OIL AND GAS ROYALTIES

Congress and Interior Should Strengthen Safeguards to Better Ensure Accurate Payments

Committee on Natural Resources

House of Representatives

United States Government Accountability Office

Highlights of GAO-26-107669, a report to the Ranking Member, Committee on Natural Resources, House of Representatives.

For more information, contact: Frank Rusco at ruscof@gao.gov.

Why This Matters

Royalties on the sale of oil and gas produced on federal lands and waters generated more than $14 billion in revenue in 2024. The Department of the Interior’s Office of Natural Resources Revenue (ONRR) oversees these payments by companies.

Companies can revise, or make adjustments to, royalties if they over- or underpaid, or they can request a refund to be reimbursed if they overpaid.

GAO Key Takeaways

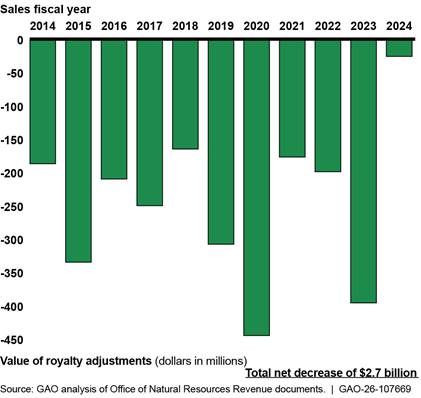

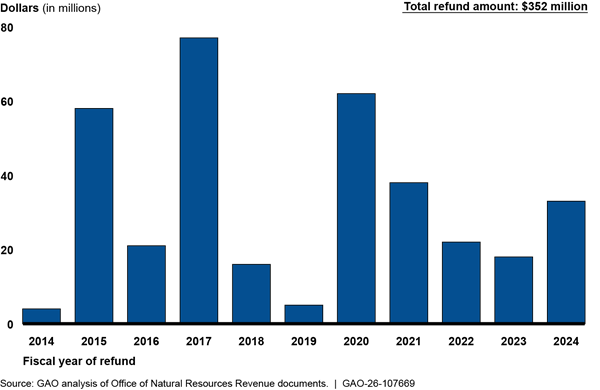

Companies’ net adjustments decreased their originally reported royalties from about $96 billion to $93 billion, or by 2.8 percent, in fiscal years 2014–2024. Adjustments included $300 million to royalties initially paid 4–6 years prior. ONRR also approved $352 million in refunds. Royalties must be processed within defined time frames:

· Companies can make adjustments up to 6 years after their original payment.

· Concurrently, ONRR has 7 years to verify that royalties were accurately paid. This can take an average of 18 months or much longer, according to ONRR officials.

ONRR may not have enough time under current statutory requirements to ensure royalties are accurate. This is especially true when companies submit adjustments toward the end of the 6-year statutory time frame, which provides ONRR one year to review. ONRR recommended to Congress in 2011 that it shorten the statutory time frame for a company to adjust royalties from 6 to 3 years, but this change was not enacted. Industry representatives noted that companies generally use electronic systems, which has improved efficiency and reduced the need for a longer time to submit adjustments. At present, the opportunity still exists to provide ONRR with additional time to verify adjustments, thereby ensuring that it is safeguarding federal revenues.

Net Royalty Adjustments of Oil and Gas Royalties from Federal Leases, 2014–2024

Note: Adjustments made based on fiscal year of original royalty payment.

How GAO Did This Study

GAO analyzed ONRR data extracts from fiscal years 2014 through 2024, reviewed documentation, assessed data systems and tools, and interviewed ONRR officials and two industry stakeholder organizations.

What GAO Recommends

GAO is recommending that Congress consider shortening the time frame for companies to make adjustments, as well as making four recommendations to ONRR. ONRR concurred with three recommendations and partially concurred with one. In response, GAO revised the recommendation language.

|

Abbreviations |

|

|

|

|

|

FOGRMA |

Federal Oil and Gas Royalty

Management Act of |

|

IBLA |

Interior Board of Land Appeals |

|

OIG |

Office of the Inspector General |

|

ONRR |

Office of Natural Resources Revenue |

|

RSFA |

Federal Oil and Gas Royalty Simplification and Fairness Act of 1996 |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

November 25, 2025

The Honorable Jared Huffman

Ranking Member

Committee on Natural Resources

House of Representatives

Dear Representative Huffman:

Oil and gas production from almost 26,000 leases on federal lands and in federal waters contributes to the nation’s energy supply. In April 2025, the Department of the Interior reported that oil and gas production from federal leases represented 26 percent and 14 percent of all U.S. domestic production, respectively. This production generated more than $14 billion in revenues through royalties that companies pay the federal government from oil and gas produced and sold from federal leases in fiscal year 2024, making it one of the largest sources of nontax revenue. The disbursements provide funds for states and the federal government to pursue a variety of goals, including efforts to protect public lands.

The Department of the Interior’s Office of Natural Resources Revenue (ONRR) oversees the collection, verification, and disbursement of royalties from federal oil and gas production. Each month, companies report production volumes, sales values, and royalty payments through ONRR’s IT system, and ONRR uses these reports to determine whether companies have paid the correct amount of royalties. In 1982, Congress passed the Federal Oil and Gas Royalty Management Act of 1982 (FOGRMA), requiring Interior to establish a comprehensive inspection, collection, and accounting and auditing system. This system is to provide Interior the capability to accurately determine oil and gas royalties, interest, fines, penalties, fees, deposits, and other payments owed, and to collect and account for such amounts in a timely manner.[1] Under FOGRMA, ONRR is responsible for ensuring accurate royalty payments from companies that produce oil and gas from federal lands and waters.

ONRR’s regulations specify how companies are to determine the correct amount of royalties.[2] Royalty calculations can be complex. The calculations involve multiple variables, such as the market price of oil and gas and allowable deductions, including transportation and processing costs that reduce the amount of royalties owed.[3] Companies may submit adjustments if they later determine their initial payment was incorrect.[4] For example, if companies initially reported transportation costs of $2 per barrel but later identified documentation supporting costs of $3 per barrel, they may revise their royalty calculations to reflect increased deductions, resulting in lower royalty payments. If companies determine that they overpaid royalties, they may apply the overpayment to future royalty obligations. Alternatively, companies may request a refund if they prefer to be reimbursed. To request a refund, companies submit a written request to ONRR and state the reasons for the overpayment.

Under federal law, companies and ONRR must follow specific time frames for reporting royalty payments and verifying their accuracy. Specifically, the Federal Oil and Gas Royalty Simplification and Fairness Act of 1996 (RSFA) allows companies to submit adjustments up to 6 years from the original reporting due date.[5] RSFA also only permits ONRR to verify the correctness of royalties and collect any unpaid royalties up to 7 years from the original reporting due date.[6] If a company makes an adjustment in the final 2 years of the 6-year period—referred to as late-period adjustments—ONRR generally has, at most, 1 to 3 years to conduct compliance activities, and finalize any administrative remedies or enforcement actions to collect unpaid royalties before the 7-year statutory window closes.[7]

In 2022, Interior’s Office of Inspector General (OIG) reported that ONRR did not consistently monitor or analyze risks in adjustments to royalty reporting.[8] Specifically, the OIG recommended that ONRR implement a policy requiring companies to report adjustments consistently and develop a risk-based approach to help ensure the accuracy of reported adjustments. ONRR has taken steps to address these OIG recommendations. In 2008, we found that these statutory time frames may constrain ONRR’s oversight and recommended that the agency evaluate whether it could efficiently and accurately collect royalties within the existing time frames.[9] ONRR agreed with our recommendation and submitted a study to Congress, recommending the deadline for companies to adjust royalties be shortened to 3 years. Congress has not enacted changes to this statutory deadline to implement the study’s recommendation. The management of federal oil and gas royalty collection has been on our High Risk List since 2011, in part due to concerns about the complexity and challenges of ensuring timely and accurate royalty reporting and collection.[10]

You asked us to review how ONRR provides assurance that adjustments and refunds are accurate. This report examines (1) the amount of royalty adjustments in fiscal years 2014 through 2024 and how companies’ reporting of late-period adjustments affected ONRR’s ability to ensure accurate royalty payments, and (2) the amount of refunds ONRR approved in those years and the challenges associated with refund processing.

To examine the total amount of adjustments, and how companies’ reporting of late-period adjustments affected ONRR’s ability to ensure accurate royalty payments, we analyzed ONRR’s summary adjustment data in fiscal years 2014 through 2024 and reviewed the IT systems ONRR uses to track and monitor adjustment data. We worked with ONRR to establish the reliability of the data generated from its systems through interviews with knowledgeable ONRR staff and reviewed documentation, including formulas used to create adjustment data variables, a data glossary, data model diagram, and summary outputs from its system. We requested and analyzed aggregate-level data on federal oil and gas adjustments. We confirmed with ONRR the total amounts of adjustments and royalties in fiscal years 2014 through 2024 as a check on the accuracy of the data they provided. We then summarized adjustment data by fiscal year of the original royalty reporting date, and by the difference between original royalty reporting and adjustment date. We found these data to be reliable for analyzing total and late-period adjustments.

We reviewed data on voluntary agreements ONRR signed with companies to extend the time for reporting and conducting compliance. We interviewed ONRR officials to understand data reliability and reporting practices. We also reviewed ONRR’s processes and guidance on adjustments, and we interviewed ONRR auditors about recent changes in adjustment reporting. For criteria we used GAO guidance on internal control in the federal government.[11] Because royalties are collected at both the state and federal level, we also reviewed time frames for adjustments and compliance activities in nine states which are a part of the State and Tribal Royalty Audit Committee that conduct compliance work under a contract with ONRR: Alaska, California, Colorado, Montana, New Mexico, North Dakota, Oklahoma, Wyoming, and Utah. In addition, we interviewed two key industry stakeholder organizations who represented more than 600 large and medium-sized oil and gas companies about their members’ views on ONRR’s adjustment and refund processes.[12]

To examine refunds and the challenges associated with refund processing, we analyzed ONRR refund data in fiscal years 2014 through 2024. We reviewed data on both completed refunds and refund requests. We worked with ONRR staff to establish the reliability of the data they generated from their systems through interviews and data analysis. We confirmed the accuracy of outliers in the data with ONRR. We also reviewed refund summaries provided by ONRR, which produced the same results as our analysis of completed refund data. We interviewed ONRR officials to understand data reliability and reporting practices. We summarized the number and amount of completed refunds by fiscal year and type, as well as the amount of denied refund requests. We found these data to be reliable for the purpose of reporting on refunds.

We reviewed ONRR’s procedures, processes, and guidance on refund processing, and we interviewed ONRR auditors about any challenges with reviewing refunds. For criteria we used GAO guidance on internal control in the federal government. We also examined all Interior Board of Land Appeals case summary data related to federal oil and gas royalty disputes for fiscal years 2014 through August 2024 to analyze the associated adjustments and refunds. In addition, we interviewed two industry stakeholder organizations about any challenges companies may face with the refund process.

We conducted this performance audit from June 2024 to September 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

Federal Oversight of Oil and Gas Production on Federal Lands

Several bureaus and an office within Interior are responsible for the process of leasing, permitting, and inspecting oil and gas production on federal lands and waters.[13] This process generally follows these steps:

· Leasing. Interior holds auctions through which companies may secure the rights to federal leases that allow them to drill for oil and gas upon meeting certain conditions.

· Permitting. Once a company obtains a lease, it may conduct further exploration and subsequently determine whether it would like to drill a well. If a company plans to drill, it must first secure a permit to drill from Interior by submitting an application to the appropriate bureau. The bureau reviews the application for completeness and to ensure technical elements conform to applicable regulations.

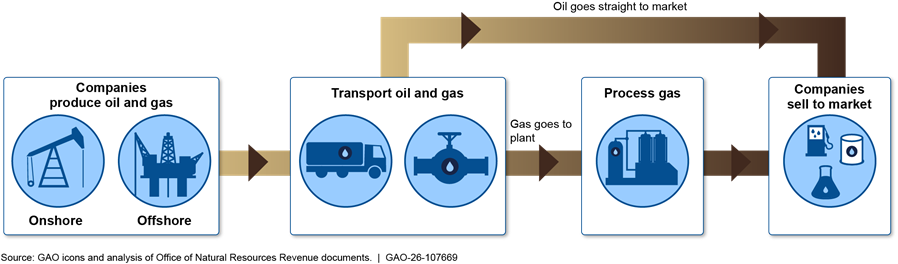

· Production. Companies produce oil and gas from their lease. Products are either transported directly to market or further processed before being sold to the market (see fig. 1).

· Inspecting.

Interior bureaus have inspection and enforcement programs that are designed to

verify that companies comply with all requirements at lease sites, including

those related to measuring oil and gas volumes.

ONRR’s Oversight of Federal Royalties and Compliance Activities

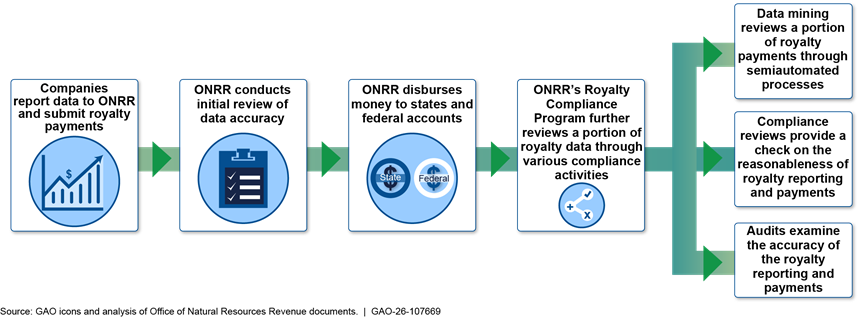

ONRR is the office within Interior that oversees federal royalties by collecting, disbursing, and verifying the accuracy of company-paid royalties through compliance activities:

· Collecting. Companies are typically obligated to pay royalties on any oil or gas they produce from federal leases and then sell. Companies are to submit monthly reports of their royalty calculations, generally via a web-based portal to ONRR’s IT system, as well as monthly payments to the U.S. Treasury based on those calculations. Each month, they calculate royalties using this equation:

Royalty payment = (sales volume x unit price x royalty rate) – deductions.[14]

Deductions can include allowances for reasonable, actual costs of transportation or processing.[15]

· Disbursing. ONRR reconciles the company-reported data with Treasury payments, then disburses the royalty revenue to the appropriate federal, state, or other accounts. All transactions are recorded in ONRR’s IT system.

· Verifying. ONRR is responsible for verifying accurate royalties through its compliance programs, including ensuring that the royalty revenues generated from the sale of oil and gas extracted from leased federal lands are accurately reported and paid. ONRR’s compliance program implements statutory requirements from FOGRMA and RSFA. FOGRMA mandates a comprehensive auditing system.[16] RSFA directs ONRR not to conduct audit activities if ONRR and the relevant state determine that the cost of conducting or requiring the audits exceeds expected collections based on the most current 12 months of activity.[17]

ONRR compliance activities include data mining, compliance reviews, and audits, which provide varying levels of assurance that royalties are accurately paid:[18]

· Data mining. ONRR began its data mining program in 2011 and officially organized it within the compliance program beginning in fiscal year 2018. Data mining is an activity to identify and resolve data errors prior to audits and compliance reviews. According to ONRR officials, data mining examines large sets of company-reported data for certain common errors, such as irregularities in the volume of oil or gas extracted. Officials stated that data mining generally identifies obvious data errors that ONRR staff work with companies to correct.

· Compliance reviews. Compliance reviews assess the reasonableness of companies’ self-reported production and royalty data. Unlike audits, compliance reviews are quicker, more limited checks on the accuracy of the data, and may examine underlying source documentation.

· Audits. ONRR audits involve detailed examinations of companies’ royalty payments and reports. During an audit, ONRR staff assess the accuracy and completeness of companies’ self-reported production and royalty data by comparing the data to third-party documents, such as sales contracts and receipts from pipeline companies. Audits are designed to ensure that companies comply with lease terms, federal laws, regulations, and policies. ONRR aims to complete each audit within 18 months, according to ONRR officials.

Figure 2: Office of Natural Resources Revenue’s (ONRR) Process for Collecting, Disbursing, and Verifying Royalties for Oil and Gas on Leased Federal Lands

Royalty Adjustments and Refund Requests

After paying royalties, companies may find that their reported royalty calculations were incorrect. To address this, companies can adjust the reporting and may also request a refund.

Adjustments. Companies can revise any portion of their original monthly royalty report to correct over- or underreported royalty amounts. Companies can submit adjustments and a corresponding reason code via ONRR’s online portal and do not need to provide supporting documentation. Companies may also submit adjustments to address errors identified during ONRR’s compliance activities. Adjustments can increase or decrease the total payment:

· Positive adjustment. The company underreported royalties owed, which increases the total payment. The company owes ONRR additional royalties.

· Negative adjustment. The company overreported royalties owed, which decreases the total payment and may reduce a future royalty payment.

Refund requests. Companies may request a refund if they determine they overreported royalties owed or overpaid for other reasons; alternatively, they can apply any overpayment toward reducing a future royalty payment. With refund requests, companies are required by statute to submit reason(s) why the payment was an overpayment, as well as follow other direction in ONRR guidance.[19] ONRR has 120 days to either approve or deny refund requests.[20] Its process since 2019 includes the following steps:

1. Submission. The company submits a written refund request, along with supporting documentation such as amended reports, an explanation of the overpayment, and relevant contractual information.

2. Initial screening. ONRR reviews the request to check if it is complete and includes the required documentation. If information is missing, ONRR may request additional information or deny the request.

3. Substantive review. For royalty refund requests over $100,000 or within 120 days of the end of the 6-year statutory adjustment period, ONRR financial specialists refer the refund reports to compliance for further review or audit. In March 2025, ONRR officials indicated that they would no longer send these reports for such review. According to officials, the change will follow the requirements of the statute, as discussed later in this report.

4. Approval process. ONRR determines whether to approve or deny the refund. For complex or high-value claims, staff may coordinate with legal or other internal teams for further review. Approved refunds may still be subject to audit.

5. Notification. ONRR sends written notice to the company detailing the outcome, including any adjustments to the refunded amount if approved or the reason for denial.

6. Payment issuance. If ONRR approves the request, it coordinates with the U.S. Treasury to issue the refund.

ONRR has several categories for the types of refunds it issues, including the following:

· Royalty refund based on adjustment. A company requests a refund for a negative adjustment (e.g., a company adjusts its royalty payment from $100 to $50 and requests a $50 refund).

· Payment refund. A company requests a refund that is not related to adjustments, such as for a duplicate payment.[21]

· Compliance. ONRR determines, based on a compliance review or audit, that the company overreported royalties owed, and the company requests a refund for the amount overpaid.

Reported Challenges That Interior Faces to Manage Federal Oil and Gas Resources

Over the past 2 decades, we have identified persistent challenges in Interior’s management of federal oil and gas resources, particularly in the areas of royalty adjustments and refunds. These challenges have raised concerns about the accuracy and timeliness of royalty collection and the overall effectiveness of oversight efforts.

For example, in 2008, we found that the revenue management arm of ONRR’s predecessor, the Minerals Management Service, faced challenges in its ability to maintain the accuracy of production and royalty data entered by companies.[22] Specifically, the agency’s ability to maintain the accuracy of production and royalty data was hampered because companies could adjust their previously entered royalty data. Then and today, companies could legally adjust their royalty data in ONRR’s IT system up to 6 years after the initial reporting due date. Typically, ONRR may legally issue monetary demands for unpaid royalties up to 7 years after companies initially reported the royalties. This allows ONRR a single year, in some cases, to identify any erroneous adjustments and issue a monetary demand for any additional royalties due.

We therefore recommended that ONRR study whether it could efficiently and accurately collect royalties within the statutory time frames and report its findings to Congress. ONRR implemented this recommendation by completing a study in 2011, which suggested shortening the time frame for companies to make adjustments from 6 years to 3 years. This would allow ONRR up to 4 years after the adjustments to conduct any compliance activities. As of August 2025, Congress has not enacted changes to implement the study’s recommendation about this statutory deadline.

In February 2011, partly due to the challenges we identified in our prior work, we added Interior’s management of federal oil and gas resources to our list of program areas at high risk for fraud, waste, abuse, and mismanagement.[23] In the February 2025 update to our High Risk List, we found that Interior has made progress to improve its management of federal oil and gas resources but additional steps are needed to improve its royalty determination and collection.[24] These historical challenges highlight key vulnerabilities in Interior’s oversight framework and provide important context for understanding the federal oil and gas leasing and production process.

Companies Submitted Adjustments Resulting in Decreased Royalties, and Large Late-Period Adjustments Affected ONRR’s Ability to Ensure Accurate Royalties

Companies submitted $2.7 billion in net royalty

adjustments in fiscal years 2014 through 2024, retroactively decreasing their

originally reported royalties of $96 billion.[25]

Almost $300 million of the net royalty adjustments were late-period adjustments

made by companies on royalties initially paid in fiscal years 2014 through

2019—meaning that companies adjusted royalties from 4 up to 6 years after they

initially reported them. As stated previously, for such late-period

adjustments, ONRR has limited time to conduct compliance activities within the

7-year statutory time frame for issuing monetary demands. Opportunities exist

for Congress and ONRR to improve adjustment reviews, such as shortening the

time frame for companies to make adjustments and developing policies for and

tracking the use of voluntary agreements (which extend statutory time frames to

make adjustments and conduct compliance activities), respectively.

Companies Submitted Adjustments That Retroactively Decreased Royalties by $2.7 Billion over 10 Years

For original royalty payments made in fiscal years 2014 through 2024, companies submitted adjustments that decreased their originally reported royalties of $96 billion by approximately $2.7 billion, according to ONRR data.[26] The annual net value of these adjustments varied, ranging from a high of $444 million in 2020 to a low of $25 million in 2024 (see fig. 3). During this period, there were no years where the net royalty adjustment value—the combined value of all negative and positive adjustments—was positive. Officials told us this trend aligns with how companies typically submit adjustments based on available past data.

Figure 3: Net Royalty Adjustments, Based on Sales Date, of Oil and Gas Royalties from Federal Leases, 2014–2024

Note: Adjustments made based on fiscal year of original royalty payment.

Because companies have up to 6 years to make adjustments, the net royalty adjustment values in fiscal years 2019 through 2024 are likely to change as further adjustments occur, but based on the trend since fiscal year 2014, the net total is unlikely to be positive. According to ONRR officials and oil and gas industry association representatives, companies make adjustments for various reasons. For example, a company may realize that it made an incorrect calculation related to transportation deductions and submit an adjustment based on an updated calculation.

When companies submit adjustments, they must include an adjustment reason code to indicate the reason for the adjustment—for example, as a result of a compliance activity completed by ONRR.[27] The majority of adjustments are made using a generic adjustment reason code. However, ONRR summary data reports are able to analyze patterns in reporting and highlight significant trends, including patterns in adjustment behavior across volumes, transportation and processing deductions, and total royalties. For example, ONRR can calculate the net transportation deductions made across fiscal years 2014 through 2024 and can further refine its results to examine specific dates, products, locations, companies, or other variables of interest.

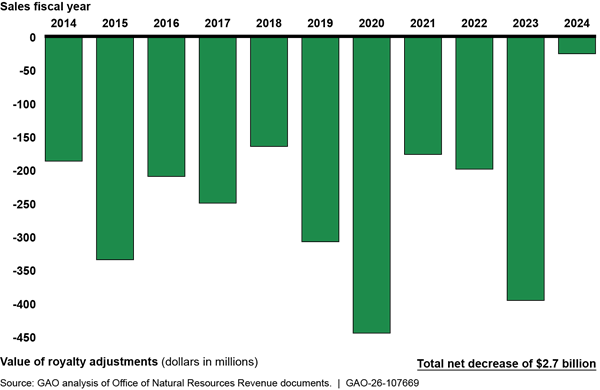

Companies Made Late-Period Adjustments That Decreased Net Reported Royalties by Almost $300 Million

According to ONRR data, companies made substantial late-period adjustments from 4 up to 6 years after the original royalty payment. For the years where late-period adjustments can be determined (fiscal years 2014 through 2019), companies made millions of dollars in both negative and positive adjustments, resulting in net negative adjustments of almost $300 million (see fig. 4).[28] According to ONRR data, companies made about one-third—or approximately $929 million—of the total net adjustments of $2.7 billion for fiscal years 2014 through 2024 within the first year after the initial royalty payment date. The remaining two-thirds—or about $1.76 billion—were made after the first year.

Figure 4: Late-Period Royalty Adjustments, Based on Sales Date, of Oil and Gas Royalties from Federal Leases, 2014–2024

Note: Companies can make adjustments past the 6-year statutory deadline due to extensions or compliance-related adjustments.

As stated previously, most late-period adjustments are made 4 to 6 years after the original payment, up to the statutory deadline for companies. Additional adjustments can be made past the 6-year statutory deadline in certain circumstances, due to compliance-related adjustments or through extensions of the deadline due to voluntary agreements between ONRR and companies. For example, for sales made in fiscal year 2014, companies made net negative adjustments of almost $41 million in years 4 up to 6 (where the adjustments would have been made in fiscal years 2018–2020) but made net positive adjustments of almost $10 million after 6 years (where adjustments would have been made in fiscal year 2021 and beyond).

ONRR Faces Challenges Conducting Compliance on Late-Period Adjustments Within the Statutory Time Frame

ONRR officials told us that late-period adjustments create challenges for verifying the accuracy of royalty payments through audits and compliance reviews. Specifically, ONRR officials stated that staff may not have sufficient time to complete compliance activities before the period expires to issue monetary demands for unpaid royalties.

According to ONRR officials, ONRR typically initiates an audit or compliance review about 3 years after companies initially report royalties and aims to complete those activities within 18 months. In conducting compliance activities, ONRR auditors do not examine each adjustment. Instead, they verify the reasonableness or accuracy of the final reported royalty value, which reflects the net effect of all positive and negative adjustments. Auditors also told us that certain types of adjustments—such as those involving transportation deductions for offshore oil and gas—require extensive technical analysis of infrastructure such as pipelines and platforms.

ONRR auditors said that when companies make complex late-period adjustments, it compresses the time available for the agency to collect and review data, conduct audits or compliance reviews, and issue monetary demands to collect unpaid royalties. Officials also noted that staffing challenges—including retirements and auditors moving to other positions within and outside ONRR—have strained ONRR’s audit capacity and limited its ability to quickly reassign staff to review late-period adjustments.

Representatives from two oil and gas industry associations that represent large and mid-sized oil and gas companies said they would be open to shortening the time frame for making adjustments. One representative noted that since RSFA’s enactment in 1996, companies have transitioned from paper-based systems to electronic systems, which has improved efficiency and reduced the need for a lengthy adjustment period. One association we spoke with cited challenges related to adjustments that affect companies’ ability to submit adjustments on time and accurately. These challenges include (1) loss of knowledge due to the need for long-term record retention and staff turnover, and (2) inconsistent or changing guidance to companies on calculations and procedures.

States with responsibilities for collecting oil and gas royalties had different time frames for allowing companies to make adjustments and for the state to issue monetary demands.[29] We found that for the nine states we reviewed, state agencies responsible for collecting state oil and gas royalties have a range of legally permitted time frames for adjustments.[30] We found that some states have equal time frames for making adjustments and auditing and collecting royalties. For example, Alaska has 6 years for both actions while California has 4 years for both actions.[31] In contrast, Colorado has a 1-year period for making adjustments and a 6-year period for collecting royalties.[32]

As previously stated, based on our September 2008 recommendation, ONRR completed a study in 2011 and recommended that Congress revise RSFA to shorten the adjustment period from 6 years to 3 years, while maintaining the 7-year period to issue any monetary demands for unpaid royalties.[33] As of August 2025, Congress has not revised the statutory adjustment period in RSFA. As a result, ONRR continues to face challenges ensuring the accuracy of late-period adjustments, and there are risks of lost federal revenue. Under FOGRMA, ONRR is required to establish a comprehensive accounting and auditing system to provide the capability to accurately determine oil and gas royalties. By shortening the time frame for adjustments, Congress could allow ONRR more time to review reported royalties to help better ensure accurate collections and better safeguard an important source of federal revenue.

Opportunities Exist for ONRR to Enhance Its Use of Voluntary Agreements with Companies to Help Ensure Accurate Payments for Late-Period Adjustments

ONRR’s statutory deadline of 7 years for conducting compliance activities cannot be extended except in a few specified circumstances, such as through a voluntary agreement with the company.[34] Through these or other similar agreements, ONRR can also extend the 6-year deadline for adjustments.[35] According to ONRR staff, such agreements are rare and are typically used when additional time is needed to complete an audit or to give a company time to make necessary adjustments.[36]

According to ONRR officials, companies have the choice of signing these agreements, and ONRR cannot coerce companies to enter into voluntary agreements. Voluntary agreements are not template or boilerplate documents and are considered on a case-by-case basis. Companies negotiate the terms with ONRR through counsel and can also refuse to sign after lengthy time investments from both sides, according to ONRR officials. Because of this, ONRR cannot consistently use such agreements.

While these agreements may offer benefits, they also carry significant risks for ONRR and the taxpayer, partly because they allow companies to make additional adjustments to a period that would otherwise be beyond the statutory deadline. ONRR must consider the risks of additional erroneous adjustments, time lost during negotiations, and resources diverted from the work of conducting audits.

Currently, ONRR does not have formal policies guiding when or how to use these voluntary agreements, according to ONRR officials. In addition, ONRR officials stated that staff use them informally and infrequently, often relying on individual staff judgment. The absence of policy could limit ONRR’s ability to consistently apply the agreements in cases where agreements might help ensure accurate royalty collections—particularly when companies make large late-period adjustments. As previously stated, under FOGRMA, ONRR is required to establish a comprehensive accounting and auditing system to provide the capability to accurately determine oil and gas royalties. Additionally, federal standards for internal control call for agencies to design control activities to achieve objectives and respond to risks. By developing a risk-based policy to guide the use of voluntary agreements—such as consistently seeking them for late-period adjustments that exceed a specified monetary threshold—ONRR could improve the consistency and effectiveness of its compliance efforts.

Additionally, ONRR has an ad hoc system that does not consistently and formally track voluntary agreements. Because staff use these agreements infrequently and without a formal process, ONRR officials stated that staff track them individually. As a result, ONRR does not have comprehensive data in a centralized system on the use of voluntary agreements, including the number of agreements in place, the types of companies involved, and the specific compliance activities they support. Without this information, ONRR has limited insight into how voluntary agreements contribute to its capability to accurately determine, collect, and account for royalties in a timely manner, as required by FOGRMA.

Additionally, federal standards for internal control call for agencies to use quality information to achieve their objectives. Quality information should be accessible, complete, and accurate to help management make informed decisions and evaluate performance in achieving key objectives and addressing risks. By not having a centralized system to consistently track voluntary agreements, ONRR does not know whether the agreements are being used appropriately and loses opportunities to learn how to leverage this existing tool to collect accurate payments.

ONRR Approved $350 Million in Refund Requests and Could Improve Its Review Process

ONRR approved $352 million in refunds requested by companies in fiscal years 2014 through 2024 and denied almost $30 million. In some cases, companies chose to appeal refund requests that ONRR rejected to ONRR’s director, the Interior Board of Land Appeals (IBLA), or both.[37] ONRR is making changes to its refund review process, according to officials, and we found opportunities for ONRR to improve related communications and guidance.

Most Approved Refund Requests Were Related to Issues Such as Duplicate Payments

In fiscal years 2014 through 2024, ONRR approved $352 million in refunds requested by companies, according to ONRR summary data (see fig. 5). Total approved refunds were significantly higher in 2015, 2017, and 2020, and individual refund amounts varied widely, ranging from a few dollars to over $15 million.

Figure 5: Total Amount of Federal Refunds Approved by the Office of Natural Resources Revenue (ONRR) to Companies, Fiscal Years 2014–2024

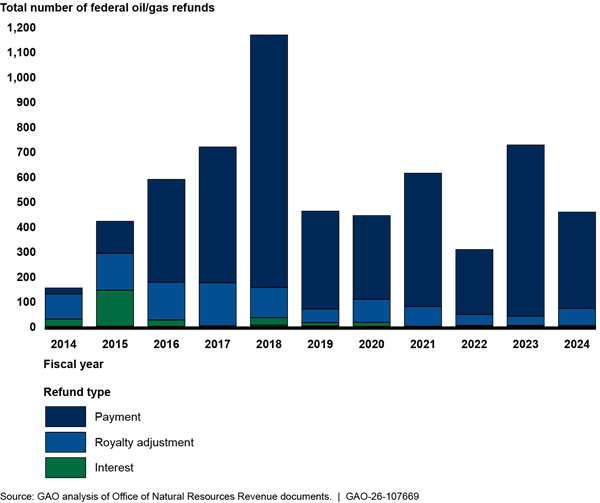

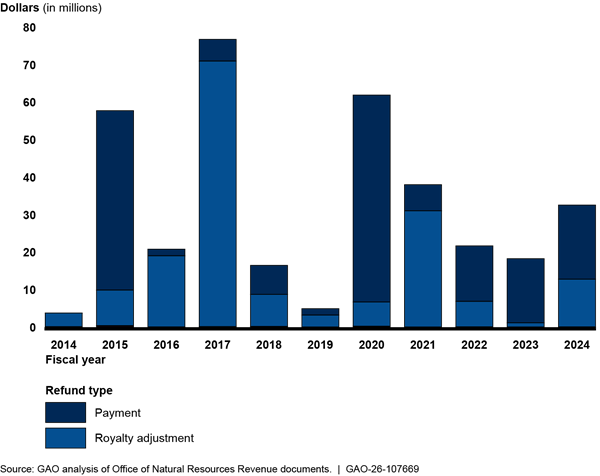

ONRR approved the following types of refund requests in fiscal years 2014 through 2024 (see fig. 6):

· Payment refunds made up 76 percent (4,587 out of 6,064) approved refund requests. Payment refunds are unrelated to adjustments in the royalty payment formula and stem from issues such as duplicate payments, according to ONRR officials. For example, one company made duplicate payments of $25 million, which were identified and refunded.

· Royalty refunds based on adjustments made up 17 percent of approved refund requests. In these cases, companies choose to request a refund for an adjustment that lowers their payments, rather than letting the balance roll over to the next month.

· Refunds related to compliance or interest together made up less than 5 percent of refunds.[38] For compliance-related refunds, ONRR determines, based on a compliance review or audit, that the company overreported royalties owed, according to ONRR officials. For interest-related refunds, a company has negative interest based on overpayment or interest on overpaid royalties, according to ONRR officials.[39]

Figure 6: Total Number of Federal Refunds Approved by the Office of Natural Resources Revenue (ONRR), by Refund Type, Fiscal Years 2014–2024

Note: Refunds for compliance also occurred but the number was negligible compared to the other categories.

Refund amounts in fiscal years 2014 through 2024 were also highest for payment refunds and royalty refunds based on adjustments (see fig. 7). Payment refunds accounted for $178 million in refunds (51 percent), and royalty refunds based on adjustments accounted for $173 million (49 percent). The remaining categories combined accounted for less than 1 percent of the amount of all refunds.

Figure 7: Total Amount of Federal Refunds Approved by the Office of Natural Resources Revenue (ONRR), by Refund Type, Fiscal Years 2014–2024

Note: Refunds for compliance and interest occurred but the dollars amounts were negligible compared to the other categories.

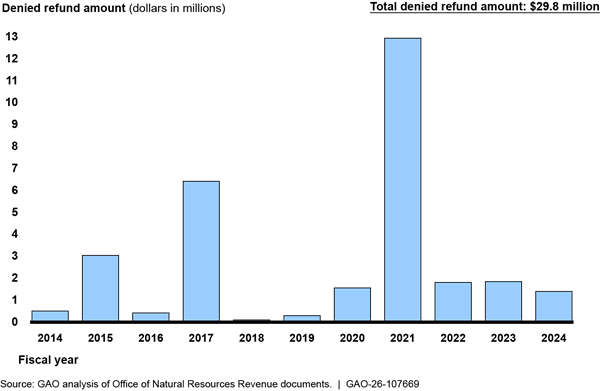

Based on available ONRR data for denied refund requests, in fiscal years 2014 through 2024, ONRR denied almost $30 million in refund requests (see fig. 8). Two years had significantly higher denial amounts—2017 and 2021—when overall refund totals also increased. According to ONRR documents and ONRR officials, reasons for denials included incorrect royalty reporting or incomplete documentation supporting the requests.

Companies Appealed Refund Decisions Totaling over $104 Million to ONRR’s Director and the Interior Board of Land Appeals

When a company disagrees with ONRR’s decision related to a refund request, it can appeal to ONRR’s director. The process typically begins with ONRR’s director, who reviews the appeal and either approves or denies it. If the director denies the appeal, the company may then appeal the decision to the IBLA along with a statement of reasons. ONRR will file a response and submit the administrative record.[40] The IBLA will then issue a decision or dispositive order.[41] ONRR’s director and the IBLA have 33 months (2 years and 9 months) total from the date the company files the appeal to issue a final decision.[42]

During fiscal years 2014 through 2024, 14 companies appealed at least 24 ONRR decisions to ONRR’s director and the IBLA related to refund requests.[43] As of June 2025, there are 12 cases still pending at the IBLA. Of the remainder, one case was decided by the IBLA, while 11 cases have been further appealed in federal court, according to an official from Interior’s Office of the Solicitor.[44]

Examples of decisions being appealed include the following:

· One order to a company to report and pay on a previously accepted and issued refund request totaling over $700,000.

· Eight orders to revise royalty reporting on previously accepted and issued refund requests totaling over $60 million, a portion of the total $352 million in refunds issued in FY2014–2024.

· Ten decisions to deny refund requests totaling over $44 million.

· Seven denied requests to exceed statutory limits on royalty allowances (i.e., deductions).[45]

In these cases, most refund requests were due to companies’ adjustments to claim transportation allowances they had not claimed when paying their royalties, according to ONRR officials.[46] According to officials from Interior’s Office of the Solicitor, the director denied appeals related to refund requests stemming from differing interpretations between ONRR and companies regarding transportation deductions. For example, in one case, a company submitted a refund request after it recalculated its transportation deductions by several million dollars to claim additional costs for depreciation of equipment according to officials from Interior’s Office of the Solicitor. ONRR initially approved the request and issued a refund. After conducting an audit, ONRR directed the company to correct its reporting. ONRR also disagreed with the company’s method of depreciation for the equipment. Subsequently, the company appealed to the IBLA regarding ONRR’s order to repay the refunded royalties. The appeal was decided by the IBLA in July 2025 on the merits in ONRR’s favor.

As ONRR Changes Its Review Process, Opportunities Exist to Improve Communication at ONRR

ONRR officials told us they are revising the process for reviewing refund requests, as of March 2025. From 2019 through March 2025, compliance staff reviewed company-provided documentation for royalty refund requests over $100,000 or within 120 days of the statutory deadline for adjustments and recommended whether to approve or deny refund requests. However, ONRR has determined that this process was not supported by FOGRMA and is reverting to its pre-2019 refund request process.

ONRR officials stated that the revised process will focus on whether the refund request is valid and follows the requirements of FOGRMA and ONRR guidance, such as providing accurate, complete information and documentation. According to officials, reviewing refund requests is not intended to include a comprehensive assessment of the accuracy of the reporting. For example, refund request approvals or denials do not validate the accuracy of the original royalty reporting or adjustments that lead to a refund, according to ONRR officials.

Also under the revised process, ONRR staff told us refund staff no longer have a documented procedure that directs refund staff to communicate approvals or denials to compliance staff, who may use this information to select leases and companies for compliance activities. Instead, compliance staff may independently get this information from the ONRR IT system. Having real-time access to adjustment and refund information will help the office effectively manage its resources, according to ONRR officials. However, compliance staff may not be aware of approved or denied refund requests—especially those that are of high amounts and involve complex issues.

As previously stated, under FOGRMA, ONRR must have a comprehensive accounting and auditing system to provide the capability to accurately determine oil and gas royalties and to collect and account for royalties, including royalties that involve adjustments and refunds, in a timely manner. Additionally, federal standards for internal control call for agencies to internally communicate the necessary quality information to achieve their objective. If staff responsible for processing requests do not communicate information about approved refunds to staff responsible for compliance reviews, ONRR may not be managing its resources sufficiently to gain insight on refunds, particularly those of large amounts, and may lose opportunities to further examine refunds that contain inaccuracies.

Opportunities Exist for ONRR to Improve Guidance for Required Documentation

Existing ONRR guidance for companies states that companies are to provide supporting documentation for refund requests that includes a brief explanation of how the overpayment occurred, as well as a completed form that reverses the originally reported overpayment and provides the corrected data.[47] ONRR has provided additional ad hoc guidance to companies on what documentation is sufficient on a case-by-case basis rather than creating detailed guidance because each case is unique, according to ONRR officials. ONRR did not always clearly communicate what documentation was necessary to support the requests. Additionally, ONRR did not always clearly communicate the rationale for denials or explain why a refund request was denied.

ONRR’s guidance does not specify what constitutes sufficient documentation to support a refund request or how to best communicate this to companies, leaving it to companies to figure out what to provide.[48] Guidance is provided on a case-by-case basis because each refund request is unique, according to ONRR officials, so detailed guidance on what information is required to support the request is not considered necessary. Recent refund requests have featured increasing complexity as companies submit novel interpretations of royalty valuation regulations, according to ONRR officials.

However, as previously stated, under FOGRMA, ONRR must have a comprehensive accounting and auditing system to provide the capability to accurately determine oil and gas royalties and to collect and account for royalties, including royalties that involve adjustments and refunds, in a timely manner. ONRR must also issue a decision for a royalty refund request in 120 days, per FOGRMA. Additionally, federal standards for internal control call for agencies to use quality information to achieve their objectives and design a process that uses the entity’s objectives and related risks to identify the information requirements needed to achieve the objectives and address the risks.

Without detailed internal guidance on what documentation is required to support a refund request, ONRR staff do not have a standard under which to review refund requests and appropriately approve or deny requests. Lack of clarity over what constitutes sufficient documentation may be contributing to appeals of refund decisions, based on our review of IBLA cases. Representatives from large and mid-sized oil and gas industry associations noted that if ONRR developed clear guidance on what information to include in refund requests, the office potentially could avoid the time and resources spent to deny the request as well as the lengthy appeals process. Ultimately, uncertainty about the basis for approving or denying refund requests may undermine fiscal accountability and erode public trust in the royalty management process.

Conclusions

Royalty revenue from oil and gas production from federal lands and waters provides billions of dollars for federal and state programs. To ensure the accuracy and timeliness of these revenues, ONRR plays an essential role in overseeing the adjustments and refund requests submitted by oil and gas companies.

Challenges with the adjustment process have led to significant risks of lost federal revenue. ONRR’s oversight of adjustments, including audits and compliance reviews, is hindered by companies’ long statutory time frame to report adjustments—especially when companies submit large late-period adjustments that reduce the original payments due. ONRR previously identified challenges related to these time frames to Congress, but no action has been taken. Because ONRR staff may not have sufficient time to complete compliance activities for late-period adjustments before the period to issue monetary demands for unpaid royalties expires, the office may miss opportunities to collect underpaid royalties. ONRR could address other aspects of the adjustment process to better promote its oversight and safeguard federal revenue, such as by improving its guidance on the use of voluntary agreements.

Similarly, ONRR faces challenges in overseeing refund requests, which may undermine fiscal accountability and erode public trust in the royalty management process. ONRR is revising its process for reviewing refund requests and has opportunities to make additional changes, such as ensuring there is a documented procedure to communicate information about approved refund requests and developing internal guidance, which would help companies understand how to submit sufficient documentation with their requests. Addressing these challenges would help ONRR identify cases for compliance reviews and clarify the basis for approving or denying refund requests, thus better ensuring companies pay their fair share for using public resources.

Matter for Congressional Consideration

We are recommending the following matter for congressional consideration:

To help ensure ONRR has sufficient time to review and verify royalty payments before the statutory period for finalizing any enforcement actions to collect unpaid royalties expires, Congress should consider shortening the statutory time frame during which companies may make adjustments. (Matter for Consideration 1)

Recommendations for Executive Action

We are making the following four recommendations to ONRR:

The Director of ONRR should develop a written policy to guide the use of voluntary agreements that considers the risks and benefits of their use, such as by establishing specific criteria for pursuing agreements to review late-period adjustments. (Recommendation 1)

The Director of ONRR should develop a centralized system to consistently track the use of voluntary agreements to extend the time available for audits. (Recommendation 2)

The Director of ONRR should ensure there is a documented procedure in place to communicate information about approved refunds to staff responsible for selecting cases for compliance. (Recommendation 3)

The Director of ONRR should develop detailed internal guidance on what documentation is required to support a refund request and how best to communicate this to companies. (Recommendation 4)

Agency Comments and Our Evaluation

We provided a draft of this report to Interior for review and comment. In its written comments, reproduced in appendix I, the agency stated that it concurred with three of our four recommendations and identified steps it would take to address them. The agency partially concurred with one recommendation on communicating information about approved refunds to staff responsible for selecting cases for compliance. Interior stated that ONRR systematically tracks refund data and makes it available on demand. In response to Interior’s comments, we modified the recommendation language to state that ONRR should have a documented policy in place to ensure this information is communicated to staff. Interior also provided technical comments, which we incorporated as appropriate.

As agreed with your office, unless you publicly announce the contents of this report earlier, we plan no further distribution until 30 days from the report date. At that time, we will send copies of this report to the appropriate congressional committees, the Secretary of the Interior, and other interested parties. In addition, the report will be available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at ruscof@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix II.

Sincerely,

Frank Rusco

Director, Natural Resources and Environment

GAO Contact

Frank Rusco at ruscof@gao.gov

Staff Acknowledgments

In addition to the contact named above, Christine Kehr (Assistant Director), Jesse Lamarre-Vincent (Analyst in Charge), Britany Evans, David Dornisch, Glenn C. Fischer, Wil Gerard, Cindy Gilbert, Daniel Mahoney, Caitlin Scoville, Tom Short, and Sara Sullivan made key contributions to this report.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]Federal Oil and Gas Royalty Management Act of 1982, Pub. L. No. 97-451, § 101(a), 96 Stat. 2447, 2449–50 (1983) (codified as amended at 30 U.S.C. § 1711(a)). In particular, FOGRMA provides the statutory framework for royalty management, including the collection, verification, and disbursement process.

[2]ONRR product valuation regs, 30 C.F.R. pt. 1206.

[3]These costs are referred to by ONRR as allowances.

[4]If a company determines that an adjustment or refund request is necessary to correct an underpayment or overpayment, the company must make such adjustment, or request a refund, within a reasonable period of time and only during the adjustment period. 30 U.S.C. § 1721a(a)(1).

[5]RSFA specifies that the adjustment period for any obligation shall be the 6-year period following the date on which the obligation became due, except in certain circumstances. Pub. L. No. 104-185, § 5(a), 110 Stat. 1700, 1710–12 (codified in relevant part at 30 U.S.C. § 1721a(a)(4)). Under the act, royalty obligations are due on the last day of the calendar month following the month in which oil or gas is produced. 30 U.S.C. § 1724(c).

[6]RSFA generally requires that ONRR issue a demand or commence judicial proceedings within 7 years from the date on which the obligation becomes due. If the agency does not do so, any further actions regarding that obligation are generally barred, and the agency can take no further action. 30 U.S.C. § 1724(b)(1). That bar applies not only to audits, penalties, and enforcement actions, but also to further agency actions regarding the obligation, including orders, requests, demands, or other communications seeking accounting or documentation.

[7]Compliance activities include, for example, reviewing the underlying documentation.

[8]Department of the Interior, Office of Inspector General, Better Internal Controls Could Ensure Accuracy of the Office of Natural Resources Revenue’s Royalty Reporting and Adjustments, 2020-CR-009 (Washington, D.C.: January 2022).

[9]GAO, Mineral Revenues: Data Management Problems and Reliance on Self-Reported Data for Compliance Efforts Put MMS Royalty Collections at Risk, GAO‑08‑893R (Washington, D.C.: Sept. 12, 2008).

[10]Since the early 1990s, our high-risk program has focused attention on government operations with significant vulnerabilities to fraud, waste, abuse, and mismanagement or that need transformation to address economy, efficiency, or effectiveness challenges. The most recent report was issued in February 2025. GAO, High-Risk Series: Heightened Attention Could Save Billions More and Improve Government Efficiency and Effectiveness, GAO‑25‑107743 (Washington, D.C.: Feb. 25, 2025).

[11]GAO, Standards for Internal Control in the Federal Government, GAO‑14‑704G (Washington, D.C.: September 2014)

[12]We identified nine and judgmentally selected two organizations because they represent both large and medium-sized oil and gas companies—the American Petroleum Institute and the Independent Petroleum Association of America.

[13]For more information, these bureaus and their roles are discussed in GAO‑24‑103676. GAO, Federal Oil and Gas Royalties: Opportunities Exist to Improve Interior’s Compliance Program, GAO‑24‑103676 (Washington, D.C.: Aug. 9, 2024).

[14]Companies report to ONRR on form ONRR-2014 the volume sold (sales volume), the amount of revenue received from the month’s sales (sales value), and the royalty payment due to ONRR (royalty value less deductions).

[15]Transportation allowances are deductions for reasonable costs, as specified in ONRR regulations, incurred to move oil or gas from the lease site to the point of sale, such as expenses related to pipelines, trucks, or other transportation methods. Processing allowances are a deduction from royalty value for the lessee’s actual, reasonable costs of processing a gas stream. ONRR regulates these allowances, which reduce the value used to calculate royalties owed to the federal government.

[16]Pub. L. No. 97-451, § 101(a), 96 Stat. 2447, 2449–50 (1983) (codified as amended at 30 U.S.C. § 1711(a)).

[17]Pub. L. No. 104-185, § 4, 110 Stat. 1700, 1709 (1996) (codified in relevant part at 30 U.S.C. § 1724(g)).

[18]GAO, Federal Oil and Gas Royalties: Opportunities Exist to Improve Interior’s Compliance Program, GAO‑24‑103676 (Washington, D.C.: Aug. 9, 2024).

[19]See 30 U.S.C. § 1721a(b)(1)(D). ONRR guidance specifies additional prerequisites to refunds. ONRR, “Minerals Revenue Reporter Handbook—Oil, Gas, and Geothermal Resources” (Release 4.4, Jan. 16, 2025) at § 6.2.2.

[20]Refunds must be paid or denied within 120 days of the date on which the request for refund is received by ONRR. 30 U.S.C. § 1721a(b)(3).

[21]ONRR has refund codes for Lease and Rent documents, but, according to ONRR, these are documents typically requiring adjustments to place the overpayment on the company’s account. The company could then request a refund on this overpayment. We have included refunds coded as Lease or Rent with Payment refunds.

[22]GAO‑08‑893R. The recommendations in that report were made to the Minerals Management Service (MMS), ONRR’s predecessor. On October 1, 2010, the revenue management arm MMS was separated into a new office—the Office of Natural Resources Revenue—under the Assistant Secretary for Policy, Management, and Budget.

[23]GAO, 2011 High Risk Series: An Update, GAO‑11‑394T (Washington, D.C.: Feb. 17, 2011).

[25]We identified net royalty adjustments using ONRR summary data based on the sales date, including all adjustments made more than 1 month after the sales date. Companies made adjustments both increasing and decreasing the total amount of royalties during this time frame.

[26]ONRR’s data did not allow us to break out both positive and negative adjustments, which is why we are reporting the change in net adjustments.

[27]In 2022, Interior’s OIG found that, for most adjustments, companies used a code that is a generic category that does not provide a specific rationale, limiting insight into the reasons behind the changes. The OIG recommended that ONRR evaluate the use of this code for most adjustments to determine its effectiveness and develop additional codes to better capture the reasons for adjustments. ONRR concurred with the recommendation and is working on the collection of additional data as part of its modernized systems to identify reasons for industry-submitted adjustments. ONRR developed an Adjustment Monitoring Tool that could analyze adjustment data with some greater specificity than the adjustment reason code.

[28]Late-period adjustment data for fiscal years 2020 through 2024 are not available because not enough time has passed to collect these data.

[29]As another point of comparison, generally the Internal Revenue Service time frames for U.S. corporations to file amended income tax returns is within 3 years from the date the corporation filed its original return or within 2 years from the date the corporation paid the tax (if filing a claim for a refund), whichever is later.

[30]The states in our review are Alaska, California, Colorado, Montana, New Mexico, North Dakota, Oklahoma, Wyoming, and Utah.

[31]By regulation, the time period for Alaska to audit lessee records, including royalty reporting under the Alaska Net Profit Share Leasing System, is 6 years from the expiration of the calendar year in which the report was filed—the required lessee record retention period—except in the case of fraud or misrepresentation. See Alaska Admin. Code tit. 11, § 83.245(b), (e), (f). Alaska regulations also permit adjustments and refunds of such royalty payments, see id. at § 04.060(a), and an official with the Alaska Department of Natural Resources indicated that they use the 6-year audit and record retention period as guidance on the limit for collecting and payment of royalites, including adjustments and refunds. The California statute of limitations for an action based on any contract, obligation, or liability founded on an instrument in writing is 4 years. Cal. Civ. Proc. Code § 337. A California State Lands Commission official indicated that this 4-year limitation applies to both the period in which the state can collect royalties and the period in which companies can make adjustments to royalties.

[32]Colorado’s 6-year statute of limitations applies to collection of oil and gas royalties, with the claim accruing on the date when the underlying royalty payment was first due. See Colo. Rev. Stat. § 13-80-103.5(1)(a); BP Am. Prod. Co. v. Patterson, 185 P.3d 811, 812 (Colo. 2008) (en banc). By contrast, under state agency guidance, companies can make adjustments to royalty payments only within the 12 production months following the original production month when the payment was first due. Colorado State Land Board, “Colorado Oil and Gas Production Royalty—Current Period and Prior Period Reporting—Instructions for Form CO-OGRoy2020” (rev’n eff. Oct. 1, 2020).

[34]As discussed above, RSFA generally only permits ONRR to issue a demand or commence judicial proceedings within 7 years from the date on which the obligation becomes due. RSFA prohibits extending or pausing time counted toward this deadline, except in specified circumstances—one of which is a written agreement between ONRR and the lessee/designee. 30 U.S.C. §§ 1724(b)(1), 1724(d). Through such a voluntary agreement with a company, ONRR can extend the statutory time frame in which to make a demand on the company.

[35]RSFA permits the 6-year deadline for adjustments to be extended or time paused through, among other means, voluntary agreements between ONRR and the company. 30 U.S.C. §§ 1721a(a)(4), 1724(d).

[36]ONRR also may use voluntary agreements to give agencies (such as the Bureau of Land Management) additional time to make a determination that would impact royalties, according to ONRR staff.

[37]The IBLA is an independent appellate body within Interior that issues final decisions in disputes involving public lands, natural resources, and royalty management. The IBLA’s decisions are final and may be reviewed by the U.S. district courts.

[38]ONRR also identifies Lease and Rent documents typically requiring adjustments to place an overpayment on the payors account, which could be requested as a payment refund, according to ONRR officials.

[39]The FAST Act amended FOGRMA to remove the previous provision regarding interest on overpayment. Pub. L. No. 114-94, div. C, tit. XXXII, subtit. C, § 32301, 129 Stat. 1312, 1741 (2015) (amending 30 U.S.C. § 1721). Consequently, this category is no longer used.

[40]ONRR’s regulations also authorize direct appeal to the IBLA, without first appealing to the ONRR director, concerning orders to perform a restructured accounting issued by the ONRR director or other most senior career royalty management official.

[41]The IBLA may dispose of an administrative appeal by decision or by dispositive order, both of which may be reviewed by the United States district courts. Decisions are final for Interior and are binding precedent in other IBLA appeals. Dispositive orders issued by the IBLA are final for Interior and binding on the parties, but do not serve as binding precedent in other IBLA appeals.

[42]RSFA requires the Secretary to issue a final decision in the administrative proceeding within 33 months of when the proceeding was commenced, unless extended through written agreement of both parties. 30 U.S.C. § 1724(h)(1). If after the 33 months are complete, there is no final decision on behalf of Interior—either through a final IBLA decision or a final decision from the ONRR director—then the appeal is deemed to have been decided. For any nonmonetary obligation at issue in the administrative appeal, and any monetary obligation with a principal amount of less than $10,000, the issue is decided in favor of the company. However, for any monetary obligation with a principal amount of $10,000 or more, the issue is decided in favor of ONRR, and the company is then entitled to seek review in federal court. 30 U.S.C. § 1724(h)(2); see also 43 C.F.R. § 4.906.

[43]Two IBLA cases involved multiple refund-related issues.

[44]In addition to the cases identified above, there are two related appeals that the IBLA has lost jurisdiction of for which the company has not yet appealed to federal court. There is another set of similar cases in which the IBLA issued a ruling vacating and remanding to ONRR, which the company could appeal to federal court, according to officials from Interior’s Office of the Solicitor.

[45]Currently, the transportation allowance may not exceed 50 percent of the value of the oil, residue gas, gas plant products, or unprocessed gas, as determined under ONRR product valuation regulations. 30 C.F.R. §§ 1206.110(d)(1), 1206.152(e)(1). Likewise, the processing allowance may not exceed 66 2/3 percent of the value of each gas plant product, with the value first reduced for any transportation allowances related to postprocessing transportation. Id. at § 1206.159(c)(2). However, prior to changes that went into effect on January 1, 2017, ONRR’s regulations permitted it to approve transportation and processing allowances in excess of these limits in certain circumstances. See, e.g., id. at §§ 1206.109(c)(2), 1206.156(c)(3), 1206.158(c)(3) (2015).

[46]These transportation costs were determined by the companies or affiliate organizations who do not have opposing economic interests regarding that contract.

[47]ONRR, “Minerals Revenue Reporter Handbook—Oil, Gas, and Geothermal Resources” (Release 4.4, Jan. 16, 2025).

[48]See generally, ONRR Minerals Revenue Reporter Handbook; see also id. at § 6.2.2.