NATIONAL NUCLEAR SECURITY ADMINISTRATION

Additional Steps Needed to Improve Cost Estimates for Fixed Price Subcontracts

Report to Congressional Committees

September 2025

United States Government Accountability Office

A report to congressional committees

For more information, contact: Allison Bawden at BawdenA@gao.gov.

What GAO Found

Based on GAO’s analysis, none of the policies established by the management and operating (M&O) contractors operating National Nuclear Security Administration (NNSA) sites met or substantially met all 12 steps for developing a reliable cost estimate for fixed-price construction subcontracts. GAO's cost estimating guide established these 12 steps, which reflect commercial best practices to help agencies develop comprehensive, well documented, accurate, and credible cost estimates. Specifically, of the seven M&O contractors who operated NNSA sites during the period of our review, the policies of four M&O contractors met or substantially met most of the steps, but the policies of the remaining three contractors only met or substantially met a few steps.

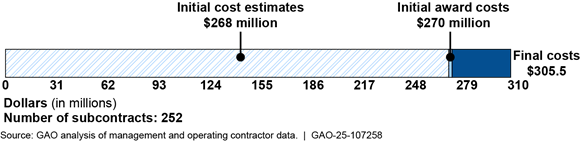

M&O contractors generally underestimated the costs associated with fixed-price construction subcontracts. Specifically, based on GAO’s analysis of 252 fixed-price construction subcontracts completed during fiscal year (FY) 2023, their combined final (or actual) costs exceeded the contractors’ initial cost estimates by more than $37 million, or 14 percent (see fig.). Most of these cost increases occurred after the M&O contractors had already awarded these subcontracts. Fixed-price subcontracts provide for a price that is firm or adjustable (based on specific contract terms), and other adjustments are at the expense of the subcontractor. According to contractor representatives, cost increases can occur for multiple reasons after the award of a fixed-price subcontract, including for expansions of the project’s scope or unanticipated expenses. In such cases, increased costs may be borne by both NNSA and subcontractor.

NNSA oversees the cost estimating policies of its M&O contractors for fixed-price construction subcontracts to a limited extent. For example, according to Department of Energy (DOE) acquisition regulations, contractor purchasing systems—which include policies for conducting cost estimates of fixed-price subcontracts—should identify and apply commercial best practices. In addition, according to DOE guidance, NNSA is to review contractor purchasing systems at least every 6 years. NNSA has approved all its M&O contractors’ purchasing systems but has not ensured that its M&O contractors’ policies are substantially meeting all 12 steps for developing a reliable cost estimate. By ensuring M&O contractors’ cost estimation policies incorporate commercial best practices consistent with GAO’s cost estimating guide, NNSA would have greater assurance that contractors’ cost estimates are more reliable for realistic program planning, budgeting, and management.

Why GAO Did This Study

NNSA spends millions of dollars on hundreds of construction projects each year to maintain and modernize the research and production infrastructure at its eight nuclear security enterprise sites. NNSA relies on M&O contractors at its sites to manage the day-to-day activities associated with these construction projects. For less costly projects, M&O contractors may use fixed-price subcontracts to procure the services of subcontractors.

The report accompanying the Senate bill for the National Defense Authorization Act for FY 2024 includes a provision for GAO to review NNSA’s use of fixed-price construction subcontracts. This report examines (1) the extent to which M&O contractor policies for estimating the costs of fixed-price subcontracts followed best practices, (2) the performance of M&O contractors in estimating costs, and (3) the extent to which NNSA oversees the cost estimating policies of its M&O contractors.

To do this work, GAO reviewed relevant regulations and DOE and NNSA directives and guidance on estimating costs for fixed-price construction subcontracts. GAO also analyzed contractor documentation and cost estimation data, and interviewed NNSA officials and M&O contractor representatives.

What GAO Recommends

GAO recommends NNSA ensure that M&O contractor policies incorporate commercial best practices related to cost estimating, which are reflected in GAO’s cost estimating guide. NNSA was provided a draft of this report for review and comment and did not provide comments on the report.

Abbreviations

|

Cost Guide |

Cost Estimating and Assessment Guide |

|

DOE |

Department of Energy |

|

M&O |

Management and operating |

|

NNSA |

National Nuclear Security Administration |

|

PanTeXas |

PanTeXas Deterrence, LLC |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

September 9, 2025

Congressional Committees

Over the next 2 decades, the United States plans to spend tens of billions of dollars to modernize its nuclear weapons stockpile, as well as the research and production infrastructure on which stockpile programs depend. The National Nuclear Security Administration (NNSA)—a separately organized agency within the Department of Energy (DOE)—is responsible for these efforts. To carry out its mission, NNSA pays for over 100 construction projects each year at its eight nuclear security enterprise sites. Many of these construction projects fall below the minor construction threshold, meaning NNSA may spend money on them without seeking congressional approval for individual projects.[1] While the individual project costs may be relatively low, collectively NNSA spends hundreds of millions of dollars a year on these projects.

NNSA relies on management and operating (M&O) contractors to manage most day-to-day activities at its eight sites, including procurement and management of construction projects.[2] NNSA’s M&O contractors use fixed-price subcontracts, along with other types of subcontracts, to procure the services of subcontractors to carry out construction activities on smaller, less costly projects. While the federal government remains responsible for determining that the overall prices of M&O contracts (including subcontracts) are fair and reasonable, M&O contractors are responsible for estimating the costs associated with the scope of work for these types of subcontracts.

The report accompanying the Senate bill for the National Defense Authorization Act for Fiscal Year (FY) 2024 includes a provision for us to review NNSA’s use of fixed-price construction subcontracts.[3] In our review we assessed (1) the extent to which M&O contractors established policies that follow best practices in estimating costs for fixed-price construction subcontracts, (2) the performance of M&O contractors in estimating costs for fixed-price construction subcontracts, and (3) the extent to which NNSA oversees the cost estimating policies of its M&O contractors for fixed-price construction subcontracts.

To address our objectives, we performed the steps described below.

· We reviewed and analyzed policies and related documentation from the seven M&O contractors at NNSA’s eight nuclear sites on estimating costs for fixed-price construction subcontracts.[4] We also interviewed contractor representatives about these policies. We then compared contractor policies against the cost estimating process steps identified in the Cost Estimating and Assessment Guide (Cost Guide).[5]

· We obtained data on 252 fixed-price construction subcontracts completed during fiscal year 2023, the most recent year for which full fiscal year data were available at the start of our review. We excluded data on select projects from our analysis—such as projects under $100,000 that did not have an independent cost estimate. We then compared final cost data to estimated cost data for these subcontracts and interviewed contractor representatives about these data.[6] To assess the reliability of the data, we provided questions and received written responses from each of the seven M&O contractors on the reliability of data and reviewed the data for accuracy and completeness. We determined that the initial cost estimates, initial award amounts, and the final costs data associated with fixed-price construction subcontracts completed in fiscal year 2023 were sufficiently reliable for the purposes of our report.

·

We reviewed relevant federal regulations and analyzed DOE and

NNSA directives and guidance related to cost estimates and subcontracting. We

then compared NNSA’s oversight activities to these regulations, directives, and

guidance. We also interviewed contractor representatives and NNSA officials to

understand NNSA’s oversight role.

For additional information on our objectives, scope, and methodology, see appendix I.

We conducted this performance audit from January 2024 to September 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

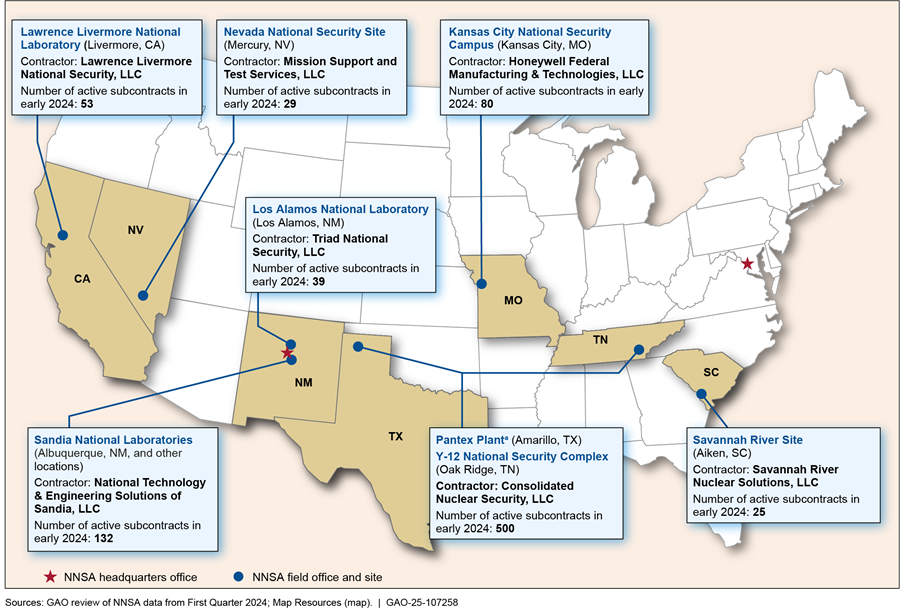

Background

NNSA’s M&O contractors rely on a set of formal policies, practices, and procedures—called a contractor purchasing system—to guide their estimation processes, among other things. Federal contracting officers review and approve, but do not prescribe all aspects of, these purchasing systems. During the period when we collected data, NNSA contracted with seven M&O contractors to operate the eight sites of the nuclear security enterprise, as seen in figure 1.[7]

Figure 1: Map of the Nuclear Security Enterprise and Number of Fixed-Price Construction Subcontracts, First Quarter 2024

Note: “Active subcontracts” refers to fixed-price construction subcontracts that were ongoing during the first fiscal quarter of 2024.

aIn the second quarter of 2024, NNSA awarded the contract for the Pantex Plant to PanTeXas Deterrence, LLC. The contract transition was completed in November 2024.

According to contractor representatives, M&O contractors generally use fixed-price subcontracts to pay for smaller construction projects. Fixed-price subcontracts provide for a firm price, or in appropriate cases, a price that is adjustable only by operation of clauses in the contract. For example, a fixed-price subcontract may include an economic price adjustment to cover increases in labor or material costs. In addition, a fixed-price subcontract may include a level-of-effort term, which may require the subcontractor to provide a specified level of effort over a stated period—such as a specified number of days or hours worked—but can be adjusted if the project takes more time. Contracts can also include options that can be exercised at the government’s discretion. Contract options can allow the government to extend the contract’s duration or increase the quantities of goods or services. Beyond the adjustments specified in the contract, any cost increases are at the expense of the contractor. In addition, fixed-price subcontracts are not subject to the same audit requirements as cost-reimbursement contracts, as we have previously reported.[8]

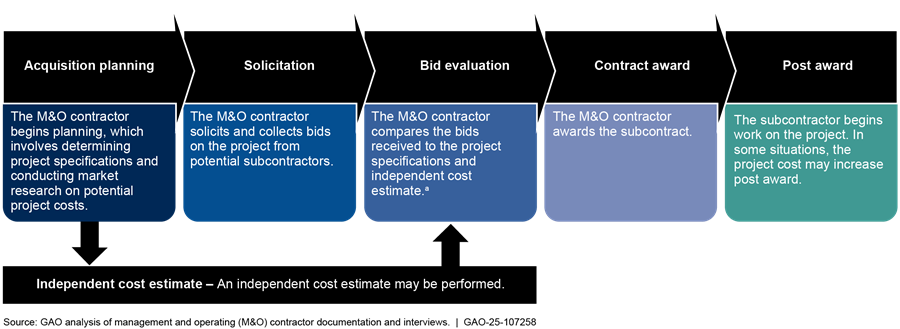

According to NNSA officials and contractor representatives, each of NNSA’s M&O contractors have processes for procuring construction subcontracts that consider factors unique to their locations and the nature of the project. Contractor representatives told us that the construction needs can vary significantly depending on the project and whether the site is focused on production or research and development. However, M&O contractors typically follow the same general procurement process for obtaining competitive bids for fixed-price construction subcontracts, as shown in figure 2.

Figure 2: Management and Operating (M&O) Contractor Procurement Process for Obtaining Competitive Bids for Fixed-Price Construction Subcontracts

aAccording to M&O contractor representatives, if there is a large difference between the independent cost estimate and bid amounts, the procurement team will work with bidders to determine the cause of the difference. In some cases, the procurement team may pick the lowest-cost bid that meets its needs. In other cases, the procurement team may request a new independent cost estimate and restart the solicitation process.

According to contractor representatives, as part of this procurement process, a team independent of the procurement team—or a separate third-party contractor—uses information about the project to calculate an independent cost estimate for the project.[9] An independent cost estimate—sometimes referred to as an independent government cost estimate— helps the M&O contractor or government to determine budgets for notional contracting actions. It also serves as a comparison point to check the reasonableness and realism of a subcontractor’s cost proposal. Some contractors may require an independent cost estimate for every project, while other contractors may only require an independent cost estimate for projects they anticipate costing more than a certain threshold (e.g., over $100,000), according to contractor representatives.

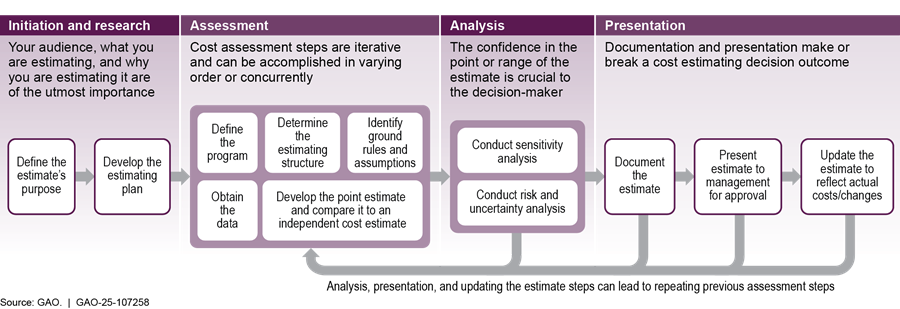

As we have previously reported, federal agencies require reliable cost information to conduct oversight of their programs and ensure the proper stewardship of public funds. To assist federal agencies, we developed the Cost Guide to establish a consistent methodology—based on commercial and government best practices—for developing, managing, and evaluating cost estimates.[10] The Cost Guide includes a 12-step cost estimating process, which we refer to as the 12 steps for developing a reliable cost estimate.[11] DOE recognizes this process and has incorporated it into its order on managing capital asset acquisitions, which generally applies to projects estimated to cost $50 million or more.[12] The 12 steps themselves are generally applicable to projects of all sizes and types, including fixed-price construction subcontracts.

As shown in figure 3, the 12 steps for developing a reliable cost estimate provide the foundational guidance for initiating, researching, assessing, analyzing, and presenting a cost estimate.[13]

Management and Operating Contractors’ Cost Estimation Policies Did Not Consistently Meet Best Practices

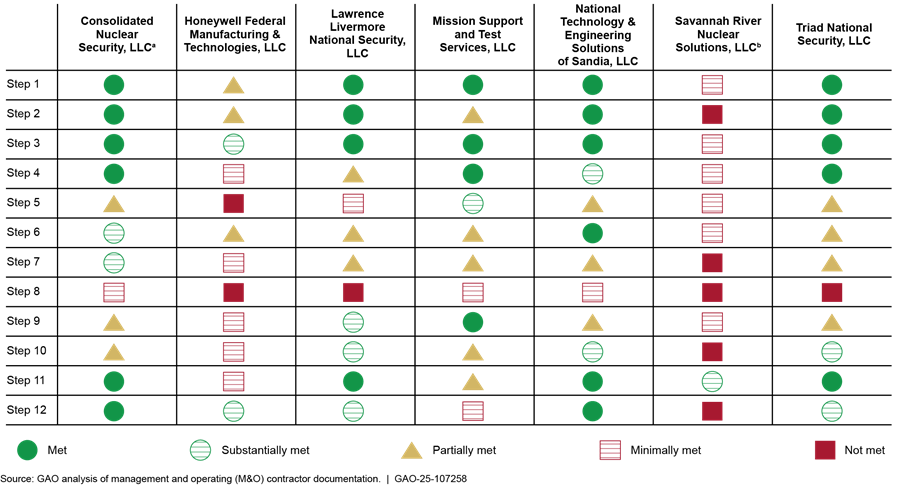

In our review of M&O contractors’ policies for fixed-price construction subcontracts, we found that none of the seven M&O contractors had established formal policies that met or substantially met all of the Cost Guide’s 12 steps for developing a reliable cost estimate—one that reflects commercial and government best practices for cost estimating.

We compared the cost estimating policies used by each of the M&O contractors—as detailed in their purchasing systems—to the Cost Guide’s 12 steps for developing reliable cost estimates. While contractors may use other informal documents, guidelines, or practices that adhere to the 12 steps, our review focused on contractors’ formal written policies. We found that the policies of four M&O contractors met or substantially met most of the steps, while the policies of the remaining three M&O contractors met or substantially met a few or one of the steps, as shown in table 1.

Table 1: Summary of GAO Assessment of M&O Contractors’ Policies Compared to the 12 Steps for Developing Reliable Cost Estimates

|

M&O contractor |

Number of steps met or substantially met |

Number of steps partially, minimally, or not met |

|

Consolidated Nuclear Security, LLCa |

8 |

4 |

|

Honeywell Federal Manufacturing & Technologies, LLC |

2 |

10 |

|

Lawrence Livermore National Security, LLC |

7 |

5 |

|

Mission Support and Test Services, LLC |

5 |

7 |

|

National Technology & Engineering Solutions of Sandia, LLC |

8 |

4 |

|

Savannah River Nuclear Solutions, LLCb |

1 |

11 |

|

Triad National Security, LLC |

7 |

5 |

Source: GAO analysis of management and operating (M&O) contractor documentation. | GAO‑25‑107258

Not Met/ Minimally Met/Partially Met - Contractor provided no evidence that satisfies any of the criteria, or contractor provided evidence that satisfies only a small portion of the criterion, or contractor provided evidence that satisfies about half of the criteria, respectively.

Met/Substantially Met – Contractor provided complete evidence that satisfies the entire criteria or contractor provided evidence that satisfies a large portion of the criteria, respectively.

aWhen we started our review in January 2024, Consolidated Nuclear Security, LLC, was the M&O contractor for both the Pantex Plant and Y-12 National Security Complex. In June 2024, NNSA awarded the M&O contract for the Pantex Plant to PanTeXas Deterrence, LLC (PanTeXas). We did not include PanTeXas in our review.

bSavannah River Nuclear Solutions, LLC, provided us with a manual containing additional guidance on developing cost estimates. However, because this manual is not designed or intended to mandate procedure for cost estimating, we did not include it as part of our assessment.

Although we found that none of the M&O contractors met or substantially met all 12 of the steps for developing a reliable cost estimate, M&O contractors’ policies generally aligned with certain steps, as shown in table 2. For more detailed information, see appendix II.

Table 2: GAO Assessment of M&O Contractors’ Policies Compared to 12 Steps for Developing a Reliable Cost Estimate

|

|

Consolidated Nuclear Security, LLCa |

Honeywell Federal Manufacturing & Technologies, LLC |

Lawrence Livermore National Security, LLC |

Mission Support and Test Services, LLC |

National Technology & Engineering Solutions of Sandia, LLC |

Savannah River Nuclear Solutions, LLCb |

Triad National Security, LLC |

|

1. Define the estimate’s purpose |

● |

◑ |

● |

● |

● |

○ |

● |

|

2. Develop the estimating plan |

● |

◑ |

● |

◑ |

● |

○ |

● |

|

3. Define the project |

● |

● |

● |

● |

● |

○ |

● |

|

4. Determine the estimating structure |

● |

○ |

◑ |

● |

● |

○ |

● |

|

5. Identify ground rules and assumptions |

◑ |

○ |

○ |

● |

◑ |

○ |

◑ |

|

6. Obtain the data |

● |

◑ |

◑ |

◑ |

● |

○ |

◑ |

|

7. Develop the point estimate |

● |

○ |

◑ |

◑ |

◑ |

○ |

◑ |

|

8. 8) Conduct sensitivity analysis |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

|

9. Conduct risk and uncertainty analysis |

◑ |

○ |

● |

● |

◑ |

○ |

◑ |

|

10. Document the estimate |

◑ |

○ |

● |

◑ |

● |

○ |

● |

|

11. Present the estimate to management for approval |

● |

○ |

● |

◑ |

● |

● |

● |

|

12. Update the estimate to reflect actual costs and changes |

● |

● |

● |

○ |

● |

○ |

● |

Legend: ○ Not Met/ Minimally Met - Contractor provided no evidence that satisfies any of the criteria, or contractor provided evidence that satisfies only a small portion of the criterion,

◑ Partially Met – Contractor provided evidence that satisfies about half of the criteria,

● Met/ Substantially Met – Contractor provided complete evidence that satisfies the entire criteria or contractor provided evidence that satisfies a large portion of the criteria.

Source: GAO analysis of management and operating (M&O) contractor documentation. | GAO‑25‑107258

aWhen we started our review in January 2024, Consolidated Nuclear Security, LLC, was the M&O contractor for both the Pantex Plant and Y-12 National Security Complex. In June 2024, National Nuclear Security Administration awarded the M&O contract for the Pantex Plant to PanTeXas Deterrence, LLC (PanTeXas). We did not include PanTeXas in our review.

bSavannah River Nuclear Solutions, LLC, provided us with a manual containing additional guidance on developing cost estimates. However, because this manual is not designed or intended to mandate procedure for cost estimating, we did not include it as part of our assessment.

For example, most M&O contractors’ policies met or substantially met step 3—define the project. According to the Cost Guide, defining the project helps describe the basic characteristics of a project.

· Cost Guide Step 3—define the project. To develop a reliable estimate, an agency must have an adequate understanding of the acquisition project—which includes the acquisition strategy, technical definition, characteristics, system design features, and technologies to be used in its design. The objective is to provide a common description of the project—including a detailed technical, program, and schedule description of the project—from which all life cycle cost estimates will be derived. The amount of information contained in the technical baseline directly affects the overall quality and flexibility of the estimate. More information generally results in fewer assumptions having to be made, thus decreasing the uncertainty associated with the estimate. With this information, the cost estimator will be able to identify the technical and project parameters that underpin the cost estimate, and the quality of the cost estimate will be elevated.

However, M&O contractors’ policies generally did not meet, minimally met, or partially met two steps in conducting reliable cost estimates—identifying ground rules and assumptions and conducting sensitivity analysis. According to the Cost Guide, these steps are important for determining the general parameters of building a cost estimate and identifying variables that are sensitive to change.

· Cost Guide Step 5—Identify ground rules and assumptions. Cost estimates are typically based on limited information and therefore are dependent on several suppositions that make it possible to complete the estimate. These suppositions are called ground rules and assumptions and typically define the estimate’s scope and establish baseline conditions on which the estimate is based. Ground rules represent a common set of agreed upon estimating standards that provide guidance and minimize conflicts in definitions, while assumptions represent a set of judgments about past, present, or future conditions postulated as true in the absence of positive proof.

· Cost Guide Step 8—Conduct sensitivity analysis. This type of analysis is typically called a what-if analysis and is often used for optimizing cost estimate parameters and assumptions. As a best practice, a sensitivity analysis should be included in all cost estimates because it examines the effects of changing cost estimate inputs, or parameters, and underlying assumptions. This can provide useful information because it highlights elements that are cost sensitive and can provide a clear picture of both the high and low costs that can be expected, with discrete reasons for what drives them. For example, it can help determine how sensitive a project is to changes in construction prices—such as labor or concrete—and at what labor or concrete price a project alternative is no longer attractive.

Not meeting these two steps can lead to poor cost estimates. For example, if an agency or contractor does not know the cost estimating ground rules and assumptions, it will not fully understand the conditions on which the estimate was structured. The rejection of even a single assumption could invalidate many aspects of the cost estimate. In addition, overly optimistic assumptions may influence the cost estimate, leading to inaccurate estimates and budgets. Likewise, without a sensitivity analysis that reveals how the cost estimate is affected by a change in a single factor, an agency or contractor will not fully understand which variable most affects the cost estimate. An agency or contractor that fails to conduct sensitivity analysis to identify the effect of uncertainties associated with different assumptions increases the chance that decisions will be made without a clear understanding of these impacts on costs.[14]

Contractors Generally Underestimated Costs of Fixed-Price Construction Subcontracts Completed in Fiscal Year 2023

In comparing contractor initial cost estimates with the final (or actual) costs of subcontracts, we found that NNSA’s M&O contractors generally underestimated the costs associated with fixed-price construction subcontracts. Specifically, based on our analysis of 252 fixed-price construction subcontracts completed during fiscal year 2023, we found that the combined final costs associated with these subcontracts exceeded the contractors’ initial cost estimates by more than $37 million—an increase of about 14 percent.[15] Most of the overall cost increase was associated with fixed-price subcontracts costing $1 million or more, and most cost increases occurred after the M&O contractors had awarded these subcontracts. According to contractor representatives, cost increases on fixed-price subcontracts can occur for multiple reasons prior to or after the award of the contract, such as changes in project scope or unanticipated expenses.[16]

Most of the Overall Cost Increase Came from Subcontracts over $1 Million and Occurred after Contract Award

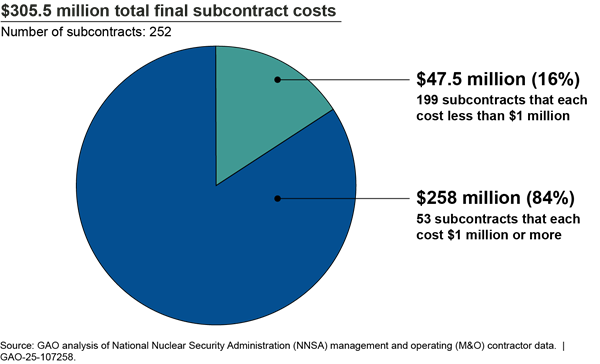

Most of the costs of the 252 subcontracts we reviewed were associated with 53 subcontracts that each cost $1 million or more. See figure 4.

Figure 4: Final Cost of Fixed-Price Construction Subcontracts Issued by NNSA M&O Contractors and Completed During Fiscal Year 2023

Note: We compared contractors’ initial cost estimates to final costs for fixed-price subcontracts completed in fiscal year 2023. We excluded some fixed-price construction subcontracts from our data that were below contractor-established cost thresholds for conducting an independent cost estimate.

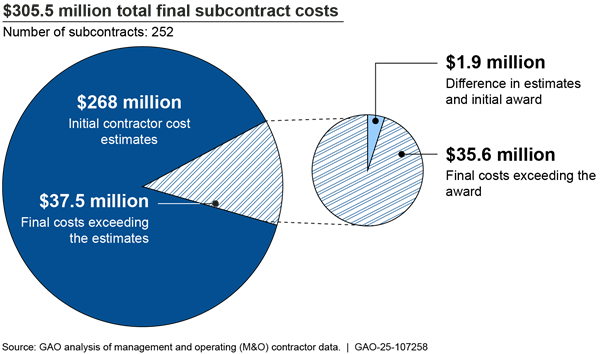

These 252 fixed-price construction subcontracts exceeded contractors’ initial cost estimates by $37.5 million in total, as shown in figure 5. Specifically, 161 (or 64 percent) of these subcontracts had final costs that exceeded their initial cost estimates. Moreover, 108 (or 43 percent) of these subcontracts had final costs that were 20 percent or more above their initial cost estimates, including 19 subcontracts that had final costs of more than double their initial cost estimates. Most of these increased costs—$35.6 million out of $37.5 million—were incurred after the M&O contractors had awarded these fixed-price subcontracts.

Figure 5: Cost Breakdown of Fixed-Price Construction Subcontracts Issued by NNSA M&O Contractors, Completed During Fiscal Year 2023

Multiple Factors Can Lead to Increased Costs

According to contractor representatives, multiple factors can lead to increased costs for fixed-price construction subcontracts after an award is made, such as changes in project scope or unanticipated expenses.

Change of Scope

M&O contractor representatives told us that they may need to change the scope of work for a project by increasing the quantities of certain commodities or labor needed to complete a project after the subcontract has been awarded. For example, representatives at one site told us about how they changed the scope of an existing project to avoid costs associated with an additional procurement. Specifically, to avoid potential schedule delays and costs associated with a new procurement effort related to utility and electrical work, representatives asked an existing project’s subcontractor, who was already working at the site, to provide pricing for installing additional utilities. The M&O contractor reviewed the price estimate, which would add more than $1 million in scope to the existing contract, and found that the proposed hours, equipment, and materials were justified by the additional scope and that the pricing was fair and reasonable. Overall, these and other expenses contributed to a roughly 70 percent increase after award, from $3.2 million to $5.5 million.

Unanticipated Expenses

M&O contractor representatives told us that unanticipated expenses can arise during construction. For example, representatives from one site told us about a project intended to install a secondary electrical feed in an older building. The project was unable to turn off power at the site to gather additional information during the design phase because a nuclear facility at the same site required a continuous power supply. As a result, the project had to rely on legacy building drawings and schematics for planning. However, representatives told us that when construction began, the subcontractors discovered that a transformer they had purchased for the project would not work based on the actual conditions in the building. The project then had to order a different transformer and update its electrical panels, which resulted in unexpected expenses. In addition, representatives said that the project faced other unforeseen field conditions, such as having to reroute a water line. Overall, these and other expenses contributed to a roughly 27 percent cost increase after award—from just under $5.5 million to above $7 million.[17] According to contractor representatives, these additional costs were paid for by both NNSA and the subcontractor.

NNSA Conducts Limited Oversight of Contractor Cost Estimating Policies and Has Not Ensured That These Policies Meet Best Practices

NNSA oversees the cost estimating policies of its M&O contractors for fixed-price construction subcontracts to a limited extent. For example, NNSA is to review contractor purchasing systems on a recurring basis and conducts related risk assessments. However, it has not ensured that its M&O contractors’ policies are applying commercial best practices related to developing reliable cost estimates—such as the 12 steps for developing a reliable cost estimate in the GAO Cost Guide.

DOE acquisition regulations require contractor purchasing systems to identify and apply commercial best practices and procedures.[18] According to DOE’s acquisition guide—which aids the department in implementing acquisition regulations—NNSA is to review contractor purchasing systems at least every 6 years.[19] Among other things, these reviews are to determine whether contractors are performing adequate cost or price analysis, including establishing and using effective pricing policies and techniques. Accordingly, these reviews should assess whether contractor purchasing systems apply the best commercial purchasing practices and procedures to help ensure the acquisition of quality products and services at fair and reasonable prices.

According to DOE’s acquisition guide, contracting officers also are to conduct risk assessments of contractor purchasing systems. According to NNSA officials, contracting officers at NNSA field offices conduct these risk assessments every 1 to 2 years, which provides another opportunity to assess contractor policies related to conducting cost estimates.

In addition to the purchasing system reviews and risk assessments, NNSA may review or approve specific subcontracts for fixed-price construction projects. According to NNSA guidance, the agency generally does so only for more costly projects.[20] According to NNSA officials, these reviews and approvals generally do not include assessing the steps taken by the contractor to create the estimate.

According to NNSA officials, the agency currently has approved all of its M&O contractors’ purchasing systems. However, NNSA has not ensured that its M&O contractors are substantially meeting all 12 steps to develop a reliable cost estimate. As described earlier, we found that none of the seven M&O contactors had established policies that met or substantially met all 12 steps.

One reason why none of the M&O contractors met or substantially met all 12 steps for developing a reliable cost estimate is that NNSA has not required its contractors to do so. NNSA officials told us that that they have not done so because each contractor is best positioned to develop its own policies on cost estimates based on the needs of the site and project. However, NNSA is responsible for overseeing and approving each contractor’s purchasing system, which (according to DOE acquisition regulations) includes ensuring that contractors apply the best commercial purchasing practices and procedures, such as those identified in GAO’s Cost Guide.[21]

As we have previously reported, a lack of formal cost estimating guidance at agencies has led, in certain circumstances, to cost estimates of poor quality. GAO’s Cost Guide provides a standard cost estimating process for agency officials and contractors. The 12-step cost estimating process and the associated best practices in the Cost Guide can be used by agencies and other organizations to ensure that their cost estimating guidance, policies, and directives fully reflect commercial and government standards for high-quality cost estimating.

As we reported earlier, none of the contractors’ policies for estimating project costs fully reflect each of the 12 steps to developing a reliable cost estimate, particularly with respect to identifying assumptions and assessing estimates’ sensitivity to them. In addition, the combined final costs associated with fixed-price construction subcontracts for fiscal year 2023 were substantially larger than the initial cost estimates, due in part to unanticipated expenses or change in scope. However, because the government ultimately bears the costs of these subcontracts, it has an interest in ensuring that the work associated with them is completed efficiently. In addition, although a single project may be relatively inexpensive compared to larger projects, the total cost of fixed-price construction contracts completed in fiscal year 2023 was more than $300 million. In addition, NNSA requires significant budgetary resources to address aging infrastructure, as we have previously reported.[22] Therefore, cost increases on these smaller projects may still affect the number of projects that can be accomplished across the nuclear security enterprise in any given year.

By ensuring M&O contractors align their cost estimating policies with the Cost Guide’s 12 steps for developing reliable cost estimates, NNSA would have greater assurance that the contractors’ cost estimates are more reliable for realistic program planning, budgeting, and management. Following a process of repeatable methods, as outlined in the Cost Guide, should enable agencies to produce reliable estimates that can be clearly traced, replicated, and updated to better manage their programs and inform decision-makers of the risks involved.

Conclusions

Every year, M&O contractors allocate hundreds of millions of dollars across dozens of fixed-price subcontracts for small construction projects at NNSA sites, but inaccurate or uninformed estimates can lead to cost growth for a variety of reasons. In fiscal year 2023, the fixed-price subcontracts completed by M&O contractors saw a combined cost growth of over $37.5 million, or approximately 14 percent above the contractors’ initial estimates, usually after the subcontracts were awarded. GAO’s Cost Guide provides cost estimating best practices, including a 12-step process to develop a reliable cost estimate. However, none of NNSA’s seven M&O contractors had site-specific cost estimating policies that met or substantially met all 12 steps from the Cost Guide. NNSA is ultimately responsible for approving the M&O contractors’ estimating policies as part of their purchasing systems and assessing whether they meet commercial and government best practices. However, NNSA has not ensured that its contractors’ policies meet or substantially meet each of the 12 steps. By ensuring that its contractors’ policies incorporate the 12 steps for developing reliable cost estimates, NNSA would have greater assurance of realistic program planning and budgeting for M&O contractors and the federal government.

Recommendation for Executive Action

We are making the following recommendation to NNSA:

The NNSA Administrator should ensure that each M&O contractor’s policy related to estimating costs for fixed-price construction subcontracts incorporates commercial best practices related to cost estimating, such as by directing its M&O contractors to fully or substantially meet each of the 12 steps identified in GAO’s Cost Guide. (Recommendation 1)

Agency Comments

We provided a draft of this report to NNSA for review and comment. NNSA did not provide comments on the report.

We are sending copies of this report to the appropriate congressional committees, the Administrator of NNSA, and other interested parties. In addition, this report is available at no charge on the GAO website at http://www.gao.gov.

If you or your staff have any questions about this report, please contact me at bawdena@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made significant contributions to this report are listed in appendix III.

Allison Bawden

Director, Natural Resources and Environment

List of Committees

The Honorable Roger F. Wicker

Chairman

The Honorable Jack Reed

Ranking Member

Committee on Armed Services

United States Senate

The Honorable John Kennedy

Chair

The Honorable Patty Murray

Ranking Member

Subcommittee on Energy and Water Development

Committee on Appropriations

United States Senate

The Honorable Mike Rogers

Chairman

The Honorable Adam Smith

Ranking Member

Committee on Armed Services

House of Representatives

The Honorable Chuck Fleischmann

Chairman

The Honorable Marcy Kaptur

Ranking Member

Subcommittee on Energy and Water Development, and Related Agencies

Committee on Appropriations

House of Representatives

Our objectives were to assess (1) the extent to which management and operating (M&O) contractors established policies that follow best practices in estimating costs for fixed-price construction subcontracts, (2) the performance of M&O contractors in estimating costs for fixed-price construction subcontracts, and (3) the extent to which the National Nuclear Security Administration (NNSA) oversees the cost estimating policies of its M&O contractors for fixed-price construction subcontracts. For our review, we included the seven M&O contractors that managed and operated NNSA’s eight nuclear security enterprise sites during fiscal year 2023 and beginning of 2024.[23]

For our first objective we reviewed and analyzed documentation on M&O contractors’ policies for estimating costs for fixed-price construction contracts. We also interviewed contractor representatives from each of the seven M&O contractors about these policies. We then compared contractor policies against the estimation process steps identified in the Cost Estimating and Assessment Guide (Cost Guide).[24] The Cost Guide identifies 12 steps that, when incorporated into an agency’s cost estimating procedures, are more likely to result in reliable and valid cost estimates. We assessed the extent to which each contractor’s policy met, substantially met, partially met, minimally met, or did not meet each of the 12 steps for developing a reliable cost estimate as defined in the Cost Guide. We then shared our preliminary observations with each M&O contractor and updated our analyses, as appropriate, based on the contractor responses provided to us. While contractors may use other informal documents, guidance, or practices that reflect the 12 steps, our review examined contractors’ formal written policy. We also did not assess the reliability of individual project estimates.

For our second objective we obtained data on fixed-price construction contracts completed during fiscal year 2023, the last year for which full fiscal year data were available at the start of our review. We then compared estimated costs, initial award amounts, and final costs data for these contracts. We excluded select projects that cost under $100,000 from our analysis because M&O contractors do not always perform an independent cost estimate for projects under $100,000. In addition, select projects were excluded because the M&O contractor told us that the project did not follow the M&O contractor’s typical procurement and project management process. For example, one M&O contractor told us some projects are managed through a project management firm located at another NNSA site. We also interviewed contractor representatives from each of the seven M&O contractors about instances in which the total costs of some fixed-price construction contracts were modified after award to pay for cost increases experienced by the subcontractors.[25] In addition, to assess the reliability of cost data for our selected subcontracts, we provided questions and received written responses from each of the seven M&O contractors on the reliability of data and reviewed the data for accuracy and completeness. We determined these data were sufficiently reliable for the purposes of this report.

For our third objective we reviewed relevant federal regulations and analyzed Department of Energy and NNSA directives and guidance related to cost estimates and subcontracting. We then compared NNSA’s oversight activities to these regulations, directives, and guidance. We also interviewed contractor representatives from each of the seven contractors and NNSA officials to understand NNSA’s oversight role in M&O policies and estimates.

We conducted this performance audit from January 2024 to September 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Appendix II: Management and Operating Contractor Policies Compared to GAO’s 12 Steps for Developing a Reliable Cost Estimate

GAO’s Cost Estimating and Assessment Guide (Cost Guide) identifies 12 steps that, when incorporated into an agency’s cost estimating policies, are more likely to result in reliable and valid cost estimates.[26] See table 3.

|

Step |

Description |

|

Define the estimate’s purpose |

The purpose of the cost estimate is determined by its intended use. |

|

Develop the estimating plan |

The estimating plan documents the members of the estimating team and the schedule for conducting the estimate. |

|

Define the program |

A technical baseline description identifies adequate technical and programmatic information on which to base the estimate. |

|

Determine the estimating structure |

A product-oriented work breakdown structure defines in detail the work necessary to meet program objectives. |

|

Identify ground rules and assumptions |

Establish the estimate’s boundaries using a common set of standards and judgments about past, present, or future conditions. |

|

Obtain the data |

Collect and adjust data from existing programs to estimate the cost of a new program. |

|

Develop the point estimate |

Develop the cost estimate for each element and compare the overall point estimate to an independent estimate. |

|

Conduct sensitivity testing |

Examine the effect of changing one assumption or cost driver at a time. |

|

Conduct a risk and uncertainty analysis |

Quantify risk and uncertainty to identify a level of confidence associated with the point estimate. |

|

Document the estimate |

Thoroughly document the estimate such that someone unfamiliar with the estimate can update or recreate it. |

|

Present the estimate to management for approval |

Present the estimate and its underlying methodologies so that management understands and is able to approve it. |

|

Update the estimate to reflect actual costs and changes |

Update the estimate to reflect changes in conditions and report progress in meeting cost goals. |

Source: GAO’s Cost Guide. | GAO‑25‑107258

Note: A cost estimate policy is considered reliable if the

step assessment ratings for each of the 12 steps are substantially or fully

met.

We analyzed the policies used by seven management and operating (M&O) contractors for estimating costs for fixed-price construction subcontracts. We compared contractor policies with the steps identified in GAO’s Cost Guide. We then shared our preliminary observations with each M&O contractor and updated our analyses, as appropriate, based on contractor responses. While contractors may use other guidance, informal documents or practices that reflect the 12 steps, our review focused on formal written policy.[27]

Based on our analysis, we found that while each contractor at least met or substantially met one or more of the steps, no contractor met or substantially met each of the 12 steps. Figure 6 shows each contactor’s score of “met,” “substantially met,” “partially met,” “minimally met,” or “not met” for each of the 12 steps.

Figure 6: GAO Assessment of M&O Contractors’ Policies Compared to 12 Steps for Developing a Reliable Cost Estimate

Met – M&O contractor provided complete evidence that satisfies the entire criterion

Substantially met – M&O contractor provided evidence that satisfies a large portion of the criterion

Partially met – M&O contractor provided evidence that satisfies about half of the criterion

Minimally met – M&O contractor provided evidence that satisfies a small portion of the criterion

Not met – M&O contractor provided no evidence that satisfies any of the criterion

aWhen we started our review in January 2024, Consolidated Nuclear Security, LLC, was the M&O contractor for both the Pantex Plant and Y-12 National Security Complex. In June 2024, NNSA awarded the M&O contract for the Pantex Plant to PanTeXas Deterrence, LLC (PanTeXas). We did not include PanTeXas in our review.

bSavannah River Nuclear Solutions, LLC, provided us with a manual containing additional guidance on developing cost estimates. However, because this manual is not designed or intended to mandate procedure for cost estimating, we did not include it as part of our assessment.

GAO Contact:

Allison Bawden, bawdena@gao.gov

Staff Acknowledgments:

In addition to the contact named above, the following staff members made key contributions to this report: Jason Holliday (Assistant Director), R. Denton Herring (Analyst in Charge), Paul Bauer, Bethany Benitez, Antoinette Capaccio, Juana Collymore, Emile Ettedgui, Cindy Gilbert, Matthew McLaughlin, Jomauri Murray, Jennifer Leotta, Lola Ostrander, Mike Silver, Sara Sullivan, and Ben Wilder.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]The minor construction threshold is currently $34 million. Minor Construction Threshold Increase, 89 Fed. Reg. 9,141 (Feb. 9, 2024).

[2]M&O contracts are agreements under which the government contracts for the operation, maintenance, or support, on its behalf, of government-owned or government-controlled research, development, special production, or testing establishments wholly or principally devoted to one or more of the major programs of the contracting agency. 48 C.F.R. § 17.601.

[3]S. Rep. No. 118-58, at 385 (2023) (accompanying National Defense Authorization Act for Fiscal Year 2024, S. 2226, 118th Cong. (2023)).

[4]During the period when we collected data, NNSA contracted with seven M&O contractors to operate the eight sites of the nuclear security enterprise.

[5]GAO, Cost Estimating and Assessment Guide: Best Practices for Developing and Managing Program Costs, GAO‑20‑195G (Washington, D.C.: Mar. 12, 2020). The Cost Guide represents a compilation of best practices that industry and the public sector can use to develop reliable cost estimates. GAO compiled these best practices with input from cost estimating, scheduling, and earned value analysis specialists from across government, private industry, and academia.

[6]According to contractor representatives, these data do not include any overhead costs paid to the M&O contractor as part of its management fees for administering these subcontracts.

[7]We began collecting fiscal year 2023 fixed-price construction data as of January 2024. During the period covered by our review, Consolidated Nuclear Solutions managed both the Pantex Plant and Y-12 National Security Complex. However, in June 2024, NNSA awarded the M&O contract for the Pantex Plant to a new contractor.

[8]GAO, Department of Energy Contracting: Actions Needed to Strengthen Subcontract Oversight, GAO‑19‑107. (Washington, DC.: Mar. 12, 2019).

[9]An independent cost estimate—referred to as an independent government cost estimate in the GAO Cost Guide—is associated with a specific contract or acquisition. It generally requires a small group and may take months to complete. These estimates are helpful to programs in assessing the feasibility of individual emergent tasks to determine if the associated costs are realistic and reasonable, and its details support for the contracting officer through the negotiation and award process.

[11]The 12 steps included in the Cost Guide can be used to determine the quality of an agency’s process, guidance, and regulations for creating and maintaining an estimate. The 12 steps are related to 18 best practices that can be used to assess the reliability of a life cycle cost estimate and to determine the extent to which an estimate is comprehensive, well documented, accurate, and credible.

[12]DOE’s project management order requires construction projects expected to cost $50 million or more to follow best practices in GAO’s cost guide. DOE, Program and Project Management for the Acquisition of Capital Assets, DOE Order 413.3B (Change 7) (Washington, D.C.: June 21, 2023). In March 2025, the Secretary of Energy issued an order directing a variety of changes to DOE Order 413.3B, including changing the threshold for applicability of the order from $50 million to $300 million at DOE’s national laboratories. The order has not yet been revised to reflect these changes.

[13]GAO considers an agency’s policy to be reliable when it substantially or fully meets all 12 steps in the process.

[14]GAO‑20‑195G. M&O contractor representatives told us that not having each of the 12 steps written as formal policy allows them flexibility in creating estimates depending on the needs of the project. Later in the report, we discuss NNSA’s efforts to oversee M&O contractors’ cost estimation policies.

[15]The scope of our review was on fixed-price construction subcontracts for which M&O contractors had conducted an independent cost estimate. As a result, we excluded some contracts completed in fiscal year 2023 that were below a certain cost threshold (e.g., $100,000) established by each M&O contractor. In addition, according to contractor representatives, these data do not include any overhead costs paid to the M&O contractor as part of its management fees for administering these subcontracts.

[16]We did not assess the extent to which sites that performed better in meeting or substantially meeting GAO’s best practices for estimating costs also performed better in estimating costs associated with fixed-price construction subcontractors for fiscal year 2023. In some cases, some sites issued only a few subcontracts for that fiscal year, which did not provide a reliable basis for generalizable conclusions.

[17]Other costs associated with the COVID-19 pandemic—such as supply chain disruptions—added to the rising price of commodities and labor and may have triggered equitable adjustment clauses (linked to commodity or labor indexes) included in subcontracts.

[18]48 C.F.R. § 970.4402-2(d).

[19]Department of Energy (DOE), Acquisition Guide, Fiscal Year 2025, version 4 (Washington, D.C.: July 25, 2025). Chapter 70.44.3, pertaining to DOE’s Oversight of its M&O Contractors’ Purchasing Systems, was last updated in May 2018.

[20]National Nuclear Security Administration (NNSA) Acquisition Letter 2025-01 (Oct. 2024). In general, NNSA must only review or approve a fixed-price construction subcontract when the estimated cost of the subcontract is above the minor construction threshold—which is currently $34 million.

[21]48 C.F.R. § 970.4402-2(d). The Cost Guide represents a compilation of best practices applicable across industry and government for ensuring reliable cost estimates. The 12 steps for developing a reliable cost estimate are a part of these best practices. GAO‑20‑195G.

[22]GAO, National Nuclear Security Administration: Reporting on Industrial Base Risks Needs Improvement, GAO‑25‑107215 (Washington, D.C.: Mar. 14, 2025).

[23]When we started our review in January 2024, Consolidated Nuclear Security, LLC (CNS), was the management and operating contractor for both the Y-12 and Pantex Nuclear sites. In June 2024, the Pantex Nuclear site contract was awarded to PanTeXas Deterrence, LLC, which took over for CNS in November 2024. We did not include PanTeXas Deterrence, LLC, in our review. Moreover, the Savannah River Site was managed under the Office of Environmental Management rather than NNSA during the time period relevant to our audit. However, NNSA funded selected fixed-price construction subcontracts at the site and therefore were included in our scope. Management of the Savannah River Site has since been transferred to NNSA.

[24]GAO, Cost Estimating and Assessment Guide: Best Practices for Developing and Managing Program Costs, GAO‑20‑195G (Washington, D.C.: Mar. 12, 2020). The Cost Guide represents a compilation of best practices that industry and the public sector can use to develop reliable cost estimates.

[25]According to contractor representatives, these data do not include any overhead costs paid to the M&O contractor as part of its management fees for administering these subcontracts.

[26]GAO, Cost Estimating and Assessment Guide: Best Practices for Developing and Managing Program Costs, GAO‑20‑195G (Washington, D.C.: Mar. 12, 2020). The Cost Guide represents a compilation of best practices that industry and the public sector can use to develop and reliable cost estimates.

[27]We did not assess the reliability of individual projects’ estimates.