2024 TAX FILING

IRS Improved Live Service and Began to Modernize Some Operations, but Timeliness Issues Persist

Report to Congressional Committees

United States Government Accountability Office

View GAO‑25‑107375. For more information, contact Jessica Lucas-Judy at (202) 512-6806 or lucasjudyj@gao.gov.

Highlights of GAO‑25‑107375, a report to congressional committees

IRS Improved Live Service and Began to Modernize Some Operations, but Timeliness Issues Persist

Why GAO Did This Study

During the annual tax filing season, IRS processes millions of tax returns and issues hundreds of billions of dollars in taxpayer refunds. IRS also provides telephone, correspondence, online, and in-person services to tens of millions of taxpayers. Partly due to the COVID-19 pandemic, IRS has faced challenges in recent years processing tax returns, meeting taxpayer service demands, and hiring employees. The IRA provided IRS tens of billions of dollars in funding to improve these and other areas.

GAO was asked to review IRS’s 2024 filing season performance. This report (1) assesses IRS’s performance processing tax returns, (2) assesses IRS’s performance providing customer service, and (3) describes IRS’s efforts to improve service and processing. GAO analyzed IRS documentation and data and interviewed officials. GAO determined that these data were sufficiently reliable by reviewing IRS documentation and interviewing officials. GAO also visited two IRS processing facilities and held discussion groups with IRS staff.

What GAO Recommends

GAO has previously made six key recommendations related to improving returns processing and customer service performance. IRS generally agreed and fully implemented one and has taken some steps to implement the others. To fully implement the remaining recommendations, IRS needs to (1) determine the cause of and address processing shortfalls, and (2) communicate time frames for processing its correspondence backlog, among other actions. IRS said that it is focused on improving service.

What GAO Found

During the 2024 filing season the Internal Revenue Service (IRS) processed 98 percent of the nearly 174 million individual and business tax returns it received, as of April 19, 2024. IRS continued to face challenges with timely processing of paper returns. For example, IRS did not meet its 13-day goal for processing individual paper returns, instead averaging 20 days. In January 2024, GAO reported that IRS faced similar challenges processing paper returns during the 2023 filing season and recommended that IRS determine the cause and address processing shortfalls. IRS agreed and changed its reporting methodology in June 2024 to account for days in which IRS is awaiting taxpayer responses. However, IRS has not yet documented the cause for the shortfalls.

IRS generally improved its customer service to taxpayers relative to 2023, serving more taxpayers on the telephone and in person. However, IRS responses to taxpayer mail continue to be delayed, with 66 percent considered late at the filing season’s end. In March 2024, IRS launched a web page showing the receipt date of correspondence that IRS is currently processing. The web page does not provide information estimating how long taxpayers can expect to wait for a response once processing begins. Fully addressing GAO’s 2022 recommendation to estimate and communicate time frames for resolving correspondence delays will better set expectations for, and potentially reduce repeat inquiries from, taxpayers.

During fiscal year 2024, IRS used Inflation Reduction Act (IRA) funding to staff and begin modernizing some filing season operations. IRS officials said this helped improve customer service during the 2024 filing season. IRS also used IRA funding for modernization efforts (e.g., mail sorting and scanning machines).

|

Abbreviations |

|

|

CSR |

customer service representative |

|

DIME |

Digital Intake to Modernized e-File |

|

ERC |

Employee Retention Credit |

|

IRA |

Inflation Reduction Act |

|

IRM |

Internal Revenue Manual |

|

IRS |

Internal Revenue Service |

|

OPM |

Office of Personnel Management |

|

SCRIPS |

Service Center Recognition/Image Processing System |

|

TAC |

Taxpayer Assistance Center |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

January 30, 2025

The Honorable Mike Crapo

Chairman

The Honorable Ron Wyden

Ranking Member

Committee on Finance

United States Senate

The Honorable Jason Smith

Chairman

The Honorable Richard E. Neal

Ranking Member

Committee on Ways and Means

House of Representatives

During the tax filing season, the Internal Revenue Service (IRS) undertakes a complex annual effort to process individual and business tax returns both electronically and on paper, issue hundreds of billions of dollars in taxpayer refunds, and enforce tax laws. IRS also provides customer service to tens of millions of taxpayers on a range of critical issues, including providing information on unprocessed and delayed returns, assisting taxpayers whose returns IRS suspended due to suspected identity theft, and responding to correspondence from taxpayers across a variety of issues.

In recent years, IRS has faced several operational challenges, partly because of the COVID-19 pandemic.[1] As we have previously reported, challenges from prior filing seasons can affect future filing season performance. For example, when IRS has a backlog of unprocessed inventory, it must process those along with incoming inventory. IRS’s recent challenges have included providing customer service via phone, addressing a backlog of taxpayer returns and correspondence, and implementing tax law changes. IRS has also faced challenges maintaining a sufficiently-sized workforce to process returns, such as attrition and difficulty hiring.

We previously reported that IRS missed its processing time goals for some returns during the 2023 filing season.[2] Additionally, we reported that IRS responses to taxpayer inquiries via mail continued to be delayed during the 2023 filing season. For that same year, we also reported that IRS had not evaluated its recent expanded use of expedited hiring authority.

In August 2022, Congress passed, and the President signed, the Inflation Reduction Act (IRA). The act provided IRS tens of billions of dollars in multi-year funding available for IRS to spend through fiscal year 2031.[3]

You asked us to assess IRS’s performance during the 2024 filing season. Additionally, the IRA includes a provision for us to support oversight of the use of funds appropriated in the IRA.[4] In this report, we (1) assess IRS’s performance during the 2024 filing season to process individual and business tax returns; (2) assess IRS’s performance to provide customer service on the telephone, online, via correspondence, and in person during the 2024 filing season; and (3) describe IRS’s efforts to support and improve taxpayer service and processing during the filing season, including efforts funded by IRA.

To address our first objective, we analyzed IRS’s 2024 weekly filing season performance data on processing electronic and paper tax returns for individuals and businesses. The data we used in this report were from the 2024 filing season, which began in late-January 2024 and ended April 15, 2024, the most recent sets of data available at the time of our review.[5] We assessed the reliability of IRS’s data on processing returns by reviewing existing information about the data and the systems that produced them, and interviewing agency officials knowledgeable about the data. We determined that these data were sufficiently reliable to report on IRS’s performance in processing returns during the 2024 filing season.

Additionally, we compared IRS’s most recently available data on return processing performance to that from prior filing seasons. We also reviewed IRS performance for timeliness in processing returns. Further, we reviewed relevant documentation and interviewed officials from IRS’s Submissions Processing division to understand contextual factors contributing to changes in performance, including hiring and technology challenges and the effects of recently enacted legislation, such as the IRA.

To address our second objective, we analyzed IRS’s 2024 weekly filing season performance data on providing customer service (via telephone, correspondence, online, and in person). The data we used in this report were from the 2024 filing season, which began in late-January 2024 and ended on April 15, 2024, the most recent sets of data available at the time of our review.[6] We reviewed relevant documentation and interviewed IRS officials to understand IRS’s ability to answer telephone inquiries, respond to taxpayer correspondence, provide service through its website, and provide in-person services. We compared data on IRS’s customer service performance during the 2024 filing season to performance data from prior filing seasons. In addition, we interviewed IRS officials and reviewed relevant documentation for contextual factors contributing to filing season performance, such as hiring and staffing challenges.

To address our third objective, we reviewed IRS appropriations to support filing season operations, and IRS spend plans for the IRA.[7] We also interviewed IRS officials knowledgeable about how IRS used IRA funding to support filing season functions. We reviewed IRS plans to transform agency operations, including filing season activities.[8]

We also reviewed IRS documents and data on 2024 filing season hiring goals, and actual hiring (including under direct hire authority). We compared these efforts to IRS’s previous efforts during recent past filing seasons.

To provide additional context for the above objectives, we visited IRS facilities in Kansas City, Missouri, in April 2024, and in Ogden, Utah, in June 2024, to observe return processing, and customer service representatives (CSR) answering taxpayer calls and handling correspondence. We selected Kansas City and Ogden because both facilities process individual and business returns and answer taxpayer telephone calls.

To obtain the perspectives of CSRs and return processing employees, we conducted two discussion groups with a total of 16 frontline staff in Ogden about challenges they encountered during and preparing for the 2024 filing season and opportunities to improve service and taxpayer compliance.

We conducted this performance audit from January 2024 to January 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Returns Processing

Every filing season, individuals and businesses submit their tax returns to IRS electronically or on paper. IRS processes these returns to determine if the information provided is sufficiently accurate to post the return to the taxpayer’s master file account, and to collect the amount the taxpayer owes the government, or is entitled to, as a refund.[9]

During returns processing, IRS checks for consistency and errors through manual and automated processes and corrects the returns when possible. If correction is not possible, IRS will notify the taxpayer about any additional information that may be needed to complete the return.

As we have previously reported, automated processes are generally more efficient and cost effective than paper-based processes, and any delays in issuing refunds can increase costs to IRS and burden the taxpayer. In addition, tax law changes can cause a higher volume of return processing errors because the provisions are new to IRS, paid preparers, and taxpayers.

Taxpayer Service

Taxpayers can get assistance from IRS in several ways:

· Telephone. Throughout the year, taxpayers can speak with a CSR to obtain information about their accounts. Taxpayers can also listen to recorded tax information or use automated phone services to obtain the status of their refunds or account information such as a balance due.

· Correspondence. Taxpayers primarily use paper, or in some cases digital, correspondence to communicate with IRS. Correspondence includes responses to IRS requests for information to help process a return or verify a taxpayer’s identity. It can also include collection notice disputes, among other issues. In addition to answering telephone calls, CSRs in IRS’s Accounts Management division are also required to respond to taxpayer correspondence, which can cover a wide range of topics. These include complex account adjustments such as amended returns and duplicate return filings, and refund and account inquiries. IRS’s policy is to generally respond to correspondence within 30 days of receipt. IRS generally considers correspondence that is older than 45 days to be overage.[10]

· In person. Taxpayers can receive face-to-face assistance at Taxpayer Assistance Centers (TAC) across the country. While most visits are by appointment only, taxpayers can also walk in and receive service without an appointment during regular business hours as well as during extended or limited Saturday hours. IRS staff at TACs provide taxpayers with help in a variety of ways, including authenticating taxpayers whose returns have been held for potential identity theft; assisting taxpayers applying for an Individual Taxpayer Identification Number; handling cash payments from taxpayers; and assisting taxpayers with account adjustments.

· Online. Taxpayers can use IRS’s online services to, for example, check their refund status, get a tax transcript, make payments or check on the status of a payment, and apply for plans to pay taxes due in scheduled payments (installment agreements).

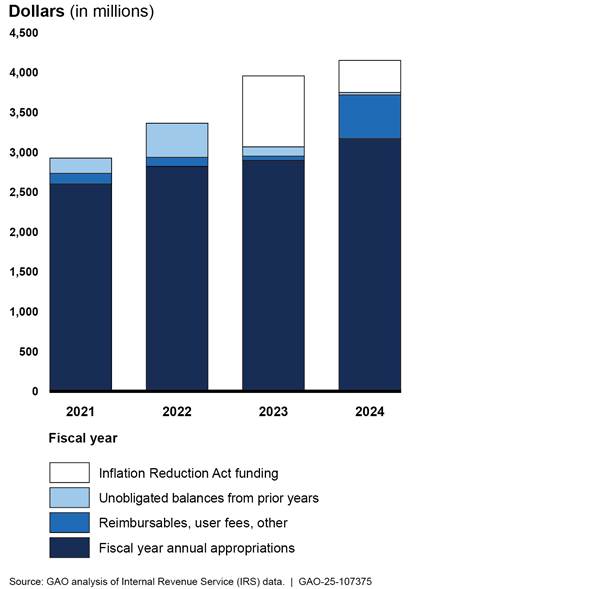

IRS Fiscal Year 2024 Appropriations

IRS’s operating budget is funded by annual appropriations and other resources, such as unobligated balances from prior years and reimbursable items. In March 2024, Congress appropriated $12.3 billion to IRS for fiscal year 2024—the same amount Congress provided for fiscal year 2023. The funds were allocated among three budget activities as follows:

· $2.8 billion for taxpayer services, which includes many filing season operations like the processing of tax returns and providing assistance to taxpayers filing returns and paying taxes due;

· $4.1 billion for operations support, which includes rent, facilities services, printing, postage, security, information systems, and telecommunications support; and

· $5.4 billion for enforcement, which includes determining and collecting owed taxes, providing legal and litigation support, and enforcing certain criminal statutes.

Congress had traditionally appropriated funds in a fourth budget activity for business systems modernization but did not fund this activity in fiscal years 2023 and 2024. In fiscal year 2022, Congress appropriated $275 million for business systems modernization.

We previously reported that IRS’s budget declined by about 20 percent ($2.9 billion) from fiscal year 2010 to 2019 after adjusting for inflation.[11] In its fiscal year 2024 budget request, IRS explained that since fiscal year 2010 the agency has supplemented the amounts appropriated for taxpayer services with funding from other sources, such as user fees, supplemental funding, and transfers from other IRS budget accounts.[12]

IRA Multi-Year Funding

In August 2022, Congress passed, and the President signed, the IRA. The act provided IRS tens of billions of dollars in multi-year funding available for IRS to spend through fiscal year 2031.[13] Congress appropriated the IRA funds to IRS as follows:

· $3.2 billion for taxpayer services;

· $25.3 billion for operations support;

· $45.6 billion for enforcement; and

· $4.8 billion for business systems modernization.[14]

However, in 2023 and 2024, Congress rescinded about $20 billion from the enforcement amount.[15]

Shortly after the IRA was enacted, the Treasury Secretary directed IRS to develop an operational plan detailing how the IRA funding was to be spent. In April 2023, IRS released the IRA Strategic Operating Plan that described five objectives and related initiatives for using IRA funding to transform the agency.[16] In May 2024, IRS published an update to the plan which described intended outcomes for the five objectives, as well as priorities for fiscal years 2024 and 2025.[17]

Tax Law Changes

One challenge for IRS is responding quickly, accurately, and effectively to tax law changes, some of which can be extensive. For example, the IRA made more than 20 changes to energy-related tax provisions, such as tax credits for energy-efficient home improvements and the purchase of clean vehicles. The 2024 filing season was the first year that individual taxpayers could claim many of the new or expanded credits.[18] The IRA included $500 million to help IRS implement these tax changes.

During the COVID-19 pandemic, Congress passed legislation that created or modified payments and tax credits to millions of individual and business taxpayers. Employers whose business operations suffered during the pandemic can claim the Employee Retention Credit (ERC) on their employment tax returns. In July 2023, the then-IRS Commissioner said that the agency was experiencing increases in questionable ERC claims. In response, in September 2023, IRS issued a processing moratorium on new ERC claims.[19] In August 2024, IRS announced it was moving forward to begin processing ERC claims for certain returns.[20]

IRS Received More Returns and Payments Electronically in 2024 and Was Less Timely for Paper Returns

IRS Processing Volume Was Similar to 2023 but Less Timely for Paper Returns

IRS received more tax returns in the 2024 filing season compared to the prior year but received substantially fewer than in the 2020 and 2021 filing seasons during the COVID-19 pandemic.[21]

IRS received nearly 174 million individual and business tax returns in the 2024 season, which was 2.8 million more (an increase of 1.7 percent) than in 2023. Specifically, IRS received 1.7 million more individual returns and 1.1 million more business returns than the previous filing season, an increase of 1.3 percent and 3.2 percent, respectively.

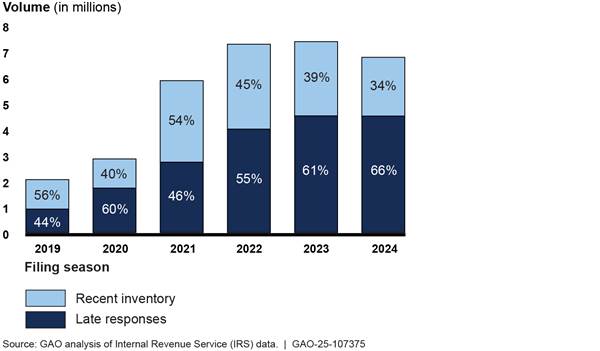

By the end of the 2024 filing season, IRS had processed about 1.5 million more individual and business returns (an increase of 0.9 percent) than in 2023.[22] See figure 1 for a comparison of the number of returns received and IRS’s rate of processing such returns from 2019 through 2023.

Figure 1: Individual and Business Tax Returns Received and Percentage Processed During Filing Seasons 2019-2024

Notes: Data for each filing season are as of the week ending: April 20, 2019; July 18, 2020; May 22, 2021; April 23, 2022; April 22, 2023; and April 19, 2024. IRS officials said that the increase in tax returns received during the 2020, 2021, and 2022 filing seasons may be attributed to the federal government’s response to the COVID-19 pandemic, such as stimulus payments to individuals who would not otherwise have filed a return. Individuals who had not filed tax returns for 2018, 2019, or 2020, and were not in IRS systems, filed returns to prove their identities and dependent information so that Economic Impact Payments could be paid to them.

Although IRS received and processed more returns in the 2024 season, the percentage processed by the end of the filing season declined slightly. During the 2023 filing season, IRS processed 98.6 percent of the 171.1 million returns it received. In 2024, IRS processed 97.9 percent of the nearly 174 million returns it received. The decrease is because the number of returns IRS received increased by a higher amount (about 2.8 million).

While as of the week ending April 19, 2024, IRS had processed 98 percent of all returns it received during the 2024 filing season, it continued to face challenges processing paper returns on time. In 2024, IRS did not meet its goals for processing individual paper returns. For Form 1040 paper returns, the time to process increased from 8 days in 2023 to 20 days in 2024, when averaged across all processing centers. According to policies in the Internal Revenue Manual (IRM), the agency’s goal is to process Form 1040 paper returns within 13 days or less.[23]

As we reported in January 2024, IRS did not meet all its timeliness goals for processing certain paper returns for the 2023 tax filing season. As a result, we recommended that IRS evaluate and determine the cause of certain returns not meeting processing time goals and develop a plan for addressing these processing shortfalls.[24] IRS agreed with the recommendation. In response, in June 2024, IRS revised its guidance to employees preparing inventory reports on how to calculate the number of days IRS spends processing returns.[25] IRS stated that this adjustment in reporting methodology would account for days in which the agency was awaiting taxpayer responses to complete processing. However, IRS did not provide us with documentation of its evaluation of the cause behind missing timeliness goals and that this change would address the underlying cause of not meeting the goals. To fully address this recommendation, IRS will need to provide documentation showing the cause for missing processing deadlines and that the agency’s action addresses that identified cause.

More Taxpayers Filed and Paid Taxes Electronically, and Addressing Our Prior Recommendations Could Further Increase Business Electronic Filing

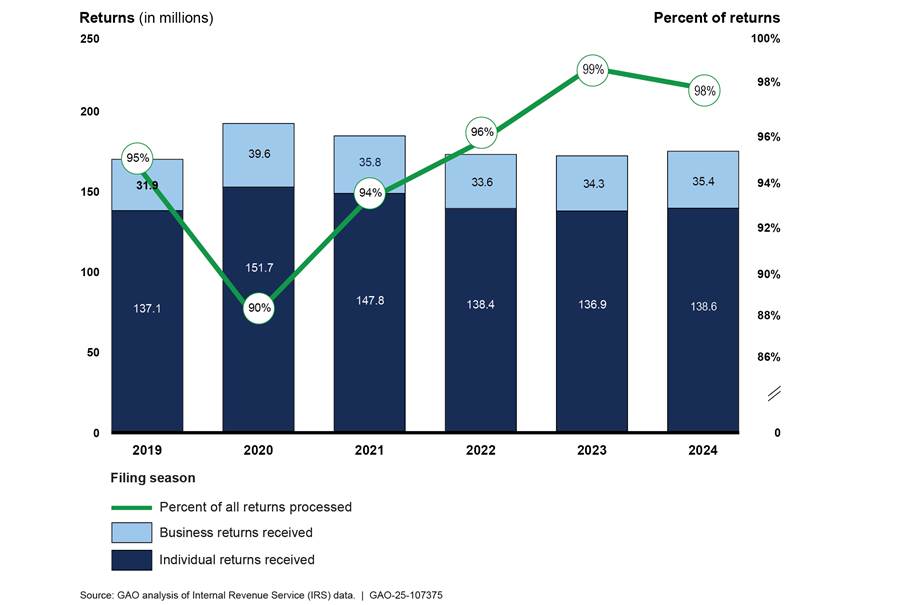

Consistent with the overall trend for the past five filing seasons, for filing season 2024, IRS continued to receive more tax returns and payments electronically and fewer on paper. During the 2024 filing season, nearly 97 percent of individual taxpayers filed their tax returns electronically—a slight increase from 96 percent in 2023. A lower percentage (about 81 percent) of business taxpayers filed their returns electronically. While this percentage is a substantial increase since before the COVID-19 pandemic, when it was about 68 percent during the 2019 filing season (see figure 2), it remains lower than the rate for individual returns.

Figure 2: Percentage of Individual and Business Returns Filed Electronically, Filing Seasons 2019-2024

Note: Data for each filing season are as of the week ending: April 20, 2019; July 18, 2020; May 22, 2021; April 23, 2022; April 22, 2023; and April 19, 2024.

During the 2024 filing season, IRS received about 1 million fewer returns filed on paper (individual and business combined) than in the 2023 filing season, and about 10 million fewer paper returns when compared to the 2019 filing season.

IRS saves significant resources when taxpayers file electronically. A paper-filed return may need to be handled by multiple employees during processing. By contrast, e-filed returns are processed using automation and only require human intervention if the return has an issue. According to IRS, a paper-filed Form 1040 cost the agency $8.65 to process in fiscal year 2023, whereas an equivalent e-filed return cost only $0.23.

However, not all IRS tax forms can be filed electronically. For example, forms used by estates (Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return) and forms used to report certain types of gifts above a given dollar amount (Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return) can only be filed on paper. IRS received about 567,000 of these forms in fiscal year 2023.

In March 2021, we reported that IRS had not comprehensively identified and addressed barriers business taxpayers face when e-filing and recommended that IRS (1) conduct an assessment to comprehensively identify barriers business taxpayers face when e-filing business-related returns, and (2) determine what actions IRS could take to address the barriers and implement those actions, as feasible.[26]

IRS agreed with these recommendations and has fully implemented the recommendation to conduct an assessment to identify barriers business taxpayers face when e-filing. IRS has also taken some steps to determine actions to address barriers. IRS’s assessment identified the lack of a real-time online signature personal identification number as the greatest barrier business taxpayers face to e-filing a return. To make it easier for businesses to e-file returns, during the first 6 months of 2024, IRS made 20 more tax forms available to file electronically, with most of these forms used by businesses. IRS officials said they plan to make more forms available for the 2025 filing season. Additionally, IRS officials told us they intend to develop an online signature personal identification number for businesses, which would address the greatest barrier IRS identified to increasing e-filing rates for employment returns. The online signature personal identification number would be a fully automated application and approval process that could issue the number in real time. As of November 2024, IRS officials said the barrier to this project is funding for further Business Tax Account enhancements and that it is in a pending status.[27]

Addressing barriers to e-filing business returns could help IRS reduce the volume of more costly paper-based work and improve services to business filers. We will continue to monitor IRS’s progress on these efforts.

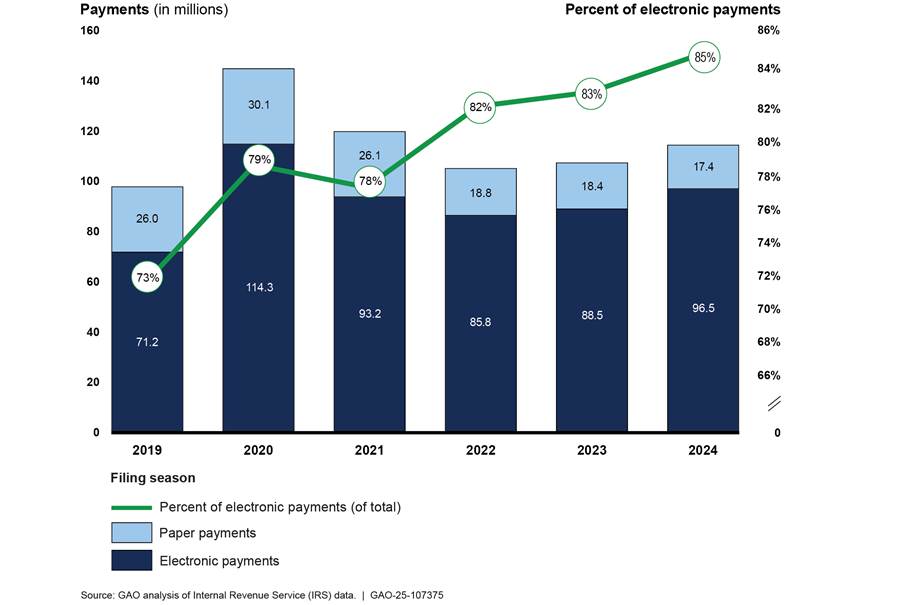

Similar to the overall trend of increasing e-filed returns, more taxpayers opted to submit tax payments electronically—rather than by paper check—during the 2024 filing season. The number of electronic payments IRS received during the 2024 filing season increased by more than 8 million (9 percent) from 2023. About 85 percent of the payments IRS received during the 2024 filing season were electronic payments compared to 73 percent during 2019 filing season (see fig. 3).

Figure 3: Electronic and Paper Payments Received and Percentage Received Electronically, Filing Seasons 2019-2024

Notes: Data for each filing season are as of the week ending: April 20, 2019; July 18, 2020; May 22, 2021; April 23, 2022; April 22, 2023; and April 19, 2024. Due to the COVID-19 pandemic, IRS extended filing deadlines in 2020 and 2021.

Electronic payments include payment types such as Automated Clearing House debits, credit cards, and payments made via IRS Online Accounts, among other things. Paper payments include checks received at third-party lockbox sites and IRS Submission Processing centers.

Compared to 2023, IRS received about 1 million (5 percent) fewer paper payments (e.g., checks or money orders) in 2024—either at IRS’s Submission Processing centers or at third-party lockbox bank locations managed by financial institutions.[28] Compared to the prepandemic 2019 filing season, IRS received about 9 million fewer paper payments in 2024. For paper payments sent to IRS’s Submission Processing centers, the total volume during the 2024 filing season was 55 percent less compared to 2019.

IRS Served More Taxpayers via Phone and in Person, but Correspondence Delays Persisted

IRS Received and Answered More Phone Calls

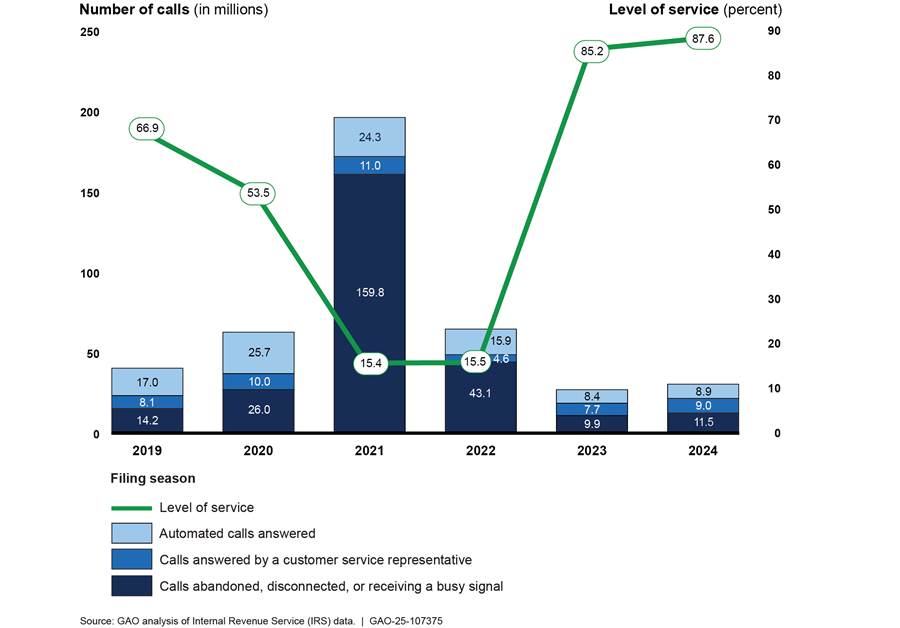

During the 2024 filing season, IRS received and answered more calls than it did in the 2023 season. As shown in table 1, IRS received 29.3 million calls during the 2024 filing season, which was 3.4 million (13 percent) more than in 2023.

Overall, IRS customer service representatives (CSR) or an IRS automated phone line answered 61 percent of calls, similar to the 62 percent answered during the 2023 filing season. IRS CSRs answered roughly 9 million of these calls—17 percent more than 2023 when CSRs answered 7.7 million calls. Another 8.9 million calls were answered by an IRS automated line, slightly more than the 8.4 million answered in 2023.

Table 1: Telephone Call Volume Answered by IRS Customer Service Representative or Automated Line, Filing Seasons 2019-2024

|

Number of calls in millions |

||||||

|

Calls |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Received |

39.3 |

61.7 |

195.1 |

63.7 |

25.9 |

29.3 |

|

Answered |

|

|

|

|

|

|

|

by a customer service representative (CSR) |

8.1 |

10.0 |

11.0 |

4.6 |

7.7 |

9.0 |

|

by an automated line |

17.0 |

25.7 |

24.3 |

15.9 |

8.4 |

8.9 |

|

Total answered |

25.1 |

35.7 |

35.3 |

20.5 |

16.1 |

17.9 |

|

Percent of calls answered |

64 |

58 |

18 |

32 |

62 |

61 |

Source: GAO analysis of Internal Revenue Service (IRS) data. | GAO‑25‑107375

Note: Answered calls are the cumulative number of calls answered by an automated line or a CSR. Telephone call data for the filing season are cumulative from January 1 of each year to April 20, 2019; July 15, 2020; May 17, 2021; April 23, 2022; April 22, 2023; and April 20, 2024, respectively. Numbers may not sum to totals due to rounding. Data from 2019 do not include all calls answered by a CSR, those that received a busy signal, or calls disconnected because IRS was not answering calls due to a 5-week lapse in appropriations, which ended in January 2019. For 2020, live telephone assistance was unavailable between late March and late April due to IRS closing all processing and customer service sites during the COVID-19 pandemic.

Telephone volumes during both the 2024 and 2023 filing seasons were substantially lower relative to the high number of calls received during the COVID-19 pandemic, and IRS answered a higher percentage of them. IRS’s call volume peaked during the 2021 filing season when IRS received about 195 million calls—roughly seven times more than the 2023 and 2024 filing seasons. IRS answered only 18 percent of these calls. During both the 2020 and 2022 filing seasons, IRS received more than twice as many calls as the 2023 and 2024 filing seasons and answered about 58 percent and 32 percent of them in 2020 and 2022, respectively.

IRS Exceeded its Goal for Telephone Service

Building off telephone service improvements from the 2023 filing season, IRS exceeded its goal for telephone service during the 2024 filing season. IRS officials told us that Inflation Reduction Act (IRA) funds helped the agency hire enough CSRs to achieve their level of service goals during both the 2024 and 2023 filing seasons.

Each year, IRS sets a goal to answer a certain percentage of phone calls from taxpayers seeking live assistance, which it refers to as the “level of service.” IRS’s level of service metric generally represents the number of taxpayers who reach a CSR divided by the number of calls the IRS system routes to them. However, not all calls that may require CSR assistance are routed directly to a CSR.[29] For example, callers could be routed to an automated line, or after navigating IRS’s phone tree, decide to end calls without receiving information they needed.

IRS’s level of service metric also only looks at a subset of IRS’s phone lines. Calls included in this metric are those to 35 phone lines in the Accounts Management division.[30] However, IRS has 64 public-facing phone lines, meaning many phone lines are not included in this level of service measure.

As shown in figure 4, IRS reported an 87.6 percent level of service for the 2024 filing season, exceeding its goal of 85 percent. In 2023, IRS’s level of service goal was also 85 percent, and IRS achieved 85.2 percent. During the 2022 and 2021 filing seasons when call volumes were substantially higher, IRS achieved levels of service of just above 15 percent.

Note: Telephone call data for the filing season are cumulative from January 1 of each year to: April 20, 2019; July 15, 2020; May 17, 2021; April 23, 2022; April 22, 2023; and April 20, 2024. IRS’s “level of service” calculation generally divides the number of taxpayers who reach a customer service representative (CSR) by the number of calls the IRS system routes to them. Calls routed for automated assistance and callers who hang up before they are placed in a queue are excluded from IRS’s calculation for “level of service.” Data from 2019 do not include all calls answered by a CSR, those that received a busy signal, or calls disconnected because IRS was not answering calls due to a 5-week lapse in appropriations, which ended in January 2019. For 2020, live telephone assistance was unavailable between late March and late April due to IRS closing all processing and customer service sites during the COVID-19 pandemic. IRS reopened live telephone assistance for identity theft-related issues on April 27, 2020, and began opening additional phone lines on May 11, 2020. All customer service telephone lines began reopening during the 2021 and 2022 filing seasons. IRS began its callback service in 2019, where taxpayers calling about certain services or topics can opt to receive a call back from IRS rather than wait on hold. According to IRS, all “callbacks” are included in phone volume figures from 2019 forward.

The average wait time for callers was slightly over 3 minutes during the 2024 filing season, which is similar to wait times experienced during the 2023 filing season.[31] Among the eight phone lines with the highest volume of calls in IRS’s Accounts Management organization, four lines experienced higher average wait times in 2024 compared to 2023, while the remaining four had lower average wait times. See table 2 for data on the level of service and average wait times for these eight phone lines during the 2023 and 2024 filing seasons.

Table 2: Level of Service and Wait Time for Highest Volume IRS Accounts Management Phone Lines, Filing Seasons 2023-2024

|

|

2023 |

2024 |

||

|

Phone line |

Level of service (percent) |

Wait time (minutes) |

Level of service (percent) |

Wait time (minutes) |

|

Refund Hotline |

96 |

1 |

77 |

6 |

|

Individual Income Tax Services |

91 |

2 |

87 |

4 |

|

Taxpayer Assistance Center Appointments |

72 |

5 |

86 |

4 |

|

Business & Specialty Tax Services |

83 |

6 |

90 |

4 |

|

Wage & Investment Identity Theft |

73 |

6 |

78 |

4 |

|

Practitioner Priority Service |

89 |

3 |

95 |

2 |

|

Wage & Investment Individual Master File Customer Response |

93 |

1 |

85 |

4 |

|

Refund Call Back |

95 |

1 |

86 |

4 |

Source: GAO analysis of Internal Revenue Service (IRS) data. | GAO‑25‑107375

Note: The listed phone lines had the eight highest volume of calls among phone lines in Accounts Management during the 2024 filing season. IRS’s “level of service” calculation generally divides the number of taxpayers who reach a CSR by the number of calls the IRS system routes to them. Calls routed for automated assistance and callers who hang up before they are placed in a queue are excluded from IRS’s calculation for “level of service.” Level of service is for the period January 1, 2023, through April 22, 2023, and January 1, 2024, through April 20, 2024.

IRS officials told us they assigned staff to phone lines based on how much demand they projected. If demand ended up being higher than projected, a lower level of service and higher wait times could result. Conversely, less demand than projected could result in a higher level of service and lower wait times.

During the 2024 filing season, IRS expanded the availability of its callback feature, which gives taxpayers calling certain phone lines the option to receive an automated call back from IRS rather than wait on hold.[32] This feature was available on 131 telephone applications during the 2024 filing season, compared to 43 applications in 2023. IRS offered about twice as many callbacks for the 2024 filing season compared to 2023. About two-thirds of call backs offered are accepted by taxpayers. IRS told us that the callback feature saved taxpayers about 2.1 million hours they would have otherwise spent waiting on hold across both filing seasons (see table 3).

|

In millions |

|||

|

|

2022 |

2023 |

2024 |

|

Callbacks Offered |

4.2 |

2.2 |

4.8 |

|

Callbacks Accepted |

2.4 |

1.4 |

3.2 |

|

Taxpayer Hours Saved |

1.3 |

0.5 |

1.6 |

Source: GAO analysis of Internal Revenue Service (IRS) information. | GAO‑25‑107375

Note: Taxpayer Hours Saved is the total of the virtual queue time for all callers who accepted the callback. Telephone callback data for the filing season are cumulative from January 1 of each year to April 23, 2022; April 22, 2023; and April 20, 2024.

IRS data show that there has been a slight increase in customer accuracy reported during the 2024 filing season for Accounts Management phone applications. IRS regularly reports on customer accuracy, which is the estimated percentage of correct answers or resolutions provided in taxpayers’ telephone calls for account assistance. During the 2024 filing season, the percentage of correct answers was 90.7 percent compared to 88.7 percent in 2023.

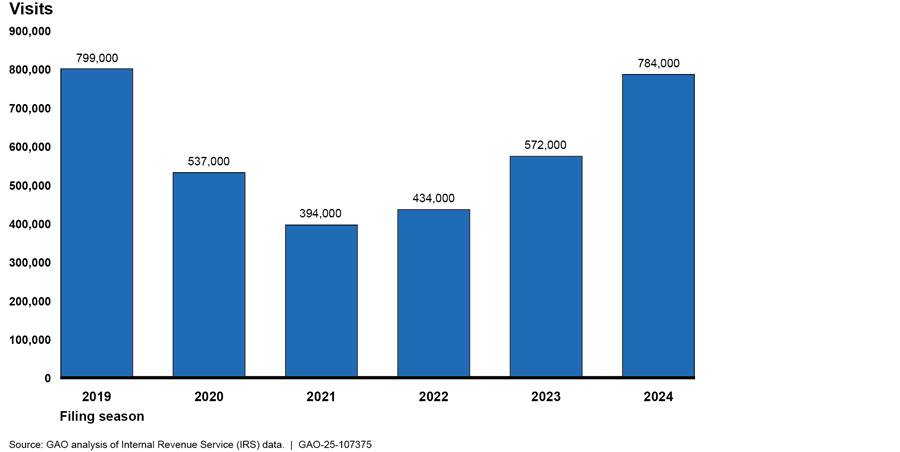

IRS Served More Taxpayers In Person but Has Not Addressed Our Prior Recommendation to Balance In-Person and Virtual Services

In-person service at IRS Taxpayers Assistance Centers (TAC) continued to increase for the 2024 filing season. As shown in figure 5, IRS served about 784,000 taxpayers at TACs during the 2024 tax filing season compared to 572,000 in the 2023 filing season—an increase of 37 percent. From the 2022 to 2023 filing seasons, the number of in-person contacts at TACs showed a roughly similar percentage increase (32 percent). IRS officials have said that funding from the IRA helped the agency to improve staffing and expand service at the TACs during both the 2023 and 2024 filing seasons.

Note: The dates for filing seasons data are January 28, 2019, to April 19, 2019; January 27, 2020, to July 17, 2020; February 12, 2021, to May 21, 2021; January 24, 2022, to April 22, 2022; January 23, 2023, to April 21, 2023; and January 29, 2024, to April 20, 2024. Due to the COVID-19 pandemic, IRS closed all Taxpayer Assistance Centers in late March 2020, and began reopening them in late June 2020. IRS also extended the filing deadlines for the 2020 and 2021 filing seasons. As we reported in 2022, IRS’s in-person services took longer to resume full operations compared to other customer service functions.

While the number of contacts at TACs during the 2024 filing season was similar to the prepandemic level of 2019 when there were about 799,000 contacts, IRS continued to face challenges providing in-person service.[33] IRS officials told us that 341 TACs were operational during the 2024 filing season, but 22 TACs did not have sufficient staff to fully operate. IRS officials told us that the agency continues to face some challenges in staffing TACs in rural areas.[34]

During the 2024 filing season, IRS continued an initiative begun in 2023 to provide TAC services on a few Saturdays. About 110 TACs offered in-person services over four Saturdays from February to May that assisted more than 21,000 taxpayers.

In addition to the Saturday events, IRS announced at the start of the 2024 filing season that about 250 TACs would offer extended hours on Tuesdays and Thursdays outside the TACs’ normal 8:30 am to 4:30 pm operating time. IRS data show that by the end of the 2024 filing season, a total of 247 TACs provided extended hours services on Tuesdays and Thursdays to over 22,000 taxpayers.

We previously reported that the total volume of visits to TACs had been declining before 2019 and IRS had no plans to assess its in-person service model.[35] Despite the decline in taxpayers served in person at TACs, as we reported in April 2022, IRS officials told us they did not plan to alter in-person taxpayer services from their current model, unless required by law, regardless of taxpayer demand for in-person service.

As a result, we recommended that IRS develop and communicate a plan for providing in-person taxpayer services relative to IRS’s plans for expanded virtual customer service options, and assess the costs and benefits of in-person versus virtual options. IRS agreed with this recommendation and has taken some action to address it but has not fully addressed it. For example, IRS developed a Taxpayer Assistance Hiring and Expansion Strategy to identify underserved areas of the country and to expand the TAC footprint.

As part of the agency’s efforts to implement its Inflation Reduction Act Strategic Operating Plan and improve taxpayers’ experience, IRS has considered in-person and online service options. But IRS has not fully communicated how it will weigh the costs and benefits to ensure that it is meeting taxpayer needs in person. In November 2024, IRS officials stated that they are evaluating how to best weigh cost and benefits and are in the process of doing a cost-benefit analysis. They said they expect to have the analysis completed and a communications plan developed by mid-2025. Developing and communicating a plan for how IRS intends to provide in-person service to taxpayers will help IRS allocate its resources among its multiple taxpayer service channels and help ensure that it is meeting taxpayer needs.

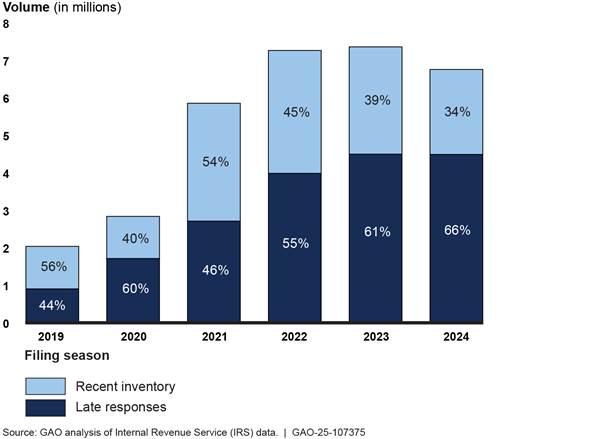

Taxpayer Correspondence Inventory Was Reduced, but Responses Continue to Be Delayed

IRS continued to face challenges responding to taxpayer correspondence during the 2024 filing season. Millions of taxpayers waited for IRS to process a wide range of correspondence, including amended returns, and to review documentation related to resolving identity theft issues, both of which may result in a refund to the taxpayer.

IRS’s inventory of taxpayer correspondence was 6.8 million at the end of the 2024 filing season. The 2024 ending inventory was about 8 percent lower than the 2023 filing season ending inventory of 7.4 million. However, the 2024 inventory level was about three times larger than the 2019 filing season level of about 2 million.

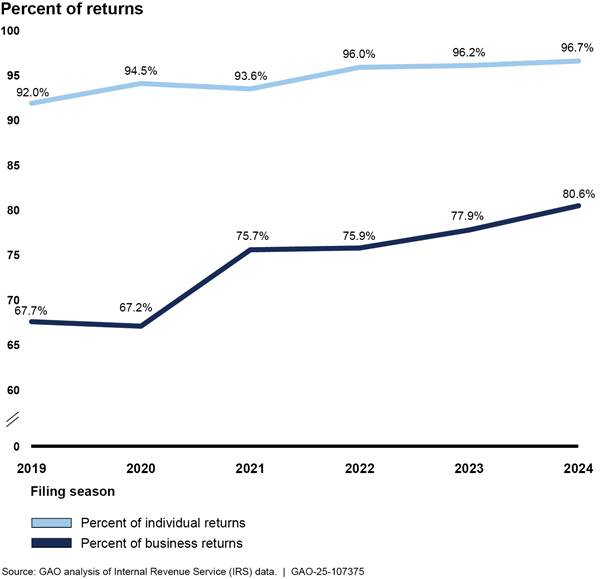

IRS’s policy is to generally respond to correspondence within 30 days of receipt. Responses that take longer than 45 days are considered late, or what IRS calls overage.[36] While IRS had a smaller correspondence inventory at the end of the 2024 filing season, a higher portion of it (66 percent) was overage compared to the 2023 filing season (61 percent). See figure 6 for IRS’s correspondence and overage rates for filing seasons 2019 through 2024.

Figure 6: IRS Correspondence Inventory and Overage Rates (Late Responses), as of the End of Each Filing Season, 2019-2024

Note: IRS’s policy is to generally respond to correspondence within 30 days of receipt, but it may take longer than that to respond to taxpayer correspondence depending on the type and complexity of the issue. IRS generally considers correspondence that is older than 45 days to be “overage.” Data reflect individual and business-related correspondence in IRS’s inventory as of the end of the filing seasons shown in the figure: April 20, 2019; July 18, 2020; May 22, 2021; April 23, 2022; April 22, 2023; and April 20, 2024. Inventory reflects all paper and digital correspondence IRS received but had not yet provided a response. Note that 2020 inventory does not reflect all taxpayer correspondence IRS received during 2020 due to IRS’s mail backlog (see GAO‑21‑251). As a result, some correspondence received in 2020 is reflected in the 2021 inventory.

At the beginning of the 2024 filing season, IRS officials told us their data showed that a significant portion of correspondence was related to claims for the Employee Retention Credit (ERC). As we noted above, IRS was experiencing increases in questionable ERC claims leading up to the summer of 2023. In September 2023, IRS announced a processing moratorium on new claims. In December 2023, IRS began sending thousands of letters to taxpayers disallowing certain ERC claims. In August 2024, IRS announced it will process certain claims received during the moratorium and that it had issued 28,000 more disallowance letters.[37] By October 2024, IRS had processing underway on about 400,000 ERC claims.

As of early November, IRS’s total correspondence inventory was about 6.9 million. IRS officials told us that about 1.1 million of this was related to ERC claims.

In recent years, IRS has struggled to balance competing demands to maintain quality telephone service levels and respond timely to written correspondence (see figure 7 that shows business correspondence in processing).[38] As we reported in April 2022, IRS’s inventory of taxpayer correspondence had increased due to the competing demands for customer service. IRS’s different customer service options are interdependent, often sharing the same staff. Consequently, IRS’s ability to respond to correspondence timely has been dependent on staff availability and managing their time between answering phones versus correspondence.

Customer service representatives (CSR) in IRS’s Accounts Management organization slightly increased the share of their time spent responding to taxpayer correspondence during the 2024 filing season. During the 2024 filing season, CSRs spent about 60 percent of their direct hours answering phone calls and 40 percent responding to correspondence. In the 2023 filing season, CSRs spent a slightly higher percentage of their time (65 percent) on phones and less of their time (35 percent) on correspondence.

Given that IRS regularly monitors its correspondence inventory, estimating time frames for when different categories of the correspondence backlog will be resolved—and communicating this information to taxpayers—would increase transparency about delays. Therefore, in 2022, we recommended that IRS estimate time frames for resolving IRS’s correspondence backlog, monitor and update these estimates periodically, and communicate this information to taxpayers and stakeholders.[39] Developing estimates would also help IRS determine how best to allocate finite resources to support its various customer service functions.

IRS agreed with this recommendation and has taken some action to implement it, including launching a new web page in March 2024 that shows the receipt date (month and year) of the correspondence that IRS is currently processing. However, the web page does not provide information on how long taxpayers can expect to wait for a response once IRS begins to process it. As of November 2024, IRS officials stated they do not intend to share this information with taxpayers and stakeholders.

While IRS has made progress on addressing its correspondence backlog, taxpayers would still benefit from IRS clearly communicating estimated time frames for resolving correspondence. Without clear, timely information on IRS’s processing timeframes for addressing taxpayer correspondence, taxpayers will lack information on when they should reasonably expect a response or refund from IRS. Taxpayers will continue to call, write, or visit IRS in person to try to obtain this information, and IRS will continue to struggle to meet demands for taxpayer customer service.

IRS Used IRA Funding to Staff and Begin Modernizing Some Operations

IRS Hired More Filing Season Employees but Has Not Evaluated if Direct Hire Authority Meets Agency Needs

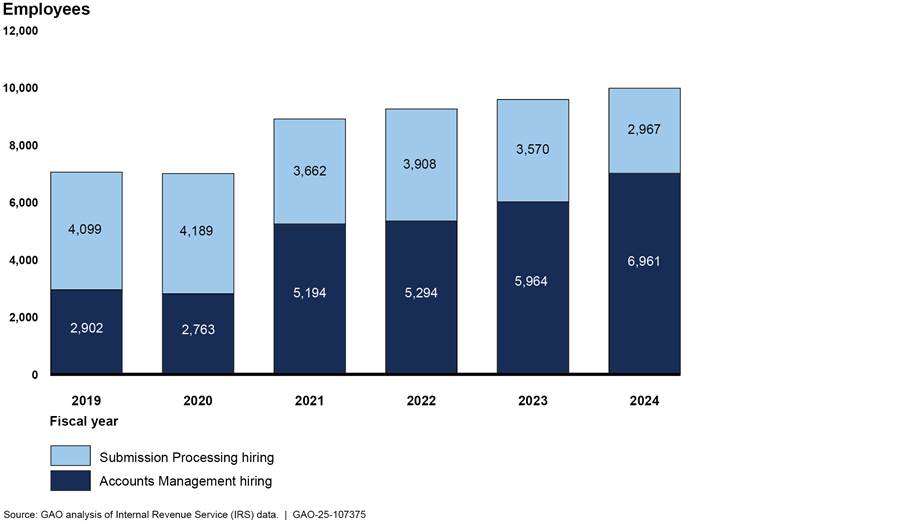

IRS hired more employees for filing season 2024 operations—more than 9,900 employees—than it hired in each of the previous five filing seasons. IRS generally hires thousands of employees every year to support the annual filing season, and many of these workers are seasonal hires.[40] We have previously reported that IRS has historically struggled to hire sufficient returns processing staff to support the influx of incoming or unexpected work, such as the millions of backlogged returns during the 2020, 2021, and 2022 filing seasons.[41]

IRS used its appropriated annual funds and IRA funds to hire these employees. As shown in figure 8, Congress appropriated $2.8 billion for taxpayer services in fiscal year 2024; IRS had originally estimated this amount would fund about 63 percent of its planned workforce in this area.[42] According to IRS officials, IRS requested that $477 million be transferred to the taxpayer services amount from two other appropriated amounts—$272 million from enforcement and $205 million from operations support. IRS officials stated that IRS then used $403 million in IRA funding and $548 million from user fees and reimbursable collections during fiscal year 2024 to support the rest of its planned taxpayer services workforce.[43] Funding for IRS’s taxpayer services workforce came from a similar mix of sources in fiscal year 2023—73 percent from annual appropriations and 23 percent from IRA funds.[44]

Notes: The majority of the unobligated balances from fiscal years 2021 and 2022 was from COVID-19 supplemental appropriations (2021 American Rescue Plan Act). Congress appropriated $2.8 billion for the taxpayer services budget activity in fiscal year 2024. IRS officials stated that IRS subsequently requested that $477 million be transferred from two other appropriated amounts ($272 million from enforcement and $205 million from operations support) to the taxpayer services amount. IRS officials stated that in fiscal year 2024, IRS increased the amount of user fees to fund taxpayer services to $548 million.

As shown in figure 9, IRS hired nearly 7,000 employees in Accounts Management and nearly 3,000 in Submission Processing in fiscal year 2024. Among other responsibilities, these employees provide customer service (Accounts Management) and process returns (Submission Processing).

Note: Accounts Management positions includes customer service representatives, tax examiners, and clerks. Submission Processing positions include tax examiners, clerks, and student trainees.

Accounts Management hiring. To fill Account Management positions, which include employees who answer taxpayer phone calls, IRS hired about 1,000 more employees for the 2024 filing season (17 percent increase) than it had for the 2023 filing season.[45] The 6,961 employees hired for Accounts Management included 5,706 CSRs, 844 tax examiners, and 411 clerks. This was the highest number of Accounts Management employees that IRS hired for each of the past five filing seasons (from 2019 to 2023).

IRS officials told us that it would not have been possible to achieve their level of service goals during the 2024 filing season without hiring these additional CSRs. These officials said that IRA funding enabled IRS to hire more CSRs than it could have using only annual appropriations.

Submission Processing hiring. Although IRS hired fewer employees for Submission Processing positions this filing season compared to 2023, it moved closer to achieving its overall goal. IRS officials told us that the fiscal year 2024 goal was 1,873 employees less than fiscal year 2023 because the agency had projected reduced workloads for functions with paper processing tasks.

For fiscal year 2024, IRS hired almost 3,000 Submission Processing employees, which was 82 percent of its goal, as shown in table 4. By comparison, IRS hired about 3,500 Submission Processing employees in fiscal year 2023, which was 65 percent of its goal. In fiscal years 2019 and 2020, IRS hired more employees but achieved only about 50 percent of its Submission Processing hiring goals.

|

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Goal |

8,203 |

8,841 |

5,473 |

5,473 |

5,473 |

3,600 |

|

Hired |

4,099 |

4,189 |

3,662 |

3,908 |

3,570 |

2,967 |

|

Percentage of Goal Hired |

50 |

47 |

67 |

71 |

65 |

82 |

Source: GAO analysis of Internal Revenue Service (IRS) information. | GAO‑25‑107375

Direct hire authority. To speed the hiring of employees for the 2024 filing season, IRS continued to use an expedited hiring process referred to as direct hire authority. IRS hired 98 percent of its fiscal year 2024 employees for Submissions Processing by using direct hire authority. The same percentage of Accounts Management CSRs were hired through direct hire authority. IRS also held 80 job fair hiring events from October 2023 to May 2024.

In general, direct hire authority enables an agency to hire a qualified applicant and bypass typical federal hiring requirements such as competitive rating, veterans’ preference, and applicant ranking procedures.[46] Direct hire authority generally helps agencies meet immediate hiring needs by reducing the time it takes to get new staff working.[47]

In January 2024, we reported that the Department of the Treasury had requested from the Office of Personnel Management (OPM) continued use of this direct hire authority for IRS, but that IRS had not evaluated the outcomes from its recent usage. As a result, we recommended that IRS develop and implement plans to monitor and evaluate its use of direct hire authority.[48] IRS agreed with our recommendation and in July 2024 told us that it was performing a monthly analysis of direct hire authority and would provide quarterly reports on its usage to Treasury and OPM.

As of September 2024, IRS had taken some action to implement this recommendation, including analyzing staff hired using direct hire authority. This analysis included direct hires by job series; pay plan, grade, and step; and appointment type, as well as hiring metrics for vacancies or direct hire events. To fully implement this recommendation, however, IRS needs to evaluate its use of direct hire authority to determine if the hiring flexibilities are meeting the agency’s needs. Without a comprehensive review, IRS may miss opportunities to develop strategies or inform efforts aimed at transforming its hiring and onboarding processes by reducing its overall time to hire.

Although IRS was able to use IRA funding and direct hire authority to support hiring filing season employees and IRS hired more of these employees than in the previous five filing seasons, IRS officials said that the agency still faced challenges in some locations with processing operations.[49] For example, the agency reached only 68 percent of its hiring goal for Submission Processing positions in Kansas City, Missouri. By contrast, IRS reached 102 percent of its goal for its Ogden, Utah, location.[50]

Attrition. Additionally, IRS continued to experience higher turnover for its filing season Accounts Management and Submission Processing campus workforces than for the agency as a whole; however, the percentage of campus employees who left IRS declined between fiscal years 2023 and 2024.[51] For fiscal year 2024, the percentages of Accounts Management and Submission Processing campus employees leaving were 12 percent and 16 percent respectively, compared to 9 percent for all of IRS (see table 5). During fiscal year 2023, 17 percent of Accounts Management campus employees and 22 percent of Submission Processing campus employees left the agency.

Table 5: Separation Data for IRS Accounts Management and Submission Processing Campus Employees, Fiscal Years 2022–2024

|

|

2022 |

2023 |

2024 |

|||

|

|

Number of employees |

Separation rate |

Number of employees |

Separation rate |

Number of employees |

Separation rate |

|

Accounts Management |

3,863 |

17 |

4,454 |

17 |

3,141 |

12 |

|

Submission Processing |

2,425 |

26 |

2,086 |

22 |

1,475 |

16 |

|

IRS-wide |

11,879 |

14 |

10,836 |

12 |

9,350 |

9 |

Source: GAO analysis of Internal Revenue Service (IRS) workforce planning data. | GAO‑25‑107375

Notes: The data only include external separations—that is, employees who left IRS. It does not include migrations such as employees who accepted another position with the same or a different business unit at IRS. The separation rate is the number of employees separating during the fiscal year, divided by the total number of IRS employees as of October 8, 2022; October 7, 2023; and October 5, 2024, respectively.

IRS has 10 campuses where employees perform various filing season activities, such as processing all tax returns filed each year, answering tax law and tax account inquiries, and adjusting tax accounts. IRS processes tax returns, related documents, and payments at Submission Processing centers located on three of these campuses. These centers are located on IRS campuses in Austin, Texas; Kansas City, Missouri; and Ogden, Utah.

IRS Used IRA Funding to Begin Modernizing Some Paper Processing Operations

During the 2024 filing season, IRS continued to use IRA funding for modernization with the goal of improving its returns processing operations and service. As noted in the agency’s IRA Strategic Operating Plan, tax returns and other documents submitted on paper have outsized effects on IRS operations in that the processing of paper takes longer, costs more, and is more prone to errors. One of IRS’s objectives for the IRA funding is to improve its services to taxpayers and one way IRS plans to do this is to reduce time-consuming manual processes and reduce errors across the agency through greater digitalization of paper. IRS used IRA funding during the 2024 filing season to purchase new mail sorting and scanning machines and to continue developing and enhancing a tool that enables taxpayers to provide IRS some documentation electronically. While these efforts are consistent with IRS’s digitalization and modernization goals in the agency’s IRA Strategic Operating Plan, it is too early to determine their effectiveness in improving IRS processing and customer service.

Replacing Aging Mail Sorting Machines

IRS receives about 200 million pieces of mail annually that it begins processing with the use of mail sorting machines. This mail includes individual and business tax returns as well as taxpayer correspondence and non-tax forms.[52] As we have previously reported, delays at any point in this process can have downstream effects such as delayed refunds to taxpayers.[53]

During the 2024 filing season, IRS installed nine new mail sorting machines at IRS locations, including the six locations that receive high volumes of mail. The mail sorting machines are used by IRS employees at Submission Processing centers to automatically count and sort mail and to attempt to detect remittances (i.e., checks). One of the new sorting machines is shown in figure 10. The 2025 filing season will be the first in which all the new machines will be operational at the start of the filing season.

The new machines replaced older ones that were decades old and were difficult for IRS to maintain and use. For example, during our site visits to IRS Submission Processing centers in 2023, IRS officials told us that the manufacturer of those older machines was no longer in business, and that the vendor hired by IRS to repair and maintain the machines had difficulty finding parts. They told us that the machines were also breaking down weekly during the 2023 filing season.

While IRS replaced the older mail sorting machines during the 2024 filing season, IRS employees were still experiencing challenges related to sorting mail. At the time of our site visits in April and June 2024, IRS employees who oversee mail sorting operations at Submission Processing centers in Kansas City, Missouri, and Ogden, Utah, told us about some technical issues with the new machines. For example, they said that the new machines were not sorting mail as well as the older machines, resulting in over estimated total mail volumes. They also told us that the machines were not processing as many pieces of mail as originally promised. IRS officials also shared with us documentation used to track issues with the new machines.

However, IRS officials told us in October 2024 that machine downtime related to these issues had decreased as IRS employees gained more experience running the new machines. IRS officials also said that machine downtime decreased after the machines’ manufacturer began basing technicians onsite at the Submission Processing centers. According to IRS officials, prior to the technicians being based onsite, IRS sometimes had to wait 1 to 3 days for technicians to arrive and resolve issues. According to IRS data and officials, overall downtime for the new machines varied from 5 to 7 percent through the end of August 2024, but that by September, downtime was less than 1 percent.

Replacing Scanning Machines and Increasing In-House Scanning

In the past few years, IRS has been undertaking efforts to scan and digitalize more of the millions of paper tax returns that taxpayers mail during the annual filing season and that IRS has to process and store. To currently process many of these paper returns, IRS employees manually enter data from those paper forms into IRS IT systems.[54] The paper returns are also stored as historic records at IRS facilities. According to IRS, scanning more paper returns during processing plus extracting more data from those paper returns will benefit both taxpayers and IRS. For example, processing times for paper returns could be reduced, resulting in faster refunds to taxpayers. Easier access to more data from paper returns could also help IRS improve its compliance, customer service, and enforcement operations.

IRS expanded a project to use outside vendors to support IRS scanning of some individual income tax returns (Form 1040) and two types of employer returns (Forms 940 and 941) for the 2024 filing season.[55] IRS began piloting this project called Digital Intake to Modernized e-File (DIME) during the 2023 filing season.[56] Paper tax returns are first shipped to off-premises vendors who scan and extract data from the returns to create an electronic record that can be transmitted to IRS like an e-filed return. After the vendors validate the data, it is transmitted to IRS via its Modernized e-File system for further validation and downstream processing. By the end of the 2024 filing season, about 82,000 paper Form 1040 returns had been processed this way, which was about 2 percent of the nearly 5 million paper Form 1040 returns that IRS received. For employer returns (Forms 940 and 941), about 800,000 paper returns were processed by DIME vendors, which was about 16 percent of the paper returns IRS received.

IRS plans to bring more of this scanning in house and reduce the agency’s use of outside vendors. IRS used funding from the IRA to purchase new scanning machines, some of which are shown in figure 11. IRS purchased these new scanners to ensure that IRS had sufficient future scanning capacity to process more incoming paper returns as well as to scan historical documents. While the machines were delivered to IRS processing centers in early 2024, they were not used to process paper tax returns during the 2024 filing season.

IRS officials explained that to use the new machines to extract more data from paper returns and then transmit that data to IRS core processing systems, IRS first needed to reconfigure its current scanning software. IRS’s existing technology called Service Center Recognition/Image Processing System (SCRIPS) is used by IRS employees at Submission Processing centers to scan and extract selected lines of data from a few types of business tax returns.[57] IRS plans to modernize SCRIPS to enable full data extraction and digital processing of all paper tax returns. As of November 2024, however, IRS officials said that the SCRIPS modernization program was still in development.

IRS did begin using the new machines to start scanning some of the 1 billion historic documents currently stored across IRS facilities.[58] Because data from the historic documents did not need to be extracted for further downstream processing, the new machines could be used to create digital images of the documents (PDF). After quality assurance is performed on the digital images and metadata, IRS will be able to dispose of the physical paper documents. IRS officials told us that as of November 2024, IRS had started with scanning historic Forms 709.[59] According to IRS documentation, the eventual digitization of all historic documents could take 2 to 3 years to complete but would eventually save IRS $40 million in annual storage costs.

Expanding the Document Upload Tool

Prior to the start of the 2024 filing season, IRS announced that taxpayers would be able to respond to nearly all correspondence through its Document Upload Tool, which allows taxpayers to digitally submit documents that would have otherwise been mailed to IRS in response to notices. Officials said the Document Upload Tool is intended to make it easier and more convenient for taxpayers to respond to IRS by offering an online portal for submitting responses and documents. Officials said the tool does not necessarily reduce the time it takes for IRS to respond, but it does improve timeliness because it reduces the time to receive, open, sort, and route a mailed response after it reaches an IRS facility. Taxpayers who prefer to use paper instead of the Document Upload Tool can continue to do so.

Figure 12: Sorting Tables Used for Paper Processing at IRS Ogden, Utah, Processing Center, June 2024

IRS first introduced a prototype of the Document Upload Tool in 2021 and it was limited to correspondence responding to certain types of notices. IRS used IRA funds to expand the tool to accept taxpayer responses to more types of notices and letters. According to IRS data as of June 2024, about 70 percent of the cost to develop and support the Document Upload Tool was funded by the IRA. IRS increased the number of notices for which taxpayers could use the tool in filing season 2023 to the nine most frequently issued notices. Then, for the 2024 filing season, IRS expanded the tool to intake all notices and letters, except those with payment or filing requirements—a total of 97 types of notices.

Taxpayer use of the Document Upload Tool has increased since IRS launched the tool, but its low overall use relative to IRS’s total paper correspondence volumes makes it difficult to assess its effect on processing and customer service. From January to April 2024, IRS received about 300,000 submissions via the Document Upload Tool, more than twice the number of submissions during the same period in 2023. In June 2024, IRS announced that 1 million submissions had been received via the Document Upload Tool cumulatively from when IRS launched its initial prototype in 2021 to June 2024. However, as stated above, taxpayers still primarily use paper to submit correspondence to IRS. In a press release announcing the tool’s 1 millionth submission, IRS said that the tool could ultimately eliminate up to 125 million paper documents that IRS receives annually.[60]

IRS continued to update the Document Upload Tool’s functionality after the filing season ended. In October 2024, IRS officials told us that they had implemented a confirmation page to the Document Upload Tool in May 2024. According to IRS documentation, the confirmation page includes the individual or business’ name, notice or letter identification number, and the date the response was submitted. However, Document Upload Tool users do not have a way to further track their submissions and therefore must call IRS to obtain information on submission status.

IRS has not yet fully integrated the Document Upload Tool with all of its correspondence processing steps. In some instances, IRS employees need to print out the documents electronically submitted by taxpayers via the tool to continue with downstream processing and making adjustments to taxpayer information and accounts. According to IRS officials, this manual process is generally needed for more specialized notices. During the 2024 filing season, submissions uploaded by taxpayers in response to 34 notice types needed to be printed by IRS employees and then added to existing paper processing steps. As we noted above, taxpayers could use the tool when responding to 97 types of IRS notices.

IRS plans to expand digital data delivery throughout the agency, such as connecting the Document Upload Tool to more of its processing systems, which would enable IRS to process the information faster. IRS officials told us in November 2024 that they were working to further integrate the Document Upload Tool with more downstream systems which would eliminate the need for employees to print the taxpayer’s uploaded documents. This work is part of IRS’s ongoing Digital Inventory Management effort to improve how documents that taxpayers submit digitally through the Document Upload Tool or other online tools are routed for processing throughout the agency.

Agency Comments

We provided a draft of this report to IRS for review and comment. In its comments, reproduced in appendix I, IRS said that the agency remains focused on improving service to taxpayers and provided examples of key achievements from the 2024 filing season. IRS also provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the appropriate congressional committees, the Commissioner of Internal Revenue, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at (202) 512-6806 or LucasJudyJ@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix II.

Jessica Lucas-Judy

Director, Tax Issues

Strategic Issues

GAO Contact

Jessica Lucas-Judy, (202) 512-6806 or lucasjudyj@gao.gov

Staff Acknowledgments

In addition to the contact named above, Erin Saunders Rath (Assistant Director), Mark Kehoe (Analyst-in-Charge), Dawn Bidne, Gavin Cooper, Ann Czapiewski, Samuel Facas, Amalia Konstas, Kirsten B. Lauber, Jamie Lundberg, Andrew Olson, and Mercedes Wilson-Barthes made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on Facebook, Flickr, X, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

Congressional Relations

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S. Government Accountability Office, 441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

Sarah Kaczmarek, Managing Director, KaczmarekS@gao.gov, (202) 512-4800, U.S.

Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Strategic Planning and External Liaison

Stephen J. Sanford, Managing

Director, spel@gao.gov, (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814, Washington,

DC 20548

[1]IRS started accepting and processing 2023 tax year returns for the 2024 filing season on January 29, 2024. The deadline for most taxpayers to file or request an extension, generally considered the end of the filing season, was April 15, 2024. In some recent years, the deadlines varied due to the COVID-19 pandemic and were as follows: July 15, 2020; May 17, 2021; April 18, 2022; and April 18, 2023.

[2]GAO, 2023 Tax Filing: IRS Improved Customer Service, but Could Further Improve Processing and Evaluate Expedited Hiring, GAO‑24‑106581 (Washington, D.C.: Jan. 25, 2024).

[3]In August 2022, Congress appropriated approximately $79.4 billion to IRS through the Inflation Reduction Act (IRA) of 2022 appropriations. See Pub. L. No. 117-169, tit. I, subtit. A, pt. 3, § 10301, 136 Stat. 1818, 1831-1833 (2022). In June 2023, the Fiscal Responsibility Act of 2023 rescinded about $1.4 billion of the amount appropriated for IRS. See Pub. L. No. 118-5, div. B, tit. II, § 251, 137 Stat. 10, 30-31 (2023). In March 2024, the Further Consolidated Appropriations Act of 2024 rescinded an additional $20.2 billion of the amount appropriated for IRS. See Pub. L. No. 118-47, div. B, tit. VI, § 640, div. D, tit. V, § 530, 138 Stat. 460, 572, 708 (2024). Enacted in September 2024, the Continuing Appropriations and Extensions Act of 2025 prevents IRS from spending an additional $20.2 billion of IRA funding, which is continued by the American Relief Act of 2025 through March 14, 2025. See Pub. L. No. 118-83, div. A, § 115, 138 Stat. 1524, 1527 (2024); Pub. L. No. 118-158, div. A, § 101, H.R. 10545, at 2 (2025).

[4]Pub. L. No. 117-169, tit. I, subtit. A, pt. 3, § 70004, 136 Stat. 1818, 2087 (2022).

[5]IRS’s filing season processing data we used for our analysis were as of April 19, 2024.

[6]IRS’s filing season customer service data we used for our analysis were as of April 20, 2024.

[7]IRS, Fiscal Year 2024 Congressional Budget Justification & Annual Performance Report and Plan, Publication 4450 (February 2023).

[8]IRS, Internal Revenue Service Inflation Reduction Act Strategic Operating Plan: FY2023–2031, Publication 3744 (Washington, D.C.: April 2023); 2024 IRA Strategic Operating Plan Annual Update, Publication 3744-B (Washington, D.C.: April 2024); and 2024 IRA Strategic Operating Plan Annual Update Supplement, Publication 3744-A (Washington, D.C.: April 2024).

[9]Master files are the official repository of all taxpayer data. The IRS master file is made up of several parts including the Individual Master File and Business Master File.

[10]IRM § 3.30.123. IRS can classify correspondence in its inventory as “overage” from 30 to 180 days after IRS receives it depending on the type of work performed by assistors. For example, correspondence cases generated internally age 75 days from the date IRS receives such cases, while international adjustment cases generated by taxpayers age 90 days from the date IRS receives them.

[11]GAO, 2022 Tax Filing: Backlogs and Ongoing Hiring Challenges Led to Poor Customer Service and Refund Delays, GAO-23-105880 (Washington, D.C.: Dec. 15, 2022) and Tax Filing: Actions Needed to Address Processing Delays and Risks to the 2021 Filing Season, GAO-21-251 (Washington, D.C.: Mar. 1, 2021).

[12]IRS, Fiscal Year 2024 Congressional Budget Justification & Annual Performance Report and Plan, Publication 4450 (February 2023).

[13]Pub. L. No. 117-169, tit. I, subtit. A, pt. 3, § 10301(1), 136 Stat. 1818, 1831–1832 (2022).

[14]The IRA also provided IRS with $500 million to carry out provisions in the act related to renewable energy tax credits, and $15 million to study and report on a potential direct electronic filing system. Pub. L. No. 117-169, tit. I, subtit. A, pt. 3, § 10301, subtit. D, pt. 8, § 13802, 136 Stat. 1818, 1831, 2013 (2022). GAO recently reported on the new IRS Direct File service in December 2024. GAO, Direct File: IRS Successfully Piloted Online Tax Filing but Opportunities Exist to Expand Access, GAO-25-106933 (Washington, D.C.: Dec. 19, 2024).

[15]In June 2023, the Fiscal Responsibility Act of 2023 rescinded about $1.4 billion of the amount appropriated for IRS. See Pub. L. No. 118-5, div, B, tit. II, § 251, 137 Stat. 10, 30-31 (2023). In March 2024, the Further Consolidated Appropriations Act of 2024 rescinded an additional $20.2 billion of the amount appropriated for IRS for enforcement activities. See Pub. L. No. 118-47, div. B, tit. VI, § 640, div. D, tit. V, § 530, 138 Stat. 460, 572, 708 (2024). Enacted in September 2024, the Continuing Appropriations and Extensions Act of 2025 prevents IRS from spending an additional $20.2 billion of IRA funding, which is continued by the American Relief Act of 2025 through March 14, 2025. See Pub. L. No. 118-83, div. A, § 115, 138 Stat 1524, 1527 (2024); Pub. L. No. 118-158, div. A, § 101, H.R. 10545, at 2 (2025).