COVID-19 RELIEF

IRS Can Use Lessons Learned to Address and Prevent Improper Payments in Future Tax Programs

Report to Congressional Committees

United States Government Accountability Office

A report to Congressional Committees

For more information, contact: Jessica Lucas-Judy at lucasjudyj@gao.gov.

What GAO Found

As of June 2025, the Internal Revenue Service (IRS) processed nearly 5 million Employee Retention Credit (ERC) claims. IRS moved quickly to administer ERC but was less prepared to assess improper payment risks and process a surge in claims. To address improper claims, IRS implemented a processing moratorium in September 2023. IRS closed most claims by December 31, 2025, according to IRS officials. GAO identified six lessons from ERC design and administration.

|

Offering Relief Through Employment Taxes Provides Benefits and Challenges · Benefits include availability to employers without tax liability. Challenges include interactions with income tax. |

|

Some Design Decisions Increased Complexity and Improper Payment Risk · Complex and retroactive eligibility criteria complicated eligibility determination. |

|

The Internal Revenue Service (IRS) Would Have Benefitted from a Comprehensive Plan for Managing Employee Retention Credit (ERC) Risks · Timely implementing a 2022 GAO recommendation on project planning could have better prepared IRS for a later surge in claims. |

|

IRS Would Have Benefitted from Additional Eligibility Reporting · Key eligibility information was not required on employment tax returns. |

|

Manual Processing for Amended Returns Complicated Compliance Efforts · Paper-only amended returns limited IRS’s ability to capture key data. |

|

ERC Implementation Could Have Benefitted from More Timely and Consistent Communication with Stakeholders. · IRS did not regularly communicate status of ERC processing. |

Source: GAO. | GAO-26-107456

These lessons could help policymakers consider future emergency employment tax relief, and help IRS better prepare for it. IRS did not complete an improper payment estimate for ERC, as required in law. The Department of the Treasury said it would not do so for pandemic programs as they are short term. However, a timely estimate could have helped identify root causes of improper payments earlier and developing one now could guide future decisions on employment tax relief. The statute of limitations for assessing tax on certain paid improper ERCs has expired. However, IRS can still pursue fraud cases indefinitely.

Employers primarily claimed ERC on paper amended returns. IRS enabled electronic filing in mid-2024 but continued to process the returns manually. Automated processing would yield cost savings and expedite refunds. IRS’s last public update on ERC processing status was in October 2024, leaving uncertainties about cash flow among some employers. IRS also did not follow all risk management and internal control principles from GAO’s A Framework for Managing Improper Payments in Emergency Assistance Programs. IRS could reduce future improper payments by incorporating this framework into its policies.

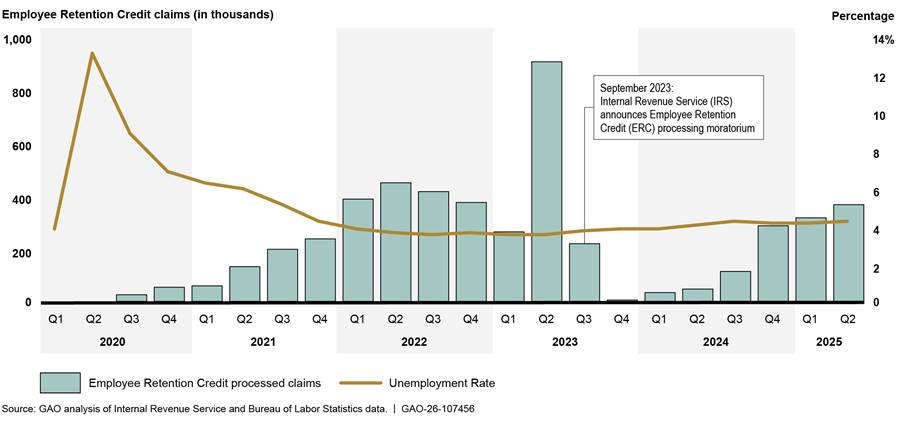

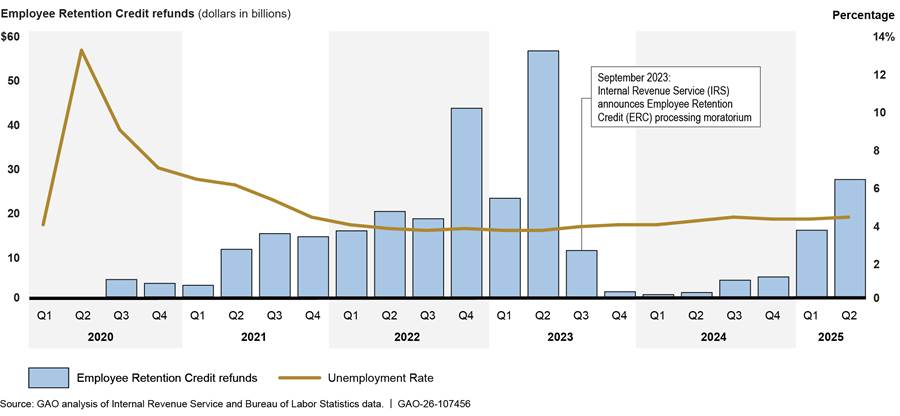

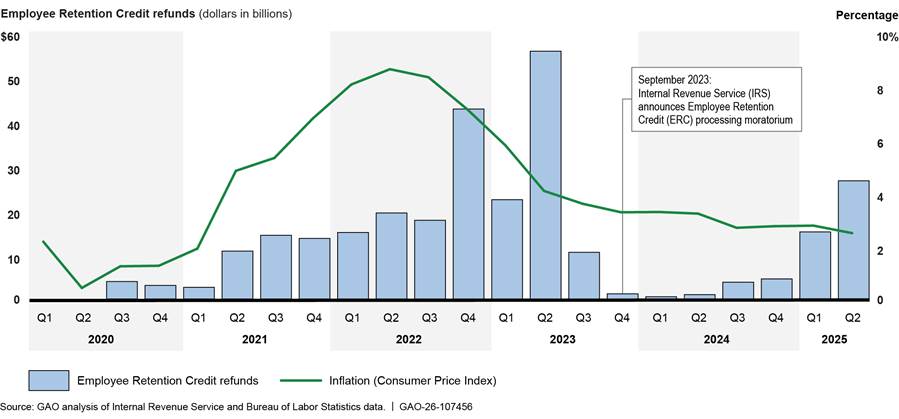

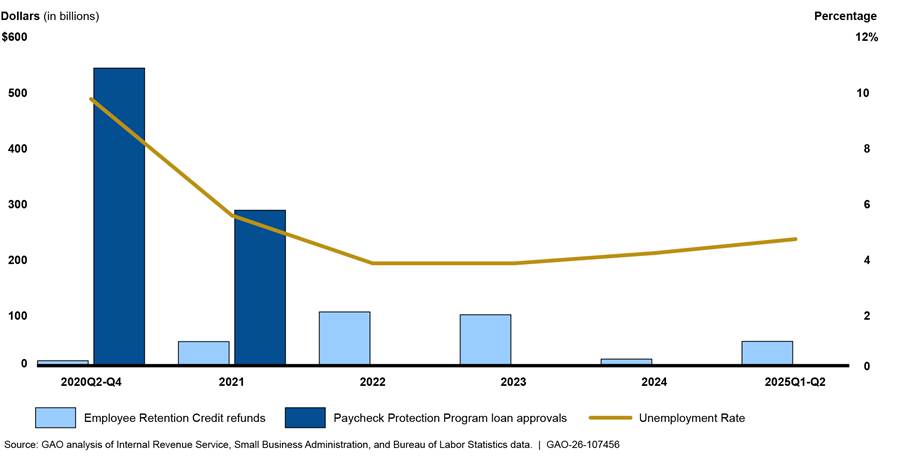

As a consequence of its design and administrative challenges, most ERC claims were not paid in 2020 or 2021, the eligibility period for the credit. About 83 percent of ERC refunds—about $235 billion—were issued in 2022 through June 2025, well after unemployment had returned to its pre-pandemic level.

Why GAO Did This Study

The ERC—which encouraged employers to keep paying employees during the COVID-19 pandemic—had provided about $283 billion to employers as of June 2025. GAO previously found that implementing new initiatives—such as the ERC—is a challenge for IRS. A law passed in July 2025 affected ERC by, in part, disallowing certain unpaid claims made after January 31, 2024.

In response to a request, this report presents lessons learned on the ERC’s design and administration, examines actions IRS can take to be better prepared for emergency employment tax relief, and describes economic conditions—such as unemployment levels—surrounding ERC.

To identify lessons learned, GAO reviewed literature and interviewed experts and agency officials about the ERC’s design and implementation. GAO observed ERC processing at an IRS campus. GAO compared documents with selected practices for managing payments in emergency programs (GAO-23-105876). GAO also analyzed IRS data on ERC processing and compared it with economic data.

What GAO Recommends

GAO is making four recommendations to IRS, including that it develop and report an improper payment estimate for ERC, automate amended employment tax return processing, provide an update to the public on ERC processing, and include key principles on managing improper payments in emergency assistance programs in its policies. IRS agreed with one recommendation, partially agreed with another, and disagreed with two. GAO maintains that all four recommendations are warranted, as explained in the report.

Abbreviations

ARPA American Rescue Plan Act

BLS Bureau of Labor Statistics

CAA, 2021 Consolidated Appropriations Act, 2021

CI Criminal Investigations

CPEO Certified Professional Employer Organization

EIN Employer Identification Number

ERC Employee Retention Credit

FAQ Frequently Asked Questions

IIJA Infrastructure Investment and Jobs Act

IRS Internal Revenue Service

MOU Memorandum of Understanding

OBBBA One Big Beautiful Bill Act

OMB Office of Management and Budget

PEO Professional Employer Organization

PIIA Payment Integrity Information Act

PMBOK® Guide A Guide to the Project Management Body of Knowledge

PPP Paycheck Protection Program

SBA Small Business Administration

TIGTA Treasury Inspector General for Tax Administration

VDP Voluntary Disclosure Program

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

February 10, 2026

Congressional Committees

The Employee Retention Credit (ERC) resulted in about $283 billion in reduced tax liability or credits to employers since enacted in the CARES Act in March 2020.[1] ERC encouraged employers to keep employees on their payrolls during the COVID-19 pandemic. This refundable tax credit was available to eligible employers whose trade or business was suspended by a government order due to COVID-19 or who were financially affected, according to the statute, during calendar quarters in 2020 and 2021.[2] Implementation of new initiatives—such as the ERC—has been a challenge for the Internal Revenue Service (IRS) as we have previously reported, including in our 2025 High-Risk Report.[3]

Early in the pandemic, federal agencies prioritized swiftly distributing funds and implementing new programs to help businesses and individuals adversely affected by COVID-19. We previously reported that while this swift response helped meet urgent needs, it involved trade-offs that put billions of dollars at increased risk for improper payments, including overpayments.[4] A surge of promoters convincing employers to file questionable ERC claims led IRS to implement a processing moratorium in September 2023.[5] Deficiencies in addressing risks and planning for enforcing ERC compliance, as identified in our prior work, and the subsequent volume and timing of questionable claims suggests there are lessons for future emergency relief.[6] In July 2025, a new law was enacted to retroactively deny some ERC claims and levy penalties on some ERC promoters.[7]

You asked us to report on ERC filing and compliance and to identify lessons learned.[8] This report (1) presents lessons learned related to the design and administration of ERC; (2) examines how IRS can be better prepared to address improper payments while managing emergency assistance through the employment tax system; and (3) describes the economic conditions surrounding ERC during and after the height of the pandemic.

To identify lessons learned and actions that IRS can take, we conducted a literature review and we reviewed legislative proposals for fiscal years 2022 to 2025, and IRS’s documentation of its research, policy and procedures, and leadership briefings from 2020 to 2025. We also interviewed (1) IRS staff and managers from offices involved in ERC implementation, including current and former executives leading ERC implementation, (2) experts with experience in ERC and tax policy that we selected through our literature review and outreach to public policy groups, and (3) two groups representing payroll professionals and an accounting industry group. We visited IRS’s Covington, Kentucky campus where ERC claims are processed to interview IRS ERC leadership and observe ERC processing. Statements from these interviews are used as examples and are not generalizable to all IRS staff, and payroll and tax professionals.

To identify actions that IRS can take to address improper payments, we compared the evidence sources listed above with criteria from A Framework for Managing Improper Payments in Emergency Assistance Programs.[9] The framework provides five principles and corresponding practices that can help federal program managers mitigate improper payments, particularly in emergency assistance programs.[10] The framework is also intended as a resource for Congress to use when designing new programs in response to emergencies.

To describe the economic conditions surrounding ERC, we analyzed ERC processing data from IRS and compared these data with unemployment, and inflation data from the Bureau of Labor Statistics, for third calendar quarter 2020 through second calendar quarter 2025.[11] We also compared ERC refund dates with Paycheck Protection Program (PPP) loan approval data, for 2020 and 2021, from the Small Business Administration. See appendix I for more information on our scope and methodology. We found these data to be sufficiently reliable for describing general ERC processing trends and economic conditions at the time ERC claims were processed.

We conducted this performance audit from February 2024 to February 2026 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Employment Tax Filing

For federal tax purposes, employers generally are required to withhold and remit taxes from their employees’ wages, including federal income tax and Federal Insurance Contribution Act taxes (Social Security and Medicare taxes). Together, they are referred to as “employment taxes.”[12] Employers must deposit employment taxes daily, semi-weekly or monthly, depending on their reported tax liabilities. Employers that accumulate $100,000 or more in taxes in a day must deposit tax by the next business day.[13]

Most employers file employment taxes quarterly, and could claim the ERC on Form 941, Employer’s Quarterly Federal Tax Return. Employers meeting certain industry or size criteria may file annually on other forms.[14]

To receive tax relief such as the ERC more quickly, employers could reduce their employment tax deposits by the anticipated ERC amount during the quarter. Certain employers filing for ERC also had the option to request an advance payment—before the end of a quarter—if the total for their COVID-19 related tax credits exceeded their reduced employment tax deposits.[15] If an employer did not claim the ERC on an original employment tax return (for example, the Form 941), employers could claim the ERC on an amended employment tax return. For Form 941 filers, that amended employment tax return is Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

ERC Eligibility

Under the CARES Act as amended, eligible employers of any size—including tax-exempt entities, eligible governmental entities, and self-employed individuals with employees—could claim the ERC.[16] The credit amount was based on qualified wages paid to employees after March 12, 2020, including certain health care expenses.[17] Under the CARES Act, as originally enacted, an employer was considered eligible for ERC when it experienced either (1) a full or partial suspension of operations due to governmental orders during any quarter, or (2) a requisite decline in gross receipts of more than 50 percent from the same quarter in 2019.[18] Under the CARES Act, as originally enacted, employers were prohibited from participating in both ERC and the PPP.[19]

Subsequent laws amended or modified key aspects of ERC, which affected implementation. The Consolidated Appropriations Act, 2021 (CAA, 2021), amended aspects of the ERC for credits in 2021, including increased credit maximums, a lower gross receipts threshold, and extending eligibility to employers who had a forgiven PPP loan.[20] The CAA, 2021 also contained retroactive amendments, most notably, the eligibility change for PPP borrowers. Given these modifications, employers could file amended employment tax returns to claim ERCs for qualified wages paid in 2020.

The American Rescue Plan Act of 2021 granted eligibility to “recovery startup businesses” who otherwise would not meet eligibility criteria to claim the credit, among other changes.[21] The Infrastructure Investment and Jobs Act retroactively terminated the ERC for wages paid after September 30, 2021, for employers other than recovery startup businesses.[22] In July 2025, Congress passed Public Law 119-21—commonly known as the One Big Beautiful Bill Act—which retroactively denied certain pending ERC claims.[23] Under the One Big Beautiful Bill Act, pending claims for the third and fourth quarters of 2021 that were filed after January 31, 2024 will be denied. The legislation also extended the statute of limitations on certain IRS assessments, and imposed penalties on ERC promoters for failing to comply with IRS due diligence requirements to confirm ERC eligibility.[24]

Decisions on the Design and IRS’s Administration of ERC Can Provide Lessons for Future Economic Relief

Based on our review of IRS documents, literature and legislative proposals, and interviews with experts, IRS management and staff, and payroll and tax professional groups, we identified six lessons for future economic relief efforts related to the design and IRS’s administration of the ERC (see appendix I for more information on our methodology). See figure 1. This section describes the contributing factors and, where applicable, provides questions policymakers can consider when designing future economic relief. A complete list of questions for policymakers is in appendix II.

Figure 1: Lessons Learned and Contributing Factors from Documents and Interviews on the Design and Administration of the Employee Retention Credit

|

Lessons Learned on Employee Retention Credit Design

We identified two lessons, each with contributing factors. We also pose questions that policymakers can consider for future tax relief. Source: GAO. | GAO‑26‑107456 |

Offering Relief Through Employment Taxes Provides Potential Benefits and Unique Challenges

|

|

Contributing Factors on Employment Tax System · Employment tax credits can offer fast relief to all employers · Credits through the employment tax system are unusual and labor intensive for the Internal Revenue Service (IRS) to administer · Until July 2025, IRS did not have statutory authority to assess erroneous filing penalties for employment tax credits · Aggregate filers complicate claims · Employment tax credits can complicate income tax liability |

Source: GAO analysis. | GAO‑26‑107456

Employment Tax Credits Can Offer Fast Relief to All Employers

The employment tax system has two advantages over using the income tax system to distribute economic relief: it (1) can disburse refunds faster, throughout the year; and (2) is available to all employers.

Faster. The frequency of employment tax deposits—which employers could make daily, semi-weekly or monthly—provided an opportunity for employers to benefit from ERC quickly during the pandemic.[25] The ERC also included both a refundable and nonrefundable portion.[26] The ERC refundable portion was any ERC amount remaining at the end of the quarter if the ERC amount exceeded the employer share of Social Security tax or Medicare tax. If an employer anticipated that during a quarter the ERC amount would exceed the employer’s employment taxes, the employer could reduce deposits during the quarter by the amount of the anticipated ERC. The nonrefundable portion of the credit is limited to the employer’s share of Social Security tax or Medicare tax, depending on the quarter.[27]

Available. The employment tax system also provides tax benefits to entities that do not have an income tax liability. Entities such as non-profit organizations that are exempt from income tax (referred to as “exempt organizations”) accounted for about 10 percent of employment in 2022. In 2022, we reported that about 9 percent of ERC claims were filed by exempt organizations.[28] Additionally, because start-up businesses may not yet have enough income to generate tax liability, employment tax credits offer relief to these entities whereas income tax credits cannot, according to one legal expert.

|

Question for policymakers to consider for future emergency economic relief Will use of the employment tax or employment tax system provide timely relief to the intended population? |

Source: GAO. | GAO‑26‑107456

Credits Through the Employment Tax System Are Unusual and Labor Intensive for IRS to Administer

Unusual. Prior to the pandemic, relatively few tax credits were claimed through the employment tax system compared to the income tax system.[29] Historically, compliance issues for employment taxes typically related to the reporting of taxable wages, such as employee and contractor classifications. As a result, IRS officials told us that when ERC was created, the agency did not have many IT systems and processes in place to administer and ensure compliance with employment tax credits.

Labor intensive. During fiscal year 2024, IRS received about 34 million original employment tax returns and about 12 million of these (35 percent) were filed on paper. Furthermore, prior to mid-2024, amended employment tax returns (Form 941-X) could only be filed on paper.

The large volumes of paper returns made delivering economic relief through employment taxes cumbersome for IRS to administer. During processing, paper-filed returns need to be handled by multiple IRS employees. Employees also need to manually key in data from paper forms into IRS IT systems. By contrast, e-filed returns are processed using automation and only require human intervention if the return has an issue.[30]

While quarterly employment tax filings provided IRS more opportunities to issue refunds to employers, the resulting increases in paper filings added to processing burdens for IRS. These processing challenges for paper returns were exacerbated during the pandemic when IRS had to suspend work at its submission processing centers. As we reported in 2021, the large volumes of paper filings created significant backlogs, delaying relief payments to struggling businesses.[31] In 2021, we recommended that IRS identify and address barriers that taxpayers face to e-filing business returns. In response to our recommendation and other factors, IRS has been taking some steps to improve electronic filing rates for businesses.[32]

|

Question for policymakers to consider for future emergency economic relief Does the Internal Revenue Service have the capacity to use the employment tax system to implement relief efficiently? |

Source: GAO. | GAO‑26‑107456

Until July 2025, IRS Did Not Have Statutory Authority to Assess Erroneous Filing Penalties for Employment Tax Credits

Since 2007, federal law has provided IRS specific authority to impose a civil penalty on erroneous claims for income tax refunds or credits.[33] The penalty is equal to 20 percent of the excessive amount claimed.[34] However, federal law did not provide for this penalty authority for other types of taxes, including employment taxes. In March 2024, the Department of the Treasury proposed that federal law extend the income tax penalty on erroneous claims to employment tax refunds or credits.[35] In July 2025, legislation was enacted to extend the penalty to employment taxes.[36]

In its March 2024 proposal, Treasury said that extending the penalties to employment taxes would discourage certain fraudulent claims. According to IRS officials, prior to the legislative change, if an employer filed erroneous ERC claims that IRS detected before issuing a refund, the only likely consequence to the employer would be the claim’s denial.[37] Promoters of ERC tax schemes might have known that the penalty for claiming erroneous income tax refunds or credits did not apply to employment tax, according to an IRS official. These promoters may have pushed employers to file erroneous ERC claims by convincing the employers that they had nothing to lose, according to IRS.

|

Question for policymakers to consider for future emergency economic relief Does federal law provide the Internal Revenue Service sufficient statutory authority to assess penalties on erroneous claims for emergency economic relief to help ensure compliance? |

Source: GAO. | GAO‑26‑107456

Aggregate Filers Complicate Claims

Third-party aggregate filers, which assist employers with various payroll and tax requirements, are subject to a series of IRS requirements that can complicate compliance decisions and delay ERC processing. To claim ERC for their clients, these filers are required to file a single aggregate employment tax return under their own employer identification number (EIN), representing themselves and their clients.[38] Aggregated information made it difficult for IRS to determine whether some ERC claims represented multiple employers. By contrast, some third parties may file employment taxes for clients, but they file separate returns for each client under the client’s employer’s EIN, therefore eliminating the extra step of IRS having to link an employer with an ERC claim on an aggregate return. See table 1 for the variations of third-party arrangements.

Table 1: Common Third-Party Arrangements, Responsibilities, and Liabilities Prior to Employee Retention Credit

|

Third-party payer arrangement |

Employment tax filings |

Employment tax payments |

Employment tax liability |

|

Third parties that file separate returns for employer clients |

|||

|

Payroll service provider: typically prepares employment tax returns, and processes withholding, deposit, and payment of employment tax. |

Employer signs the return and files under its Employer identification Number (EIN). |

Paid under the employer EIN. |

Employer is solely liable for timely filing and tax payment. |

|

Reporting agent: a type of payroll service provider that is designated as a reporting agent. The agent files returns and may deposit and pay taxes on employer’s behalf.a |

Reporting agent signs the return, filed under the employer EIN. |

Paid under the employer EIN. |

Employer is solely liable for timely filing and tax payment. |

|

Third parties that file an aggregate return |

|

|

|

|

Section 3504 agent: performs acts such as withholding, reporting and paying employment taxes.b |

Aggregate return filed under the agent’s own EIN for all clients. |

Aggregate tax paid under the agent’s EIN. |

Both employer and agent are liable for timely filing and tax payment. |

|

Professional employer organization (PEO): also known as an employee leasing organization, a PEO does some or all withholding, reporting and paying employment tax. |

Aggregate return filed under the PEO’s EIN for all clients. |

Aggregate tax paid under the PEO’s EIN. |

Circumstance dependent. |

|

Certified professional employer organization (CPEO): a PEO that has completed a certification process through the Internal Revenue Service (IRS). |

Aggregate return filed under the CPEO’s EIN for all clients. |

Aggregate tax paid under the CPEO’s EIN. |

Generally, the CPEO is solely liable for filing and tax. |

Source: GAO analysis of IRS information. | GAO‑26‑107456

Notes: The table reflects common third-party arrangements, responsibilities, and liabilities prior to Employee Retention Credit (ERC). An IRS Chief Counsel memorandum states that a third-party payer that is a section 3504 agent, certain PEOs, or a CPEO is liable for any underpayment resulting from an improperly claimed employment tax credit that the third-party payer claimed for the client on the third-party payer’s employment tax return filed under the third-party’s EIN, where the credit was claimed based on wages paid by the third-party payer to the client’s employees. This rule applies to the ERC as it would any other employment tax credit. See IRS, Office of Chief Counsel Memorandum, Liability of Certain Third-Party Payers for an Underpayment of Certain Employment Taxes Resulting from Improperly Claimed Employment Tax Credits (Feb. 05, 2024).

aAn employer and a third-party file Form 8655, Reporting Agent Authorization, with IRS to designate a payroll service provider as a Reporting Agent.

bAn employer and a third-party file Form 2678, Employer/Payer Appointment of Agent, with IRS to authorize the third party as a Section 3504 Agent of the employer.

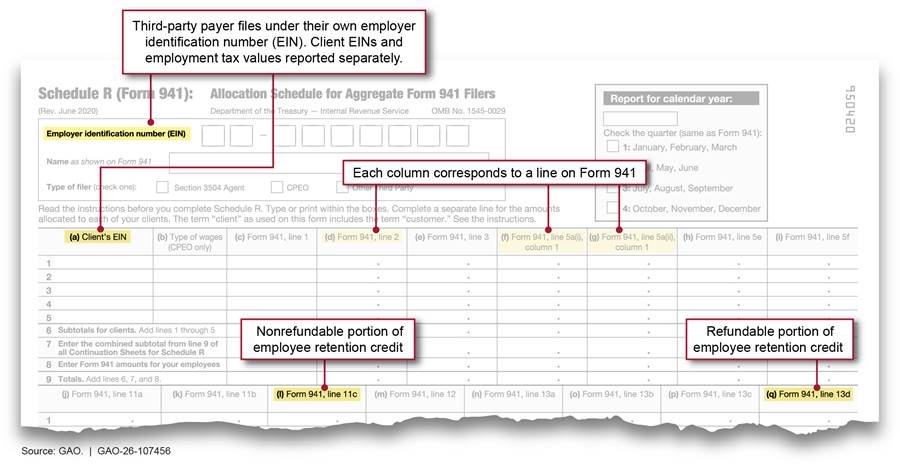

Beginning in 2020, all third-party filers filing for ERC were required to file Schedule R for any client claiming an ERC employment tax credit. Schedule R is completed with Form 941, and totals from lines on Form 941 are allocated among clients (see fig. 2). Total amounts reported on Form 941 should match the client totals on Schedule R, per line.

Figure 2: Internal Revenue Service Schedule R (Form 941) for Third-Party Payers Filing Employee Retention Credits on Behalf of Clients

Number of employers represented in an aggregate return is sometimes unclear. IRS does not have data on the population of third-party aggregate filers, according to IRS officials. Therefore, IRS also does not know the number of clients represented in aggregate filings, according to a draft legislative proposal. Despite the requirement to file Schedule R, which would provide IRS with visibility into this population (as reflected under “Client’s EIN” in fig. 2). IRS officials said third-party aggregate filers were not consistent in meeting this requirement. As a result, IRS does not always know whether some ERC claims represented multiple employers. Knowing whether a large claim represents one employer or many employers filed through a third-party helps IRS review the claim, according to IRS officials. For example, a claim of $100 million filed for one employer presents different risks than a claim of the same amount that is an aggregate filing for several employers.

All-or-nothing processing. A third-party payer’s aggregated Schedule R could represent thousands of clients, according to IRS officials. A problem with one client claim on an aggregate return could delay processing for all the claims, according to a group representing certain third-party payers. Each time a client requests a change to their ERC, the third-party payer files another amendment, according to IRS officials and payroll professionals. IRS announced a process in September 2024 for third-party payers to consolidate their ERC filings and withdraw any ineligible claims.

Limited accessible data. Client-level aggregated data from Schedule R filings are not easily extractable for analysis, according to IRS officials, because of the format and amount of information (as reflected in the individual rows for each client in fig. 2). Reviewing compliance for client-level ERC claims requires extra steps to extract the EINs and other client-specific data, which could increase the risk of improper payments.

Citing $10 billion of Professional Employer Organizations’ (PEO) ERC claims considered to be very high risk of being improperly claimed, IRS developed a legislative proposal for Treasury’s consideration for inclusion in its fiscal year 2026 General Explanations of the Administration’s Revenue Proposals.[39] IRS proposed that PEOs be required to file Schedule R, and file aggregated returns electronically. Under the proposal, PEOs would also be required to report on filing agreements with clients. The proposal also included a failure to file penalty for PEOs not filing Schedule R. The proposal stated that employment taxes that are not allocated appropriately or reconciled to a Form 941 may result in a significant loss of revenue if refunds are allocated incorrectly. Treasury officials told us that the department would not issue a fiscal year 2026 version of General Explanations of the Administration’s Revenue Proposals.

|

Question for policymakers to consider for future emergency economic relief Are there any filing requirements or arrangements that could complicate the Internal Revenue Service’s implementation and compliance efforts? |

Source: GAO. | GAO‑26‑107456

Employment Tax Credits Can Complicate Income Tax Liability

Employers generally deduct wages paid to employees on their income tax returns. Under the CARES Act, employers are barred from deducting wages claimed for ERC, thereby preventing a double tax benefit.

ERC claims filed on amended employment tax returns complicate the relationship between employment tax and income tax, especially when ERCs were delayed. According to IRS’s frequently asked questions (FAQ), ERC claimants should amend their income tax returns to reduce the amount of their original wage expenses, if that adjustment has not yet been made.[40]

When an amended income tax return is filed, employers are expected to pay any additional income tax due at the time of filing. For ERC claims facing processing delays, employers face uncertainties about how to amend their income tax returns. Therefore, to maintain cash flow, employers may hesitate to amend their income tax returns until they have received their refunds, according to a tax professional group. If an employer proactively amended its income tax return to reduce its wage deduction by the amount anticipated for ERC but the credit was disallowed, its income tax liability decreases.

In March 2024, Treasury introduced a legislative proposal to extend the statute of limitations for assessment on erroneous ERC claims to 5 years.[41] This proposal included assessing additional income tax from an ERC claimant that did not make a corresponding downward adjustment to its wage deduction. Enacted in July 2025, the One Big Beautiful Bill Act included a provision which extended the statute of limitations on tax assessments of certain ERC claims to 6 years.[42] In March 2025 IRS also issued FAQs stating that employers could adjust income tax liabilities for the year in which their ERCs were finalized. The FAQs also stated that filing a “protective claim” is an option to address the issue.[43]

|

Question for policymakers to consider for future emergency economic relief Are there implications of employment tax relief on income taxes? Issues to consider could include: · Whether corresponding benefits from income tax are allowed. · Whether the statute of limitations is sufficient for accommodating amendments to income tax returns. · Whether income tax liability can be incorporated into employment tax calculations. |

Source: GAO. | GAO‑26‑107456

Some Design Decisions Increased Complexity and Improper Payment Risk

|

|

Contributing Factors on Complexity and Improper Payment Risk · Unclear and complex eligibility criteria made verification difficult · Retroactive changes to eligibility increased amended return filings and improper payment risk · Benefit of advance payments uncertain · Lack of explicit statutory data sharing provisions affected the Internal Revenue Service’s ability to obtain Paycheck Protection Program data and necessitated an agreement |

Source: GAO analysis. | GAO‑26‑107456

Unclear and Complex Eligibility Criteria Made Verification Difficult

The language of the CARES Act regarding some ERC eligibility criteria was vague which made it difficult for employers and IRS to determine eligibility, according to IRS officials and tax and payroll professionals. Employers could claim the ERC if either (1) their business operations were fully or partially suspended by a government order as a result of the COVID-19 pandemic, or (2) their business experienced the requisite decrease in gross receipts. See sidebar.

|

CARES Act definition of suspended business operations due to a government order According to the CARES Act (Pub. L. No. 116-136), employers were eligible for the Employee Retention Credit if their businesses or trades were: “fully or partially suspended during the calendar quarter due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings (for commercial, social, religious, or other purposes) due to the coronavirus disease 2019 (COVID-19).” Source: GAO review of the CARES Act. | GAO‑26‑107456 |

Government suspension. The government suspension criteria for ERC eligibility were subjective and the statutory language did not clearly define what qualified as a government order, according to IRS counsel. Government orders that limited commerce, travel, or group meetings due to COVID-19 varied widely among states and even within states. Unlike federal declarations of disaster areas, there was no central source of information that IRS could use to verify if employers’ operations were fully or partially suspended by a state or local government order.[44] See text box.

|

Challenges with verifying COVID-19 government shutdown order Employee Retention Credit eligibility criteria In some states, the governor’s office issued statewide shutdown or stay-at-home orders that suspended business or trade. Other states gave city, county, and local governments more autonomy to issue their own orders. In some states, governors overrode or preempted those local orders. In other states, courts struck down some governors’ stay-at-home orders. The applicable dates for government orders varied widely. Some governments started issuing stay-at-home orders and closing businesses in the first quarter of 2020 (March), whereas others began in the second quarter (April). Some governments then began loosening restrictions on businesses in the second quarter. Some loosened restrictions only to later reimpose them as COVID-19 cases increased. Some governments ordered only non-essential businesses to close, others closed specific industries or types of businesses, and still others imposed capacity limitations or social distancing on businesses. Some governments issued mandatory stay-at-home orders whereas others made their stay-at-home orders voluntary or included exemptions for some activities like religious gatherings. |

Source: GAO. | GAO‑26‑107456

According to IRS officials, the IRS research division conducted exhaustive searches to obtain information on government shutdown orders. Because there was no central source for information on suspension orders, IRS used some assumptions to identify possible eligibility issues. According to IRS documents, most shutdown orders had been lifted across the continental U.S. by the third quarter of 2021; so, for the third and fourth quarters of 2021 most businesses could only qualify for ERC based on declines in gross receipts. In addition, the lack of statutory definitions for words in the law such as “suspended” and government “order,” made it difficult to audit returns, according to IRS officials.

|

CARES Act definition of requisite decline in gross receipts According to the CARES Act (Pub. L. No. 116-136), employers were eligible for the Employee Retention Credit (ERC) in 2020 if the employer experienced a decline in gross receipts as follows: · beginning with the first calendar quarter beginning after December 31, 2019, for which gross receipts for the calendar quarter are less than 50 percent of gross receipts for the same calendar quarter in the prior year; and · ending with the calendar quarter following the first calendar quarter beginning after a calendar quarter described in clause for which gross receipts of such employer are greater than 80 percent of gross receipts for the same calendar quarter in the prior year. According to the CARES Act, as amended, employers were eligible for the ERC in 2021 if the employer experienced a decline in gross receipts as follows: · the gross receipts of the employer for the calendar quarter are less than 80 percent of the gross receipts of the employer for the same calendar quarter in 2019; and · the employer could also use the alternative quarter election by comparing the preceding calendar quarter in 2021 to the same calendar quarter in 2019 to determine whether the gross receipts were less than 80 percent of the gross receipts of the quarter in 2019. Source: GAO analysis of the CARES Act. | GAO‑26‑107456 |

Some of the distinctions between essential and non-essential businesses in government shutdown orders caused confusion for the members of one business group, according to a group representative. Further, one expert said that uncertainties of the eligibility criteria and the wide variations of government suspension orders led promoters to believe that IRS would likely trust employer filings. In addition to opening the door for promoters, the uncertain eligibility criteria discouraged cautious employers who might legitimately qualify for the credit, according to IRS counsel.

Decrease in gross receipts. Employers could also be eligible for ERC if they experienced the requisite decrease in gross receipts. Employers generally report gross receipts annually on income tax returns. See sidebar.

The gross receipts definition was confusing for tax-exempt entities because most nonprofit organizations did not compute gross receipts quarterly, according to representatives from a group representing these entities. In June 2020, IRS issued a Frequently Asked Question response defining gross receipts for such organizations.[45] In December 2020, the CARES Act was retroactively amended to change the definition of gross receipts applicable to tax-exempt entities.[46]

The initial CARES Act ERC definition of a decline in gross receipts also complicated IRS’s efforts to try to confirm gross receipt losses to determine eligibility. Specifically, according to IRS chief counsel officials, the concepts and measures of gross receipts are more applicable to income, rather than employment taxes. Gross receipts in the income tax context are generally used to determine profit and, therefore, tax liability. In the employment tax context, gross receipts are not necessary to calculate employment tax liability. Employers are required to withhold a portion of an employee’s wages for purposes of paying employment taxes. Operating business income generally is not needed for employment tax purposes.

As we discuss later in this report, IRS did not require employers to report the dollar amount of declines in gross receipts when filing an ERC claim, making it difficult for IRS to confirm eligibility without a resource-intensive examination. As a result, IRS reviewed annual income tax information, according to IRS documents.

|

Question for policymakers to consider for future emergency economic relief Are definitions or eligibility criteria clear and straight-forward to report and verify? |

Source: GAO. | GAO‑26‑107456

Retroactive Changes to Eligibility Increased Amended Return Filings and Improper Payment Risk

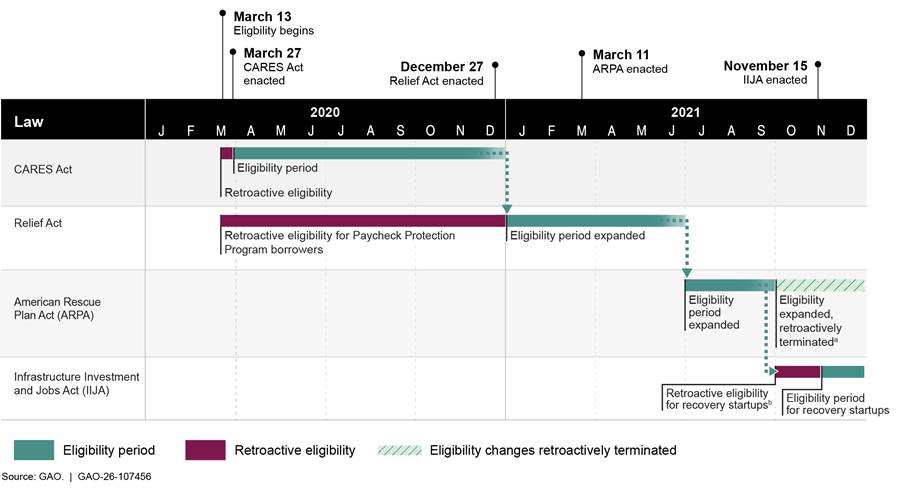

Three laws enacted in 2020 and 2021 retroactively changed the first version of the ERC in the CARES Act. These changes expanded ERC eligibility, most notably by allowing employers who had a forgiven Paycheck Protection Program (PPP) loan to also claim the ERC. These laws changed other eligibility criteria, including gross receipts thresholds. The laws also changed the maximum dollar amount of qualified wages an employer could claim. Figure 3 shows eligibility periods for each law, and corresponding retroactive eligibility.

aARPA expanded Employee Retention Credit (ERC) availability to recovery startup businesses for the third and fourth quarter of 2021. The IIJA retroactively limited the ERC to only recovery startup businesses in the 4th quarter of 2021.

bRecovery startup businesses were employers that opened after February 15, 2020, with average annual gross receipts under $1 million during the past 3 years.

The retroactive changes were often effective immediately after the laws were passed. As a result, IRS officials and two experts said IRS had little time to implement them, such as developing new processes or issuing updated guidance. According to some members of a payroll professionals group we interviewed, in some cases employers filed ERC claims based on outdated IRS guidance.

Increased amended return filings. As ERC eligibility expanded, amended return claims increased. Approximately 86 percent of ERC claims were filed on amended returns, mostly on Form 941-X, through mid-2025.[47] Because IRS did not enable electronic filing of Form 941-X until mid-2024, the manual processing of millions of paper-filed forms created a large administrative burden for IRS that delayed processing times and ERC disbursements.[48]

Improper payment risk. Legislative changes made ERC more generous through increased credit maximums. As ERC became more generous, there were uncertainties and promoters exploited employers who were not sure how to navigate the rules, according to IRS counsel. Promoters contributed to the high number of improper claims, as described in IRS’s Dirty Dozen lists in 2023 and 2024.[49] The scams raised the importance of tax compliance efforts, according to IRS officials. IRS generally has 3 years to assess tax from compliance actions, such as certain overclaimed ERC. Due to pandemic and ERC-specific factors—such as processing delays—IRS initially had a narrower window for post-refund assessments. However, as we described above, legislation enacted in July 2025 extended the statute of limitations on tax assessments of certain ERC claims to 6 years.[50]

|

Question for policymakers to consider for future emergency economic relief If considering retroactive provisions, do the benefits outweigh the administrative challenges and improper payment risks? |

Source: GAO. | GAO‑26‑107456

Benefit of Advance Payments Uncertain

The CARES Act included a provision for employers to receive advance ERC payments, prior to the end of a quarter.[51] IRS data indicate that employers did not file for the advance payments as much as might have been anticipated. Overall, filings for advance payments were relatively low. Advance COVID-19 employment tax credits amounted to about $1.4 billion, which was less than 1 percent of the total refund dollars claimed on original returns.[52] The fact that employers were instructed to reduce employment tax deposits for anticipated ERC amounts may have contributed to the low filings because they did not have a refund balance eligible for advance payment.[53]

Further, quarterly employment tax filings are already more frequent than income taxes and employers could reduce employment tax deposits throughout the quarter if they qualified for ERC. This may indicate that employers did not see much of a benefit in completing and filing a different form to receive an advance payment. It is also possible the advance payments in 2020 were low, in part, because of the prohibition at that time on claiming ERC if the employer received PPP loan forgiveness. After federal law was amended in December 2020 to remove this restriction, IRS officials said there was an increase in filings on Form 7200, Advance Payment of Employer Credits Due to COVID-19.

By April 2020, IRS had developed Form 7200 and an electronic fax system for employers to file for advance payments, helping to bypass mail-related delays. Despite the fax system, processing times averaged as high as 7 weeks. Given this turnaround time, it is possible that an employer filing for an advance payment during the last month of a quarter through the end of the quarter due date may have received a refund faster by e-filing Form 941 at the end of the quarter.[54] Paper processing times for Form 941 credits could take up to several months, according to payroll and tax professionals.

|

Question for policymakers to consider for future emergency economic relief If considering offering advance payments for an employment tax credit, do the benefits outweigh the administrative costs and challenges? |

Source: GAO. | GAO‑26‑107456

Lack of Explicit Statutory Data Sharing Provisions Affected IRS’s Ability to Obtain PPP Data and Necessitated an Agreement

The CARES Act did not provide an explicit grant of statutory authority to the Small Business Administration (SBA)—the agency administering the PPP—to share data on PPP loans with IRS. The CARES Act, which established the ERC and PPP, prohibited employers from claiming both ERC and obtaining a PPP loan. Recognizing the need to share data relative to their respective responsibilities under the ERC and PPP, IRS and the SBA started negotiating an agreement under their pre-existing authority for SBA to share limited PPP data in April 2020. The data-sharing memorandum was finalized in September 2020.[55]

Access to PPP loan data enabled IRS to more easily screen ERC claims for potential noncompliance with the rules restricting employers from using both programs (see appendix III for information on actions IRS took to do so). An IRS official stated it would have been helpful in the legislation to have greater clarity around what data can be shared and with whom. A direct grant of statutory authority for SBA to share PPP data with IRS, for example, could have facilitated IRS’s initial compliance efforts to ensure that employers with PPP loans were not also trying to claim the ERC.

In December 2020, federal law was amended to remove the restriction that had prohibited employers from both applying for PPP loan forgiveness and claiming the ERC.[56] However, a limitation was added that employers could not count the same payroll expenses when claiming ERC and obtaining PPP loan forgiveness. IRS and SBA subsequently modified their data-sharing memorandum in 2021 to share more PPP loan data from SBA. IRS could use the additional SBA data to help determine whether employers claiming ERC had used the same wage amounts for PPP loan forgiveness.

IRS officials said that when considering future legislation that provides emergency relief through the tax code, it would be helpful to include language to explicitly permit inter-agency data sharing that could aid IRS compliance efforts. An SBA official also said that having statutory authority in advance is easier than establishing agreements. In other situations where statutory restrictions have prohibited or limited data sharing between agencies, we have previously recommended that Congress consider addressing those restrictions. For example, we have recommended that Congress provide Treasury with access to the Social Security Administration’s full set of death records to prevent payments to ineligible deceased taxpayers.[57]

|

Question for policymakers to consider for future emergency economic relief If the relief hinges on other federal programs not administered by the Internal Revenue Service (IRS), would statutory provisions to permit data sharing between IRS and other agencies help facilitate IRS’s compliance efforts? |

Source: GAO. | GAO‑26‑107456

|

Lessons Learned on Employee Retention Credit Administration

We identified four lessons, each with contributing factors. Source: GAO. | GAO‑26‑107456 |

IRS Would Have Benefitted from Having a Comprehensive Plan for Managing ERC Risks

|

|

Contributing Factors on Planning and Risks · The Internal Revenue Service (IRS) did not fully leverage project management practices · The Employee Retention Credit improper payment risk assessment was late and required follow-up not completed · IRS did not effectively leverage its risk management processes |

Source: GAO analysis. | GAO‑26‑107456

IRS Did Not Fully Leverage Project Management Practices

In 2022, we reported that IRS’s plans to address potential ERC noncompliance partially demonstrated relevant project management practices we selected for review.[58] We found, for example, that IRS’s plans did not include measurable objectives and that plans for coordination among IRS units were inconsistent and incomplete. Specifically, the Office of Fraud Enforcement’s Fabricated Entities Project, which focused on identifying fraudulent entities claiming COVID-19 employment tax credits, was not included in ERC planning documents. The Fabricated Entities Project prevented payment of hundreds of millions of dollars in improper ERCs and also led to criminal investigation referrals. We recommended that IRS develop an integrated project management plan for the COVID-19 credits, including ERC.

IRS disagreed with the recommendation but as of March 2025, IRS made progress in implementing some components of a project plan. For example, IRS documented leadership decision approvals and data analyses that informed decision-making and documented stakeholder involvement, with the creation of the Servicewide ERC Team. However, as of August 2025, it did not have a project plan with measurable objectives or defined and sequenced scheduled activities.

More timely and full implementation of our prior recommendation could have helped IRS prepare to respond to the surge of questionable ERC claims in 2023 and promoters of those claims. Further, compliance activities continue for ERC claims. As of December 31, 2025, about 41,000 claims remain in examination or appeals, according to IRS officials. Employers can file an appeal anytime within 2 years of a disallowance letter. Although the statute of limitations for assessing tax on certain paid improper ERCs has expired, IRS can still pursue fraud cases indefinitely. We maintain that with measurable objectives, performance measures, comprehensive planning documents and schedule management, and other practices, IRS would be better positioned to move forward with compliance activities for ERC.

ERC Improper Payment Risk Assessment Was Late and Required Follow-Up Not Completed

In May 2022, the Treasury Inspector General for Tax Administration (TIGTA) found that IRS was late in conducting a statutorily required improper payments risk assessment on ERC.[59] The assessment should have been completed after ERC had been in operation for 12 months (by April 2021). However, IRS did not complete it until February 2022.[60] IRS officials told TIGTA they did not complete the assessment on time because they misinterpreted which U.S. Coronavirus Refundable Credit fund account was included under the requirement.[61]

When IRS did complete the improper payment risk assessment, the agency concluded that ERC was susceptible to significant improper payments.[62] The identified risk factors included complexity of the credit, volume of payments, and recent significant changes in program policies and procedures.

IRS officials confirmed, however, that they did not conduct specific follow-up steps in response to the 2022 risk assessment, as required by the Payment Integrity Information Act (PIIA).[63] If a program such as ERC is identified as susceptible to significant improper payments, the agency must, among other things, (1) develop an estimate of improper payment rates, (2) identify the root cause for improper payments, (3) develop a corrective action plan, and (4) report on the results of these requirements.[64] PIIA also requires each agency’s inspector general to issue an annual report on the agency’s compliance with applicable PIIA criteria.[65]

In August 2022, Treasury sent a memorandum to the Office of Management and Budget (OMB) stating that due to the short time frame over which the majority of disbursements would be made by the COVID-19 related programs for which Treasury was responsible, quantifying the amount and rate of improper payments, assessing the root cause, and developing corrective action plans to reduce payment errors in the future would have provided minimal value and been an ineffective use of resources.

Treasury specifically stated that many of the COVID-19 related programs would have completed disbursements before an improper payment estimate was due, approximately 3 years into a program. Based on OMB guidance, an improper payment estimate for ERC (which began in 2020) would have been due for fiscal year 2023. Further, developing timely estimates for fiscal years 2023 and 2024 would have been relevant, because after fiscal year 2022 about $183 billion in ERC claims have been paid.[66]

In its response to Treasury’s August 2022 memorandum, OMB acknowledged receipt of Treasury’s statements. [67] TIGTA acknowledged Treasury’s memorandum to OMB, but did not identify the lack of follow-up for ERC as noncompliance with applicable PIIA criteria in its May 2025 required annual report to Congress.[68] In a report covering PIIA compliance for fiscal year 2024, the Treasury Inspector General also acknowledged that IRS did not calculate or report improper payment rates for ERC, but did not make any statements about ERC PIIA compliance.[69] A TIGTA official told us that they considered IRS to be compliant with PIIA because of OMB’s acknowledgement of the August 2022 memorandum.

In 2025, IRS officials stated that the agency had taken actions to address ERC risks after the February 2022 risk assessment, such as increased scrutiny of large and questionable claims. To some degree, these efforts likely helped address improper payment risks. However, by not completing required PIIA improper payment estimates, IRS is unlikely to be able to determine the extent to which improper payments occurred. For example, in 2023, IRS publicly stated that it believed that many ERC claims were likely ineligible and cited anecdotal descriptions from tax professionals that 95 percent or more of recent claims were likely ineligible.[70]

Further, without an estimate, IRS may not be able to identify root causes for ERC improper payments, or develop effective mitigation strategies and corrective actions.[71] Once an agency has gained insight into payment integrity risks and the root causes of improper payments for a program, the agency can then take action to develop and implement effective mitigation strategies and corrective actions and coordinate across the agency on similar challenges. Improper payment estimates and related reporting also provide important information to Congress and taxpayers on agencies’ use of taxpayer funds and progress in the prevention and recovery of improper payments. This information is particularly important for emergency assistance programs such as ERC, which carry higher risks of improper payments.

We have previously reported on the importance of agency oversight of compliance with PIIA criteria and timely reporting. We have also made several recommendations to Congress on this topic, which remain open as of January 2026.[72] Given the rapid timeline of emergency assistance, time lags in assessing risk may result in improper payment issues, including those resulting from fraudulent activities, not being identified or addressed until after most or even all funds are disbursed. For emergency assistance programs, especially large programs with possible widespread improper payments, we have emphasized the importance of estimating improper payments expeditiously, including during the initial year of implementation.

IRS closed all remaining ERC claims, aside from those under examination or appeal, by December 31, 2025, according to IRS officials. New claims can no longer be filed. However, by developing an improper payment estimate for ERC, IRS could help inform future design of employment tax relief programs, if policymakers decide to create them.

IRS Did Not Effectively Leverage Its Risk Management Processes

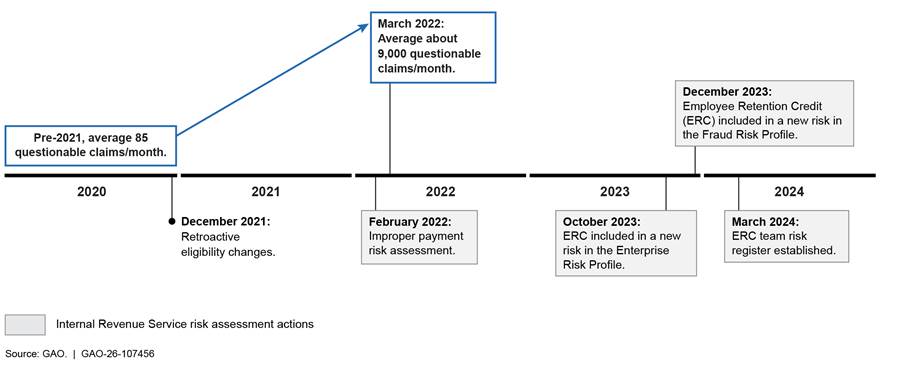

IRS’s enterprise risk management and fraud risk management processes did not identify the specific compliance risks of ERC claims on amended returns in a timely manner.[73] The warning signs for potential ERC compliance issues on amended returns started in 2021 as the number of questionable claims grew, as shown in figure 4.[74] ERC was included in risks related to refund fraud schemes in IRS’s annual Enterprise Risk Profile in October 2023 and again in 2024. IRS included ERC in its Fraud Risk Profile in December 2023.[75]

Figure 4: Timeline of Internal Revenue Service’s Employee Retention Credit Risk Identification Actions

IRS’s February 2022 designation of ERC as susceptible to significant improper payments risk should have triggered escalation of ERC to the agency designated risk official for inclusion in the agency’s risk inventory, per OMB guidance.[76] By March 2022, questionable ERC claims flagged for examination had increased by over 10,000 percent.[77] In May 2022, we reported that IRS had not documented processes to address compliance risks for amended returns and we recommended that IRS do so.[78]

The Internal Revenue Manual documents policies to help ensure compliance with OMB’s enterprise risk management requirements.[79] IRS also has a Risk Assessment Guide and Toolkit for facilitating risk assessments within business units and programs. Both IRS documents state that IRS is to use risk registers, monitor risks, and implement internal controls.

Improper payment risk assessments can help inform enterprise risk management and fraud risk management. An IRS official said the delay in risk identification was because they were focused on implementing CARES Act provisions and getting ERC claims processed. However, several sources reported that the challenges IRS faced implementing economic impact payments, and navigating pandemic-related office closures and legislative changes had eased in 2022.[80] The IRS official agreed IRS could have acknowledged the risks associated with processing paper returns, the newness of the ERC, and its retroactive provisions sooner.

Although IRS began adjusting its compliance process in 2022—such as changing review criteria and capturing additional data—these actions were not included in risk profiles.[81] Documenting risks and following a risk management process facilitates risks being monitored and considered relative to other agency risks, and resource allocation decisions. These steps could have helped IRS better adjust its processes and reduce improper payments in a timely manner, as discussed later in this report.

In October 2023, when ERC was first included in an agencywide risk profile, IRS had just implemented a processing moratorium in the prior month to give the agency time to develop a model to assess compliance issues on amended returns (see appendix IV for details on IRS’s efforts in this regard).[82] IRS established an ERC-specific risk register in March 2024. The text box below describes an example of another risk that IRS initially overlooked—promoter schemes—for which better risk management could have helped guide mitigation.

|

Risk management process could have helped the Internal Revenue Service identify promoter schemes sooner Promoters of Employee Retention Credit (ERC) schemes, a driver of improper ERC amended return claims, were not mentioned in risk assessment documents until September 2024. The Internal Revenue Service (IRS) started alerting employers about schemes promoting improper ERC claims in October 2022. However, until 2024, IRS had limited tools to analyze social media, where many ERC schemes were being promoted, according to IRS officials. Social media analysis plays a pivotal role in identifying tax schemes, but it is resource intensive because of the training and technology involved, according to Criminal Investigations (CI) officials within IRS. A risk assessment that identified ERC amended return risk and promoters may have helped IRS to prioritize social media analysis tools sooner. These tools could help IRS identify and shut down promoters while schemes are active, rather than tracking them down after the issuance of improper refunds. Eventually, IRS took actions to build capacity to identify schemes promoted in social media going forward and to engage with stakeholders, such as tax professionals. As a result of resource prioritization, in March 2024, CI started developing searches to identify individuals and businesses in social media and the dark web (a hidden part of the internet accessed using specialized software), according to CI officials. In August 2024, IRS established the Coalition Against Scam and Scheme Threats, which included state and tax industry stakeholders, to raise awareness and educate taxpayers about social media schemes, beyond just ERC. These considerations of resources, technology use, and partnerships could help IRS more quickly identify and address compliance threats in the future. |

Source: GAO. | GAO‑26‑107456

IRS Would Have Benefitted from Additional Eligibility Reporting

|

|

Contributing Factor on Eligibility Reporting · Key eligibility information not required on employment tax returns |

Source: GAO analysis. | GAO‑26‑107456

Key Eligibility Information Not Required on Employment Tax Returns

IRS used data associated with employer identification numbers, such as business establishment dates, to screen and confirm employer identities to determine eligibility for ERC. Starting with second quarter 2020 Form 941 filings, IRS incorporated some high level ERC eligibility requirements into employment tax returns. For example, Form 941 asked for total qualified wages for ERC, but not for information related to specific components of those wages. Additionally, Form 941 did not ask employers for information about the two key statutory criteria, from the CARES Act, for ERC eligibility: (1) whether they experienced either a requisite decline in gross receipts, or (2) were under a government suspension of operations order.

We recognize, as discussed previously, that statutory ERC eligibility relied on new or unclear definitions. However, designing forms and requesting eligibility information are decisions for IRS. Of the two key eligibility criteria, declines in gross receipts may have been easier to verify than information on government suspension of operations orders.[83] Most employers generally track gross receipts already for inclusion on their income tax returns. Although an imperfect determinant of eligibility, quarterly gross receipts information could have served as a data point in initial screening, among other information, for compliance activities. IRS could have also asked employers for more information about government suspension orders used for eligibility, such as the source and time period.

IRS officials told us they could not be certain that requesting more eligibility information from employers on existing tax forms would have facilitated compliance efforts. They also had concerns about IRS’s capacity to quickly process the additional information requested, according to an IRS official. Later, IRS considered or implemented other options.

· Attestation form. In 2023, IRS considered requiring an attestation form to accompany new ERC claims. This form would have requested that employers answer questions about eligibility, accuracy, and preparation of their returns. IRS planned to use the form to assess claims for processing or further review. Ultimately, IRS officials said they decided against the attestation form because of the correspondence it would create, necessitating resources for response. Further, the timing for introducing the form meant that a large group of ERCs were already allowed without it, creating a disparity with employers who would need to file it going forward, according to IRS officials.

· Narratives. A line on Form 941-X, as available during ERC’s filing period, requests a detailed narrative explanation, in a text box, of the corrections on the form. Although not specified in the instructions, employers had the option to provide information about eligibility in the box. IRS transcribed this box to check for ERC information, but discontinued it because of its “minimal impact” on data analytics. In a separate effort to inform examination selection, IRS analyzed the text box contents with software, avoiding the need for manual reviews, according to IRS officials.

· Eligibility checklist. In November 2023, IRS released an interactive online ERC eligibility checklist, which included questions about gross receipts and government orders. This was an optional tool that was not available when ERC filing began and results were not submitted to IRS. However, it could have helped employers to confirm eligibility themselves and informed decisions about whether to apply.

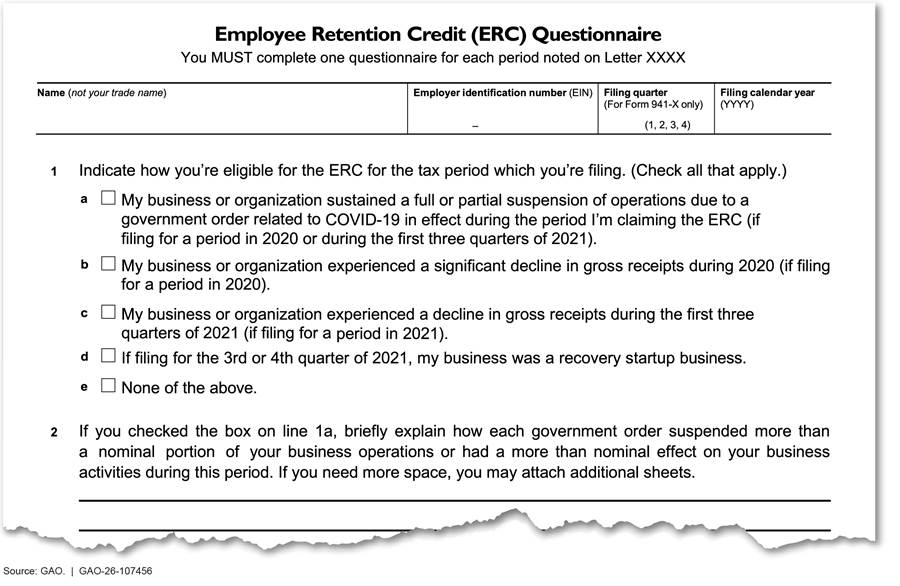

Requiring employers to address their eligibility at filing could have offered benefits to the employer and IRS. Depending on execution—ranging from asking for an attestation regarding eligibility, to answering questions, or submitting documents—the requested information could have spurred voluntary compliance or resulted in data to be used for screening. For example, asking the employer to indicate how they were eligible for ERC when they initially filed for the benefits—as done in a questionnaire sent to employers under examination, shown in figure 5—would have narrowed down eligibility scenarios. From here, IRS would have more information on potential ineligibility risks, such as an employer claiming to be under a government suspension of operations late in 2021.

According to IRS officials, changing Forms 941 and 941-X was a labor-intensive process that required programming. Further, as we have noted in prior work, additional reporting on tax forms increases taxpayer burden.[84]

By not requiring information on the core eligibility requirements for ERC, IRS had limited ability to identify ineligible employers to prevent or recapture erroneous refunds. Instead, IRS had to use resource intensive steps, such as examinations, to gather and assess eligibility information after the initial filing. There are tradeoffs to seeking additional eligibility information with the initial filing. However, when coupled with the cost to the government of improper ERC refunds, the time and staff costs required for programming new form lines—an existing process—likely would have been less than implementing the processing moratorium and developing a model to assess ERC claims. For example, IRS was able to release a revised Form 941 in about 3 months, to include COVID-19 tax credits. By contrast, the ERC processing changes based on model results continued through December 2025.

Manual Processing for Amended Returns Complicated Compliance Efforts

|

|

Contributing Factors on Manual Processing · Paper-only amended returns limited data use for compliance · New electronic filing option does not fully address challenges |

Source: GAO analysis. | GAO‑26‑107456

Paper-Only Amended Returns Limited Data Use for Compliance

According to IRS documents, paper filings hampered IRS’s ability to extract and analyze data from these paper forms and delayed their ability to identify and mitigate promoters and fraud. About 86 percent of ERC claims processed were filed on Form 941-X, which prior to mid-2024, employers could only file on paper.[85]

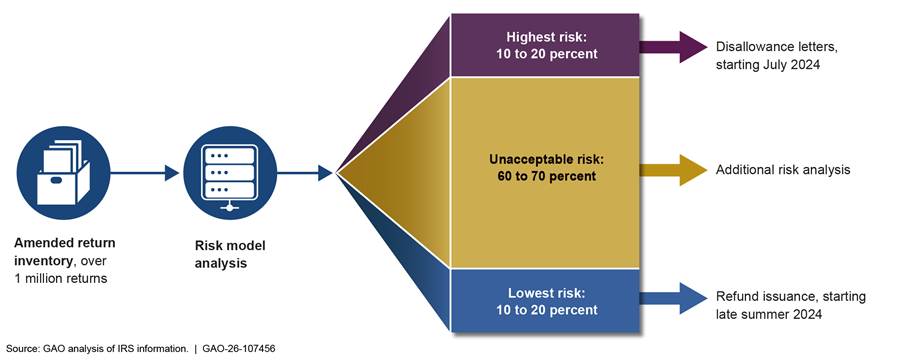

After IRS implemented the processing moratorium in September 2023, IRS digitalized information from the paper forms through transcription (manually keying in data) and an artificial intelligence program. IRS used this information to develop its risk model, which applied tests and eligibility factors to unprocessed ERC claims and sorted them into risk categories (see appendix IV for more information).[86] IRS announced it was starting to process certain ERC claims about 9 months after the moratorium began, and over 3 years since statutory changes necessitated amended filings for many new ERC claims. As of March 2025, an IRS official said they did not have plans to continue use of the artificial intelligence program to digitize Form 941-X, aside from ERC claims. The program was intended to help IRS clear the backlog of Forms 941-X.

Leveraging the experience from digitizing ERC data can help IRS address any future digitization needs for paper returns. Easier access to more data from paper returns could also help IRS improve its compliance, customer service, and enforcement operations.

New Electronic Filing Option Does Not Fully Address Processing Challenges

Making the Form 941-X available for electronic filing in 2024 was an important action towards modernizing employment tax administration. But IRS still faces challenges in increasing employers’ use of e-filing and automating more downstream processing of amended returns. Tax returns submitted on paper and that require manual processing have outsized effects on IRS operations in that the processing takes longer, uses more resources, and is more prone to errors. By contrast, e-filed returns that are processed using automation generally only require human intervention if the return has an issue.

Additionally, despite the electronic filing option, the back end processing of these forms remains highly manual. E-filing allows for data on amended returns to be transmitted to and validated and accepted by IRS. However, once the electronically filed return is accepted, actual adjustments to taxpayer accounts such as for ERC still need to be manually processed by IRS employees.

The Treasury Inspector General for Tax Administration (TIGTA) reported in March 2024 that IRS had approved funding to automate more processing of amended individual income returns filed on Form 1040-X.[87] Individual taxpayers have been able to file Form 1040-X electronically since 2020, but like the Form 941-X, the forms are still processed manually. TIGTA estimated that fully automating the processing of Forms 1040-X would result in significant annual cost savings to IRS.[88]

Although IRS has estimated that it will receive annually about five times more Forms 1040-X than Forms 941-X for fiscal years 2025 to 2032, we found that the Form 941-X volumes are still substantial enough, post-ERC, to generate significant cost savings if IRS were to automate more processing.[89] In fiscal year 2021, IRS received about 565,000 Forms 941-X. By 2023, this amount had increased to 2.5 million, driven mostly by ERC claims. For fiscal years 2025 to 2032, IRS has estimated that it will receive on average 1 million Forms 941-X annually.

Agencies should proactively identify data they may need to verify applicant identity and eligibility and resolve any barriers to accessing data before an emergency occurs, according to A Framework for Managing Improper Payments in Emergency Assistance Programs (Managing Improper Payments Framework).[90] IRS’s reliance on time-consuming manual processing of amended employment tax returns compounded the challenges IRS faced in ensuring ERC compliance and led to significant processing backlogs. As we reported in January 2025, IRS’s total inventory of correspondence—which includes amended returns—was nearly 7 million in November 2024, and about 1 million of this was related to ERC claims.[91] According to IRS officials, as of June 2025, competing priorities and limited resources were barriers to achieving automated processing in the near term.

Underway as of June 2025, the IRS’s Zero Paper initiative aims to leverage cloud-based technology to quickly extract data from tax documents and send those documents as metadata directly into IRS processing systems. Documentation that IRS provided did not specifically state whether Form 941-X processing is included in the initiative’s scope. ERC Servicewide Team officials said they were unsure of IRS’s plans for Form 941-X processing improvements. Although electronic filing facilitates the use of data for compliance purposes, faster refund processing is not possible until more processing of amended returns can be automated.

Including Form 941-X in IRS’s modernization efforts for processing and data capture, such as in the Zero Paper initiative, could help reduce the correspondence backlog. It could also help prepare IRS for any future surge in claims on amended returns, particularly should legislation again provide emergency relief through the employment tax system. In a 2025 committee report, the House Committee on Appropriations recognized the challenges of paper-based processes for employment tax credits. The report directed IRS to brief the Committee on its approach to digitizing 941-X and Schedule R forms within 30 days after enactment of the related appropriations act for fiscal year 2026.[92]

ERC Implementation Could Have Benefitted from More Timely and Consistent Communication with Stakeholders

|

|

Contributing Factors on Communication · IRS actions in response to some tax practitioner feedback may have reduced improper payments · Guidance did not fully meet all tax practitioners’ and employers’ needs · Information on processing status of ERC claims not regularly communicated |

Source: GAO analysis. | GAO‑26‑107456

IRS Actions in Response to Some Tax Practitioner Feedback May Have Reduced Improper Payments

IRS was responsive to stakeholder suggestions regarding some evolving ERC challenges. Specifically:

· ERC Voluntary Disclosure Programs (VDP).[93] In December 2023 IRS announced an ERC VDP as an opportunity for employers who claimed and received an ERC for which they were not entitled to repay those funds at a discount.[94] IRS also offered a second VDP in 2024. These programs were developed and adapted in response to tax practitioner feedback, according to IRS officials. The growth of ERC promoters and IRS communication in 2023 about ERC scams led to increased interest among stakeholders for a VDP, according to IRS officials.

· Online Communications. IRS updated its website in response to tax practitioner feedback. For example, IRS updated its ERC web page and the online ERC eligibility tool based on feedback from tax practitioners, according to IRS officials.

· Professional Responsibility Guidance. As a result of outreach efforts to employers about possible excessive ERC claims, tax professionals requested that IRS provide guidance on professional responsibility obligations for clients’ ERC claims, according to IRS officials. In response, IRS released a bulletin in March 2023 with information on how tax professionals can ensure they are meeting professional responsibilities when preparing returns claiming ERC.[95]

The VDP, website material, and professional responsibility guidance are examples of IRS using lessons learned stemming from stakeholder input. Developing programs and other responses that help address the cause of stakeholder concerns can help IRS reduce improper payments, including those stemming from fraud, in future relief efforts.[96]

Guidance Did Not Fully Meet All Tax Practitioners’ and Employers’ Needs

In 2022, we reported that IRS developed and revised guidance and tax forms for the COVID-19 employment tax credits under tight timeframes during the pandemic. IRS began releasing guidance and forms just days after the CARES Act was enacted in March 2020. IRS continued to issue updates as more legislation was enacted during the pandemic. IRS also issued frequently asked questions (FAQ) and tax tips and held outreach events. IRS continued to update FAQs in 2025 and issued legal memorandums in 2023 through 2025 on issues such as third-party payer claims and whether certain supply chain disruptions could qualify an employer for ERC.[97] Several payroll and tax professionals told us that some IRS guidance like FAQs was helpful, and they recognized the challenges for IRS to issue new material quickly. Several stakeholder groups also told us about examples where guidance was not issued timely, or it was unclear.

For example, in March 2025, IRS issued guidance on when to amend income tax returns that had passed the deadline for filing.[98] Some employers may have continued to delay filing amended income tax returns until IRS notified them about their ERC claim, according to the FAQs and the Taxpayer Advocate Service.[99] IRS internal documentation acknowledged that employer decisions about filing income tax amendments may have been driven by the moratorium and length of time to process the claims. A tax preparer group representative also told us in 2024 that they asked IRS for guidance on whether employers can use protective claims in anticipation of an ERC refund.[100] IRS’s March 2025 guidance confirmed that a protective claim can be filed for the wage expense deduction. It also stated that under special statutory rules, employers could amend income tax returns in the years in which their ERCs were finalized, allowing for income tax amendments beyond the filing deadline.[101]

In its annual report, released in January 2024, the Taxpayer Advocate Service said that based on ERC implementation, IRS should ensure that its guidance and procedures are timely, simple, and practical for both taxpayers and IRS employees, and address any failures in processes early.[102] An IRS official said delays issuing guidance can be attributed to the multistep process for developing guidance and receiving approval, among other things.

Additional guidance is generally no longer needed for ERC since the credit can no longer be claimed. In the next section on applying lessons learned, we further discuss how IRS can be better prepared in the future to administer emergency relief through the employment tax system.

Information on Processing Status of ERC Claims Not Regularly Communicated