TRACKING THE FUNDS

Specific Fiscal Year 2024 Provisions for Federal Agencies

Report to Congressional Committees

November 2024

GAO-25-107549

United States Government Accountability Office

View GAO-25-107549. For more information, contact Jeff Arkin at (202) 512-6806 or arkinj@gao.gov or Allison Bawden at (202) 512-3841 or bawdena@gao.gov.

Highlights of GAO-25-107549 a report to Congressional Committees

November 2024

TRACKING THE FUNDS

Specific Fiscal Year 2024 Provisions for Federal Agencies

Why GAO Did This Study

As part of recent appropriations legislation, Members of Congress could request to designate funding through legislative provisions for specific projects in their communities. Congress has continued this process for fiscal year 2024. These provisions are called “Community Project Funding” in the House of Representatives and “Congressionally Directed Spending” in the U.S. Senate.

Congress included a provision in the joint explanatory statement accompanying the Further Consolidated Appropriations Act, 2024 for GAO to review agencies’ implementation of CPF/CDS provisions. This report provides an overview of the fiscal year 2024 CPF/CDS provisions. Specifically, it describes (1) the agencies that were tasked with administering these funds; (2) the purpose of the funds, types of designated recipients, and location of projects; and (3) the period of availability of the funds.

GAO analyzed data from the Consolidated Appropriations Act, 2024; the Further Consolidated Appropriations Act, 2024; and these acts’ accompanying joint explanatory statements to describe the agencies designated funds and the purposes, recipients, and locations of the funds. GAO compared this information to the corresponding information from GAO’s prior work on fiscal year 2023 provisions.

What GAO Found

The Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024, and their accompanying joint explanatory statements, designated about $14.6 billion for 8,098 Community Project Funding/Congressionally Directed Spending (CPF/CDS) provisions for fiscal year 2024. This compared to $15.3 billion for 7,233 provisions for fiscal year 2023. The provisions designate funds for particular recipients to use for specific projects in their communities.

For fiscal year 2024, Congress appropriated funds to 19 federal agencies—the same agencies as in fiscal year 2023—to administer projects using the designated funds. The provisions were for projects with a broad range of purposes, such as community and regional development, natural resources and environment, and transportation.

For fiscal year 2024, the patterns of designated funding to various recipient types—such as higher education organizations—and locations of projects with designated funding were generally proportional to the patterns for the prior year.

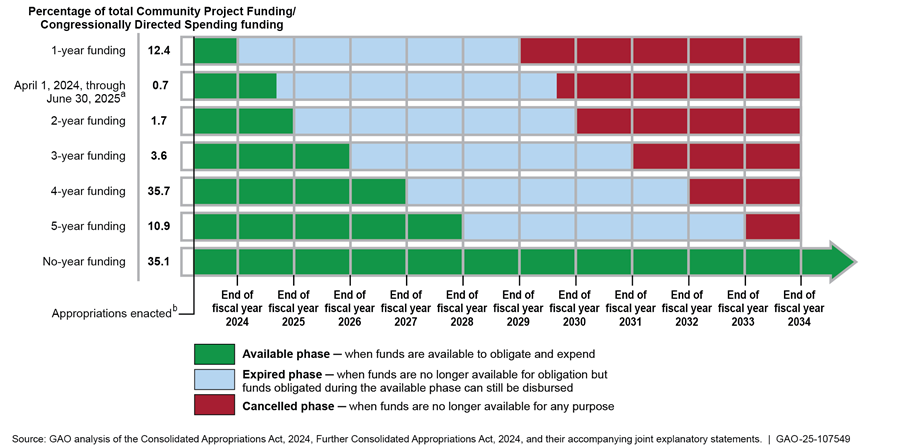

When Congress appropriated funds for fiscal year 2024, it specified a time period applicable to each appropriation from which funds were designated for specific recipients. For example, about 65 percent of the funds are available for agencies to obligate (e.g., by signing a contract or awarding a grant) for a fixed period, ranging from 1 to 5 years. The remaining 35 percent of funds are not time limited; the funds are available for obligation until expended. These percentages are similar percentages to those for fiscal year 2023. Once the period of availability expires, agencies generally have 5 years to expend or outlay the funds.

Abbreviations

|

CPF/CDS |

Community Project Funding/Congressionally Directed Spending |

|

OMB |

Office of Management and Budget |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

November 21, 2024

Congressional Committees

As part of recent appropriations legislation, Members of Congress could request to designate funding through legislative provisions for specific projects in their communities. The Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024, and the accompanying joint explanatory statements, designated about $14.6 billion for 8,098 such provisions.[1] These provisions designate certain amounts of funds for particular recipients, such as nonprofit organizations or local governments, to use for specific projects. These provisions are called “Community Project Funding” in the House of Representatives and “Congressionally Directed Spending” in the U.S. Senate.[2] The funds were appropriated to 19 federal agencies to administer projects with a broad range of purposes, such as education, health care, and transportation.[3]

The joint explanatory statement accompanying the Further Consolidated Appropriations Act, 2024 includes a provision for us to review agencies’ implementation of Community Project Funding/Congressionally Directed Spending (CPF/CDS). This report provides an overview of fiscal year 2024 provisions. Specifically, it describes (1) the agencies that were tasked with administering these funds; (2) the purposes of the funds, types of designated recipients, and location of projects; and (3) the period of availability of these funds. For each of these objectives, we compared what we found for fiscal year 2024 provisions to the corresponding information from our prior work on fiscal year 2023 provisions. We are also publishing an online dataset to accompany this report.[4]

To identify the agencies that were tasked with administering these projects, we analyzed tables included in the joint explanatory statements accompanying the Consolidated Appropriations Act, 2024 and the Further Consolidated Appropriations Act, 2024.[5] This report focuses on the 19 agencies that received funding provisions for fiscal years 2023 and 2024.[6]

To describe the purposes for and recipients of the fiscal year 2024 provisions as well as the locations of the projects, we analyzed data from the Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024 and their accompanying joint explanatory statements. To characterize the purpose of the provisions, we matched the budget account number to the applicable Office of Management and Budget budget function.[7] We also categorized the designated recipients of these funds into four types: federal government; tribal/state/local/territorial government; higher education organizations; and other nonprofit organizations.

To determine the period of availability of these funds, we reviewed the Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024 and supplemental materials.

We used data collection instruments for the 19 agencies to correct or confirm the information that we developed from our analysis. We also conducted checks to identify and address errors or omissions in the data from these data collection instruments. We found the data to be reliable for the purpose of describing the government-wide execution of CPF/CDS provisions for fiscal year 2024. Appendix I provides more information on our objectives, scope, and methodology.

We conducted this performance audit from April 2024 to November 2024 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

In recent years, the Senate and House Appropriations Committees have adopted a process by which Members of Congress may submit requests for funding for specific projects for review by the committees.[8] Approved requests for fiscal year 2024 were included in the joint explanatory statements accompanying the Consolidated Appropriations Act, 2024 and the Further Consolidated Appropriations Act, 2024. The Senate and House observed similar rules for these requests for fiscal year 2024, as in prior years. The Senate and House limited funds designated through these provisions to 1 percent or less of total discretionary appropriations. Congress also continued to include other constraints, such as prohibiting members from designating funds directly to for-profit entities and requiring that Members certify that they had no financial interest in the projects for which they submitted requests for funds.

Congress provides budget authority to federal agencies to incur financial obligations through annual appropriations acts or other legislation. See table 1 for key terms and definitions in the budget process.

|

Key Term |

Definition |

|

Appropriation |

An appropriation provides an agency budget authority

to incur obligations and to make |

|

Apportionment |

The action by which the Office of Management and

Budget (OMB) distributes amounts |

|

Allotment |

An authorization by either the agency head or another

authorized employee, such as a |

|

Obligation |

An obligation is a definite commitment that creates a

legal liability on the part of the |

|

Outlay |

The issuance of checks, disbursement of cash, or

electronic transfer of funds made to |

|

Period of availability |

When Congress appropriates funds, it specifies the

period during which the funds are |

|

Expired appropriations |

At the end of the period of availability, the

appropriation expires, meaning that the agency An expired appropriation account generally closes at

the end of the 5-year period, unless |

Source: GAO‑05‑734SP and GAO‑23‑106561. | GAO‑25‑107549

aIn limited situations, certain agencies may have specific statutory authority that extends the expired fund stage beyond the 5-year window. If unpaid obligations to recipients remain outstanding after the funds are canceled, an agency may have limited authority to pay the recipients using appropriations that will be current at that time and available for the same purpose. The agency’s ability to use current appropriations to liquidate old obligations, however, is limited. For example, the cumulative total of old obligations payable from a current appropriation may not exceed the lesser of 1 percent of the current appropriation or the remaining balance (whether obligated or unobligated) canceled when the appropriation account is closed. 31 U.S.C. 1553(b); GAO, Principles of Federal Appropriations Law: Annual Update of the Third Edition, Vol. I, ch. 5, D.4, GAO-15-303SP (Washington, D.C.: Mar. 2015.

The funds designated through the CPF/CDS provisions are part of larger lump-sum appropriations that cover a number of programs, projects, or other items. Many of the provisions may be administered through the award of grants. Agencies that receive lump-sum appropriations for the purpose of executing grant programs typically use merit-based or competitive allocation processes to distribute the funds. However, because these provisions designate funds for specific recipients or projects, agencies do not use such processes to award CPF/CDS funds. Rather, agencies are directed to distribute these funds to the recipients designated through the provisions.

Agencies may only obligate funds during the period in which they are available. An agency may record an obligation only when an obligational event occurs. The timing of the event varies depending on the nature of the agency’s action and on the underlying legal authorities. For example, the obligational event for a contract generally occurs when the agency enters into a binding agreement with the contractor. For some grants, the obligational event may occur when the agency awards the grant while, for others, it may occur immediately when the appropriation for the grant becomes law.[9]

The Same Agencies Were Appropriated Funds for Fiscal Years 2023 and 2024, and Total Funding Decreased

Congress appropriated funding for specific CPF/CDS provisions to 19 federal agencies for fiscal year 2024—the same agencies that received funding for fiscal year 2023. As shown in table 2, Congress designated about $14.6 billion for 8,098 provisions for fiscal year 2024—compared to about $15.3 billion and 7,233 provisions for fiscal year 2023—a decrease of about 5 percent in designated funding and an increase of 12 percent in the number of provisions.

The Departments of Housing and Urban Development and Transportation received the most designated funding across the last 2 years while the Department of Housing and Urban Development received the most provisions. The amounts of funding designated by the provisions ranged from $8,000 (two projects received this amount: the Department of Justice for patrol vehicle equipment in West Virginia, and the U.S. Army Corps of Engineers for a harbor project in Maryland) to about $237 million (to the U.S. Army Corps of Engineers for the Chickamauga Lock construction project in Tennessee).

Table 2: Community Project Funding/Congressionally Directed Spending Provisions in the 2023 and 2024 Consolidated Appropriations Acts by Federal Agency

|

Federal agency |

Total designated funding for fiscal year 2024 provisions (dollars in millions) |

Number of |

Total designated funding for fiscal year 2023 provisions (dollars in millions) |

Number of |

|

Department of Housing and Urban Development |

$3,289.0 |

2,407 |

$2,982.3 |

1,616 |

|

Department of Transportation |

2,761.2 |

1,014 |

2,595.2 |

773 |

|

Department of Defense |

1,565.8 |

143 |

2,198.9 |

158 |

|

Army Corps of Engineers |

1,488.6 |

217 |

1,019.5 |

175 |

|

Environmental Protection Agency |

1,460.0 |

1,039 |

1,502.6 |

732 |

|

Department of Health and Human Services |

1,049.0 |

622 |

1,847.1 |

1,288 |

|

Department of Agriculture |

778.3 |

622 |

494.5 |

362 |

|

Department of Justice |

597.4 |

786 |

407.4 |

464 |

|

Department of Commerce |

442.6 |

222 |

506.3 |

138 |

|

Department of Homeland Security |

293.8 |

200 |

319.2 |

168 |

|

Department of Education |

290.4 |

331 |

630.0 |

600 |

|

Small Business Administration |

116.5 |

144 |

179.7 |

207 |

|

Department of the Interior |

113.4 |

86 |

125.1 |

97 |

|

Department of Labor |

107.8 |

128 |

217.3 |

249 |

|

Department of Energy |

83.7 |

48 |

222.0 |

152 |

|

National Aeronautics and Space Administration |

56.7 |

38 |

30.7 |

15 |

|

National Archives and Records Administration |

55.9 |

39 |

37.0 |

30 |

|

Office of National Drug Control Policy |

13.0 |

11 |

10.5 |

8 |

|

General Services Administration |

$1.5 |

1 |

3.0 |

1 |

|

Total |

$14,564.8 |

8,098 |

$15,328.3 |

7,233 |

Source: GAO analysis of the joint explanatory statements accompanying the Consolidated Appropriations Act, 2023, the Consolidated Appropriations Act, 2024, and the Further Consolidated Appropriations Act, 2024. | GAO‑25‑107549

Note: The dollar amounts for the agencies may not sum to the total dollar amount due to rounding.

Total Funding for Fiscal Year 2024 Provisions for Purposes, Recipient Types, and Locations Is Proportionally Similar to Fiscal Year 2023

More than $1 Billion Was Designated for Fiscal Year 2024 for Each of Four Purposes

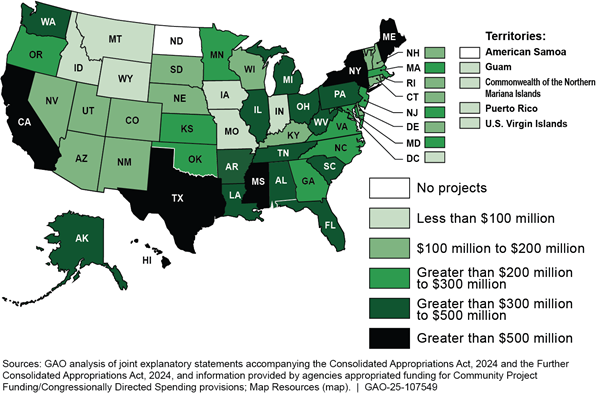

Congress designated fiscal year 2024 provisions for a variety of purposes, also known as budget functions, which are broad categories into which all federal spending is placed (see figure 1). The proportion of funding designated to these purposes was similar for fiscal year 2023. Four budget functions each accounted for more than $1 billion for fiscal year 2024.[10]

· Community and Regional Development. A total of $3.9 billion (about 27 percent) for projects such as correctional facility improvements, a welding and machining training facility, and water infrastructure upgrades. For fiscal year 2023, $3.3 billion (about 22 percent) was designated for this purpose.

· Natural Resources and Environment. A total of $3.3 billion (about 22 percent) for projects including trail improvements, watershed management, and sewer systems extensions. For fiscal year 2023, $2.8 billion (about 18 percent) was designated for this purpose.

· Transportation. A total of $2.8 billion (about 19 percent) for projects including road improvements, airport terminal expansions and improvements, and enhancements to public transit. For fiscal year 2023, $2.6 billion (about 17 percent) was designated for this purpose.

· National Defense. A total of $1.6 billion (about 11 percent) for projects including the planning and design for a tactical vehicle lab, minor construction at a missile range, and dry dock replacements at Joint Base Pearl Harbor-Hickam. For fiscal year 2023, $2.2 billion (about 14 percent) was designated for this purpose.

Figure 1: Budget Functions for Amounts Designated through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024

aThe category “Other” includes the General Government budget function and multiple functions, which covers projects with two or more budget functions. Funding for the Departments of Homeland Security and the Interior is included under multiple functions. The joint explanatory statements accompanying the Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024 provided $70.5 million for General Government and $294.6 million for multiple functions.

Tribal, State, Local, and Territorial Governments Were Designated to Receive Almost Half the Fiscal Year 2024 Funding

As in our prior reports, we categorized designated recipients of fiscal year 2024 provisions into the following types: federal government; tribal/state/local/territorial government; higher education organizations, such as universities and colleges; and other nonprofit organizations.[11]

Tribal, state, local, or territorial governments were designated to receive almost half of the amount appropriated for the fiscal year 2024 provisions (about 48 percent) while higher education organizations were designated to receive the least (about 9 percent), as shown in table 3. Overall, the proportion of funding by recipient type was about the same as for fiscal year 2023.

Table 3: Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024, by Type of Recipient

|

Recipient type |

Total designated funding |

Percentage of total designated funding |

Number of provisions |

|

Tribal/state/local/territorial government |

$7,014.8 |

48.2 |

4,446 |

|

Federal government |

3,165.0 |

21.7 |

390 |

|

Other non-profit organizations |

3,033.2 |

20.8 |

2,513 |

|

Higher education organizations |

1,351.9 |

9.3 |

749 |

|

Total |

$14,564.8 |

100 |

8,098 |

Source: GAO analysis of the joint explanatory statements accompanying the Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024. | GAO‑25‑107549

Note: The dollar amounts for the recipient types may not sum to the total dollar amount due to rounding.

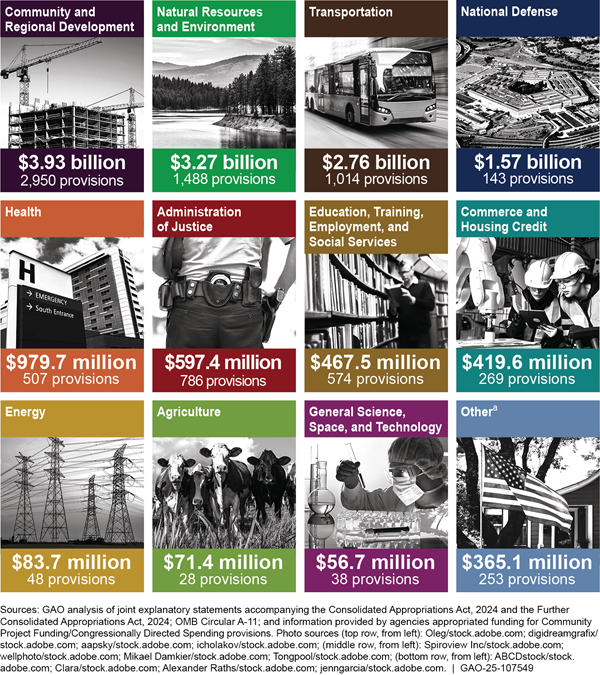

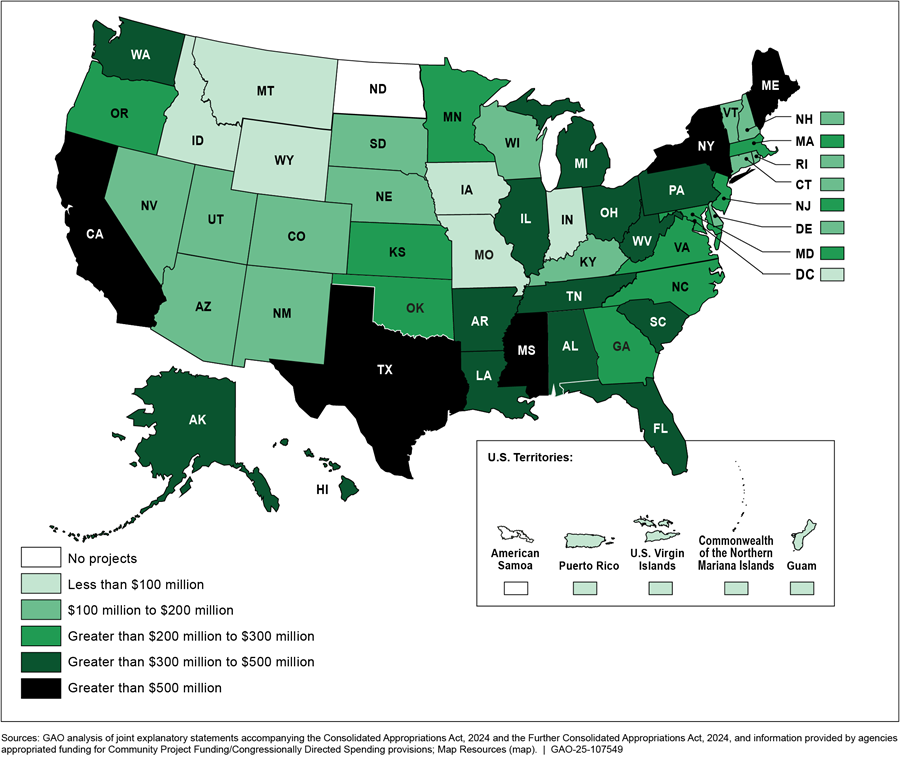

Almost All States and Territories Received Designated Funding for Fiscal Year 2024

Congress designated provisions for projects in 49 states (all except North Dakota), the District of Columbia, and four of the five U.S. territories (Guam, Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands; none for America Samoa) for fiscal year 2024.[12] The number of provisions and amount of funding varied across locations, but the pattern of total funding designated was generally proportionate to fiscal year 2023. For example, California was designated to receive the largest total amount and greatest number of provisions of any state in both fiscal years.

As shown in figure 2, we found that 19 states each received more than $300 million, including five states with more than $500 million, in amounts designated by these provisions for fiscal year 2024.[13] There were 27 projects that affected more than one state. For example, a lock and dam project on Lake Seminole affects Florida, Georgia, and Alabama. Designated funds for these 27 projects totaled almost $235.5 million and affected 33 states.

Figure 2: Distribution of Funding Provided through Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024, by Location

Note: Community Project Funding/Congressionally Directed Spending provisions include 27 projects that affect more than one state. Appropriated funds for these projects across multiple states total almost $235.5 million and affect 33 states.

Most Fiscal Year 2024 Funds Must Be Obligated within 5 Years

When Congress appropriated funds for the fiscal year 2024 provisions, it specified a time period applicable to each appropriation from which funds were designated to specific recipients. As shown in figure 3, about 65 percent of the funds are available for a fixed period ranging from 1 to 5 years, while the remaining 35 percent are no-year funds that will be available for obligation until they are expended. These percentages are similar to fiscal year 2023.

Figure 3: Periods of Availability for Community Project Funding/Congressionally Directed Spending Provisions in the Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024

Note: Congress has passed laws that allow some accounts additional time to disburse funds beyond the standard statutory 5-year period after the available phase has ended. This additional time is not reflected in the figure. The percentage of total CPF/CDS funding does not equal 100 percent due to rounding.

aThe Department of Labor received funding provisions specifying this period of availability.

bCongress and the President enacted the Consolidated Appropriations Act, 2024 on March 9, 2024, and the Further Consolidated Appropriations Act, 2024 on March 23, 2024.

Agency Comments

We provided a draft of this report to the 19 agencies that were appropriated funds through CPF/CDS provisions for fiscal year 2024 for review and comment. We received technical comments from the Departments of Agriculture, Health and Human Services, and Justice, and the Small Business Administration. We incorporated these comments as appropriate. The other 15 agencies informed us they had no comments.

We are sending copies of this report to the appropriate congressional committees, the 19 agencies that were appropriated funds, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact Jeff Arkin at (202) 512-6806 or arkinj@gao.gov or Allison Bawden at (202) 512-3841 or bawdena@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix II.

Jeff Arkin

Director, Strategic Issues

Allison Bawden

Director, Natural Resources and Environment

Congressional Addressees

The Honorable Patty Murray

Chair

The Honorable Susan Collins

Vice Chair

Committee on Appropriations

United States Senate

The Honorable Chris Van Hollen

Chair

The Honorable Bill Hagerty

Ranking Member

Subcommittee on Financial Services and General Government

Committee on Appropriations

United States Senate

The Honorable Jack Reed

Chair

The Honorable Deb Fischer

Ranking Member

Subcommittee on Legislative Branch

Committee on Appropriations

United States Senate

The Honorable Tom Cole

Chairman

The Honorable Rosa DeLauro

Ranking Member

Committee on Appropriations

House of Representatives

The Honorable David Joyce

Chairman

The Honorable Steny Hoyer

Ranking Member

Subcommittee on Financial Services and General Government

Committee on Appropriations

House of Representatives

The Honorable David Valadao

Chairman

The Honorable Adriano Espaillat

Ranking Member

Subcommittee on Legislative Branch

Committee on Appropriations

House of Representatives

This report provides an overview of fiscal year 2024 Community Project Funding/Congressionally Directed Spending (CPF/CDS). Specifically, this report describes (1) the agencies that were tasked with administering these funds; (2) the purposes of the funds, the types of designated recipients, and the locations of the projects; and (3) the period of availability of the funds.

For each of these objectives, we compared what we found for fiscal year 2024 provisions to the corresponding information from our prior work on fiscal year 2023 provisions.

To identify the agencies that were appropriated funds for these projects, we analyzed tables included in the joint explanatory statements accompanying the Consolidated Appropriations Act, 2024 and the Further Consolidated Appropriations Act, 2024. These tables list each CPF/CDS provision and represent the complete list of these provisions. Our report focuses on the 19 agencies responsible for administering provisions for fiscal years 2023 and 2024.[14]

We then used this information to create a dataset. We used the joint explanatory statements to identify the following data fields: subcommittee, agency, subunit, account, project, recipient, location, funding amount, and requester. If information for one of these fields was not in the joint explanatory statements, we inferred it from other information or sources. For example, if the location field was not included for a particular provision, we used the description of the recipient, project, or congressional requester to determine the state. We also compared information from the joint explanatory statements to the Fiscal Year 2024 President’s Budget Appendix to identify budget account numbers. This field represents the budget account associated with the relevant projects.

To describe the purposes for the funds, types of designated recipients, and locations of projects, we analyzed the dataset described above. Specifically, to describe the broad purpose of these funds, we matched the accounts for the provisions listed in the joint explanatory statement to budget accounts from the Fiscal Year 2024 President’s Budget Appendix. We used the budget account numbers to determine the applicable budget functions from Office of Management and Budget (OMB) Circular No. A-11 for each provision.[15] Budget functions are broad categories of spending into which all federal spending is divided, regardless of the federal agency that oversees individual federal programs.

To help describe the types of designated recipients of these funds, we organized them into four categories: federal government; tribal, state, territorial, or local governments; higher education organizations; and other nonprofit organizations. These categories are based on categories used in USAspending.gov and are consistent with the categories we used for our prior work on fiscal years 2022 and 2023 provisions. The Senate and House Appropriations Committees’ process for requesting these provisions specified that a designated recipient cannot be a for-profit entity. We did not assess compliance with this requirement. Thus, for the purposes of this report, we assigned all recipients that are not federal government; tribal, state, territorial, and local government; or higher education organizations to the “other nonprofit organization” category.

We categorized recipients into these four categories based on (1) the recipient’s name and project description and (2) information provided by the federal agency that was designated funds to obligate these recipients.

We include only states, the District of Columbia, and territories in our analysis because the location data included in the joint explanatory statements show a project’s location as a state or territory. We are not able to separate out Tribal Nations because the joint explanatory statements do not include this information. Projects related to tribal governments are included within the relevant state or territory.

To determine the period of availability of these funds, we identified the relevant information for each applicable appropriation in the Consolidated Appropriations Act, 2024 and the Further Consolidated Appropriations Act, 2024.

We provided the relevant subset of the dataset described above to each of the 19 agencies to confirm accuracy. Specifically, we provided each agency with the data fields described above for the CPF/CDS provisions for which they are responsible. We asked the agencies to verify the accuracy of the data and provide any corrections as needed. We revised information for 24 fiscal year 2024 CPF/CDS provisions based on technical corrections made by the Environmental Protection Agency pursuant to its permanent authority granted by the Department of the Interior, Environment, and Related Agencies Appropriations Act, 2006.[16] We also conducted checks to identify and address errors or omissions in the data from these data collection instruments. We found the data to be reliable for the purpose of describing the government-wide execution of CPF/CDS provisions for fiscal year 2024.

We did not assess the merits of the projects funded in the CPF/CDS provisions. We also did not assess the ability of specific recipients to carry out the projects described in the Consolidated Appropriations Act, 2024 and the Further Consolidated Appropriations Act, 2024, and the accompanying joint explanatory statements.

We conducted this performance audit from April 2024 to November 2024 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

GAO Contacts

Jeff Arkin, (202) 512-6806 or arkinj@gao.gov

Allison Bawden, (202) 512-3841 or bawdena@gao.gov

Staff Acknowledgments

In addition to the contacts named above, Janice Latimer (Assistant Director), John Villecco (Analyst in Charge), Ann Marie Cortez, Ann Czapiewski, Holly Firlein, Gabriel Nelson, Karly Newcomb, Daniella Royer, Dylan Stagner, and Walter Vance made key contributions to this report.

GAO’s Mission

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on Facebook, Flickr, X, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

Congressional Relations

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S. Government Accountability Office, 441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

Sarah Kaczmarek, Managing Director, KaczmarekS@gao.gov, (202) 512-4800, U.S.

Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Strategic Planning and External Liaison

Stephen J. Sanford, Managing

Director, spel@gao.gov, (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814, Washington,

DC 20548

[1]Consolidated Appropriations Act, 2024, Pub. L. No. 118-42, 138 Stat. 25 (Mar. 8, 2024); 170 Cong. Rec. S1223 (Mar. 5, 2024). Section 4 of the Consolidated Appropriations Act, 2024 notes that this explanatory statement printed in the Congressional Record shall be treated as if it were a joint explanatory statement of a committee of conference. Pub. L. No. 118-42, § 4. Further Consolidated Appropriations Act, 2024, Pub. L. No. 118-47, 138 Stat. 460 (Mar. 23, 2024); 170 Cong. Rec. H1501 (Mar. 22, 2024). Section 4 of the Further Consolidated Appropriations Act, 2024 notes that this explanatory statement printed in the Congressional Record shall be treated as if it were a joint explanatory statement of a committee of conference. Pub. L. No. 118-47, § 4.

[2]We have issued a series of reports in response to these provisions for fiscal year 2022 and 2023. See our Tracking the Funds website, www.gao.gov/tracking-funds. The Tracking the Funds website includes additional data and visualizations as a part of this work.

[3]For the purpose of our report, we count the U.S Army Corps of Engineers and the Office of National Drug Control Policy, which is within the Executive Office of the President, as agencies.

[4]This dataset can be accessed on our public website at https://www.gao.gov/products/gao-25-107549.

[5]We did not assess the merits of the projects funded in these provisions. We also did not assess the ability of specific recipients to carry out the projects described in the Consolidated Appropriations Act, 2024 and Further Consolidated Appropriations Act, 2024, and the accompanying joint explanatory statements.

[6]For more information on the execution of the fiscal year 2022 and fiscal year 2023 CPF/CDS, see GAO, Tracking the Funds: Agencies Continued Executing FY 2022 and 2023 Community Project Funding/Congressionally Directed Spending Provisions, GAO‑25‑107274 (Washington, D.C.: Nov. 21, 2024).

[7]Budget functions are broad categories of spending into which all federal spending is divided, regardless of the federal agency that oversees individual federal programs. There are 20 broad budget functions, which are further divided into subfunctions.

[8]See GAO, Tracking the Funds: Specific Fiscal Year 2023 Provisions for Federal Agencies, GAO‑23‑106561 (Washington, D.C.: Sept. 28, 2023); and Tracking the Funds: Specific Fiscal Year 2022 Provisions for Federal Agencies, GAO‑22‑105467 (Washington, D.C.: Sept. 12, 2022).

[9]If the obligational event occurs immediately when the appropriation becomes law, the amount remains obligated even after the appropriation’s period of availability for new obligations expires. We did not determine when the obligational event would arise for each specific grant action that agencies may take for funds designated through the CPF/CDS provisions in the Consolidated Appropriations Act, 2024 and the Further Consolidated Appropriations Act, 2024. For more information regarding the obligational event of grants, see GAO‑22‑105467, appendix VI.

[10]The examples highlighted for different budget functions are illustrative. For the full list of provisions, see our online dataset available at https://www.gao.gov/products/gao-25-107549.

[11]GAO‑23‑106561. In some cases, the designated recipient is the federal government. For example, a provision designated funds to the Department of the Interior to support the research and recovery of bull trout, which is a threatened species under the Endangered Species Act.

[12]Projects related to tribal governments are included within the relevant state or territory because the location data in the joint explanatory statements only show a project’s location as a state (including the District of Columbia) or territory.

[13]For more information on the amount and number of provisions by state, see our website Tracking the Funds.

[14]For the purpose of our report, we count the U.S Army Corps of Engineers and the Office of National Drug Control Policy, which is within the Executive Office of the President, as agencies.

[15]There are 20 broad budget functions that are further divided into subfunctions. For more information on budget functions, see Office of Management and Budget, Preparation, Submission, and Execution of the Budget Circular, OMB Circular No. A-11 (Washington, D.C.: July 25, 2024).

[16]Department of the Interior, Environment, and Related Agencies Appropriations Act, 2006, Pub. L. No. 109-54, title II, 119 Stat 499, 530 (Aug. 2, 2005) (providing the agency with authority to make technical corrections to select grants for the construction of drinking water, wastewater, and stormwater infrastructure and for water quality protection).