2024 LOBBYING DISCLOSURE

Observations on Compliance with Requirements

Report to Congressional Committees

United States Government Accountability Office

For more information, contact Yvonne D. Jones at JonesY@gao.gov.

Highlights of GAO-25-107523, a report to congressional committees

Observations on Compliance with Requirements

Why GAO Did This Study

The Lobbying Disclosure Act of 1995, as amended, requires lobbyists to file quarterly lobbying disclosure reports and semiannual contribution reports, among other requirements. The law includes a provision for GAO to annually audit the extent of lobbyists’ compliance with the act.

This report (1) determines the extent to which lobbyists demonstrated compliance with disclosure requirements, (2) identifies challenges or potential improvements to compliance that lobbyists report, and (3) describes the efforts of the U.S. Attorney’s Office for the District of Columbia in enforcing compliance. This report is GAO’s 18th annual review under the provision.

GAO reviewed a stratified random sample of 100 quarterly lobbying disclosure reports filed for the third and fourth quarters of calendar year 2023 and the first and second quarters of calendar year 2024. GAO also reviewed a random sample of 160 contribution reports from year-end 2023 and midyear 2024. This methodology allowed GAO to generalize to the population of 67,577 quarterly disclosure reports with $5,000 or more in lobbying activity and 35,034 contribution reports. In addition, through a survey, GAO obtained the views of 99 different lobbyists on any challenges or potential improvements to aid compliance. GAO also interviewed U.S. Attorney’s Office officials.

GAO provided a draft of this report to the Department of Justice for review. The Department of Justice provided technical comments, which GAO incorporated as appropriate.

What GAO Found

Most lobbyists provided documentation for key elements of their disclosure reports to demonstrate compliance with the Lobbying Disclosure Act of 1995, as amended. For the third and fourth quarters of 2023 and the first and second quarters of 2024, GAO estimates that

· 97 percent of lobbyists who filed new registrations also filed quarterly lobbying disclosure reports as required for the quarter in which they first registered,

· 93 percent of lobbyists who filed quarterly lobbying disclosure reports provided documentation for lobbying income and expenses, and

· 95 percent of semiannual contribution reports included all reportable political contributions.

These findings are generally consistent with GAO’s findings since 2015.

Lobbyists are required to report certain criminal convictions. GAO found that, of the 258 individual lobbyists in its sample, none failed to report a conviction.

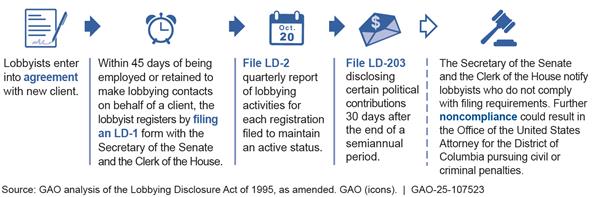

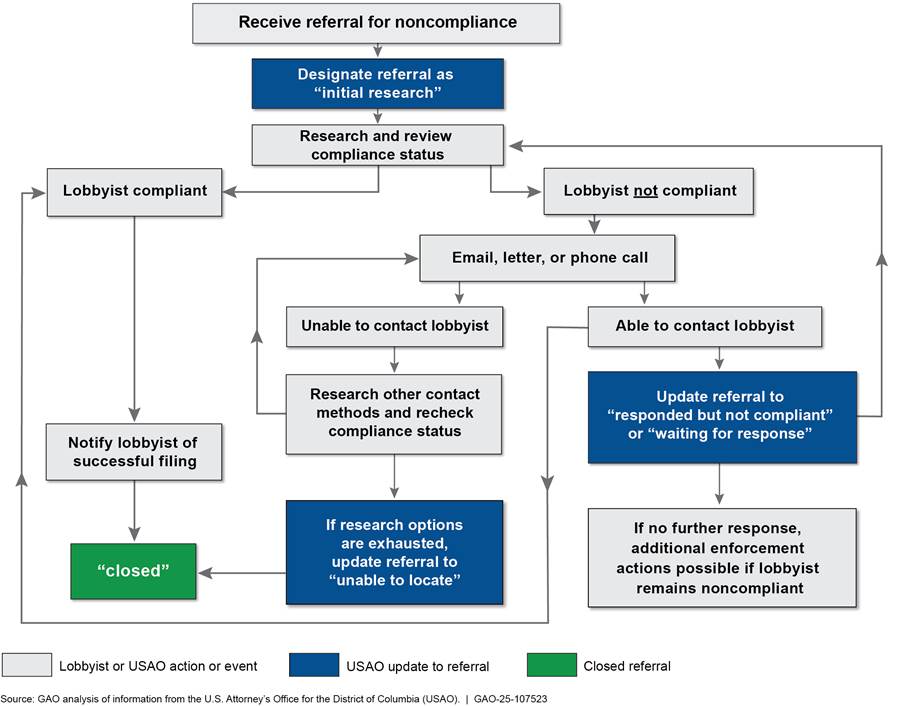

The figure below describes the typical filing and enforcement processes.

GAO found that most lobbyists surveyed reported some level of ease in complying with quarterly disclosure requirements and in understanding the definitions of terms used in quarterly lobbying disclosure reports. However, based on GAO’s estimates, 21 percent of quarterly lobbying disclosure reports included individual lobbyists who had not properly disclosed covered positions—certain jobs in the executive and legislative branches—as required.

To bring lobbyists into compliance, the U.S. Attorney’s Office for the District of Columbia continues to contact lobbyists who have not filed their disclosure reports. From 2015 through 2024, the office received 3,566 referrals from the Secretary of the Senate and the Clerk of the House for failure to file quarterly lobbying disclosure reports. As of December 2024, about 36 percent of these referrals were closed as in compliance, and about 63 percent were pending further action.

Abbreviations

|

FEC |

Federal Election Commission |

|

HLOGA |

Honest Leadership and Open Government Act of 2007 |

|

JACK Act |

Justice Against Corruption on K Street Act of 2018 |

|

LDA |

Lobbying Disclosure Act of 1995 |

|

USAO |

U.S. Attorney’s Office for the District of Columbia |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

April 1, 2025

Congressional Committees

The Honest Leadership and Open Government Act of 2007 (HLOGA) amended the Lobbying Disclosure Act of 1995 to require lobbyists to file quarterly lobbying disclosure reports and semiannual reports on certain political contributions.[1] HLOGA also increased civil penalties and added criminal penalties for failure to comply with lobbying disclosure requirements. In addition, HLOGA includes a provision for us to annually audit the extent of lobbyists’ compliance with the Lobbying Disclosure Act of 1995, as amended (LDA), by reviewing publicly available lobbying registrations and other matters.[2] This is our 18th report under this provision.[3]

As with our prior reports, our objectives were to (1) determine the extent to which lobbyists demonstrated compliance with LDA disclosure requirements for reports filed in 2023-2024, and describe how that compliance compares with prior years; (2) identify the challenges or improvements lobbyists report in complying with LDA disclosure requirements; and (3) describe the resources and authorities available to the U.S. Attorney’s Office for the District of Columbia (USAO) to enforce the LDA, and efforts USAO has made to improve enforcement.[4]

To determine the extent to which lobbyists could demonstrate compliance with reporting requirements, we examined a stratified random sample of 100 quarterly lobbying disclosure (LD-2) reports with income or expenses of $5,000 or more filed during the third and fourth quarters of calendar year 2023 and the first and second quarters of calendar year 2024.[5]

We selected the randomly sampled reports from the publicly downloadable database maintained by the Secretary of the Senate.[6] This methodology allows us to generalize some elements to the population of LD-2 reports. We then surveyed and interviewed each lobbyist in our sample.[7] Our questionnaire asked lobbyists to confirm key elements of LD-2 reports, such as the amount of income or expenses reported for lobbying activities, and whether the lobbyists maintained written documentation for these pieces of information, among other topics.

In our follow-up interviews, we asked lobbyists to provide written documentation for key elements of their LD-2 reports, including

· the amount of income or expenses reported for lobbying activities,

· the lobbyists listed in the report,

· the houses of Congress and the federal agencies that they lobbied, and

· the general issue area codes listed to describe their lobbying activity.

We reviewed whether lobbyists listed on the LD-2 reports properly disclosed (1) prior covered official positions, and (2) certain criminal convictions at the state or federal level as required by the Justice Against Corruption on K Street Act of 2018 (JACK Act).[8] We also reviewed whether the lobbyists filed semiannual contribution reports listing certain federal political contributions.

To determine whether lobbyists reported their federal political contributions as required by the LDA, we analyzed a stratified random sample of year-end 2023 and midyear 2024 semiannual contribution (LD-203) reports. The sample contains 80 LD-203 reports that list contributions and 80 LD-203 reports that do not. We selected the randomly sampled reports from the publicly downloadable contributions database maintained by the Secretary of the Senate (see appendix II for a list of lobbyists randomly selected for our review of LD-203 reports).

We then checked the contributions reported in the Federal Election Commission’s (FEC) database against the contributions identified in our sample.[9] This comparison helped us determine whether all relevant contributions reported in the FEC database were also reported on the LD-203s as required. As needed, we contacted lobbyists to ask them to provide explanations and documentation to clarify differences we observed. This methodology allows us to generalize to the population of LD-203 reports both with and without contributions.

To determine whether lobbyists were meeting the requirement to file an LD-2 report for the quarter in which they registered, we compared new registrations (LD-1) filed in the third and fourth quarters of 2023 and the first and second quarters of 2024 to the corresponding LD-2 reports on file with the Secretary of the Senate.

To identify any challenges or potential improvements to compliance, we used a structured web-based survey to obtain views from lobbyists included in our sample of reports. We asked lobbyists how easy or difficult it was to comply with the LD-2 disclosure requirements in general. We also asked them how well they understood lobbying terms such as lobbying activities, terminating lobbyists, issue codes, and covered positions.

To describe the resources and authorities available to USAO and its efforts to improve LDA enforcement, we reviewed USAO documents, analyzed USAO data, and interviewed USAO officials. A more detailed description of our methodology is provided in appendix III.

To assess the reliability of the data we used for this report, we reviewed available documentation, obtained information from knowledgeable officials, and tested and checked the data. We found the data to be sufficiently reliable for the purposes of our reporting objectives.

The mandate does not require us to identify lobbyist organizations that failed to register and report in accordance with LDA requirements. The mandate also does not require us to determine whether reported lobbying activity or political contributions represented the full extent of lobbying activities that took place.

We conducted this performance audit from April 2024 to April 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

The LDA defines a lobbyist as an individual who is employed or retained by a client for compensation for services that include more than one lobbying contact (certain written or oral communication to covered officials, such as a high-ranking agency official or a member of Congress made on behalf of a client), and whose lobbying activities represent at least 20 percent of the time the individual spends on behalf of the client during the quarter.[10] Lobbying firms are persons or entities that have one or more employees who are lobbyists on behalf of a client other than that person or entity.[11] However, for the purposes of our report, we use the term lobbyist to refer to individual lobbyists, lobbying firms (including self-employed individuals who are lobbyists), or organizations with in-house lobbyists, unless noted otherwise.[12]

The LDA requires lobbyists to register with the Secretary of the Senate and the Clerk of the House of Representatives and to file quarterly reports disclosing their lobbying activities.[13] Lobbyists are required to file their registrations and reports electronically with the Secretary of the Senate and the Clerk of the House through a single entry point. Registrations and reports must, to the extent practicable, be publicly available in downloadable, searchable databases from the Secretary of the Senate and the Clerk of the House. Figure 1 provides an overview of the registration and filing process.

Lobbyists are required to register with the Secretary of the Senate and the Clerk of the House by completing an LD-1 form for each client if the lobbyists receive or expect to receive more than $3,500 in income in a quarterly period from that client for lobbying activities.[14] When registering, lobbyists must identify any affiliated organizations that contribute more than $5,000 for lobbying in a quarterly period and actively participate in the planning, supervision, or control of the lobbying activities.[15]

Lobbyists are also required to submit a quarterly lobbying disclosure (LD-2) report for each registration filed. The information in LD-2s includes, among other details,

· the name of the client for whom the lobbyist lobbied;

· a list of individuals who acted as lobbyists on behalf of the client during the reporting period;

· whether any new individual lobbyists listed served in covered positions in the executive or legislative branch, such as high-ranking agency officials or congressional staff positions, in the previous 20 years;

· codes describing general lobbying issue areas, such as agriculture and education;

· a description of the specific lobbying issues;

· houses of Congress and federal agencies lobbied during the reporting period; and

· reported income (or expenses for organizations with in-house lobbyists) related to lobbying activities during the quarter (rounded to the nearest $10,000).

The LDA also requires lobbyists to report certain political contributions semiannually in the LD-203 report. These reports must be filed 30 days after the end of a semiannual period by each lobbyist who has filed a registration and by each individual lobbyist listed on an LD-2 report. The lobbyists must

· list the name of each federal candidate or officeholder, leadership political action committee, or political party committee to which they contributed at least $200 in the aggregate during the semiannual period;

· report contributions made to presidential library foundations and presidential inaugural committees;

· report funds contributed to pay the cost of an event to honor or recognize an official who was previously in a covered position, funds paid to an entity named for or controlled by a covered official, and contributions to a person or entity in recognition of an official, or to pay the costs of a meeting or other event held by or in the name of a covered official; and

· certify that they have read and are familiar with the gift and travel rules of the Senate and House and that they have not provided, requested, or directed a gift or travel to a member, officer, or employee of Congress that would violate those rules.

No specific statutory requirement exists for lobbyists to generate or maintain documentation in support of the information disclosed in the reports they file. However, guidance issued by the Secretary of the Senate and the Clerk of the House recommends that lobbyists retain copies of their filings and documentation supporting reported income or expenses for at least 6 years after they file their reports.

In January 2019, the JACK Act was enacted.[16] The JACK Act amended the LDA. It requires that lobbyists disclose in their lobbying registrations and quarterly lobbying disclosure reports whether individual lobbyists have been convicted of certain criminal acts at the federal or state level. Specifically, the act requires that, for any listed individual lobbyist who has been convicted of an offense (involving bribery, extortion, embezzlement, an illegal kickback, tax evasion, fraud, a conflict of interest, making a false statement, perjury, or money laundering), the lobbyist is to provide the date of conviction and a description of the offense in the lobbying registration and subsequent quarterly reports.

The LDA requires that the Secretary of the Senate and the Clerk of the House guide and assist lobbyists with the registration and reporting requirements and develop common standards, rules, and procedures for LDA compliance. The Secretary of the Senate and the Clerk of the House review the guidance periodically.[17] It was last revised on February 28, 2025, to update registration thresholds reflecting changes in the Consumer Price Index.

The guidance provides definitions of LDA terms, elaborates on registration and reporting requirements, includes specific examples of different disclosure scenarios, and explains why certain scenarios prompt or do not prompt disclosure under the LDA. The offices of the Secretary of the Senate and the Clerk of the House told us they continue to consider information we report on lobbying disclosure compliance when they periodically update the guidance. In addition, they stated that they email registered lobbyists to provide reminders to file reports by the quarterly and semiannual due dates.

The Secretary of the Senate and the Clerk of the House, along with USAO, are responsible for ensuring LDA compliance. The Secretary of the Senate and the Clerk of the House are to notify lobbyists in writing when they are not complying with LDA reporting requirements. Subsequently, they are to refer to USAO lobbyists who fail to provide an appropriate response within 60 days of being notified. USAO researches these referrals and communicates with the lobbyists by email, phone, or letter to inform them that they are not in compliance and what must be done to reach compliance. If USAO does not receive a response after 60 days, it decides whether to pursue a civil or criminal case against each noncompliant lobbyist. A civil case could lead to penalties up to $200,000 for each violation, while a criminal conviction could lead to a maximum of 5 years in prison.

Most Lobbyists Are Complying with Federal Lobbying Disclosure Requirements

Lobbyists Filed Quarterly Lobbying Disclosure Reports as Required for Most New Lobbying Registrations

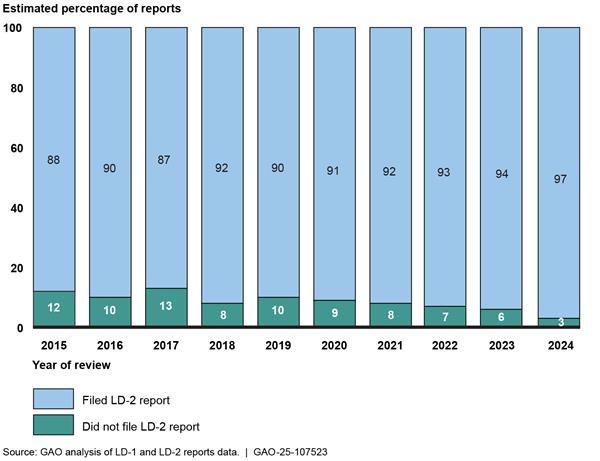

Under the LDA, within 45 days of being employed or retained to make a lobbying contact on behalf of a client, the lobbyist must register by filing an LD-1 form with the Secretary of the Senate and the Clerk of the House.[18] Thereafter, the lobbyist must file quarterly lobbying disclosure (LD-2) reports detailing the lobbying activities. Of the 4,051 new registrations we identified for the third and fourth quarters of 2023 and the first and second quarters of 2024, we identified a matching LD-2 report filed within the same quarter as the registration for 3,926 of them (97 percent).

These results are similar to the findings we have reported in prior reviews. We used the Senate lobbying disclosure database as the source of the reports. We also used an electronic matching algorithm that addresses misspellings and other minor inconsistencies between the registrations and reports. Figure 2 shows lobbyists filed disclosure reports as required for most new lobbying registrations from 2015 through 2024.

Figure 2: Comparison of Newly Filed Lobbying Registrations (LD-1) to Initial Quarterly Lobbying Disclosure (LD-2) Reports, 2015—2024

As part of their regular compliance procedures, the Secretary of the Senate and the Clerk of the House are to follow up with lobbyists who filed new registrations if quarterly reports were not also filed. If the Secretary of the Senate and the Clerk of the House are unsuccessful in bringing the lobbyist into compliance, they must refer those cases to USAO.

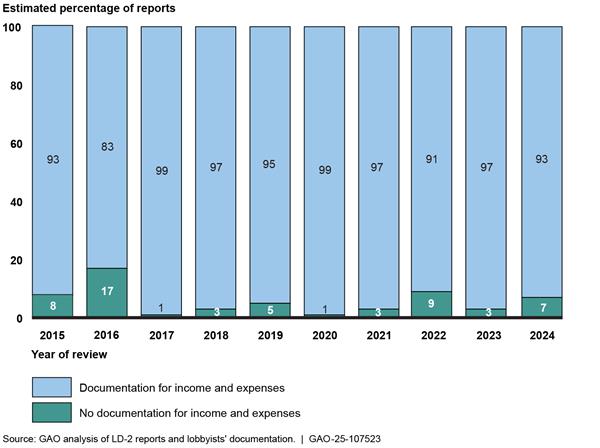

For Most Quarterly Lobbying Disclosure Reports, Lobbyists Provided Documentation for Key Elements, Including Income and Expenses

For selected elements of lobbyists’ LD-2 reports in our sample that can be generalized to the population of lobbying reports, our findings have generally been consistent from year to year.[19] Most lobbyists reporting $5,000 or more in income or expenses provided written documentation to varying degrees for the reporting elements in their disclosure reports.

Figure 3 shows that lobbyists provided documentation for income and expenses for most sampled LD-2 reports from 2015 through 2024.[20] Our 2024 estimate does not represent a statistically significant change from 2023.[21]

Figure 3: Estimated Percentage of Quarterly Lobbying Disclosure (LD-2) Reports with Documentation for Income and Expenses, 2015—2024

Note: Estimated percentages have a margin of error of 10 percentage points or fewer. For 2015, percentages do not total 100 due to rounding.

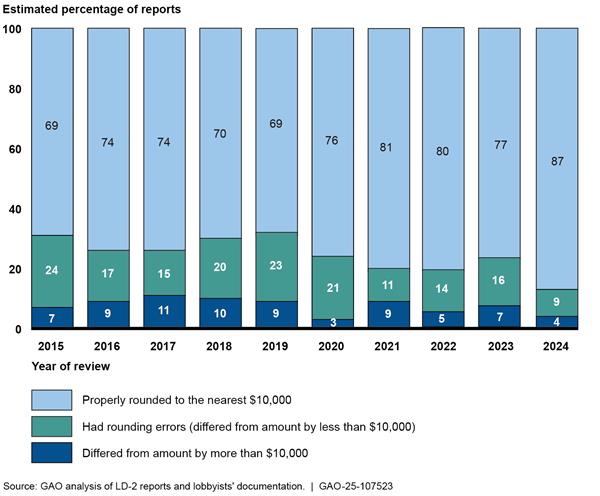

For LD-2 reports where lobbyists provided supporting documentation for income or expenses, we found that the reported income or expenses amount sometimes differed from the supporting documentation.[22] Figure 4 shows that in 2024, an estimated 4 percent of LD-2 reports had income or expenses amounts that differed by more than $10,000 from the amounts lobbyists provided to us on their supporting documentation. In addition, we estimated that 9 percent of reports for which lobbyists provided supporting documentation had rounding errors in amounts less than $10,000 on reported income or expenses.[23] These values do not represent statistically significant changes as compared to 2023. In 2016, the Secretary of the Senate and the Clerk of the House updated guidance to include an additional example about rounding expenses to the nearest $10,000. Nevertheless, we have found that rounding difficulties have been a recurring issue on LD-2 reports from 2015 through 2024.

Figure 4: Estimated Percentage of Quarterly Lobbying Disclosure (LD-2) Reports with Differences in Reported and Documented Amount of Income and Expenses, 2015—2024

Note: Estimated percentages have a maximum margin of error of 12 percentage points or fewer. For 2019, 2021, and 2022, percentages do not total 100 due to rounding.

The LDA requires that lobbyists disclose lobbying contacts made with federal agencies on behalf of the client during the reporting period. This year, of the 100 LD-2 reports in our sample, 36 disclosed lobbying activities at federal agencies. In 26 of those 36 cases, lobbyists provided supporting documentation. Specifically, 16 lobbyists provided documentation for all of their disclosed lobbying activities at federal agencies, and 10 lobbyists provided documentation for some of their disclosed lobbying activities at federal agencies.[24]

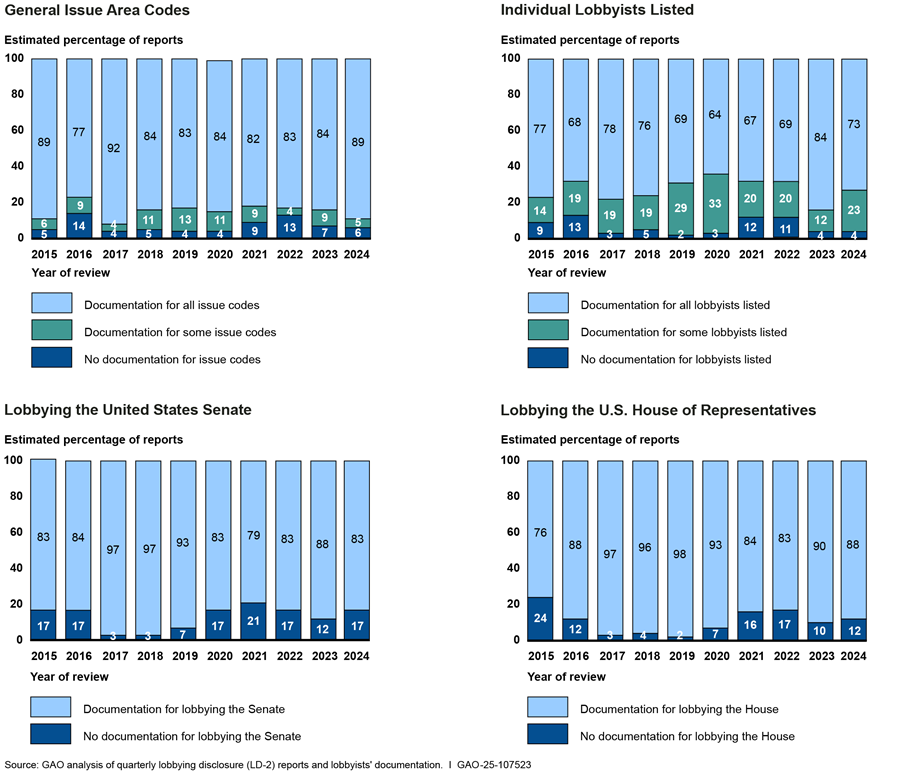

Figure 5 shows that, for most LD-2 reports, lobbyists provided documentation for selected elements of their LD-2 reports, such as general issue area codes for lobbying activities, lobbying the Senate and the House, and individual lobbyists listed from 2015 through 2024. Our 2024 estimates do not represent statistically significant changes from 2023.[25]

Figure 5: Extent to Which Lobbyists Provided Documentation for Various Reporting Requirements, 2015—2024

Note: Estimated percentages have a margin of error of 12 percentage points or fewer. For general issue area codes in 2020, individual lobbyists in 2021, and lobbying in the U.S. Senate in 2016, percentages do not total to 100 due to rounding.

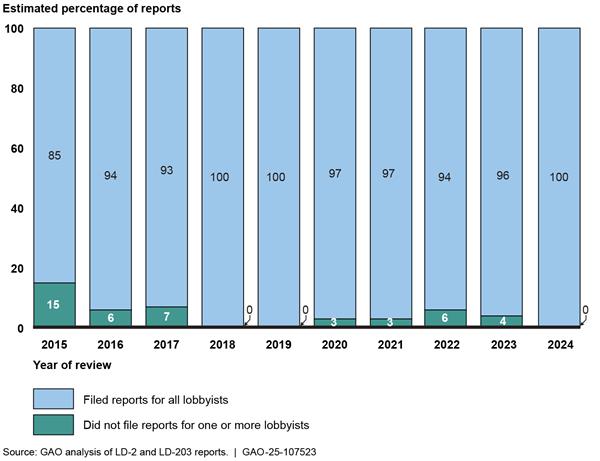

For Most Quarterly Lobbying Disclosure Reports, Lobbyists Filed Contribution Reports for All Listed Lobbyists

We estimated that most lobbyists who filed quarterly lobbying disclosure (LD-2) reports for quarters 3 and 4 of 2023 and quarters 1 and 2 of 2024 also filed contribution (LD-203) reports as required. Our findings are consistent with those of prior years (see fig. 6). Individual lobbyists and lobbying firms reporting lobbying activity are required to file LD-203 reports semiannually, even if they have no contributions to report, because they must certify compliance with the gift and travel rules.

Figure 6: Estimated Percentage of Quarterly Lobbying Disclosure (LD-2) Reports Where Listed Lobbyists Filed Contribution (LD-203) Reports for Their Organizations and Individual Lobbyists, 2015—2024

Note: Estimated percentages have a maximum margin of error of 10 percentage points or fewer.

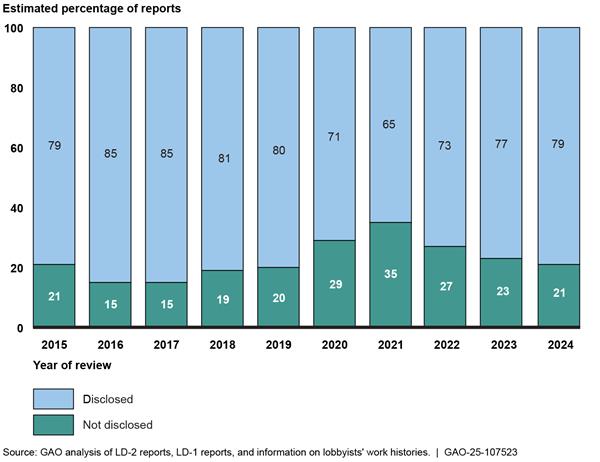

Some Lobbyists May Not Have Properly Disclosed Their Previously Held Covered Positions

The LDA requires that lobbyists disclose previously held covered positions in the executive or legislative branch, such as high-ranking agency officials and congressional staff. Covered positions can be disclosed either on a lobbying registration (LD-1) report, where lobbyists list the employees who are expected to act as lobbyists on behalf of the new client, or on the quarterly lobbying disclosure (LD-2) filing when adding a new individual lobbyist. For 2024, we estimated that 21 percent of the LD-2 forms included individual lobbyists who had not properly disclosed covered positions as required.[26] This estimate does not represent a statistically significant change from 2023. As in our other reports, these results indicate that some lobbyists may be unclear about the need to disclose certain covered positions, such as paid congressional internships. Figure 7 shows the extent to which lobbyists may not have properly disclosed one or more covered positions as required from 2015 through 2024.

Figure 7: Estimated Percentage of Quarterly Lobbying Disclosure (LD-2) Reports Where Listed Individual Lobbyists May Not Have Properly Disclosed One or More Covered Positions, 2015—2024

Note: Estimated percentages have a maximum margin of error of 11 percentage points or fewer. Covered positions can be disclosed either on a lobbying registration (LD-1) report, where lobbyists list the employees who are expected to act as lobbyists on behalf of the new client, or on the LD-2 report when adding a new individual lobbyist.

Lobbyists Reported No Criminal Convictions on Quarterly Lobbying Disclosure Reports for This Year’s Review

Lobbyists were required to begin disclosing relevant convictions in their first quarter 2019 LD-2 reports. None of the lobbyists in our sample of LD-2 reports for the third and fourth quarters of 2023 and the first and second quarters of 2024—which together consisted of 258 individual lobbyists—disclosed any convictions in the reports. We researched these lobbyists and found no violations covered by the Justice Against Corruption on K Street Act of 2018.

Most Lobbyists Did Not Report Working with Affiliated Organizations

Lobbyists must report working with affiliated organizations on the LD-1 or on any LD-2 report. Affiliated organizations are entities that contribute more than $5,000 for lobbying in a quarterly period and actively participate in the planning, supervision, or control of the lobbying activities.[27] From our sample of LD-2 reports, three lobbyists reported working with an affiliated organization on the LD-1. All three listed the affiliated organizations on their LD-1 reports.[28] Of these three lobbyists, one confirmed working with an affiliated organization during our interview. The other two lobbyists stated that they did not work with affiliated organizations. A fourth lobbyist we interviewed told us they worked with an affiliated organization but had not reported it on the LD-2 in our sample or on the LD-1.[29]

Some Lobbyists Amended Their Quarterly Lobbying Disclosure Reports After We Contacted Them

Of the 100 LD-2 reports in our sample, lobbyists amended 23 reports to change previously reported information after we contacted them. Of the 23 reports, five were amended after we notified the lobbyists of our review but before we met with them. The remaining 18 reports were amended after we met with the lobbyists to review their documentation. An additional five lobbyists said that they planned to amend their reports after the interview, but had not filed an amendment as of January 2025.

We consistently find a notable number of amended LD-2 reports in our sample each year following notification of our review. These amendments suggest that our contact may spur some lobbyists to scrutinize their reports more closely than they would have without our review. Table 1 lists reasons lobbyists in our sample amended their LD-2 reports after being notified of our review.

Table 1: Reasons Lobbyists in Our Sample Amended Their Quarterly Lobbying Disclosure (LD-2) Reports, August 2024 to December 2024

|

|

Number of times reason was selected |

|

Updated income or expenses |

7 |

|

Changed Senate, House, or executive branch agency lobbying activity |

19 |

|

Changed general issue area codes lobbied |

2 |

|

Changed individual lobbyists |

5 |

Source: GAO analysis of LD-2 reports. | GAO‑25‑107523

Note: Lobbyists amended 23 of the 100 LD-2 reports in our sample. Eight were amended for more than one reason. Data are as of January 2025.

Most Contribution Reports Disclosed Political Contributions Listed in the Federal Election Commission Database

As part of our review, we compared contributions listed on lobbyists’ contribution (LD-203) reports against political contributions reported in the Federal Election Commission database to identify whether relevant political contributions were omitted on LD-203 reports in our sample. The sample of LD-203 reports we reviewed contained 80 reports with contributions and 80 reports without contributions. We found that lobbyists failed to disclose one or more reportable contributions on 13 LD-203 reports in our sample, which represents an estimated 5 percent of all LD-203 reports filed for the second half of 2023 and the first half of 2024. All 13 LD-203 reports were amended in response to our review. Table 2 shows our results from 2015 through 2024.

Table 2: Numbers and Percentages of Contribution (LD-203) Reports That Omitted One or More Political Contributions, 2015—2024

|

Year of review |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Number of reports in our sample with contributions that had one or more omissions |

11 |

9 |

11 |

9 |

6 |

13 |

8 |

14 |

9 |

12 |

|

Number of reports in our sample without contributions that had one or more omissions |

0 |

1 |

1 |

0 |

0 |

0 |

3 |

2 |

4 |

1 |

|

Estimated percentage of all reports in the population with one or more omissions |

4% |

5% |

6% |

4% |

2% |

5% |

6% |

7% |

7% |

5% |

Source: GAO analysis of LD-203 reports and Federal Elections Commission data. | GAO‑25‑107523

Note: Estimated percentages in the table have a maximum margin of error of 5 percentage points.

Most Lobbyists Reported Some Level of Ease in Complying with Quarterly Lobbying Disclosure Requirements

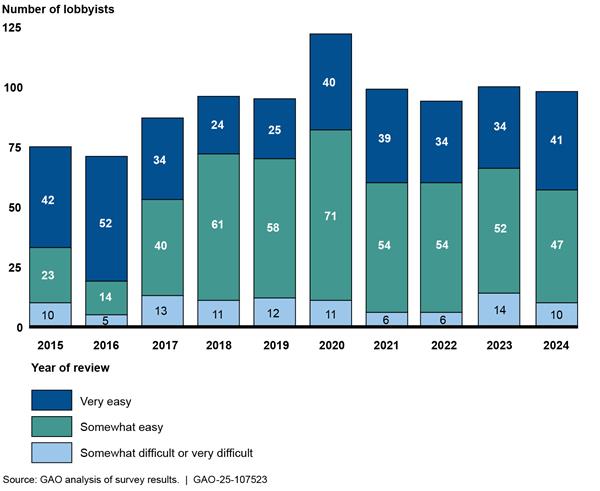

Most lobbyists reported that they found it “very easy” or “somewhat easy” to comply with quarterly lobbying disclosure (LD-2) requirements. Of the 99 different lobbyists responding to our survey, 41 reported that complying with the disclosure requirements was “very easy,” 47 reported it was “somewhat easy,” and 10 reported it was “somewhat difficult” or “very difficult” (see fig. 8).[30]

Note: The number of possible responses varies because of changes in sample size over time. In 2020, the sample size increased to 129, as we oversampled lobbyists in the event we received lower response rates during the COVID-19 pandemic. Due to the nature of our sample, these results cannot be generalized to the population of lobbyists. For details on our methodology, see appendix III.

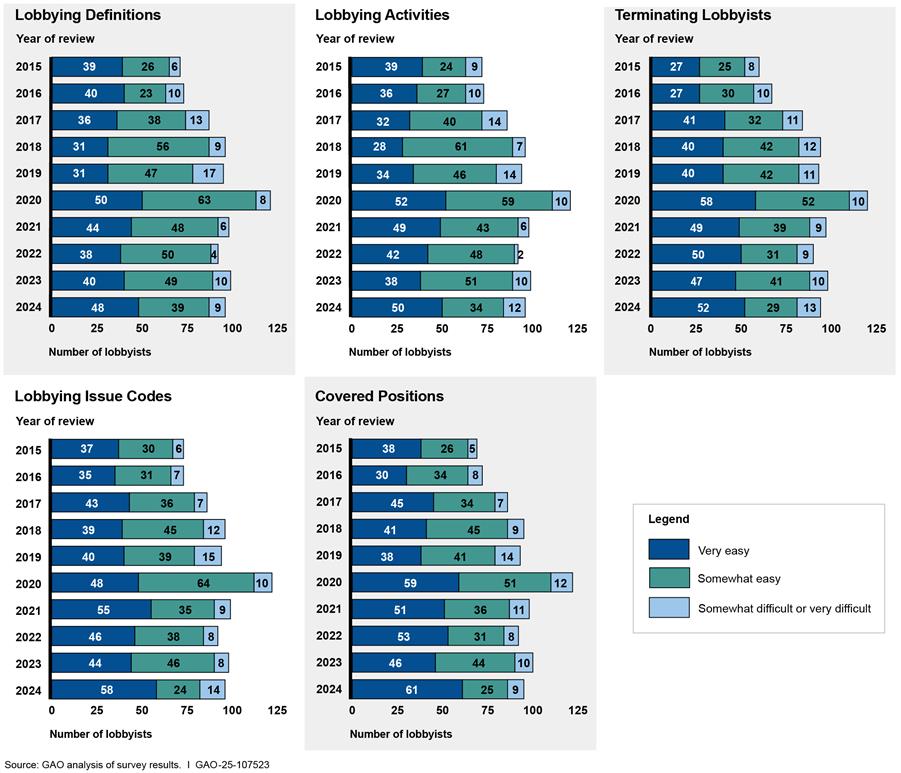

Most lobbyists we surveyed rated the definitions of terms used in LD-2 reporting as “very easy” or “somewhat easy” to understand to meet their reporting requirements. Figure 9 shows what lobbyists reported as their ease of understanding the terms associated with LD-2 reporting requirements from 2015 through 2024.

Note: The number of possible responses varies because of changes in sample size over time. For example, in 2020, the sample size increased to 129, as we oversampled lobbyists in the event we received lower response rates during the COVID-19 pandemic. Due to the nature of our sample, these results cannot be generalized to the population of lobbyists. For details on our methodology, see appendix III.

U.S. Attorney’s Office for the District of Columbia Continues to Enforce the Lobbying Disclosure Act

The U.S. Attorney’s Office Has Resources and Authorities to Enforce Lobbying Disclosure Act Compliance

According to officials from the U.S. Attorney’s Office for the District of Columbia (USAO), the following personnel are assigned to enforce reporting requirements under the Lobbying Disclosure Act (LDA):

· two full-time employees—a permanent program compliance coordinator and a civil investigator;

· three paralegal specialists, assigned part time, one of whom was newly assigned in 2024;

· various assistant U.S. attorneys, assigned as needed, to pursue criminal or civil penalties; and

· two unpaid part-time student interns for the fall 2024 semester and new interns for the spring 2025 semester.

USAO, along with the Secretary of the Senate and the Clerk of the House, is responsible for ensuring LDA compliance. USAO’s process for enforcing the LDA begins when the Secretary of the Senate or the Clerk of the House sends USAO a referral.[31] Referrals are the notifications indicating that lobbyists have not filed quarterly lobbying disclosure (LD-2) reports or semiannual contributions (LD-203) reports as required by the LDA.[32]

Enforcement actions reflect attempts to bring lobbyists into compliance. These actions include, but are not limited to, sending emails or letters and making phone calls. According to USAO officials, resolving referrals for noncompliance can take anywhere from a few days to years, depending on circumstances. Figure 10 provides an overview of USAO’s process for enforcing LDA compliance.

When USAO receives a referral, officials enter it into a database where they track referrals’ status. In the database, USAO officials stated they mark all referrals as pending until they close them and track the status of pending referrals through action codes, such as

· initial research,

· responded but not compliant,

· waiting for a response/no response, and

· unable to locate.

USAO officials initially categorize all pending referrals as “initial research.” During this initial phase, USAO officials research whether the lobbyist is still noncompliant. If the lobbyist has complied, USAO officials said they close the referral as in compliance. This situation may occur when lobbyists respond to written notifications of noncompliance from the Secretary of the Senate or the Clerk of the House after USAO receives the referral.

If USAO officials find in their initial research that lobbyists for whom they received referrals continue to be noncompliant, they contact the lobbyists by letter, email, or phone.[33] The communications inform the lobbyists that they are noncompliant with the LDA, the actions needed to reach compliance, and the potential consequences for failure to comply.

After USAO officials initially contact the lobbyist, they update the referral in their database based on the lobbyist’s response. If officials successfully contact the lobbyist but the lobbyist is not yet compliant, they change the status of the referral to either “responded but not compliant” or “waiting for a response/no response.” These referrals remain pending. USAO officials noted that they attempt to review and update cases on a rolling basis. If USAO officials are unable to make contact with the lobbyist after exhausting all options for contacting the lobbyist, they update the referral to “unable to locate” and may designate a reason, such as “bad address” or “deceased.” These “unable to locate” referrals are closed. USAO officials said approximately 10 percent of referrals in USAO’s database are classified as “unable to locate.”

Once USAO officials receive the necessary information to support that the lobbyist is compliant, they send notice to the lobbyist to confirm the lobbyist’s successful filing. USAO officials then close the referral as in compliance.

In cases where a lobbyist is repeatedly referred for not filing disclosure reports but does not appear to be actively lobbying, USAO suspends enforcement actions. USAO officials reported they continue to monitor these lobbyists and will resume enforcement actions if required.

USAO considers lobbyists chronic offenders if (1) they repeatedly fail to file LD-2 and LD-203 reports but are allegedly lobbying, and (2) USAO has received more than 10 referrals for them. USAO officials track chronic offenders in their database.[34] They send all chronic offenders “chronic offender letters,” which identify all reporting periods where the lobbyist remains noncompliant. In addition, USAO assigns an investigator to review all the facts and circumstances surrounding each chronic offender. If the investigator finds good cause to pursue the case, an attorney is assigned. The assigned attorney is to follow up with the chronic offender and determine the appropriate enforcement actions, which may include a settlement or other civil action.

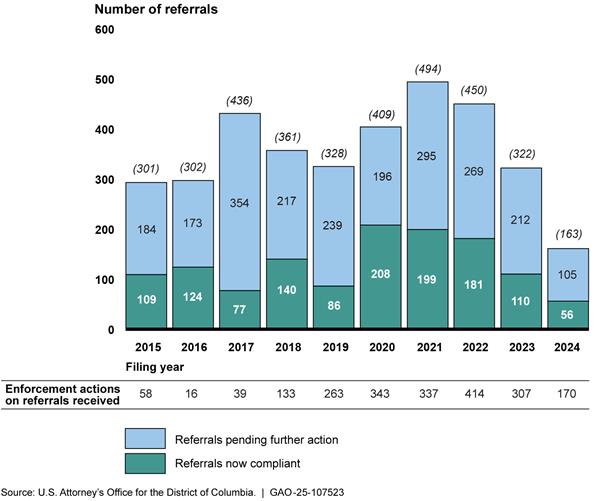

Status of LD-2 Enforcement Efforts

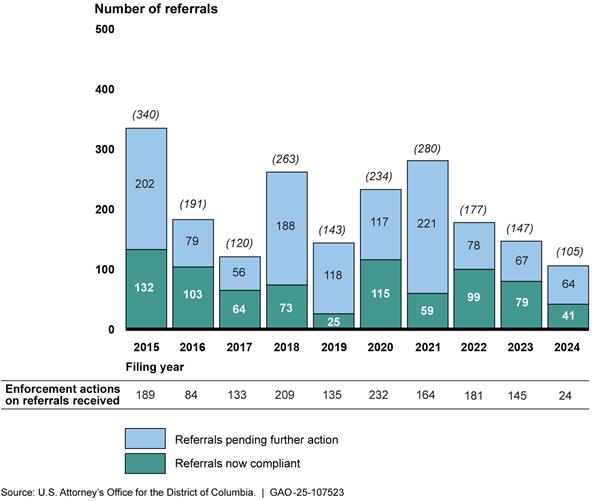

USAO received 3,566 referrals from both the Secretary of the Senate and the Clerk of the House for failure to comply with LD-2 reporting requirements cumulatively for filing years 2015 through 2024. Figure 11 shows the number and status of the referrals received and the number of enforcement actions taken by USAO to bring lobbyists into compliance. Enforcement actions include letters, emails, and telephone calls.

Figure 11: Status of Lobbying Disclosure Act Referrals for Failure to File Quarterly Lobbying Disclosure (LD-2) Reports, 2015—2024 (as of December 2024)

Note: According to Secretary of the Senate and Clerk of the House staff, they send most referrals to the U.S. Attorney’s Office for the District of Columbia within 6 months of the filing deadline. However, some referrals fall outside this 6-month period. The number of referrals pending further action and the number of referrals now compliant may not sum to the total number of referrals, shown in parentheses. This difference occurs because referrals for lobbyists or clients who are deceased or no longer in business are included in the total number of referrals but are not displayed in the bar chart.

According to USAO data, about 36 percent (1,290 of 3,566) of the total LD-2 referrals received were closed as in compliance as of December 2024, because lobbyists filed their outstanding reports before or after the Department of Justice contacted them. About 63 percent (2,244 of 3,566) of LD-2 referrals were pending further action because USAO could not locate the lobbyists, did not receive a response from the lobbyists after an enforcement action, or planned to conduct additional research to determine if it can locate the lobbyist. The remaining 32 LD-2 referrals (about 1 percent) did not require action or were suspended because the lobbyist or client was no longer in business, or the individual lobbyist was deceased.

Status of LD-203 Enforcement Efforts

Both lobbying firms and the individual lobbyists with each firm are required to file LD-203 reports, which disclose contributions to federal political campaigns, among other details.[35] USAO categorizes referrals for failure to file LD-203s into two types:

1. LD-203(R) referrals for lobbying firms or organizations with in-house lobbyists that failed to file LD-203s disclosing the firms’ or organizations’ contributions, as required.

2. LD-203 referrals for lobbying firms or organizations with in-house lobbyists whose employees failed to file LD-203s disclosing the individual lobbyists’ contributions, as required.

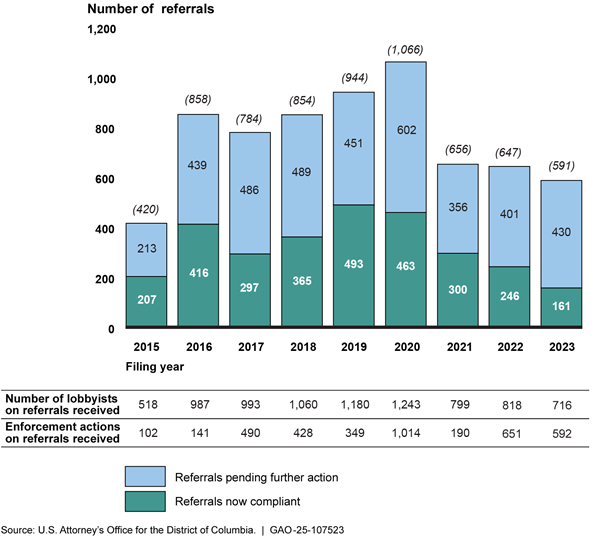

Cumulatively from 2015 through 2024, USAO received 2,000 LD-203(R) referrals. As of December 2024, USAO closed about 40 percent (790 of 2,000) of these LD-203(R) referrals as in compliance because the lobbying firms filed their outstanding reports. About 60 percent (1,190 of 2,000) of the referrals were pending further action. The remaining 20 referrals (1 percent) were suspended because the lobbyist or client was no longer in business, or the lobbyist was deceased.[36] Figure 12 shows the number and status of LD-203(R) referrals received and the number of enforcement actions taken by USAO to bring lobbying firms into compliance.

Figure 12: Status of Lobbying Disclosure Act LD-203(R) Referrals for Lobbying Firms’ Failure to File Contribution Reports, 2015—2024 (as of December 2024)

Note: According to Secretary of the Senate and Clerk of the House staff, they send most referrals to the U.S. Attorney’s Office for the District of Columbia within 6 months of the filing deadline. However, some referrals fall outside this 6-month period. The number of referrals pending further action and the number of referrals now compliant may not sum to the total number of referrals, shown in parentheses. This difference occurs because referrals for lobbyists or clients who are deceased or no longer in business are included in the total number of referrals but are not displayed in the bar chart.

Because LD-203 referrals are addressed to lobbying firms or organizations that employ individual lobbyists who failed to file LD-203s, a single LD-203 referral may list multiple individual lobbyists. For example, if two individual lobbyists employed by the same lobbying firm failed to file their LD-203s, then USAO would receive a single referral for the lobbying firm with two lobbyists listed. USAO tracks both the number of LD-203 referrals it receives and the number of lobbyists listed on these referrals.

Cumulatively from 2015 through 2023, USAO received 6,820 LD-203 referrals from the Secretary of the Senate and the Clerk of the House for lobbying firms or organizations with in-house lobbyists whose employees failed to file LD-203s disclosing the individual lobbyists’ contributions (see fig. 13). As of January 2025, USAO officials have not yet received LD-203 referrals for 2024. Therefore, we have omitted 2024 data in the LD-203 analysis and figure below. Officials expect the Secretary of the Senate and the Clerk of the House to send these referrals in early 2025, similar to previous years.

Figure 13: Status of Lobbying Disclosure Act LD-203 Referrals for Lobbying Firms That Employ Individual Lobbyists Who Failed to File Contributions Reports, 2015—2023 (as of December 2024)

Note: As of December 2024, no referrals had been received for 2024. According to Secretary of the Senate and Clerk of the House staff, they send most referrals to the U.S. Attorney’s Office for the District of Columbia within 6 months of the filing deadline. However, some referrals fall outside this 6-month period. The number of referrals pending further action and the number of referrals now compliant may not sum to the total number of referrals, shown in parentheses. This difference occurs because referrals for lobbyists or clients who are deceased or no longer in business are included in the total number of referrals but are not displayed in the bar chart.

Figure 13 shows the number and status of LD-203 referrals received and the number of enforcement actions taken by USAO to bring lobbyists into compliance. About 43 percent (2,948 of 6,820) of LD-203 referrals received were closed as in compliance as of December 2024, because all of the listed lobbyists had filed their outstanding reports before or after USAO contacted them. About 57 percent (3,867 of 6,820) of the referrals are pending further action because USAO could not locate the lobbyists, did not receive a response from the lobbyists, or plans to conduct additional research to determine if it can locate the lobbyists.[37] USAO officials said that many of the LD-203 referrals are still pending because the individual lobbyists no longer lobby for the firms affiliated with the referrals. The remaining five referrals (less than 1 percent) were suspended because the lobbyist or client was no longer in business, or the individual lobbyist was deceased.

Status of Civil and Criminal Enforcement Actions

USAO officials reported that, in 2024, the Department of Justice took one civil enforcement action against a lobbyist. Specifically, the department reached a civil settlement with a lobbyist that included a $65,000 penalty and an agreement that the lobbyist permanently retire from lobbying at the federal level. USAO officials stated that they had identified this lobbyist as a chronic offender. USAO officials did not report taking any criminal enforcement actions in 2024. Civil and criminal enforcement actions for LDA violations can include complaints, lawsuits, settlements, civil penalties, and prosecutions.

Justice Against Corruption on K Street Act of 2018 Enforcement

USAO officials stated that, as of December 2024, the Department of Justice has not brought any prosecutions related to nondisclosure of relevant crimes under the Justice Against Corruption on K Street Act of 2018 (JACK Act) since the law’s requirements went into effect. USAO confirmed its enforcement role regarding the JACK Act is the same as any other prosecution. If the individual or organization has filed a lobbying disclosure report with misrepresentations, USAO officials said they can initiate criminal prosecution or impose civil penalties under the LDA.

Agency Comments

We provided a draft of this report to the Department of Justice for review and comment. The Department of Justice provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the Attorney General, the Secretary of the Senate, the Clerk of the House of Representatives, and appropriate congressional committees and members. In addition, this report is available at no charge on the GAO website at http://www.gao.gov.

If your or your staff have any questions about this report, please contact me at jonesy@gao.gov. Contact points for our offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made major contributions to this report are listed in appendix IV.

Yvonne D. Jones

Director, Strategic issues

List of Committees

The Honorable Rand Paul, M.D.

Chairman

The Honorable Gary C. Peters

Ranking Member

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Charles E. Grassley

Chairman

The Honorable Richard J. Durbin

Ranking Member

Committee on the Judiciary

United States Senate

The Honorable Mitch McConnell

Chairman

The Honorable Alex Padilla

Ranking Member

Committee on Rules and Administration

United States Senate

The Honorable Bryan Steil

Chairman

The Honorable Joe Morelle

Ranking Member

Committee on House Administration

House of Representatives

The Honorable Jim Jordan

Chairman

The Honorable Jamie Raskin

Ranking Member

Committee on the Judiciary

House of Representatives

The Honorable James Comer

Chairman

The Honorable Gerald E. Connolly

Ranking Member

Committee on Oversight and Government Reform

House of Representatives

Appendix I: List of Lobbyists and Clients from the Random Sample of Quarterly Lobbying Disclosure (LD-2) Reports

Table 3 includes the lobbyists and clients listed on the 116 randomly selected LD-2 reports in our sample. We removed some LD-2 reports from the original sample; see appendix III for details on our methodology.

Table 3: Names of Lobbyists and Clients Listed on Random Sampling of Quarterly Lobbying Disclosure (LD-2) Reports Filed for the Third and Fourth Quarters of 2023 and First and Second Quarters of 2024

|

Lobbyists |

Clients |

|

A10 ASSOCIATES, LLC |

FLAMINGO AIR, INC. |

|

ACG ADVOCACY |

ATI, INC. |

|

AKIN GUMP STRAUSS HAUER & FELD |

ATLANTIC AVIATION HOLDINGS CORPORATION |

|

ALPINE GROUP PARTNERS, LLC. |

BABEL STREET |

|

ALSTON & BIRD LLP |

ALLSUP, INC. |

|

ALSTON & BIRD LLP |

MECHANICAL CONTRACTORS ASSOCIATION OF AMERICA |

|

ALSTON & BIRD LLP |

FAIRVIEW HEALTH SERVICES |

|

AMERICAN COMPOSITES MANUFACTURERS ASSOCIATION |

AMERICAN COMPOSITES MANUFACTURERS ASSOCIATION |

|

ARTEMIS POLICY GROUP LLC |

THE HEMOPHILIA ALLIANCE |

|

AVOQ, LLC (FRA TEAM SUBJECT MATTER, LLC) |

PFIZER, INC. |

|

BARKER LEAVITT, PLLC (SKA MR. JAMES C. BARKER) |

WASATCH FRONT REGIONAL COUNCIL |

|

BOSE PUBLIC AFFAIRS GROUP |

GEORGE E. WARREN CORPORATION |

|

BROWNSTEIN HYATT FARBER SCHRECK, LLP |

MODERNATX, INC. |

|

BROWNSTEIN HYATT FARBER SCHRECK, LLP |

AMERICAN HOTEL & LODGING ASSOCIATION |

|

CAE USA INC. |

CAE USA INC. |

|

CAPITOL COUNSEL LLC |

LAS VEGAS SANDS CORPORATION |

|

CAPITOL HILL CONSULTING GROUP |

DAVITA INC |

|

CAPITOL SOUTH, LLC |

ENVIRONMENTAL WORKING GROUP |

|

CAPITOL VENTURE LLC |

AMERICAN OPTOMETRIC ASSOCIATION |

|

CAPROCK STRATEGIES, LLC |

MCLANE GROUP INTERNATIONAL, LP |

|

CORNERSTONE GOVERNMENT AFFAIRS, INC. |

AMERICAN FEDERATION FOR AGING RESEARCH |

|

CORNERSTONE GOVERNMENT AFFAIRS, INC. |

UNIVERSITY OF CHICAGO |

|

COZEN O’CONNOR PUBLIC STRATEGIES |

ASSOCIATION OF REGIONAL WATER ORGANIZATIONS |

|

CRESTVIEW STRATEGY US LLC |

CAPITAL POWER CORPORATION |

|

CROSSROADS STRATEGIES, LLC |

VIFOR INTERNATIONAL AG (CSL VIFOR) |

|

CROSSROADS STRATEGIES, LLC |

SECURITIES INDUSTRY AND FINANCIAL MARKETS ASSOCIATION (SIFMA) |

|

CROWELL & MORING LLP |

FLEXTRONICS INTERNATIONAL USA, INC. |

|

DCI GROUP, L.L.C. |

EN+ GROUP, IPJSC |

|

DESIMONE CONSULTING, LLC |

WASHINGTON STATE UNIVERSITY |

|

DICKINSON WRIGHT PLLC |

AFFIRM, INC. |

|

DORSEY & WHITNEY LLP |

VAREX IMAGING CORPORATION |

|

EFRUS FEDERAL ADVISORS LLC |

AUTERION GOVERNMENT SOLUTIONS |

|

ELEVATE GOVERNMENT AFFAIRS, LLC |

GENERAL ELECTRIC COMPANY |

|

ELEVATE GOVERNMENT AFFAIRS, LLC |

ENERGY FAIR TRADE COALITION |

|

FAEGRE DRINKER BIDDLE & REATH LLP |

NATIONAL ACADEMY OF ELDER LAW ATTORNEYS |

|

FARRAGUT PARTNERS LLP |

T-MOBILE ASSOCIATION |

|

FEDERAL HALL POLICY ADVISORS, LLC |

ALLSTATE INSURANCE COMPANY |

|

FEDERAL HALL POLICY ADVISORS, LLC |

VANTAGESCORE SOLUTIONS, LLC |

|

FRANKLIN SQUARE GROUP, LLC |

ROBLOX CORPORATION |

|

FS VECTOR LLC |

BANK POLICY INSTITUTE |

|

GOVBIZ ADVANTAGE, INC. |

APTERA MOTORS CORP |

|

HOLLAND & KNIGHT LLP |

RED LAKE BAND OF CHIPPEWA INDIANS |

|

HOLLAND & KNIGHT LLP |

UL LLC D/B/A UL SOLUTIONS |

|

HYUNDAI MOTOR COMPANY |

HYUNDAI MOTOR COMPANY |

|

ICE MILLER STRATEGIES LLC |

ITSEASY PASSPORT & VISA SERVICES |

|

INVARIANT LLC |

ARM HOLDINGS PLC |

|

INVARIANT LLC |

CALIFORNIA DATE COMMISSION |

|

IRRIGATION AND ELECTRICAL DISTRICTS ASSOCIATION OF ARIZONA, INC. |

IRRIGATION AND ELECTRICAL DISTRICTS ASSOCIATION OF ARIZONA, INC |

|

JBS COMMUNICATIONS, LLC |

KENTUCKY AND TENNESSEE MARINA ASSOCIATIONS |

|

K&L GATES, LLP |

AMERICAN SUPERCONDUCTOR CORPORATION |

|

KASOWITZ BENSON TORRES LLP |

IAI NORTH AMERICA |

|

KELLER PARTNERS & COMPANY |

UNIVERSAL HEALTH SERVICES, INC.: UHS |

|

LAND TRUST ALLIANCE |

LAND TRUST ALLIANCE |

|

LAVENDER CONSULTANTS |

ENOVA INTERNATIONAL, INC |

|

LEDGE COUNSEL, INC. |

ZERO TO THREE |

|

LEWIS-BURKE ASSOCIATES, LLC |

BOSTON UNIVERSITY |

|

LOT SIXTEEN LLC |

ADVANCED ENERGY UNITED (FKA ADVANCED ENERGY ECONOMY) |

|

LOT SIXTEEN LLC |

BPC ACTION (BIPARTISAN POLICY CENTER) |

|

MAERSK AGENCY U.S.A., INC. |

MAERSK AGENCY U.S.A., INC. |

|

MARCH OF DIMES |

MARCH OF DIMES |

|

MASON STREET CONSULTING, LLC |

GLOBAL MEDICAL RESPONSE |

|

MATTOON & ASSOCIATES, LLC |

IHEARTMEDIA INC |

|

MCALLISTER & QUINN, LLC |

THE MARGOLIN GROUP ON BEHALF OF COUNTY OF SANTA CLARA |

|

MERCHANT MCINTYRE & ASSOCIATES, LLC |

COLUMBIA GORGE COMMUNITY COLLEGE |

|

MG HOUSING STRATEGIES LLC |

THE WISHCAMPER COMPANIES |

|

MICHAEL POWELSON |

ECOLOGICAL RESTORATION BUSINESS ASSOCIATION |

|

MILLER STRATEGIES, LLC |

GRAIL LLC |

|

MINDSET ADVOCACY, LLC |

INVESTMENT ADVISER ASSOCIATION (IAA) |

|

ML STRATEGIES, LLC |

CREARE |

|

MONUMENT ADVOCACY |

VALVE CORPORATION |

|

MORAN GLOBAL STRATEGIES, INC. |

NATIONAL ASSOCIATION OF FEDERAL EQUITY RECEIVERS (NAFER) |

|

MR. DOYCE BOESCH |

CR CAPITAL PARTNERS |

|

NATIONAL ASSOCIATION OF SURETY BOND PRODUCERS |

NATIONAL ASSOCIATION OF SURETY BOND PRODUCERS |

|

NATIONAL AUTOMATIC MERCHANDISING ASSOCIATION |

NATIONAL AUTOMATIC MERCHANDISING ASSOCIATION |

|

NELSON MULLINS RILEY & SCARBOROUGH |

ORANGEBURG COUNTY |

|

NELSON MULLINS RILEY & SCARBOROUGH |

HEMOPHILIA OF GEORGIA |

|

NEW FRONT STRATEGIES GROUP, LLC |

W.L. GORE & ASSOCIATES, INC. |

|

NVG, LLC |

OATLY INC. |

|

OCULUS STRATEGIES, LLC |

DATALOCKER |

|

PENN STRATEGIES |

BUTTON HOLDINGS |

|

POLARIS GOVERNMENT RELATIONS, LLC |

PERFORMANCE DRONE WORKS |

|

RICH FEUER ANDERSON |

APPRAISAL INSTITUTE |

|

RUBIN HEALTH POLICY CONSULTING, LLC |

KINDRED HEALTHCARE D/B/A SCIONHEALTH (FKA KINDRED HEALTHCARE OPERATING, INC) |

|

S-3 GROUP |

KOCH GOVERNMENT AFFAIRS, LLC FKA KOCH COMPANIES PUBLIC SECTOR, LLC |

|

S-3 GROUP |

STANDARD INDUSTRIES LTD. |

|

SHIONOGI INC. |

SHIONOGI INC. |

|

SONORAN POLICY GROUP, LLC D/B/A STRYK GLOBAL

DIPLOMACY, FORMERLY |

HORIZON THERAPEUTICS (F/K/A) HORIZON PHARMA USA INC |

|

SPLITOAK STRATEGIES LLC |

BRISTOL-MYERS SQUIBB |

|

SQUIRE PATTON BOGGS |

NLMK PENNSYLVANIA |

|

SUSTAINABLE STRATEGIES DC |

CITY OF HUNTINGTON, WV |

|

SWISHER INTERNATIONAL, INC., F/K/A SI GROUP CLIENT SERVICES |

SWISHER INTERNATIONAL, INC., F/K/A SI GROUP CLIENT SERVICES |

|

TENCENT HOLDINGS LIMITED |

TENCENT HOLDINGS LIMITED |

|

THE FERGUSON GROUP |

MOORESVILLE-NC TOWN OF |

|

THE GABOTON GROUP, LLC |

BODYSPHERE CORPORATION |

|

THE GALLAGHER GROUP, LLC |

SMT CORPORATION, INC. |

|

THE MADISON GROUP |

INTUIT, INC. AND AFFILIATES (FORMERLY INTUIT, INC.) |

|

THE MAJORITY GROUP, LLC |

NATIONSTAR MORTGAGE |

|

THE VOGEL GROUP |

GOTION, INC. |

|

THORN RUN PARTNERS |

BOEHRINGER INGELHEIM PHARMACEUTICALS, INC. |

|

THORN RUN PARTNERS |

ASTRANIS SPACE TECHNOLOGIES CORP. |

|

TIBER CREEK GROUP |

DEUTSCHE BANK USA (FKA DEUTSCHE BANK SECURITIES INC.) |

|

TORREY ADVISORY GROUP (FORMERLY MICHAEL TORREY ASSOCIATES, LLC) |

SOUTHEASTERN LUMBER MANUFACTURERS ASSOCIATION |

|

U.S. APPLE ASSOCIATION |

U.S. APPLE ASSOCIATION |

|

UNITED SERVICE ORGANIZATIONS |

UNITED SERVICE ORGANIZATIONS |

|

UNIVERSITY OF ALASKA |

UNIVERSITY OF ALASKA |

|

VAN BUSKIRK AND ASSOCIATES LLC |

OCEANEERING INTERNATIONAL INC |

|

VAN SCOYOC ASSOCIATES |

CITY OF THOUSAND OAKS, CA |

|

VAN SCOYOC ASSOCIATES |

SAN DIEGO COUNTY |

|

VANTAGE KNIGHT, INC. |

VICINITY ENERGY, LLC |

|

VENABLE LLP |

THE VISION COUNCIL |

|

VENN STRATEGIES |

7-ELEVEN |

|

VENTURE GOVERNMENT STRATEGIES, LLC (FKA HOBART HALLAWAY & QUAYLE VENTURES, LLC) |

MICROSOFT CORPORATION |

|

WEST FRONT STRATEGIES LLC |

VAPOR TECHNOLOGY ASSOCIATION |

|

WESTMORELAND160, LLC |

SRC INC. |

|

WINNING STRATEGIES WASHINGTON |

FAIRLEIGH DICKINSON UNIVERSITY |

|

ZIEBART CONSULTING, LLC |

ENERGY INFRASTRUCTURE COUNCIL FKA MASTER LIMITED PARTNERSHIP ASSOCIATION |

Source: Lobbying disclosure database of the Secretary of the Senate. | GAO‑25‑107523

Table 4: Names of Lobbyists Listed on Random Sampling of Contribution (LD-203) Reports with Contributions Listed, Filed Year-End 2023 or Midyear 2024

|

Lobbyists |

Reporting Period |

|

AFLAC INCORPORATED |

Midyear 2024 |

|

AMERICAN ACADEMY OF PHYSICIAN ASSOCIATES |

Year-end 2023 |

|

AMERICAN ASSOCIATION OF NEUROLOGICAL SURGEONS |

Year-end 2023 |

|

AMERICAN ASSOCIATION OF ORAL AND MAXILLOFACIAL SURGEONS |

Midyear 2024 |

|

AMERICAN TRUCKING ASSOCIATIONS |

Midyear 2024 |

|

AMERICAN WATER |

Year-end 2023 |

|

ARCONIC CORPORATION |

Midyear 2024 |

|

HECTOR ALCALDE |

Year-end 2023 |

|

JOHN ARIALE |

Year-end 2023 |

|

JAMES BAILEY |

Midyear 2024 |

|

RYAN BERNSTEIN |

Midyear 2024 |

|

KATHLEEN BLACK |

Midyear 2024 |

|

JORDAN BONFITTO |

Year-end 2023 |

|

MICHAEL BOPP |

Midyear 2024 |

|

JOHN BREAUX |

Year-end 2023 |

|

BURTON STRATEGY GROUP |

Year-end 2023 |

|

CAE USA INC. |

Year-end 2023 |

|

CARRIER GLOBAL CORPORATION |

Year-end 2023 |

|

C.H. ROBINSON WORLDWIDE, INC. |

Midyear 2024 |

|

MEGHAN CLUNE WOLTMAN |

Midyear 2024 |

|

COMCAST CORPORATION |

Year-end 2023 |

|

STEPHEN CONAFAY |

Midyear 2024 |

|

DAVID CONNOLLY |

Year-end 2023 |

|

BOBBY CUNNINGHAM |

Year-end 2023 |

|

DOMINION ENERGY, INC. |

Year-end 2023 |

|

JORDAN ELSBURY |

Midyear 2024 |

|

SHAWNA FRANCIS WATLEY |

Midyear 2024 |

|

JUSTIN GOODMAN |

Midyear 2024 |

|

REBECCA GOULD |

Midyear 2024 |

|

GEOFFREY GRAY |

Midyear 2024 |

|

KELSE GRISWOLD-BERGER |

Midyear 2024 |

|

TREVOR HANGER |

Year-end 2023 |

|

ANDREW HARKER |

Year-end 2023 |

|

TODD HARMER |

Midyear 2024 |

|

WILLIAM HEYNIGER |

Year-end 2023 |

|

IHEARTMEDIA, INC. |

Year-end 2023 |

|

JORDAN LAW FIRM, LLC |

Midyear 2024 |

|

JAMES KLEIN |

Midyear 2024 |

|

PATRICIA KNIGHT |

Year-end 2023 |

|

OLIVIA KURTZ |

Midyear 2024 |

|

JULIE LASSETER |

Midyear 2024 |

|

JOHN LONGSTRETH |

Year-end 2023 |

|

ANASTASIOS MANATOS |

Year-end 2023 |

|

MARNE MAROTTA |

Midyear 2024 |

|

BRUCE MARSH |

Midyear 2024 |

|

JOHN MASON |

Year-end 2023 |

|

DANIEL MATTOON |

Year-end 2023 |

|

STEPHEN MCCALL |

Year-end 2023 |

|

MATTHEW MCGINLEY |

Year-end 2023 |

|

STERLING MCHALE |

Year-end 2023 |

|

BOBBY MCMILLIN |

Midyear 2024 |

|

GUSTAF MILLER |

Year-end 2023 |

|

PAUL MORINVILLE |

Midyear 2024 |

|

JEFFERY MORTIER |

Midyear 2024 |

|

BARBARA ROHDE |

Year-end 2023 |

|

M&T BANK CORPORATION |

Year-end 2023 |

|

NATIONAL AIR CARRIER ASSOCIATION |

Year-end 2023 |

|

NATIONAL ASSOCIATION OF POSTAL SUPERVISORS |

Year-end 2023 |

|

NATIONAL ASSOCIATION OF WHEAT GROWERS |

Midyear 2024 |

|

NEW LANTERN, LLC |

Year-end 2023 |

|

NEXTDECADE CORPORATION |

Midyear 2024 |

|

DAVID OHRENSTEIN |

Midyear 2024 |

|

RODNEY PEELE |

Year-end 2023 |

|

ROCK CENTRAL |

Year-end 2023 |

|

MARK RODGERS |

Midyear 2024 |

|

CHRISTOPHER ROE |

Midyear 2024 |

|

MICHAEL SAYRE |

Year-end 2023 |

|

DOUG SCHWARTZ |

Midyear 2024 |

|

DANIEL SHORTS |

Midyear 2024 |

|

JEFFREY STOLTZFOOS |

Midyear 2024 |

|

ELIZABETH SULLIVAN |

Midyear 2024 |

|

JONATHAN TALISMAN |

Year-end 2023 |

|

THE J.M. SMUCKER COMPANY |

Year-end 2023 |

|

LEONOR TOMERO |

Midyear 2024 |

|

LAURA VAUGHT |

Midyear 2024 |

|

PUNEET VERMA |

Year-end 2023 |

|

MELISSA WADE |

Year-end 2023 |

|

LISA WHISLER |

Midyear 2024 |

|

JOEL WHITE |

Year-end 2023 |

|

DAVID WHITMER |

Midyear 2024 |

Source: Lobbying contribution database of the Secretary of the Senate. Year-end reports for calendar year 2023 and midyear reports for calendar year 2024. | GAO‑25‑107523

Table 5: Names of Lobbyists Listed on Random Sampling of Contribution (LD-203) Reports Without Contributions Listed, Filed Year-End 2023 or Midyear 2024

|

Lobbyist |

Reporting Period |

|

ALLIANCE FOR EXCELLENT EDUCATION |

Midyear 2024 |

|

ALLIED FOR PROGRESS |

Midyear 2024 |

|

AMERICAN DEFENSE INTERNATIONAL |

Year-end 2023 |

|

AUGUSTA UNIVERSITY (FORMERLY GEORGIA REGENTS UNIVERSITY) |

Year-end 2023 |

|

THEODORE AUSTELL |

Midyear 2024 |

|

DONALD BARNES |

Midyear 2024 |

|

GIDGET BENITEZ |

Year-end 2023 |

|

PEGGY BINZEL |

Midyear 2024 |

|

THOMAS BISHOP |

Year-end 2023 |

|

ZACH BODHANE |

Midyear 2024 |

|

STEPHEN BONNER |

Year-end 2023 |

|

COLIN BRAINARD |

Year-end 2023 |

|

CAPITOL 6 ADVISORS |

Year-end 2023 |

|

CAPITOL CHAMBERS STRATEGIES |

Midyear 2024 |

|

CENTER FOR CLIMATE AND ENERGY SOLUTIONS |

Midyear 2024 |

|

JOHN CHAMBERS |

Year-end 2023 |

|

CLOUDFACTORS LLC |

Year-end 2023 |

|

TARA CORVO |

Midyear 2024 |

|

JACOB COURVILLE |

Year-end 2023 |

|

ROBERT CURIS |

Year-end 2023 |

|

JODIE CURTIS |

Year-end 2023 |

|

HOPE DAMPHOUSSE |

Midyear 2024 |

|

KIMBERLY DEAN |

Midyear 2024 |

|

DEANNA DEVENEY |

Midyear 2024 |

|

LUKE DOUGLAS |

Year-end 2023 |

|

DRUG POLICY ALLIANCE |

Year-end 2023 |

|

NIA DUGGINS |

Midyear 2024 |

|

DAVID DUNLAP |

Midyear 2024 |

|

BRIAN EAGLE |

Midyear 2024 |

|

ANNA FEDEWA |

Midyear 2024 |

|

BART FISHER |

Year-end 2023 |

|

DANIEL FISHER |

Midyear 2024 |

|

SARA FLETCHER |

Year-end 2023 |

|

FREE PRESS ACTION FUND |

Midyear 2024 |

|

TODD GILLENWATER |

Year-end 2023 |

|

EDWIN GILROY |

Year-end 2023 |

|

JOHN GLASS |

Midyear 2024 |

|

JESSICA GREENE |

Year-end 2023 |

|

DAVID GRIMALDI |

Midyear 2024 |

|

HNI CORPORATION |

Year-end 2023 |

|

JASON HOIS |

Year-end 2023 |

|

INTERNATIONAL BUSINESS MACHINES CORPORATION (IBM) |

Midyear 2024 |

|

HANNAH IZON |

Midyear 2024 |

|

JAMES P. KEESE |

Year-end 2023 |

|

JOHN J. FASO CONSULTING LLC |

Year-end 2023 |

|

KATE KALUTKIEWICZ |

Midyear 2024 |

|

MARTIN KANNER |

Year-end 2023 |

|

KATHERINE OH |

Midyear 2024 |

|

YOGIN KOTHARI |

Midyear 2024 |

|

HAROLD LAWRENCE |

Midyear 2024 |

|

LIBERTY PARTNERS GROUP, LLC |

Year-end 2023 |

|

MICHAEL LIEBERMAN |

Year-end 2023 |

|

ROBERT LIKINS |

Midyear 2024 |

|

GARRETT LUKKEN |

Midyear 2024 |

|

RACHEL MAGNUSON |

Year-end 2023 |

|

HELEN MENEFEE-LIBEY |

Year-end 2023 |

|

ALYSSA MORRISSEY |

Midyear 2024 |

|

RAYMOND MORRISSEY |

Midyear 2024 |

|

ALAN PASETSKY |

Midyear 2024 |

|

SHARI RENDALL |

Year-end 2023 |

|

NATIONAL COUNCIL FOR COMMUNITY AND EDUCATION PARTNERSHIPS |

Midyear 2024 |

|

PHIL OLIVA |

Midyear 2024 |

|

EBEN PECK |

Year-end 2023 |

|

PEGGY RAMIN |

Midyear 2024 |

|

SCOTT SALMON |

Midyear 2024 |

|

SANDHILLS STRATEGIC SOLUTIONS |

Midyear 2024 |

|

JOHN SHEA |

Year-end 2023 |

|

DANELLE SMITH |

Midyear 2024 |

|

SOUTHERN CALIFORNIA PUBLIC RADIO |

Year-end 2023 |

|

GRANT SPELLMEYER |

Year-end 2023 |

|

PETER STEHOUWER |

Year-end 2023 |

|

AUGUSTINE TANTILLO |

Year-end 2023 |

|

RICARDO TERRAZAS |

Midyear 2024 |

|

THE ESTOPINAN GROUP, LLC |

Year-end 2023 |

|

MADELINE VEY |

Year-end 2023 |

|

MARK VIETH |

Year-end 2023 |

|

WASHINGTON ADVOCACY GROUP |

Midyear 2024 |

|

DAVID WILLIAMSON |

Midyear 2024 |

|

STEVEN WILSON |

Year-end 2023 |

|

CHARLES YESSAIAN |

Year-end 2023 |

Source: Lobbying contribution database of the Secretary of the Senate. Year-end reports for calendar year 2023 and midyear reports for calendar year 2024. | GAO‑25‑107523

Our objectives were to (1) determine the extent to which lobbyists demonstrated compliance with Lobbying Disclosure Act (LDA) disclosure requirements for reports filed in 2023-2024, and describe how that compliance compares with prior years; (2) identify the challenges or improvements lobbyists report in complying with LDA disclosure requirements; and (3) describe the resources and authorities available to the U.S. Attorney’s Office for the District of Columbia (USAO) to enforce the LDA and efforts USAO has made to improve enforcement.[38]

We used information in the lobbying disclosure database maintained by the Secretary of the Senate. To assess whether these disclosure data were sufficiently reliable for the purposes of this report, we reviewed relevant documentation, consulted with knowledgeable officials, and completed electronic data testing. Based on our review of this information, we determined that Senate data were sufficiently reliable for the purposes of our reporting objectives.

We used the Senate lobbying disclosure database to draw a sample of quarterly disclosure (LD-2) reports from the third and fourth quarters of 2023 and the first and second quarters of 2024, to draw a sample of year-end 2023 and midyear 2024 contribution reports (LD-203), and to download documents associated with these samples (e.g., amended LD-2 reports). We also used the database to download data on the population of new client registration (LD-1) reports filed for the third and fourth quarters of 2023 and the first and second quarters of 2024, and to download data on the associated population of LD-2 reports filed in the quarter of registration.

We did not evaluate the Offices of the Secretary of the Senate or the Clerk of the House, both of which have key roles in the lobbying disclosure process. However, we consulted with officials from these offices, who provided us with general background information at our request.

To assess the extent to which lobbyists could provide evidence of their compliance with reporting requirements, we examined a stratified random sample of 100 LD-2 reports from the third and fourth quarters of 2023 and the first and second quarters of 2024.[39] We removed reports with no lobbying activity and with income or expenses of less than $5,000 from our sample.[40] We drew our sample from the population of 67,577 quarterly disclosure reports filed for the third and fourth quarters of 2023 and the first and second quarters of 2024 available in the public Senate database, as of our final download date for each quarter.

Our sample of LD-2 reports was not designed to detect differences over time. However, we conducted tests of significance to compare generalizable estimates for 2024 with those from each preceding year, dating back to 2015. We found that results were generally consistent from year to year and few statistically significant changes existed (as noted in our report) after using a Bonferroni adjustment to account for multiple comparisons.[41]

Our sample is based on a stratified random selection and is only one of a large number of samples that we may have drawn. Because each sample could have provided different estimates, we express our confidence in the precision of our particular sample’s results as a 95 percent confidence interval. This interval would contain the actual population value for 95 percent of the samples that we could have drawn. The percentage estimates we present in our report about LD-2 reports have 95 percent confidence intervals of within plus or minus 12 percentage points or fewer of the estimates themselves. We report the maximum margin of error of 12 percentage points, though individual estimates may have smaller margins of error.

Using a structured web-based survey, we asked all lobbyists in our sample to confirm key elements of the LD-2 reports, including

· the amount of income or expenses reported for lobbying activities,

· the lobbyists listed in the report,

· the houses of Congress and the federal agencies that they lobbied, and

· the issue area codes listed to describe their lobbying activity.

We also used the survey to ask whether the lobbyists maintained and could provide written documentation for these pieces of information. After lobbyists submitted survey responses, we interviewed them or their designees to review their documentation supporting selected elements of their LD-2 reports.

Prior to each interview, we conducted research to determine whether individual lobbyists properly disclosed their covered positions as required by the LDA. We reviewed the individual lobbyists’ previous work histories by searching sources such as lobbying firms’ websites, LinkedIn, LegiStorm, and Google. Prior to 2008, individual lobbyists were only required to disclose covered official positions held within 2 years of registering as an individual lobbyist for the client. The Honest Leadership and Open Government Act of 2007 amended that time frame to require disclosure of positions held 20 years before the date the individual lobbyists first lobbied on behalf of the client.

Individual lobbyists are required to disclose previously held covered official positions either on the LD-1 or on an LD-2 report.[42] Consequently, those who held covered official positions may have disclosed the information on the LD-1 or an LD-2 report filed prior to the report we examined as part of our random sample. Where we found evidence that an individual lobbyist previously held a covered official position and that information was not disclosed on the LD-2 report under review, we conducted an additional review of the publicly available Secretary of the Senate database to determine whether the lobbyist properly disclosed the covered official position on a prior report or LD-1. Finally, if, based on our searches, an individual lobbyist appeared to have held a covered position that was not disclosed, we asked for an explanation during the interview to ensure that our research was accurate. Despite these discussions and our research, we cannot be certain that we identified all covered positions lobbyists held.

To determine whether lobbyists in our LD-2 sample worked with affiliated organizations, we reviewed lobbying disclosure reports and interviewed lobbyists.[43] Prior to interviews, we reviewed the LD-2 reports in our sample, as well as the LD-1s associated with them, to identify whether lobbyists listed one or more affiliated organizations. During interviews, we also asked lobbyists whether they worked with affiliated organizations on behalf of the client listed on that LD-2. In discussing lobbyists’ work with affiliated organizations, we must rely on information lobbyists self-report because no independent or outside source exists that would allow us to verify the information they provide.

The Justice Against Corruption on K Street Act of 2018 (JACK Act), which amended the Lobbying Disclosure Act of 1995, added disclosure requirements for lobbyists. The JACK Act requires that lobbyists disclose on all LD-1 and LD-2 reports whether individual lobbyists have been convicted of certain criminal acts at the federal or state level. Offenses include bribery, extortion, embezzlement, an illegal kickback, tax evasion, fraud, conflict of interest, making false statements, perjury, or money laundering. Lobbyists who have been convicted of these offenses must provide the date of the conviction and a description of the offense. Lobbyists were required to begin disclosing this information on their quarter one 2019 LD-2 reports.

To determine whether lobbyists in our sample of LD-2 reports complied with the JACK Act, we analyzed information on their criminal background records. First, we used lobbyists’ websites, LinkedIn, and Google to positively identify these individual lobbyists. Then, we downloaded criminal background records on each individual lobbyist from the Accurint and CLEAR databases. The information in these databases comes from public and private sources and includes details such as criminal arrests or convictions. We used this information to determine whether each lobbyist had committed a crime that the lobbyist would be required to report under the JACK Act. When the information in CLEAR and Accurint reports was unclear (i.e., we could not determine whether the lobbyist had been convicted of relevant crimes), we followed up with additional criminal background checks.

In addition to examining the content of the LD-2 reports, we determined whether the lobbyists in our sample of LD-2 reports filed certain LD-203 reports. We searched the Senate lobbying disclosure database to find these reports. In all cases, we determined whether both the lobbying firms (or organizations with in-house lobbyists) and the individual lobbyists listed on the LD-2s in our sample filed LD-203 reports. For LD-2s filed for the third and fourth quarters of 2023 in our sample, we determined whether the lobbyists submitted LD-203 reports covering the second half of calendar year 2023 (year-end reports). For LD-2s filed for the first and second quarters of 2024 in our sample, we determined whether the lobbyists submitted LD-203 reports covering the first half of calendar year 2024 (midyear reports).

We conducted this review of LD-203 filings on our random selection of LD-2 reports. As a result, our findings are generalizable to the population of LD-2 reports; we can estimate the percentage of LD-2 reports that listed lobbying firms, organizations with in-house lobbyists, and individual lobbyists who filed LD-203 reports. However, our sample is not a direct probability sample of lobbying firms, organizations with in-house lobbyists, or individual lobbyists listed on LD-2 reports. As such, we cannot estimate the likelihood that LD-203 reports were appropriately filed for the populations of lobbying firms, organizations with in-house lobbyists, or individual lobbyists listed on LD-2 reports.

We also determined the extent to which the population of lobbyists who registered in the third and fourth quarters of 2023 and the first and second quarters of 2024 met the LDA’s requirement to file an LD-2 report in the quarter of registration. To match LD-1s with corresponding LD-2s, we used data filed with the Secretary of the Senate and an electronic matching algorithm that includes strict and loose text matching procedures. We began by matching reports and registrations using the Senate identification number, which is linked to a unique lobbyist-client pair. For registrations not matched to a report by the Senate identification number, we searched for matching filings based on cleaned and standardized versions of the client and registrant name.

For reports we could not directly match by identification number or standardized name, we attempted to match reports and registrations based on near matches between clients’ and registrants’ names. This process allowed for variations in the names to accommodate minor misspellings or typographical errors. In these cases, we used professional judgment to determine whether cases with typographical errors were sufficiently similar to consider as matches.

To determine the extent to which lobbyists accurately reported information on their LD-203 reports as required by the LDA, we analyzed a stratified random sample of LD-203 reports. The sample contains 80 reports that listed political contributions and 80 reports that did not list political contributions. In each category, half are from the year-end 2023 filing period and half are from the midyear 2024 filing period. We drew our sample from the population of 35,034 LD-203 reports, which included 17,817 year-end 2023 reports (5,003 listed political contributions and 12,814 did not) and 17,217 midyear 2024 reports (5,387 listed political contributions and 11,830 did not).[44]