National Association of Realtors.[16] Examples of online real estate platforms include Realtor.com, Redfin, and Zillow.

The platforms’ listings and search tools provide wide-ranging information on properties and neighborhoods. Listing information can incorporate data and photographs from multiple listing services.[17] Other information can include neighborhood school ratings and disaster risk information. Certain platforms provide virtual property tours and display home value estimates of homes generated by automated valuation models.[18]

Online platforms also advertise services to homebuyers. For example, homebuyers can use the platforms to find real estate agents or brokers. In addition, homebuyers can research financing options, and some platforms offer mortgage lending services or feature sponsored mortgage lenders.

Online platforms are increasingly using AI, including machine learning, to generate information for users. For example, they may incorporate these technologies into automated valuation models to aggregate and analyze large volumes of data and improve the property value estimates. AI also may be used to enhance property search tools and offer virtual assistants to answer homebuyers’ questions.

Lenders and Enterprises Use Automated Valuation Models for Multiple Functions

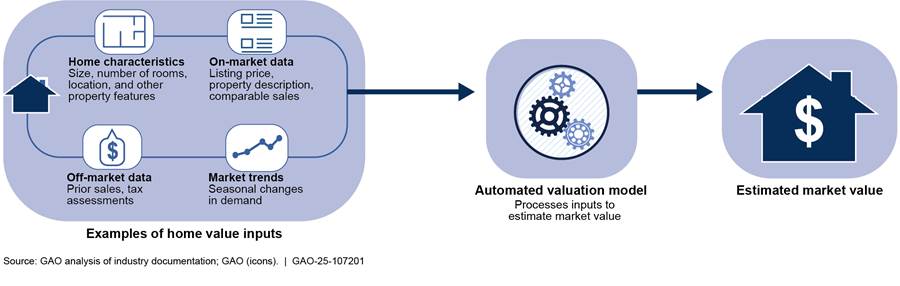

Automated valuation models are software programs or tools that use algorithms to estimate a property’s market value using information such as a property’s sales history, sales of similar properties, and characteristics of the property and its location. Mortgage lenders and the enterprises use automated valuation models to estimate the fair market value of properties and for other functions (see fig. 3). Lenders also may use the models to assess the quality of a traditional appraisal, according to proptech company representatives we interviewed.

Although lender use of automated valuation models for various functions has increased in recent years, lenders generally do not use them as a substitute for traditional appraisals for new purchase loans. Several factors contribute to this. First, federal loan programs, such as those of FHA and VA, require the use of traditional appraisals for new purchase loans. Second, the enterprises require traditional appraisals for most of the loans they purchase. Third, lender and borrower preferences also support the ongoing use of traditional appraisals, according to a 2023 study of automated valuation models and to enterprise officials and a selected proptech company representative we interviewed. Lenders typically obtain traditional appraisals because loans sold to the enterprises generally require them, according to the study.[19]

Automated valuation models also may have limited applicability for certain properties due to limited data on comparable properties. One proptech company estimated that the models cannot assess about 15 percent of residential properties because of their unique or remote nature.

The enterprises have developed automated valuation models that they use for issuing appraisal waiver offers and other risk-management purposes. For example, Fannie Mae and Freddie Mac issue appraisal waiver offers if properties meet certain eligibility criteria. Lenders can choose to accept the waiver or obtain a traditional appraisal.[20] Approximately 10–15 percent of new purchase loans delivered to the enterprises have qualified for an appraisal waiver, according to enterprise officials.

The enterprises also use their automated valuation models for internal purposes, according to Fannie Mae and Freddie Mac officials. For example, the enterprises use these models as quality checks to validate appraised property values. Fannie Mae also uses its models to price foreclosed properties and distressed assets, determine mortgage insurance termination eligibility based on property value, and monitor loan performance and the expected outcomes of purchased loans. Freddie Mac uses its model to support certain investor disclosures related to credit risk transfer and portfolio management. Freddie Mac and Fannie Mae incorporated machine learning—a type of artificial intelligence—into their models in 2018 and 2020, respectively. They use machine learning to leverage larger datasets, increase the number of properties covered, and improve estimate accuracy, according to enterprise officials.

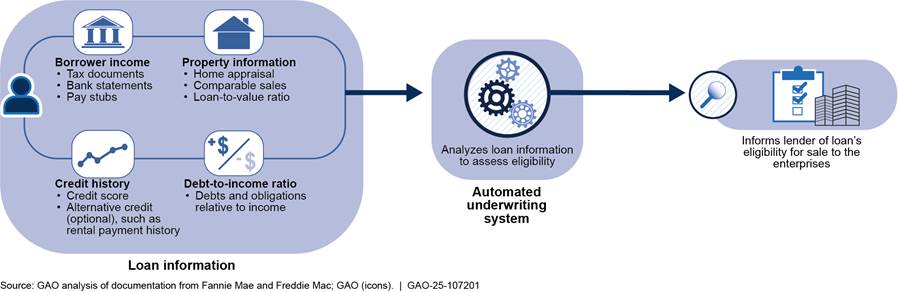

Nonbank Mortgage Lenders Use Enterprises’ Automated Underwriting Systems to Evaluate Loan Eligibility

In general, automated underwriting systems are digital platforms lenders use to evaluate loan applications. They analyze borrower loan application data to evaluate credit risk and predict the likelihood of loan repayment. Fannie Mae and Freddie Mac developed their own proprietary systems, upon which bank and nonbank mortgage lenders rely (see fig. 4).[21] In addition, some lenders use additional automated underwriting systems to support lending decisions and for other internal purposes, according to Fannie Mae and Freddie Mac officials.

Lenders use the enterprises’ systems to evaluate whether a mortgage loan meets eligibility requirements for sale to the enterprises, which can be a critical factor in lenders’ decisions to originate loans.[22] However, neither the enterprises nor their systems make credit decisions for lenders.[23] Ultimately, the decision to underwrite a loan is made by the lender.

The enterprises’ systems dominate the mortgage market, according to Fannie Mae officials and representatives of a mortgage lending industry group. These officials and representatives told us that nonbank mortgage lenders primarily use these systems because they sell most of the loans they originate to the enterprises on the secondary market.

Although lenders primarily use the enterprises’ automated underwriting systems, some maintain their own systems for determining whether to purchase loans for their portfolios, according to Fannie Mae officials. Some lenders also may develop or use third-party automated systems that use algorithmic models to assess borrower risk and inform credit decisions. These algorithmic models can analyze larger volumes of data than those traditionally used in mortgage underwriting.

Fannie Mae and Freddie Mac’s automated underwriting systems do not use AI to make decisions on loan purchase eligibility, but certain inputs to these systems use machine learning. For example, Fannie Mae’s automated valuation models are incorporated into its underwriting systems. Freddie Mac’s underwriting system has used machine learning to summarize credit information since 2023.

Lenders’ private automated underwriting systems also may use AI to automate certain underwriting tasks such as reviewing borrower documentation, according to representatives of two proptech companies and a study we reviewed.[24]

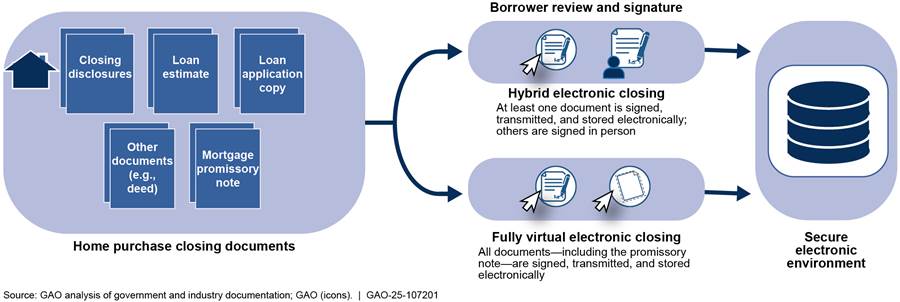

Use of Fully Virtual Mortgage Closings Is Limited

An e-closing generally refers to mortgage closings in a secure electronic environment in which one or more required documents are accessed, presented, signed, and stored electronically (see fig. 5). More specifically, an e-closing can be fully virtual or hybrid. In a hybrid closing, some documents—such as notarized documents—are physically signed, while others are signed and stored digitally.

E-closing tools are digital tools that automate closing processes and have built-in mechanisms to help ensure the accuracy of mortgage closing documents. The tools use encryption technologies to protect sensitive loan data, may include tamper-evident digital seals to verify document integrity, and track closing processes. E-closing tools generally do not use advanced forms of AI, according to representatives from the Mortgage Industry Standards Maintenance Organization.

They said that currently, most closings are completed in-person or as a hybrid process. VA permits electronic signatures in the course of closings as part of the VA Home Loan Program, and the enterprises allow hybrid and fully virtual e-closings. The use of e-closing increased during the COVID-19 pandemic in 2020 and 2021. However, fully virtual closings remain rare, according to representatives of an industry group, a nonbank mortgage lender, and one of the enterprises. The industry group, which represents mortgage lenders, estimated that just 3 percent of closings were fully virtual.

Lender preferences and state regulatory requirements affect the use of e-closing tools. Fannie Mae and Freddie Mac reported before the COVID-19 pandemic that lenders and other industry participants showed limited interest in adopting e-closing tools or faced implementation challenges.[25] Representatives of the Mortgage Industry Standards Maintenance Organization also told us that lender preferences were a common challenge affecting adoption. In addition, Fannie Mae and a lender we interviewed told us that homebuyers generally have not shown strong preferences for e-closings. Furthermore, state statutes vary regarding electronic signatures, and states and localities have differing requirements for property records and electronic or remote notarization, according to Fannie Mae guidance.[26]

Proptech Products May Simplify Homebuying and Expedite Underwriting but Also Present Consumer and Market Risks

Selected proptech products can simplify homebuying, improve appraisal accuracy, speed up the underwriting process, and increase convenience for homebuyers. However, they also may pose risks related to market distortions, consumer data privacy, regulatory compliance, and transparency, according to our literature review and interviews with federal officials, industry stakeholders, and selected proptech companies.[27]

Online Platforms May Simplify Homebuying but Can Pose Risks

Potential Benefits

Simplify the homebuying process for homebuyers. Online platforms may offer a “one-stop” resource for the home-buying process. The platforms can aggregate real estate listings from multiple sources, personalize property recommendations, and connect buyers with real estate agents and lenders. The platforms also may allow users to secure financing directly from the platform.

Increase homebuyer access to information. Online platforms may increase access to information by providing home listings, neighborhood data (such as school ratings and climate risk information), financing options, and information on the homebuying process. Representatives from an industry group noted that platforms also allow prospective homebuyers to estimate the mortgage amount for which they may qualify without engaging directly with a lender. Representatives from one company (an online platform) noted they recently added a tool that calculates property affordability for a user. The tool incorporates users’ financial information (such as credit score and debts), real-time mortgage rates, and related costs (such as homeowners’ insurance and homeowners’ association fees). Some platforms also offer information on financing options that may help first-time and low-income borrowers, including downpayment assistance programs and FHA-insured loans.

Potential Risks

Distort housing market prices. The use of automated valuation models in online real estate platforms may distort housing prices by creating a feedback loop.[28] One study we reviewed found that Zillow’s valuation tool affected listing and sales prices in several U.S. cities. Specifically, higher initial Zillow valuation estimates led to higher listing prices, and higher Zillow valuations after a property was listed also generally led to higher sales prices.[29] However, most types of valuation methodologies, including traditional appraisals and tax assessments, involve similar types of risks, according to representatives of a proptech company (an online platform) we interviewed.

Increase risks to consumer data privacy. Online platforms may obtain potentially sensitive consumer data to personalize product offerings and enhance digital marketing to consumers. In one study, consumers noted reservations about virtual reality technologies and digital marketing in real estate, expressing concerns that companies might obtain excessive personal information.[30] Another study noted that virtual reality technologies should have robust data protection protocols and encryption to safeguard consumers’ sensitive personal information.[31]

Noncompliance with fair housing laws. Online platforms’ use of some AI models could result in discrimination against certain consumers in violation of fair housing laws.[32] For example, if search algorithms and chatbots are not trained to recognize problematic search terms—such as references to protected class characteristics like race, national origin, disability, or religion—they may generate search results that illegally “steer” consumers to certain listings.[33] To help mitigate this risk, Zillow developed a tool to detect language in searches and chatbots that potentially violates antidiscrimination laws. When such language is flagged, Zillow product developers determine how to respond, such as amending the model to rephrase consumer questions or educate consumers about fair housing laws.[34]

In addition, there is a risk that online platforms may use algorithms or AI to target advertisements toward or away from specific consumers. According to HUD guidance, such targeting practices may violate the Fair Housing Act.[35] For example, the guidance explains that targeting could deny consumers in protected classes information about housing opportunities, target vulnerable consumers for predatory products, or steer homebuyers to particular neighborhoods. Representatives of a law firm told us that homebuyers may be unaware they are not seeing certain advertisements, potentially missing opportunities available to others.

According to HUD officials with whom we spoke, platforms’ listing or other policies also may lead to Fair Housing Act violations by denying certain consumers housing opportunities and services. In 2022, Redfin entered into a settlement agreement with 10 housing organizations over its minimum price policy, which excluded services for homes below a set amount. Under the policy, if a property fell below its minimum price threshold, Redfin would not provide services to the seller such as 3D walkthroughs of the property, premium placement of the listing on its website, and a personalized dashboard to track buyers viewing the property. The organizations alleged that such policies could perpetuate racial segregation and contribute to the racial wealth gap.[36]

Automated Valuation Models May Improve Appraisal Accuracy and Save Time, but Could Perpetuate Discrimination

Potential Benefits

Improve accuracy and consistency and reduce bias. Automated valuation models used during mortgage underwriting may be more accurate and more consistent in some areas than traditional appraisals. For example, the accuracy of traditional appraisals may be undermined because appraisers know the home’s contract price. A 2019 study by academic and Fannie Mae researchers found that appraisers tend to set appraisal values at the exact contract price when they know that price.[37] Automated valuation models do not incorporate contract prices and therefore avoid this issue.[38] However, VA officials noted that contract prices still may be relevant in assessing whether a property’s price is supported by market data.

Automated valuation models also may improve appraisal consistency and reduce bias by removing some of the subjectivity inherent in traditional appraisals. Appraisers apply their own judgment throughout the appraisal process, such as identifying comparable properties, adjusting for property characteristics, and reconciling values to determine market price. Studies have found that racial bias exists in traditional appraisals. For example, a 2023 Brookings Institution literature review found that anecdotal and empirical evidence suggested a high degree of racial bias in traditional appraisals.[39] Compared to traditional appraisals, automated valuation models may reduce bias because they do not consider the race of the buyer or seller, according to commenters on an interagency rule and representatives of two proptech companies we interviewed.[40]

Reduce appraisal time. Automated valuation models reduce the time required to complete an appraisal.[41] Traditional appraisals can take more than a week, while automated models can generate valuations in seconds. This can be particularly beneficial for homebuyers in competitive housing markets where quick decisions are often needed, according to representatives of an industry group we interviewed.

Reduce costs. Use of automated valuation models may reduce closing and other administrative costs. Based on our analysis, a traditional appraisal generally can cost homebuyers from $350 to $600, while automated models can estimate values at little cost to the homebuyer.[42] Representatives from an industry group representing lenders said a growing shortage of appraisers may result in longer turnaround times and higher costs or rush fees. Traditional appraisals also can cost more in rural areas, due to travel time and additional effort needed to identify comparable properties. Representatives of the industry group also said that greater use of automated models could help address appraiser shortages and create cost-saving opportunities for lenders and homebuyers.

Limitations and Risks

Lack reliability where comparable data are limited. Automated valuation models may not be reliable when data for comparable properties are limited, according to studies we reviewed and interviews with representatives from a proptech company and two industry groups. The precision of the models’ estimates depends heavily on the availability of current data and sufficient information on recent sales of comparable homes.[43]

One company reported that its automated valuation models can estimate values for approximately 85 percent of all U.S. properties, but lack sufficient data to estimate valuations for the remaining 15 percent. For example, properties in both urban and rural areas can be more difficult to appraise because they tend to be older, less homogenous, and have limited comparable sales data, according to representatives from a consumer advocacy group we interviewed.

Perpetuate discrimination due to use of historical data. While automated valuation models do not take into account the race of participants in individual transactions, they may perpetuate valuation disparities by continuing to undervalue properties in historically undervalued communities. Although industry-sponsored tests have found that models may estimate home values more reliably than traditional appraisals, other research has found that reliance on historical housing price data makes it difficult to correct for the effects of past discrimination embedded in these data.[44] Representatives of two consumer advocacy groups emphasized the importance of reviewing models for potential bias and implementing guardrails to ensure they do not amplify disparities in home valuation.

Reduce transparency. Information available to consumers on the inputs and accuracy of automated valuation models is generally limited, due to the “black box” nature of AI models and the lack of publicly available information on methodologies used in valuation models.[45] One study we reviewed noted that model vendors often do not disclose data variables used as inputs and may selectively report statistics on model accuracy.[46]

Lack of transparency on the data and methodology used can make it difficult for users and consumers to identify data errors or evaluate the accuracy of results. This limits the models’ explainability—that is, the ability to understand how and why an AI system produces decisions, predictions, or recommendations. According to HUD officials, the lack of transparency in AI models may hinder consumers’ and regulators’ ability to assess or challenge discriminatory practices.

Although publicly available information on model inputs and accuracy may be limited, vendors share certain information with their clients. For example, two industry participants that submitted public comments on the Quality Control Standards for Automated Valuation Models rule and representatives of two companies and a law firm with whom we spoke noted that lenders have processes to obtain information from vendors.[47] Representatives of one of the companies told us they shared information on model methodology and data inputs with clients under nondisclosure agreements due to the proprietary nature of their models.

Automated Underwriting Systems May Improve Quality, Efficiency, and Access to Credit, but Those That Use AI Present Risks

Potential Benefits

Improve underwriting quality. Traditional automated underwriting systems have built-in checks and safeguards to reduce the potential for human error. For example, the enterprises’ automated underwriting systems, which assess loans for eligibility for sale to Fannie Mae and Freddie Mac, provide automated error codes to lenders to resolve data quality problems and validity issues in the underwriting process.

Freddie Mac reported in 2023 that loans leveraging its automated technologies, including its automated underwriting system, were less likely to have problems than loans that did not use these technologies.[48] FHFA officials said the enterprises’ automated underwriting systems helped manage safety and soundness risks because FHFA and the enterprises calibrated the systems to help lenders make risk-based lending recommendations. In addition, VA officials told us that lenders’ use of underwriting technologies adds another quality check to the underwriting process, including appraisal review.

Speed up the underwriting process. AI-driven automated underwriting systems can speed up lender tasks such as document review and income and employment verification. AI applications can scan large volumes of loan files, extract relevant information, and pass it on to the underwriter in summary form.[49] This can reduce the time needed to assess borrower credit risk.[50] Representatives of one proptech company told us that improvements in AI-driven automated underwriting tools’ ability to recognize employment and income documents will allow lenders to complete underwriting more quickly.

Increase access to credit. Automated underwriting systems that use AI-based algorithmic models and alternative data sources may improve default risk predictions by identifying patterns not captured through traditional underwriting.[51] For example, lenders can incorporate data on utility, rental, or credit card payments to help determine a borrower’s ability to repay. This may expand credit access for homebuyers with multiple or inconsistent income streams, such as gig workers, whose income can be difficult to assess.[52]

Freddie Mac representatives told us that incorporating alternative credit variables into Freddie Mac’s underwriting system in 2023 helped increase loan acceptance rates, particularly for Black borrowers.[53] One study we reviewed noted that although current AI-based models may reflect historical biases in mortgage underwriting, opportunities exist for proactive, responsible AI model development to remove systemic barriers to credit access.[54]

Limitations and Risks

Perpetuate biases. Although AI is not widely used to make credit decisions on mortgage loans, studies we reviewed and an industry group we interviewed noted that its use in underwriting systems may perpetuate biases in mortgage lending.[55] Additionally, data used to train AI-powered algorithmic models may reflect past underwriting decisions and lending practices influenced by discriminatory practices such as redlining.[56] One study we reviewed found that these models may identify data linked to a borrower’s immigration status or prior residence in neighborhoods with elevated default risk.[57] Another study noted that including data that may reflect historical biases in an automated underwriting system may disproportionately penalize certain homebuyers, such as immigrants.[58]

Reduce transparency of loan denials. Another potential risk involving AI-based algorithmic models in underwriting systems is reduced transparency. As previously noted, AI-based models often lack explainability due to their “black box” nature. When mortgage lenders deny a loan application, they must disclose their reasons to the applicant.[59] But the use of AI-based algorithmic models in underwriting systems may complicate a lender’s ability to explain adverse decisions because the model’s reasoning may not be transparent, according to representatives of a research organization and a consumer advocacy group we interviewed. This may make it challenging for borrowers to understand why their applications were denied and for lenders to comply with fair lending laws, according to a study we reviewed.[60] Further, the lack of transparency in AI-based models also may hinder consumers’ and regulators’ ability to assess whether loan decisions comply with the Fair Housing Act, according to HUD officials.

Limit access to credit for certain homebuyers. Automated underwriting systems may exclude some homebuyers—particularly from underserved communities—who do not fit traditional lending models, according to representatives from an industry group and a research organization we interviewed. These systems may lack the flexibility to evaluate nonconventional loan products and may overlook borrowers with unique credit needs.[61]

E-Closing Tools Promote Secure Transactions and Increase Convenience for Homebuyers, and Present Limited Risks

Potential Benefits

Promote completeness and accuracy of mortgage closing documents. CFPB has reported that e-closing tools may assist lenders by automating closing processes and leveraging built-in quality assurance mechanisms to promote accuracy of mortgage closing documents. For example, digital equivalents of promissory notes give lenders more control over loan certification by preventing lost documentation, avoiding missing signatures, and expediting fund transfers.[62] By reducing errors and increasing efficiencies, e-closing tools can help lenders and homebuyers save time and reduce costs throughout the closing process.[63]

Complete transactions securely. E-closing tools help ensure that transactions are secure by using encryption technologies to protect sensitive loan data, implementing tamper-evident digital seals to verify loan documentation, and tracking closing processes through comprehensive audit trails.

Increase convenience for homebuyers. E-closing tools may increase convenience by allowing homebuyers to participate in mortgage closings remotely. Remote access is particularly helpful for homebuyers who cannot be physically present, such as military personnel, according to CFPB officials and representatives we interviewed from the Mortgage Industry Standards Maintenance Organization.

Improve homebuyers’ understanding. E-closing tools may improve homebuyers’ understanding of the closing process by providing access to loan documents and educational materials well before the closing date. For example, in a 2015 report on an e-closing pilot program, CFPB said that participants reported feeling more empowered by having better-organized information and additional time to review their mortgage loan materials.[64]

Risks

We identified fewer potential risks associated with e-closing tools than with the other product types we selected. Our literature search did not identify any relevant studies on the risks of e-closing tools. However, e-closing tools can pose risks related to wire fraud, according to FTC and CFPB officials we interviewed. For example, fraudsters may target borrowers with phishing scams during the closing process.[65] In addition, consumer advocates told us that e-closing tools may not be the best option for borrowers needing more personalized assistance from lenders during the closing process.

Proptech Oversight Generally Has Not Focused on Specific Products, and FHFA Has Not Communicated Revised Expectations

With the exception of FHFA, federal agency oversight of proptech products generally has not focused specifically on the selected products.[66] FHFA and the enterprises conducted oversight of selected products for compliance with fair lending and other consumer protection requirements. In 2025, agencies began implementing the priorities of their new leadership and responding to various executive orders directing changes to policies and programs.[67] For example, FHFA began changing its fair lending oversight of the enterprises, but has not communicated revised expectations for enterprise compliance or its related supervision.

FHFA Conducted Proptech-Specific Oversight, but Has Not Communicated Revised Expectations on Fair Lending Oversight Changes

Oversight of Enterprises’ Proptech Tools

FHFA conducts fair lending and consumer protection oversight focused on Fannie Mae’s and Freddie Mac’s use of proptech. For example, it conducts safety and soundness examinations and has issued regulations and guidance relevant to the enterprises’ use of proptech products.

· FHFA annually conducts from three to five targeted examinations at each enterprise focused on the safety and soundness of enterprise models, including automated underwriting systems and automated valuation models, according to agency officials. These examinations include reviewing the enterprises’ model documentation and development plans.

· In July 2024, FHFA and five other regulatory agencies issued a final rule requiring mortgage originators and secondary market issuers to implement quality control standards for automated valuation models used in valuing real estate collateral securing mortgage loans.[68] The rule requires the enterprises to adopt policies and practices to protect against data manipulation and comply with nondiscrimination laws. The rule provides a framework for the enterprises’ use of the models, and a standard that FHFA can use in its examinations of the enterprises’ models, according to officials.

· FHFA also issued advisory bulletins that, although not specific to the selected proptech products, apply to the enterprises’ use of these products, according to FHFA officials. For example, a 2013 advisory bulletin set supervisory expectations for model risk-management frameworks, and a 2022 bulletin provided supplemental guidance on gaps created by technology changes.[69] Additionally, a 2022 advisory bulletin contained guidance on managing risks associated with the use of AI and machine learning, including compliance with consumer protection, fair lending, and privacy laws.[70]

FHFA Changes to Fair Lending Oversight

Beginning in early 2025, FHFA made changes to its fair lending oversight program, but has not communicated revised compliance and supervisory expectations to the enterprises. Table 2 lists key fair lending oversight documents FHFA officials identified that are applicable to our selected proptech products and actions FHFA took related to them.[71]

Table 2: Key FHFA Oversight Documents on Fair Lending Relevant to Selected Property Technology Products and Related Agency Actions Taken Through July 2025

|

Type of oversight |

Title |

Summary |

FHFA actions taken January–July 2025 |

|

|

Policy statement |

Policy Statement on Fair Lendinga |

Established FHFA’s position on monitoring, information gathering, supervisory examinations, and administrative enforcement related to the Equal Credit Opportunity Act, Fair Housing Act, and Federal Housing Enterprises Financial Safety and Soundness Act |

None |

|

|

Rule |

Fair Lending, Fair Housing, and Equitable Housing Finance Plansb |

Subpart A: A general introduction to the regulations, including definitions and compliance and enforcement applicability Subpart B: Requirements related to fair housing and fair lending compliance; prohibition on unfair or deceptive acts or practices; and reporting and certification of compliance with fair housing and fair lending provisions and on unfair or deceptive acts or practices Subpart C: Enterprise requirements for Equitable Housing Finance Plans, including planning, adoption, reporting, and public engagement Subpart E: Requirements for the enterprises to collect, maintain, and provide single-family mortgage data |

March 25, 2025 – FHFA Director waived requirements for planning, adoption, reporting, and public engagement July 28, 2025 – FHFA issued notice of a proposed rulemaking to repeal the rule |

|

|

Guidance |

Advisory Bulletin: Enterprise Fair Lending and Fair Housing Compliance (AB 2021-04)c |

Guidance on fair lending law compliance, supervisory expectations for effective fair lending programs, and fair lending risk factors |

Rescinded April 7, 2025 |

|

|

Advisory Bulletin: Regulated Entity Unfair or Deceptive Acts or Practices Compliance (AB 2024-06)d |

Expectations for compliance with the Federal Trade Commission Act prohibition on unfair or deceptive acts or practices and guidance on related risk management |

Rescinded March 24, 2025 |

||

|

Advisory Bulletin: Enterprise Fair Lending and Fair Housing Rating System (AB 2024-05)e |

Established a risk-focused rating system to annually assess enterprise fair lending, fair housing, and equitable housing compliance practices and outcomes |

Rescinded April 7, 2025 |

||

Source: GAO analysis of Federal Housing Finance Agency (FHFA) documentation and interviews with agency officials. | GAO‑25‑107201

Note: Although not all of FHFA’s guidance is specific to property technology products it applies to the enterprises’ use of these products, according to FHFA officials.

aPolicy Statement on Fair Lending, 86 Fed. Reg. 36199 (July 9, 2021).

bEquitable Housing Finance Plans are strategic planning documents that Fannie Mae and Freddie Mac released in 2022 and late 2024. The equitable housing finance plans were required to be adopted by the enterprises every three years. Fair Lending, Fair Housing, and Equitable Housing Finance Plans, 89 Fed. Reg. 42768 (May 16, 2024) (codified at 12 C.F.R. pt. 1293).

cFederal Housing Finance Agency, Division of Housing Mission and Goals, Advisory Bulletin: Enterprise Fair Lending and Fair Housing Compliance, AB 2021-04 (Washington, D.C.: Dec. 20, 2021).

dFederal Housing Finance Agency, Advisory Bulletin: Regulated Entity Unfair or Deceptive Acts or Practices Compliance, AB 2024-06 (Washington, D.C.: Nov. 29, 2024)

eFederal Housing Finance Agency, Advisory Bulletin: Enterprise Fair Lending and Fair Housing Rating System, AB 2023-05 (Washington, D.C.: Sept. 27, 2023).

Prior Compliance and Supervisory Expectations Relating to Fair Lending Oversight

Prior to 2025, as part of FHFA’s supervision of the enterprises, FHFA conducted examinations that focused specifically on fair lending compliance. The examinations were risk-based and targeted to one or more enterprise activities. From 2019 through 2024, FHFA conducted five such examinations. FHFA also established an Enterprise Fair Lending and Fair Housing Rating System, which assessed each enterprise’s fair lending compliance and assigned ratings based on its evaluations.

Before 2025, FHFA’s advisory bulletins also provided supervisory expectations and practical guidance specific to Fannie Mae’s and Freddie Mac’s operations and provided examples of how FHFA’s supervisory expectations could apply to the enterprises’ proptech products. For example, the advisory bulletin on fair lending and fair housing compliance outlined expectations that each enterprise would maintain a fair lending program, listed factors associated with higher fair lending risk, and suggested the enterprises should conduct internal fair lending evaluations to consider less discriminatory alternatives when developing automated underwriting models.

Finally, the enterprises were required to plan for, adopt, and issue Equitable Housing Finance Plans and conduct public engagement about them.[72]

2025 Changes to Fair Lending Oversight Program

In 2025, FHFA changed its examination approach, rescinded various advisory bulletins and waived portions of its fair lending rule for the enterprises in response to various executive orders, according to FHFA officials.[73] For example, rather than having dedicated examination teams that focused specifically on fair lending compliance, in April 2025 agency officials told us that the agency planned to evaluate fair lending risk as part of its safety and soundness examinations, as appropriate. They also told us that they no longer intended to implement the enterprise fair lending and fair housing rating system and would use FHFA’s existing composite rating system (which evaluates the enterprises on various aspects of their operations) to assess fair lending compliance. Relatedly, FHFA rescinded its advisory bulletin on the fair lending and fair housing rating system.[74] In July 2025, FHFA also issued a notice of proposed rulemaking to repeal its Fair Lending, Fair Housing, and Equitable Housing Finance Plans regulation.[75]

FHFA’s orders rescinding advisory bulletins and regulatory waiver of certain fair lending rule requirements state that the enterprises remain obligated to comply with applicable statutory and regulatory requirements. However, the orders do not contain any additional guidance on FHFA’s supervisory expectations or more information on how the enterprises should ensure compliance under FHFA’s revised supervisory framework.

FHFA officials told us that agency communications clearly convey that the enterprises must continue to comply with all applicable laws and regulations regarding fair housing and fair lending. They noted that the rescission orders, waiver of certain Equitable Housing Finance Plan requirements, and some transmittal emails reiterated that these changes did not relieve the enterprises of their legal obligations.

However, FHFA has not provided the enterprises with information about how fair lending risk will be incorporated into safety and soundness examinations. FHFA officials said the enterprises would learn of this change when FHFA began including fair lending compliance assessments in examination reports, consistent with practices it used prior to implementing the fair lending and fair housing rating system in 2024.

In addition, in May 2025, FHFA officials told us they had not decided whether the enterprises needed further guidance on fair lending. Officials stated that additional guidance may be considered during supervision if needed, but they did not identify what would prompt such a decision.

Representatives from one of the enterprises told us they were uncertain about what would replace the rating system or whether FHFA would again assess fair lending risk during safety and soundness examinations. Representatives of the other enterprise did not discuss FHFA’s fair lending rating system or further anticipated changes by FHFA.

Federal internal control standards state that management should communicate relevant and quality information with appropriate external parties regarding matters impacting the functioning of the internal control system.[76] In FHFA’s case, the enterprises rely on information from FHFA to help achieve the agency’s objectives of ensuring compliance with legal and regulatory requirements related to fair lending practices and to address related risks.

Given the extent of FHFA’s changes to its fair lending oversight program, providing additional written direction would help ensure that the enterprises clearly understand FHFA’s supervisory expectations and compliance requirements, which are intended to help promote sustainable housing opportunities for underserved communities.[77]

Enterprise Fair Lending Activities

Fannie Mae and Freddie Mac take steps to comply with fair lending and other consumer protection laws, including monitoring and mitigating the risks of automated underwriting systems and valuation model technologies. Each enterprise maintains fair lending policies or standards that require new models and changes to existing models to be assessed for potential fair lending impacts. Freddie Mac officials say they continually evaluate new data sources and techniques to improve the stability and fairness of their automated underwriting system.

The enterprises also maintain policies related to third-party relationships, including vendors that support their automated underwriting systems and valuation models, which may present potential fair lending risks. For example, Fannie Mae officials stated they review third-party vendor documentation; conduct data testing on third-party vendors’ products when possible; or review vendors’ own fair lending or fair housing testing results.

Both enterprises took actions to improve their automated underwriting systems as part of their 2022–2024 Equitable Housing Finance Plans.[78] For example, to help enhance access to credit, they incorporated positive rent payment and bank statement data into their underwriting systems.[79] As mentioned previously, Freddie Mac also introduced an alternative credit variable that helped increase loan acceptance rates for historically underserved borrowers with little or no credit history, who are more likely to be Black or Latino borrowers.

In April 2025, Freddie Mac officials told us the enterprise would comply with direction from FHFA and other applicable regulatory agencies regarding any changes needed to its fair lending program in response to recent executive orders. Fannie Mae officials reported that, as of April 2025, no changes had been made or planned to its fair lending policies or standards, pending their review of recent executive orders and FHFA communications of changes.

CFPB Oversees Nonbank Lenders’ Proptech Use, but Its Future Role Is Uncertain

Opinions, Rules, and Guidance

CFPB has issued an advisory opinion and a rule related to the proptech products included in our review. In February 2023, CFPB issued an advisory opinion on the application of the Real Estate Settlement Procedures Act to online real estate platforms.[80] The opinion states that online real estate platforms that allow consumers to comparison shop for mortgage loans or other real estate settlement services may violate the act if the non-neutral use or presentation of information has the effect of steering consumers to specific service providers based on the payment received from those providers. In December 2024, CFPB officials told us that following issuance of this advisory opinion, they began collecting information on supervised nonbank lenders’ participation in online real estate platforms to determine whether any violations of the Real Estate Settlement Procedures Act might exist.

Additionally, as discussed previously, in June 2024, CFPB and other financial regulators issued a joint final rule on quality control standards for automated valuation models, which will become effective in October 2025.

In May 2025, CFPB withdrew a number of its guidance documents, interpretive rules, and policy statements.[81] This included two circulars, issued in May 2022 and September 2023, that, among other things, had clarified adverse action notification requirements when lenders use AI or other complex credit models in decision-making.[82] These circulars specified that adverse action notice requirements—which seek to prevent and identify discrimination—apply equally to all credit underwriting decisions, whether made manually or through algorithmic models.

Monitoring and Supervision

Until late 2024, CFPB conducted risk-based examinations of nonbank mortgage lenders to oversee their compliance with fair lending and other consumer protection laws.[83] According to CFPB officials in July 2024, criteria considered in the examination prioritization process included lenders’ use of technology, product offerings, market share, and other risk factors.

CFPB’s mortgage origination examinations of nonbank lenders covered the entire loan origination process, including the use of loan origination software and e-closing tools.[84] Although CFPB’s fair lending examinations did not specifically focus on proptech, examiners could consider proptech products when collecting and analyzing information.[85] For example, the examination procedures include evaluations of underwriting decisions, lenders’ use of traditional underwriting or automated underwriting models, and policies and procedures governing these processes for fair lending compliance.[86] As of December 2024, CFPB officials told us that the agency had not taken any enforcement actions related to the selected products.

CFPB also has supervisory and enforcement authority over third-party service providers to CFPB’s regulated entities.[87] Service providers to nonbank mortgage lenders are expected to comply with federal consumer financial law. In July 2024, CFPB officials stated that nonbank mortgage lenders were required to oversee their business relationships with service providers in a manner that ensures compliance with federal consumer financial law. In December 2024, CFPB officials told us CFPB could choose to examine a third-party service provider if concerns arise during a lender examination or if a lender reports problems with a service provider or its products.

Nonbank lenders are also subject to supervision by state regulators, which conduct regular examinations. According to officials of the Conference of State Bank Supervisors, state regulators may monitor nonbank lenders’ use of technology as part of examinations, but they do not evaluate specific technology tools lenders use.

As of July 2025, the administration and Members of Congress were reviewing CFPB’s role in overseeing consumer financial protection laws, including fair lending laws.[88]

According to an April 2025 memorandum outlining CFPB’s supervision and enforcement priorities for 2025, CFPB’s oversight of nonbank mortgage lenders appears to be changing relative to previous years.[89] The memorandum indicates that CFPB will reduce its supervisory focus on nonbanks relative to depository institutions and shift resources from enforcement and supervision that can be performed by states. With respect to fair lending enforcement, the memorandum states that CFPB “will not engage in or facilitate unconstitutional racial classification or discrimination” and “will pursue only matters with proven actual intentional racial discrimination and actual identified victims.”[90] It is not clear how any changes may affect future oversight of the proptech products discussed in our review.[91]

Other Agencies’ Oversight Generally Is Not Specific to Proptech Products

FHA and VA

FHA and VA officials told us that neither agency monitors lenders’ use of proptech products, including automated underwriting systems or automated valuation models. Neither agency has developed guidance for lenders or conducted lender oversight specific to the use of proptech products.

Instead, FHA and VA oversee lenders for compliance with agency-specific program requirements, which include guidelines and quality control requirements for lenders participating in their programs.[92] Both agencies’ policies require human verification of underwriting and appraisals. Therefore, lenders cannot rely solely on automated underwriting systems or automated valuation models to determine eligibility for FHA-insured or VA-guaranteed mortgage loan programs. FHA and VA require an approved underwriter to sign off on each loan application, whether accepted or denied, and generally require traditional appraisals.[93] For example, FHA officials stated that the agency has established defined rules and developed a scoring model to monitor appraisals submitted through its electronic portal.

In addition, FHA’s quality control program has requirements specific to lenders’ compliance with fair lending laws. For example, FHA requires lenders’ quality control plans to contain procedures related to fair lending compliance. These procedures include a monthly review of a sample of denied FHA loan applications to verify that no civil rights violations occurred and that fair lending requirements were met.[94]

However, officials at FHA and VA noted that lenders can use proptech products to supplement their underwriting and appraisal practices. For example, VA allows lenders to use automated underwriting systems as a quality check because such systems can provide a risk assessment and expedite loan processing and approval. Similarly, lenders can use automated valuation models as part of internal risk reviews if all program standards for appraisals are otherwise met.

Neither FHA nor VA has taken enforcement actions specific to the selected products in our review. VA officials stated that VA does not enforce compliance with fair lending and consumer protection laws that are under the jurisdiction of HUD, CFPB, or other agencies. FHA officials stated that FHA can take enforcement action against lenders or refer cases to HUD FHEO or CFPB if it identifies fair lending or consumer protection violations during its lender monitoring reviews.

FHEO

To enforce the Fair Housing Act, FHEO investigates fair housing complaints and conducts compliance reviews, among other activities.[95] FHEO officials stated that these efforts can include reviewing proptech products. FHEO officials told us they had conducted few fair housing investigations focused on the proptech products in our review and had not identified any potential fair housing violations or taken enforcement actions associated with these products.

FHEO also conducts Secretary-initiated investigations, which typically address high-level, systemic issues affecting large numbers of aggrieved persons, according to FHEO officials.[96] For example, in August 2018, FHEO began an investigation into Facebook’s (later renamed Meta) use of algorithmic tools for targeting housing-related advertisements to certain consumers.[97] FHEO alleged that Facebook’s algorithms used characteristics protected under the Fair Housing Act to determine which users received housing advertisements. FHEO referred the case to the Department of Justice, which settled with the company in June 2022. The company agreed to stop using an advertising tool for targeting housing advertisements, among other terms.[98]

In May 2024, FHEO issued guidance on the application of the Fair Housing Act to the advertising of housing, credit, and real estate transactions through digital platforms.[99] The guidance describes the responsibilities and potential liability of both advertisers and advertising platforms. It also explains how advertisement targeting and delivery functions may risk violating the Fair Housing Act when deployed for housing-related advertisements. FHEO officials noted that advertising practices are often a component of allegations in Fair Housing Act and related cases. After issuing the guidance, FHEO added provisions to some conciliation agreements requiring advertising platforms to comply with the guidance when conducting marketing activities, according to FHEO officials.[100]

FHEO officials we interviewed also identified several challenges associated with investigating potential discrimination related to proptech products. First, consumers may not be aware that proptech products contributed to alleged discrimination. This can make it difficult to determine whether such products are relevant to a complaint. Second, limited publicly available information and companies’ reluctance to share proprietary information can constrain FHEO’s ability to determine whether to open an investigation. Third, once an investigation is opened, obtaining the necessary data and documentation can be time-consuming. This can make it difficult for FHEO to meet its 100-day investigation deadline—an ongoing challenge for the office.[101]

In addition, investigations related to companies’ use of technology can require additional technical expertise and staff resources, according to FHEO officials. FHEO must investigate every jurisdictional complaint it receives, regardless of staffing or resource levels.[102]

FTC

FTC targets its enforcement efforts to issues it determines cause the greatest harm to consumers. One source of information for identifying these issues is the collection of consumer complaints.[103] FTC officials stated it can be challenging to prove the elements of deception or unfairness—required under the FTC Act—for emerging areas of commerce and new technologies, such as proptech products.[104] FTC officials explained it also can be challenging to identify discrimination from consumer complaints because consumers may not be aware they are experiencing discrimination.

FTC officials told us that they do not have publicly available information on whether the proptech products included in our review pose significant risks to consumers. They also said that, as of May 2025, FTC had not taken any public enforcement actions involving these products.

Conclusions

The proptech products we reviewed offer benefits to prospective homebuyers, lenders, and the housing market. However, they also pose risks, such as potential market distortions, regulatory compliance risks, and limited transparency. To varying degrees, several agencies play a role in overseeing the use of these products. FHFA is the one agency that has provided oversight specifically focused on these products. Given FHFA’s recent changes to its fair lending oversight program—and Fannie Mae and Freddie Mac’s central roles in the mortgage market—providing additional written direction to the enterprises would help ensure that the enterprises clearly understand FHFA’s supervisory expectations and compliance requirements, which are intended to help promote sustainable housing opportunities for underserved communities.

Recommendation for Executive Action

The Director of FHFA should provide written direction to the enterprises that clarifies FHFA’s expectations for how the enterprises are to comply with fair lending requirements and how FHFA will supervise their compliance in light of rescinded supervisory and compliance guidance related to fair lending laws. (Recommendation 1)

Agency Comments

We provided a draft of this report to CFPB, FHFA, FTC, HUD and VA for review and comment.

FHFA provided written comments that are reprinted in appendix III and summarized below. In addition, CFPB, FHFA, FTC, and HUD provided technical comments, which we incorporated as appropriate. VA did not have any comments on the report.

In its written response, FHFA neither agreed nor disagreed with our recommendation. The agency stated that it believes that no further action is required to address the recommendation, based on its 2025 communications with the enterprises that stated that the enterprises are responsible for complying with all applicable statutory requirements, including fair lending requirements. FHFA also stated that its October 2019 compliance risk management guidance communicates the agency’s supervisory expectations for the enterprises’ compliance programs to maintain the safety and soundness of operations and to be designed in a way that promotes compliance with applicable laws, regulations, rules, and other compliance obligations. FHFA also noted that as part of its annual supervisory planning process, its Division of Enterprise Regulation will continue to assess relevant risks to the enterprises, including their compliance programs and compliance with laws and regulations such as fair lending, in developing its annual risk-based supervision plans.

We maintain that FHFA should provide written direction to the enterprises that clarifies its expectations and processes. Given the extent of recent and potential future changes to FHFA’s fair lending oversight of the enterprises’ property technology products—including the proposed repeal of the Fair Lending, Fair Housing, and Equitable Housing Finance Plans regulation—it is important that FHFA provide clear direction to the enterprises related to the changes. Doing so will help the enterprises understand what is expected of them and how they can comply with requirements in the revised regulatory environment.

While FHFA’s compliance risk management guidance provides direction to the enterprises on establishing an enterprise-wide risk management program, it does not specifically discuss fair lending or FHFA’s examination processes. Additionally, FHFA’s rescission orders, waivers, and emails to the enterprises affirmed the enterprises’ legal obligations. However, FHFA has not provided the enterprises with information about how fair lending compliance will be incorporated into its safety and soundness examinations going forward. Given the large and important role the enterprises’ property technology tools play in the mortgage market and the potential for increased risks associated with greater use of AI, additional communication to the enterprises would help ensure they fully understand FHFA’s expectations and revised oversight processes and would aid in their compliance.

As agreed with your office, unless you publicly announce the contents of this report earlier, we plan no further distribution until 30 days from the report date. At that time, we will send copies to the appropriate congressional committees, the Acting Director of the Consumer Financial Protection Bureau, Director of the Federal Housing Finance Agency, Chair of Federal Trade Commission, Secretary of Housing and Urban Development, Secretary of Veterans Affairs, and other interested parties. In addition, the report will be available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at cackleya@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix IV.

Alicia Puente Cackley

Director, Financial Markets and Community Investment

This report examines (1) how selected property technology (proptech) products are used in the homebuying process, (2) the potential benefits and risks these products may pose to homebuyers and the housing market, and (3) how federal entities oversee compliance with fair lending and other relevant consumer protection laws for selected products.

We selected four types of proptech products: online real estate platforms, automated valuation models, automated underwriting systems, and electronic closing tools. We selected these products because they are used by different housing market participants (such as homebuyers and lenders) during various stages of the homebuying process and because some may pose potential risks to homebuyers.