ADOPTION TAX CREDIT

IRS Needs a Comprehensive Educational Outreach Plan

Report to Congressional Requesters

United States Government Accountability Office

View GAO-25-107429. For more information, contact James R. McTigue, Jr. at mctiguej@gao.gov.

Highlights of GAO-25-107429, a report to Congressional requesters

IRS Needs a Comprehensive Educational Outreach Plan

Why GAO Did This Study

In the United States, over 100,000 children are adopted annually. More than half of adoptions are performed through the public foster care system. Individuals can pay thousands of dollars in expenses to adopt a child. In 1996, the adoption tax credit was established and encourages adoptions by offsetting related costs.

GAO was asked to review IRS’s administration of the adoption tax credit. This report examines (1) IRS’s outreach to educate individuals on the availability and requirements to claim the adoption tax credit, and (2) the frequency and results of audits IRS conducted on the adoption tax credit for tax years 2012 through 2021.

GAO reviewed IRS’s education efforts on the adoption credit and interviewed relevant officials. GAO also interviewed a nongeneralizable sample of seven adoption stakeholders, including state adoption and foster care agencies and nongovernmental organizations, including those that provide tax and legal assistance for adoptive families. Lastly, GAO reviewed the results of adoption tax credit audits for tax years 2012 through 2021, the most current data available.

What GAO Recommends

GAO is recommending that IRS develop a comprehensive educational outreach plan for the adoption tax credit, including identifying key stakeholders and developing clear, consistent messaging. IRS concurred with GAO’s recommendation.

What GAO Found

The Internal Revenue Service (IRS) does not have an educational plan to help ensure that its outreach and communication efforts for the adoption tax credit are effective. In 2011, GAO recommended that IRS should include relevant adoption stakeholders and clarify its documentation requirements for the credit. GAO also reported IRS audited a high percentage of returns that claimed the credit. In 2012, in response to GAO’s recommendation, IRS took some steps to improve its adoption tax credit communications strategy. However, IRS does not currently have a comprehensive educational outreach plan to engage with adoption stakeholders and provide clear, consistent information to taxpayers.

Examples of Qualified and Non-qualified Adoption Expenses

Note: See figure 3 in GAO-25-107429 for more information on certain expenses.

IRS has developed adoption tax credit materials but has not consistently provided the information to key adoption stakeholders, such as state agencies. Some stakeholders told GAO that having these materials would help them in assisting adoptive families. Additionally, some of these materials did not provide clear, consistent messages on how to accurately claim the credit. Also, IRS’s list of approved documentation taxpayers should retain when claiming the credit is not easily accessible. As a result, taxpayers may (1) not know they are eligible for the credit, (2) inaccurately claim the credit, or (3) be unprepared if audited.

GAO also found that the percentage of returns claiming the adoption credit were generally audited at the same rate as all individual tax returns for tax years 2012 through 2021. However, among adoption credits audited during this time, 41 percent were adjusted by IRS. The average increase to the credit was approximately $6,000 and the average decrease was approximately $7,000. IRS officials could not easily provide an explanation for these changes.

An educational outreach plan for the adoption tax credit would help IRS ensure that adoptive families know about the credit, their eligibility, and other requirements. Such a plan is particularly important in light of changes to the credit that were enacted in July 2025. Improved education and guidance, along with more engagement with adoption stakeholders—such as the Department of Health and Human Services' Administration for Children and Families—could help taxpayers avoid costly mistakes in either failing to claim the credit or doing so inappropriately. Improved understanding of the credit could also save IRS resources by reducing the need for expensive audits.

|

Abbreviations |

|

|

ACF |

Administration for Children and Families |

|

IRS |

Internal Revenue Service |

|

SB/SE |

Small Business/Self-Employed Division |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

August 11, 2025

The Honorable David Schweikert

Chairman

Subcommittee on Oversight

Committee on Ways and Means

House of Representatives

The Honorable Blake Moore

House of Representatives

In the United States, over 100,000 children are adopted annually.[1] Individuals may adopt children through (1) domestic public adoption such as via a state foster care program, (2) domestic private adoption, or (3) international adoption.[2] In the United States, more than half of adoptions are performed through the public foster care system.

In 1996, Congress established the adoption tax credit.[3] The credit encourages adoptions by offsetting adoption expenses for families. Individuals can pay thousands of dollars in expenses to adopt a child. For example, a private or international adoption can range from $25,000 to $60,000, while a public adoption can range from $0 to $2,500.[4]

For a brief time—in tax years 2010 and 2011—the adoption tax credit was refundable, which means that taxpayers who claimed the credit could receive the full amount of their credit as a refund if they had no tax liability.[5] During those 2 tax years, the Internal Revenue Service (IRS) implemented a process to review all adoption tax credit claims to minimize fraud and improper payments.

In 2011 we reported that, as of August 2011, of the nearly 100,000 returns that claimed the adoption tax credit during the 2010 tax year, 68 percent were selected for audit.[6] Of those audited, 83 percent resulted in no change to the taxes owed or the amount of the taxpayer’s refund.

From the 2012 tax year until recently, the adoption tax credit was not refundable. In July 2025, Congress passed, and the president signed, legislation allowing up to $5,000 of qualified adoption expenses to be refundable—that is taxpayers could receive up to $5,000 of their credit as a refund if they had no tax liability for tax years starting in 2025.[7]

You asked us to review IRS’s administration of the adoption tax credit. This report examines (1) IRS’s outreach to educate individuals on the availability and requirements to claim the adoption tax credit, and (2) the frequency and results of audits IRS conducted on the adoption tax credit for the 2012 through 2021 tax years.

To address our first objective, we reviewed IRS’s education materials on the adoption tax credit and interviewed IRS officials responsible for communication and outreach. We also interviewed three selected state adoption and foster care agencies as well as two nongovernmental and two professional organizations. The purpose of those interviews was to obtain their views on IRS’s outreach and education efforts. To address our second objective, we compared the percentage of audits of returns that claimed the adoption tax credit to the percentage of audits of all individual income tax returns. We also reviewed the results of audits on the adoption tax credit, including any changes to the amount of the credit the taxpayer claimed, for tax years 2012 through 2021, which was the most current information available. A more comprehensive description of our work is in appendix I.

The changes to the adoption tax credit enacted in July 2025 occurred after we completed our analysis. Throughout the report, we refer to the requirements of the credit prior to July 2025. These changes do not materially affect our findings and conclusions.

We conducted this performance audit from February 2024 to August 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Changes to the Adoption Tax Credit Over Time

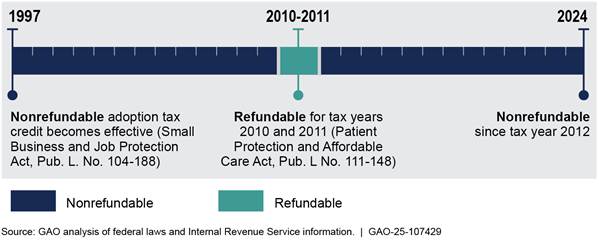

The adoption tax credit was established in 1996 and encourages adoptions by offsetting associated adoption costs for families. Legislation originally established it as a nonrefundable tax credit.[8] For tax years 2010 and 2011, legislation temporarily changed the credit to be fully refundable.[9] For tax years 2012 through 2024, the full amount of the adoption tax credit was nonrefundable (see fig. 1). Starting in tax year 2025, up to $5,000 of the adoption tax credit is refundable.

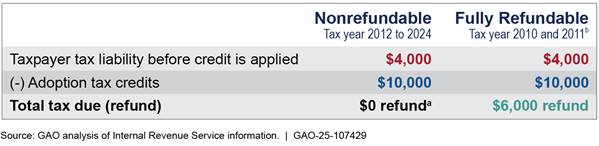

As shown in figure 2, a nonrefundable tax credit decreases a taxpayer’s tax liability and is limited to an individual’s total tax liability for the year. A refundable tax credit also decreases a taxpayer’s tax liability, and if the amount of the credit is greater than the taxpayer’s tax liability, the dollar difference is paid to the taxpayer as a refund.

Figure 2: Simplified Example of the Effects of the Nonrefundable and Fully Refundable Adoption Tax Credit on a Taxpayer’s Liability for Tax Years 2010-2024

Note: This figure does not include an example of the effects of the partially refundable tax credit that applies starting in tax year 2025.

aAny adoption credit more than an individual’s tax liability may be carried forward for up to 5 years, for a total of 6 years to claim the credit. 26 U.S.C. § 23(c).

bMaximum adoption tax credit amounts are adjusted each year for inflation. The maximum credit allowed was $13,170 in 2010 and $13,360 in 2011.

We have previously reported that refundable tax credits have presented a challenge to IRS.[10] Due to their complexity, some refundable credits can be overclaimed or underclaimed, which is considered an improper payment. For example, IRS faces large numbers of improper payments involving the refundable Earned Income Tax Credit.[11] Further, because taxpayers can claim refundable credits in excess of their tax liability, these credits are more susceptible to fraud.

Adoption Tax Credit Eligibility

The adoption tax credit is available for taxpayers who adopt an eligible child. For purposes of the adoption tax credit, an eligible child is an individual who is under the age of 18 or is physically or mentally incapable of self-care.[12]

The amount of the credit is determined by (1) the taxpayer’s total qualified adoption expenses, (2) whether the child who was adopted has “special needs” (which we refer to as a special needs adoption), and (3) the taxpayer’s income.

|

Special needs adoptions For purposes of the adoption tax credit, a child with special needs is any child that: · the state or Tribe determines cannot or should not be returned to their parent(s); · the state or Tribe determines has a specific factor or condition that makes it reasonable to conclude that such child cannot be placed with adoptive parents without providing adoption assistance; and · is a citizen or resident of the United States. States or Tribes may categorize a child as special needs based on factors that they consider difficult to place a child for adoption. This can include their ethnic background, age, or membership in a minority or sibling group, or the presence of factors such as medical conditions or physical, mental, or emotional handicaps. Source: 26 U.S.C. § 23(d)(3); Pub. L. No. 119-21, § 70403, 139 Stat. at ___ (2025) and GAO review of Internal Revenue Service information. | GAO‑25‑107429 |

Taxpayers are to use Form 8839, Qualified Adoption Expenses, to claim the credit.[13] If the adoption is not deemed a special needs adoption (see sidebar), taxpayers may claim only the amount of the credit limited to the amount of expenses they have incurred. Some of these expenses may include home studies, meetings with attorneys, or travel expenses. See figure 3 for examples of qualified expenses.

For special needs adoptions, taxpayers can claim up to the maximum amount of the credit without regard to actual expenses incurred.[14]

Certain types of adoption expenses, such as expenses related to stepchildren adoptions or expenses related to surrogate parenting arrangements, are not qualified expenses for the tax credit.

aAccording to the Internal Revenue Manual

(IRM), during an audit of a taxpayer claiming the adoption tax credit for

adoptions that are not special needs adoptions, taxpayers must provide

verification of their expenses. Acceptable proof of expenses includes checks

and receipts showing proof of payment. IRM 4.19.15.5.3(1), (5).

bRe-adoption is the legal process of adopting a child again in the

United States after the child has been lawfully adopted in another country.

cIn states that allow a registered domestic partner to adopt their

partner’s child, expenses may be considered qualified expenses.

dIn most cases, employer-provided adoption benefits are paid under a

qualified adoption assistance program.

Adoption Tax Credit Limitations

The credit is subject to income and dollar limitations that change year to year based on inflation. For tax year 2024, the credit was reduced for taxpayers with a modified adjusted gross income over $252,150 and was phased out completely for taxpayers with $292,150 in income or more. The income limit is the same across tax filing statuses, including single, married filing jointly, and head of household. The maximum dollar amount a taxpayer can claim per child is $16,810 for expenses incurred during tax year 2024.

Any credit more than an individual’s tax liability may be carried forward for up to 5 years. Therefore, individuals have a total of 6 years to receive up to the full amount for which they are eligible.

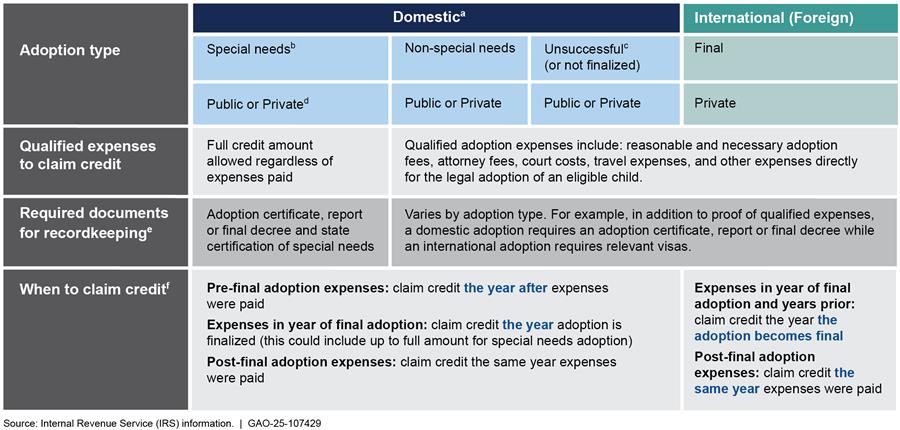

Adoption Tax Credit Filing Requirements

As shown in figure 4, each adoption type has different requirements for how to claim the adoption tax credit. For example, a public adoption via state foster care that is deemed as a special needs adoption does not require payment of qualified expenses to claim the credit. Most public adoptions are considered special needs.[15]

aA domestic adoption is the adoption of a child

who is a U.S. citizen or resident at the time the adoption process begins.

bFor special needs adoptions, a child qualifies if they are a U.S.

citizen or resident who cannot or should not return to their parents’ home (as

determined by a state), and are unlikely to be adopted without assistance (as

determined by a state). Starting in tax year 2025, Indian tribal governments

can also determine whether a child has special needs.

cAdoption expenses incurred for unsuccessful adoptions or adoptions

still in progress may be claimed for domestic adoptions. However, expenses

incurred for unsuccessful international adoptions do not qualify for the

credit.

dMost domestic public adoptions are special needs adoptions, but few

other adoptions are special needs adoptions.

eIf a claim is audited, IRS lists substantiation requirements for

specific copies of records and receipts for qualified expenses. See IRS, Notice

2010-66, https://www.irs.gov/irb/2010‑42_IRB#NOT‑2010‑66.

fIndividuals can claim the credit for up to a total of 6 years to

claim the full amount. After the first year, any credit more than an individual’s

tax liability may be carried forward for up to 5 years.

Federal and State Roles in Adoption Benefits

In addition to IRS, other federal and state agencies share information about certain adoption benefits for individuals. For example, the Administration for Children and Families (ACF), within the Department of Health and Human Services, oversees states’ administration of payments for adoption assistance to adoptive families of eligible children. In its oversight role, Health and Human Services provides information to states through guidance and technical assistance.

In addition, state agencies designate which children are considered to have special needs. These state agencies provide guidance to adoptive families on how to manage the adoption process and frequently receive inquiries about documentation and other administrative requirements. Documentation certifying adoptions varies from state to state.

IRS’s Educational Outreach for the Adoption Tax Credit Is Inconsistent and Unclear

IRS Communicates Adoption Tax Credit Information Through Various Materials and Channels

IRS communicates information about the adoption tax credit through various materials such as:

· Instructions for Form 8839 on Qualified Adoption Expenses. Provides guidelines on the credit and how to claim it. Instructions are updated annually with current credit amounts and income thresholds.[16]

· Adoption Tax Credit web page. A dedicated web page with information derived from the instructions.[17] This web page includes an interactive tool to help taxpayers determine their eligibility for the credit.[18] In response to our ongoing work, in December 2024, IRS revised content about the adoption tax credit on this web page.[19]

· Tax Tips. Brief summaries to provide taxpayers high-level information about specific tax topics and are typically communicated through IRS email newsletters.[20]

· Informational flyer. In response to our ongoing work, in November 2024, IRS released a new publication dedicated to the adoption tax credit.[21]

IRS used several communication channels to share this information, including:

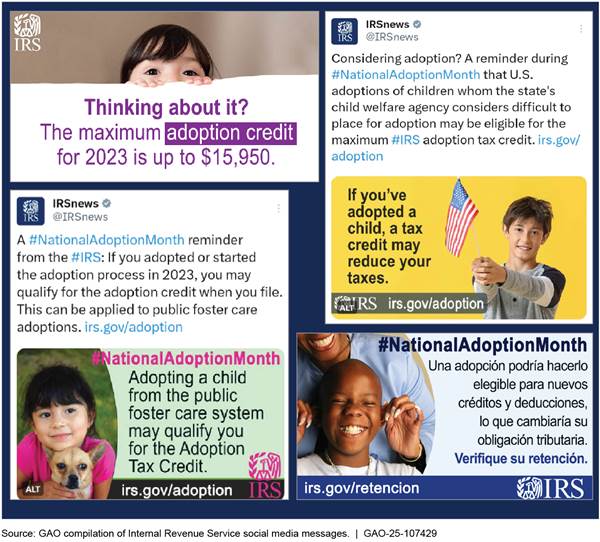

· Social media. IRS shares posts during annual tax filing seasons and National Adoption Month (November). See figure 5 for examples.

· Communication bundles. IRS officials told us they use consolidated communication bundles to share information with IRS’s external partners during each tax filing season. These bundles contain a collection of information—such as links to tax tips and content for social media—and include some material on the adoption tax credit.

· Conferences. IRS officials distributed general tax information at several conferences focused on families and children.

Figure 5: Examples of Internal Revenue Service (IRS) Social Media Outreach for the Adoption Tax Credit for Filing Season 2024

IRS Did Not Consistently Provide Outreach to Key Adoption Stakeholders

IRS has not consistently provided adoption tax credit materials directly to key adoption stakeholders such as federal agencies, state adoption and foster care agencies, and other relevant organizations. Our Leading Practices for Consumer Education Planning states that agencies should identify and engage all key stakeholders involved in outreach efforts.[22] IRS officials initially told us that they did not provide direct outreach on the adoption tax credit because they sent general informational materials to the agency’s established external partners, including ACF, state departments of revenue, and other family-related organizations.[23]

Officials from ACF stated that IRS has not communicated or coordinated with them despite IRS listing them as outreach partners. Similarly, some adoption stakeholders, including state agency officials, said they did not receive IRS materials for the adoption tax credit. They said having these materials would help them in assisting adoptive families.

Federal law requires that states inform families about the adoption tax credit if they are, or are considering, adopting a child from foster care.[24] To meet this requirement, we found that selected states’ efforts varied. For example, state officials we spoke to either distributed their own informational material or briefly mentioned the credit to families during adoption trainings.

Officials from one adoption stakeholder organization told us that many foster care adoptive parents are unaware of the adoption tax credit until late in the adoption process due to limited knowledge among their caseworkers or attorneys.

In October 2011, we recommended that IRS ensure that its outreach and education efforts for the adoption tax credit specifically included state and local adoption officials and clarify acceptable documentation for the certification of special needs adoptees.[25] IRS agreed with the recommendation and told us that they had plans to undertake targeted communications specifically to state and local adoption officials.

Our recommendation in October 2011 was focused on short-term actions IRS needed to improve for outreach efforts while the credit was refundable. During the 2012 filing season, IRS subsequently addressed the recommendation. IRS took steps to improve its adoption communications strategy, including issuing email alerts to adoption advocacy and public policy organizations.

In March 2025, prior to the change in the law, IRS officials again told us that they rely on external partners to share information about the adoption tax credit. Further, officials said they do not intend to establish communications with state and local officials or develop an outreach campaign for the adoption tax credit unless they develop new informational material, there are legislative changes to the credit, or a stakeholder requests outreach.

IRS Did Not Communicate Clear, Consistent Messages for the Adoption Tax Credit

While IRS has informational materials on the adoption tax credit, we found these materials did not provide clear, consistent messages on multiple topics related to the credit, including but not limited to (1) eligible children and qualified expenses, (2) types of adoptions, (3) special needs, and (4) documentation and recordkeeping. Our Leading Practices for Consumer Education Planning states that agencies should develop clear and consistent audience messages based on budget, goals, and audience research findings.[26]

· Eligible children and qualified expenses. The statute defines eligible child as a person under the age of 18 or any individual who is physically or mentally incapable of self-care. Whether or not adoption expenses qualify for the credit can depend on other characteristics of the child. For example, a taxpayer cannot claim the credit for expenses related to adopting a child through surrogacy or those who are stepchildren.[27] Some materials discuss the definition of eligible child separately from the limitations on qualified expenses related to characteristics of the child, which has caused confusion for some taxpayers about their eligibility to claim the credit.

One tax professional organization we spoke with raised concerns about the lack of clarity on surrogacy and stepchild adoptions. This stakeholder was not clear on whether expenses for these adoptions qualify for the adoption tax credit and suggested that additional information on these situations would be helpful for tax professionals.

IRS’s lack of clarity on these topics is reflected in three tax preparation software products that do not ask taxpayers whether the child they are claiming for the adoption tax credit is by surrogacy or a stepchild, as discussed in more detail below. In contrast, IRS’s online tool—the adoption tax credit interactive tax assistant—asks users about stepchildren to help determine eligibility. A more integrated presentation of the definition of an eligible child and the parts of the definition of qualified adoption expenses related to characteristics of the child could improve IRS guidance. Without such changes, guidance from tax professionals may be inconsistent and result in some taxpayers improperly claiming the adoption tax credit.

· Types of adoptions. IRS’s adoption tax credit materials do not clearly and consistently distinguish the requirements by adoption type. For example, while the instructions for Form 8839 cover the different types of adoptions—such as domestic, foreign, special needs, and unsuccessful—the information for each adoption type is generally scattered under other topics. Other materials provide some information about each adoption type, but the content and messaging on different adoption scenarios is not communicated consistently and can be difficult for taxpayers to navigate.

According to some adoption stakeholders we spoke with, taxpayers can get confused about requirements for specific adoption scenarios. IRS includes some examples of detailed scenarios in its instructions for completing Form 8839. However, officials from one state agency said IRS’s information is dense and written for tax professionals, making it difficult for the average foster parent or adoptive family to understand. The state officials noted that IRS’s materials are not commonly used by its staff or adoptive families due to the complexity of information about the credit. Some other stakeholder organizations suggested that IRS create separate outreach material by adoption type to help mitigate ongoing confusion.

· Special needs. IRS’s outreach materials do not consistently communicate information on special needs adoptions, in some cases omitting the information altogether. An adoption deemed “special needs” does not require individuals to pay any qualified expenses to claim the full credit. Based on the definition of a child with special needs in the tax code, most public adoptions are considered special needs.[28]

IRS provides information on special needs adoptions in the instructions to Form 8839 and on the adoption credit web page. However, we found that special needs information was missing from multiple outreach materials, such as the informational flyer and tax tips. As a result, if an individual relied solely on the flyer or the tax tips, they might claim the wrong amount or may think they are ineligible. Furthermore, one tax professional stakeholder we spoke with said that the IRS materials lack guidance on documentation needed to prove a special needs adoption.

Another adoption organization told us that many tax professionals they are familiar with are unaware of special needs adoptions, as they follow tax preparation software without fully understanding the nuances of the credit. They said that families they work with often need to explain eligibility to their tax preparers.

· Documentation and recordkeeping. While IRS provides information on qualified adoption expenses and related recordkeeping to prove these expenses, IRS’s list of approved documentation is not easily accessible to the public. For example, in Form 8839 instructions, IRS includes an online link to a list from 2010, when the credit was refundable.[29] Another list is available in IRS’s Internal Revenue Manual. However, the Internal Revenue Manual is the official source of operating instructions to IRS employees and is not primarily for taxpayers’ use. Notably, the Internal Revenue Manual provides a list of acceptable documentation of a state’s determination of special needs that is not found in the Form 8839 instructions or other informational material on the adoption tax credit.[30] See appendix II for a list of IRS’s approved documentation to substantiate an adoption tax credit claim.

According to one adoption tax credit stakeholder we spoke with, IRS’s limited guidance and outreach on this topic leaves taxpayers to rely on other sources for clarification, such as online community forums and tax professionals. Stakeholder officials stated that taxpayers who are unaware of the adoption tax credit before consulting a tax professional may miss opportunities to claim expenses or lack necessary receipts and documentation. Additionally, other stakeholders also told us that some tax professionals are unfamiliar with the credit and some may have given taxpayers inaccurate advice.

Another stakeholder organization, which provides legal assistance for adoptive families, said it commonly receives questions about required documentation, including legal records, receipts, invoices, and other proof of adoption expenses. For example, organization officials said that some families have asked about what expenses qualify—such as background check fees—and some families did not know that expenses for stepchild adoptions do not qualify for the credit. As a result, officials told us they advise tax professionals to file paper returns with complete documentation to reduce follow-up requests from IRS.

We also found inconsistent information within IRS’s interactive tax assistant tool for the adoption tax credit. Table 1 shows selected scenarios we assessed against IRS’s Form 8839 instructions for claiming the adoption tax credit. For example, in scenario 3, the adoption is for a child by surrogacy, which is not an eligible expense, but the tool does not address this.

Table 1: Selected Scenarios Using the Internal Revenue Service’s (IRS) Interactive Tax Assistant Tool for the Adoption Tax Credit Compared to IRS Instructionsa

|

Scenario |

Results |

|

|

Scenario 1: Adopting spouse’s child (stepchild) |

✔ |

Tool asks whether the child being adopted is your spouse’s child (stepchild). When indicating “yes” in this case, the tool informs the taxpayer that they are not eligible for the credit. |

|

Scenario 2: Special needs adoption with no qualifying expenses paid |

✔ |

Tool asks if a state determined that the child has special needs. When indicating “yes” and responding “no” to any paid qualifying expenses, the tool informs the taxpayer that they are eligible for the credit.b |

|

Scenario 3: Adoption of child by surrogacy |

✖ |

Tool does not ask any questions or provide any information about this scenario. Tool does provide a list of qualified expenses but not a list of non-qualified expenses. IRS instructions include this scenario under non-qualified expenses. |

|

Scenario 4: Adoption of child with disability over age 18 |

✔ |

Tool asks if child is physically or mentally unable to take care of themselves. When indicating “yes” in this case, the tool informs the taxpayer that they are eligible for the credit.b |

|

Scenario 5: Adoption is in process, and the taxpayer has no date of birth and no identification number, such as Social Security Number (SSN) or Adoption Taxpayer Identification Number (ATIN). This may be because the child is not yet identified or the information is not available to the taxpayer. |

✖ |

Tool requires a date of birth for an “in-process” adoption. This is not required per IRS instructions. Tool indicated eligibility for the credit but noted that the taxpayer could not claim the credit until the child had a valid SSN or ATIN. This does not correspond to IRS’s instructions. |

✔= Consistent with IRS information ✖ = Not consistent with IRS information

Source: GAO analysis of Internal Revenue Service (IRS) information. | GAO‑25‑107429

aIRS has an online Interactive Tax Assistant tool to help taxpayers determine their eligibility for the adoption tax credit. See https://www.irs.gov/help/ita/am‑i‑eligible‑to‑claim‑a‑credit‑for‑adopting‑a‑child‑or‑to‑exclude‑employer‑provided‑adoption‑benefits‑from‑my‑employer. IRS Instructions for Form 8839 on Qualified Adoption Expenses provides taxpayers guidelines on the adoption tax credit and how to claim it.

bAll other inputs to the tool in these scenarios were consistent with the taxpayer being eligible for the credit.

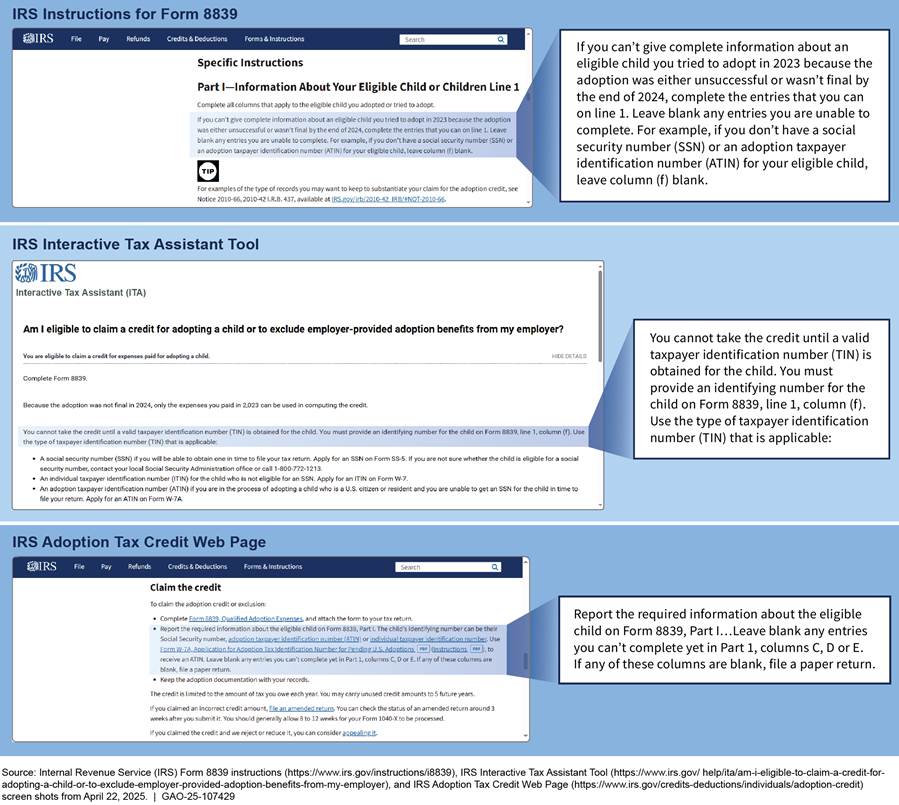

Figure 6 illustrates IRS’s conflicting instructions provided in scenario 5 of the table above. IRS instructions for Form 8839 state that if identifying information about an eligible child, such as the name, date of birth, or the tax identification number, is not available because an adoption was either unsuccessful or not finalized, a taxpayer can leave this section blank. In contrast, the IRS Interactive Tax Assistant Tool informs the taxpayer that they must include a valid taxpayer identification number for the child on Form 8839 to claim the credit for an in-process adoption where the taxpayer indicated they do not have one for the child. Moreover, IRS’s Adoption Tax Credit web page tells taxpayers to report the “required information about the eligible child” on Form 8839, without specifying what that includes, but as noted above, IRS instructions for Form 8839 state that none of this information is required if not available. The web page also states that if certain information is left blank, then the taxpayer should file a paper return. Form 8839 instructions do not stipulate a paper filing requirement for any reason.

Note: The Interactive Tax Assistant results were provided based on indicating the adoption was not finalized and that there was no taxpayer identification number available for the child.

This lack of clarity and consistency in IRS’s communications on the adoption tax credit is reflected in some tax preparation companies’ software products and guidance. For example, we reviewed three selected tax preparation companies’ software products to determine the possible effects of the lack of clarity and consistency in IRS’s communications.[31] We found that the software did not always ask certain questions necessary to provide all taxpayers with correct information about their eligibility for the credit. The questions the software products did not ask were consistent with the lack of clarity and consistency in IRS’s guidance.

As shown in table 2, in some instances, the software does not allow eligible taxpayers to proceed to claim the credit (e.g., requiring a birth date). In contrast, some software did not ask questions that would stop an ineligible claim (e.g., adopting a stepchild or through surrogacy). In addition, some software, rather than asking direct questions, provided information elsewhere, such as information on qualified expenses, which aligns with IRS outreach materials on these topics. For one of the tax software providers, a user would need to use the search tool to find relevant information.

|

Question |

Tax software 1 |

Tax software 2 |

Tax software 3 |

|

Child’s age/date of birth? |

✔ |

✔ |

✔ |

|

Child has a disability?a |

✔ |

✔ |

✔b |

|

Child designated as special needs |

✔ |

✖c |

✖c |

|

Child is foreign or |

✔ |

✔ |

✔ |

|

Child is a stepchild (spouse’s child)? |

✖ |

✔ |

✖ |

|

Child by surrogacy? |

✖ |

✖ |

✖ |

|

In-process or finalized adoption? |

✔ |

✔ |

✔ |

✔= Question asked ✖= Not asked

![]() = Required adoptive child’s date of birth when not

required per Internal Revenue Service instructions for Form 8839 on Qualifying

Adoption Expenses

= Required adoptive child’s date of birth when not

required per Internal Revenue Service instructions for Form 8839 on Qualifying

Adoption Expenses

Source: GAO analysis of tax software information. | GAO‑25‑107429

Note: Our review of the software did not assess their compliance with any applicable legal requirements.

aAn eligible child includes any individual, regardless of age, who is physically or mentally unable to take care of themselves.

bIf an eligible child’s age was over 17, a question was asked if the child was disabled.

cThis software program asks if a child has

special needs but does not specifically ask if a state has determined if a

child has special needs. The taxpayer will need to conduct additional searches

to learn more about what special needs means in the context of the adoption tax

credit.

IRS Does Not Have an Educational Outreach Plan for the Adoption Tax Credit

IRS does not have an educational outreach plan specific to the adoption tax credit. IRS officials told us that unless a credit is new or there are substantive changes, IRS does not develop specific outreach campaigns dedicated to each credit. However, IRS develops and uses outreach plans for other credits such as the Earned Income Tax Credit.

In July 2024, IRS initiated a year-long contract with a consulting firm to help improve agency-wide education and outreach efforts to underserved communities. As part of the contract, IRS had developed preliminary plans that included high-level outreach on the adoption tax credit in conjunction with other family-related credits. The plans did not include developing an educational outreach plan specifically for the adoption tax credit. In March 2025, IRS closed the office responsible for the initiative. According to IRS officials, the agency ended its contract and plans to continue these efforts internally.

Our Leading Practices for Consumer Education Planning identifies nine practices agencies can incorporate while planning their education outreach efforts, as shown in table 3.[32]

|

Leading practice |

Description |

|

Analyze the situation |

Analyze the situation, including key target dates and competing voices or messages. Review relevant past experiences to identify applicable “lessons learned” that may help guide efforts. |

|

Identify stakeholders |

Identify and engage all key stakeholders involved in outreach efforts and clarify their roles and responsibilities. |

|

Identify credible messengers |

Identify who will be delivering the messages and ensure that the source is credible with audiences. |

|

Design media mix |

Plan the media mix (e.g., online, print, broadcast) to optimize earned media (e.g., news stories, opinion editorials) and paid media. |

|

Define goals and objectives |

Define the goals of the outreach campaign and the objectives that will help the campaign meet those goals. |

|

Identify resources |

Identify available short-term and long-term budgetary and other resources. |

|

Research target audiences |

Conduct audience research and measure audience awareness. Identify any potential audience-specific obstacles, such as access to information. |

|

Develop consistent, clear messages |

Develop clear and consistent audience messages based on budget, goals, and audience research findings. |

|

Establish metrics to measure success |

Establish both process and outcome metrics to measures success in achieving objectives of the outreach campaign. |

Source: GAO. | GAO‑25‑107429

The leading practices include identifying and engaging key stakeholders in outreach efforts and developing clear and consistent audience messages. As stated above, IRS does not consistently provide outreach to key adoption stakeholders, and IRS’s informational materials on the credit lack clarity on requirements by adoption type, omit information on special needs adoptions, and do not consistently provide guidance on recordkeeping.

During our review, IRS took various steps to expand its outreach efforts. For example, IRS added five adoption partners to its collective outreach list and published a new informational flyer dedicated to the credit. According to IRS officials, these efforts resulted in one information briefing requested by a new partner. However, IRS did not build on these efforts by finding additional adoption partners or requesting feedback from its current partners about its materials to ensure credible messaging for relevant audiences.

In August 2024, IRS officials told us they recognized the importance of tailored adoption credit outreach material for specific audiences. In response to our work, IRS published a new informational flyer dedicated to the credit in November 2024. This flyer, however, largely reproduced information from other outreach materials and omitted some content, such as information on special needs adoptions. Officials from one selected adoption stakeholder organization we spoke with expressed dissatisfaction with the new flyer. They said the publication was too general and not especially helpful for taxpayers. Furthermore, as of May 2025, the flyer had not been updated for the tax year 2024 maximum credit amount.

While IRS has taken some steps to improve its outreach, it still has not developed an education plan that would help ensure its outreach efforts are clear and consistent. Without a strategic approach to educate taxpayers on the adoption tax credit, IRS may continue to miss opportunities to clearly communicate relevant information about the credit to adoptive families that may be eligible and adoption stakeholders who assist these families.

An educational outreach plan can help facilitate compliance. As discussed below, close to half of completed adoption tax credit audits resulted in thousands of dollars in changes from the taxpayers’ original claim. By having an educational outreach plan, IRS would ensure that eligible individuals have the information they need to appropriately claim the credit and retain proper documentation and records in case they are audited. Additionally, IRS could use the audit results to better inform its education efforts.

Adoption Tax Credit Audits Are Infrequent but Can Result in Thousands of Dollars in Changes

Returns Claiming the Adoption Tax Credit Were Generally Audited At the Same Rate As All Individual Tax Returns

IRS’s Small Business/Self-Employed (SB/SE) Division is responsible for auditing the adoption tax credit to ensure taxpayer compliance. SB/SE develops an annual plan to guide audit decisions. As part of this plan, SB/SE identifies which credits to audit and the total number of returns to be audited. For each fiscal year, the audit plan strives to ensure audit coverage across different types of tax returns.

Specific to the adoption tax credit, SB/SE may audit returns of taxpayers who claimed the credit. However, according to SB/SE officials, an examiner may or may not specifically audit the adoption tax credit. Nevertheless, SB/SE counts all these returns as audited adoption tax credit returns. Moreover, SB/SE officials told us that they do not calculate the rate of returns audited that claim the adoption tax credit because it is not a regular statistic they track and report.

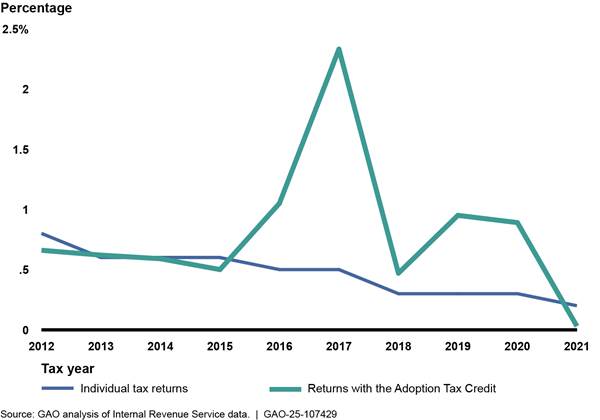

In general, for tax years 2012 through 2021, we calculated that the percentage of audited returns claiming the adoption tax credit was comparable to the percentage of all individual income tax returns audited, with the exception of a few years including tax years 2016 and 2017. Officials explained that the variance was due to sampling. As shown in figure 7, the percentage of all individual income tax returns selected for audit, as well as for audited returns that claimed the adoption tax credit, was typically less than 1 percent.

Figure 7: Percentage of Audits for All Individual Income Tax Returns and Those Claiming the Adoption Tax Credit, Tax Years 2012-2021

In 2011, we reported that 68 percent of almost 100,000 returns that claimed the

adoption tax credit during the 2010 tax year were selected for audit.[33] We attributed that high percentage

to IRS not making a concerted effort to communicate or convey information to

key stakeholders that submitting applicable adoption documentation was

necessary to claim the adoption tax credit. At that time, the adoption tax

credit was fully refundable and IRS categorized it a high risk for fraud.

To mitigate the risk of fraud and improper payments associated with refundable tax credits, IRS developed a compliance strategy that required taxpayers who claimed the credit to file a paper return and provide applicable adoption documentation.[34] If taxpayers did not provide documentation or if auditors could not verify the legitimacy of it, the claim was audited.[35]

In tax year 2012, the credit reverted to being nonrefundable. In response, IRS revised some of its adoption tax credit procedures. For instance, while taxpayers who claimed the credit still had to file a paper return, they were not required to submit any documentation. IRS also did not audit a large volume of adoption tax credit claims. As a result of these changes, as shown in figure 7, the percentage of audited returns claiming the adoption tax credit was less than 1 percent for the 2012 tax year.

Adoption Tax Credit Audits Could Include Reviews of Prior Year Returns

While the percentage of audits for returns claiming the adoption tax credit is generally comparable to that for all individual income tax returns, it can represent either an over or undercount of all the audits SB/SE performed on the credit itself. For example:

· Review of prior years’ returns. If an audited return includes an amount claimed for the adoption tax credit that is carried forward from prior years, an auditor may review all years that included adoption credit claims to ensure that the total amount did not exceed the maximum credit allowed. To complete this work, an auditor may need to review adoption tax credit claims starting with the year when the credit was initially claimed. According to SB/SE officials, if an auditor reviewed an adoption credit claim spanning multiple years, each tax return reviewed would be included in the number of adoption tax credits audited for each tax year.

· Professional judgment. Auditors use professional judgment when selecting issues to review on a return selected for audit. For instance, according to SB/SE officials, if an experienced auditor conducts a targeted audit on a specific credit, such as the Earned Income Tax Credit, they may also review an adoption tax credit claim on the return if they have reason to believe there is a potential problem. At the same time, according to an SB/SE official, an auditor may not review the adoption tax credit as part of the audit.

As shown in table 4, the percentage of adoption tax credits that were audited for tax years 2012 through 2017 is generally higher than the percentage of audited returns which claimed the credit during the same time. This is because an auditor may be required to review up to 5 prior years of a taxpayer’s returns to audit the total amount of the credit claimed. In some years, the percentage of credits audited is lower than the percentage of returns audited that claimed the credit. SB/SE officials said this may have occurred because the return could have been selected for audit due to other reasons and the auditor opted not to review the adoption tax credit.

|

Tax year |

Total number of adoption credits audited |

Estimated returns that claimed the adoption tax credita |

Percentage of adoption credits auditedb |

|

2012 |

766 |

30,485 |

2.51 |

|

2013 |

700 |

55,036 |

1.27 |

|

2014 |

778 |

73,951 |

1.05 |

|

2015 |

572 |

63,960 |

0.89 |

|

2016 |

896 |

66,250 |

1.35 |

|

2017 |

978 |

79,670 |

1.23 |

|

2018 |

375 |

76,127 |

0.49 |

|

2019 |

529 |

63,531 |

0.83 |

|

2020 |

579 |

64,773 |

0.89 |

|

2021c |

219 |

71,702 |

0.31 |

Source: GAO analysis of Internal Revenue Service data. | GAO‑25‑107429

aEstimated returns that claimed the adoption tax credit is based on a stratified probability sample of individual income tax returns selected before audit. All estimates presented in this table have a margin of error no greater than plus or minus 17,146 at the 95 percent level of confidence.

bThe percentage of credits audited cannot be compared to the percentage of returns audited that claimed the adoption tax credit because it can include audits performed on prior year returns that claimed the adoption tax credit and may also exclude returns that were audited because the credit was not reviewed based on the auditor’s judgment.

cAudits for this tax year are still in

progress.

Close to Half of Completed Adoption Tax Credit Audits Resulted in Thousands of Dollars of Changes by IRS

For tax years 2012 through 2021 more than half of audits SB/SE completed resulted in no change. However, as shown in table 5, 41 percent of audited adoption tax credits from tax years 2012 through 2021 either increased or decreased from the taxpayers’ original claim.

|

Result |

Number of audited |

Percentage of total adoption credit auditsa |

Total dollar amount |

|

Increased credit |

1,102 |

17% |

$8,145,000 |

|

Decreased credit |

1,559 |

24% |

(12,470,000) |

|

No change |

3,740 |

58% |

0 |

|

Total |

6,401 |

100% |

(4,325,000) |

Source: GAO analysis of Internal Revenue Service data. | GAO‑25‑107429

aDue to rounding, the percentage of total audits do not sum to 100 percent.

bRounded to the nearest thousand.

The results of these audits had no effect on the total amount of expenditures related to the adoption tax credit. For tax years 2012 through 2021, taxpayers claimed over $3 billion in adoption tax credits. As a result of these audits, the changes had a negligible overall effect on total expenditures.

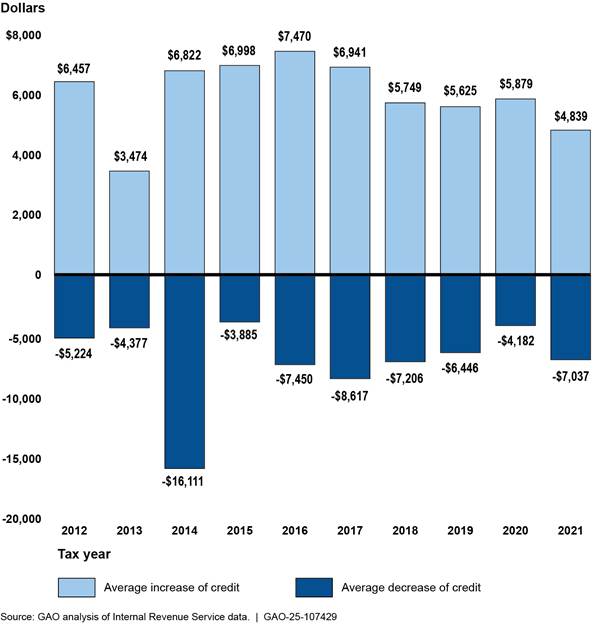

As shown in figure 8, for tax years 2012 through 2021, the average increase to a credit was approximately $6,000 and the average decrease was approximately $7,000.

Figure 8: Average Dollar Amount Change to Adoption Tax Credit Per Audited Return, Tax Years 2012-2021

SB/SE officials said that they were unable to provide an explanation why the

auditors changed the original credit’s value without reviewing the auditors’

individual audit documentation.

As discussed above, an educational outreach plan can help facilitate taxpayer compliance and reduce errors. This in turn could reduce the need for costly audits as well as help eligible taxpayers who may be underclaiming the credit.

Conclusions

In 1996, the adoption tax credit was established to help taxpayers offset expenses incurred during the adoption process. To help taxpayers learn about this credit, IRS has communicated adoption tax credit information through various material and channels. However, IRS has not consistently provided this information to key adoption stakeholders such as state adoption agencies. Additionally, some IRS information was unclear and inconsistently communicated on topics such as special needs adoptions and the adoption of a stepchild.

The lack of clear and consistent information can cause confusion for taxpayers as they prepare their taxes. Taxpayers may claim the credit when they are not eligible or claim an inaccurate amount. These taxpayers could be subjected to a costly and time-consuming audit resulting in an unexpected tax liability.

IRS has a responsibility to ensure that taxpayers are aware of the credits for which they are eligible and how to accurately claim these credits. By having an adoption tax credit educational outreach plan that incorporates leading practices for consumer education planning, IRS could assist more taxpayers to appropriately and accurately claim the credit. The newly enacted changes to the adoption tax credit for tax years beginning in 2025 heighten the need for renewed educational outreach efforts by IRS to assist taxpayers and key stakeholders.

Recommendation for Executive Action

We are making the following recommendation to IRS:

The Commissioner of Internal Revenue should direct the Acting Chief of Communications and Liaison and the Chief Taxpayer Experience Officer to develop a comprehensive educational outreach plan for the adoption tax credit that aligns with our Leading Practices for Consumer Education Planning, including identifying key stakeholders and developing clear, consistent messaging. (Recommendation 1)

Agency Comments

We provided a draft of this report to IRS for review and comment. In its comments, reproduced in appendix III, IRS agreed with our recommendation to develop a comprehensive educational outreach plan for the adoption tax credit. IRS stated that the enactment of changes to the credit, specifically making up to $5,000 refundable, present an opportunity to expand its communication efforts. Officials also stated that IRS is committed to develop a comprehensive, forward-looking outreach plan that identifies key stakeholders and delivers clear, consistent messaging to ensure that all eligible taxpayers are well-informed and supported.

We are sending copies of this report to the appropriate

congressional committees, the Commissioner of the IRS, and other interested

parties. In addition, the report is available at no charge on the GAO website

at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at

mctiguej@gao.gov. Contact points for our

Offices of Congressional Relations and Public Affairs may be found on the last

page of this report. GAO staff who made key contributions to this report are

listed in appendix IV.

James R. McTigue, Jr.

Director, Strategic Issues

Tax Policy and Administration

This report examines (1) the Internal Revenue Service’s (IRS) outreach to educate individuals on the availability and requirements to claim the adoption tax credit, and (2) the frequency and results of audits IRS conducted on the adoption tax credit for the 2012 through 2021 tax years.

In July 2025, Congress passed, and the president signed, legislation which changes some requirements of the adoption tax credit.[36] The changes to the adoption tax credit occurred after we completed our analysis. Throughout the report, we refer to the requirements of the credit prior to July 2025. These changes do not materially affect our findings and conclusions.

IRS Outreach on Adoption Tax Credit

To address our first objective, we interviewed IRS officials from the Communications and Liaison and Taxpayer Services Divisions who are responsible for creating adoption tax credit materials, identifying stakeholders, and disseminating the materials to those stakeholders. We reviewed these materials, including instructions, websites, and applicable sections of the Internal Revenue Manual for clarity, consistency, and accuracy. We conducted selected simulations using IRS’s Interactive Tax Assistant Tool for the Adoption Tax Credit to identify consistencies between the tool and other IRS material. We interviewed IRS representatives from the former Transformation & Strategy Office who were overseeing the work performed by a consulting firm responsible for agency-wide education and outreach efforts.

To obtain the views of organizations that assist individuals and groups during the adoption process, we interviewed three state adoption and foster care agencies along with two nongovernmental and two professional organizations. For purposes of this report, we refer to these groups as stakeholders. We interviewed these stakeholders about their thoughts on IRS’s outreach efforts, interactions they may have had with IRS, and challenges individuals may have had in claiming the adoption tax credit.

We also obtained written responses from the Administration for Children and Families (ACF), within the Department of Health and Human Services. ACF oversees states’ administration of payments for adoption assistance to adoptive families of eligible children.

To select state agencies, we reviewed the amount of federal adoption and guardianship incentive funding each state received from ACF.[37] We categorized the states into three groups ranked by the amount of federal funding they received: high, medium, and low. We randomly selected one state from each of those groupings. As a result, we spoke with state officials from three states: Illinois, Alabama, and New Mexico. We also reviewed adoption tax credit materials developed by the Illinois state foster care agency.

To select nongovernmental organizations, we conducted an online search of organizations that assist individuals and groups through the adoption process. We identified organizations based on the adoption types they support, including, but not limited to, foster care, domestic-private, and international. We interviewed officials from both the National Council for Adoption and Families Rising because they provide nationwide assistance to individuals who are adopting.

Additionally, based on recommendations during stakeholder interviews, we interviewed professionals with the Academy of Adoption and Reproduction Attorneys and the American Institute of Certified Public Accountants.

Although these stakeholders do not represent the experiences of all groups, they provide illustrative examples of the experiences some entities have had with IRS outreach or advising individuals.

We also interviewed representatives from three tax software preparation companies on their processes to incorporate IRS’s instructions on the adoption tax credit into their products and services. We selected these companies due to the multiple formats individuals could use to file their taxes to claim the credit. We conducted selected simulations to determine the user experience for claiming the adoption tax credit. The online software products we selected for our review required users to pay a fee to file an electronic federal return. None of the companies’ free products include the option to file Form 8839 on Qualified Adoption Expenses. We shared our results with the three tax software preparation companies.

Frequency and Results of Adoption Tax Credit Audits

To obtain the frequency and results of audits conducted on the adoption tax credit, we reviewed audit data for tax years 2012 through 2021. We chose tax year 2012 because the credit was last reviewed in tax year 2011 by the IRS Taxpayer Advocate Service. Additionally, we selected tax year 2021 as it was the most recent year that IRS had data on closed and in-progress audits. We also interviewed officials from IRS’s Small Business/Self-Employed (SB/SE) Division who are responsible for conducting adoption tax credit audits and maintaining the results.

To determine the frequency of audits for tax years 2012 through 2021 on the adoption tax credit, we requested audit data on (1) the number of completed audits for all individual tax returns as part of IRS’s annual audit selection along with the number of those returns that had the adoption tax credit on the return, and (2) the total number of adoption tax credits audited for each tax year along with the results:

· Audited Returns with Adoption Tax Credit Claims. SB/SE officials provided the number of completed and in-progress audits they performed on returns that claimed the adoption tax credit for tax years 2012 through 2021. These data included audited returns where the taxpayer claimed the adoption tax credit. However, if the return was selected for audit due to another reason, such as the Earned Income Tax Credit, the adoption credit may or may not have been audited. Additionally, SB/SE officials said that they did not calculate the percentage which the adoption tax credit was audited.

To calculate this percentage, we divided the number of completed and in-progress audits by the estimated number of total returns that claimed the adoption tax credit. We obtained the estimated number of total returns that claimed the adoption tax credit from IRS’s Statistics of Income-Table 1.3-All Returns: Sources of Income, Adjustments, Deductions, Credits, and Tax Items, by Filing Status for tax years 2012 through 2021. The estimated number of returns that claimed the adoption tax credit is based on a stratified probability sample of individual income tax returns selected before audit.

We compared this to the annual audit rate of individual income tax returns for tax years 2012 through 2021. Both percentages were calculated using the same formula—total number of returns audited divided by total number of returns. We obtained the annual individual income tax audit rate from Table 17-Examination Coverage and Recommended Additional Tax After Examination, by Type and Size of Return within the Internal Revenue Service Data Book, 2022 and 2023.

· Credits Audited and Results. Since the total number of audited returns with adoption tax credit claims did not provide a complete count of adoption tax credits audited, SB/SE provided data that included the total number of credits audited for tax years 2012 through 2021. These data included all adoption tax credits that were audited during annual audits, including reviews of prior year returns, and when an auditor uses professional judgment to review the credit as part of an audit of another issue.

To calculate the percentage of adoption credits audited, we divided the total number of credits audited by the estimated number of total returns that claimed the adoption tax credit. We obtained the estimated number of total returns that claimed the adoption tax credit from IRS’s Statistics of Income-Table 1.3-All Returns: Sources of Income, Adjustments, Deductions, Credits, and Tax Items, by Filing Status for tax years 2012 through 2021. The estimated number of returns that claimed the adoption tax credit is based on a stratified probability sample of individual income tax returns, selected before audit.

We also obtained data on changes to the credit due to audits for tax years 2012 through 2021. These data included the total number of credits in which the dollar value either increased or decreased due to the audit and by how much, as well as the total number of credits for which the audit resulted in no change to the credit. SB/SE provided us this information from IRS’s audit management system in February 2025.

To assess the reliability of the data, we interviewed IRS officials and reviewed documentation for any data limitations. We determined that the data were sufficiently reliable to obtain the frequency and results of audits IRS conducted on the adoption tax credit.

We conducted this performance audit from February 2024 to August 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Appendix II: Internal Revenue Service List of Acceptable Documentation to Verify an Eligible Child for the Adoption Tax Credit

The Internal Revenue Service (IRS) requires taxpayers who are audited to verify their returns. This includes taxpayers who claim the adoption tax credit. Taxpayers must verify that a legal adoption has either been finalized or is in progress and provide verification of their qualified expenses, excluding special needs adoptions. If part of the credit claimed is a carryforward from a prior year, the taxpayer must provide a worksheet explaining how the carryforward was computed. The carryforward worksheet is found in the instructions for Form 8839 on Qualified Adoption Expenses.

Audited taxpayers must be able to provide proper documentation for each child claimed. Table 6 shows IRS’s guidelines for acceptable documentation according to adoption type.

Table 6: Internal Revenue Service List of Acceptable Documentation to Verify an Eligible Child for the Adoption Tax Credit

|

Eligible adoption types |

Acceptable documentationa |

|

|

Domesticb |

Finalized |

· Adoption certificate, report or final decree signed by a representative of the State Court, showing the names of the adoptive child and parent |

|

Not finalized (in-process) or Unsuccessful (attempted, failed) |

Taxpayer must provide one or more of the following: · A copy of, or a receipt from, a home study completed by an authorized placement agency · A placement agreement with an authorized placement agency · A document signed by a hospital official authorizing the release of a newborn child from the hospital for legal adoption · A court document ordering or approving the placement of the child with the taxpayer for legal adoption · An affidavit or notarized statement signed under penalties of perjury from an adoption attorney, government official, or other authorized person. The documents must state that the signor either: o placed or is placing a child with you for legal adoption, or o is facilitating the adoption process in an official capacity, with a description of the actions taken to facilitate the process. |

|

|

Foreignc |

Finalized Hague adoption |

· Hague Adoption Certificate (Immigrating Child), or · IH-3 visa, or · A foreign adoption decree, translated into English |

|

Finalized Non-Hague adoption |

· A foreign adoption decree, translated into English, or · IR-2 or IR-3 visa |

|

|

Special needsd |

Finalized |

Taxpayers must provide both of the following documents: · Adoption certificate, report or final decree signed by a representative of the State Court showing the names of the adoptive child and parent, and · The state’s determination of special needs designation. The following are acceptable documentation of the state’s determination of special needs (this list is not all inclusive): o A signed adoption assistance or subsidy agreement issued by the state or county o Certification from the state or county welfare agency verifying that the child is approved to receive adoption assistance o Certification from the state or county welfare agency verifying that the child has special needs |

Source: GAO analysis of Internal Revenue Service (IRS) information. | GAO‑25‑107429

aEligible adoption types—excluding special needs—also require acceptable proof of adoption expenses, which include checks and receipts showing proof of payment. IRS does not require qualified expenses for special needs adoptions to claim the maximum amount of adoption tax credit.

bDomestic adoption. A domestic adoption involves an eligible child who is a citizen or resident of the United States (including U.S. territories) at the time the adoption effort began. For domestic adoptions, eligible taxpayers may claim the credit even if the adoption never became final. Expenses related to the adoption of the child of a spouse (stepchild) or child by surrogacy are not qualified expenses.

cForeign adoption. A foreign adoption involves an eligible child who was not a citizen or resident of the United States (including U.S. territories) at the time the adoption effort began. For foreign adoptions, eligible taxpayers may claim the credit only when the adoption becomes final. For documentation purposes, IRS distinguishes between a Hauge adoption and a non-Hague adoption. A Hague adoption involves a foreign child from a country that is a party to the Hague Adoption Convention which entered into force for the United States on April 1, 2008.

dSpecial needs. If the adoption is domestic and final, and is of a special needs child (as determined by the state where the adoption occurs), the taxpayer is entitled to claim the maximum amount of the credit (minus any amounts claimed for that child in a previous year) even if the taxpayer paid no qualified adoption expenses. A child meets the definition of special needs if all of the following statements are true:

· The child was a citizen or resident of the United States or its possessions at the time the adoption process began,

· The state has determined that the child cannot or should not be returned to their parents’ home, and

· The state has determined that the child is unlikely to be adopted unless assistance is provided to the adoptive parents.

Foreign children do not meet the definition of children with special needs for purposes of the adoption credit. U.S. children who have disabilities may not have special needs for purposes of the adoption credit. Generally, “special needs adoptions” are the adoptions of children whom the state’s child welfare agency considers difficult to place for adoption. Legislation enacted in July 2025 recognized Indian tribal governments for purposes of determining whether a child has special needs.

GAO Contact

James R. McTigue, Jr., mctiguej@gao.gov

Staff Acknowledgments

In addition to the individual named above, Erin Saunders Rath (Assistant Director), Regina Morrison (Analyst in Charge), Marybeth Acac, Jacqueline Chapin, Alicia White, Gina Hoover, Andrew J. Stephens, and Jennifer Stratton made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]National Council for Adoption, Adoption by the Numbers: 2021 and 2022 (Alexandria, VA: March 2025).

[2]According to the Congressional Research Service, for tax purposes, adoptions can be categorized in one of three ways: (1) a domestic public adoption is one that is facilitated with the involvement of a state child welfare agency; (2) a domestic private adoption is one that is facilitated by a private agency, adoption facilitator, or attorney; and (3) an international adoption is one that involves adoption of a noncitizen or nonresident child by families who are citizens or legal residents of the United States. See Congressional Research Service, Adoption Tax Benefits: An Overview, R44745 (Oct. 19, 2020). State foster care programs are generally among the programs administered by a state child welfare agency.

[3]Small Business Job Protection Act of 1996, Pub. L. No. 104-188, § 1807(a), 110 Stat. 1755, 1899–1901 (1996) codified at 26 U.S.C. § 23.

[4]Department of Health and Human Services, Administration for Children and Families, Children's Bureau, Planning for Adoption: Knowing the Costs and Resources (June 2022).

[5]Patient Protection and Affordable Care Act, Pub. L. No. 111-148, § 10909(b), 124 Stat. 119, 1022–1024 (2010). While the credit was refundable it was codified at 26 U.S.C. § 36C in the subpart containing refundable tax credits.

[6]GAO, Adoption Tax Credit: IRS Can Reduce Audits and Refund Delays, GAO‑12‑98 (Washington, D.C.: Oct. 20, 2011).

[7]An Act to provide for reconciliation pursuant to title II of H. Con. Res. 14, Pub. L. No. 119-21, § 70402, 139 Stat. 72, ___ (2025). (commonly known as the One Big Beautiful Bill Act or OBBBA).

[8]Small Business Job Protection Act of 1996, Pub. L. No. 104-188, § 1807(a), 110 Stat. 1755, 1899–1901 (1996), codified at 26 U.S.C. § 23. Also see Congressional Research Service, Adoption Tax Benefits: An Overview, R44745 (Oct. 19, 2020). The act also included a provision excluding from income of employees certain amounts paid by an employer in connection to adoption. 26 U.S.C. § 137.

[9]Patient Protection and Affordable Care Act, Pub. L. No. 111-148, § 10909(b), 124 Stat. 119, 1022–1023 (2010).

[10]GAO, Comprehensive Compliance Strategy and Expanded Use of Data Could Strengthen IRS's Efforts to Address Noncompliance, GAO‑16‑475 (Washington, D.C.: May 27, 2016).

[11]GAO, Improper Payments: Information on Agencies' Fiscal Year 2024 Estimates, GAO‑25‑107753 (Washington, D.C.: Mar. 11, 2025).

[12]26 U.S.C. § 23(d)(2).

[13]Per IRS instructions, the purpose of Form 8839 is for taxpayers to determine the amount of adoption credit, and any employer-provided adoption benefits they can exclude from their income. Taxpayers can claim both the exclusion and the credit for expenses of adopting an eligible child. For example, depending on the cost of the adoption, in tax year 2024 taxpayers were able to exclude up to $16,810 from their income and also be able to claim a credit of up to $16,810. Taxpayers cannot claim both a credit and exclusion for the same expenses. However, special needs adoptions may be eligible for both the full amount of the exclusion and credit, even if the taxpayer or employer did not pay any qualified adoption expenses.

[14]In July 2025, the law was changed to recognize Indian tribal governments for purposes of determining whether a child has special needs. Pub. L. No. 119-21, § 70403, 139 Stat. at ___ (2025). Since this change occurred after we completed our analysis, throughout this report, we refer to states as determining whether a child has special needs since that was the law at the time.

[15]According to the Administration for Children and Families, an office within the Department of Health and Human Services, the families of 94 percent of children adopted with child welfare agency involvement received an adoption subsidy in fiscal year 2022. IRS considers an adoption assistance or subsidy agreement issued by a state or county to be evidence of a state’s determination of special needs.

[16]Internal Revenue Service, Instructions for Form 8839 (2024), https://www.irs.gov/instructions/i8839.

[17]Internal Revenue Service, Adoption Credit, https://www.irs.gov/credits‑deductions/individuals/adoption‑credit.

[18]Internal Revenue Service, Interactive Tax Assistant: Am I eligible to claim a credit for adopting a child or to exclude employer-provided adoption benefits from my employer?, https://www.irs.gov/help/ita/am‑i‑eligible‑to‑claim‑a‑credit‑for‑adopting‑a‑child‑or‑to‑exclude‑employer‑provided‑adoption‑benefits‑from‑my‑employer.

[19]IRS officials told us that the Adoption Tax Credit web page replaced Tax Topic 607, Adoption credit and adoption assistance programs. In general, the purpose of the web page was to create a centralized location for adoption tax credit information.

[20]See, for example, Internal Revenue Service, IRS Tax Tip 2024-27, Adoptive parents: Don’t forget about the Adoption Tax Credit, https://www.irs.gov/newsroom/adoptive‑parents‑dont‑forget‑about‑the‑adoption‑tax‑credit.

[21]Internal Revenue Service, Publication 5851-B (Rev.8-2024), https://www.irs.gov/pub/irs‑pdf/p5851b.pdf.

[22]GAO, Affordable Broadband: FCC Could Improve Performance Goals and Measures, Consumer Outreach, and Fraud Risk Management GAO‑23‑105399 (Washington, D.C.: Jan. 25, 2023) and Digital Television Transition: Increased Federal Planning and Risk Management Could Further Facilitate the DTV Transition GAO‑08‑43 (Washington, D.C.: Dec. 11, 2007).

[23]IRS has several contact lists of partner organizations it uses to conduct outreach about tax credits and deductions.

[24]42 U.S.C. § 671(a)(33). To be eligible for foster care and adoption assistance, states must have an approved plan which provides that the state will inform any individual who is adopting—or whom the state is made aware is considering adopting—a child who is in foster care under the responsibility of the state of the potential eligibility of the individual for the federal tax credit.

[25]GAO‑12‑98. At the time of our report, individuals were required to provide documentation that their child had special needs when claiming the adoption tax credit.

[27]IRS’s information on the adoption tax credit generally includes rules on surrogacy and stepchildren under non-qualified expenses. In addition, IRS does not use the terms stepchild or stepparent in its materials. Rather, IRS consistently refers to a stepchild as a spouse’s child, which may not be clear to some taxpayers. IRS does, however, mention that in states that allow a registered domestic partner to adopt their partner’s child, expenses toward these adoptions may be considered qualified expenses.

[28]According to ACF, the families of 94 percent of children adopted with child welfare agency involvement received an adoption subsidy in fiscal year 2022. IRS considers an adoption assistance or subsidy agreement issued by a state or county to be evidence of a state’s determination of special needs.