U.S. VICTIMS OF STATE SPONSORED TERRORISM FUND

1983 Beirut Barracks and 1996 Khobar Towers Bombing Claimants Due $614 Million

Report to Congressional Committees

November 2024

GAO-25-107564

United States Government Accountability Office

View GAO‑25‑107564. For more information, contact Triana McNeil at (202) 512-8777 or McNeilT@gao.gov or Nagla'a El-Hodiri at (202) 512-7279 or ElHodiriN@gao.gov.

Highlights of GAO‑25‑107564, a report to congressional committees

November 2024

U.S. Victims of State Sponsored Terrorism Fund

1983 Beirut Barracks and 1996 Khobar Towers Bombing Claimants Due $614 Million

Why GAO Did This Study

Acts of state sponsored terrorism have resulted in the death and injury of thousands of U.S. persons and the suffering of victims’ family members. The Fund was established in 2015 by the Justice for United States Victims of State Sponsored Terrorism Act. Administered by a Special Master, who is appointed by the Attorney General, and supported by DOJ personnel, the Fund provides compensation to eligible claimants though regular payment distribution rounds.

The Fairness Act includes a provision for GAO to determine lump sum catch-up payments for eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims. To conduct this work, GAO reviewed relevant legislation and DOJ documentation; analyzed Fund data on new and existing claimants; and interviewed Fund officials. In December 2023 and July 2024, GAO published Federal Register Notices requesting public comments on GAO's planned methodology for calculating lump sum catch-up payments. GAO received and carefully considered all comments received.

What GAO Recommends

Congress should consider amending the Justice for United States Victims of State Sponsored Terrorism Act to allow any of the 274 victims who did not apply for lump sum catch-up payments due to DOJ’s guidance to receive such payments.

What GAO Found

GAO determined that lump sum catch-up payments to 2,081 eligible victims of the 1983 Beirut barracks and 1996 Khobar Towers bombings total about $614 million. Lump sum catch-up payments are to result in the percentage of the claims these victims received from the U.S. Victims of State Sponsored Terrorism Fund (Fund) being equal to the percentage of the claims non-9/11 victims of state sponsored terrorism received from the Fund. However, 274 claimants did not submit applications for the payments during the statutory application time frame and therefore cannot be included in lump sum catch-up payments without action by Congress.

Specifically, GAO found that Department of Justice (DOJ) guidance may have discouraged up to 274 eligible Beirut barracks and Khobar Towers bombing victims from applying for lump sum catch-up payments. According to DOJ officials who administer the Fund—which provides compensation to certain U.S. persons injured in acts of international state sponsored terrorism—these claimants may have refrained from submitting applications after contacting the Fund or reviewing its application procedures. Under GAO’s interpretation of the Fairness for 9/11 Families Act (Fairness Act), claimants who previously applied and were found eligible to participate in the Fund could still receive catch-up payments but must have submitted applications within the statutory application time frame (December 29, 2022, through June 27, 2023). The Fund, however, took the view that these existing claimants could not submit a separate or “successive” application in order to apply for catch-up payments because each claimant may only submit one application per claim under the Fund’s procedures.

Existing claimants who did submit timely applications are eligible for catch-up payments and are included in our calculations. According to Fund officials, as provided by the Fairness Act, the Special Master will authorize catch-up payments in amounts as determined by GAO.

The Fairness Act does not authorize GAO to include the 274 claimants in its determination of lump sum catch-up payments given the application submission requirement, and DOJ officials have stated that the Fund cannot allow these claimants to submit successive applications under the Fund’s established procedures. However, GAO determined that lump sum catch-up payments for these 274 claimants would be about $116 million. Amending the Justice for United States Victims of State Sponsored Terrorism Act would allow claimants who did not apply because of Fund guidance to receive lump sum catch-up payments.

|

Abbreviations |

|

|

|

|

|

DOJ |

Department of Justice |

|

Fairness Act |

The Fairness for 9/11 Families Act |

|

Fund |

The United States Victims of State Sponsored Terrorism Fund |

|

In Re 650 |

In Re 650 Fifth Avenue and Related Properties |

|

Peterson |

Peterson v. Islamic Republic of Iran |

|

Victims Act |

Justice for United States Victims of State Sponsored Terrorism Act |

|

|

|

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

November 1, 2024

Congressional Requesters

Acts of state sponsored terrorism have resulted in the death and injury of thousands of U.S. persons and the suffering of victims’ family members.[1] These include the 1983 and 1996 bombings of the U.S. Marine barracks in Beirut and Khobar Towers in Saudi Arabia, respectively, and the 9/11 attacks. In 2015, the Justice for United States Victims of State Sponsored Terrorism Act (Victims Act) was enacted, establishing the United States Victims of State Sponsored Terrorism Fund (Fund).[2] The Fund provides compensation to certain U.S. persons injured in acts of international state sponsored terrorism and their immediate family members. As of August 2024, the Fund has allocated approximately $3.4 billion to eligible claimants in four payment rounds between 2017 and 2023.[3]

Since the Fund’s establishment in 2015, the Victims Act has been amended several times. Most recently, the Fairness for 9/11 Families Act (Fairness Act), enacted in December 2022, amended the Victims Act to include a provision for GAO to determine lump sum catch-up payments for eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims.[4]

To conduct this work, we analyzed Fund data and interviewed officials who support the Fund. In addition, prior to issuing this final report, the Fairness Act required us to publish our proposed methodology to estimate the catch-up payments in a Federal Register Notice, and to solicit public comments.[5] We published Notices on December 28, 2023, and July 9, 2024.[6] The public comments received on these Notices helped to inform our final methodology to determine catch-up payments. Among other things, we received input on claimant eligibility for catch-up payments, the percentage used to calculate catch-up payments, and whether to offset catch-up payments with compensation received from other sources.[7]

We conducted this performance audit from July 2023 to November 2024 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

United States Victims of State Sponsored Terrorism Fund

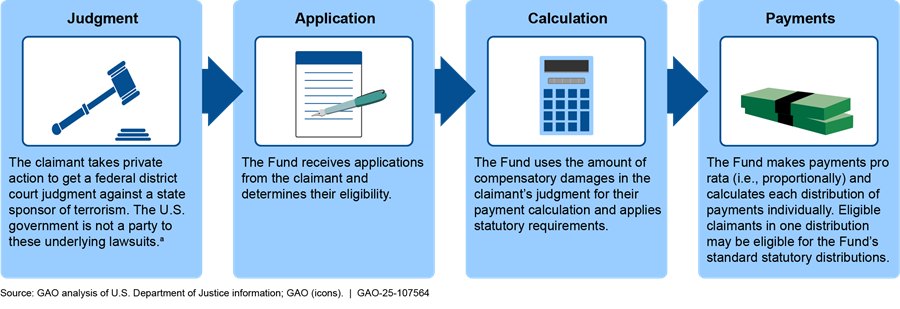

The Fund is administered by a Special Master—an official appointed by the Attorney General under the Victims Act to administer compensation from the Fund—and supported by Department of Justice (DOJ) personnel.[8] Subject to the availability of funding, the Fund provides compensation through regular payment distribution rounds.[9] To be eligible to receive compensation from the Fund, an individual must submit a claim, through an application. Additionally, a claimant generally must hold a final judgment issued by a United States district court awarding the claimant compensatory damages arising from acts of international terrorism. For regular payment distribution rounds, once a claim is determined eligible, the Fund is to determine the amount of payment on an individual basis in accordance with specific statutory requirements, including that payments be made on a pro rata basis (i.e., proportionally), that compensatory damages awards on which claims are based are subject to statutory caps, and that applicants must provide information regarding compensation from sources other than the Fund, among other requirements.[10]

DOJ published a Federal Register Notice in July 2016 that describes the Fund’s eligibility requirements and the procedures for the submission and consideration of applications to the Fund.[11] According to Fund officials, the Fund uses the procedures set forth in the Notice to determine the eligibility of victims to receive payments from the Fund. For example, it uses the procedures to determine if the claimant submitted a prior application to the Fund and was found eligible for regular payment distributions. The Notice specifies that “[o]nly one application may be submitted for each claim.”[12] Figure 1 below shows the claimant application process to participate in the Fund.

aThe Fund also provides compensation to eligible claimants who were held hostage in the United States embassy in Iran from 1979 to 1981 and their spouses and children. These claimants do not need to obtain judgments and are not the subject of GAO’s mandate.

Lump Sum Catch-Up Payments for 1983 Beirut Barracks Bombing Victims and 1996 Khobar Towers Bombing Victims

The Fairness Act included a provision for GAO to calculate lump sum catch-up payments to 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims.[13] Lump sum catch-up payments to specific claimants as determined by GAO are separate from the Fund’s regular payment distribution rounds. The Fairness Act further established eligibility requirements for these lump sum catch-up payments. In order to receive these payments, Beirut barracks and Khobar Towers bombing victims must have submitted applications to the Fund within the statutory application time frame, which was December 29, 2022, through June 27, 2023.[14] They must also have been awarded a qualifying final judgment before December 29, 2022.[15]

In establishing the framework for these lump sum catch-up payments, the Fairness Act amended the Victims Act to provide a new opportunity for certain victims of these acts of state sponsored terrorism to participate in the Fund and to receive lump sum catch-up payments. Before the enactment of the Fairness Act, many Beirut barracks bombing and Khobar Towers bombing victims had not applied to participate in the Fund, although they were not precluded from doing so. Because victims must generally submit applications within 90 days of obtaining a final judgment, those who had not done so were time barred from applying.[16] The Fairness Act changed that and allowed these victims, who had not previously submitted any applications to the Fund, to apply to participate in the Fund and to receive lump sum catch-up payments.[17] The Fairness Act, in directing the Comptroller General to determine amounts of lump sum catch-up payments, also permitted Beirut barracks bombing and Khobar Towers bombing victims who had previously applied and been deemed eligible for regular distribution payments from the Fund to submit duplicate or successive applications to the Fund in order to apply for these catch-up payments.[18] We refer to applications in this group as “successive applications.”[19]

The Fairness Act also amended a provision of the Victims Act related to victims who were involved in certain lawsuits against Iran. At the time the Fund was established, the law allowed plaintiffs in two identified lawsuits, Peterson v. Islamic Republic of Iran (Peterson) and In Re 650 Fifth Avenue and Related Properties (In Re 650)[20] to make a choice regarding submitting an application to the Fund. Plaintiffs could choose not to apply to participate in the Fund and receive and retain payments from Peterson or In Re 650, if any.[21] Alternatively, plaintiffs could choose to participate in the Fund. If they chose to participate, they were required to irrevocably assign to the Fund all rights, title, and interest in their claims to the assets at issue in those cases.[22] Lastly, plaintiffs in these cases were also permitted to submit an application for conditional payment from the Fund. For these “conditional claimants,” the Special Master was required to determine and set aside payment amounts, pending a final judgment in these cases.[23] In the event that a final judgment was entered in favor of the plaintiffs in the Peterson action and funds were distributed, the payments allocated to claimants who applied for a conditional payment were to be considered void, and any funds previously allocated to such conditional payments were to be made available and distributed to all other eligible claimants.[24] A final judgment in favor of plaintiffs in Peterson was entered, and distributions to them commenced on October 19, 2016.[25] Accordingly, conditional claimants who received funds through the Peterson case did not receive award payments from the Fund, and the Fund did not include them in award calculations in 2017 for the first round of payments or in subsequent payment rounds.[26] The Fairness Act allowed the Comptroller General to include both the plaintiffs in Peterson who chose not to participate in the Fund as well as these conditional claimants in GAO’s lump sum catch-up payment calculations because they satisfied the eligibility requirements for those payments.[27] The conditional claimants are eligible for lump sum catch-up payments despite their decision to file applications for conditional payment from the Fund and accept Peterson payments.[28]

The Fairness Act also amended a provision of the Victims Act that limits the ability of claimants to receive payments from the Fund based on the percent of compensatory damages awarded to others in the Fund. The Victims Act outlines minimum payments requirements based on whether eligible applicants have received, or are entitled or scheduled to receive, 30 percent or more of the amount they are owed on their claims from any source other than the Fund.[29] Such applicants shall not receive any payment from the Fund until all other eligible applicants generally have received from the Fund an amount equal to 30 percent of the amount they are owed (referred to as the “30 percent rule”).[30] As a result of amendments made to the Victims Act by the Fairness Act, Peterson plaintiffs who may not receive regular Fund distributions because they have received 30 percent or more of their judgments from sources other than the Fund can receive lump sum catch-up payments.[31] The Peterson plaintiffs who applied during the statutory application time frame had received more than 30 percent of their judgments.

The Fund received applications from 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims who applied during the statutory application time frame. For applications submitted by new entrants to the Fund, Fund officials report that they assessed the applications consistent with existing Fund procedures, including determining claimants’ eligibility to participate in the Fund. For claimants who had already been in the Fund and submitted new applications during the statutory application time frame—i.e., successive applications—the Fund administratively closed their applications. According to the Fund, in accordance with Fund procedures in place since 2016, individuals, including those already found eligible by the Fund or who applied conditionally to the Fund, can submit only one application to the Fund.

Lump Sum Catch-Up Payments Total About $614 Million; However, Some Potentially Eligible Claimants Did Not Submit Applications

Lump Sum Catch-Up Payments for 2,081 Claimants Total About $614 Million

According to our analysis of the Fund’s data, a total of 2,081 claimants submitted applications during the statutory application time frame—on or after December 29, 2022, and by June 27, 2023. Of these applications, 1,773 were submitted by Beirut barracks victims and 308 were submitted by Khobar Towers victims.

Additionally, of the 2,081 applications,1,569 were submitted by new claimants who had not previously applied to the Fund and who are eligible to participate in the Fund, and 512 were submitted by existing claimants who received a prior eligibility determination from the Fund for regular payment distributions.[32] For purposes of our analysis, we determined that these 2,081 claimants were eligible for catch-up payments and therefore we included them in our calculation.

We determined that the total lump sum catch-up payments for the 2,081 eligible Beirut barracks and Khobar Towers bombing victims total about $614 million: about $493 million for the 1,773 eligible Beirut barracks bombing victims, and about $120 million for the 308 eligible Khobar Towers bombing victims.[33] The lump sum catch-up payment amount is the amount that, after receiving the lump sum catch-up payments, would result in the percentage of claims received from the Fund being equal to the percentage of the claims of non-9/11 victims of state sponsored terrorism received from the Fund. To calculate this total:

· We first determined the overall percentage of claims non-9/11 victims of state sponsored terrorism received from the Fund during the first three rounds of Fund distributions. This was calculated by determining the payment amounts received by non-9/11 claimants from the Fund in the first through third payment rounds.[34] We then summed the payments for the three payment rounds across all non-9/11 claimants.[35] This totaled about $1.448 billion. Next, we determined the net eligible claims[36] of the non-9/11 claimants as of the third round that they received a payment, offset by qualifying compensation from other sources, and summed across all claimants. This totaled about $9.027 billion. We divided the amount of payments from the Fund (i.e., about $1.448 billion) by the non-9/11 victims’ net eligible claims offset by qualifying compensation from other sources (i.e., about $9.027 billion) to identify 16.0353 percent. This determines the amount of payments that non-9/11 victims received as a percentage of their claims during the first three rounds of the Fund distributions.

· Using this percent, we determined the total amount needed to provide lump sum catch-up payments to the eligible Beirut barracks and Khobar Towers claimants.[37] We applied the percent to the claimants’ net eligible claims offset by qualifying compensation from other sources (about $4.106 billion). This produced an amount of about $658 million.

· We then subtracted payments that some eligible Beirut barracks and Khobar Towers claimants have received during the first four rounds of the Fund’s distributions (about $44 million). After subtracting that amount, the final lump sum catch-up payment amount was about $614 million.

DOJ Guidance May Have Discouraged up to 274 Beirut Barracks and Khobar Towers Bombing Victims Who Were Already in the Fund from Applying for Lump Sum Catch-Up Payments

Under the Fairness Act, one of the requirements for 1983 Beirut barracks and 1996 Khobar Towers claimants to receive a lump sum catch-up payment is that claimants must have “submitted applications” during the statutory application time frame.[38] In our interpretation of the Comptroller General’s mandate under the Fairness Act, claimants who previously applied to the Fund and were found eligible could submit an application in order to apply for lump sum catch-up payments. The Fund, however, takes the view that claimants who have applied to the Fund and were found eligible cannot file subsequent applications—for lump sum catch-up payments or any other reason.

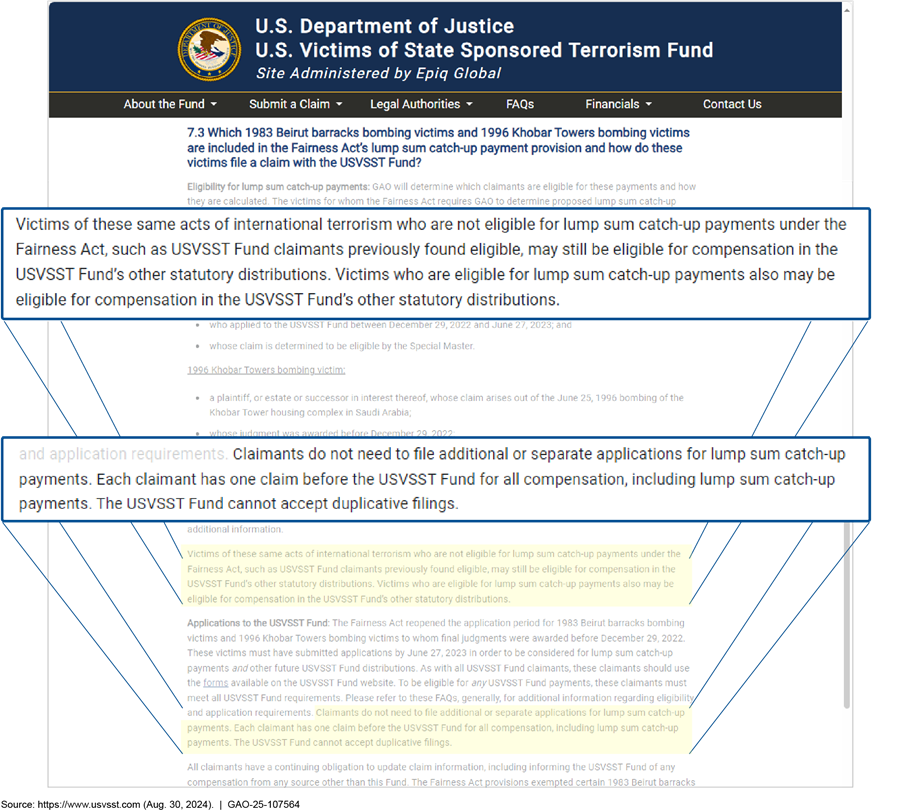

According to Fund officials, the statute and Fund procedures together prevent the Fund from accepting successive applications from existing eligible claimants because each claimant to the Fund may only submit one application per claim.[39] This effectively means that these claimants cannot receive lump sum catch-up payments because they cannot have submitted an application during the statutory application time frame. The procedures the Fund is referring to were initially issued in a July 14, 2016, Federal Register Notice, which stated that “[o]nly one application may be submitted for each claim.”[40] The Fund did not change these application procedures after the enactment of the Fairness Act.[41] Rather, to comply with the Fairness Act’s requirement that the Special Master update Fund procedures as necessary as a result of the Fairness Act’s enactment, the Fund updated the frequently asked questions section of its website.[42] The frequently asked questions conveyed that Beirut barracks bombing victims and Khobar Towers bombing victims previously found eligible are not eligible to receive lump sum catch-up payments (see fig. 2).[43]

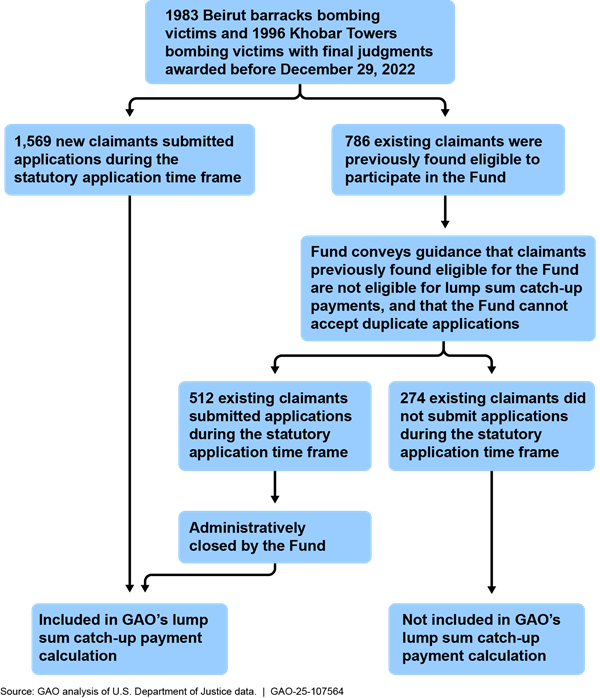

According to our analysis of the Fund’s data, 1,569 new Beirut barracks and Khobar Towers claimants submitted applications during the statutory application time frame and were determined by the Fund to be eligible to participate in the Fund. These claimants are included in our calculation of lump sum catch-up payments. Additionally, according to our analysis of the Fund’s data, 786 Beirut barracks and Khobar Towers bombing claimants previously applied to the Fund and were previously found eligible to participate in the Fund (i.e., for the Fund’s regular payment distribution rounds) (see fig. 3).

Of these 786 claimants, 512 submitted applications during the statutory application time frame despite DOJ’s guidance stating that the Fund could not accept duplicate applications and that they were not eligible for lump sum catch-up payments.[44] According to Fund officials, the Fund administratively closed these applications because the Fund considered the applications to be successive applications. Although the Fund administratively closed these applications, we included them in our catch-up payment calculations because these 512 claimants submitted applications during the statutory application time frame and met other applicable requirements. According to Fund officials, as provided by the Fairness Act, the Special Master will authorize lump sum catch-up payments in amounts as determined by GAO.

Additionally, in our analysis of the Fund’s data, 274 of the 786 claimants did not submit applications during the statutory application time frame. According to Fund officials, the 274 claimants may have refrained from submitting applications after contacting the Fund or reviewing the Fund’s application procedures based on the advice from their counsel or the Fund. In comments received on our July 2024 Federal Register Notice, many individuals and attorneys stated they were dissuaded from filing successive applications because of information they received from the Fund. For instance, two attorneys representing 225 claimants with prior eligibility determinations commented that they did not submit applications for lump sum catch-up payments because Fund officials told them the claimants were not eligible and that any duplicate applications submitted would not be accepted.[45]

The Comptroller General does not have the authority to include the 274 claimants in the determination of lump sum catch-up payments because individuals must have submitted an application to be eligible for those payments under the Fairness Act.[46] However, in our analysis of the Fund’s data, we estimated that lump sum catch-up payments for these 274 claimants would be about $116 million.[47]

The Special Master has the authority to grant a claimant, for good cause, a reasonable extension of the application submission deadlines.[48] However, according to Fund officials, the Special Master cannot grant an application deadline extension to the 274 claimants who did not re-apply during the Fairness Act’s application time frame because the Special Master cannot accept successive applications. In other words, because only new claimants can submit applications during the Fairness Act’s application time frame, there is no basis for an application deadline extension from the Special Master, according to Fund officials. In addition, Fund officials have stated that this “good cause” provision by its terms does not apply to provisions of the Fairness Act related to lump sum catch-up payments.[49] As such, after receiving requests to grant such a deadline extension from existing eligible Beirut barracks or Khobar Towers claimants, the Special Master informed those claimants that their duplicate claims would be administratively closed and did not grant any deadline extensions.

The Fairness Act does not authorize GAO to include these claimants in our calculations of lump sum catch-up payments given the application submission requirement, and Fund officials have stated that the Fund’s procedures do not provide for accepting or reviewing additional applications from claimants who previously applied to the Fund and were found eligible. This means there is no mechanism to address the advice the Fund provided that may have prevented otherwise eligible claimants from submitting applications during the statutory application time frame. Amending the Justice for United States Victims of State Sponsored Terrorism Act to direct the Special Master to make lump sum catch-up payments to those among the 274 claimants who did not submit applications during the statutory application time frame because of Fund guidance would provide a mechanism for them to receive lump sum catch-up payments.[50] The claimants who can demonstrate to the Fund that they did not apply for lump sum catch-up payments because of Fund guidance—such as through documentation of written or verbal communications with the Fund, or a sworn statement that describes reliance on that guidance—would be placed in the same position as if the Fund had not provided guidance contrary to GAO’s interpretation and implementation of the Comptroller General’s mandate under the Fairness Act. To ensure that the Fund can identify these claimants and make payments if the statute is amended, we are providing the claim identification numbers and lump sum catch-up payment amounts that we calculated for the 274 claimants to the Special Master with this report.

Conclusions

Certain U.S. persons injured in acts of international state sponsored terrorism and their immediate family members may be eligible to receive compensation from the United States Victims of State Sponsored Terrorism Fund. The Fairness Act included a provision for GAO to calculate lump sum catch-up payments to 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims who applied during the act’s application time frame. A total of 2,081 claimants timely submitted such applications, and we determined that the lump sum catch-up payments for these claimants total about $614 million.

Fund guidance may have discouraged up to 274 Beirut barracks and Khobar Towers bombing victims who were already in the Fund from submitting applications during the statutory application time frame in order to apply for lump sum catch-up payments. The Fund conveyed to the public, including to existing eligible claimants and their counsel, that Beirut barracks bombing victims and Khobar Towers bombing victims previously found eligible for regular payment distributions are not eligible to receive lump sum catch-up payments. We could not include these claimants in our catch-up payment calculations because they did not submit applications during the time frame, which is a requirement under the Fairness Act. Amending the Justice for United States Victims of State Sponsored Terrorism Act to direct the Special Master to make lump sum catch-up payments to those among the 274 claimants who did not submit applications because of Fund guidance would provide a mechanism for them to receive lump sum catch-up payments.

Matter for Congressional Consideration

Congress should consider amending the Justice for United States Victims of State Sponsored Terrorism Act to direct the Special Master to make lump sum catch-up payments to 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims who did not apply for those payments because of DOJ guidance that stated that only one application may be submitted for each claim and that Fund claimants previously found eligible for regular payment distributions are not eligible for lump sum catch-up payments. (Matter for Consideration 1).

Agency Comments and our Evaluation

We provided a draft of this report to the Department of Justice (DOJ) for review and comment. DOJ responded to the draft in written comments, which we reproduced in appendix IV.

In its comments, DOJ described the department’s and the Special Master’s roles in administering the United States Victims of State Sponsored Terrorism Fund (Fund), as well as the application procedures issued by the Fund. DOJ also noted amendments made to the Fund’s governing statute, the Justice for United States Victims of State Sponsored Terrorism Act (Victims Act), including provisions for GAO to determine lump sum catch-up payments to certain groups of victims.

In its comments, DOJ stated that GAO established an application submission requirement for claimants to be eligible for lump sum catch-up payments. Specifically, DOJ stated that GAO “add[ed] a new application procedure and requirement that applied to only 786 of the Beirut barracks bombing or Khobar Towers bombing claimants,” that GAO did not provide notice to claimants of this requirement, and that the Fairness Act itself did not mandate or establish separate application procedures for lump sum catch-up payments. As noted in our report, in order to receive catch-up payments, the Fairness Act required Beirut barracks and Khobar Towers bombing victims to have submitted applications to the Fund within the statutory application time frame, which was December 29, 2022, through June 27, 2023.[51] This is a statutory requirement, not one created by GAO. While the Fairness Act did not prescribe the form of application, an application was explicitly required. Further, we note that claimants recognized this explicit statutory requirement. Hundreds of existing claimants submitted applications during the statutory application time frame in order to apply for catch-up payments, despite DOJ’s guidance stating that the Fund could not accept duplicate applications and that existing claimants were not eligible for those payments, and additional claimants flagged the requirement in their questions or requests for advice from the Fund.

DOJ also stated that we used different procedures for lump sum catch-up payments for Beirut barracks and Khobar Towers bombing victims than for lump sum catch-up payments for 9/11 victims, spouses, and dependents. It stated that, for the 9/11 cohort, we calculated catch-up payments “based on each claimants’ [sic] sole application to the Fund,” while requiring separate applications for the Beirut barracks and Khobar Towers cohort. DOJ further stated that “[t]he Fund treated the provisions in the statute relating to these [lump sum catch-up payments] the same way as it treated the analogous language in the statute relating to the 9/11 [lump sum catch-up payments].” However, there were key differences in the statutory provisions for the 9/11 cohort and the Beirut barracks and Khobar Towers cohort with respect to the application submission requirement, such that the language was not analogous. As noted in our report, the Sudan Claims Resolution Act permitted 9/11 victims, spouses, and dependents to receive lump sum catch-up payments if they had applied to the Fund before the date of enactment of that act.[52] Therefore, GAO could calculate lump sum catch-up payments for 9/11 victims, spouses, and dependents who submitted applications to the Fund prior to the date of enactment of the Sudan Claims Resolution Act. In contrast, GAO cannot calculate lump sum catch-up payments to Beirut barracks bombing victims and Khobar Towers bombing victims unless they have submitted an application during the 180-day period from the date of enactment of the Fairness Act.

In order to give effect to the application submission requirement found in the Fairness Act, we included in our calculation of lump sum catch-up payments individuals who submitted applications during the statutory application time frame and were determined by the Fund to be eligible to participate in the Fund. This included 512 existing claimants. Because the Fund publicly conveyed that Beirut barracks bombing victims and Khobar Towers bombing victims previously found eligible need not apply for lump sum catch-up payments and are not eligible to receive those payments, up to 274 additional existing claimants may have refrained from submitting applications. As GAO lacks the authority to determine catch-up payments for claimants who did not submit applications during the statutory time frame, our report includes a matter for congressional consideration. This matter, if implemented, would direct the Special Master to make lump sum catch-up payments to those among the 274 existing claimants who did not submit applications during the statutory application time frame because of Fund guidance.

DOJ also stated its views regarding GAO’s inclusion of the 78 individuals who are Peterson conditional claimants in its lump sum catch-up payment calculations. According to DOJ, “GAO’s decision to permit ‘successive’ applications ignores the statutory choice these claimants were required to and did make at the inception of the Fund.” However, the Fairness Act provided for the Comptroller General to include in GAO’s lump sum catch-up payment calculations the claimants who satisfied the eligibility requirements for those payments.[53] Because the 78 conditional claimants satisfied these eligibility requirements, GAO included them. The Fairness Act also amended a provision of the Victims Act that limits the ability of claimants to receive payments from the Fund until other claimants in the Fund have received 30 percent of their compensatory damages (i.e., the “30 percent rule”). The amendment specifically allows Peterson plaintiffs who have received 30 percent or more of their judgments from sources other than the Fund to receive lump sum catch-up payments.[54] Accordingly, this provision of the Fairness Act required an approach for GAO’s lump sum catch-up payment calculations that is different than the Fund’s methodology for regular payment distributions. As a result of these amendments, the 78 Peterson conditional claimants, who had already received more than 30 percent of their judgments, can receive lump sum catch-up payments.

DOJ also stated that GAO’s lump sum catch-up payment calculation methodology, particularly our use of offsets, diverges from that of the Fund’s long-standing, publicly available calculation methodology. DOJ further noted that “[t]his manner of applying offsets will result in payments of [lump sum catch-up payments] to claimants who have already recovered large percentages of their compensatory damages amounts from sources of compensation other than the Fund.” We agree. The Fairness Act requires a payment methodology for lump sum catch-up payments that is different from the Fund’s payment methodology. As noted in our report, the Victims Act, as amended by the Fairness Act, requires that we determine lump sum catch-up payments “based on the amounts outstanding and unpaid on eligible claims.” As such, we subtracted recoveries from other sources received by claimants under their final judgments from their net eligible claims to produce the amount “outstanding and unpaid” on their claims. This is not necessarily equivalent to how the Fund applies offsets in administering the 30 percent rule. We did not apply the 30 percent rule because, for purposes of lump sum catch-up payments, the Fairness Act made this provision inapplicable to Peterson plaintiffs who had received 30 percent or more of their judgments as a result of those proceedings.

Finally, DOJ stated that the Special Master will authorize lump sum catch-up payments in amounts calculated by GAO, consistent with the statute.

We are sending copies of this report to the appropriate congressional committees, the Department of Justice, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

Information on each lump sum catch-up payment amount pursuant to 34 U.S.C. 20144(d)(4)(D)(iii)(I)-(II) is being provided under separate cover.

If you or your staff have any questions about this report, please contact Triana McNeil at (202) 512-8777 or McNeilT@gao.gov or Nagla’a El-Hodiri at (202) 512-7279 or ElhodiriN@gao.gov.

Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix V.

Triana McNeil

Director, Homeland Security and Justice

Nagla’a El-Hodiri

Director, International Affairs and Trade

List of Committees

The Honorable Patty Murray

Chair

The Honorable Susan Collins

Vice-Chair

Committee on Appropriations

United States Senate

The Honorable Richard J. Durbin

Chair

The Honorable Lindsey Graham

Ranking Member

Committee on the Judiciary

United States Senate

The Honorable Tom Cole

Chairman

The Honorable Rosa DeLauro

Ranking Member

Committee on Appropriations

House of Representatives

The Honorable Jim Jordan

Chairman

The Honorable Jerrold Nadler

Ranking Member

Committee on the Judiciary

House of Representatives

Our objective was to determine lump sum catch-up payments for eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims.[55] To determine the lump sum catch-up payment amounts, we obtained Fund data from the Department of Justice (DOJ). We obtained spreadsheets of Fund data that included information on (1) payments from the Fund received by non-9/11 claimants in the first through third payment rounds;[56] (2) net eligible claims[57] of these non-9/11 claimants; (3) qualifying compensation from other sources received by these non-9/11 claimants;[58] (4) net eligible claims[59] of the 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims who submitted eligible applications to the Fund within the statutory application time frame (between December 29, 2022, and June 27, 2023); and (5) qualifying compensation from other sources received by the 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims who submitted eligible applications to the Fund within the statutory application time frame. We also obtained information on qualifying compensation from other sources from counsel representing the 78 conditional claimants who were judgment creditors in Peterson v. Islamic Republic of Iran.[60] This information covered seventeen payment distributions to these individuals, including payments received in connection with Peterson.

First, we determined the amount of payments that non-9/11 claimants received in the first three rounds of Fund payments, as a percentage of their net eligible claims offset by qualifying compensation from other sources. We determined the payment amounts received by non-9/11 claimants from the Fund in the first through third payment rounds.[61] We then summed the payments for the three payment rounds across all non-9/11 claimants. We determined the net eligible claims of the non-9/11 claimants as of the third round that they received a payment, offset by qualifying compensation from other sources, and summed across all claimants. Next, we divided the amount of payments by the net eligible claims offset by qualifying compensation from other sources to determine the percentage called for in our mandate of 16.0353 percent.

Second, using GAO’s percentage calculation, we determined the total amount needed to provide lump sum catch-up payments to the 2,081 eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims based on these victims’ net eligible claims offset by qualifying compensation from other sources. To identify a claimant’s lump sum catch-up payment, we multiplied this amount by the GAO percentage that we calculated above. Then, to identify a net lump sum catch-up payment, we subtracted any amount of money a claimant had previously received from the Fund.

According to information from the Fund, some claimants who are eligible for regular Fund distributions and who applied for lump sum catch-up payments reported that they had recovered some payments on their final judgments. We obtained from the Fund information on qualifying compensation from other sources as of March 2024 for these claimants. Fund officials confirmed that, based on information included in these applications, all applicants who reported compensation from other sources are judgment creditors in Peterson whose offsets are the amounts recovered in Peterson. These offsets amounted to 30 percent or more of these claimants’ judgments. We separately confirmed that the conditional claimants who were judgment creditors in Peterson also received 30 percent or more of their judgments in connection with that litigation by obtaining offset information from counsel representing those claimants. As a result, claimants from both of these groups were permitted to receive lump sum catch-up payments under the terms of the Fairness Act, although they ordinarily would be barred from receiving regular payment distributions from the Fund.[62]

We received data from the Fund as of May 2024 for 1,773 claimants for the 1983 Beirut barracks bombing and 308 claimants for the 1996 Khobar Towers bombing who submitted eligible applications to the Fund and applied in the statutory application time frame. Of those, 512 had received a prior eligibility determination from the Fund[63] and 1,569 were new applicants. We also received data on 5 victims of these attacks who submitted applications during the statutory application time frame whose eligibility was not approved by the Fund as of October 2024. We did not include these victims in our final lump sum catch-up payment calculations.

We assessed the reliability of the Fund data by reviewing related documentation and interviewing knowledgeable agency officials. We also assessed the reliability of the data we received from attorneys representing the 78 conditional claimants who were judgment creditors in Peterson by interviewing those attorneys and comparing the data they provided to the Fund data. We used the data provided by those attorneys because that provided more information on qualifying compensation from other sources than the information provided by the Fund. Our review of the data found it to be sufficiently reliable for the purposes of determining catch-up payments for eligible claimants.

On December 28, 2023, we published a Federal Register Notice that detailed our proposed methodology to estimate lump sum catch-up payments to eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims.[64] We received 319 comments on this Notice, which we summarized in our Notice published on July 9, 2024.[65] GAO received 310 comments from individuals and 9 comments from law firms representing victims of state sponsored terrorism. GAO received 316 comments by email; the remaining 3 comments were received in voicemails or letters. In general, comments from individuals were from 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims, 9/11 victims and their family members, and Members of Congress;[66] and comments from law firms were from attorneys representing 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims. In our July 9, 2024, Notice, we summarized and responded to the types of comments GAO received. The types of comments received included comments that raised equity issues related to the United States Victims of State Sponsored Terrorism Fund (Fund) and lump sum catch-up payments; raised issues related to eligibility criteria for a lump sum catch-up payment; expressed support for GAO’s percentage calculation methodology or asked GAO to use the Fund’s payment percentage; and provided differing views on offsetting eligible claims with compensation from other sources for lump sum catch-up payments.

Our July 2024 Federal Register Notice contained our revised methodology for calculating lump sum catch-up payments to eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims and the estimated amount needed for the payments. We received a total of 80 comments. GAO received 72 comments from individuals and 8 comments from law firms representing victims of state sponsored terrorism. GAO received 78 comments by email; the remaining 2 comments were received in voicemails. In general, comments from individuals were from 1983 Beirut barracks bombing victims, 1996 Khobar Towers bombing victims, 9/11 victims and their family members, and Members of Congress;[67] and comments from law firms were from attorneys representing 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims.

Summary of Comments on Second Federal Register Notice

GAO has carefully considered all comments received. Below, we summarize and respond to the following types of comments GAO received:[68]

· Eligibility criteria for a lump sum catch-up payment;

· the Fund’s position on successive applications;

· responsibility for determining who is a claimant in the Fund;

· Request to use the Fund’s payment percentage;

· Offsetting eligible claims with compensation from other sources for lump sum catch-up payments;

· Calculation of lump sum catch-up payments;

· Meaning of “1983 Beirut barracks bombing victim” and “1996 Khobar Towers bombing victim”;

· Meaning of “final judgment”; and

· Issue related to the methodology of prior Fund distributions.

Eligibility Criteria for a Lump Sum Catch-up Payment: the Fund’s Position on Successive Applications

GAO received comments regarding the Fund’s policy that victims cannot submit successive applications in order to apply for lump sum catch-up payments. Some comments expressed support for GAO’s view that the provision for lump sum catch-up payments in section 101 of the Fairness for 9/11 Families Act (Fairness Act) does not disqualify claimants who previously applied to the Fund and then filed a subsequent, timely application for those payments. The majority of comments raised concerns about the Fund’s policy on eligibility. Many commenters expressed concern about the effect of the Fund’s position that claimants who previously applied to the Fund and were found eligible, could not submit applications during the statutory application time frame in order to apply for lump sum catch-up payments. We received comments from or on behalf of at least 232 of the 274 Beirut barracks and Khobar Towers bombing victims who had received prior eligibility determinations from the Fund and did not apply for lump sum catch-up payments (or about 85 percent of those individuals). These commenters stated that they were dissuaded from filing successive applications because of information they received from the Fund. For instance, two attorneys representing 225 claimants with prior eligibility determinations commented that they did not submit applications for lump sum catch-up payments because Fund officials told them the claimants were not eligible, and that any duplicate applications submitted would not be accepted. According to a comment from one of these attorneys, two of their clients only received a fourth-round distribution from the Fund, which amounted to a payment percentage of 0.4047 percent. Commenters asked GAO to recommend that the Fund take action to address this issue, such as notifying claimants of the error, opening a new application period for lump sum catch-up payments, and providing updated data to GAO for revised lump sum catch-up payment estimates. Comments also asked GAO to revise its lump sum catch-up payment calculations to include 1983 Beirut barracks bombing victims and 1996 Khobar Towers victims who had a claim on file with the Fund before December 29, 2022.

GAO’s Response: One of the requirements under the Fairness Act to be able to receive a lump sum catch-up payment is that claimants must have “submitted applications” between December 29, 2022 and June 27, 2023.[69] In our interpretation of the Comptroller General’s mandate under the Fairness Act, claimants who previously applied to the Fund and were found eligible could still apply for lump sum catch-up payments. Because such claimants are able to receive these payments, we have included them in our payment calculations that are to be used by the Fund to provide lump sum catch-up payments. However, the Fairness Act does not permit GAO to include claimants who did not submit applications during the statutory application time frame in our determination of lump sum catch-up payments, given the Fairness Act’s application submission requirement. According to Fund officials, the statute and Fund procedures together prevent the Fund from accepting successive applications from existing eligible claimants because each claimant to the Fund may only submit one application per claim.[70] The Special Master has the authority to grant a claimant, for good cause, a reasonable extension of the application submission deadlines.[71] However, according to Fund officials, the Special Master cannot grant an application deadline extension to an existing eligible Beirut barracks or Khobar Towers claimant who did not re-apply during the Fairness Act’s application time frame because the Special Master cannot accept successive applications. In other words, because only new claimants can submit applications during the Fairness Act’s application time frame, there is no basis for an application deadline extension from the Special Master, according to Fund officials. In addition, Fund officials have stated that this “good cause” provision by its terms does not apply to provisions of the Fairness Act related to lump sum catch-up payments.[72] As such, after receiving requests to grant such a deadline extension from existing eligible Beirut barracks or Khobar Towers claimants, the Special Master informed those claimants that their duplicate claims would be administratively closed and did not grant any deadline extensions. In light of this issue, which, if left unresolved will mean some 274 otherwise eligible victims will not receive lump sum catch-up payments, our report includes a matter for congressional consideration. In particular, we state that Congress should consider amending the Justice for United States Victims of State Sponsored Terrorism Act (Victims Act) to direct the Special Master to make lump sum catch-up payments to claimants who did not apply for those payments because of Fund guidance. Amending the statute would place affected claimants in the same position as if the Fund had not provided guidance contrary to GAO’s interpretation of the Comptroller General’s mandate in the Fairness Act.[73]

Eligibility Criteria for a Lump Sum Catch-up Payment: Responsibility for Determining who is a Claimant in the Fund

One comment responded to the information GAO provided in its second Federal Register Notice that the Fund was, at the time we issued that Notice, reviewing the eligibility of 14 victims of the 1983 Beirut barracks bombing and the 1996 Khobar Towers bombing. The comment, submitted by an attorney, stated that GAO, not the Fund, should determine whether these victims fall within the statutory definitions of 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims.[74]

GAO’s Response: Under the Victims Act, the Special Master has the authority to determine whether a claim is an eligible claim.[75] Section 101 of the Fairness Act directed the Comptroller General to propose lump sum catch-up payments to the 1983 Beirut barracks bombing victims and the 1996 Khobar Towers bombing victims who have submitted applications in accordance with 34 U.S.C. 20144(c)(3)(A)(ii)(II).[76] As a precondition for receiving lump sum catch-up payments, the Fund must have deemed a victim eligible to participate in the Fund. The language in the Comptroller General’s mandate does not alter the Special Master’s authority for determining whether a victim submitted an eligible claim that would allow the victim to participate in the Fund, and does not confer such authority on the Comptroller General. As such, GAO is not able to make a determination about whether any of the victims it identified in its second Federal Register Notice as potentially eligible are, in fact, eligible to participate in the Fund.

Request to Use the Fund’s Payment Percentage

GAO received comments about the use of the Fund’s payment percentage for our estimation of lump sum catch-up payments. For example, commenters suggested that GAO add the payment percentages calculated by the Fund in the first through fourth rounds to determine the percentage needed for catch-up payments. Commenters also stated that the Comptroller General’s mandate was designed to generate over one billion dollars in lump sum catch-up payments.

GAO’s Response: We responded to similar comments in our second Federal Register Notice, and direct individuals to that response.[77] The following response supplements that earlier response.

GAO is taking an approach that is consistent with its approach in conducting a similar audit pursuant to the Sudan Claims Resolution Act. The language used in the Fairness Act to describe the percentage resulting from the receipt of lump sum catch-up payments for 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims is the same as the pertinent language in the Sudan Claims Resolution Act, which directed us to estimate lump sum catch-up payments to 9/11 victims, spouses, and dependents.[78] In other words, Congress used the same language on calculating the payment percentage for both GAO audits, both of which are provisions of the Victims Act.[79] Identical words used in different parts of the same statute are presumed to have the same meaning.[80]

In conducting its earlier audit pursuant to the Sudan Claims Resolution Act, GAO did not use the Fund’s payment percentage in calculating lump sum catch-up payments.[81] As a result, the percentage calculation by GAO (5.8573 percent) was lower than the Fund’s payment percentage (17.8516 percent). These respective calculations reflected different approaches. For the two payment rounds at issue, GAO identified the overall percentage of the claims that 9/11 family members received from the Fund. This approach took into account that some claimants only received second round payments, while others received payments in both rounds.[82] The Fund calculates a payment percentage for each distribution round separately, and does not calculate a weighted average percentage among claimants who are found eligible across different payment rounds.[83] As a result, GAO could not use the Fund’s approach to satisfy its statutory mandate. These differences contributed to a GAO percentage calculation that was lower than the Fund’s payment percentage. In the Fairness Act—which also contains GAO’s mandate to calculate lump sum catch-up payments for 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims—Congress appropriated lump sum catch-up payments to 9/11 victims, spouses, and dependents in amounts consistent with GAO’s payment percentage calculation.[84]

As with that earlier audit, the percentage calculation by GAO (16.0353 percent) is lower than the Fund’s payment percentage in the first through third rounds (23.6901 percent). As with that earlier audit, these calculations reflected different approaches. For the three payment rounds at issue, GAO identified the overall percentage of the claims that non-9/11 victims of state sponsored terrorism received from the Fund. This approach took into account that some non-9/11 claimants only received second and third round payments (and not first round payments), and that some non-9/11 claimants only received third round payments (and not first or second round payments). The Fund calculates a payment percentage for each distribution round separately, and does not calculate a weighted average percentage among claimants who are found eligible across different payment rounds. As a result, GAO could not use the Fund’s approach to satisfy its statutory mandate. Consistent with the outcome of that earlier audit, given these methodological differences, GAO’s percentage calculation is lower than the Fund’s payment percentage. While GAO acknowledges that commenters have cited the statements of individual Members of Congress, some of whom were involved in developing the Fairness Act, the statute tasked GAO with determining amounts of proposed lump sum catch-up payments pursuant to the terms of the statute.

Offsetting Eligible Claims with Compensation from Other Sources for Lump Sum Catch-up Payments

GAO received comments regarding our approach of offsetting potentially eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims’ net eligible claims by compensation from other sources. Some commenters advocated for the final lump sum catch-up payment estimates provided by GAO to not be offset by compensation from other sources for this population. These commenters stated that 34 U.S.C. 20144(d)(3)(A) does not provide authority for GAO to use “sources other than this Fund” as an offset; that GAO ignores portions of 34 U.S.C. 20144(d)(3)(A); that GAO’s interpretation does not reflect congressional intent; and that GAO’s approach is not consistent with the one it took in estimating lump sum catch-up payments to 9/11 victims, spouses, and dependents.

GAO’s Response: We responded to similar comments in our second Federal Register Notice, and direct individuals to that response.[85] The following response supplements that earlier response.

Section 101 of the Fairness Act requires GAO to conduct this audit “in accordance with clauses (i) and (ii) of [34 U.S.C. 20144(d)(3)(A)].”[86] Clause (ii) involves the application of individual and family statutory caps, which we applied in calculating claimants’ net eligible claims. Clause (i) generally provides direction to the Special Master on how to divide and allocate funds among 9/11 and non-9/11 victims.[87] While clause (i) generally imposes requirements on the Special Master rather than the Comptroller General, in order to give meaning to the language in GAO’s mandate that it conduct this audit in accordance with clause (i), there must be language in clause (i) applicable to GAO.[88] Of the three provisions in clause (i), the first and third relate to 9/11 victims and therefore are not relevant to GAO’s audit. The second provision of clause (i) describes an aspect of making pro rata payments to non-9/11 related victims of state sponsored terrorism. Under that provision, the Special Master is directed to make these payments “based on the amounts outstanding and unpaid on eligible claims, until such amounts have been paid in full or the Fund is closed.”[89] Given this language, and to give effect to the reference to clause (i) in our mandate, we determined lump sum catch-up payments “based on the amounts outstanding and unpaid on eligible claims.”[90]

This aspect of the provision does not include any terms that are defined in subsection (j) of the statute. Absent a statutory definition, we apply the ordinary meaning of this phrase.[91] In applying that interpretive approach, we are mindful that this provision does not include any limiting language, such as verbiage stating that it only applies to amounts outstanding and unpaid by the Fund on eligible claims. As a result, we construe it to mean amounts paid on eligible claims, i.e., recoveries from other sources that have been paid on claimants’ final judgments. Not all compensation from other sources necessarily counts as an offset for this purpose. We obtained from the Fund compensation from other sources that the Fund would offset from its awards under its calculation methodology.[92] We then confirmed with the Fund, or plaintiffs’ counsel as applicable, that all of these amounts were recoveries paid on claimants’ final judgments.[93] We then subtracted these amounts from the claimants’ net eligible claims to produce the amount “outstanding and unpaid” on their claims for purposes of determining lump sum catch-up payments.

This approach is consistent with the one GAO took in estimating lump sum catch-up payments to 9/11 victims, spouses, and dependents.[94] Like the Fairness Act, the Sudan Claims Resolution Act required GAO to conduct its audit “in accordance with clauses (i) and (ii) of [34 U.S.C. 20144(d)(3)(A)].”[95] In conducting that audit, GAO recognized that if Congress authorized lump sum catch-up payments for 9/11 victims, spouses, and dependents, such payments would vary based on, among other things, compensation received by individuals from other sources, such as payments already made on a claimant’s judgment.[96] These payments would take into account compensation received by individuals from other sources, in part to comply with the Victims Act’s requirement that payments from available funds be made “based on the amounts outstanding and unpaid on eligible claims.”[97] However, that population did not have qualifying compensation from other sources—in other words, we did not identify payments already made on any of those claimants’ judgments. As a result, even though we took the same approach as we are taking in the current audit, there was nothing for GAO to offset for eligible 9/11 victims, spouses, and dependents in that prior work.

Calculation of Lump Sum Catch-up Payments

GAO received a comment stating that GAO should apply its calculated percentage to a claimant’s judgment after subtracting payments that a claimant already received or is entitled to or scheduled to receive outside the Fund.

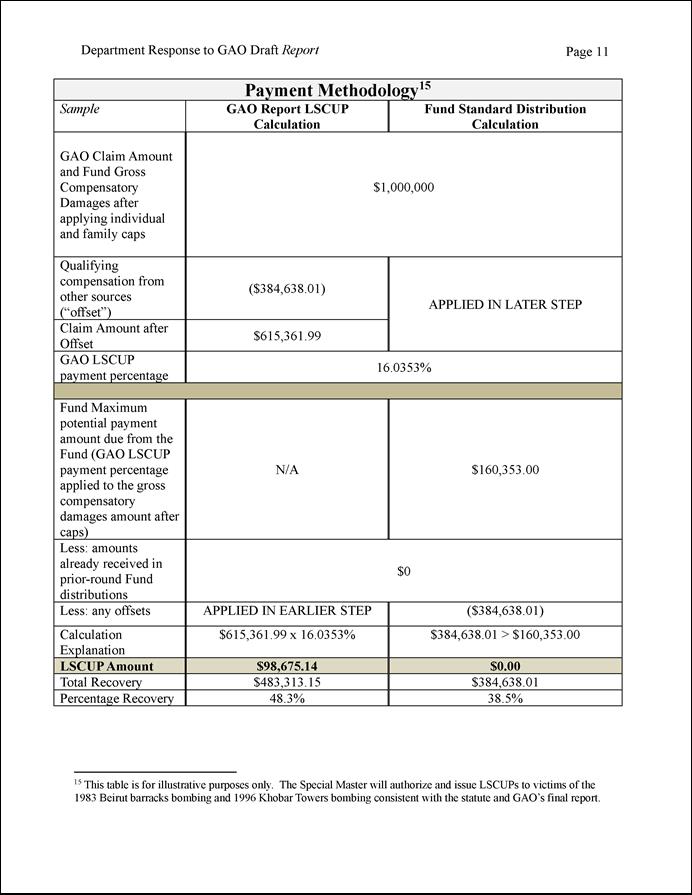

GAO Response: To identify a claimant’s lump sum catch-up payment, the calculated GAO percentage of 16.0353 percent will be applied to the claimant’s net eligible claims offset by qualifying compensation from other sources—i.e., recoveries from other sources that have been paid on claimants’ final judgments. Under this approach, GAO is applying its calculated percentage to a claimant’s net eligible claims after subtracting qualifying compensation from other sources. Here is a calculation illustrating this approach, presuming that an individual claimant has a compensatory damages award in a final judgment of $1,000,000 and qualifying compensation from other sources of $384,638.01:[98]

· $1,000,000[99] – $384,638.01 = $615,361.99. This represents a claimant’s net eligible claim offset by qualifying compensation from other sources. This is the amount outstanding and unpaid on the claim for purposes of determining lump sum catch-up payments.

· $615,361.99 x 16.0353 percent = $98,675.14.

· We will next subtract any amount of money a claimant had previously received from the Fund to determine their lump sum catch-up payment.

This approach is different than the Fund’s approach to calculating regular distribution payments.[100] Given the terms of the Victims Act, as amended by the Fairness Act, certain claimants who received compensation from sources other than the Fund may receive a lump sum catch-up payment, but not receive payment in the Fund’s standard statutory distributions.[101]

Meaning of “1983 Beirut Barracks Bombing Victim” and “1996 Khobar Towers Bombing Victim”

GAO received comments about the meaning of the terms “1983 Beirut barracks bombing victim” and “1996 Khobar Towers bombing victim,” which were included in the Fairness Act. Several comments raised concerns that GAO was interpreting these terms to consist solely of a judgment creditor in Peterson v. Islamic Republic of Iran (Peterson) or a Settling Judgment Creditor in In Re 650 Fifth Avenue and Related Properties (In Re 650). Another comment raised concerns that GAO was interpreting these terms to include anyone other than a judgment creditor in Peterson or a Settling Judgment Creditor in In Re 650.

GAO’s Response: GAO is including all 1983 Beirut barracks and 1996 Khobar Towers bombing victims who meet applicable requirements, not just Peterson judgment creditors or In Re 650 Settling Judgment Creditors. Section 101 of the Fairness Act requires GAO to determine lump sum catch-up payments to 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims who submit eligible applications for those catch-up payments.[102]

Under the statute, the term “1983 Beirut barracks bombing victim”

A. means a plaintiff, or estate or successor in interest thereof, who has an eligible claim under subsection (c) that arises out of the October 23, 1983, bombing of the United States Marine Corps barracks in Beirut, Lebanon; and

B. includes a plaintiff, estate, or successor in interest described in subparagraph (A) who is a judgment creditor in the proceedings captioned Peterson v. Islamic Republic of Iran, No. 10 Vic. 4518 (S.D.N.Y.), or a Settling Judgment Creditor as identified in the order dated May 27, 2014, in the proceedings captioned In Re 650 Fifth Avenue & Related Properties, No. 08 Vic. 10934 (S.D.N.Y. filed Dec. 17, 2008).[103]

Under the statute, the term “1996 Khobar Towers bombing victim”

A. means a plaintiff, or estate or successor in interest thereof, who has an eligible claim under subsection (c) that arises out of the June 25, 1996 bombing of the Khobar Tower housing complex in Saudi Arabia; and

B. includes a plaintiff, estate, or successor in interest described in subparagraph (A) who is a judgment creditor in the proceedings captioned Peterson v. Islamic Republic of Iran, No. 10 Vic. 4518 (S.D.N.Y.), or a Settling Judgment Creditor as identified in the order dated May 27, 2014, in the proceedings captioned In Re 650 Fifth Avenue & Related Properties, No. 08 Vic. 10934 (S.D.N.Y. filed Dec. 17, 2008).[104]

Given the use of the verb “includes,” instead of language indicating that both conditions must be met, we conclude that those identified in 34 U.S.C. 20144(j)(15)(B) and 20144(j)(16)(B) are illustrative applications of those who qualify as 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims, respectively.[105] Even if someone does not fit within subparagraph (B) of either definition, they would still be considered a 1983 Beirut barracks bombing victim or a 1996 Khobar Towers bombing victim if they fit within subparagraph (A) of either definition.[106] GAO has applied this interpretation in estimating lump sum catch-up payments for eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims.

Meaning of “Final Judgment”

GAO received comments from attorneys representing four 1983 Beirut barracks bombing victims who asserted that these individuals satisfied the requirements for lump sum catch-up payments, in part because they received final judgments before December 29, 2022.

GAO Response: Under 34 U.S.C. 20144(d)(4)(D)(i), individuals are entitled to lump sum catch-up payments if they “submitted applications in accordance with subsection (c)(3)(A)(ii)(II) on or after December 29, 2022.” That subsection, in describing the application-submission deadline, permits a 1983 Beirut barracks bombing victim to apply for lump sum catch-up payments if their final judgment was awarded before December 29, 2022.[107] In determining whether a 1983 Beirut barracks bombing victim was awarded a final judgment before December 29, 2022, the following statutory definition of that term applies:

The term “final judgment” means an enforceable final judgment, decree or order on liability and damages entered by a United States district court that is not subject to further appellate review, but does not include a judgment, decree, or order that has been waived, relinquished, satisfied, espoused by the United States, or subject to a bilateral claims settlement agreement between the United States and a foreign state. In the case of a default judgment, such judgment shall not be considered a final judgment until such time as service of process has been completed pursuant to [28 U.S.C. 1608(e)].[108]

We confirmed with the Fund that it has also applied the definition of “final judgment” in the Victims Act when assessing the eligibility for all claims.

Issue Related to the Methodology of Prior Fund Distributions

One comment expressed concern about the Special Master’s methodology for making regular Fund distributions to claimants after the first round. It stated that in making those regular payment distributions, the Special Master divided available funds in a way that resulted in overpayments to non-9/11 related victims of state sponsored terrorism. According to the comment, the commenters raised this issue in order to ensure that all Fund claimants are treated fairly and equitably and given it might impact GAO’s lump sum catch-up calculations.

GAO Response: Under the Comptroller General’s mandate, we are to calculate lump sum catch-up payments for eligible claimants based on amounts that the Fund already distributed. The mandate does not provide for GAO to revisit the methodology used by the Special Master to distribute regular distribution payments to non-9/11 victims of state sponsored terrorism. Section 101 of the Fairness Act requires GAO to determine lump sum catch-up payments for eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims in “amounts that, after receiving the lump sum catch-up payments, would result in the percentage of the claims of such victims received from the Fund being equal to the percentage of the claims of non-9/11 victims of state sponsored terrorism received from the Fund, as of [December 29, 2022].”[109]

GAO Contacts

Triana McNeil, (202) 512-8777 or McNeilT@gao.gov and Nagla’a El-Hodiri, (202) 512-7279 or ElHodiriN@gao.gov.

Staff Acknowledgments

In addition to the contacts named above, David Lutter (Assistant Director), Kim Frankena (Assistant Director), James Lawson (Analyst-in-Charge), David Ballard, John Karikari, Amanda Miller, Lisa Motley, Kevin Reeves, Bolko Skorupski, Janet Temko-Blinder, and Christopher Zubowicz made key contributions to this report.

GAO’s Mission

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on Facebook, Flickr, X, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

Congressional Relations

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S. Government Accountability Office, 441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

Sarah Kaczmarek, Managing Director, KaczmarekS@gao.gov, (202) 512-4800, U.S.

Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Strategic Planning and External Liaison

Stephen J. Sanford, Managing

Director, spel@gao.gov, (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814, Washington,

DC 20548

[1]Under the Justice for United States Victims of State Sponsored Terrorism Act, the term “state sponsor of terrorism” means a country the government of which the Secretary of State has determined, for purposes of 50 U.S.C. § 4605(j) (since repealed), 22 U.S.C. § 2371, 22 U.S.C. § 2780, or any other provision of law, is a government that has repeatedly provided support for acts of international terrorism. Pub. L. No. 114-113, div. O, tit. IV, § 404(j)(7), 129 Stat. 3007, 3017 (2015) (codified at 34 U.S.C. § 20144(j)(7)); see also 50 U.S.C. §§ 4813(c), 4826(c)(1). As of August 2024, there are four countries designated under these authorities: Cuba, the Democratic People’s Republic of Korea (North Korea), Iran, and Syria.

[2]Pub. L. No. 114-113, § 404, 129 Stat. at 3007-18.

[3]The Fund’s allocations distributed to eligible claimants occurred in 2017, 2019, 2020, and 2023. For more information on sources of deposits to the Fund, see GAO, U.S. Victims of State Sponsored Terrorism Fund: Options for Increasing Deposits and Their Potential Impacts, GAO‑24‑106863 (Washington, D.C.: May 1, 2024).

[4]The act provides for GAO to determine lump sum catch-up payments for eligible 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims in “amounts that, after receiving the lump sum catch-up payments, would result in the percentage of the claims of such victims received from the Fund being equal to the percentage of the claims of non-9/11 victims of state sponsored terrorism received from the Fund, as of [December 29, 2022].” Pub. L. No. 117-328, div. MM, § 101(b)(3)(B)(iii), 136 Stat. 6106, 6108 (2022) (pertinent portion codified at 34 U.S.C. § 20144(d)(4)(D)(i)). The Fairness Act additionally established and appropriated $3 billion to a reserve fund for those lump sum catch-up payments for eligible Beirut barracks and Khobar Towers bombing victims. Id. § 101(b)(3)(B)(iii), 136 Stat. at 6109 (pertinent portion codified at 34 U.S.C. § 20144(d)(4)(D)(iv)(III)(aa)). “[N]ot later than 1 year after the Special Master disperses all lump sum catch-up payments” from the reserve fund the reserve fund is to terminate; all amounts remaining in the reserve fund in excess of proposed lump sum catch-up payments shall be deposited into the Fund. 34 U.S.C. § 20144(d)(4)(D)(iv)(IV).

[5]Pub. L. No. 117-328, § 101(b)(3)(B)(iii), 136 Stat. at 6108 (pertinent portion codified at 34 U.S.C. § 20144(d)(4)(D)(i)-(ii)). See app. I for more information on our scope and methodology.

[6]Notice of Planned Methodology for Estimating Lump Sum Catch-Up Payments to Eligible 1983 Beirut Barracks Bombing Victims and 1996 Khobar Towers Bombing Victims, 88 Fed. Reg. 89,693 (Dec. 28, 2023); Notice of Estimated Lump Sum Catch-Up Payments to Eligible 1983 Beirut Barracks Bombing Victims and 1996 Khobar Towers Bombing Victims and Planned Methodology, 89 Fed. Reg. 56,376 (July 9, 2024). See app. II for additional information on the Federal Register Notices.

[7]See app. III for a summary of public comments on the Federal Register Notices and our responses.

[8]See 34 U.S.C. § 20144(b)(1).

[9]Regular payment distribution rounds occur when the Special Master authorizes a payment distribution to eligible claimants. The Fund then allocates a specified amount for payment distribution. Since 2017, the Fund has allocated nearly $3.4 billion in four rounds of distributions to all claimants eligible to receive payment, with the allocations occurring in 2017, 2019, 2020, and 2023. In addition to providing compensation through regular payment distribution rounds, the Fund provides compensation through lump sum catch-up payments. The statutory eligibility requirements for lump sum catch-up payments for 1983 Beirut barracks bombing victims and 1996 Khobar Towers bombing victims are described below.

[10]See 34 U.S.C. § 20144(b)(2)(B), (c), (d). For non-9/11 related victims, the statutory cap for individuals is $20,000,000. Non-9/11 related victims and their immediate families are subject to a collective $35,000,000 family statutory cap. A compensatory damages award is the amount of damages recoverable in satisfaction of, or in recompense for, loss or injury sustained.

[11]Justice for United States Victims of State Sponsored Terrorism Act, 81 Fed. Reg. 45,535, 45,537-38 (July 14, 2016).

[12]Id. at 45,537; see Pub. L. No. 114-113, § 404(b)(2)(A), 129 Stat. at 3008 (codified at 34 U.S.C. § 20144(b)(2)(A) (requiring the publication in the Federal Register and on a website procedures necessary for United States persons to apply and establish eligibility for payment not later than 60 days after the initial appointment of the Special Master)).