NUCLEAR WASTE CLEANUP

DOE Needs to Improve Contractor Oversight at the Waste Isolation Pilot Plant

Report to Congressional Committees

United States Government Accountability Office

Highlights of GAO-25-107333, a report to congressional committees.

For more information, contact Nathan Anderson at AndersonN@gao.gov.

Why This Matters

The Waste Isolation Pilot Plant (WIPP) is the nation’s only geologic repository for disposing of certain nuclear waste from defense-related activities, such as contaminated soil. The Department of Energy (DOE) expects the site to operate until the 2080s. However, much of the infrastructure is in degraded condition, increasing risks of failure and impacting WIPP’s waste disposal mission.

GAO Key Takeaways

DOE commissioned a survey in 2016 that identified over $37 million in deferred maintenance costs for WIPP’s site infrastructure—including buildings, electrical substations, hoists, and other assets. Some infrastructure has been refurbished or replaced since then. However, our analysis shows 29 of 56 assets that are essential to the mission were in substandard or inadequate condition in 2023 (the most recent data at the time of our review).

WIPP’s contractor handles daily maintenance, refurbishment, and replacement of infrastructure. The contractor also maintains data about the condition and deficiencies of site infrastructure. DOE uses the data to make decisions about assets. DOE has repeatedly identified issues with the data, including unreliable values, but has not ensured that the contractor develops timelines to correct those issues.

DOE evaluates the contractor’s performance annually and approves long-term plans for infrastructure management. However, DOE has not consistently incentivized the contractor to develop and execute long-term plans. Accurate data and clear long-term management plans would help DOE plan, prioritize, and fund critical maintenance for WIPP’s infrastructure and reduce costly emergency refurbishment of assets critical to nuclear waste disposal.

How GAO Did This Study

We visited WIPP in 2024. We analyzed data and documents and interviewed officials from DOE and from the contractor. We compared this information against DOE’s requirements for data maintenance and reporting and for contractor oversight.

What GAO Recommends

We made three recommendations to DOE to improve data collection and ensure that the site contractor is meeting long-term site infrastructure planning requirements. DOE concurred with our recommendations.

No table of contents entries found.

Abbreviations

|

CBFO |

Carlsbad Field Office |

|

CPAR |

Contractor Performance Assessment Report |

|

DOE |

Department of Energy |

|

EM |

Office of Environmental Management |

|

EMCBC |

Environmental Management

Consolidated Business |

|

FIMS |

Facilities Information Management System |

|

IPL |

integrated priority list |

|

NWP |

Nuclear Waste Partnership, LLC |

|

M&O |

management and operating |

|

PEMP |

performance evaluation and measurement plan |

|

PER |

performance evaluation report |

|

SIMCO |

Salado Isolation Mining Contractors, LLC |

|

WIPP |

Waste Isolation Pilot Plant |

This is a work of the U.S. government and is not subject to copyright protection in the United States. The published product may be reproduced and distributed in its entirety without further permission from GAO. However, because this work may contain copyrighted images or other material, permission from the copyright holder may be necessary if you wish to reproduce this material separately.

June 24, 2025

Congressional Committees

Constructed in the 1980s, the Waste Isolation Pilot Plant (WIPP) in Carlsbad, New Mexico, currently serves as the nation’s only deep geologic repository for the disposal of certain transuranic waste generated from atomic energy defense activities.[1] This waste can include clothing, soil, and other items contaminated with small amounts of plutonium and other manmade radioactive elements. The nuclear waste is shipped to WIPP from sites around the country and disposed of underground, approximately 2,150 feet beneath the earth’s surface. The Department of Energy’s (DOE) Office of Environmental Management (EM) oversees WIPP and originally estimated the waste disposal phase at the facility would last for a period of 25 years. DOE estimated WIPP would receive its first transuranic waste shipments in 1998, and projected waste disposal activities at WIPP to end by 2023.[2] Consequently, DOE managed site infrastructure at WIPP based on the expected life of the facility, and according to a 2016 condition assessment survey of the site’s infrastructure, performed minimal additional maintenance on site infrastructure due to the expectation that the infrastructure would not be needed once the site reached its waste disposal capacity.[3] As of 2024, DOE had filled approximately 44 percent of the site’s capacity for transuranic waste.[4]

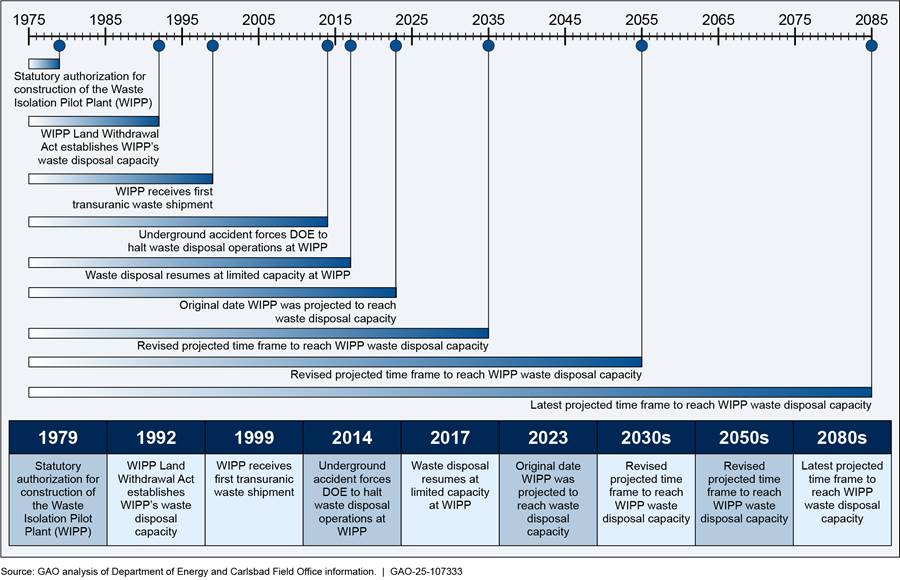

DOE has revised WIPP’s waste shipment schedule projections to accept waste until the early 2080s, due to a number of factors including the rate of waste emplacement, the amount of waste stored, and method of calculating waste volume, among others. This change in WIPP’s operational time frame means that site infrastructure and equipment will now be required to operate at least 50 years beyond what was originally expected. Some site infrastructure at WIPP has degraded and is now in poor condition. According to DOE, site infrastructure in poor condition increases the potential for infrastructure failure, allowing greater risk of unforeseen delay to waste disposal operations or shutdown of the site.

Following an underground radiological accident at WIPP in February 2014, DOE suspended waste disposal operations as it worked to decontaminate the affected areas and restore operations. As part of the restoration efforts after the accident, a DOE contractor conducted the aforementioned condition assessment survey in 2016 to identify deficiencies of site infrastructure at WIPP. The survey identified over $37 million in deferred maintenance—maintenance that was not performed when it should have been or was scheduled to be. The survey also identified over $6 million in modernization costs. These costs are for improvements to site infrastructure which are intended to result in better quality work, increased capacity, and extended useful life. DOE resumed waste disposal operations at WIPP in January 2017, but since then, the facility has continued to operate at reduced disposal capacity while upgrades are installed to improve overall site functions and worker safety. DOE estimated that WIPP’s maintenance and repair costs for fiscal year 2025 are approximately $14.2 million.[5]

Senate Report No. 117-130, accompanying a bill for the National Defense Authorization Act for Fiscal Year 2023, includes a provision for us to report on significant findings and trends related to the actions DOE has taken to bring WIPP toward full operational status.[6] This report examines (1) how DOE manages site infrastructure at WIPP, (2) what is known about the condition of infrastructure at WIPP and the extent to which DOE is maintaining and using available tools to plan for the management of site infrastructure, and (3) the extent to which DOE has provided oversight of contractor actions to address aging site infrastructure at WIPP.

To address all three objectives, we conducted a site visit to WIPP in May 2024. During the site visit, we obtained documentation and interviewed officials from DOE’s Carlsbad Field Office (CBFO), which manages and oversees WIPP operations under EM. We also obtained documentation and interviewed officials from WIPP’s current management and operating (M&O) contractor.[7] This review did not include large capital asset projects, as we previously reported on the status of capital asset projects at WIPP.[8] We focused on site infrastructure and non-capital asset projects, such as minor construction and general plant projects at WIPP.

To examine how DOE manages site infrastructure at WIPP, we reviewed protocols, orders, and procedures relevant to DOE’s infrastructure management, such as DOE Order 430.1C, Real Property Asset Management.[9] We reviewed the two most recent M&O contracts, one from the previous and one from the current contractor at WIPP. We also reviewed CBFO WIPP site infrastructure procedure and protocol documents. We interviewed CBFO and current M&O contractor representatives from WIPP to discuss their respective roles and responsibilities in managing WIPP site infrastructure.

To learn about the condition of WIPP’s infrastructure and determine the extent to which DOE is maintaining and using available tools to plan for the management of site infrastructure, we reviewed and analyzed data from DOE’s Facilities Information Management System (FIMS), and we reviewed processes for correcting data deficiencies. Specifically, we reviewed the data to analyze changes and trends in site infrastructure condition from fiscal years 2016 through 2023.[10] We also reviewed DOE Order 430.1C, Real Property Asset Management, for DOE site infrastructure data maintenance and reporting requirements. To assess the reliability of the FIMS data we received, we (1) performed electronic testing and visual inspections of the data for obvious errors in accuracy and completeness; (2) reviewed related documentation, including the available results of DOE’s annual data validations; and (3) interviewed agency and contractor representatives knowledgeable about the data and asked agency officials about any discrepancies (such as missing data, duplicate records, or data entry errors) found in the data. The Condition Index field had missing values that were primarily limited to leased assets, which the owner of the lease maintains, and to non-mission critical assets. Based on our review, we determined that the data that were present for the Condition Index and Overall Asset Condition data fields were sufficiently reliable for the purpose of comparing the condition of real property assets at WIPP in fiscal years 2016 and 2023.

We determined, however, that some data related to maintenance costs were not reliable due to known inaccuracies within the Annual Required Maintenance and Annual Actual Maintenance data fields that were flagged during DOE’s annual data validations. The results of the data validations showed repeated inaccuracies in these fields due to incomplete costs within the source data. Additionally, the data validation results did not contain the steps that officials at WIPP planned to take to correct the inaccuracies. Current contractor representatives told us that many of the values listed as zero dollars for these fields were likely inaccurate. Through visual inspection of the data, we identified missing and inconsistent data in the Annual Actual Maintenance and Annual Required Maintenance data fields that matched concerns discussed in agency documentation and interviews. Therefore, we did not use these data to describe general trends in maintenance costs for site infrastructure in this report.

To determine the extent to which DOE has provided oversight of contractor actions to address aging site infrastructure at WIPP, we reviewed and analyzed all nine performance evaluation and measurement plans (PEMP), contractor performance assessment reports (CPAR), fee determination scorecards, and performance evaluation reports (PER) for the former and current M&O contractors at WIPP for fiscal years 2016 through 2024. We reviewed the Federal Acquisition Regulation and DOE Acquisition Regulation for relevant contractor oversight and evaluation requirements, such as requirements for the PEMP process to evaluate contractor performance. We reviewed the PEMPs, CPARs, fee determination scorecards, and PERs to identify and assess the clarity and content of language regarding long-term site infrastructure planning and DOE’s efforts to incentivize that planning. We reviewed WIPP M&O contracts and contract modifications of the former and current site contractors for fiscal years 2016 through 2024 for long-term site infrastructure planning requirements. We also reviewed site infrastructure scheduling and prioritization documents, such as WIPP’s risk register and integrated priority list (IPL).[11] Additionally, we interviewed CBFO and current M&O contractor representatives to understand the decision-making process behind site infrastructure planning and maintenance.

We conducted this performance audit from January 2024 to June 2025, in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Background

To help accomplish the mission at WIPP, DOE hires M&O contractors to run the operations of the site. Operations include, but are not limited to, planning and scheduling infrastructure projects, conducting routine maintenance, and maintaining site infrastructure data. The M&O contractor at WIPP was Nuclear Waste Partnership, LLC (NWP) for fiscal years 2012 through 2022. In July 2022, DOE awarded the WIPP site contract to Salado Isolation Mining Contractors, LLC (SIMCO).[12] The current WIPP M&O contract is a cost-plus-award-fee contract, as was the former contract. Contractors can be incentivized to perform specific tasks and earn award fees upon successful task completion through this contract type.[13]

DOE tracks WIPP’s asset information, such as annual maintenance costs, operating status, and overall asset condition, in the FIMS database. FIMS serves as DOE’s corporate real property database as specified by DOE Order 430.1C, Real Property Asset Management.[14] DOE Headquarters relies on FIMS data for making daily management decisions related to condition, utilization, mission, status, maintenance and operations costs, and dispositions and future acquisitions of real property. According to DOE documentation, complete and accurate information on real property assets is critical to DOE for managing facilities and satisfying several external reporting requirements, including the Federal Real Property Profile Management System.[15]

WIPP Site Infrastructure Terms and Definitions

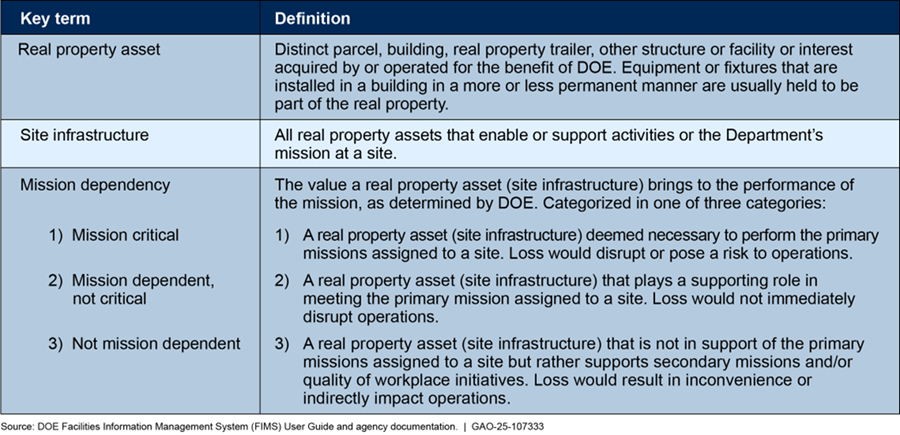

DOE relies upon the successful operation and functionality of WIPP’s site infrastructure to assist in performing the site’s mission of transuranic waste disposal. Site infrastructure, known as real property assets by DOE, includes land, buildings, trailers, and other structures. We use the term “site infrastructure” throughout the report to describe real property assets. At WIPP, site infrastructure includes electrical substations, the waste handling building, and the salt hoist, which is responsible for transporting mined salt out of the underground to the surface (see fig. 1).

DOE categorizes site infrastructure by its mission dependency, which is the value a real property asset brings to the performance of the mission, as determined by DOE. Site infrastructure is divided into three categories of mission dependency: (1) mission critical; (2) mission dependent, not critical; and (3) not mission dependent. Figure 2 defines some of the terms and concepts involving site infrastructure at DOE sites.

Long-Term Site Infrastructure Planning and Future Site Projections

In response to the radiological accident at WIPP in 2014, DOE has been running waste disposal operations at reduced capacity. According to DOE officials, WIPP had been receiving as many as 36 waste shipments per week prior to the accident in 2014. When operations resumed in 2017, the number of shipments was reduced to eight to 10 per week.[16] By 2022, waste shipments increased to 14 per week, and in 2024 DOE reported that WIPP was at approximately 44 percent of its statutory capacity for transuranic waste disposal. DOE bases its projected closure time frame for WIPP on the projected volume of waste streams it expects to receive from the generator sites. DOE originally projected WIPP would reach its statutory capacity for transuranic waste disposal by 2023, but as previously stated, the agency has since revised the projected closure time frame of WIPP a few times, with the latest projected closure time frame estimated in the 2080s. See figure 3 for a timeline of significant events and waste disposal capacity projections at WIPP.

Figure 3: Timeline of Significant Events and Department of Energy (DOE) Waste Disposal Capacity Projections at WIPP

Since resuming waste disposal operations at WIPP, DOE has been working to restore the site to full operational status. Significant planned upgrades to the site infrastructure include but are not limited to the Safety Significant Confinement Ventilation System and the Utility Shaft capital asset projects.[17] According to DOE, these site infrastructure upgrades will significantly increase airflow to the underground space, which is currently restricted due to the accident. This will allow for simultaneous salt mining, maintenance, and disposal operations—a concurrent capacity that was lost after the 2014 accident. Additionally, the construction of two new underground panels—mined spaces containing seven disposal rooms where the waste is deposited—aims to replace disposal space that was lost due to the accident in 2014.

DOE recognizes that its ability to support WIPP’s mission into the future is contingent on repairing, refurbishing, and recapitalizing aged and failing infrastructure at WIPP. To this end, DOE is planning to undertake several site infrastructure improvements over the next decade. These include the refurbishment of the shaft and hoist systems, replacement of electrical substations, and installation of additional backup generators. According to CBFO’s 2019 Strategic Plan, major repairs and replacements of site infrastructure at WIPP are necessary to maintain the safety of site personnel and nuclear materials and to ensure waste disposal capability at a production rate that supports EM’s cleanup mission. Shutdown or loss of an asset designated as mission critical could disrupt or risk site operations.

DOE officials told us that after the 2014 underground accident that led to the suspension of waste disposal operations at WIPP, they acknowledged the degradation over time of many systems critical to the facility and the limited effort directed toward long-term planning due to the original site closure projections. Based on our review of agency documents and interviews with CBFO and WIPP M&O contract officials, long-term site infrastructure planning involves planning activities conducted to ensure the long-term operability, suitable condition, and availability of site infrastructure to meet program mission projections. This may include activities such as long-term budgeting, scheduling, forecasting, and prioritizing of site infrastructure management projects, such as minor construction projects. In contrast, short-term plans address more immediate matters such as the routine maintenance of site infrastructure.

Current contractor representatives at WIPP stated that since the operating posture has changed and the facility’s life has been extended, there is a need to upgrade the infrastructure to be able to support the extended life of WIPP. For example, the representatives told us that the salt hoist, which is designated as a mission critical asset, was built in 1924 and installed at WIPP in 1984, and needs to be replaced. See figure 4 for a photo of part of the salt hoisting system at WIPP.

Figure 4: Workers Inspecting Part of the Salt Hoisting System at the Waste Isolation Pilot Plant in Carlsbad, New Mexico

DOE Contracts for Site Infrastructure Management at WIPP, While Overseeing the Contractor’s Planning and Evaluating Its Performance

DOE contracts for management of WIPP with an M&O

contractor, who conducts the daily maintenance activities at the site and

long-term planning to manage site infrastructure. Daily maintenance involves

both routine preventive maintenance and corrective maintenance for emerging

issues. More extensive deficiencies may require replacement or refurbishment,

which can take years to execute and require prioritization and long-term

planning. CBFO oversees the M&O contractor’s site infrastructure management

by attending meetings, approving plans, and evaluating its performance.

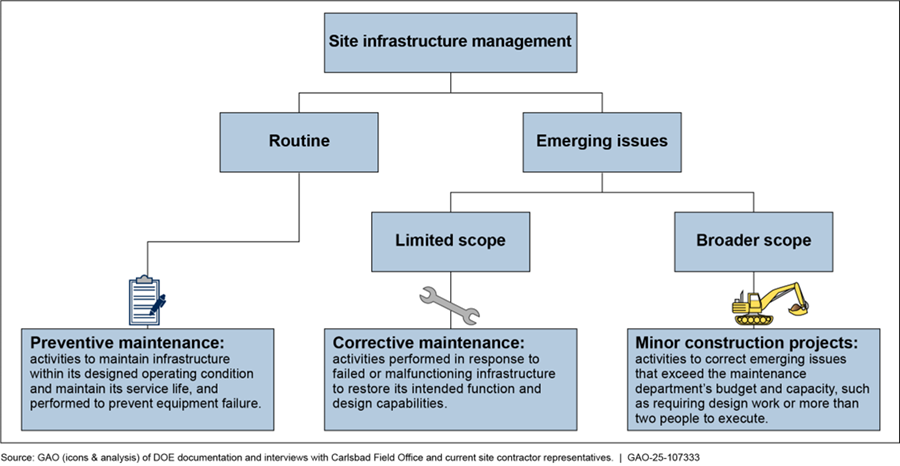

WIPP’s M&O Contractor Plans and Executes Daily Maintenance Activities and Future Planning for Infrastructure

According to the contracts, it is the role of WIPP’s M&O contractor to plan and execute the maintenance, refurbishment, and replacement of site infrastructure at WIPP. The contractor’s responsibilities generally include managing daily upkeep of site infrastructure through routine preventive maintenance activities and corrective maintenance activities for emerging issues. According to DOE Order 430.1C, preventive maintenance includes periodic activities taken to maintain infrastructure within its designed operating condition, maintain its service life, and prevent equipment failure. Corrective maintenance includes activities performed in response to failed or malfunctioning infrastructure to restore its intended function and design capabilities.

Current contractor representatives described the types of activities that are considered preventive maintenance and how they develop schedules for this work. For example, they told us that preventive maintenance includes activities such as lubricating certain equipment monthly and non-destructive testing. They base the frequency of preventive maintenance on the original equipment manufacturer’s recommended schedule and regulatory requirements. However, the M&O contractor’s engineering department may change the frequency of preventive maintenance activities if it finds deficiencies or declining performance during its assessments of site infrastructure.

Corrective maintenance includes a variety of activities, such as replacing hoist headropes, according to the current contractor’s documentation. Current contractor representatives stated that corrective maintenance needs are identified via several means, including during routine inspections, while performing preventive maintenance, or when reported by operators.

Under the current WIPP M&O contract, the M&O contractor is responsible for scheduling and prioritizing preventive maintenance and corrective maintenance activities. Current contractor representatives told us that they hold several planning meetings to schedule and prioritize preventive maintenance and corrective maintenance activities. They schedule preventive maintenance tasks on a rolling 90-day schedule. Each week they plan the schedule to balance the preventive maintenance with other activities at WIPP. They also told us they do not defer preventive maintenance. Rather, they complete the maintenance within a grace period, which they told us is predetermined based on DOE maintenance guidance. If they cannot meet that timeline, they take the site infrastructure offline.

Current contractor representatives stated that there is no set timeline for when corrective maintenance must be addressed. They track all pending corrective maintenance and review the backlog weekly, and the activities remain on the list until completed or deemed no longer necessary. When prioritizing maintenance activities, the representatives told us that they consider whether an asset is labeled as mission critical, which signals the importance of the asset to executing WIPP’s mission.

Current contractor representatives told us they typically evaluate infrastructure issues first as corrective maintenance. If the evaluation reveals that the repairs would exceed the maintenance department’s budget and capacity, they progress to minor construction projects. The representatives noted that eventually all site infrastructure will need to be refurbished or replaced, no matter how well it is maintained. See figure 5 for an overview of how maintenance of the WIPP site infrastructure is categorized.

Current contractor representatives said that minor construction projects take years to plan and fund due to their scale, and these are managed through the integrated priority list (IPL). CBFO officials and the M&O contractor develop the IPL, which is a list of activities that they estimate they could perform during future fiscal years. Officials then prioritize these activities using a variety of considerations, including mission criticality of an asset, anticipated funding, and risk to the mission. According to the most recent agency documentation provided, as of February 2024, the WIPP IPL had over 100 projects on it through fiscal year 2033. It is consistently reviewed and revised based on changing conditions at the site, and contractor representatives said that they seek approval from CBFO on the IPL and minor construction projects.

The contractor representatives told us they prioritize and schedule maintenance activities and minor construction projects to minimize their impact on WIPP operations. Specifically, they aim to schedule more disruptive activities during WIPP’s quarterly and annual maintenance outages to reduce the impact on waste emplacement and salt mining. For example, the representatives said that several of the substations that provide power to WIPP need to be replaced, but they would need to shut down the facility to do this. To minimize disruption, they are planning a precursor project to establish temporary power first. They told us this plan should allow them to avoid losing power to the entire site and instead operate with only some limitations while they replace the substations.

According to the WIPP M&O contracts, the M&O contractor is also responsible for maintaining the data about site infrastructure deficiencies, among other information, in DOE’s FIMS database. Current contractor representatives told us they have a staff member who serves as their FIMS administrator and is responsible for attending assessments for site infrastructure and inputting data into FIMS.

A DOE Field Office Provides Oversight and Incentives to the M&O Contractor

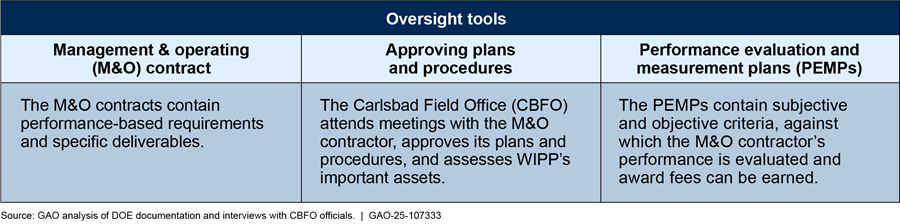

DOE has multiple tools that CBFO uses to perform oversight of the M&O contractor. These include the contract itself; approving the contractor’s plans and procedures; and incentives in PEMPs (see fig. 6). CBFO, with support from the CBFO Technical Assistance Contractor, use these tools to oversee the WIPP M&O contractor’s activities, including those related to site infrastructure management.[18]

Figure 6: Department of Energy’s (DOE) Tools for Oversight at the Waste Isolation Pilot Plant (WIPP)

According to our review, the agency’s M&O contracts set performance-based requirements for managing WIPP (including the site infrastructure). Both the former and current M&O contracts contain specific requirements related to site infrastructure management. These include multi-year site plans as well as requirements that the M&O contractor ensures site infrastructure is available and in a suitable condition to execute WIPP’s mission. The M&O contracts also contain requirements regarding budget planning and maintenance of site infrastructure at WIPP.

CBFO officials told us they oversee WIPP’s M&O contractor by attending meetings, approving plans and procedures, and assessing important infrastructure assets. Although CBFO is not involved in planning and executing daily activities for managing site infrastructure at WIPP, CBFO attends the contractor’s planning meetings, communicates expectations, and approves the procedures the contractor uses for these activities. CBFO also joins the current contractor’s engineers to visit and review assets to see how they are being maintained and that preventive maintenance is being executed.

CBFO officials stated that they approve the contractor’s plans for long-term management of site infrastructure and identify the funding for projects, but they do not dictate which site infrastructure to replace and when to replace it. Rather, their role is to ensure the M&O contractor takes an integrated approach that considers a range of factors, such as safety or whether single points of failure exist, when deciding on long-term asset management at WIPP. CBFO officials told us they participate in an integrated process with the M&O contractor to determine the prioritization of minor construction projects on the IPL. However, the evaluation on whether to replace an asset ultimately comes from the M&O contractor, according to CBFO officials.

CBFO evaluates the M&O contractor’s performance against contract requirements through an annual PEMP. As stated above, a PEMP generally contains subjective and objective criteria against which the M&O contractor’s performance is evaluated and award fees can be earned. For example, we reviewed the PEMPs for WIPP’s M&O contractors from fiscal years 2016 through 2024, and one subjective criterion that appeared in several of the PEMPs was management performance. In one year, CBFO evaluated the previous M&O contractor for management performance based, in part, on a sub-criterion for reducing WIPP’s maintenance backlog.

CBFO officials also stated that the PEMP can be used to incentivize the M&O contractor’s attention to important projects, such as infrastructure priorities. For example, in the fiscal year 2018 PEMP, CBFO used an objective criterion to incentivize the former M&O contractor to address aging and degraded infrastructure at WIPP by completing certain infrastructure projects within the year. In the fiscal year 2024 PEMP, CBFO included an incentive challenging the current contractor to establish its warehouse spare part program to ensure parts for mission critical equipment would be kept in stock. CBFO officials explained that they included this incentive because some of WIPP’s aging equipment needs parts that take months to manufacture, which can delay WIPP’s mission if they are not on hand when needed.

Over Half of Mission Critical Site Infrastructure at WIPP Is in Substandard Condition, and DOE Has Not Always Used Available Tools for Corrective Action

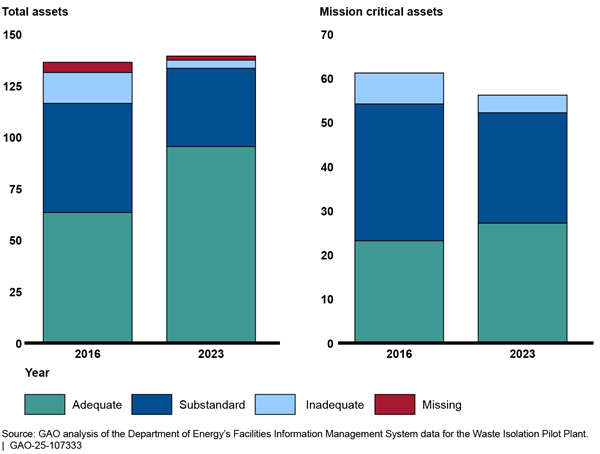

The condition of site infrastructure at WIPP showed some improvements from fiscal year 2016 to fiscal year 2023.[19] However, over half of mission critical assets remained in substandard or inadequate condition as of fiscal year 2023. According to DOE documentation, site infrastructure is assigned condition ratings of “substandard” or “inadequate” when routine assessments reveal deficiencies in reliability or capacity that limit WIPP’s mission. Additionally, WIPP data reliability issues for certain data in the FIMS database may impact DOE officials’ ability to make fully informed decisions for complex-wide funding and strategies. According to DOE officials, complete and accurate information on infrastructure is critical to managing facilities. However, WIPP failed four of its last five data validations, with some data issues lingering for years, and DOE officials have not ensured that the WIPP contractor has timelines to correct these known issues.

Substandard and Inadequate Condition of Some Infrastructure Could Limit Mission Performance

Our data analysis on the condition of site infrastructure at WIPP showed that there were more mission critical assets in adequate condition in fiscal year 2023 than in fiscal year 2016. However, over half of mission critical assets were in substandard or inadequate condition as of fiscal year 2023. We analyzed two metrics in FIMS to understand the condition of site infrastructure at WIPP: Condition Index and Overall Asset Condition. These metrics indicate the extent of repairs that a piece of site infrastructure (i.e., an asset) needs and the extent to which any deficiencies may impair the asset’s mission performance, respectively.

· Condition Index describes an asset’s current physical condition, according to DOE documentation. It is a calculation that compares an asset’s repair needs against the cost to replace it. DOE’s Master Asset Plan categorizes the Condition Index values on a scale ranging from very good to very poor. A low Condition Index value, represented as very poor, indicates that the cost of repairing an asset is approaching or exceeding the cost of replacing it. A high value, represented as very good, indicates that few repairs are needed.

· Overall Asset Condition reflects an asset’s ability to meet mission requirements. An asset in adequate condition is considered fully capable of performing its mission, while an asset in substandard or inadequate condition has deficiencies or puts the mission at risk.

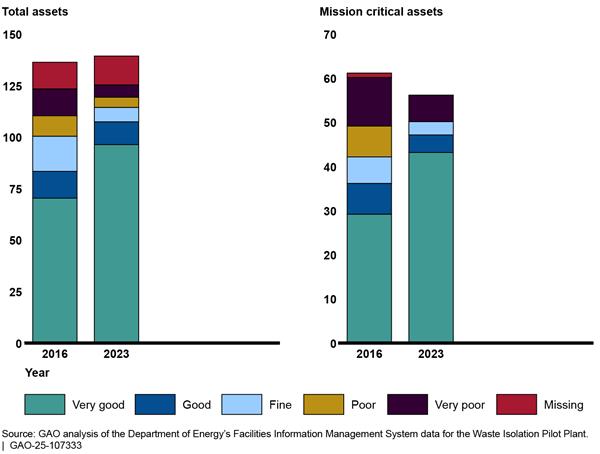

From fiscal year 2016 to fiscal year 2023, Condition Index values for WIPP assets improved for total assets and for mission critical assets, according to our analysis (see fig. 7). The percentage of poor and very poor assets in fiscal year 2023 was 8 percent for total assets and 11 percent for mission critical assets. In fiscal year 2016, the percentages were 17 percent and 30 percent, respectively. For example, FIMS data showed an improved Condition Index value for WIPP’s lightning poles, which protect the site from lightning strikes, after they were replaced in fiscal year 2020, because the replacement addressed the asset’s needed repairs. However, the data showed that other site infrastructure, such as one of the substations that provides power to WIPP and is designated as mission critical, remained in poor and very poor condition throughout this period due to its high repair needs.

Figure 7: Count of Condition Index Scores for Site Infrastructure at the Waste Isolation Pilot Plant in Fiscal Years 2016 and 2023

Note: The Condition Index metric is calculated based on an asset’s repair needs and the cost to replace it. DOE’s Master Asset Plan categorizes the Condition Index scores on a scale ranging from very good to very poor. Very good indicates that the cost of repairs is low, relative to the replacement cost. Very poor indicates that the cost of repairs is close to or exceeds the replacement cost. Missing represents assets that did not have populated data in the Condition Index field (13 total assets in 2016 and 14 total assets in 2023). At least half of the assets with missing Condition Index data were primarily leased assets that the owner of the lease maintains.

According to our analysis of the Overall Asset Condition metric, less than half (42 of 139) of total assets at WIPP remain in substandard or inadequate condition as of fiscal year 2023 (down from 68 of 136 total assets in fiscal year 2016). Nevertheless, more than half of mission critical assets (29 of 56) remain in substandard or inadequate condition as of fiscal year 2023 (down from 38 of 61 mission critical assets in fiscal year 2016). For example, FIMS data showed that the Overall Asset Condition of some mission critical assets improved to adequate condition during this time period, such as two of the backup generators, while others deteriorated to substandard or inadequate condition, such as two of the electrical substations. DOE documentation identifies these substations as examples of site infrastructure that is critical to executing WIPP’s mission and has known deficiencies in reliability or capacity that limit WIPP’s mission. Figure 8 summarizes the Overall Asset Condition for total assets and mission critical assets at WIPP.

Figure 8: Count of Overall Asset Condition Scores for Site Infrastructure at the Waste Isolation Pilot Plant in Fiscal Years 2016 and 2023

Note: The Overall Asset Condition metric contains three categories. Adequate indicates the asset is fully capable of performing its mission. Substandard indicates an asset has deficiencies that limit the performance or capacity of the mission. Inadequate indicates an asset has major deficiencies or puts the mission at risk. Missing represents assets that did not have populated data in the Overall Asset Condition field.

FIMS data showed that another mission critical asset—the salt handling shaft, used to remove mined salt from WIPP’s underground panels—has had an Overall Asset Condition of substandard since its first assessment in fiscal year 2016. In 2024, the salt handling shaft underwent emergency refurbishment due to a high risk of failure, according to CBFO officials (see fig. 9). Current contractor representatives told us they had plans to refurbish it in fiscal year 2025 because they knew salt was beginning to encroach on the shaft. However, they initiated the emergency refurbishment because the salt encroachment had progressed more quickly than expected, and they wanted to begin the project before it failed completely and led to a site-wide problem. (We previously reported that if a site infrastructure failure was to pause or slow waste emplacement at WIPP, it could impair DOE’s ability to meet its cleanup and national security missions.[20]) The contractor representatives said the impact of the emergency refurbishment to WIPP’s mission was limited because waste emplacement continued while salt mining was paused for the duration of the project, and they were able to quickly identify funds to finance the work.

Figure 9: Contractors Refurbishing the Salt Handling Shaft at the Waste Isolation Pilot Plant in New Mexico in 2024

DOE Does Not Ensure the WIPP M&O Contractor Corrects Known Data Deficiencies

Our review of available DOE documentation from fiscal years 2019 through 2024 showed that some of WIPP’s data had repeated reliability issues found during annual data validation efforts. But DOE did not ensure the WIPP M&O contractors developed timelines to correct those issues using its existing oversight tools.[21] According to agency officials, DOE Headquarters relies on FIMS data for making management, disposition, and acquisition decisions. DOE and current contractor representatives told us that the FIMS data validation process involves annually reviewing the data for errors and inconsistencies. Specifically, every year, the Environmental Management Consolidated Business Center (EMCBC) tests a sample of WIPP assets to check the validity of their FIMS data. EMCBC officials visit a sample of WIPP’s site infrastructure with the system engineer responsible for the asset to compare whether the results of their inspection match the data entered in FIMS. For example, to check the Overall Asset Condition field, the asset’s system engineer and EMCBC officials assess the asset to decide if the existing rating is accurate.

EMCBC provides DOE sites with scorecards that contain the validation results for individual FIMS data fields. According to current contractor representatives and DOE documentation, EMCBC scores FIMS data fields as green, yellow, or red based on the extent of deficiencies found during validations. Green scores indicate few, if any, deficiencies; yellow scores indicate some deficiencies, but the extent of the deficiencies does not impact overall FIMS quality; and red scores indicate deficiencies that affect the quality of the FIMS data and require corrective action.

For FIMS data that score red during the annual validations, the site contractors then submit corrective action plans, as outlined in DOE guidance for implementing DOE Order 430.1C, to address the errors to EMCBC and the DOE Office of Asset Management for approval.[22] The corrective action plans have fields that should be populated to track the planned and actual timelines to address the errors and to list the steps that a site intends to use to resolve the identified data deficiencies. We found that the M&O contractors had not consistently complied with this requirement and DOE’s Office of Environmental Management (EM) had not taken actions to hold contractors accountable for doing so.

Our review of WIPP’s six scorecards for fiscal years 2019 through 2024 (which covered both the prior and current M&O contractors) showed that WIPP received red overall scores in four of its last five FIMS validations for DOE-owned site infrastructure. In some cases, deficiencies for maintenance data lingered for 3 years, with resolutions not reflected in the FIMS data as required.[23] In all of the corrective action plans that we reviewed, the fields for planned timelines were left blank. The M&O contractors had not identified the planned dates for correcting the data deficiencies. In addition, the contractors had identified the actual date the deficiencies were mitigated in only one of four corrective action plans we reviewed. Additionally, in one case, the M&O contractor did not describe the steps that a WIPP M&O contractor representative planned to follow to correct the data issues. Specifically, in 2022, instead of listing the steps to correct an identified deficiency in the Annual Actual Maintenance field, the WIPP M&O contractor representative requested suggestions from DOE Headquarters. However, the M&O contractor was unable to find and implement a solution by the next validation, and the data field remained red in the next two annual validations.

Under DOE Order 430.1C, EM is required to review and certify FIMS data and plans.[24] Additionally, according to the DOE memorandum on fiscal year 2025 FIMS Reporting Deadlines and Validation Guidance, EM is required to oversee the contractors’ execution of corrective action plans until the data and processes are corrected.[25] However, our review of the corrective action plans that we received showed that EM did not ensure the WIPP M&O contractors fully used DOE’s corrective action plans to develop timelines to correct identified issues with FIMS data.

As described previously, CBFO is responsible for evaluating the M&O contractor’s performance at WIPP. By not ensuring that the M&O contractor develops timelines to implement corrective action plans, as outlined in DOE guidance for implementing DOE Order 430.1C, EM may be limiting CBFO’s ability to evaluate the WIPP M&O contractor’s maintenance of FIMS data and ensure accountability for accurate FIMS data.[26] Without detailed timelines to correct the data, the M&O contractor could supply inaccurate data without consequences, which may result in DOE using inaccurate data for its planning, funding scenarios, and investment prioritization.

Maintenance Information for Site Infrastructure Is Incomplete Due to Data Collection Deficiencies

Information about estimated and actual maintenance costs for site infrastructure at WIPP is incomplete or unreliable because of gaps in certain data collected in FIMS. Our review of DOE documentation showed that EMCBC had scored the Annual Required Maintenance (estimated maintenance costs) and Annual Actual Maintenance fields for DOE-owned site infrastructure at WIPP as red—i.e., deficient and requiring corrective action—beginning in 2022 due to inaccurate and incomplete data. The information in these FIMS data fields represents the estimated and actual maintenance costs for each piece of infrastructure. We found that in many cases the dollar values were zero. Current contractor representatives told us that they were aware of gaps in the FIMS data for these fields. In addition, they noted that they typically perform maintenance on most site infrastructure, so any zero-dollar values typically represent a gap in the FIMS data, not that an asset required no preventive or corrective maintenance.

According to DOE Order 430.1C, DOE elements must “report asset level annual required maintenance in FIMS for the upcoming fiscal year, including the estimated fully burdened costs of predictive and preventive maintenance and repair activities.”[27] The DOE documentation we reviewed showed that Annual Actual Maintenance data in FIMS failed the annual validations from 2022 through 2024 because they did not include labor and material costs at the asset level. Current contractor representatives told us they use the Annual Actual Maintenance costs to calculate the estimated Annual Required Maintenance for specific site infrastructure at WIPP, which made these data inaccurate as well.[28] They stated that their maintenance records for site infrastructure did not consistently include labor and material costs. This is because labor costs are not always recorded and the costs for materials are not currently captured in FIMS.

The contractor representatives told us that they have implemented changes to collect the missing maintenance costs for fiscal year 2024 data and going forward, but the data resulting from these changes had not yet been validated by EMCBC. They stated that they have developed a new system to calculate maintenance costs for FIMS that will pull the hours of labor performed from WIPP’s maintenance database and material costs from the warehouse inventory database. EMCBC officials will review these changes during the next FIMS validation in spring 2025.

As described previously, the M&O contractor is responsible for maintaining FIMS data for site infrastructure at WIPP, but CBFO is responsible for overseeing the implementation of real property asset management requirements, including the collection of FIMS asset-level annual required maintenance costs. DOE officials told us complete and accurate information on infrastructure is critical to manage facilities and satisfy several external reporting requirements. DOE uses the data to compare sites across the EM complex, conduct funding scenarios, and develop investment strategies.[29] The WIPP M&O contractor recently took action to improve the maintenance cost data at the asset level. It will be important for EM officials to monitor these improvements to ensure that they accurately capture complete cost data. At WIPP, there is a risk that the lack of complete and accurate maintenance cost data at the asset level will restrict management decisions about maintaining or replacing assets. Furthermore, without ensuring that WIPP accurately captures FIMS asset-level annual required maintenance costs, EM is unable to ensure the reliability of DOE infrastructure planning, both at WIPP and potentially across the EM complex.

DOE Does Not Consistently Use Oversight Tools to Ensure WIPP M&O Contractors Address Long-Term Infrastructure Planning Requirements

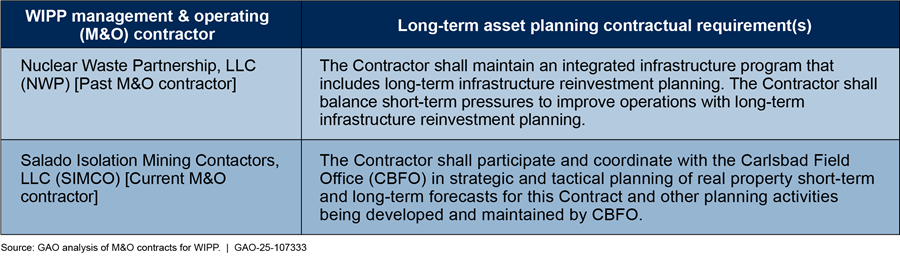

DOE has not consistently used available contract oversight tools—specifically, the performance incentives and evaluations—to ensure that WIPP’s M&O contractors are addressing long-term site infrastructure planning, according to our review.

CBFO conducts oversight of the WIPP M&O contactors through the annual PEMPs that establish criteria, provide incentives, and develop metrics for measuring contractor performance. The results of the PEMP evaluations are recorded in performance evaluation reports (PERs) and summarized in award fee scorecards. Additionally, CBFO assesses contractor performance according to government-wide criteria and reports on it in the Contractor Performance Assessment Reporting System.

Our review of the contracts for the former and the current WIPP M&O contractors identified language in both contracts requiring the contractors to conduct long-term site infrastructure planning (see fig. 10). The current M&O contract for WIPP includes a clause that provides that DOE is to evaluate the contractor’s performance of all requirements and in accordance with the PEMP. This clause specifies that the PEMPs will address all of the requirements of contract performance specified in the contract directly or by reference.[30]

Figure 10: Long-Term Site Infrastructure Planning Requirements in Management and Operating (M&O) Contracts for the Waste Isolation Pilot Plant (WIPP)

Note: The M&O contractor at WIPP was Nuclear Waste Partnership, LLC (NWP) for fiscal years 2012 through 2022. In July 2022, DOE awarded the WIPP site contract to Salado Isolation Mining Contractors, LLC (SIMCO).

According to our review of the PEMPs, CBFO clearly incentivized the M&O contractors to conduct long-term site infrastructure planning in one of nine PEMPs from fiscal years 2016 through 2024.[31] Specifically, in the fiscal year 2016 PEMP, CBFO included two performance-based incentives that directed the contractor to have a long-term site infrastructure planning focus.

· In the first performance-based incentive, CBFO incentivized the contractor to develop an “overarching vision and strategy for WIPP to achieve its operational lifetime through fiscal year 2050 with both near-term and long-term operational activities and projects.” CBFO stipulated that the operational activities must align with other plans such as the IPL and 10-year site plans for WIPP.[32]

· The second performance-based incentive in the 2016 PEMP was for the contractor to develop and implement a Material Condition and Aging Management Program and evaluate recommendations from the CBFO Infrastructure Improvement Plan. This included developing a prioritized list of asset activities and completing material condition assessments of high-risk assets. The contractor earned the majority of the award fee available for meeting this incentive.

CBFO’s remaining eight PEMPs from our review lacked clear incentives for the M&O contractors to conduct long-term site infrastructure planning, making it difficult to determine whether DOE was evaluating those contract requirements. Specifically:

· The PEMPs for fiscal years 2017 through 2019 contained language about evaluating the contractor on its management performance, in part, for “effective planning.” However, this language did not specify whether long-term site infrastructure planning would be evaluated as part of this criterion.

· From fiscal years 2020 through 2024, CBFO incorporated long-range planning in the PEMPs as part of the contractor’s evaluation, but the PEMPs did not specify whether planning for WIPP’s site infrastructure was included. According to our review, the PEMPs for fiscal years 2020 through 2024 contained language that the contractor would be evaluated on its cost control performance, in part, for “long range planning to control costs.”

In addition, CBFO’s evaluations—using the PERs and CPARs—of the contractors’ performance was inconsistent in evaluating long-term site infrastructure planning for fiscal years 2017 through 2024. Specifically:

· In fiscal year 2017, CBFO did not mention long-term site infrastructure planning in the evaluations.

· In fiscal years 2018 and 2019, our analysis of the PERs and CPARs could not conclusively determine if CBFO’s evaluations specifically assessed the contractor’s long-term site infrastructure planning. For example, in fiscal year 2018, CBFO evaluated the management performance of the contractor regarding its long-range plans for creating additional underground panels and maintaining areas until 2050. However, these actions focused on waste disposal and not site infrastructure.

· In fiscal year 2020, CBFO’s evaluation included long-term site infrastructure planning.

· In fiscal year 2021, our analysis of the PERs and CPARs could not conclusively determine if CBFO’s evaluation specifically assessed long-term site infrastructure planning. In 2021, CBFO evaluated the management performance of the contractor regarding its 10-year WIPP shipping projections. However, we could not determine if site infrastructure was included in the evaluation.

· In fiscal years 2022 and 2023, CBFO’s evaluation included long-term site infrastructure planning. For example, in the 2023 evaluation, CBFO mentioned the contractor’s planning to ensure adequate site infrastructure, including that the contractor should assess impacts from delay and rescheduling of infrastructure projects, such as the salt handling shaft refurbishment.

· In fiscal year 2024, our analysis of the PERs and CPARs could not conclusively determine if CBFO’s evaluation specifically assessed long-term site infrastructure planning. For example, CBFO evaluated the quality performance of the contractor’s minor construction project forecasts. However, we could not determine if the forecasts were long-term in nature.

CBFO has evidence that providing incentives in the PEMPs can be an effective way to prompt the contractor to work on short-term priority goals at WIPP. For example, CBFO consecutively included clear incentive language in four of nine PEMPs to reduce the preventive maintenance backlogs for site infrastructure at WIPP.[33] CBFO evaluated the contractor directly on the backlog reductions and awarded the contractor the majority of fees associated with meeting the criteria. In the CPARs for those years, CBFO indicated that the M&O contractor successfully reduced the backlogs in all but one fiscal year. The effectiveness of this incentivization and evaluation process is also reflected by the general improvement in the Condition Index metric for site infrastructure at WIPP during those 4 years, as described above.[34]

CBFO officials echoed the importance of having clearly stated, performance-based incentives for long-term site infrastructure planning in their 2018 evaluation of the former M&O contractor. CBFO reported that the contractor would not engage in long-term planning activities without being prompted by CBFO or having performance-based incentives applied, although long-term site infrastructure reinvestment planning was a contractual requirement.

When we asked CBFO officials how they address long-term site infrastructure planning in the PEMPs, they responded that anything not incentivized as a performance-based incentive within the objective criteria can theoretically be addressed in the subjective criteria of the PEMP. However, there is no designated place in the PEMP for long-term site infrastructure planning. CBFO officials told us that since the 2014 accident they have been operating in a reactionary mode to try to keep up with emerging corrective maintenance issues on the aging site infrastructure at WIPP. For example, the waste hoist that is used to transport transuranic waste from the surface to the underground facility is a mission critical asset that repeatedly required unplanned maintenance throughout 2024, according to officials from the Defense Nuclear Facilities Safety Board.[35] In one instance, in June 2024 the waste hoist stalled while transporting nuclear waste underground. CBFO officials told us that the waste hoist motor is 40 years old and likely past its design life.

By focusing on emerging maintenance issues and not having a designated place in the PEMPs to incentivize or evaluate long-term infrastructure planning, CBFO is not taking a proactive approach to addressing WIPP’s aging site infrastructure. Consistent use of oversight tools such as the PEMP to incentivize the contractor to plan for the long-term operability and availability of site infrastructure could help decrease the risk of costly emergency refurbishments of mission critical assets, like the salt shaft, or even failure of critical site infrastructure that could impact WIPP’s waste disposal mission.

CBFO has oversight tools, such as the PEMP, to incentivize the contractor to undertake actions that plan for the long-term operability and availability of site infrastructure, but it is not consistently using them. The use of PEMPs and evaluation processes to incentivize the contractor to undertake long-term site infrastructure planning activities, such as developing strategies for the operability of WIPP’s assets through the life cycle of the facility, would assist CBFO in addressing the challenge of aging infrastructure at WIPP. Without consistently using available oversight tools, such as the performance evaluation and measurement plan and performance evaluation process, DOE cannot ensure long-term site infrastructure planning is achieved and risks greater failure of critical site infrastructure, which could impact WIPP’s waste disposal mission.

Conclusions

DOE expects to continue transuranic waste disposal activities at WIPP until the early 2080s, which will require the M&O contractor to perform long-term maintenance on site infrastructure that must be functional decades longer than originally planned. Although the number of site infrastructure assets in good or very good conditions has increased since fiscal year 2016, over half of the WIPP’s mission critical infrastructure is in substandard or inadequate condition. DOE uses data from FIMS to inform decisions for long-term management of that infrastructure, such as conducting funding scenarios and developing investment strategies across the EM complex and at WIPP. However, DOE has not ensured that the M&O contractor submits complete corrective action plans to address known data validation issues. By requiring the contractor to establish timelines to correct issues as they arise, DOE could better ensure the use of reliable and accurate data for site infrastructure planning.

Contractor representatives responsible for managing WIPP’s infrastructure data said they have implemented changes to correct the ongoing data reliability issues with the annual required maintenance FIMS data field, and they expect the corrections will be validated in the spring of 2025. However, until DOE monitors whether recent improvements in data collection at WIPP allow the site to accurately capture FIMS asset-level annual required maintenance costs, DOE cannot ensure the accuracy of these data and the reliability of its infrastructure plans. Further, by monitoring recent improvements in data collection at WIPP, DOE could better ensure investment strategies for infrastructure at the site and across the EM complex are reliable and based on accurate data.

DOE uses the annual PEMP and evaluation process to conduct oversight of WIPP’s M&O contractor. However, DOE clearly incentivized the contractor to conduct long-term site infrastructure planning in only one fiscal year from 2016 to 2024. Additionally, DOE’s evaluations of M&O contractors did not always specifically mention long-term site infrastructure planning and there is no designated element for this in the PEMP. By ensuring that CBFO consistently uses oversight tools to ensure the WIPP M&O contractor satisfies all long-term site infrastructure planning requirements, DOE would be in a better position to ensure the long-term operability and functionality of WIPP’s mission critical infrastructure and decrease the risk of infrastructure failure.

Recommendations for Executive Action

We are making the following three recommendations to DOE:

The Assistant Secretary of Environmental Management should direct Carlsbad Field Office site officials to ensure that the M&O contractor establishes and documents timelines to correct identified data validation issues in FIMS. (Recommendation 1)

The Assistant Secretary of Environmental Management should monitor whether recent improvements in data collection at WIPP allow the site to accurately capture FIMS asset-level annual required maintenance costs, as required in DOE Order 430.1C. (Recommendation 2)

The Assistant Secretary of Environmental Management should ensure the Carlsbad Field Office consistently uses available oversight tools, such as the performance evaluation and measurement plan and performance evaluation process, to incentivize the WIPP M&O contractor to satisfy all contractual long-term site infrastructure planning requirements. (Recommendation 3)

Agency Comments

We provided a draft of this report to DOE for review and comment. DOE concurred with our three recommendations and stated that it will ensure that the recommendations are addressed. DOE’s comments are reproduced in appendix II. The agency also provided technical comments, which we incorporated as appropriate.

In its written comments, DOE stated that CBFO site officials would ensure the M&O contractor at WIPP establishes timelines and plans to address identified data validation issues in FIMS. Additionally, DOE stated that CBFO officials would monitor recent improvements in data collection at WIPP to assess whether the improved processes are successful. Finally, DOE stated that CBFO will use available oversight tools, such as the PEMP, to incentivize the WIPP M&O contractor to satisfy all contractual long-term site infrastructure planning requirements. Specifically, CBFO plans to revise the fiscal year 2026 PEMP to provide appropriate focus on contract performance relating to long-term planning for site infrastructure needs.

We are sending copies of this report to the appropriate congressional committees, the Secretary of Energy, and other interested parties. In addition, the report will be available at no charge on the GAO website at https://www.gao.gov.

If you or your staff have any questions about this report, please contact me at AndersonN@gao.gov. Contact points for our Offices of Congressional Relations and Public Affairs may be found on the last page of this report. GAO staff who made key contributions to this report are listed in appendix III.

Nathan Anderson

Director, Natural Resources and Environment

List of Committees

The Honorable Roger F. Wicker

Chairman

The Honorable Jack Reed

Ranking Member

Committee on Armed Services

United States Senate

The Honorable John N. Kennedy

Chair

The Honorable Patty Murray

Ranking Member

Subcommittee on Energy and Water Development

Committee on Appropriations

United States Senate

The Honorable Mike Rogers

Chairman

The Honorable Adam Smith

Ranking Member

Committee on Armed Services

House of Representatives

The Honorable Chuck Fleischmann

Chairman

The Honorable Marcy Kaptur

Ranking Member

Subcommittee on Energy and Water Development, and Related Agencies

Committee on Appropriations

House of Representatives

This report examines (1) how the Department of Energy (DOE) manages site infrastructure at the Waste Isolation Pilot Plant (WIPP), (2) what is known about the condition of infrastructure at WIPP and the extent to which DOE is maintaining and using available tools to plan for the management of site infrastructure, and (3) the extent to which DOE has provided oversight of contractor actions to address aging site infrastructure at WIPP.

To address all three objectives, we conducted a site visit to WIPP in May 2024. During the site visit, we obtained documentation and interviewed officials from DOE’s Carlsbad Field Office (CBFO), which manages and oversees WIPP operations under DOE’s Office of Environmental Management (EM). We also obtained documentation and interviewed officials from WIPP’s current management and operating (M&O) contractor. This review did not include large capital asset projects, as GAO has previously reported on the status of capital asset projects at WIPP.[36] We focused on site infrastructure and non-capital asset projects, such as minor construction and general plant projects at WIPP.

To examine how DOE manages site infrastructure at WIPP, we reviewed protocols, orders, and procedures relevant to DOE’s infrastructure management, such as DOE Order 430.1C, Real Property Asset Management.[37] We reviewed the two most recent M&O contracts, one from the previous and one from the current contractors at WIPP, as well as the contract modifications that contained performance evaluation and measurement plans (PEMPs). We also reviewed CBFO WIPP site infrastructure procedure and protocol documents, and we interviewed CBFO and current M&O contractor representatives from WIPP to discuss their respective roles and responsibilities in managing WIPP site infrastructure.

To learn about the condition of WIPP’s infrastructure and determine the extent to which DOE is maintaining and using available tools to plan for the management of site infrastructure, we reviewed and analyzed data from DOE’s Facilities Information Management System (FIMS). Specifically, we reviewed the data to analyze changes and trends in site infrastructure condition from fiscal years 2016 through 2023 for total assets and mission critical assets, given their importance to WIPP operations.[38] We analyzed two metrics in FIMS to understand the condition of site infrastructure at WIPP: Condition Index and Overall Asset Condition. The Condition Index metric describes an infrastructure asset’s current physical condition, according to DOE documentation. It is a calculation that compares an asset’s repair needs against the cost to replace it. DOE’s Master Asset Plan categorizes the Condition Index scores on a scale ranging from very good to very poor. Very good indicates that the cost of repairs is low, relative to the replacement cost. Very poor indicates that the cost of repairs is close to or exceeds the replacement cost. The Overall Asset Condition metric reflects an asset’s ability to meet mission requirements. Asset assessments and other indicators are used to determine whether an asset is in Adequate, Substandard, or Inadequate overall condition.

To assess the reliability of the FIMS data we received, we (1) performed electronic testing and visual inspections of the data for obvious errors in accuracy and completeness; (2) reviewed related documentation, including the available results of DOE’s annual data validations; and (3) interviewed agency and contractor representatives knowledgeable about the data and asked agency officials about any discrepancies (such as missing data, duplicate records, or data entry errors) found in the data. We requested DOE documentation on FIMS data validations for fiscal years 2014 through 2023. CBFO provided scorecards for 2019 through 2024. According to current contractor representatives and DOE documentation, the Office of Environmental Management Consolidated Business Center scores FIMS data fields as green, yellow, or red based on the extent of deficiencies found during validations. Green scores indicate few, if any, deficiencies; yellow scores indicate some deficiencies, but the extent of the deficiencies does not impact overall FIMS quality; and red scores indicate deficiencies that affect the quality of the FIMS data and require corrective action. Our review focused on whether the FIMS fields we identified as related to the condition of site infrastructure at WIPP received red scores. The Condition Index field had missing values that were primarily limited to leased assets, which the owner of the lease maintains, and to non-mission critical assets. Based on our review, we determined that the data that were present for the Condition Index and Overall Asset Condition data fields were sufficiently reliable for the purpose of comparing the condition of real property assets at WIPP in fiscal years 2016 and 2023.

However, we determined that some FIMS data were not reliable due to known inaccuracies within the Annual Required Maintenance and Annual Actual Maintenance data fields that were flagged during DOE’s annual data validations. The results of the data validations showed repeated inaccuracies in these fields due to incomplete costs within the source data. Additionally, the data validation results did not contain the steps that officials at WIPP would take to correct the inaccuracies. Current contractor representatives told us that many of the values listed as zero dollars for these fields were likely inaccurate. Through visual inspection of the data, the team identified missing and inconsistent data in the Annual Actual Maintenance and Annual Required Maintenance data fields that matched concerns discussed in agency documentation and interviews. As a result, we did not use these data to describe general trends in maintenance costs for site infrastructure in this report.

We also reviewed DOE Order 430.1C, Real Property Asset Management, for DOE site infrastructure data maintenance and reporting requirements. Finally, we reviewed DOE’s corrective action plans to understand how the agency ensures sites correct FIMS data deficiencies. We requested DOE documentation on FIMS data validations for fiscal years 2014 through 2023. CBFO provided corrective action plans for 2020 through 2022 and 2024 for DOE-owned assets. We reviewed these documents to identify whether the M&O contractors had filled out the planned steps to correct identified data deficiencies, the planned dates for correction, and the actual dates for correction.

To determine the extent to which DOE has provided oversight of contractor actions to address aging site infrastructure at WIPP, we reviewed and analyzed all nine PEMPs, contractor performance assessment reports (CPAR), fee determination scorecards, and performance evaluation reports (PER) for the former and current M&O contractors at WIPP for fiscal years 2016 through 2024. We reviewed the Federal Acquisition Regulation and DOE Acquisition Regulation for relevant contractor oversight and evaluation requirements, such as requirements for the PEMP process to evaluate contractor performance. We reviewed the PEMPs, CPARs, fee determination scorecards, and PERs to identify and assess the clarity and content of language regarding long-term site infrastructure planning and efforts to incentivize that planning. We reviewed WIPP M&O contracts and contract modifications of the former and current site contractors for fiscal years 2016 through 2024 for long-term site infrastructure planning requirements. We also reviewed site infrastructure scheduling and prioritization documents, such as WIPP’s risk register and integrated priority list. Additionally, we interviewed CBFO and current M&O contractor representatives to understand the decision-making process behind site infrastructure planning and maintenance.

We conducted this performance audit from January 2024 to June 2025 in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

GAO Contact

Nathan Anderson at AndersonN@gao.gov.

Staff Acknowledgments

In addition to the contact named above, Jeffrey Barron (Assistant Director), Luqman Abdullah (Analyst in Charge), and Archie Scoville made significant contributions to this report. Also contributing to this report were Gwendolyn Kirby, Claudia Hadjigeorgiou, Jeanette Soares, Cindy Gilbert, Pamela Davidson, Christoph Hoashi-Erhardt, William Bauder, and Adrian Apodaca.

The Government Accountability Office, the audit, evaluation, and investigative arm of Congress, exists to support Congress in meeting its constitutional responsibilities and to help improve the performance and accountability of the federal government for the American people. GAO examines the use of public funds; evaluates federal programs and policies; and provides analyses, recommendations, and other assistance to help Congress make informed oversight, policy, and funding decisions. GAO’s commitment to good government is reflected in its core values of accountability, integrity, and reliability.

Obtaining Copies of GAO Reports and Testimony

The fastest and easiest way to obtain copies of GAO documents at no cost is through our website. Each weekday afternoon, GAO posts on its website newly released reports, testimony, and correspondence. You can also subscribe to GAO’s email updates to receive notification of newly posted products.

Order by Phone

The price of each GAO publication reflects GAO’s actual cost of production and distribution and depends on the number of pages in the publication and whether the publication is printed in color or black and white. Pricing and ordering information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077,

or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard, Visa, check, or money order. Call for additional information.

Connect with GAO

Connect with GAO on X,

LinkedIn, Instagram, and YouTube.

Subscribe to our Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

To Report Fraud, Waste, and Abuse in Federal Programs

Contact FraudNet:

Website: https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454

Media Relations

Sarah Kaczmarek, Managing Director, Media@gao.gov

Congressional Relations

A. Nicole Clowers, Managing Director, CongRel@gao.gov

General Inquiries

[1]“Transuranic” refers to elements that have atomic numbers greater than uranium. Transuranic waste is defined in the Waste Isolation Pilot Plant Land Withdrawal Act as “waste containing more than 100 nanocuries of alpha-emitting transuranic isotopes per gram of waste, with half-lives greater than 20 years, except for (A) high-level radioactive waste; (B) waste that the Secretary of Energy has determined, with the concurrence of the Administrator [of the Environmental Protection Agency], does not need the degree of isolation required by the disposal regulations; or (C) waste that the Nuclear Regulatory Commission has approved for disposal on a case-by-case basis in accordance with [10 C.F.R. Part 61].” Pub L. No. 102-579, § 2(20), 106 Stat. 4777, 4779 (1992). Atomic energy defense activities are defined as any activity of the Secretary performed in whole or in part in carrying out defense nuclear waste and materials by-products management, among other activities.

[2]According to DOE, the mission of WIPP is to safely and permanently dispose of the nation’s defense-related transuranic waste. Waste disposal activities were estimated to end by 2023, followed by a 7–10-year period for decontamination, decommissioning, and final closure. Our review focused on waste disposal activities at the site and the projected end dates of those activities.

[3]In 2016, a DOE contractor conducted a condition assessment survey to identify deficiencies of site infrastructure at WIPP. The focus of the assessment was to identify all deficiencies, including systems at or approaching the end of their design life, and prepare estimated costs for their replacement.

[4]Established by the Waste Isolation Pilot Plant Land Withdrawal Act, the statutory limit of transuranic waste that can be disposed of at WIPP is 6.2 million cubic feet. In 2024, DOE reported that WIPP was at approximately 44 percent of its statutory capacity for transuranic waste disposal.

[5]DOE’s fiscal year 2025 Congressional Justification shows direct maintenance and repair for operations at the Carlsbad Field Office to be $14,241,000 in fiscal year 2025.

[6]S. Rep. No. 117-130, at 365-366 (2022).

[7]M&O contracts are agreements under which the government contracts for the operation, maintenance, or support, on its behalf, of a government-owned or -controlled research, development, special production, or testing establishment wholly or principally devoted to one or more major programs of the contracting federal agency. 48 C.F.R. § 17.601. The work conducted by the contractor is closely related to the agency’s mission and is of a long-term or continuing nature.

[8]See GAO‑22‑105057 and GAO‑21‑48 for GAO’s previous work on capital asset projects at WIPP. A capital asset project has a defined start and end point and can include the construction of new facilities for treating and disposing of waste, as well as environmental remediation of lands.

[9]Department of Energy, Real Property Asset Management, DOE Order 430.1C (Change 2) (Washington, D.C.: Sept. 17, 2020).

[10]According to DOE officials, one of the metrics we reviewed, “Overall Asset Condition,” is a newer metric in FIMS. The metric for WIPP was first consistently populated in FIMS in fiscal year 2016, which is when we chose to begin our analysis. The last year of validated data available at the time of our analysis was fiscal year 2023.

[11]A risk register is a document that helps site officials track risk and plan mitigation measures. An IPL is a list of activities that site officials estimate they could perform during future fiscal years.

[12]According to DOE officials, SIMCO’s contract was subject to a bid protest and the contractor did not take operational responsibility for WIPP until February 2023. The contract amount for the current contractor is $947,424,307 for the period of November 1, 2022, through July 31, 2026.

[13]Under the Federal Acquisition Regulation, a cost-plus-award-fee contract is a cost-reimbursement contract that provides for a fee consisting of (a) a base amount (which may be zero) fixed at inception of the contract and (b) an award amount, based upon a judgmental evaluation by the Government, sufficient to provide motivation for excellence in contract performance. 48 C.F.R. § 16.305.

[14]Department of Energy, Real Property Asset Management, DOE Order 430.1C (Change 2) (Washington, D.C.: Sept. 17, 2020).

[15]The Federal Real Property Profile Management System was originally created because of Executive Order 13327, Federal Real Property Asset Management, and is the federal government’s database of all real property under the custody and control of all executive branch agencies, except when otherwise required for reasons of national security.

[16]According to DOE officials, WIPP’s waste shipment rate was reduced because the underground ventilation system was running in filtration mode—a much lower air ventilation rate than the unfiltered mode—due to the contamination in the underground from the 2014 WIPP radiological accident. Under these filtration conditions, work activities, such as waste disposal, are reduced.

[17]As previously stated, this review did not include capital asset projects, as we have previously reported on the status of capital asset projects at WIPP. See GAO‑22‑105057 and GAO‑21‑48 for our previous work on capital asset projects at WIPP.

[18]According to CBFO officials, the CBFO Technical Assistance Contractor supports CBFO’s oversight of WIPP’s M&O contractor in a number of ways, including contract support, overseeing maintenance activities and attending maintenance and IPL meetings, and overseeing the M&O contractor’s management of FIMS data for WIPP site infrastructure.

[19]According to DOE officials, “Overall Asset Condition” is a newer metric in FIMS. The metric for WIPP was first consistently populated in FIMS in fiscal year 2016, which was the starting point for our analysis.