SOCIAL SECURITY DEATH DATA

Do Not Pay System Has Yielded Financial Benefits, but SSA Should Better Evaluate States’ Cost to Obtain Data

Report to Congressional Committees

United States Government Accountability Office

A report to congressional committees.

For more information, contact M. Hannah Padilla at PadillaH@gao.gov

What GAO Found

Under a 3-year pilot program, the Department of the Treasury’s Do Not Pay system has temporary access to the Social Security Administration’s (SSA) full Death Master File. Prior to the pilot, the system had access to a less-comprehensive version of the file which excluded state death records. In January 2026, Congress passed a bill that, if enacted, would make access permanent.

In April 2025, Treasury reported that the first year of this pilot (calendar year 2024) resulted in identification and prevention or recovery of $113.5 million in improper payments. This amount, offset by $4.6 million in costs, represented a return on investment of about 23 times Treasury’s pilot costs. Treasury projects that the pilot will result in over $337 million in net benefits over 3 years.

Death data collected by states are their property, and statute requires SSA to pay states for use of these data. In September 2023, SSA concluded negotiations on new contracts to obtain states’ death data. Under these contracts, SSA paid states $23.8 million in 2024, a significant increase from 2023.

The Social Security Act, as amended, specifies that SSA shall reimburse states for specific costs associated with death data, including (1) a fee for use of the data and (2) the full documented cost of transmitting the data to SSA. However, GAO found that SSA did not obtain the required state cost information and therefore did not consider it during negotiations. Instead, SSA and the states agreed on a fee structure based on the timeliness of submission of death records.

Agencies receiving state death data must pay SSA a proportional share of its costs in obtaining the data from states. Of the $25.9 million in estimated state death record costs for 2025, SSA’s proportional share is projected to decline, from 42 percent in 2024 to 23 percent in 2025, due to a methodology change. Specifically, SSA calculated its 2025 share based on the percentage of SSA’s total federal outlays rather than on costs of obtaining data. SSA estimated that its outlays were about 23 percent of the federal total, so it decided that would be its cost share for 2025. For the remaining 77 percent, SSA distributed 36 percent to Treasury and 41 percent to other agencies without regard to cost (each of the other agencies is to contribute the same amount, approximately $1.533 million).

Why GAO Did This Study

Improper payments remain a long-standing and significant problem in the federal government. GAO previously reported that one strategy to help prevent improper payments is up-front verification of eligibility through data sharing and matching. Agencies can verify the eligibility of applicants through Treasury’s Do Not Pay system—a centralized data-matching service for agencies to use in preventing and detecting improper payments. This service currently includes the full Death Master File, SSA’s compilation of deceased Social Security number holders, to help agencies prevent improper payments.

This report (1) describes the first-year results of the 3-year pilot to include SSA’s full Death Master File in Treasury’s Do Not Pay system, (2) evaluates the extent to which SSA’s payments for state death data are based on states’ documented costs, and (3) evaluates the extent to which SSA is charging agencies a proportional share of its costs. GAO analyzed SSA and Treasury documentation and interviewed federal and state agency officials.

What GAO Recommends

GAO is making three recommendations to SSA to (1) ensure that contracts for state death data reflect statutorily authorized costs and include necessary documentation required by law; (2) conduct an analysis of state cost information, including its availability, and determine whether renegotiating the fee schedule accordingly is necessary; and (3) revise its methodology to incorporate costs for calculating proportional shares of state death data costs. SSA agreed with GAO’s recommendations.

Abbreviations

DMF Death Master File

DNP Do Not Pay

EDR electronic death registration

HHS Department of Health and Human Services

IDH Integrity Data Hub

NAPA National Academy of Public Administration

NAPHSIS National Association for Public Health Statistics and Information Systems

SSA Social Security Administration

VRO vital records office

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

February 12, 2026

Congressional Committees

Improper payments remain a long-standing, widespread, and significant problem in the federal government. Executive branch agencies have reported cumulative improper payment estimates totaling about $2.8 trillion since fiscal year 2003, including $162 billion for fiscal year 2024.[1] We have identified reducing improper payments and improving fraud risk management as opportunities for the federal government to improve fiscal responsibility and help reduce the deficit.[2] We previously reported that one strategy to help prevent improper payments is up-front verification of eligibility through data sharing and matching.[3] The statutory Do Not Pay (DNP) initiative, codified by the Payment Integrity Information Act of 2019, requires agencies to take steps to verify eligibility and prevent improper payments before the release of any federal funds.[4]

Under the DNP initiative, agencies review certain databases to verify eligibility before issuing any payment or award. To facilitate access to these databases, the DNP initiative required the creation of a “working system”—referred to as the DNP system—which is hosted by the Department of the Treasury. The DNP system is a web-based, centralized data-matching service that allows agencies to verify eligibility by reviewing multiple databases before making payments and awards. Examples of available databases include the (1) General Service Administration’s System for Award Management, which includes debarred contractors, and (2) Treasury’s Debt Check, which includes individuals who owe delinquent child support or nontax debt to the federal government. The DNP system also includes death data from the Social Security Administration (SSA) to help agencies identify and stop issuing payments to deceased individuals.

The Social Security Act requires SSA to share its full death file—referred to in this report as the full Death Master File (DMF)—to the extent possible with agencies that provide federally funded benefits, provided that the arrangement meets statutory requirements.[5] However, for several years, SSA officials have stated that the Social Security Act did not allow SSA to share its full DMF with the DNP system. As a result, we previously recommended that Congress amend the Social Security Act to explicitly allow SSA to do so.[6]

The Consolidated Appropriations Act, 2021, amended the Social Security Act and granted SSA temporary authority to share its full death file with Treasury for use in the DNP system for a period of 3 years.[7] SSA began sharing the full DMF with Treasury for this purpose in December 2023, under a 3-year pilot program. In addition, the Consolidated Appropriations Act, 2021, directs SSA to compensate states for a share of certain costs related to the data, as well as a fee for the right to use the information, and the states’ full documented costs of transmitting the data to SSA. The act also requires agencies that receive state death data to pay SSA a proportional share of applicable costs.[8]

In March 2022, we recommended that Congress amend the Social Security Act to make permanent the requirement for SSA to share its full death data with Treasury.[9] In January 2026, both houses of Congress passed a bill that would grant SSA permanent authority to continue sharing the full DMF with Treasury for use in the DNP system, to take effect after the expiration of SSA’s current 3-year temporary authority on December 27, 2026.[10] If this measure becomes law, it will address our recommendation.[11]

SSA contracts with state vital records offices (VRO) to obtain death data included in the full DMF. Death data collected by states are the property of the states, and SSA pays the states for use of these data. SSA passes a portion of the cost of obtaining state death data to agencies receiving the full DMF.

We prepared this report at the initiative of the Comptroller General. This report (1) describes the first-year results of the 3-year pilot to include SSA’s full DMF File in Treasury’s DNP system; (2) evaluates the extent to which SSA’s payments for state death data are based on states’ documented costs; and (3) evaluates the extent to which SSA has developed a process to charge agencies a proportional share of its costs for obtaining and sharing state death data.

For the first objective, we interviewed Treasury officials and reviewed Treasury’s documentation on the integration of the full DMF with the DNP system. Interview topics and documentation included DNP system user and onboarding guides, cost-benefit analyses assessing the inclusion of the full DMF in the DNP system, analyses of the results of the first year of the pilot, and Treasury’s public reporting and presentations. We also interviewed officials of agencies that have access or are currently in the process of obtaining access to the full DMF through the DNP system to determine whether such access has been or is likely to be beneficial. To understand the statutory requirements, we reviewed language from the Consolidated Appropriations Act, 2021, which directed SSA to provide the full DMF to the DNP system.

Regarding the second objective, we reviewed a 2022 study conducted by the National Academy of Public Administration (NAPA) to understand states’ costs of producing death data records.[12] In addition, we reviewed communication between SSA and the National Association for Public Health Statistics and Information Systems (NAPHSIS) related to negotiating the cost per record paid by SSA for state death data and the terms, clauses, and award amounts from contracts between SSA and several states.[13] To understand requirements governing SSA’s purchase of state death data, we reviewed the Social Security Act and other relevant legal provisions.

In addition, we interviewed officials from SSA and from NAPHSIS, which negotiated the cost per record paid by SSA for state death data. We also interviewed officials from state VROs, which collect vital statistics.[14] To select state VROs for interviews, we considered factors such as number of deaths by state for fiscal year 2022 and variation in commercial death record prices.[15] We selected 11 VROs for interview: Alaska, California, the District of Columbia, Illinois, Kentucky, Massachusetts, Michigan, New Mexico, New York City, Utah, and Vermont. We also interviewed SSA, Treasury, and NAPHSIS officials to obtain information on SSA’s fees paid to states.

For the third objective, we obtained and analyzed information from SSA used to determine an agency’s proportional share of costs associated with obtaining and sharing state death data. Additionally, we reviewed the Social Security Act and other relevant legal provisions and supporting documentation related to sharing state death data with federal agencies. These included the reimbursable agreements and contracts between SSA and federal agencies and documentation related to negotiations regarding SSA and Treasury.

We conducted this performance audit from November 2023 to February 2026 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Description of Full Death Master File

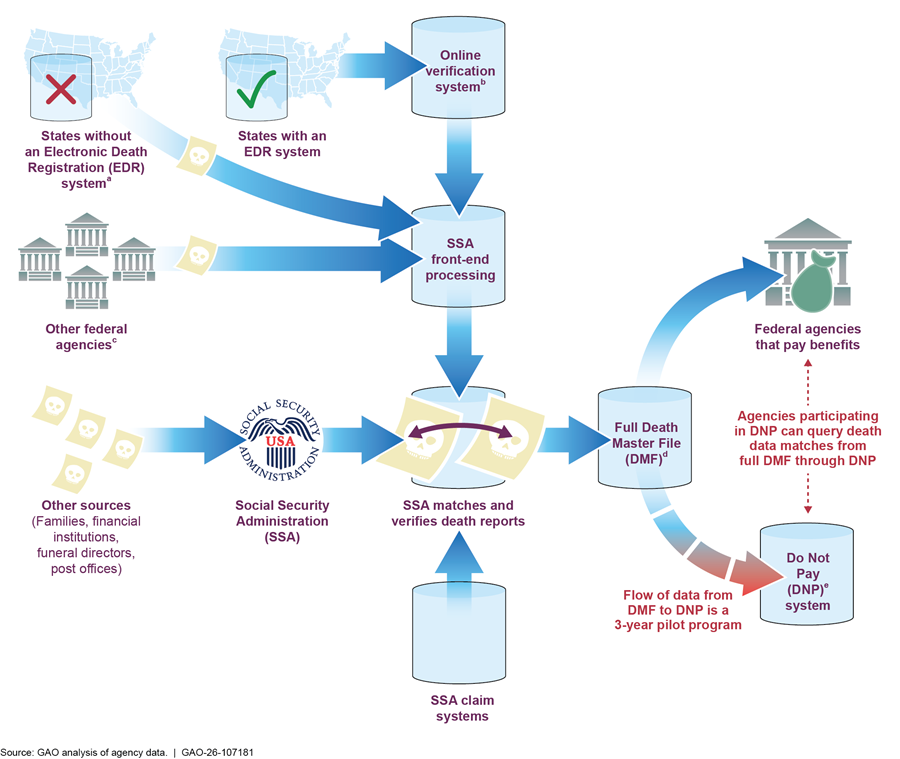

SSA collects death information which includes the deceased individual’s Social Security number, first name, middle name, surname, date of birth, and date of death, to administer its programs. From this information, SSA compiles a less-comprehensive public DMF, which excludes state death records, and the full DMF which includes state death records.[16] It uses death data from the states and other sources to help determine eligibility for and, upon the Social Security number holder’s death, the termination of benefits payments.[17] SSA shares its full DMF with other federal agencies, consistent with statutory requirements.[18]

The full DMF is available in the DNP system for a 3-year pilot program, which began on December 27, 2023.[19] The DNP system previously only included the less-comprehensive public DMF. This was because, according to SSA, it did not have the authority to share its full DMF with the DNP system. Figure 1 shows how SSA collects and subsequently distributes death data from its sources to other federal agencies through the full DMF.

aAn EDR system is a secure, web-based system for electronically registering deaths. According to the Centers for Disease Control and Prevention’s National Center for Health Statistics, an EDR system simplifies the data collection process and enhances communication between medical certifiers (medical examiners/coroners and health care providers), funeral directors, and local and state registrars as they work together to register deaths. Funeral directors may also submit death information to SSA outside of the EDR system in some circumstances. The term “states” refers to the 50 states, New York City, the District of Columbia, and the five territories that provide death data to SSA.

bStates that use an EDR system share death data with SSA through a two-step process. First, a state’s EDR system transmits death data with specific identifying information, including a Social Security number, to SSA through an online verification system. The EDR system allows states to validate that the information matches SSA records and to correct any discrepancies before finalizing and registering the record. Then, following validation, the state submits ‘fact of death’ information to SSA via SSA’s secure portal.

cSSA receives death data from federal agencies including the Centers for Medicare & Medicaid Services, the Department of State, the Department of Veterans Affairs, and the Office of Personnel Management.

dThe full DMF is SSA’s file containing records of deceased individuals who have been assigned Social Security numbers. SSA officially refers to this file, which includes state death records, as the full file of death information.

eThe DNP system is a data-matching service for agencies to use in preventing improper payments, including those to deceased individuals.

The DNP System

Treasury grants access to the DNP system to agencies that request it for purposes of verifying payment or award eligibility in accordance with the statutory requirements. Interested agencies choose which functionalities and data sources to use, including whether to access the full DMF, based on their needs. As of March 2025, 78 federal agencies and other entities—including 20 Offices of Inspector General—had access to the full DMF within the DNP system. Treasury has been working to increase state access to the DNP system. For example, it partnered with the National Association of State Workforce Agencies to provide state unemployment insurance agencies with access to the DNP system’s data sources and services, including the full DMF.[20]

The DNP system provides six options for agencies to submit payment files for matching against approved data sources. Treasury refers to these options as “functionalities.”[21]

Treasury provides agencies with the results of matching conducted against DNP system data sources. It does not provide agencies with full copies of the data sources themselves. For example, when an agency uses the DNP system to verify eligibility, it may search a list of individuals against data sources, including SSA’s full DMF. Treasury returns results showing whether any individuals included in the agency’s submission matched those included in the full DMF. However, the agency does not receive the full DMF from Treasury.

State Death Data

SSA contracted with state VROs to obtain death data for use in administering SSA programs. VROs generally send death data to SSA using electronic death registration (EDR) systems.[22] SSA and VROs, represented by NAPHSIS, negotiated a fee schedule whereby SSA pays states on a per-record basis based on the timeliness with which the states submit their data to SSA.[23] As part of this negotiation, NAPHSIS developed a standard contract with SSA. Each state then signed a contract with SSA that included a fee schedule identical to the standard contract amounts that NAPHSIS negotiated. These individual state contracts established the cost for SSA to obtain death data from states, whether by EDR or non-EDR methods. The contracts are generally structured with a 1-year base period and 4 option years, allowing for a potential term of up to 5 years.

By law, states that voluntarily contract with SSA are to receive payment from SSA covering their full documented costs of transmitting the data to SSA, as well as a fee for use of the data. The fee for use of data is to include the states’ costs associated with collecting and maintaining the data, as well as a fee for the right to use the information.[24]

Each agency receiving state death data must reimburse SSA for the agency’s proportional share of SSA’s costs for obtaining the data from states and the full documented cost to the Commissioner of developing the arrangement with the agency and transmitting the information to the agency.[25] According to SSA officials, it compiles its actual costs of obtaining death data from states on a quarterly basis. When compiling actual costs, SSA includes other related costs associated with sharing data, such as developing the contracts with the states and transmitting the data to agencies, including the SSA personnel hours required to provide the data. SSA works with its acquisition office to evaluate the actual number of death notifications received and determine the actual agency reimbursements for each quarter. SSA then collects reimbursements and other related costs from the agencies that obtain the state death data from SSA.

Eight federal agencies, including Treasury, had reimbursement agreements with SSA for 2025, compared to nine for 2024.[26] While agencies share in the cost of obtaining state death data, they are not involved in negotiating the contracts signed with states. Only SSA negotiates with NAPHSIS to set the per-record rates for state death data that are included in these contracts.

Following its determination of the total expected costs to obtain state death data under the contracts, SSA negotiates with agencies to determine their proportional share of these costs. The proportional share of costs paid by SSA and other agencies each year depends in part on how many agencies have committed to receiving the full DMF from SSA in that year. For example, if the number of agencies receiving the full DMF decreases from one year to the next, SSA and the remaining agencies would need to absorb an additional portion of the total cost for obtaining death data from states compared to the prior year. The bulk of agencies’ payments to SSA consists of agencies’ reimbursements to SSA for the full DMF.[27]

Agencies Reported Benefits from Access to the Full Death Master File

Treasury Reported Benefit of Nearly $109 Million for First Year of Pilot Program

In April 2025, Treasury determined that integrating the full DMF in the DNP system led to a net benefit of nearly $109 million for the first year of the pilot program. Specifically, Treasury estimated that access to the full DMF had helped it prevent, identify, or recover approximately $113.5 million in improper payments. This amount, offset by $4.6 million in costs, represented a return exceeding 23 times Treasury’s investment in the program. Treasury’s analysis was based on a return-on-investment study covering the first full year of access, from January 2024 through December 2024.[28] To calculate these benefits, Treasury relied on data from DNP system payments identified by the agencies as improper and the results of Treasury’s analytics projects. Treasury also relied on feedback from agencies.

Treasury’s investment in the program, or costs for implementing the full DMF into the DNP system, consisted of both recurring and onetime expenses. These costs included annual reimbursements to SSA for access to the full DMF and personnel costs.[29] Treasury also included onetime costs it incurred to implement the full DMF into the DNP system, such as those related to developing technology, testing, and establishing a direct connection from SSA to Treasury’s secure platform. Treasury prorated these onetime costs over the expected 3-year period of the pilot program. Additionally, Treasury reported that some costs were offset by savings. For example, implementing the full DMF into the DNP system allowed Treasury to discontinue its previous public DMF subscription.

Treasury estimated $337 million in net benefits over the entire 3-year duration of the pilot program. This projection assumed a 5 percent increase in benefits for each subsequent year, minus known future costs. These costs include Treasury’s upcoming reimbursement contracts with SSA to continue receiving death data, as well as a onetime $1.56 million cost to increase the data exchange frequency from weekly to daily. Treasury stated that it plans to periodically update its benefit assessment over the remaining 2 years of the pilot program. In future assessments, it may also include additional financial benefits, including those resulting from increased state use of the DNP system.

Treasury and Federal Agencies Reported Additional Benefits from Access to Full Death Master File

Treasury and federal agencies reported that access to the full DMF through the DNP system contributed to additional benefits. Specifically, Treasury reported an increase in death record matches, and the Departments of Labor and Health and Human Services (HHS) reported improved data access for states.

Treasury stated that integration of the full DMF resulted in a 174 percent increase in the total number of death record matches and a 9.81 percent increase in overall number of searches in 2024. Additionally, Treasury found that the full DMF had the most comprehensive death data compared to other death data sources available in the DNP system. Further, it concluded that the full DMF provided timelier data than other death data sources available in the DNP system. It reported that this increase in coverage and timeliness has been a major benefit to users’ abilities to identify, prevent, or recover improper payments.

Agencies that partnered with Treasury also reported benefits. For example, as a result of a partnership between Labor and Treasury, in July 2024 states administering unemployment insurance programs obtained access to DNP system data sources, including the full DMF.[30] The Unemployment Insurance Integrity Center’s Integrity Data Hub (IDH) provided states with access to DNP system data sources and services.[31] Prior to Labor partnering with Treasury, the IDH included various data sources for death verification, including SSA’s public DMF, but not the full DMF.

Labor reported improvements in the volume and quality of data available to state agencies through the DNP system. According to Labor, state agencies need access to the best data sources, which includes the full DMF, to avoid payments to deceased individuals. Since partnering with Treasury, the Unemployment Insurance Integrity Center has monitored the volume of data provided to IDH through the DNP system, and the monitoring results are shared with Labor. According to Labor, as of March 2025, DNP system access led to a sevenfold increase in the volume of death matches states obtained via the IDH.

According to Labor officials, the agency has not yet conducted an analysis of the estimated effect on improper payments resulting from the inclusion of the full DMF in the DNP system. However, Labor stated that it received positive feedback from state agencies regarding the additional data sources provided through the DNP system, including the full DMF.

Similar to Labor, HHS is also working with Treasury to expand states’ access to full DMF through DNP. In 2024, Treasury partnered with HHS and established the DNP system as the technical service provider of the Public Assistance Reporting Information System. This system is administered by HHS’s Office of the Administration for Children and Families.[32] In April 2025, Administration for Children and Families officials stated that the agency was working with states to create an agreement that will specify each state’s rights to access and use of death data, including the full DMF through the DNP system.

Administration for Children and Families officials stated that most states have expressed a strong interest in obtaining the full DMF through the DNP system, and the agency expects to start providing the death data matching service to states through the DNP system in fiscal year 2026. Treasury has not evaluated the financial benefits (e.g., prevention of improper payments) resulting from its partnerships with agencies such as Labor and the Administration for Children and Families. However, Treasury is monitoring these efforts and indicated that they have the potential for millions in improper payments identification and reduction.

Payments for Death Data Have Increased, and SSA Did Not Follow Requirements in Determining Compensation to States

SSA’s Payments Have More Than Doubled Under New Contracts with States

In September 2023, SSA concluded negotiations with NAPHSIS on new contracts to obtain death data from states. The new contracts, which went into effect on December 27, 2023, more than doubled the prices SSA pays for state death data.

Table 1 presents SSA’s fee structure for paying states for each death record under the current and prior contracts.

|

Data upload timeliness |

Current contracta |

Prior contractb |

Percentage increase |

|

0–6 days |

$9.08 |

$3.73 |

143 |

|

7–30 days |

$7.00 |

$1.81 |

287 |

|

31–120 days |

$2.92 |

$0.88 |

232 |

|

Non-EDR, 0–120 days |

$2.92 |

$0.88 |

232 |

|

120+ days (EDR and non-EDR) |

$1.87 |

$0.01 |

18,600 |

Source: GAO analysis of Social Security Administration (SSA) information. | GAO‑26‑107181

Note: States receive a set amount tied to the timeliness of reporting and whether the data were submitted via an electronic death registration (EDR) system. Timeliness is measured as the number of business days elapsed between the date of death and when SSA receives the certified death report from the state.

aThese are per-record costs, effective December 27, 2023, for the 1-year base period under the current contracts.

bThese are per-record costs, effective through December 26, 2023, for the final period covered under the prior contracts.

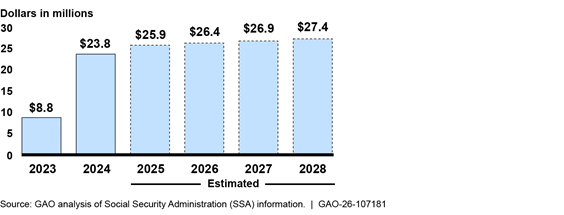

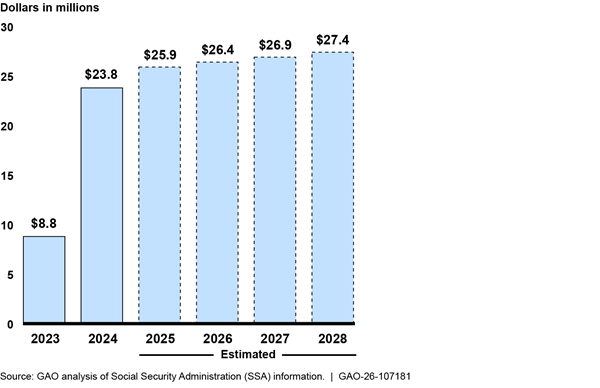

Under the new contracts, SSA estimates that it would pay $132 million to states for death data over a 5-year period (from December 27, 2023, through December 26, 2028) if all option years are exercised. Under the previous contracts, SSA paid states $8.8 million for death data in 2023. Under the new contracts, SSA paid states $23.8 million in 2024, an increase of 172 percent from 2023.[33] SSA estimates further increases in payments to states through 2028 (see fig. 2).

Figure 2: SSA’s Actual and Estimated Future Costs for Obtaining Death Records from States, 2023–2028

Note: SSA’s estimated costs for years 2025 through 2028 are based on option year costs included in SSA’s contracts with states. The contracts, which establish the cost for SSA to obtain death data from states, are structured with a 1-year base period and 4 option years, allowing for a potential term of up to 5 years. The most recent contracts include a 1-year base period of December 27, 2023, through December 26, 2024, with 4 subsequent option years extending through December 26, 2028.

SSA Did Not Follow Requirements in Determining Compensation to States for Death Data

The Social Security Act, as amended, has specific requirements for SSA to follow in determining compensation to each state for providing its death data. The act states that compensation shall encompass the following components:

1. A fee, to be established by SSA in consultation with the states, for the use of the data by SSA and other agencies receiving the data. This fee compensates the states for a share of the costs to (1) collect and maintain the data; (2) ensure the completeness, timeliness, and accuracy of the data; and (3) maintain, enhance, and operate the electronic systems that allow for the transmission of the data. It also includes a fee for the right to use the information.[34]

2. The full documented cost to the state of transmitting the data to SSA, including the cost of maintaining, enhancing, and operating any electronic system used solely for transmitting such information to SSA.[35]

However, SSA did not adhere to these provisions. SSA agreed to pay each state an identical amount per death record, with the amount tied to the timeliness of reporting and whether the data was submitted via an EDR system. According to SSA, payments to states in accordance with this schedule are meant to encompass the state costs referenced in statute. However, SSA did not obtain this information from states during contract formation or contract performance to help ensure that the prices in the fee schedule reflected statutorily authorized costs. Instead, it relied on incomplete data included in the NAPA study. This study contained VRO responses to a survey that NAPHSIS conducted. The study found that VROs reported difficulties in tracking their death data-related costs.

According to VRO officials we interviewed, many of them do not directly track the full costs for transmitting death data. These officials added that they generally do not isolate costs associated with death data because they perform many functions beyond collecting and maintaining death data or transmitting it to SSA. For example, VRO staff may collect data on births, marriages, and divorces, in addition to deaths, and may not separately track time spent on each activity. Further, the extent of states’ monitoring of the costs of maintaining death records varies. For example, one VRO reported that it conducts cost studies on an as-needed basis. Another VRO told us that it did not conduct any cost analyses.

NAPHSIS stated that its starting point for negotiation on behalf of the states was the price each state charged for a death certificate. However, according to NAPHSIS, this price is often set by state statute; is not necessarily representative of the actual cost to transmit the data; and may not be sufficient to cover the costs incurred by states for activities such as collecting the data or ensuring the completeness, timeliness, and accuracy of information. Following negotiations, SSA contract specialists compared the final negotiated pricing for EDR data, estimated at $132.0 million, against their own cost estimate of $136.5 million, as well as the average commercial price for death certificates. However, SSA’s estimate did not consider the costs incurred by states as outlined in the Social Security Act. Instead, it was the sum of the estimated price SSA paid to obtain death records from states for 2023 and staff salaries, based on data collected by NAPHSIS and included in the NAPA study.

SSA did not comply with the Social Security Act’s requirements to reimburse states for specific costs and fees associated with use of death data. Without this information, SSA does not know if it is paying too much or too little for states’ data. Identifying and estimating relevant costs would enable SSA to determine the extent to which the current pricing structure is inconsistent with the act. State cost information, such as information on the cost to ensure complete, timely, and accurate data, could inform a renegotiated fee schedule. If supported by such information, the renegotiated fee schedule could retain certain features of the current pricing structure, such as uniform rates for all states and higher fees for timely reporting, which may help lower administrative costs and increase efficiency.

SSA’s Share of Death Data Costs Has Decreased, and Its Cost Allocation Methodology Was Not Based on Proportional Share

SSA’s Share of Death Data Costs Has Decreased as It Allocates More Costs to Treasury and Other Agencies

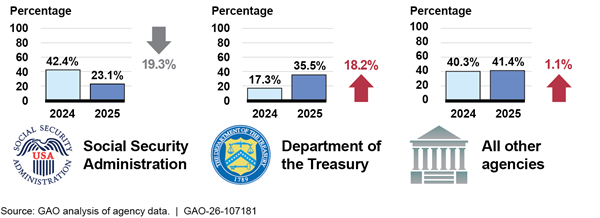

Each agency receiving state death data must reimburse SSA for the agency’s proportional share of SSA’s costs for obtaining the data from states.[36] SSA’s share of death data costs is projected to decrease from 42.4 percent of the total paid to states for 2024 to 23.1 percent of the total paid to states for 2025. For 2024, SSA paid states about $23.8 million for reporting death data. SSA received reimbursements of $13.7 million from agencies for access to the death data, bringing SSA’s share of costs to $10.1 million. For 2025, SSA estimated it will pay $25.9 million to states and projects to receive $19.9 million in reimbursements from agencies, bringing SSA’s share of costs to $6.0 million.

See table 2 for a detailed breakdown of agencies’ actual payments in 2024 and estimated costs for 2025 under the current contracts for obtaining death data from states.

|

Federal agency |

Actual 2024 payments |

Estimated 2025 costs |

Percentage change in costs |

|

U.S. Census Bureau |

$1,200,000 |

$1,533,588 |

28% |

|

Centers for Medicare & Medicaid Services |

$1,200,000 |

$1,533,588 |

28% |

|

Department of Agriculture |

$1,200,000 |

$1,533,588 |

28% |

|

Department of Defense |

$1,200,000 |

$1,533,588 |

28% |

|

Department of Housing and Urban Development |

$1,200,000 |

$1,533,588 |

28% |

|

Department of the Treasury |

$4,127,102 |

$9,203,588 |

123% |

|

Internal Revenue Servicea |

$1,200,000 |

$1,533,588 |

28% |

|

Pension Benefit Guaranty Corporation |

$1,200,000 |

$1,533,588 |

28% |

|

Railroad Retirement Boardb |

$1,200,000 |

$0 |

-100% |

|

Social Security Administration |

$10,104,285 |

$5,986,013 |

-41% |

|

Total |

$23,831,388 |

$25,924,717 |

9% |

Source: GAO analysis of Social Security Administration (SSA) information. | GAO‑26‑107181

Note: SSA also provides two agencies with its full Death Master File (DMF), which includes state-reported deaths, without requiring reimbursement. SSA officially refers to the full DMF as its full file of death information. Pursuant to 38 U.S.C. § 5106, the Department of Veterans Affairs is not required to reimburse SSA for the file. GAO receives SSA’s full death file for audit purposes pursuant to our authority under 31 U.S.C. § 716.

aAlthough the Internal Revenue Service is part of the Department of the Treasury, it obtains the full DMF separately for conducting its operation. Treasury’s actual payment and estimated cost do not include the Internal Revenue Service’s actual payment and estimated cost.

bAccording to SSA, the Railroad Retirement Board decided not to renew its agreement to obtain death data from SSA for 2025 and instead elected to access state death data through Treasury’s Do Not Pay system. Treasury’s estimated 2025 payments include $1,533,588 for what would have been the Railroad Retirement Board’s share of 2025 state death data contract payments.

As illustrated above, SSA allocated a greater portion of costs to other agencies for 2025. SSA estimated that the annual contract costs for states’ death data will increase to $25.9 million for 2025. Of this total, SSA assigned Treasury to commit to reimbursing about $9.2 million to SSA, exceeding the $6.1 million cap that Treasury and SSA previously agreed on in 2023—a cap Treasury did not reach with its $4.1 million reimbursement to SSA in 2024. All other agencies committed to reimbursing SSA about $1.5 million each for 2025.

For 2025, Treasury’s estimated reimbursement payment of $9.2 million represents about 35.5 percent of SSA’s estimated total contract costs—the most of any agency.[37] All other agencies reimbursement payments represent about 5.9 percent each, for a combined 41.4 percent of the total. SSA’s unreimbursed costs represent about 23.1 percent of the total. See figure 3 for federal agencies’ share of costs for 2024 and 2025 state death data contract payments.

SSA’s Cost Allocation Was Not Based on Considerations Related to Agencies’ Proportional Share of State Death Data Costs

The Social Security Act requires agencies that receive state death data to pay SSA their proportional share (as determined by SSA in consultation with each agency) of:

· the payments that SSA makes to states for the death data,

· SSA’s costs of developing the contracts with the states, and

· SSA’s costs of carrying out a required NAPA study on death data sources and access.[38]

In September 2023, SSA initially developed an estimated annual contract cost of $22.5 million and allocated more than half of that amount as its own share for 2024. For the remainder, SSA drafted funding scenarios on the basis that Treasury would provide no more than $6.1 million for its share, and other agencies—four at the time of negotiation—would contribute roughly $1.2 million each. According to SSA, Treasury would pay more than the other agencies because it provides data to multiple entities through the DNP system at no charge, thereby representing multiple agencies.

At the time, SSA also determined that Treasury’s contracted reimbursement would decrease if any additional agencies agreed to the $1.2 million contract with SSA for access to the full DMF. Eight other agencies eventually signed state death data sharing agreements with SSA for 2024, resulting in Treasury’s share decreasing to around $4.1 million. Table 3 presents Treasury’s and the other eight federal agencies’ actual payments, as well as the frequency of receiving the full DMF for 2024.

|

Federal agency |

Actual payment in 2024 |

|

Frequency of receiving the full DMF |

|

U.S. Census Bureau |

$1,200,000 |

|

Quarterly updates |

|

Centers for Medicare & Medicaid Services |

$1,200,000 |

|

Weekly updates |

|

Department of Agriculture |

$1,200,000 |

|

Weekly updates |

|

Department of Defense |

$1,200,000 |

|

Monthly updates |

|

Department of Housing and Urban Development |

$1,200,000 |

|

Weekly updates |

|

Department of the Treasury |

$4,127,102 |

|

Weekly updates + two full files per year |

|

Internal Revenue Service |

$1,200,000 |

|

Weekly updates + one full file per year |

|

Pension Benefit Guaranty Corporation |

$1,200,000 |

|

Weekly updates + one full file per year |

|

Railroad Retirement Board |

$1,200,000 |

|

Monthly updates |

|

Total |

$13,727,102 |

|

Not applicable |

Source: GAO analysis of Social Security Administration (SSA) information. | GAO‑26‑107181

Note: The full DMF is SSA’s file containing records of deceased individuals who have been assigned Social Security numbers. SSA officially refers to this file, which includes state death records, as the full file of death information. In addition to agencies listed above, SSA provides two agencies with its full DMF without requiring reimbursement. Pursuant to 38 U.S.C. § 5106, the Department of Veterans Affairs is not required to reimburse SSA. GAO receives SSA’s full death file for audit purposes pursuant to our authority under 31 U.S.C. § 716.

For 2025, SSA changed its methodology to calculate its share of estimated total contract costs based upon its own disbursements as a percentage of the federal government’s overall outlays. SSA determined that since its 2023 outlays represented around 23 percent of total federal outlays, it would cover 23 percent of the total costs for state death data in 2025—around $6 million—while Treasury and other agencies cover the remainder. However, SSA did not apply this same methodology to Treasury and the other agencies. Instead of calculating other agencies’ reimbursement rates based on their disbursements as a share of federal outlays, SSA arbitrarily distributed the remaining 77 percent of costs to Treasury and other agencies by increasing their reimbursement payments. Additionally, SSA determined that Treasury would cover the costs of any agency that stops reimbursing it due to obtaining death data from the DNP system instead.

SSA stated that it established and implemented methodologies to allocate total cost to obtain state death data. However, SSA’s methodology for allocating total cost was not based on considerations related to agencies’ proportional share of costs. SSA did not present analyses, such as how often agencies use or query death data, how often agencies receive death data, or other considerations for SSA’s determination of the agencies’ shares. Instead, SSA explained that when setting up the new cost-sharing arrangement, it wanted to balance between the amount Treasury was willing to pay, mitigating SSA’s own costs, and trying to maintain as many non-Treasury agencies as possible.

In addition, under the methodologies that SSA applied to divide out the total cost to obtain state death data for 2024 and 2025, agencies do not have information on their share of costs until all agreements for receiving the full DMF are finalized. SSA has no guarantee that agencies currently receiving the full DMF will elect to continue receiving it—and continue making reimbursement payments to SSA—in future years. This means SSA and other agencies may need to cover a larger or smaller share of costs than initially anticipated during contract negotiations.

Without a methodology for cost allocation based on considerations related to an agency’s proportional share of costs, actual and estimated recipient agency reimbursement costs may not accurately reflect the agency’s proportional share of SSA’s total costs for obtaining death data from states. This may limit agencies’ ability to make informed decisions about the cost effectiveness of obtaining access to the full DMF. In addition, SSA may not be adequately reimbursed for the cost to obtain state death data in accordance with the Social Security Act. It also increases the risk that SSA and agencies will use disproportionate amounts of their own funds to subsidize one or more agencies’ access to state death data.

Conclusions

The effectiveness of the DNP system depends on its access to comprehensive data, including comprehensive death data from SSA’s full DMF. The Ending Improper Payments to Deceased People Act, which recently passed both houses of Congress, would help ensure that agencies continue to have access to these key eligibility data by granting SSA permanent authority to share the full DMF with Treasury for use in the DNP system.

SSA plays an important role in obtaining and distributing death data for the federal government. This comes at a cost to SSA, as it must compensate states for providing death data and arrange for its sharing. However, SSA lacks sufficient information to be able to comply with the Social Security Act’s requirements to reimburse states for specific costs and fees associated with use of death data. Without this information, SSA’s ability to negotiate appropriate prices with states may also be limited. In addition, absent a sound cost allocation methodology that is based on considerations related to agencies’ proportional share of costs, agencies, including Treasury, may not be able to make informed decisions about the cost-effectiveness of obtaining access to the full DMF.

Recommendations for Executive Action

We are making the following three recommendations to SSA.

The SSA Commissioner should ensure that contracts for state death data reflect statutorily authorized costs and include necessary documentation required by law. (Recommendation 1)

The SSA Commissioner should ensure that SSA conducts an analysis of state cost information, including its availability, and determine whether renegotiating the fee schedule for state death data is necessary to ensure that prices reflect statutorily authorized costs. (Recommendation 2)

The SSA Commissioner should ensure that SSA revises its methodology for allocating costs to obtain state death data to incorporate costs for calculating proportional shares of state death data costs. (Recommendation 3)

Agency Comments and Third-Party Views

We provided a draft of this report to Labor, HHS, SSA, Treasury, and NAPHSIS for review and comment. In written comments provided by SSA (reproduced in app. I), SSA concurred with our recommendations. Labor, HHS, SSA, Treasury, and NAPHSIS provided technical comments, which we incorporated as appropriate.

We are sending copies of this report to the appropriate congressional committees, the Secretary of Labor, Secretary of Health and Human Services, Secretary of the Treasury, Executive Director of NAPHSIS, and other interested parties. In addition, this report is available at no charge on GAO’s website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at PadillaH@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix II.

M. Hannah Padilla

Director, Financial Management and Assurance

List of Committees

The Honorable Mike Crapo

Chairman

The Honorable Ron Wyden

Ranking Member

Committee on Finance

United States Senate

The Honorable Rand Paul, M.D.

Chairman

The Honorable Gary C. Peters

Ranking Member

Committee on Homeland Security and Government Affairs

United States Senate

The Honorable James Comer

Chairman

The Honorable Robert Garcia

Ranking Member

Committee on Oversight and Government Reform

House of Representatives

The Honorable Pete Sessions

Chairman

The Honorable Kweisi Mfume

Ranking Member

Subcommittee on Government Operations

Committee on Oversight and Government Reform

House of Representatives

GAO Contact

M. Hannah Padilla, PadillaH@gao.gov

Staff Acknowledgments

In addition to the contact named above, Dan Flavin (Assistant Director), Seong Bin Park (Auditor in Charge), Seth Brewington, Marcia Carlsen, McRae Dickenson, Jason Kelly, Christopher Klemmer, Mark Oppel, Courtney Paz, Sabrina Rivera, Amanda Stogsdill, and Jingxiong Wu made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

David A. Powner, Acting Managing Director, CongRel@gao.gov

General Inquiries

[1]GAO, Improper Payments: Information on Agencies’ Fiscal Year 2024 Estimates, GAO‑25‑107753 (Washington, D.C.: Mar. 11, 2025). An improper payment is defined by law as any payment that should not have been made or that was made in an incorrect amount (including overpayments and underpayments) under statutory, contractual, administrative, or other legally applicable requirements. It includes any payment to an ineligible recipient, any payment for an ineligible good or service, any duplicate payment, any payment for a good or service not received (except for such payments where authorized by law), and any payment that does not account for credit for applicable discounts. 31 U.S.C. § 3351(4). When an executive agency’s review is unable to discern whether a payment was proper because of insufficient or lack of documentation, that payment must also be included in the agency’s improper payment estimate. 31 U.S.C. § 3352(c)(2)(A).

[2]GAO, The Nation’s Fiscal Health: Strategy Needed as Debt Levels Accelerate, GAO‑25‑107714 (Washington, D.C.: Feb. 5, 2025). Improper payments and fraud are two distinct concepts that are related but not interchangeable. We define fraud as the act of obtaining something of value through willful misrepresentation. While all fraudulent payments are considered improper, not all improper payments are due to fraud. For more information on the relationship between improper payments and fraud, see GAO, Improper Payments and Fraud: How They Are Related but Different, GAO‑24‑106608 (Washington, D.C.: Dec. 7, 2023).

[3]GAO, Improper Payments: Strategy and Additional Actions Needed to Help Ensure Agencies Use the Do Not Pay Working System as Intended, GAO‑17‑15 (Washington, D.C.: Oct. 14, 2016).

[4]31 U.S.C. § 3354.

[5]42 U.S.C. § 405(r)(3).

[7]Pub. L. No. 116-260, div. FF, tit. VIII, § 801 (2020), codified at 42 U.S.C. § 405(r)(11). SSA maintains two sets of death data that it shares with external users. SSA’s “ full DMF” contains death data SSA has obtained on its own, including state-reported death data. SSA shares the full DMF with certain agencies that pay federally funded benefits, such as the Department of Defense and the Centers for Medicare & Medicaid Services. SSA also maintains a “public DMF.” The public DMF is a subset of the full DMF and does not include state-reported death data. The public DMF is distributed by the Department of Commerce’s National Technical Information Service and is shared with other users.

[8]42 U.S.C. 405(r)(2), (3). Agencies should also pay SSA the full documented cost of developing the arrangement and transmitting the data to the agency.

[9]GAO, Emergency Relief Funds: Significant Improvements Are Needed to Ensure Transparency and Accountability for COVID-19 and Beyond, GAO‑22‑105715 (Washington, D.C.: Mar. 17, 2022).

[10]Ending Improper Payments to Deceased People Act, S. 269, 119th Cong. (2026).

[11]On February 3, 2026, the bill was presented to the President for approval.

[12]The National Academy of Public Administration, A Report to Congress on Sources of and Access to State Death Data (Washington, D.C.: July 2022). This study was mandated by the Consolidated Appropriations Act, 2021.

[13]SSA uses a standardized contract with identical terms and clauses but with a modified quantity of estimated death records for each state. SSA’s contracts with states provide a standardized price table in which the amount SSA pays per record varies based on how quickly the death record is received following the date of death. The contracts also specify that states are to collect and maintain death data and ensure the completeness, timeliness, and accuracy of the death data while also maintaining, enhancing, and operating the electronic death registration systems used for the transmission of death data to SSA.

[14]The term “states” in this report refers to the 50 states, New York City, the District of Columbia, and the five territories that provide death data to SSA. New York City and New York State maintain separate vital records offices. New York City includes the five counties of Bronx, Kings, New York, Queens, and Richmond. New York State encompasses the state’s remaining 57 counties. Of the five territories that provide death data to SSA, three—Guam, American Samoa, and the U.S. Virgin Islands—do not use an electronic death registration system and remain paper based.

[15]In making our selection, we retrieved death data for 2022 from the National Center for Health Statistics. We retrieved data for 56 of 57 vital records jurisdictions—all except for American Samoa. According to the National Center for Health Statistics, American Samoa was not included in the agency’s vital statistics reporting because it had not adopted the most recent (2003) standard certificates for births, deaths, and fetal deaths. See: GAO, U.S. Territories: Coordinated Federal Approach Needed to Better Address Data Gaps, GAO‑24‑106574 (Washington, D.C.: May 9, 2024). To select jurisdictions, we sorted the jurisdictions from highest to lowest and split jurisdictions into categories. Within each category, we calculated the average, minimum, maximum, and standard deviation for fiscal year 2022 death numbers and price per death record using data from all reporting jurisdictions. We selected the three jurisdictions from each category that exhibited the highest, lowest, and average price per death record.

[16]SSA refers to the full DMF, which includes state death records, as the full file of death information. SSA refers to the public DMF, which excludes state death records, as both the public file of death information and the Limited Access death master file.

[17]SSA receives death data from multiple sources, including state VROs, funeral home directors, family members, other federal agencies, and financial institutions.

[18]42 U.S.C. § 405(r).

[19]The Ending Improper Payments to Deceased People Act (S. 269), discussed above, would grant SSA permanent authority to continue sharing the full DMF for use in the DNP system following the end of the 3-year pilot.

[20]As of July 2024, Unemployment Insurance agencies in 52 states and territories have access to the DNP system through the Unemployment Insurance Integrity Center’s Integrity Data Hub.

[21]The six functionalities are (1) online search, in which the agency searches a name or other uniquely identifiable information (e.g., Tax Identification Number) to match against approved data sources; (2) single query functionality, in which the agency relies on an application programming interface to create a connection between the user’s payment systems and the DNP system; (3) multiple query functionality, in which the agency relies on an application programming interface to create a search criteria of up to 100 entities to be matched against the agency’s approved data source; (4) payment integration, in which the agency may match its payments against data sources at the time of disbursement; (5) batch matching, in which the agency sends a payment file to the DNP system to match against approved data sources; and (6) continuous monitoring, in which the DNP system performs a comparison of the agency’s payee file against approved data sources based on a specified frequency (e.g., biweekly, monthly, or yearly).

[22]An EDR system automates the electronic registering and processing of death reports to improve timeliness and accuracy. Three territories, Guam, American Samoa, and the U.S. Virgin Islands, do not use an EDR system and remain paper based.

[23]NAPHSIS is a nonprofit membership organization representing the 57 vital records jurisdictions that collect, process, and issue vital records in the United States.

[24]42 U.S.C. § 405(r)(2)(A), (B). The fee for the use of the information includes a share of the costs to the state associated with collecting and maintaining the information; ensuring the completeness, timeliness, and accuracy of such information; maintaining, enhancing, and operating the electronic systems that allow for the transmission of the information; and a fee for the right to use such information.

[25]42 U.S.C. § 405(r)(3). While most agencies must reimburse SSA, SSA provides two agencies with the full DMF without requiring reimbursement. Pursuant to 38 U.S.C. § 5106, the Department of Veterans Affairs is not required to reimburse SSA. GAO receives SSA’s full death file for audit purposes, rather than for those purposes outlined in the Social Security Act, pursuant to our authority under 31 U.S.C. § 716.

[26]For 2025, the eight agencies include the U.S. Census Bureau, Centers for Medicare & Medicaid Services, Department of Agriculture, Department of Defense, Department of Housing and Urban Development, Department of the Treasury, Internal Revenue Service, and the Pension Benefit Guaranty Corporation. For 2024, these eight plus the Railroad Retirement Board had reimbursement agreements. According to SSA, the Railroad Retirement Board opted out of renewing its agreement to obtain death data from SSA for 2025 and instead elected to access state death data through Treasury’s DNP system.

[27]SSA also charges all agencies an annual fixed cost for developing the data exchange agreement, which includes an administrative fee and the cost of contract negotiations with NAPHSIS, and variable transaction and system costs to transmit the information to the federal agencies.

[28]Treasury’s analysis evaluated three topics: (1) the initial effect of full DMF access for the first year of the pilot, calculated as the sum of improper payments prevented, identified, and recovered, less acquisition and implementation costs; (2) changes in agency engagement and use resulting from implementation of the full DMF; and (3) the coverage, comprehensiveness, and timeliness of the full DMF compared with other DNP system death data sources. As part of the analysis, Treasury filtered data to include only those improper payments uniquely identified by the full DMF (i.e., where the full DMF was the sole data source for the death).

[29]Treasury and SSA previously agreed that Treasury would pay SSA up to $6.12 million annually for access to the full DMF. This amount was designated as Treasury’s proportional share of SSA’s anticipated costs, including its payments to states for their death data. Treasury’s total reimbursements to SSA for 2024 totaled $4.13 million, or about $2 million less than the $6.12 million cap. Treasury’s costs were lower than expected because more agencies than expected continued to obtain the full DMF directly from SSA in 2024.

[30]Overseen by Labor and administered by the states, the Unemployment Insurance program is a federal-state partnership that provides temporary financial assistance to eligible workers who become unemployed through no fault of their own.

[31]IDH is a centralized, multistate data system that provides state workforce agencies with cross-matching capabilities to analyze unemployment insurance claims data to detect and prevent unemployment insurance fraud and improper payments. As of March 2025, 52 state unemployment insurance agencies have access to DNP system data matches through the IDH.

[32]The Public Assistance Reporting Information System provides data-matching services to states to help them identify individuals who may be receiving benefits, such as Medicaid, from multiple states, thereby preventing duplicate benefits payments. As the service’s technical service provider, the DNP system provides interstate duplicate matching reports to states.

[33]Deaths increased by about 4 percent over the same period, according to SSA monthly transaction data.

[34]42 U.S.C. § 405(r)(2)(A),(B).

[35]42 U.S.C. § 405(r)(2)(A).

[36]42 U.S.C. § 405(r)(3). Agencies receiving state death data from SSA must also reimburse SSA for the full documented cost of developing the arrangement and transmitting the information to the agency. This requirement was not a consideration in our review.

[37]If enacted, the Ending Improper Payments to Deceased People Act (S. 269), in making permanent SSA’s authority to share the full DMF with Do Not Pay, would revise the current statutory language on payment. Specifically, the bill would require the Commissioner of Social Security and the agency operating the DNP system (currently Treasury) to enter into an agreement, based on an agreed-upon methodology, which covers the proportional share of state death data costs, which the Commissioner of Social Security and the agency operating the DNP system may periodically review. The change would take effect on December 27, 2026. At this time, it is unclear how this provision will affect the current agreement between SSA and Treasury.

[38]42 U.S.C. § 405(r)(3)(A)(i).