DOD FINANCIAL MANAGEMENT

Insights into the Auditability of DOD’s Fiscal Year 2024 Balance Sheet

Report to Congressional Committees

United States Government Accountability Office

A report to congressional committees.

For more information, contact: Asif A. Khan at khana@gao.gov.

What GAO Found

For the seventh consecutive year since the Department of Defense (DOD) was required to undergo full-scope audits, DOD received a disclaimer of opinion on its financial statement audit in fiscal year 2024, meaning DOD could not provide auditors with sufficient, appropriate evidence needed to support information in its financial statements due to ineffective systems and processes. The National Defense Authorization Act for Fiscal Year 2024 requires DOD to receive an unmodified (clean) audit opinion by December 31, 2028.

DOD’s balance sheet, a principal financial statement, is a snapshot of its financial position at a point in time—showing its assets (what it owns) and liabilities (what it owes). Reliable balance sheet data support informed decision-making and improve mission operations. In fiscal year 2024, DOD’s balance sheet included information from 67 DOD components, making consolidation a complex process.

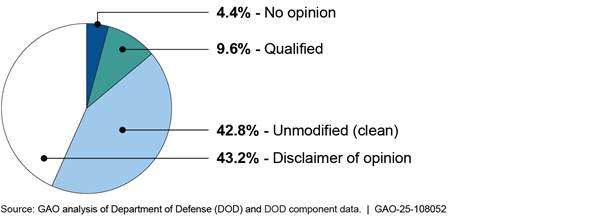

Although DOD received a disclaimer of opinion on its DOD-wide financial statements in fiscal year 2024, 11 DOD components received clean audit opinions. These components contributed $1.8 trillion of DOD’s total reported assets (42.8 percent) and $3.1 trillion of its reported liabilities (72.2 percent). However, nearly all of DOD’s total reported assets attributable to components with clean opinions related to the Military Retirement Fund. Similarly, nearly all assets attributable to components that received disclaimers of opinion related to the Army, Navy, and Air Force.

Percentage of DOD’s Total Reported Assets Related to Each Type of Audit Opinion at the Component Level, Fiscal Year 2024

Additionally, in fiscal year 2024, DOD’s Office of Inspector General identified 28 DOD-wide material weaknesses, which hinder sustainable business processes and a functioning internal control environment for its financial management operations. GAO’s analysis showed that several identified DOD-wide material weaknesses directly affected $2.1 trillion (50.3 percent) of DOD’s reported assets and $146.9 billion (3.4 percent) of its reported liabilities, indicating that there is an increased risk that these amounts are materially misstated. However, pervasive material weaknesses may affect all balance sheet data.

Why GAO Did This Study

DOD reported over $4.1 trillion in assets on its balance sheet as of September 30, 2024. DOD’s assets represent a significant portion of the federal government’s reported total assets. The ability to properly account for and report these assets would improve DOD’s ability to successfully carry out its mission and is critical to achieve an unmodified (clean) audit opinion.

However, DOD remains the only major federal agency that has yet to receive a clean audit opinion on its financial statements. This not only impedes DOD’s financial transparency but that of the U.S. government as a whole.

DOD’s financial statement audits promote accountability and transparency in how DOD manages its money and help identify financial and operational issues. DOD obtaining a clean audit opinion is important to ensure that information in its financial statements is reliable for informed decision-making.

This report, developed in connection with our mandate to audit the U.S. government’s consolidated financial statements, provides insight on the auditability of DOD’s balance sheet as of September 30, 2024. This report presents information on (1) component audit opinions as they relate to DOD’s reported total assets and liabilities and (2) DOD-wide identified material weaknesses as they relate to reported total assets and liabilities.

GAO reviewed the fiscal year 2024 agency financial reports for DOD and its components to determine which audit opinions each received and what identified material weaknesses were present DOD-wide and at the component level. GAO analyzed the amounts (1) related to each type of audit opinion at the component level and (2) directly affected by identified material weaknesses.

Abbreviations

CFO Act Chief Financial Officer Act of 1990

DFAS Defense Finance and Accounting Service

DOD Department of Defense

GF General Fund

NDAA National Defense Authorization Act

SFFAS Statement of Federal Financial Accounting Standards

WCF Working Capital Fund

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

September 18, 2025

Congressional Committees

The Department of Defense (DOD) reported over $4.1 trillion in assets as of September 30, 2024. DOD’s assets represent a significant portion of the federal government’s reported total assets. DOD’s ability to properly account for and report these assets improves its ability to successfully carry out its mission and is critical for DOD to achieve an unmodified (clean) audit opinion. However, DOD remains the only major federal agency that has yet to receive a clean audit opinion on its financial statements, as serious financial management problems have prevented DOD from adequately supporting the information in its financial statements. This not only impedes DOD’s financial transparency but that of the U.S. government as a whole. DOD financial management has been on our High-Risk List since 1995 because of these concerns.[1]

The National Defense Authorization Act for Fiscal Year 2024 requires that the Secretary of Defense ensure that DOD receives a clean audit opinion by December 31, 2028.[2] To meet this mandate, DOD’s financial statements will need to be auditable.[3]

Since fiscal year 2018, DOD has been required by law to undergo annual, full-scope financial statement audits, which examine DOD’s reported financial information to determine whether DOD presents its financial statements fairly, in accordance with U.S. generally accepted accounting principles.[4] These financial statement audits have value beyond the audit opinion, as they identify weaknesses in DOD’s operations and processes and can lead to financial and operational benefits.[5] Fairly presented financial statements and underlying financial information would enable DOD and its component entities to make better informed decisions, improve operations, and prevent wasteful practices.

The balance sheet, one of DOD’s principal financial statements, is critical to DOD’s auditability. The purpose of the balance sheet is to present a comprehensive view of DOD’s overall financial position at a point in time. DOD has placed an increased emphasis on balance sheet auditability in recent years. Examining DOD’s balance sheet provides insight into areas of progress and the challenges that remain in achieving a clean audit opinion by 2028, as mandated.

This report, developed in connection with fulfilling our mandate to audit the U.S. government’s consolidated financial statements, provides insight on the auditability of DOD’s consolidated balance sheet as of September 30, 2024.[6] This report presents information on (1) component-level audit opinions as they relate to DOD’s reported total assets and liabilities and largest balance sheet line items and (2) DOD-wide identified material weaknesses[7] as they relate to reported total assets and liabilities and largest balance sheet line items.[8]

To conduct this work, we reviewed DOD publications and prior GAO and DOD Office of Inspector General (OIG) work to identify the material weaknesses relevant to DOD’s balance sheet as of September 30, 2024. We used two factors to evaluate the extent to which DOD’s balance sheet as of September 30, 2024, was auditable: (1) component audit opinions and (2) identified material weaknesses that are relevant to the balance sheet.

We used DOD’s reported financial information in our analysis; however, this information had limitations. Auditors reported that DOD could not provide sufficient evidence for them to conclude whether DOD fairly presented its financial statements in accordance with U.S. generally accepted accounting principles. Auditors also identified material misstatements within DOD’s balance sheet. Appendix I provides additional details on our objectives, scope, and methodology.

We conducted this performance audit from January 2025 to September 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

A balance sheet is a financial statement that provides a comprehensive understanding of an entity’s financial position at a point in time—showing its assets (what it owns) and liabilities (what it owes).[9] On a balance sheet, assets and liabilities are reported in different categories, called line items. Appendix II provides an illustrative DOD balance sheet, showing its largest balance sheet line items as of September 30, 2024.

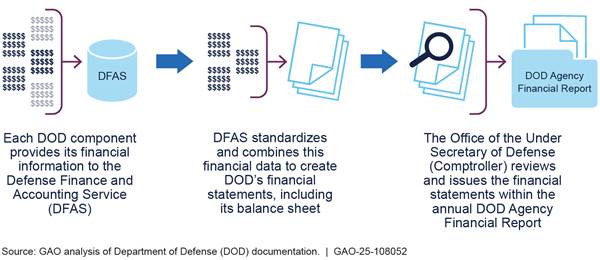

Preparation of DOD’s Balance Sheet

DOD’s balance sheet is a consolidation of information from across DOD. Preparing DOD’s consolidated balance sheet is a complex process, requiring the coordination of many entities. In fiscal year 2024, DOD’s financial statements consisted of information from 67 different DOD entities, which included the military services (Army, Navy, Air Force, and Marine Corps), defense agencies, and other components.[10]

At the end of every fiscal year, financial information from DOD’s components undergoes a consolidation process to create DOD’s consolidated financial statements. Each DOD component provides its financial information to the Defense Finance and Accounting Service (DFAS). Then, DFAS standardizes and combines this financial data to create DOD’s consolidated financial statements, including its balance sheet. The Office of the Under Secretary of Defense (Comptroller) reviews and issues the financial statements within the annual DOD agency financial report. See figure 1 for the DOD’s process for preparing its financial statements.

DOD’s Financial Statement Audits

DOD is required by law to undergo annual financial statements audits.[11] DOD’s financial statement audits are independent examinations of its financial statements that promote accountability and transparency in how DOD manages its money and help identify financial and operational issues. The purpose of a financial statement audit is for auditors to provide an opinion on whether DOD’s financial statements are fairly presented, in all material respects, in accordance with accounting principles. If auditors are able to conclude that the financial statements are fairly presented, the financial statement audit results in a clean opinion.[12]

During an audit, auditors may identify material weaknesses in internal controls over financial reporting and material misstatements. Effective internal controls over financial reporting provide management with reasonable assurance regarding the preparation of reliable financial statements in accordance with the U.S. generally accepted accounting principles. Material weaknesses mean that internal controls over financial reporting are not effective and that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis. Remediating material weaknesses is imperative for DOD to have sustainable business processes and a functioning internal control environment in its financial management operations.

Material misstatements are errors or instances of fraud that cause the financial statements to not be presented fairly. Material misstatements can result in reported amounts being understated or overstated in the financial statements. An auditor may be able to issue a clean audit opinion even with material weaknesses, if management can provide sufficient, appropriate evidence to support information reported in the financial statements. However, an auditor cannot issue a clean opinion if management does not correct identified material misstatements.

DOD undergoes audits at two different levels—the DOD-wide level and component level. DOD OIG conducts the DOD-wide financial statement audits and contracts with independent public accounting firms to perform individual financial statement audits of certain DOD components.[13] DOD OIG uses the results of these components’ audits when developing the DOD-wide audit opinion. As part of the DOD‑wide audit, DOD OIG also performs limited audit procedures on the DOD components that do not undergo individual financial statement audits. Because these components do not undergo individual audits, they do not receive their own audit opinions.

In fiscal year 2024, DOD received a disclaimer of opinion for the seventh consecutive year since the full-scope audits were required in fiscal year 2018, as management was unable to provide auditors with sufficient, appropriate evidence needed to support information in DOD’s financial statements and complete audit procedures due to ineffective systems and processes. DOD OIG identified 28 material weaknesses and two material misstatements. DOD OIG also asserted that, because of insufficient evidence, it may not have identified all issues that could affect the financial statements. Until DOD is able to provide auditors with sufficient, appropriate evidence to support the information in its financial statements, including its completeness, DOD will not be able to receive a clean audit opinion.

Balance Sheet Auditability

The balance sheet is critical to DOD’s auditability, as its purpose is to present a comprehensive view of DOD’s financial position. However, according to DOD OIG, DOD was unable to provide sufficient support for several of DOD’s largest balance sheet line items, including Inventory and Related Property; General and Right-to-Use Property, Plant, and Equipment; Environmental and Disposal Liabilities; and Accounts Payable.

As required by law, DOD annually evaluates how advanced certain components are in achieving auditable financial statements.[14] To determine this, DOD considers factors such as audit opinion and the percentage of material weaknesses added or downgraded. In recent years, DOD has placed an increased emphasis on balance sheet auditability in its assessment of the auditability of these components.

Additionally, Congress requested GAO’s support in tracking DOD’s progress toward achieving a clean audit opinion. To do so, GAO assisted Congress in developing a DOD Financial Management Scorecard that uses several key indicators, including balance sheet auditability.[15]

DOD Components’ Financial Statement Audit Opinions Show Varying Levels of Auditability

Although DOD received a disclaimer of opinion on its DOD-wide financial statements in fiscal year 2024, 11 DOD components received clean audit opinions. These components accounted for $1.8 trillion of DOD’s total reported assets (42.8 percent) and $3.1 trillion of its reported liabilities (72.2 percent). Similarly, our examination of DOD’s largest balance sheet line items shows that portions of these line items’ balances were reported by these 11 components that received clean audit opinions on their component financial statements.

Portions of DOD’s Total Reported Assets and Liabilities Were Reported by Components That Received Clean Audit Opinions

DOD’s balance sheet as of September 30, 2024, was made up of financial information from 67 components, of which 24 underwent audits and received the following audit opinions:

· Eleven received clean audit opinions and contributed $1.8 trillion in assets (42.8 percent) of DOD’s total reported assets and $3.1 trillion in liabilities (72.2 percent) of DOD’s total reported liabilities.[16]

· One received a qualified opinion and contributed $395 billion in assets (9.6 percent) of DOD’s total reported assets and $934.2 billion in liabilities (21.5 percent) of DOD’s total reported liabilities.

· Twelve received disclaimers of opinion and contributed $1.8 trillion in assets (43.2 percent) of DOD’s total reported assets and $247.5 billion in liabilities (5.7 percent) of DOD’s total reported liabilities.

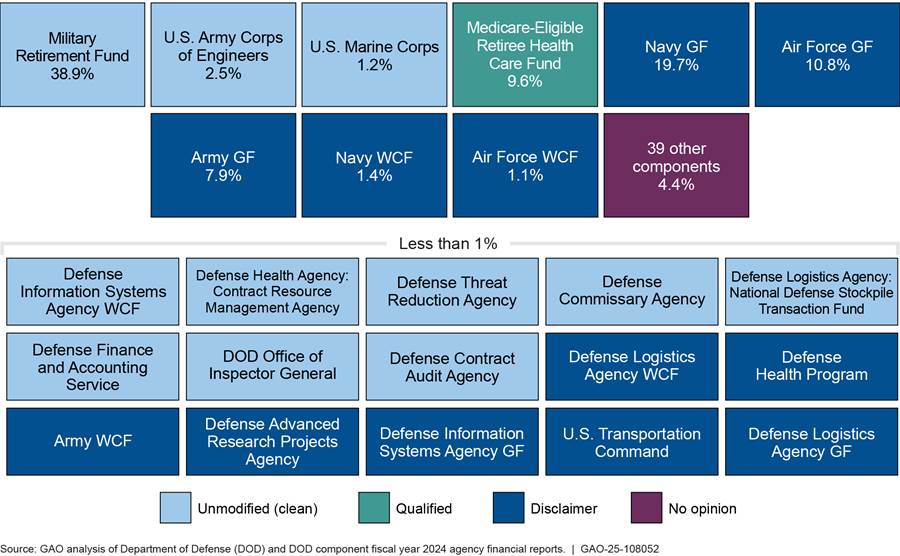

Additionally, 39 DOD components that did not receive audit opinions did not undergo individual audits (contributing $182.4 billion (4.4 percent) of DOD’s total reported assets).[17] Figure 2 shows DOD components’ financial statement audit opinions for fiscal year 2024 and the percentage of DOD’s total reported assets that were attributable to each component.

Note: Some DOD agencies report financial information in separate funds, such as general funds (GF) and working capital funds (WCF). These funds are treated as separate reporting entities and therefore issue their own financial statements.

Of the 43.2 percent of DOD’s total reported assets that are attributable to components that received disclaimers of opinion, 41.6 percent ($1.7 trillion) is attributable to just three components: the Army, Navy, and Air Force. These services received disclaimers of opinion for the seventh consecutive year since DOD’s full-scope audits were required in fiscal year 2018. The fourth military service that reports separate audited financial statements—the Marine Corps—did receive a clean opinion for its second year in fiscal year 2024; however, it only accounts for $49 billion, or 1.2 percent of DOD’s total reported assets.

Additionally, of the 42.8 percent of DOD’s total reported assets that are attributable to components that received clean opinions, 38.9 percent ($1.6 trillion) is attributable to just one component: the Military Retirement Fund. This component, which accounts for more of DOD’s reported assets than any other component, received its 30th consecutive clean audit opinion in fiscal year 2024.

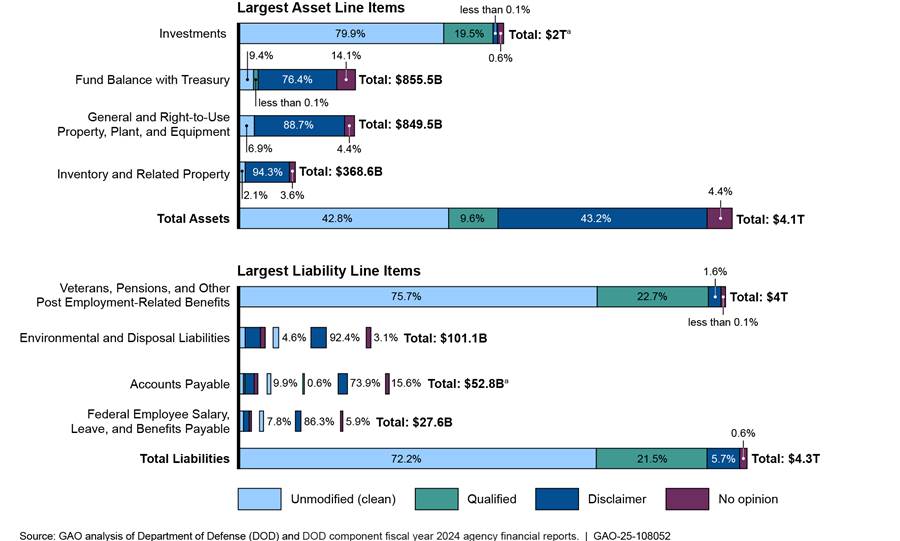

Portions of DOD’s Largest Balance Sheet Line Items Were Reported by Components That Received Clean Opinions on Their Financial Statements

Because DOD’s balance sheet is consolidated from component financial information, portions of DOD’s largest balance sheet line items are from the 11 components that received clean opinions. The extent to which these 11 components contributed to DOD’s largest line items varied significantly. For example, of the components that reported the Investments line item, two received clean opinions, which accounted for 79.9 percent of DOD’s total reported Investments line item. However, while four components that reported the Inventory and Related Property line item received clean opinions, these only accounted for 2.1 percent of DOD’s total reported Inventory and Related Property line item. Figure 3 shows the extent to which DOD’s largest balance sheet line items were related to each type of audit opinion at the component level.

Figure 3: DOD’s Largest Balance Sheet Line Items by Audit Opinion at the Component Level, Fiscal Year 2024

Notes: Percentages provided above may not total to 100% due to rounding.

As part of the DOD financial statement consolidation process, DOD is required to eliminate intradepartmental transactions to avoid overstating accounts. Therefore, the components’ combined balances do not align with those reported on DOD’s financial statements. Accounts Payable and, in turn, Total Liabilities were subject to significant amounts of intradepartmental eliminations in fiscal year 2024. For the purposes of our analysis, we used DOD’s Accounts Payable and Total Liabilities balances prior to intradepartmental eliminations to align with components’ combined balances.

aDOD’s balance sheet reports Investments and Accounts Payable in two categories: Intragovernmental and Other than Intragovernmental. For the purposes of our analysis, Intragovernmental and Other than Intragovernmental balances were combined to reflect the total balances for these line items.

These data show that while the DOD-wide financial statements received a disclaimer of opinion overall, significant portions of the balance sheet are attributable to components with clean opinions.

Material Misstatements and Material Weaknesses Hinder DOD’s Balance Sheet Auditability

DOD OIG identified two material misstatements and 28 material weaknesses DOD-wide, which impede auditability. However, not all DOD components under audit contributed to the DOD-wide material weaknesses. We determined that some of these DOD-wide material weaknesses directly related to $2.1 trillion (50.3 percent) of DOD’s reported assets and $146.9 billion (3.4 percent) of its reported liabilities. Our examination of DOD’s largest balance sheet line items shows that portions of DOD-wide line item balances were directly related to material weaknesses at the component level.

Omissions from DOD’s Balance Sheet Resulted in Material Misstatements

As previously stated, material misstatements in DOD’s financial statements prevent DOD from receiving a clean opinion. The two material misstatements DOD OIG identified in fiscal year 2024 regarding Security Assistance Accounts and the Joint Strike Fighter Program related to two material omissions from the balance sheet.

Security Assistance Accounts.[18] DOD OIG reported that DOD’s balance sheet should, but did not, contain the financial information for the Defense Security Cooperation Agency’s Security Assistance Accounts.[19] DOD OIG reported that its omission from the balance sheet resulted in a material misstatement. For example, the Security Assistance Accounts reported $16.7 billion for the line item, Other than Intragovernmental Accounts Payable, which would have increased DOD’s corresponding line item by 40.8 percent, thus resulting in a material understatement on DOD’s balance sheet as of September 30, 2024.

Joint Strike Fighter Program. DOD OIG also identified that DOD did not properly account for, manage, and report Joint Strike Fighter Program government property, resulting in a material weakness for the sixth consecutive year and a material misstatement in the DOD-wide financial statements.[20] With an estimated total life cycle cost of $2 trillion, the Joint Strike Fighter Program is DOD’s most costly weapons system in history and consists of DOD’s most advanced fighter aircraft. Not reporting Joint Strike Fighter Program information properly results in a material understatement of assets on DOD’s balance sheet and specifically affects the line items (1) Inventory and Related Property and (2) General and Right-to-Use Property, Plant, and Equipment.

Until DOD can resolve material misstatements and ensure that the balance sheet is complete, it will not receive a clean audit opinion.

Portions of DOD’s Total Reported Assets and Liabilities Were Directly Related to Identified Material Weaknesses

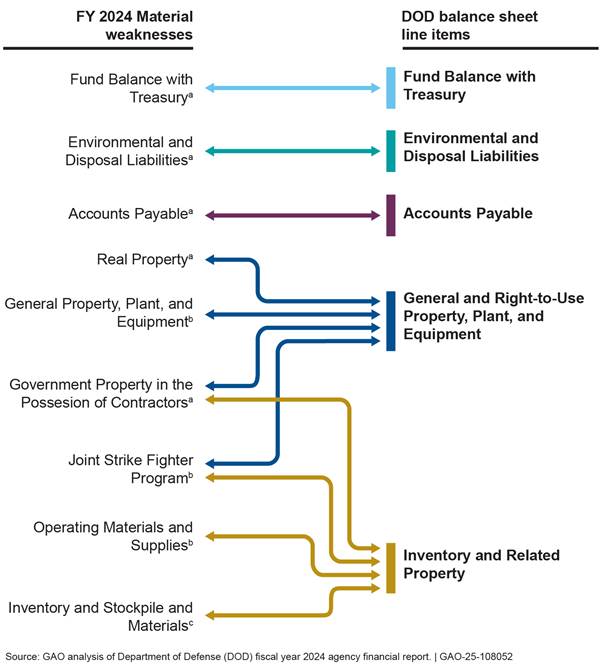

To determine the extent to which DOD’s total reported assets and liabilities were directly related to identified material weaknesses, we determined which material weaknesses were directly related to asset and liability line items on the balance sheet. Of the 28 identified material weaknesses, nine directly related to five of DOD’s largest balance sheet line items (see fig. 4). For example, because of the severity and number of issues identified related to DOD’s inventory processes, DOD OIG identified Inventory and Stockpile Materials as a material weakness, which directly related to the Inventory and Related Property line item on the balance sheet. Material weaknesses directly related to three asset line items, which totaled $2.1 trillion, and two liability line items, which totaled $146.9 billion.

Figure 4: DOD Material Weaknesses Directly Related to Balance Sheet Line Items, Fiscal Year (FY) 2024

aDOD’s planned material weakness remediation year: 2026.

bDOD’s planned material weakness remediation year: 2027.

cDOD’s planned material weakness remediation year: 2028.

In fiscal year 2024, these material weaknesses directly related to $2.1 trillion (or 50.3 percent) of DOD’s total reported assets and $146.9 billion (or 3.4 percent) of DOD’s total reported liabilities.

Portions of DOD’s Largest Balance Sheet Line Items Were Directly Related to Material Weaknesses at the Component Level, Showing Varying Levels of Auditability

Even though some of DOD’s largest balance sheet line items were directly related to material weaknesses at the DOD-wide level, not all components that made up these line items had material weaknesses identified for these line items at the component level. For example, though Fund Balance with Treasury is a DOD-wide material weakness, the military services, which account for 74.7 percent of DOD’s reported Fund Balance with Treasury, all downgraded or resolved their Fund Balance with Treasury material weaknesses. Additionally, 95.2 percent of DOD’s reported General and Right-to-Use Property, Plant, and Equipment line item was attributable to components that had identified material weaknesses directly related to this line item. See table 1 for more detail and additional examples.

Table 1: Portions of DOD’s Largest Balance Sheet Line Items with Identified Material Weaknesses at the Component Level, Fiscal Year 2024

|

DOD-wide line items directly related to material weaknesses |

Dollar amount of DOD’s total line item value directly related to component‑level material weaknesses |

Percentage of DOD’s total line item value directly related to component‑level material weaknesses |

|

Fund Balance with Treasurya |

$26.3 billion |

3.1 |

|

General and Right-to-Use Property, Plant, and Equipment |

808.7 billion |

95.2 |

|

Inventory and Related Property |

354.6 billion |

96.2 |

|

Environmental and Disposal Liabilities |

40.6 billion |

40.1 |

|

Accounts Payableb |

38.4 billion |

72.8 |

Source: GAO. │ GAO‑25‑108052

aAccording to DOD OIG, the DOD-wide Fund Balance with Treasury material weakness remained in fiscal year 2024 because a material amount of the Fund Balance with Treasury line item had outstanding findings.

bThe Department of Defense’s (DOD) balance sheet reports Accounts Payable in two categories: Intragovernmental and Other than Intragovernmental. For the purposes of our analysis, we combined DOD’s Intragovernmental and Other than Intragovernmental Accounts Payable balances to reflect the total balance of this line item.

DOD OIG stated that, because of insufficient evidence, it may not have identified all issues and material weaknesses that could affect the financial statements. Consequently, there may be additional, component-level material weaknesses that could affect the balance sheet and have not been identified.

Finally, while some of the largest balance sheet line items did not have material weaknesses that directly related to them, several material weaknesses that DOD OIG identified in fiscal year 2024 indirectly related to the balance sheet and may affect multiple or all balance sheet line items. For example, the Financial Management Systems Modernization material weakness increases the risk that information used throughout the balance sheet is inaccurate, unreliable, or outdated due to outdated financial management systems (see app. III for examples of pervasive material weaknesses that relate to data in the balance sheet). Therefore, financial information in any line item could be materially misstated due to this material weakness.

Agency Comments

We provided a draft of this report to DOD for review and comment. DOD provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the appropriate congressional committees; the Secretary of Defense; the Office of the Under Secretary of Defense (Comptroller)/Chief Financial Officer; the Offices of the Assistant Secretaries of the Air Force, Army, and Navy (Financial Management & Comptroller); the Department of Defense Office of Inspector General; and other interested parties. In addition, the report is available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at khana@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix IV.

Asif A. Khan

Director, Financial Management and Assurance

List of Committees

The Honorable Roger F. Wicker

Chairman

The Honorable Jack Reed

Ranking Member

Committee on Armed Services

United States Senate

The Honorable Rand Paul, M.D.

Chairman

The Honorable Gary C. Peters

Ranking Member

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Mike Rogers

Chairman

The Honorable Adam Smith

Ranking Member

Committee on Armed Services

House of Representatives

The Honorable James Comer

Chairman

The Honorable Robert Garcia

Ranking Member

Committee on Oversight and Government Reform

House of Representatives

This report provides insight on the auditability of the Department of Defense’s (DOD) balance sheet as of September 30, 2024. This report presents information on (1) component audit opinions as they relate to DOD’s total assets and liabilities and largest balance sheet line items and (2) DOD-wide material weaknesses as they relate to total assets and liabilities and largest balance sheet line items.

For the scope of this work, we reviewed DOD’s consolidated balance sheet as of fiscal year 2024. We reviewed the notes to the financial statements to gain an understanding of DOD’s consolidated balance sheet and its line items. We considered and reviewed the DOD Office of Inspector General’s (OIG) report, Understanding the Results of the Audit of the Fiscal Year 2024 DOD Financial Statements, to gain an understanding of the process used to prepare DOD’s consolidated balance sheet and DOD’s financial statement audits. Additionally, we considered prior instances of how DOD and GAO have assessed DOD’s balance sheet auditability.

To address the two objectives, we reviewed the fiscal year 2024 agency financial reports of DOD and its components to determine what audit opinions each received and the material weaknesses identified for each. We reviewed DOD OIG’s fiscal year 2024 Independent Auditor’s Report to gain an understanding of DOD’s fiscal year 2024 material misstatements and material weaknesses and determine how they related to DOD’s balance sheet.

To assess the auditability of DOD’s consolidated balance sheet as of September 30, 2024, we calculated

· the amount of DOD’s total assets and liabilities, as reported on the balance sheet, attributable to components that received unmodified, qualified, and disclaimers of opinion, as well as the amount attributable to components that did not undergo audits and therefore did not receive audit opinions;

· the amount of DOD’s largest asset and liability line items, as reported on the balance sheet, attributable to components that received unmodified, qualified, and disclaimers of opinion, as well as the amount attributable to components that did not undergo audits and therefore did not receive audit opinions;

· the amount of DOD’s total assets and liabilities, as reported on the balance sheet, that were directly related to DOD-wide material weaknesses;

· the amount of DOD’s largest asset and liability line items, as reported on the balance sheet, that were directly related to DOD-wide material weaknesses; and

· the extent to which the exclusion of the Defense Security Cooperation Agency’s Security Assistance Accounts understated or overstated DOD’s Other than Intragovernmental line items, as reported on the balance sheet.

We conducted this performance audit from January 2025 to September 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

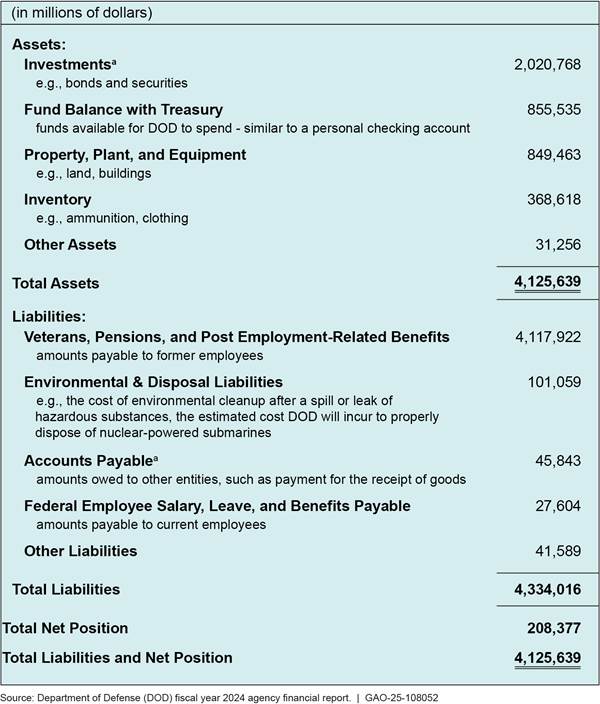

Figure 5 is an illustration of the Department of Defense’s (DOD) balance sheet using monetary amounts from fiscal year 2024. This balance sheet is reformatted to show only DOD’s largest asset and liability line items discussed in this report.

Note: Line item balances presented above may not be consistent with totals due to rounding.

aDOD’s balance sheet reports Investments and Accounts Payable in two categories: Intragovernmental and Other than Intragovernmental. For the purposes of our analysis, Intragovernmental and Other than Intragovernmental balances were combined to reflect total balances for these line items.

While the Department of Defense (DOD) Office of Inspector General (OIG) identified material weaknesses specific to certain balance sheet line items during the fiscal year 2024 audit of DOD’s financial statements, it also identified material weaknesses with pervasive effects on the financial statements that may affect multiple or all balance sheet line items. Examples of pervasive material weaknesses, which increase the risk of material misstatement, are as follows:

· Financial Management Systems Modernization. DOD’s continued use of outdated, noncompliant systems increased the risk of DOD not being able to produce accurate, reliable, and timely financial information. According to DOD OIG, this will continue to impede DOD’s and its components’ ability to achieve clean audit opinions.

· Intragovernmental Transactions and Intradepartmental Eliminations. DOD is required to report intragovernmental balances on its financial statements and eliminate intradepartmental balances from its financial statements. As part of the process of preparing DOD-wide financial statements, intradepartmental transaction amounts are required to be eliminated to avoid overstating accounts. However, DOD did not sufficiently record the necessary intragovernmental or intradepartmental transaction data, resulting in incomplete, inaccurate, and unsupported adjustments and intradepartmental eliminations.

· Universe of Transactions. DOD and its components could not provide a complete population of transactions to support balance sheet line items due to a lack of internal controls, policies, and procedures. As a result, DOD could not verify that financial statement information was complete and adequately supported.

· DOD-Wide Oversight and Monitoring. DOD did not have an effective oversight process of DOD component-level financial information included in the DOD-wide financial statements. The component-level financial data included in the DOD-wide financial statements did not consistently match the audited component financial statements.

Asif A. Khan, khana@gao.gov

In addition to the contact named above, Roger Stoltz (Assistant Director), Tulsi Bhojwani (Analyst in Charge), Crystal Alfred, Melissa Bentley, Victoria Cline, Giovanna Cruz, Edgar Fletes, Dakota Hunt, Jonathan Meyer, and Tri Tran made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]GAO, High-Risk Series: Heightened Attention Could Save Billions More and Improve Government Efficiency and Effectiveness, GAO‑25‑107743 (Washington, D.C.: Feb. 25, 2025).

[2]National Defense Authorization Act for Fiscal Year 2024, Pub. L. No. 118-31, § 1005, 137 Stat.136, 379 (2023), reprinted at 10 U.S.C. § 240a note.

[3]In this report, “auditable” refers to the ability to receive an unmodified (clean) audit opinion, which would require DOD to adequately support the information in its financial statements (including its completeness), and auditors to conclude that management has presented its financial statements fairly.

[4]National Defense Authorization Act for Fiscal Year 2018, Pub. L. No. 115-91, § 1002(b), 131 Stat. 1283, 1538 (2017), presently codified at 10 U.S.C. § 240a. During 2002 through 2017, the DOD Office of Inspector General performed limited-scope audits on DOD’s agencywide financial statements. While DOD has undergone full financial statement audits since fiscal year 2018, auditors have identified scope limitations that prevent auditors from performing the necessary procedures to conclude on the financial statements. Under audit continuation plans, the auditors can continue to perform additional limited testing rather than stopping audit activities when a basis for disclaimer of opinion has been reached. This continued testing can provide valuable feedback that enhances department-wide efforts to improve systems, processes, and internal controls.

[5]GAO, Financial Management: DOD Has Identified Benefits of Financial Statement Audits and Could Expand Its Monitoring, GAO‑24‑106890 (Washington, D.C.: Sept. 24, 2024).

[6]Unless otherwise noted, “balance sheet” henceforth refers to DOD’s consolidated balance sheet.

[7]A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis.

[8]DOD’s largest asset line items as of September 30, 2024, were (1) Investments; (2) Fund Balance with Treasury; (3) General and Right-to-Use Property, Plant, and Equipment; and (4) Inventory and Related Property. Together, the balances of these line items account for 99 percent of DOD’s total reported assets. DOD’s largest liability line items as of September 30, 2024, were (1) Veterans, Pensions, and Other Post Employment-Related Benefits; (2) Environmental and Disposal Liabilities; (3) Accounts Payable; and (4) Federal Employee Salary, Leave, and Benefits Payable. Together, the balances of these line items account for 99 percent of DOD’s total reported liabilities.

[9]There are four principal financial statements used by federal agencies: (1) the consolidated balance sheet, (2) consolidated statements of net cost, (3) consolidated statements of changes in net position, and (4) combined statements of budgetary resources.

[10]The fiscal year 2024 Air Force financial statements included the Space Force. Additionally, the number of components that are consolidated into DOD’s financial statements may vary from year to year.

[11]The Government Management Reform Act of 1994, amending a provision originally enacted by the Chief Financial Officers Act of 1990 (CFO Act), required that specific large federal agencies, including DOD, prepare annual agencywide financial statements and have those financial statements audited beginning in fiscal year 1996. See CFO Act, Pub. L. No. 101-576, 104 Stat. 2838 (Nov. 15, 1990), and Government Management Reform Act of 1994, Pub. L. No. 103-356, 108 Stat. 3410 (Oct. 13, 1994). This provision has since been amended to include most other executive agencies. 31 U.S.C. § 3515.

[12]There are four types of audit opinions: (1) unmodified (clean) opinion, in which auditors conclude that the financial statements are fairly presented; (2) qualified opinion, in which auditors conclude that the financial statements are fairly presented, with noted exceptions; (3) adverse opinion, in which auditors conclude that the financial statements are not fairly presented; and (4) disclaimer of opinion, in which auditors do not express an opinion on the financial statements because they do not have enough evidence to form an opinion and conclude that there could be misstatements that are both material and pervasive.

[13]For fiscal year 2024, DOD prepared and issued financial statements for 28 components and contracted with independent public accounting firms to perform audits of these financial statements. Of these audits, DOD OIG indicated that nine were required by 31 U.S.C. § 3515(c), as implemented by Office of Management and Budget Bulletin No. 24-02; four were required to by 50 U.S.C. § 3108; and 15 were conducted at the discretion of DOD management. The financial data for the four components subject to 50 U.S.C. § 3108 audits are not publicly available and thus are not included in our analysis.

[14]10 U.S.C. § 240h requires DOD to annually submit a report that includes a ranking of all the military departments and defense agencies in order of how advanced each is in achieving auditable financial statements.

[15]The House Committee on Oversight and Government Reform, Subcommittee on Government Operations, uses DOD’s Financial Management Scorecard—which was developed with support from GAO in 2024 and 2025—to analyze the results of DOD’s financial statement audits.

[16]As of the date of DOD’s fiscal year 2024 agency financial report, the financial statements for three components—the U.S. Marine Corps, DOD OIG, and the Defense Logistics Agency Stockpile Transaction Fund—had not yet been finalized due to granted extensions. As a result, DOD’s fiscal year 2024 financial statements included draft financial data for these components. We used the data as they were reported in DOD’s fiscal year 2024 financial statements as well as the finalized fiscal year 2024 data for these components in our analysis. These three components accounted for 1.2 percent of DOD’s total reported assets in fiscal year 2024.

[17]The components that do not undergo individual audits tend to report smaller amounts in assets. In fiscal year 2024, 31 of the 39 components each reported less than 0.1 percent of DOD’s total reported assets.

[18]The Security Assistance Accounts includes foreign military sales. For more information, see the Defense Security Cooperation Agency’s Security Assistance Accounts, Agency Financial Report for Fiscal Year 2024 (Washington, D.C.: Nov. 8, 2024).

[19]Statement of Federal Financial Accounting Standards (SFFAS) No. 47, Reporting Entity, provides guidance on determining which entities DOD should consolidate and report in the DOD-wide financial statements and what information it should present in those statements. According to DOD OIG, DOD should have consolidated the Security Assistance Accounts within its financial statements, based on SFFAS 47 criteria.

[20]DOD OIG reported that, in accordance with SFFAS No. 3, Accounting for Inventory and Related Property, and No. 6, Accounting for Property, Plant, and Equipment, DOD should account for and report Joint Strike Fighter Program government property in the DOD-wide financial statements.