NAVY SHIPBUILDING

Enduring Challenges Call for Systemic Change

Statement of Shelby S. Oakley, Director, Contracting and National Security Acquisitions

Before the Subcommittee on Seapower, Committee on Armed Services, U.S. Senate

For Release on Delivery Expected at 2:30 p.m. ET

United States Government Accountability Office

For more information, contact Shelby S. Oakley at oakleys@gao.gov.

Highlights of GAO-25-108225, a testimony before the Subcommittee on Seapower, Committee on Armed Services, U.S. Senate

Enduring Challenges Call for Systemic Change

Why GAO Did This Study

Although the Navy has seen a near doubling of its shipbuilding budget over the past 2 decades, acquisition challenges have resulted in consistent failure to increase its ship count as planned. GAO has regularly reported that the Navy’s shipbuilding acquisition approach does not align with innovative practices that promote timely, predictable development and delivery of new, fully capable ships.

This statement addresses (1) challenges that Navy practices pose to achieving desired shipbuilding outcomes, and (2) leading commercial practices that could improve Navy results over both the near term and far term.

This statement is based on information from GAO-25-108136, GAO-24-106546, GAO-24-105503, and GAO-23-106222, among others. Information about the scope and methodology of prior work on which this statement is based can be found in those products.

What GAO Recommends

GAO has made 90 recommendations to the Navy since 2015 to improve its shipbuilding acquisition practices and outcomes. The Navy agreed with many of them. However, the Navy has only fully or partially addressed 30; 60 remain unaddressed. GAO’s leading practices, observations on the industrial base, and open recommendations provide a starting point for the Navy to develop a holistic approach to improve its shipbuilding outcomes.

What GAO Found

Although maritime threats have been growing, the Navy has not increased its fleet size as planned over the past 20 years. Over this period, GAO has found that the Navy’s shipbuilding acquisition practices consistently resulted in cost growth, delivery delays, and ships that do not perform as expected. For example, GAO identified schedule risks in 2024 for the Constellation class frigate program. Counter to leading ship design practices, construction for the lead ship started before the ship design work was complete, and delivery is expected to be delayed by at least 3 years.

The Navy’s recent practices with the frigate program are similar to its prior performance with its Littoral Combat Ship and Zumwalt Class Destroyer programs. Both programs were hampered by weak business cases that over-promised the capability that the Navy could deliver. Together, these two ship classes consumed tens of billions of dollars more to acquire than initially budgeted and ultimately delivered far less capability and capacity to fleet users than the Navy had promised. The Navy cannot expect to look within its existing playbook to find answers. Current challenges can provide the Navy leadership with the impetus to look for solutions outside of the existing defense acquisition paradigm. Specifically, the Navy can innovate by using effective, proven ship design practices and product development approaches that are rooted in the approaches of industry-leading companies worldwide.

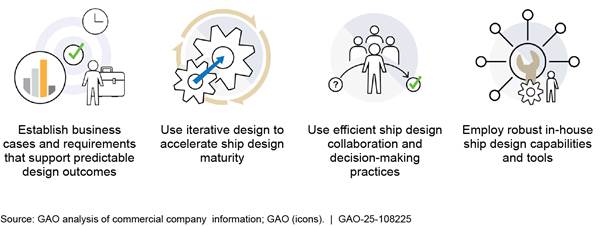

GAO has previously identified leading ship design practices used by commercial ship buyers and builders that the Navy can use to achieve more timely, predictable outcomes for its shipbuilding programs.

Leading Practices Supporting Timely Ship Design and Delivery

While the Navy strives to improve its shipbuilding performance, marginal changes within the existing acquisition structures are unlikely to provide the foundational shift needed to break the pervasive cycle of delivery delays and cost overruns. Leading practices offer the Navy a near-term path toward restoring credibility with the operational fleet, Congress, and the taxpayers. More importantly, over the long-term, these leading practices can help the Navy redefine its shipbuilding acquisition process, achieve its goals related to the number of ships needed to compete against potential adversaries, and reinforce the superiority of the Navy fleet.

Chairman Scott, Ranking Member Kaine, and Members of the Subcommittee:

Thank you for the opportunity to discuss the U.S. Navy’s acquisition challenges with its surface ship programs. Today’s Navy is imperiled by cost growth and schedule delays within its shipbuilding portfolio. As we recently reported, the Navy has no more ships today than when it released its first 30-year shipbuilding plan in 2003.[1] This stagnation has occurred despite regular demands and plans for a substantial increase to the Navy’s fleet size and a near doubling of its shipbuilding budget (inflation adjusted) over the past 2 decades. In a time of strategic competition, with near peer adversaries rapidly fielding technically advanced, disruptive technologies and expanding their fleets, the Navy’s current acquisition outcomes demand that it retools how to acquire new capabilities. The Navy’s findings from its 45-day shipbuilding review last year echoed problems we have reported on for years about acquisition strategy and design issues contributing to unrealistic ship delivery schedules. These issues underscore the need for acquisition change, including closer scrutiny of business cases for the Navy’s surface ship programs.

The Navy historically sets extensive and detailed requirements for new vessels many years before these vessels are fielded. It locks in major commitments to construct ships before design stability is achieved. These actions have led to unrealistic cost and schedule expectations. In turn, these unmet expectations disturb the Navy’s funding plans, driving the department to redirect resources intended to pay for other needs and resulting in unfunded capabilities. In this environment, Navy programs and their shipbuilders are effectively made to operate in a perpetual state of triage. As a result, the Navy must divert its attention to shipbuilding programs that fall behind schedule and grow in cost. For decades, the Navy has written off this anticipated chaos as mere “first of class” challenges that affect lead ships. However, our analysis of the Navy’s recent shipbuilding performance shows that lead ship challenges regularly cascade to follow-on ships, causing entire programs to run aground. Further, delays in delivering new ships to the fleet exacerbate the risks of obsolescence and capabilities becoming irrelevant when threats evolve. These challenges hinder the Navy’s ability to meet operational and national security needs.

To its credit, the Navy has taken action over the past decade aimed at addressing some of the problems that have beset key shipbuilding programs. These actions include efforts to reduce technical risk by incorporating proven systems into new ship designs as well as increased engagement with industry and fleet users about requirements and design prior to construction. The Navy and the Department of Defense have also dedicated funding—$775 million—intended to bolster the surface ship shipbuilding industrial base.[2] During this same period, we have made 90 recommendations to the Navy focused on improving the practices and results of its shipbuilding programs.[3] The Navy largely agreed with our recommendations and has taken action to fully address 23 and partially address 7 of them. However, we currently have 52 open recommendations that the Navy has yet to address, and 8 more that we closed without the Navy taking action because the recommended actions were overcome by events. Navy action to implement our recommendations would contribute to improvements for its shipbuilding results and lead the Navy to reexamine and change its approach to shipbuilding.

My statement today will address: (1) challenges that Navy practices pose to achieving desired surface ship shipbuilding outcomes, and (2) leading commercial practices that could improve Navy shipbuilding results over the near term and far term. This testimony largely leverages a testimony statement we recently delivered before the Subcommittee on Seapower and Projection Forces, Committee on Armed Services, House of Representatives.[4] Further, this testimony includes findings and analyses from our recent reports related to Navy shipbuilding and weapon system acquisitions, more generally; capstone work on past Navy shipbuilding performance and lessons learned; and foundational reports on leading practices in shipbuilding, ship design, and product development. This statement highlights acquisition challenges from four Navy shipbuilding programs.

For the reports cited in this statement, we analyzed Navy guidance, data, and documentation; performed site visits to shipyards; and interviewed officials from the Navy, other Department of Defense organizations, and shipbuilding companies, among other methodologies. These activities supported our efforts to determine the extent to which Navy shipbuilding programs are meeting their cost, schedule, and performance goals and delivering vessels with needed capability to the fleet. The reports directly cited in this statement, which we published from June 2018 through February 2025, provide further detailed information on their objectives, scope, and methodology.[5] For statements related to the Navy’s Zumwalt Class Destroyer (DDG 1000) and Medium Landing Ship (LSM), we summarized Navy reviewed information as part of our upcoming Weapon Systems Annual Assessment. We conducted the work on which this statement is based in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

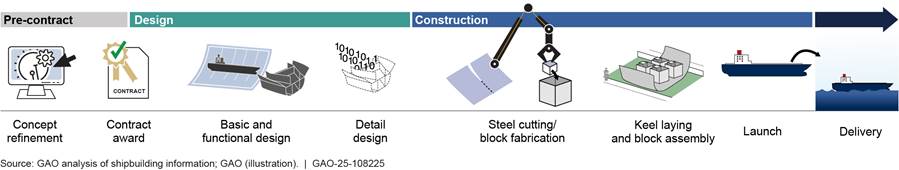

Shipbuilding Process

Shipbuilding is a complex, multistage industrial activity that includes common key events regardless of the type of ship construction or nature of the buyer (government or commercial). As shown in figure 1, key events are sequenced among three primary stages that move from concept through design and construction to deliver a new ship.

Figure 1: Notional Ship Design and Construction Process

Note: This figure depicts a generic shipbuilding process. Navy shipbuilding programs and commercial companies may use different terms to describe their design phases within the overall process. Further details on the basic process used for commercial or government ship design and construction can be found in GAO‑24‑105503.

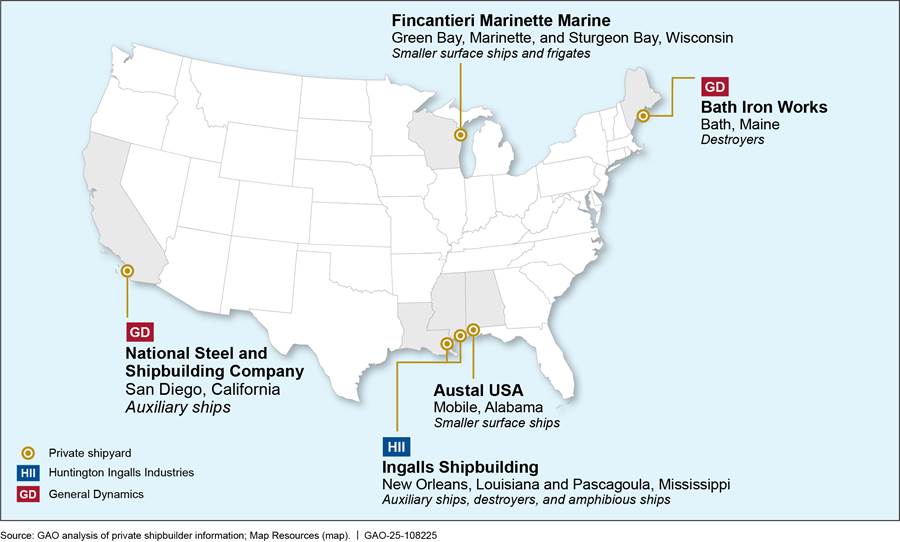

Navy Industrial Base for Surface Ships

At the prime contractor level, the Navy primarily uses five private shipyards for its surface ship shipbuilding programs. Given workforce and capacity limitations, improving the industrial base has been a priority across the Navy. Figure 2 shows the locations of the major private shipyards that the Navy contracts with for surface ship shipbuilding.

Figure 2: Locations of Major Shipyards That Build Non-nuclear Navy Surface Ships

These shipyards use a network of suppliers, known as the supplier base, to provide a range of items, from raw materials to manufactured items.

Weak Business Cases Allow Navy Programs to Start Fast and Affordably but Cause Them to Finish Slow and at a Higher Cost

Persistent challenges in meeting shipbuilding cost, schedule, and performance goals have resulted in less-capable ships, limited fleet growth, and diminished the Navy’s credibility as a steward of taxpayer dollars. Our June 2018 report on Navy shipbuilding performance over the prior 10 years expounded on these persistent problems. We found that Navy ships cost billions more and take years longer to build than planned while often falling short of quality and performance expectations.[6] Most recently, in February 2025, we summarized the Navy’s shipbuilding cost and schedule challenges—including that most surface ship programs under construction are projected to be delivered late—and the effect that they have had on the Navy’s ability to meet its goals, including to increase the size of the fleet.[7] These problems often stem from a weak business case that leads to poor acquisition decisions. Two programs, the Littoral Combat Ship (LCS) and the DDG 1000 exemplify what can go wrong when a sound business case is lacking. Unfortunately, two newer programs, the Constellation class Frigate and LSM, have experienced similar problems.

Navy Shipbuilding Challenges Are Often a Result of Poor Acquisition Decisions

The Navy’s shipbuilding challenges are often a result of poor acquisition decisions made during the early stages of shipbuilding programs. For example, shipbuilding programs often are not based on a sound business case—the balance of technologies, design knowledge, funding, and time needed to transform warfighter needs into a product. Poor acquisition decisions are compounded by a budget process that requires the Navy to secure long-range funding commitments before the business case—including resources and design knowledge—is fully understood. Past performance indicates that once funding for the lead ship is secured, the Navy continues to award contracts for subsequent ships as the program’s business case deteriorates. The lack of a sound business case results in the following challenges:

· An imbalance between the resources planned to execute a program and the capabilities to be acquired. This imbalance forms during the pursuit to fund lead ship construction, when competitive pressures to get funding for the program are high and many aspects of the program remain unknown.

· Weak business cases often over-promise the capability that the Navy can deliver within the planned costs and schedule.

· As ship construction progresses and these initial business cases predictably begin to erode, Navy shipbuilding programs come under pressure to control growing costs and schedules. This has generally entailed reducing planned quantities, scaling back promised capabilities, and accepting delivery of ships that fall short of the quality-related terms of their contracts. In other words, the Navy pays more to get less.

Past Surface Ship Programs Exemplify Dangers of Poor Business Cases

The Navy’s LCS and DDG 1000 programs exemplify the dangers of allowing deficient business cases to fester in Navy shipbuilding programs. Together, these two ship classes—which remain part of the Navy’s fleet—consumed tens of billions of dollars more to acquire than initially budgeted and ultimately delivered far less capability and capacity to fleet users than the Navy had advertised. Reasons for this underperformance are outlined below.

Littoral Combat Ship (LCS)

· Funding commitments based on unstable requirements. The Navy budgeted and contracted for initial ships (called seaframes in the LCS program) based on its plans to design and construct them to commercial rather than military standards. During construction, the Navy decided that the ships’ survivability requirements were inadequate and necessitated additional funding for contract changes aimed at acquiring more robust and capable seaframes, which required significant design churn.

· Beginning construction with incomplete design disrupted schedule. Bolstering vital ship components and systems to increase LCS survivability drove design changes that rippled throughout the seaframes. Implementation of new Naval Vessel Rules (design guidelines) required program officials to redesign major elements of each LCS design to meet enhanced survivability requirements, even after construction had begun on the first ship. While these requirements changes improved the robustness of the designs, they contributed to time-consuming out-of-sequence work and rework on the lead ships.

· Technologies that matured years later than needed. As the Navy and its shipbuilders worked to resolve seaframe design and construction deficiencies, they had yet to mature technologies associated with: (1) watercraft launch, handling, and recovery systems within each seaframe design and (2) developmental mine countermeasures, surface warfare, and anti-submarine warfare systems planned for LCS’s reconfigurable mission packages.[8] Although these systems were crucial to LCS’s ability to perform their planned missions, they have never fully delivered their promised capabilities. Further, as seaframe costs increased and mission needs evolved, the Navy gained insights into performance limitations facing each design, leading it to ultimately scale back its investment in mission package quantities. Consequently, the overall capacity that the LCS fleet can devote to a single, focused mission need is now greatly diminished as compared to the expectations that framed the Navy’s business case for LCS.

Zumwalt class Destroyer

(DDG 1000)

· Technology immaturity increases costs. To meet new transformational goals set forth by the Secretary of Defense, in 2001 the Navy restructured the DD 21 Land Attack Destroyer program into the DD(X) (eventually DDG 1000) Destroyer program. As part of this restructure, the program planned to mature and introduce to the fleet 12 new, developmental technologies, which the program intended to demonstrate using 10 engineering development models. To fund this immense technology development effort and offset rising costs, the Navy reduced planned ship quantities from 32 to 16, then from 16 to eight, and eventually from eight to the current total of three ships. This instability has resulted in each ship costing $10.6 billion, more than seven times the original estimated unit cost.

· Technologies that informed ship design, but later proved infeasible. The program’s pursuit of 12 technologies took far longer than it initially forecasted, with several technologies ultimately never achieving their planned capability or cost. However, as the Navy extended its technology development timeline, it concurrently moved forward with ship design and eventually lead ship construction. This created several situations where the Navy designed DDG 1000 to provide a specific capability, even though the Navy had yet to demonstrate the feasibility of the technology that underpinned that capability. One example is the class’s Advanced Gun System and (planned) Long Range Land Attack Projectile. The Navy moved forward in designing and constructing DDG 1000 class ships with the Advanced Gun System in anticipation that development of the gun’s munitions—the Long Range Land Attack Projectiles—would conclude satisfactorily. That did not occur. Rather, as Projectile development progressed, the Navy determined that it would be cost prohibitive to acquire the munitions, in part due to unit cost increases associated with buying Projectile stocks for only three ships as compared to 32 or 16 ships.

· Long acquisition timeline diminished the program’s relevance. After 15 years elapsed between identifying the need for the DDG 1000 program and construction on the lead ship, the program’s relevance diminished. During that time, the Navy shifted from a focus on capability needs for operations in nearshore waters to deeper water operations. It determined that the DDG 51 class of destroyers would be more effective for missions than the DDG 1000 class ships. More recently, to provide more relevant mission capabilities to DDG 1000 class ships, the Navy has begun removing Advanced Gun Systems from these ships and replacing them with the new Conventional Prompt Strike weapon system.

New Surface Ship Programs Are Charting a Similar Course as Past Programs

As the LCS and DDG 1000 class stories were unfolding to the Navy, its shipbuilders, and the general public, Navy officials testified before Congress multiple times that it was learning lessons from these programs. For instance, the Navy has limited the introduction of new technologies and leveraged existing designs for some new ship classes. However, it is not clear that the Navy actually learned from its experiences. Newer surface ship programs—the Constellation class Frigate (FFG 62) and Medium Landing Ship (LSM) programs—are showing key symptoms associated with deficient business cases, as outlined below.

Constellation class Frigate (FFG 62)

· Funding commitments based on unstable design. In April 2020, the Navy awarded a fixed-price incentive type contract for detail design and construction of the lead frigate with options for construction of up to nine additional ships.[9] To reduce technical risk, the Navy intended to leverage and modify an existing Italian frigate design. In August 2022, after the Navy certified to Congress that the basic and functional designs were 88 percent complete, the Navy approved the shipbuilder to begin constructing the lead frigate. At this point, the Navy had exercised options for construction of the first two follow-on ships (FFG 63 and 64). By May 2024, the Navy had exercised options for construction of three additional frigates (FFG 65, FFG 66, and FFG 67)—putting the Navy’s total commitment at over $3.4 billion. This pace of contract actions so soon after the start of lead ship construction led to problems. As we reported in May 2024, the Navy used metrics for measuring design progress that obscured its visibility into the actual basic and functional design progress. As a result, the Navy substantially overstated design progress when it approved construction to begin. We recommended that the Navy restructure its functional design review practices to better reflect actual design progress completed, which the Navy has since implemented.[10] However, the lead ship is now delayed 3 years and construction has effectively stalled as the Navy and its shipbuilder continue to negotiate crucial technical requirements associated with the ship design. This has resulted in the Navy reporting the basic and functional design was just 70 percent complete, as of December 2024, over 2 years after the Navy certified the design was 88 percent complete and construction began.

· Undemonstrated systems pose technical risk. The frigate program is leveraging many already proven systems to reduce technical risk. However, our May 2024 report found that two key systems—the propulsion and machinery control systems—pose high risk to frigate capabilities and schedule.[11] These systems include newly designed components and software code that have never been demonstrated on a Navy ship. Nonetheless, the Navy did not plan to fully demonstrate these systems before the previously estimated delivery date (December 2026) for the lead frigate. We recommended that the Navy ensure that its Test and Evaluation Master Plan incorporates—based on anticipated lead ship delivery delays—additional land-based testing activities for these two systems. The Navy partially agreed with this recommendation by stating that it will leverage early opportunities for risk reduction land-based testing, but it does not intend to update its Test and Evaluation Master Plan to include additional test objectives related to the propulsion or machinery control systems. Given that the Navy has previously faced challenges with integrating propulsion and machinery control systems on other ships, this approach increases the likelihood that deficiencies may not be discovered until the ship is at sea, potentially limiting fleet availability and leading to costly repairs.

· Design changes and resulting weight growth risk undermining planned capabilities. The Navy and shipbuilder’s ongoing reckoning of frigate performance and technical requirements has triggered a series of design changes. These changes have since reduced the commonality between the parent design approach the Navy and shipbuilder pursued during the program’s 16-month conceptual design phase.[12] As a result of these changes, in part, the frigate now bears little resemblance to the parent design that the Navy touted as a built-in, risk reduction measure for the program in 2020. Now, in 2025, the ongoing redesign has driven weight growth at levels that exceed available tolerances. Already the Navy is considering a reduction in the frigate’s speed requirement as one potential way, among others, to resolve this weight growth.

Medium Landing Ship (LSM)

· Unrealistic design plans contributed to schedule delays and likely increased costs. The Navy plans to use LSMs to transport Marines and their supplies from shore to shore in contested operational environments. The program originally intended to leverage an existing ship design to shorten LSM’s development effort. However, the Navy determined through industry engagement, such as in concept studies, that existing designs would require significant changes to meet program requirements. For example, none of the existing designs that the Navy assessed would provide needed cargo fuel capacity or meet beaching requirements. A Navy cost analysis also indicated that design changes to meet LSM’s survivability requirements could increase each hull’s cost by more than $115 million. The Navy planned to award an LSM detail design and construction contract in 2025 but canceled the solicitation in December 2024.

According to program officials, one of the reasons the program canceled this solicitation is because the offers received for lead ship detail design and construction were hundreds of millions of dollars higher than expected. This turn of events calls into question whether the program’s conceptual design activities with shipbuilders effectively positioned the Navy and Marine Corps to understand potential ship design options and to set realistic expectations about the cost and schedule to execute a program that meets both services’ requirements. The LSM program is now in the process of revising its cost estimates and schedule, including its timelines to award contracts for detail design and construction and to deliver ships to the fleet.

· Evolving acquisition strategy is causing short-term delays but may increase design stability before construction. The original acquisition strategy for LSM’s detail design and construction contract would not have ensured that—consistent with leading ship design practices—basic and functional design are completed before awarding a construction contract. In December 2024, Congress directed the Secretary of the Navy to certify that LSM’s basic and functional design is complete before entering into a construction contract.[13] This congressional action is consistent with our May 2024 findings on leading ship design practices and our recommendation that Navy shipbuilding programs complete basic and functional design before awarding detail design and construction contracts for new ships.[14] According to program officials, this was a contributing factor in the program’s decision to cancel its detail design and construction solicitation. Program officials stated that they are revising the LSM acquisition strategy to account for the increased design maturity required by Congress, consistent with our recommendation on design stability.[15]

The Navy’s recent performance in the frigate and LSM programs carries too many similarities to its prior performance in the LCS and DDG 1000 programs to presume that the Navy has learned the lessons from its prior shipbuilding efforts and has implemented corrective fixes. The Navy cannot expect to look within its existing playbook to find answers. The ongoing problems with more recent ship acquisitions can provide the impetus Navy leadership needs to look for solutions outside of the existing defense acquisition paradigm. The Navy has an opportunity to do so as it considers upcoming acquisitions, such as T-AGOS 25 Explorer Class Ocean Surveillance Ship and DDG(X) Guided Missile Destroyer. Specifically, our work has shown that innovative, effective ship design practices and product development approaches, rooted in industry-leading companies worldwide, provide a new approach that would increase the Navy’s chances of success.

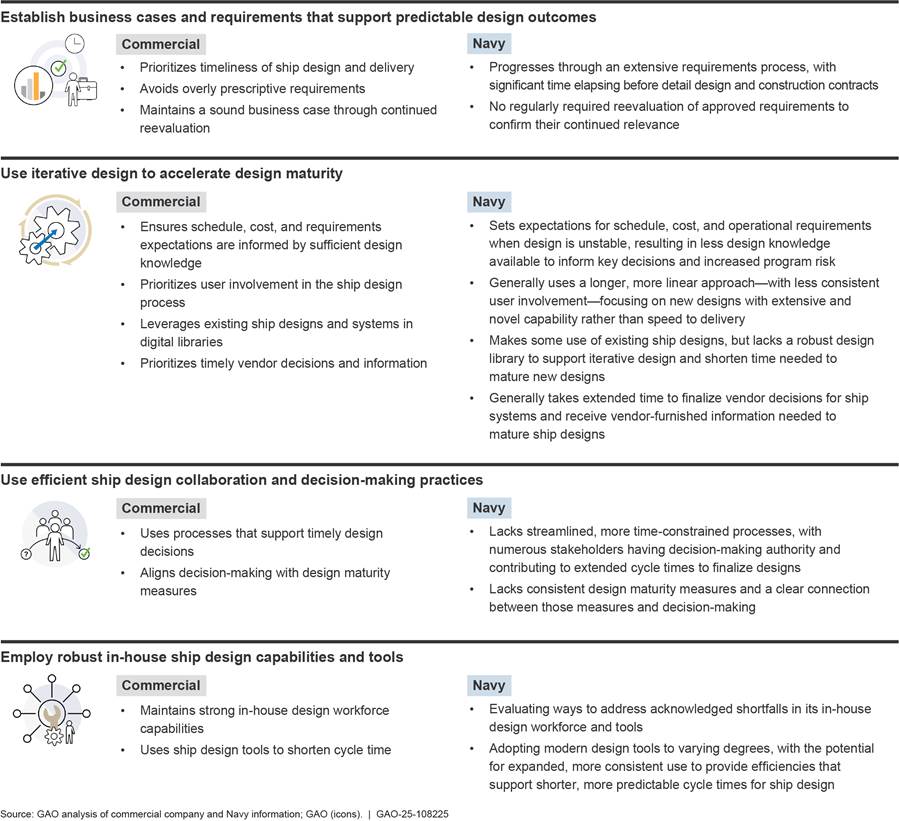

Leading Practices Offer a New Approach to Meet Modern Challenges

The results of our Navy shipbuilding work over many years demonstrates that leading practices from commercial industry can be applied thoughtfully to improve outcomes, even when cultural and structural differences yield different sets of incentives and priorities. For example, our recent reports on Navy ship design and the Constellation class frigate program identified opportunities for the Navy to embrace leading practices to support timely, predictable program outcomes.[16]

To identify opportunities to shorten the Navy’s timeline for delivering new capability to the fleet, we compared the Navy’s practices to a combination of (1) the leading ship design practices used by commercial ship buyers and builders and (2) broader leading practices for product development.[17]

Leading Ship Design Practices

Our analysis illuminated how the demands pushing the Navy to increase the pace of design and construction for new ships will likely go unfulfilled without reforming practices to improve timeliness, provide greater flexibility, and ensure sufficient design knowledge when making key program decisions (see fig. 3).

Figure 3: Navy Design Practices Deviate from Leading Ship Design Practices for Commercial Companies

Leading Product Development Practices

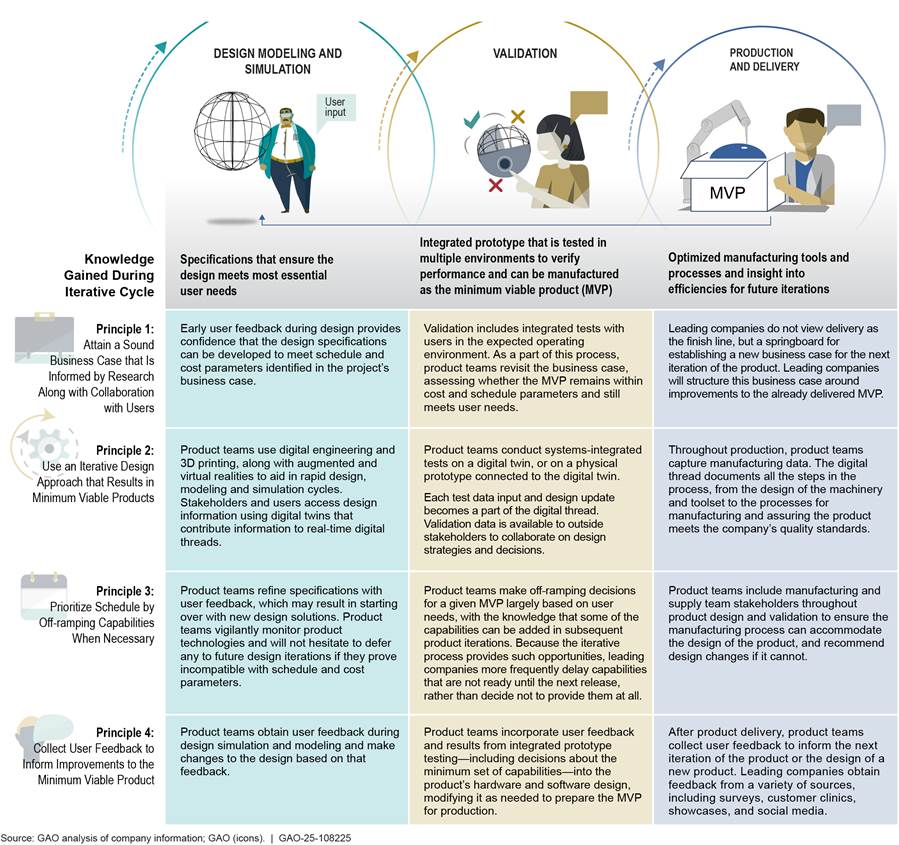

At the same time, the Navy has an opportunity to position itself for longer term success by looking outside the world of shipbuilding, exclusively, to the iterative development approaches that leading product development companies in other industries use. As we found in July 2023, iterative development cycles are at the heart of how these leading companies successfully deliver innovative, relevant, essential products to users on timelines that are responsive to those users’ needs.[18] Further, in March 2022, we identified four key principles that help characterize how product developments move through iterative development cycles.[19] Figure 4 illustrates the structure for iterative development cycles and identifies how product developers implement the four principles within that structure.

Figure 4: Iterative Cycles of Design, Validation, and Production Used for Product Development

In May 2024, we applied the findings of our work on leading practices for ship design and product development in reporting on the Navy’s Constellation class frigate program.[20] In that report, we identified opportunities for the Navy to move the frigate design and construction away from a traditional, linear development pathway and retool the acquisition strategy for the program’s future ships with leading practices in mind. For example, an acquisition strategy structured around iterative cycles could help the Navy deliver future frigates to the fleet at a faster pace and with increased assurance that their capabilities are matched to evolving mission needs. Consistent with leading practices, such a structure would include continuous engagement with stakeholders and users to inform the business case and subsequent design development. It would also use modern tools like digital engineering, a digital thread, and additive manufacturing as key enablers to iterative development, with off-ramping of capabilities used, when needed, to meet schedule interests.[21]

Our May 2024 report on the Navy’s frigate program also highlighted the importance of a clear connection between measures of ship design maturity and decision-making. As I noted earlier, we found that, counter to leading ship design practices, the Navy began frigate construction in August 2022 without completing functional design to demonstrate that the ship’s design was stable. We also found that inadequate design review practices and metrics obscured the Navy’s visibility into the frigate design’s progress and presented an obstacle to forecasting realistic ship delivery dates. The consequences of these practices are now well-known, with over $200 million in estimated cost growth to the lead ship and a delivery delay of 3 years. The Navy generally agreed with our recommendations from that report and has taken action to address one of our five recommendations. Specifically, the frigate program has restructured its functional design metrics to ensure that—consistent with our recommendation—design progress measures reflect the quality rather than the quantity of design deliverables received from the shipbuilder.

We understand that completing functional design in 3D modeling before awarding detail design and construction contracts, as we recommended in our ship design practices report, represents a significant change to the Navy’s traditional acquisition approach for its shipbuilding programs.[22] However, the frigate’s functional design problems—and the associated cost and schedule problems that continue to beset the program—emphasize the need for the Navy to stabilize its new ship designs before awarding contracts for detail design and lead ship construction.

The need to ensure a stable design before making major commitments to programs is further underscored when considering the ramifications that program shortfalls can have on the Navy’s force structure plans. For example, in the case of the frigate, the Navy’s shipbuilding plan for fiscal year 2025 states that recent updates to its battle force structure objectives include 58 frigates. This is a more than an 80 percent increase in Constellation class ships from the initial 2022 battle force plans and 34 more ships than the Navy included in its 2016 Force Structure Assessment. However, this increased reliance on frigates to support a larger, more capable fleet is imperiled if the Navy cannot overcome the significant problems facing this program.

In conclusion, until the Navy makes changes to address the weak business cases it puts forward in its shipbuilding programs, we will continue to see the same outcomes. Leading practices offer the Navy a near-term path toward restoring credibility with fleet operators, Congress, and taxpayers. More importantly, over the long term, these leading practices can help redefine the shipbuilding acquisition process in ways that position the Navy to achieve its force structure goals faster, support its industrial base, and thwart potential adversaries’ attempts to compete with the superiority of the Navy fleet.

Chairman Scott, Ranking Member Kaine, and Members of the Subcommittee, this completes my prepared statement. I would be pleased to respond to any questions that you may have at this time.

GAO Contact and Staff Acknowledgments

If you or your staff have any questions about this testimony, please contact Shelby S. Oakley, Director, Contracting and National Security Acquisitions, at oakleys@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this statement.

GAO staff who made key contributions to this testimony are Christopher R. Durbin (Assistant Director), Nathan Foster (Analyst-in-Charge), Stephanie Gustafson, Riley Knight, Christine Pecora, Mazarine-Claire Penzin, Hiba Sassi, Jillian Schofield, Alyssa Weir, and Adam Wolfe. Other staff who made key contributions to the reports cited in the testimony are identified in the source products.

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]GAO, Shipbuilding and Repair: Navy Needs a Strategic Approach for Private Sector Industrial Base Investments, GAO‑25‑106286 (Washington, D.C.: Feb. 27, 2025).

[2]This funding reflects Navy direct investments made to the surface combatant and frigate industrial base and does not reflect contract incentives for private investment paid between fiscal years 2014–2028.

[3]This total only includes recommendations from our publicly available reports.

[4]GAO. Navy Shipbuilding: A Generational Imperative for System Change, GAO‑25‑108136 (Washington, D.C.: Mar. 11, 2025).

[5]GAO‑25‑106286; Weapon Systems Annual Assessment: DOD Is Not Yet Well-Positioned to Field Systems with Speed, GAO‑24‑106831 (Washington, D.C.: June 17, 2024); Navy Frigate: Unstable Design Has Stalled Construction and Compromised Delivery Schedules, GAO‑24‑106546 (Washington, D.C.: May 29, 2024); Navy Shipbuilding: Increased Use of Leading Design Practices Could Improve Timeliness of Deliveries, GAO‑24‑105503 (Washington, D.C.: May 2, 2024); Leading Practices: Iterative Cycles Enable Rapid Delivery of Complex, Innovative Products, GAO‑23‑106222 (Washington, D.C.: July 27, 2023); Leading Practices: Agency Acquisition Policies Could Better Implement Key Product Development Principles, GAO‑22‑104513 (Washington, D.C.: Mar. 10, 2022); and Navy Shipbuilding: Past Performance Provides Valuable Lessons for Future Investments, GAO‑18‑238SP (Washington, D.C.: June 6, 2018).

[8]The Navy sought to embed LCS’s mine countermeasures, surface warfare, and anti-submarine warfare capabilities within mission packages. The Navy anticipated that those packages would be comprised of unmanned underwater vehicles, unmanned surface vehicles, towed systems, and hull- and helo-mounted weapons.

[9]Fixed-price incentive contracts generally include a profit adjustment formula referred to as a share line, as well as a target cost, target profit, and a price ceiling. There are two types of fixed-price incentive contracts: fixed-price incentive (firm target) and fixed-price incentive (successive target). Fixed-price incentive (firm target) contracts are commonly used in Navy shipbuilding programs.

[12]In February 2018, the Navy competitively awarded conceptual design contracts valued at nearly $15 million each to five industry teams. The conceptual design phase was intended to enable industry to mature parent ship designs and help refine technical and operational program requirements.

[13]Servicemember Quality of Life Improvement and National Defense Authorization Act for Fiscal Year 2025, Pub. L. No. 118-159, § 128 (2024).

[21]Digital engineering, which includes digital twins and digital threads, is a key component of the iterative development that leading companies employ to virtually model, collect, store, and share real-time product data. Additive manufacturing is a computer-controlled process that creates physical objects, such as aircraft components, by depositing materials, usually in layers. During product development, leading companies off-ramp capabilities—or remove them from the planned delivery—if those capabilities are not essential to the core functionality of the product and removing them enable the product to be delivered faster to users than initially planned.