LABOR ORGANIZATION OVERSIGHT

Department of Labor Should Enhance Enforcement and Assistance Processes

Report to Congressional Requesters

United States Government Accountability Office

View GAO-25-107297. For more information, contact Thomas Costa at CostaT@gao.gov.

Highlights of GAO-25-107297, a report to congressional requesters

Department of Labor Should Enhance Enforcement and Assistance Processes

Why GAO Did This Study

On behalf of their members, labor organizations negotiate collective bargaining agreements related to pay, safety, and workplace policies. OLMS promotes transparency and financial integrity in labor organizations through its enforcement of LMRDA. In part, this law aims to prevent improper practices by labor organizations and protect the rights and interests of their members. OLMS pursues this goal through audits, investigations, and compliance assistance.

GAO was asked to review how OLMS administers LMRDA provisions that apply to labor organizations. This report examines the extent to which OLMS (1) ensures labor organizations adhere to LMRDA requirements and (2) helps labor organizations comply with LMRDA requirements. GAO reviewed relevant federal laws, annual reports and compliance assistance publications, and all 172 compliance audit closing letters issued in calendar year 2023, the most recent available at the onset of GAO’s review. GAO also analyzed fiscal year 2019 to 2023 enforcement and compliance assistance data and interviewed OLMS national and regional officials.

What GAO Recommends

GAO is making seven recommendations, including that OLMS assess voluntary compliance results and establish a mechanism to cite related publications in audit closing letters. The Department of Labor concurred with all seven recommendations. In its comments, the agency outlined its plans to implement them.

What GAO Found

The Department of Labor undertakes several efforts to enforce the requirements of the Labor-Management Reporting and Disclosure Act (LMRDA), but it could improve its processes to ensure violations are adequately addressed. Each year, the department’s Office of Labor-Management Standards (OLMS) selects some labor organizations for audits of their financial reports, based on factors such as member complaints, to ensure financial integrity. Most audits identified reporting and recordkeeping violations, but OLMS’s response to addressing them varies. OLMS primarily relies on voluntary compliance—an organization’s promise to maintain accurate reports and proper records in the future—to address recordkeeping violations. Some recordkeeping violations could reveal weaknesses that leave labor organizations vulnerable to theft and misuse of funds. However, OLMS has not assessed whether assurances of voluntary compliance result in corrective actions. As a result, OLMS does not know if its focus on voluntary compliance is an effective means to ensure labor organizations are adequately safeguarding members’ dues.

To support compliance, OLMS provides over 50 publications covering all sections of LMRDA requirements, but the agency does not have a mechanism to cite them in audit closing letters when relevant. Specifically, in GAO’s review of 172 closing letters—which OLMS uses to summarize violations it identifies and cite available assistance—from 2023, letters did not consistently reference publications that could help labor organizations address recordkeeping violations. For example, 46 closing letters with violations were related to documenting credit card expenses, and none referenced a related publication. According to OLMS officials, investigators determine which publications to reference on a case-by-case basis. However, OLMS does not have a systematic process to help investigators consistently cite related guidance in audit closing letters. This may leave labor organizations unaware of the available resources to address violations and comply with the LMRDA.

|

Abbreviations |

|

|

|

|

|

COVID-19 |

Coronavirus disease 2019 |

|

e-filing |

electronic filing |

|

LMRDA |

Labor-Management Reporting and Disclosure Act of 1959 |

|

OLMS |

Office of Labor-Management Standards |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

June 17, 2025

The Honorable Tim Walberg

Chairman

Committee on Education and Workforce

House of Representatives

The Honorable Rick W. Allen

Chairman

Subcommittee on Health, Employment, Labor, and Pensions

Committee on Education and Workforce

House of Representatives

The Honorable Virginia Foxx

House of Representatives

On behalf of their members, labor organizations negotiate collective bargaining agreements with employers related to pay, employee safety, and workplace policies. In 2024, over 14 million workers—about 10 percent of the U.S. workforce—were members of labor organizations.[1] The Department of Labor’s Office of Labor-Management Standards (OLMS) aims to promote transparency, democracy, and financial integrity among labor organizations through its administration of the Labor-Management Reporting and Disclosure Act of 1959, as amended (LMRDA).[2] The LMRDA was enacted to prevent and eliminate improper practices by labor organizations, employers, and labor relations consultants, as well as to protect the rights of employees and the public.[3] The law establishes financial disclosures and reporting requirements for labor organizations and establishes standards for the regular election of their officers, among other things.

We were asked to examine how OLMS administers LMRDA provisions that apply to labor organizations.[4] This report examines the extent to which OLMS (1) ensures labor organizations adhere to LMRDA requirements and (2) helps labor organizations comply with LMRDA requirements.

To address both objectives, we reviewed relevant federal laws, regulations, and agency documents outlining enforcement and compliance assistance policies and procedures. We also reviewed all compliance audit closing letters—the letter OLMS sends to labor organizations at the end of every compliance audit—issued in calendar year 2023, the most recent year available when we began our review. From these letters, we analyzed the number and nature of violations listed and the corresponding OLMS response to the violation, including if OLMS required corrective action and if it specified compliance assistance materials to help the labor organization address the violation.[5] We reviewed the Department of Labor’s strategic plan to identify related agency performance goals as well as OLMS annual reports to identify performance results for fiscal years 2019 through 2024.[6] We interviewed officials from OLMS’s national office, as well as regional and district directors from all four of the agency’s regional offices.[7] We assessed agency enforcement and compliance assistance efforts against federal standards for internal controls.[8]

To address the first objective, we also analyzed fiscal year 2019 through 2023 case-level data on enforcement operations from OLMS’s Case Data System. This centralized database tracks information on ongoing cases, including open/close dates, status of cases, information about violations, and case resolution. We analyzed data on overall case load, staff days, and results of investigations and audits for closed cases. We assessed the reliability of the data by checking for missing data, outliers, and obvious errors, making comparisons to published data, reviewing data documentation, and interviewing officials about data entry and validation procedures. According to OLMS officials, the agency is in the process of replacing its Case Data System. Based on these steps, we determined the data were reliable for the purposes of our reporting objective. We also relied on OLMS’s public reporting for data on the number and results of election investigations.

To address the second objective, we also analyzed all compliance assistance publications on the OLMS website to identify the range of topics covered. In addition, we analyzed data from OLMS’s Compliance Assistance System and other documents to analyze the number of compliance assistance sessions, topics covered, and participant characteristics in fiscal years 2019 through 2023. The Compliance Assistance System stores information on each compliance assistance session conducted, including presentation topics, presentation hours, and attendee counts. We assessed the reliability of these data by checking for missing data, outliers, and obvious errors, making comparisons to published data, and interviewing officials knowledgeable about the data system. We found that data were generally reliable for the purpose of our reporting objective.

We conducted this performance audit from January 2024 to June 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Labor-Management Reporting and Disclosure Act of 1959

The LMRDA aims to protect the rights and interests of employees and members of labor organizations by preventing improper practices on the part of labor organizations, employers, labor relations consultants, and their officers and representatives. These provisions apply to labor organizations, including unions, that represent private sector and U.S. Postal Service workers.[9]

The LMRDA includes the following sections:[10]

· Title I (bill of rights) establishes a bill of rights for members of labor organizations, including equal rights to nominate candidates and vote in officer elections; and provides access to copies of collective bargaining agreements.[11]

· Title II (reporting requirements) requires labor organizations to adopt a constitution and bylaws and to file an annual report to disclose financial condition and operations for the preceding fiscal year.

· Title III (trusteeships) identifies purposes for which a trusteeship—when a labor organization suspends the autonomy of a subordinate body—may be established and unlawful acts relating to labor organizations under trusteeship.

· Title IV (elections) establishes standards for officer elections, such as when and how to hold officer elections.

· Title V (safeguards for labor organizations) covers three areas, among others.

· It establishes officers’ fiduciary responsibility to manage funds to benefit members rather than themselves.[12]

· It requires that officers and employees of labor organizations hold insurance (bonding) to protect against financial losses associated with fraudulent or dishonest acts.[13]

· It prohibits persons who have been convicted of certain crimes, including bribery, extortion, or embezzlement, from holding labor organization office or employment or serving in other prohibited capacities.[14]

Labor Organization Structure and Reporting Requirements

There are various levels of labor organizations. Parent bodies, such as national and international labor organizations, charter local affiliates that are governed by the same constitution and bylaws. An intermediate body, another type of labor organization, is also subordinate to a national or international labor organization.

Within 90 days of the date in which they become subject to reporting requirements, labor organizations must file the Form LM-1 that collects basic information about the organization and its practices. Additionally, they must file one of the annual financial disclosure reports (Forms LM-2, LM-3, and LM-4) within 90 days of the end of their fiscal year. The level of financial disclosure and type of form filed varies by the amount of a labor organization’s receipts. In fiscal year 2024, 20,547 labor organizations filed the following reports:

· 4,920 LM-2 reports—for labor organizations with annual receipts of $250,000 or more;

· 9,538 LM-3 reports—for labor organizations with annual receipts of $10,000–$250,000; and

· 6,089 LM-4 reports—for labor organizations with less than $10,000 in annual receipts.

The LMRDA requires officer elections to be held at least every 3 to 5 years depending on the level of the organization. As a result, new officers may be routinely in place who are responsible for complying with reporting requirements. A labor organization’s President and Treasurer or the corresponding principal officers must both sign submitted financial disclosure reports.

OLMS’s Organization and Roles

OLMS has field offices across 12 districts organized under four regions and a national office. In fiscal year 2023, OLMS had budget approval for 208 full-time equivalent employees and an appropriation of about $48.5 million.

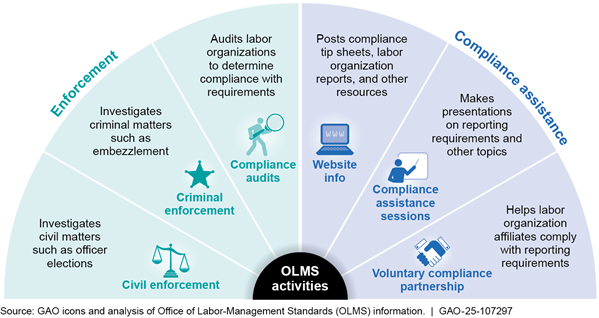

OLMS has a variety of enforcement and compliance assistance roles (see fig. 1). Enforcement operations are conducted entirely in the field, while the national office develops compliance assistance materials and has other planning and oversight functions. For example, OLMS field offices investigate potential civil and criminal violations of the LMRDA and refer these matters for prosecution. To assist with compliance, OLMS’s national office posts tip sheets and other publications explaining the LMRDA requirements. In addition, OLMS conducts compliance assistance sessions for labor organization officers, members, employers, and other interested parties. OLMS offers compliance assistance sessions both in-person and virtually through its national and field offices. These sessions cover a range of topics under the LMRDA, including financial recordkeeping and internal controls, officer elections, financial disclosure reporting, and required electronic (e-filing) reports.

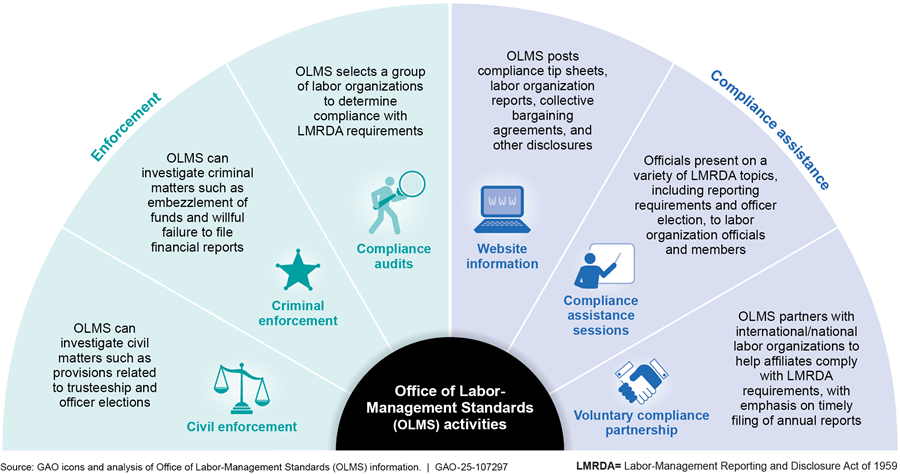

Through its website, OLMS also publicly shares key information about disclosures, violations, and enforcement actions (see fig. 2). For example, the website includes:

· a public disclosure page with LMRDA-required reports, including labor organizations’ financial disclosures and collective bargaining agreements;

· criminal and civil enforcement actions by year, including details about indictments, pleas, and sentencing;

· final agency determinations, such as for election and trusteeship investigations;

· closing letters to labor organizations, which outline any violations found in compliance audits;

· news releases and blog posts on updates and current topics; and

· schedule of upcoming compliance assistance sessions and other information.

Voluntary Compliance Partnership Program

OLMS partners with international and national labor organizations to assist their affiliates in complying with the LMRDA through its Voluntary Compliance Partnership program. As of fiscal year 2024, OLMS had 50 voluntary compliance partnership agreements in effect. The partnerships focus on improving the timely filing of the annual financial disclosure reports; ensuring all affiliates are adequately bonded; providing a review of embezzlement methods and areas of financial concern to help develop safeguards that prevent the misuse of funds; and sharing financial best practices, among other activities. Annually, OLMS provides a packet of information to these partners that covers each of these areas and links to applicable compliance assistance information, such as OLMS compliance tips and fact sheets.

Coordination with Other Agencies

As part of its enforcement program under the LMRDA, the Department of Labor has memoranda of understanding with the National Labor Relations Board and the Department of Justice with respect to enforcement responsibilities under the LMRDA.[15]

National Labor Relations Board. OLMS and the National Labor Relations Board signed agreements in 2020 and 2021 related to information sharing and other coordination activities. Additionally, aside from the activities outlined in these agreements, OLMS officials said the National Labor Relations Board provides them with a monthly list of all petitions seeking to establish exclusive collective bargaining representation by the petitioning labor organization. These petitions include contacts for the entity that filed them. Among these, OLMS officials said the agency identifies labor organizations that do not currently file reports under the LMRDA and sends a letter informing them of their potential reporting obligations.

Department of Justice. The Department of Labor’s agreement (as carried out by OLMS) with the Department of Justice identifies the respective responsibilities of each agency for conducting investigations under the LMRDA. For example, according to the agreement, the Department of Labor is generally responsible for investigating most criminal matters, and the Department of Justice is responsible for prosecuting them.[16] In addition, the agreement provides that the Department of Labor is responsible for investigating civil matters, and if it concludes that a civil enforcement action should be instituted, it will refer the case to the Department of Justice to initiate a lawsuit.

OLMS Prioritizes Addressing Election Complaints and Potential Criminal Activity, but Does Not Have Written Procedures to Follow Up on Identified Audit Violations

OLMS Prioritizes Resolving Election Complaints Within Required Timeframes

One of OLMS’s main enforcement priorities is resolving election complaints, according to officials. The LMRDA requires OLMS to resolve complaints from labor organization members about potential officer election violations within 60 days or file a lawsuit.[17] OLMS uses the timeliness of its response to assess how well the agency is promoting union democracy. However, when more time is needed to resolve an allegation, OLMS may seek a time waiver from the labor organization to extend the deadline beyond 60 days.

According to OLMS annual reports, OLMS averaged 55–74 days to resolve election complaints in fiscal years 2019 through 2024, and it was within OLMS’s targeted timeframe in 4 of the last 6 fiscal years (see table 1).[18] According to OLMS officials, targets are higher than 60 days because they account for the use of waivers when necessary.[19] OLMS officials stated the agency received more complaints—almost a 50 percent increase over the previous year—than anticipated in fiscal year 2023, which made it difficult to address them in a timely manner and led to missing their target.[20]

Table 1: Numbers of Election Investigations Conducted by OLMS and Days to Resolve, by Fiscal Year (FY)

|

|

FY 2019 |

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

FY 2024 |

|

Election investigations |

100 |

100 |

78 |

85 |

126 |

112 |

|

Average days to resolve officer election complaints (performance target) |

65.6 (69) |

64.9 (68) |

66.9 (67) |

55.2 (66) |

73.7 (65) |

66.3 (65) |

Source: Office of Labor-Management Standards (OLMS) annual reports, FY 2019–2024. | GAO‑25‑107297

Notes: These reports generally state that an estimated 7,000 elections occurred during the preceding year. According to OLMS officials, total election investigations include cases under the Labor-Management Reporting and Disclosure Act of 1959 and the Civil Service Reform Act, and the reported days to resolve a case includes cases for which there was a time waiver. For the purposes of its performance reporting, OLMS measures the days to resolve an election case (by voluntary agreement between the parties, filing of a lawsuit, or determination by OLMS that the violation would not have altered the election outcome) rather than the days to close it, which would include the time to issue a statement of reasons for closure.

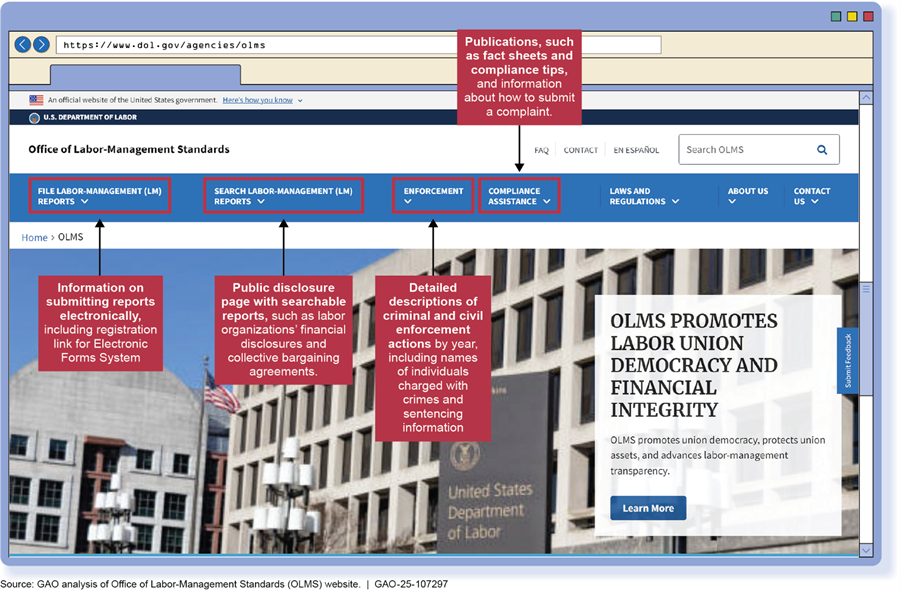

When OLMS receives a written election complaint, it determines whether the complaint is within its jurisdiction (see fig. 3).[21] When a complaint does not meet requirements for further investigation, OLMS sends the complainant a letter that provides information on their labor organization’s internal complaint procedures and any actions they can take to correct their submission.[22] When a complaint meets the requirements for further investigation, OLMS does so by interviewing the complainant and others knowledgeable of the situation and by reviewing election records and other documents. According to OLMS officials, these investigations nearly always include reviewing procedures for nominating candidates and recounting ballots related to the claim to determine the effect on the outcome. Generally, the scope of OLMS’s investigations is limited to the issues the complainant raised during the internal dispute procedures for their labor organization.

Notes: The LMRDA provisions require OLMS to resolve complaints from labor organization members about potential officer election violations within 60 days or file a lawsuit. However, when more time is needed to resolve an allegation, OLMS may seek a time waiver from the labor organization to extend the deadline beyond 60 days. A labor organization that represents only employees of state, county, or municipal governments is not subject to the laws administered by OLMS.

In its election investigations of local labor organizations, OLMS found violations in about one-third to one-half of complaints in fiscal years 2019 through 2023. Some commonly identified issues included not providing adequate safeguards to ensure a fair election, denial of the reasonable opportunity for all members to vote, and improper application of candidate eligibility qualifications.[23] If OLMS determines that the violation did not affect the outcome of the election, it does not take further action with respect to the labor organization’s election.[24]

When, through its investigation of allegations raised in a complaint, OLMS finds that violations of election standards may have affected the outcome of an election, OLMS seeks to enter into a voluntary compliance agreement with the labor organization to rerun the election under OLMS supervision. If OLMS is not able to obtain a voluntary compliance agreement, the Secretary of Labor, in consultation with the Department of Justice, files suit. According to OLMS annual reports, voluntary compliance agreements were more common than lawsuits (see table 2).

Table 2: Results from Election Investigations Where OLMS Determined a Rerun Was Required, by Fiscal Year (FY)

|

|

FY 2019 |

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

FY 2024 |

|

Voluntary compliance agreements obtained |

19 |

17 |

14 |

7 |

12 |

19 |

|

Lawsuits filed |

3 |

3 |

8 |

4 |

5 |

2 |

|

Number of supervised elections completeda |

24 |

17 |

27 |

12 |

13 |

17 |

Source: Office of Labor-Management Standards (OLMS) annual reports, FY 2019–2024. | GAO‑25‑107297

aSupervised elections may be completed in a fiscal year different from when a voluntary compliance agreement is obtained or a lawsuit is filed.

Notes: When, through its investigation of allegations raised in a complaint, OLMS finds that violations of election standards may have affected the outcome of an election, OLMS seeks to enter into a voluntary compliance agreement with the labor organization to rerun the election under OLMS supervision. If OLMS is not able to obtain a voluntary compliance agreement, the Secretary of Labor, in consultation with the Department of Justice, files a lawsuit. If OLMS determines that violations did not occur or did not affect the outcome of the election, it does not take further action with respect to the labor organization’s election, and those instances are not included in this table.

OLMS Uses Multiple Strategies to Increase Timely Disclosure Reporting by Labor Organizations

OLMS aims to increase timely financial disclosure reporting by promoting widespread adoption of electronic filing (e-filing) and following up in multiple ways with labor organizations that file late financial disclosures. In fiscal years 2019 through 2023, OLMS focused on increasing e-filing to increase the timeliness and accuracy of submitted reports, including financial disclosures. E-filing enables automated form checks from the system at the time of report submission and allows labor organizations to import financial data kept in accounting programs.[25] According to OLMS annual reports, 85.3 percent of reports were e-filed in fiscal year 2019, and this increased to nearly all submitted reports (99.6 percent) in fiscal year 2023.

OLMS is also working to reduce the number of labor organizations that miss the deadline for required reports, including financial disclosures. Financial disclosure reports are due 90 days after the end of the labor organization’s fiscal year, and according to officials, OLMS follows up with the labor organization if the report is not filed within 15 days of the due date.[26] If a labor organization files its financial disclosure report 15 or more days late for 3 consecutive years, OLMS deems it chronically delinquent. OLMS officials stated that it could be a challenge to get labor organizations to prioritize timely filing given a lack of monetary penalties in the LMRDA for late filing. However, the agency aims to reduce delinquency in several different ways:

· Opening cases for delinquent financial disclosure report filers. When a labor organization has a financial disclosure report delinquent by 15 or more days, OLMS officials said its relevant field office opens an investigation to obtain compliance, which includes written inquiries, follow-up phone calls, and offers of compliance assistance.[27] According to OLMS, the number of delinquency investigations it opened decreased in recent years because e-filing and working with national labor organization partners increased timely filing. The number of labor organizations that missed the filing deadline for financial disclosure reports decreased from fiscal years 2019 through 2023 (see table 3).

Table 3: Number of Financial Disclosure Reports Filed by Labor Organizations after Deadline, by Fiscal Year (FY) and Extent of Delay

|

|

FY 2019 |

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

|

Total labor organization financial disclosures received |

21,341 |

21,318 |

21,342 |

20,900 |

20,738 |

|

Late filing, 6-12 months after the deadline |

377 |

252 |

270 |

187 |

168 |

|

Late filing, more than 12 months after the deadline |

296 |

278 |

274 |

329 |

24a |

|

Total that did not file a financial disclosure report by the annual deadline |

5,951 |

4,904 |

4,950 |

3,482 |

3,518 |

Source: Office of Labor-Management Standards data and annual reports. | GAO‑25‑107297

aThis number is expected to increase as remaining delinquent filers for FY 2023 continue to file.

Note: These data are for LM-2, LM-3, and LM-4 forms submitted by labor organizations and total delinquent reports include those not filed at all for the fiscal year.

· Monitoring organizations at risk of chronic delinquency. To prevent chronic delinquency, OLMS maintains a “watch list” of organizations that were late in filing its financial disclosure report by 15 or more days the previous 2 years and sets a goal for the number of these that file on time in the current year. The number of chronically delinquent organizations fluctuated between fiscal years 2019 through 2024, from a high of 1,576 in fiscal year 2021 to a low of 1,128 in fiscal year 2023.[28] According to OLMS’s fiscal year 2024 annual report, 501 organizations that had been on the watch list did not become chronically delinquent because they filed a timely report that third year (see table 4). OLMS was successful in surpassing its target, which was to prevent 360 organizations on its watch list from becoming chronically delinquent.

Table 4: Number of Labor Organizations on the Chronically Delinquent Watch List, by Fiscal Year (FY)

|

|

FY 2019 |

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

FY 2024 |

|

Number of labor organizations on chronically delinquent watchlist at the start of the fiscal year |

1,400 |

1,301 |

1,576 |

1,503 |

1,128 |

1,199 |

|

Number of labor organizations removed from chronically delinquent watchlist during the fiscal year (target) |

712 (—) |

380 (—) |

771 (—) |

676 (553) |

652 (338) |

501 (360) |

Source: Office of Labor-Management Standards data and annual reports. | GAO‑25‑107297

Note: The chronically delinquent watchlist includes labor organizations that filed financial disclosure reports 15 or more days late for 2 consecutive years.

· Working with national and international labor organizations to inform them of delinquent affiliates. Each national or international labor organization participating in the Voluntary Compliance Partnership program regularly receives a list of affiliates that filed late at least once in the last 2 years and the number of days late. According to OLMS officials, the program includes partnerships with some of the largest labor organizations and they cover around 80 percent of labor organization affiliates. The reported overall on-time filing rate for labor organizations under the Voluntary Compliance Partnership was higher than those outside the partnership in fiscal year 2023 (85 percent for Partnership participants and 70 percent for others).

OLMS Audits and Investigates Labor Organizations to Enforce Compliance with the LMRDA

Separate from promoting timely reporting, OLMS uses two key strategies to enforce labor organizations’ compliance with the LMRDA’s provisions related to financial integrity: compliance audits and criminal investigations. In a compliance audit, investigators review financial and other records to assess compliance with provisions of the LMRDA that require labor organizations to disclose their financial condition and operations on an annual basis. OLMS may identify a matter of potential criminal significance, such as theft of labor organization assets, through this process. Given that OLMS cannot audit every labor organization, it considers various factors as it prioritizes which labor organizations to audit. Specifically, each year, OLMS selects labor organizations to audit based on failure to file required reports on a timely basis, discrepancies in financial disclosure reports, and complaints received from members.[29]

Until recently, OLMS assessed its success in promoting financial integrity by monitoring efficiency in identifying potential criminal cases. Specifically, through fiscal year 2023, OLMS measured the rate of compliance audits that resulted in a criminal investigation, and it established a goal in fiscal year 2023 of 17.5 percent of audits leading to a criminal investigation.[30] According to annual reports from fiscal years 2019 through 2023, OLMS exceeded its goals for this rate in 3 of the 5 years. OLMS reported that it achieved maximum efficiency in this area because its performance—18.3 percent of audits in fiscal year 2023—had plateaued.

Addressing potential criminal violations is another time-sensitive enforcement priority (in addition to resolving election complaints), according to officials.[31] OLMS identified violations in a majority of the criminal investigations it completed from fiscal years 2019 through 2023 (see table 5).

Table 5: Number of Criminal Investigations Closed by OLMS and Percentage That Identified Criminal Violations, by Fiscal Year (FY)

|

|

FY 2019 |

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

|

Number of closed Investigations |

210 |

236 |

194 |

195 |

208 |

|

Percentage of closed investigations where OLMS identified violations |

66% |

61% |

69% |

59% |

67% |

Source: GAO analysis of FY 2019–2023 data from the Office of Labor-Management Standards’ (OLMS) Case Data System. | GAO‑25‑107297

Notes: Our analysis uses the case closure date to categorize cases by fiscal year. According to OLMS officials, there are typically case milestones earlier than the closure date after which OLMS considers the case processed; OLMS uses total processed cases for the purposes of its annual reporting. These data include cases that were closed after referral or legal action was completed.

According to OLMS, the primary focus of criminal investigations is identifying embezzlement—willful theft of labor organization funds for personal use—and crimes often associated with embezzlement include false reports and false records. OLMS officials reported that they would investigate any indication of embezzlement, regardless of the amount. Officials in one region noted that even if a loss from embezzlement is low, it could still have a large negative impact on a small labor organization. Cases are forwarded to the U.S. Attorney’s Office for potential prosecution. Officials said that they would pursue state and local prosecution if federal prosecution was not possible. According to case data, OLMS referred 25 cases to local prosecutors in 2023 (out of 139 cases where a violation was identified).

Starting in fiscal year 2024, OLMS assessed its efforts to improve financial integrity using a new metric: the percentage of compliance audit violations resolved through voluntary compliance. According to OLMS officials, voluntary compliance is achieved when, in response to a violation, a labor organization agrees to maintain adequate records or accurate reports in the future, provide proof of bonding coverage, or provide necessary governing documents or other required reports.

According to case data, from fiscal years 2019 through 2023, OLMS identified LMRDA violations in at least 92 percent of labor organizations selected for audit (see table 6). Reporting violations (e.g., failing to report disbursements to officers) and recordkeeping violations (e.g., inadequate documentation of credit card expenses), were most common and were typically resolved by voluntary compliance.

|

|

FY 2019 |

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

|

Number of closed audits |

250 |

242 |

219 |

247 |

221 |

|

Percentage where OLMS identified any violations |

92% |

97% |

93% |

94% |

96% |

|

Percentage where OLMS identified reporting violations |

59% |

60% |

63% |

73% |

60% |

|

Percentage where OLMS identified recordkeeping violations |

68% |

72% |

65% |

74% |

72% |

Source: GAO analysis of FY 2019-2023 data from the Office of Labor-Management Standards (OLMS) Case Data System. | GAO‑25‑107297

Note: Some of the closed compliance audits resulted in a criminal investigation.

At the close of a compliance audit, OLMS sends the audited organization a closing letter, which states OLMS’s findings and how the organization can come into compliance, if necessary. We analyzed the violations and agency response listed in all 172 compliance audit closing letters posted in 2023 (see table 7).[32] Of the 172 closing letters, 123 letters (72 percent) identified both reporting and recordkeeping violations.

|

Category of Violations |

Examples of Specific Compliance Issues Within Category |

|

Reporting deficiencies |

· failing to accurately disclose disbursements to officers (86 letters) · failure to file bylaws (e.g., not filing a current copy when revisions have been made to constitution or bylaws) (62 letters) · inaccurately reporting receipts (e.g., reporting a fund transfer as a receipt and disbursement) (31 letters) · failing to report acquisition or disposition of property (e.g., not disclosing when gifts were distributed to labor organization members) (27 letters) |

|

Inaccurate or incomplete recordkeeping |

· inadequate documentation for general reimbursements (e.g., for reimbursed expenses) (59 letters) · issues related to credit cards (e.g., inadequate documentation of credit card expenses incurred by officers) (46 letters) · lost wages (e.g., inadequate documentation of reimbursement to officers for lost wage payments) (41 letters) · incomplete explanations of meal expenses (e.g., not recording the business covered) (41 letters) · failing to record information in meeting minutes (e.g., not recording decisions/approvals for certain expenses) (42 letters) |

|

Other issues/violations |

· inadequate bonding (27 letters) · issues related to expense policy (e.g., lack of a clear policy on expenses that personnel can claim for reimbursement) (22 letters) · issues related to signatures on checks (e.g., lack of multiple signatures to verify expenses) (34 letters) |

Source: GAO analysis of 2023 Compliance Audit Program closing letters. | GAO‑25‑107297

Notes: Numbers of letters in parentheses indicate how many closing letters mentioned a specific kind of issue. A compliance audit closing letter may mention multiple violations or issues and there may be overlap in some of the issues identified (e.g., inadequate documentation of meal expenses can be related to inadequate documentation of credit card expenses).

OLMS Follow-Up to Address Reporting and Recordkeeping Violations It Identified in Audits Is Limited

OLMS conducts limited follow-up on reporting and recordkeeping violations it identifies. In response to reporting violations, OLMS either requires the organization to correct the issue and file an amended financial disclosure report, or it does not require an amended report and relies on the labor organization’s agreement that the organization will properly report items in future reports.[33] Among audit closing letters in 2023 where OLMS identified errors on financial disclosure reports, OLMS did not require the audited organization to file amended reports in 72 out of 129 instances (56 percent).[34] According to OLMS officials, individual investigators and their managers determine whether to require that a particular labor organization submit an amended report, and they would generally consider the severity of the reporting violation when determining how to respond. For example, officials from one region noted that misreporting payments to officers or total cash balances could be a violation that is significant enough to misrepresent the organization’s financial position. In instances where OLMS does not require the labor organization to file an amended financial disclosure report, members may not have an accurate depiction of how some funds are being used.

OLMS’s written procedures for audits do not define considerations or criteria that investigators should apply when determining whether to require an amended report. OLMS’s stated performance objectives include promoting financial integrity and transparency for labor organizations.[35] Federal standards for internal control also require that managers define the risks the organization will tolerate as consistent with meeting its performance objectives.[36] Without written criteria, OLMS staff may not be able to identify which types of violations are severe enough to potentially impede the agency’s ability to meet its goal of promoting financial integrity and transparency. In turn, members may not have a clear understanding of how their labor organization is using its funds.

With respect to recordkeeping violations, audit closing letters in 2023 described deficiencies in maintaining adequate records as required by LMRDA in 144 out of 172 letters. In 122 out of 144 letters with recordkeeping violations (85 percent), OLMS took no further enforcement action based on the audited organization’s assurances it would maintain adequate records in the future. According to OLMS officials, these violations were considered resolved through voluntary compliance, and once voluntary compliance is noted, OLMS does not follow up or track these organizations to confirm that the issues are fixed in future reporting. Similarly, there are no follow-up procedures to track implementation of any other recommendations OLMS may make to the labor organization to help them ensure financial safeguards, such as maintaining a policy for multiple signatures on checks.[37] Officials said that this is due to a lack of staff capacity and decisions about how to prioritize limited investigative resources.

Recordkeeping errors may indicate gaps in practices that could leave organizations vulnerable to the theft or misuse of funds. For example, one activity OLMS recommends to ensure adequate recordkeeping practices is that the labor organization establish an understanding through meeting minutes or other means about the level of salaries and allowances to which officers are entitled. In 36 audit closing letters issued in 2023, OLMS identified recordkeeping violations related to not maintaining documentation of authorized salaries. According to federal standards for internal controls, agencies should use valid indicators to achieve their goals and should document corrective actions to resolve audit findings.[38] However, OLMS officials said they have not assessed whether resolving violations identified in audits through voluntary compliance results in corrective actions that help labor organizations improve their safeguards to ensure financial integrity. Without assessing whether voluntary compliance results in the audited labor organization taking corrective action to address underlying issues, OLMS may not reduce the likelihood of similar errors in the future. Furthermore, OLMS will not know if its new performance measure—percent of audits resolved through voluntary compliance—is an effective indicator of compliance or use of its resources.[39]

By following up in a portion of cases on corrective actions taken after the audit, OLMS would have more assurance that underlying issues related to violations it identified were addressed. OLMS officials expressed concerns about the resources required to follow up on identified violations by re-auditing labor organizations. However, we have previously reported that even relatively small, statistically valid random samples can help agencies assess overall compliance, identify areas where corrective strategies are needed, and potentially help improve the effectiveness of their enforcement approach.[40]

OLMS has no documented practices or procedures outlining how OLMS investigators should follow up to document corrective actions taken in response to audit findings. Instead, officials in all four regions said that to follow-up after an audit, managers can, at their discretion, maintain a list of labor organizations to re-audit in the future based on the issues uncovered during a particular audit. However, this list for potential re-auditing is tracked by individual managers and information is not maintained in an agency-wide system. According to federal standards for internal control, agency personnel should report internal control issues through established reporting lines in support of its objectives.[41] By better tracking labor organizations that OLMS determined may warrant further follow-up based on their history of audit violations, it could better use its resources and enforcement efforts where they are most effective.

OLMS Provides Resources to Help Labor Organizations Comply with LMRDA, but Could Develop Processes to Improve the Quality and Reach of Its Assistance

OLMS Has Many Publications to Explain Requirements, but Does Not Consistently Cite Related Publications in Audit Letters

OLMS has a variety of publications on its website designed to assist labor organizations in complying with LMRDA requirements, but it does not fully leverage them when it identifies violations during audits. OLMS has over 50 publications spanning all sections of LMRDA (see table 8).

|

Topic |

Publications |

|

Member rights |

Seven publications, including on member rights and officer responsibilities under the Labor-Management Reporting and Disclosure Act of 1959 (LMRDA). |

|

Reporting and disclosure |

29 publications, including publications on LMRDA recordkeeping requirements for unions and common reasons for late reports. |

|

Trusteeships |

Two publications, including publications on trusteeship requirements under the LMRDA. |

|

Elections |

16 publications, including publications on conducting officer elections and updating membership mailing lists. |

|

Financial safeguards for labor organizations |

23 publications, including publications on bonding requirements and the prohibition against certain persons holding office or employment. |

Source: GAO analysis of OLMS publications. | GAO‑25‑107297

Notes: Some publications may address multiple topics, and the counts of publications may not be mutually exclusive across topics. For example, a publication may cover both financial safeguards and reporting and disclosure requirements. The counts presented in this table are based on OLMS’s categorizations as listed on its website.

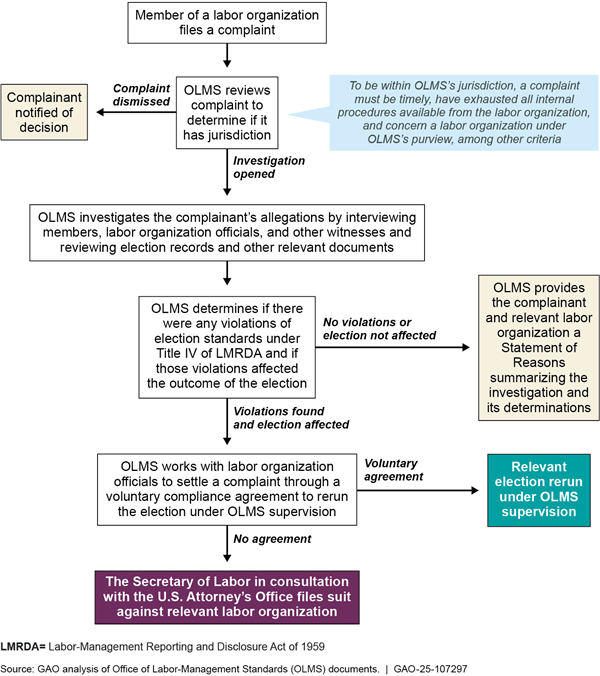

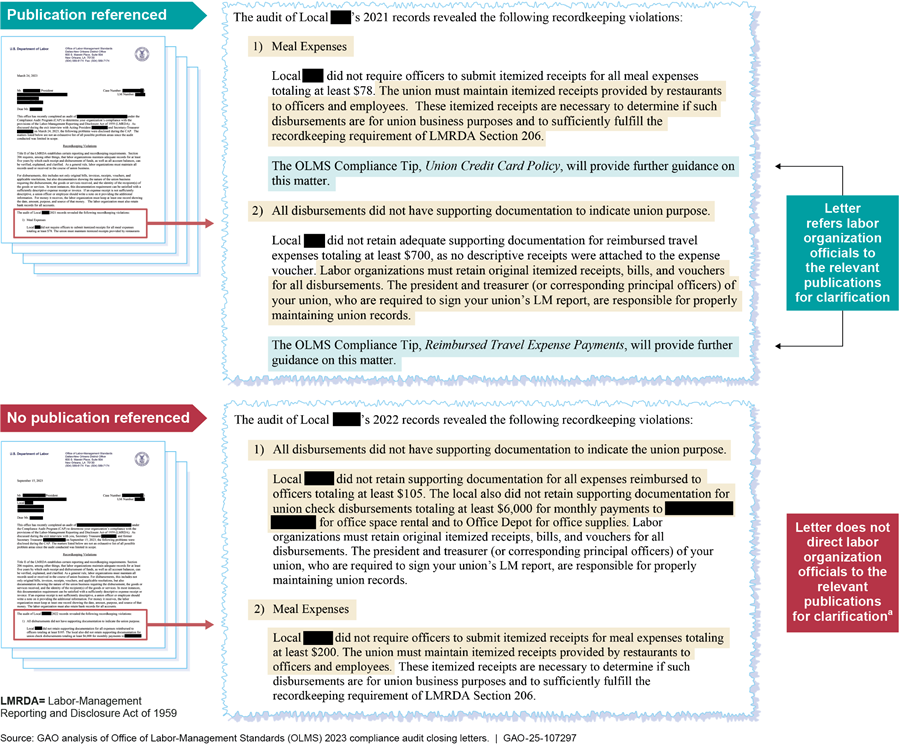

These publications include information that could help labor organizations address violations that frequently arise during audits. However, we found that OLMS did not consistently reference these publications in audit closing letters when relevant. In our review of OLMS’s 172 audit closing letters from 2023, OLMS identified recordkeeping violations for 144 labor organizations, with a median of three violations per labor organization. In limited instances, OLMS referenced publications that could assist the labor organization in correcting particular recordkeeping issues. For example, 46 closing letters identified credit card recordkeeping violations, but none referenced the Union Credit Card Policy publication. Similarly, of the 41 closing letters identifying meal expense recordkeeping violations, only one referenced a related publication (see fig. 4). However, in 37 out of 41 closing letters that identified a lost wage violation, OLMS referenced a publication that provides examples of required documentation for lost wage vouchers. Officials from two regions said that the publication on lost wage violations may be relied on frequently because this is a common issue that may indicate potential areas of abuse. However, other issues that were identified at a similar frequency, such as documenting credit card expenses, could also represent vulnerabilities.

Figure 4: Examples of Audit Closing Letters With and Without References to Potentially Relevant Compliance Assistance Publications

aOLMS has many publications explaining requirements, including those related to disbursements. For example, OLMS’s publication, LMRDA Recordkeeping Requirements for Unions, explains documentation requirements to support disbursements, such as itemized receipts for credit card charges and vouchers for expenditures.

According to OLMS officials, investigators determine which compliance assistance publications to reference in the closing letter on a case-by-case basis. OLMS officials said that new investigator training covers which publications to provide during a compliance audit, but we found no written guidance or specific mechanism to help investigators determine the publications to reference in these letters. For example, the closing letter template does not include examples or instructions on how or whether to reference publications. Officials said that investigators typically provide relevant compliance assistance verbally during the exit interview for the audit that is not reflected in the letter because they feel it is better to provide the assistance in person.[42]

However, documenting available compliance assistance publications in the letter is important because labor organizations regularly elect new officers who are responsible for meeting requirements, and new officers may not have been present during a previous audit. OLMS’s objectives for compliance assistance include helping labor organizations understand their responsibilities under the LMRDA. According to federal internal control standards, agencies should communicate quality information externally to achieve their objectives.[43] Developing a mechanism to consistently cite related publications in audit closing letters could help promote compliance by increasing the likelihood that current and future labor organization officers are aware of available compliance assistance publications and fully understand LMRDA requirements.

OLMS Could Improve the Quality of Its Publications and Sessions by Systematically Reviewing Them and Incorporating Feedback

Some of OLMS’s compliance assistance may not adequately meet the needs of labor organizations, and OLMS does not have a systematic process to review and incorporate feedback into its assistance efforts.

Compliance Assistance Publications

Our analysis found that some publications did not fully address violations frequently identified in 2023 compliance audits. For example, in 2023, OLMS identified recordkeeping violations related to meal expenses in 41 of 172 closing letters. The Union Credit Card Policy publication describes some documentation requirements for meal expenses, but it does not address all requirements. Specifically, it addresses requirements such as providing a written explanation of the labor organization business conducted and listing the full names and titles of all individuals incurring food and beverage charges. However, it does not mention that records must also include the names of the restaurants where officers or employees incurred meal expenses, as specified in a closing letter.

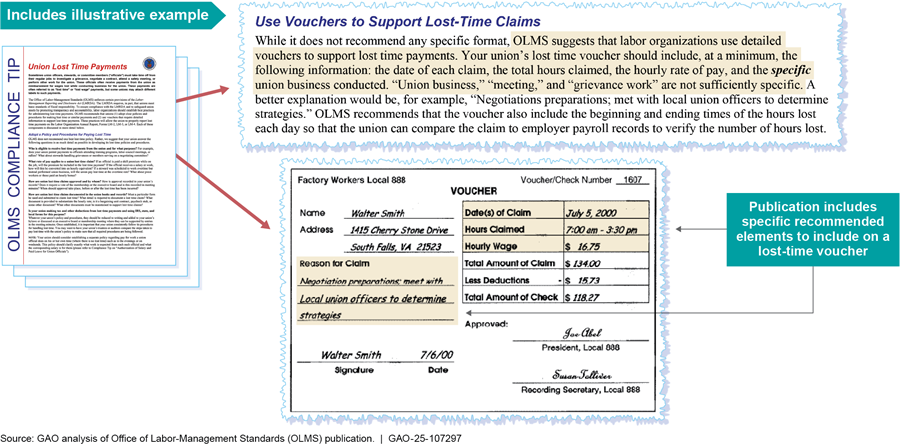

Other guidance addressing frequently cited violations provided more complete compliance assistance. For instance, in 41 of 172 closing letters, OLMS mentioned recordkeeping violations related to lost wages. The publication Union Lost Time Payments addresses these recordkeeping violations by outlining specific documentation requirements, such as including the date of each claim, total hours claimed, and official business conducted, and provides an illustrative example that encompasses all of these requirements (see fig. 5).

In addition, some frequent violations may not be addressed in any available compliance assistance publications. For example, in 2023, OLMS found that 27 labor organizations did not properly report asset disposition and that 34 did not maintain adequate records to support disposition of property, which includes gifts or giveaway items. We found no OLMS publications that clarify how gift items should be reported and recorded. According to OLMS officials, compliance assistance publications are updated on an as-needed basis and OLMS does not have a systematic process to update compliance assistance publications regularly based on analyses of ongoing compliance issues. For example, officials noted the agency had recently updated its publication on properly reporting investments in annual financial disclosure reports. OLMS initiated this update based on public inquiries received and issues staff noticed during audits, though in 2023 audit closing letters, violations related to reporting investments were cited relatively infrequently.[44]

According to federal internal control standards, agencies should periodically evaluate their methods of communication to ensure they are effectively conveying quality information.[45] A key function of OLMS’s compliance assistance activities is to meet the needs of labor organization officers and members and promote compliance with LMRDA requirements. A systematic process to regularly review and update its compliance assistance publications would help ensure that they provide consistent and comprehensive information. Further, it would provide an opportunity for OLMS to provide new or additional information in response to frequently cited violations identified in its compliance audits. Without such a process, OLMS’s assistance may not be fully responsive to frequently cited violations, its effectiveness in preventing reporting and recordkeeping violations may be limited, and labor organizations may not have the tools they need to comply with LMRDA requirements.

Compliance Assistance Sessions

OLMS conducts virtual and in-person compliance assistance sessions to help labor organization officers and members understand requirements under the LMRDA. In addition to standard presentations, OLMS also conducts tailored compliance assistance sessions by request. OLMS officials cited ongoing challenges with low turnout for these sessions, and that OLMS does not have a standardized process for collecting and tracking participant feedback.

OLMS has recently met its targets for numbers of compliance assistance sessions and hours participants spent in them following a drop during COVID-19 (see table 9). However, officials from two out of the four regional offices reported current challenges with low turnout for their compliance assistance sessions. One regional office stated that year to year, the district saw representatives from 2 to 3 percent of labor organizations in its jurisdiction attend its compliance assistance sessions, though invitations go out to all labor organizations in the region. Officials in another regional office said it was difficult to identify convenient locations for in-person sessions because the region covers a large geographic area. Officials said that the agency was considering strategies to increase participation in regions with relatively low participation rates.

Table 9: Total and Targets for Compliance Assistance Sessions and Participant Hours, by Fiscal Year (FY)

|

|

|

FY 2019 |

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

FY 2024 |

|

Total compliance assistance sessions (target) |

— (—) |

— (—) |

99 (66) |

105 (70) |

116 (74) |

113 (77) |

|

|

Total participant hours (target) |

14,199 (15,000) |

4,333 (8,000) |

8,294 (12,000) |

9,188 (12,000) |

12,984 (12,000) |

14,483 (12,000) |

|

Source: Office of Labor-Management Standards’ (OLMS) Congressional budget justifications and annual reports. | GAO‑25‑107297

Notes: OLMS calculates participant hours by multiplying the number of participants by the hours of instruction for each session. OLMS did not report total and target compliance assistance sessions in fiscal years 2019 and 2020. These data include sessions for labor organizations and other entities such as employers.

OLMS does not collect feedback on compliance assistance sessions in a standardized manner across regions or districts. OLMS national office officials stated that field staff typically distribute evaluation forms to attendees at the end of a session. However, we found that feedback collection methods varied by region. Two regional offices reported using feedback evaluation forms that were distributed at the end of the session. The other two regional offices reported that they did not specifically solicit feedback. For example, officials in one regional office that did not provide a feedback evaluation form said sometimes participants informally provided comments during the session or by email afterwards.

Further, OLMS officials said that the feedback that they collect on compliance assistance sessions is not systematically tracked or recorded across the agency. Instead, regional officials may share insights on an ad hoc basis during regular coordination meetings with the national office and regional directors. Regional officials were unaware if information on successful strategies might have informed similar improvements across other field offices.[46]

By not systematically collecting and tracking feedback, OLMS could be missing opportunities to benefit from feedback as it has done in certain instances. According to regional OLMS officials, the feedback they collected helped them make improvements for future sessions, such as increasing accessibility or covering topics that are of most interest to the audience. For example, one regional official said their office incorporated requests to use completed financial disclosure report examples in presentations on filling out annual financial forms, replacing the use of blank forms. According to federal internal control standards, agencies should periodically review policies, procedures, and related control activities to ensure their continued relevance and effectiveness in achieving objectives.[47] A key function of OLMS’s compliance assistance activities is to meet the needs of labor organization officers and their members while promoting compliance with requirements. Without a standardized way to collect and track feedback on compliance assistance sessions, OLMS may be missing opportunities to identify feedback patterns and ultimately to enhance the quality, relevance, and attendance of its compliance assistance sessions.

OLMS Has Assistance and Information That Could Help Members of Labor Organizations but Reported Challenges in Reaching Out to Them

OLMS aims to provide key information to members of labor organizations, but it faces challenges in communicating with them, according to officials. OLMS hosts compliance assistance sessions and maintains information on its website that may particularly benefit members. For instance, about a third of its compliance assistance sessions in fiscal year 2023 covered officer elections. These sessions are helpful to members because they describe the rights of members to nominate candidates and to vote, as well as explain how to submit complaints to OLMS regarding the election process. OLMS also has information on its website that can help members better understand their rights under the LMRDA. In addition, OLMS posts financial disclosure reports, audit closing letters, and publications on its website to promote organizational transparency and ensure that members are informed about how their dues are used.[48]

However, OLMS officials cited reaching members of labor organizations as the agency’s main challenge in providing compliance assistance. For example, OLMS officials said it is difficult to directly inform members of labor organizations about compliance assistance sessions. This is because invitations to compliance assistance sessions are sent to labor organization officers using the contact information provided in their labor organization’s financial disclosure reports. OLMS officials noted that officers might be reluctant to share these invitations with members when the topics discussed might conflict with the officers’ interests. As a result, they stated the agency’s communications about compliance assistance sessions typically did not reach members. According to our analysis of fiscal year 2019–2023 OLMS data, members do attend compliance assistance sessions, but most sessions are only attended by officers.

Further, OLMS officials stated that the agency attempts to directly engage members have had limited success. For example, OLMS officials stated they partnered with other agencies such as the Occupational Safety and Health Administration to participate in the other agency’s workplace sessions to increase workers’ awareness of OLMS and its functions. Despite these efforts, officials said that many labor organization members are generally unaware of the agency. This limited awareness may also be reflected in the agency’s website engagement. For example, OLMS created a YouTube video linked on its website with information on member rights that could be helpful to the more than 14 million members of labor organizations in 2024. This video garnered about 5,600 views over a four-year period. In comparison, compliance assistance publications primarily targeted at labor organization officers of the 20,547 filing labor organizations in fiscal year 2024 received 9,797 page views within only a six-month period (January 1 to June 3, 2024).

OLMS identifies meeting the needs of members as one of the goals of its compliance assistance activities. Additionally, OLMS officials said soliciting input from members is important because they are in the best position to know if their dues are being used appropriately and can provide an effective check on the labor organization’s financial disclosures. Officials said that they have considered various ideas for how to reach members but have not yet identified an overall strategy for engaging with them. According to federal internal control standards, agencies should consider a variety of factors to select appropriate methods for external communication, including the audience and nature of information.[49] By assessing how to best reach members and clarifying a strategy to communicate with them, OLMS could raise the profile and mission of the agency with that target audience. In doing so, OLMS could leverage its existing partnerships with national labor organizations to solicit ideas on effective ways to directly engage or obtain input from members of labor organizations.

Conclusions

Effective enforcement of the LMRDA is critical to protecting the rights for members of labor organizations and preventing improper practices by labor organizations. To achieve this mission, OLMS undertakes several efforts to promote democratic standards in officer elections, obtain timely disclosure reporting, and pursue prosecution when it uncovers theft of labor organization funds. OLMS compliance audits are another key enforcement tool that allows investigators to uncover reporting and recordkeeping violations that affect the accuracy of a labor organization’s financial disclosure. However, without clear criteria that investigators can apply to determine when labor organizations should amend their financial disclosures or without subsequent follow up to ensure corrective actions are implemented, underlying causes may persist and continue to generate violations. Relatedly, OLMS has started using voluntary compliance with disclosure requirements to measure its effectiveness in ensuring the financial integrity of labor organizations. Without assessing the results of voluntary compliance, OLMS cannot determine how well its enforcement efforts ensure labor organizations follow through on their commitments to comply with requirements in the future. In turn, OLMS does not have assurance that labor organizations are providing accurate financial information to their members. Additionally, without formally tracking labor organizations that managers determine warrant additional follow-up based on past violations, OLMS may be missing opportunities to use its limited enforcement resources more effectively.

OLMS publications are designed to help labor organizations understand their responsibilities and LMRDA requirements. However, OLMS audit closing letters do not always cite relevant publications, potentially leaving labor organization officers unaware of tools they can use to stay in compliance with the law. OLMS is also missing opportunities to improve the effectiveness of its publications and assistance sessions by not systematically reviewing them and incorporating session participant feedback on the needs of labor organizations. Additionally, OLMS does not have a strategy to reach members of labor organizations—a key audience that is meant to benefit from the protections established by LMRDA. OLMS’s ability to promote transparency and accountability for labor organizations is only as good as its ability to reach labor organizations and their members. Without more action to incorporate feedback into its assistance and improve the reach of its communications, including to labor organization members, some of OLMS’s efforts to improve transparency and protect rights may have limited impact.

Recommendations for Executive Action

We are making seven recommendations to the Secretary of Labor.

The Secretary of Labor should ensure the Director of OLMS establishes written criteria investigators can apply when determining whether to require an amended financial disclosure report following a compliance audit. (Recommendation 1)

The Secretary of Labor should ensure the Director of OLMS assesses whether voluntary compliance results in labor organizations taking corrective action after violations are identified during a compliance audit. For example, OLMS could regularly follow up on a sample of violations to help estimate how often voluntary compliance results in an actual change of behavior. (Recommendation 2)

The Secretary of Labor should ensure the Director of OLMS establishes documented procedures to track labor organizations that OLMS officials determine merit follow up based on past violations identified during a compliance audit. (Recommendation 3)

The Secretary of Labor should ensure the Director of OLMS develops a mechanism to cite related compliance assistance publications in compliance audit closing letters. (Recommendation 4)

The Secretary of Labor should ensure the Director of OLMS establishes a systematic process to regularly review and update as needed its compliance assistance publications. For example, OLMS could use information on common violations identified in its compliance audits to assess whether there are any gaps in topics covered by its publications. (Recommendation 5)

The Secretary of Labor should ensure the Director of OLMS establishes a systematic process to collect and track feedback from compliance assistance sessions, ensuring feedback is used for program improvement across all regions. (Recommendation 6)

The Secretary of Labor should ensure the Director of OLMS develops a strategy for conducting effective outreach to members of labor organizations. This could include leveraging existing partnerships, such as the Voluntary Compliance Partnership Program, to solicit ideas on improving member engagement or informing members about their rights. (Recommendation 7)

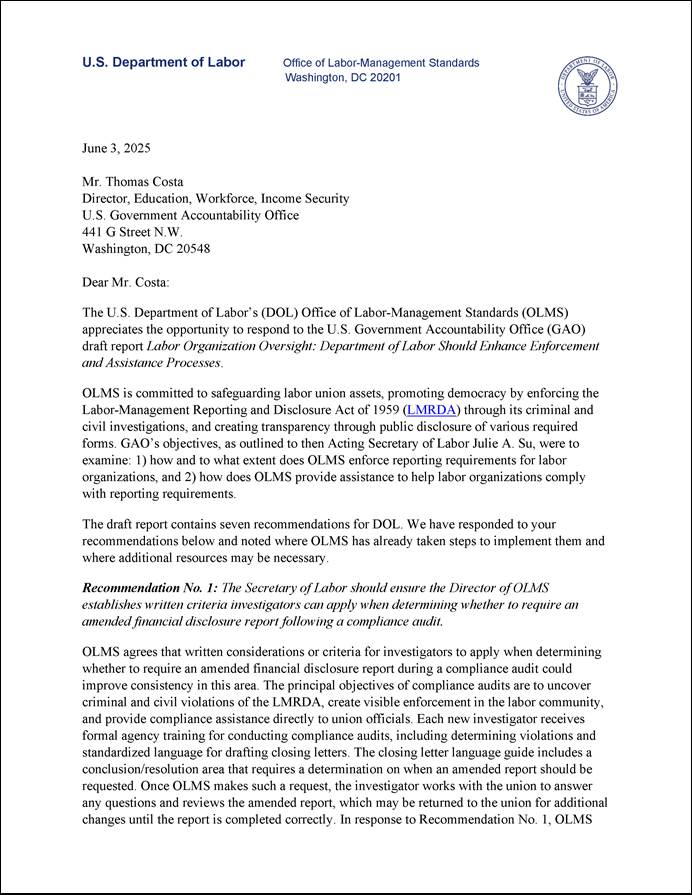

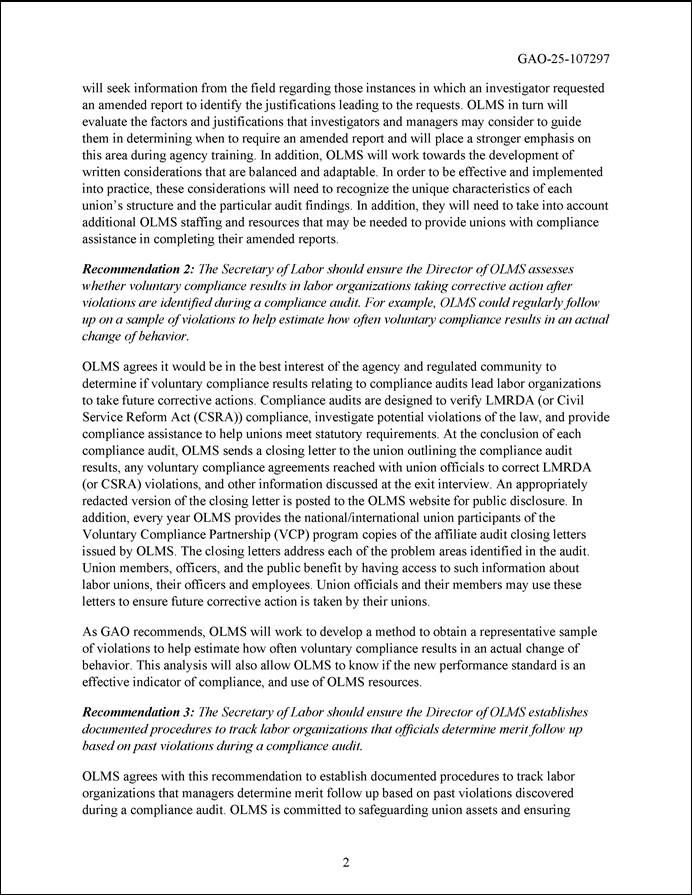

Agency Comments

We provided a draft of this report to the Department of Labor for review and comment. The department concurred with all seven of our recommendations and described its plans and initial steps that OLMS is taking to address them. The Department of Labor’s comments are reproduced in appendix I. The agency also provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the appropriate congressional committees, the Secretary of Labor, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov. If you or your staff have any questions about this report, please contact me at CostaT@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix II.

Thomas Costa,

Director, Education, Workforce, and Income Security

Thomas Costa, CostaT@gao.gov

Staff Acknowledgments

In addition to the contact named above, key contributors to this report were Betty Ward-Zukerman (Assistant Director), Amrita Sen (Analyst in Charge), and Peter Choi. Other contributors to this report were Howard Arp, Will Beichner, James Bennett, Charlotte Cable, Heather J. Dunahoo, Randi Hall, Heather Keister, Serena Lo, Ying Long, Will Stupski, and Adam Wendel.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]This includes members of labor organizations in private and public sectors (such as local government labor organizations). Bureau of Labor Statistics, “Union Members Summary,” (Washington, D.C.: Jan. 28, 2025), www.bls.gov/news.release/union2.nr0.htm.

[2]Pub. L. No. 86-257, 73 Stat. 519 (codified as amended at 29 U.S.C. §§ 401 et seq.).

[3]For the purposes of LMRDA, a labor organization is defined as one engaged in an industry affecting commerce and includes any organization of any kind, any agency, or employee representation committee, group, association, or plan so engaged in which employees participate and which exists for the purpose, in whole or in part, of dealing with employers concerning grievances, labor disputes, wages, rates of pay, hours, or other terms or conditions of employment, and any conference, general committee, joint or system board, or joint council so engaged which is subordinate to a national or international labor organization, other than a state or local central body. 29 U.S.C. § 402(i).

[4]This report focuses on how OLMS administers LMRDA provisions that apply to labor organizations specifically. The scope of our review excludes provisions that pertain to requirements for employers, labor consultants, surety companies, and reports from individual officers and employees of a labor organization. In May 2024, the Department of Labor’s Office of Inspector General reported on LMRDA requirements related to persuader activity (from consultants hired by employers); this report contained six recommendations. See Department of Labor Office of Inspector General, OLMS Can Do More to Protect Workers’ Rights to Unionize Through Enforcing Persuader Activity Disclosure, 09-24-002-16-001 (Washington, D.C., May 2024), https://www.oig.dol.gov/public/reports/oa/2024/09-24-002-16-001.pdf.

[5]This analysis describes the contents of the 2023 compliance audit closing letters and results are not generalizable. Because the nature of compliance audits depends on the facts and circumstances of each individual matter, we did not assess or draw conclusions about the appropriateness of individual audit findings.

[6]OLMS released its fiscal year 2024 annual report in January 2025, after we completed most of our audit work. We incorporated an additional year of data when the report provided comparable updated information.

[7]To inform this review, we made multiple outreach attempts to labor organizations. One labor organization responded to our outreach. Accordingly, we used the information we received for context and did not report more broadly on labor organization perspectives.

[8]GAO, Standards for Internal Control in the Federal Government, GAO‑14‑704G (Washington, D.C.: Sept. 2014).

[9]OLMS also enforces elements of the Civil Service Reform Act of 1978 and the Foreign Service Act of 1980, which established similar provisions as LMRDA for labor organizations that represent federal workers.

[10]Title VI of the LMRDA includes various provisions which provide for the Secretary of Labor’s investigative authority under the act as well as establish criminal penalties for certain activities. Title VII of the LMRDA contains amendments to the Labor Management Relations Act, 1947.

[11]Generally, provisions in this section can only be enforced by members through private civil actions. The Secretary of Labor can enforce the right for members to receive a copy of the collective bargaining agreement.

[12]Fiduciary obligations are enforced only through private civil actions in any federal district court or any state court of competent jurisdiction. The LMRDA provides for criminal enforcement authority in instances of embezzlement and theft.

[13]OLMS assesses bonding level during compliance audits.

[14]According to officials, if OLMS becomes aware of a violation of a prohibited person holding office, either through the course of an investigation or from an inquiry, it will notify the labor organization and the Department of Justice as appropriate.

[15]OLMS officials said that the agency oversees labor organizations that represent federal employees, including from the Department of Labor. OLMS has administrative barriers in place, such as maintaining some information systems separate from the rest of the department, in support of carrying out these functions.

[16]Our scope of review did not include supporting activities performed by the Department of Justice or other agencies with which OLMS may coordinate.

[17]One of the agency’s goals is to promote labor organization democracy by enforcing standards for an estimated 7,000 annual officer elections established under the LMRDA. Officials said that they also investigate election complaints under the Civil Service Reform Act, which does not have the same 60-day requirement, although they aim to provide resolution for the case in a similar timeframe as investigations under LMRDA.

[18]According to OLMS officials, an election case is considered resolved when a voluntary compliance agreement is obtained, a lawsuit is filed, or when it is determined (marked by the date of a meeting between OLMS and the department’s legal counsel) that there was no violation that may have affected the outcome of the election. For the purposes of performance reporting, OLMS uses information outside its case management system to report on the days to resolve an election case.

[19]According to agency procedures, waivers should be used when necessary, such as needing more time for the labor organization to consider settlement proposals. Officials said that there are times when waivers are necessary because they are tracking multiple complaints for the same election or due to factors beyond OLMS’s control, such as a government shutdown. According to case data, OLMS used time waivers in 39-54 percent of cases in fiscal years 2019 through 2023.

[20]According to its most recent annual report, OLMS also received more election complaints than anticipated in fiscal year 2024.

[21]To be within OLMS’s jurisdiction, an election complaint must be timely, have exhausted all internal procedures available from the labor organization, and concern a labor organization under OLMS’s purview, among other criteria. A labor organization that represents only employees of state, county, or municipal governments is not subject to the laws administered by OLMS.

[22]According to data from fiscal years 2019 through 2023, 10–17 percent of election complaints were administratively closed because they did not meet requirements for further investigation. Complaints are administratively closed when some investigative resources are used to determine the complaint does not meet the requirements to open an investigation. A small number of cases are cancelled instead of administratively closed. These are cases where it is immediately apparent that the complaint is not in OLMS’s jurisdiction and no investigative resources are spent. OLMS publicly reports on the number of election complaint investigations conducted, but not on the number of complaints received. According to officials, the most common reasons a complaint is dismissed is because the complainant did not properly exhaust internal dispute procedures or file timely.

[23]Adequate safeguards include the right of any candidate to have an observer at the polls and at the counting of the ballots.

[24]Not all violations result in an election rerun.

[25]OLMS’s e-filing system performs some basic consistency checks for all reports when they are filed. These checks are not intended to assess the accuracy of the disclosures, as opposed to compliance audits, which are more comprehensive reviews conducted on a select group of labor organizations to assess their compliance with the LMRDA, including reporting requirements.

[26]A labor organization’s fiscal year does not necessarily coincide with the government’s fiscal year.

[27]According to OLMS officials, there are some limited instances in which a delinquent reports case is not opened, such as when a labor organization is already undergoing a separate investigation or audit. In these cases, OLMS would pursue the delinquent report under the case that is open.

[28]OLMS may have a delinquent report case open for a labor organization that is also on the chronically delinquent watch list.

[29]Each year, OLMS also selects some labor organizations for a compliance audit on a random basis.