HEALTH INSURANCE MARKETPLACES

CMS Has Limited Assurance That Premium Tax Credits Exclude Certain State Benefit Costs

Report to the Chair

Committee on Energy and Commerce

House of Representatives

November 2024

GAO-25-107220

United States Government Accountability Office

View GAO-25-107220. For more information, contact John E. Dicken at (202) 512-7114 or dickenj@gao.gov.

Highlights of GAO-25-107220, a report to the Chair of the Committee on Energy and Commerce, House of Representatives

November 2024

Health Insurance Marketplaces

CMS Has Limited Assurance That Premium Tax Credits Exclude Certain State Benefit Costs

Why GAO Did This Study

In February 2024, over 20 million Americans purchased health insurance coverage through the marketplaces established by the Patient Protection and Affordable Care Act. In 2022, 90 percent of marketplace enrollees were eligible for federal APTC payments, which totaled over $75 billion.

CMS has expressed concerns that states may not identify non-EHB mandated benefits and that the APTCs do not exclude the costs of these benefits, resulting in improper federal payments.

GAO was asked to review states’ non-EHB mandated benefits and CMS efforts to ensure that federal funds do not subsidize their costs. This report (1) describes what is known about states’ non-EHB mandated benefits and (2) examines CMS efforts to ensure that APTCs exclude the costs of states’ non-EHB mandated benefits.

GAO reviewed federal law, regulations, and CMS documentation; and interviewed CMS officials and stakeholders from three national organizations with insight on state-mandated benefits.

What GAO Recommends

GAO is recommending that CMS conduct a risk assessment to determine whether its oversight approach is sufficient to ensure that APTCs exclude the costs of non-EHB mandated benefits or whether additional oversight is needed. The Department of Health and Human Services (HHS) agreed with the recommendation. HHS also provided technical comments, which GAO incorporated as appropriate.

What GAO Found

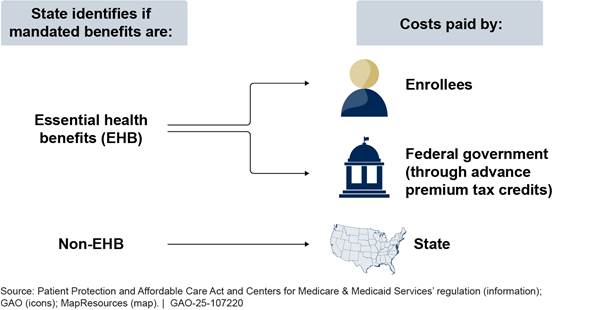

Marketplace plans are statutorily required to cover essential health benefits (EHB). These benefits include items and services in 10 categories, such as emergency services and hospitalization. The federal advance premium tax credit (APTC) is available to help eligible enrollees afford their marketplace plans.

States may mandate additional benefits for marketplace plans to cover. States are responsible for identifying these non-EHB mandated benefits based on the standard established by the Centers for Medicare & Medicaid Services (CMS). CMS does not collect information on states that have identified non-EHB mandated benefits. Through interviews with relevant national organizations, GAO found at least six states that identified non-EHB mandated benefits. These states’ mandated benefits included pediatric hearing aids and fertility care.

APTCs must exclude the costs of non-EHB mandated benefits, so that federal funds are not used to subsidize their costs. To calculate APTCs, CMS relies on insurers to report premium data that excludes the cost of these benefits.

CMS oversees the requirements related to non-EHB mandated benefits primarily through technical assistance, according to agency officials. CMS officials said that states frequently reach out to them for assistance, including asking them for advice on whether a benefit requirement they are considering would be a non-EHB mandated benefit.

However, CMS has not assessed whether its oversight approach is sufficient, and thus, has limited assurance that APTC amounts exclude the costs of non-EHB mandated benefits. This poses a risk to its oversight objective and is inconsistent with federal internal control standards that call for identifying, analyzing, and responding to risks related to achieving agency objectives. Conducting such an assessment of its oversight approach and making changes as appropriate would provide greater assurance that the APTC is appropriately excluding these costs.

|

Abbreviations |

|

|

|

|

|

APTC |

advance premium tax credit |

|

CMS |

Centers for Medicare & Medicaid Services |

|

EHB |

essential health benefits |

|

HHS |

Department of Health and Human Services |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

The Honorable Cathy McMorris Rodgers

Chair

Committee on Energy and Commerce

House of Representatives

Dear Madam Chair:

In February 2024, over 20 million Americans purchased health insurance coverage from federal and state marketplaces established by the Patient Protection and Affordable Care Act.[1] Marketplace plans must cover essential health benefits (EHB), which include items and services in 10 categories.[2] States determine the benefits covered in each of these categories by defining an EHB benchmark plan.[3] Individuals purchasing health coverage through the marketplaces, depending on their income and other eligibility requirements, may receive premium tax credits to help them afford their health insurance plan. Eligible individuals can opt to have the federal government pay the premium tax credit in advance, known as an advance premium tax credit (APTC).[4] In 2022, 90 percent of marketplace enrollees received an APTC, with total federal payments exceeding $75 billion.[5]

States may require marketplace plans to cover items and services in addition to EHB; we refer to such benefits as non-EHB mandated benefits. However, APTCs cannot be used to offset the costs of these additional benefits.[6] Specifically, the Centers for Medicare & Medicaid Services (CMS)—the federal agency responsible for determining the APTC amounts—must exclude the costs of non-EHB mandated benefits from the APTC calculation. CMS delegates responsibility for identifying non-EHB mandated benefits to the states.

However, CMS has expressed concerns about states’ compliance with this requirement. For example, in the 2021 Payment Notice, CMS noted state confusion regarding the identification of non-EHB mandated benefits and concerns that the premium data it uses to calculate the APTCs did not exclude their costs, resulting in improper federal payments.[7] CMS reiterated these concerns in its 2022 and 2023 Payment Notices.[8]

You asked us to review states’ non-EHB mandated benefits, including CMS’s efforts to ensure that federal funds are not subsidizing their costs. This report

1. describes what is known about states’ non-EHB mandated benefits, and

2. examines CMS efforts to ensure that APTCs exclude the costs of states’ non-EHB mandated benefits.

To describe what is known about states’ non-EHB mandated benefits, we interviewed CMS officials and representatives from a nongeneralizable selection of three national stakeholder organizations representing health plans, state regulators, or consumers.[9] From these interviews, we identified examples of states with non-EHB mandated benefits. We contacted state officials to confirm the scope of their respective mandates. These examples may not represent the universe of non-EHB mandated benefits nationally.

To examine CMS efforts to ensure that APTCs exclude the costs of states’ non-EHB mandated benefits, we reviewed federal law, regulations, and CMS guidance, and interviewed CMS officials. From these sources, we identified federal requirements related to non-EHB mandated benefits and CMS’s oversight related to these requirements.[10] We assessed CMS’s oversight approach relative to federal internal control standards for responding to program risks. We determined that the risk assessment component of internal control was significant to our objective, specifically the underlying principle that federal agencies should identify, analyze, and respond to risks related to achieving agency objectives.[11] Our review was limited to CMS’s efforts to ensure that APTCs exclude the costs of non-EHB mandated benefits. We did not examine other aspects of CMS’s APTC calculation.[12]

We conducted this performance audit from December 2023 to November 2024 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

States must identify non-EHB mandated benefits based on a standard established in regulation by CMS.[13] CMS’s standard specifies that a benefit required by state action taking place on or after January 1, 2012, other than for compliance with federal requirements, is a non-EHB mandated benefit.[14] To facilitate states’ identification of these benefits, CMS changed the standard in the 2025 Payment Notice.[15] Beginning on January 1, 2025, non-EHB mandated benefits are defined as those that are (1) required by state action taking place on or after January 1, 2012, other than for compliance with federal requirements and (2) not covered in the state’s EHB benchmark plan. (See table 1.)

|

Current standard |

Standard effective January 1, 2025 |

|

Defined by year. Benefits required by state action on or after January 1, 2012, other than for compliance with federal requirements, are considered non-EHB. |

Defined by year and relative to state EHB benchmark plan. Benefits required by state action on or after January 1, 2012, other than for compliance with federal requirements, that are not covered in a state’s EHB benchmark plan are considered non-EHB. |

Source: Centers for Medicare & Medicaid Services’ (CMS) regulation. | GAO‑25‑107220

Notes: The current standard was established in 2013 and is effective through 2024. CMS considers non-EHB mandated benefits to include those specific to care, treatment, and services, thus this standard does not apply to those related to provider types, benefit delivery methods, or reimbursement methods. Each state defines an EHB benchmark plan that specifies the items and services that all marketplace plans must cover as EHB.

To cover the costs of non-EHB mandated benefits, states may make payments either directly to the enrollee or to the marketplace plan on behalf of the enrollee. The amount of the state payment is based on the costs of non-EHB mandated benefits, which marketplace plans report to states.

Similarly, CMS is responsible for calculating, reviewing, and authorizing APTC payments to marketplace plans on behalf of eligible enrollees. As previously noted, the APTCs must not cover the costs of non-EHB mandated benefits, which states must pay. Rather, the amount of the APTC is based on an enrollee’s income and the cost of a standard benchmark plan—specifically the EHB share of the benchmark plan premium.[16] To support the provision of APTCs, insurers must submit plan premium data and the EHB share of the premium.[17] The APTC limits what the enrollee would pay for that plan to be no more than a certain percentage of their income.

To improve its oversight of states’ non-EHB mandated benefits, CMS imposed a requirement beginning in 2021 that states report non-EHB mandated benefits to the agency on an annual basis.[18] CMS noted that these reports would provide the agency with the information it needed to ensure that states identify non-EHB mandated benefits requiring state payments, and thus, improve the accuracy of APTC payments. However, CMS repealed the requirement in the 2023 Payment Notice before ever enforcing it, citing consistent feedback from states and stakeholders that the reporting policy was unnecessary and burdensome.[19]

At Least Six States Have Identified Non-EHB Mandated Benefits

Through stakeholder interviews, we found at least six states that had identified certain services to be non-EHB mandated benefits. Most commonly, these states’ non-EHB mandated benefits covered pediatric hearing aids (three states) and fertility care (two states). In addition, three of these states—Maine, Massachusetts, and Montana—identified more than one non-EHB mandated benefit. (See table 2.)

Table 2: Examples of Mandated Benefits Six States Identified as Non-Essential Health Benefits (EHB), January 2024

|

State |

Non-EHB mandated benefits |

|

Maine |

Fertility servicesa Testing for bone marrow donation suitability |

|

Massachusetts |

Cleft palate remediation Pediatric hearing aidsb Treatment of body composition changes caused by HIV associated lipodystrophy syndromec |

|

Minnesota |

Pediatric neuropsychiatric disorder treatmentd |

|

Montana |

Pediatric hearing aidsb Fertility servicesa |

|

Utah |

Diagnosis and treatment of autism spectrum disorder |

|

Virginia |

Pediatric hearing aidsb |

Source: Interviews with stakeholders and information from state officials. | GAO‑25‑107220

Notes: The Centers for Medicare & Medicaid Services does not collect or maintain information on states’ non-EHB mandates. Thus, we relied on stakeholder interviews to identify examples of states that have identified mandated benefits as non-EHB. These examples may not represent the universe of non-EHB mandates nationally.

aMaine and Montana both mandate coverage of certain fertility care, though the scope of coverage varies. Maine covers fertility diagnostic care, fertility treatment, and fertility preservation services. Montana covers standard fertility preservation services for insured persons diagnosed with cancer and where the standard of care involves treatment that may cause iatrogenic infertility.

bMassachusetts, Montana, and Virginia all mandate coverage of pediatric hearing aids, though the scope of coverage varies. Massachusetts specifically covers hearing aids and related services for children 21 years of age or younger and Montana and Virginia cover hearing aids and related services for children 18 years of age or younger.

cSpecifically, treatments to correct or repair disturbances of body composition caused by HIV associated lipodystrophy syndrome including, but not limited to, reconstructive surgery and other restorative procedures.

dPediatric autoimmune neuropsychiatric disorders associated with streptococcal infections and pediatric acute-onset neuropsychiatric syndrome are clinical diagnoses given to children who experience a sudden onset of neuropsychiatric symptoms related to an infection. These symptoms may include, but are not limited to, obsessions/compulsions, food restrictions, depressions, anxiety, and irritability.

Officials from these states told us they make payments for the costs of these non-EHB mandated benefits directly to the marketplace plans, with annual payments ranging from $32,000 in Minnesota to $4.6 million in Utah.[20] These payments made up a small portion of the total marketplace premiums in Minnesota and Utah, less than 0.01 percent and 0.5 percent respectively.[21]

CMS’s Oversight Approach Provides Limited Assurance That APTCs Exclude the Costs of Non-EHB Mandated Benefits

CMS relies primarily on technical assistance provided at states’ request to oversee states’ compliance with requirements related to non-EHB mandated benefits, according to agency officials. CMS officials said that states frequently reach out to them for assistance though they do not systematically track the technical assistance they provide. For example, the officials said that states have asked them for advice on how to apply the non-EHB mandated benefits standard to coverage requirements they are considering. CMS officials noted that, based on the agency’s input, states have often narrowed the scope of mandates to exclude marketplace plans, thus avoiding the federal requirements. CMS officials cited such examples as evidence that states are aware of the federal requirements when they consider mandating additional benefits.

CMS officials told us they believe their current approach of providing technical assistance to states is effective for ensuring state compliance with the requirements related to non-EHB mandated benefits, and thus the accuracy of APTCs. In addition, CMS officials told us that they expect the changes finalized in the 2025 Payment Notice to increase state compliance by making the identification of non-EHB mandated benefits more intuitive. CMS officials indicated the agency plans to provide additional guidance to states to clarify the new standard and facilitate their efforts to identify these benefits. While the officials did not provide a timeline for the release of this additional guidance, they said they were considering questions that arise when providing technical assistance to inform its content.[22] CMS officials also noted that states’ non-EHB mandated benefits are generally narrowly focused and benefit mandates typically have had a negligible effect on premiums.

However, CMS has not assessed whether its oversight approach is sufficient to ensure that states identify non-EHB mandated benefits and that APTC amounts exclude the costs of these benefits. CMS does not have comprehensive information on whether, or to what extent, states identify non-EHB mandated benefits according to the agency’s standard. Further, we identified one state that inappropriately placed the onus on CMS to determine whether a mandated benefit was non-EHB, rather than identify these benefits itself.[23] In addition, CMS does not know whether the premium data submitted by marketplace plans and used to calculate APTCs exclude the costs of non-EHB mandated benefits.[24]

As a result, CMS has limited assurance that APTCs accurately exclude the costs of non-EHB mandated benefits. This poses a risk to its oversight objective and is inconsistent with federal internal control standards. These standards state that agencies should identify, analyze, and respond to risks related to achieving agency objectives. Assessing whether its current oversight approach is sufficient to respond to identified risks and making changes as appropriate would be consistent with these standards. Such an assessment would also provide greater assurance that the APTCs accurately exclude the costs of non-EHB mandated benefits.

Conclusions

CMS is responsible for ensuring that APTCs are not used to subsidize the costs of any non-EHB benefits states may mandate. However, in recent Payment Notices, CMS has repeatedly noted state confusion regarding non-EHB mandated benefits and expressed concerns about whether it has the information needed to ensure that APTCs are excluding the costs of these benefits. CMS officials maintain that their reliance on technical assistance is an effective oversight approach. However, until CMS conducts a risk assessment to determine whether this approach is sufficient for identifying states’ compliance with requirements related to non-EHB mandated benefits, the agency will not know whether additional oversight is needed.

Recommendation for Executive Action

The Administrator of CMS should conduct a risk assessment to determine whether its oversight approach is sufficient to ensure that APTCs exclude the costs of non-EHB mandated benefits or whether additional oversight is needed. CMS should make changes as appropriate based on the results of this assessment. (Recommendation 1)

Agency Comments

We provided a draft of this report to the Department of Health and Human Services (HHS) for review and comment. The department provided written comments, which are reprinted in appendix I and summarized below. A senior technical advisor from CMS’s Office of Legislation provided oral comments, which are summarized below. HHS also provided technical comments, which we incorporated as appropriate.

In its written comments, HHS concurred with our recommendation, stating that CMS will review its current oversight approach and determine whether additional oversight is needed. HHS highlighted its ongoing efforts, such as rulemaking and technical assistance, taken to ensure the accuracy of non-EHB mandated benefit reporting and proper APTC payment. HHS also stated these oversight efforts seek to balance state compliance with preserving state resources and reaffirming states’ responsibility for identifying non-EHB mandated benefits. Additionally, in providing oral comments, a CMS official expressed concern that our draft report title did not reflect the report’s focus on non-EHB mandated benefits, which represent one aspect of the APTC calculation. We agreed that the title could be clearer and made minor changes to clarify it.

As agreed with your office, unless you publicly announce the contents of this report earlier, we plan no further distribution until 30 days from the report date. At that time, we will send copies to the Secretary of Health and Human Services, the Administrator of CMS, and other interested parties. In addition, the report will be available at no charge on GAO’s website at http://www.gao.gov.

If you or your staff have any questions about this report, please contact me at (202) 512-7114 or at DickenJ@gao.gov. Contact points for our Office of Congressional Relations and Office of Public Affairs can be found on the last page of this report. Other major contributors to this report are listed in appendix II.

Sincerely,

John E. Dicken

Director, Health Care

GAO Contact

John E. Dicken, (202) 512-7114 or DickenJ@gao.gov

Acknowledgments

In addition to the contact named above, Susan Anthony (Assistant Director), Kelly Krinn (Analyst-in-Charge), Laura Elsberg, Kaitlin Farquharson, and Emily Wilson Schwark made key contributions to this report.

GAO’s Mission

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on Facebook, Flickr, X, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

Congressional Relations

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S. Government Accountability Office, 441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

Sarah Kaczmarek, Managing Director, KaczmarekS@gao.gov, (202) 512-4800, U.S.

Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Strategic Planning and External Liaison

Stephen J. Sanford, Managing

Director, spel@gao.gov, (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814, Washington,

DC 20548

[1]See generally, Pub. L. No. 111-148, tit. I, subtit. D, 124 Stat. 119, 162-213 (2010).

[2]For the purposes of this report, we use the term “marketplace plans” to mean qualified health plans. The 10 EHB categories are: (1) ambulatory patient services; (2) emergency services; (3) hospitalization; (4) maternity and newborn care; (5) mental health and substance use disorder services including behavioral health treatment; (6) prescription drugs; (7) rehabilitative and habilitative services and devices; (8) laboratory services; (9) preventive and wellness services and chronic disease management; and (10) pediatric services, including oral and vision care. 42 U.S.C. § 18022(a)(1)(B). See also 45 C.F.R. § 147.150(a) (2023).

[3]Because the EHB benchmark plan is different in each state, the specific items and services defined as EHB may vary across states.

[4]The APTC is aimed at lowering the monthly insurance premium for eligible individuals who purchase marketplace plans. The APTC amount varies by individual and is calculated based on multiple factors, including estimated income. Individuals who choose to have the premium tax credit paid to marketplace plans on their behalf must reconcile the amount of the APTC with the premium tax credit for which they are eligible on their income tax returns.

[5]We calculated total APTC payments using monthly average enrollment and APTC payments for 2022, the most recent year of data available at the time of our study. See Centers for Medicare & Medicaid Services, Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average (Baltimore, Md: Aug.11, 2023).

[6]Under 26 U.S.C. § 36B(b)(3)(D), the costs of non-EHB mandated benefits must not be taken into account in determining premium assistance amounts. See also 26 C.F.R. § 1.36B-3(j). For purposes of this report, we refer to the premium attributable to non-EHB mandated benefits as the costs of non-EHB mandated benefits.

[7]85 Fed. Reg. 29,164, 29,218-26 (May 14, 2020).

[8]86 Fed. Reg. 24,140, 24,229-32 (May 5, 2021) and 87 Fed. Reg. 27,208, 27,291-95 (May 6, 2022).

[9]We spoke with representatives of National Association of Insurance Commissioners, National Health Law Program, and AHIP (formerly known as America’s Health Insurance Plans).

[10]Federal regulations explicitly exclude certain benefits from EHB. For plan years beginning on or before January 1, 2026, these benefits include routine non-pediatric dental services, routine non-pediatric eye exam services, long-term/custodial nursing home care benefits, and non-medically necessary orthodontia. 45 C.F.R. § 156.115(d) (2023). Federal expenditures cannot be used to fund these excluded services. An EHB benchmark plan may cover abortion services, but federal law provides that no plan is required to cover abortion services as part of the requirement to cover EHB. 42 U.S.C. § 18023(b)(1)(A); 45 C.F.R. § 156.115(c) (2023). Federal funds may not be used for abortion services, except where the pregnancy is the result of rape or incest, or the life of the pregnant woman is endangered. For non-excepted abortion services, plans must collect from each enrollee an amount equal to the actuarial value of the coverage but not less than $1 per month—segregated from any other premium amounts collected by the plan—to be used to pay for the costs associated with providing abortion services. 42 U.S.C. § 18023(b)(2)(B)-(D); 45 C.F.R. § 156.280(d) (2023). See GAO, Health Insurance Exchanges: Coverage of Non-excepted Abortion Services by Qualified Health Plans, GAO‑14‑742R (Washington, D.C.: Sept. 15, 2014).

[11]GAO, Standards for Internal Control in the Federal Government, GAO‑14‑704G (Washington, D.C.: Sept. 10, 2014). Internal control is a process effected by an entity’s oversight body, management, and other personnel that provides reasonable assurance that the objectives of an entity will be achieved.

[12]GAO has examined APTCs more broadly in other reports. See GAO, Payment Integrity: Additional Coordination Is Needed for Assessing Risks in the Improper Payment Estimation Process for Advance Premium Tax Credits, GAO‑23‑105577 (Washington, D.C.: Mar. 9, 2023) and Improper Payments: Improvements Needed in CMS and IRS Controls over Health Insurance Premium Tax Credit, GAO‑17‑467 (Washington, D.C.: July 13, 2017).

[13]45 C.F.R. § 155.170(a)(3) (2023). Prior to 2016, marketplaces were responsible for identifying non-EHB mandated benefits.

[14]This standard was established in 2013 and is effective through 2024. State action may include legislation, regulation, guidance, or other action mandating benefits. CMS considers non-EHB mandated benefits to include those specific to care, treatment, and services, thus this standard does not apply to those related to provider types, cost sharing, or reimbursement methods.

[15]89 Fed. Reg. 26,218, 26,264-68, 26,419 (Apr. 15, 2024).

[16]26 C.F.R. § 1.36B-3. While APTCs are calculated based on the premium cost of a benchmark plan, consumers do not need to be enrolled in that plan to qualify for APTCs.

[17]45 C.F.R. § 156.470(a) (2023).

[18]85 Fed. Reg. 29164, 29,218-26 (May 14, 2020).

[19]87 Fed. Reg. 27208, 27,291-93 (May 6, 2022). In the 2023 Payment Notice, CMS noted that expanded technical assistance and clarifying guidance could improve states’ identification of non-EHB mandated benefits.

[20]Minnesota and Utah reported their total payment amounts for non-EHB mandated benefits for 2022 and 2021, respectively.

[21]Based on available monthly average enrollment and premium data, the annual premium totaled over $632 million in Minnesota in 2022 and nearly $1 billion in Utah in 2021.

[22]CMS officials told us that they also provided informational presentations to state regulators and other stakeholders to educate them about the revisions included in the 2025 Payment Notice.

[23]In enacting two benefit mandates since 2012, this state’s fiscal analysis anticipated that those benefits would meet CMS’s standard defining non-EHB mandated benefits. However, state officials told us the state was not assuming the costs of these benefits because it was CMS’s responsibility to identify non-EHB mandated benefits. CMS officials told us that they are aware some states include language in mandates that places the onus on CMS to determine if a mandated benefit is non-EHB. CMS also noted this concern in the 2025 Payment Notice. CMS officials said they have explained to several states through technical assistance that it is the state’s responsibility to make such determinations. However, because CMS does not collect final state determinations on mandates, agency officials said they are not always aware of how states implemented their feedback.

[24]CMS provides written instructions to insurers on how to allocate premiums for purposes of calculating the APTC, including directions on excluding the costs of non-EHB mandated benefits. CMS officials could not identify any oversight approach beyond technical assistance that it uses to ensure that APTCs exclude the premium costs of non-EHB mandated benefits. CMS officials told us they conduct broad oversight of APTCs and take steps to assess the premium data submitted by marketplace plans. For instance, according to officials, CMS ensures that premium data reported by marketplace plans is consistent across submissions and that plans appropriately identify benefits that are excluded from EHB by federal law.