Highlights

What GAO Found

GAO’s 2020 annual report identifies 168 new actions for Congress or executive branch agencies to improve the efficiency and effectiveness of government in 29 new mission areas and 10 existing areas. For example:

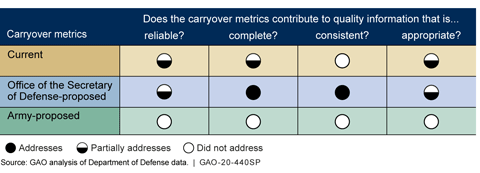

- The Department of Defense could potentially save hundreds of millions of dollars annually by accurately measuring and reducing excess funded, unfinished work at military depots.

- The Centers for Medicare & Medicaid Services could better ensure that states implement Medicaid provider screening and enrollment requirements, which could potentially save tens of millions of dollars annually.

- The Government National Mortgage Association could enhance the efficiency and effectiveness of its operations and risk management and reduce costs or enhance federal revenue by tens of millions of dollars annually.

- The Internal Revenue Service should establish a formal collaborative mechanism with the Department of Labor to better manage fragmented efforts and enhance compliance for certain individual retirement accounts that engaged in prohibited transactions, and thereby potentially increase revenues by millions of dollars.

- Improved coordination and communication between the Department of Health and Human Services’ Office of the Assistant Secretary for Preparedness and Response and its emergency support agencies—including the Federal Emergency Management Agency and Departments of Defense and Veterans Affairs—could help address fragmentation and ensure the effective provision of public health and medical services during a public health emergency.

- The Department of Education should analyze data and use it to verify borrowers’ income and family size information on Income-Driven Repayment plans to safeguard the hundreds of billions of dollars in federal investment in student loans and potentially save more than $2 billion.

- The Internal Revenue Service could increase coordination among its offices to better manage fragmented efforts to ensure the security of taxpayer information held by third-party providers.

GAO identified 88 new actions related to 10 existing areas presented in 2011 through 2019 annual reports. For example:

- The Department of the Navy could achieve billions of dollars in cost savings by improving its acquisition practices and ensuring that ships can be efficiently sustained.

- The Office of Management and Budget could improve oversight of disaster relief funds and address government-wide improper payments, which could result in significant cost savings.

- The U.S. Army Corps of Engineers and the U.S. Coast Guard could better identify and communicate lessons learned in contracting following a disaster to improve fragmented interagency coordination.

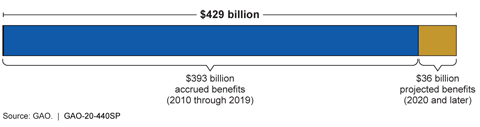

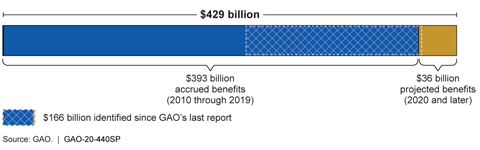

Significant progress has been made in addressing many of the 908 actions that GAO identified from 2011 to 2019 to reduce costs, increase revenues, and improve agencies’ operating effectiveness. As of March 2020, Congress and executive branch agencies have fully or partially addressed 79 percent of all actions (721 of 908 actions)—57 percent (519 actions) fully addressed and 22 percent (202 actions) partially addressed. This has resulted in approximately $429 billion in financial benefits. About $393 billion of these benefits accrued between 2010 and 2019, and $36 billion are projected to accrue in future years. This is an increase of $166 billion from GAO’s 2019 annual report. These are rough estimates based on a variety of sources that considered different time periods and utilized different data sources, assumptions, and methodologies.

Total Reported Financial Benefits of $429 Billion, as of March 2020

While Congress and executive branch agencies have made progress toward addressing actions that GAO has identified since 2011, further steps are needed. GAO estimates that tens of billions of additional dollars could be saved should Congress and executive branch agencies fully address the remaining 467 open actions, including the new ones identified in 2020. Addressing the remaining actions could lead to other benefits as well, such as increased public safety, and more effective delivery of services. For example:

| Area name and description (year-number links to Action Tracker) | Mission | Potential benefits (Source when financial) |

| DOE’s Treatment of Hanford’s Low Activity Waste (2018-17): The Department of Energy may be able to reduce certain risks and adopt alternative approaches to treating a portion of its low-activity radioactive waste. | Energy | Tens of billions (GAO) |

| Advanced Technology Vehicles Manufacturing Loan Program (2014‑13): Unless the Department of Energy can demonstrate demand for new Advanced Technology Vehicles Manufacturing loans and viable applications, Congress may wish to consider rescinding all or part of the remaining credit subsidy appropriations. | Energy | $4.3 billion (DOE) |

| Federal Shared Services (2019-05): The Office of Management and Budget and the General Services Administration could better position themselves to achieve their cost savings goals and reduce inefficient overlap and duplication by strengthening their implementation of selected federal shared service reform efforts. | General government | $2 billion over 10 years (OMB) |

| Medicare Payments by Place of Service (2016-30): Medicare could have cost savings if Congress were to equalize the rates Medicare pays for certain health care services, which often vary depending on where the service is performed. | Health | Billions annually (MedPAC and Bipartisan Policy Center) |

| Identity Theft Refund Fraud (2016‑22): The Internal Revenue Service could improve the agency’s efforts to prevent refund fraud associated with identity theft. | General government | Billions (GAO) |

| DOD Oversight of Foreign Reimbursements (2020-27): By implementing a process to monitor orders and resolve outstanding reimbursements, the Department of Defense could recover overdue repayments for sales made to foreign partners. | International affairs | Millions (GAO) |

| VA Long-Term Care Fragmentation (2020-11): The Department of Veterans Affairs should implement a consistent approach to better manage long-term care programs at the Veterans Affairs Medical Center level and improve access to the right care for veterans. | Health | Better long-term care for veterans |

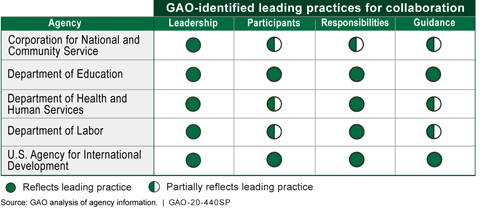

| Federal Research (2019-15): Implementing leading practices for collaboration to better manage fragmentation could help agencies improve their research efforts to maintain U.S. competitiveness in quantum computing and synthetic biology. | Science and the environment | Maintain U.S. competitiveness in the global economy |

Note: All estimates of potential financial benefits are dependent on various factors, such as whether action is taken and how it is taken. For estimates of potential financial benefits where outside estimates of potential financial benefits were not available, GAO developed the notional estimates, which are intended to provide a sense of the potential magnitude of benefits. Notional estimates have been developed using broad assumptions about potential financial benefits which are rooted in previously identified losses, the overall size of the program, previous experience with similar reforms, and similar rough indicators of potential financial benefits.

Why GAO Did This Study

The federal government has made an unprecedented financial response to the COVID-19 pandemic. At the same time, opportunities exist for achieving billions of dollars in financial savings and improving the efficiency and effectiveness of a wide range of federal programs in other areas.

Congress included a provision in statute for GAO to identify and report on federal programs, agencies, offices, and initiatives—either within departments or government-wide—that have duplicative goals or activities. GAO also identifies areas that are fragmented or overlapping and additional opportunities to achieve cost savings or enhance revenue collection.

This report discusses the new areas identified in GAO’s 2020 annual report—the 10th report in this series; the progress made in addressing actions GAO identified in its 2011 to 2019 reports; and examples of open actions directed to Congress or executive branch agencies.

To identify what actions exist to address these issues, GAO reviewed and updated prior work, including matters for congressional consideration and recommendations for executive action.

Introduction

Congressional Addressees

Responding to Coronavirus Disease 2019 (COVID-19) and its effects on public health and the economy is among the country’s highest immediate priorities. At the same time, opportunities exist for achieving billions of dollars in financial savings and improving the efficiency and effectiveness of a wide range of federal programs in other areas.

To call attention to these opportunities, Congress passed and the President signed into law a provision for us to identify and report to Congress on federal programs, agencies, offices, and initiatives—either within departments or government-wide—that have duplicative goals or activities.[1] As part of this work, we also identify additional opportunities to achieve greater efficiency and effectiveness that result in cost savings or enhanced revenue collection.

In our nine previous reports issued from 2011 to 2019, we introduced more than 325 areas and more than 900 actions for Congress or executive branch agencies to reduce, eliminate, or better manage fragmentation, overlap, or duplication; achieve cost savings; or enhance revenues.[2] Congress and executive branch agencies have partially or fully addressed 721 (79 percent) of the actions we identified from 2011 to 2019, resulting in about $429 billion in financial benefits. We estimate tens of billions more dollars could be saved by fully implementing our open actions.[3]

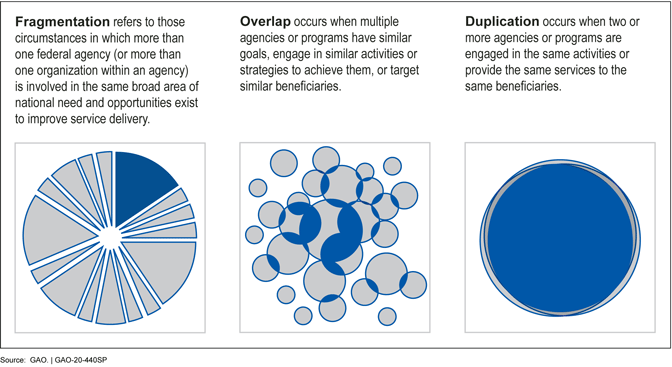

Figure 1 defines the terms we use in this work.

| | GAO’s Online Action Tracker GAO’s Action Tracker, a publicly accessible website, allows Congress, executive branch agencies, and the public to track the government’s progress in addressing the issues we have identified. GAO’s Action Tracker includes a downloadable spreadsheet containing all actions. Areas and actions in the spreadsheet can be sorted and filtered by the year identified, mission, area name, implementation status, and implementing entities (Congress or executive branch agencies). The spreadsheet additionally notes which actions are also GAO priority recommendations—those recommendations GAO believes warrant priority attention from the heads of departments or agencies. With the release of this report, GAO is concurrently releasing the latest updates to these resources. Source: GAO. | GAO-20-440SP

|

Our 2020 report identifies 29 new areas where a broad range of federal agencies may be able to achieve greater efficiency or effectiveness.

For each area, we suggest actions that Congress or executive branch agencies could take to reduce, eliminate, or better manage fragmentation, overlap, or duplication, or achieve other financial benefits. In addition to identifying new areas and actions, we continue to monitor the progress Congress and executive branch agencies have made in addressing actions we previously identified (see sidebar).

This report is based upon work we previously conducted in accordance with generally accepted government auditing standards or our quality assurance framework. See appendix I for more information on our scope and methodology.

Major Findings

IN THIS SECTION

- New Opportunities Exist to Improve Efficiency and Effectiveness across the Federal Government

- Congress and Executive Branch Agencies Continue to Address Actions Identified over the Last 10 Years across the Federal Government, Resulting in Significant Benefits

- Action on Remaining and New Areas Could Yield Significant Additional Benefits

New Opportunities Exist to Improve Efficiency and Effectiveness across the Federal Government

This report presents 168 new actions for Congress or executive branch agencies across the 29 new areas.[4] Of these 29 new areas, 18 concern fragmentation, overlap, or duplication in government missions and functions (see table 1). Appendix II provides more detailed information about these 18 areas.

| Mission | Area |

|---|---|

| Defense | Army Small Business Engagement: Army Futures Command should take steps to better manage fragmentation by formalizing its coordination with other Army organizations and to track and assess their small business engagement for research and development. |

| DOD Privatization of Utility Services: The Department of Defense should take steps to ensure the entities involved in privatizing utilities at military installations better manage fragmentation by improving collaboration in collecting data and capturing lessons learned. | |

| Economic development | SBA’s Microloan Program: The Small Business Administration’s Microloan Program should enhance its collaboration with other federal agencies that engage in microlending activities to better manage fragmentation. |

| General government | Bank Secrecy Act Implementation: The Financial Crimes Enforcement Network should ensure consistent participation by the futures sector in key Bank Secrecy Act collaboration mechanisms to help address fragmentation and improve implementation. |

| DATA Act Data Governance: The Office of Management and Budget, in collaboration with the Department of the Treasury, should establish a robust data governance structure to ensure greater consistency and comparability of reported data to better manage fragmentation in federal spending data. | |

| Federal Agencies’ Evidence-Building Activities: The Corporation for National and Community Service, Department of Health and Human Services, and Department of Labor could each improve their internal collaboration to more effectively build evidence to meet decision makers’ needs, and thereby better manage fragmented efforts within their agencies. | |

| Individual Retirement Accounts: The Internal Revenue Service should establish a formal collaborative mechanism with the Department of Labor to better manage fragmented efforts and enhance compliance for certain individual retirement accounts that engaged in prohibited transactions, and thereby potentially increase revenues by millions of dollars. | |

| IRS Third Party Cybersecurity Practices: Increased coordination among the Internal Revenue Service’s offices could better manage fragmented efforts to ensure the security of taxpayer information held by third-party providers. | |

| Tax-Exempt Entities Compliance: The Internal Revenue Service should better leverage fragmented data about tax-exempt entities to enhance the detection of noncompliance, improve the effectiveness of enforcement programs, and enhance federal revenues by potentially millions of dollars in tax changes. | |

| Health | Public Health and Medical Emergency Response: Improved coordination and communication between the Office of the Assistant Secretary for Preparedness and Response and its emergency support agencies could help address fragmentation and ensure the effective provision of public health and medical services during a public health emergency. |

| VA Long-Term Care Fragmentation: The Department of Veterans Affairs should implement a consistent approach to better manage long-term care programs at the Veterans Affairs Medical Center level and improve access to the right care for veterans. | |

| Homeland security/law enforcement | Coast Guard Specialized Forces: Assessing the extent to which unnecessary and potentially inefficient overlap or duplication exists among Deployable Specialized Forces’ capabilities would better position the Coast Guard to identify capability gaps and reallocate resources, as needed, and could potentially save millions of dollars. |

| DHS’s Processes for Apprehended Families: The Department of Homeland Security should take steps to address fragmented processes for identifying, collecting, documenting, and sharing information about noncitizen family members apprehended at the southwest border. | |

| National Strategy for Transportation Security: The Department of Homeland Security should communicate how the National Strategy for Transportation Security aligns with other governance documents to guide federal transportation security efforts and help avoid potential overlapping strategies. | |

| Surface Transportation Security Training: The Transportation Security Administration should improve the planning and implementation of its security training and exercise program to address its fragmented coordination procedures. | |

| International affairs | U.S. Assistance to Central America: To address fragmentation of U.S. assistance activities in El Salvador, Guatemala, and Honduras, the Department of State should establish a comprehensive approach to monitoring and evaluating projects that support the objectives of prosperity, governance, and security in those countries. |

| Science and the environment | Public Access to Federally Funded Research Results: Agencies could increase public access to federally funded research results and manage fragmentation by implementing leading collaboration practices. |

| Training, employment, and education | USDA’s Nutrition Education Efforts: The U.S. Department of Agriculture should develop a formal mechanism for better coordinating fragmented nutrition education efforts across the department to maximize program reach and impact and avoid potential duplication of effort. |

We also present 11 new areas where Congress or executive branch agencies could take action to reduce the cost of government operations or enhance revenue collections for the U.S. Department of the Treasury (see table 2). Appendix III provides more detailed information about these 11 areas.

| Mission | Area |

|---|---|

| Defense | Defense Agencies and DOD Field Activities Reform: By improving its guidance and documentation of efficiency initiatives, the Department of Defense could help ensure the department achieves desired cost savings across its business functions. |

| DOD Maintenance Depot Funding: The Department of Defense could potentially save hundreds of millions of dollars annually by accurately measuring and reducing excess funded, unfinished work at military depots. | |

| General government | Ginnie Mae’s Mortgage-Backed Securities Program: The Government National Mortgage Association could enhance the efficiency and effectiveness of its operations and risk management and reduce costs or enhance federal revenue by tens of millions of dollars annually. |

| IRS Tax Debt Collection Contracts: The Internal Revenue Service could potentially collect millions of dollars in additional revenue and save federal costs by analyzing tax debt cases to make better decisions on the types of cases it assigns to contracted private collection agencies. | |

| Virtual Currency Tax Information Reporting: The Internal Revenue Service should increase third-party information reporting on virtual currency transactions to improve tax compliance and potentially increase revenue. | |

| Health | Medicaid Provider Enrollment: The Centers for Medicare & Medicaid Services could ensure that states implement Medicaid provider screening and enrollment requirements, which could potentially save tens of millions of dollars annually. |

| VA Allocation of Health Care Funding: The Department of Veterans Affairs should improve its funding allocation process to help ensure the more efficient use of funds at its medical centers. | |

| Information technology | Open Source Software Program: The Department of Defense needs to fully implement the open source software pilot program to reduce duplication and potentially achieve millions of dollars annually in cost savings to the agency. |

| International affairs | DOD Oversight of Foreign Reimbursements: By implementing a process to monitor orders and resolve outstanding reimbursements, the Department of Defense could recover millions of dollars in overdue repayments for sales made to foreign partners. |

| Drawback Program Modernization: U.S. Customs and Border Protection should improve its internal controls over the drawback program—which provides refunds of certain duties, taxes and fees—to potentially prevent millions of dollars in improper drawback refunds. | |

| Training, employment, and education | Student Loan Income-Driven Repayment Plans: The Department of Education should improve verification of borrowers’ income and family size information on Income-Driven Repayment plans to safeguard the hundreds of billions of dollars in federal investment in student loans and potentially save more than $2 billion. |

In addition to these 29 new areas, we identified 88 new actions related to 10 existing areas presented in our 2011 to 2019 annual reports (see table 3). Appendix IV provides more detailed information about these new actions.

| Mission | New action (area name links to Action Tracker) | Year introduced (year links to report) |

|---|---|---|

| Defense | Navy Shipbuilding: In March 2020, GAO identified 12 actions for the Navy to improve its acquisition practices and ensure ships can be efficiently sustained, potentially saving billions of dollars. | 2017 |

| Energy | Oil and Gas Resources: In September 2019, GAO identified two new actions to improve the Department of the Interior’s valuations of offshore oil and gas resources, each which could increase the amount of revenue collected by tens of millions of dollars annually. | 2011 |

| General government | Disaster Response Contracting: In April 2019, GAO identified two actions the U.S. Army Corps of Engineers and U.S. Coast Guard can take to improve fragmented interagency coordination of lessons learned following disasters. | 2019 |

| Federal Shared Services: In March 2020, GAO identified a new action to improve the Department of Housing and Urban Development’s working capital fund and better position it to achieve over one million dollars in previously identified potential annual savings. | 2019 | |

| Government-wide Improper Payments: In June 2019, GAO identified a new action that could improve oversight of disaster relief funds and long-standing problems of improper payments, which could result in significant cost savings. | 2011 | |

| Identity Theft Refund Fraud: In January 2020, GAO identified three new actions to help the Internal Revenue Service prevent refund fraud associated with identity theft. If implemented, these actions could potentially save millions of dollars. | 2016 | |

| Health | VA Medical Supplies Procurement: In January 2020, GAO identified a new action to help the Department of Veterans Affairs assess duplication in its medical supply program. | 2018 |

| Homeland security/law enforcement | Homeland Security Grants: In November 2019, GAO identified two new actions to help reduce the risk of duplicate funding in emergency relief assistance for transit agencies. | 2012 |

| Information technology | Cloud Computing: In April 2019, GAO identified 28 new actions to help agencies save millions of dollars through better planning and implementation of cloud-based computing solutions. | 2013 |

| Federal Data Centers: In April 2019, GAO identified 36 new actions to help federal agencies meet the Office of Management and Budget’s data center consolidation and optimization goals, resulting potentially in hundreds of millions of dollars in savings. | 2011 |

Congress and Executive Branch Agencies Continue to Address Actions Identified over the Last 10 Years across the Federal Government, Resulting in Significant Benefits

Congress and executive branch agencies have made consistent progress in addressing many of the actions we have identified since 2011, as shown in figure 2 and table 4. As of March 2020, Congress and executive branch agencies had fully or partially addressed nearly 80 percent of the actions we identified from 2011 to 2019. See GAO’s online Action Tracker for the status of all actions.

Note: Due to rounding, the total percentages may not add up to exactly 100 percent.

aIn assessing actions suggested for Congress, GAO applied the following criteria: “addressed” means relevant legislation has been enacted and addresses all aspects of the action needed; “partially addressed” means a relevant bill has passed a committee, the House of Representatives, or the Senate during the current congressional session, or relevant legislation has been enacted but only addressed part of the action needed; and “not addressed” means a bill may have been introduced but did not pass out of a committee, or no relevant legislation has been introduced. Actions suggested for Congress may also move to “addressed” or “partially addressed,” with or without relevant legislation, if an executive branch agency takes steps that address all or part of the action needed. At the beginning of a new congressional session, GAO reapplies the criteria. As a result, the status of an action may move from partially addressed to not addressed if relevant legislation is not reintroduced from the prior congressional session.

bIn assessing actions suggested for the executive branch, GAO applied the following criteria: “addressed” means implementation of the action needed has been completed; “partially addressed” means the action needed is in development or started but not yet completed; and “not addressed” means the administration, the agencies, or both have made minimal or no progress toward implementing the action needed.

cOf the 80 “other” actions, 32 are categorized as “closed-not addressed” and 48 as “consolidated or other.” GAO no longer assesses actions categorized as “closed-not addressed” or “consolidated or other.” GAO generally categorizes actions as “closed-not addressed” when the action is no longer relevant due to changing circumstances. However, in most cases, “consolidated or other” actions were replaced or subsumed by new actions based on additional audit work or other relevant information. In 2020, one congressional action and four executive branch actions were consolidated and replaced by new actions, causing the cumulative action count for 2011 to 2019 to increase from 903 to 908.

Actions Taken by Congress and Executive Branch Agencies Led to Billions in Financial Benefits

As a result of steps Congress and executive branch agencies have taken to address our open actions, we have identified approximately $429 billion in total financial benefits, including $166 billion identified since our last report. About $393 billion of the total benefits accrued between 2010 and 2019, while approximately $36 billion are projected to accrue in 2020 or later, as shown in figure 3.[5]

Figure 3: Total Reported Financial Benefits of $429 Billion, as of March 2020

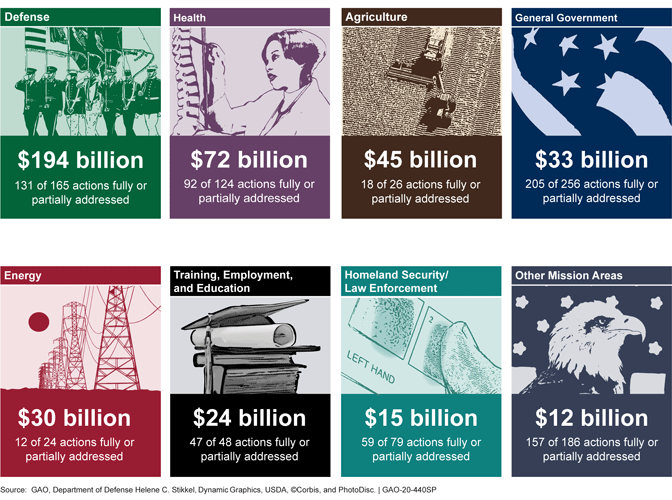

Since our first annual report in 2011, these benefits have contributed to missions across the federal government, as shown in figure 4.

Figure 4: Combined Benefits Achieved by Addressing Actions Highlighted in Duplication Reports over the Last 10 years, by Mission as of March 2020

Table 5 highlights examples of results achieved in addressing actions we identified over the past 10 years.

| Area name (annual report year/area number links to Action Tracker)a | Actions taken | Financial benefit |

|---|---|---|

| Weapon Systems Acquisition Programs (2011‑38) | Congress passed the Weapon Systems Acquisition Reform Act of 2009, which implemented a number of GAO’s recommendations for how the Department of Defense (DOD) develops and acquires weapon systems. GAO highlighted the need for additional action in this area in its 2011 report. Since then, DOD has followed more best practices for these acquisitions, which greatly reduced cost growth for weapons systems over time.a | Savings of approximately $180.0 billion from 2011 through 2017, according to GAO analysis. |

| Medicaid Demonstration Waivers (2014‑21) | The Department of Health and Human Services changed processes to curtail some problematic methods used to determine spending limits for Medicaid Demonstrations, restricted the amount of unspent funds states can accrue and carry forward to expand demonstrations, and could further reduce federal spending by addressing other problematic methods. | Savings of approximately $64.3 billion from 2016 through 2018, and tens of billions of additional savings could potentially accrue from 2019-2022, according to agency and GAO estimates. |

| Farm Program Payments (2011‑35) | Congress passed the Agricultural Act of 2014, which eliminated direct payments to farmers, thereby eliminating a duplicative payments structure that had not been intended to be permanent.b | Savings of approximately $44.5 billion from fiscal year 2015 through fiscal year 2023, of which about $24.7 billion has accrued and $19.8 billion is expected to accrue in fiscal year 2020 or later, according to the Congressional Budget Office (CBO). |

| Domestic Ethanol Production (2011‑13) | Congress allowed the Volumetric Ethanol Excise Tax Credit to expire at the end of 2011, which eliminated duplicative federal efforts directed at increasing domestic ethanol production.c | Reduced revenue losses by about $29.1 billion from fiscal year 2012 to fiscal year 2016, according to GAO analysis. |

| Higher Education Assistance (2013‑16) | The Department of Education changed its estimation approach for calculating the cost of Income-Driven Repayment plans, allowing the agency to transfer unused funds to the Department of the Treasury. | Financial benefits of approximately $24.2 billion during 2018, according to agency estimates. |

| Passenger Aviation Security Fees (2012‑48) | Congress passed the Bipartisan Budget Act of 2013, which modified the passenger security fee from its prior per enplanement structure ($2.50 per enplanement with a maximum one-way-trip fee of $5.00) to a structure that increases the passenger security fee to a flat $5.60 per one-way-trip.d | Increased revenue of about $12.9 billion in fee collections over a 10-year period beginning in fiscal year 2014 and continuing through fiscal year 2023, of which $7.7 billion has accrued and $5.1 billion is expected to accrue in fiscal year 2020 or later, according to CBO and other estimates. |

| Agencies’ Use of Strategic Sourcing (2013‑23) | The Department of Veterans Affairs evaluated strategic sourcing opportunities, set goals, tracked metrics, and ultimately procured a larger share of goods and services–including information technology (IT)–using contracts aligned with strategic sourcing principles. | Cost avoidance of about $10.8 billion from fiscal years 2013 through 2017, and billions could potentially accrue from 2017 to 2019, according to GAO estimates. |

| Tax Policies and Enforcement (2015‑17) | Congress amended the audit procedures applicable to certain large partnerships to require that they pay audit adjustments at the partnership level.e | Increased revenue of about $9.3 billion from fiscal years 2019 to 2025, of which about $1.3 billion has accrued and $8.0 billion is expected to accrue in fiscal year 2020 or later, according to the Joint Committee on Taxation. Hundreds of millions in additional savings could potentially accrue, according to GAO estimates. |

| Real Estate‑Owned Properties (2014‑18) | The Department of Housing and Urban Development made improvements to increase the recoveries from disposing of properties it receives when loans default, such as by selling these loans and increasing property inspections and oversight of contractors disposing of these properties. | Savings of about $5.5 billion from 2013 through 2018, according to agency estimates. |

| Combat Uniforms (2013-02) | The Army chose not to introduce a new family of camouflage uniforms into its inventory. | Savings of about $4.2 billion from fiscal years 2014 through 2018. |

| Federal Data Centers (2011‑15) | The 24 federal agencies participating in the Office of Management and Budget’s (OMB) data center consolidation and optimization efforts have taken steps to consolidate 6,250 data centers as of April 2019. | Cost savings and avoidances of about $4.2 billion from fiscal years 2011 through 2019, based on GAO analysis of agency reported data. Hundreds of millions in additional savings could potentially accrue from fiscal years 2019 through 2020, according to agency estimates. |

| Information Technology Investment Portfolio Management (2014‑24) | Nine agencies migrated commodity IT areas to shared services in response to OMB’s 2012 guidance to review their portfolios and identify duplicative, low-value, and wasteful investments, contributing to savings. | Savings of an estimated $3.3 billion from fiscal years 2012 through 2019, and billions in additional savings based on estimates of potential savings that could have occurred from fiscal years 2013 through 2015, according to agency estimates. |

| Overseas Defense Posture (2012‑37) | United States Forces Korea conducted a series of consultations with the military services to evaluate the costs and benefits associated with tour normalization, and DOD decided not to move forward with the full tour normalization initiative because it was not affordable. | Savings of an estimated $3.1 billion from fiscal years 2012 through 2016, according to agency estimates. |

| Navy’s Information Technology Enterprise Network (2012-38) | The Navy has completed key acquisition decisions, improved the Next Generation Enterprise Network schedule to better reflect key schedule estimating practices, and improved its risk management so that future acquisition decisions better reflect the state of the program’s exposure to risks. | Savings of about $2.6 billion from fiscal years 2013 through 2017. |

| Homeland Security Grants (2012‑17) | Congress limited preparedness grant funding until the Federal Emergency Management Agency completes a national preparedness assessment of capability gaps.f | Savings of about $2.6 billion from fiscal years 2011 through 2013, according to GAO estimates. |

| Medicare Advantage Payments (2012‑45) | Congress increased the minimum adjustment made for differences in diagnostic coding patterns between Medicare Advantage plans and traditional Medicare providers.g | Savings of approximately $2.5 billion from fiscal years 2013 through 2022; this includes $750 million expected to accrue in fiscal year 2020 or later according to CBO. Billions in additional savings could potentially accrue, according to GAO and other agency estimates. |

| Federal Payments for Hospital Uncompensated Care (2017-25) | Centers for Medicare & Medicaid Services announced in a final rule that the agency would begin basing Medicare Uncompensated Care payments on hospital uncompensated care costs.h | Savings of about $2.3 billion in fiscal years 2018 and 2019, with potential for billions of dollars in fiscal year 2020, according to GAO estimates. |

| Overseas Military Presence (2011-36) | DOD has taken steps to assess costs and benefits of overseas military presence options. | Savings of about $2.3 billion from 2013 through 2017, according to GAO estimates. Millions in additional savings could potentially accrue, according to agency estimates. |

| DOD’s Business Systems (2011‑08) | DOD canceled the Air Force’s Expeditionary Combat Support System because of significant cost and schedule overages. | Savings of about $1.6 billion from 2013 through 2025, according to GAO analysis of agency estimates. This includes about $738 million expected to accrue in fiscal year 2020 or later. Hundreds of millions in additional savings could potentially accrue from 2020 to 2021, according to GAO and other agency estimates. |

| Strategic Petroleum Reserve (2015‑15) | The Department of Energy (DOE) completed a long-term strategic review of the Strategic Petroleum Reserve in August 2016, as Congress required in 2015. | DOE reported savings of $1.2 billion from selling crude oil from the reserve in fiscal years 2017 and 2018, with a potential for billions in total sales through 2025, according to CBO. |

Note: The estimates in this report are from a range of sources, including GAO, executive branch agencies, CBO, and the Joint Committee on Taxation. Some estimates have been updated since GAO’s 2019 report to reflect more recent analysis.

aPub. L. No. 111-23, 123 Stat. 1704 (2009).

bPub. L. No. 113-79, § 1101, 128 Stat. 649, 658 (2014).

c26 U.S.C. § 6426(b)(6).

dPub. L. No. 113-67, § 601(b), 127 Stat. 1165, 1187 (2013).

eBipartisan Budget Act of 2015, Pub. L. No. 114-74, § 1101, 129 Stat. 584, 625–638 (2015).

fPub. L. No. 112-10, § 1632, 125 Stat. 38, 143 (2011); Pub. L. No. 112-74, 125 Stat. 786, 960–962 (2011); Pub. L. No. 113-6, 127 Stat. 198, 358–360 (2013); Pub. L. No. 113-76, 118 Stat. 5, 261–262 (2014).

gAmerican Taxpayer Relief Act of 2012, Pub. L. No. 112-240, § 639, 126 Stat. 2313, 2357 (2013).

h82 Fed. Reg. 37990, 38000 (Aug. 14, 2017).

Other Benefits Resulting from Actions Taken by Congress and Executive Branch Agencies

Our suggested actions, when implemented, often result in benefits such as strengthened program oversight; improvements in major government programs or agencies; more effective and equitable government; and increased international security. The following recent examples illustrate these types of benefits.

- Housing Assistance (2012-28): The federal government and state and local entities provide both rental assistance and affordable housing through a wide variety of programs. In February 2012, we found instances of fragmentation and overlap among federal rental assistance program.

We recommended that the Secretary of the Department of Housing and Urban Development (HUD) work with states and localities to develop an approach for compiling and reporting on the collective performance of federal, state, and local rental assistance programs.

In 2019, Executive Order 13878 established the White House Council on Eliminating Regulatory Barriers to Affordable Housing.[6] The establishment of the council and the actions taken by HUD are positive steps for reaching out to states and localities and allowing Congress, decision makers, and stakeholders to evaluate collective performance data and provide mechanisms for setting priorities, allocating resources, and restructuring efforts, as needed, to achieve long-term housing goals.

- Military and Veterans Health Care (2012-15): The Departments of Defense (DOD) and Veterans Affairs (VA) play key roles in offering support to servicemembers and veterans through various programs and activities. In 2012, we found that the departments needed to improve integration across care coordination and case management programs to reduce duplication and better assist servicemembers, veterans, and their families.

We recommended that the Secretaries of Defense and Veterans Affairs develop and implement a plan to strengthen functional integration across all DOD and VA care coordination and case management.

The departments took several steps between 2012 and 2019 to address this, including establishing a Care Coordination Business Line within their joint Health Executive Committee. This function is intended to develop mechanisms for making joint policy decisions, involve the appropriate decision makers for timely implementation of policy, and ensure that outcomes and goals are identified and achieved, among other things. By taking these steps, DOD and VA strengthen their oversight and more closely integrate care coordination efforts.

- Tax Policies and Enforcement (2015-17): Since 1980, partnerships’ and S corporations’ share of business receipts increased greatly.[7] These entities generally do not pay income taxes; instead, income or losses (hundreds of billions of dollars annually) flow through to partners and shareholders on their personal income tax returns. In 2014, we found that the full extent of partnership and S corporation income misreporting is unknown.

Electronic filed (e-filed) tax returns provide the Internal Revenue Service (IRS) with digital information to improve enforcement operations and service to taxpayers. We recommended that Congress consider expanding the mandate that partnerships and corporations e-file their tax returns to cover a greater share of filed returns.

In 2018, Congress passed and the President signed legislation lowering the e-file threshold for partnership and corporation returns.[8] Requiring greater e-filing of tax return information will help IRS identify which partnership and corporation tax returns would be most productive to examine, and could reduce the number of compliant taxpayers selected for examination. Further, expanded e-filing will reduce IRS’s tax return processing costs.

- Coordination of Overseas Stabilization Efforts (2019-12): The United States has a national security interest in promoting stability in countries affected by violent conflict. We looked at how three federal agencies and an independent institute support conflict prevention, mitigation, and stabilization efforts, such as removing explosives hidden near homes. In 2019, we found that although these entities have worked together in Iraq, Nigeria, and Syria, they had not documented their agreement on key areas of collaboration, such as clarifying roles and responsibilities for stabilization efforts.

We recommended that the Departments of State and Defense and the U.S. Agency for International Development should document their agreement to coordinate U.S. stabilization efforts. In 2019, the agencies took several steps to address this such as publishing a directive with the agreed upon definition of stabilization, description of agency roles and responsibilities, and related policies and guidance.

Articulating their agreement in formal documents should help strengthen the agencies’ coordination of U.S. stabilization efforts and mitigate the risks associated with fragmentation, overlap, and duplication.

Action on Remaining and New Areas Could Yield Significant Additional Benefits

Congress and executive branch agencies have made progress toward addressing the 1,076 actions we have identified since 2011.[9] However, further efforts are needed to fully address the 467 actions that are partially addressed, not addressed, or new.[10] We estimate that at least tens of billions of dollars in additional financial benefits could be realized should Congress and executive branch agencies fully address open actions, and other improvements can be achieved as well.[11]

Open Areas Directed to Congress and Executive Branch Agencies with Potential Financial Benefits

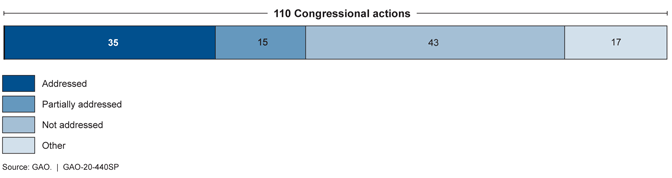

In our 2011 to 2020 annual reports, we directed 110 actions to Congress, including the three new congressional actions we identified in 2020. Of the 110 actions, 58 (about 53 percent) remained open as of March 2020. Appendix V has a full list of all open congressional actions.

We also directed 966 actions to executive branch agencies, including 165 new actions identified in 2020.[12] As shown in figure 5, these actions span the government and are directed to dozens of federal agencies. Six of these agencies—DOD, IRS, OMB, VA, and the Departments of Health and Human Services (HHS) and Homeland Security, have more than 20 open actions. Of the 966 actions, 409 (42 percent) remained open as of March 2020.

Figure 5: Number of Partially Addressed and Not Addressed Actions since 2011, by Agency

A significant number of open actions are directed to four agencies that made up about 79 percent of federal outlays in fiscal year 2019—HHS, the Social Security Administration, the Department of the Treasury (Treasury), and DOD. Figure 6 highlights agencies with open actions as well as their fiscal year 2019 share of federal outlays.

Figure 6: Fiscal Year 2019 Outlays and Number of Open Actions since 2011, by Agency

We identified potential financial benefits associated with many open areas with actions directed to Congress and the executive branch. These benefits range from millions of dollars to tens of billions of dollars. For example, DOD could potentially save hundreds of millions of dollars annually by accurately measuring and reducing excess funded, unfinished work at military depots.

In another example, IRS should establish a formal collaborative mechanism with the Department of Labor to better manage fragmented efforts and enhance compliance for certain individual retirement accounts that engaged in prohibited transactions, and thereby potentially increase revenues by millions of dollars.

Table 6 highlights examples of areas where additional action could potentially result in financial benefits of $1 billion or more.

| Area name and description (year-number links to Action Tracker) | Mission | Potential financial benefitsa (Source) |

|---|---|---|

| *DOE’s Treatment of Hanford’s Low-Activity Waste (2018‑17): The Department of Energy (DOE) may be able to reduce certain risks by adopting alternative approaches to treating a portion of its low-activity radioactive waste. (GAO-17-306) | Energy | Tens of billions (GAO) |

| *Advanced Technology Vehicles Manufacturing Loan Program (2014‑13): Unless the Department of Energy can demonstrate demand for new Advanced Technology Vehicles Manufacturing loans and viable applications, Congress may wish to consider rescinding all or part of the remaining credit subsidy appropriations. (GAO-14-343SP) | Energy | $4.3 billion (DOE) |

| Federal Shared Services (2019-05): The Office of Management and Budget and the General Services Administration could better position themselves to achieve their cost savings goals and reduce inefficient overlap and duplication by strengthening their implementation of selected federal shared service reform efforts. (GAO-19-94) | General government | $2 billion over 10 years (Office of Management and Budget) |

| *Oil and Gas Resources (2011-45): Congress may wish to provide additional guidance or take additional actions to direct the Department of the Interior to improve management of federal oil and gas resources. (GAO-19-531,GAO-15-39, GAO-14-50, GAO-10-313, GAO-09-74, GAO-08-691) | Energy | $1.7 billion over 10 years (Department of the Interior) |

| *U.S. Enrichment Corporation Fund (2015-16): Congress may wish to permanently rescind the entire $1.7 billion balance of the U.S. Enrichment Corporation Fund. (GAO-15-404SP) | Energy | $1.7 billion (GAO) |

| *Tobacco Taxes (2013-31) By modifying tobacco tax rates to eliminate tax differentials between similar tobacco products Congress could reduce federal revenue losses from substitution, which were as much as $2.5 to $3.9 billion between April 2009 and September 2018. For example, if the pipe tobacco tax rate were equal to the higher rate for similar products, it could increase revenues by an estimated $1.3 billion between fiscal year 2019 and fiscal year 2023 (GAO-19-467, GAO-12-475) | International affairs | $1.3 billion (GAO) |

| Medicare Clinical Laboratory Payments (2019‑25): The Centers for Medicare & Medicaid Services should take steps to avoid paying more than necessary for clinical laboratory tests. (GAO-19-67) | Health | $1 billion, or billions (GAO) |

| *Medicare Payments by Place of Service (2016‑30): Medicare could have cost savings if Congress were to equalize the rates Medicare pays for certain health care services, which often vary depending on where the service is performed. (GAO-16-189) | Health | Billions annually (MedPAC and Bipartisan Policy Center) |

| Additional Opportunities to Improve Internal Revenue Service Enforcement of Tax Laws (2013-22) The Internal Revenue Service can realize cost savings and increase revenue collections by billions of dollars by, among other things, using more rigorous analyses to better allocate enforcement and other resources. (GAO-13-156, GAO-13-151) | General government | Billions (GAO) |

| Department of Energy Environmental Liability (2019‑20): DOE could develop a program-wide strategy to improve decision-making on cleaning up radioactive and hazardous waste. (GAO-19-28) | Energy | Billions (GAO) |

| *Navy Shipbuilding (2017-18): The Navy could achieve cost savings by improving its acquisition practices and ensuring that ships can be efficiently sustained. (GAO-20-2, GAO-17-211, GAO-16-71) | Defense | Billions (GAO) |

| Identity Theft Refund Fraud (2016‑22): The Internal Revenue Service could improve the agency’s efforts to prevent refund fraud associated with identity theft. (GAO-20-174, GAO-18-418, GAO-16-508) | General government | Billions (GAO) |

| *Internal Revenue Service Enforcement Efforts (2012-44): Enhancing the Internal Revenue Service enforcement and service capabilities can help reduce the gap between taxes owed and paid by collecting billions in tax revenue and facilitating voluntary compliance. (GAO-12-176, GAO-11-493, GAO-09-238, GAO-08-956) | General government | Billions (GAO) |

| *Tax Expenditures (2011-17): Periodic reviews could help identify ineffective tax expenditures and redundancies in related tax and spending programs, potentially reducing revenue losses. (GAO-16-622, GAO-15-83) | General government | Billions (GAO) |

Note: All estimates of potential savings are dependent on various factors, such as whether action is taken and how it is taken. Actual savings may be less, depending on costs associated with implementing the action, unintended consequences, and the effect of other factors that could and should be controlled. The individual estimates in this table should be compared with caution, as they come from a variety of sources, which consider different time periods and utilize different data sources, assumptions, and methodologies.

aGAO developed the notional estimates, which are intended to provide a sense of potential magnitude of financial benefits. Notional estimates have been developed using broad assumptions about potential benefits which are rooted in previously identified losses, the overall size of the program, previous experience with similar reforms, and similar rough indicators of potential benefits. GAO generally determines the notional label (“millions” vs. “tens of millions” vs. “hundreds of millions”) using a risk-based approach that takes into account such factors as the possible minimum and maximum values of the cost savings estimate (where available), the quality of the data underlying those values, the certainty of those values, and/or the rigor of the estimation method used.

Open Areas with Other Benefits Directed to Congress and Executive Branch Agencies

Table 7 shows selected areas where Congress and executive branch agencies can take action to achieve other benefits, such as increased public safety, and more effective delivery of services.

| Area name and description (year-number links to Action Tracker) | Mission | Potential benefit |

|---|---|---|

| Public Health and Medical Emergency Response (2020-10): Improved coordination and communication between the Department of Homeland Security’s Office of the Assistant Secretary for Preparedness and Response and its emergency support agencies—including the Federal Emergency Management Agency and Departments of Defense and Veterans Affairs—could help address fragmentation and ensure the effective provision of public health and medical services during a public health emergency. (GAO-19-592) | Health | More effective provision of public health and medical services during a public health emergency |

| Federal Research (2019-15): Implementing leading practices for collaboration to better manage fragmentation could help agencies improve their research efforts to maintain U.S. competitiveness in quantum computing and synthetic biology. (GAO-18-656) | Science and the environment | Maintain U.S. competitiveness in the global economy |

| Disaster Response Contracting (2019-21): Agencies could improve contracting decisions and interagency coordination by formalizing processes for lessons learned and updating guidance on maximizing the use of advance contracts, to the extent practical and cost-effective. (GAO-19-281, GAO-19-93) | General government | Better coordination and reduced risk of paying more than needed for products and services |

| DOD Advertising (2017-05): The Department of Defense should improve coordination and information sharing across its fragmented advertising programs for more efficient and effective use of resources. (GAO-20-93, GAO-16-396) | Defense | More efficient and effective use of DOD’s advertising resources |

| Domestic Disaster Assistance (2012-51): The Federal Emergency Management Agency could reduce the costs to the federal government related to major disasters declared by the President by updating the principal indicator on which disaster funding decisions are based and better measuring a state’s capacity to respond without federal assistance. (GAO-12-838) | Social services | Better assessment of states’ capabilities to respond to and recover from disaster |

| *Food Safety (2011-01): The Office of Management and Budget, relevant agencies, and Congress can address inconsistent oversight, ineffective coordination, and inefficient use of resources caused by the fragmented federal approach to food safety. (GAO-17-74, GAO-15-180) | Agriculture | Reduced fragmentation for federal food safety oversight efforts |

| Economic Development Programs (2011-09): The efficiency and effectiveness of fragmented economic development programs are unclear. (GAO-12-819) | Economic development | Better information to assess the effectiveness of programs supporting entrepreneurs |

Closing

This report was prepared under the coordination of Jessica Lucas-Judy, Director, Strategic Issues, who may be reached at (202) 512-9110 or lucasjudyj@gao.gov, and J. Christopher Mihm, Managing Director, Strategic Issues, who may be reached at (202) 512-6806 or mihmj@gao.gov. Specific questions about individual issues may be directed to the area contact listed at the end of each summary. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report.

Gene L. Dodaro

Comptroller General of the United States

Congressional Addressees

The Honorable Richard Shelby

Chairman

The Honorable Patrick Leahy

Vice Chairman

Committee on Appropriations

United States Senate

The Honorable Mike Enzi

Chairman

The Honorable Bernie Sanders

Ranking Member

Committee on the Budget

United States Senate

The Honorable Ron Johnson

Chairman

The Honorable Gary C. Peters

Ranking Member

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Nita Lowey

Chairwoman

The Honorable Kay Granger

Ranking Member

Committee on Appropriations

House of Representatives

The Honorable John Yarmuth

Chairman

The Honorable Steve Womack

Ranking Member

Committee on the Budget

House of Representatives

The Honorable Carolyn Maloney

Chairwoman

The Honorable Jim Jordan

Ranking Member

Committee on Oversight and Reform

House of Representatives

The Honorable Mark R. Warner

United States Senate

Appendixes

IN THIS SECTION

- Appendix I: Objectives, Scope, and Methodology

- Appendix II: New Areas in Which GAO Has Identified Fragmentation, Overlap, or Duplication

- 1. Army Small Business Engagement

- 2. DOD Privatization of Utility Services

- 3. SBA’s Microloan Program

- 4. Bank Secrecy Act Implementation

- 5. DATA Act Data Governance

- 6. Federal Agencies’ Evidence-Building Activities

- 7. Individual Retirement Accounts

- 8. IRS Third Party Cybersecurity Practices

- 9. Tax-Exempt Entities Compliance

- 10. Public Health and Medical Emergency Response

- 11. VA Long-Term Care Fragmentation

- 12. Coast Guard Specialized Forces

- 13. DHS’s Processes for Apprehended Families

- 14. National Strategy for Transportation Security

- 15. Surface Transportation Security Training

- 16. U.S. Assistance to Central America

- 17. Public Access to Federally Funded Research Results

- 18. USDA’s Nutrition Education Efforts

- Appendix III: New Areas in Which GAO Has Identified Other Cost Savings or Revenue Enhancement Opportunities

- 19. Defense Agencies and DOD Field Activities Reform

- 20. DOD Maintenance Depot Funding

- 21. Ginnie Mae’s Mortgage-Backed Securities Program

- 22. IRS Tax Debt Collection Contracts

- 23. Virtual Currency Tax Information Reporting

- 24. Medicaid Provider Enrollment

- 25. VA Allocation of Health Care Funding

- 26. Open Source Software Program

- 27. DOD Oversight of Foreign Reimbursements

- 28. Drawback Program Modernization

- 29. Student Loan Income-Driven Repayment Plans

- Appendix IV: New Actions Added to Existing Areas

- Appendix V: Open Congressional Actions, by Mission

- Appendix VI: Additional Information on Programs Identified

Appendix I: Objectives, Scope, and Methodology

Section 21 of Public Law 111-139, enacted in February 2010, requires us to conduct routine investigations to identify federal programs, agencies, offices, and initiatives with duplicative goals and activities within departments and government-wide.[13] This provision also requires us to report annually to Congress on our findings, including the cost of such duplication, with recommendations for consolidation and elimination to reduce duplication and specific rescissions (legislation canceling previously enacted budget authority) that Congress may wish to consider.

Our objectives in this report are to (1) identify potentially significant areas of fragmentation, overlap, and duplication and opportunities for cost savings and enhanced revenues that exist across the federal government; (2) assess to what extent have Congress and executive branch agencies addressed actions in our 2011 to 2019 annual reports; and (3) highlight examples of open actions directed to Congress or key executive branch agencies.

For the purposes of our analysis, we used the term “fragmentation” to refer to circumstances in which more than one federal agency (or more than one organization within an agency) is involved in the same broad area of national need. We used the term “overlap” when multiple agencies or programs have similar goals, engage in similar activities or strategies to achieve them, or target similar beneficiaries. We considered “duplication” to occur when two or more agencies or programs are engaged in the same activities or provide the same services to the same beneficiaries.[14] While fragmentation, overlap, and duplication are associated with a range of potential costs and benefits, we include them in this report only if there may be opportunities to improve how the government delivers these services.

This report presents 18 new areas of fragmentation, overlap, or duplication where greater efficiencies or effectiveness in providing government services may be achievable. The report also highlights 11 other new opportunities for potential cost savings or revenue enhancements.[15] In addition to these 29 new areas, we identified 88 new actions related to 10 existing areas presented in our 2011 to 2019 annual reports.[16]

To identify what actions, if any, exist to address fragmentation, overlap, and duplication and take advantage of opportunities for cost savings and enhanced revenues, we reviewed and updated our prior work and recommendations to identify what additional actions Congress may wish to consider and agencies may need to take. For example, we used our prior work identifying leading practices that could help agencies address challenges associated with interagency coordination and collaboration and with evaluating performance and results in achieving efficiencies.[17]

To identify the potential financial and other benefits that might result from actions addressing fragmentation, overlap, or duplication, or taking advantage of other opportunities for cost savings and enhanced revenues, we collected and analyzed data on costs and potential savings to the extent they were available. Estimating the benefits that could result from addressing these actions was not possible in some cases because information about the extent and impact of fragmentation, overlap, and duplication among certain programs was not available.

Further, the financial benefits that can be achieved from addressing fragmentation, overlap, or duplication or taking advantage of other opportunities for cost savings and enhanced revenues were not always quantifiable in advance of congressional and executive branch decision-making. In addition, the needed information was not readily available on, among other things, program performance, the level of funding devoted to duplicative programs, or the implementation costs and time frames that might be associated with program consolidations or terminations. As possible, we used partial data and conservative assumptions to provide rough estimates of potential savings magnitude, when more precise estimates were not possible.

Appendix VI provides additional information on the federal programs or other activities related to the new areas of fragmentation, overlap, duplication, and cost savings or revenue enhancement discussed in this report, including budgetary information when available.

We assessed the reliability of any computer-processed data that materially affected our findings, including cost savings and revenue enhancement estimates. The steps that we take to assess the reliability of data vary but are chosen to accomplish the auditing requirement that the data be sufficiently reliable given the purposes for which they are used in our products. We review published documentation about the data system and inspector general or other reviews of the data. We may interview agency or outside officials to better understand system controls and to assure ourselves that we understand how the data are produced and any limitations associated with the data. We may also electronically test the data to see whether values in the data conform to agency testimony and documentation regarding valid values, or we may compare data to source documents. In addition to these steps, we often compare data with other sources as a way to corroborate our findings. For each new area in this report, specific information on data reliability is located in the related products.

We provided drafts of our new area summaries to the relevant agencies for their review and incorporated these comments as appropriate.

Assessing the Status of Previously Identified Actions

To examine the extent to which Congress and executive branch agencies have made progress in implementing the 908 actions in the approximately 325 areas we have reported on in previous annual reports on fragmentation, overlap, and duplication, we reviewed relevant legislation and agency documents such as budgets, policies, strategic and implementation plans, guidance, and other information between April 2019 and March 2020.

We also analyzed, to the extent possible, whether financial or other benefits have been attained, and included this information as appropriate (see discussion below on the methodology we used to estimate financial benefits.) In addition, we discussed the implementation status of the actions with officials at the relevant agencies. Throughout this report, we present our counts as of March 2020 because that is when we received our last updates. The progress statements and updates are published on GAO’s Action Tracker.

We used the following criteria in assessing the status of actions:

- In assessing actions suggested for Congress, we applied the following criteria: “addressed” means relevant legislation has been enacted and addresses all aspects of the action needed; “partially addressed” means a relevant bill has passed a committee, the House of Representatives, or the Senate during the current congressional session, or relevant legislation has been enacted but only addressed part of the action needed; and “not addressed” means a bill may have been introduced but did not pass out of a committee, or no relevant legislation has been introduced.

Actions suggested for Congress may also move to “addressed” or “partially addressed” with or without relevant legislation if an executive branch agency takes steps that address all or part of the action needed. At the beginning of a new congressional session, we reapply the criteria. As a result, the status of an action may move from partially addressed to not addressed if relevant legislation is not reintroduced from the prior congressional session.

- In assessing actions suggested for the executive branch, we applied the following criteria: “addressed” means implementation of the action needed has been completed; “partially addressed” means the action needed is in development or started but not yet completed; and “not addressed” means the administration, the agencies, or both have made minimal or no progress toward implementing the action needed.

Since 2011, we have categorized 80 actions as “other” and are no longer assessing these actions. We categorized 48 “other” actions as “consolidated or other.” In most cases, “consolidated or other” actions were replaced or subsumed by new actions based on additional audit work or other relevant information. We also categorized 32 of the “other” actions as “closed-not addressed.” Actions are generally “closed-not addressed” when the action is no longer relevant because of changing circumstances.

Methodology for Generating Total Financial Benefits Estimates

To calculate the total financial benefits resulting from actions already taken (addressed or partially addressed) and potential financial benefits from actions that are not fully addressed, we compiled available estimates for all of the actions from GAO’s Action Tracker, from 2011 through 2019, and from reports identified for inclusion in the 2020 annual report, and linked supporting documentation to those estimates. Each estimate was reviewed by one of our technical specialists to ensure that estimates were based on reasonably sound methodologies.

The financial benefits estimates came from a variety of sources, including our analysis, Congressional Budget Office estimates, individual agencies, the Joint Committee on Taxation, and others. Because of differences in time frames, underlying assumptions, quality of data and methodologies among these individual estimates, any attempt to generate a total will be associated with uncertainty that limits the precision of this calculation. As a result, our totals represent a rough estimate of financial benefits, rather than an exact total.

For actions that have already been taken, individual estimates of realized financial benefits covered a range of time periods stretching from 2010 through 2029. To calculate the total amount of realized financial benefits that have already accrued and those that are expected to accrue, we separated those that accrued from 2010 through 2019 and those expected to accrue between 2020 and 2029. For individual estimates that span both periods, we assumed that financial benefits were distributed evenly over the period of the estimate.[18] For each category, we summed the individual estimates to generate a total. To account for uncertainty and imprecision resulting from the differences in individual estimates, we present these realized savings to the nearest billion dollars, rounded down.

There is a higher level of uncertainty for estimates of potential financial benefits that could accrue from actions not yet taken because these estimates are dependent on whether, how, and when agencies and Congress take our recommended actions, or due to lack of sufficiently detailed data to make reliable forecasts. As a result, many estimates of potential savings are notionally stated using terms like millions, tens of millions, or billions, to demonstrate a rough magnitude without providing a more precise estimate.

Further, many of these estimates are not tied to specific time frames for the same reason. To calculate a total for potential savings, with a conservative approach, we used the minimum number associated with each term.[19] To account for the increased uncertainty of potential estimates and the imprecision resulting from differences among individual estimates, we calculated potential financial benefits to the nearest $10 billion, rounded down, and presented our results using a notional term.

This report is based upon work we previously conducted in accordance with generally accepted government auditing standards. Generally accepted government auditing standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Appendix II: New Areas in Which GAO Has Identified Fragmentation, Overlap, or Duplication

This appendix presents 18 new areas in which we found evidence of fragmentation, overlap, or duplication among federal government programs.

1. Army Small Business Engagement

Army Futures Command should take steps to better manage fragmentation by formalizing its coordination with other Army organizations and to track and assess small businesses that are engaged in research and development.

| | Potential Benefit Better coordination and improved tracking and assessment to improve the Army’s modernization effort Implementing Entity Department of the Army Link to Actions GAO identified three actions for the Army to take related to small business engagement in support of research and development. See GAO’s Action Tracker. Related GAO Product Contact Information Jon Ludwigson at (202) 512-4841 or LudwigsonJ@gao.gov |

The Army is planning to spend billions of dollars enhancing its capabilities and upgrading its weapon systems—a process it refers to as modernization. Army Futures Command, established in June 2018 by combining several existing Army organizations, oversees modernization and develops requirements and technology to achieve the Army’s priorities. The Command considers small businesses a potential source for the technologies it needs to modernize weapon systems. Thus, to support modernization, the Command is working to increase access to innovation from small businesses engaged in research and development to identify and develop innovative capabilities that will support the warfighter.

In July 2019, GAO reported that Army Futures Command is continuing the Army’s existing small business engagement initiatives for research and development, including the billions of dollars in contracts awarded prior to formation of the Command, and also plans to enhance and improve small business outreach. However, GAO found that the Command did not coordinate, track, or assess its activities to better manage fragmentation of effort.

Specifically, GAO found that Army small business engagement initiatives were fragmented as the Command did not fully leverage other Army organizations that have years of experience working with small businesses, such as the Army Office of Small Business Programs. GAO also found that the Command did not systematically track and measure its engagement with small businesses for research and development and that the Command’s planning and management of its small business engagement efforts may lack complete information. Command officials stated that these deficiencies exist because they focused on establishing the Command and engaging with small businesses as quickly as possible.

Federal internal control standards state that, during the establishment of an organizational structure, management should consider how organizations across and outside of the new organization interact to fulfill their overall responsibilities. Further, these standards state that management should use quality information from reliable sources in a timely manner to achieve the Command’s objectives. If the Command does not formalize coordination roles and responsibilities, it risks potentially duplicating small business-related work and creating overlap and fragmentation.

GAO identified three recommendations for the Department of the Army, including that it (1) formalize coordination roles and responsibilities for small business engagement in support of research and development, (2) systematically track its small business engagement in support of research and development across its subordinate organizations, and (3) establish Command-wide performance measures and develop a plan to use these measures to systematically assess the effectiveness of small business engagement in support of research and development. The Army concurred with these recommendations and stated it would implement them by June 2020.

As of February 2020, the Department of Defense (DOD) outlined steps Army Futures Command is taking to address GAO’s recommendations. DOD officials stated that Army Futures Command Office of Small Business Programs is developing policies and formalizing the roles and responsibilities for small business engagement in support of research and development. Further, Army Futures Command has also developed processes to systematically track small business engagement in support of research and development across the Command. Command officials plan to use these data to develop a baseline for understanding the current industry footprint and capabilities, assessing the growth and gaps, and assessing the effectiveness of small business engagement across the Command. An Army Futures Command official stated that it is still developing Command-wide performance measures to systematically assess that effectiveness.

Improving the coordination, tracking, and assessing of the Army’s small business engagement for research and development could better manage fragmentation in these efforts. These improvements could also better inform the command of its engagement with small businesses for research and development. The information gained will help Army Futures Command better direct small business engagement to provide needed capability to the warfighter.

Table 20 in appendix VI provides additional program information related to this issue area.

Agency Comments and GAO’s Evaluation

GAO provided a draft of this report section to DOD for review and comment. In its response, DOD officials stated that Army Futures Command is taking the steps necessary to implement GAO’s recommendations, as reflected above.

Related GAO Product

Army Modernization: Army Futures Command Should Take Steps to Improve Small Business Engagement for Research and Development. GAO-19-511. Washington, D.C.: July 17, 2019.

2. DOD Privatization of Utility Services

The Department of Defense should take steps to ensure the entities involved in privatizing utilities at military installations better manage fragmentation by improving collaboration in collecting data and capturing lessons learned.

| | Potential Benefit Reduced time to award privatized utility services contracts Implementing Entity Department of Defense Link to Actions GAO identified two actions for the Department of Defense to improve collaboration related to utilities privatization. See GAO’s Action Tracker. Related GAO Product Contact Information Tim DiNapoli at 202-512-4841 or DiNapoliT@gao.gov |

Since 1988, the military departments have privatized utility systems—such as electricity, natural gas, water, and wastewater—on military installations through the use of service contracts to companies who upgrade, maintain, and operate the systems. The Office of the Assistant Secretary of Defense for Sustainment oversees the Department of Defense’s (DOD) utilities privatization program, and the military departments have statutory authority to convey, or privatize, utility systems under their jurisdiction, such as those on military installations. In the privatization process, military departments transfer ownership of utility systems to nonfederal utility providers who, according to DOD, in turn upgrade the utilities to industry standards and provide services back to the installation through utility services contracts.

DOD has acknowledged that it has not maintained its utility systems in accordance with industry standards due to competing funding priorities. To improve the reliability of its systems, DOD had privatized 614 of 2,590 utility systems on military installations worldwide as of December 2019. Members of Congress, DOD, and industry have expressed concerns over the amount of time needed to award utilities privatization contracts. DOD has a stated goal of reducing the amount of time needed to award these contracts.

In April 2020, GAO reported that from fiscal years 2016 through 2018, DOD components had awarded 21 new contracts for privatized utility services on military installations. On average, the contracting process took about 4 years from solicitation to contract award. GAO also found that DOD has demonstrated a number of leading practices for collecting, analyzing, validating, and sharing lessons learned to improve the timeliness of the utilities privatization process.

However, DOD does not maintain consistent data on the time required to complete key steps in the pre-award process. In particular, it does not have data on when military departments begin to consider privatization and when a complete inventory of the associated infrastructure, such as pipes and valves, is available to use in the solicitation process. No DOD regulation or policy that GAO reviewed requires collection of these data. However, in 2014, Defense Logistics Agency Energy officials established milestones to plan and monitor key pre-award activities. GAO found that the length of time from receipt of requirements to contract award was reduced from an average of 61 months pre-2014 to an average of 35 months post-2014.