ADVANCED MANUFACTURING

Aligning Strategies and Improving Agency Reviews Could Help Institutes Achieve National Goals

Report to Congressional Committees

United States Government Accountability Office

For more information, contact Hilary Benedict at benedicth@gao.gov.

Highlights of GAO-25-107369, a report to congressional committees

Aligning Strategies and Improving Agency Reviews Could Help Institutes Achieve National Goals

Why GAO Did This Study

Advanced manufacturing uses cutting-edge tools, methods, and materials to create high-value products, such as 3-D-printed aircraft parts. Congress established the Manufacturing USA Program in 2014 to stimulate U.S. leadership in advanced manufacturing, mainly through a national network of public-private partnership institutes.

Congress included a provision for GAO to report periodically on the Manufacturing USA Program. This report examines Program changes since fiscal year (FY) 2019, including in institute funding, and the extent to which institutes helped achieve advanced manufacturing goals.

GAO reviewed documents and data from the agencies and 17 institutes and interviewed agency officials and representatives of six institutes and 22 members. GAO selected agencies’ oldest institutes, as they had the most time to achieve the goals.

What GAO Recommends

GAO recommends Congress consider amending certain statutory requirements to better align Manufacturing USA’s strategic planning timeframes with those for updating the National Strategy for Advanced Manufacturing.

GAO recommends that DOD and DOE track timeframes for reviewing project funding or membership application requests and analyze the information for potential improvements. The agencies generally concurred with the recommendations.

What GAO Found

The Departments of Commerce, Defense (DOD), and Energy (DOE) coordinate the Manufacturing USA Program and sponsor its institutes. Institute members, such as manufacturers and universities, help fund the institutes and conduct advanced manufacturing research and development (R&D) and workforce training. Key changes to the Program since FY 2019 included establishing new institutes—expanding the network from 14 to 17, as of December 2024. Also, Commerce formed a task team with DOD and DOE to continue implementing GAO’s prior recommendations to develop networkwide performance metrics. Another task team has begun developing common policies on membership by entities from China or other countries of concern.

Commerce led the update of the strategic plan for the Manufacturing USA Program released in October 2024. However, Commerce officials described challenges. Specifically, the planning cycle required in statute does not align with mandatory 4-year updates to the National Strategy for Advanced Manufacturing. Aligning the strategic planning timeframes could better ensure the Manufacturing USA Program plan reflects the priorities of the national strategy.

The 17 institutes generally increased their overall funding, memberships, technical capabilities, and activity on R&D and workforce training projects. In general, the institutes diversified their funding sources away from sponsoring agency baseline funding by also obtaining other federal funding, such as federal awards for certain projects, and nonfederal funds, like membership dues.

The six selected institutes and 22 members GAO interviewed described institutes’ progress toward developing new technologies, building supply chain resilience, or other advanced manufacturing goals. However, they identified challenges, including long, uncertain timeframes for DOD and DOE to review some institutes’ requests to fund new projects or membership applications. By not tracking review times, DOD and DOE could delay institutes’ progress toward advanced manufacturing goals or discourage members’ participation.

Abbreviations

|

AFFOA |

Advanced Functional Fabrics of America Institute |

|

AI |

artificial intelligence |

|

AIM Photonics |

American Institute for Manufacturing Integrated Photonics |

|

America Makes |

The National Additive Manufacturing Innovation Institute |

|

AMMTO |

Advanced Materials and Manufacturing Technologies Office |

|

AMNPO |

Advanced Manufacturing National Program Office |

|

ARM Institute |

Advanced Robotics for Manufacturing Institute |

|

BioFabUSA |

Advanced Regenerative Manufacturing Institute |

|

BioMADE |

Bioindustrial Manufacturing and Design Ecosystem |

|

CESMII |

Clean Energy Smart Manufacturing Innovation Institute |

|

CHIPS |

Creating Helpful Incentives to Produce Semiconductors |

|

CyManII |

Cybersecurity Manufacturing Innovation Institute |

|

DOD |

Department of Defense |

|

DOE |

Department of Energy |

|

EPIXC |

Electrified Processes for Industry without Carbon |

|

FY |

fiscal year |

|

IACMI |

Institute for Advanced Composites Manufacturing Innovation |

|

IEDO |

Industrial Efficiency and Decarbonization Office |

|

JDMC |

Joint Defense Management Council |

|

LIFT |

Lightweight Innovations For Tomorrow |

|

ManTech |

Manufacturing Technology Program |

|

MEP |

Hollings Manufacturing Extension Partnership |

|

MxD |

Manufacturing Times Digital |

|

NextFlex |

America’s Flexible Hybrid Electronics Manufacturing Institute |

|

NIIMBL |

National Institute for Innovation in Manufacturing Biopharmaceuticals |

|

NIST |

National Institute of Standards and Technology |

|

PowerAmerica |

Next Generation Power Electronics Manufacturing Innovation Institute |

|

R&D |

research and development |

|

RAMI Act |

Revitalization American Manufacturing and Innovation Act of 2014, as amended |

|

RAPID |

Rapid Advancement in Process Intensification Deployment Institute |

|

REMADE |

Reducing Embodied-energy And Decreasing Emissions |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

June 4, 2025

Congressional Committees

Advanced manufacturing—which combines cutting-edge tools, methods, and materials in the design and fabrication of high-value products and components—can reduce costs and raise productivity by enabling flexible and customizable manufacture of goods. The resulting products are wide-ranging, from replacement parts produced on demand for military aircraft to human skin regrown from burn victims’ own cells. The flexibility of some advanced manufacturing tools and methods, such as 3-D printing, can enable production virtually anywhere—potentially reducing supply chain risks such as reliance on foreign suppliers. The flexibility can also allow products to be customized or made in small quantities when doing so through traditional manufacturing would be too difficult or too costly.

In recent decades, the U.S. has lagged behind other nations in the production of semiconductors and other advanced technology products. The U.S. trade deficit in advanced technology goods exceeded $200 billion in 2023.[1] Furthermore, the U.S. risks falling behind China in deploying advanced manufacturing technologies and training the advanced manufacturing workforce, according to a 2021 report.[2]

Laws, such as the Revitalize American Manufacturing and Innovation Act of 2014 (as first enacted, the original RAMI Act, and as amended, the RAMI Act), have sought to reverse such trends.[3] The RAMI Act directs the Secretary of Commerce to establish the Manufacturing USA Program to stimulate U.S. leadership in advanced manufacturing research, innovation, and technology and to accelerate development of the advanced manufacturing workforce, among other purposes.[4] The act directs the Secretary of Commerce to do so mainly by establishing a network of advanced manufacturing institutes.[5] As of December 2024, this network comprises 17 public-private partnership institutes that support research and development (R&D) on specific advanced manufacturing technologies and provide workforce education and training.

Each of the 17 institutes was established by a federal department. The Department of Commerce sponsors one institute; the Department of Defense (DOD) sponsors nine institutes; and the Department of Energy (DOE) sponsors seven institutes. Because these departments have generally maintained their sponsorship of the institutes, we refer to them herein as sponsoring agencies. These sponsoring agencies provide funding for the institutes’ operations, known as baseline funding, through financial assistance awards to nonfederal entities that manage and operate the institutes. Institute members—including private companies, universities, and others—help fund the institutes through annual dues and may contribute funding or in-kind resources for R&D or workforce education and training projects. Institute members may propose such projects in response to institute project calls and collaboratively plan and carry them out with other members. Results of projects can vary widely, including new training curricula, data on manufacturing process improvements, new software programs, device prototypes, or other innovations.

The institutes were initially envisioned to become financially self-sustaining within 5 to 7 years of their establishment.[6] However, amendments to the RAMI Act in 2019 allow Commerce and DOE to renew financial assistance awards to institutes, subject to a rigorous merit review prior to renewal, as well as require a performance assessment of each institute every 5 years after the initial award.[7] According to DOD officials, DOD and its nine institutes are not subject to the RAMI Act.[8]

The RAMI Act also includes a provision for GAO to report on the Manufacturing USA Program every 3 years through 2030. Specifically, we are to review the management, coordination, and industry utility of the Program, including the progress made in achieving national and programmatic goals for advanced manufacturing and in implementing prior GAO recommendations.[9] This is our fourth review under that provision and follows our report from December 2021.[10]

This report examines (1) key changes in the management, operation, and governance of the Manufacturing USA Program and its institutes since fiscal year (FY) 2019 and further changes planned; (2) how sponsoring agencies assess the institutes’ performance, including financial sustainability, and how institutes’ funding sources have changed; and (3) the extent to which selected institutes’ efforts have helped achieve national and programmatic advanced manufacturing goals, and any challenges they face in achieving the goals.

To address these objectives, we gathered and analyzed documentation and interviewed officials from the three sponsoring agencies. Specifically:

· For the first objective, we analyzed strategic plans, agency financial assistance awards to institutes, and other documents, and interviewed agency officials to obtain information about changes since FY 2019. We also collected data from the 17 institutes on key changes during the 5-year period from FY 2019 through FY 2023 in institute funding, membership, R&D and workforce education and training projects, and other topics.

· To address the second objective, we gathered and analyzed documents and interviewed agency officials on processes and metrics to assess institutes’ performance. We also collected data from the 17 institutes on baseline funding received in FY 2019 through FY 2023 from the sponsoring agencies and other funding sources. We determined the data were sufficiently reliable for our purposes.

· To address the third objective, we interviewed officials from six institutes—selected to represent the oldest institutes across the three sponsoring agencies—about their efforts to achieve advanced manufacturing goals and challenges they faced. We also interviewed a nongeneralizable sample of 22 members of the six institutes about their experience and challenges.

See appendix I for more information on our scope and methodology.

We conducted this performance audit from February 2024 to June 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Manufacturing USA Program

A number of efforts by the White House to study and promote advanced manufacturing in the U.S. led to Congress’s passage of the original RAMI Act and establishment of the Manufacturing USA Program.[11] For example, the President’s Council of Advisors on Science and Technology issued a series of reports beginning in June 2011 that recommended a national network of advanced manufacturing institutes to help bridge the “valley of death.” This is the gap that frequently occurs between the early stages of technology R&D and the later stages of commercialization of that technology by industry. Additionally, in January 2013, the National Science and Technology Council proposed a national manufacturing innovation network, which was later formalized under the original RAMI Act.[12]

There are two types of Manufacturing USA institutes: (1) those that receive financial assistance authorized under the RAMI Act and (2) those established by agencies using other legal authorities but which are part of the Manufacturing USA Program. The first category includes the Commerce-sponsored National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL) and the DOE-sponsored Electrified Processes for Industry without Carbon (EPIXC) institute.[13] The remaining 15 institutes were established by DOD and DOE using different statutory funding authorities. Specifically, DOD-sponsored institutes were established under authorities provided to its Manufacturing Technology Program, and DOE-sponsored institutes were established under the Energy Policy Act of 2005.[14]

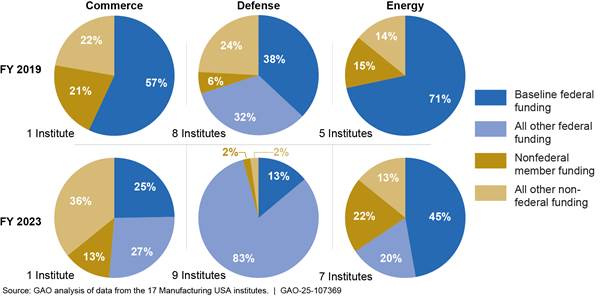

Figure 1 shows the Manufacturing USA network of institutes as of December 2024.

Offices within the three sponsoring agencies oversee their agency’s Manufacturing USA institutes and coordinate their agency’s participation in the Manufacturing USA Program:

· Commerce. Commerce oversees and provides financial assistance to Commerce-sponsored institutes. The Secretary of Commerce is required to establish a national program office within the National Institute of Standards and Technology (NIST) to oversee and carry out the Program, per the RAMI Act. This office is known as the Advanced Manufacturing National Program Office (AMNPO).[15] The RAMI Act specifies a number of functions for the national program office.[16] One function of AMNPO is to facilitate cooperation and coordination between the Program and those of other federal departments and agencies whose missions contribute to or are affected by advanced manufacturing.[17] In carrying out this function, AMNPO brings together sponsoring agencies and other federal agencies into an interagency team.[18] The entire effort is known collectively as Manufacturing USA.

· Defense. DOD’s advanced manufacturing efforts and Manufacturing USA Program coordination are overseen by the Manufacturing Technology (ManTech) Program.[19] Contracting personnel within DOD’s military services help ManTech administer DOD’s financial assistance awards for the institutes. Program managers within the military services help the services and ManTech oversee the institutes.

· Energy. Two offices within DOE’s Office of Energy Efficiency and Renewable Energy—the Advanced Materials and Manufacturing Technologies Office (AMMTO) and the Industrial Efficiency and Decarbonization Office (IEDO)—oversee DOE’s Manufacturing USA institutes and coordinate the agency’s participation in the Manufacturing USA Program. Grants officers and others in the Office of Energy Efficiency and Renewable Energy help these offices administer DOE’s financial assistance awards for the institutes, according to DOE officials.

Advanced Manufacturing Goals

We analyzed various sources and identified four national and programmatic advanced manufacturing goals: (1) developing and implementing advanced manufacturing technologies; (2) growing the advanced manufacturing workforce; (3) building resilience into U.S. manufacturing supply chains; and (4) promoting Manufacturing USA institutes’ financial sustainability. The sources we analyzed included

· The RAMI Act. The act includes nine Program purposes to improve the competitiveness of U.S. manufacturing through accelerating innovation and developing advanced manufacturing capabilities.[20] The purposes include stimulating leadership in advanced manufacturing research, innovation, and technology; accelerating development of an advanced manufacturing workforce; and creating and preserving jobs, among other purposes.

· Manufacturing USA Program Strategic Plan. AMNPO released the most recent strategic plan in October 2024. Previous plans were released in February 2016 and January 2021.[21]

· National Strategy for Advanced Manufacturing. The National Science and Technology Council within the Executive Office of the President updates the national strategy every 4 years. This strategy, which was last updated in October 2022, outlines U.S. advanced manufacturing priorities and goals, such as supporting manufacturing advancements in specific technologies, including semiconductors, and enhancing supply chain interconnections and workforce training.[22]

For more on this analysis, see appendix II.

Manufacturing USA Network and Activities Grew Even with Strategic Planning Challenges and Some Delays in Agency Funding

Agencies Expanded the Manufacturing USA Network and Made Other Changes, But Commerce Officials Identified Strategic Planning Challenges

Since FY 2019, the three sponsoring agencies initiated several key management, operation, and governance changes. Specifically, the agencies supported and expanded the network of institutes, made changes to the Manufacturing USA Program governance, and began implementing new Program requirements in the CHIPS and Science Act of 2022.[23] In addition, Commerce took steps toward implementing two recommendations from our May 2019 report related to network-wide performance measures but has not yet fully implemented them.[24]

|

The Electrified Process for Industry without Carbon (EPIXC) Institute Launched in Tempe, Arizona, in May 2023, this institute focuses on electric heating technologies to reduce manufacturing carbon emissions and is sponsored by DOE’s Industrial Efficiency and Decarbonization Office. The institute reported initial fiscal year 2024 activities, such as technology road mapping and securing facilities, and institute officials told us they were reviewing over 100 applications from new members at the time of our review. In October 2024, DOE announced five new EPIXC projects to reduce industrial emissions in communities across the country, according to DOE’s website. Examples of the projects include developing microwave plasma heating technologies in steel manufacturing, electrified calcination in cement manufacturing, and electromagnetic heating in propane manufacturing. Source: GAO analysis of institute data and Department of Energy (DOE) information. | GAO 25-107369 |

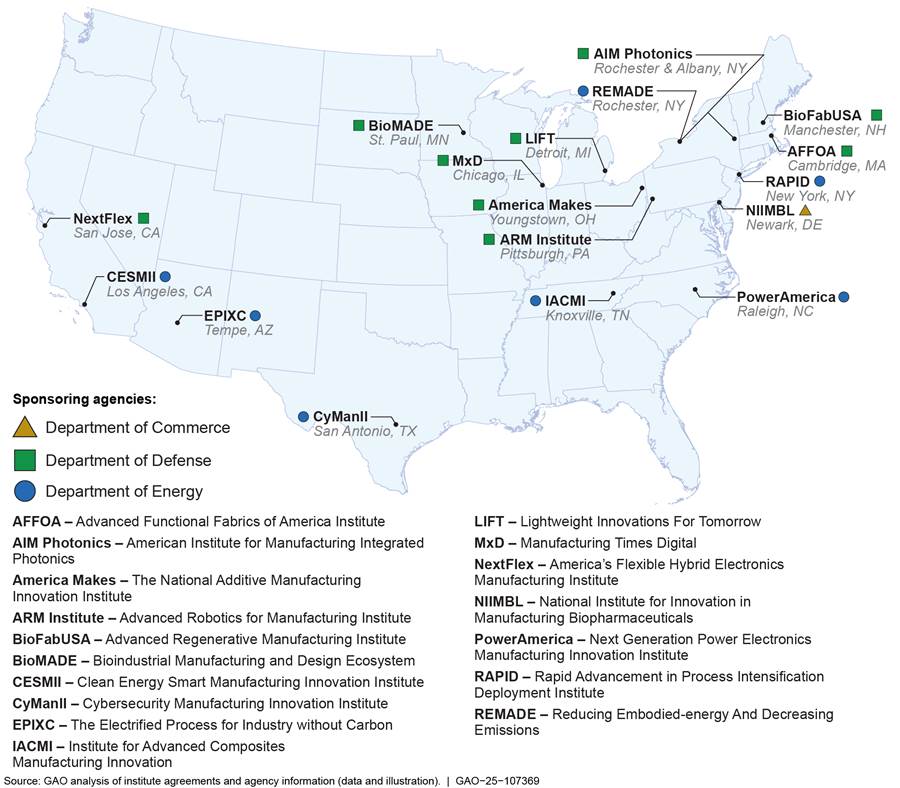

Support and expansion of the Manufacturing USA network. The sponsoring agencies have continued to support and expand the Manufacturing USA network of institutes. Since FY 2019, the agencies renewed their financial assistance agreements with 12 institutes and, as of December 2024, agency officials said they were in the process of renewing 1 more.[25]

Also, three new institutes were added to the Manufacturing USA network—one DOD and two DOE institutes—bringing the total number of institutes to 17 (see fig. 2). Specifically, DOD established its newest institute, Bioindustrial Manufacturing and Design Ecosystem (BioMADE), in October 2020. DOE established its Cybersecurity Manufacturing Innovation Institute (CyManII) in September 2020 and EPIXC—the newest institute in the Manufacturing USA network during the period of our review—in May 2023 (see sidebar). Although EPIXC did not begin operating until FY 2024, institute officials told us they received agency authorization to spend federal funds in FY 2023.[26]

Figure 2 shows the performance periods for each institute’s financial assistance agreement with its sponsoring agency, including extensions and follow-on agreements.

Figure 2: Performance Periods for Sponsoring Agencies’ Financial Assistance Awards to Manufacturing USA Institutes, as of December 2024

Note: Chart reflects initial and follow-on financial assistance awards as well as extensions. Dates cover the base performance period of financial assistance awards and do not include optional periods available on some awards.

Furthermore, Commerce is establishing two new institutes in 2025—one under the CHIPS and Science Act of 2022 and the other under Commerce’s authority under the RAMI Act.[27] In 2024, Commerce solicited proposals for an institute focused on digital twins in semiconductor manufacturing and an institute focused on artificial intelligence (AI) for resilient manufacturing.[28] In January 2025, Commerce announced a $285 million award for the semiconductor-related institute, which will be headquartered in North Carolina.[29] In December 2024, Commerce officials said they plan to select an awardee for the AI institute in early 2025. The number of Manufacturing USA institutes will total 19 once the AI-focused institute is established.

At the same time, the number of Manufacturing USA institutes could continue to change in the future. DOE officials told us in December 2024 that the agency does not plan to renew its financial assistance award to the Reducing Embodied-energy And Decreasing Emissions (REMADE) institute after the current award ends in 2026. REMADE conducts R&D on technologies to recycle and reuse metals, fibers, and other materials. The officials said DOE’s portfolio in this area had changed significantly, and the agency determined that an institute was no longer the most effective mechanism for meeting its goals. They said it was too soon to know whether the institute would remain within the Manufacturing USA network without DOE’s sponsorship. In addition, while the CHIPS and Science Act of 2022 authorized Commerce to establish up to three new semiconductor-related Manufacturing USA institutes, Commerce officials told us in December 2024 that they do not have plans to establish additional semiconductor institutes other than the digital twin institute discussed above.

Changes to Manufacturing USA Program governance. Under Commerce’s lead, the agencies made changes to the Manufacturing USA Program’s governance, including updating the Program’s strategic plan, standing up the Manufacturing USA Council, and establishing new coordination mechanisms.

Updated strategic plan. In October 2024, Commerce released an updated strategic plan for the Manufacturing USA Program:[30] The updated plan retained the first three goals of the previous plan—to (1) increase the competitiveness of U.S. manufacturing; (2) create and facilitate the transition of innovative technologies into scalable, cost-effective, and high-performing domestic manufacturing capabilities; and (3) accelerate the development of an advanced manufacturing workforce.

The updated plan includes a revised fourth goal for the Program—to promote a network of institutes that build long-term support for and within their communities. According to the plan, an interagency team updated the fourth goal to incorporate lessons learned, enhance the effects of the Program, and meet current national needs.[31]

Although Commerce issued an updated strategic plan, AMNPO officials described two challenges with the RAMI Act requirement to update the Manufacturing USA strategic plan every 3 years. First, the deadline in the act for updating the plan can fall at or near the end of a presidential 4-year term, as it did for the October 2024 update. As a result, the current strategic plan essentially reflects priorities of the prior administration, which may not align with priorities of the administration implementing the plan.

Second, the 3-year planning cycle for the Manufacturing USA strategic plan is not in sync with requirements for updating the National Strategy for Advanced Manufacturing. This National Strategy is to be updated every 4 years by the National Science and Technology Council, as required by the America COMPETES Reauthorization Act of 2010, as amended.[32] This Council updated the National Strategy in October 2022 and is working on the next update, expected in 2026, according to the AMNPO officials.

The AMNPO officials told us that, as a result, they are considering updating the Manufacturing USA strategic plan starting in 2025 to better align with the forthcoming National Strategy and the new administration. However, doing so would entail restarting the planning cycle very soon into the current plan.

In July 2023, we identified practices to help manage and assess the results of federal efforts.[33] We found that one practice is to define the goals of federal efforts, which guide organizations’ activities and allow decision makers and stakeholders to assess performance. Aligning goals across organizational levels is one key action that can help to implement this practice. However, the AMNPO officials said that the differing planning cycles among the strategic plans, as required in statute, make it difficult to ensure the goals for the Manufacturing USA strategic plan align with those of the National Strategy. Aligning the timeframes for updating these plans could help ensure that lower-level goals, such as those of the Manufacturing USA Program, reflect higher-level national goals and the goals of the executive administration that is implementing them. Also, rather than revisiting strategic plans soon after issuance, it could increase the efficiency of the planning process over the long term, which the AMNPO officials said involves many contributors and can be lengthy.

New advisory councils. Since FY 2019, AMNPO or the institutes established two new councils to improve institute collaboration. First, AMNPO established the Manufacturing USA Council in May 2023, as required by the CHIPS and Science Act of 2022.[34] The Manufacturing USA Council includes the heads of Manufacturing USA institutes receiving federal funding at any time. The Council is designed to foster collaboration among the institutes and work with AMNPO in carrying out its functions, according to the Council’s charter.[35] One of the Council’s efforts has been to create a task team to improve coordination between the Manufacturing USA Program and Commerce’s Manufacturing Extension Partnership Program, which aids small- and medium-sized manufacturers.[36]

Additionally, in April 2023, the institute directors established a U.S. Manufacturing Innovation Council as a 501(c)(6) nonprofit corporation. The council promotes collaboration among the institutes for the purpose of advocating policy positions to Congress that would support advanced manufacturing R&D, according to the council’s corporate filings and institute directors we interviewed. This is in contrast to the Manufacturing USA Council, which does not advocate to Congress and includes federal employees.

Studying implementation of new requirements on foreign membership. The CHIPS and Science Act of 2022 also required the sponsoring agencies, in consultation with Commerce, to make policies that include a process to review and approve or deny Manufacturing USA institute membership to foreign-owned organizations, particularly from China or other countries of concern.[37] In April 2024, sponsoring agency officials established a working group to review existing policies and establish procedures across the agencies for screening foreign entities participating in the Manufacturing USA Program, according to Commerce officials. At the time of our review, the officials told us the working group had met, but they did not yet know when the group would complete its work or when the agencies would implement any new process changes.

Commerce officials said the working group intends to develop more uniform policies for foreign membership of institutes. Sponsoring agency and institute officials told us that existing policies and processes to screen current or potential members for foreign ownership had similarities but also varied. For example, some institutes said their policies disallow membership to entities from China and other countries of concern, and some institutes and agencies said the institutes only allow membership to entities with a substantial U.S. manufacturing presence. Some institute officials also told us the terms and conditions in their financial assistance agreements include having policies for limiting or excluding foreign membership. However, not all institutes used the same definitions of foreign ownership or screening process. For example, DOD officials told us that while there is not a single definition, most DOD institutes base a determination of whether there is a substantial U.S. presence on the number of people involved in manufacturing, rather than just sales or R&D. Alternatively, Commerce officials said that foreign entities would need to have R&D or manufacturing facilities inside the U.S. that align with institutes’ technology focus areas.

Status of prior GAO recommendations. Commerce has recently taken steps toward, but has not fully implemented, two recommendations on performance management from our May 2019 report.[38] The first recommendation was for Commerce to work with other sponsoring agencies to develop and implement network-wide performance goals for the Manufacturing USA Program with measurable targets and time frames. The second was for Commerce to ensure that the Manufacturing USA network-wide performance measures are directly aligned with the network-wide performance goals, the Manufacturing USA strategic objectives and Program goals, and the statutory purposes of the RAMI Act.

Commerce continues to make progress on these recommendations. AMNPO officials told us they had formed a working group with DOD and DOE to develop and implement network-wide performance measures and goals for the Manufacturing USA Program. As discussed in the October 2024 Manufacturing USA Program Strategic Plan, the working group plans to evaluate and improve the Program’s measures based on program goals and other considerations. The plan also states that the Program will pilot a revised set of measures, which is expected to be completed by 2027. AMNPO officials said that they anticipate these revised performance measures will align with the Manufacturing USA strategic objectives and Program goals.[39] We continue to believe that by working with DOD and DOE to fully implement our prior recommendations—including developing measurable targets and time frames—Commerce could better observe and report on the Program’s overall progress made toward achieving the statutory purposes of the Manufacturing USA Program.

Agency reorganization. In 2022, DOE reorganized its former Advanced Manufacturing Office into two new offices—AMMTO and IEDO—to better align DOE-funded R&D and other efforts, including its Manufacturing USA institutes, with DOE’s technical focus areas. Under the reorganization, AMMTO, which funds efforts to develop manufacturing technologies, now oversees five of the seven DOE institutes. IEDO, which funds efforts to reduce industrial energy use and emissions, oversees the remaining two. In addition, officials told us that the new offices have formed relationships with a new Office of the Under Secretary for Infrastructure. DOE established the new office in 2022 to focus on large-scale technology demonstrations. The DOE officials told us the new office may provide opportunities for scaling up R&D at DOE’s Manufacturing USA institutes.

Institutes’ Overall Funding, Number of Projects, Membership, and Capabilities Generally Increased from Fiscal Year 2019 through 2023

From FY 2019 through FY 2023, the Manufacturing USA institutes—particularly the Commerce and DOD institutes—generally increased their overall funding, numbers of R&D and workforce projects, membership, and capabilities, despite funding delays at some institutes.

Institutes’ overall funding. Institutes’ overall funding increased between FY 2019 and FY 2023, particularly those sponsored by Commerce and DOD, according to data from the 17 institutes (see table 1).

Table 1: Funding Received by Manufacturing USA Institutes in Fiscal Years (FY) 2019 through 2023 (millions of dollars, inflation adjusted to FY 2023)

|

Sponsoring agency |

2019 |

2020 |

2021 |

2022 |

2023 |

Percent change FY 2019 |

|

Commerce (1 institute) |

22 |

31 |

116 |

34 |

56 |

+159 |

|

Defense (9 institutes) |

266 |

215 |

384 |

290 |

729 |

+174 |

|

Energy (7 institutes) |

49 |

59 |

68 |

66 |

68 |

+40 |

Source: GAO analysis of data from the 17 Manufacturing USA institutes. | GAO‑25‑107369

Note: Rows reflect funds received by institutes, as they reported to us, and do not reflect the value of in-kind contributions of goods or services received. Amounts may differ from agency obligations or institute expenditures. Not all institutes reported receiving funding in all years. Specifically, DOD’s BioMADE and DOE’s CyManII institutes began operating in 2021 and did not receive funding in FY 2019 and 2020. DOE’s EPIXC institute was established in May 2023 but did not begin operating until FY 2024.

As part of its overall increase, Commerce’s institute, NIIMBL, received almost $9 million from the CARES Act in FY 2020 and $83 million from the American Rescue Plan Act of 2021 in FY 2021 to prepare for, prevent the spread of, and respond to the coronavirus pandemic.[40]

Eight of DOD’s nine institutes increased their overall funding from FY 2019 through FY 2023. In particular, DOD’s BioMADE institute received $350 million in FY 2023 to develop a network of bioindustrial manufacturing plants (see sidebar).

|

BioMADE Institute Experienced Significant Growth Since it began in 2020 in St. Paul, Minnesota, the Department of Defense’s Bioindustrial Manufacturing and Design Ecosystem (BioMADE) institute experienced significant growth. Bioindustrial manufacturing involves the use of living organisms, cells, tissues, enzymes, or cell-free systems to produce materials and products for non-pharmaceutical applications. BioMADE reported annual revenues of approximately $18 million in FY 2021 and $378 million in FY 2023. It also reported 67 active projects, 240 members, and 55 full-time employees in FY 2023. In 2022, Congress directed DOD to invest in a network of bioindustrial manufacturing facilities to support and scale processes for production of chemicals, materials, and other products necessary to support national security or secure fragile supply chains. (James M. Inhofe National Defense Authorization Act for Fiscal Year 2023, Pub. L. No. 117-263, § 215, 136 Stat. 2395, 2472 (2022)). DOD officials told us they helped BioMADE prepare a proposal and receive over $350 million in under 6 weeks from the funding opportunity’s creation. BioMADE also received funding from the state of Minnesota and, in 2023, announced its intention to establish its first bioindustrial manufacturing campus in that state. BioMADE is exploring opportunities with six other states—California, Georgia, Hawaii, Indiana, Iowa, and North Carolina—to establish additional bioindustrial manufacturing facilities and has plans to expand to a network of 12 to 15 facilities nationwide, according to the institute. Source: GAO analysis of institute data. | GAO 25-107369 |

While combined funding for DOE’s seven institutes increased during this period, two institutes experienced a substantial increase. In one case, the increase exceeded 400 percent. Another DOE institute, EPIXC, was new and reported receiving no funding during the period. Overall funding for other DOE institutes decreased slightly during the period.

R&D and workforce development projects. The combined number of active R&D and workforce projects at institutes increased for two of the agencies, Commerce and DOD, and decreased slightly at DOE-sponsored institutes from FY 2019 through FY 2023 (see table 2). R&D projects composed the majority of projects for all three agencies’ institutes.

Table 2: Annual Number of Active Projects at Manufacturing USA Institutes, by Sponsoring Agency, Fiscal Years (FY) 2019 through 2023

|

Sponsoring agency |

2019 |

2020 |

2021 |

2022 |

2023 |

Percent change, FY 2019 to FY 2023 |

|

Commerce (1 institute) |

40 |

58 |

77 |

82 |

76 |

+90 |

|

R&D projects |

26 |

43 |

61 |

71 |

62 |

|

|

Workforce education projects |

14 |

15 |

16 |

11 |

14 |

|

|

Defense (9 institutes) |

445 |

354 |

461 |

568 |

645 |

+45 |

|

R&D projects |

357 |

259 |

323 |

398 |

466 |

|

|

Workforce education projects |

88 |

95 |

138 |

170 |

179 |

|

|

Energy (7 institutes) |

175 |

206 |

182 |

179 |

160 |

-9 |

|

R&D projects |

135 |

167 |

155 |

152 |

133 |

|

|

Workforce education projects |

40 |

39 |

27 |

27 |

27 |

|

Source: GAO analysis of data from the 17 Manufacturing USA institutes. | GAO‑25‑107369

Note: Rows reflect the number of projects active in a given year and may include projects that institutes initiated in that year or in a prior year. Not all institutes reported conducting projects in all years. Specifically, DOD’s BioMADE and DOE’s CyManII institutes began operating in 2021 and thus did not conduct projects in FY 2019 and 2020. DOE’s EPIXC institute was established in May 2023 but did not begin operating until FY 2024.

Because projects’ scopes, resources, and duration can vary, we compared the number of institutes’ projects to data on the institutes’ project expenditures. Combined project expenditures for Commerce and DOD institutes also increased from FY 2019 through FY 2023, although at a higher rate than the increase in the number of projects. Specifically, project expenditures at Commerce’s institute increased by roughly 400 percent during the period, while project expenditures at DOD’s institutes roughly doubled. Also, NIIMBL officials reported that the institute obtained new funding sources for projects and added new R&D capacity, such as NIIMBL-directed programs to focus R&D in specific areas, a faculty fellows program for guest researchers, and research by permanent R&D staff of the institute, in addition to existing project calls for member-led R&D.

For DOE’s institutes, the combined number of projects decreased slightly from FY 2019 through FY 2023, according to institute data. Officials with one institute, PowerAmerica, told us the institute’s total project expenditures decreased by roughly 80 percent from $19 million in FY 2019 to under $4 million in FY 2023, and the number of active projects decreased by roughly the same percentage in those years. The institute reduced its project work after experiencing a lapse in funding from DOE, which we will discuss later.

Institute membership. Combined membership steadily increased at the three agencies’ institutes, according to our analysis of institute data (see table 3). Seven institutes, including a mix of new and more established institutes across the three agencies, grew their memberships by 50 percent or more.

Table 3: Annual Number of Members of Manufacturing USA Institutes, by Sponsoring Agency, Fiscal Years (FY) 2019 through 2023

|

Sponsoring agency |

2019 |

2020 |

2021 |

2022 |

2023 |

Percent change, FY 2019 to FY 2023 |

|

Commerce (1 institute) |

139 |

178 |

200 |

218 |

226 |

+63 |

|

Defense (9 institutes) |

1,596 |

1,720 |

1,815 |

1,983 |

2,233 |

+40 |

|

Energy (7 institutes) |

461 |

486 |

594 |

638 |

698 |

+51 |

Source: GAO analysis of data from the 17 Manufacturing USA institutes. | GAO‑25‑107369

Note: Rows represent the peak number of institute members in a given fiscal year. Not all institutes reported membership in all years. Specifically, DOD’s BioMADE and DOE’s CyManII institutes began operating in 2021 and did not have members in FY 2019 and 2020. DOE’s EPIXC institute was established in May 2023 but did not begin operating until FY 2024.

The overall mix of entities that were members was generally stable over time (see table 4). Of the different types of entities we analyzed, small- or medium-sized businesses composed the largest proportion, in total, of institutes’ members. Academic institutions composed the next largest proportion. Large businesses and other entities, such as federal laboratories and non-profit organizations, composed the rest.

Table 4: Percentage of Manufacturing USA Institute Members, by Type of Entity, March 2020 and June 2024

|

Sponsoring agency |

Small- or medium-sized businesses |

Large businesses |

Academic institutions |

Other entities |

|

Commerce |

|

|

|

|

|

2020 (1 institute) |

33 |

7 |

39 |

20 |

|

2024 (1 institute) |

31 |

10 |

37 |

22 |

|

Defense |

|

|

|

|

|

2020 (7 institutes) |

49 |

17 |

20 |

13 |

|

2024 (8 institutes) |

52 |

11 |

21 |

15 |

|

Energy |

|

|

|

|

|

2020 (5 institutes) |

35 |

24 |

26 |

15 |

|

2024 (6 institutes) |

39 |

23 |

24 |

14 |

|

Total |

|

|

|

|

|

2020 (13 institutes) |

44 |

18 |

23 |

14 |

|

2024 (15 institutes) |

47 |

14 |

23 |

15 |

Source: GAO analysis of data from Manufacturing USA institutes. | GAO‑25‑107369

Note: Rows may not sum to 100 percent due to rounding. For this analysis, we compared membership lists as of around March 2020 to lists current as of around June 2024 or reviewed other data from institutes. We included DOD’s BioMADE institute and DOE’s CyManII in the analysis for 2024 but not 2020, because those institutes were established after 2020. We did not include DOD’s LIFT or DOE’s EPIXC institutes in this analysis.

Officials from most of the 17 institutes reported that their institute had changed its membership tiers, benefits, or fees to help retain members and encourage new ones. Specifically, officials from seven institutes told us their institute had reduced membership costs. For example, some institute officials said institutes reduced fees for one or more membership tiers or created new, lower-cost tiers. Officials from two institutes said institutes extended benefits available to higher-tier members—such as access to intellectual property from institute projects—to members at lower tiers. Officials from one DOE institute reported it increased membership fees but added new, lower tier levels to reduce the barrier to membership for smaller companies and academic institutions.

In addition, officials from 9 of the 17 institutes told us institutes would like to see future changes in the size or mix of their members. For example, officials from DOD’s BioMADE institute told us they would like to recruit more medium and large businesses and members that are headquartered in states where the institute does not currently have members. Officials from other institutes said institutes would like to attract members with additional technical capabilities to support R&D projects. Officials from DOE’s cybersecurity institute, CyManII, told us the institute wants to increase membership at the local and national levels to help it and members better respond to potential cyber threats.

Other changes at institutes. Officials with institutes from all three agencies reported making other substantial changes, such as adding technical capabilities, changing technical focus areas, increasing the number of employees, or making management or governance changes from FY 2019 through FY 2023 (see table 5).

Table 5: Number of Manufacturing USA Institutes Reporting Substantial Changes in Fiscal Years (FY) 2019 through 2023

|

Sponsoring agency |

Made substantial equipment or facility upgrades |

Made substantial changes to technical focus areas |

Increased employees by 50 percent or more |

Made substantial management or governance changes |

|

Commerce (1 institute) |

1 of 1 |

0 of 1 |

1 of 1 |

1 of 1 |

|

Defense (9 institutes) |

7 of 9 |

6 of 9 |

6 of 9 |

6 of 9 |

|

Energy (7 institutes) |

2 of 7 |

1 of 7 |

0 of 7 |

3 of 7 |

Source: GAO analysis of data from the 17 Manufacturing USA institutes. | GAO‑25‑107369.

Note: Not all institutes reported changes in all years. Specifically, DOE’s EPIXC institute was established in May 2023 but did not begin operating until FY 2024.

Officials from ten institutes across the three agencies told us they acquired substantial new facilities or equipment for conducting their research missions. For example, officials from DOD’s AFFOA institute told us the institute opened regional “fabric discovery centers” in Massachusetts and Pennsylvania to help focus R&D and prototyping of advanced fabrics and fibers into different areas, including defense, functional fabrics for everyday use, and “smart” fabrics integrated with other technologies. Additionally, officials with DOE’s CyManII institute told us the institute opened a 17,000-square-foot “cybersecurity for manufacturing” facility near San Antonio, Texas, focused on technology demonstration, engineering consulting, and hands-on workforce training.[41]

Officials from seven institutes, mainly DOD-sponsored institutes, told us the institute made significant changes to its technology focus areas. For example, officials from DOD’s LIFT institute told us the institute expanded its original focus on reducing the weight of manufacturing materials to include R&D into other advanced materials, manufacturing processes, and systems engineering. In addition, officials from DOD’s NextFlex institute told us the institute expanded its original focus on certain bendable and flexible electronics to include a broader range of these electronics, because industry was expanding into those technologies.

Finally, officials from seven institutes in Commerce and DOD said the institute increased its staff by at least 50 percent from FY 2019 through FY 2023.These increases in staff generally tracked with institutes’ increases in membership, funding, or technical capabilities. In contrast, no officials from DOE’s institutes reported an increase of 50 percent or more in the number of employees, and officials from one institute, PowerAmerica, told us the institute downsized from 12 to four employees after its baseline funding from DOE temporarily ended in FY 2020. In addition, officials from institutes across all three agencies said the institutes made leadership changes, established new advisory councils, or made other substantial management or governance changes.

A Few Institutes Experienced Funding Delays, But DOE Institutes Were Most Affected

Since FY 2019, three of the seven DOE institutes experienced significant lapses in baseline funding, delays in DOE’s renewal of the institute’s financial assistance award, or both:

· PowerAmerica.

According to DOE, PowerAmerica expended its baseline funding in April 2021. DOE

had not decided at the time whether to renew its financial assistance awards

for its Manufacturing USA institutes, according to DOE officials and our

December 2021 report.

DOE extended the award term without additional funding after April 2021, known

as a no-cost extension, through August 2023. DOE did so to continue overseeing

the institute’s work that was still in process, according to institute

officials. During this period, DOE established an award renewal process for its

Manufacturing USA institutes.[42]

According to DOE officials, DOE initiated the process for PowerAmerica in June

2023. DOE provided the institute a conditional renewal in October 2023 and,

following negotiations with the institute, a final award—including baseline

funding—in late 2024. As a result, PowerAmerica operated without new baseline

funding from DOE for several years.

· IACMI. IACMI’s initial 5-year financial assistance award from DOE—followed by no-cost extensions—ended in June 2022. The following month the agency initiated the renewal process, according to DOE officials. Because the institute’s award renewal was not completed until September 2023, the institute experienced a gap of more than 1 year without an award and, according to IACMI officials, went years without new baseline funding.

· RAPID. DOE began the renewal process for the RAPID institute shortly after its initial award to that institute ended in June 2023, according to agency officials. Although DOE extended that award for part of the time in which the renewal process was underway, the institute was without an award agreement for over a year. DOE officials said the agency finalized a new agreement with RAPID in September 2024.

DOE officials said the reorganization of its advanced manufacturing efforts (discussed earlier) staffing shortages, and competing priorities to complete other DOE awards contributed to the long timelines for renewing its awards to the institutes. Furthermore, DOE officials told us it was late in renewing its awards because it reconsidered its earlier decision not to renew its awards beyond their initial period of performance in light of the RAMI Act amendments of 2019—allowing DOE (and Commerce) to renew financial assistance awards with their institutes.

Institute officials told us they used different strategies to make up for the funding lapses or delays in renewal of their financial assistance award. For example, PowerAmerica officials told us that during the lapse the institute used its reserves to continue funding existing projects. The institute reduced projects, spending, and employees after its baseline funding ended. IACMI officials told us the institute had about $20 million in baseline funding left over from its initial financial assistance award and obtained other sources of funding to remain financially sustainable when its baseline funding ended. The officials also told us the institute decreased active projects and project outlays after its baseline funding ended.

In addition, DOD or institute officials reported temporary lapses in funding for two DOD institutes. DOD’s LIFT institute’s baseline funding lapsed between February 2022 and February 2023 when the institute’s first financial assistance award ended and its second began. To help cover the gap, DOD officials told us the agency arranged for the institute to receive other DOD funding, which the officials said was just one approach they used to help fund institutes when their financial assistance awards have lapsed. Lastly, ManTech officials told us that a multiyear extension of DOD’s initial financial assistance agreement with the AFFOA institute had lapsed in 2023, resulting in a gap in financial assistance until a new award—expected in 2026—goes into effect.

Agencies Conducted Assessments and Continued Sponsoring Institutes as Institutes Increasingly Obtained Non-Baseline Funding

Agencies Used Different Processes and Timelines but Some Common Metrics to Assess Institutes’ Performance

The three sponsoring agencies used different processes and timelines to assess institutes’ performance and to decide whether to renew their financial assistance awards to institutes, though with some common criteria and performance metrics. Specifically:

Commerce’s evaluation process. NIST uses a multipart process for assessing the performance of Commerce institutes and determining whether to renew their awards.[43] First, the institute reports quantitative metrics annually to NIST. The annual metrics are incorporated into the institute renewal assessment performed near the end of the institute’s current financial assistance award, according to AMNPO officials. As part of the renewal process, the institute prepares a written report summarizing its performance and progress against NIST’s renewal standards using narrative and quantitative metrics. Then, a panel of experts external to NIST conducts a 2-day performance evaluation of the institute (on site or virtually), including presentations by the institute and a question-and-answer session. Finally, AMNPO staff summarize the results in a report for the NIST director, who decides whether to renew the agency’s financial award to the institute. NIST used this process for NIIMBL’s renewal in May 2021, near the end of its initial award.

DOD’s evaluation process. DOD also uses a multipart process to determine whether its institutes are still the appropriate solution to meet DOD mission needs and are managed effectively, among other criteria. Similar to Commerce, DOD’s institutes report quantitative performance metrics at least annually to ManTech. Then, DOD’s Joint Defense Management Council (JDMC) conducts a multiday, on-site evaluation.[44] The on-site evaluation is attended by representatives of the JDMC and the military services and includes presentations on the institute’s R&D and workforce development initiatives, question-and-answer sessions, and other activities. After the evaluation, the JDMC determines its recommendation. Officials in the Office of the Secretary of Defense consider the JDMC’s recommendation and other information in their decision whether to renew DOD’s agreement for the institute or to phase out DOD’s baseline funding for the institute within 2 years.

JDMC evaluates DOD institutes on a rotating 5-year schedule. From FY 2021 through FY 2024, JDMC evaluated eight of DOD’s nine institutes and plans to evaluate the ninth in FY 2026.[45] The JDMC generally conducts two evaluations per year but plans to pause its reviews in FY 2025 to assess potential changes to the review process, according to ManTech officials.

DOE’s evaluation process. DOE’s process includes on-site reviews of institutes and other evaluations. As with the other sponsoring agencies, the on-site reviews occur over multiple days and may include presentations and other activities and lead to recommendations for improvement. According to DOE policies and officials, the reviews are to be conducted annually. However, DOE officials told us that few such reviews were conducted in FY 2023 and FY 2024, in part, because of delays in DOE’s efforts to renew awards for some institutes as described earlier. In addition to the on-site reviews, DOE’s policies require evaluating institutes’ past performance as part of the decision whether to renew financial assistance awards.[46] DOE uses this and other information to determine whether to invite the institute to submit a full renewal application. DOE conducts a merit review of the full application, and a selection official decides whether to renew the institute award and the funding amount. DOE officials told us they have used this review process since FY 2022 to evaluate whether to renew DOE’s financial assistance awards with institutes.

Performance metrics. The agencies consider some common areas of performance and metrics in their assessments of institutes. For example:

· Planning and facilitating R&D projects. Examples of metrics common to at least two of the sponsoring agencies included the number and dollar value of R&D projects, percentage of R&D projects meeting technical objectives, and number of publications resulting from projects.

· Workforce education and training activities. Common metrics also included the number and value of workforce projects. Other workforce-related metrics, used by at least one agency, included the number of manufacturing workers or students receiving training and the percentage of institute members involved in workforce development activities.

· Facilitating partnerships and knowledge sharing. Metrics included the extent to which members of different tiers—such as large businesses and small- or medium-sized businesses—collaborated on projects, and the number of knowledge sharing events held.

· Promoting institutes’ financial sustainability. Examples included the rate of member retention and the percentage of institutes’ funding that came from sources other than baseline funding from the sponsoring agency.

Sponsoring Agency Baseline Funding Decreased as a Share of Total Funding as Institutes Secured Other Funding Sources

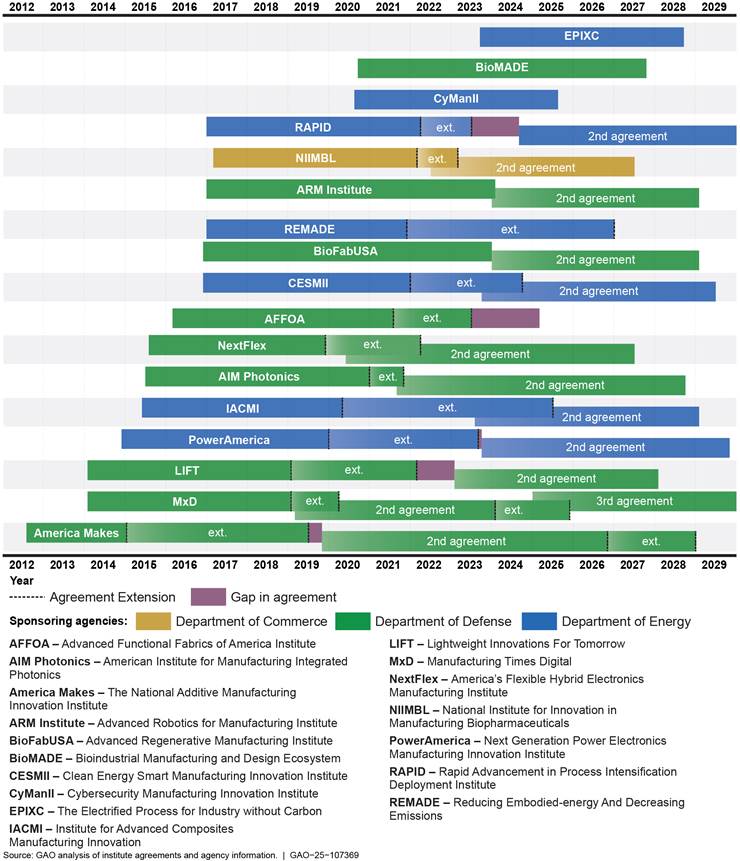

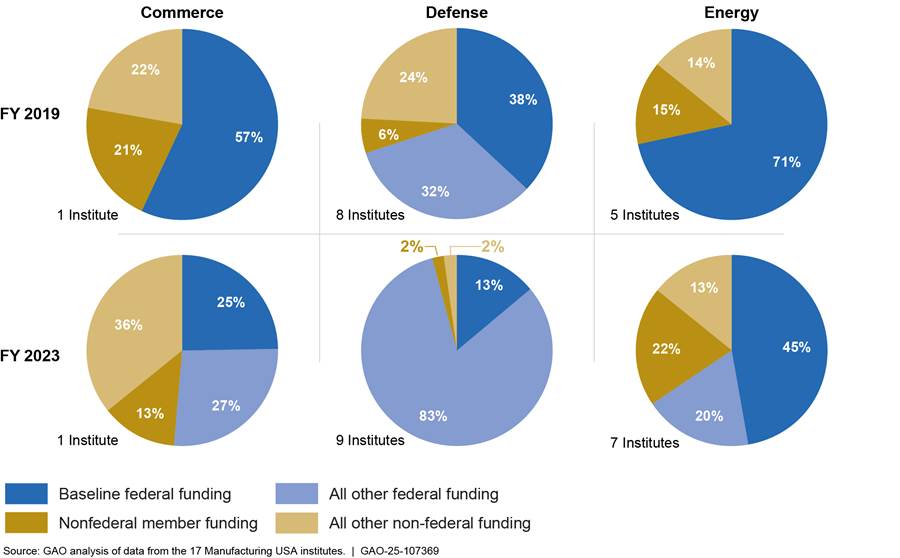

Sponsoring agency baseline funding decreased as a share of total funding across most Manufacturing USA institutes, as institutes obtained other funding sources. About half of the institutes (8 of the 17) received an increased amount of baseline funding from sponsoring agencies from FY 2019 through FY 2023. However, we found that most institutes (12 of 17) decreased baseline funding as a percentage of funding from all sources, including federal non-baseline, member, and other funding. Most of the non-baseline funding institutes received in FY 2023 was from other federal sources. The shift from baseline to non-baseline federal funding was particularly pronounced for DOD-sponsored institutes, which in total increased their share of non-baseline federal funding from 32 percent in FY 2019 to 83 percent in FY 2023. Commerce and DOE institutes obtained a more even mix of federal and nonfederal funding (see fig. 3).

Figure 3: Change in Funding Sources for Manufacturing USA Institutes from Fiscal Year (FY) 2019 to FY 2023

Note: Pies may not sum to 100 percent due to rounding.

Institutes reported receiving funding from multiple sources—baseline, non-baseline federal, member, and other funding—in FY 2019 through FY 2023, which supported their efforts in a variety of ways. More information on these funding sources is below and in appendix III.

Baseline federal funding. Baseline funding received by 8 institutes increased between FY 2019 and FY 2023 and decreased for 8 others, according to institute data.[47] However, at a sponsoring agency level, baseline funding received by Manufacturing USA institutes (adjusted to FY 2023 dollars) increased between FY 2019 and FY 2023. Specifically:

· For Commerce’s institute, baseline funding increased from $10.5 million in FY 2019 to $14 million in FY 2023, in part, because the agency renewed the institute’s financial assistance award late in FY 2022.[48]

· For DOD’s institutes, baseline funding increased from $86 million in FY 2019 (eight institutes) to $93 million in FY 2023 (nine institutes).

· For DOE’s institutes, baseline funding increased from $30 million in FY 2019 (five institutes) to $31 million in FY 2023 (seven institutes, including two institutes, PowerAmerica and EPIXC, that reported receiving no baseline funding in that year).

Baseline funding received in a given year may vary, in part, by the stage of an institute’s financial assistance award with its sponsoring agency, according to agency officials and institute data. A few institutes received more baseline funding earlier in the performance period of their award, while for a few others, baseline funding remained relatively flat or declined during that period.

Non-baseline federal funding. Most institutes reported receiving non-baseline funding from their sponsoring agency or another federal agency in FY 2019 through FY 2023. Institutes reported receiving this funding for R&D projects or workforce development activities. For example, DOD’s NextFlex institute reported receiving over $166 million in funding for various projects for DOD in FY 2019 through FY 2023. Also, DOD’s BioMADE institute received around $368 million in non-baseline funding from DOD in those years, including the over $350 million, discussed earlier, in FY 2023 for bioindustrial manufacturing. Further, 12 of the 17 institutes, mainly in Commerce and DOD, reported receiving a total of $175 million in COVID-19-related funding from multiple agencies and funding sources.[49] Institutes reported using the COVID-19-related funding for various R&D or training efforts. For example, NIST funded a project at DOD’s BioMADE institute to develop antigens for rapid COVID testing.

Member funding. All but one of the 17 institutes reported receiving funding from membership dues, and over half received other funding from members in FY 2019 through FY 2023. For Commerce and DOD institutes, membership dues constituted most of the funds that institutes received from members, according to institute data. For DOE’s institutes, other non-dues funding, such as fees or costs for workshops and other meetings or equipment-related costs, comprised most of their member funding. Furthermore, most institutes said members provided funding or in-kind contributions to help defray the costs of R&D. In-kind contributions included consulting services, equipment, intellectual property, or other resources from members. Fifteen of the 17 institutes reported receiving various in-kind contributions in FY 2019 through FY 2023. These contributions can be substantial. For example, one institute reported receiving approximately $2.6 million in donated equipment and consulting services, while others reported receiving tens-of-millions in in-kind contributions for projects including, at one institute, $30.2 million in software licenses.

Other funding. Nearly all of the 17 institutes reported receiving non-baseline funding from sources other than federal agencies and members in FY 2019 through FY 2023. Institutes reported receiving this funding from various sources, such as research-for-hire and consulting services, state and local grants, funding from private foundations, and rental or miscellaneous income. For example, two institutes reported using funding from private foundations to help fund R&D projects in vaccine manufacturing or other areas. Also, in FY 2023, a DOE institute began a service to help small- and medium-sized manufacturers integrate smart manufacturing into their operations, offering the institute’s analytical tools and professional coaching.[50]

In addition, institutes may apply the funding or in-kind contributions from members and other nonfederal sources toward their required cost-share with their sponsoring agency. Cost-share provisions in the agencies’ financial assistance awards require that the institutes obtain nonfederal funding or in-kind contributions that typically are of equal or greater value to the amount of baseline funding received by the institute. The institutes reported that they applied funding or in-kind contributions from various sources toward their required cost-share. For example, one DOD institute reported receiving around $245 million largely from two states and industry partners in FY 2019 through FY 2023 which the institute said it applied toward its required cost-share. Commerce’s institute also reported receiving around $15 million in state funding in FY 2023 for a planned 70,000-square-foot biopharmaceutical research and training facility.

Selected Institutes’ Achievements in Supply Chains or Other Areas Helped Further National Goals, but Agency Delays Could Reduce Effectiveness

The six selected institutes and 22 members we interviewed described institute achievements in supply chains or other areas that helped further advanced manufacturing goals. However, they also cited some challenges that could reduce institutes’ effectiveness in making progress toward these goals, including agency delays in reviewing funding requests for new R&D and workforce projects or membership applications for some DOD or DOE institutes.

Institutes and Members Reported Progress Toward Advanced Manufacturing Goals

Our analysis of examples of institutes’ achievements provided by officials from six selected institutes and 22 members we interviewed showed that the institutes’ efforts have helped further advanced manufacturing goals. We grouped the examples provided into three key categories described in more detail below: (1) developing and implementing advanced manufacturing technologies; (2) growing the advanced manufacturing workforce; and (3) building resilience into U.S. manufacturing supply chains. These categories align with the advanced manufacturing goals established in the RAMI Act, the National Strategy for Advanced Manufacturing, and the Strategic Plan for the Manufacturing USA Program (see app. II).

Developing and implementing advanced manufacturing technologies. Officials from the six selected institutes and 18 of the 22 members we interviewed discussed examples of R&D projects in which a technology, process, or industrial standard (1) was successfully implemented in the supply chain, (2) was brought closer to such implementation, or (3) led to follow-on investment outside the institute. For example:

· Members of DOE’s PowerAmerica institute told us about their R&D on semiconductors made from silicon carbide—an experimental material that could outperform traditional silicon-based electronics. A large business member told us that, through this R&D, the company was able to halve the size and improve the performance of electronic components in its next generation of off-road vehicles, currently under development. Representatives of a university said their R&D through the institute produced similar positive results and helped them compete for and win additional research grants outside the institute.

· Members of DOD’s America Makes and LIFT institutes described various innovations resulting from R&D on 3-D printing. For example, the owner of a small- to medium-sized company told us that the R&D the company conducted through America Makes led to industry qualification and acceptance of a certain type of plastic, which the company uses to 3-D-print replacement parts for military aircraft. In one LIFT project, a university representative worked with another member to successfully demonstrate that scrap metal—including doors from military vehicles and other battlefield discards—could be superheated, pulverized, and reused to 3-D print other metal products or components.

· An academic member of Commerce’s NIIMBL institute led an R&D project to develop an improved method for preserving vaccines and other biopharmaceuticals that is faster and more energy efficient than existing methods. The member collaborated with other members, including a large pharmaceutical company, which provided vaccine material for the R&D that otherwise would have been difficult or costly to obtain. The work has led to a patented technology and venture capital for a new startup in 2023 to commercialize the technology, according to the member.

Growing the advanced manufacturing workforce. Officials from the six selected institutes and 16 of the 22 members we interviewed described various institute efforts aimed at upskilling the existing manufacturing workforce through hands-on, virtual, or hybrid training; training students and future workers in advanced manufacturing; or exposing K-12 students to advanced manufacturing technologies and careers. These efforts included standalone workforce development initiatives or workforce development components of R&D projects. For example:

· To upskill the existing manufacturing workforce, a representative of a small- to medium-sized biomedical manufacturer reported collaborating with other members of Commerce’s NIIMBL institute to develop a training course on cell-therapy manufacturing. Cell therapy can include customizable therapies to treat conditions, such as severe burns, using the patient’s own cells or cells from others, according to the representative. The course includes both online and in-person components. Although the course was intended to train existing workers, students worldwide have accessed the online portion, which may augment their education or expose them to advanced manufacturing technologies and careers.

· To upskill the workforce and train students and future workers, officials from DOE’s IACMI institute said they used workforce development funds from DOD to create a network of centers for training on Computer Numerical Control machines. These machines allow for precise and customizable cutting and shaping of materials, such as fiberglass or metals. Since 2021, IACMI expanded the training network to 36 centers nationwide, and the officials said they plan to create similar centers to provide training on advanced forging and casting.

· To train students and expose future workers to advanced manufacturing, one university member of DOD’s America Makes institute said their department used the institute’s training materials to update its department’s advanced manufacturing curriculum and to provide training to younger students. For instance, the member created a “mobile lab” through the institute, which brings age-appropriate 3-D printers to K-12 schools and underserved communities to expose younger students and future workers to advanced manufacturing technologies and careers.

Building resilience into U.S. manufacturing supply chains. Officials from the six selected institutes and 15 of the 22 members described projects or other institute efforts that helped manufacturers build resilience into U.S. manufacturing supply chains or have the potential to do so. According to these officials and members, these efforts aimed to increase resilience by creating technologies and methods that prevent production outages, reduce reliance on large or foreign suppliers, and improve efficiency. For example:

· DOD’s MxD institute and one of its members highlighted a project to develop a low-cost sensor package that improves monitoring capabilities for older machinery. This technology allows manufacturers to retrofit older machines with modern monitoring systems, which can extend the life of the machines without the need for costly replacements. In collaboration with NIST Manufacturing Extension Partnership centers, MxD installed sensor kits in facilities of 10 small- and medium-sized manufacturers and aims to install 10,000 more kits, contingent on securing funding.

· After adding cybersecurity as a focus area, MxD partnered with a large-business member to pilot a cybersecurity awareness campaign for the company’s defense-industry suppliers. The campaign included online toolkits, webinars, and other components aimed at helping suppliers prevent and address cyberattacks.

· One small- to medium-sized business member of LIFT reported working on R&D that resulted in a lower-cost method for producing small quantities of custom metal material, which he said is otherwise only sold in large quantities by major suppliers.

Cutting across the advanced manufacturing goals, all the members we interviewed stated that the institutes facilitated collaboration and knowledge sharing that they said might be unlikely or more challenging without the institutes. Members said that the institutes can provide a neutral environment for competitors to collaborate on R&D and share information, which can help companies overcome fears of losing their competitive advantage. Additionally, a few members said that it would have been difficult or impossible to convince their companies to pay the full cost of the R&D they performed through the institutes; or, if the company did conduct the R&D, it may not have been willing to share the results. Several members also said that the diversity of members has led to productive collaborations across different industries, organizations, and professions that otherwise would have been unlikely. Other members said that—while collaborative R&D does take place outside of Manufacturing USA—the institutes sometimes simplify the process, such as by facilitating up-front agreement on intellectual property rights.

Institutes and Members Cited Some Challenges to Making Progress Toward Advanced Manufacturing Goals

Officials from the selected institutes and members we interviewed discussed some challenges that could reduce institutes’ effectiveness in making progress toward advanced manufacturing goals. For example:

· Barriers to industry adoption of innovations. Several members told us that it can take many years for industry groups and companies to recognize new manufacturing technologies and methods and adopt them as an industry standard. Others said that smaller companies in particular may be unaware of innovations or may not adopt them, especially if the benefits are not well known. Two members said that suppliers for DOD’s large equipment manufacturers would unlikely adopt new technologies or methods without a specific DOD requirement.[51] To help address such challenges, members said that institute events, such as conferences and technology demonstrations, can raise awareness, build confidence in innovations, and connect companies and industry groups.

· Challenges identifying outcomes of R&D and workforce efforts. A few of the selected institutes and members told us that outcomes of R&D and workforce efforts can be difficult to identify or measure. For example, a NIIMBL member told us the that the long development timeline for its industry’s products has made measuring the effects of specific R&D efforts difficult for the member and others in the industry. Another member told us it can be difficult to track participants in workforce projects to know about outcomes, such as their career advancement. Alternatively, an MxD member told us its project has helped suppliers reduce their cybersecurity risks, but the member has not found a good way to quantify the downstream effects. Further, one institute said that the need to maintain competitive advantage may restrict members’ willingness or ability to report on project outcomes. To address these challenges, one institute extended the timeframe for reporting on the impacts of its R&D and workforce initiatives; however, according to the institute’s director, it would be difficult to expect members to report over the long term. As we have previously found, reliable outcomes information—while sometimes difficult to obtain—is key for effective, evidence-based program management.[52]

· Limited access to institute resources. Some members said that geographic distance can limit their ability to access hands-on training or advanced manufacturing equipment, which many institutes make available to their members. In addition, a few members said they found it difficult to search for training materials or information and data from past R&D projects in one institute’s online member portal.

· Shifting R&D environment. Two members described changes affecting the focus and oversight of R&D work at one of the selected institutes. One of the members told us R&D project scopes had become more focused on discrete, short turnaround tasks for DOD-funded work and less focused on longer-term R&D problems defined by industry. The member said this change had reduced graduate students’ opportunities to work on institute projects and may limit members’ ability to understand and help determine the overall direction of the institute’s R&D. Another member described how participating in DOD-funded work through the institute provided a less beneficial experience than past work the member had participated in because of the extra level of administrative oversight the institute provided on the DOD-funded work. The member said that, in the past, they have worked directly with DOD on other project work and that the additional layer of institute oversight on the current project was less efficient. These examples highlight potential effects of focusing on agency-funded project work as a means to improve financial sustainability, which, as described earlier, occurred to a greater degree among the DOD-sponsored institutes from FY 2019 through FY 2023.

· Other R&D scoping challenges. Other members told us that institutes’ scoping of R&D projects could sometimes complicate R&D progress. For example, members of one DOD institute told us that the scopes of some institute-funded projects were too small and not strategically coordinated, thus potentially complicating progress on technology commercialization. Alternatively, a large business member of a DOE institute told us that the large scopes of projects there had made it more challenging to communicate R&D progress within the company. The member said that because the technologies they work on have a longer path to commercialization, smaller, coordinated projects could make it easier to explain R&D progress and show short term benefits.

DOE and DOD Delays in Reviewing Some Institutes’ Projects and Membership Applications Could Reduce Institutes’ Effectiveness

Officials from some DOE and DOD institutes told us that long, uncertain timeframes—of several months, typically—could reduce those institutes’ effectiveness in furthering advanced manufacturing goals. These long, uncertain timeframes occurred during DOE’s and DOD’s reviews of some institutes requests to begin R&D and workforce development projects or DOE review of membership applications.