TAXPAYER EXPERIENCE

IRS Should Fully Establish Its Approach for Using Evidence to Assess Service Improvement Results

Report to Congressional Committees

United States Government Accountability Office

For more information, contact Jessica Lucas-Judy at lucasjudyj@gao.gov.

Highlights of GAO-25-107408, a report to congressional committees

IRS Should Fully Establish Its Approach for Using Evidence to Assess Service Improvement Results

Why GAO Did This Study

IRS has struggled with long-standing challenges in improving how taxpayers experience interacting with IRS services. Policymakers have recognized the critical importance of improving taxpayer services IRS provides, as well as the related taxpayers’ experience in using the services. IRA provided IRS tens of billions of dollars over 10 years for improving operations, including services to taxpayers.

The IRA includes a provision for GAO to oversee the distribution and use of IRA funds. This report (1) describes IRS’s plans and actions to improve services to meet taxpayer wants and needs, (2) describes IRS’s plans and actions to improve the taxpayer experience and overcome related challenges, and (3) evaluates whether IRS is assessing how service improvement efforts have improved the taxpayer experience using evidence.

GAO reviewed IRS documents and interviewed IRS officials and relevant stakeholders, including members of 10 selected groups that represent taxpayers. GAO also compared IRS’s strategic plans, projects, and other documents to federal guidance, including federal statutes, OMB guidance, and practices that GAO had identified to help agencies build and use evidence to manage performance.

What GAO Recommends

GAO recommends that IRS fully establish an evidence-based approach to determine the effects of service improvements on the taxpayer experience. IRS agreed with the recommendation and outlined planned steps to implement it.

What GAO Found

As of February 2025, the Internal Revenue Service (IRS) had been implementing a strategy to improve taxpayer services with Inflation Reduction Act (IRA) funds. IRS developed two strategic objectives aligned with a range of service improvement projects. These included efforts such as to

· improve access to live assistance on the telephone and in person, and

· expand features that allow taxpayers to perform interactions online.

GAO interviewed 10 selected groups that represent taxpayers about what they want and need from IRS. These included clear guidance and tools. IRS officials described ongoing or planned actions to address these wants and needs, such as simplifying taxpayer notices and providing IRS staff computer systems and data to help taxpayers. In March 2025, however, IRS said it is reassessing which IRA projects to continue because of changes in IRS funding and staffing levels.

IRS’s efforts to improve the taxpayer experience have been spurred by statutory requirements, including IRS’s Taxpayer Experience Strategy as required by the Taxpayer First Act of 2019. IRS has acted to follow Office of Management and Budget (OMB) guidance for high-impact service providers, including developing annual plans to improve priority services. IRS faces challenges in demonstrating that it has improved the taxpayer experience, such as limited data and measures, uncertain funding and staffing levels, and changes in complex tax laws. IRS officials outlined efforts to address these challenges, such as developing new measures, data, and tools on how taxpayers experience IRS services.

IRS documents state that these service improvements are intended to improve the taxpayer experience. For example, its 2023 strategic plan said IRS would make it easier for taxpayers to meet their tax responsibilities and receive tax incentives for which they are eligible. IRS has also taken some actions to develop and use evidence to assess progress in improving services but has not fully established an evidence-based approach such as by using 13 key practices GAO has identified to determine the effects of these efforts on the taxpayer experience. For example, IRS has not fully established key practices to:

· define taxpayer experience goals related to service improvements;

· generate new evidence from measures, analytical tools, and dashboards to track progress with the taxpayer experience goals;

· involve external stakeholders to help assess the effects of its service improvements on the taxpayer experience; and

· promote accountability for achieving the taxpayer experience goals.

IRS officials said establishing an evidence-based approach using these and other key practices has been delayed. The IRS offices that had been coordinating IRA and taxpayer experience initiatives were disbanded in March 2025 and April 2025, respectively, according to IRS officials. As IRS reorganizes and reassesses priorities, integrating all key practices in an evidence-based approach can inform decisions to make the best use of resources in improving the taxpayer experience.

Abbreviations

CAP Cross-agency priority

HISP High-impact service provider

IRA Inflation Reduction Act of 2022

IRS Internal Revenue Service

OMB Office of Management and Budget

QR Quick-Response

SOP Strategic Operating Plan

TIGTA Treasury Inspector General for Tax Administration

TSO Transformation and Strategy Office

TXO Taxpayer Experience Office

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

July 17, 2025

Congressional Committees:

The Internal Revenue Service’s (IRS) stated mission is to “provide America’s taxpayers top-quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all.” IRS serves taxpayers in many ways, including through toll-free telephone assistance and the IRS.gov website, where taxpayers can learn how to comply with tax laws in filing a tax return or when to expect a refund to arrive.

IRS has struggled with long-standing challenges in improving the taxpayer experience when serving and interacting with taxpayers. Congress, the National Taxpayer Advocate, and others have recognized the critical importance of improving taxpayer services IRS provides, as well as the related taxpayers’ experience in using the services. For example, to improve the taxpayer experience in receiving services, Congress passed the Taxpayer First Act in 2019.[1]

Furthermore, a June 2018 National Taxpayer Advocate report said that voluntary tax compliance heavily relies on taxpayer service and experience, noting that survey data show that taxpayers’ experiences lag behind the experiences of users of services from other government agencies and the private sector.[2] The previous administration established a federal customer experience priority area in its President’s Management Agenda to include modernizing the service experience for high-impact federal programs.[3] The Office of Management and Budget (OMB) designated IRS as one of 38 high-impact service providers and issued guidance for these providers to manage customer experience and improve service delivery.[4] In April 2025, the Secretary of the Treasury announced preliminary goals and objectives that he said will form the framework for the Department of the Treasury’s upcoming strategic plan, one of which is to deliver a modern taxpayer experience to improve service, privacy, and collection.

In August 2022, Congress passed, and the President signed, the Inflation Reduction Act (IRA). The act provided IRS approximately $79.4 billion in multiyear funding available for IRS to spend through fiscal year 2031.[5] Subsequent laws have rescinded or prevented IRS from spending over half of this amount, reducing the amount IRS can spend to $37.6 billion.[6] Upon IRA’s enactment, the then-Secretary of the Treasury directed IRS to develop a plan for using IRA funding. In response, IRS delivered its Inflation Reduction Act Strategic Operating Plan. The plan presented an “IRA transformation vision,” and five IRA transformation objectives. Each objective included initiatives, key projects, and major milestones. In March 2025, IRS officials said the office that had been leading this effort had been disbanded and that IRS would make decisions about which IRA projects to continue and which office would lead them.

The IRA includes a provision for us to oversee distribution and use of IRA funds.[7] This report (1) describes IRS’s plans and actions under IRA to improve services to taxpayers to meet their wants and needs, (2) describes IRS’s plans and actions to improve the taxpayer experience and address related challenges, and (3) evaluates whether IRS is assessing how service improvement efforts have improved the taxpayer experience using evidence.

To describe IRS’s plans and actions under IRA to improve service to meet taxpayer wants and needs, we analyzed available IRS documents. More specifically, we reviewed information on IRS’s strategic objectives, initiatives, and underlying specific projects as documented in IRS’s April 2023 IRA strategic plan and the April 2024 update to it, and in its Strategic Implementation Management System. We also reviewed Treasury Inspector General for Tax Administration reports on the status of IRS IRA strategic plan implementation and funding for taxpayer services.[8] To identify taxpayer wants and needs, we also interviewed members of 10 selected groups who represent taxpayers. We summarized their views on such issues as what taxpayers want or need from IRS such as improving services and how IRS is addressing their views. We selected these groups from a list IRS provided and our existing contacts in the tax community. The summarized interview results are not generalizable but provide examples of views among various groups of taxpayers. Appendix II describes our methodologies for selecting these groups as well for interviewing their members and summarizing their views.

To describe IRS’s plans and actions to improve the taxpayer experience and address related challenges, we summarized IRS’s actions as documented in its January 2021 response to the Taxpayer First Act of 2019.[9] We also reviewed OMB guidance for high-impact service providers, such as IRS, to understand the actions for which the guidance calls. We interviewed IRS and OMB officials and obtained documents to summarize the steps IRS has taken to implement guidance. This included IRS’s customer experience action plans for 2024 as well as the strategic planning documents described above. We interviewed IRS officials and reviewed IRS and other documents from the tax community to identify the challenges IRS faces and how IRS is addressing them.

To evaluate whether IRS is assessing how service improvement efforts have improved the taxpayer experience using evidence, we reviewed IRS’s IRA strategic plan and related documents and interviewed IRS officials on IRS’s efforts to use evidence in making such assessments. We shared 13 key evidence practices that we have previously identified for performance management and evidence-building activities to help manage and assess the results of federal efforts.[10] Specifically, we provided IRS with a list of those evidence practices and examples of how it could apply them in the taxpayer experience context. In turn, IRS officials provided documents and testimony on IRS’s efforts for each of the 13 practices, including documents on the April 2024 update to IRS’s IRA strategic plan and the status of IRA projects. We analyzed this IRS information to illustrate IRS’s progress and plans toward addressing four selected key practices for using evidence to assess how its service improvements also improve the taxpayer experience. Appendix II discusses our evaluation of IRS’s use of evidence for the taxpayer experience.

We conducted this performance audit from February 2024 to July 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Taxpayer Services Can Involve Several Interactions to Complete a Journey

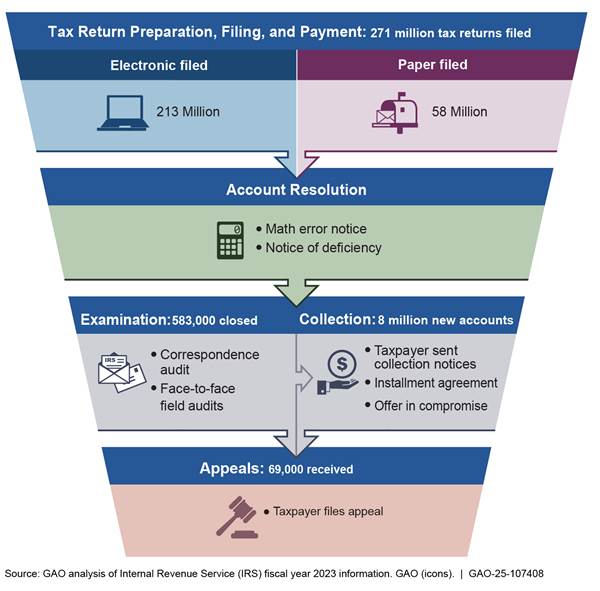

Taxpayers may interact with IRS as they use IRS services to address their tax obligations. This experience may involve a one-time interaction or multiple interactions over time in various phases, such as in preparing and filing tax returns as well as paying taxes owed, as shown in figure 1.

Within each phase, taxpayers can have various interactions with IRS. For example, within the account resolution phase for a filed tax return, a taxpayer can have service interactions for activities to resolve issues involving identity theft, math errors, and refunds.

Taxpayers interact with IRS through what IRS calls five service channels, including:

· tax forms and publications,

· website (IRS.gov),

· toll-free telephone assistance operations,

· in-person taxpayer assistance centers, and

· correspondence (paper-based interactions).[11]

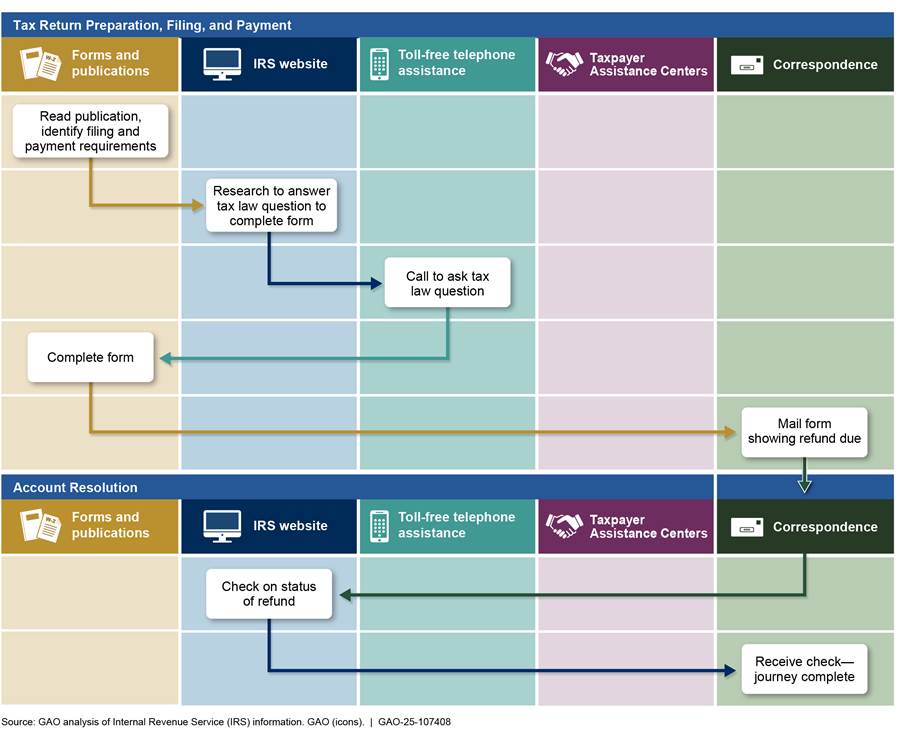

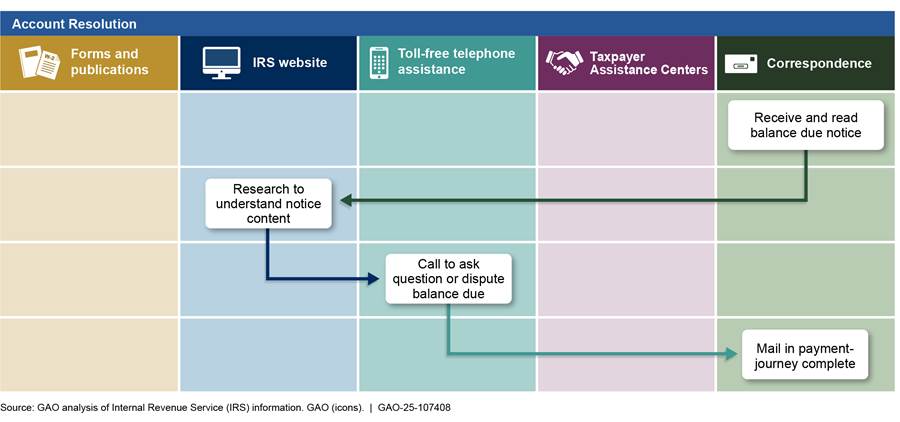

The taxpayer experience with the service channels could include a series of interactions or a multistage process, which is how OMB guidance defines a service journey.[12] Figures 2 and 3 below illustrate examples of two possible taxpayer journeys across service channels: preparing and filing a paper tax return with a refund due and resolving an account for a filed return on which the tax owed was not paid.

Figure 2: Example of a Taxpayer Journey in Preparing and Filing a Paper Tax Return Due a Refund of Paid Taxes

Figure 3: Example of an Account Resolution Taxpayer Journey After Return Filing Without Paying Taxes Owed

Taxpayer interactions with IRS can be very complex, especially if taxpayers face journeys with multiple IRS interactions to accomplish accurate filing and IRS acceptance of tax return, or a longer and more complex journey to resolve an account issue on the filed taxpayer return.

Taxpayer Experience Is Defined from the Taxpayer’s Perspective in Completing IRS Service Journeys

Customer experience—or taxpayer experience in the context of IRS services—is defined as “the public’s perceptions of and overall satisfaction with interactions with an agency, product, or service.”[13] OMB further builds on this definition of customer experience as referring to

… a combination of factors that result from touchpoints between an individual, business, or organization and the Federal government over the duration of an interaction, service journey, and relationship.[14]

OMB specifies the experience factors that result from service touchpoints, including:

· ease, simplicity, effort (burden, friction);

· efficiency, speed;

· transparency;

· equity (e.g., participation, access);

· humanity (e.g., respect, dignity, empathy);

· effectiveness, perceived value of the service itself;

· interactions with any employees;

· perceived responsiveness to individual needs; and

· ability to provide feedback.[15]

These definitions and explanations touch on an important distinction between customer service and customer experience.[16] Customer service is the assistance an organization provides to those who buy or use its products or services and is a tactic the organization uses to improve the experiences customers have with their services. In other words, customer service is delivered from the perspective of the organization delivering the service. By comparison, the customer experience with a service is shaped by the customer’s collective interactions—or “touchpoints”—with that service. This may be a single interaction or the sum of many interactions as the customer works across that service to attempt to get their desired result. So, customer experience is from the perspective of the customer.

In the context of taxpayer services, IRS has also explained that taxpayer experience is not only based on a single customer service touchpoint, but on all service interactions:

Taxpayer experience goes beyond “customer service” to solve a problem. It covers all taxpayer transactions with the IRS across service, compliance, and other program areas throughout their lifetime of interactions … the “experience” is the sum of all interactions and includes every touchpoint with a product or service.[17]

This distinction between the internally focused “service” perspective of IRS and the externally focused “experience” perspective of the taxpayer has implications for IRS efforts to improve taxpayer services. Determining whether and how any service enhancements improve the experience relies on the perspectives of taxpayers and those who represent them during service interactions and journeys.

Evidence-Based Policy Making Encourages Key Practices

Federal decision-makers need evidence about whether federal programs and activities are achieving intended results.[18] They can use evidence to determine how federal programs and activities could best make progress toward objectives. Evidence also can help these decision-makers better understand and address challenges as well as set priorities to help improve implementation and performance.

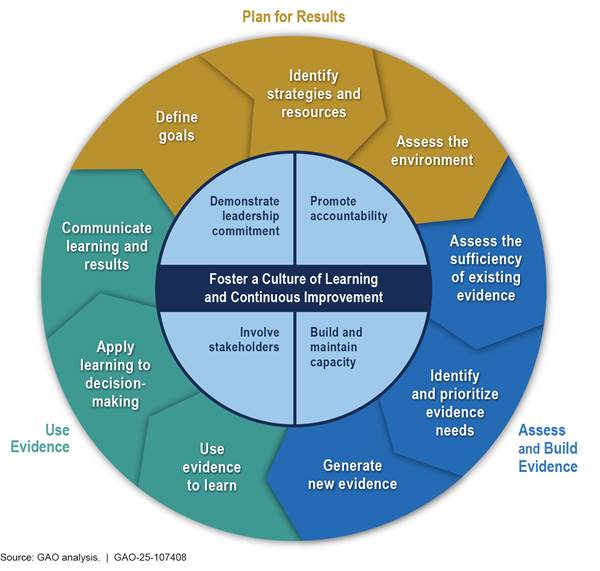

The Foundations for Evidence-Based Policymaking Act of 2018 created a framework for federal agencies to take a more comprehensive and integrated approach to evidence building.[19] The act included a provision for us to identify actions to help improve agency evidence-building capacity.[20] In response, we issued a guide in July 2023 that identified 13 key practices to help executive branch leaders and employees at any organizational level—such as a project or program, component agency or office, department, or cross-agency effort—build and use evidence to manage the organization’s performance.[21]

The 13 practices cover four interrelated topic areas. Three topic areas—(1) plan for results, (2) assess and build evidence, and (3) use evidence—and their nine practices comprise an iterative cycle. Implementing one practice can inform actions taken to implement others. For example, effectively using evidence starts with defining goals to be attained and assessing the existing and new evidence to be used to attain those goals. The fourth topic area—foster a culture of learning and continuous improvement—and its four practices are central to effectively implementing the cycle (see fig. 4).

IRS Has Been Implementing a Strategy to Improve Taxpayer Services Under IRA

IRS Developed Strategic Objectives and Related Priorities and Projects for Improving Services to Taxpayers

IRS developed two strategic objectives to guide its efforts to improve services to taxpayers.[22] As stated in IRS’s 2023 IRA Strategic Operating Plan (SOP), the strategic objectives are:

· Strategic objective 1: Dramatically improve services to help taxpayers meet their obligations and receive the tax incentives for which they are eligible.

· Strategic objective 2: Quickly resolve taxpayer issues when they arise.

For each strategic objective, IRS aligned a series of strategic initiatives, priority groupings, strategic subgoals, and projects, all of which IRS said it intends to use to improve taxpayer services.[23] Table 1 shows the priority groupings for the two strategic objectives, along with IRS’s intended outcomes, and future states if the related projects succeed.

Table 1: IRS Strategic Operating Plan Objectives with Related Priorities and Intended Outcomes for Taxpayer Services

|

Priority grouping |

Intended outcomes |

Future state for intended outcomes |

|

Strategic Objective 1: Dramatically improve services to help taxpayers meet their obligations and receive the tax incentives for which they are eligible |

||

|

Enhance Live Assistance |

Improve service for both call centers and in-person engagement facilities. |

When taxpayers need help, they can easily reach IRS for live assistance. |

|

Expand Online Services |

Access for individuals, businesses, and tax professionals to secure online accounts and self-service tools that allow them to view account information, make changes, interact with IRS, and manage preferences for payments, refunds, and communications. |

Taxpayers can complete all interactions with IRS online if they choose and see comprehensive, updated information on tax status. |

|

Accelerate Digitalization |

Allowing taxpayers to electronically submit forms and documents to IRS and digitizing the paper IRS receives enables better data extraction and processing at IRS. |

A paperless tax system end to end that speeds up processing time and puts an end to paper backlogs. |

|

Improve Employee Tools |

Provide employees tools they need, including equipment, easy access to data, and intuitive systems to manage accounts. |

Fully equipped, empowered, and engaged workforce serves taxpayers. |

|

Strategic Objective 2: Quickly resolve taxpayer issues when they arise |

||

|

Simplify Notices |

Improve communications with taxpayers by making IRS notices easier to understand and providing online access to those who choose to engage electronically. |

Notices will be simple and actionable for individuals and businesses; digital notices will be available in online accounts. |

|

Disrupt Scams |

Protect taxpayers by preventing scams before they happen or identifying them at filing and use data analytics and private sector partnerships to detect and disrupt scams. |

Personalized and proactive notifications to dismantle scams and provide support for victims. |

Source: GAO summary of Internal Revenue Service’s (IRS) 2024 IRA Strategic Operating Plan Annual Update Supplement. | GAO‑25‑107408

Table 2 shows the status of 152 projects aligned with priority groupings for the two strategic objectives aimed at improving taxpayer services.

|

Projects by priority grouping identified |

|||

|

Priority grouping |

Total |

Project status |

|

|

Closeda |

Open or work in progressb |

||

|

Enhance Live Assistance |

10 |

10 |

0 |

|

Expand Online Services |

21 |

14 |

7 |

|

Accelerate Digitalization |

24 |

22 |

2 |

|

Improve Employee Tools |

9 |

9 |

0 |

|

Simplify Notices & Disrupt Scamsc |

24 |

15 |

9 |

|

Total |

88 |

70 |

18 |

|

Priority Grouping Not Assignedd |

64 |

49 |

15 |

|

Grand total |

152 |

119 |

33 |

Source: GAO analysis of Internal Revenue Service (IRS) documentation from its system for tracking its projects. | GAO‑25‑107408

aOf the 119 closed projects, IRS labelled 85 projects as finished and completed their aims and 34 projects as either finished but did not complete their aims or skipped.

bIRS reported four projects as open but not started unlike projects that are works in progress.

cIRS combined these two priority groupings in its documentation.

dIRS said that no priority grouping had been assigned for these projects because IRS had not yet linked them to a key result.

Projects include a range of ways IRS intends to improve taxpayer services, including providing new ways for taxpayers to interact with IRS or making changes to existing service modes. Examples of projects by priority grouping include:

Enhance live assistance. Expanding the use of chatbots to provide services to taxpayers, including live callback on priority telephone lines and more available and accessible service.[24] For example, we previously reported that IRS expanded the availability of its callback feature during the 2024 filing season, which gives taxpayers calling certain phone lines the option to receive an automated call back from IRS rather than wait on hold. IRS told us that the callback feature saved taxpayers about 2.1 million hours they would have otherwise spent waiting on hold across the 2023 and 2024 filing seasons.[25]

Expand online services. Expanding Individual Online Account payment features (e.g., modernizing electronic payment channels) to allow individual and business taxpayers or their authorized representative to schedule and cancel payments, and save their bank information.

Accelerate digitalization. Revising 150 priority nontax forms to make them modern, mobile friendly, and easy for taxpayers to complete. We also previously reported that IRS expanded its Document Upload Tool, which allows taxpayers to digitally submit documents that would have otherwise been mailed to IRS in response to notices.[26]

Improve employee tools. Building a case management system so that employees can access information to enable seamless taxpayer service and appropriate authorities to resolve issues and answer questions during the first interaction.

Simplify notices and disrupt scams. Updating notices so that they provide clear and effective explanations of issues and steps to resolution that taxpayers can understand.

We asked how IRS was using the results of closed projects for improving services. IRS cited closed projects on (1) streamlining the notice update process, and (2) deploying new technology that enabled IRS to more quickly and efficiently program the redesigned notices. However, IRS did not provide any measures to show how these projects affected taxpayers, as we discuss in more detail later in the report. In February 2025, IRS said it has been focusing on reaching related milestones for projects to improve services before measuring their effects on taxpayers.[27]

IRS Cited Efforts Planned or Underway to Address the Needs That Selected Taxpayer Groups Identified

We interviewed 10 taxpayer groups from May through September 2024 about what taxpayers want and need from IRS to meet their tax obligations.[28] We summarized the results of those interviews and in October 2024 shared the resulting list with IRS.

In November 2024, IRS officials agreed that the list reflected their understanding of taxpayer wants and needs. They also cited efforts in the 2024 IRA SOP Annual Update Supplement that they believe will address these wants and needs. These efforts include a mix of strategic objectives, priority groupings, and strategic subgoals. Table 3 shows these IRS-cited efforts for each taxpayer want and need from the list we shared with IRS.

|

Taxpayer wants and needs identified in GAO interviews of selected taxpayer groups |

Planned strategic objectives, priorities, and subgoals |

|

Timely access for taxpayers and practitioners to online accounts to avoid unneeded phone calls and notices. |

Expand online services so that individual and business taxpayers as well as their tax professionals can perform most required IRS interactions through their accounts. Modernize technology in a timely way to meet needs including standards to ensure data security. |

|

Secure and easy-to-use IRS online tools. |

|

|

Smooth and clear IRS interactions that clarify the problem and actions to take. |

Enhance live assistance so that taxpayers who call reach IRS staff in a timely manner and are highly satisfied. Quickly resolve taxpayer issues when they arise. |

|

IRS responsiveness when taxpayers take actions, such as respond to notices. |

|

|

IRS staff adequately trained to quickly address and resolve taxpayer inquiries. |

|

|

IRS computers and data that allow IRS staff to resolve problems timely. |

Improve tools and technology so that IRS staff will have the hardware, software, and data to deliver effective and efficient results to taxpayers. |

|

Sufficient IRS staffing to timely respond to taxpayer calls or correspondence. |

Expand staffing with streamlined, efficient methods for workforce planning, recruiting, and hiring. |

|

Improved identity theft protection and faster resolution of issues. |

Disrupt scams by using advanced analytics and expertise to proactively identify and rapidly minimize impacts of tax scams. |

|

Clear and timely IRS guidance. |

Improve guidance by simplifying notices and enhancing live assistance such as when answering taxpayer calls or scheduling taxpayers for in-person support. |

|

Clear IRS notices that tell taxpayers what they need to do and that are not unnecessary. |

Simplify notices to be easy to understand and meet needs. Customize notice content through technical solutions and streamlined clearances. |

Source: Interviews with 10 selected taxpayer groups and Internal Revenue Service (IRS) information. | GAO‑25‑107408

Note: As of March 2025, IRS officials said they were reassessing IRS’s planned strategic actions, including Inflation Reduction Act projects, to determine which actions and projects to continue.

As of March 2025, IRS officials said IRS was reassessing its planned strategic actions, including IRA projects, to determine which actions and projects to continue. IRS officials also said this reassessment may affect some of the planned actions that table 3 describes.

IRS’s Recent Taxpayer Experience Efforts Spurred by Statutory Requirements and OMB Guidance Face Challenges

IRS Took Actions to Respond to the Taxpayer First Act

The Taxpayer First Act, enacted in 2019, required IRS to implement a strategy to meet reasonable taxpayer service expectations and adopt leading practices from the private sector, among other things.[29] In response, IRS developed and issued its taxpayer experience strategy as presented in its January 2021, Taxpayer First Act Report to Congress.[30] The strategy called for “a new era in tax administration” characterized by “high quality, personalized service” to help taxpayers understand and comply with filing and reporting obligations. This entailed having well-trained employees, clear and timely communications, partnerships within the tax community, and improved technology, among other efforts.

The report further described IRS’s strategy for making interactions with IRS efficient, informative, personalized, convenient, and secure. According to the report, these actions would provide taxpayers a better experience by spending less time and having fewer interactions with IRS and by having more options for interacting with IRS and for easily and securely accessing tax information. To facilitate movement to such better taxpayer experiences, IRS created the Taxpayer Experience Office in 2022.[31]

Our 2020 report on IRS’s transition from improving taxpayer services to ensuring that these improvements enhance the taxpayer experience pointed to necessary IRS actions to facilitate this transition.[32] Our recommendations to IRS included implementing:

· performance goals that align with IRS’s strategic goals and expectations for an improved experience;

· measures and targets aligned clearly with these goals throughout IRS; and

· measures that reflect taxpayer journeys and key transactions.

IRS Has Generally Followed OMB Customer Experience Guidance

Executive Order 14058, Transforming Federal Customer Experience and Service Delivery To Rebuild Trust in Government, establishes a framework for improving service delivery and customer experience within the federal government.[33] OMB Circular A-11, Section 280, most recently updated in July 2024, supports the implementation of the executive order by describing actions to be taken by high-impact service providers, which include:

· identifying two designated priority services;

· collecting and reporting customer experience feedback data on those services;

· submitting an annual customer experience action plan to OMB with a focus on improvement actions for designated services; and

· annually updating a customer experience capacity assessment and participating in an annual “deep dive meeting” with OMB on the assessment.[34]

Available IRS documentation showed that IRS has acted on these steps. According to OMB officials, IRS has completed these steps for fiscal years 2022 to 2024. For example, IRS designated as its two priority services (1) filing an individual tax return, and (2) managing an individual online account. Furthermore, IRS’s customer experience action plans for 2024 outlined efforts to implement a pilot project on “Direct File” in which certain taxpayers could file their tax returns digitally for free with IRS.[35] The plans also discussed efforts to enhance IRS’s online accounts for individual taxpayers, including secure messaging, notice delivery, and a document upload tool.

IRS Cited Various Efforts to Address Identified Challenges in Improving Taxpayer Experience

From reviewing IRS and other documents and interviewing IRS officials, we identified challenges IRS faces in improving taxpayer experience, such as demonstrating that changes in taxpayer services improved the experience. Table 4 summarizes the challenges and IRS efforts to address them, as of February 2025.

Table 4: Challenges IRS Faces Related to Improving the Taxpayer Experience, and Efforts IRS Identified to Address the Challenges, as of February 2025

|

IRS taxpayer experience challenges |

IRS efforts to address the challenges |

|

IRS was in the early stages of transitioning and maturing in multiple ways to better reflect how taxpayers experience interactions with IRS. For example, IRS was transitioning from: |

|

|

· its traditional focus on interactions with a single service to understanding what taxpayers experience in journeys of multiple interactions. |

IRS officials said IRS was early in its transition to assess the taxpayer experience. IRS was (1) establishing and aggregating baseline data for the taxpayer experience; (2) developing dashboards to visualize the experience and other data, such as number of contacts and time to resolve the issue along major taxpayer journeys; (3) developing more taxpayer experience measures beyond the historical transactional and operational measures for IRS services and the current project milestone measures; (4) creating standard measures for its taxpayer surveys as well as centralizing and improving oversight and evaluation of survey feedback; and (5) incorporating operational and survey measures to drive improvement. |

|

· focusing on deadlines for implementing projects to improve taxpayer services to specifying how the service improvements will improve taxpayer experiences. |

|

|

· existing data and measures that focus on service operations to data and measures that focus on taxpayer experience. |

|

|

Resolving taxpayers’ issues can require coordination across IRS units, which can complicate taxpayer journeys and lengthen processing times. |

IRS officials cited collaboration efforts across business units involving its strategies to improve products, services, and the taxpayer experience. |

|

IRS’s changing environment makes it difficult to implement long-term initiatives to improve the taxpayer experience. For example: |

|

|

· uncertainty about stable multiyear funding hinders efforts to modernize IRS computer systems and offer digital services to quickly resolve taxpayer issues.a |

IRS had been using Inflation Reduction Act (IRA) multiyear funding to secure vendor support for addressing modernization needs. IRS has a Transformation Roadmap for addressing its strategic objective to create foundational technology that is modern, scalable, and easy to maintain. According to IRS officials, consistent, stable multiyear funding in fiscal year 2026 and beyond would help keep the technology current and offer new digital services intended to resolve taxpayer issues rapidly.b |

|

· complicated and changing tax laws limit IRS’s ability to offer timely guidance to taxpayers. |

IRS officials said its counsel had ongoing work on the annual Priority Guidance Plan. Specifically, the Office of Online Services said it was committed to ensuring that the information provided on the IRS.gov website remains accurate, user friendly and current in alignment with changing tax laws based on technology and user feedback, among other actions. |

|

· being unable to hire enough staff trained to help taxpayers can undercut the ability to optimally improve taxpayer experiences. |

IRS officials said IRS had efforts to boost hiring and training as well as improved systems to enable staff to improve taxpayer experiences. IRS intended to use a learning environment and dashboards that will provide data to enhance this training. IRS officials said IRS was emphasizing a culture that empowers staff to improve the taxpayer experience, using new tools and processes.b |

Source: GAO summary of the Internal Revenue Service’s (IRS) February 2025 responses on its challenges to improve the taxpayer experience. | GAO‑25‑107408

aIn a January 2025 report on major IT acquisition and management challenges for federal agencies, we identified how a critical action on improving customer experience relates to addressing a major challenge in improving IT capacity and capability. See High-Risk Series: Critical Actions Needed to Urgently Address IT Acquisition and Management Challenges, GAO‑25‑107852 (Washington, D.C.: Jan. 23, 2025).

bIn March 2025, IRS officials said it was unclear how reductions to its IRA funding and to its staffing will affect these efforts to address the challenges.

IRS Intends for Its Service Improvements to Improve the Taxpayer Experience but Has Not Fully Established an Evidence-Based Approach to Assess Results

IRS Intends for Its Service Improvements to Improve the Taxpayer Experience and Has Noted Progress

As noted earlier, IRS has many efforts planned and underway to improve taxpayer services. IRS’s IRA planning documents state that these service improvements are intended to improve the taxpayer experience. For example, in referring to IRS strategic objectives to improve service and quickly resolve issues, IRS’s April 2023 IRA SOP stated:

We will make it easier for taxpayers to meet their tax responsibilities and receive tax incentives for which they are eligible. We will adopt a customer-centric approach that dedicates more resources to helping taxpayers get it right the first time, while addressing issues in the simplest ways appropriate.

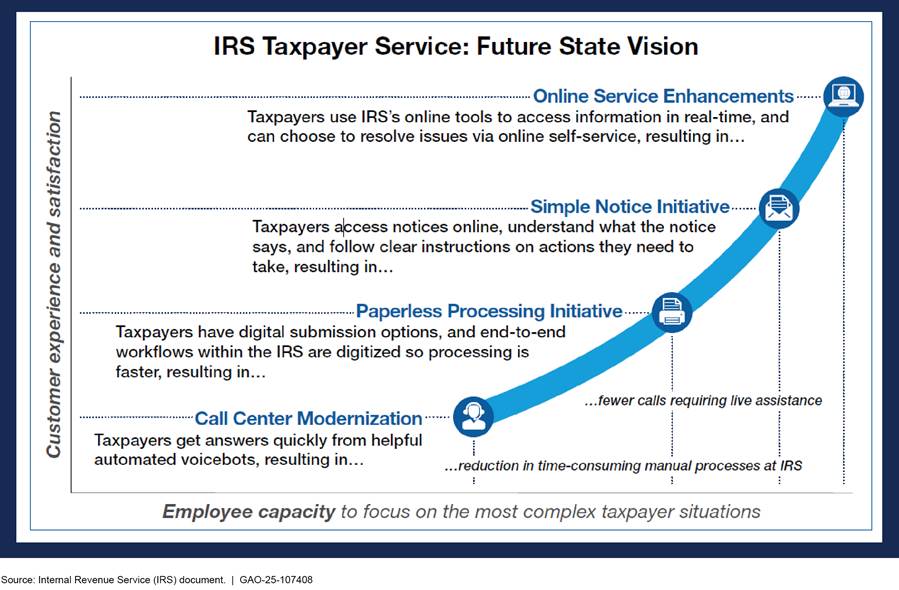

IRS’s future state vision is that all taxpayers can meet all of their tax responsibilities, including all interactions with IRS, in a completely digital manner if they prefer. IRS’s April 2024 update supplement includes a graphic to visualize how four taxpayer service efforts could achieve the future vision with some intended effects on taxpayer experience and satisfaction (see fig. 5).

Figure 5: IRS’s Future State Vision on Taxpayer Service Efforts and Taxpayer Experience and Satisfaction, as of April 2024

IRS officials said that IRS was still early in its service transformation to improve the taxpayer experience using the IRA funding from 2022 to develop the 2023 SOP. Even so, they noted examples of progress in IRS’s July 2024 press release that highlighted various completed taxpayer service projects that used IRA funds.[36] These projects included adding six features to the individual online account and allowing certain business forms to be filed electronically. The press release noted that IRS was still progressing toward other milestone goals for improving digital services.

IRS officials further noted recent public statements from other parties about IRS’s progress in implementing service improvement projects. In a December 2024 report, the National Taxpayer Advocate said taxpayer experience noticeably improved in fiscal year 2024, including shorter wait times for taxpayers to reach customer service representatives.[37] In January 2025, the prior administration reported on telephone service progress associated with IRA funding, including IRS’s implementing conversational voice technologies to reduce taxpayer burden and providing taxpayers a call-back option.[38] The Treasury Inspector General for Tax Administration (TIGTA) reported in February 2025 on IRS’s progress in redesigning notices to make them easier to understand, making taxpayer notices available online, and allowing taxpayers to reply to notices electronically.[39] TIGTA reported that its review of 25 redesigned notices determined that the notices generally were shorter, easier to read, and, when relevant, included Quick-Response (QR) codes. In general, these reports or statements did not cite specific measures or other evidence from IRS on the extent that these service improvements affected the taxpayer experience.

IRS Has Not Yet Fully Established an Evidence-Based Approach to Assess Results from Service Improvements on the Taxpayer Experience

As of March 2025, IRS had taken some actions toward building and using evidence related to the taxpayer experience. Until IRS fully establishes an evidence-based approach for the taxpayer experience, IRS will not be assured that it has the information it needs to assess progress toward its taxpayer experience goals, determine what worked well and where improvements are needed, and identify the best investments of its resources to make those improvements.

IRS officials explained that they have focused on implementing service improvement projects. They said that until IRS finished these projects for improving services, they could not yet indicate when IRS would fully establish an evidence-based approach for knowing whether and how the taxpayer experience has improved. Our analysis indicated that IRS has taken some actions that could be related to using evidence to determine any improvements to the taxpayer experience. IRS officials said they had not aligned these actions into a systematic approach.

Our 2023 report on evidence-based policy making provides such a systematic approach.[40] We shared with IRS the 13 key practices that could provide that systematic approach to assess progress made and to plan for further progress. Although IRS had not fully implemented these 13 practices, our interviews with IRS officials and reviews of documents that they provided indicated that IRS had taken some related actions and had some plans to implement the practices. The following discuss examples of practices for which we illustrate some related progress and plans that IRS has made toward implementing the practices. The examples address four key practices on (1) defining goals for improving the taxpayer experience, (2) generating new evidence such as from measures related to each goal and from taxpayer journeys at IRS, (3) involving stakeholders such as those representing taxpayers, and (4) promoting accountability for taxpayer experience goals.[41]

Defining Goals for the Taxpayer Experience

Agency actions to define goals and identify both long-term outcomes and near-term measurable results are necessary to implement other evidence-based key practices, such as identifying measures and other evidence that align with the goals and using evidence to make informed decisions to improve performance toward goals. Setting specific, measurable goals guides agencies in assessing the types of evidence they have and need to develop. In turn, agencies then can use such evidence to assess progress in achieving the goals and decide whether to adjust their goals or actions to achieve them. Learning about the reasons for any gap in the results achieved enables an agency to apply the learning in taking informed action to improve performance in achieving goals. In our September 2020 report we made a related recommendation on taxpayer experience goals.[42]

As discussed above, IRS adopted two strategic objectives and 14 related subgoals for improving taxpayer services. Our initial analysis indicated that not all the subgoals clearly stated intended outcomes for improving the taxpayer experience. After we shared this analysis with IRS officials, they provided supplemental information in December 2024 that explained how all the subgoals are intended to improve the taxpayer experience. Table 5 in appendix III summarizes our analysis of the subgoals and IRS’s supplemental information related to OMB’s experience factors.

IRS officials said that they do not yet know when IRS will formally document how all 14 subgoals on improving taxpayer services will also improve the taxpayer experience.

Generating New Evidence on Taxpayer Experience Measures and Journeys

IRS has acknowledged the need to develop evidence to better measure taxpayer experience and understand service journeys that taxpayers experience when they interact with IRS. In our September 2020 report, we discussed the importance of having new measures to assess performance against taxpayer experience goals and better evidence about the service journeys that taxpayers experience in interacting with IRS. We also made related recommendations on measures for taxpayer experience goals and taxpayer journeys.[43]

IRS is still working on measures that align with each of the 14 subgoals, discussed above, to enable IRS to assess how meeting the subgoals improved the taxpayer experience. As of January 2025, IRS officials shared information on measures for the first subgoal on improving taxpayer satisfaction with, and timely access to, IRS’s telephone assistance.[44]

IRS officials also noted that IRS’s taxpayer service survey and operational measures and data generally provide information on taxpayers’ single interactions on a given channel of service rather than capture taxpayers’ experience with potential multiple interactions or service channels that may be involved in completing a journey. IRS’s April 2023 IRA SOP called for gathering and analyzing evidence to learn about taxpayer’s service journey pain points.[45] As noted in IRS documentation, such evidence could be used to identify and take action to address those points and thereby improve service experiences.

In December 2024, IRS officials provided documentation on a data analysis project called the Customer Experience Analytics Visualization Tool. The tool included data from several IRS systems that IRS officials said they could use to track key events and transactions in a given taxpayer service journey. The tool also provided general estimates of taxpayer effort or burden associated with various service journeys so that IRS could identify problematic interactions and journeys that need action to improve the taxpayer experience. IRS officials said that they had started to use the tool under an ongoing research and development project to identify journeys that may affect many taxpayers and have a higher effort or burden level.

IRS officials said they are continuing to enhance the tool and work toward fuller use of it for decision-making on evidence it needs to better understand taxpayer journeys and as part of an evidence-based approach for improving the taxpayer experience. Officials said that the tool is a primary means by which IRS would, by October 2025, address recommendations in a TIGTA report on IRS’s use of customer satisfaction survey results.[46] IRS officials also said they plan to develop dashboards of data that will help them understand taxpayer journeys.

Officials said that depicting a taxpayer’s journey experience will likely require IRS to identify a suite of satisfaction measures from surveys of taxpayers and operational measures to be analyzed together.[47] They said that this step will allow IRS to assess the extent that survey and operational measures reflect the taxpayer experience in various journeys and that IRS will develop additional measures if gaps are found.

IRS officials said that they do not yet know when IRS will formally document what measures—including operational measures and taxpayer survey data—will be aligned with each of the 14 subgoals to track progress on improving the taxpayer experience.

Involving External Stakeholders Who Represent the Taxpayer Perspective

Under the evidence-based policy making approach, involving a range of internal and external stakeholders is vital to the success of federal efforts.[48] In the context of taxpayer experience, engaging external stakeholders such as taxpayers and those who represent them is especially critical because it provides direct feedback from those who experience the tax process. Determining whether and how any service improvements also improve the experience relies on the perspective of the taxpayer in completing service interactions and journeys.

IRS provided documentation on its engagement with internal stakeholders to coordinate implementation of efforts to improve services. For example, IRS cited its Transformation and Strategy Office (TSO) for coordinating efforts and transformation progress across IRS and its transformation steering committees to improve IRS-wide decision-making and mitigate the risk of not coordinating across IRS subunits.[49] IRS officials also said they engage regularly with three advisory committees as well as with other external stakeholders involved with taxpayers. Furthermore, IRS participates in IRS tax forums attended by these other stakeholders. IRS officials said that such engagements generally focused on identifying IRS efforts to improve services for taxpayers. IRS has not yet planned how it will regularly engage external stakeholders on how these service improvements affect the taxpayer experience.

Our interviews with members of taxpayer groups explored opportunities to engage with IRS as it develops and revises tools and systems. In general, these members indicated that taxpayers are better served when IRS engages the groups more. We asked for their views on the degree to which IRS seeks and incorporates their feedback on IRS’s various efforts to improve the taxpayer experience. Our analysis of the interview responses pointed to a range of perspectives on IRS’s level of engagement with the taxpayer groups related to different efforts to improve the taxpayer experience:

· At one end of the range of perspectives, IRS was soliciting feedback and showing how IRS incorporated it. For example, IRS was becoming more open to hearing and acting on feedback from tax professionals, such as on improving notices to taxpayers.

· In the middle of the range, IRS was soliciting feedback but did not show how IRS was incorporating it. For example, IRS did not indicate whether and how it used feedback received through established IRS channels when groups recommended changes to services.

· At the other end of the range, IRS did not regularly solicit feedback, such as on user needs to help build online services for taxpayers.

IRS’s experience with one IRA-funded project may provide a model for involving external stakeholders to gain their feedback to assess and improve the taxpayer experience. Our December 2024 report on IRS’s implementation of the Direct File pilot project discussed how IRS effectively engaged stakeholders to improve the pilot from the taxpayers’ perspective.[50] Specifically, we found that appropriate two-way communication and input, including for assessment, provided opportunities to improve the taxpayer experience. For example, IRS observed and considered the experience of taxpayers using Direct File and found that they made certain data input errors, causing their returns to be rejected. IRS developed and implemented an alternative process taxpayers could use and reported that those changes reduced taxpayer errors.

Promoting Accountability for the Taxpayer Experience

The promoting accountability key practice involves assigning responsibility for performance management and evidence-building activities. For example, to ensure progress towards organizational goals, the organization connects those goals to the day-to-day activities of its managers and employees. This helps identify who is responsible for achieving relevant results. In turn, organizational leaders can hold responsible parties accountable for various actions, including assessing progress in achieving a goal using evidence and planning for improvements in the evidence to effectively guide decision-making.

IRS has focused on managing projects to improve taxpayer services and on tracking project milestones. In doing so, IRS designated specific IRS subunits, leadership, and staff for the projects that were aligned with related strategic objectives and subgoals on improving taxpayer services. IRS also created an IRS-wide advisory committee to coordinate these service improvement efforts and offer decisions on them.

By April 2023, IRS had also created its TSO to oversee and guide all transformation efforts related to the strategic objectives, including those related to service improvements. In January 2025, TIGTA reported on IRS’s governance structure for implementing its planned IRA transformation efforts.[51] As mentioned above, in March 2025 IRS officials said TSO had been disbanded and that IRS was determining which IRA-related projects to continue.

In March 2022, IRS had also announced creation of its Taxpayer Experience Office (TXO) to facilitate coordination with the IRS subunits that interact with taxpayers on the taxpayer experience. In April 2025, IRS officials said TXO had been disbanded and its staff had been let go.

With the disbanding of TSO and TXO, IRS did not announce which subunits would be accountable for fulfilling their responsibilities, particularly in regard to the taxpayer experience. The groundwork that IRS had created to manage implementation of service improvements could serve as a foundation for identifying the IRS subunits, leadership, and staff who will be accountable and responsible for building evidence to assess achievement of taxpayer experience goals and taking actions when necessary to improve goal achievement. Formalizing these roles will better ensure that the necessary evidence is assessed and used to improve the taxpayer experience across all IRS subunits that have interactions with taxpayers.

Conclusions

The evidence-based policy-making practices provide a systematic approach to identify and generate the evidence needed to determine how efforts to improve customer services affected the customer experience. An agency then can decide how to adjust its efforts or goals on improving the experience.

IRS has taken actions to collect some evidence on how its service improvements affect the taxpayer experience. IRS recognizes that it needs to align such actions into a systematic evidence-based approach on the taxpayer experience. IRS has not yet specified when it will fully establish this approach given its focus on finishing its service improvements. In addition, the status of IRS’s efforts to improve the taxpayer experience is unclear due to pauses in Strategic Operating Plan-related projects and recent changes in agency leadership, funding, and staffing. As IRS revisits its strategic plans, fully establishing an evidence-based approach, such as identified in our 2023 report, would increase the chances that IRS can generate evidence to inform decisions that best use its resources to meet its goals for improving the taxpayer experience through IRS services. Furthermore, disbanding TSO and TXO heightens the importance of assigning accountability and responsibility for meeting taxpayer experience goals.

Recommendation for Executive Action

We recommend that the Commissioner of Internal Revenue fully establish an evidence-based approach, such as we identified, to determine whether and how improvements to services affect the taxpayer experience. (Recommendation 1)

Agency Comments

We provided a draft of this report to the Commissioner of Internal Revenue for review and comment. IRS provided written comments, which are reproduced in appendix IV. IRS agreed with our recommendation to fully establish an evidence-based approach to assess the effects of service improvements on the taxpayer experience. IRS referred generally to its ongoing efforts to modernize technology and transform how taxpayers interact with IRS to improve their service experience. IRS also outlined planned steps to implement our recommendation.

We are sending copies of this report to the appropriate congressional committees, the Commissioner of the IRS, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at lucasjudyj@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix V.

Jessica Lucas-Judy

Director, Tax Issues

Strategic Issues

List of Committees

The Honorable Mike Crapo

Chairman

The Honorable Ron Wyden

Ranking Member

Committee on Finance

United States Senate

The Honorable Rand Paul, M.D.

Chairman

The Honorable Gary C. Peters

Ranking Member

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable James Comer

Chairman

The Honorable Robert Garcia

Ranking Member

Committee on Oversight and Government Reform

House of Representatives

The Honorable Jason Smith

Chairman

The Honorable Richard Neal

Ranking Member

Committee on Ways and Means

House of Representatives

Appendix I: Internal Revenue Service Taxpayer Services Annual Funding from the Inflation Reduction Act and Other Sources

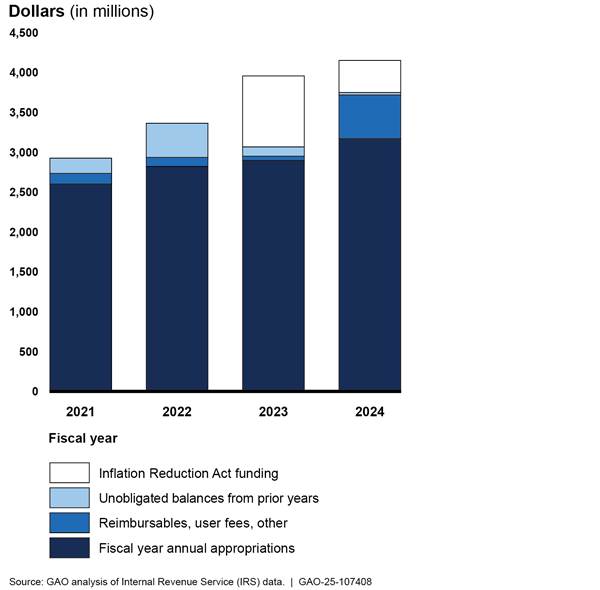

Based on our review of the data provided, the Internal Revenue Service’s (IRS) tracking of its use of Inflation Reduction Act (IRA) funding has focused at a high level on taxpayer services. Figure 6 shows amounts and sources of funding on all taxpayer services from fiscal years 2021 through 2024 broken down by sources such as appropriated annually by Congress, IRA, and other sources.[52]

Notes: The majority of the unobligated balances from fiscal years 2021 and 2022 was from COVID-19 supplemental appropriations. Congress appropriated $2.8 billion for the taxpayer services budget activity in fiscal year 2024. IRS officials stated that IRS subsequently requested that $477 million be transferred from two other appropriated amounts ($272 million from enforcement and $205 million from operations support) to the taxpayer services amount. IRS officials stated that in fiscal year 2024, IRS increased the amount of user fees to fund taxpayer services to $548 million. Reimbursable activities (or “reimbursables”), as defined in the Internal Revenue Manual, refers to IRS functioning as the provider of reimbursable goods or services; user fees refer to the fees under 26 U.S.C. § 7528 that the IRS is required to collect for ruling letters, opinion letters determination letters and other similar requests; and other consisted of recoveries from previous years.

In addition, as of December 2024, planned IRS obligations for taxpayer services for fiscal year 2025 was $4.5 billion, including $1.3 billion from IRA.[53]

In this report, we (1) describe the Internal Revenue Service’s (IRS) plans and actions under the Inflation Reduction Act (IRA) to improve services to taxpayers to meet their wants and needs; (2) describe IRS’s plans and actions to improve the taxpayer experience and address related challenges; and (3) evaluate whether IRS is assessing how service improvement efforts have improved the taxpayer experience using evidence.

To describe IRS’s plans and actions under IRA to improve services to taxpayers, we analyzed available documents and interviewed IRS officials on efforts related to the relevant strategic objectives in its April 2023 IRA Strategic Operating Plan and the April 2024 update to it. We analyzed the status of 152 projects from IRS’s Strategic Implementation Management System related to these objectives. We reviewed Treasury Inspector General for Tax Administration (TIGTA) reports on the status of IRS IRA strategic plan implementation and funding for taxpayer services.[54] We also analyzed IRS budgets and funding for its taxpayer services for fiscal years 2021 through 2025.

To identify taxpayers’ wants and needs in terms of IRS services, we interviewed members of 10 selected groups that represent taxpayers to obtain their views. To select these groups, we considered a list of such groups provided by IRS as well as our existing contacts in the tax community. The final list of taxpayer groups consisted of:

· American Bar Association – Tax Section

· American Institute of Certified Public Accountants

· Council for Electronic Revenue Communication Advancement

· Electronic Tax Administration Advisory Committee

· IRS Advisory Council

· National Association of Enrolled Agents

· National Association of Tax Professionals

· National Taxpayer Advocate/Taxpayer Advocate Service

· National Taxpayers Union

· Taxpayer Advocacy Panel

We considered these 10 groups to be a reasonably sized nongeneralizable sample of tax professional groups with experience and knowledge to address our questions and provide examples of views among various groups of taxpayers. Specifically, these national-level groups include tax professionals who regularly work with taxpayers and IRS, thus providing professional knowledge relevant to what taxpayers want and need from IRS’s efforts to improve taxpayer services.

Based on our review of IRS documents and related literature from the tax community, we developed interview discussion points for the 10 groups and summarized group members’ responses on taxpayers’ wants and needs as well as IRS’s efforts related to improving taxpayer services and addressing their views. In addition, we asked the taxpayer groups about their perceptions of the extent to which IRS reaches out to them for their feedback and then incorporates such feedback in its processes.

To describe IRS’s plans and actions to improve the taxpayer experience, we summarized IRS’s key steps and actions in response to the Taxpayer First Act of 2019. To understand what related federal guidance calls for, we also reviewed and summarized the various actions called for in Office of Management and Budget (OMB) guidance for federal high-impact service providers put forth in OMB Circular A-11 Section 280. We also summarized the steps IRS has taken to implement the guidance. To do so, we reviewed IRS and OMB documents as well as interviewed IRS and OMB officials. This included IRS’s customer experience action plans for 2024 as well as the strategic planning documents described above.

To describe the challenges IRS faces in improving the taxpayer experience, we interviewed IRS officials and reviewed IRS documents, as well as documents from the Taxpayer Advocate Service and TIGTA. We developed a list of challenges for IRS to confirm and then collected IRS’s high-level responses on how it was addressing the confirmed challenges.

To evaluate whether IRS is assessing how service improvement efforts have improved the taxpayer experience using evidence, we reviewed documents, including IRS’s April 2023 IRA Strategic Operating Plan and information on the status of IRA projects. We also interviewed IRS officials on using evidence to assess how the service improvements improved the taxpayer experience. We learned that IRS still was implementing its service improvement projects and had not established an evidence-based approach for the taxpayer experience.

We provided IRS with 13 key practices we identified for evidence-based policymaking to manage and assess the results of federal efforts, as well as ways to implement them.[55] We asked IRS for information on actions it has taken or is planning to take to implement these 13 evidence practices to assess how any service improvements affected the taxpayer experience. In turn, IRS officials provided documents and testimony on IRS’s efforts for each of the 13 practices, including documents on the April 2024 update to IRS’s IRA strategic plan and the status of IRA projects.

We analyzed this IRS information and selected key practices to illustrate IRS’s actions and plans for (1) defining goals such as those for improving the taxpayer experience, (2) generating new evidence such as from measures aligned to each goal and from taxpayers’ journeys at IRS, (3) involving stakeholders such as those representing taxpayers, and (4) promoting accountability for achieving the goals.

As discussed in the body of our report, we selected these four key practices because of their importance in informing actions taken on the other nine key practices. For example,

· defining goals informs the assessment of current evidence and needs for new evidence;

· if the current evidence is not sufficient, generating new evidence is critical to inform key practices on using the evidence to determine the achievement of the goals;

· involving stakeholders, such as groups representing taxpayers at IRS, often is vital to successful efforts, such as IRS’s efforts to improve the experience of taxpayers; and

· promoting accountability helps ensure that agency officials have clear responsibilities on actions needed to achieve the defined goals.

We conducted this performance audit from February 2024 to July 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Appendix III: Analysis of the Internal Revenue Service’s Taxpayer Service Subgoals and Supplemental Information Related to the Office of Management and Budget’s Experience Factors

Our initial analysis indicated that not all of the 14 subgoals the Internal Revenue Service (IRS) associated with its two strategic objectives for improving taxpayer services clearly stated intended outcomes for improving the taxpayer experience. We compared the stated subgoals to the experience factors that the Office of Management and Budget (OMB) identified for federal agencies providing services to customers.[56] Our analysis pointed to eight subgoals that did not explicitly cite one or more of the OMB experience factors. After we shared this analysis with IRS officials, they provided supplemental information in December 2024 that explained how the eight subgoals address one of more OMB factors. Table 5 summarizes our analysis of the subgoals and IRS’s supplemental information related to OMB’s experience factors.

Table 5: Comparison of IRS’s Strategic Subgoals and Supplemental Taxpayer Experience Information to Office of Management and Budget (OMB) Customer Experience Factors

|

Strategic Objective 1: Dramatically improve services to help taxpayers meet their obligations and receive the tax incentives for which they are eligible. |

||

|

Strategic subgoal |

Supplemental IRS information to clarify intended taxpayer experience outcomes |

OMB experience factors addressed by IRS subgoal or supplemental information |

|

When taxpayers call the IRS, they are able to reach an agent in a timely manner and have high levels of satisfaction with the interaction |

N/Aa |

efficiency/speed and satisfaction |

|

Simultaneous to call center improvements, paper processing speeds are kept at high levels |

Expediting processing of paper-filed returns and reducing the backlog of inventory will improve the taxpayer experience by decreasing wait times for refunds and other account actions. |

efficiency/speed |

|

Taxpayers can schedule a timely appointment for face-to-face support across all geographies |

N/A |

efficiency/speed and equity (access) |

|

Taxpayers in underserved communities have increased access to IRS services |

N/A |

equity (access) |

|

Individual taxpayers can perform most of their required interactions with the IRS through their Individual Online Account |

Using online accounts improves the taxpayer experience by allowing taxpayers to provide and receive information and access services at any time. In contrast, IRS phone lines for individuals are typically only available M-F, 7AM-7PM. Online accounts can reduce burden on taxpayers who no longer have to call IRS or mail paper to IRS. Online accounts will improve the experience if they can be a one-stop shop for all tax needs. |

ease/simplicity/effort (burden/friction) and equity (access) |

|

Businesses can perform most of their required interactions with the IRS through their Business Online Account |

||

|

Tax professionals can perform most of their required interactions with the IRS through their Tax Professional Online Account |

||

|

Taxpayers have easy-to-use digital channels for receiving information from and submitting information to the IRS in line with commercial expectations (e.g., banks, insurers) |

N/A |

ease/simplicity/effort (burden/friction) and perceived responsiveness to individual needs |

|

Paper that taxpayers choose to send to IRS is digitized at the point of receipt |

Digitizing paper returns will eliminate errors from manually inputting data from paper returns, which will speed up processing, reduce storage costs, and allow IRS to focus more resources on service. |

efficiency/speed |

|

Once digitized, information is processed throughout the IRS in a digitally optimized manner |

Digital processing will improve taxpayer experience by decreasing processing times. Digitally extracting digitized data from paper returns will enable IRS employees to more quickly and accurately answer taxpayer questions and resolve issues. |

efficiency/speed and effectiveness/perceived value |

|

IRS employees have the hardware, software, and supplies needed to deliver effective and efficient results to taxpayers |

N/A |

effectiveness/perceived value and efficiency/speed |

|

Strategic Objective 2: Quickly resolve taxpayer issues when they arise |

||

|

Taxpayer notices are easy to understand and meet taxpayer needs |

N/A |

ease/simplicity/effort (burden/friction) and perceived responsiveness to individual needs |

|

IRS Business Units and Office of Taxpayer Correspondence can quickly customize content and recipients of notices via improved technical solutions and streamlined clearance processes |

Improving processes for redesigning notices is intended to support the previous subgoal on making taxpayer notices easy to understand and meet taxpayer needs. |

ease/simplicity/effort (burden/friction) and perceived responsiveness to individual needs |

|

IRS uses advanced analytics, government, and external partner expertise to proactively identify and rapidly minimize the impact of tax scams |

Scams can lead to stolen or delayed refunds and penalties, which burdens taxpayers to resolve those issues. Using advanced analytics and stakeholder expertise can better protect taxpayers from scams and reduce their burden. |

ease/simplicity/effort (burden/friction) |

Source: GAO analysis of IRS IRA Strategic Operating Plan Annual Update Supplement (April 2024), additional information IRS provided in December 2024, and OMB Circular A-11 Section 280. | GAO‑25‑107408

aMeans “not applicable,” as the stated subgoal cited one or more OMB experience factors.

GAO Contact

Jessica Lucas-Judy, lucasjudyj@gao.gov

Staff Acknowledgments

In addition to the contact named above, Tom Short (Assistant Director), Ronald W. Jones (Analyst-in-Charge), Karen Cassidy, Caitlin Cusati, Ann Czapiewski, Ryan Guthrie, Amy Konstas, Terence Lam, Ben Licht, Sheila McCoy, Alan Rozzi, Sarah Veale, and Mercedes Wilson-Barthes made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]Pub. L. No. 116-25, 133 Stat. 981 (2019).

[2]National Taxpayer Advocate, Fiscal Year 2019 Objectives Report to Congress, Vol 1, IRS Publication 4054 (Rev. 06-2018).

[3]The previous administration also established a cross-agency priority (CAP) goal for high-impact services. The Office of Management and Budget coordinates with agencies to develop these CAP goals which are 4-year outcome-oriented federal priority goals required by the GPRA Modernization Act of 2010. Pub. L. No. 111-352, 124 Stat. 3866 (2011) (codified as amended at 31 U.S.C. § 1120(a)).

[4]Executive Order 14058, Transforming Federal Customer Experience and Service Delivery to Rebuild Trust in Government, defines high-impact service providers as federal entities that provide or fund customer-facing services that “have a high impact on the public, whether because of a large customer base or a critical effect on those served.” They provide federal services administered at the state or local level. See Exec. Order No. 14058, Transforming Federal Customer Experience and Service Delivery to Rebuild Trust in Government, 86 Fed. Reg. 71357, 71359 (Dec. 16, 2021). IRS was first designated as a high-impact service provider in 2018 and continued to be so designated as of March 2025. IRS uses the terms taxpayer experience and customer experience interchangeably.

[5]Inflation Reduction Act of 2022, Pub. L. No. 117-169, tit. I, subtit. A, pt. 3, § 10301, 136 Stat. 1818, 1831-1833.

[6]In June 2023, the Fiscal Responsibility Act of 2023 rescinded about $1.4 billion of the amount appropriated for IRS. In March 2024, the Further Consolidated Appropriations Act of 2024 rescinded an additional $20.2 billion of the amount appropriated for IRS. Enacted in September 2024, the Continuing Appropriations and Extensions Act of 2025 prevented IRS from spending an additional $20.2 billion of IRA funding, which was reaffirmed by the American Relief Act of 2025 (through March 14, 2025) and the Full-Year Continuing Appropriations and Extensions Act of 2025 (through September 30, 2025). See Fiscal Responsibility Act of 2023, Pub. L. No. 118-5, div. B, tit. II, § 251, 137 Stat. 10, 30-31; Further Consolidated Appropriations Act, 2024, Pub. L. No. 118-47, div. B, tit. VI, § 640, div. D, tit. V, § 530, 138 Stat. 460, 572, 708; Continuing Appropriations and Extensions Act, 2025, Pub. L. No. 118-83, div. A, § 115, 138 Stat. 1524, 1527 (2024); American Relief Act, 2025, Pub. L. No. 118-158, div. A, § 101, 138 Stat. 1722, 1723 (2024); Full-Year Continuing Appropriations and Extensions Act, 2025, Pub. L. No. 119-4, div. A, tit. I, § 1101(5), (8), 139 Stat. 9, 11. Appendix I provides information on IRS taxpayer services funding from IRA and other sources in fiscal years 2021 through 2025.

[7]Pub. L. No. 117-169, tit. VII, § 70004, 136 Stat. 1818, 2087 (2022).

[8]Treasury Inspector General for Tax Administration, Inflation Reduction Act: Progress Is Being Made to Improve Content of and Expand Digital Delivery and Response Options for Taxpayer Notices, 2025-408-010 (Washington, D.C.: Feb. 14, 2025); and Inflation Reduction Act: Continued Assessment of Transformation Efforts – Evaluation of Fiscal Year 2023 Delivery of Initiatives, 2024-IE-R010 (Washington, D.C.: Mar. 11, 2024).

[9]Pub. L. No. 116-25, § 1101, 133 Stat. 981, 985–986 (2019).

[10]GAO, Evidence-Based Policymaking: Practices to Help Manage and Assess the Results of Federal Efforts, GAO‑23‑105460 (Washington, D.C.: July 12, 2023).

[11]IRS website services include those that are “authenticated” (where a taxpayer logs on to obtain service through an online account or tools like “Where’s My Refund?”) and those that are “non-authenticated” (where a taxpayer accesses general tax information or uses open access tools like the “Tax Withholding Estimator”).