CAPITAL INVESTMENT GRANTS PROGRAM

DOT Should Tailor Technical Assistance Provided to New and Potential Applicants

Report to Congressional Committees

June 2025

United States Government Accountability Office

For more information, contact Elizabeth Repko at repkoe@gao.gov.

Highlights of GAO-25-107672, a report to congressional committees

CAPITAL INVESTMENT GRANTS PROGRAM

DOT Should Tailor Technical Assistance Provided to New and Potential Applicants

Why GAO Did This Study

FTA’s CIG program supports transit capital projects that are locally planned, implemented, and operated. For fiscal year 2025, Congress appropriated $3.805 billion in program funding for CIG projects.

The Infrastructure Investment and Jobs Act continued a requirement for GAO to biennially review FTA’s implementation of the program. This report discusses: (1) technical assistance, including the programs, activities, resources, and services that FTA offers project sponsors throughout the CIG process and (2) the extent to which this technical assistance meets project sponsors’ needs.

GAO reviewed reports since 2016 on the CIG program and FTA’s website. GAO interviewed 10 project sponsors, FTA staff, and three stakeholders, including the Capital Investment Grants Working Group. GAO sent a survey to all 61 current project sponsors and received responses from 53 of them to determine the extent to which FTA’s technical assistance meets project sponsors’ needs and aligns with federal internal controls for external communication.

What GAO Recommends

GAO recommends that FTA tailor its technical assistance for new and potential project sponsors to clarify program requirements, processes, and timelines in the early stages of a project, including before projects enter the CIG program. Additionally, GAO continues to believe that FTA should implement its July 2020 recommendation related to improving communication. DOT concurred with our recommendation.

What GAO Found

The Federal Transit Administration (FTA) provides Capital Investment Grants (CIG) for transit capital projects, such as new bus rapid transit systems or extensions to existing light rail systems. FTA offers technical assistance—including expertise, documents, events, and tools—to help project sponsors, which are typically transit agencies, navigate the CIG process. In recent years, FTA adjusted its technical assistance to help meet emerging needs. For example, given the increased interest in bus rapid transit projects, FTA convened a roundtable so that project sponsors could share lessons learned.

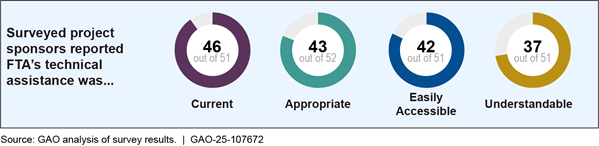

In response to GAO’s survey, project sponsors reported that they use the technical assistance that FTA provides, and it largely meets their needs. Nearly all 53 responding project sponsors—across all experience levels within the program—said they accessed most of the agency’s technical assistance resources. Most respondents characterized FTA’s technical assistance as generally accessible, current, appropriate, and understandable.

Although project sponsors reported that FTA’s technical assistance generally met their needs, some project sponsors identified areas for improvement. First, more than a third of surveyed project sponsors reported that FTA’s communication of its review timelines is not always clear. In July 2020, GAO recommended FTA improve its communication of review timelines and expectations with project sponsors. DOT did not concur with the recommendation, stating that it was in communication with project sponsors on a recurring basis. However, implementing GAO’s recommendation could reduce the confusion that some project sponsors continue to experience with FTA’s review timelines.

Second, 18 project sponsors that provided open-ended responses to GAO’s survey and several stakeholders interviewed by GAO said FTA should improve its technical assistance for new and potential project sponsors regarding program requirements, processes, and timelines. For example, five survey respondents and one stakeholder mentioned it would be helpful for FTA to connect potential sponsors with other sponsors to share lessons learned. Better tailoring resources for new and potential project sponsors could improve project sponsors’ understanding of program requirements and reduce the likelihood that they withdraw from the program or ask for an extension. Doing so may also help reduce project sponsors’ overall project costs and the resources FTA expends on recurring reviews and follow-up communications.

|

Abbreviations |

|

|

|

|

|

APTA |

American Public Transportation Association |

|

CIG |

Capital Investment Grants |

|

DOT |

Department of Transportation |

|

FTA |

Federal Transit Administration |

|

IIJA |

Infrastructure Investment and Jobs Act |

|

NEPA |

National Environmental Policy Act of 1969 |

|

NTI |

National Transit Institute |

|

PMOC |

Project Management Oversight Contractors |

|

STOPS |

Simplified Trips-on-Project Software |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

June 18, 2025

The Honorable Tim Scott

Chairman

The Honorable Elizabeth Warren

Ranking Member

Committee on Banking, Housing, and Urban Affairs

United States Senate

The Honorable Sam Graves

Chairman

The Honorable Rick Larsen

Ranking Member

Committee on Transportation and Infrastructure

House of Representatives

Millions of people in the United States use transit each day to travel for work, leisure, health care, and education. The Capital Investment Grants (CIG) program supports transit capital projects that are locally planned, implemented, and operated. For fiscal year 2025, Congress appropriated $3.805 billion for the CIG program, which funds fixed guideway investment projects, including new and expanded rail (heavy, commuter, and light), streetcars, bus rapid transit, and ferries, as well as corridor-based bus rapid transit investments that emulate the features of rail.[1] The program is administered by the Federal Transit Administration (FTA).

The Infrastructure Investment and Jobs Act (IIJA) continued a requirement for GAO to biennially review FTA’s implementation of the program. GAO is to include information on FTA’s processes and procedures for awarding grants and the outcomes of recent projects, among other things.[2] In December 2024, FTA issued new guidance that made changes to the processes and procedures for evaluating, rating, and recommending projects. Because FTA was updating this guidance during this audit, our review did not focus on FTA’s process for evaluating and rating CIG projects.[3] Instead, this report addresses:

· technical assistance, including the programs, activities, resources, and services that FTA offers project sponsors, which are typically transit agencies, throughout the CIG program process, and

· the extent to which this technical assistance meets project sponsors’ needs.

In addition, appendix I provides information on the Information Collection and Analysis Plans completed since our April 2023 CIG report.[4] To describe the Information Collection and Analysis Plans, we reviewed the plans to identify the differences between predicted and actual outcomes and interviewed the two project sponsors that completed them.

To identify the types of technical assistance that fall within the scope of both objectives, we first defined technical assistance by reviewing various working definitions from FTA, the Department of Transportation (DOT), GAO, and the Congressional Research Service.[5] We defined technical assistance as programs, activities, resources, and services provided by FTA and the agency’s CIG consultants to help project sponsors access and use CIG funding and build the local capacity of project sponsors to improve project performance.

To identify the technical assistance that FTA offers project sponsors and the extent to which such assistance meets project sponsors’ needs, we reviewed our reports since 2016 on the CIG program and FTA’s website.[6] We interviewed 10 project sponsors, officials and staff from FTA headquarters and three FTA regional offices, three Project Management Oversight Contractors (PMOC) who assist FTA in its statutory requirement to perform project management oversight (which, as implemented by FTA, includes projects in the CIG program).[7] We also interviewed three stakeholders, including the American Public Transportation Association (APTA), a nonprofit association representing all public transportation modes; the Capital Investment Grants Working Group, a coalition of transit agencies, cities, and private sector members that advocates for and supports CIG; and the Eno Center for Transportation, an independent nonpartisan think tank focusing on transportation issues. We selected project sponsors for interviews based on experience level, number and types of active CIG projects, project mode, size of transit agency, and geography. We used these characteristics to ensure we had a sample that is representative of the variety of project sponsors within the scope of this engagement. We selected FTA regional offices for interviews to ensure they reflect diversity in geographic location and workloads, and we selected PMOCs that FTA identified had extensive experience with CIG projects to obtain perspectives about their role with various project sponsors.

We also emailed a survey to all 61 current CIG project sponsors as of November 2024. We developed the questions for the survey based on interviews and pre-tested the survey with three project sponsors. We sent the survey on November 18, 2024, and followed up with multiple emails and calls to encourage responses. To identify the universe of current CIG projects, we collected project information from FTA and APTA’s CIG dashboards and sent the list to FTA for confirmation. There were 93 CIG projects within the scope of this engagement being implemented by the 61 project sponsors. We used the survey to obtain information on:

· the extent to which project sponsors use technical assistance and guidance when applying to and progressing through the CIG project process;

· the usefulness of FTA’s technical assistance;

· specific challenges throughout the CIG process for which project sponsors request technical assistance; and

· opportunities for FTA to better meet project sponsors’ technical assistance needs.[8]

The survey response rate was 87 percent, with the 53 respondents representing all experience levels, project types, and geographic regions. For a copy of the survey instrument sent to project sponsors, see appendix II.

To assess the extent to which FTA’s technical assistance meets project sponsors’ needs, we reviewed the technical assistance that is available to project sponsors. Additionally, we analyzed the results of the project sponsor survey to determine what technical assistance project sponsors accessed and to obtain their views on the usefulness of this technical assistance. Finally, to the extent project sponsors identified areas where the technical assistance did not fully meet their needs, we assessed whether the assistance provided aligned with the internal control principle that management should externally communicate the necessary quality information to achieve its objectives.[9]

We conducted this performance audit from June 2024 to June 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Project Types

CIG is a discretionary grant program that is a key source of federal support for transit capital projects that are locally planned, implemented, and operated. There are three types of CIG projects. New Starts projects include new fixed guideway projects or extensions to existing fixed guideway systems that are seeking $150 million or more in CIG funds or have a total estimated capital cost of $400 million or more.[10] Small Starts projects are new fixed guideway projects, extensions to existing fixed guideway systems, or corridor-based bus rapid transit projects that are seeking less than $150 million in CIG funds and have a total estimated capital cost of less than $400 million. Core Capacity projects are investments in existing fixed-guideway corridors that are at or over capacity today or will be in 10 years, where the proposed project will increase capacity by at least 10 percent. In 2015, Congress authorized an Expedited Project Delivery Pilot Program that is separate and distinct from the CIG program for similar, but not entirely the same, project types.[11]

The maximum portion of the project costs eligible for CIG funds for any CIG project varies depending on the project type: New Starts projects are capped at 60 percent CIG funding, while Small Starts and Core Capacity projects can receive up to 80 percent CIG funding. In all cases, total federal funds may not exceed 80 percent. See appendix III for more information about the CIG share for current projects.

Grant Process

To request entry into the CIG program, project sponsors submit an application to FTA with information on their project. Once accepted into the program, sponsors must follow a multi-step, multi-phase process outlined in statute. Project sponsors must submit several detailed deliverables within specified time frames throughout the process. These steps vary depending on whether the project is a New Starts, Core Capacity, or Small Starts project.[12] New Starts and Core Capacity projects complete the following steps:

· Pre-entry into Project Development. Project sponsors submit an application to FTA with information on their project. Prior to doing so, FTA encourages project sponsors to complete whatever work they feel is necessary to facilitate their ability to complete the required steps in Project Development within the specified time frames. For example, project sponsors may identify critical third-party agreements, identify the appropriate project delivery method, or develop preliminary cost estimates.

· Project Development. During the Project Development phase, sponsors must complete the following activities: select a “locally preferred alternative” and get it adopted into the metropolitan transportation plan, complete the environmental review process required by the National Environmental Policy Act of 1969 (NEPA), and develop information for FTA to develop a project rating.[13] Sponsors must also develop a Project Management Plan, obtain a commitment of at least 30 percent of the non-CIG capital funds needed for their project, and develop cost and ridership predictions, among other things.[14] At the end of the Project Development phase, FTA is to evaluate and rate the projects seeking CIG funding according to statutory criteria to determine eligibility (using a five-point scale: low, medium-low, medium, medium-high, and high) to advance into the Engineering phase.[15] Projects have 2 years to complete the activities and submit completed documentation to FTA during Project Development, unless FTA grants an extension.[16] At this point when the project enters into Engineering, the total amount of CIG funding is finalized.

· Engineering. During Engineering, sponsors must complete several steps, including but not limited to executing all critical third-party agreements, such as agreements with utility companies, and completing sufficient engineering and design to develop a firm and reliable cost, scope, and schedule.[17] Further, FTA requires that project sponsors obtain commitments of at least 50 percent of the non-CIG capital funds and make sufficient progress advancing the level of design within 3 years of a project’s advancement into Engineering. At the end of the Engineering phase and before FTA awards a construction grant agreement, project sponsors must meet FTA readiness requirements related to technical capacity, staffing, and oversight. FTA evaluates and rates the projects a second time, and proposed projects must obtain at least a “medium” overall project rating at the end of Engineering to be eligible for funding.

· Construction Grant Agreement. FTA is required by statute to submit an annual report to specified congressional committees recommending projects for funding.[18] FTA’s CIG Annual Reports are companion documents to the President’s budget requests to Congress, according to FTA. Generally, FTA does not begin negotiating a CIG construction grant agreement, known as a full funding grant agreement, for New Starts and Core Capacity projects with a project sponsor until a project is recommended for funding by FTA in the Annual Report.[19] According to FTA, in making these recommendations, it considers the evaluation and rating of the project according to the statutory criteria, the availability of CIG program funds, and the date the project is expected to begin construction. Once Congress appropriates CIG funds and FTA allocates funds to projects, FTA funds the projects through a multi-year construction grant agreement.

· Information Collection and Analysis Plan. As part of the CIG process, the CIG program statute requires project applicants to develop an Information Collection and Analysis Plan during Engineering to collect and analyze information and the accuracy of predicted project outcomes. After the project is open for service for 2 years, the project sponsor collects data for the Information Collection and Analysis Plan. Among information the study must include are data on the project’s actual outcomes and analysis of the accuracy of predicted outcomes.[20] According to FTA officials, sponsors should complete these studies within 5 years of starting project operations.

Small Starts projects complete these same steps, but the requirements under Project Development and Engineering are combined in one step called Project Development.[21] In addition, Small Starts project sponsors must obtain commitments of at least 50 percent of all non-CIG funds within 3 years of a project’s advancement into Project Development and continue to make sufficient progress advancing the project’s level of design during that time. If a sponsor does not meet these requirements, FTA withdraws the project from the CIG program. Small Starts projects are not required to complete an Information Collection and Analysis Plan.

CIG Oversight

FTA staff in the agency’s headquarters and regional offices, with the help of consultant PMOCs, oversee projects that compete for CIG program funding. This oversight is designed to enable FTA to monitor projects’ readiness to advance to the next project phase and ultimately to project completion.[22] FTA and the PMOCs evaluate each project’s risk, scope, cost, schedule, and Project Management Plan, as well as the project sponsor’s technical capacity and capability, before a project is recommended for entry to Engineering or for a grant agreement.[23] The PMOCs help FTA oversee the project sponsor’s planning, design, and construction of projects and provide technical assistance to project sponsors throughout the development and construction process. FTA determines the extent and type of monitoring activities the PMOCs conduct on a project and has Oversight Procedures that provide guidance for PMOCs and others on FTA’s project management oversight processes. During the Project Development and Engineering phases, project sponsors submit periodic updates to FTA on different aspects of their projects, such as on project cost, schedule, risk, projected ridership, project financing, and readiness to progress through the process.

FTA Offers a Variety of Technical Assistance to Help Project Sponsors Navigate the CIG Process

FTA has characterized the CIG program as “one of the government’s most complex and rigorous programs,” with a “myriad of requirements.”[24] Several stakeholders we interviewed also mentioned that the program process is complex due to factors such as the length of time to complete the process, various requirements, and number of stakeholders involved, with two saying it is more complex than the processes for other transit grant programs. Projects can take many years to move from Project Development through completion of the Information Collection and Analysis Plan. For many current projects, the process is expected to take at least 5 years, not including the time the project sponsor invests in preparing the project to enter FTA’s process, according to FTA’s dashboard.

While completing the various requirements of the CIG program, project sponsors must engage with several other stakeholders and processes, adding to the complexity. Stakeholders, such as contractors and elected state and local officials, and processes, such as local political and budgetary processes, may have timelines and priorities that do not align with the CIG program process. For example, one project sponsor told us that if FTA does not release its project rating in a timely manner, then the sponsor may not be able to meet the deadline to apply for additional funding through their county’s capital planning process.

To help navigate this complex process, FTA meets regularly with project sponsors and offers many types of technical assistance, including expertise, documents, events, and tools. While FTA’s statutory requirements for the CIG program do not include technical assistance, FTA officials told us the agency provides technical assistance to educate project sponsors—which range from first time applicants to those with many projects’ worth of experience—about CIG requirements and to help them complete program steps and develop the required deliverables. In recent years, FTA has adjusted its technical assistance to meet project sponsors’ emerging needs. For example, given the increased interest in developing bus rapid transit projects in the last few years, FTA convened a bus rapid transit roundtable so that project sponsors could share lessons learned from these types of projects. See table 1 for a description of FTA’s technical assistance for CIG project sponsors.

Table 1: Federal Transit Administration’s (FTA) Technical Assistance for Capital Investment Grants (CIG) Program Project Sponsors

|

|

Expertise |

|

|

Ongoing assistance provided by a team comprised of FTA headquarters and regional staff |

Projects entering the program are assigned points-of-contact at their local regional office as well as headquarters. These teams may change throughout the lifecycle of the project, including the addition of specialized team members, such as those who focus on environmental review. |

|

|

Project Management Oversight Contractors (PMOCs) |

PMOCs assist project sponsors by providing feedback and recommendations to project sponsors regarding successful project management practices and help set projects up for successful delivery, including through discussions about project requirements. |

|

|

FTA quarterly review meetingsa |

FTA headquarters, FTA regional staff, and the assigned PMOCs meet quarterly with project sponsors to discuss project updates and suggest ways to overcome challenges. |

|

|

|

Documents |

|

|

CIG website |

The website hosts links to relevant program documentation and updates, including guidance, regulations, information on how to apply, and more. |

|

|

CIG Policy Guidance |

Program guidance outlines the requirements associated with each type of CIG project and serves as a guide for FTA and project sponsors. |

|

|

Reporting Instructions |

Reporting instructions list information for each project type that project sponsors must provide for FTA to evaluate and rate the projects. |

|

|

Project Management Oversight website |

FTA offers numerous resource documents related to project management, including its Oversight Procedures that provide guidance for PMOCs and others on FTA’s project management oversight processes as well as resources on specific topics (e.g., utility relocations and cost estimating). |

|

|

|

Events |

|

|

Roundtables |

Roundtables are gatherings hosted by FTA where the agency facilitates the sharing of experiences and lessons learned among project sponsors. |

|

|

FTA and National Transit Institute (NTI) trainings, FTA seminars, and webinarsb |

Sessions hosted either in person or virtually that provide project sponsors and consultants information on the general CIG process and program requirements or on more specific topics such as risk-assessment, modeling travel, project management, and more. |

|

|

FTA office hours at American Public Transportation Association’s conference |

Officials from FTA headquarters hold sessions for project sponsors, enabling sponsors to provide updates on their ongoing and potential projects, build relationships with FTA staff, and ask FTA questions about the program. |

|

|

|

Tools |

|

|

Simplified Trips-on-Project Software (STOPS model) |

STOPS is a software package that applies a set of travel models to predict detailed transit travel patterns that project sponsors can use to predict ridership and other measures used for project ratings. |

|

|

Templates and worksheets |

Project applicants use templates and worksheets, published by FTA, to develop and report the necessary information to FTA, such as Standard Cost Category Workbooks. These templates and worksheets are used for developing project ratings and reporting the capital costs and schedules of proposed projects. |

|

Source: GAO icons and analysis of FTA documentation and interviews with agency officials and stakeholders. | GAO‑25‑107672

aIn addition to quarterly review meetings, FTA highlighted that they meet with project sponsors regularly throughout a project. These meetings generally take place monthly, bi-weekly, or weekly depending on the needs of the project sponsor.

bNTI develops, promotes, and delivers training and education programs for the public transit industry through cooperative partnerships with industry, government, institutions, and associations.

In addition to FTA’s technical assistance, project sponsors hire consultants for various aspects of the CIG process. Of the project sponsors who responded to our survey, all but one reported using a consultant.

Project Sponsors Are Largely Satisfied with FTA’s Technical Assistance but Identified Shortcomings in Support for New Project Sponsors

Project Sponsors Use the Technical Assistance FTA Provides and Are Mostly Satisfied with Its Quality

Overall, project sponsors use the technical assistance FTA provides and are largely satisfied with the quality of the assistance.

Use

Project sponsors by and large use the technical assistance FTA provides. Project sponsors that responded to our survey told us they accessed most of the agency’s technical assistance resources. For instance, all respondents accessed the CIG Policy Guidance, and most accessed the Oversight Procedures (43 of 53) and FTA or NTI trainings, seminars, or webinars (44 of 52). All project sponsors that responded to our survey used FTA’s CIG website to find information on regulations, program updates, and other guidance. While still widely accessed, project sponsors that responded to our survey used two resources—office hours at APTA’s conferences and the STOPS model—somewhat less frequently. According to the survey responses, nine out of 51 project sponsors were not aware of FTA’s office hours and 13 of 51 were aware but did not attend. These results likely reflect that FTA office hours are a relatively new effort; FTA started hosting office hours at APTA’s annual conference in 2024. FTA officials told us that office hours were well attended by project sponsors. Apart from a few cancellations, project sponsors filled all the available office hour slots at the conference. Additionally, just over one-fifth of the project sponsors that responded to our survey (11 of 52) did not use the STOPS model. However, some sponsors have access to other proprietary modeling software to address CIG requirements, and not all CIG projects are required to produce ridership estimates.[25]

Quality

Project sponsors are largely satisfied with the quality of FTA’s technical assistance. Survey respondents characterized FTA’s technical assistance as generally understandable (37 of 51), easily accessible (42 of 51), current (46 of 51), and appropriate (43 of 52). Survey respondents reported that the available resources helped project sponsors understand program guidelines and requirements, overcome project challenges, and construct project timelines and cost estimates. Survey respondents also found FTA’s technical assistance to be helpful. We asked survey respondents to rate the technical assistance resources they accessed on a 3-point scale: “Not Helpful,” “Somewhat Helpful,” and “Very Helpful.” Of the survey respondents that accessed each type of technical assistance, most said the assistance was helpful.[26]

Some technical assistance resources were described as particularly helpful in interviews and survey responses for staff who used them:

· PMOCs. While PMOCs’ primary role is to provide project management oversight support to FTA, survey respondents stated PMOCs are essential to a project’s success. PMOCs provide technical support and guidance, which help sponsors meet program requirements and improve project delivery. Of the survey respondents who worked with a PMOC, all found them to be helpful (46 out of 46).[27] Project sponsors and PMOCs mentioned that early engagement of PMOCs can be beneficial for project development and project delivery.

· FTA Staff. Project sponsors described FTA staff at all levels as helpful, specifically stating that FTA staff have provided guidance that helped them meet CIG program requirements. Nearly all the survey respondents indicated that the FTA staff assigned to their project were helpful. Project sponsors cited the Systems Planning and Analysis staff at FTA headquarters as particularly helpful.[28] Additionally, project sponsors reported that headquarters staff regularly clarified aspects of the CIG process and regulatory information. FTA regional staff were generally viewed as providing useful support and guidance to project sponsors, especially throughout processes such as environmental review. However, three stakeholders we interviewed mentioned variation in the quality of assistance between FTA regional offices. One attributed this variation to challenges associated with regional staff’s bandwidth and tenure. Regional offices with more experience offered higher quality assistance, according to interviews with three stakeholders and one survey respondent.

· Roundtables. Four project sponsors, all three PMOCs, and two stakeholders that we interviewed specifically mentioned peer-to-peer support, such as roundtables, as a valuable resource. Additionally, almost all (47 of 49) of the project sponsors who responded to our survey and attended a roundtable reported that they were helpful. According to one PMOC, project sponsors say that roundtables are the best CIG-related events they attend, specifically because of the opportunity to meet with other sponsors and discuss common challenges. This past year, in addition to recurring roundtables, FTA offered sessions that focused on bus rapid transit projects and third-party railroad agreements. Thirteen project sponsors that responded to our survey stated that at roundtables, they were able to build relationships and share lessons learned to help one another navigate the CIG process. For example, one project sponsor reached out to several other project sponsors that presented at a roundtable to learn more about their experiences designing elevated stations, which then informed the sponsor’s own design process.[29]

· Trainings, webinars, and seminars. Project sponsors reported that in-person and virtual training opportunities provided helpful insights into the CIG application, process, project delivery methodologies, and regulatory requirements. Some survey respondents reported that FTA trainings and seminars kept them apprised of program best practices, such as project management methods. Additionally, one sponsor we interviewed stated that virtual opportunities increased access to training for smaller or resource-constrained project sponsors. Furthermore, 42 out of the 44 survey respondents who attended a training or webinar from NTI or FTA found them to be helpful. PMOCs told us that feedback they have received from project sponsors for project management courses has been similarly positive. Project sponsors that responded to our survey and two PMOCs we interviewed stated that additional trainings would be helpful, specifically on topics such as managing the environmental review process and completing the templates and the ratings package. One PMOC told us they are working with NTI to develop new training programs.

In interviews, one project sponsor and one stakeholder also told us that the level and quality of FTA’s technical assistance has improved over time. They specifically mentioned improvements to FTA’s website, the STOPS model, and templates for the rating package in recent years. For example, the stakeholder noted that the FTA website has improved, and FTA is trying to do a better job of making information available. Another stakeholder mentioned that FTA offered more visibility into ridership forecasting and the related templates by participating in more recent panel discussions and APTA committees.

Some Assistance Was Not Always Clear, Available Early Enough in the Process, or Sufficiently Tailored to Project Sponsors’ Needs

Although project sponsors reported that FTA’s technical assistance largely met their needs, some project sponsors noted shortcomings. Areas where FTA can improve the clarity, availability, and tailoring of their program documentation and communication relate to the agency’s review timelines and resources available to new and potential project sponsors.[30]

Review Timelines

More than a third of project sponsors that responded to our survey reported that FTA’s communication of the agency’s review timelines was not always clear. We heard FTA’s review process characterized as a “black box,” by one sponsor, where sponsors received limited information on the status of their project during the review process. Specifically, while some (33 out of 52) survey respondents thought that FTA provided clear timelines, 19 out of 52 said it had not or it did so sometimes but not always. Twelve project sponsors that responded to our survey mentioned they experienced challenges related to FTA providing vague or unclear timelines, particularly during extended review processes, such as the environmental review. Additionally, one project sponsor told us that without knowledge of FTA’s decision timelines, it can be difficult for sponsors to coordinate with local budgeting processes.

We have previously recommended FTA improve some aspects of its communication with CIG project sponsors. Specifically, in July 2020, we recommended that FTA better clarify its estimated time frames for reviewing submissions and responding to sponsors’ requests.[31] As of March 2025, DOT continues to not concur with this recommendation. At the time of our report, the Department stated that FTA already communicates ample information, including time frames, with sponsors. We continue to believe that fully addressing our prior recommendation could help sponsors navigate the project development process, as well as bridge gaps in expectations and reduce areas of confusion that project sponsors mentioned in our current work. For example, as noted in the prior report, FTA communicates the required time frame to respond to projects, but there are many interim steps within the time frame. Project sponsors reported being unaware of the pace of FTA’s decision-making process. Relatedly, some of the sponsors that responded to our recent survey described times when they were uncertain of when they should expect to receive decisions or reviews from FTA. For example, one sponsor said they requested an estimate for when FTA would complete a review at their monthly and quarterly meetings with FTA, but were unable to get a clear, concise explanation.

New and Potential Sponsors

Project sponsors that responded to our survey, as well as PMOCs and a stakeholder we interviewed, reported that FTA should tailor technical assistance to new project sponsors. Additionally, we heard that FTA should increase the availability of assistance for new sponsors, particularly early in the process and before project sponsors formally enter the CIG program.[32] As discussed below, to meet the 2-year Project Development time limit for New Starts and Core Capacity projects, FTA encourages projects sponsors to start work on CIG’s Project Development requirements prior to entering the CIG program’s Project Development phase.[33] As such, project sponsors who had not gone through the CIG process before did not have a clear understanding of the CIG process and requirements during the pre-entry to Project Development and in the early stages of Project Development phases.

· Pre-Entry to Project Development. According to FTA, project sponsors have an incentive to enter the program as early as possible, because should a project successfully obtain a grant agreement, FTA reimburses sponsors for activities undertaken on CIG projects once projects enter Project Development. However, because new and potential project sponsors do not always have access to clear information during pre-entry, they may not be prepared to meet program requirements during Project Development. For example, third-party agreements are a common challenge for new sponsors, according to two PMOCs we interviewed. Sponsors work on these agreements early-on in the process but may not always have a full understanding of the requirements or a realistic expectation of the time it takes to complete the agreements. For example, one survey respondent said there was no guidance on how FTA determines the criticality of utility agreements—a decision that should be made early-on to ensure the agreements are executed by the required deadline.[34] While FTA provides technical assistance, such as the third-party railroad agreement roundtable, aimed at helping sponsors with third-party agreements, that assistance is not available until sponsors are in the program’s project pipeline.

During pre-entry to Project Development, potential project sponsors have access to agency guidance and other technical assistance posted on FTA’s public website. For example, FTA noted that Oversight Procedures related to PMOCs’ oversight of third-party agreements and specifically utility agreements, are publicly available on its website. In addition, FTA regional staff told us that they meet with potential sponsors to discuss CIG requirements and whether projects are good candidates for the CIG program. However, the staff explained that they do not have the resources to support potential sponsors on CIG related work during the pre-entry phase.

Some survey respondents suggested FTA host trainings or webinars for potential project sponsors to help them understand program timelines, milestones, and deliverables. Five survey respondents and one stakeholder mentioned it would be helpful for FTA to connect potential sponsors with other sponsors, either at a roundtable or by sharing contact information, to share lessons learned. According to one PMOC we interviewed, FTA has ongoing efforts that could be helpful if offered more broadly. These efforts include assisting new project sponsors with in-person project meetings and early engagement of PMOCs. However, FTA officials we spoke with said resource constraints also limit the reach of the agency’s efforts. FTA officials said that the agency has not instituted the early assignment of PMOCs for every CIG project or made it available to sponsors that have yet to enter the CIG process because it is subject to funding availability.

· Project Development. Six project sponsors indicated that after formally entering the CIG program, they found that program information, particularly on the CIG process and requirements, was not sufficiently clear or tailored to new project sponsors and was not always conveyed early enough in the process. As a result, some New Starts and Core Capacity project sponsors found it difficult to move through the 2-year Project Development time limit efficiently, which, according to FTA, is the purpose of the time limit. For example, one sponsor that responded to our survey shared that after seeking assistance from FTA, they received a link to a 500-page document. FTA did not direct them to specific portions of the document that may have addressed their specific questions. The sponsor said this was not helpful and they needed additional assistance. All three PMOCs we interviewed stated that inexperienced project sponsors have a much harder time navigating the CIG process and understanding how to meet program requirements. According to FTA regional staff, confusion exists among new sponsors as to how to meet program requirements.

FTA officials told us that the agency assigns PMOCs to eligible projects when they enter the program to provide project management oversight support to FTA and assist project sponsors. However, PMOCs engagement with projects typically starts in the later stages of Project Development. As a result, new sponsors may not understand what requirements apply to their projects in the early phase of Project Development. A few project sponsors that responded to our survey reported feeling overwhelmed or confused when preparing deliverables before the PMOC engaged with their projects. Five sponsors noted that examples of other projects’ deliverables or additional instructions could help them meet CIG requirements more efficiently.

Several project sponsors also reported that having additional information about the Oversight Procedures earlier in the project would help familiarize them with CIG requirements. For example, one project sponsor reported that providing the checklists that PMOCs use to review projects to project sponsors would help in the preparation of documents that more directly address requirements and may potentially shorten review timelines. Similarly, another project sponsor reported that it would be helpful for the PMOC to familiarize them with the Oversight Procedures so they could have a common understanding of the requirements, which could streamline the Project Development and review processes. Furthermore, a few project sponsors reported PMOCs vary in the quality of their technical assistance and flexibility of their oversight. According to one PMOC we interviewed, the amount of technical assistance a project receives does not always align with project need, particularly for new sponsors. According to FTA, every project has unique challenges, so the level of technical assistance FTA provides varies.

According to FTA, its objectives include reliable, transparent, and responsive service to grant recipients.[35] In addition, federal internal control standards call for the communication of quality information so that external parties can help achieve agency objectives.[36] FTA could better clarify program requirements and tailor its technical assistance resources to meet the needs of potential and new sponsors. Without more tailored guidance before and during the CIG Project Development phase, new and potential project sponsors may experience delayed delivery timelines or increased schedules. This may increase the likelihood that a sponsor will withdraw from the CIG program or ask FTA for an extension to Project Development, which, if not approved, can limit the amount of eligible expenses for FTA reimbursement. According to FTA, of the 46 New Starts and Core Capacity projects that entered Project Development since 2013, half (23) requested extensions, and 14 withdrew from the program prior to Engineering.[37] Furthermore, providing clearer, more tailored resources to new and potential project sponsors could help FTA provide better service to CIG grant recipients and may result in FTA spending fewer resources on iterative reviews and ongoing communication with sponsors that may otherwise be needed to clarify program requirements.

Conclusions

FTA has increased its efforts to assist project sponsors through the complex requirements of the CIG program. While those efforts largely meet project sponsors’ needs, there are opportunities for FTA to better assist project sponsors. By fully implementing our previous recommendation to better clarify FTA’s estimated time frames for reviewing submissions and responding to sponsors’ requests, FTA can address the project management challenges project sponsors continue to face related to uncertain and vague agency review timelines. This would give project sponsors more information to coordinate with local processes. Further, FTA can better assist potential and new project sponsors, who find the CIG process particularly challenging but do not have access to much of the agency’s technical assistance during the pre-entry phase of the process. By better tailoring technical assistance for new project sponsors and increasing access to program information early in the CIG process, FTA could help these project sponsors more effectively meet program requirements within specified time frames, which, in turn, could lead to FTA expending fewer resources on reviewing their project submissions.

Recommendation for Executive Action

We are making the following recommendation to FTA.

The Administrator of FTA should take steps to tailor its technical assistance for new and potential project sponsors to clarify program requirements, processes, and timelines during the pre-entry and early Project Development phases of the CIG program. Such technical assistance could include workshops for potential sponsors or connecting new and potential sponsors with more experienced sponsors. (Recommendation 1)

Agency Comments and Our Evaluation

We provided a draft of this report to DOT for review and comment. DOT concurred with our recommendation (see letter reproduced in appendix IV). DOT also provided technical comments, which we incorporated, as appropriate.

We are sending copies of this report to the appropriate congressional committees, the Acting Administrator of FTA, and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at repkoe@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix V.

Elizabeth Repko

Director, Physical Infrastructure

Sponsors of Capital Investment Grants (CIG) projects that receive major capital project funding under a full funding grant agreement from the Federal Transit Administration (FTA) are required to produce an Information Collection and Analysis Plan (formerly known as Before and After Study Plan).[38] These plans are for the collection and analysis of information to assess the impact of the project after it is built. In the plan, the project sponsor is to compare predicted versus actual construction costs, operating and maintenance costs, service levels, project scope, and ridership after project has opened, among other things. Under FTA regulations, the full funding grant agreement requires implementation of the plan.[39] The studies resulting from these plans inform FTA’s decisions on future proposed projects and contribute to the likelihood that major capital projects will start on time, finish on budget, and meet ridership goals.

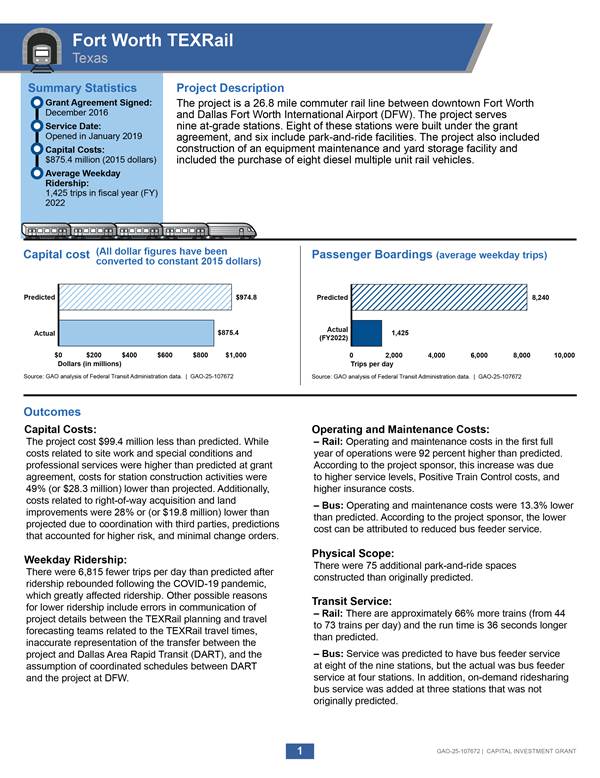

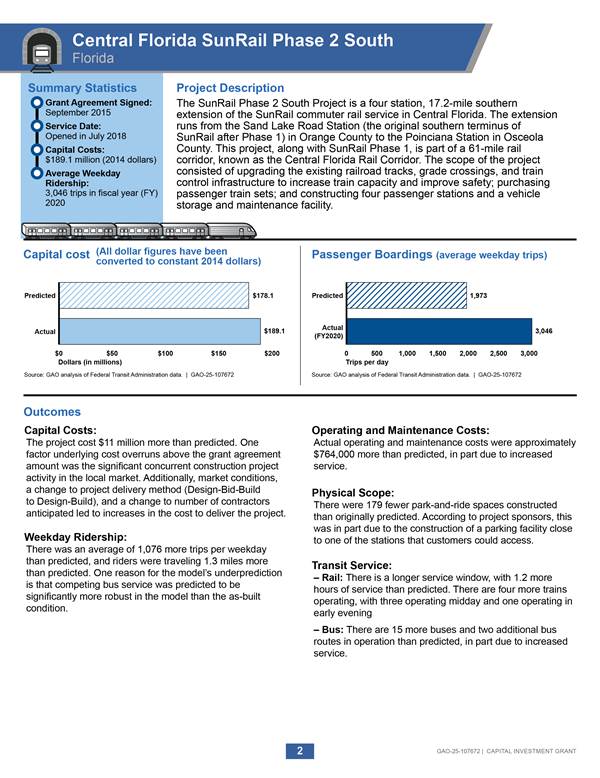

Since we last reported on these plans in April 2023, two additional sponsors published their projects’ Before and After Studies.[40] The projects are TEXRail, operated by Trinity Metro, and SunRail Phase 2 South, operated by the Florida Department of Transportation. We summarized these two projects, including predicted versus actual comparisons from the project sponsors’ plans.

Source: GAO analysis of Capital Investment Grants (CIG) project sponsors’ information | GAO-25-107672

Source: GAO analysis of Capital Investment Grants (CIG) project sponsors’ information | GAO-25-107672

Appendix II: GAO Survey of Capital Investment Grants Program Project Sponsors on Technical Assistance

The purpose of this survey was to obtain project sponsors’ perspectives on the technical assistance provided by the Federal Transit Administration (FTA) throughout the Capital Investment Grants (CIG) program. Our survey was comprised of closed- and open-ended questions. We sent a fillable Word survey via email to the 61 project sponsors in our sample. We contacted sponsors who did not respond to the survey by email and phone. We administered this survey in November through December 2024. We received responses from 53 project sponsors, for an 87 percent response rate. The questions we asked in our survey are shown below.

Please answer each of the following questions based on your agency’s experience with New Starts, Small Starts, Core Capacity, and Expedited Project Delivery Pilot.

1. It is our understanding that your agency requested [X]% of total project costs from CIG and is set to receive [X]%.[41]

a. Are these the correct shares of CIG funds?

Yes

No - what are the correct amounts?

b. What is the total federal share (i.e., all federal funds, including CIG) for each of the projects listed above?

c. Please list all federal funding sources for these projects.

d. How did your agency determine the requested federal share of CIG funds?

2. How experienced is your agency with the CIG process, taking into consideration the number of CIG projects initiated and completed, project complexity and recency, staff turnover, and hands-on experience navigating the process?

Little experience

Some experience

Very experienced

3. How familiar is your agency with the aspects of the CIG process that are statutorily required (e.g., ratings and project justification criteria)?

a. Very familiar

Somewhat familiar

A little familiar

Not at all familiar

b. How helpful would it be if FTA provided project sponsors with information on what is statutorily required?

4. Has your agency ever considered pursuing a CIG project type (i.e., New Starts, Small Starts, Core Capacity, and Expedited Project Delivery Pilot) but then did not apply for or continue with the program? Only include experiences from the last 10 years. Check all that apply.

a. Yes, decided not to apply

Yes, withdrew from a project type

Yes, moved a project from one CIG project type to another

No

Don’t Know

b. If yes, what type of project(s) did your agency consider or initially pursue?

c. If yes, what factors influenced your agency’s decision(s)?

5. Has your agency hired an outside consultant to assist with the CIG process? Only include experiences from the last 10 years

a. Yes

No

Not applicable

b. If yes, for what aspects of the CIG process?

6. For the following resources, please indicate how helpful they were to your agency. If your agency did not access the resource, please indicate whether you were aware of it.

|

|

If your agency accessed any of the following, how helpful did your agency find the resource? |

If your agency did not access any of the following, was your agency aware of the resource? |

|

||||

|

|

Very Helpful |

Somewhat Helpful |

Not Helpful |

Don’t Know |

Aware of Resource and Did Not Access |

Not Aware of This Resource |

Please Explain |

|

a. FTA’s website |

|

||||||

|

b. CIG policy guidance |

|

||||||

|

c. New Starts, Small Starts, or Core Capacity reporting instructions |

|

||||||

|

d. FTA templates (i.e., travel forecasts, land use, mobility cost efficiency and congestion relief, rating estimation, etc.) |

|

||||||

|

e. FTA headquarters staff |

|

||||||

|

f. FTA regional staff |

|

||||||

|

g. Project Management Oversight Contractors (PMOC) |

|

||||||

|

h. PMOC Oversight Procedures |

|

||||||

|

i. FTA quarterly review meetings |

|

||||||

|

j. FTA roundtables (i.e., Project Construction, Planning and Project Development, Third-Party Railroad Agreement, etc.) |

|

||||||

|

k. The STOPS model |

|

||||||

|

l. FTA or National Transit Institute (NTI) trainings, FTA seminars, or webinars |

|

||||||

|

m. Office hours at the American Public Transportation Association’s (APTA) conference |

|

||||||

|

n. Other: |

|

||||||

7. What stages of the CIG process, if any, has your agency found to be difficult or challenging and why? Please include the relevant project phases (i.e., pre-entry into project development, project development, engineering, grant agreement, Before and After study).

a. What, if any, technical assistance did your agency access to overcome these challenges?

b. If accessed, how helpful was the technical assistance?

8. How often did your agency request technical assistance from FTA?

a. Daily

Weekly

Monthly

A few times a year

Only at major milestones

Other:

b. How, if at all, did the frequency of technical assistance vary by project phase?

9. Throughout the program, did FTA answer your questions in a timely manner?

a. Yes

No

Varied

Please Explain:

b. Did FTA provide clear timelines and expectations for their decision-making?

Yes

No

Varied

Please Explain:

10. Overall, was the technical assistance your agency received….

|

|

Yes |

No |

Varied |

Please Explain |

|

a. Understandable (Clear) |

|

|||

|

b.

Appropriate (Responsive to |

|

|||

|

c. Current (Up to date) |

|

|||

|

d. Easily accessed |

|

11. How, if at all, might FTA improve technical assistance to better meet project sponsors’ needs in the following areas?

a. Environmental review process (i.e., NEPA)

b. Project application templates (i.e., travel forecasts, land use, mobility cost efficiency and congestion relief, etc.)

c. Technical assistance for project sponsors that are new to CIG

d. PMOC Oversight Procedures

e. Forecasting ridership

f. Cost Estimating

g. Before and After studies

h. Planning for time and resource allocation for each project phase

i. Addressing local challenges (i.e., third-party agreements, historical preservation process, etc.)

j. Addressing other challenges, including those mentioned in Question 7

12. What changes, if any, could FTA or Congress make to further support project sponsors throughout the CIG program and why?

13. Please use this space to share anything else you would like GAO to know regarding technical assistance throughout the CIG program

Capital Investment Grants (CIG) projects receive federal funding authorized under 49 U.S.C. § 5309 from the Federal Transit Administration (FTA), in addition to funding from other federal and local sources. The amount of CIG funding FTA provides to projects as a percent of the total project cost is known as the CIG share. A project’s CIG share is assessed multiple times throughout the process. The maximum CIG share varies by project type: 60 percent for New Starts and 80 percent for Small Starts and Core Capacity projects. The CIG share of project costs under the Expedited Project Delivery Pilot is limited to 25 percent.[42] CIG project sponsors request a preliminary grant amount as part of their ratings package at the end of the Project Development phase. FTA locks in the Section 5309 CIG funding amount (the dollar amount) at entry into the Engineering phase for New Starts and Core Capacity and at the award of a construction grant agreement for Small Starts projects. For New Starts and Core Capacity projects, the CIG share may change from when sponsors enter Engineering to when they execute a full funding grant agreement. During this time, project sponsors may lower their request or adjust the project cost.[43]

When project sponsors request CIG funding, they consider the amount of available local funding and FTA’s local financial commitment criteria.[44] Table 2 provides summary CIG funding information for the 93 projects in our survey sample. Of the 93 projects, 77 requested CIG funding. Eight of the 77 projects requested the maximum CIG share.[45] Most projects requested less than 50 percent CIG share (48 out of 77). Project sponsors we interviewed reported they strategically asked for less than the maximum available federal share to improve their project’s rating. According to the 2024 CIG Policy Guidance, projects that request less than a 50 percent federal match will receive a higher local financial commitment rating.[46]

Most CIG projects do not receive the maximum possible CIG share due to factors including project sponsors that request less than the maximum possible share, changes to total project cost, and FTA discretion. According to FTA officials we interviewed, when FTA decides how much funding to award a project, it considers factors, including 1) the number of projects that are seeking CIG funding, 2) the amount of funding available, and 3) how much money has been authorized and appropriated to the CIG program. According to FTA, it grants funds at the Administrator’s discretion on a case-by-case basis.

|

Project name |

Location |

Mode |

Section 5309 share of total project cost, requested |

Section 5309 share of total project cost, at entry to Engineering Phasea |

Section 5309 share of total project Cost, at grant agreement |

|

Core Capacity projects |

|||||

|

BART Transbay Corridor Core Capacity Project |

San Francisco, CA |

HR |

45.1 |

43 |

43.2 |

|

Canarsie Line Power and Station Improvements |

New York City, NY |

HR |

31.8 |

31.8 |

27.8 |

|

FrontRunner Strategic Double Track Project |

Salt Lake City, UT |

CR |

80 |

TBD |

TBD |

|

Green Line Transformation Program |

Boston, MA |

LRT |

TBD |

TBD |

TBD |

|

Peninsula Corridor Electrification Project |

San Carlos, CA |

CR |

32.7 |

32.7 |

33.5 |

|

Portal North Bridge |

Hudson County, NJ |

CR |

47.3 |

47.3 |

44.3 |

|

Red and Purple Line Modernization Project Phase 1 |

Chicago, IL |

HR |

48 |

48 |

46.3 |

|

Expedited Project Delivery Pilot projects |

|||||

|

East San Fernando Valley Transit Corridor Phase 1 Project |

Los Angeles, CA |

LRT |

25 |

N/A |

25 |

|

West Seattle Link Extension |

Seattle, WA |

LRT |

TBD |

N/A |

TBD |

|

New Starts projects |

|||||

|

Advanced Rapid Transit North-South Corridor |

San Antonio, TX |

BRT |

60 |

60 |

55.7 |

|

Austin Light Rail Phase 1 Project |

Austin, TX |

LRT |

50 |

TBD |

TBD |

|

BART Silicon Valley Phase II |

San Jose, CA |

HR |

49.4 |

40 |

TBD |

|

Broward Commuter Rail South |

Broward County, FL |

CR |

49 |

TBD |

TBD |

|

Capitol Extension Project |

Phoenix, AZ |

LRT |

TBD |

TBD |

TBD |

|

Double Track Northwest Indiana |

Gary/Michigan City, IN |

CR |

37.9 |

37.9 |

35.2 |

|

Eagle Commuter Rail Gold Line |

Denver, CO |

CR |

50 |

50 |

50.4 |

|

Federal Way Link Extension |

Seattle, WA |

LRT |

25 |

25 |

25 |

|

Gold Line |

St. Paul, MN |

BRT |

45 |

45 |

47.4 |

|

Green Line Extension |

Boston, MA |

LRT |

41.7 |

41.7 |

43.4 |

|

Hudson Tunnel |

Secaucus, NJ-NY |

CR |

47.3 |

47.3 |

47.2 |

|

Inglewood Transit Connector Project |

Los Angeles, CA |

HR |

60 |

50 |

TBD |

|

Interstate Bridge Replacement Program |

Vancouver/Portland, WA-OR |

LRT |

TBD |

TBD |

TBD |

|

Jefferson Alignment MetroLink Expansion Project |

St. Louis, MO |

LRT |

TBD |

TBD |

TBD |

|

Long Island Rail Road East Side Access |

New York City, NY |

CR |

35.6 |

35.6 |

35.6 |

|

Lowcountry Rapid Transit |

Charleston, SC |

BRT |

60 |

60 |

TBD |

|

Lynnwood Link Extension |

Seattle, WA |

LRT |

50 |

50 |

35.9 |

|

Maryland National Capital Purple Line |

Bethesda, MD |

LRT |

37.1 |

37.1 |

37.4 |

|

METRO Blue Line Extension (Bottineau LRT) |

Minneapolis, MN |

LRT |

49 |

49 |

TBD |

|

METRO Purple Line BRT |

St. Paul, MN |

BRT |

49 |

TBD |

TBD |

|

Northeast Corridor Rapid Transit Project |

Miami, FL |

CR |

49 |

TBD |

TBD |

|

Northwest Extension Phase II |

Phoenix, AZ |

LRT |

39.4 |

39.4 |

39.4 |

|

Red and Blue Line Platform Extensions |

Dallas, TX |

LRT |

49.9 |

49.9 |

47.2 |

|

Red Line Extension |

Chicago, IL |

HR |

60 |

50 |

34.3 |

|

Regional Connector Transit Corridor |

Los Angeles, CA |

LRT |

48 |

48 |

47.7 |

|

Southwest LRT |

Minneapolis, MN |

LRT |

50 |

50 |

46.4 |

|

Santa Ana Garden Grove Streetcar |

Los Angeles, CA |

SC |

50 |

50 |

36.5 |

|

Second Avenue Subway Phase 1 |

New York City, NY |

HR |

26.7 |

26.7 |

23.32 |

|

Second Avenue Subway Phase 2 |

New York City, NY |

HR |

49 |

49 |

44.2 |

|

South Central/Downtown Hub Light Rail |

Phoenix, AZ |

LRT |

49.5 |

39.5 |

39.4 |

|

Southeast Gateway Line |

Los Angeles, CA |

LRT |

TBD |

TBD |

TBD |

|

Southwest LRT |

Minneapolis, MN |

LRT |

50 |

50 |

46.4 |

|

Streetcar Main Street Extension |

Kansas City, MO |

SC |

49.5 |

49.5 |

49.5 |

|

TexRail |

Fort Worth, TX |

CR |

50 |

50 |

48.3 |

|

Third Street Central Subway |

San Francisco, CA |

LRT |

59.7 |

59.7 |

59.7 |

|

Transbay Downtown Rail Extension |

San Francisco, CA |

CR |

49 |

41 |

TBD |

|

Valley Link Rail Project Phase 1 |

Livermore, CA |

CR |

25 |

TBD |

TBD |

|

West Lake Corridor |

Lake County, IN |

CR |

49.4 |

49.4 |

37.5 |

|

Westside Subway Section 1 |

Los Angeles, CA |

HR |

44 |

44 |

44.3 |

|

Westside Subway Section 2 |

Los Angeles, CA |

HR |

49.9 |

49.9 |

47.5 |

|

Westside Subway Section 3 |

Los Angeles, CA |

HR |

35.5 |

35.5 |

36.12 |

|

Small Starts projects |

|||||

|

82nd Avenue Transit Project |

Portland, OR |

BRT |

TBD |

N/A |

TBD |

|

Advanced Rapid Transit (ART) East-West Corridor |

San Antonio, TX |

BRT |

49.4 |

N/A |

TBD |

|

Austin Expo Center Bus Rapid Transit |

Austin, TX |

BRT |

63.6 |

N/A |

63.6 |

|

Campbellton Community Investment Corridor BRT |

Atlanta, GA |

BRT |

47 |

N/A |

TBD |

|

Clayton Southlake BRT |

Atlanta, GA |

BRT |

19 |

N/A |

TBD |

|

Culture Connector |

Seattle, WA |

SC |

26.3 |

N/A |

TBD |

|

Davis-Salt Lake City Community Connector |

Salt Lake City, UT |

BRT |

TBD |

N/A |

TBD |

|

Division Street Bus Rapid Transit Project |

City of Spokane, WA |

BRT |

TBD |

N/A |

TBD |

|

Downtown-Uptown-Oakland-East End |

Pittsburgh, PA |

BRT |

51.5 |

N/A |

51.5 |

|

Downtown Riverfront Streetcar |

Sacramento, CA |

SC |

50 |

N/A |

TBD |

|

East Colfax Avenue BRT |

Denver, CO |

BRT |

53.4 |

N/A |

TBD |

|

East Main Street BRT |

Columbus, OH |

BRT |

39 |

N/A |

TBD |

|

East-West Bank BRT Corridor |

New Orleans, LA |

BRT |

TBD |

N/A |

TBD |

|

East-West Corridor Rapid Transit Phase I Project |

Miami, FL |

BRT |

33 |

N/A |

TBD |

|

Federal Boulevard BRT Project |

Denver, CO |

BRT |

47.1 |

N/A |

TBD |

|

Hamilton Avenue Corridor BRT |

Cincinnati, OH |

BRT |

80 |

N/A |

TBD |

|

IndyGo Blue Line Rapid Transit |

Indianapolis, IN |

BRT |

37.9 |

N/A |

TBD |

|

Link Rapid Transit Project |

Rochester, MN |

BRT |

52.6 |

N/A |

TBD |

|

Madison East West Bus |

Madison, WI |

BRT |

56.9 |

N/A |

56.9 |

|

Madison North-South BRT |

Madison, WI |

BRT |

78.4 |

N/A |

TBD |

|

Maryland Parkway Bus Rapid Transit Project |

Las Vegas, NV |

BRT |

49.5 |

N/A |

39.7 |

|

Memphis Innovation Corridor |

Memphis, TN |

BRT |

65.2 |

N/A |

TBD |

|

METRO F Line Bus Rapid Transit |

Minneapolis, MN |

BRT |

54.5 |

N/A |

TBD |

|

MetroHealth Line BRT |

Cleveland, OH |

BRT |

40 |

N/A |

TBD |

|

METRORapid Gulfton Corridor Project |

Houston, TX |

BRT |

TBD |

N/A |

TBD |

|

Midvalley Connector |

Salt Lake County, UT |

BRT |

60.7 |

N/A |

TBD |

|

Milwaukee North-South BRT Corridor |

Milwaukee, WI |

BRT |

77.5 |

N/A |

TBD |

|

North-South BRT |

Chapel Hill, NC |

BRT |

80 |

N/A |

TBD |

|

Pleasant Valley Bus Rapid Transit |

Austin, TX |

BRT |

65.9 |

N/A |

65.9 |

|

RapidRide I Line |

Seattle, WA |

BRT |

47.3 |

N/A |

TBD |

|

RapidRide J Line |

Seattle, WA |

BRT |

49.9 |

N/A |

49.9 |

|

RapidRide K Line |

Seattle, WA |

BRT |

TBD |

N/A |

TBD |

|

Reading Road Corridor BRT |

Cincinnati, OH |

BRT |

70 |

N/A |

TBD |

|

SURF! Busway and Bus Rapid Transit Project |

Monterey Bay, CA |

BRT |

22.1 |

N/A |

TBD |

|

Tampa Streetcar Extension |

Tampa, FL |

SC |

TBD |

N/A |

TBD |

|

Tucson High-Capacity Transit Project |

Tucson, AZ |

BRT |

TBD |

N/A |

TBD |

|

University-Medical BRT |

Huntsville, AL |

BRT |

TBD |

N/A |

TBD |

|

Veirs Mill Road BRT |

Montgomery County, MD |

BRT |

80 |

N/A |

TBD |

|

Wake Bus Rapid Transit: Southern Corridor Project |

Raleigh, NC |

BRT |

49.4 |

N/A |

TBD |

|

Wake Bus Rapid Transit: Western Corridor |

Raleigh, NC |

BRT |

38.6 |

N/A |

TBD |

|

West Broad Street BRT |

Columbus, OH |

BRT |

38.2 |

N/A |

TBD |

|

West Elizabeth BRT Corridor Project |

Fort Collins, CO |

BRT |

65 |

N/A |

TBD |

|

West Valley Connector |

San Bernardino, CA |

BRT |

27.9 |

N/A |

27.9 |

Legend: BRT = Bus rapid transit; CR = Commuter rail; HR = Heavy rail; LRT = Light rail transit; SC = Streetcar; N/A = Not applicable

Source: GAO analysis of FTA data and project sponsors’ survey responses to GAO’s survey. | GAO‑25‑107672

Note: Data are from FTA’s FY24 and FY25 Annual Reports on Funding Recommendations.

aApplicable only to Core Capacity and New Starts projects.

GAO Contact

Elizabeth Repko, repkoe@gao.gov

Staff Acknowledgments

In addition to the contact above, Nancy Lueke (Assistant Director); Stephanie Purcell (Analyst-In-Charge); Geoff Hamilton; Emma Hultgren; Delwen Jones; Kelly Rubin; Malika Williams; and Alicia Wilson made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]This amount comprises $1.6 billion from the Infrastructure Investment and Jobs Act (IIJA) (Pub. L. No. 117-58, 135 Stat. 429, 1438 (2021)) and $2.2 billion from the Full-Year Continuing Appropriations and Extensions Act, 2025 (Pub. L. No. 119-4, div. A, tit. I, § 1101(a)(12), 139 Stat. 9) incorporating by reference fiscal year 2024 Department of Transportation appropriations in division F of the Consolidated Appropriations Act, 2024 (Pub. L. No. 118-42, 138 Stat. 25, 333). The term “fixed-guideway” means a public transportation facility (1) using and occupying a separate right-of-way for the exclusive use of public transportation; (2) using rail; (3) using a fixed catenary system (i.e., a system using overhead power lines); (4) for a passenger ferry system; or (5) for a bus rapid transit system. 49 U.S.C. § 5302(8).

[2]IIJA, div. C, § 30005(a)(7)(C)(V), 135 Stat. 429, 899 (2021) (codified at 49 U.S.C. § 5309(o)(2)).

[3]Various executive orders, such as Executive Order 14154, Unleashing American Energy (90 Fed. Reg. 8353 (Jan. 29, 2025)), and Executive Order 14151, Ending Radical and Wasteful Government DEI Programs and Preferencing (90 Fed. Reg. 8339 (Jan. 29, 2025)), direct federal agencies to review and take specified actions with respect to their programs. Among other things, Executive Order 14154 requires agencies to pause the disbursement of funds appropriated through the IIJA and directed agencies to review their processes, policies, and programs for issuing grants and other financial disbursements under the IIJA for consistency with the law and Executive Order. According to FTA officials, as of March 2025, FTA was evaluating whether any existing guidance documents or other requirements are subject to revision per new or rescinded Executive Orders and Department of Transportation (DOT) Orders.

[4]These were formerly called Before and After Studies. GAO, Capital Investment Grants Program: Cost Predictions Have Improved, but the Pandemic Complicates Assessing Ridership Predictions, GAO‑23‑105479 (Washington, D.C.: Apr. 10, 2023).

[5]GAO, Grants Management: Agencies Provided Many Types of Technical Assistance and Applied Recipients’ Feedback, GAO‑20‑580 (Washington, D.C.: Aug.11, 2020).

[6]GAO‑23‑105479; Capital Investment Grants Program: FTA Should Improve the Effectiveness and Transparency of Its Reviews, GAO‑20‑512 (Washington, D.C.: July 16, 2020); Capital Investment Grants Program: FTA Should Address Several Statutory Provisions, GAO‑18‑462 (Washington, D.C.: May 31, 2018); and Public Transit: Observations on Recent Changes to the Capital Investment Grant Program, GAO‑16‑495 (Washington, D.C.: Apr. 28, 2016).

[7]In addition to the CIG program, PMOCs help DOT oversee other types of major capital projects that use federal loans, such as projects that received funding through the Transportation Infrastructure Finance and Innovation Act program and the Railroad Rehabilitation and Improvement Financing program.

[8]We did not include any changes to the CIG process that were part of the updated December 2024 guidance as part of the survey.

[9]GAO, Standards for Internal Control in the Federal Government, GAO‑14‑704G (Washington, D.C.: September 2014).

[10]New Starts projects also include bus rapid transit projects or an extension to an existing bus rapid transit system. 49 U.S.C. § 5309(a)(5).

[11]Pub. L. No. 114-94, § 3005(b), 129 Stat. 1312, 1454 (2015) as amended by the Infrastructure Investment and Jobs Act, Pub. L. No. 117-58, div C, § 30005(b), 135 Stat. 429, 900 (2021). Congress authorized up to eight projects, regardless of CIG project type, to apply for the Expedited Project Delivery Pilot Program. While Expedited Project Delivery Pilot Program projects can be New Starts, Small Starts, or Core Capacity projects, they must be supported, in part, through a public-private partnership, be operated and maintained by employees of an existing public transportation provider, and have a federal share not exceeding 25 percent of the project cost, among other things. Another difference from the CIG program is that while a CIG program Core Capacity project may not include project elements designed to maintain a state of good repair of the existing fixed guideway system, a pilot program Core Capacity project may, in general, include such elements. FTA is to expedite its review and notify applicants within 120 days of receiving a complete application whether the application has been approved. As of February 2025, FTA has signed one full funding grant agreement (part of the grant process discussed below) under the pilot program. The project sponsor, the Los Angeles County Metropolitan Transportation Authority, will use CIG funds to support the construction of a light rail line.

[12]Our description of the CIG process does not include new steps in the process from the December 2024 guidance.

[13]See CIG program statute provisions at 49 U.S.C. § 5309(d)(2)(A), (e)(2)(A), (h)(6)(B). See also National Environmental Policy Act (NEPA) of 1969, as amended, Pub. L. No. 91-190, 83 Stat. 852 (1970), codified, as amended at 42 U.S.C. § 4321 et seq. See also 23 C.F.R. Part 771. During the Project Development phase, CIG projects must complete the environmental review process required under NEPA that results in a final FTA environmental decision such as a categorical exclusion, a finding of no significant impact, or a combined final environmental impact statement/record of decision.

[14]For Core Capacity projects, FTA evaluates existing ridership information. As discussed in more detail later, certain New Starts and Small Starts projects may not need to produce ridership forecasts if they meet specified eligibility requirements.