NAVY SHIPBUILDING

A Generational Imperative for Systemic Change

Statement of Shelby S. Oakley, Director, Contracting and National Security Acquisitions

Before the Subcommittee on Seapower and Projection Forces, Committee on Armed Services, House of Representatives

For Release on Delivery Expected at 10:00 a.m. ET

United States Government Accountability Office

For more information, contact Shelby S. Oakley at (202) 512-4841 or oakleys@gao.gov.

Highlights of GAO-25-108136, a testimony before the Subcommittee on Seapower and Projection Forces, Committee on Armed Services, House of Representatives

A Generational Imperative for Systemic Change

Why GAO Did This Study

Although the Navy has seen a near doubling of its shipbuilding budget over the past 2 decades, acquisition challenges have resulted in consistent failure to increase its ship count as planned. GAO has regularly reported that the Navy’s shipbuilding acquisition approach does not align with innovative practices that promote timely, predictable development and delivery of new ships.

This statement addresses (1) challenges that Navy practices pose to achieving desired shipbuilding outcomes; (2) barriers to innovation presented by Navy budgeting and acquisition processes; (3) shipbuilding infrastructure and workforce challenges; and (4) leading commercial practices that could improve Navy shipbuilding and acquisition results.

This statement is based on information from GAO-25-106286, GAO-24-105503, and GAO-23-106222, among other work. Information about the scope and methodology of prior work on which this statement is based can be found in those products.

What GAO Recommends

GAO has made 90 recommendations to the Navy since 2015 to improve its shipbuilding acquisition practices and outcomes. The Navy agreed with many of them. However, the Navy has only fully or partially addressed 30, with 60 recommendations unaddressed. Our leading practices, observations on the industrial base, and open recommendations provide a starting point for the Navy to develop a holistic approach to improve its shipbuilding outcomes.

What GAO Found

Despite growing maritime threats, the Navy has failed to increase its fleet size as planned over the past 20 years. Over this period, GAO has found that the Navy’s shipbuilding acquisition practices consistently resulted in cost growth, delivery delays, and ships that do not perform as expected. For example, cost and schedule risks that GAO identified in 2017 for the Columbia class submarine program have recently been realized, with at least a 1-year delay to the first submarine’s delivery and hundreds of millions of dollars in additional cost.

The Navy’s existing budget and acquisition processes lack the schedule-driven principles found in leading industry practices, which prioritize the timely, predictable development and delivery of innovative, essential capabilities to users. This contributes to Navy shipbuilding programs struggling to deliver new ships with needed warfighting capability in a timely, cost-effective manner. Without changes that embrace leading practices, the Navy risks not keeping pace as technological innovation provides adversaries with new ways of fighting.

Infrastructure and workforce limitations worsen the Navy’s shipbuilding challenges. Shipyards have problems with aging facilities and equipment as well as space limitations that are affecting shipbuilding performance. Shipyards are also struggling to replace the loss of experienced, skilled workers with new ones. While the Navy has made investments to improve shipyard capabilities, the Navy has not developed a cohesive strategy to confront these challenges.

GAO has previously identified leading ship design practices used by commercial ship buyers and builders that the Navy can use to achieve more timely, predictable outcomes for its shipbuilding programs.

Leading Practices Supporting Timely Ship Design and Delivery

While the Navy strives to improve its shipbuilding performance, marginal changes within the existing acquisition structures are unlikely to provide the foundational shift needed to break the pervasive cycle of delivery delays and cost overruns. The Navy must take comprehensive action on a scale necessary to match the demands that it faces in this era of strategic competition. Without a thorough retooling of its processes, the Navy is likely to continue creating conditions where overall fleet capability falls short of expectations and needs.

Chairman Kelly, Ranking Member Courtney, and Members of the Subcommittee:

Thank you for the opportunity to discuss the U.S. Navy’s acquisition challenges. Today’s Navy is imperiled by cost growth and schedule delays within its shipbuilding portfolio. As we recently found, the Navy has no more ships today than when it released its first 30-year shipbuilding plan in 2003.[1] This stagnation has occurred despite regular demands and plans for a substantial increase to the Navy’s fleet size and a near doubling of its shipbuilding budget (inflation adjusted) over the past 2 decades. In a time of strategic competition, with near peer adversaries rapidly fielding technically advanced, disruptive technologies and expanding their fleets, the Navy’s current acquisition outcomes demand that it retools how to acquire new capabilities. The Navy’s findings from its 45-day shipbuilding review last year, which echoed problems we have reported on for years about acquisition strategy and design issues contributing to unrealistic ship delivery schedules, underscore the need for acquisition change.

The Navy continues to set extensive and detailed requirements for new vessels many years before they are fielded as well as lock in major commitments to construct ships before design stability is achieved. This has led to unrealistic cost and schedule expectations. In maintaining this status quo, Navy programs and their shipbuilders are effectively made to operate in a perpetual state of triage. As a result, the Navy must divert its attention to shipbuilding programs that fall behind schedule and grow in cost. These unmet expectations disturb the Navy’s funding plans, driving the department to redirect resources intended to pay for other needs and resulting in unfunded capabilities. Further, delays in delivering new ships to the fleet exacerbate issues with obsolescence and capabilities becoming irrelevant when threats evolve. Lack of focus on sustainment when designing ships and persistent challenges maintaining its fleet further hinder the Navy’s ability to meet operational and national security needs.

To its credit, the Navy has taken action in recent years to minimize some of the problems that plagued key shipbuilding programs. This includes efforts to reduce technical risk by incorporating proven systems into new ship designs as well as increased engagement with industry and fleet users about requirements and design prior to construction. The Navy and the Department of Defense (DOD) have also dedicated significant funding over the last decade—nearly $6 billion—through contract incentives and direct investments to bolster the shipbuilding industrial base. During this same period, we have made 90 recommendations to the Navy focused on improving the practices and results of its shipbuilding programs.[2] The Navy largely agreed with our recommendations and has taken action to fully address 23 of them. However, we currently have 52 open recommendations that the Navy has yet to address, 7 others that the Navy has partially addressed, and 8 more that we closed without the Navy taking action because they were overcome by events. Navy action to implement our recommendations would contribute to improvements for its shipbuilding results and lead the Navy to reexamine and change its approach to shipbuilding.

My statement today will address: (1) challenges that Navy practices pose to achieving desired shipbuilding outcomes; (2) barriers to fielding innovative capabilities presented by Navy budgeting and acquisition processes; (3) shipbuilding infrastructure and workforce challenges; and (4) leading commercial practices that could improve Navy shipbuilding and acquisition results. This testimony largely leverages our recent reports related to Navy shipbuilding, broader DOD use of modern practices to improve outcomes for weapon system acquisitions, leading practices in product development, and capstone work on past Navy shipbuilding performance and lessons learned.[3]

For the reports cited in this statement, among other methodologies, we analyzed Navy guidance, data, and documentation; performed site visits to shipyards; and interviewed officials from the Navy, other DOD organizations, and shipbuilding companies. These activities supported our efforts to determine the extent to which Navy shipbuilding programs are meeting their cost, schedule, and performance goals and delivering vessels with needed capability to the fleet. Our reports cited in this statement, which were published from July 2013 through February 2025, provide further detailed information on their objectives, scope, and methodology. We conducted the work on which this statement is based in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Shipbuilding Practices

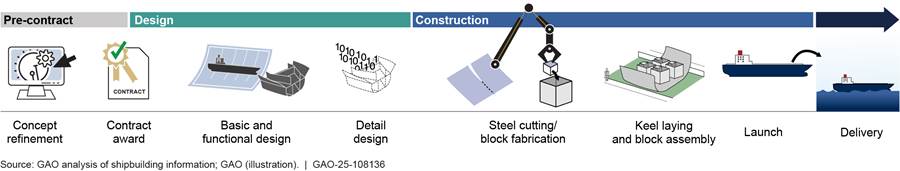

Shipbuilding is a complex, multistage industrial activity that includes common key events regardless of the type of ship construction or nature of the buyer (government or commercial). As shown in figure 1, key events are sequenced among three primary stages that move from concept through design and construction to deliver a new ship.

Figure 1: Notional Ship Design and Construction Process

Note: This figure depicts a generic shipbuilding process; Navy shipbuilding programs and commercial companies may use different terms to describe their design phases within the overall process. Further details on the basic process used for commercial or government ship design and construction can be found in GAO‑24‑105503.

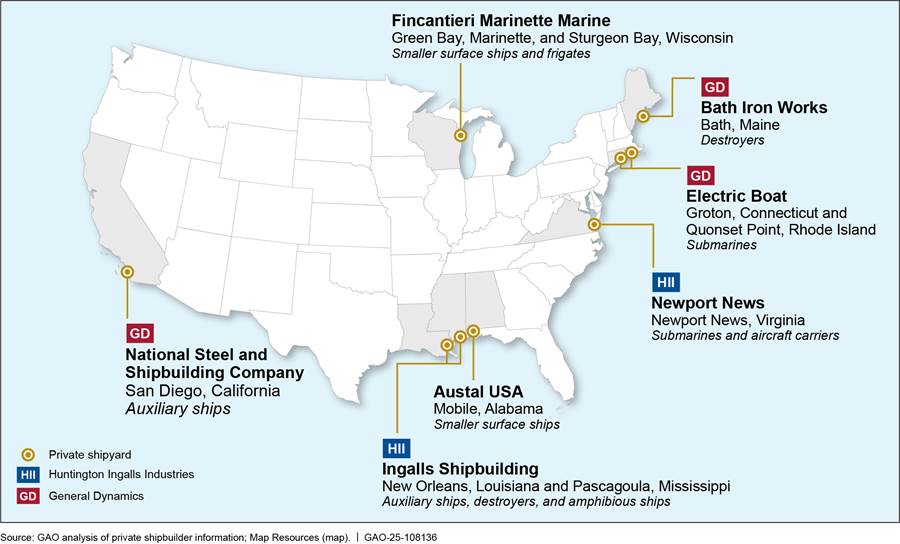

Navy Shipbuilding Industrial Base

At the prime contractor level, the Navy primarily uses seven private shipyards for its shipbuilding programs. Figure 2 shows the locations of the major private shipyards that the Navy contracts with for shipbuilding.

Figure 2: Locations of Major Shipyards That Build Navy Ships

These shipyards use a network of suppliers, known as the supplier base, to provide a range of items, from raw materials to manufactured items.

Leading Practices in Product Development

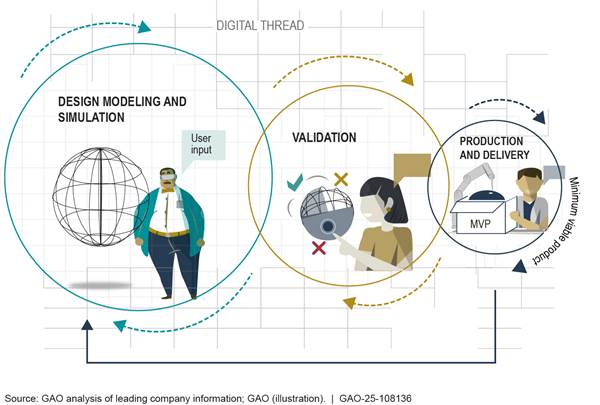

Our work identifying leading commercial practices outlines key underlying principles, as shown in figure 3, that support timely, predictable development and delivery of innovative, essential capabilities to users.[4]

Figure 3: Key Principles Used by Commercial Companies to Enable Successful Product Development

These key principles, which permeate each stage of product development, enable leading companies to develop and deliver innovative hardware and software products with speed to satisfy user needs. They also ensure that the business case for a product reflects valid user needs and resources available to support its development and production. Maintaining a sound business case can include intentionally deferring or cancelling capabilities based on user feedback or test results, when necessary. With these principles as their foundation, leading companies employ an iterative process for product development that involves continuous cycles, as shown in figure 4.

Figure 4: Iterative Cycles of Design, Validation, and Production Used for Product Development

This iterative process—like Agile software development—revolves around companies rapidly developing and deploying products. Through the iterative cycles, key practices demonstrated by companies include:

· receipt of continuous feedback from product users;

· focus on delivering a minimum viable product—a product with the minimum capabilities needed for users to recognize value and that can be followed by successive updates; and

· continual updates to product design information in a digital thread—a common source of information connecting stakeholders with real-time data across the product life cycle to inform product decisions.

Other development activities overlap between iterative cycles as product teams design, validate, and test subcomponents and integrated systems. Within the continuous cycles, digital engineering is an enabler of successful iterative development—not a stand-alone activity. It uses associated digital tools to help stakeholders make decisions based on real-time information to ensure that programs are on track to meet the right requirements.

Navy’s Schedule, Cost, and Performance Shortfalls Are Long-Standing

The imperative to change is evident by the Navy’s continued inability to deliver ships to the fleet on time and within cost. During the past 2 decades, we have consistently found performance shortfalls in Navy shipbuilding programs and made recommendations to help the Navy resolve them. Our 2018 report on Navy shipbuilding performance over the prior 10 years expounded on these persistent problems, finding that Navy ships cost billions more and take years longer to build than planned while often falling short of quality and performance expectations.[5] We also found that the Navy did not fully acknowledge and understand the risks it took by choosing to proceed with ship construction before technologies and ship designs were sufficiently matured.

Since 2018, we have continued to find significant challenges in Navy shipbuilding, as well as ship modernization. The challenges we identified have contributed to schedule delays, cost growth, and performance shortfalls. Some of our findings on these shortfalls include:

· In December 2024, we found that the Navy wasted $1.84 billion maintaining and modernizing four cruisers that were subsequently decommissioned without deploying after modernization.[6] Two of the ships underwent about 8 years of maintenance and modernization, but according to Navy officials, would have required significant effort to complete their modernizations and over $200 million in additional funds.

· In a December 2024 report on the Navy’s amphibious fleet, we found that the Navy is not on pace to replace its largest amphibious ships without significant additional investment.[7] Further, we found that, to avoid a sustained drop in fleet size, the Navy would need to keep nearly all its legacy amphibious assault ships in service past their expected service lives while it waits for new ships. The Navy estimates that extending the service life for some ships to meet the fleet requirement will require up to $1 billion per ship.

· In September 2024, we reported that our analysis of recent data for the Columbia class program showed that cost and schedule performance for lead submarine construction had consistently fallen short of targets. We also found that the lack of improvement through early 2024 and future risks will likely add to cost and schedule growth.[8] These findings are a continuation of our reporting going back to 2017 that the lead submarine’s aggressive schedule and the program’s optimistic cost estimate did not adequately reflect risks.[9]

· In June 2024, we found that the Virginia class submarine program’s rate of production to meet fleet needs remains at 60 percent of the planned rate of two submarines per year.[10] We also found that the shipbuilder is completing work at a higher cost than expected, resulting in an estimated need for $530 million more than planned to complete the first two Block V submarines in the class.

· In May 2024, we found that the Navy and the shipbuilder for the Constellation class frigate program were struggling to stabilize the ship design and, consequently, ship construction had effectively stalled.[11] These problems contributed to an estimated delay of 3 years to the lead frigate’s delivery and the shipbuilder expecting to exceed the contract ceiling price on the fixed price incentive (firm) contract for the lead ship.[12]

· In April 2022, we reported that the Navy shipbuilding plan outlined spending $4.3 billion over 5 years for 21 robotic autonomous maritime systems—systems with no crew onboard.[13] In doing so, the Navy did not account for the costs of operations and sustainment and the digital infrastructure necessary to enable them. This creates risk that unrealistic cost estimates will skew the Navy’s understanding of the affordability of these systems and undermine decision-making for future force plans.

· In March 2020, we found that the Navy’s lack of focus on sustainment when designing ships resulted in significant and costly problems for the fleet. For example, we estimated that the fleet spent billions of dollars to address unexpected problems affecting multiple ship classes because shipbuilding programs did not identify or mitigate sustainment risks through planning during the acquisition process. According to fleet leadership, these problems contributed to the fleet’s inability to maintain ships at planned cost and schedule.[14]

Most recently, in February 2025, we summarized the Navy’s shipbuilding schedule and cost challenges and the effect that they have had on the Navy’s ability to meet its goals for the fleet.[15]

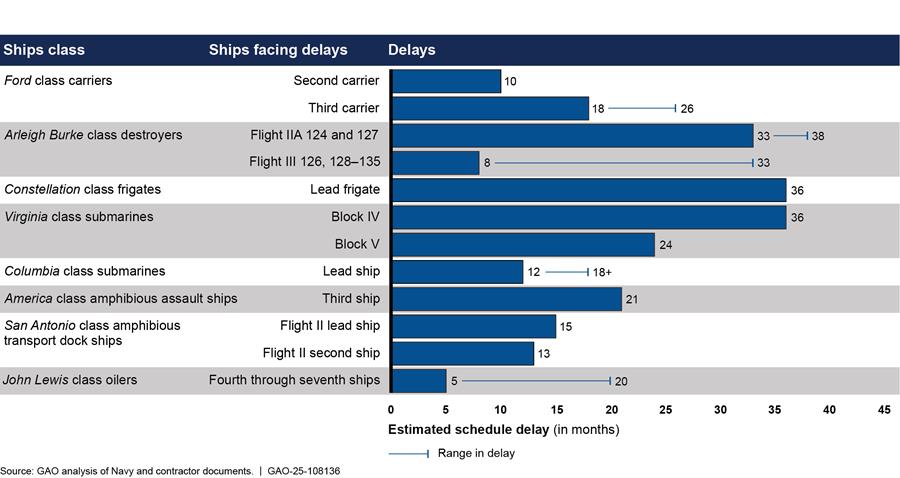

· Schedule. Significant schedule delays continue for most ships currently under construction, as shown in figure 5.

Figure 5: Schedule Delays for Navy Ships Under Construction as of September 2024

Note: This analysis reflects 37 out of 45 battle force ships currently under construction. We excluded Littoral Combat Ships because the Navy is not planning to procure additional quantities of this class under its shipbuilding plan. We also excluded command and support ships and ships for which there was not sufficient data to measure schedule performance.

· Cost. Many shipbuilding programs are experiencing cost overruns. For example, our independent analysis of the cost for the first Columbia class submarine indicates hundreds of millions of dollars in additional construction costs for which the government could be responsible.[16] For the lead Constellation class frigate and a block of six John Lewis class oilers, estimated costs have increased above the contracts’ ceiling prices—generally the maximum the government will pay under the contract. The regularity of cost increases across programs erodes the Navy’s buying power to execute its overall shipbuilding plan, particularly because the Navy generally budgets to the target price, not the contract ceiling price.[17]

Not only is a new approach necessary to meet existing cost and schedule targets, but the Navy also needs to increase the pace and volume of ship deliveries to overcome the construction backlog within its shipbuilding portfolio and meet its goals for future ships to maintain superiority over adversaries. For example, shipbuilders delivered seven new battle force ships in fiscal year 2023, whereas they would need to average about 13 ship deliveries per year for 30 years to meet the Navy’s goal of a 383-ship fleet. Given the performance of Navy shipbuilding programs over the past 2 decades, achieving—or even approaching—this goal will require the Navy and its shipbuilders to break with its current approach.

Navy Budget and Acquisition Processes Stifle Innovative Technologies

The pace and availability of technological advancements is driving warfighting changes that underscore the need to accelerate delivery of new capabilities to the fleet. The Navy has two fundamental problems that stunt its ability to pursue and field innovative capabilities with speed. The first is the structure of its budget process and the second is its linear acquisition process. Neither process is structured to support iteration and user involvement for shipbuilding programs, which are hallmarks of innovative practices used by leading commercial companies.

Navy Faces Rapid Change from Warfighting Innovations

According to the Chief of Naval Operations’ (CNO) 2024 Navigation Plan, the Navy has seen breakthroughs in battlefield innovation over the last 2 years that have profound implications for the changing character of war. Further, the plan says that cheaper, more accessible technology is creating innovative, unconventional combat capability that is available to state and non-state actors alike. For example, the plan cites the Ukrainian Navy’s use of a combination of missiles, robotic surface vessels, and agile digital capabilities to deny the Russian Navy use of the western Black Sea and threaten Russia’s supply lines to occupying forces in Crimea. It also cites Houthi forces’ use of a mix of ballistic missiles, cruise missiles, and drones in the Red Sea against the U.S. and partner navies at sea for the first time. Without the ability to consistently keep pace with this rapidly evolving technology and the character of war, the Navy risks fielding outdated technology and being ill-prepared to face key threats.

Budget Processes Lack Timeliness and Flexibility Needed to Rapidly Deliver Innovation to the Fleet

Navy ships are reliant on other Navy acquisition programs to produce and integrate systems that provide the ships’ mission capabilities. Much like ships, these systems, such as weapons, radars, and sensors, typically go through the Navy’s budget process. As previously discussed, the Navy’s signature programs, such as the Columbia and Virginia classes of submarines, Arleigh Burke class destroyers, and Ford class aircraft carriers, often develop overly optimistic cost, schedule, and performance expectations—known as a business case—to gain initial funding. We have found this optimism regularly leads to cost overruns for programs and creates budget instability when funding is moved between programs in budget planning to pay for these predictable, but unplanned, costs.[18]

Further, the length of time required to develop and execute the budget also stifles DOD’s ability to quickly develop capability, as discussed by the Commission on Planning, Programming, Budgeting, and Execution Reform.[19] For instance, the Navy is already 6 months into the current fiscal year and has largely finalized its fiscal year 2026 budget for next year. Thus, addressing a need that arises now may have to wait until the Navy receives its fiscal year 2027 funding. By the time the fiscal year 2027 funding is likely to be approved, 18 to 24 months will have elapsed. Further, given that the Navy is currently operating under a continuing resolution, it would generally not be able to start a new effort, and increasing funding for an existing program would have to be balanced against other priorities. Under these conditions, the capability sought by the fleet could already be outdated before the Navy begins to acquire it.

While this issue goes beyond the Navy, collectively, these types of budget limitations make it difficult to fund innovative, iterative acquisitions in a manner that provides for programs to be expanded and accelerated if they are working or quickly ended if they are not—a hallmark of leading commercial companies. While there are some pockets of success for the Navy, these successes are typically smaller dollar projects or funded outside the formal budget process, such as through rapid acquisition cells.

For example, several key capabilities have been in development for decades, but the Navy has yet to field them, in part, due to funding issues:

· Robotic autonomous systems. In April 2022, we reported that senior Navy officials told us the Navy divides its efforts between three different offices within the Office of the Chief of Naval Operations—surface, undersea, and warfare integration.[20] These offices prioritize and allocate funding across the Navy’s investments, which typically do not overlap. While this structure works for investing in individual surface and undersea systems, it does not facilitate collective efforts that span these areas, such as the digital infrastructure, which generally includes data repositories and complex digital models. As such, the Navy has pursued fielding of robotic autonomous systems for over 10 years but continues to struggle to field them.[21]

· High energy lasers. The Navy has identified high energy lasers as a key surface ship capability. In April 2023, we found that DOD and the Navy were having trouble establishing acquisition programs to field lasers, even though lasers have been in development for decades.[22] DOD has long noted the existence of a chasm between its technology community and its acquisition community that impedes consistent technology transition. Department insiders often refer to this as the “valley of death,” which exists because the acquisition community may require a higher level of technology maturity to begin a program than the science and technology community requires to complete its work.

· Conventional Prompt Strike. In June 2022 and again in June 2024, we reported that program officials told us funding issues and test challenges have resulted in delays to the Conventional Prompt Strike program, a hypersonic weapon system. This is a key capability planned for the DDG 1000 class destroyers and some Virginia class submarines.[23] Nevertheless, even though hypersonic weapons have been in development for decades and DOD has identified them as a top priority, the Navy has yet to field them.

Our work covering a range of programs and leading practices also illustrates that increasing the speed of future acquisitions requires immediate investment in digital capabilities and open systems architecture.[24] However, with regular budgetary pressures from shipbuilding program cost increases and perpetually unfunded needs, investments in future digital capabilities are constantly under fiscal pressure and are often not prioritized. For instance, we recently found that the use of a modular open systems approach can, among other benefits, help programs achieve the kind of rapid product development demonstrated by leading commercial companies.[25] An open system also enables the Navy to acquire innovative warfighting capabilities with more flexibility and increases opportunities for competition by allowing independent suppliers to build components that can plug into the existing system through the open connections. Despite these potential benefits, the Navy is lagging the other military services in embracing a modular open systems approach, with little detailed guidance to facilitate the use of such an approach.

In contrast, leading commercial companies focus on first delivering products with the minimum capabilities needed for users to recognize value and with systems designed to enable successive updates. When employing this leading practice approach, systems with modular designs and open interfaces are better positioned to accept upgrades rapidly and affordably as part of future iterations.[26] To help the Navy improve its approach to modular open systems, we recommended actions to ensure the department’s planning, coordination, resources, and guidance reflects a commitment to using open systems to enable portfolio-wide benefits. DOD agreed with these recommendations directed to the Navy, but action has yet to be taken to address them.

Acquisition Processes Do Not Enable Pace Needed for New Ship Deliveries

DOD and the Navy have yet to make needed changes to their acquisition processes that will enable programs to effectively balance oversight with the need to develop knowledge to field capability at speed. The urgency to find this balance is growing as technology evolves rapidly and adversaries field cheaper and more disruptive capabilities.

In February 2025, we found that DOD remains alarmingly slow in delivering new and innovative weapon system capabilities, even as national security threats continue to grow.[27] In June 2024, we reported that DOD planned to invest more than $2 trillion to develop and acquire its costliest weapon programs. Yet, the expected time frame for major defense acquisition programs to deliver an initial capability to the warfighter is 10 years, with shipbuilding programs regularly taking even longer to deliver new ships to the fleet. These timelines are incompatible with evolving threats and the rate of technological change.

As we found in December 2024 and have regularly found in other work, the Navy’s acquisition policies and practices pose challenges to delivering new capability with speed.[28] If an innovative technology or capability is fortunate enough to receive funding amid the competition for limited dollars, the Navy must then have an efficient, accessible pathway to acquire it. In 2020, DOD revamped its acquisition policies, with the intent to more quickly deliver innovative capabilities to the warfighter. These reforms, known collectively as the “adaptive acquisition framework,” established four pathways that weapon system acquisition programs can follow: (1) urgent capability, (2) middle tier, (3) major capability, and (4) software.

Although the Navy’s policy for the software acquisition pathway fully incorporated an iterative development structure, we found that the same type of full structure does not exist for its use of the urgent capability, middle tier, and major capability acquisition pathways. The lack of such a structure across acquisition pathways impairs the Navy’s ability to deliver capabilities that can respond to the rapid pace of technological change. This is especially relevant when considering the previously described long lead times necessary to get funding. Based on these challenges, in December 2024, we recommended that the Navy revise its acquisition policies and relevant guidance to reflect leading practices that use iterative cycles to facilitate speed and innovation. We also recommended that the Navy designate one or more pilot programs to provide lessons learned through using these practices.[29] The Navy agreed with our recommendations but has yet to take action to address them.

Lastly, we have found that the Navy has achieved mixed results involving the user in the acquisition process. In 2023, we found that a Navy software program achieved positive results by iterating often and involving users in the acquisition process.[30] However, for our most recent annual review of Navy shipbuilding and other DOD weapon system programs, we found that programs were not consistently involving users for other types of programs.[31] As we found in 2020, the lack of a role for the Navy’s fleet in informing key program decisions is concerning when considering that such decisions have significant influence on operating and sustaining ships and submarines.[32]

Industrial Base Limitations Impede Navy’s Ability to Improve Shipbuilding Outcomes

The Navy’s shipbuilding industrial base is experiencing significant infrastructure and workforce challenges that contribute to persistent schedule and cost shortfalls for shipbuilding programs. The Navy attempts to demonstrate stable demand for new ship construction with its long-term shipbuilding plans and contracting strategies, but this approach has not led to desired private investment to improve the industrial base. Further, despite billions in investments by the Navy and DOD to improve the industrial base, they have yet to fully assess whether the investments are having the intended effect. The lack of an overall strategy for managing the ship industrial base impedes the Navy’s ability to establish a cohesive approach to confront shipyard infrastructure and workforce challenges and the associated performance shortfalls for its shipbuilding programs.

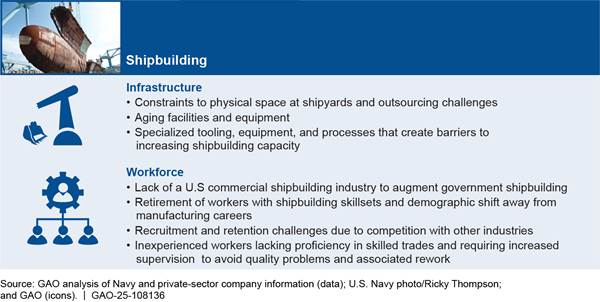

Infrastructure and Workforce Limitations Weigh on Shipbuilding Outcomes

We recently found that, due in part to infrastructure and workforce limitations, none of the seven shipbuilders that construct Navy battle force ships are currently positioned to meet the Navy’s ship delivery goals.[33] As shown in figure 6, several factors contribute to these limitations.

Figure 6: Key Infrastructure and Workforce Challenges Facing the Shipbuilding Industrial Base

Despite the shipbuilding industry facing these significant limitations, the Navy’s goals in its shipbuilding plan assume that shipbuilders will be able to eliminate excess construction backlog and produce future ships on time and within budget. As previously discussed, our prior work has shown that Navy shipbuilding has regularly fallen short of schedule and cost goals, and current performance is consistent with these trends.

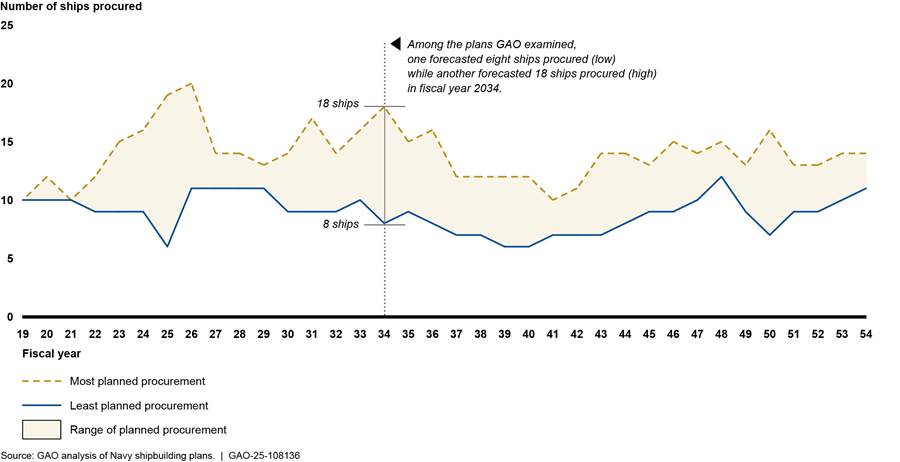

Navy Shipbuilding Plans and Contracting Strategies Have Not Driven Private Industrial Base Investments

As we recently reported, the Navy’s current approach for managing the ship industrial base has been largely ineffective at encouraging private industry to invest independently.[34] The Navy has sought to inspire such investments in infrastructure and workforce by communicating stable shipbuilding demand. However, the Navy’s reliance on long-range planning and contracting strategies that aim to provide a stable demand signal has not resulted in sufficient industry investments to meet the Navy’s capacity needs. As we found, this is, in part, because the Navy provides a highly variable demand signal in the plans from year to year, as shown below in figure 7.

Figure 7: Greatest and Least Number of Ships Planned for Procurement in Navy Annual Shipbuilding Plans, Fiscal Years 2019-2025

Note: Shipbuilding plans contain projections of future ship procurements, and as such, not every plan includes projections for fiscal years 2019 through 2024. Additionally, since each shipbuilding plan projects the next 30 years, years 2049 through 2054 only reflect projections from more recent shipbuilding plans. The Navy did not release a shipbuilding plan for fiscal year 2021 and the Navy’s fiscal year 2022 shipbuilding plan did not include 30-year procurement projections. The fiscal years 2023 through 2025 plans included multiple variations of potential future procurement, with each variation differing in the number of ships the Navy would buy.

Similarly, Navy efforts to convey shipbuilding demand through its contracting strategies, such as using multi-ship acquisition authorities to purchase multiple ships, have also not spurred desired private investment in the industrial base.[35] Contracts awarded using multi-ship acquisition authorities may be valued at hundreds of millions of dollars to billions of dollars and signal the potential for years of stable work. However, we found that even with this demand signal, shipbuilders have been reluctant to invest in their capability and capacity without additional Navy funding, such as investment incentives.

Benefits Are Uncertain from DOD’s Shipbuilding Industrial Base Investments

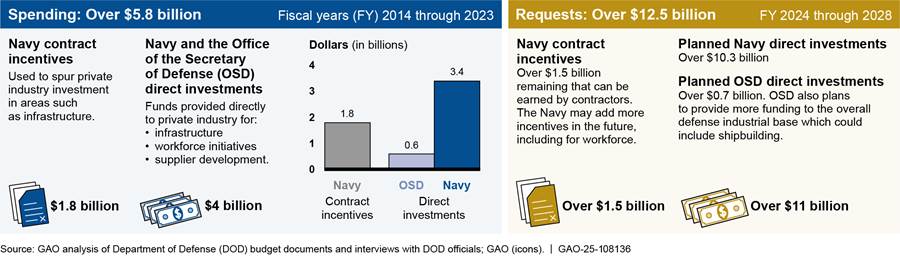

DOD’s Office of the Secretary of Defense (OSD) and the Navy are spending billions of dollars to support improvements to the shipbuilding industrial base. During a recent 10-year period, both combined to spend nearly $6 billion on contract incentives and direct investments focused on improving shipbuilder infrastructure, facilities, and workforce. In total, they plan to spend over $18 billion by the end of fiscal year 2028, as shown in figure 8.

Figure 8: Navy and OSD Investments and Budget Requests for the Shipbuilding Industrial Base, Fiscal Years 2014–2028

This spending includes about $1.15 billion in contract incentives earned by shipbuilders under submarine construction contracts as well as nearly $400 million in earned incentives under contracts for destroyer construction, according to DOD. It also includes direct Navy investments in the industrial base to support programs like the Constellation class frigate and the Virginia and Columbia classes of submarines.

Although shipbuilders have been receiving these funds for years, the Navy and OSD have yet to fully determine the funds’ effectiveness or ensure full visibility into how they are spent. Specifically, we found that the Navy does not consistently track all its investments involving these contract incentives. Further, neither the Navy nor OSD have fully assessed the effectiveness of their support of the shipbuilding industrial base and the extent to which the investments contribute to desired outcomes, such as increased shipbuilding capacity or efficiency and cost savings. The Navy and OSD also do not have full visibility across their investments to prevent duplication or overlap, nor do they coordinate across all investments to prevent such occurrences. Without improvements—as we recommended in February 2025—to help ensure the programmatic and aggregate effects of their investments are understood and redundancies avoided, the extent to which the Navy’s and OSD’s investments are improving the industrial base’s capacity and capability will remain uncertain.[36] DOD did not provide official comments for the issued report. The Navy indicated in draft comments that it generally agreed with the substance of our recommendations but has yet to take action to address them.

Navy Efforts to Improve Industrial Base Challenges Are Hindered by Lack of Long-Term Management Strategy

The Navy has yet to develop an overall management strategy to address challenges affecting the health of the shipbuilding industrial base. The lack of such a strategy limits the Navy’s ability to drive corporate investments in infrastructure and workforce improvements. It also impairs the Navy’s ability to navigate its competing priorities that seek to expand the industrial base and increase opportunities for competition without imperiling the existing ship industrial base. Addressing these challenges through the development and implementation of a cohesive management strategy, as we recommended in February 2025, would enable decision-makers to effectively assess and align their actions to manage the industrial base and close the gap between the Navy’s shipbuilding goals and shipbuilding performance.[37] As previously stated, the Navy indicated in draft comments that it generally agreed with the substance of our recommendations but has yet to take action to address them.

The Navy recently stood up a new Maritime Industrial Base program office that Navy officials said will be positioned to develop a strategy for the ship industrial base. The establishment of this new office presents an opportunity for the Navy to improve the effectiveness of its industrial base efforts by developing performance measures to gauge results from investments. However, until action is taken to implement a strategy, the Navy will not be able to effectively align or assess its actions to manage the ship industrial base, including the billions of dollars it plans to spend on the industrial base in the coming years.

A New Approach Is Needed to Meet Modern Challenges

Given the realities and constraints we have reported on, a new approach is needed to cost-effectively acquire ships on time and quickly field viable, innovative capabilities. There is no singular solution for the Navy to overcome its struggles to meet its fleet goals and keep pace with rapidly evolving adversary capabilities. However, incorporating key leading practices—such as iterative development, digitization, and off-ramping—into Navy budget and acquisition processes would support needed improvements. The results of our Navy shipbuilding work over many years demonstrates that leading practices from commercial industry can be applied thoughtfully to improve outcomes, even when cultural and structural differences yield different sets of incentives and priorities. For example, our recent reports on Navy ship design and the Constellation class frigate program identified opportunities for the Navy to embrace leading practices to support timely, predictable program outcomes.[38]

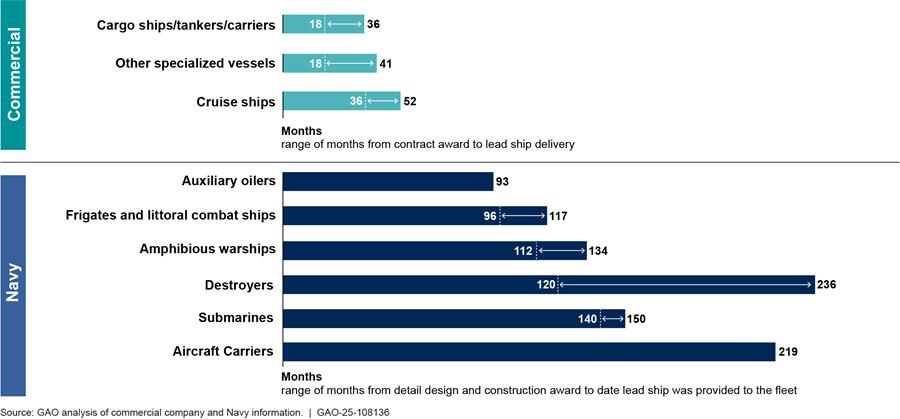

As part of our May 2024 reporting on leading ship design practices, we found that cycle times for the Navy to design and deliver ships to the fleet far exceed typical cycle times for a range of commercial ships, as shown in figure 9.

Figure 9: Comparison of Design and Construction Cycle Times for Selected Commercial Ships and Navy Ships Provided to the Fleet Since 2007

Note: For commercial ships, the range of months indicates the shortest and longest typical periods for companies to deliver a lead ship after contract award. For Navy ships, the range of months for different ship types indicates the shortest and longest periods for the Navy to provide selected lead ships to the fleet since 2007. We measured Navy cycle times based on the actual obligation work limiting date (OWLD) or planned date, as of January 2024, for lead ships that had yet to reach OWLD. OWLD generally coincides with when a Navy ship is provided to the operational fleet. While the fleet has some responsibilities for operating and maintaining the ship prior to OWLD, the acquisition program office is still managing construction-related work on the ship until this date. Since we found that commercial ships typically enter operation soon after delivery, Navy OWLD provides the best proxy for comparison to commercial delivery dates. For Navy programs that had a contract prior to the detail design and construction award, we used that contract award date as the start of the cycle.

To identify opportunities to shorten the Navy’s timeline for delivering new capability to the fleet, we compared the Navy’s practices to a combination of (1) broader leading practices for product development previously discussed and (2) the leading ship design practices used by commercial ship buyers and builders.[39] Our analysis illuminated how the demands pushing the Navy to increase the pace of design and construction for new ships will likely go unfulfilled without reforming practices to improve timeliness, provide greater flexibility, and ensure sufficient design knowledge when making key program decisions (see fig. 10).

Figure 10: GAO Comparison of Leading Ship Design Practices for Commercial Companies and U.S. Navy

In May 2024, we applied the findings of our work on leading practices for ship design and product development in reporting on the Navy’s Constellation class frigate program.[40] In that report, we identified opportunities for the Navy to move away from a traditional, linear development pathway for frigate design and construction and rethink the acquisition strategy for the program’s future ships with leading practices in mind. For example, program development of an acquisition strategy structured around iterative cycles could help the Navy deliver future frigates to the fleet at a faster pace and with increased assurance that their capabilities are matched to evolving mission needs. Consistent with leading practices, such a structure would include continuous engagement with stakeholders and users to inform the business case and subsequent design development. It would also use modern tools like digital engineering, a digital thread, and additive manufacturing as key enablers to iterative development, with off-ramping of capabilities used, when needed, to meet schedule interests.

Our May 2024 report on the Navy’s frigate program also highlighted the importance of a clear connection between measures of ship design maturity and decision-making. Specifically, we found that, counter to leading ship design practices, the Navy began frigate construction in August 2022 without completing functional design to demonstrate that the ship’s design was stable. We also found that inadequate design review practices and metrics obscured the Navy’s visibility into the frigate design’s progress and presented an obstacle to forecasting realistic ship delivery dates. The consequences of these practices are now well known, with significant cost growth to the lead ship and an estimated delivery delay of 3 years. The Navy generally agreed with our recommendations from this report and has taken action to address one of our five recommendations. Specifically, the frigate program has restructured its functional design metrics to ensure that—consistent with our recommendation—design progress measures reflect the quality rather than the quantity of design deliverables received from the shipbuilder.

We understand that completing functional design in 3D modeling before awarding detail design and construction contracts, as we recommended in our ship design practices report, represents a significant change to the Navy’s traditional acquisition approach for its shipbuilding programs.[41] However, the frigate’s functional design problems—and the associated cost and schedule problems that continue to plague the program—emphasize the need for the Navy to stabilize its new ship designs before awarding contracts for detail design and lead ship construction.

The need to ensure a stable design before making major commitments to programs is further emphasized when considering the ramifications that program shortfalls can have on the Navy’s force structure plans. For example, in the case of the frigate, the Navy’s shipbuilding plan for fiscal year 2025 states that recent updates to its battle force structure objectives include 58 frigates. This is more than an 80 percent increase in Constellation class ships from the initial 2022 battle force plans and 34 more ships than the Navy included in its 2016 Force Structure Assessment. However, this increased reliance on frigates to support a larger, more capable fleet is imperiled if the Navy cannot overcome the significant problems facing this program.

In conclusion, with the Navy facing challenges to maintaining superiority, it must take steps to halt the cycle of unmet shipbuilding and acquisition expectations. The Navy recognizes these challenges in their strategy documents but, thus far, its actions focus on improving its existing processes. Confronting these challenges demands a new approach that ensures the ships being delivered meet the fleet’s needs and possess the flexibility to be modified efficiently as technology advances and threats evolve.

In the face of this need, it is worth echoing what we stated nearly a decade ago when given a similar opportunity to present the findings of our work before members of Congress. It remains too simplistic to look at an individual program, or the Navy’s overall shipbuilding enterprise, as a product of a broken acquisition process. Rather, it is indicative of a process that is in equilibrium. Navy shipbuilding programs work in a structure where programs spend years creating optimistic business cases to get funding only to eventually run over cost and fall behind. It has worked this way for decades with similar outcomes: weapon systems that are the best in the world, but cost significantly more, take longer, and perform less than advertised. However, with the Navy being pressed to keep pace with peer adversaries that are growing increasingly capable, the cracks in this structure have become more pronounced and business as usual will not be effective in meeting these threats.

Moving forward, our many open recommendations and our work focusing on leading commercial practices should serve as a springboard for the foundational change that the Navy needs to make to meet this imperative. While the Navy has made some improvements and continues to pursue others, making marginal improvements within the existing structure is unlikely to result in the necessary substantive change. The Navy must take comprehensive action on a scale necessary to match the demands that it faces in this era of strategic competition.

Chairman Kelly, Ranking Member Courtney, and Members of the Subcommittee, this completes my prepared statement. I would be pleased to respond to any questions that you may have at this time.

GAO Contact and Staff Acknowledgments

If you or your staff have any questions about this testimony, please contact Shelby S. Oakley, Director, Contracting and National Security Acquisitions, at (202) 512-4841 or oakleys@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this statement.

GAO staff who made key contributions to this testimony are Laurier Fish (Assistant Director), Anne McDonough (Assistant Director), Sean Merrill (Analyst-in-Charge), Lindsey Cross, Marcus Ferguson, Luke Hagemann, Brittany Morey, Joseph Neumeier, Christine Pecora, Alyssa Weir, and Adam Wolfe. Other staff who made key contributions to the reports cited in the testimony are identified in the source products.

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on Facebook, Flickr, X, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

Congressional Relations

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S. Government Accountability Office, 441 G Street NW, Room 7125, Washington, DC 20548

Public Affairs

Sarah Kaczmarek, Managing Director, KaczmarekS@gao.gov, (202) 512-4800, U.S.

Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Strategic Planning and External Liaison

Stephen J. Sanford, Managing

Director, spel@gao.gov, (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814, Washington,

DC 20548

[1]GAO, Shipbuilding and Repair: Navy Needs a Strategic Approach for Private Sector Industrial Base Investments, GAO‑25‑106286 (Washington, D.C.: Feb. 27, 2025).

[2]This total only includes recommendations from our publicly available reports.

[3]GAO‑25‑106286; Weapon Systems Acquisition: DOD Needs Better Planning to Attain Benefits of Modular Open Systems, GAO‑25‑106931 (Washington, D.C.: Jan. 22, 2025); Navy Frigate: Unstable Design Has Stalled Construction and Compromised Delivery Schedules, GAO‑24‑106546 (Washington, D.C.: May 29, 2024); Navy Shipbuilding: Increased Use of Leading Design Practices Could Improve Timeliness of Deliveries, GAO‑24‑105503 (Washington, D.C.: May 2, 2024); Leading Practices: Iterative Cycles Enable Rapid Delivery of Complex, Innovative Products, GAO‑23‑106222 (Washington, D.C.: July 27, 2023); Uncrewed Maritime Systems: Navy Should Improve Its Approach to Maximize Early Investments, GAO‑22‑104567 (Washington, D.C.: Apr. 7, 2022); Leading Practices: Agency Acquisition Policies Could Better Implement Key Product Development Principles, GAO‑22‑104513 (Washington, D.C.: Mar. 10, 2022); and Navy Shipbuilding: Past Performance Provides Valuable Lessons for Future Investments, GAO‑18‑238SP (Washington, D.C.: June 6, 2018).

[6]GAO, Navy Ship Modernization: Poor Cruiser Outcomes Demonstrate Need for Better Planning and Quality Oversight in Future Efforts, GAO‑25‑106749 (Washington, D.C: Dec. 17, 2024).

[7]GAO, Amphibious Warfare Fleet: Navy Needs to Complete Key Efforts to Better Ensure Ships Are Available for Marines, GAO‑25‑106728 (Washington, D.C.: Dec. 3, 2024).

[8]GAO, Columbia Class Submarine: Overcoming Persistent Challenges Requires Yet Undemonstrated Performance and Better-Informed Supplier Investments, GAO‑24‑107732 (Washington, D.C.: Sept. 30, 2024).

[9]GAO, Columbia Class Submarine: Immature Technologies Present Risks to Achieving Cost, Schedule, and Performance Goals, GAO‑18‑158 (Washington, D.C.: Dec. 21, 2017).

[10]GAO, Weapon Systems Annual Assessment: DOD Is Not Yet Well-Positioned to Field Systems with Speed, GAO‑24‑106831 (Washington, D.C.: June 17, 2024).

[12]Fixed-price incentive contracts generally include a target cost or price, target profit, and price ceiling. The price ceiling is generally the maximum the government will pay under the contract. The government may pay for adjustments under other contract clauses that are unrelated to the contract price ceiling. See FAR Federal Acquisition Regulation § 16.403-1(a).

[14]GAO, Navy Shipbuilding: Increasing Focus on Sustainment Early in the Acquisition Process Could Save Billions, GAO‑20‑2 (Washington, D.C.: Mar. 24, 2020). In January 2025, we reported that the Navy has not implemented 46 of our recommendations from eight reports to help the Navy address ship sustainment problems. GAO, Navy Surface Ships: Maintenance Funds and Actions Needed to Address Ongoing Challenges, GAO‑25‑106990 (Washington, D.C.: Jan. 31, 2025).

[16]As reported in GAO‑24‑107732, our independent analysis calculated likely cost overruns that are more than six times higher than Electric Boat’s overrun estimate and almost five times more than the Navy’s overrun estimate. As a result, the government could be responsible for hundreds of millions of dollars in additional construction costs for the lead submarine. Due to DOD’s determination that more specific cost information is sensitive, we omitted this information from our publicly available report.

[17]GAO‑25‑106286 and Navy Shipbuilding: Need to Document Rationale for the Use of Fixed-Price Incentive Contracts and Study Effectiveness of Added Incentives, GAO‑17‑211 (Washington, D.C.: Mar. 2017).

[19]Commission on Planning, Programming, Budgeting, and Execution Reform, Defense Resourcing for the Future, (Arlington, VA: Mar. 6, 2024). Congress established the Commission on Planning, Programming, Budgeting, and Execution (PPBE) Reform in Section 1004 of the National Defense Authorization Act for Fiscal Year 2022 to examine the effectiveness of DOD’s PPBE process.

[21]We intend to discuss the Navy’s continuing efforts with remote autonomous systems in a forthcoming report based on ongoing work.

[22]GAO, Directed Energy Weapons: DOD Should Focus on Transition Planning, GAO‑23‑105868 (Washington, D.C.: Apr. 17, 2023).

[23]GAO‑24‑106831 and Weapon Systems Annual Assessment: Challenges to Fielding Capabilities Faster Persist, GAO‑22‑105230 (Washington, D.C.: June 8, 2022).

[25]As defined in GAO‑25‑106931, in general, a modular open systems approach for weapons systems includes a combination of engineering and business practices in which weapons systems are designed with modular components that are linked by clearly defined system interfaces. Modern weapon systems consist of a major system platform—like a ship—that is composed of major system components like engines and optical sensors. The connections between the ship’s components are referred to as interfaces. For the current statutory definitions of a modular open systems approach, major system components, and major system platforms, see 10 U.S.C. § 4401(b)(1)-(3).

[26]GAO, Weapon System Sustainment: Aircraft Mission Capable Goals Were Generally Not Met and Sustainment Costs Varied by Aircraft, GAO‑23‑106217 (Washington, D.C.: Nov. 10, 2022); and Defense Acquisitions: DOD Efforts to Adopt Open Systems for Its Unmanned Aircraft Systems Have Progressed Slowly, GAO‑13‑651 (Washington, D.C.: July 21, 2013).

[27]GAO, High-Risk Series: Heightened Attention Could Save Billions More and Improve Government Efficiency and Effectiveness, GAO‑25‑107743 (Washington, D.C.: Feb. 25, 2025).

[28]GAO, DOD Acquisition Reform: Military Departments Should Take Steps to Facilitate Speed and Innovation, GAO‑25‑107003 (Washington, D.C. Dec. 12, 2024).

[30]GAO, Defense Software Acquisitions: Changes to Requirements, Oversight, and Tools Needed for Weapon Programs. GAO‑23‑105867 (Washington, D.C.: July 20, 2023).

[35]Statute provides special acquisition authorities that enable the purchase of multiple ships in bulk to achieve cost savings. We refer to these special acquisition authorities as “multi-ship acquisition authorities.” These authorities include multiyear procurement authorities pursuant to 10 U.S.C. § 3501, as well as other provisions. Section 3501 authority, for example, may be used if such a contract will result in significant savings in anticipated costs or necessary defense industrial base stability not otherwise achievable through annual contracts.